Deck 4: Financial Markets and Net Present Value: First Principles of Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/36

العب

ملء الشاشة (f)

Deck 4: Financial Markets and Net Present Value: First Principles of Finance

1

Which of the following is not true?

A) Financial markets can be used to adjust consumption patterns over time.

B) Corporate investment decisions have nothing to do with financial markets.

C) Financial markets deal with cash flows over time.

D) Investment decisions rely on the economic principles of financial markets.

A) Financial markets can be used to adjust consumption patterns over time.

B) Corporate investment decisions have nothing to do with financial markets.

C) Financial markets deal with cash flows over time.

D) Investment decisions rely on the economic principles of financial markets.

Corporate investment decisions have nothing to do with financial markets.

2

An investment should be made in period 0 if:

A) desired consumption in period 0 is less than income.

B) desired consumption in period 1 is greater than income.

C) return on the investment is greater than the interest rate.

D) return on the investment is less than the interest rate.

A) desired consumption in period 0 is less than income.

B) desired consumption in period 1 is greater than income.

C) return on the investment is greater than the interest rate.

D) return on the investment is less than the interest rate.

return on the investment is greater than the interest rate.

3

You have an investment opportunity available to you that requires $400,000. You have no funds available but you will have income of $120,000 this year. The investment will have a net payoff $33,000 at the end of the year. If the market rate is 7.5% will you make the investment?

A) No, because I need $280,000 more than I will have.

B) Yes, because I will $3,000 above my required return.

C) No, because I only get $33,000 back on my $400,000.

D) Yes, because the market rate is less than the borrowing rate.

A) No, because I need $280,000 more than I will have.

B) Yes, because I will $3,000 above my required return.

C) No, because I only get $33,000 back on my $400,000.

D) Yes, because the market rate is less than the borrowing rate.

Yes, because I will $3,000 above my required return.

4

Financial markets develop to accommodate _________ between individuals.

A) trade and barter

B) barter and lending

C) borrowing and lending

D) lending and trade

A) trade and barter

B) barter and lending

C) borrowing and lending

D) lending and trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

5

A financial instrument, by its possession, that entitles the holder to receive the payments are called:

A) principal instruments.

B) interest only instruments.

C) registered instruments.

D) bearer instruments.

A) principal instruments.

B) interest only instruments.

C) registered instruments.

D) bearer instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

6

The first or basic principle of finance dictates that an individual will invest in a project if:

A) they are made better off in the financial markets.

B) they are unable to adjust their savings and consumption in the financial markets.

C) the project is at least as desirable as what is available in the financial markets.

D) the interest rate for borrowing and lending is not equal.

A) they are made better off in the financial markets.

B) they are unable to adjust their savings and consumption in the financial markets.

C) the project is at least as desirable as what is available in the financial markets.

D) the interest rate for borrowing and lending is not equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

7

The ray that connects the maximum one can consume in Year 0 with the maximum one can consume in Year 1 represents:

A) all the investment possibilities and has a slope equal to (1 + r).

B) all best consumption alternatives and has a slope equal to -(1 + r).

C) all the savings choices and has a slope equal to 1.

D) all the best consumption choices and has a slope equal to 1.

A) all the investment possibilities and has a slope equal to (1 + r).

B) all best consumption alternatives and has a slope equal to -(1 + r).

C) all the savings choices and has a slope equal to 1.

D) all the best consumption choices and has a slope equal to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

8

The present value of future cash flows minus initial cost is called:

A) the future value of the project.

B) the net present value of the project.

C) the equivalent sum of the investment.

D) the initial investment risk equivalent value.

A) the future value of the project.

B) the net present value of the project.

C) the equivalent sum of the investment.

D) the initial investment risk equivalent value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

9

The following statement, that the value of an investment to an individual is not dependent on consumption preferences, is called the:

A) marginal rate of substitution.

B) separation theorem.

C) value additivity principle.

D) investor's dilemma.

A) marginal rate of substitution.

B) separation theorem.

C) value additivity principle.

D) investor's dilemma.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

10

According to the net present value rule, an investment should be made if:

A) the net present value has no risk.

B) the net present value is greater than the cost of investment.

C) the net present value is less than present value.

D) the net present value is more desired than consumption.

E) the net present value is positive.

A) the net present value has no risk.

B) the net present value is greater than the cost of investment.

C) the net present value is less than present value.

D) the net present value is more desired than consumption.

E) the net present value is positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

11

You have an investment opportunity available to you that requires $400,000. You have no funds available but you will have income of $120,000 this year. The investment will have a payoff $433,000 at the end of the year. If the market rate is 8.25% what is the net present value?

A) $33,000

B) $433,000

C) $0.00

D) $23,100

E) $30,485

A) $33,000

B) $433,000

C) $0.00

D) $23,100

E) $30,485

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

12

One of the functions of financial intermediaries is to make sure the market clears. This means:

A) setting the appropriate interest rates.

B) recording the parties to the transactions.

C) making sure the total amount to be lent equals the total amount to be borrowed.

D) minimizing the spread between rates.

A) setting the appropriate interest rates.

B) recording the parties to the transactions.

C) making sure the total amount to be lent equals the total amount to be borrowed.

D) minimizing the spread between rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the amount of money to be lent is exactly equal to the amount desired to be borrowed then the market is cleared at:

A) the equilibrium interest rate.

B) the marginal rate of substitution.

C) the crossover rate.

D) the short term yield curve rate.

A) the equilibrium interest rate.

B) the marginal rate of substitution.

C) the crossover rate.

D) the short term yield curve rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

14

The consumption opportunity set moves further out when an investment is available because:

A) the total number of alternatives are now greater.

B) the investment is better than what is available in the market.

C) the project rate of return is less than the market rate.

D) the market rate is irrelevant to the investment choice.

A) the total number of alternatives are now greater.

B) the investment is better than what is available in the market.

C) the project rate of return is less than the market rate.

D) the market rate is irrelevant to the investment choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is true?

A) Stockholders prefer corporations to make investments when the net present value is positive.

B) Stockholders prefer corporations to make investments only when the probability of loss is very low.

C) Most corporate charters require a stockholder vote on decisions concerning large investment projects.

D) Stockholders prefer corporations to make all investments with positive net incomes.

A) Stockholders prefer corporations to make investments when the net present value is positive.

B) Stockholders prefer corporations to make investments only when the probability of loss is very low.

C) Most corporate charters require a stockholder vote on decisions concerning large investment projects.

D) Stockholders prefer corporations to make all investments with positive net incomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

16

The separation theorem says that:

A) expected return of a portfolio is separate from its variance. Investment decisions can be made separately from consumption decisions.

B) lending decisions can be made jointly with borrowing decisions.

C) systematic risk and unsystematic risk should be considered separately.

D) variance of a portfolio is separate from its covariance.

A) expected return of a portfolio is separate from its variance. Investment decisions can be made separately from consumption decisions.

B) lending decisions can be made jointly with borrowing decisions.

C) systematic risk and unsystematic risk should be considered separately.

D) variance of a portfolio is separate from its covariance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

17

A lender with no investment opportunities has equal income in period 0 and in period 1. Which of the following correctly describes the consequence of an increase in the interest rate?

A) Consumption in period 0 stays the same while consumption in period 1 decreases.

B) Consumption in period 0 stays the same while consumption in period 1 increases.

C) Consumption in period 0 increases while consumption in period 1 decreases.

D) Consumption in period 0 decreases while consumption in period 1 stays the same.

A) Consumption in period 0 stays the same while consumption in period 1 decreases.

B) Consumption in period 0 stays the same while consumption in period 1 increases.

C) Consumption in period 0 increases while consumption in period 1 decreases.

D) Consumption in period 0 decreases while consumption in period 1 stays the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

18

An individual with no investment opportunities has income of $15,000 in period 0 and income of $10,000 in period 1. If the interest rate is 7%, which of the following points is on the individual's consumption possibility line?

A) $3,000 in period 0 and $21,215 in period 1.

B) $4,000 in period 0 and $21,116 in period 1.

C) $10,000 in period 0 and $15,350 in period 1.

D) $16,000 in period 0 and $9,000 in period.

E) $18,800 in period 0 and $6,200 in period 1.

A) $3,000 in period 0 and $21,215 in period 1.

B) $4,000 in period 0 and $21,116 in period 1.

C) $10,000 in period 0 and $15,350 in period 1.

D) $16,000 in period 0 and $9,000 in period.

E) $18,800 in period 0 and $6,200 in period 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

19

Components of a loan which is fully paid back are:

A) the interest and financial market payments.

B) the principle repayment and the down payment.

C) the interest payment and principal repayment.

D) the down payment and interest payment.

A) the interest and financial market payments.

B) the principle repayment and the down payment.

C) the interest payment and principal repayment.

D) the down payment and interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following conditions do not characterize perfect capital markets?

A) Trading is costless; access to the financial markets is free.

B) Information about borrowing and lending opportunities is readily available.

C) There are many traders; no single trader can have a significant impact on market prices.

D) A few influential firms can control the financial market.

A) Trading is costless; access to the financial markets is free.

B) Information about borrowing and lending opportunities is readily available.

C) There are many traders; no single trader can have a significant impact on market prices.

D) A few influential firms can control the financial market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

21

A corporation has the following opportunity to invest in a project with a return of $42,000 in one period. The current investment is $46,900. The financial market rate is 14%.

The financial market rate is 5%. Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.) NPV = -42,000 + (46,900/1.05) = -

The financial market rate is 5%. Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.) NPV = -42,000 + (46,900/1.05) = -

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

22

A corporation has the following opportunity to invest in a project with a return of $42,000 in one period. The current investment is $46,900. The financial market rate is 14%.

If the corporation had cash on hand of $25,000 before raising any capital for the investment and the financial market rate is 9%. How much will the current shareholders earn.?

If the corporation had cash on hand of $25,000 before raising any capital for the investment and the financial market rate is 9%. How much will the current shareholders earn.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

23

The separation theorem in financial markets is fundamental to allowing managers to maximize all shareholders wealth. Explain the separation theorem and how the financial markets provide for all different types of investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

24

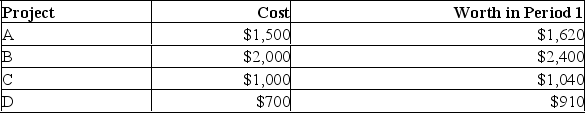

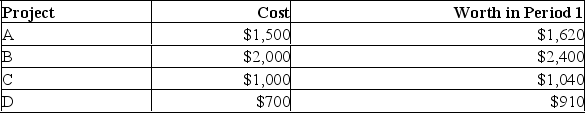

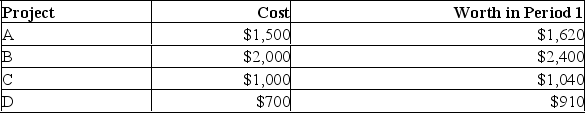

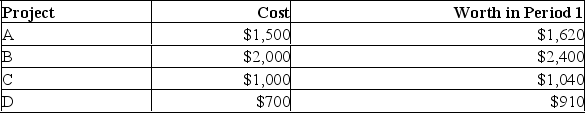

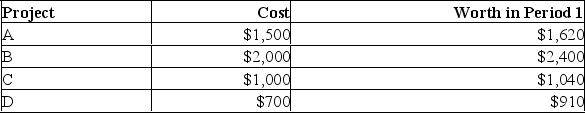

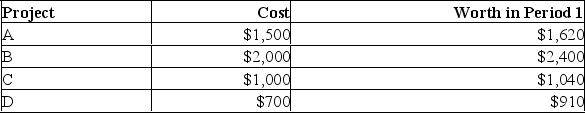

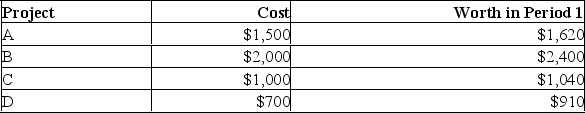

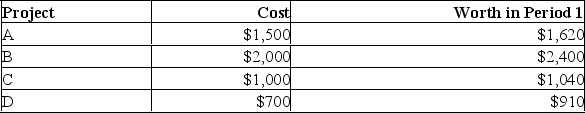

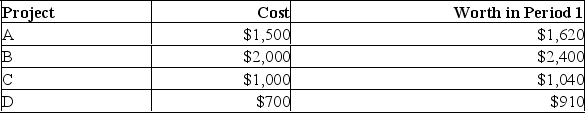

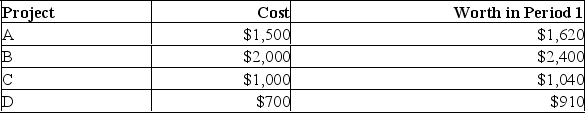

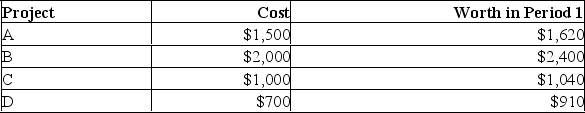

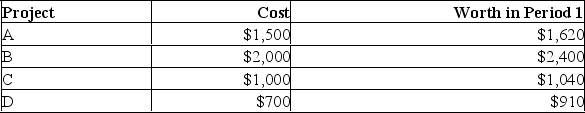

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $10,000 in period 0 and $25,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $10,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 1 if the individual consumes $20,000 in period 0 and the individual follows the NPV rule?

An individual has income of $10,000 in period 0 and $25,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $10,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 1 if the individual consumes $20,000 in period 0 and the individual follows the NPV rule?

An individual has income of $10,000 in period 0 and $25,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $10,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 1 if the individual consumes $20,000 in period 0 and the individual follows the NPV rule?

An individual has income of $10,000 in period 0 and $25,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $10,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 1 if the individual consumes $20,000 in period 0 and the individual follows the NPV rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

25

Diagrams illustrating the consumption choices for a corporation show the two period trade-off as originating in the northwest quadrant, or (-X, Y), because:

A) corporations have a tendency to waste resources.

B) unlike an individual, corporations have no consumption endowment.

C) each investor cannot maximize their own consumption.

D) people differ in tastes and preferences.

A) corporations have a tendency to waste resources.

B) unlike an individual, corporations have no consumption endowment.

C) each investor cannot maximize their own consumption.

D) people differ in tastes and preferences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

26

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects?

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects?

D.

Period 1 consumption is $1,620 + $2,400 + $910 = $4,930

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects?

Suppose that the market interest rate falls to 5%. What is the maximum possible consumption in period 1 if the individual takes on the optimal set of investment projects? D.

Period 1 consumption is $1,620 + $2,400 + $910 = $4,930

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

27

An individual has $60,000 income in period 0 and $30,000 income in period 1. If the individual desires to consume $19,000 in period 1 and the market interest rate is 8%, what is the maximum amount of consumption in period 0?

A) $50,000

B) $70,185

C) $71,000

D) $61,880

A) $50,000

B) $70,185

C) $71,000

D) $61,880

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

28

Shareholders of corporations generally do not vote on every investment decision but depend on managers to maximize value by:

A) choosing the highest net income projects.

B) investing at the market rate of return.

C) buying shares back from investors.

D) following the NPV rule to choose investments.

A) choosing the highest net income projects.

B) investing at the market rate of return.

C) buying shares back from investors.

D) following the NPV rule to choose investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

29

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

If the market interest rate is 11%, what is the optimal investment? What is maximum consumption in period 1 if the individual takes on the optimal set of investment projects and consumes all other period 0 income?

If the market interest rate is 11%, what is the optimal investment? What is maximum consumption in period 1 if the individual takes on the optimal set of investment projects and consumes all other period 0 income?

D.

Period 1 consumption is $2,400 + $910 = $3,310

If the market interest rate is 11%, what is the optimal investment? What is maximum consumption in period 1 if the individual takes on the optimal set of investment projects and consumes all other period 0 income?

If the market interest rate is 11%, what is the optimal investment? What is maximum consumption in period 1 if the individual takes on the optimal set of investment projects and consumes all other period 0 income? D.

Period 1 consumption is $2,400 + $910 = $3,310

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

30

Corporate managers can maximize shareholder wealth by choosing positive NPV projects because:

A) all investors have the same preferences.

B) the unhappy shareholders can sell off shares.

C) the separation theorem in financial markets states that all investors will be satisfied with the same investment decision regardless of personal preferences.

D) managers are wiser than shareholders regarding investments.

A) all investors have the same preferences.

B) the unhappy shareholders can sell off shares.

C) the separation theorem in financial markets states that all investors will be satisfied with the same investment decision regardless of personal preferences.

D) managers are wiser than shareholders regarding investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

31

A corporation has the following opportunity to invest in a project with a return of $42,000 in one period. The current investment is $46,900. The financial market rate is 14%.

Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.)

Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

32

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

An individual has income of $20,000 in period 0 and $42,000 in period 1. An investment opportunity that costs $15,000 in period 0 is worth $18,000 in period 1. The market interest rate is 6%. What is the maximum possible consumption in period 1 if the individual consumes $16,000 in period 0 and follows the NPV rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

33

An individual has income of $35,000 in period 0 and $40,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,000 in period 1. What is the maximum possible consumption in period 0 if the individual consumes $50,000 in period 1 when the market rate of interest is 8%?

A) $26,000

B) $26,667

C) $44,000

D) $44,720

A) $26,000

B) $26,667

C) $44,000

D) $44,720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the corporation had cash on hand of $25,000 before raising any capital for the investment and the financial market rate is 9%. Graph and explain the investment choice the corporation should make. (Hint: Determine the NPV.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

35

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

An individual has income of $15,000 in period 0 and $20,000 in period 1. An investment opportunity that costs $10,000 in period 0 is worth $11,500 in period 1. The market interest rate is 8%. What is the maximum possible consumption in period 0 if the individual consumes $26,000 in period 1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

36

An individual has an income of $4,000 in period 0 and $0 in period 1. The individual has the potential investment opportunities given below:

At what market rates of interest would make the individual indifferent between (1) all consumption in Period 0 and none in Period 1 and (2) no consumption in Period 0 and all consumption in Period 1?

At what market rates of interest would make the individual indifferent between (1) all consumption in Period 0 and none in Period 1 and (2) no consumption in Period 0 and all consumption in Period 1?

At what market rates of interest would make the individual indifferent between (1) all consumption in Period 0 and none in Period 1 and (2) no consumption in Period 0 and all consumption in Period 1?

At what market rates of interest would make the individual indifferent between (1) all consumption in Period 0 and none in Period 1 and (2) no consumption in Period 0 and all consumption in Period 1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck