Deck 2: Accounting Statements and Cash Flow

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/59

العب

ملء الشاشة (f)

Deck 2: Accounting Statements and Cash Flow

1

The TimeNow Corporation had 2017 fixed assets of $1345, current assets of $260, current liabilities of $180 and shareholder's equity of $775. The 2016 fixed assets were $1300, current assets of $220, current liabilities of 300, long-term liabilities of $390 and shareholder's equity of $750. What was the change in net working capital for TimeNow in 2017?

A) 80.

B) 20.

C) 60.

D) 160.

A) 80.

B) 20.

C) 60.

D) 160.

160.

2

Which of the following statements concerning the income statement is not true?

A) It measures performance over a specific period of time.

B) It determines after-tax income of the firm.

C) It includes deferred taxes.

D) It does not include depreciation.

E) It treats interest as an expense or revenue.

A) It measures performance over a specific period of time.

B) It determines after-tax income of the firm.

C) It includes deferred taxes.

D) It does not include depreciation.

E) It treats interest as an expense or revenue.

It does not include depreciation.

3

Accounting liquidity is defined as:

A) the amount of cash the firm has.

B) the turnover ratio.

C) the ability of the assets to generate income.

D) the ease and quickness with which assets can be converted to cash.

A) the amount of cash the firm has.

B) the turnover ratio.

C) the ability of the assets to generate income.

D) the ease and quickness with which assets can be converted to cash.

the ease and quickness with which assets can be converted to cash.

4

In the Statement of Financial Position assets are:

A) all relatively illiquid.

B) listed at current market value.

C) listed at market value as of the most recent fiscal year.

D) listed at cost.

A) all relatively illiquid.

B) listed at current market value.

C) listed at market value as of the most recent fiscal year.

D) listed at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under IFRS the value of all the firm's assets are reported at:

A) Carrying value or market value.

B) Book value or liquidation value.

C) Market value or Carrying value.

D) Book value or Carrying value.

A) Carrying value or market value.

B) Book value or liquidation value.

C) Market value or Carrying value.

D) Book value or Carrying value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

6

Fixed assets can be either tangible or intangible. Intangible assets are:

A) property, plant and equipment.

B) can be converted to cash in the normal course of business.

C) can be very valuable, although they have no physical presence, such as trademarks or patents.

D) are highly liquid.

A) property, plant and equipment.

B) can be converted to cash in the normal course of business.

C) can be very valuable, although they have no physical presence, such as trademarks or patents.

D) are highly liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

7

According to IFRS, revenue is recognized as income when:

A) a contract is signed to perform a service or deliver a good.

B) the transaction is complete and the goods or services delivered.

C) payment is received.

D) income taxes are paid.

A) a contract is signed to perform a service or deliver a good.

B) the transaction is complete and the goods or services delivered.

C) payment is received.

D) income taxes are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is not included in the computation of operating cash flow?

A) Earnings before interest and taxes.

B) Interest paid.

C) Depreciation.

D) Current taxes.

A) Earnings before interest and taxes.

B) Interest paid.

C) Depreciation.

D) Current taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

9

_____ refers to the firm's dividend payments less any net new equity raised.

A) Operating cash flow

B) Capital spending

C) Net working capital

D) Cash flow from creditors

E) Cash flow to shareholders

A) Operating cash flow

B) Capital spending

C) Net working capital

D) Cash flow from creditors

E) Cash flow to shareholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Statement of Financial Position is based on which following equality:

A) Fixed Assets = (Stockholder's equity + Current Assets)

B) Assets = (Liabilities + Stockholder's equity)

C) Assets = (Current Long Term Debt + Retained earnings)

D) Fixed Asset = (Liabilities + Stockholder's equity)

A) Fixed Assets = (Stockholder's equity + Current Assets)

B) Assets = (Liabilities + Stockholder's equity)

C) Assets = (Current Long Term Debt + Retained earnings)

D) Fixed Asset = (Liabilities + Stockholder's equity)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

11

For a firm with long-term debt, net income is equal to:

A) Pretax income - Interest expense - Taxes.

B) Dividends + Addition to retained earnings.

C) EBIT - Taxes.

D) Taxes + Addition to retained earnings.

E) Pretax income * (1 - Marginal tax rate).

A) Pretax income - Interest expense - Taxes.

B) Dividends + Addition to retained earnings.

C) EBIT - Taxes.

D) Taxes + Addition to retained earnings.

E) Pretax income * (1 - Marginal tax rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

12

Of the following assets, which is the generally the least liquid?

A) Marketable securities.

B) Cash.

C) Inventory.

D) Accounts receivable.

A) Marketable securities.

B) Cash.

C) Inventory.

D) Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

13

Noncash items refer to:

A) the credit sales of a firm.

B) the accounts payable of a firm.

C) the costs incurred for the purchase of intangible fixed assets.

D) expenses charged against revenues that do not directly affect cash flow.

E) all accounts on the Statement of Financial Position other than cash on hand.

A) the credit sales of a firm.

B) the accounts payable of a firm.

C) the costs incurred for the purchase of intangible fixed assets.

D) expenses charged against revenues that do not directly affect cash flow.

E) all accounts on the Statement of Financial Position other than cash on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

14

Intangible fixed assets would include:

A) building.

B) machinery.

C) trademarks.

D) equipment.

A) building.

B) machinery.

C) trademarks.

D) equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which one of these accounts is classified as a current asset on the balance sheet?

A) intangible asset

B) accounts payable

C) preferred stock

D) inventory

E) net plant and equipment

A) intangible asset

B) accounts payable

C) preferred stock

D) inventory

E) net plant and equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

16

Assets are listed on the Statement of Financial Position in order of:

A) decreasing liquidity.

B) increasing liquidity.

C) increasing size.

D) relative life.

A) decreasing liquidity.

B) increasing liquidity.

C) increasing size.

D) relative life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

17

Net working capital is defined as:

A) current assets plus fixed assets.

B) current assets plus stockholders' equity.

C) fixed assets minus long-term liabilities.

D) total assets minus total liabilities.

E) current assets minus current liabilities.

A) current assets plus fixed assets.

B) current assets plus stockholders' equity.

C) fixed assets minus long-term liabilities.

D) total assets minus total liabilities.

E) current assets minus current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

18

The primary distinction between tangible and intangible assets is that:

A) intangible assets have a physical existence while tangible assets do not.

B) intangible assets do not have a physical existence while tangible assets do.

C) since tangible assets do not have a physical existence they do not show up on the balance sheet.

D) since intangible assets do not have a physical existence they do not show up on the balance sheet.

A) intangible assets have a physical existence while tangible assets do not.

B) intangible assets do not have a physical existence while tangible assets do.

C) since tangible assets do not have a physical existence they do not show up on the balance sheet.

D) since intangible assets do not have a physical existence they do not show up on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

19

The earnings before interest and taxes, EBIT, on the income statement provides results on:

A) the post financing effect on the earnings capability of the firm.

B) the operating income for the period.

C) the gross margin of the firm.

D) the extraordinary items of the firm for the period.

A) the post financing effect on the earnings capability of the firm.

B) the operating income for the period.

C) the gross margin of the firm.

D) the extraordinary items of the firm for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

20

The TimeNow Corporation had 2017 fixed assets of $1345, current assets of $260, current liabilities of $180 and shareholder's equity of $775. What was the net working capital for TimeNow in 2017?

A) $260.

B) $180.

C) $80.

D) $390.

A) $260.

B) $180.

C) $80.

D) $390.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

21

Calculate net income based on the following information. Sales = $250.00

Cost of goods sold = $160.00

Depreciation = $35.00

Interest paid = $20.00

Tax rate = 34%

A) $23.10.

B) $11.90.

C) $35.00.

D) $46.20.

E) $36.30.

Cost of goods sold = $160.00

Depreciation = $35.00

Interest paid = $20.00

Tax rate = 34%

A) $23.10.

B) $11.90.

C) $35.00.

D) $46.20.

E) $36.30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

22

From the following income statement information, calculate Johnson's after tax cash flow from operations. Net sales = $2,500

Cost of goods sold = $1050

Operating expenses = $490

Depreciation = $300

Tax rate = 34%

A) $660.00

B) $990.00

C) $1257.00

D) $735.60

E) $1059.00

Cost of goods sold = $1050

Operating expenses = $490

Depreciation = $300

Tax rate = 34%

A) $660.00

B) $990.00

C) $1257.00

D) $735.60

E) $1059.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

23

Mirotronic Co. has a receivables turnover of 4 times. Sales are $20,000. What is the collection period? (Use 365 days in a year.)

A) 91.25 days

B) 90 days

C) 1.37 days

D) 21.92 days

A) 91.25 days

B) 90 days

C) 1.37 days

D) 21.92 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

24

Dividends per share is equal to dividends paid:

A) divided by the par value of common stock.

B) divided by the total number of shares outstanding.

C) divided by total shareholders' equity.

D) multiplied by the par value of the common stock.

E) multiplied by the total number of shares outstanding.

A) divided by the par value of common stock.

B) divided by the total number of shares outstanding.

C) divided by total shareholders' equity.

D) multiplied by the par value of the common stock.

E) multiplied by the total number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cash flow to shareholder is defined as:

A) total cash flow from the firm plus cash flow to the bondholders.

B) repurchases of equity less cash dividends paid plus new equity sold.

C) cash flow from operations less cash flow to creditors.

D) cash dividends plus repurchases of equity minus new equity sold.

A) total cash flow from the firm plus cash flow to the bondholders.

B) repurchases of equity less cash dividends paid plus new equity sold.

C) cash flow from operations less cash flow to creditors.

D) cash dividends plus repurchases of equity minus new equity sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

26

Donny Dell Inc. had a days in inventory (based on 365 days) of 5. Cost of goods sold were $4,526. Net working capital was $70 and total current assets were $400. What is Donny Dell's quick ratio?

A) 11.315.

B) 1.024.

C) 4.829.

D) 14.00.

A) 11.315.

B) 1.024.

C) 4.829.

D) 14.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

27

Over the year, the Rigem Co. had cash flow from operations of $938, and had net capital spending of $225. In addition, the firm's Net Working Capital increased by $73. What was Rigem's total cash flow?

A) $1,236.

B) $748.

C) $640.

D) $786.

A) $1,236.

B) $748.

C) $640.

D) $786.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

28

The primary source of the firm's cash flow is usually:

A) net income.

B) tax credits.

C) earnings before interest and depreciation minus taxes.

D) capital spending after taxes.

E) working capital requirements.

A) net income.

B) tax credits.

C) earnings before interest and depreciation minus taxes.

D) capital spending after taxes.

E) working capital requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not a use of Net Working Capital?

A) Retirement of long-term debt.

B) Dividends.

C) Sale of equity.

D) Acquisition of fixed assets.

A) Retirement of long-term debt.

B) Dividends.

C) Sale of equity.

D) Acquisition of fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

30

Midget Co. has a profit margin on sales of 4% and a ROE of 18%. If Midget's debt-to-equity ratio is .8, what is the total asset turnover ratio?

A) 2.500.

B) 5.625.

C) 2.000.

D) 10.125.

A) 2.500.

B) 5.625.

C) 2.000.

D) 10.125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

31

Donny Dell Inc. had a days in inventory of 5 (based on 365 days). The inventory turnover was:

A) 5.

B) 60.

C) 73.

D) cannot be figured without the inventory value.

A) 5.

B) 60.

C) 73.

D) cannot be figured without the inventory value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

32

What is the effect on net working capital if the corporation decides to increase their investment in inventory and pay for it with cash?

A) Increase in NWC.

B) Decrease in NWC.

C) Depends on the amount of the investment.

D) No effect.

E) Depends on the amount of cash.

A) Increase in NWC.

B) Decrease in NWC.

C) Depends on the amount of the investment.

D) No effect.

E) Depends on the amount of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

33

The cash flow of the firm is defined as the cash flow of the assets. This cash flow must be equal to:

A) cash flow to equity minus cash flow to debtholders.

B) cash flow to debtholders minus cash flow to equity.

C) cash flow from changes in working capital plus cash flow to equity.

D) cash flow to equity plus cash flow to debtholders.

A) cash flow to equity minus cash flow to debtholders.

B) cash flow to debtholders minus cash flow to equity.

C) cash flow from changes in working capital plus cash flow to equity.

D) cash flow to equity plus cash flow to debtholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

34

When making financial decisions related to assets, you should:

A) always consider market values.

B) place more emphasis on book values than on market values.

C) rely primarily on the value of assets as shown on the balance sheet.

D) only consider market values if they are less than book values.

A) always consider market values.

B) place more emphasis on book values than on market values.

C) rely primarily on the value of assets as shown on the balance sheet.

D) only consider market values if they are less than book values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

35

Earnings per share is equal to:

A) net income divided by the total number of shares outstanding.

B) net income divided by the par value of the common stock.

C) gross income multiplied by the par value of the common stock.

D) operating income divided by the par value of the common stock.

E) net income divided by total shareholders' equity.

A) net income divided by the total number of shares outstanding.

B) net income divided by the par value of the common stock.

C) gross income multiplied by the par value of the common stock.

D) operating income divided by the par value of the common stock.

E) net income divided by total shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tan Co. had total operating revenues of $720 over the past year. During that time, average receivables were $90. What was the average collection period (ACP) given a 365-day year?

A) 8.00 days.

B) 4.56 days.

C) 40.97 days.

D) 45.63 days.

A) 8.00 days.

B) 4.56 days.

C) 40.97 days.

D) 45.63 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

37

For any individual period the firm cash flows are a circular flow of funds, this means:

A) that cash flows are always invested in fixed assets.

B) that cash flows are always in a spiral away from the firm.

C) that firm cash flows must be borrowed externally to be reinvested in the economy.

D) that all cash flows generated by the firm must equal the cash flows paid to the creditors and shareholders.

A) that cash flows are always invested in fixed assets.

B) that cash flows are always in a spiral away from the firm.

C) that firm cash flows must be borrowed externally to be reinvested in the economy.

D) that all cash flows generated by the firm must equal the cash flows paid to the creditors and shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

38

Net capital spending is equal to:

A) net additions to Net Working Capital.

B) the net change in fixed assets.

C) net income plus depreciation.

D) total cash flow to shareholders less interest and dividends paid.

A) net additions to Net Working Capital.

B) the net change in fixed assets.

C) net income plus depreciation.

D) total cash flow to shareholders less interest and dividends paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

39

Dorr Corp. had an ROA of 8%. Dorr's profit margin was 4% on sales of $250. What were total assets?

A) $125.

B) $500.

C) $30.

D) $220.

A) $125.

B) $500.

C) $30.

D) $220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

40

Donny Dell Inc.'s cost of goods sold were $4,526. They had net working capital of $70 and total current assets were $400. If inventory was 62 what is the current ratio of Donny Dell?

A) 7.3.

B) 5.71.

C) 1.21.

D) 4.71.

A) 7.3.

B) 5.71.

C) 1.21.

D) 4.71.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

41

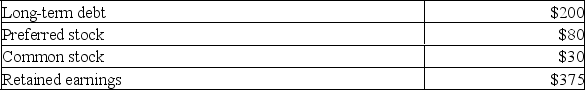

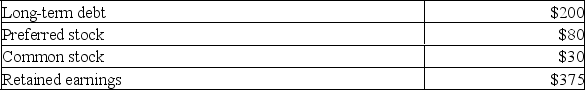

The Paymore Co. reported the following long-term liabilities and stockholder's equity for 2017:

In 2017, Paymore earned $125 in net income and paid a $40 dividend. What is the 2017 total common shareholder equity figure?

In 2017, Paymore earned $125 in net income and paid a $40 dividend. What is the 2017 total common shareholder equity figure?

In 2017, Paymore earned $125 in net income and paid a $40 dividend. What is the 2017 total common shareholder equity figure?

In 2017, Paymore earned $125 in net income and paid a $40 dividend. What is the 2017 total common shareholder equity figure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

42

Discuss the difference between book values and market values on the Statement of Financial Position and explain which is more important to the financial manager and why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Cliplink Company has an equity multiplier of 3.36? What are the debt ratio and debt to equity ratios of Cliplink?

A) 0.70, 2.36.

B) 2.36, 0.70.

C) 0.30, 0.70.

D) cannot be calculated without values for debt or equity.

A) 0.70, 2.36.

B) 2.36, 0.70.

C) 0.30, 0.70.

D) cannot be calculated without values for debt or equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

44

Assuming that the current ratio is currently 2, which of the following actions will increase it?

A) Purchasing inventory with cash.

B) Purchasing inventory on short-term credit.

C) Paying off a short-term bank loan with long-term debt.

D) A customer paying an overdue bill.

A) Purchasing inventory with cash.

B) Purchasing inventory on short-term credit.

C) Paying off a short-term bank loan with long-term debt.

D) A customer paying an overdue bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

45

Grady's Candies paid a total of $32 million in dividends in 2017. In addition, the company issued $22.5 million in new stock in that year. What was Grady's cash flow to stockholder's in 2017?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

46

Based on the following information, calculate stockholders equity:

cash = $5.00

accounts payable = $12.00

other current liabilities = $65.00

accounts receivable = $20.00

inventory = $50.00

net fixed assets = $175.00

long-term debt = $40.00

cash = $5.00

accounts payable = $12.00

other current liabilities = $65.00

accounts receivable = $20.00

inventory = $50.00

net fixed assets = $175.00

long-term debt = $40.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

47

Peggy Grey's Cookies has net income of $360. The firm pays out 40% of the net income to its shareholders as dividends. During the year, the company sold $80 worth of common stock. What is the cash flow to stockholders?

A) $64.

B) $136.

C) $144.

D) $224. Cash flow to stockholders = .40($360) - $80 = $64

A) $64.

B) $136.

C) $144.

D) $224. Cash flow to stockholders = .40($360) - $80 = $64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Hi-Lite Corp. had a profitable year and their ROE was 14.4%. The company paid out $1.20 of their earnings of $3.00 for the year. What is Hi-Lite's sustainable growth?

A) 17.20%

B) 8.64%

C) 5.76%

D) 43.20%

A) 17.20%

B) 8.64%

C) 5.76%

D) 43.20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

49

Pion Inc. reported current assets of $80 and fixed assets of $150 as of December 31. The company, as of December 31, also reports current liabilities of $72 and long-term liabilities of $149. Calculate Pion's shareholder's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

50

Logit Co. paid dividends of $400. And retained 33.33% of their earnings. The sales for the year were $12,000 and total assets of 10,000. What was the rate of return on assets?

A) 5%.

B) 6%.

C) 10%.

D) 12%.

A) 5%.

B) 6%.

C) 10%.

D) 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

51

Cos Co.'s after-tax net income was $120. Their interest paid was $50. Assuming the corporate tax is 40%, what is Cos CO.'s interest coverage ratio?

A) 6.7.

B) 2.4.

C) 1.44.

D) 5.0.

A) 6.7.

B) 2.4.

C) 1.44.

D) 5.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

52

Pete's Boats has beginning long-term debt of $180 and ending long-term debt of $210. The beginning and ending total debt balances are $340 and $360, respectively. The interest paid is $20. What is the amount of the cash flow to creditors?

A) -$10.

B) $0.

C) $10.

D) $40. Cash flow to creditors = $20 - ($210 - $180) = -$10

A) -$10.

B) $0.

C) $10.

D) $40. Cash flow to creditors = $20 - ($210 - $180) = -$10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Lo-Gro Co. in 2014 had equity of $15 million, net income of $1,800,000 of which 60% was paid out as dividends. The ROE and retained earnings for the Lo-Gro Co. are:

A) 1.2%; $720,000.

B) 4.8%; $720,000.

C) 12%; $1,080,000.

D) 12%; $720,000.

A) 1.2%; $720,000.

B) 4.8%; $720,000.

C) 12%; $1,080,000.

D) 12%; $720,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

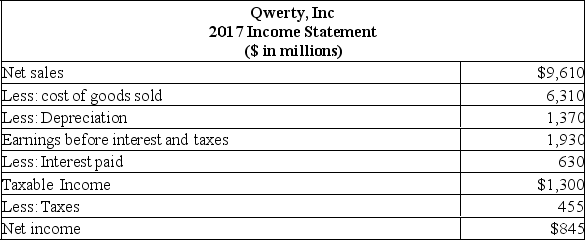

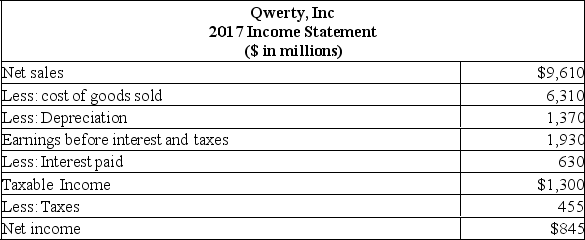

54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

55

Sin Co. stock sells for $28.00 per share. The total market value of the equity is $40 million. The market-to-book ratio is 7. What is the book value per share?

A) $128.00.

B) $196.00.

C) $1.43.

D) $4.00.

A) $128.00.

B) $196.00.

C) $1.43.

D) $4.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Lo-Gro Co. in 2014 had equity of $15 million, net income of $1,800,000 of which 60% was paid out as dividends. The sustainable growth rate for the Lo-Gro Co. is:

A) 0.48%.

B) 4.80%.

C) 0.72%.

D) 7.20%.

A) 0.48%.

B) 4.80%.

C) 0.72%.

D) 7.20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Simmons Company reported retained earnings in 2016 of $4750. In 2017, Simmons earned $1120 before taxes and paid a dividend of $730. Simmon's tax rate is 34%. What is Simmons' retained earnings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Hi-Lite Corp. had a profitable year and their ROE was 14.4%. The company paid out $1.20 of their earnings of $3.00 for the year. The market price of their stock at year end was $28. What was Hi-Lite's price-earnings ratio?

A) 23.33.

B) 9.33.

C) 4.03.

D) 12.10.

A) 23.33.

B) 9.33.

C) 4.03.

D) 12.10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck