Deck 5: Worldcom Wizardry: From Worldcom to Worldcon

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 5: Worldcom Wizardry: From Worldcom to Worldcon

1

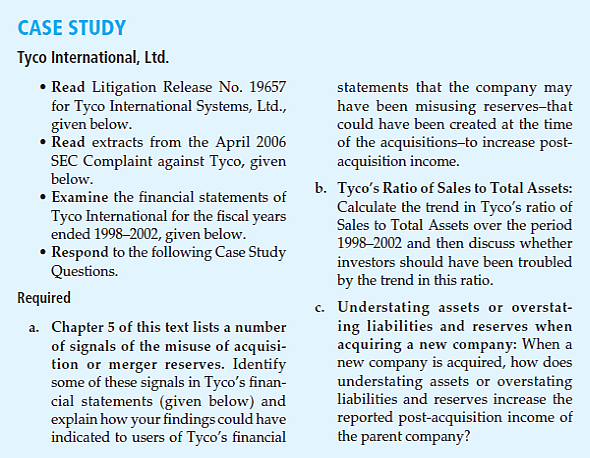

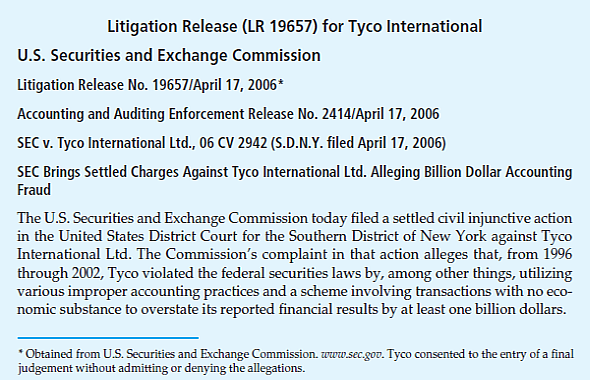

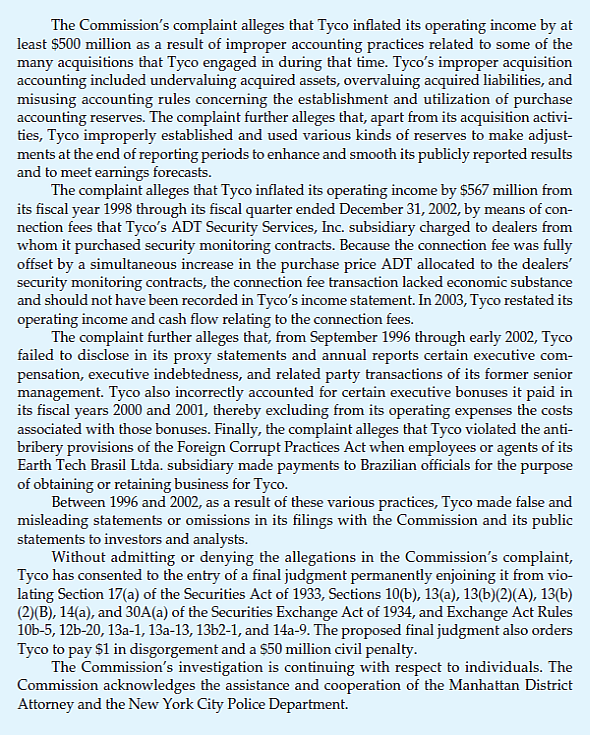

Case Study

Requirement a

Signal number 1

Signal number 1 referring to the misuse of acquisition or merger reserves. Acquiring (parent)companies willfully understates the value of net assets of the selling company, to overstate the amount of goodwill. Main purpose of overstatement of reserves is to reverse the reserves into revenue in the later period.

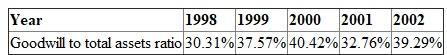

Determine goodwill to total assets ratios for Company T

Working notes:

Working notes:

Calculate goodwill to total assets ratio.

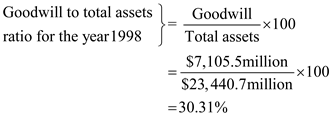

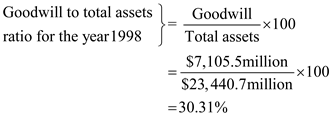

For the year 1998:

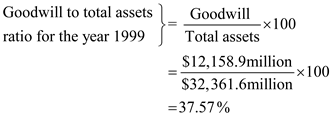

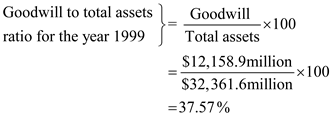

For the year 1999:

For the year 1999:

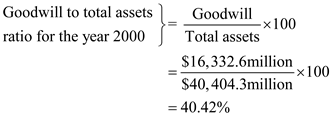

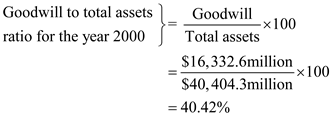

For the year 2000:

For the year 2000:

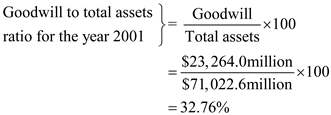

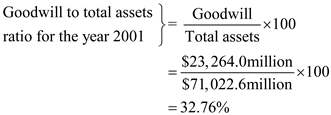

For the year 2001:

For the year 2001:

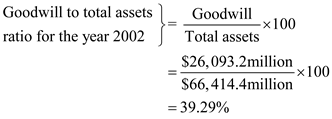

For the year 2002:

For the year 2002:

Explanation about Company T's fictitious allocation to goodwill with reference to signal number 1.

Explanation about Company T's fictitious allocation to goodwill with reference to signal number 1.

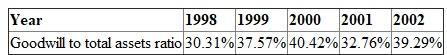

• Goodwill to total assets ratios surprisingly raised from 30.31% in 1998 to 40.42% in 2000, but it gets decrease to 32.76% in 2001. Even though, goodwill to total assets ratio was decreased in 2001, it fell by a large percentage.

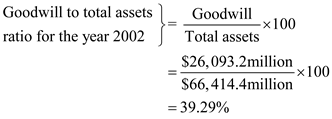

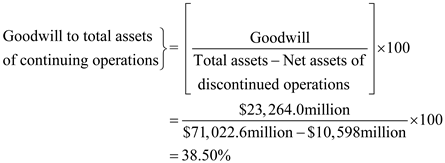

• $10.598million of total assets was recorded as net assets of discontinued operations in the consolidated balance sheet of Company T for the year 2001. Hence, it is necessary to deduct the amount of net assets of discontinued operations ($10,598 million)from the total assets ($71,022 million)of Company T, to arrive at goodwill as a percentage of total assets of continuing operations in 2001 amounted to 38.50%).

• Goodwill to total assets ratio of Company T increased to 39.29% during the year 2002.

•

If the purchase price of the acquiring company exceeds its net asset value, then the surplus amount can be allocated to goodwill. Accordingly, Company T created false reserves. It is very clear that the Company T allocates a larger amount to goodwill at the time of acquisition of companies. Company T creates reserve to reverse them into profit in the future period. Hence, signal number 1 indicates that the Company T allocates a larger portion of amounts to goodwill at the time of acquisition of other companies.

Working note:

Calculate the ratio of goodwill to total assets of continuing operations for the year 2001:

Signal number 4

Signal number 4

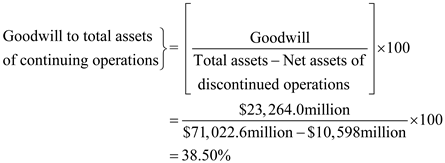

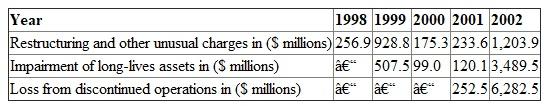

Signal number 1 referring to the misuse of large one-time charges in income statement. The investors of the company need to be very alert with the large one-time charges that are reported in the income statement during the acquisition period. This is signal that the company creates false reserves which help to increase the earnings of the future period.

Therefore, it is necessary to inspect the one-time charges of company T in its income statement.

Identify the one-time charges of Company T.

Explanation about Company T's fictitious allocation of large one-time charges with reference to signal number 4.

Explanation about Company T's fictitious allocation of large one-time charges with reference to signal number 4.

• The above one-time charges have been used by Company T to produce cookie-jar reserves, which can be released in later years to overstate earnings. SEC (Securities and Exchange Commission)took action Company T for its overstatement of earnings of $500million in the year subsequent to acquisition.

• Company T overstate its earnings by understate the value of net asset of acquired companies, and by increase the equivalent amount of goodwill, or by increase the one-time charges in its income statement.

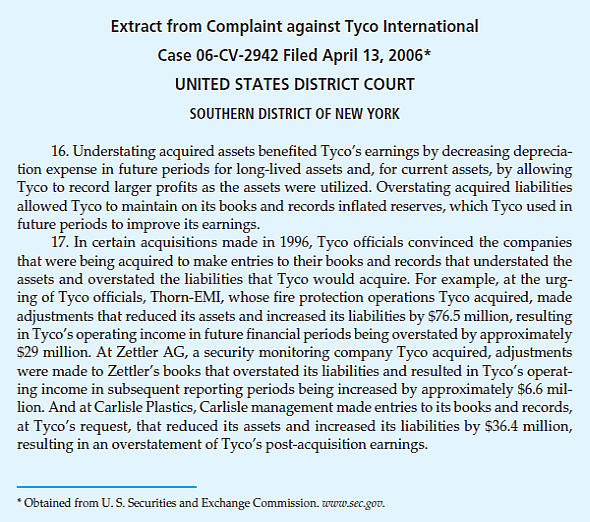

Requirement b

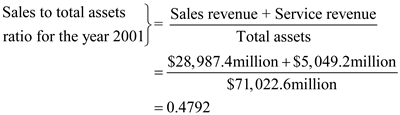

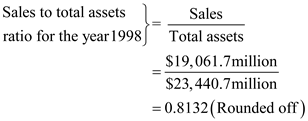

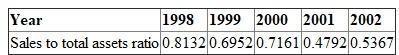

Calculate sales to total assets ratio.

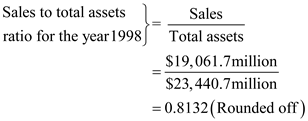

For the year 1998:

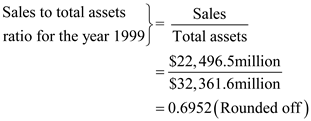

For the year 1999:

For the year 1999:

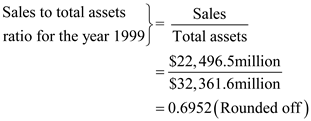

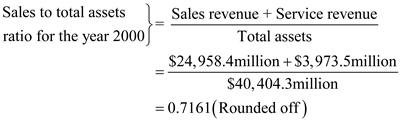

For the year 2000:

For the year 2000:

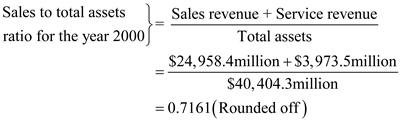

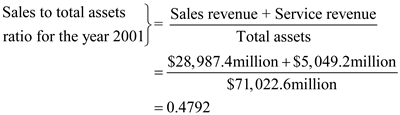

For the year 2001:

For the year 2001:

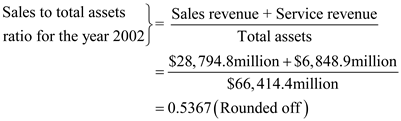

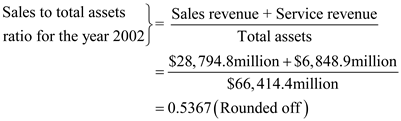

For the year 2002:

For the year 2002:

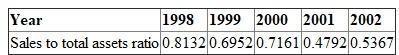

Determine the trend of sales to total assets ratios for Company T.

Determine the trend of sales to total assets ratios for Company T.

Explanation for Company T's trend in sales to total assets ratio:

Explanation for Company T's trend in sales to total assets ratio:

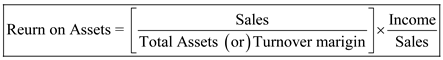

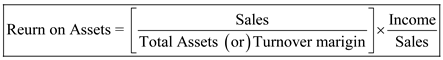

• According to DuPont formula, the return on assets can be split into the following:

• It is important to find that the investment made in assets produce revenues and that can be measured by the turnover ratio. Also it is very important to note, whether the generated revenue exceed the total costs and create a profit. Profit can be measured by the margin ratio.

• It is important to find that the investment made in assets produce revenues and that can be measured by the turnover ratio. Also it is very important to note, whether the generated revenue exceed the total costs and create a profit. Profit can be measured by the margin ratio.

• The sales to total assets ratio of Company T gradually goes down from 0.1832 in 1998 to 0.4792 in 2001.

• Massive investment in goodwill in the past years did not facilitate the Company T to generate sales at a stable rate, when compared to the amount of investment made in all assets.

• Obviously, investors should have been worried that the amounts invested on acquisition did not generate reasonable revenue.

• From the year 2000 to 2002, Company T split the revenue as sales revenue and service revenue in its disclosure.

• Thus, sales to total asset ratios from 2000 to 2002 consist of service revenue since the warning sign is actually testing whether the assets are earning income at a feasible rate as opposed to just earning sales specifically.

Requirement c

Explanation about understating assets or overstating liabilities and reserves on acquisition of a new company:

• If a current asset (stock)is devalued at the time of acquisition and it is sold at a future period, then the resulting amount of gross profit will be larger.

• If a liability of an expense is recognized on acquisition, but the actual expense will be occurred only in future, then this will bring about increased revenue in the subsequent period.

• If a reserve for doubtful debts is overstated in a financial statement of a company on acquisition, then the company requires recording the smaller bad-debt expenses in future, otherwise it should reverse the reserve in the subsequent period.• On acquisition if a company understates its assets or overstates the amount of reserves, then it will allocates an equivalent amount of purchase price to goodwill.

Requirement a

Signal number 1

Signal number 1 referring to the misuse of acquisition or merger reserves. Acquiring (parent)companies willfully understates the value of net assets of the selling company, to overstate the amount of goodwill. Main purpose of overstatement of reserves is to reverse the reserves into revenue in the later period.

Determine goodwill to total assets ratios for Company T

Working notes:

Working notes: Calculate goodwill to total assets ratio.

For the year 1998:

For the year 1999:

For the year 1999:  For the year 2000:

For the year 2000:  For the year 2001:

For the year 2001:  For the year 2002:

For the year 2002:  Explanation about Company T's fictitious allocation to goodwill with reference to signal number 1.

Explanation about Company T's fictitious allocation to goodwill with reference to signal number 1. • Goodwill to total assets ratios surprisingly raised from 30.31% in 1998 to 40.42% in 2000, but it gets decrease to 32.76% in 2001. Even though, goodwill to total assets ratio was decreased in 2001, it fell by a large percentage.

• $10.598million of total assets was recorded as net assets of discontinued operations in the consolidated balance sheet of Company T for the year 2001. Hence, it is necessary to deduct the amount of net assets of discontinued operations ($10,598 million)from the total assets ($71,022 million)of Company T, to arrive at goodwill as a percentage of total assets of continuing operations in 2001 amounted to 38.50%).

• Goodwill to total assets ratio of Company T increased to 39.29% during the year 2002.

•

If the purchase price of the acquiring company exceeds its net asset value, then the surplus amount can be allocated to goodwill. Accordingly, Company T created false reserves. It is very clear that the Company T allocates a larger amount to goodwill at the time of acquisition of companies. Company T creates reserve to reverse them into profit in the future period. Hence, signal number 1 indicates that the Company T allocates a larger portion of amounts to goodwill at the time of acquisition of other companies.

Working note:

Calculate the ratio of goodwill to total assets of continuing operations for the year 2001:

Signal number 4

Signal number 4 Signal number 1 referring to the misuse of large one-time charges in income statement. The investors of the company need to be very alert with the large one-time charges that are reported in the income statement during the acquisition period. This is signal that the company creates false reserves which help to increase the earnings of the future period.

Therefore, it is necessary to inspect the one-time charges of company T in its income statement.

Identify the one-time charges of Company T.

Explanation about Company T's fictitious allocation of large one-time charges with reference to signal number 4.

Explanation about Company T's fictitious allocation of large one-time charges with reference to signal number 4. • The above one-time charges have been used by Company T to produce cookie-jar reserves, which can be released in later years to overstate earnings. SEC (Securities and Exchange Commission)took action Company T for its overstatement of earnings of $500million in the year subsequent to acquisition.

• Company T overstate its earnings by understate the value of net asset of acquired companies, and by increase the equivalent amount of goodwill, or by increase the one-time charges in its income statement.

Requirement b

Calculate sales to total assets ratio.

For the year 1998:

For the year 1999:

For the year 1999:  For the year 2000:

For the year 2000:  For the year 2001:

For the year 2001:  For the year 2002:

For the year 2002:  Determine the trend of sales to total assets ratios for Company T.

Determine the trend of sales to total assets ratios for Company T.  Explanation for Company T's trend in sales to total assets ratio:

Explanation for Company T's trend in sales to total assets ratio: • According to DuPont formula, the return on assets can be split into the following:

• It is important to find that the investment made in assets produce revenues and that can be measured by the turnover ratio. Also it is very important to note, whether the generated revenue exceed the total costs and create a profit. Profit can be measured by the margin ratio.

• It is important to find that the investment made in assets produce revenues and that can be measured by the turnover ratio. Also it is very important to note, whether the generated revenue exceed the total costs and create a profit. Profit can be measured by the margin ratio. • The sales to total assets ratio of Company T gradually goes down from 0.1832 in 1998 to 0.4792 in 2001.

• Massive investment in goodwill in the past years did not facilitate the Company T to generate sales at a stable rate, when compared to the amount of investment made in all assets.

• Obviously, investors should have been worried that the amounts invested on acquisition did not generate reasonable revenue.

• From the year 2000 to 2002, Company T split the revenue as sales revenue and service revenue in its disclosure.

• Thus, sales to total asset ratios from 2000 to 2002 consist of service revenue since the warning sign is actually testing whether the assets are earning income at a feasible rate as opposed to just earning sales specifically.

Requirement c

Explanation about understating assets or overstating liabilities and reserves on acquisition of a new company:

• If a current asset (stock)is devalued at the time of acquisition and it is sold at a future period, then the resulting amount of gross profit will be larger.

• If a liability of an expense is recognized on acquisition, but the actual expense will be occurred only in future, then this will bring about increased revenue in the subsequent period.

• If a reserve for doubtful debts is overstated in a financial statement of a company on acquisition, then the company requires recording the smaller bad-debt expenses in future, otherwise it should reverse the reserve in the subsequent period.• On acquisition if a company understates its assets or overstates the amount of reserves, then it will allocates an equivalent amount of purchase price to goodwill.

2

Fill in the blank with information and concepts from this chapter.

Investors should be wary of large ________ - ______ charges in the income statement around the acquisition period because these are often signals that the company could be creating false reserves.

Investors should be wary of large ________ - ______ charges in the income statement around the acquisition period because these are often signals that the company could be creating false reserves.

One-time Charges

The investors of the company need to be very alert with the large one-time charges that are reported in the income statement during the acquisition period. This is signal that the company creates false reserves which help to increase the earnings of the future period.

Thus, the correct answer is

.

.

The investors of the company need to be very alert with the large one-time charges that are reported in the income statement during the acquisition period. This is signal that the company creates false reserves which help to increase the earnings of the future period.

Thus, the correct answer is

.

. 3

Signal #4 for the scheme of improper use of merger reserves is the occurrence of large, one-time charges in the income statement around the time of the acquisition period. Compare the use of one-time charges in the income statement to the use of large amounts of goodwill for the improper use of merger reserves.

Improper Use of Mergers

Company W used two schemes to overstate the earnings of the company:

1. Company W created unwanted cookie-jar reserves to increase the later earnings and present false picture of company that it is financially healthy.

2. Company W reclassified the line-cost expenses as the capital assets. Therefore, those costs were classified as capital asset instead of expenses. They were reported in the balance sheet instead of the income statement. This overstated the earnings.

Use of one-time charges

• Creation of false reserves reduces the net asset value of the acquired company's asset.

• When goodwill is created, the earnings do not reduced during creation of false reserve. Here, goodwill is debited.• When there are large one-time charges in the income statement, there is a decrease in the earning during reserve creation.

• In the above stated case, the cookie jar reserves are being used as the earnings for the future period.• This shows that the acquisition of the company made is successful. It results in increased profits.

• When the excess mergers are being out from the company, the false profit vanishes.

Company W used two schemes to overstate the earnings of the company:

1. Company W created unwanted cookie-jar reserves to increase the later earnings and present false picture of company that it is financially healthy.

2. Company W reclassified the line-cost expenses as the capital assets. Therefore, those costs were classified as capital asset instead of expenses. They were reported in the balance sheet instead of the income statement. This overstated the earnings.

Use of one-time charges

• Creation of false reserves reduces the net asset value of the acquired company's asset.

• When goodwill is created, the earnings do not reduced during creation of false reserve. Here, goodwill is debited.• When there are large one-time charges in the income statement, there is a decrease in the earning during reserve creation.

• In the above stated case, the cookie jar reserves are being used as the earnings for the future period.• This shows that the acquisition of the company made is successful. It results in increased profits.

• When the excess mergers are being out from the company, the false profit vanishes.

4

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

When goodwill on the acquisition of a company relates to a company that does not have or is unlikely to have a supernormal return on assets, it is a signal that the stated goodwill may be fictitious.

When goodwill on the acquisition of a company relates to a company that does not have or is unlikely to have a supernormal return on assets, it is a signal that the stated goodwill may be fictitious.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fill in the blank with information and concepts from this chapter.

The misallocation of expenses as assets is known as the improper __________ of expenses.

The misallocation of expenses as assets is known as the improper __________ of expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

When Company A acquires Company B, does the fact that Company A paid more for Company B than its net asset value mean that "goodwill" has been acquired? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

WorldCom overstated its sales by holding its books open at the close of a reporting period.

WorldCom overstated its sales by holding its books open at the close of a reporting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

Fill in the blank with information and concepts from this chapter.

A signal of the fictitious reporting of expenses as assets is a decrease in the ratio of _________ to assets.

A signal of the fictitious reporting of expenses as assets is a decrease in the ratio of _________ to assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

Why is a decreasing sales-to-PPE ratio a signal of possible overstatement of assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

WorldCom overstated its earnings by capitalizing rather than expensing approximately $3.8 billion of its costs.

WorldCom overstated its earnings by capitalizing rather than expensing approximately $3.8 billion of its costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fill in the blank with information and concepts from this chapter.

When a(n) _______ cost remains constant as a percentage of sales while sales decrease, it is a signal that the cost is being understated.

When a(n) _______ cost remains constant as a percentage of sales while sales decrease, it is a signal that the cost is being understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

Explain why the overstatement of a reserve for accumulated depreciation of an acquired company at the time of acquisition would cause an overstatement of goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

WorldCom overstated its earnings by improper accounting for multiple element contracts.

WorldCom overstated its earnings by improper accounting for multiple element contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fill in the blank with information and concepts from this chapter.

If a company changes its accounting policy to begin capitalizing a cost that it previously recorded as an expense, it is a signal that the ____________ of the company's earnings may be deteriorating.

If a company changes its accounting policy to begin capitalizing a cost that it previously recorded as an expense, it is a signal that the ____________ of the company's earnings may be deteriorating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

How was WorldCom able to continue to acquire so many companies and overstate goodwill by so much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

If a company overstates merger reserves at the time of acquiring another company, it can release the surplus reserves into earnings in a later period without decreasing net income at the time of the creation of the reserve.

If a company overstates merger reserves at the time of acquiring another company, it can release the surplus reserves into earnings in a later period without decreasing net income at the time of the creation of the reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

WorldCom is presented in this textbook as an illustration of overstating earnings by: (a) Holding books open after the close of a reporting period.

(b) Misuse of multiple element contracts.

(c) Improper use of merger reserves and improper capitalization of expenses.

(d) Understatement of reserves for bad debts.

(b) Misuse of multiple element contracts.

(c) Improper use of merger reserves and improper capitalization of expenses.

(d) Understatement of reserves for bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

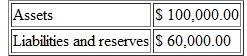

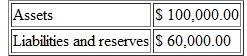

Action Co. has agreed to pay $45,000 to acquire 100 percent of the shares of Sub Co. Action Co. believes that the fair value of Sub Co.'s assets, liabilities, and reserves at the date of acquisition are as follows:

Action Co. believes that based on Sub Co.'s future earnings potential, it is prepared to pay $5,000 more for Sub Co. than its net asset value. Action Co. decides to overstate reserves related to Sub Co. by $10,000 at the time of acquisition and to overstate goodwill by a corresponding amount.

Action Co. believes that based on Sub Co.'s future earnings potential, it is prepared to pay $5,000 more for Sub Co. than its net asset value. Action Co. decides to overstate reserves related to Sub Co. by $10,000 at the time of acquisition and to overstate goodwill by a corresponding amount.

How much goodwill will be recorded in respect of the acquisition of Sub Co.?

Action Co. believes that based on Sub Co.'s future earnings potential, it is prepared to pay $5,000 more for Sub Co. than its net asset value. Action Co. decides to overstate reserves related to Sub Co. by $10,000 at the time of acquisition and to overstate goodwill by a corresponding amount.

Action Co. believes that based on Sub Co.'s future earnings potential, it is prepared to pay $5,000 more for Sub Co. than its net asset value. Action Co. decides to overstate reserves related to Sub Co. by $10,000 at the time of acquisition and to overstate goodwill by a corresponding amount.How much goodwill will be recorded in respect of the acquisition of Sub Co.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

When a company that makes a number of acquisitions also creates significant reserves, it is a signal that the company may be creating false reserves.

When a company that makes a number of acquisitions also creates significant reserves, it is a signal that the company may be creating false reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is not a signal of overstatement of earnings by improper use of merger reserves? (a) When goodwill on acquisition relates to a company that does not have or is unlikely to have a supernormal return on assets.

(b) When the sales-to-PPE ratio decreases after an acquisition.

(c) When a company that makes a number of acquisitions also creates significant reserves.

(d) Adjustments that increase goodwill in a later period, with respect to an earlier acquisition.

(b) When the sales-to-PPE ratio decreases after an acquisition.

(c) When a company that makes a number of acquisitions also creates significant reserves.

(d) Adjustments that increase goodwill in a later period, with respect to an earlier acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

At the time of Big Company's acquisition of Small Company, Big Company believed that Small Company's reserve for doubtful debts was correctly stated at $30,000. Big Company purposely overstated the reserves at the time of acquisition by $20,000 by specifically stating that it believed that this reserve was understated by this amount.

At the end of the next accounting period following the acquisition, the reserve for doubtful debts balance was $50,000 before considering any entries for that period. Based on aging of the accounts receivable, it appeared that the reserve for doubtful debts balance needed to be stated at $55,000.

Required

a. As a result of the overstatement of the doubtful debts reserve in the acquisition period, what is the bad debt expense in the period following the acquisition?

b. If the reserve for doubtful debts had not been overstated at the time of the acquisition, what would the bad debt expense have been in the period following the acquisition?

At the end of the next accounting period following the acquisition, the reserve for doubtful debts balance was $50,000 before considering any entries for that period. Based on aging of the accounts receivable, it appeared that the reserve for doubtful debts balance needed to be stated at $55,000.

Required

a. As a result of the overstatement of the doubtful debts reserve in the acquisition period, what is the bad debt expense in the period following the acquisition?

b. If the reserve for doubtful debts had not been overstated at the time of the acquisition, what would the bad debt expense have been in the period following the acquisition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

When the PPE amount on the balance sheet increases while revenue decreases, it is a signal that expenses may be improperly capitalized.

When the PPE amount on the balance sheet increases while revenue decreases, it is a signal that expenses may be improperly capitalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

When revenue decreases, one would expect fixed costs to: (a) Remain constant as a percentage of sales.

(b) Increase as a percentage of sales.

(c) Decrease as a percentage of sales.

(d) None of the above.

(b) Increase as a percentage of sales.

(c) Decrease as a percentage of sales.

(d) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

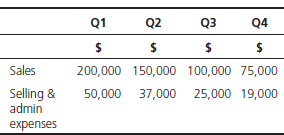

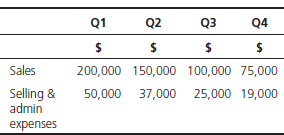

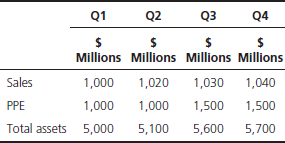

Extracts for Zeddy Company's quarterly income statements and balance sheets for quarters 1-4 are as follows:

Calculate selling and administrative expenses as a percentage of sales for quarters 1-4 and comment on the results.

Calculate selling and administrative expenses as a percentage of sales for quarters 1-4 and comment on the results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

If the notes to the financial statements indicate that a company is capitalizing costs that other companies in the same industry recognize as expenses, it is a signal that the company is capitalizing questionable costs.

If the notes to the financial statements indicate that a company is capitalizing costs that other companies in the same industry recognize as expenses, it is a signal that the company is capitalizing questionable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following costs can be capitalized without contravening GAAP? (a) Customer acquisition costs.

(b) Software development costs.

(c) Interest costs related to amounts invested in assets under construction.

(d) All of the above.

(b) Software development costs.

(c) Interest costs related to amounts invested in assets under construction.

(d) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

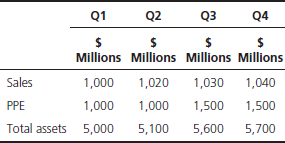

Extracts from Zee's quarterly income statements and balance sheets for the four quarters of year 1 are as follows:

Required

a. Calculate the sales/PPE ratio for quarters 1-4.

b. Calculate the sales/total assets ratio for quarters 1-4.

c. Comment on the above ratios.

Required

a. Calculate the sales/PPE ratio for quarters 1-4.

b. Calculate the sales/total assets ratio for quarters 1-4.

c. Comment on the above ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

Special charges in the income statement that write off previously capitalized costs are always a sign that a company has become conservative in recognizing earnings and that the quality of its earnings is increasing.

Special charges in the income statement that write off previously capitalized costs are always a sign that a company has become conservative in recognizing earnings and that the quality of its earnings is increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following reserve accounts was not examined by WorldCom's Bankruptcy Examiner? (a) Bad debt reserves.

(b) Tax reserves.

(c) Legal reserves.

(d) Cooperative advertising reserves.

(b) Tax reserves.

(c) Legal reserves.

(d) Cooperative advertising reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

30

Answer the question with T for true or F for false for more practice with key terms and concepts from this chapter.

If a parent company discovers that the assets of an acquired company are worth less than it believed at the time of the acquisition, it is appropriate to increase goodwill because this means that the excess of the purchase price over the net asset value of the acquired company was greater than what the parent company originally believed.

If a parent company discovers that the assets of an acquired company are worth less than it believed at the time of the acquisition, it is appropriate to increase goodwill because this means that the excess of the purchase price over the net asset value of the acquired company was greater than what the parent company originally believed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a company overstates the reserves of a company that it acquires and increases goodwill by a corresponding amount in the period of the acquisition in order to release the reserves in a later period, which of the following will occur? (a) A decrease in the amount of the group's operating income in its consolidated income statement in the period of the acquisition.

(b) No decrease in operating income, but a decrease in net income in the group's consolidated income statement in the period of the acquisition.

(c) No decrease in operating income and no decrease net income in the period of the acquisition.

(d) An increase net income in the period of the acquisition.

(b) No decrease in operating income, but a decrease in net income in the group's consolidated income statement in the period of the acquisition.

(c) No decrease in operating income and no decrease net income in the period of the acquisition.

(d) An increase net income in the period of the acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

Fill in the blank with information and concepts from this chapter.

The opportunity for the creation of WorldCom was the court-ordered breakup of ________, which was then forced to lease long-distance phone lines.

The opportunity for the creation of WorldCom was the court-ordered breakup of ________, which was then forced to lease long-distance phone lines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a company misclassifies an expense as an asset, this will likely cause which of the following signals? (a) Accounts receivable increase as a percentage of sales.

(b) Fixed expenses increase as percentage of sales.

(c) Asset turnover ratio increases.

(d) Asset turnover ratio decreases.

(b) Fixed expenses increase as percentage of sales.

(c) Asset turnover ratio increases.

(d) Asset turnover ratio decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fill in the blank with information and concepts from this chapter.

WorldCom's Bankruptcy Examiner alleged that WorldCom's ______ was the fuel that kept its acquisition engine running.

WorldCom's Bankruptcy Examiner alleged that WorldCom's ______ was the fuel that kept its acquisition engine running.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

WorldCom improperly accounted for its line cost expense by: (a) Allocating line-cost expense to PPE in its first recording of the line-cost transactions.

(b) Initially properly debiting the line-cost expense to an expense account and later transferring the expense to PPE.

(c) Misclassifying part of its line-cost expense as goodwill.

(d) Adding its line-cost expense to inventory to reduce cost of goods sold.

(b) Initially properly debiting the line-cost expense to an expense account and later transferring the expense to PPE.

(c) Misclassifying part of its line-cost expense as goodwill.

(d) Adding its line-cost expense to inventory to reduce cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

Fill in the blank with information and concepts from this chapter.

When a company inappropriately overstates purchase acquisition reserves, it also overstates ________ by a corresponding amount.

When a company inappropriately overstates purchase acquisition reserves, it also overstates ________ by a corresponding amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

An overstatement of goodwill on the acquisition of a company can be accomplished by: (a) An understatement of the value of the assets of the acquired company.

(b) An understatement of the liabilities of the acquired company.

(c) An understatement of reserves required for the restructuring of an acquired company.

(d) A bargain purchase price of the acquired company that is below its net asset value.

(b) An understatement of the liabilities of the acquired company.

(c) An understatement of reserves required for the restructuring of an acquired company.

(d) A bargain purchase price of the acquired company that is below its net asset value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

Fill in the blank with information and concepts from this chapter.

When a company overstates reserves at the time of acquisition, in later periods, it can release the ________ reserves back into earnings.

When a company overstates reserves at the time of acquisition, in later periods, it can release the ________ reserves back into earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

With which of the following gatekeepers did WorldCom's Bankruptcy Examiner find fault? (a) The board of directors.

(b) The investment banking company.

(c) Both (a) and (b).

(d) None of the above.

(b) The investment banking company.

(c) Both (a) and (b).

(d) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

40

Fill in the blank with information and concepts from this chapter.

Adjustments that increase _________ in a later period, with respect to an earlier acquisition, are further signs that a company may be creating false reserves.

Adjustments that increase _________ in a later period, with respect to an earlier acquisition, are further signs that a company may be creating false reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

Signal #1 for the scheme of improper use of acquisition or merger reserves is a parent company allocating large amounts to good-will when acquiring other companies. Explain why this could be a signal of "improper use of acquisition or merger reserves."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck