Deck 2: Analyzing Transactions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 2: Analyzing Transactions

1

Team Activity

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

Based on the information in the company's most recent annual report, answer the following questions:

1. What amount of total assets does the company report on its balance sheet?

2. What amount of total liabilities does the company report on its balance sheet?

3. Using the accounting equation, determine the company's stockholders' equity. Compare this amount to the amount of stockholders' equity reported on the company's balance sheet.

4. How many years of information are reported on the company's income statement?

5. How many years of information are reported on the company's balance sheet?

6. What is the difference between the information reported on the income statement and the information reported on the balance sheet?

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

Based on the information in the company's most recent annual report, answer the following questions:

1. What amount of total assets does the company report on its balance sheet?

2. What amount of total liabilities does the company report on its balance sheet?

3. Using the accounting equation, determine the company's stockholders' equity. Compare this amount to the amount of stockholders' equity reported on the company's balance sheet.

4. How many years of information are reported on the company's income statement?

5. How many years of information are reported on the company's balance sheet?

6. What is the difference between the information reported on the income statement and the information reported on the balance sheet?

In the present case, company F is selected and the required data can be taken from the form 10K filed from annual report recently submitted by the company on April 27, 2016.The filed report to the concerned authorities regarding its financial statements for the year ended on December 31, 2015 and related notes can be easily provided figures of the total values of assets, liabilities and equity. From the investor's section of the company's official website or from the database service required information can be collected.1.The recent annual report of the company provides following information about the company.

Assets: The rights or resources that has acquired by the company to extract benefits for a longer period from their economic value. Generally, the capital investment is used to procure the assets as the higher amounts of expenses are involved in it.

The company, F has reported total amount of assets of $49.41 billion which includes $4.91 billion of cash, $13.53 billion of marketable securities, $2.56 billion of receivables, and $659 million of other current assets, $5.69 billion of plant and equipment, $21.27 billion of intangibles, and $796 million of deposits and others.

Above figures are extracted from the assets side i.e. shown at the upper most part of the balance sheet of the company. At a point of time, the value of assets needs to mention in the balance sheet. The value of intangibles i.e. $21.27 billion represents that they are acquired during the current year only.

2.Liabilities: The obligations or the debt amounts that has arisen out of the past or current transactions of the company. The capital investment is also a type of an internal liability for the company. The company is liable to pay its owners in future.

The company, F has reported total liabilities of 5.19 billion which includes 1.93 billion current liabilities, 107 million of non-current capital leases, and 3.16 billion of other long term liabilities.

Above figures are extracted from the liabilities side i.e. shown in the middle of the balance sheet of the company. At a point of time, the amount of liabilities needs to mention in the balance sheet.

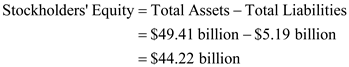

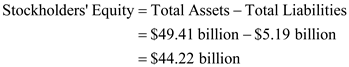

3.Stockholders' Equity: The value that shows the initial investment introduced by the owners whether in cash or kind, further it is added with the profits earned during the subsequent years. It is classified into two broad groups named as common stock and retained earnings. The value of stockholders' equity can be computed by putting the above figures of assets and liabilities in the accounting equation i.e.

On the Company's balance sheet, the reported stockholders' equity amounts to $44.22 billion that is same as computed from the above formula. Although there can be a minor rounding off difference between two values.

On the Company's balance sheet, the reported stockholders' equity amounts to $44.22 billion that is same as computed from the above formula. Although there can be a minor rounding off difference between two values.

4.In the present case, the company F has provided information of 6 Years in the income statement i.e. from the year 2010 to 2015.5.In the present case, the company F has provided information of 5 Years in the balance sheet i.e. from the year 2011 to 2015.6.The income statement provides the information related to revenues and expenses of the business and indicates the company's net profit earned during the period.

But the balance sheet provides the information regarding the balance of company's assets, liabilities, and shareholders' equity at a particular point of reporting time.

Assets: The rights or resources that has acquired by the company to extract benefits for a longer period from their economic value. Generally, the capital investment is used to procure the assets as the higher amounts of expenses are involved in it.

The company, F has reported total amount of assets of $49.41 billion which includes $4.91 billion of cash, $13.53 billion of marketable securities, $2.56 billion of receivables, and $659 million of other current assets, $5.69 billion of plant and equipment, $21.27 billion of intangibles, and $796 million of deposits and others.

Above figures are extracted from the assets side i.e. shown at the upper most part of the balance sheet of the company. At a point of time, the value of assets needs to mention in the balance sheet. The value of intangibles i.e. $21.27 billion represents that they are acquired during the current year only.

2.Liabilities: The obligations or the debt amounts that has arisen out of the past or current transactions of the company. The capital investment is also a type of an internal liability for the company. The company is liable to pay its owners in future.

The company, F has reported total liabilities of 5.19 billion which includes 1.93 billion current liabilities, 107 million of non-current capital leases, and 3.16 billion of other long term liabilities.

Above figures are extracted from the liabilities side i.e. shown in the middle of the balance sheet of the company. At a point of time, the amount of liabilities needs to mention in the balance sheet.

3.Stockholders' Equity: The value that shows the initial investment introduced by the owners whether in cash or kind, further it is added with the profits earned during the subsequent years. It is classified into two broad groups named as common stock and retained earnings. The value of stockholders' equity can be computed by putting the above figures of assets and liabilities in the accounting equation i.e.

On the Company's balance sheet, the reported stockholders' equity amounts to $44.22 billion that is same as computed from the above formula. Although there can be a minor rounding off difference between two values.

On the Company's balance sheet, the reported stockholders' equity amounts to $44.22 billion that is same as computed from the above formula. Although there can be a minor rounding off difference between two values.4.In the present case, the company F has provided information of 6 Years in the income statement i.e. from the year 2010 to 2015.5.In the present case, the company F has provided information of 5 Years in the balance sheet i.e. from the year 2011 to 2015.6.The income statement provides the information related to revenues and expenses of the business and indicates the company's net profit earned during the period.

But the balance sheet provides the information regarding the balance of company's assets, liabilities, and shareholders' equity at a particular point of reporting time.

2

Normal entries for accounts

During the month, Gates Labs Co. has a substantial number of transactions affecting each of the following accounts. State for each account whether it is likely to have (A) debit entries only, (B) credit entries only, or (C) both debit and credit entries.

1. Accounts Payable

2. Accounts Receivable

3. Cash

4. Fees Earned

5. Insurance Expense

6. Dividends

7. Utilities Expense

During the month, Gates Labs Co. has a substantial number of transactions affecting each of the following accounts. State for each account whether it is likely to have (A) debit entries only, (B) credit entries only, or (C) both debit and credit entries.

1. Accounts Payable

2. Accounts Receivable

3. Cash

4. Fees Earned

5. Insurance Expense

6. Dividends

7. Utilities Expense

Double entry accounting system : In double entry system there are two effects given for each transaction. The same amount is credited to a particular account/s which is debited in account/s. There are certain rules that, a particular type of account can have only credit entries, only debit entries, or both type of entries.

Here, in this case we are required to find out that the given accounts can have which type of entries.

a.Following transactions will have only Debit entries:

Insurance Expense: It will have only debit entries. Amount of insurance premium paid or payable will be debited to this account and cash/bank or insurance payable amount will be credited accordingly.

Dividends: It will have only debit entries. Amount of dividend paid or payable will be debited to this account and cash/bank or dividend payable amount will be credited accordingly.

Utilities Expense Account: It will have only debit entries. Amount of utility expense paid or payable will be debited to this account and cash/bank or utilities expense payable amount will be credited accordingly.

b.Fees Earned: It will have only credit entries. Fees received or receivable will be credited to this account and cash or fees receivable account will be debited respectively.

c.Following will have both Debit and Credit entries;

Accounts Payable: It will have both type of entries of debit and credit. When goods are purchased on credit, this account will be credited and when payment is done through cash/bank or goods are returned, this account will be debited.Accounts Receivable: It will have both type of entries of debit and credit. When goods are sold on credit, this account will be debited and when payment is received through cash/bank or goods are returned, this account will be credited.Cash: It will have both type of entries of debit and credit. When cash is received, it is debited. And when cash is paid, it is credited.

Here, in this case we are required to find out that the given accounts can have which type of entries.

a.Following transactions will have only Debit entries:

Insurance Expense: It will have only debit entries. Amount of insurance premium paid or payable will be debited to this account and cash/bank or insurance payable amount will be credited accordingly.

Dividends: It will have only debit entries. Amount of dividend paid or payable will be debited to this account and cash/bank or dividend payable amount will be credited accordingly.

Utilities Expense Account: It will have only debit entries. Amount of utility expense paid or payable will be debited to this account and cash/bank or utilities expense payable amount will be credited accordingly.

b.Fees Earned: It will have only credit entries. Fees received or receivable will be credited to this account and cash or fees receivable account will be debited respectively.

c.Following will have both Debit and Credit entries;

Accounts Payable: It will have both type of entries of debit and credit. When goods are purchased on credit, this account will be credited and when payment is done through cash/bank or goods are returned, this account will be debited.Accounts Receivable: It will have both type of entries of debit and credit. When goods are sold on credit, this account will be debited and when payment is received through cash/bank or goods are returned, this account will be credited.Cash: It will have both type of entries of debit and credit. When cash is received, it is debited. And when cash is paid, it is credited.

3

Retained earnings account balance

As of January 1, Retained Earnings had a credit balance of $314,000. During the year, dividends totaled $10,000, and the business incurred a net loss of $320,000.

A. Compute the balance of Retained Earnings as of the end of the year.

B. Assuming that there have been no recording errors, will the balance sheet prepared at December 31 balance? Explain.

As of January 1, Retained Earnings had a credit balance of $314,000. During the year, dividends totaled $10,000, and the business incurred a net loss of $320,000.

A. Compute the balance of Retained Earnings as of the end of the year.

B. Assuming that there have been no recording errors, will the balance sheet prepared at December 31 balance? Explain.

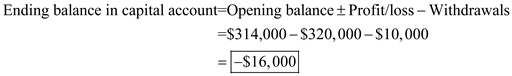

a.

Compute ending balance in capital account:

Therefore, ending balance in capital account is 16,000debit balance

Therefore, ending balance in capital account is 16,000debit balance

b.

Since the business has incurred a loss, therefore the closing balance in the capital account will be negative i.e. the capital account will have a debit balance.

Assuming that there have been no recording errors and no posting errors as well, the balance sheet prepared at December 31 will balance for sure.

Just the balance in the capital account will be negative i.e. capital account will have a debit balance as against the normal credit balance.

Compute ending balance in capital account:

Therefore, ending balance in capital account is 16,000debit balance

Therefore, ending balance in capital account is 16,000debit balance b.

Since the business has incurred a loss, therefore the closing balance in the capital account will be negative i.e. the capital account will have a debit balance.

Assuming that there have been no recording errors and no posting errors as well, the balance sheet prepared at December 31 will balance for sure.

Just the balance in the capital account will be negative i.e. capital account will have a debit balance as against the normal credit balance.

4

Target: Horizontal analysis

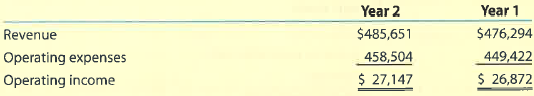

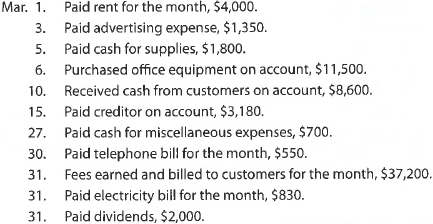

The following data (in millions) are taken from the financial statements of Target Corporation , the owner of Target stores:

A. For Target, determine the amount of change in millions and the percent of change (rounded to one decimal place) from Year 1 to Year 2 for:

1. Revenue

2. Operating expenses

3. Operating income

B. What conclusions can you draw from your analysis of the revenue and total operating expenses?

The following data (in millions) are taken from the financial statements of Target Corporation , the owner of Target stores:

A. For Target, determine the amount of change in millions and the percent of change (rounded to one decimal place) from Year 1 to Year 2 for:

1. Revenue

2. Operating expenses

3. Operating income

B. What conclusions can you draw from your analysis of the revenue and total operating expenses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

Corrected trial balance

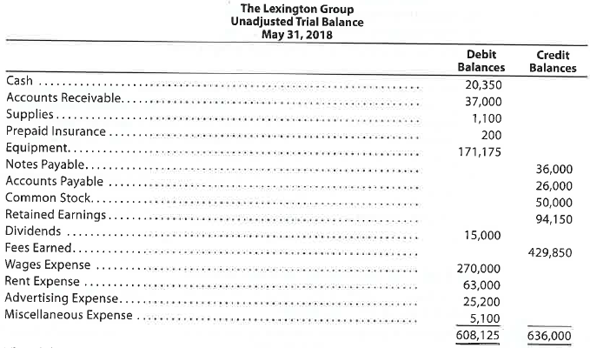

The Lexington Group has the following unadjusted trial balance as of May 31, 2018:

The debit and credit totals are not equal as a result of the following errors:

A. The cash entered on the trial balance was overstated by $7,000.

B. A cash receipt of $8,200 was posted as a debit to Cash of $2,800.

C. A debit of $16,500 to Accounts Receivable was not posted.

D. A return of $125 of defective supplies was erroneously posted as a $1,250 credit to Supplies.

E. An insurance policy acquired at a cost of $3,600 was posted as a credit to Prepaid Insurance.

F. The balance of Notes Payable was understated by $9,000.

G. A credit of $10,000 in Accounts Payable was overlooked when determining the balance of the account.

H. A debit of $5,000 for dividends was posted as a credit to Retained Earnings.

I. The balance of $60,300 in Rent Expense was entered as $63,000 in the trial balance.

J. Gas, Electricity, and Water Expense, with a balance of $16,350, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of May 31, 2018.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

The Lexington Group has the following unadjusted trial balance as of May 31, 2018:

The debit and credit totals are not equal as a result of the following errors:

A. The cash entered on the trial balance was overstated by $7,000.

B. A cash receipt of $8,200 was posted as a debit to Cash of $2,800.

C. A debit of $16,500 to Accounts Receivable was not posted.

D. A return of $125 of defective supplies was erroneously posted as a $1,250 credit to Supplies.

E. An insurance policy acquired at a cost of $3,600 was posted as a credit to Prepaid Insurance.

F. The balance of Notes Payable was understated by $9,000.

G. A credit of $10,000 in Accounts Payable was overlooked when determining the balance of the account.

H. A debit of $5,000 for dividends was posted as a credit to Retained Earnings.

I. The balance of $60,300 in Rent Expense was entered as $63,000 in the trial balance.

J. Gas, Electricity, and Water Expense, with a balance of $16,350, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of May 31, 2018.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Identifying transactions

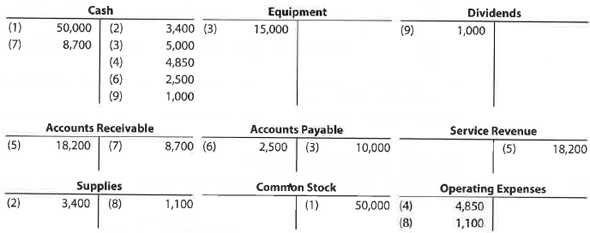

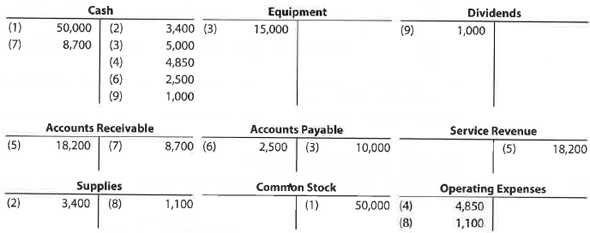

Napa Tours Co. is a travel agency. The nine transactions recorded by Napa Tours during April 2018, its first month of operations, are indicated in the following T accounts:

Indicate for each debit and each credit: (A) whether an asset, liability, stockholders' equity, dividend, revenue, or expense account was affected and (B) whether the account was increased (+) or decreased (?). Present your answers in the following form, with transaction (1) given as an example:

Napa Tours Co. is a travel agency. The nine transactions recorded by Napa Tours during April 2018, its first month of operations, are indicated in the following T accounts:

Indicate for each debit and each credit: (A) whether an asset, liability, stockholders' equity, dividend, revenue, or expense account was affected and (B) whether the account was increased (+) or decreased (?). Present your answers in the following form, with transaction (1) given as an example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

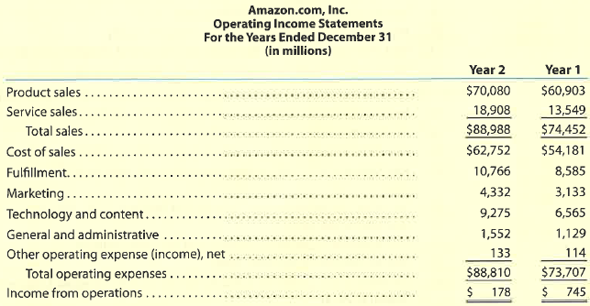

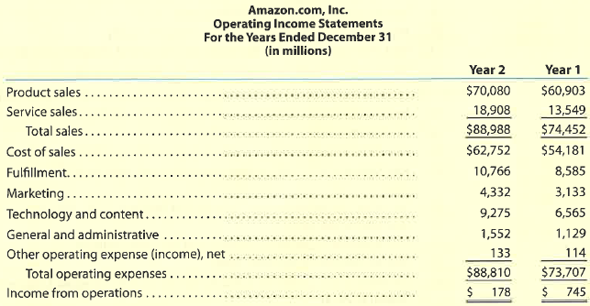

Continuing Company Analysis-Amazon: Horizontal analysis

Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations for two recent years follow:

A. Prepare a horizontal analysis of the operating income statements. (Round percentages to one decimal place.)

B. Interpret the results of the horizontal analysis.

Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations for two recent years follow:

A. Prepare a horizontal analysis of the operating income statements. (Round percentages to one decimal place.)

B. Interpret the results of the horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

Journal entry for fees earned

Prepare a journal entry on August 13 for cash received for services rendered, $9,000.

Prepare a journal entry on August 13 for cash received for services rendered, $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

Corrected trial balance

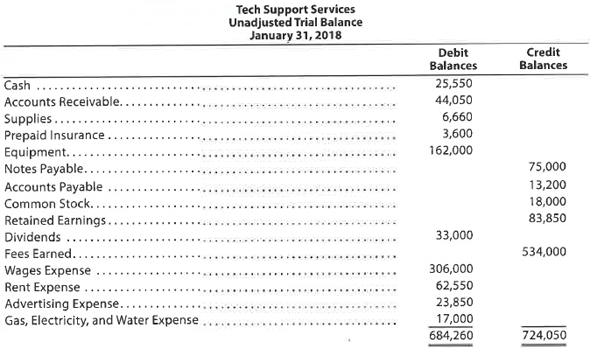

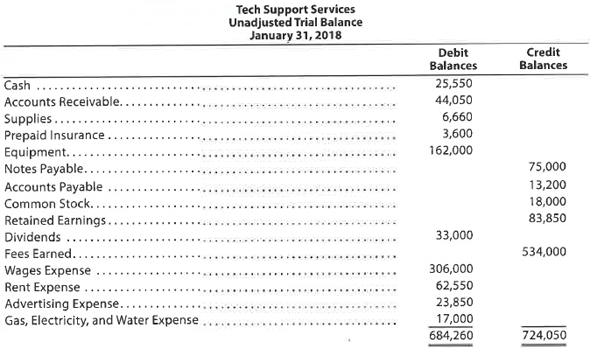

Tech Support Services has the following unadjusted trial balance as of January 31, 2018:

The debit and credit totals are not equal as a result of the following errors:

A. The cash entered on the trial balance was overstated by $8,000.

B. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

C. A debit of $12,350 to Accounts Receivable was not posted.

D. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

E. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid Insurance.

F. The balance of Notes Payable was overstated by $21,000.

G. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

H. A debit of $6,000 for dividends was posted as a debit to Retained Earnings.

I. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial balance.

J. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of January 31, 2018.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Tech Support Services has the following unadjusted trial balance as of January 31, 2018:

The debit and credit totals are not equal as a result of the following errors:

A. The cash entered on the trial balance was overstated by $8,000.

B. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

C. A debit of $12,350 to Accounts Receivable was not posted.

D. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

E. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid Insurance.

F. The balance of Notes Payable was overstated by $21,000.

G. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

H. A debit of $6,000 for dividends was posted as a debit to Retained Earnings.

I. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial balance.

J. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of January 31, 2018.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

Journal entries

Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.

Based upon the T accounts in Exercise 2-13, prepare the nine journal entries from which the postings were made. Journal entry explanations may be omitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

Rules of debit and credit and normal balances

State for each account whether it is likely to have (A) debit entries only, (B) credit entries only, or (C) both debit and credit entries. Also, indicate its normal balance.

1. Accounts Payable

2. Cash

3. Dividends

4. Miscellaneous Expense

5. Insurance Expense

6. Fees Earned

State for each account whether it is likely to have (A) debit entries only, (B) credit entries only, or (C) both debit and credit entries. Also, indicate its normal balance.

1. Accounts Payable

2. Cash

3. Dividends

4. Miscellaneous Expense

5. Insurance Expense

6. Fees Earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

McIntyre Company adheres to a policy of depositing all cash receipts in a bank account and making all payments by check. The cash account as of December 31 has a credit balance of $1,850, and there is no undeposited cash on hand.

(a) Assuming that no errors occurred during journalizing or posting, what caused this unusual balance?

(b) Is the $1,850 credit balance in the cash account an asset, a liability, owner's equity, a revenue, or an expense?

(a) Assuming that no errors occurred during journalizing or posting, what caused this unusual balance?

(b) Is the $1,850 credit balance in the cash account an asset, a liability, owner's equity, a revenue, or an expense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

Trial balance errors

For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

A. The payment of cash for the purchase of office equipment of $12,900 was debited to Land for $12,900 and credited to Cash for $12,900.

B. The payment of $1,840 on account was debited to Accounts Payable for $184 and credited to Cash for $1,840.

C. The receipt of cash on account of $3,800 was recorded as a debit to Cash for $8,300 and a credit to Accounts Receivable for $3,800.

For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

A. The payment of cash for the purchase of office equipment of $12,900 was debited to Land for $12,900 and credited to Cash for $12,900.

B. The payment of $1,840 on account was debited to Accounts Payable for $184 and credited to Cash for $1,840.

C. The receipt of cash on account of $3,800 was recorded as a debit to Cash for $8,300 and a credit to Accounts Receivable for $3,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Trial balance

Based upon the data presented in Exercise 2-13, (A) prepare an unadjusted trial balance, listing the accounts in their proper order. (B) Based upon the unadjusted trial balance, determine the net income or net loss.

Based upon the data presented in Exercise 2-13, (A) prepare an unadjusted trial balance, listing the accounts in their proper order. (B) Based upon the unadjusted trial balance, determine the net income or net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

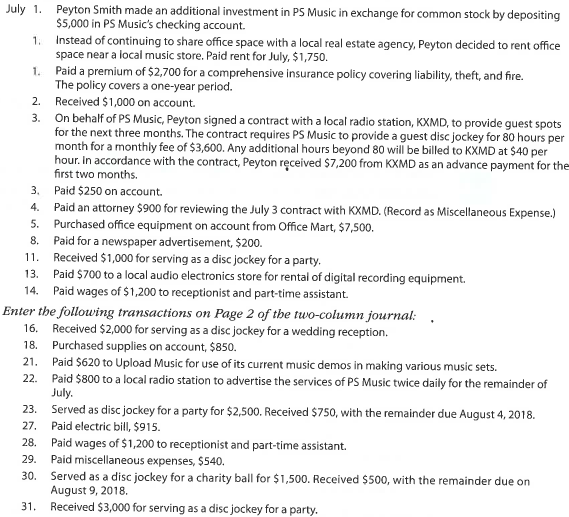

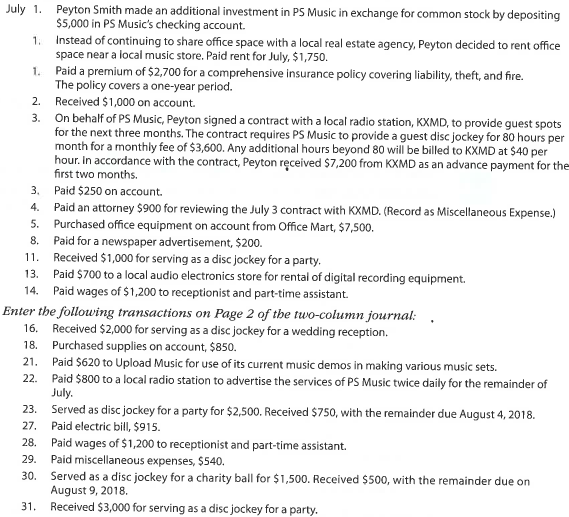

The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations:

PS Music's chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows:

Instructions

1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark (?) in the Posting Reference column. ( Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.)

2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations.

3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance as of July 31, 2018.

PS Music's chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows:

Instructions

1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark (?) in the Posting Reference column. ( Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.)

2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations.

3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance as of July 31, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

Chart of accounts

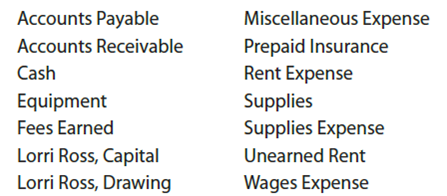

Outdoor Leadership School is a newly organized business that teaches people how to inspire and influence others. The list of accounts to be opened in the general ledger is as follows:

List the accounts in the order in which they should appear in the ledger of Outdoor Leadership School and assign account numbers. Each account number is to have two digits: the first digit is to indicate the major classification (1 for assets, for example), and the second digit is to identify the specific account within each major classification (11 for Cash, for example).

Outdoor Leadership School is a newly organized business that teaches people how to inspire and influence others. The list of accounts to be opened in the general ledger is as follows:

List the accounts in the order in which they should appear in the ledger of Outdoor Leadership School and assign account numbers. Each account number is to have two digits: the first digit is to indicate the major classification (1 for assets, for example), and the second digit is to identify the specific account within each major classification (11 for Cash, for example).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume that a trial balance is prepared with an account balance of $8,900 listed as $9,800 and an account balance of $1,000 listed as $100. Identify the transposition and the slide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

Trial balance

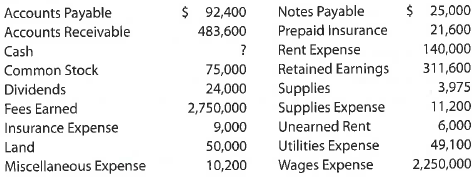

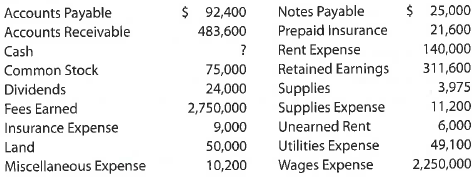

The accounts in the ledger of Atlantic Furniture Company as of July 2018 are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted.

Prepare an unadjusted trial balance, listing the accounts in their normal order and inserting the missing figure for cash.

The accounts in the ledger of Atlantic Furniture Company as of July 2018 are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted.

Prepare an unadjusted trial balance, listing the accounts in their normal order and inserting the missing figure for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the difference between an account and a ledger?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

Journal entries and trial balance

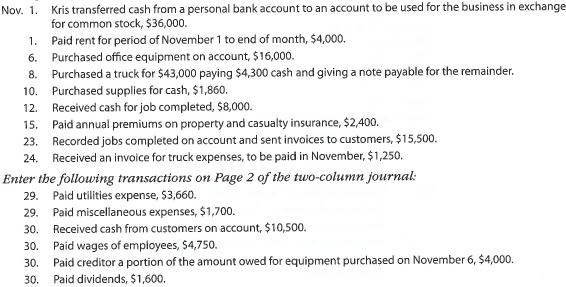

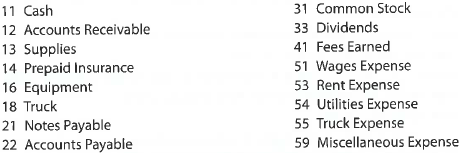

On November 1, 2018, Kris Lehman established an interior decorating business, Modern Designs. During the month, Kris completed the following transactions related to the business:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Modern Designs as of November 30, 2018.

4. Determine the excess of revenues over expenses for November.

5. Can you think of any reason why the amount determined in (4) might not be the net income for November?

On November 1, 2018, Kris Lehman established an interior decorating business, Modern Designs. During the month, Kris completed the following transactions related to the business:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Modern Designs as of November 30, 2018.

4. Determine the excess of revenues over expenses for November.

5. Can you think of any reason why the amount determined in (4) might not be the net income for November?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

Normal balances of accounts

Identify each of the following accounts of Kaiser Services Co. as asset, liability, stockholders' equity, revenue, or expense, and state in each case whether the normal balance is a debit or a credit:

A. Accounts Payable

B. Accounts Receivable

C. Cash

D. Common Stock

E. Dividends

F. Fees Earned

G. Office Equipment

H. Rent Expense

I. Supplies

J. Wages Expense

Identify each of the following accounts of Kaiser Services Co. as asset, liability, stockholders' equity, revenue, or expense, and state in each case whether the normal balance is a debit or a credit:

A. Accounts Payable

B. Accounts Receivable

C. Cash

D. Common Stock

E. Dividends

F. Fees Earned

G. Office Equipment

H. Rent Expense

I. Supplies

J. Wages Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Effect of errors on trial balance

Indicate which of the following errors, each considered individually, would cause the trial balance totals to be unequal:

A. A fee of $21,000 earned and due from a client was not debited to Accounts Receivable or credited to a revenue account, because the cash had not been received.

B. A receipt of $11,300 from an account receivable was journalized and posted as a debit of $11,300 to Cash and a credit of $ 11,300 to Fees Earned.

C. A payment of $4,950 to a creditor was posted as a debit of $4,950 to Accounts Payable and a debit of $4,950 to Cash.

D. A payment of $5,000 for equipment purchased was posted as a debit of $500 to Equipment and a credit of $500 to Cash.

E. Payment of cash dividends of $19,000 was journalized and posted as a debit of $1,900 to Salary Expense and a credit of $ 19,000 to Cash.

Indicate which of the preceding errors would require a correcting entry.

Indicate which of the following errors, each considered individually, would cause the trial balance totals to be unequal:

A. A fee of $21,000 earned and due from a client was not debited to Accounts Receivable or credited to a revenue account, because the cash had not been received.

B. A receipt of $11,300 from an account receivable was journalized and posted as a debit of $11,300 to Cash and a credit of $ 11,300 to Fees Earned.

C. A payment of $4,950 to a creditor was posted as a debit of $4,950 to Accounts Payable and a debit of $4,950 to Cash.

D. A payment of $5,000 for equipment purchased was posted as a debit of $500 to Equipment and a credit of $500 to Cash.

E. Payment of cash dividends of $19,000 was journalized and posted as a debit of $1,900 to Salary Expense and a credit of $ 19,000 to Cash.

Indicate which of the preceding errors would require a correcting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Chart of accounts

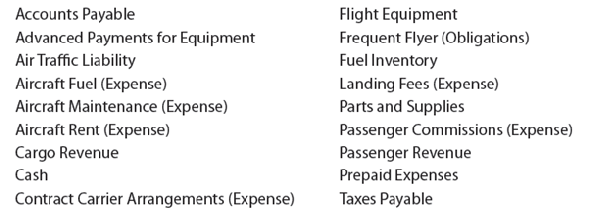

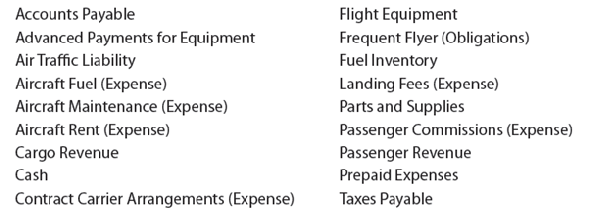

The following accounts appeared in recent financial statements of Delta Air Lines :

Identify each account as either a balance sheet account or an income statement account. For each balance sheet account, identify it as an asset, a liability, or owner's equity. For each income statement account, identify it as a revenue or an expense.

The following accounts appeared in recent financial statements of Delta Air Lines :

Identify each account as either a balance sheet account or an income statement account. For each balance sheet account, identify it as an asset, a liability, or owner's equity. For each income statement account, identify it as a revenue or an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

Journal entries and trial balance

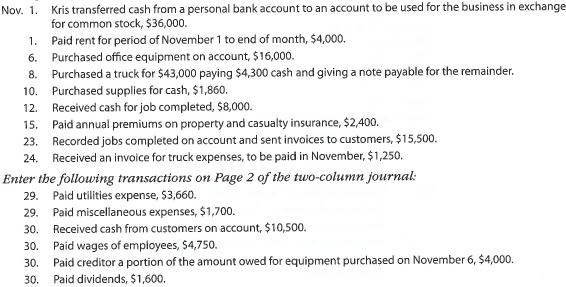

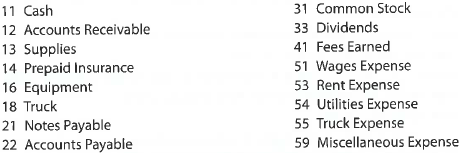

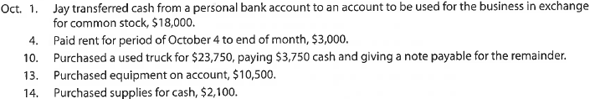

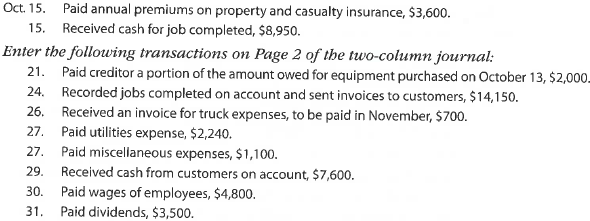

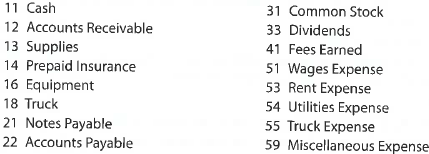

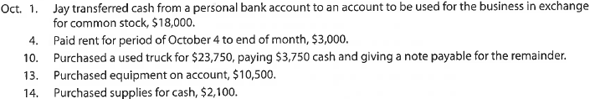

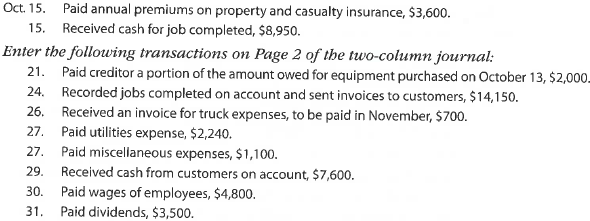

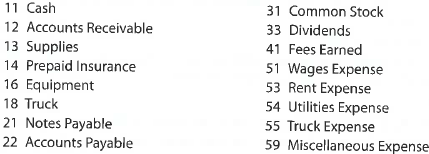

On October 1, 2018, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2018.

4. Determine the excess of revenues over expenses for October.

5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

On October 1, 2018, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2018.

4. Determine the excess of revenues over expenses for October.

5. Can you think of any reason why the amount determined in (4) might not be the net income for October?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

Correcting entries

The following errors took place in journalizing and posting transactions:

A. The receipt of $8,400 for services rendered was recorded as a debit to Accounts Receivable and a credit to Fees Earned.

B. The purchase of supplies of $2,500 on account was recorded as a debit to Office Equipment and a credit to Supplies.

Journalize the entries to correct the errors. Omit explanations.

The following errors took place in journalizing and posting transactions:

A. The receipt of $8,400 for services rendered was recorded as a debit to Accounts Receivable and a credit to Fees Earned.

B. The purchase of supplies of $2,500 on account was recorded as a debit to Office Equipment and a credit to Supplies.

Journalize the entries to correct the errors. Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Errors in trial balance

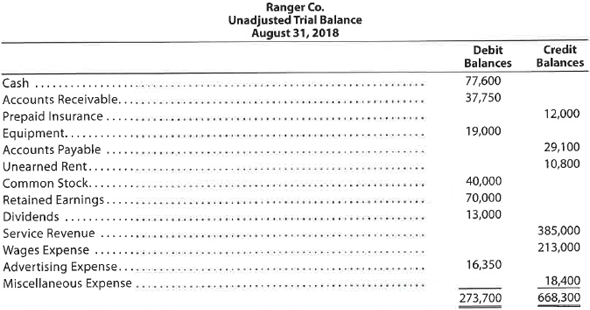

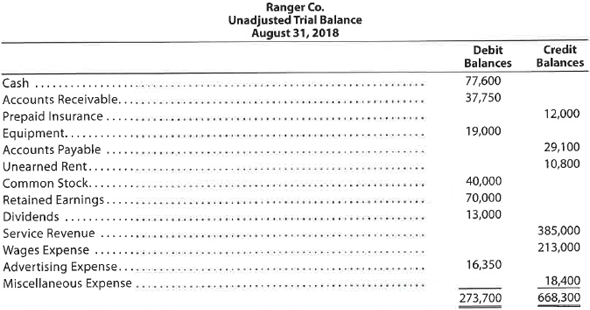

The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance:

When the ledger and other records are reviewed, you discover the following: (1) the debits and credits in the cash account total $77,600 and $62,100, respectively; (2) a billing of $9,000 to a customer on account was not posted to the accounts receivable account; (3) a payment of $4,500 made to a creditor on account was not posted to the accounts payable account; (4) the balance of the unearned rent account is $5,400; (5) the correct balance of the equipment account is $190,000; and (6) each account has a normal balance.

Prepare a corrected unadjusted trial balance.

The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance:

When the ledger and other records are reviewed, you discover the following: (1) the debits and credits in the cash account total $77,600 and $62,100, respectively; (2) a billing of $9,000 to a customer on account was not posted to the accounts receivable account; (3) a payment of $4,500 made to a creditor on account was not posted to the accounts payable account; (4) the balance of the unearned rent account is $5,400; (5) the correct balance of the equipment account is $190,000; and (6) each account has a normal balance.

Prepare a corrected unadjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Entries into T accounts and trial balance

Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus Architects completed the following transactions:

A. Issued common stock to Marjorie Knaus in exchange for $30,000.

B. Paid January rent for office and workroom, $2,500.

C. Purchased used automobile for $28,500, paying $6,000 cash and giving a note payable for the remainder.

D. Purchased office and computer equipment on account, $8,000.

E. Paid cash for supplies, $2,100.

F. Paid cash for annual insurance policies, $3,600.

G. Received cash from client for plans delivered, $9,000.

H. Paid cash for miscellaneous expenses, $2,600.

I. Paid cash to creditors on account, $4,000.

J. Paid installment due on note payable, $1,875.

K. Received invoice for blueprint service, due in February, $5,500.

L. Recorded fees earned on plans delivered, payment to be received in February, $31,400.

M. Paid salary of assistants, $6,000.

N. Paid gas, oil, and repairs on automobile for January, $1,300.

Instructions

1. Record these transactions directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Salary Expense, Blueprint Expense, Rent Expense, Automobile Expense, Miscellaneous Expense. To the left of the amount entered in the accounts, place the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

3. Prepare an unadjusted trial balance for Knaus Architects as of January 31, 2018.

4. Determine the net income or net loss for January.

Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus Architects completed the following transactions:

A. Issued common stock to Marjorie Knaus in exchange for $30,000.

B. Paid January rent for office and workroom, $2,500.

C. Purchased used automobile for $28,500, paying $6,000 cash and giving a note payable for the remainder.

D. Purchased office and computer equipment on account, $8,000.

E. Paid cash for supplies, $2,100.

F. Paid cash for annual insurance policies, $3,600.

G. Received cash from client for plans delivered, $9,000.

H. Paid cash for miscellaneous expenses, $2,600.

I. Paid cash to creditors on account, $4,000.

J. Paid installment due on note payable, $1,875.

K. Received invoice for blueprint service, due in February, $5,500.

L. Recorded fees earned on plans delivered, payment to be received in February, $31,400.

M. Paid salary of assistants, $6,000.

N. Paid gas, oil, and repairs on automobile for January, $1,300.

Instructions

1. Record these transactions directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Salary Expense, Blueprint Expense, Rent Expense, Automobile Expense, Miscellaneous Expense. To the left of the amount entered in the accounts, place the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

3. Prepare an unadjusted trial balance for Knaus Architects as of January 31, 2018.

4. Determine the net income or net loss for January.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Communication and Decision Making

The complexity of the current business and regulatory environment has increased the demand for individuals in all fields of business who have the ability to analyze business transactions and interpret their effects on the financial statements. Search the Internet or your local newspaper for job opportunities in business. One possible Web site is www.careerbuilder.com.

Select a job opportunity to explore further. Write a brief memo to your instructor describing how the ability to analyze business transactions and interpret their effects on the financial statements would be needed for the job opportunity you have selected.

The complexity of the current business and regulatory environment has increased the demand for individuals in all fields of business who have the ability to analyze business transactions and interpret their effects on the financial statements. Search the Internet or your local newspaper for job opportunities in business. One possible Web site is www.careerbuilder.com.

Select a job opportunity to explore further. Write a brief memo to your instructor describing how the ability to analyze business transactions and interpret their effects on the financial statements would be needed for the job opportunity you have selected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assume that when a purchase of supplies of $2,650 for cash was recorded, both the debit and the credit were journalized and posted as $2,560. (a) Would this error cause the trial balance to be out of balance? (b) Would the trial balance be out of balance if the $2,650 entry had been journalized correctly but the credit to Cash had been posted as $2,560?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

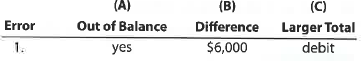

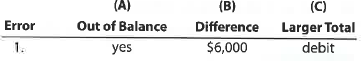

Effect of errors on trial balance?

The following errors occurred in posting from a two-column journal:

1. A credit of $6,000 to Accounts Payable was not posted.

2. An entry debiting Accounts Receivable and crediting Fees Earned for $5,300 was not posted.

3. A debit of $2,700 to Accounts Payable was posted as a credit.

4. A debit of $480 to Supplies was posted twice.

5. A debit of $3,600 to Cash was posted to Miscellaneous Expense.

6. A credit of $780 to Cash was posted as $870.

7. A debit of $12,620 to Wages Expense was posted as $ 12,260.

Considering each case individually (i.e., assuming that no other errors had occurred), indicate: (A) by "yes" or "no" whether the trial balance would be out of balance; (B) if answer to (A) is "yes," the amount by which the trial balance totals would differ; and (C) whether the Debit or Credit column of the trial balance would have the larger total. Answers should be presented in the following form, with error (1) given as an example:

The following errors occurred in posting from a two-column journal:

1. A credit of $6,000 to Accounts Payable was not posted.

2. An entry debiting Accounts Receivable and crediting Fees Earned for $5,300 was not posted.

3. A debit of $2,700 to Accounts Payable was posted as a credit.

4. A debit of $480 to Supplies was posted twice.

5. A debit of $3,600 to Cash was posted to Miscellaneous Expense.

6. A credit of $780 to Cash was posted as $870.

7. A debit of $12,620 to Wages Expense was posted as $ 12,260.

Considering each case individually (i.e., assuming that no other errors had occurred), indicate: (A) by "yes" or "no" whether the trial balance would be out of balance; (B) if answer to (A) is "yes," the amount by which the trial balance totals would differ; and (C) whether the Debit or Credit column of the trial balance would have the larger total. Answers should be presented in the following form, with error (1) given as an example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

Entries into T accounts and trial balance

Ken Jones, an architect, organized Jones Architects on April 1, 2018. During the month, Jones Architects completed the following transactions:

A. Transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $18,000.

B. Purchased used automobile for $19,500, paying $2,500 cash and giving a note payable for the remainder.

C. Paid April rent for office and workroom, $3,150.

D. Paid cash for supplies, $1,450.

E. Purchased office and computer equipment on account, $6,500.

F Paid cash for annual insurance policies on automobile and equipment, $2,400.

G. Received cash from a client for plans delivered, $12,000.

H. Paid cash to creditors on account, $1,800.

I. Paid cash for miscellaneous expenses, $375.

J. Received invoice for blueprint service, due in May, $2,500.

K. Recorded fees earned on plans delivered, payment to be received in May, $15,650.

L. Paid salary of assistant, $2,800.

M. Paid cash for miscellaneous expenses, $200.

N. Paid installment due on note payable, $300.

O. Paid gas, oil, and repairs on automobile for April, $550.

Instructions

1. Record these transactions directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Rent Expense, Salary Expense, Blueprint Expense, Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, place the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

3. Prepare an unadjusted trial balance for Jones Architects as of April 30, 2018.

4. Determine the net income or net loss for April.

Ken Jones, an architect, organized Jones Architects on April 1, 2018. During the month, Jones Architects completed the following transactions:

A. Transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $18,000.

B. Purchased used automobile for $19,500, paying $2,500 cash and giving a note payable for the remainder.

C. Paid April rent for office and workroom, $3,150.

D. Paid cash for supplies, $1,450.

E. Purchased office and computer equipment on account, $6,500.

F Paid cash for annual insurance policies on automobile and equipment, $2,400.

G. Received cash from a client for plans delivered, $12,000.

H. Paid cash to creditors on account, $1,800.

I. Paid cash for miscellaneous expenses, $375.

J. Received invoice for blueprint service, due in May, $2,500.

K. Recorded fees earned on plans delivered, payment to be received in May, $15,650.

L. Paid salary of assistant, $2,800.

M. Paid cash for miscellaneous expenses, $200.

N. Paid installment due on note payable, $300.

O. Paid gas, oil, and repairs on automobile for April, $550.

Instructions

1. Record these transactions directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Rent Expense, Salary Expense, Blueprint Expense, Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, place the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

3. Prepare an unadjusted trial balance for Jones Architects as of April 30, 2018.

4. Determine the net income or net loss for April.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Walmart: Horizontal analysis

The following data (in millions) are taken from the financial statements of Walmart Stores, Inc. :

A. For Walmart, determine the amount of change in millions and the percent of change (rounded to one decimal place) from Year 1 to Year 2 for:

1. Revenue

2. Operating expenses

3. Operating income

B. Comment on the results of your horizontal analysis in requirement (A).

C. Based on ADM-3, compare and comment on the two-year change in operating results between Target and Walmart.

The following data (in millions) are taken from the financial statements of Walmart Stores, Inc. :

A. For Walmart, determine the amount of change in millions and the percent of change (rounded to one decimal place) from Year 1 to Year 2 for:

1. Revenue

2. Operating expenses

3. Operating income

B. Comment on the results of your horizontal analysis in requirement (A).

C. Based on ADM-3, compare and comment on the two-year change in operating results between Target and Walmart.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

Transactions

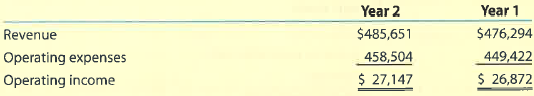

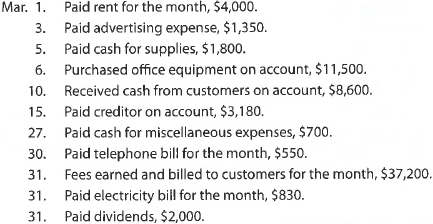

Zenith Consulting Co. has the following accounts in its ledger: Cash, Accounts Receivable, Supplies, Office Equipment, Accounts Payable, Common Stock, Retained Earnings, Dividends, Fees Earned, Rent Expense, Advertising Expense, Utilities Expense, Miscellaneous Expense.

Journalize the following selected transactions for March 2018 in a two-column journal. Journal entry explanations may be omitted.

Zenith Consulting Co. has the following accounts in its ledger: Cash, Accounts Receivable, Supplies, Office Equipment, Accounts Payable, Common Stock, Retained Earnings, Dividends, Fees Earned, Rent Expense, Advertising Expense, Utilities Expense, Miscellaneous Expense.

Journalize the following selected transactions for March 2018 in a two-column journal. Journal entry explanations may be omitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Errors in trial balance

Identify the errors in the following trial balance. All accounts have normal balances.

Identify the errors in the following trial balance. All accounts have normal balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ethics in Action

Buddy Dupree is the accounting manager for On-Time Geeks, a tech support company for individuals and small businesses. As part of his job, Buddy is responsible for preparing the company's trial balance. His supervisor placed a "hard deadline" of Friday at 5 pm for the completion of the trial balance. Unfortunately, Buddy was unable to get the trial balance to balance by the due date. The credit side of the trial balance exceeded the debit side by $3,000. To make the deadline, Buddy decided to add a $3,000 debit to the vehicles account balance. He selected the vehicles account because it will not be significantly affected by the additional $3,000.

1. Is Buddy behaving ethically? Why?

2. Who is affected by Buddy's decision?

3. How should Buddy have handled this situation?

Buddy Dupree is the accounting manager for On-Time Geeks, a tech support company for individuals and small businesses. As part of his job, Buddy is responsible for preparing the company's trial balance. His supervisor placed a "hard deadline" of Friday at 5 pm for the completion of the trial balance. Unfortunately, Buddy was unable to get the trial balance to balance by the due date. The credit side of the trial balance exceeded the debit side by $3,000. To make the deadline, Buddy decided to add a $3,000 debit to the vehicles account balance. He selected the vehicles account because it will not be significantly affected by the additional $3,000.

1. Is Buddy behaving ethically? Why?

2. Who is affected by Buddy's decision?

3. How should Buddy have handled this situation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Journal entry for dividends

Prepare a journal entry on June 30 for dividends of $11,500.

Prepare a journal entry on June 30 for dividends of $11,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

Assume that Muscular Consulting erroneously recorded the payment of $7,500 of owner withdrawals as a debit to Salary Expense. (a) How would this error affect the equality of the trial balance? (b) How would this error affect the income statement, statement of owner's equity, and balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Entries to correct errors

The following errors took place in journalizing and posting transactions:

A. Insurance of $18,000 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance.

B. Dividends of $10,000 were recorded as a debit to Wages Expense and a credit to Cash.

Journalize the entries to correct the errors. Omit explanations.

The following errors took place in journalizing and posting transactions:

A. Insurance of $18,000 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance.

B. Dividends of $10,000 were recorded as a debit to Wages Expense and a credit to Cash.

Journalize the entries to correct the errors. Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

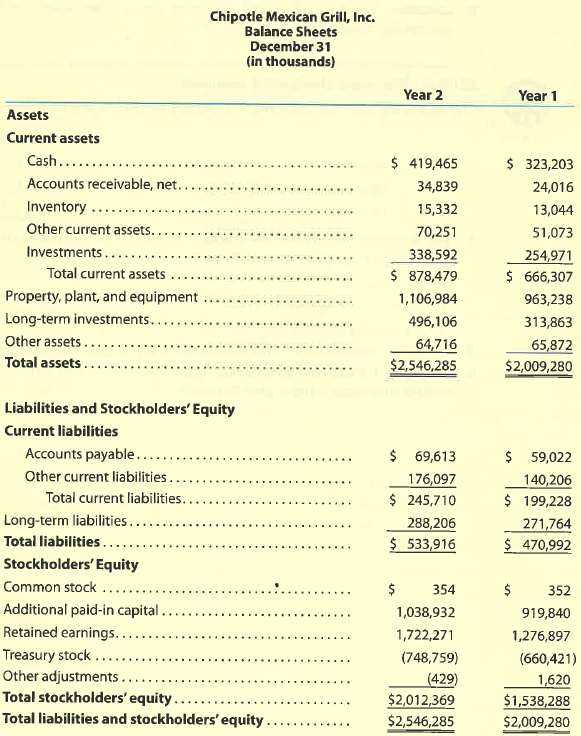

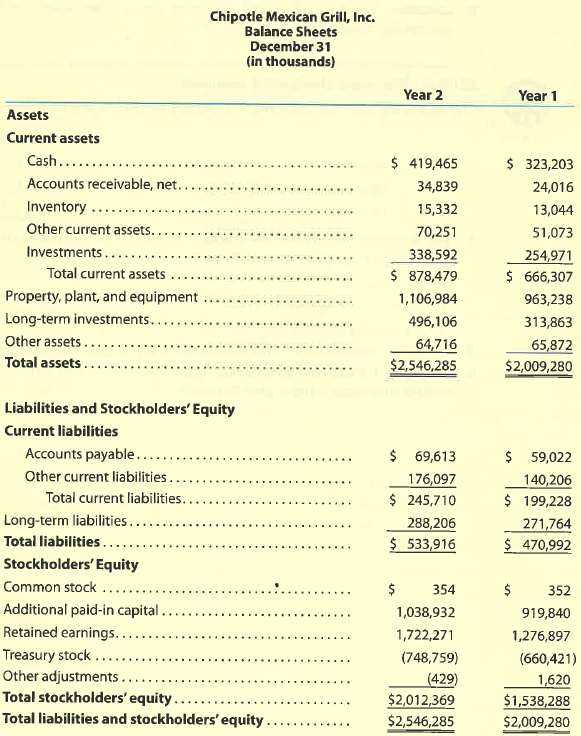

Chipotle: Horizontal analysis

Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle's balance sheets for the end of two recent years are as follows:

A. Prepare a horizontal analysis of the two balance sheets. (Round percentages to one decimal place.)

B. Interpret the horizontal analysis with respect to the change in total assets, total liabilities, and total stockholders' equity. (Treasury stock will be discussed in a later chapter and may be omitted from your analysis.)

Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle's balance sheets for the end of two recent years are as follows:

A. Prepare a horizontal analysis of the two balance sheets. (Round percentages to one decimal place.)

B. Interpret the horizontal analysis with respect to the change in total assets, total liabilities, and total stockholders' equity. (Treasury stock will be discussed in a later chapter and may be omitted from your analysis.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

eCatalog Services Company performed services in October for a specific customer for a fee of $7,890. Payment was received the following November.

(a) Was the revenue earned in October or November?

(b) What accounts should be debited and credited in (1) October and (2) November?

(a) Was the revenue earned in October or November?

(b) What accounts should be debited and credited in (1) October and (2) November?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

Journalizing and posting

On October 3, 2018, Regal Company purchased $3,600 of supplies on account. In Regal's chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21.

A. Journalize the October 3, 2018, transaction on page 91 of Regal Company's two-column journal. Include an explanation of the entry.

B. Prepare a four-column account for Supplies. Enter a debit balance of $770 as of October 1, 2018. Place a check mark (?) in the Posting Reference column.

C. Prepare a four-column account for Accounts Payable. Enter a credit balance of $26,200 as of October 1, 2018. Place a check mark (?) in the Posting Reference column.

D. Post the October 3, 2018, transaction to the accounts.

E. Do the rules of debit and credit apply to all companies?

On October 3, 2018, Regal Company purchased $3,600 of supplies on account. In Regal's chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21.

A. Journalize the October 3, 2018, transaction on page 91 of Regal Company's two-column journal. Include an explanation of the entry.

B. Prepare a four-column account for Supplies. Enter a debit balance of $770 as of October 1, 2018. Place a check mark (?) in the Posting Reference column.

C. Prepare a four-column account for Accounts Payable. Enter a credit balance of $26,200 as of October 1, 2018. Place a check mark (?) in the Posting Reference column.

D. Post the October 3, 2018, transaction to the accounts.

E. Do the rules of debit and credit apply to all companies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

Entries to correct errors

The following errors took place in journalizing and posting transactions:

a. Cash of $8,800 received on account was recorded as a debit to Fees Earned and a credit to Cash.

b. A $1,760 purchase of supplies for cash was recorded as a debit to Supplies Expense and a credit to Accounts Payable.

Journalize the entries to correct the errors. Omit explanations.

The following errors took place in journalizing and posting transactions:

a. Cash of $8,800 received on account was recorded as a debit to Fees Earned and a credit to Cash.

b. A $1,760 purchase of supplies for cash was recorded as a debit to Supplies Expense and a credit to Accounts Payable.

Journalize the entries to correct the errors. Omit explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

Journal entry for asset purchase

Prepare a journal entry for the purchase of office supplies on March 9 for $1,775, paying $275 cash and the remainder on account.

Prepare a journal entry for the purchase of office supplies on March 9 for $1,775, paying $275 cash and the remainder on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Rules of debit and credit

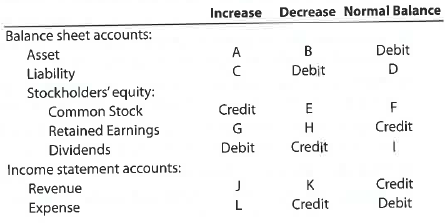

The following table summarizes the rules of debit and credit. For each of the items A through L, indicate whether the proper answer is a debit or a credit.

The following table summarizes the rules of debit and credit. For each of the items A through L, indicate whether the proper answer is a debit or a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Assume that Sunshine Realty Co. borrowed $300,000 from Columbia First Bank and Trust. In recording the transaction, Sunshine erroneously recorded the receipt as a debit to Cash, $300,000, and a credit to Fees Earned, $300,000. (a) How would this error affect the equality of the trial balance? (b) How would this error affect the income statement, statement of owner's equity, and balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Do the terms debit and credit signify increase or decrease, or can they signify either? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Journal entries and trial balance

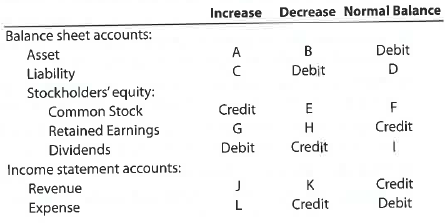

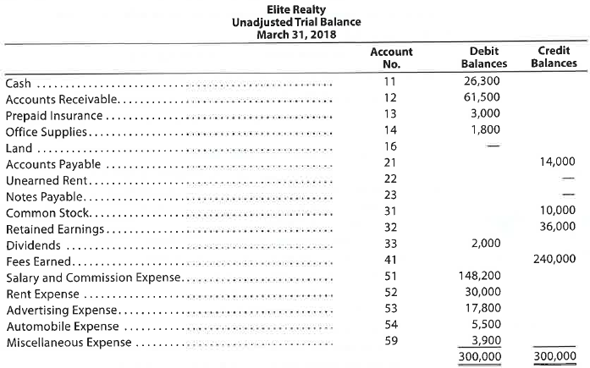

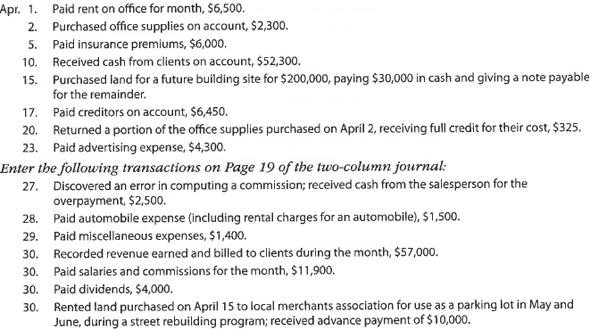

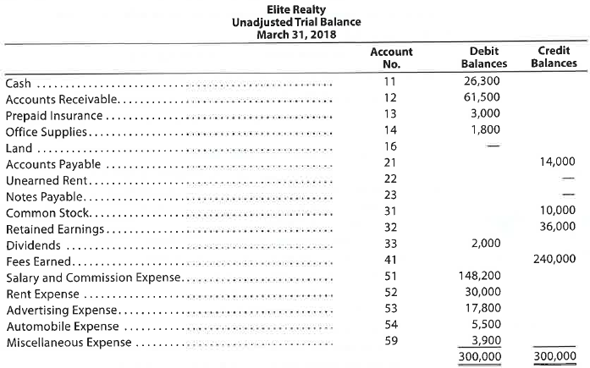

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2018, follows:

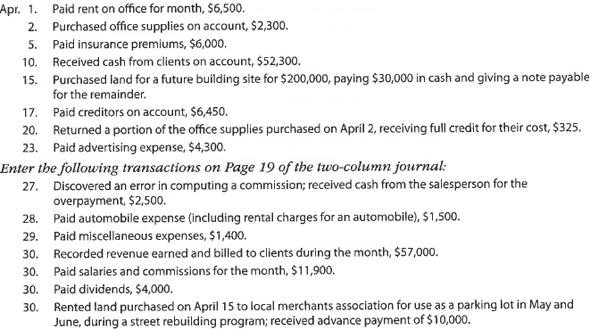

The following business transactions were completed by Elite Realty during April 2018:

Instructions

1. Record the April 1, 2018, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of April 30, 2018.

5. Assume that the April 30 transaction for salaries and commissions should have been $19,100. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2018, follows:

The following business transactions were completed by Elite Realty during April 2018:

Instructions

1. Record the April 1, 2018, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of April 30, 2018.

5. Assume that the April 30 transaction for salaries and commissions should have been $19,100. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Transactions and T accounts

The following selected transactions were completed during August of the current year:

1. Billed customers for fees earned, $73,900.

2. Purchased supplies on account, $1,960.

3. Received cash from customers on account, $62,770.

4. Paid creditors on account, $820.

a. Journalize these transactions in a two-column journal, using the appropriate number to identify the transactions. Journal entry explanations may be omitted.

b. Post the entries prepared in (a) to the following T accounts: Cash, Supplies, Accounts Receivable, Accounts Payable, Fees Earned. To the left of each amount posted in the accounts, place the appropriate number to identify the transactions.

c. Assume that the unadjusted trial balance on August 31 shows a credit balance for Accounts Receivable. Does this credit balance mean that an error has occurred?

The following selected transactions were completed during August of the current year:

1. Billed customers for fees earned, $73,900.

2. Purchased supplies on account, $1,960.

3. Received cash from customers on account, $62,770.

4. Paid creditors on account, $820.

a. Journalize these transactions in a two-column journal, using the appropriate number to identify the transactions. Journal entry explanations may be omitted.

b. Post the entries prepared in (a) to the following T accounts: Cash, Supplies, Accounts Receivable, Accounts Payable, Fees Earned. To the left of each amount posted in the accounts, place the appropriate number to identify the transactions.

c. Assume that the unadjusted trial balance on August 31 shows a credit balance for Accounts Receivable. Does this credit balance mean that an error has occurred?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Chart of accounts

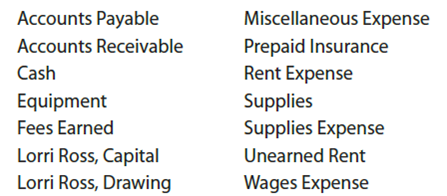

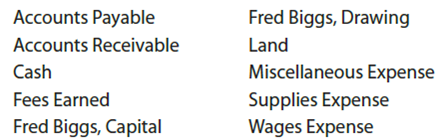

Oak Interiors is owned and operated by Fred Biggs, an interior decorator. In the ledger of Oak Interiors, the first digit of the account number indicates its major account classification (1-assets, 2-liabilities, 3-owner's equity, 4-revenues, 5-expenses). The second digit of the account number indicates the specific account within each of the preceding major account classifications. Match each account number with its most likely account in the list that follows. The account numbers are 11, 12, 13, 21, 31, 32, 41, 51, 52, and 53.

Oak Interiors is owned and operated by Fred Biggs, an interior decorator. In the ledger of Oak Interiors, the first digit of the account number indicates its major account classification (1-assets, 2-liabilities, 3-owner's equity, 4-revenues, 5-expenses). The second digit of the account number indicates the specific account within each of the preceding major account classifications. Match each account number with its most likely account in the list that follows. The account numbers are 11, 12, 13, 21, 31, 32, 41, 51, 52, and 53.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

Journal entries and trial balance

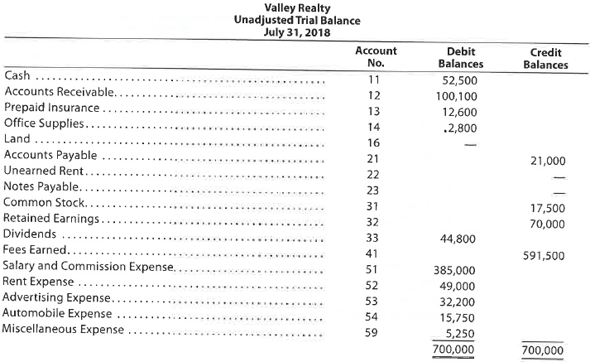

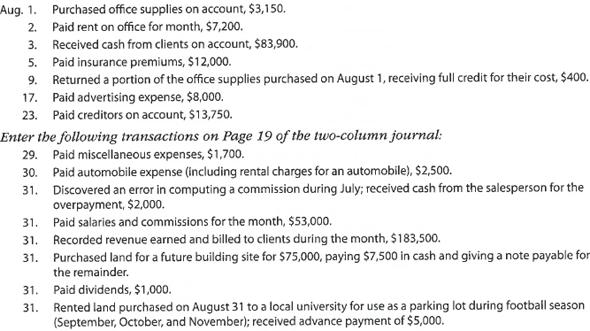

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2018, follows:

The following business transactions were completed by Valley Realty during August 2018:

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31, 2018.

5. Assume that the August 31 transaction for dividends should have been $10,000. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2018, follows:

The following business transactions were completed by Valley Realty during August 2018:

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (?) in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31, 2018.

5. Assume that the August 31 transaction for dividends should have been $10,000. (A) Why did the unadjusted trial balance in (4) balance? (B) Journalize the correcting entry. (C) Is this error a transposition or slide?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Checking accounts are a common form of deposits for banks. Assume that Surety Storage has a checking account at Ada Savings Bank. What type of account (asset, liability, owner's equity, revenue, expense, drawing) does the account balance of $11,375 represent from the viewpoint of (a) Surety Storage and (b) Ada Savings Bank?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

Journal entries and trial balance

On October 1, 2018, Jay Crowley established Affordable Realty, which completed the following transactions during the month:

A. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $40,000.

B. Paid rent on office and equipment for the month, $4,800.

C. Purchased supplies on account, $2,150.

D. Paid creditor on account, $1,100.

E. Earned sales commissions, receiving cash, $18,750.

F. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800.

G. Paid office salaries, $3,500.

H. Determined that the cost of supplies used was $1,300.

I. Paid dividends, $1,500.

Instructions

1. Journalize entries for transactions (A) through (I), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted.

2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance.

3. Prepare an unadjusted trial balance as of October 31, 2018.

4. Determine the following:

A. Amount of total revenue recorded in the ledger.

B. Amount of total expenses recorded in the ledger.

C. Amount of net income for October.

5. Determine the increase or decrease in retained earnings for October.

On October 1, 2018, Jay Crowley established Affordable Realty, which completed the following transactions during the month:

A. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $40,000.

B. Paid rent on office and equipment for the month, $4,800.

C. Purchased supplies on account, $2,150.

D. Paid creditor on account, $1,100.

E. Earned sales commissions, receiving cash, $18,750.

F. Paid automobile expenses (including rental charge) for month, $1,580, and miscellaneous expenses, $800.

G. Paid office salaries, $3,500.

H. Determined that the cost of supplies used was $1,300.

I. Paid dividends, $1,500.

Instructions

1. Journalize entries for transactions (A) through (I), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted.