Deck 6: How to Value Bonds and Stocks

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 6: How to Value Bonds and Stocks

1

If its yield to maturity is less than its coupon rate, a bond will sell at a ____, and increases in market interest rates will ____.

A) discount; decrease this discount.

B) discount; increase this discount.

C) premium; decrease this premium.

D) premium; increase this premium.

A) discount; decrease this discount.

B) discount; increase this discount.

C) premium; decrease this premium.

D) premium; increase this premium.

premium; decrease this premium.

2

All else constant, a coupon bond that is selling at a premium, must have:

A) a coupon rate that is equal to the yield to maturity.

B) a market price that is less than par value.

C) semi-annual interest payments.

D) a yield to maturity that is less than the coupon rate.

A) a coupon rate that is equal to the yield to maturity.

B) a market price that is less than par value.

C) semi-annual interest payments.

D) a yield to maturity that is less than the coupon rate.

a yield to maturity that is less than the coupon rate.

3

A bond is listed in the Financial Post as a 8.800 of September 22/25. This bonds pays:

A) $88.25 in July and January.

B) $44 in July and January.

C) $88.25 in July.

D) $88 in July.

A) $88.25 in July and January.

B) $44 in July and January.

C) $88.25 in July.

D) $88 in July.

$44 in July and January.

4

Gugenheim, Inc. offers a 7% coupon bond with annual payments. The yield to maturity is 5.85% and the maturity date is 9 years. What is the market price of a $1,000 face value bond?

A) $742.66

B) $868.67

C) $869.67

D) $1,078.73

E) $1,079.59

A) $742.66

B) $868.67

C) $869.67

D) $1,078.73

E) $1,079.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following amounts is closest to the value of a bond that pays $55 semiannually and has an effective semiannual interest rate of 5%? The face value is $1,000 and the bond matures in 3 years. There are exactly six months before the first interest payment.

A) $1,014.

B) $1,055.

C) $888.

D) $1,025.

E) $1,000.

A) $1,014.

B) $1,055.

C) $888.

D) $1,025.

E) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

Consider a bond which pays 7% semi-annually and has 8 years to maturity. The market requires an interest rate of 8% on bonds of this risk. What is this bond's price?

A) $942.50

B) $911.52

C) $941.74

D) $1064.81

A) $942.50

B) $911.52

C) $941.74

D) $1064.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

A consol:

A) always sells at a premium.

B) always sells at a discount.

C) is an agent that makes interest payments.

D) has no maturity.

E) pays no interest.

A) always sells at a premium.

B) always sells at a discount.

C) is an agent that makes interest payments.

D) has no maturity.

E) pays no interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

Part of the Rock, Inc. has a 6% coupon bond that matures in 11 years. The bond pays interest semiannually. What is the market price of a $1,000 face value bond if the yield to maturity is 12.9%?

A) $434.59

B) $580.86

C) $600.34

D) $605.92

E) $947.87

A) $434.59

B) $580.86

C) $600.34

D) $605.92

E) $947.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

Your firm offers a 10-year, zero coupon bond. The yield to maturity is 8.8%. What is the current market price of a $1,000 face value bond?

A) $430.24

B) $473.26

C) $835.56

D) $919.12

E) $1,088.00

A) $430.24

B) $473.26

C) $835.56

D) $919.12

E) $1,088.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

The newly issued bonds of the Cain Corp. offer a 6% coupon with semiannual interest payments. The bonds are currently priced at par value. The effective annual rate provided by these bonds must be:

A) equal to 3%.

B) greater than 3% but less than 4%.

C) equal to 6%.

D) greater than 6% but less than 7%.

E) equal to 12%.

A) equal to 3%.

B) greater than 3% but less than 4%.

C) equal to 6%.

D) greater than 6% but less than 7%.

E) equal to 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

A consol is selling at $1,200 with an interest rate of 5%. How much would this bond sell for if the interest rate were 8% instead?

A) $200.

B) $750.

C) $1,650.

D) $1,920.

A) $200.

B) $750.

C) $1,650.

D) $1,920.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

All else constant, a bond will sell at _____ when the yield to maturity is _____ the coupon rate.

A) a premium; higher than

B) a premium; equal to

C) at par; higher than

D) a discount; higher than

A) a premium; higher than

B) a premium; equal to

C) at par; higher than

D) a discount; higher than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

The zero coupon bonds of Quipta Inc. have a market price of $394.47, a face value of $1,000, and a yield to maturity of 6.87%. How many years is it until this bond matures?

A) 7 years

B) 10 years

C) 14 years

D) 18 years

E) 21 years

A) 7 years

B) 10 years

C) 14 years

D) 18 years

E) 21 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

A level coupon bond:

A) pays the same principal every period.

B) pays the same taxes every period.

C) is a zero-coupon annuity.

D) is an annuity over the life of the bond.

A) pays the same principal every period.

B) pays the same taxes every period.

C) is a zero-coupon annuity.

D) is an annuity over the life of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

The coupon of a bond is:

A) its time period to maturity.

B) its current price.

C) its face value.

D) its yield to maturity.

E) the amount of the interest payment.

A) its time period to maturity.

B) its current price.

C) its face value.

D) its yield to maturity.

E) the amount of the interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

A bond with a 7% coupon that pays interest semi-annually and is priced at par will have a market price of _____ and interest payments in the amount of _____ each.

A) $1,007; $70

B) $1,070; $35

C) $1,070; $70

D) $1,000; $35

A) $1,007; $70

B) $1,070; $35

C) $1,070; $70

D) $1,000; $35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

The value of a 20 year zero-coupon bond when the market required rate of return of 9% (semi-annual) is:

A) $414.64.

B) $318.38.

C) $171.93.

D) $178.43.

A) $414.64.

B) $318.38.

C) $171.93.

D) $178.43.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

Zero-coupon bonds:

A) always sell at a discount before maturity.

B) always sell at a premium before maturity.

C) have no face value.

D) have no maturity.

A) always sell at a discount before maturity.

B) always sell at a premium before maturity.

C) have no face value.

D) have no maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

Queen and Bees, Inc. offers a 7% coupon bond with semiannual payments and a yield to maturity of 7.73%. The bonds mature in 9 years. What is the market price of a $1,000 face value bond?

A) $953.28

B) $963.88

C) $1,108.16

D) $1,401.26

E) $1,401.86

A) $953.28

B) $963.88

C) $1,108.16

D) $1,401.26

E) $1,401.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

A pure discount bond:

A) has no face value.

B) pays interest annually.

C) pays interest semiannually.

D) pays no coupon.

A) has no face value.

B) pays interest annually.

C) pays interest semiannually.

D) pays no coupon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Double Dip Co. is expecting its ice cream sales to decline due to the increased interest in healthy eating. Thus, the company has announced that it will be reducing its annual dividend by 5% a year for the next two years. After that, it will maintain a constant dividend of $1 a share. Two weeks ago, the company paid a dividend of $1.40 per share. What is this stock worth if you require a 9% rate of return?

A) $10.86

B) $11.11

C) $11.64

D) $12.98

E) $14.23

A) $10.86

B) $11.11

C) $11.64

D) $12.98

E) $14.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following values is closest to the amount that should be paid for a stock that will pay a dividend of $10 one year from now and $11 two years from now? The stock will be sold in 2 years for an estimated price of $120. The appropriate discount rate is 9%.

A) $114.

B) $119.

C) $124.

D) $129.

E) $138.

A) $114.

B) $119.

C) $124.

D) $129.

E) $138.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

The No-zip Snap Company had net earnings of $127,000 this past year. Dividends were paid of $38,100 on the company's equity of $1,587,500. The estimated growth for No-Zip is:

A) 2.4%

B) 5.6%

C) 7.2%

D) 16.8%

A) 2.4%

B) 5.6%

C) 7.2%

D) 16.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

Martha's Vineyard recently paid a $3.60 annual dividend on its common stock. This dividend increases at an average rate of 3.5% per year. The stock is currently selling for $62.10 a share. What is the market rate of return?

A) 2.5%

B) 3.5%

C) 5.5%

D) 6.0%

E) 9.5%

A) 2.5%

B) 3.5%

C) 5.5%

D) 6.0%

E) 9.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

The dividend growth rate is equal to the product of what two ratios?

A) ROA, current ratio.

B) ROE, retention ratio.

C) PM, ROA.

D) ROA, ROE.

A) ROA, current ratio.

B) ROE, retention ratio.

C) PM, ROA.

D) ROA, ROE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following amounts is closest to what should be paid for Overland common stock? Overland has just paid a dividend of $2.25. These dividends are expected to grow at a rate of 5% in the foreseeable future. The required rate of return is 11%.

A) $20.45

B) $21.48

C) $37.50

D) $39.38

E) $47.70

A) $20.45

B) $21.48

C) $37.50

D) $39.38

E) $47.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

A stock you are interested in paid a dividend of $1 last month. The anticipated growth rate in dividends and earnings is 25% for the next 2 years before settling down to a constant 5% growth rate. The discount rate is 12%. Calculate the expected price of the stock.

A) $15.38

B) $20.50

C) $21.05

D) $22.27

E) $26.14

A) $15.38

B) $20.50

C) $21.05

D) $22.27

E) $26.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

The No-zip Snap Company had net earnings of $127,000 this past year. Dividends were paid of $38,100 on the company's equity of $1,587,500. If No-Zip has 100,000 shares outstanding with a current market price of $11 5/8 per share, what is the required rate of return?

A) 9%

B) 6%

C) 4.2%

D) 14%

A) 9%

B) 6%

C) 4.2%

D) 14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a company is currently paying $.40 in dividends and they are expected to grow at 7% for the next 6 years and then grow at 4% thereafter the dividend expected in year 8 is:

A) $4.33.

B) $0.65.

C) $4.39.

D) $0.69.

E) $0.67.

A) $4.33.

B) $0.65.

C) $4.39.

D) $0.69.

E) $0.67.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

Mortgage Instruments Inc. is expected to pay dividends of $1.03 next year. The company just paid dividends of $1. This growth rate is expected to continue. How much should be paid for Mortgage Instruments stock just after the dividend if the appropriate discount rate is 5%?

A) $20.

B) $21.

C) $34.

D) $52.

A) $20.

B) $21.

C) $34.

D) $52.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

A 12-year, 5% coupon bond pays interest annually. The bond has a face value of $1,000. What is the percentage change in the price of this bond if the market yield rises to 6% from the current yield of 4.5%?

A) 11.11% decrease

B) 12.38% decrease

C) 12.38% increase

D) 14.13% decrease

E) 14.13% increase

A) 11.11% decrease

B) 12.38% decrease

C) 12.38% increase

D) 14.13% decrease

E) 14.13% increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

What would be the maximum an investor should pay for the common stock of a firm that has no growth opportunities but pays a dividend of $1.36 per year? The next dividend will be paid in exactly 1 year. The required rate of return is 12.5%.

A) $17.00

B) $9.52

C) $10.88

D) $12.24

A) $17.00

B) $9.52

C) $10.88

D) $12.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following amounts is closest to what should be paid for Overland common stock? Overland has just paid a dividend of $2.25. These dividends are expected to grow at a rate of 5% in the foreseeable future. The risk of this company suggests that future cash flows should be discounted at a rate of 11%.

A) $39.38

B) $37.50

C) $21.48

D) $20.45

A) $39.38

B) $37.50

C) $21.48

D) $20.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

Zeta Corporation has issued a $1,000 face value zero-coupon bond. Which of the following values is closest to the correct price for the bond if the appropriate discount rate is 4% and the bond matures in 8 years?

A) $968.

B) $731.

C) $1,000.

D) $1,125.

A) $968.

B) $731.

C) $1,000.

D) $1,125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

Jackson Central has a 6-year, 8% annual coupon bond with a $1,000 par value. Earls Enterprises has a 12-year, 8% annual coupon bond with a $1,000 par value. Both bonds currently have a yield to maturity of 6%. Which of the following statements are correct if the market yield increases to 7%?

A) Both bonds would decrease in value by 4.61%.

B) The Earls bond will increase in value by $88.25.

C) The Jackson bond will increase in value by 4.61%.

D) The Earls bond will decrease in value by 7.56%.

E) The Earls bond will decrease in value by $50.68.

A) Both bonds would decrease in value by 4.61%.

B) The Earls bond will increase in value by $88.25.

C) The Jackson bond will increase in value by 4.61%.

D) The Earls bond will decrease in value by 7.56%.

E) The Earls bond will decrease in value by $50.68.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

Weisbro and Sons common stock sells for $21 a share and pays an annual dividend that increases by 5% annually. The market rate of return on this stock is 9%. What is the amount of the last dividend paid by Weisbro and Sons?

A) $.77

B) $.80

C) $.84

D) $.87

E) $.88

A) $.77

B) $.80

C) $.84

D) $.87

E) $.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

The value of common stock today depends on:

A) the expected future holding period and the discount rate.

B) the expected future dividends and the capital gains.

C) the expected future dividends, capital gains and the discount rate.

D) the expected future holding period and capital gains.

A) the expected future holding period and the discount rate.

B) the expected future dividends and the capital gains.

C) the expected future dividends, capital gains and the discount rate.

D) the expected future holding period and capital gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

S&P Inc. common stock sells for $39.86 a share at a market rate of return of 9.5%. The company just paid its annual dividend of $1.20. What is the rate of growth of its dividend?

A) 5.2%

B) 5.5%

C) 5.9%

D) 6.0%

E) 6.3%

A) 5.2%

B) 5.5%

C) 5.9%

D) 6.0%

E) 6.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Felix Corp. projects to pay a dividend of $.75 next year and then have it grow at 12% for the following 3 years before growing at 8% indefinitely thereafter. The equity has a required return of 10% in the market. The price of the stock should be ___.

A) $9.38

B) $17.05

C) $41.67

D) $59.80

E) $62.38

A) $9.38

B) $17.05

C) $41.67

D) $59.80

E) $62.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Bell Weather Co. is a new firm in a rapidly growing industry. The company is planning on increasing its annual dividend by 20% a year for the next four years and then decreasing the growth rate to 5% per year. The company just paid its annual dividend in the amount of $1.00 per share. What is the current value of one share if the required rate of return is 9.25%?

A) $35.63

B) $38.19

C) $41.05

D) $43.19

E) $45.81

A) $35.63

B) $38.19

C) $41.05

D) $43.19

E) $45.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

Shares of common stock of the Samson Inc. offer an expected total return of 12%. The dividend is increasing at a constant 8% per year. The dividend yield must be:

A) -4%.

B) 4%.

C) 8%.

D) 12%.

E) 20%.

A) -4%.

B) 4%.

C) 8%.

D) 12%.

E) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

The discount rate can be thought of as the sum of what two parts?

A) ROE, retention ratio.

B) Dividend yield, growth rate in dividends.

C) Price, growth rate in dividends.

D) Dividend yield, price.

E) ROA, ROE.

A) ROE, retention ratio.

B) Dividend yield, growth rate in dividends.

C) Price, growth rate in dividends.

D) Dividend yield, price.

E) ROA, ROE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

Spot rates are the interest rates that prevail in the market from:

A) the current period until the sale of the security.

B) time zero until the asset's maturity.

C) one period forward to maturity.

D) some unknown future period.

A) the current period until the sale of the security.

B) time zero until the asset's maturity.

C) one period forward to maturity.

D) some unknown future period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

The P/E ratio is a multiple of earnings that investors pay for a stock. The P/E is __________ related to growth, __________ related to the discount rate, and __________ related to the stock's risk.

A) positively; positively; negatively.

B) negatively; positively; positively.

C) positively; negatively; negatively.

D) negatively; negatively; positively.

A) positively; positively; negatively.

B) negatively; positively; positively.

C) positively; negatively; negatively.

D) negatively; negatively; positively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

LCP, a newly formed medical group, is currently paying dividends of $.50. These dividends are expected to grow at a 20% rate for the next 5 years and at a 3% rate thereafter. What is the value of the stock if the appropriate discount rate is 12%?

A) $8.08.

B) $11.17.

C) $14.22.

D) $17.32.

E) $30.90.

A) $8.08.

B) $11.17.

C) $14.22.

D) $17.32.

E) $30.90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

Angelina's made two announcements concerning its common stock today. First, the company announced that its next annual dividend has been set at $2.16 a share. Secondly, the company announced that all future dividends will increase by 4% annually. What is the maximum amount you should pay to purchase a share of Angelina's stock if your goal is to earn a 10% rate of return?

A) $21.60

B) $22.46

C) $27.44

D) $34.62

E) $36.00

A) $21.60

B) $22.46

C) $27.44

D) $34.62

E) $36.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

The net present value of a growth opportunity, NPVGO, can be defined as:

A) the present value of an investment in one new project.

B) the steady growth in dividends from continual re-investment with positive NPV.

C) continual reinvestment of earnings when r < g.

D) a single period investment when r > g.

A) the present value of an investment in one new project.

B) the steady growth in dividends from continual re-investment with positive NPV.

C) continual reinvestment of earnings when r < g.

D) a single period investment when r > g.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

The common stock of Eddie's Engines Corp. sells for $25.71 a share. The stock is expected to pay $1.80 per share next month when the annual dividend is distributed. Eddie's has established a pattern of increasing its dividends by 4% annually and expects to continue doing so. What is the market rate of return on this stock?

A) 7%

B) 9%

C) 11%

D) 13%

E) 15%

A) 7%

B) 9%

C) 11%

D) 13%

E) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

A firm is known as a 'Cash Cow':

A) because it has several good growth opportunities.

B) because it pays out all of its non-growing earnings.

C) because dividends are growing at a rapid rate.

D) because the discount rate is extremely low.

A) because it has several good growth opportunities.

B) because it pays out all of its non-growing earnings.

C) because dividends are growing at a rapid rate.

D) because the discount rate is extremely low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

Firms with higher expected growth opportunities usually sell for:

A) a lower price earnings multiple.

B) the same price earnings multiple for all firms.

C) a higher price earnings multiple.

D) a price that depends on the payout ratio only.

E) a price independent of the P/E.

A) a lower price earnings multiple.

B) the same price earnings multiple for all firms.

C) a higher price earnings multiple.

D) a price that depends on the payout ratio only.

E) a price independent of the P/E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the quoted dividend yield in the paper was 2.2% and the dividend was listed as $0.72 what price is used in the calculation of dividend yield?

A) the day open of $32.15.

B) the day low of $32.

C) the day close of $32.73.

D) the day high of $33.50.

A) the day open of $32.15.

B) the day low of $32.

C) the day close of $32.73.

D) the day high of $33.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

A firm's value increases when it invests in projects that have:

A) a rate of return less than the discount rate.

B) a rate of return equal to the discount rate.

C) a rate of return greater than the discount rate.

D) a rate of return equal to or less than the discount rate.

A) a rate of return less than the discount rate.

B) a rate of return equal to the discount rate.

C) a rate of return greater than the discount rate.

D) a rate of return equal to or less than the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

A corporate bond with a face value of $1,000 matures in 4 years and has an 8% coupon paid at the end of each year. The current price of the bond is $932. What is the yield to maturity for this bond?

A) 5.05%.

B) 8.58%.

C) 10.15%.

D) 11.92%.

E) 6.48%.

A) 5.05%.

B) 8.58%.

C) 10.15%.

D) 11.92%.

E) 6.48%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

The average Japanese P/E ratio was reported as between 40 and 100 in recent years while the average U.S. P/E ratio was 25. The reason for the higher Japanese P/E ratio has been partially explained by:

A) growth opportunities over stated earnings.

B) understated earnings and low interest rates.

C) overstated earnings and low interest rates.

D) understated earnings and overstated growth opportunities.

E) low interest rates and greater growth opportunities.

A) growth opportunities over stated earnings.

B) understated earnings and low interest rates.

C) overstated earnings and low interest rates.

D) understated earnings and overstated growth opportunities.

E) low interest rates and greater growth opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

The term structure can be described as the:

A) relationship of spot rates of interest and bond prices.

B) relationship of coupon rates and money rates.

C) relationship of spot rates of interest and maturity.

D) relationship of coupon rates and maturity.

A) relationship of spot rates of interest and bond prices.

B) relationship of coupon rates and money rates.

C) relationship of spot rates of interest and maturity.

D) relationship of coupon rates and maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Stand Still Co. has been earning $1 per share on 400,000 shares, and paying out all of the earnings. The discount rate for a company of this risk is 10%. The company has an investment opportunity with a cost of $1,500,000 and expects to earn $230,000 after taxes, but they must reinvest 35% of these earnings to continue to maintain the expansion in earnings. What is the value of the company without the investment and what is the value with the investment?

A) $200,000; $1,500,000

B) $4,000,000; $6,600,000

C) $4,000,000; $3,995,000

D) $400,000; $15,000,000

A) $200,000; $1,500,000

B) $4,000,000; $6,600,000

C) $4,000,000; $3,995,000

D) $400,000; $15,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

Assume that you are using the dividend growth model to value stocks. If you expect the market rate of return to increase across the board on all equity securities, then you should also expect the:

A) market values of all stocks to increase, all else constant.

B) market values of all stocks to remain constant as the dividend growth will offset the increase in the market rate.

C) market values of all stocks to decrease, all else constant.

D) stocks that do not pay dividends to decrease in price while the dividend-paying stocks maintain a constant price.

E) dividend growth rates to increase to offset this change.

A) market values of all stocks to increase, all else constant.

B) market values of all stocks to remain constant as the dividend growth will offset the increase in the market rate.

C) market values of all stocks to decrease, all else constant.

D) stocks that do not pay dividends to decrease in price while the dividend-paying stocks maintain a constant price.

E) dividend growth rates to increase to offset this change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

ABC Imports paid a $1.00 per share annual dividend last week. Dividends are expected to increase by 5% annually. What is one share of this stock worth to you today if the appropriate discount rate is 14%?

A) $7.14

B) $7.50

C) $11.11

D) $11.67

E) $12.25

A) $7.14

B) $7.50

C) $11.11

D) $11.67

E) $12.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

The closing price of a stock is quoted at 22.87, with a P/E of 26 and a net change of 1.42. Based on this information, which one of the following statements is correct?

A) The closing price on the previous day was $1.42 higher than today's closing price.

B) A dealer will buy the stock at $22.87 and sell it at $26 a share.

C) The stock increased in value between yesterday's close and today's close by $.0142.

D) The earnings per share are equal to 1/26th of $22.87.

E) The earnings per share have increased by $1.42 this year.

A) The closing price on the previous day was $1.42 higher than today's closing price.

B) A dealer will buy the stock at $22.87 and sell it at $26 a share.

C) The stock increased in value between yesterday's close and today's close by $.0142.

D) The earnings per share are equal to 1/26th of $22.87.

E) The earnings per share have increased by $1.42 this year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

The discount rate in equity valuation is composed entirely of:

A) the dividends paid and the capital gains yield.

B) the dividend yield and the growth rate.

C) the dividends paid and the growth rate.

D) the capital gains earned and the growth rate.

E) the capital gains earned and the dividends paid.

A) the dividends paid and the capital gains yield.

B) the dividend yield and the growth rate.

C) the dividends paid and the growth rate.

D) the capital gains earned and the growth rate.

E) the capital gains earned and the dividends paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

Given r1 = .050 and r2 = .054, what can you deduce about investor's expectations of future short-term interest rates if the expectations hypothesis is correct?

A) Investors expect future short-term rates to be greater than current short-term rates.

B) Investors expect future short-term rates to be less than current short-term rates.

C) Investors expect future short-term rates to be equal to current short-term rates.

D) Investors expect future short-term rates to be higher than current forward rates.

A) Investors expect future short-term rates to be greater than current short-term rates.

B) Investors expect future short-term rates to be less than current short-term rates.

C) Investors expect future short-term rates to be equal to current short-term rates.

D) Investors expect future short-term rates to be higher than current forward rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

The market rate of interest on 2 year bonds is 6.25% while the rate on a one year bond maturing on one year is 5.50%. The forward rate on a one year bond one year from now is 6.5%. The liquidity premium to induce investors to hold the 2 year bond is:

A) 0.250%.

B) 0.005%.

C) 0.125%.

D) 0.500%.

A) 0.250%.

B) 0.005%.

C) 0.125%.

D) 0.500%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

Suppose that there are three zero coupon bonds with maturity date 1 year, 2 year and 3 year respectively. The current price of the 1 year, 2 year and 3 year bonds respectively are $826.45, $718.18 and $640.66 respectively. The yield to maturity of the first year bond is:

A) 21%.

B) 18%.

C) 12%.

D) 11%.

A) 21%.

B) 18%.

C) 12%.

D) 11%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Explain why some bond investors are subject to liquidity risk and/or default risk. How does each of these risks affect the yield of a bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

A forward rate prevailing from period three through to period four can be:

A) readily observed in the market place.

B) extracted from high coupon bonds.

C) extracted from spot rates with 2 and 3 year maturities.

D) extracted from spot rates with 3 and 4 years to maturity.

A) readily observed in the market place.

B) extracted from high coupon bonds.

C) extracted from spot rates with 2 and 3 year maturities.

D) extracted from spot rates with 3 and 4 years to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

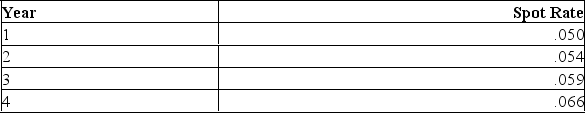

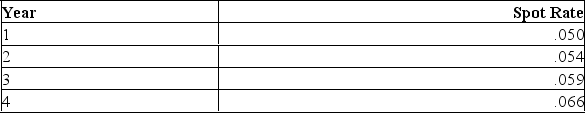

Given the following set of spot rates:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

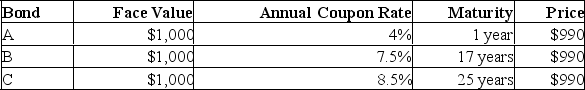

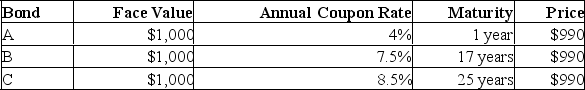

Given the opportunity to invest in one of the three bonds listed below, which would you purchase? Assume an interest rate of 7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

The liquidity preference hypothesis explains that the 2nd year forward rates are set higher than the expected spot rate over year two because:

A) of a downward sloping yield curve.

B) of long term rates being greater than short term rates.

C) investors must be induced to buy the riskier two-year bond.

D) two year bonds are less risk than one year's bonds when rates are higher.

A) of a downward sloping yield curve.

B) of long term rates being greater than short term rates.

C) investors must be induced to buy the riskier two-year bond.

D) two year bonds are less risk than one year's bonds when rates are higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is true?

A) The spot rate is a weighted average of the yields to maturity.

B) The spot rate is always higher than the yield to maturity.

C) The yield to maturity is a weighted average of spot rates.

D) The yield to maturity is always higher than the spot rate.

A) The spot rate is a weighted average of the yields to maturity.

B) The spot rate is always higher than the yield to maturity.

C) The yield to maturity is a weighted average of spot rates.

D) The yield to maturity is always higher than the spot rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose that a bond that will mature in two years has a face value of $1000 and 20% coupon rate. The one year spot market interest rate is 13% and the expected second period's forward rate is 12%. According to the expectation hypothesis, the two year spot rate is:

A) 11.50%.

B) 9.12%.

C) 12.74%.

D) 7.00%.

A) 11.50%.

B) 9.12%.

C) 12.74%.

D) 7.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

In the above example, the price of the bond is

A) $1121.

B) $1000.

C) $1325.

D) $1200.

A) $1121.

B) $1000.

C) $1325.

D) $1200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

A number of publicly traded firms pay no dividends yet investors are willing to buy shares in these firms. How is this possible? Does this violate our basic principle of stock valuation? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

What can you deduce about forward rates of interest if the liquidity-preference hypothesis of the term structure is correct?

A) The forward rate is less than investor's expectations of next year's one-year interest rate.

B) The forward rate is greater than investor's expectations of next year's one-year interest rate.

C) The forward rate is equal to investor's expectations of next year's one-year interest rate.

D) The forward rate is equal to the risk-free interest rate.

A) The forward rate is less than investor's expectations of next year's one-year interest rate.

B) The forward rate is greater than investor's expectations of next year's one-year interest rate.

C) The forward rate is equal to investor's expectations of next year's one-year interest rate.

D) The forward rate is equal to the risk-free interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Show that a firm with earnings of $10,000 a year in perpetuity would be better off paying all earnings in dividends rather than investing 25% of its earnings (also in perpetuity) in projects earning 14% if its discount rate is 15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose that an investor disagrees with market expectations and feels that the forward rate prevailing in the market is higher than what it should be, then the investor can make profit by:

A) selling a bond now and buying it up later.

B) selling a bond now.

C) buying a bond now.

D) buying a bond now and selling it later.

A) selling a bond now and buying it up later.

B) selling a bond now.

C) buying a bond now.

D) buying a bond now and selling it later.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose that a bond that will mature in three years is now traded at $99.83. The annual coupon payment is $5.635. Its yield to maturity is

A) 3.42%.

B) 5.10%.

C) 5.69%.

D) 7.20%.

A) 3.42%.

B) 5.10%.

C) 5.69%.

D) 7.20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following amounts is closest to the present value of a bond with coupon payment of $80 and a face value of $1,000? Interest payments are made at the end of each of 2 years, and the bond matures in 2 years. The spot interest rate for the first year is 10%, and the spot interest rate for the second year is 12%.

A) $910

B) $934

C) $949

D) $1,000

A) $910

B) $934

C) $949

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

The expectations hypothesis states that the forward rate over second period is:

A) set to the spot rate expected to prevail over the second period.

B) equal to the first period spot rate.

C) always greater than the spot rate in period one.

D) always greater than the period 3 forward rate.

A) set to the spot rate expected to prevail over the second period.

B) equal to the first period spot rate.

C) always greater than the spot rate in period one.

D) always greater than the period 3 forward rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

In the above problem, the yield to maturity of the 2 year bond is:

A) 21%.

B) 18%.

C) 12%.

D) 11%.

A) 21%.

B) 18%.

C) 12%.

D) 11%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Term structure refers to:

A) how interest rates vary over different structures of bonds.

B) how interest rates vary over different structures of corporate securities.

C) how interest rates vary over time with otherwise identical bonds.

D) the maturity dates of a bond issue.

A) how interest rates vary over different structures of bonds.

B) how interest rates vary over different structures of corporate securities.

C) how interest rates vary over time with otherwise identical bonds.

D) the maturity dates of a bond issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck