Deck 3: The Adjusting Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 3: The Adjusting Process

1

Adjusting entries

On March 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Potomac Realty:

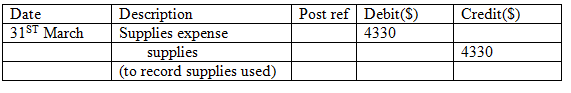

• The supplies account balance on March 31 is $5,620. The supplies on hand on March 31 are $1,290.

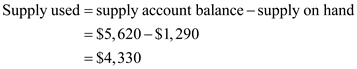

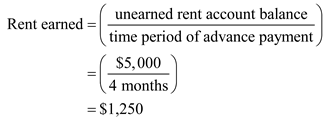

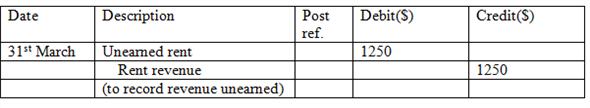

• The unearned rent account balance on March 31 is $5,000 representing the receipt of an advance payment on March 1 of four months' rent from tenants.

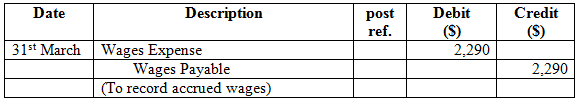

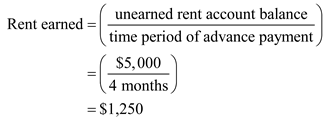

• Wages accrued but not paid at March 31 are $2,290.

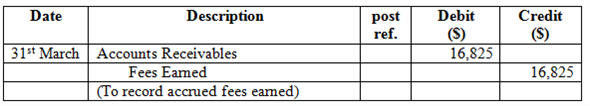

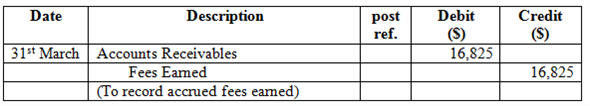

• Fees accrued but unbilled at March 31 are $16,825.

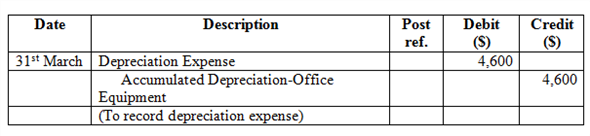

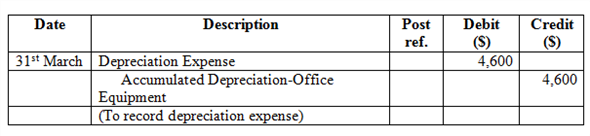

• Depreciation of office equipment is $4,600.

Instructions

1. Journalize the adjusting entries required at March 31.

2. Briefly explain the difference between adjusting entries and entries that would be made to correct errors.

On March 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Potomac Realty:

• The supplies account balance on March 31 is $5,620. The supplies on hand on March 31 are $1,290.

• The unearned rent account balance on March 31 is $5,000 representing the receipt of an advance payment on March 1 of four months' rent from tenants.

• Wages accrued but not paid at March 31 are $2,290.

• Fees accrued but unbilled at March 31 are $16,825.

• Depreciation of office equipment is $4,600.

Instructions

1. Journalize the adjusting entries required at March 31.

2. Briefly explain the difference between adjusting entries and entries that would be made to correct errors.

There are two areas where such adjusted entries are required before the issuance of the financial statement: revenue or expenses has been occurred but are not entered or recorded in accounting books and such expenses should be recorded in current period's income statement and balance sheet.

Next is when some amount has already mentioned in accounting books but amount has to be divided between two or more accounting period.

Few facts were given about company P in order to make adjusting entries for the period 31 st March:

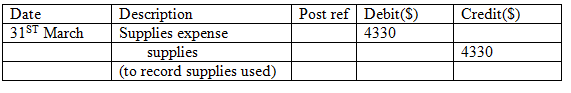

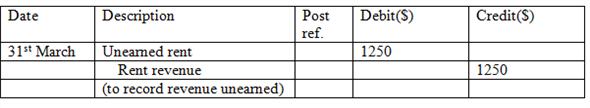

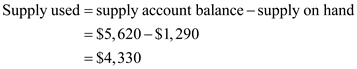

On 31 st March Supplies account balance is $5,620 and supplies on hand is $1,290:

Adjusting entry:

Working Note:

Working Note:

Determine supplies used as follows

Expenses are recognized when they are incurred whether the cash for such expenses is paid or not. When Expenses are used, consumed, utilized are considered then such expenses are incurred or has expired when cash has been paid for future such a situation is called deferral. Here deferral is treated as expense therefore supplies account decreases and credit an asset and supplies expenses are increased and are debited.On 31 st March unearned rent account balance $5,000 which represent advance payment for four months which has been received on 1 st March.

Expenses are recognized when they are incurred whether the cash for such expenses is paid or not. When Expenses are used, consumed, utilized are considered then such expenses are incurred or has expired when cash has been paid for future such a situation is called deferral. Here deferral is treated as expense therefore supplies account decreases and credit an asset and supplies expenses are increased and are debited.On 31 st March unearned rent account balance $5,000 which represent advance payment for four months which has been received on 1 st March.

Adjusting entry:

Working Note:

Working Note:

Determine rent earned as:

Under the accrual concept, income is recognized when earned regardless of when collected.That is why this entry is passed to recognize the rent which is earned but not received. Here unearned rent is a liability to the company which means the amount is already been received for providing services in future. That is why to adjust this, unearned rent is debited with the amount which is received in advance. Similarly, the amount which is received in advance is an asset and adds up to the cash balance of the company. That is why rent revenue is credited with the amount which is received by the company.

Under the accrual concept, income is recognized when earned regardless of when collected.That is why this entry is passed to recognize the rent which is earned but not received. Here unearned rent is a liability to the company which means the amount is already been received for providing services in future. That is why to adjust this, unearned rent is debited with the amount which is received in advance. Similarly, the amount which is received in advance is an asset and adds up to the cash balance of the company. That is why rent revenue is credited with the amount which is received by the company.

On 31st March wages have been accrued but not paid are $2,290.

Adjusting entry:

According to the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expenses is paid or not. In the adjusting entry above, Wages expense is debited to recognize the expense and Wages payable is credited to record a liability since the amount is yet to be paid.On 31 st March fees accrued but unbilled $16,825.Adjusting entry:

According to the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expenses is paid or not. In the adjusting entry above, Wages expense is debited to recognize the expense and Wages payable is credited to record a liability since the amount is yet to be paid.On 31 st March fees accrued but unbilled $16,825.Adjusting entry:

Under the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expense is paid or not and revenue are recognized when the services have been performed.In the adjusting entry above, accrual is for revenue where fees has been earned but are not recorded therefore Accrued receivable is debited as an asset and Fees earned is credited because whether they have received fees or not it has been earned and therefore is a liability.

Under the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expense is paid or not and revenue are recognized when the services have been performed.In the adjusting entry above, accrual is for revenue where fees has been earned but are not recorded therefore Accrued receivable is debited as an asset and Fees earned is credited because whether they have received fees or not it has been earned and therefore is a liability.

Depreciation of office equipment is $4,600.

Adjusting entry:

Depreciation is an expense account; which represent that part of the cost of asset that has been used hence, it is presented in the income statement. Accumulated depreciation is deducted from fixed asset therefore known as contra asset account therefore is a balance sheet item. Here depreciation expense is increased therefore is debited and accumulated depreciation increases the balance account therefore credited.2.Adjusting entries are a planned process where entries have to be passed to update the accounts into accrual concepts while correcting entries are not planned but they are passed only when any error is made while passing any entry.

Depreciation is an expense account; which represent that part of the cost of asset that has been used hence, it is presented in the income statement. Accumulated depreciation is deducted from fixed asset therefore known as contra asset account therefore is a balance sheet item. Here depreciation expense is increased therefore is debited and accumulated depreciation increases the balance account therefore credited.2.Adjusting entries are a planned process where entries have to be passed to update the accounts into accrual concepts while correcting entries are not planned but they are passed only when any error is made while passing any entry.

Next is when some amount has already mentioned in accounting books but amount has to be divided between two or more accounting period.

Few facts were given about company P in order to make adjusting entries for the period 31 st March:

On 31 st March Supplies account balance is $5,620 and supplies on hand is $1,290:

Adjusting entry:

Working Note:

Working Note: Determine supplies used as follows

Expenses are recognized when they are incurred whether the cash for such expenses is paid or not. When Expenses are used, consumed, utilized are considered then such expenses are incurred or has expired when cash has been paid for future such a situation is called deferral. Here deferral is treated as expense therefore supplies account decreases and credit an asset and supplies expenses are increased and are debited.On 31 st March unearned rent account balance $5,000 which represent advance payment for four months which has been received on 1 st March.

Expenses are recognized when they are incurred whether the cash for such expenses is paid or not. When Expenses are used, consumed, utilized are considered then such expenses are incurred or has expired when cash has been paid for future such a situation is called deferral. Here deferral is treated as expense therefore supplies account decreases and credit an asset and supplies expenses are increased and are debited.On 31 st March unearned rent account balance $5,000 which represent advance payment for four months which has been received on 1 st March.Adjusting entry:

Working Note:

Working Note:Determine rent earned as:

Under the accrual concept, income is recognized when earned regardless of when collected.That is why this entry is passed to recognize the rent which is earned but not received. Here unearned rent is a liability to the company which means the amount is already been received for providing services in future. That is why to adjust this, unearned rent is debited with the amount which is received in advance. Similarly, the amount which is received in advance is an asset and adds up to the cash balance of the company. That is why rent revenue is credited with the amount which is received by the company.

Under the accrual concept, income is recognized when earned regardless of when collected.That is why this entry is passed to recognize the rent which is earned but not received. Here unearned rent is a liability to the company which means the amount is already been received for providing services in future. That is why to adjust this, unearned rent is debited with the amount which is received in advance. Similarly, the amount which is received in advance is an asset and adds up to the cash balance of the company. That is why rent revenue is credited with the amount which is received by the company.On 31st March wages have been accrued but not paid are $2,290.

Adjusting entry:

According to the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expenses is paid or not. In the adjusting entry above, Wages expense is debited to recognize the expense and Wages payable is credited to record a liability since the amount is yet to be paid.On 31 st March fees accrued but unbilled $16,825.Adjusting entry:

According to the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expenses is paid or not. In the adjusting entry above, Wages expense is debited to recognize the expense and Wages payable is credited to record a liability since the amount is yet to be paid.On 31 st March fees accrued but unbilled $16,825.Adjusting entry: Under the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expense is paid or not and revenue are recognized when the services have been performed.In the adjusting entry above, accrual is for revenue where fees has been earned but are not recorded therefore Accrued receivable is debited as an asset and Fees earned is credited because whether they have received fees or not it has been earned and therefore is a liability.

Under the accrual concept of accounting, expenses are recognized when incurred whether the cash for the expense is paid or not and revenue are recognized when the services have been performed.In the adjusting entry above, accrual is for revenue where fees has been earned but are not recorded therefore Accrued receivable is debited as an asset and Fees earned is credited because whether they have received fees or not it has been earned and therefore is a liability.Depreciation of office equipment is $4,600.

Adjusting entry:

Depreciation is an expense account; which represent that part of the cost of asset that has been used hence, it is presented in the income statement. Accumulated depreciation is deducted from fixed asset therefore known as contra asset account therefore is a balance sheet item. Here depreciation expense is increased therefore is debited and accumulated depreciation increases the balance account therefore credited.2.Adjusting entries are a planned process where entries have to be passed to update the accounts into accrual concepts while correcting entries are not planned but they are passed only when any error is made while passing any entry.

Depreciation is an expense account; which represent that part of the cost of asset that has been used hence, it is presented in the income statement. Accumulated depreciation is deducted from fixed asset therefore known as contra asset account therefore is a balance sheet item. Here depreciation expense is increased therefore is debited and accumulated depreciation increases the balance account therefore credited.2.Adjusting entries are a planned process where entries have to be passed to update the accounts into accrual concepts while correcting entries are not planned but they are passed only when any error is made while passing any entry. 2

Communication

Delta Air Lines is a major passenger airline headquartered in the United States. Most Delta passengers purchase their tickets several weeks prior to taking the trip and use a credit card such as VISA or American Express to pay for their ticket. The credit card company pays the airline at the time the flight is booked, several weeks prior to the flight.

Write a brief memo to your instructor explaining when Delta should recognize revenue from ticket sales.

Delta Air Lines is a major passenger airline headquartered in the United States. Most Delta passengers purchase their tickets several weeks prior to taking the trip and use a credit card such as VISA or American Express to pay for their ticket. The credit card company pays the airline at the time the flight is booked, several weeks prior to the flight.

Write a brief memo to your instructor explaining when Delta should recognize revenue from ticket sales.

Adjusting and Reversing Entries

Reversing entry is exact opposite entry for the adjusting entry. This entry is recorded in the beginning of the year for the opposite entry made at the end of the year to pay the liabilities. The adjusting entries will useful to review the balance of the trial balance.

In the present case, the memo is to be written to inform the staff regarding the recognition of revenue from the sale of air tickets. The same memo is as below:

MEMORANDUM

TO: Instructor

FROM: DA company

DATE: 21/10/2016

SUBJECT: Estimation of the point of time for the revenue-recognition from the sales of ticket.

This memo gives information about the process of recognizing revenue from sale of ticket. The sale of ticket occurs when the flight is booked. In case of online bookings, the payment has generally received by the airline companies from the banks of the customers. Here, the customer has the right to cancel the ticket or to get refund of the ticket or to fly in a later flight. Therefore, in this case, the recognition of the amount of revenue should not be recorded until the flight has taken off.

If the customer has travelled then DA Company should record the revenue accordingly. Similarly, in case of the non-refundable ticket, the revenue recognition can be recorded at the time of payment by the DA Company.

On the o ther side, if the flight has been cancelled and the customer is not able to travel through the flight, the airline company has to reverse the sale transaction, in case of non-refundable ticket. To avoid reverse entry, most of the travel companies arrange for alternative seat in other flight and let customer reach to his or her destination and there is no requirement of the reversing entry.

While issuing or selling such tickets to the customers by the airline companies, the assumption of complete and timely service has taken and fulfilled by providing the seat to their customers.

Hence, it can stated that the recognition of the amount of revenue depends on the various factors like the nature of ticket, purpose of the customer, mode of payment and many other factors and the recording of entries will vary in the different manner accordingly.

Reversing entry is exact opposite entry for the adjusting entry. This entry is recorded in the beginning of the year for the opposite entry made at the end of the year to pay the liabilities. The adjusting entries will useful to review the balance of the trial balance.

In the present case, the memo is to be written to inform the staff regarding the recognition of revenue from the sale of air tickets. The same memo is as below:

MEMORANDUM

TO: Instructor

FROM: DA company

DATE: 21/10/2016

SUBJECT: Estimation of the point of time for the revenue-recognition from the sales of ticket.

This memo gives information about the process of recognizing revenue from sale of ticket. The sale of ticket occurs when the flight is booked. In case of online bookings, the payment has generally received by the airline companies from the banks of the customers. Here, the customer has the right to cancel the ticket or to get refund of the ticket or to fly in a later flight. Therefore, in this case, the recognition of the amount of revenue should not be recorded until the flight has taken off.

If the customer has travelled then DA Company should record the revenue accordingly. Similarly, in case of the non-refundable ticket, the revenue recognition can be recorded at the time of payment by the DA Company.

On the o ther side, if the flight has been cancelled and the customer is not able to travel through the flight, the airline company has to reverse the sale transaction, in case of non-refundable ticket. To avoid reverse entry, most of the travel companies arrange for alternative seat in other flight and let customer reach to his or her destination and there is no requirement of the reversing entry.

While issuing or selling such tickets to the customers by the airline companies, the assumption of complete and timely service has taken and fulfilled by providing the seat to their customers.

Hence, it can stated that the recognition of the amount of revenue depends on the various factors like the nature of ticket, purpose of the customer, mode of payment and many other factors and the recording of entries will vary in the different manner accordingly.

3

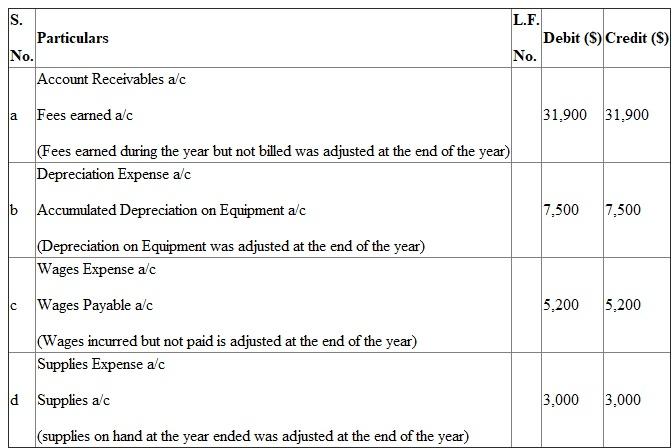

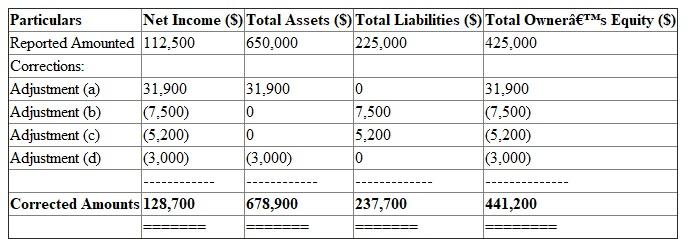

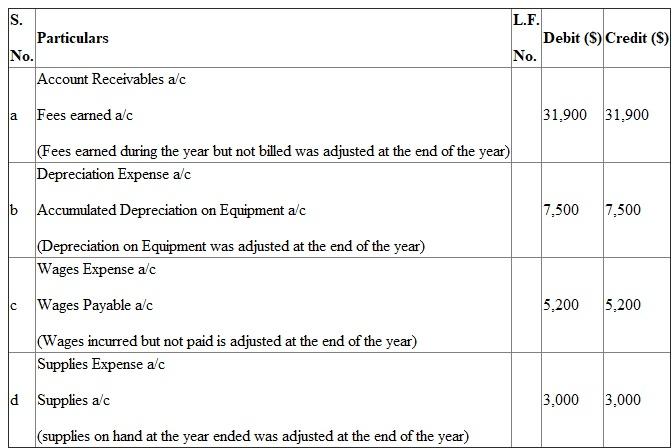

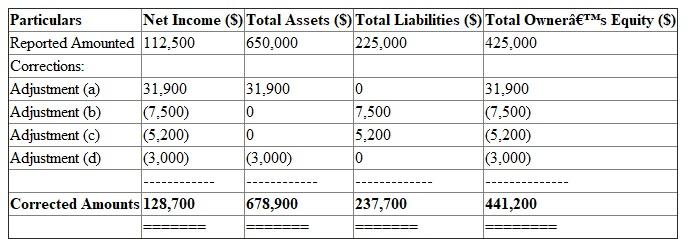

Adjusting entries and errors

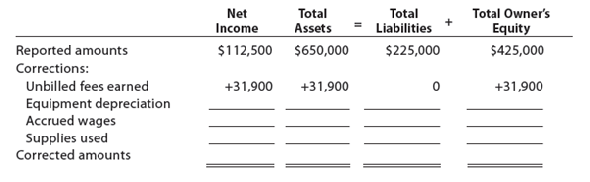

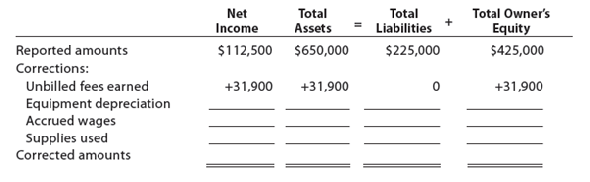

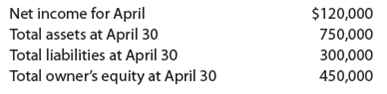

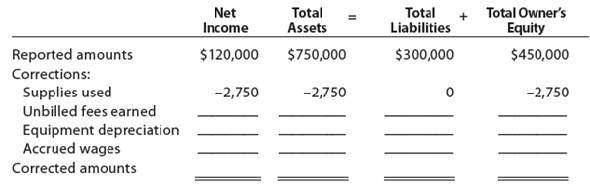

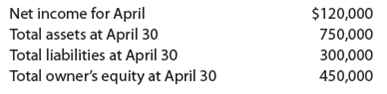

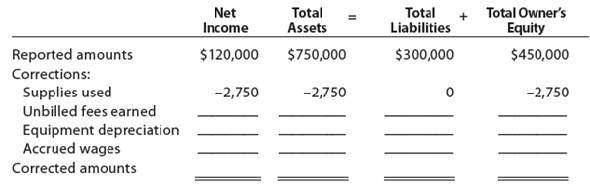

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney:

In preparing the financial statements, adjustments for the following data were overlooked:

• Unbilled fees earned at August 31, $31,900.

• Depreciation of equipment for August, $7,500.

• Accrued wages at August 31, $5,200.

• Supplies used during August, $3,000.

Instructions

1. Journalize the entries to record the omitted adjustments.

2. Determine the correct amount of net income for August and the total assets, liabilities, and owner's equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker Jacobs, an attorney:

In preparing the financial statements, adjustments for the following data were overlooked:

• Unbilled fees earned at August 31, $31,900.

• Depreciation of equipment for August, $7,500.

• Accrued wages at August 31, $5,200.

• Supplies used during August, $3,000.

Instructions

1. Journalize the entries to record the omitted adjustments.

2. Determine the correct amount of net income for August and the total assets, liabilities, and owner's equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

1)

Journal Entries in the books of Tucker Jacobs on August 31

2)

2)

Statement showing Correct Net Income for August and

total assets, liabilities and owners' equity as on August 31

Journal Entries in the books of Tucker Jacobs on August 31

2)

2)Statement showing Correct Net Income for August and

total assets, liabilities and owners' equity as on August 31

4

Adjusting entries for prepaid insurance

The prepaid insurance account had a balance of $3,000 at the beginning of the year. The account was debited for $32,500 for premiums on policies purchased during the year. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (A) the amount of unexpired insurance applicable to future periods is $4,800; (B) the amount of insurance expired during the year is $30,700.

The prepaid insurance account had a balance of $3,000 at the beginning of the year. The account was debited for $32,500 for premiums on policies purchased during the year. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (A) the amount of unexpired insurance applicable to future periods is $4,800; (B) the amount of insurance expired during the year is $30,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

Adjusting entries

On May 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Oceanside Realty:

• Fees accrued but unbilled at May 31 are $19,750.

• The supplies account balance on May 31 is $12,300. The supplies on hand at May 31 are $4,150.

• Wages accrued but not paid at May 31 are $2,700.

• The unearned rent account balance at May 31 is $9,000, representing the receipt of an advance payment on May 1 of three months' rent from tenants.

• Depreciation of office equipment is $3,200.

Instructions

1. Journalize the adjusting entries required at May 31.

2. Briefly explain the difference between adjusting entries and entries that would be made to correct errors.

On May 31, the following data were accumulated to assist the accountant in preparing the adjusting entries for Oceanside Realty:

• Fees accrued but unbilled at May 31 are $19,750.

• The supplies account balance on May 31 is $12,300. The supplies on hand at May 31 are $4,150.

• Wages accrued but not paid at May 31 are $2,700.

• The unearned rent account balance at May 31 is $9,000, representing the receipt of an advance payment on May 1 of three months' rent from tenants.

• Depreciation of office equipment is $3,200.

Instructions

1. Journalize the adjusting entries required at May 31.

2. Briefly explain the difference between adjusting entries and entries that would be made to correct errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

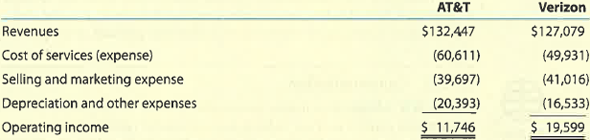

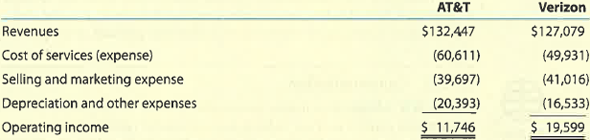

AT T and Verizon: Vertical analysis

The following income statement data for AT T Inc. and Verizon Communications Inc. were taken from their recent annual reports (in millions):

A. Prepare a vertical analysis of the income statement for AT T. (Round to one decimal place.)

B. Prepare a vertical analysis of the income statement for Verizon. (Round to one decimal place.)

C. Based on Requirements A and B, how does AT T compare to Verizon?

The following income statement data for AT T Inc. and Verizon Communications Inc. were taken from their recent annual reports (in millions):

A. Prepare a vertical analysis of the income statement for AT T. (Round to one decimal place.)

B. Prepare a vertical analysis of the income statement for Verizon. (Round to one decimal place.)

C. Based on Requirements A and B, how does AT T compare to Verizon?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Adjustment for depreciation

The estimated amount of depreciation on equipment for the current year is $7,700. Journalize the adjusting entry to record the depreciation.

The estimated amount of depreciation on equipment for the current year is $7,700. Journalize the adjusting entry to record the depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

Adjusting entries for unearned and accrued fees

The balance in the unearned fees account, before adjustment at the end of the year, is $97,770. Of these fees, $39,750 have been earned. In addition, $24,650 of fees have been earned but have not been billed. Journalize the adjusting entries (A) to adjust the unearned fees account and (B) to record the accrued fees.

The balance in the unearned fees account, before adjustment at the end of the year, is $97,770. Of these fees, $39,750 have been earned. In addition, $24,650 of fees have been earned but have not been billed. Journalize the adjusting entries (A) to adjust the unearned fees account and (B) to record the accrued fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

Ethics in Action

Chris P. Bacon is the chief accountant for CV Industries, a large manufacturing company. In addition to its normal business activities, the company has excess warehouse space that it rents out to local businesses. Because the typical renter is a small business, CV Industries requires renters to make lease payments for the entire rental period on the day the lease is signed. As a result, CV Industries typically reports a large unearned rent balance on its balance sheet.

After making adjusting entries for the current year, Chris prepares the adjusted trial balance and notices that the company's earnings will decline significantly. He presents the adjusted trial balance to the company's CFO, Antonio Beldin, who is concerned about the earnings decline. Mr. Beldin notices the large unearned rent balance and proposes making an additional end-of- period adjusting entry to recognize the entire unearned rent balance as revenue in the current period. Chris protests, reminding Mr. Beldin that the adjusting entry for unearned rent has already been made. Mr. Beldin assures Chris that his proposal is acceptable, reminding Chris that "because we have already received the cash, we have the right to recognize the revenue in the current period." He instructs Chris to make the additional adjusting journal entry. Chris is hesitant to follow these instructions, but he is sensitive to the company's emphasis on earnings growth and makes the adjusting entry as instructed.

1. Is Chris behaving ethically? Why?

2. Who is affected by Chris's decision?

Chris P. Bacon is the chief accountant for CV Industries, a large manufacturing company. In addition to its normal business activities, the company has excess warehouse space that it rents out to local businesses. Because the typical renter is a small business, CV Industries requires renters to make lease payments for the entire rental period on the day the lease is signed. As a result, CV Industries typically reports a large unearned rent balance on its balance sheet.

After making adjusting entries for the current year, Chris prepares the adjusted trial balance and notices that the company's earnings will decline significantly. He presents the adjusted trial balance to the company's CFO, Antonio Beldin, who is concerned about the earnings decline. Mr. Beldin notices the large unearned rent balance and proposes making an additional end-of- period adjusting entry to recognize the entire unearned rent balance as revenue in the current period. Chris protests, reminding Mr. Beldin that the adjusting entry for unearned rent has already been made. Mr. Beldin assures Chris that his proposal is acceptable, reminding Chris that "because we have already received the cash, we have the right to recognize the revenue in the current period." He instructs Chris to make the additional adjusting journal entry. Chris is hesitant to follow these instructions, but he is sensitive to the company's emphasis on earnings growth and makes the adjusting entry as instructed.

1. Is Chris behaving ethically? Why?

2. Who is affected by Chris's decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Adjustment for accrued expense

Prospect Realty Co. pays weekly salaries of $27,600 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

Prospect Realty Co. pays weekly salaries of $27,600 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the effect of the credit portion of an adjusting entry is to increase the balance of a liability account, which of the following statements describes the effect of the debit portion of the entry?

a. Increases the balance of a revenue account.

b. Increases the balance of an expense account.

c. Increases the balance of an asset account.

a. Increases the balance of a revenue account.

b. Increases the balance of an expense account.

c. Increases the balance of an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Adjusting entries for prepaid and accrued taxes

A-Z Construction Company was organized on May 1 of the current year. On May 2, A-Z Construction prepaid $18,480 to the city for taxes (license fees) for the next 12 months and debited the prepaid taxes account. A-Z Construction is also required to pay in January an annual tax (on property) for the previous calendar year. The estimated amount of the property tax for the current year (May 1 to December 31) is $45,000.

A. Journalize the two adjusting entries required to bring the accounts affected by the two taxes up to date as of December 31, the end of the current year.

B. What is the amount of tax expense for the current year?

A-Z Construction Company was organized on May 1 of the current year. On May 2, A-Z Construction prepaid $18,480 to the city for taxes (license fees) for the next 12 months and debited the prepaid taxes account. A-Z Construction is also required to pay in January an annual tax (on property) for the previous calendar year. The estimated amount of the property tax for the current year (May 1 to December 31) is $45,000.

A. Journalize the two adjusting entries required to bring the accounts affected by the two taxes up to date as of December 31, the end of the current year.

B. What is the amount of tax expense for the current year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

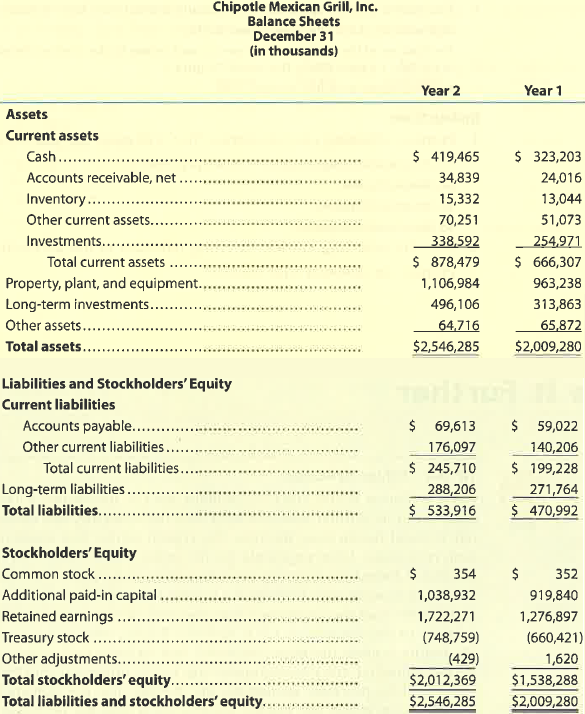

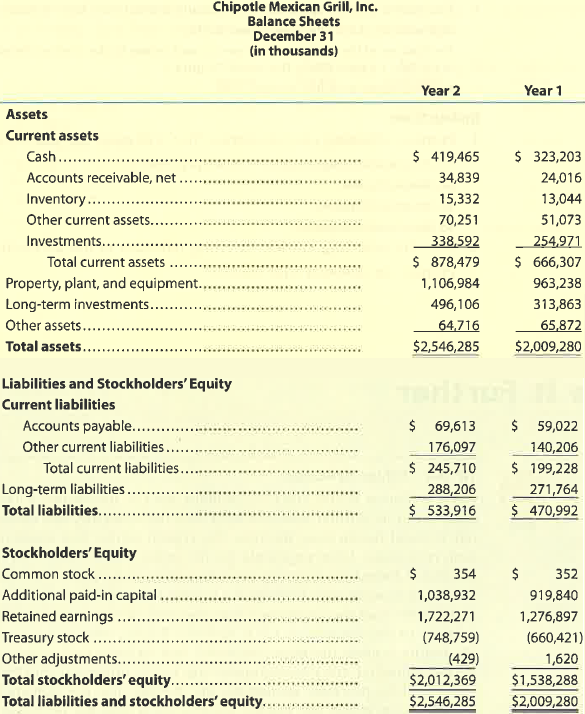

Chipotle: Vertical analysis

Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle's balance sheets for the end of two recent years are as follows (in thousands):

A. Prepare a vertical analysis of the two balance sheets. (Round percentages to one decimal place.)

B. Interpret the vertical analysis with respect to the change in the percent of asset, liability, and stockholders' equity components to total assets. (Treasury stock will be discussed in a later chapter and may be omitted from your analysis.)

Chipotle Mexican Grill, Inc. is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle's balance sheets for the end of two recent years are as follows (in thousands):

A. Prepare a vertical analysis of the two balance sheets. (Round percentages to one decimal place.)

B. Interpret the vertical analysis with respect to the change in the percent of asset, liability, and stockholders' equity components to total assets. (Treasury stock will be discussed in a later chapter and may be omitted from your analysis.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the difference between adjusting entries and correcting entries?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Effect of omitting adjusting entry

Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31. Indicate which items will be erroneously stated, because of the error, on (a) the income statement for the year and (b) the balance sheet as of October 31. Also indicate whether the items in error will be overstated or understated.

Accrued salaries owed to employees for October 30 and 31 are not considered in preparing the financial statements for the year ended October 31. Indicate which items will be erroneously stated, because of the error, on (a) the income statement for the year and (b) the balance sheet as of October 31. Also indicate whether the items in error will be overstated or understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Adjustment for depreciation

The estimated amount of depreciation on equipment for the current year is $8,200. Journalize the adjusting entry to record the depreciation.

The estimated amount of depreciation on equipment for the current year is $8,200. Journalize the adjusting entry to record the depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Type of adjustment

Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense:

A. Cash received for use of land next month

B. Fees earned but not received

C. Rent expense owed but not yet paid

D. Supplies on hand

Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, or (4) accrued expense:

A. Cash received for use of land next month

B. Fees earned but not received

C. Rent expense owed but not yet paid

D. Supplies on hand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Effect of omitting adjusting entry

The adjusting entry for accrued fees was omitted at October 31, the end of the current year. Indicate which items will be in error, because of the omission, on (A) the income statement for the current year and (B) the balance sheet as of October 31. Also indicate whether the items in error will be overstated or understated.

The adjusting entry for accrued fees was omitted at October 31, the end of the current year. Indicate which items will be in error, because of the omission, on (A) the income statement for the current year and (B) the balance sheet as of October 31. Also indicate whether the items in error will be overstated or understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

Effect of omitting adjustments

For the year ending April 30, Urology Medical Services Co. mistakenly omitted adjusting entries for (1) $1,400 of supplies that were used, (2) unearned revenue of $6,600 that was earned, and (3) insurance of $9,000 that expired. Indicate the combined effect of the errors on (A) revenues, (B) expenses, and (C) net income for the year ended April 30.

For the year ending April 30, Urology Medical Services Co. mistakenly omitted adjusting entries for (1) $1,400 of supplies that were used, (2) unearned revenue of $6,600 that was earned, and (3) insurance of $9,000 that expired. Indicate the combined effect of the errors on (A) revenues, (B) expenses, and (C) net income for the year ended April 30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Determining fixed asset's book value

The balance in the equipment account is $3,150,000, and the balance in the accumulated depreciation-equipment account is $2,075,000.

A. What is the book value of the equipment?

B. Does the balance in the accumulated depreciation account mean that the equipment's loss of value is $2,075,000? Explain.

The balance in the equipment account is $3,150,000, and the balance in the accumulated depreciation-equipment account is $2,075,000.

A. What is the book value of the equipment?

B. Does the balance in the accumulated depreciation account mean that the equipment's loss of value is $2,075,000? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Is the matching concept related to (a) the cash basis of accounting or (b) the accrual basis of accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

Adjusting entries

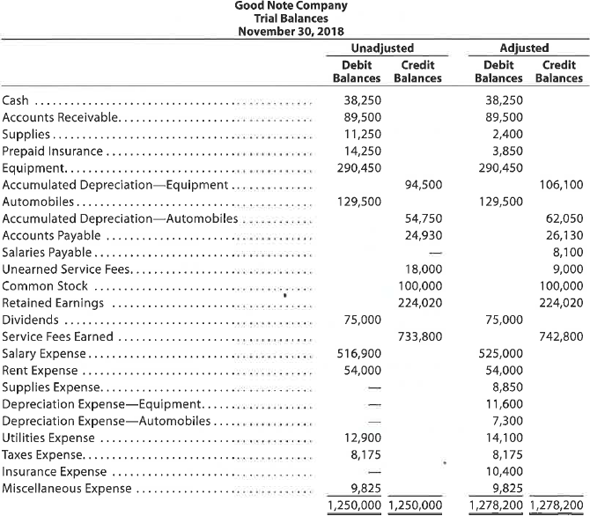

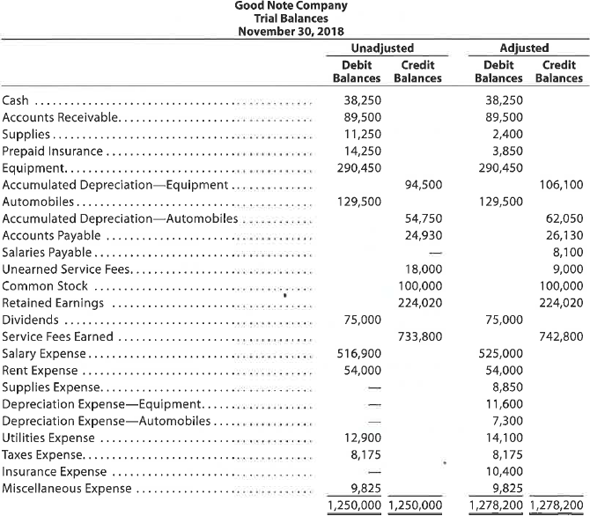

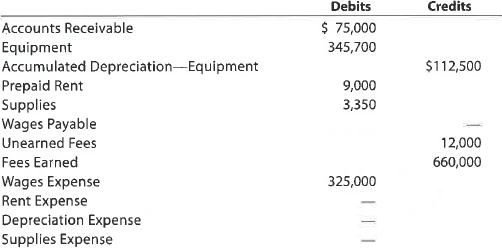

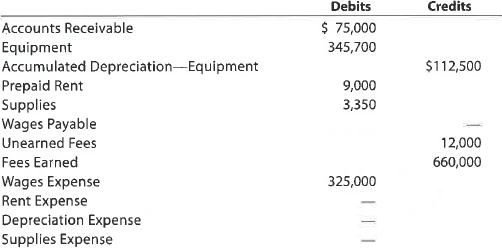

Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2018, the end of the current year, the accountant for Good Note prepared the following trial balances:

Instructions

Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.

Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2018, the end of the current year, the accountant for Good Note prepared the following trial balances:

Instructions

Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Does every adjusting entry affect net income for a period? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

Book value of fixed assets

In a recent balance sheet, Microsoft Corporation reported Property, Plant, and Equipment of $27,804 million and Accumulated Depreciation of $14,793 million.

A. What was the book value of the fixed assets?

B. Would the book value of Microsoft's fixed assets normally approximate their fair market values?

In a recent balance sheet, Microsoft Corporation reported Property, Plant, and Equipment of $27,804 million and Accumulated Depreciation of $14,793 million.

A. What was the book value of the fixed assets?

B. Would the book value of Microsoft's fixed assets normally approximate their fair market values?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Classifying adjusting entries

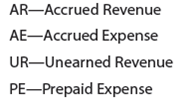

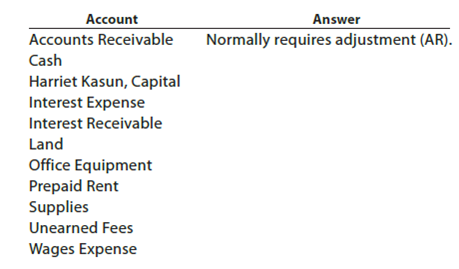

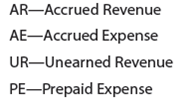

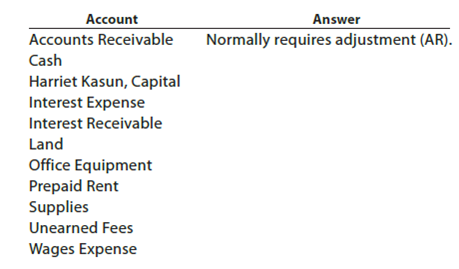

The following accounts were taken from the unadjusted trial balance of Legislative Results Inc., a congressional lobbying firm. Indicate whether or not each account would normally require an adjusting entry. If the account normally requires an adjusting entry, use the following notation to indicate the type of adjustment:

To illustrate, the answer for the first account follows:

The following accounts were taken from the unadjusted trial balance of Legislative Results Inc., a congressional lobbying firm. Indicate whether or not each account would normally require an adjusting entry. If the account normally requires an adjusting entry, use the following notation to indicate the type of adjustment:

To illustrate, the answer for the first account follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

Adjusting entries

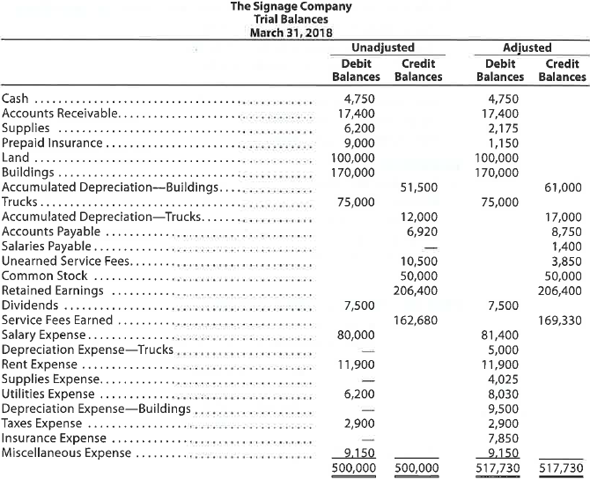

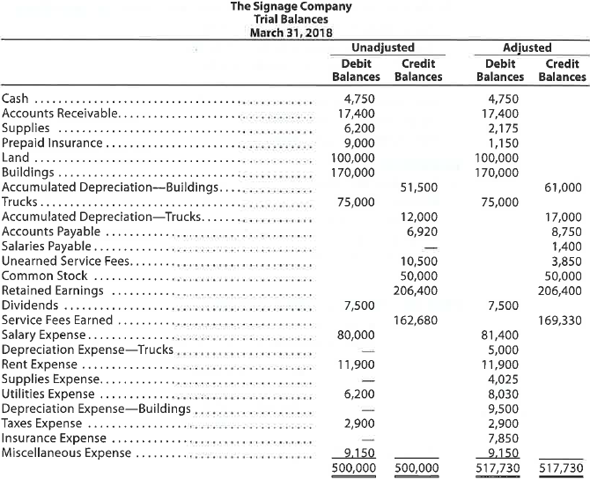

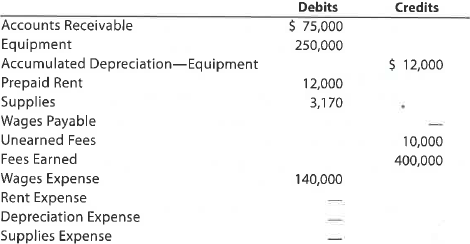

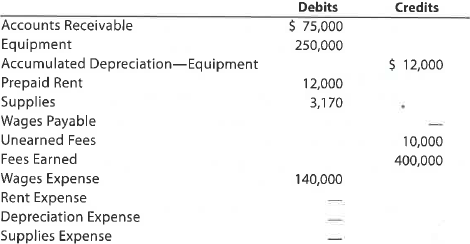

The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 2018, the accountant for The Signage Company prepared the trial balances shown at the top of the following page.

Instructions

Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one adjusting entry.

The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 2018, the accountant for The Signage Company prepared the trial balances shown at the top of the following page.

Instructions

Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Effect of omitting adjusting entry

When preparing the financial statements for the year ended October 31, accrued salaries owed to employees for October 30 and 31 were overlooked. The accrued salaries were included in the first salary payment in November. Indicate which items will be erroneously stated, because of failure to correct the initial error, on (A) the income statement for the month of November and (B) the balance sheet as of November 30.

When preparing the financial statements for the year ended October 31, accrued salaries owed to employees for October 30 and 31 were overlooked. The accrued salaries were included in the first salary payment in November. Indicate which items will be erroneously stated, because of failure to correct the initial error, on (A) the income statement for the month of November and (B) the balance sheet as of November 30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Effects of errors on financial statements

For a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $3,446 million. For the same period, Costco reported income before income taxes of $3,197 million. Assume that the adjusting entry for $3,446 million of accrued expenses was not recorded at the end of the current period. What would have been the income (loss) before income taxes?

For a recent period, the balance sheet for Costco Wholesale Corporation reported accrued expenses of $3,446 million. For the same period, Costco reported income before income taxes of $3,197 million. Assume that the adjusting entry for $3,446 million of accrued expenses was not recorded at the end of the current period. What would have been the income (loss) before income taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Adjusting entries

Selected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the current year, are as follows:

Data needed for year-end adjustments are as follows:

• Unbilled fees at July 31, $11,150.

• Supplies on hand at July 31, $900.

• Rent expired, $6,000.

• Depreciation of equipment during year, $8,950.

• Unearned fees at July 31, $2,000.

• Wages accrued but not paid at July 31, $4,840.

Instructions

1. Journalize the six adjusting entries required at July 31, based on the data presented.

2. What would be the effect on the income statement if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

Selected account balances before adjustment for Atlantic Coast Realty at July 31, the end of the current year, are as follows:

Data needed for year-end adjustments are as follows:

• Unbilled fees at July 31, $11,150.

• Supplies on hand at July 31, $900.

• Rent expired, $6,000.

• Depreciation of equipment during year, $8,950.

• Unearned fees at July 31, $2,000.

• Wages accrued but not paid at July 31, $4,840.

Instructions

1. Journalize the six adjusting entries required at July 31, based on the data presented.

2. What would be the effect on the income statement if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for unbilled fees and accrued wages were omitted at the end of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

Adjustment for unearned revenue

On June 1, 2018, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 2018.

On June 1, 2018, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Effect of errors on adjusted trial balance

For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

A. The adjustment for accrued wages of $5,200 was journalized as a debit to Wages Expense for $5,200 and a credit to Accounts Payable for $5,200.

B. The entry for $1,125 of supplies used during the period was journalized as a debit to Supplies Expense of $1,125 and a credit to Supplies of $1,152.

For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

A. The adjustment for accrued wages of $5,200 was journalized as a debit to Wages Expense for $5,200 and a credit to Accounts Payable for $5,200.

B. The entry for $1,125 of supplies used during the period was journalized as a debit to Supplies Expense of $1,125 and a credit to Supplies of $1,152.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

Effects of errors on financial statements

For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $553 million. The income before taxes for Campbell for the year was $1,073 million.

A. Assume the adjusting entry for $553 million of accrued expenses was not recorded at the end of the year. By how much would income before taxes have been misstated?

B. What is the percentage of the misstatement in (A) to the reported income of $1,073 million? (Round to one decimal place.)

For a recent year, the balance sheet for The Campbell Soup Company includes accrued expenses of $553 million. The income before taxes for Campbell for the year was $1,073 million.

A. Assume the adjusting entry for $553 million of accrued expenses was not recorded at the end of the year. By how much would income before taxes have been misstated?

B. What is the percentage of the misstatement in (A) to the reported income of $1,073 million? (Round to one decimal place.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Adjusting entries

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow:

Data needed for year-end adjustments are as follows:

• Supplies on hand at November 30, $550.

• Depreciation of equipment during year, $1,675.

• Rent expired during year, $8,500.

• Wages accrued but not paid at November 30, $2,000.

• Unearned fees at November 30, $4,000.

• Unbilled fees at November 30, $5,380.

Instructions

1. Journalize the six adjusting entries required at November 30, based on the data presented.

2. What would be the effect on the income statement if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow:

Data needed for year-end adjustments are as follows:

• Supplies on hand at November 30, $550.

• Depreciation of equipment during year, $1,675.

• Rent expired during year, $8,500.

• Wages accrued but not paid at November 30, $2,000.

• Unearned fees at November 30, $4,000.

• Unbilled fees at November 30, $5,380.

Instructions

1. Journalize the six adjusting entries required at November 30, based on the data presented.

2. What would be the effect on the income statement if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

3. What would be the effect on the balance sheet if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

Identify the four different categories of adjusting entries frequently required at the end of an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

On November 1 of the current year, a business paid the November rent on the building that it occupies. (a) Do the rights acquired at November 1 represent an asset or an expense? (b) What is the justification for debiting Rent Expense at the time of payment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Effects of errors on financial statements

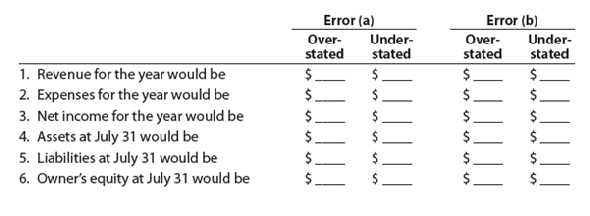

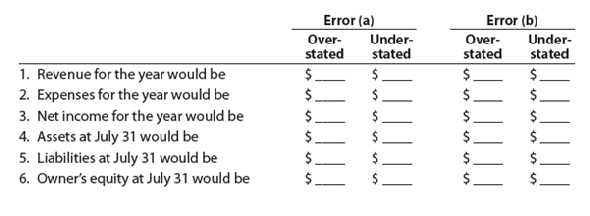

The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($34,900) and (b) accrued wages ($12,770). Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet. Set up a table similar to the following, and record your answers by inserting the dollar amount in the appropriate spaces. Insert a zero if the error does not affect the item.

The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($34,900) and (b) accrued wages ($12,770). Indicate the effect of each error, considered individually, on the income statement for the current year ended July 31. Also indicate the effect of each error on the July 31 balance sheet. Set up a table similar to the following, and record your answers by inserting the dollar amount in the appropriate spaces. Insert a zero if the error does not affect the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Team Activity

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

1. Based on the information in the company's most recent annual report, answer the following questions:

A. In what industry does the company operate?

B. How many years of information are reported on the company's income statement?

C. How much net income does the company report on its income statement for each year presented?

D. How much revenue does the company report on its income statement for each year presented?

E. Within the notes to the financial statements, find the note on significant accounting policies. Based on the information in this note, when does the company recognize revenue?

2. Based solely on the company's net income, has the company's performance improved, remained constant, or deteriorated over the periods presented? Briefly explain your answer.

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

1. Based on the information in the company's most recent annual report, answer the following questions:

A. In what industry does the company operate?

B. How many years of information are reported on the company's income statement?

C. How much net income does the company report on its income statement for each year presented?

D. How much revenue does the company report on its income statement for each year presented?

E. Within the notes to the financial statements, find the note on significant accounting policies. Based on the information in this note, when does the company recognize revenue?

2. Based solely on the company's net income, has the company's performance improved, remained constant, or deteriorated over the periods presented? Briefly explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

Adjusting entries for accrued salaries

Garcia Realty Co. pays weekly salaries of $17,250 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (A) on Wednesday and (B) on Thursday.

Garcia Realty Co. pays weekly salaries of $17,250 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (A) on Wednesday and (B) on Thursday.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

Adjusting entries for unearned fees

The balance in the unearned fees account, before adjustment at the end of the year, is $18,000. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $3,600.

The balance in the unearned fees account, before adjustment at the end of the year, is $18,000. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $3,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Effects of errors on financial statements

If the net income for the current year had been $196,400 in Exercise 3-23, what would have been the correct net income if the proper adjusting entries had been made?

If the net income for the current year had been $196,400 in Exercise 3-23, what would have been the correct net income if the proper adjusting entries had been made?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

Nike: Vertical analysis

The following data are taken from recent financial statement of Nike, Inc. (in millions):

A. Determine the amount of change (in millions) and percent of change in net income from Year 1 to Year 2. (Round to one decimal place.)

B. Determine the percentage relationship between net income and sales for Year 2 and Year 1. (Round to one decimal place.)

C. What conclusions can you draw from your analyses?

The following data are taken from recent financial statement of Nike, Inc. (in millions):

A. Determine the amount of change (in millions) and percent of change in net income from Year 1 to Year 2. (Round to one decimal place.)

B. Determine the percentage relationship between net income and sales for Year 2 and Year 1. (Round to one decimal place.)

C. What conclusions can you draw from your analyses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Adjusting entries and adjusted trial balances

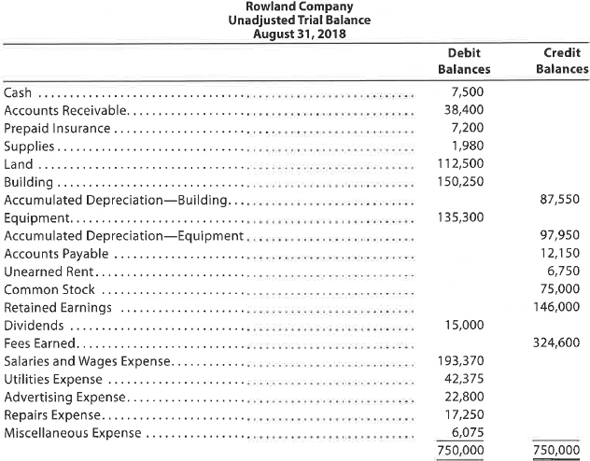

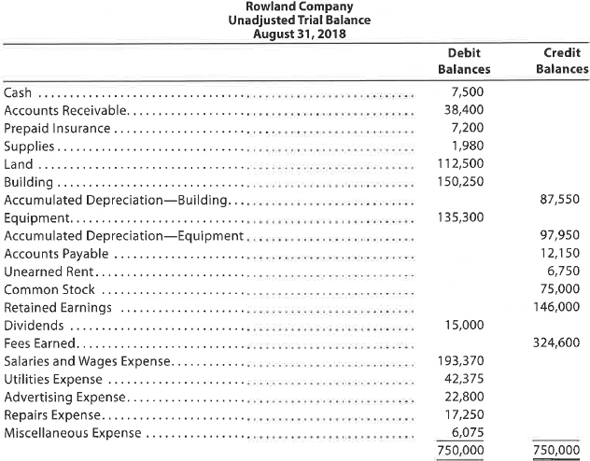

Rowland Company is a small editorial services company owned and operated by Marlene Rowland. On August 31, 2018, the end of the current year, Rowland Company's accounting clerk prepared the following unadjusted trial balance:

The data needed to determine year-end adjustments are as follows:

• Unexpired insurance at August 31, $6,000.

• Supplies on hand at August 31, $480.

• Depreciation of building for the year, $7,500.

• Depreciation of equipment for the year, $4,150.

• Rent unearned at August 31, $1,550.

• Accrued salaries and wages at August 31, $3,200.

• Fees earned but unbilled on August 31, $11,330.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense.

2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance.

Rowland Company is a small editorial services company owned and operated by Marlene Rowland. On August 31, 2018, the end of the current year, Rowland Company's accounting clerk prepared the following unadjusted trial balance:

The data needed to determine year-end adjustments are as follows:

• Unexpired insurance at August 31, $6,000.

• Supplies on hand at August 31, $480.

• Depreciation of building for the year, $7,500.

• Depreciation of equipment for the year, $4,150.

• Rent unearned at August 31, $1,550.

• Accrued salaries and wages at August 31, $3,200.

• Fees earned but unbilled on August 31, $11,330.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense.

2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Explain the purpose of the two accounts: Depreciation Expense and Accumulated Depreciation. (b) What is the normal balance of each account? (c) Is it customary for the balances of the two accounts to be equal in amount? (d) In what financial statements, if any, will each account appear?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Adjusting entries for depreciation; effect of error

On December 31, a business estimates depreciation on equipment used during the first year of operations to be $13,900.

a. Journalize the adjusting entry required as of December 31.

b. If the adjusting entry in (a) were omitted, which items would be erroneously stated on (1) the income statement for the year and (2) the balance sheet as of December 31?

On December 31, a business estimates depreciation on equipment used during the first year of operations to be $13,900.

a. Journalize the adjusting entry required as of December 31.

b. If the adjusting entry in (a) were omitted, which items would be erroneously stated on (1) the income statement for the year and (2) the balance sheet as of December 31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

Continuing Company Analysis-Amazon: Vertical analysis

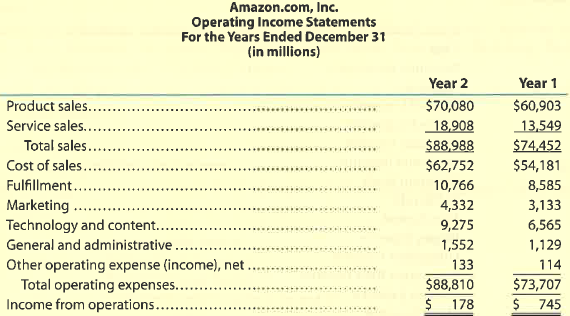

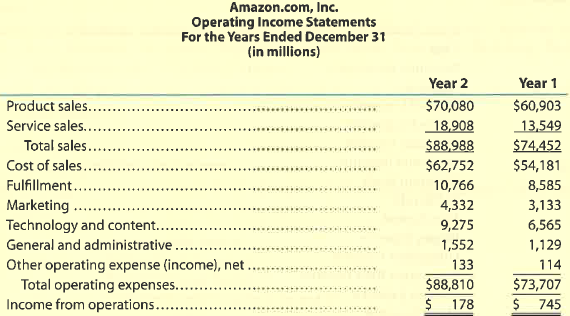

Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations for two recent years are as follows (in millions):

A. Prepare a vertical analysis of the two operating income statements. (Round percentages to one decimal place.)

B. Use the vertical analysis to explain the decrease in income from operations.

Amazon.com, Inc. is the largest Internet retailer in the United States. Amazon's income statements through income from operations for two recent years are as follows (in millions):

A. Prepare a vertical analysis of the two operating income statements. (Round percentages to one decimal place.)

B. Use the vertical analysis to explain the decrease in income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Adjustment for accrued revenues

At the end of the current year, $17,555 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees.

At the end of the current year, $17,555 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Adjusting entries and adjusted trial balances

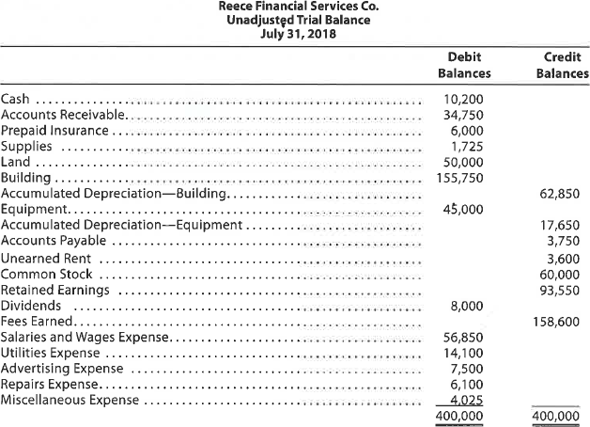

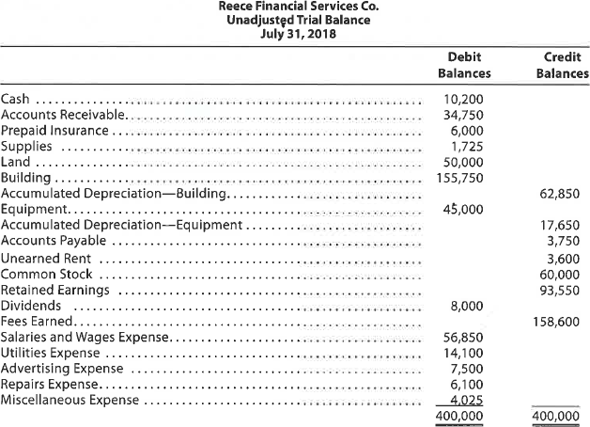

Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services' accounting clerk prepared the following unadjusted trial balance at July 31, 2018:

The data needed to determine year-end adjustments are as follows:

• Depreciation of building for the year, $6,400.

• Depreciation of equipment for the year, $2,800.

• Accrued salaries and wages at July 31, $900.

• Unexpired insurance at July 31, $1,500.

• Fees earned but unbilled on July 31, $10,200.

• Supplies on hand at July 31, $615.

Rent unearned at July 31, $300.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense.

2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance.

Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services' accounting clerk prepared the following unadjusted trial balance at July 31, 2018:

The data needed to determine year-end adjustments are as follows:

• Depreciation of building for the year, $6,400.

• Depreciation of equipment for the year, $2,800.

• Accrued salaries and wages at July 31, $900.

• Unexpired insurance at July 31, $1,500.

• Fees earned but unbilled on July 31, $10,200.

• Supplies on hand at July 31, $615.

Rent unearned at July 31, $300.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense.

2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

Effect of omitting adjusting entry

At the end of July, the first month of the business year, the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (A) the income statement for July and (B) the balance sheet as of July 31. Also indicate whether the items in error will be overstated or understated.

At the end of July, the first month of the business year, the usual adjusting entry transferring rent earned to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated, because of the error, on (A) the income statement for July and (B) the balance sheet as of July 31. Also indicate whether the items in error will be overstated or understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

Adjusting entries from trial balances

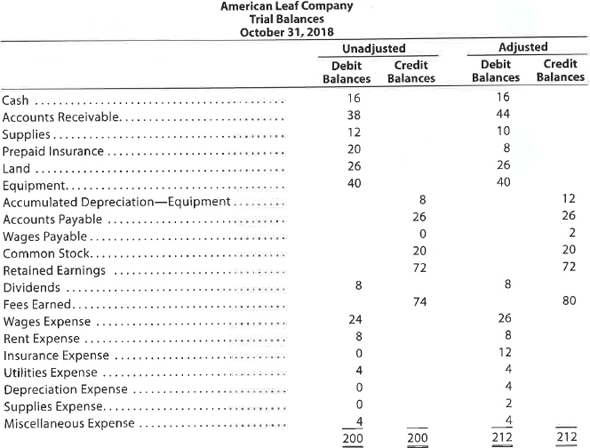

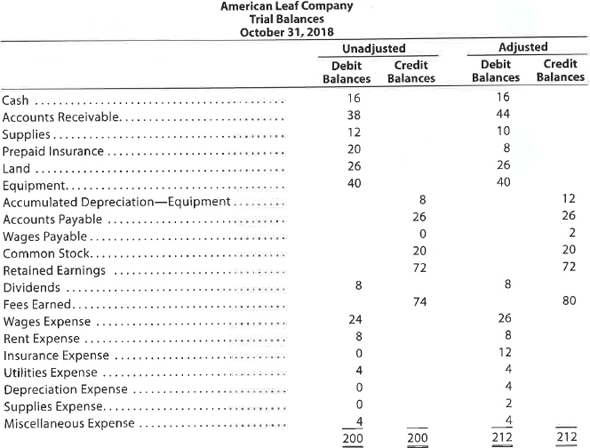

The unadjusted and adjusted trial balances for American Leaf Company on October 31, 2018, follow:

Journalize the five entries that adjusted the accounts at October 31, 2018. None of the accounts were affected by more than one adjusting entry.

The unadjusted and adjusted trial balances for American Leaf Company on October 31, 2018, follow:

Journalize the five entries that adjusted the accounts at October 31, 2018. None of the accounts were affected by more than one adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Accounts requiring adjustment

Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry:

A. Building

B. Cash

C. Wages Expense

D. Miscellaneous Expense

E. Common Stock

F. Prepaid Insurance

Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry:

A. Building

B. Cash

C. Wages Expense

D. Miscellaneous Expense

E. Common Stock

F. Prepaid Insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

Why are adjusting entries needed at the end of an accounting period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

Adjustment for prepaid expense

The prepaid insurance account had a beginning balance of $4,500 and was debited for $16,600 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future periods is $5,600.

The prepaid insurance account had a beginning balance of $4,500 and was debited for $16,600 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future periods is $5,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Adjusting entry for supplies

The balance in the supplies account, before adjustment at the end of the year, is $4,850. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $880.

The balance in the supplies account, before adjustment at the end of the year, is $4,850. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

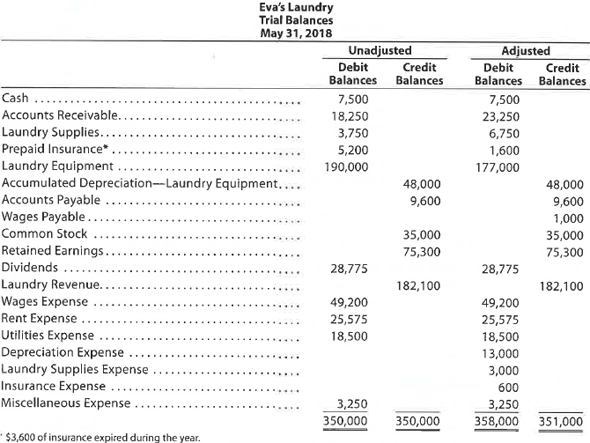

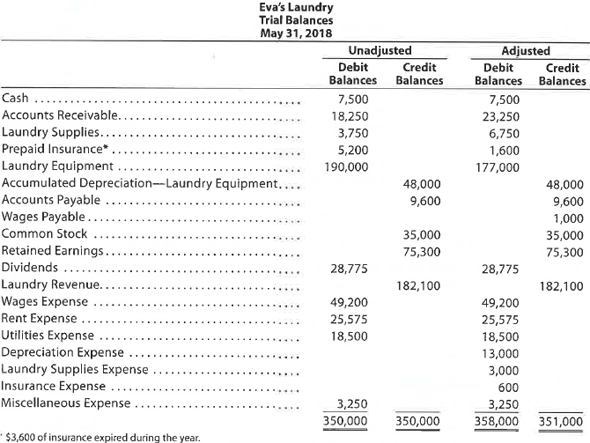

Adjusting entries from trial balances

The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant's adjusting entries, assuming that none of the accounts were affected by more than one adjusting entry.

The accountant for Eva's Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant's adjusting entries, assuming that none of the accounts were affected by more than one adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

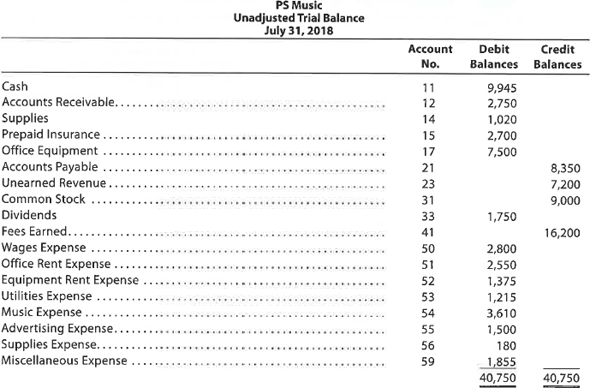

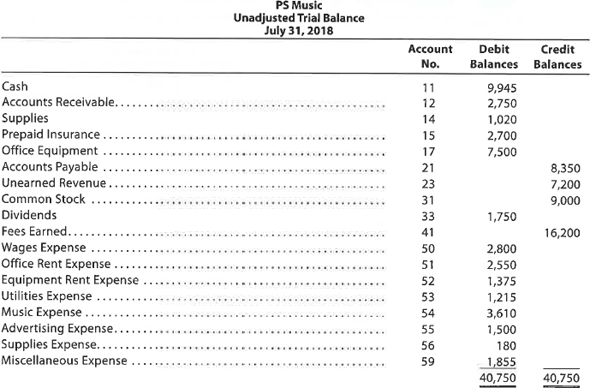

The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows:

The data needed to determine adjustments are as follows:

• During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

• Supplies on hand at July 31, $275.

• The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2.

• Depreciation of the office equipment is $50.

• The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2.

• Accrued wages as of July 31 were $140.

Instructions

1. Prepare adjusting journal entries. You will need the following additional accounts:

2. Post the adjusting entries, inserting balances in the accounts affected.

3. Prepare an adjusted trial balance.

The data needed to determine adjustments are as follows:

• During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2.

• Supplies on hand at July 31, $275.

• The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2.

• Depreciation of the office equipment is $50.

• The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2.

• Accrued wages as of July 31 were $140.

Instructions

1. Prepare adjusting journal entries. You will need the following additional accounts:

2. Post the adjusting entries, inserting balances in the accounts affected.

3. Prepare an adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Adjusting entry for accrued fees

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients.

A. Journalize the adjusting entry to record the accrued fees.

B. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Explain.

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients.

A. Journalize the adjusting entry to record the accrued fees.

B. If the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

If the effect of the debit portion of an adjusting entry is to increase the balance of an asset account, which of the following statements describes the effect of the credit portion of the entry?

a. Increases the balance of a revenue account.

b. Increases the balance of an expense account.

c. Increases the balance of a liability account.

a. Increases the balance of a revenue account.

b. Increases the balance of an expense account.

c. Increases the balance of a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Determining supplies purchased

The supplies and supplies expense accounts at December 31, after adjusting entries have been posted at the end of the first year of operations, are shown in the following T accounts:

Determine the amount of supplies purchased during the year.

The supplies and supplies expense accounts at December 31, after adjusting entries have been posted at the end of the first year of operations, are shown in the following T accounts:

Determine the amount of supplies purchased during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

How are revenues and expenses reported on the income statement under (a) the cash basis of accounting and (b) the accrual basis of accounting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Adjusting entries

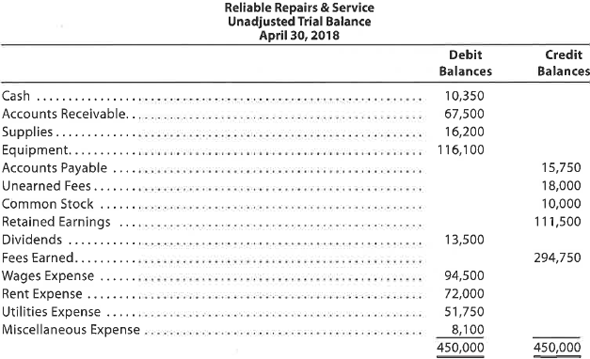

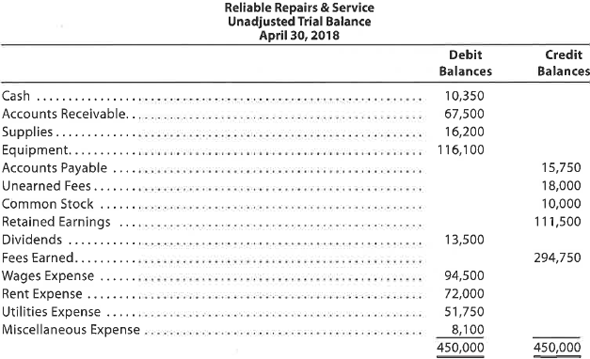

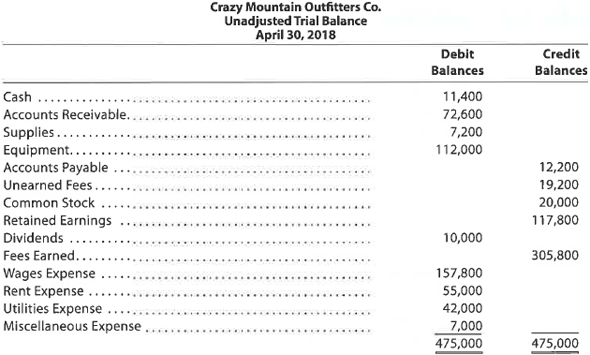

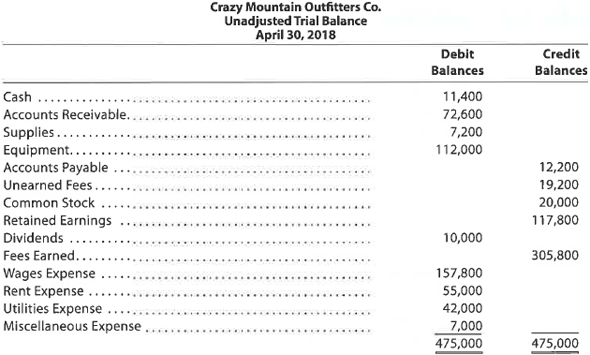

Reliable Repairs Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations:

For preparing the adjusting entries, the following data were assembled:

• Fees earned but unbilled on April 30 were $9,850.

• Supplies on hand on April 30 were $4,660.

• Depreciation of equipment was estimated to be $6,470 for the year.

• The balance in unearned fees represented the April 1 receipt in advance for services to be provided. During April, $15,000 of the services were provided.

• Unpaid wages accrued on April 30 were $5,200.

Instructions

1. Journalize the adjusting entries necessary on April 30, 2018.

2. Determine the revenues, expenses, and net income of Reliable Repairs Service before the adjusting entries.

3. Determine the revenues, expense, and net income of Reliable Repairs Service after the adjusting entries.

4. Determine the effect of the adjusting entries on Retained Earnings.

Reliable Repairs Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations:

For preparing the adjusting entries, the following data were assembled:

• Fees earned but unbilled on April 30 were $9,850.

• Supplies on hand on April 30 were $4,660.

• Depreciation of equipment was estimated to be $6,470 for the year.

• The balance in unearned fees represented the April 1 receipt in advance for services to be provided. During April, $15,000 of the services were provided.

• Unpaid wages accrued on April 30 were $5,200.

Instructions

1. Journalize the adjusting entries necessary on April 30, 2018.

2. Determine the revenues, expenses, and net income of Reliable Repairs Service before the adjusting entries.

3. Determine the revenues, expense, and net income of Reliable Repairs Service after the adjusting entries.

4. Determine the effect of the adjusting entries on Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

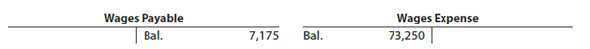

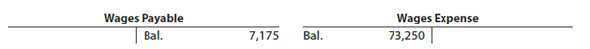

Determining wages paid