Deck 13: Investing in Mutual Funds and Real Estate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/43

العب

ملء الشاشة (f)

Deck 13: Investing in Mutual Funds and Real Estate

1

For each pair of funds listed below, select the fund that would be less risky and briefly explain your answer.

a. Growth versus growth-and-income

b. Equity-income versus high-grade corporate bonds

c. Intermediate-term bonds versus high-yield municipals

d. International versus balanced

a. Growth versus growth-and-income

b. Equity-income versus high-grade corporate bonds

c. Intermediate-term bonds versus high-yield municipals

d. International versus balanced

a. The growth versus growth-and-income:

The growth-and-income fund would be less risky because return thereon is not only from capital gains as a growth but also involves interest and dividends as an income.

With the income from interest and dividend, the total return increases irrespective of whether the capital gains are there or not. Also the share price becomes stable if the market is down as investors will be more interested in such securities that provide income rather than the securities relying upon only growth.

b. Equity-income versus high-grade corporate bonds:

The high-grade corporate bonds fund would be less risky as it is generally considered that the debt securities are less risky than the equity securities.

c. Intermediate-term bonds versus high-yield municipals:

The intermediate-term bonds fund would be slightly less risky as it can be an investment grade bonds having maturities of around seven to ten years, In contrast, the high-yield municipal bond fund may consist of will have securities that are rated below-investment grade and hence riskier.

d. International versus balanced:

The balanced fund are less risky as if we purchase an international fund that will be more risky in terms of foreign exchange rates or a political risk and in balanced fund is just a fairly conservative investment tool which provides capital gains as well as income from a portfolio.

The growth-and-income fund would be less risky because return thereon is not only from capital gains as a growth but also involves interest and dividends as an income.

With the income from interest and dividend, the total return increases irrespective of whether the capital gains are there or not. Also the share price becomes stable if the market is down as investors will be more interested in such securities that provide income rather than the securities relying upon only growth.

b. Equity-income versus high-grade corporate bonds:

The high-grade corporate bonds fund would be less risky as it is generally considered that the debt securities are less risky than the equity securities.

c. Intermediate-term bonds versus high-yield municipals:

The intermediate-term bonds fund would be slightly less risky as it can be an investment grade bonds having maturities of around seven to ten years, In contrast, the high-yield municipal bond fund may consist of will have securities that are rated below-investment grade and hence riskier.

d. International versus balanced:

The balanced fund are less risky as if we purchase an international fund that will be more risky in terms of foreign exchange rates or a political risk and in balanced fund is just a fairly conservative investment tool which provides capital gains as well as income from a portfolio.

2

Assume that you've just inherited $100,000 and wish to use all or part of it to make a real estate investment.

a. Would you invest directly in real estate, or indirectly through something like a REIT Explain.

b. Assuming that you decided to invest directly, would you invest in income-producing property or speculative property Why Describe the key characteristics of the types of incomeproducing or speculative property you would seek.

c. What financial and nonfinancial goals would you establish before beginning the search for suitable property

d. If you decide to invest in real estate indirectly, which type(s) of securities would you buy, and why

a. Would you invest directly in real estate, or indirectly through something like a REIT Explain.

b. Assuming that you decided to invest directly, would you invest in income-producing property or speculative property Why Describe the key characteristics of the types of incomeproducing or speculative property you would seek.

c. What financial and nonfinancial goals would you establish before beginning the search for suitable property

d. If you decide to invest in real estate indirectly, which type(s) of securities would you buy, and why

a)An amount of $100,000 is not enough money to buy a decent house where I live, so if I were to invest directly in real estate, I would have to borrow a significant amount of money. I do not like to borrow money since there is a risk of default. In addition, I do not have the time to take care of piece of property. I would need to hire a property manager to collect the rent, and to maintain the property, thus decreasing my earnings.

I would prefer to invest in a REIT since it offers the benefits of real estate ownership in terms of both current income and capital appreciation, but without the problems involved in managing a property. In addition, REITs have a history of good returns. Note that historical values do not necessarily indicate future returns.

REITs are more liquid than physical properties. If I have to change my mind about investing in real estate, it would be easy to sell the REIT; however, it may be difficult to sell a piece of property within a reasonable amount of time.

b)Speculating in raw land is a high risk investment. Compare this to income-producing property which can offer attractive current income in the form of rent as well as from price appreciation. I would prefer to invest in income-producing property since it is a low-risk investment than speculative property.

The key characteristics of the types of income-producing property I would seek are:

• A property that has no major issues. For example, a house with a weak foundation is a major issue that is difficult to fix, while a house that needs new carpeting is comparatively easier to fix.

• The property should be strategically located so that it can be expected to appreciate in value.

• If purchasing commercial property such as an office building, industrial space, warehouse or retail space, then it should be strategically located so that it can serve its commercial purpose. For example, retail space should be located in a high-traffic area.

• If purchasing residential property such as a house or apartment, then it should be strategically located so that it can expect to attract tenants so that it can maintain a high occupancy rate. An example of a good location is near a college.

• If purchasing residential property, the maintenance and management costs have to be low enough to turn a good profit.

• The property must be in a good neighborhood.

• Local regulations concerning tenants must be favorable.

• The supply and demand of properties in the area must be favorable.

c)A financial goal would be to have enough money to purchase the mortgage-free house. I do not want to borrow money to purchase the property as I do not want to risk a default. Although using no leverage would decrease the rate of return on the investment, it gives me a peace of mind that money cannot buy.

A non-financial goal would be to have enough time to research and inspect properties for purchase. Inspecting properties is time-consuming, and I would not want to regret a purchase because I did not do the proper research or inspect it properly. I would also need the time and skills to fix the property because it should be unsuitable as is for generating income.

d)

If I were to invest in real estate indirectly, I would invest in REITs because they provide an easy way to diversify a portfolio. There are many to choose from, and many have produced competitive returns in the past. I would prefer hybrid REITs as they offer greater diversification than equity or mortgage REITs would alone.

I would prefer to invest in a REIT since it offers the benefits of real estate ownership in terms of both current income and capital appreciation, but without the problems involved in managing a property. In addition, REITs have a history of good returns. Note that historical values do not necessarily indicate future returns.

REITs are more liquid than physical properties. If I have to change my mind about investing in real estate, it would be easy to sell the REIT; however, it may be difficult to sell a piece of property within a reasonable amount of time.

b)Speculating in raw land is a high risk investment. Compare this to income-producing property which can offer attractive current income in the form of rent as well as from price appreciation. I would prefer to invest in income-producing property since it is a low-risk investment than speculative property.

The key characteristics of the types of income-producing property I would seek are:

• A property that has no major issues. For example, a house with a weak foundation is a major issue that is difficult to fix, while a house that needs new carpeting is comparatively easier to fix.

• The property should be strategically located so that it can be expected to appreciate in value.

• If purchasing commercial property such as an office building, industrial space, warehouse or retail space, then it should be strategically located so that it can serve its commercial purpose. For example, retail space should be located in a high-traffic area.

• If purchasing residential property such as a house or apartment, then it should be strategically located so that it can expect to attract tenants so that it can maintain a high occupancy rate. An example of a good location is near a college.

• If purchasing residential property, the maintenance and management costs have to be low enough to turn a good profit.

• The property must be in a good neighborhood.

• Local regulations concerning tenants must be favorable.

• The supply and demand of properties in the area must be favorable.

c)A financial goal would be to have enough money to purchase the mortgage-free house. I do not want to borrow money to purchase the property as I do not want to risk a default. Although using no leverage would decrease the rate of return on the investment, it gives me a peace of mind that money cannot buy.

A non-financial goal would be to have enough time to research and inspect properties for purchase. Inspecting properties is time-consuming, and I would not want to regret a purchase because I did not do the proper research or inspect it properly. I would also need the time and skills to fix the property because it should be unsuitable as is for generating income.

d)

If I were to invest in real estate indirectly, I would invest in REITs because they provide an easy way to diversify a portfolio. There are many to choose from, and many have produced competitive returns in the past. I would prefer hybrid REITs as they offer greater diversification than equity or mortgage REITs would alone.

3

Briefly describe the basic structure and investment considerations associated with a REIT. What are the three basic types of REITs

One of the best ways for an individual to invest in real estate is through real estate investment trust (REIT). REIT is a closed-end investment company that invests in various types of real estate and real estate mortgages. REIT is like a mutual fund it sells shares of stock to the investing public and uses the proceeds, along with borrowed funds, to invest in a portfolio of real estate investment and the investors own part of the real estate portfolio held by REIT. REIT appeals to investors because it offers both capital appreciation and current income. They also provide dividend yields.

REIT is popular among the investors who seek portfolio diversification, because these trusts have relatively low correlations with other market sectors, such as common stocks and bonds. The three basic types of REITs are Equity REIT, Mortgage REIT and Hybrid REIT.

REIT is popular among the investors who seek portfolio diversification, because these trusts have relatively low correlations with other market sectors, such as common stocks and bonds. The three basic types of REITs are Equity REIT, Mortgage REIT and Hybrid REIT.

4

What's the difference between a load fund and a no-load fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

5

What are automatic reinvestment plans, and how do they differ from automatic investment plans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

6

What investor service is most closely linked to the notion of a fund family If a fund is not part of a family of mutual funds, can it still offer a full range of investor services Explain. Using a source such as The Wall Street Journal or perhaps your local newspaper, find two examples of fund families and list some of the mutual funds that they offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

7

Lilia Castillo is thinking about investing in some residential income-producing property that she can purchase for $200,000. Lilia can either pay cash for the full amount of the property or put up $50,000 of her own money and borrow the remaining $150,000 at 8 percent interest. The property is expected to generate $30,000 per year after all expenses but before interest and income taxes. Assume that Lilia is in the 28 percent tax bracket. Calculate her annual profit and return on investment, assuming that she (a) pays the full $200,000 from her own funds or (b) borrows $150,000 at 8 percent. Then discuss the effect, if any, of leverage on her rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is a 12(b)-1 fund Can such a fund operate as a no-load fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

9

What are the most common reasons for buying mutual funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

10

Using a source like Barron's, Forbes, Money, or Morningstar , along with any related Web sites, select five mutual funds-a growth fund, an index fund, a sector fund, an international fund, and a high-yield corporate bond fund-that you believe would make good investments. Briefly explain why you selected each of the funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

11

Using the Find a REIT section of the Invest in REITs Web site, http://www.investinreits.com/ findaREIT/findareit.cfm, select two publicly traded real estate investment trusts in different property categories. Using information you can find on this Web site and other Internet sites, prepare a comparison that includes:

a. The type of REIT (equity, mortgage, or hybrid) that each represents.

b. The type and quality of the properties that they hold.

c. Each REIT's financial performance and management track record.

Based on your analysis, in which REIT would you invest Explain why in terms of how it does or does not meet your investment objectives.

a. The type of REIT (equity, mortgage, or hybrid) that each represents.

b. The type and quality of the properties that they hold.

c. Each REIT's financial performance and management track record.

Based on your analysis, in which REIT would you invest Explain why in terms of how it does or does not meet your investment objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

12

Briefly describe a back-end load , a low load , and a hidden load. How can you tell what kind of fees and charges a mutual fund has

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

13

Briefly describe the steps in the mutual fund selection process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

14

Mutual funds offer convenience, diversification, and the services of professional money managers and analysts. Mutual funds can be particularly appealing for small investors who don't have a lot of money and for those who are new to investing. This project will help you learn more about the various types of mutual funds and how to pick the funds that best suit your investment objectives.

Assume that you've just received a windfall of $50,000 and would like to invest it all in mutual funds. There are several ways to classify mutual funds, but for this project, we will consider the following eight categories:

Growth

Value

Equity-income

Bond

Balanced

Index

Socially responsible

International

Pick three or four categories that you believe best meet your financial needs and risk tolerance, and then select one fund from each category. You are strongly encouraged to use some of the online sources and other references mentioned in this chapter to help you make your selections. For each fund, find the following information:

a. Name of fund, its ticker symbol, the fund manager, and the tenure of the fund manager.

b. Category and size of the fund-try to find the Morningstar style box.

c. Loads, fees, and other charges; minimum investment required.

d. Performance of the fund over the past one, three, and five years. Compare the fund's performance to at least two or three other funds in its category and to an appropriate index over these same periods.

e. How much did the fund pay out last year in dividends and in distributions of short- and long-term capital gains

f. What was the approximate yield on the fund last year (You may have to compute this yourself; use the approximate yield formula or a handheld calculator after finding its price one year ago from a source such as http://finance.yahoo.com.)g. What services does the fund offer, such as automatic reinvestment plans or phone switching

h. Briefly explain why you selected the fund and how it meets your investment objectives.

Assume that you've just received a windfall of $50,000 and would like to invest it all in mutual funds. There are several ways to classify mutual funds, but for this project, we will consider the following eight categories:

Growth

Value

Equity-income

Bond

Balanced

Index

Socially responsible

International

Pick three or four categories that you believe best meet your financial needs and risk tolerance, and then select one fund from each category. You are strongly encouraged to use some of the online sources and other references mentioned in this chapter to help you make your selections. For each fund, find the following information:

a. Name of fund, its ticker symbol, the fund manager, and the tenure of the fund manager.

b. Category and size of the fund-try to find the Morningstar style box.

c. Loads, fees, and other charges; minimum investment required.

d. Performance of the fund over the past one, three, and five years. Compare the fund's performance to at least two or three other funds in its category and to an appropriate index over these same periods.

e. How much did the fund pay out last year in dividends and in distributions of short- and long-term capital gains

f. What was the approximate yield on the fund last year (You may have to compute this yourself; use the approximate yield formula or a handheld calculator after finding its price one year ago from a source such as http://finance.yahoo.com.)g. What services does the fund offer, such as automatic reinvestment plans or phone switching

h. Briefly explain why you selected the fund and how it meets your investment objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

15

About a year ago, Nigel Palmer bought some shares in the Equity Partners Mutual Fund. He bought the fund at $24.50 a share, and it now trades at $26. Last year, the fund paid dividends of 40 cents a share and had capital gains distributions of $1.83 a share. Using the approximate yield formula, what rate of return did Nigel earn on his investment Repeat the calculation using a handheld financial calculator. Would he have made a 20 percent rate of return if the stock had risen to $30 a share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

16

Using Yahoo! Finance or another investor information Web site, find three real estate- related stocks. Evaluate them as potential additions to your portfolio. Do you think they provide the same degree of diversification as other forms of real estate investments Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is a mutual fund Why are diversification and professional management so important to mutual funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

18

What's the difference between a growth fund and a balanced fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

19

Why does it pay to invest in no-load funds rather than load funds Under what conditions might it make sense to invest in a load fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

20

Todd O'Hanlon has worked in the management services division of Focus Consultants for the past five years. He currently earns an annual salary of about $120,000. At 33, he's still a bachelor and has accumulated about $100,000 in savings over the past few years. He keeps his savings in a money market account, where it earns about 3 percent interest. Todd wants to get "a bigger bang for his buck," so he has considered withdrawing $50,000 from his money market account and investing it in the stock market. He feels that such an investment can easily earn more than 3 percent. Heidi Jackson, a close friend, suggests that he invest in mutual fund shares. Todd has approached you, his broker, for advice.

Critical Thinking Questions

1. Explain to Todd the key reasons for purchasing mutual fund or ETF shares.

2. What special fund features might help Todd achieve his investment objectives

3. What types of mutual funds or ETFs would you recommend to Todd

4. What recommendations would you make regarding Todd's dilemma about whether to go into stocks, mutual funds, or ETFs Explain.

5. Explain to Todd the rationale for choosing ETFs over mutual funds.

Critical Thinking Questions

1. Explain to Todd the key reasons for purchasing mutual fund or ETF shares.

2. What special fund features might help Todd achieve his investment objectives

3. What types of mutual funds or ETFs would you recommend to Todd

4. What recommendations would you make regarding Todd's dilemma about whether to go into stocks, mutual funds, or ETFs Explain.

5. Explain to Todd the rationale for choosing ETFs over mutual funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

21

Describe an ETF and explain how these funds combine the characteristics of open- and closed-end funds. Within the Vanguard family of funds, which would most closely resemble a "Spider" (SPDR) In what respects are the Vanguard fund (that you selected) and SPDRs the same, and how are they different If you could invest in only one of them, which would it be Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

22

Identify three potential sources of return to mutual fund investors, and briefly discuss how each could affect total return to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

23

Contrast mutual fund ownership with direct investment in stocks and bonds. Assume that your class is going to debate the merits of investing through mutual funds versus investing directly in stocks and bonds. Develop some pro and con arguments for this debate, and be prepared to discuss them in class. If you had to choose a side, which one would it be Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

24

What's an international fund, and how does it differ from a global fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which would you rather have: $100 in dividend income or $100 in capital gains distribution $100 in realized capital gains or $100 in unrealized capital gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

26

Who are the key players in a typical mutual fund organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

27

A year ago, the Alpine Growth Fund was being quoted at an NAV of $21.50 and an offer price of $23.35; today, it's being quoted at $23.04 (NAV) and $25.04 (offer). Use the approximate yield formula or a handheld financial calculator to find the rate of return on this load fund; it was purchased a year ago, and its dividends and capital gains distributions over the year totaled $1.05 a share. ( Hint: As an investor, you buy fund shares at the offer price and sell at the NAV.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

28

Describe how to evaluate the attractiveness of investing in an index-based ETF.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

29

Eileen Mahurin is the director of a major charitable organization in Knoxville, Tennessee. A single mother of one young child, she earns what could best be described as a modest income. Because charitable organizations aren't known for their generous retirement programs, Eileen has decided it would be best for her to do a little investing on her own. She'd like to set up a program to supplement her employer's retirement program and, at the same time, provide some funds for her child's college education (which is still 12 years away). Although her income is modest, Eileen believes that with careful planning, she could probably invest about $250 a quarter, and she hopes to increase this amount over time. Eileen now has about $15,000 in a bank savings account, which she's willing to use to kick off this program. In view of her investment objectives, she isn't interested in taking a lot of risk. Because her knowledge of investments extends no further than savings accounts, series EE bonds, and a little bit about mutual funds, she approaches you for some investment advice.

Critical Thinking Questions

1. In view of Eileen's long-term investment goals, do you think mutual funds or ETFs are the more appropriate investment vehicle for her

2. Do you think that she should use her $15,000 savings to start a mutual fund or an ETF investment program

3. What type of mutual fund or ETF investment program would you set up for Eileen In your answer, discuss the types of funds you'd consider, the investment objectives you'd set, and any investment services (such as withdrawal plans) you'd seek. Would taxes be an important consideration in your investment advice Explain.

4. Do you think some type of real estate investment would make sense for Eileen If so, what type would you suggest Explain.

Critical Thinking Questions

1. In view of Eileen's long-term investment goals, do you think mutual funds or ETFs are the more appropriate investment vehicle for her

2. Do you think that she should use her $15,000 savings to start a mutual fund or an ETF investment program

3. What type of mutual fund or ETF investment program would you set up for Eileen In your answer, discuss the types of funds you'd consider, the investment objectives you'd set, and any investment services (such as withdrawal plans) you'd seek. Would taxes be an important consideration in your investment advice Explain.

4. Do you think some type of real estate investment would make sense for Eileen If so, what type would you suggest Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

30

What's an asset allocation fund How do these funds differ from other types of mutual funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

31

How important is general market behavior in affecting the price performance of mutual funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

32

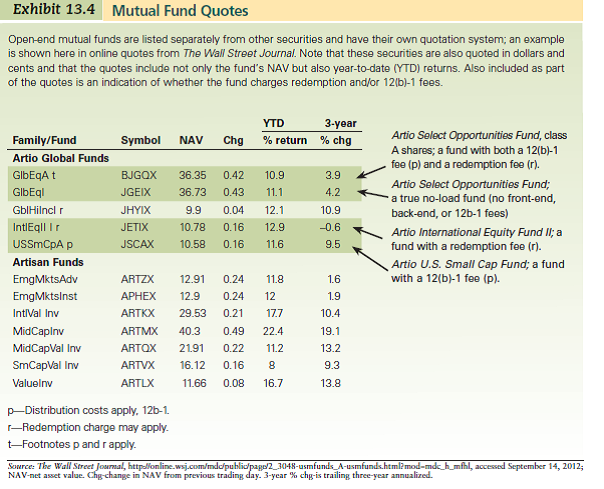

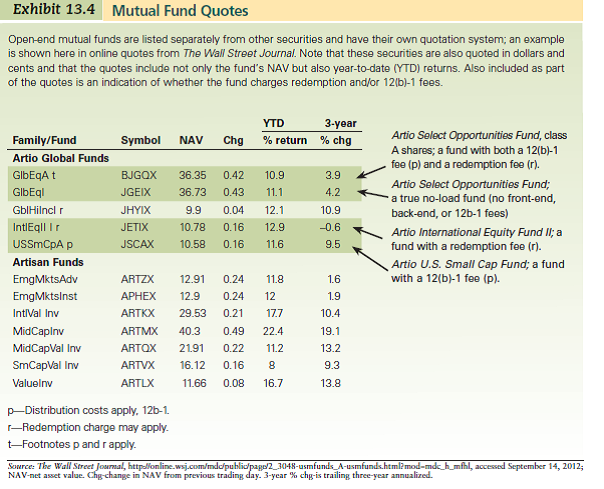

Using the mutual fund quotes in Exhibit 13.4, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds

a. Artio Select Opportunities Fund, class A shares (GlbEqA )

b. Artio Select Opportunities Fund (GlbEqI)c. Artio International Equity Fund II (IntlEqII I)d. Artio U.S. Small Cap Fund (USSmCpA)According to the quotes, which of these four funds have 12(b)-1 fees Which have redemption fees Are any of them no-loads Which fund has the highest year-to-date return Which has the lowest

(Reference Exhibit 13.4)

a. Artio Select Opportunities Fund, class A shares (GlbEqA )

b. Artio Select Opportunities Fund (GlbEqI)c. Artio International Equity Fund II (IntlEqII I)d. Artio U.S. Small Cap Fund (USSmCpA)According to the quotes, which of these four funds have 12(b)-1 fees Which have redemption fees Are any of them no-loads Which fund has the highest year-to-date return Which has the lowest

(Reference Exhibit 13.4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

33

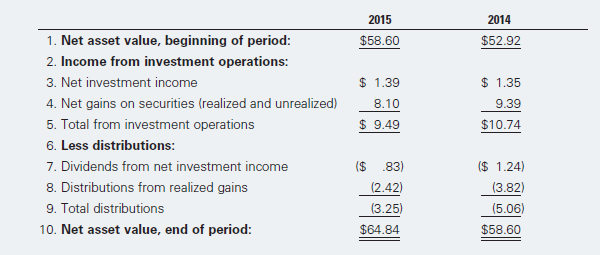

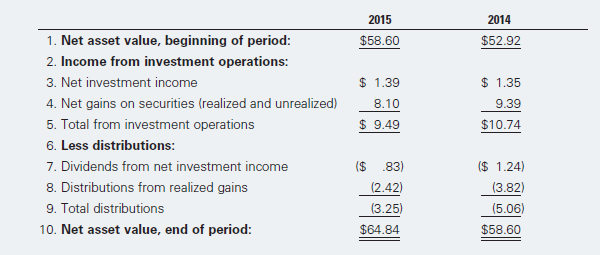

Here is the per-share performance record of the Mile High Growth-and-Income fund for 2015 and 2014:

Use this information to find the rate of return earned on this fund in 2014 and in 2015. What is your assessment of the investment performance of this fund for the 2014-2015 period

Use this information to find the rate of return earned on this fund in 2014 and in 2015. What is your assessment of the investment performance of this fund for the 2014-2015 period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

34

Define and briefly discuss the role of each of these factors in evaluating

a proposed real estate investment:

a. Cash flow and taxes

b. Appreciation in value

c. Use of leverage

a proposed real estate investment:

a. Cash flow and taxes

b. Appreciation in value

c. Use of leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

35

What's the difference between an open-end mutual fund and an ETF

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

36

If growth, income, and capital preservation are the primary objectives of mutual funds, why do we bother to categorize them by type

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

37

Why is speculating in raw land considered a high-risk venture

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

38

Imagine that you've just inherited $40,000 from a rich uncle. Now you're faced with the problem of deciding how to spend it. You could make a down payment on a condo-or better yet, on that BMW that you've always wanted; or you could spend your windfall more profitably by building a mutual fund portfolio. Let's say that, after a lot of soul-searching, you decide to build a mutual fund portfolio. Your task is to develop a $40,000 mutual fund portfolio. Use actual funds and actual quoted prices, invest as much of the $40,000 as you possibly can, and be specific! Briefly describe the portfolio that you end up with, including the investment objectives that you're trying to achieve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

39

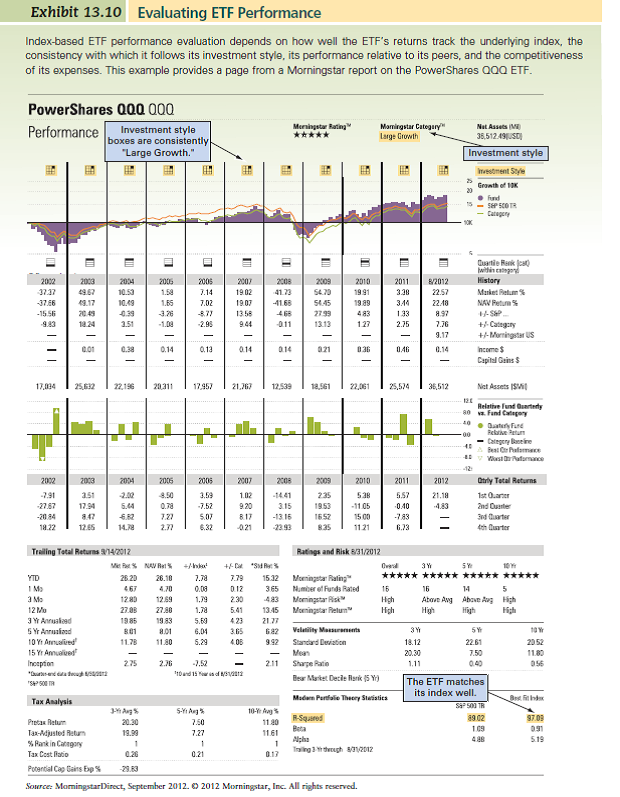

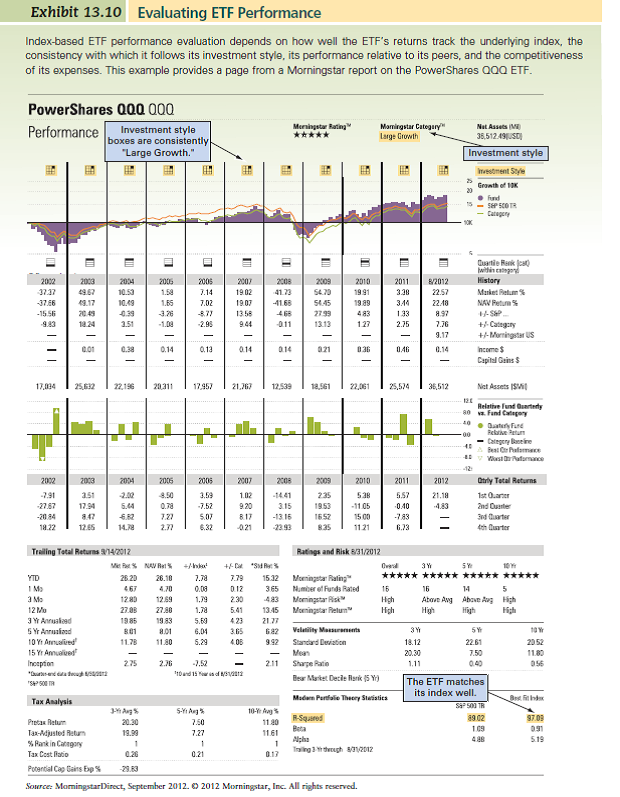

Using the Morningstar information in Exhibit 13.10, evaluate the performance of the QQQ index-based ETF. Specifically, comment on how well it tracks the underlying NASDAQ 100 index and how its performance compares with other similar ETFs.

(Reference Exhibit 13.10)

(Reference Exhibit 13.10)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

40

Describe the major categories of income property, and explain the advantages and disadvantages of investing in income property. How can a single-family home be used to generate income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

41

What types of ETFs are available to investors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

42

What are fund families What advantages do these families offer investors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

43

Describe how the following securities allow investors to participate in the real estate market.

a. Stock in real estate-related companies

b. Real estate limited partnerships (LPs) or limited liability companies (LLCs)

a. Stock in real estate-related companies

b. Real estate limited partnerships (LPs) or limited liability companies (LLCs)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck