Deck 20: Cost Behavior and Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 20: Cost Behavior and Cost-Volume-Profit Analysis

1

Ethics and professional conduct in business

Edward Seymour is a financial consultant to Cornish Inc., a real estate syndicate. Cornish Inc. finances and develops commercial real estate (office buildings). The completed projects are then sold as limited partnership interests to individual investors. The syndicate makes a profit on the sale of these partnership interests. Edward provides financial information for the offering prospectus, which is a document that provides the financial and legal details of the limited partnership offerings. In one of the projects, the bank has financed the construction of a commercial office building at a rate of 10% for the first four years, after which time the rate jumps to 15% for the remaining 20 years of the mortgage. The interest costs are one of the major ongoing costs of a real estate project. Edward has reported prominently in the prospectus that the break-even occupancy for the first four years is 65%. This is the amount of office space that must be leased to cover the interest and general upkeep costs over the first four years. The 65% break-even is very low and thus communicates a low risk to potential investors. Edward uses the 65% break-even rate as a major marketing tool in selling the limited partnership interests. Buried in the fine print of the prospectus is additional information that would allow an astute investor to determine that the break-even occupancy will jump to 95% after the fourth year because of the contracted increase in the mortgage interest rate. Edward believes prospective investors are adequately informed as to the risk of the investment.

Comment on the ethical considerations of this situation.

Edward Seymour is a financial consultant to Cornish Inc., a real estate syndicate. Cornish Inc. finances and develops commercial real estate (office buildings). The completed projects are then sold as limited partnership interests to individual investors. The syndicate makes a profit on the sale of these partnership interests. Edward provides financial information for the offering prospectus, which is a document that provides the financial and legal details of the limited partnership offerings. In one of the projects, the bank has financed the construction of a commercial office building at a rate of 10% for the first four years, after which time the rate jumps to 15% for the remaining 20 years of the mortgage. The interest costs are one of the major ongoing costs of a real estate project. Edward has reported prominently in the prospectus that the break-even occupancy for the first four years is 65%. This is the amount of office space that must be leased to cover the interest and general upkeep costs over the first four years. The 65% break-even is very low and thus communicates a low risk to potential investors. Edward uses the 65% break-even rate as a major marketing tool in selling the limited partnership interests. Buried in the fine print of the prospectus is additional information that would allow an astute investor to determine that the break-even occupancy will jump to 95% after the fourth year because of the contracted increase in the mortgage interest rate. Edward believes prospective investors are adequately informed as to the risk of the investment.

Comment on the ethical considerations of this situation.

Ethical Considerations

An ethical consideration involves an act of informing a prospective investor about all possible information in the prospectus. Further, it involves highlighting all the major risk factors in the prospectus in a simple language.

The act of Edward Seymour shall be considered unethical. This is due to following reasons -:

1. All risk information is not highlighted;

2. The information on increased project cost is not given in simple language thereby misleading small investors.

An ethical consideration involves an act of informing a prospective investor about all possible information in the prospectus. Further, it involves highlighting all the major risk factors in the prospectus in a simple language.

The act of Edward Seymour shall be considered unethical. This is due to following reasons -:

1. All risk information is not highlighted;

2. The information on increased project cost is not given in simple language thereby misleading small investors.

2

Describe how total variable costs and unit variable costs behave with changes in the level of activity.

Total variable costs vary in direct proportion to changes in the level of activity.

Unit variable costs remain the same with changes in the level of activity.

Unit variable costs remain the same with changes in the level of activity.

3

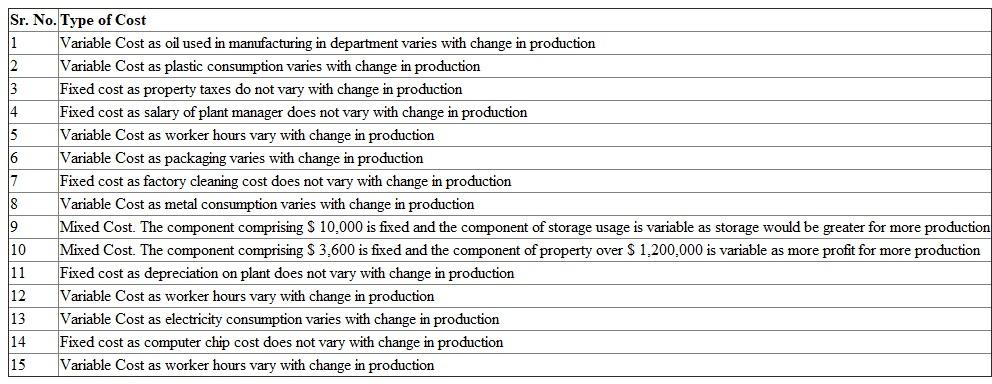

Classify costs

Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as either variable, fixed, or mixed.

1. Oil used in manufacturing equipment

2. Plastic

3. Property taxes, $165,000 per year on factory building and equipment

4. Salary of plant manager

5. Cost of labor for hourly workers

6. Packaging

7. Factory cleaning costs, $6,000 per month

8. Metal

9. Rent on warehouse, $10,000 per month plus $25 per square foot of storage used

10. Property insurance premiums, $3,600 per month plus $0.01 for each dollar of property over $1,200,000

11. Straight-line depreciation on the production equipment

12. Hourly wages of machine operators

13. Electricity costs, $0.20 per kilowatt-hour

14. Computer chip (purchased from a vendor)

15. Pension cost, $1.00 per employee hour on the job

Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as either variable, fixed, or mixed.

1. Oil used in manufacturing equipment

2. Plastic

3. Property taxes, $165,000 per year on factory building and equipment

4. Salary of plant manager

5. Cost of labor for hourly workers

6. Packaging

7. Factory cleaning costs, $6,000 per month

8. Metal

9. Rent on warehouse, $10,000 per month plus $25 per square foot of storage used

10. Property insurance premiums, $3,600 per month plus $0.01 for each dollar of property over $1,200,000

11. Straight-line depreciation on the production equipment

12. Hourly wages of machine operators

13. Electricity costs, $0.20 per kilowatt-hour

14. Computer chip (purchased from a vendor)

15. Pension cost, $1.00 per employee hour on the job

The costs which alter with the change in production are called variable costs. The costs which remain constant despite of change in production are called fixed costs.

All costs cannot be segregated into fixed or variable. Some costs are semi- variable or mixed in nature; that is variable as well as fixed.

Table showing classification of costs

All costs cannot be segregated into fixed or variable. Some costs are semi- variable or mixed in nature; that is variable as well as fixed.

Table showing classification of costs

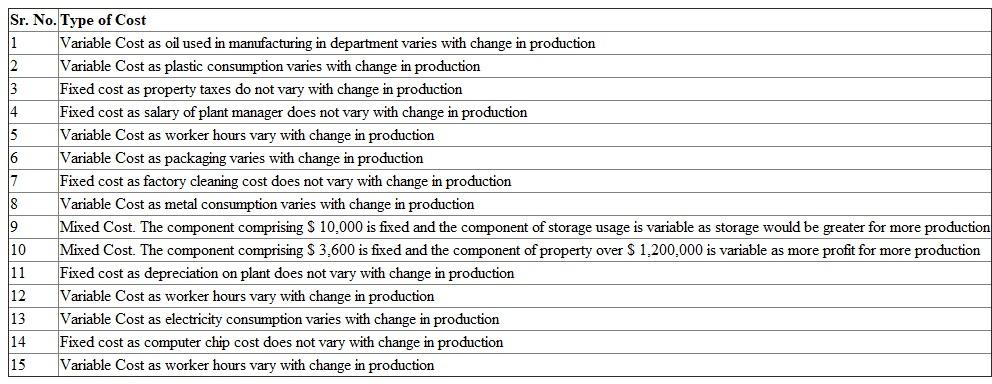

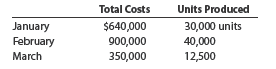

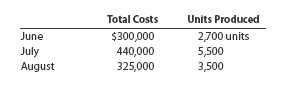

4

High-low method

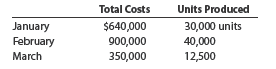

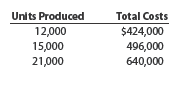

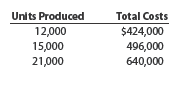

The manufacturing costs of Lightfoot Industries for three months of the year follow:

Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

The manufacturing costs of Carrefour Enterprises for the first three months of the year follow:

Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

The manufacturing costs of Lightfoot Industries for three months of the year follow:

Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

The manufacturing costs of Carrefour Enterprises for the first three months of the year follow:

Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Classify costs

Seymour Clothing Co. manufactures a variety of clothing types for distribution to several major retail chains. The following costs are incurred in the production and sale of blue jeans:

a. Shipping boxes used to ship orders

b. Consulting fee of $200,000 paid to industry specialist for marketing advice

c. Straight-line depreciation on sewing machines

d. Salesperson's salary, $10,000 plus 2% of the total sales

e. Fabric

f. Dye

g. Thread

h. Salary of designers

i. Brass buttons

j. Legal fees paid to attorneys in defense of the company in a patent infringement suit, $50,000 plus $87 per hour

k. Insurance premiums on property, plant, and equipment, $70,000 per year plus $5 per $30,000 of insured value over $8,000,000

l. Rental costs of warehouse, $5,000 per month plus $4 per square foot of storage used m. Supplies

n. Leather for patches identifying the brand on individual pieces of apparel

o. Rent on plant equipment, $50,000 per year

p. Salary of production vice president

q. Janitorial services, $2,200 per month

r. Wages of machine operators

s. Electricity costs of $0.10 per kilowatt-hour

t. Property taxes on property, plant, and equipment

Instructions

Classify the preceding costs as either fixed, variable, or mixed. Use the following tabular headings and place an X in the appropriate column. Identify each cost by letter in the cost column.

Seymour Clothing Co. manufactures a variety of clothing types for distribution to several major retail chains. The following costs are incurred in the production and sale of blue jeans:

a. Shipping boxes used to ship orders

b. Consulting fee of $200,000 paid to industry specialist for marketing advice

c. Straight-line depreciation on sewing machines

d. Salesperson's salary, $10,000 plus 2% of the total sales

e. Fabric

f. Dye

g. Thread

h. Salary of designers

i. Brass buttons

j. Legal fees paid to attorneys in defense of the company in a patent infringement suit, $50,000 plus $87 per hour

k. Insurance premiums on property, plant, and equipment, $70,000 per year plus $5 per $30,000 of insured value over $8,000,000

l. Rental costs of warehouse, $5,000 per month plus $4 per square foot of storage used m. Supplies

n. Leather for patches identifying the brand on individual pieces of apparel

o. Rent on plant equipment, $50,000 per year

p. Salary of production vice president

q. Janitorial services, $2,200 per month

r. Wages of machine operators

s. Electricity costs of $0.10 per kilowatt-hour

t. Property taxes on property, plant, and equipment

Instructions

Classify the preceding costs as either fixed, variable, or mixed. Use the following tabular headings and place an X in the appropriate column. Identify each cost by letter in the cost column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

Classify costs

Cromwell Furniture Company manufactures sofas for distribution to several major retail chains. The following costs are incurred in the production and sale of sofas:

a. Fabric for sofa coverings

b. Wood for framing the sofas

c. Legal fees paid to attorneys in defense of the company in a patent infringement suit, $25,000 plus $160 per hour

d. Salary of production supervisor

e. Cartons used to ship sofas

f. Rent on experimental equipment, $50 for every sofa produced

g. Straight-line depreciation on factory equipment

h. Rental costs of warehouse, $30,000 per month

i. Property taxes on property, plant, and equipment

j. Insurance premiums on property, plant, and equipment, $25,000 per year plus $25 per $25,000 of insured value over $16,000,000

k. Springs

l. Consulting fee of $120,000 paid to efficiency specialists m. Electricity costs of $0.13 per kilowatt-hour

n. Salesperson's salary, $80,000 plus 4% of the selling price of each sofa sold

o. Foam rubber for cushion fillings

p. Janitorial supplies, $2,500 per month

q. Employer's FICA taxes on controller's salary of $180,000

r. Salary of designers

s. Wages of sewing machine operators

t. Sewing supplies

Instructions

Classify the preceding costs as either fixed, variable, or mixed. Use the following tabular headings and place an X in the appropriate column. Identify each cost by letter in the cost column.

Cromwell Furniture Company manufactures sofas for distribution to several major retail chains. The following costs are incurred in the production and sale of sofas:

a. Fabric for sofa coverings

b. Wood for framing the sofas

c. Legal fees paid to attorneys in defense of the company in a patent infringement suit, $25,000 plus $160 per hour

d. Salary of production supervisor

e. Cartons used to ship sofas

f. Rent on experimental equipment, $50 for every sofa produced

g. Straight-line depreciation on factory equipment

h. Rental costs of warehouse, $30,000 per month

i. Property taxes on property, plant, and equipment

j. Insurance premiums on property, plant, and equipment, $25,000 per year plus $25 per $25,000 of insured value over $16,000,000

k. Springs

l. Consulting fee of $120,000 paid to efficiency specialists m. Electricity costs of $0.13 per kilowatt-hour

n. Salesperson's salary, $80,000 plus 4% of the selling price of each sofa sold

o. Foam rubber for cushion fillings

p. Janitorial supplies, $2,500 per month

q. Employer's FICA taxes on controller's salary of $180,000

r. Salary of designers

s. Wages of sewing machine operators

t. Sewing supplies

Instructions

Classify the preceding costs as either fixed, variable, or mixed. Use the following tabular headings and place an X in the appropriate column. Identify each cost by letter in the cost column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

Break-even sales, contribution margin

"For a student, a grade of 65 percent is nothing to write home about. But for the airline... [industry], filling 65 percent of the seats... is the difference between profit and loss.

The [economy] might be just strong enough to sustain all the carriers on a cash basis, but not strong enough to bring any significant profitability to the industry For the airlines..., the emphasis will be on trying to consolidate routes and raise ticket prices... "

Source: Edwin McDowell, "Empty Seats, Empty Beds, Empty Pockets," The New York Times , January 6, 1992, p. C3.

The airline industry is notorious for boom and bust cycles. Why is airline profitability very sensitive to these cycles? Do you think that during a down cycle the strategy to consolidate routes and raise ticket prices is reasonable? What would make this strategy succeed or fail? Why?

"For a student, a grade of 65 percent is nothing to write home about. But for the airline... [industry], filling 65 percent of the seats... is the difference between profit and loss.

The [economy] might be just strong enough to sustain all the carriers on a cash basis, but not strong enough to bring any significant profitability to the industry For the airlines..., the emphasis will be on trying to consolidate routes and raise ticket prices... "

Source: Edwin McDowell, "Empty Seats, Empty Beds, Empty Pockets," The New York Times , January 6, 1992, p. C3.

The airline industry is notorious for boom and bust cycles. Why is airline profitability very sensitive to these cycles? Do you think that during a down cycle the strategy to consolidate routes and raise ticket prices is reasonable? What would make this strategy succeed or fail? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following costs would be classified as variable and which would be classified as fixed, if units produced is the activity base?

a. Direct materials costs

b. Electricity costs of $0.35 per kilowatt-hour

a. Direct materials costs

b. Electricity costs of $0.35 per kilowatt-hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

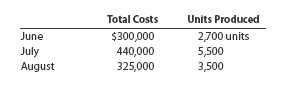

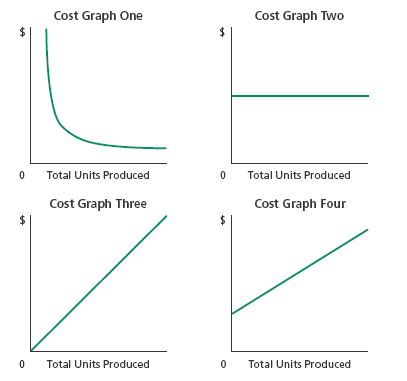

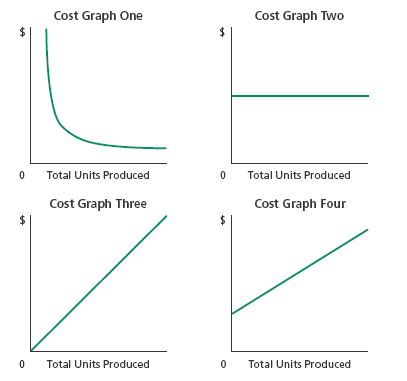

Identify cost graphs

The following cost graphs illustrate various types of cost behavior:

For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases:

a. Total direct materials cost

b. Electricity costs of $1,000 per month plus $0.10 per kilowatt-hour

c. Per-unit cost of straight-line depreciation on factory equipment

d. Salary of quality control supervisor, $20,000 per month

e. Per-unit direct labor cost

The following cost graphs illustrate various types of cost behavior:

For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases:

a. Total direct materials cost

b. Electricity costs of $1,000 per month plus $0.10 per kilowatt-hour

c. Per-unit cost of straight-line depreciation on factory equipment

d. Salary of quality control supervisor, $20,000 per month

e. Per-unit direct labor cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

Contribution margin

Michigan Company sells 10,000 units at $100 per unit. Variable costs are $75 per unit, and fixed costs are $125,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

Weidner Company sells 22,000 units at $30 per unit. Variable costs are $24 per unit, and fixed costs are $40,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

Michigan Company sells 10,000 units at $100 per unit. Variable costs are $75 per unit, and fixed costs are $125,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

Weidner Company sells 22,000 units at $30 per unit. Variable costs are $24 per unit, and fixed costs are $40,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Break-even sales under present and proposed conditions

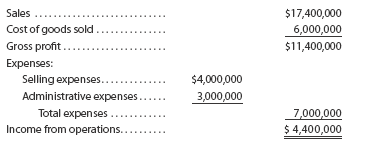

BeeGee Company, operating at full capacity, sold 150,000 units at a price of $116 per unit during the current year. Its income statement is as follows:

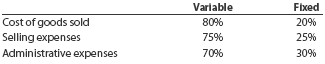

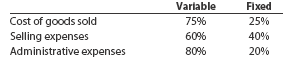

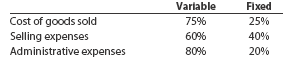

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $3,625,000 in yearly sales. The expansion will increase fixed costs by $1,000,000 but will not affect the relationship between sales and variable costs.

Instructions

1. Determine the total variable costs and the total fixed costs for the current year.

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

3. Compute the break-even sales (units) for the current year.

4. Compute the break-even sales (units) under the proposed program for the following year.

5. Determine the amount of sales (units) that would be necessary under the proposed program to realize the $4,400,000 of income from operations that was earned in the current year.

6. Determine the maximum income from operations possible with the expanded plant.

7. If the proposal is accepted and sales remain at the current level, what will the income or loss from operations be for the following year?

8. Based on the data given, would you recommend accepting the proposal? Explain.

BeeGee Company, operating at full capacity, sold 150,000 units at a price of $116 per unit during the current year. Its income statement is as follows:

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $3,625,000 in yearly sales. The expansion will increase fixed costs by $1,000,000 but will not affect the relationship between sales and variable costs.

Instructions

1. Determine the total variable costs and the total fixed costs for the current year.

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

3. Compute the break-even sales (units) for the current year.

4. Compute the break-even sales (units) under the proposed program for the following year.

5. Determine the amount of sales (units) that would be necessary under the proposed program to realize the $4,400,000 of income from operations that was earned in the current year.

6. Determine the maximum income from operations possible with the expanded plant.

7. If the proposal is accepted and sales remain at the current level, what will the income or loss from operations be for the following year?

8. Based on the data given, would you recommend accepting the proposal? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Break-even sales under present and proposed conditions

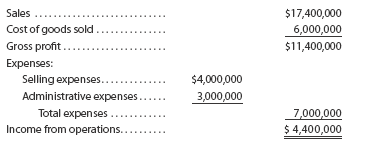

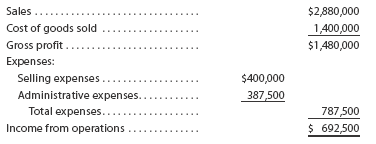

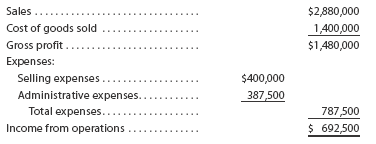

Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows:

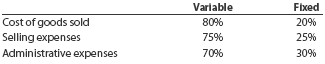

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $900,000 in yearly sales. The expansion will increase fixed costs by $212,500 but will not affect the relationship between sales and variable costs.

Instructions

1. Determine the total fixed costs and the total variable costs for the current year.

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

3. Compute the break-even sales (units) for the current year.

4. Compute the break-even sales (units) under the proposed program for the following year.

5. Determine the amount of sales (units) that would be necessary under the proposed program to realize the $692,500 of income from operations that was earned in the current year.

6. Determine the maximum income from operations possible with the expanded plant.

7. If the proposal is accepted and sales remain at the current level, what will the income or loss from operations be for the following year?

8. Based on the data given, would you recommend accepting the proposal?

Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows:

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $900,000 in yearly sales. The expansion will increase fixed costs by $212,500 but will not affect the relationship between sales and variable costs.

Instructions

1. Determine the total fixed costs and the total variable costs for the current year.

2. Determine (a) the unit variable cost and (b) the unit contribution margin for the current year.

3. Compute the break-even sales (units) for the current year.

4. Compute the break-even sales (units) under the proposed program for the following year.

5. Determine the amount of sales (units) that would be necessary under the proposed program to realize the $692,500 of income from operations that was earned in the current year.

6. Determine the maximum income from operations possible with the expanded plant.

7. If the proposal is accepted and sales remain at the current level, what will the income or loss from operations be for the following year?

8. Based on the data given, would you recommend accepting the proposal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Break-even analysis

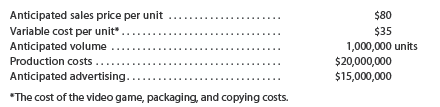

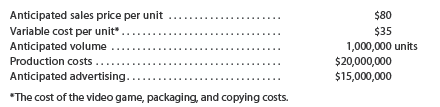

Somerset Inc. has finished a new video game, Snowboard Challenge. Management is now considering its marketing strategies. The following information is available:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

James: I think we need to think of some way to increase our profitability. Do you have any ideas?

Thomas: Well, I think the best strategy would be to become aggressive on price.

James: How aggressive?

Thomas: If we drop the price to $60 per unit and maintain our advertising budget at $15,000,000, I think we will generate total sales of 2,000,000 units.

James: I think that?s the wrong way to go. You're giving too much up on price. Instead, I think we need to follow an aggressive advertising strategy.

Thomas: How aggressive?

James: If we increase our advertising to a total of $25,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price.

Thomas: I don't think that?s reasonable. We?ll never cover the increased advertising costs.

Which strategy is best: Do nothing? Follow the advice of Thomas Seymour? Or follow James Hamilton's strategy?

Somerset Inc. has finished a new video game, Snowboard Challenge. Management is now considering its marketing strategies. The following information is available:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

James: I think we need to think of some way to increase our profitability. Do you have any ideas?

Thomas: Well, I think the best strategy would be to become aggressive on price.

James: How aggressive?

Thomas: If we drop the price to $60 per unit and maintain our advertising budget at $15,000,000, I think we will generate total sales of 2,000,000 units.

James: I think that?s the wrong way to go. You're giving too much up on price. Instead, I think we need to follow an aggressive advertising strategy.

Thomas: How aggressive?

James: If we increase our advertising to a total of $25,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price.

Thomas: I don't think that?s reasonable. We?ll never cover the increased advertising costs.

Which strategy is best: Do nothing? Follow the advice of Thomas Seymour? Or follow James Hamilton's strategy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Describe how total fixed costs and unit fixed costs behave with changes in the level of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

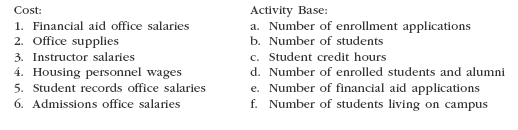

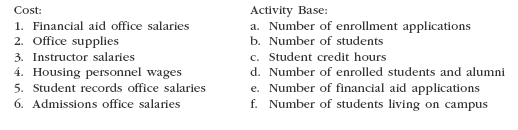

Identify activity bases

For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all.

For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

Break-even point

Santana sells a product for $115 per unit. The variable cost is $75 per unit, while fixed costs are $65,000. Determine (a) the break-even point in sales units and (b) the breakeven point if the selling price were increased to $125 per unit.

Elrod Inc. sells a product for $75 per unit. The variable cost is $45 per unit, while fixed costs are $48,000. Determine (a) the break-even point in sales units and (b) the breakeven point if the selling price were increased to $95 per unit.

Santana sells a product for $115 per unit. The variable cost is $75 per unit, while fixed costs are $65,000. Determine (a) the break-even point in sales units and (b) the breakeven point if the selling price were increased to $125 per unit.

Elrod Inc. sells a product for $75 per unit. The variable cost is $45 per unit, while fixed costs are $48,000. Determine (a) the break-even point in sales units and (b) the breakeven point if the selling price were increased to $95 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

Break-even sales and cost-volume-profit chart

For the coming year, Cleves Company anticipates a unit selling price of $100, a unit variable cost of $60, and fixed costs of $480,000.

Instructions

1. Compute the anticipated break-even sales (units).

2. Compute the sales (units) required to realize a target profit of $240,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within the relevant range.

4. Determine the probable income (loss) from operations if sales total 16,000 units.

For the coming year, Cleves Company anticipates a unit selling price of $100, a unit variable cost of $60, and fixed costs of $480,000.

Instructions

1. Compute the anticipated break-even sales (units).

2. Compute the sales (units) required to realize a target profit of $240,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 20,000 units within the relevant range.

4. Determine the probable income (loss) from operations if sales total 16,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Break-even sales and cost-volume-profit chart

For the coming year, Culpeper Products Inc. anticipates a unit selling price of $150, a unit variable cost of $110, and fixed costs of $800,000.

Instructions

1. Compute the anticipated break-even sales (units).

2. Compute the sales (units) required to realize income from operations of $300,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 40,000 units within the relevant range.

4. Determine the probable income (loss) from operations if sales total 32,000 units.

For the coming year, Culpeper Products Inc. anticipates a unit selling price of $150, a unit variable cost of $110, and fixed costs of $800,000.

Instructions

1. Compute the anticipated break-even sales (units).

2. Compute the sales (units) required to realize income from operations of $300,000.

3. Construct a cost-volume-profit chart, assuming maximum sales of 40,000 units within the relevant range.

4. Determine the probable income (loss) from operations if sales total 32,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

Variable costs and activity bases in decision making

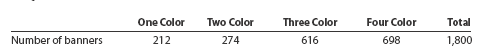

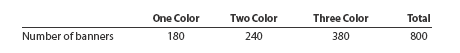

The owner of Warwick Printing, a printing company, is planning direct labor needs for the upcoming year. The owner has provided you with the following information for next year's plans:

Each color on the banner must be printed one at a time. Thus, for example, a four-color banner will need to be run through the printing operation four separate times. The total production volume last year was 800 banners, as follows:

As you can see, the four-color banner is a new product offering for the upcoming year. The owner believes that the expected 1,000-unit increase in volume from last year means that direct labor expenses should increase by 125% (1,000 4 800). What do you think?

The owner of Warwick Printing, a printing company, is planning direct labor needs for the upcoming year. The owner has provided you with the following information for next year's plans:

Each color on the banner must be printed one at a time. Thus, for example, a four-color banner will need to be run through the printing operation four separate times. The total production volume last year was 800 banners, as follows:

As you can see, the four-color banner is a new product offering for the upcoming year. The owner believes that the expected 1,000-unit increase in volume from last year means that direct labor expenses should increase by 125% (1,000 4 800). What do you think?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

In applying the high-low method of cost estimation to mixed costs, how is the total fixed cost estimated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

Identify activity bases

From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons' commission of 5% of the sales price for each car sold, and (3) administrative costs for ordering cars.

a. Number of cars sold

b. Dollar amount of cars ordered

c. Number of cars ordered

d. Number of cars on hand

e. Number of cars received

f. Dollar amount of cars sold

g. Dollar amount of cars received

h. Dollar amount of cars on hand

From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons' commission of 5% of the sales price for each car sold, and (3) administrative costs for ordering cars.

a. Number of cars sold

b. Dollar amount of cars ordered

c. Number of cars ordered

d. Number of cars on hand

e. Number of cars received

f. Dollar amount of cars sold

g. Dollar amount of cars received

h. Dollar amount of cars on hand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

Target profit

Versa Inc. sells a product for $100 per unit. The variable cost is $75 per unit, and fixed costs are $45,000. Determine (a) the break-even point in sales units and (b) the breakeven point in sales units if the company desires a target profit of $25,000.

Scrushy Company sells a product for $150 per unit. The variable cost is $110 per unit, and fixed costs are $200,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $50,000.

Versa Inc. sells a product for $100 per unit. The variable cost is $75 per unit, and fixed costs are $45,000. Determine (a) the break-even point in sales units and (b) the breakeven point in sales units if the company desires a target profit of $25,000.

Scrushy Company sells a product for $150 per unit. The variable cost is $110 per unit, and fixed costs are $200,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Break-even sales and cost-volume-profit chart

Last year, Hever Inc. had sales of $500,000, based on a unit selling price of $250. The variable cost per unit was $175, and fixed costs were $75,000. The maximum sales within Hever Inc.'s relevant range are 2,500 units. Hever Inc. is considering a proposal to spend an additional $33,750 on billboard advertising during the current year in an attempt to increase sales and utilize unused capacity.

Instructions

1. Construct a cost-volume-profit chart indicating the break-even sales for last year. Verify your answer, using the break-even equation.

2. Using the cost-volume-profit chart prepared in part (1), determine (a) the income from operations for last year and (b) the maximum income from operations that could have been realized during the year. Verify your answers using the mathematical approach to cost-volume-profit analysis.

3. Construct a cost-volume-profit chart indicating the break-even sales for the current year, assuming that a noncancellable contract is signed for the additional billboard advertising. No changes are expected in the unit selling price or other costs. Verify your answer, using the break-even equation.

4. Using the cost-volume-profit chart prepared in part (3), determine (a) the income from operations if sales total 2,000 units and (b) the maximum income from operations that could be realized during the year. Verify your answers using the mathematical approach to cost-volume-profit analysis.

Last year, Hever Inc. had sales of $500,000, based on a unit selling price of $250. The variable cost per unit was $175, and fixed costs were $75,000. The maximum sales within Hever Inc.'s relevant range are 2,500 units. Hever Inc. is considering a proposal to spend an additional $33,750 on billboard advertising during the current year in an attempt to increase sales and utilize unused capacity.

Instructions

1. Construct a cost-volume-profit chart indicating the break-even sales for last year. Verify your answer, using the break-even equation.

2. Using the cost-volume-profit chart prepared in part (1), determine (a) the income from operations for last year and (b) the maximum income from operations that could have been realized during the year. Verify your answers using the mathematical approach to cost-volume-profit analysis.

3. Construct a cost-volume-profit chart indicating the break-even sales for the current year, assuming that a noncancellable contract is signed for the additional billboard advertising. No changes are expected in the unit selling price or other costs. Verify your answer, using the break-even equation.

4. Using the cost-volume-profit chart prepared in part (3), determine (a) the income from operations if sales total 2,000 units and (b) the maximum income from operations that could be realized during the year. Verify your answers using the mathematical approach to cost-volume-profit analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

Break-even sales and cost-volume-profit chart

Last year, Parr Co. had sales of $900,000, based on a unit selling price of $200. The variable cost per unit was $125, and fixed costs were $225,000. The maximum sales within Parr Co.'s relevant range are 7,500 units. Parr Co. is considering a proposal to spend an additional $112,500 on billboard advertising during the current year in an attempt to increase sales and utilize unused capacity.

Instructions

1. Construct a cost-volume-profit chart indicating the break-even sales for last year. Verify your answer, using the break-even equation.

2. Using the cost-volume-profit chart prepared in part (1), determine (a) the income from operations for last year and (b) the maximum income from operations that could have been realized during the year. Verify your answers arithmetically.

3. Construct a cost-volume-profit chart indicating the break-even sales for the current year, assuming that a noncancellable contract is signed for the additional billboard advertising. No changes are expected in the selling price or other costs. Verify your answer, using the break-even equation.

4. Using the cost-volume-profit chart prepared in part (3), determine (a) the income from operations if sales total 6,000 units and (b) the maximum income from operations that could be realized during the year. Verify your answers arithmetically.

Last year, Parr Co. had sales of $900,000, based on a unit selling price of $200. The variable cost per unit was $125, and fixed costs were $225,000. The maximum sales within Parr Co.'s relevant range are 7,500 units. Parr Co. is considering a proposal to spend an additional $112,500 on billboard advertising during the current year in an attempt to increase sales and utilize unused capacity.

Instructions

1. Construct a cost-volume-profit chart indicating the break-even sales for last year. Verify your answer, using the break-even equation.

2. Using the cost-volume-profit chart prepared in part (1), determine (a) the income from operations for last year and (b) the maximum income from operations that could have been realized during the year. Verify your answers arithmetically.

3. Construct a cost-volume-profit chart indicating the break-even sales for the current year, assuming that a noncancellable contract is signed for the additional billboard advertising. No changes are expected in the selling price or other costs. Verify your answer, using the break-even equation.

4. Using the cost-volume-profit chart prepared in part (3), determine (a) the income from operations if sales total 6,000 units and (b) the maximum income from operations that could be realized during the year. Verify your answers arithmetically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Variable costs and activity bases in decision making

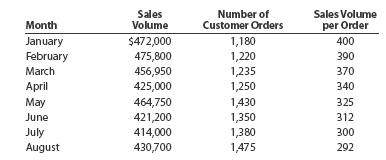

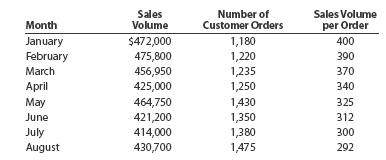

Sales volume has been dropping at Mumford Industries. During this time, however, the Shipping Department manager has been under severe financial constraints. The manager knows that most of the Shipping Department's effort is related to pulling inventory from the warehouse for each order and performing the paperwork. The paperwork involves preparing shipping documents for each order. Thus, the pulling and paperwork effort associated with each sales order is essentially the same, regardless of the size of the order. The Shipping Department manager has discussed the financial situation with senior management. Senior management has responded by pointing out that sales volume has been dropping, so that the amount of work in the Shipping Department should be dropping. Thus, senior management told the Shipping Department manager that costs should be decreasing in the department.

The Shipping Department manager prepared the following information:

Given this information, how would you respond to senior management?

Sales volume has been dropping at Mumford Industries. During this time, however, the Shipping Department manager has been under severe financial constraints. The manager knows that most of the Shipping Department's effort is related to pulling inventory from the warehouse for each order and performing the paperwork. The paperwork involves preparing shipping documents for each order. Thus, the pulling and paperwork effort associated with each sales order is essentially the same, regardless of the size of the order. The Shipping Department manager has discussed the financial situation with senior management. Senior management has responded by pointing out that sales volume has been dropping, so that the amount of work in the Shipping Department should be dropping. Thus, senior management told the Shipping Department manager that costs should be decreasing in the department.

The Shipping Department manager prepared the following information:

Given this information, how would you respond to senior management?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

If fixed costs increase, what would be the impact on the (a) contribution margin? (b) income from operations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

Identify fixed and variable costs

Intuit Inc. develops and sells software products for the personal finance market, including popular titles such as Quickbooks® and TurboTax®. Classify each of the following costs and expenses for this company as either variable or fixed to the number of units produced and sold:

a. Packaging costs

b. Sales commissions

c. Property taxes on general offices

d. Shipping expenses

e. Straight-line depreciation of computer equipment

f. President's salary

g. Salaries of software developers

h. Salaries of human resources personnel

i. Wages of telephone order assistants

j. CDs

k. Users' guides

Intuit Inc. develops and sells software products for the personal finance market, including popular titles such as Quickbooks® and TurboTax®. Classify each of the following costs and expenses for this company as either variable or fixed to the number of units produced and sold:

a. Packaging costs

b. Sales commissions

c. Property taxes on general offices

d. Shipping expenses

e. Straight-line depreciation of computer equipment

f. President's salary

g. Salaries of software developers

h. Salaries of human resources personnel

i. Wages of telephone order assistants

j. CDs

k. Users' guides

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

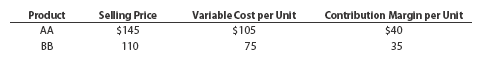

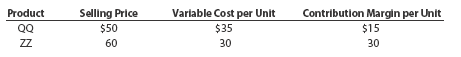

Sales mix and break-even analysis

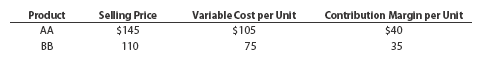

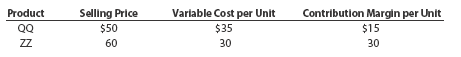

Wide Open Industries Inc. has fixed costs of $475,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow:

The sales mix for products AA and BB is 60% and 40%, respectively. Determine the breakeven point in units of AA and BB.

Einhorn Company has fixed costs of $105,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow:

The sales mix for products QQ and ZZ is 40% and 60%, respectively. Determine the break-even point in units of QQ and ZZ.

Wide Open Industries Inc. has fixed costs of $475,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow:

The sales mix for products AA and BB is 60% and 40%, respectively. Determine the breakeven point in units of AA and BB.

Einhorn Company has fixed costs of $105,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow:

The sales mix for products QQ and ZZ is 40% and 60%, respectively. Determine the break-even point in units of QQ and ZZ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

Sales mix and break-even sales

Data related to the expected sales of laptops and tablets for Tech Products Inc. for the current year, which is typical of recent years, are as follows:

The estimated fixed costs for the current year are $2,498,600.

Instructions

1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year.

2. Based on the break-even sales (units) in part (1), determine the unit sales of both laptops and tablets for the current year.

3. Assume that the sales mix was 50% laptops and 50% tablets. Compare the break-even point with that in part (1). Why is it so different?

Data related to the expected sales of laptops and tablets for Tech Products Inc. for the current year, which is typical of recent years, are as follows:

The estimated fixed costs for the current year are $2,498,600.

Instructions

1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year.

2. Based on the break-even sales (units) in part (1), determine the unit sales of both laptops and tablets for the current year.

3. Assume that the sales mix was 50% laptops and 50% tablets. Compare the break-even point with that in part (1). Why is it so different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

Sales mix and break-even sales

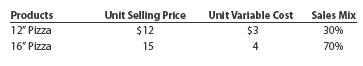

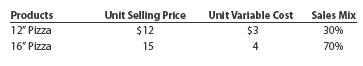

Data related to the expected sales of two types of frozen pizzas for Norfolk Frozen Foods Inc. for the current year, which is typical of recent years, are as follows:

The estimated fixed costs for the current year are $46,800.

Instructions

1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year.

2. Based on the break-even sales (units) in part (1), determine the unit sales of both the 12? pizza and 16? pizza for the current year.

3. Assume that the sales mix was 50% 12? pizza and 50% 16? pizza. Compare the break-even point with that in part (1). Why is it so different?

Data related to the expected sales of two types of frozen pizzas for Norfolk Frozen Foods Inc. for the current year, which is typical of recent years, are as follows:

The estimated fixed costs for the current year are $46,800.

Instructions

1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year.

2. Based on the break-even sales (units) in part (1), determine the unit sales of both the 12? pizza and 16? pizza for the current year.

3. Assume that the sales mix was 50% 12? pizza and 50% 16? pizza. Compare the break-even point with that in part (1). Why is it so different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

Break-even analysis

Group Project

Break-even analysis is one of the most fundamental tools for managing any kind of business unit. Consider the management of your university or college. In a group, brainstorm some applications of break-even analysis at your university or college. Identify three areas where break-even analysis might be used. For each area, identify the revenues, variable costs, and fixed costs that would be used in the calculation.

Group Project

Break-even analysis is one of the most fundamental tools for managing any kind of business unit. Consider the management of your university or college. In a group, brainstorm some applications of break-even analysis at your university or college. Identify three areas where break-even analysis might be used. For each area, identify the revenues, variable costs, and fixed costs that would be used in the calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

An examination of the accounting records of Clowney Company disclosed a high contribution margin ratio and production at a level below maximum capacity. Based on this information, suggest a likely means of improving income from operations. Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

Relevant range and fixed and variable costs

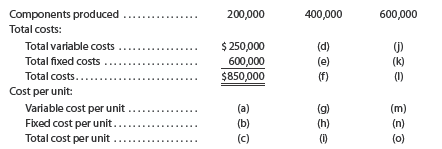

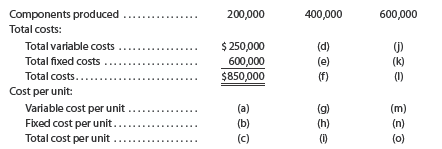

Quigley Inc. manufactures memory chips for electronic toys within a relevant range of 200,000 to 600,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared:

Complete the cost schedule, identifying each cost by the appropriate letter (a) through (o).

Quigley Inc. manufactures memory chips for electronic toys within a relevant range of 200,000 to 600,000 memory chips per year. Within this range, the following partially completed manufacturing cost schedule has been prepared:

Complete the cost schedule, identifying each cost by the appropriate letter (a) through (o).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

Operating leverage

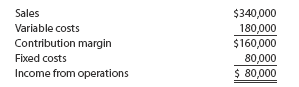

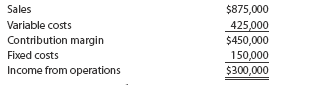

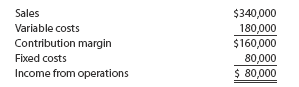

SungSam Enterprises reports the following data:

Determine SungSam Enterprises's operating leverage.

Westminster Co. reports the following data:

Determine Westminster Co.'s operating leverage.

SungSam Enterprises reports the following data:

Determine SungSam Enterprises's operating leverage.

Westminster Co. reports the following data:

Determine Westminster Co.'s operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Contribution margin, break-even sales, cost-volume-profit chart,, 3, 4, 5 margin of safety, and operating leverage

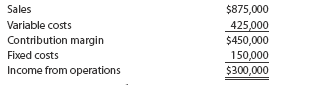

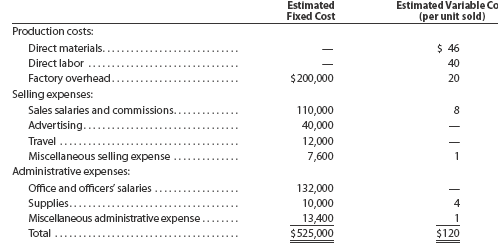

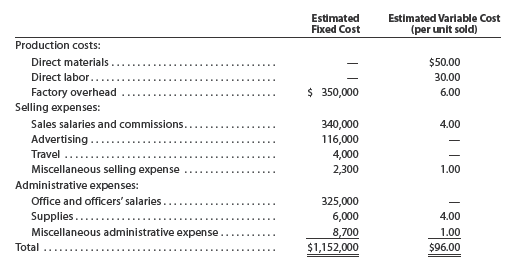

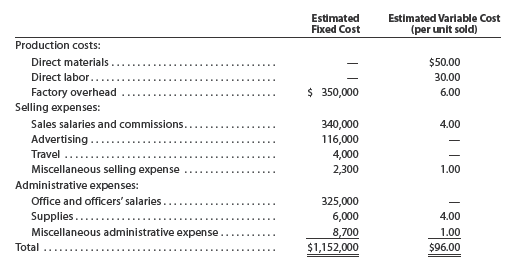

Wolsey Industries Inc. expects to maintain the same inventories at the end of 2016 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

It is expected that 21,875 units will be sold at a price of $160 a unit. Maximum sales within the relevant range are 27,000 units.

Instructions

1. Prepare an estimated income statement for 2016.

2. What is the expected contribution margin ratio?

3. Determine the break-even sales in units and dollars.

4. Construct a cost-volume-profit chart indicating the break-even sales.

5. What is the expected margin of safety in dollars and as a percentage of sales?

6. Determine the operating leverage.

Wolsey Industries Inc. expects to maintain the same inventories at the end of 2016 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

It is expected that 21,875 units will be sold at a price of $160 a unit. Maximum sales within the relevant range are 27,000 units.

Instructions

1. Prepare an estimated income statement for 2016.

2. What is the expected contribution margin ratio?

3. Determine the break-even sales in units and dollars.

4. Construct a cost-volume-profit chart indicating the break-even sales.

5. What is the expected margin of safety in dollars and as a percentage of sales?

6. Determine the operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

Contribution margin, break-even sales, cost-volume-profit chart margin of safety, and operating leverage

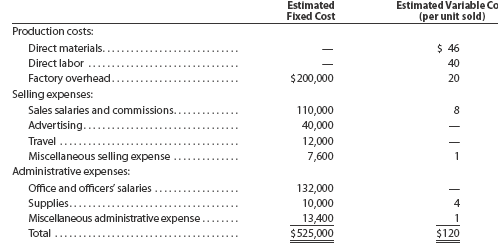

Belmain Co. expects to maintain the same inventories at the end of 2016 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units.

Instructions

1. Prepare an estimated income statement for 2016.

2. What is the expected contribution margin ratio?

3. Determine the break-even sales in units and dollars.

4. Construct a cost-volume-profit chart indicating the break-even sales.

5. What is the expected margin of safety in dollars and as a percentage of sales?

6. Determine the operating leverage.

Belmain Co. expects to maintain the same inventories at the end of 2016 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows:

It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units.

Instructions

1. Prepare an estimated income statement for 2016.

2. What is the expected contribution margin ratio?

3. Determine the break-even sales in units and dollars.

4. Construct a cost-volume-profit chart indicating the break-even sales.

5. What is the expected margin of safety in dollars and as a percentage of sales?

6. Determine the operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

If the unit cost of direct materials is decreased, what effect will this change have on the break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

High-low method

Diamond Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows:

a. Determine the variable cost per unit and the total fixed cost.

b. Based on part (a), estimate the total cost for 17,000 units of production.

Diamond Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows:

a. Determine the variable cost per unit and the total fixed cost.

b. Based on part (a), estimate the total cost for 17,000 units of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

Margin of safety

Melton Inc. has sales of $1,750,000, and the break-even point in sales dollars is $875,000. Determine the company's margin of safety as a percent of current sales.

Junck Company has sales of $550,000, and the break-even point in sales dollars is $385,000. Determine the company's margin of safety as a percent of current sales.

Melton Inc. has sales of $1,750,000, and the break-even point in sales dollars is $875,000. Determine the company's margin of safety as a percent of current sales.

Junck Company has sales of $550,000, and the break-even point in sales dollars is $385,000. Determine the company's margin of safety as a percent of current sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

Both Austin Company and Hill Company had the same unit sales, total costs, and income from operations for the current fiscal year; yet, Austin Company had a lower break-even point than Hill Company. Explain the reason for this difference in break-even points.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

High-low method for a service company

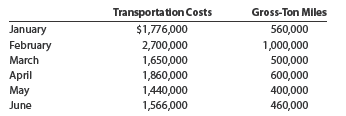

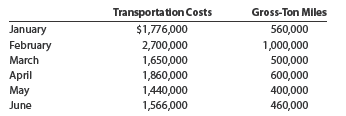

Boston Railroad decided to use the high-low method and operating data from the past six months to estimate the fixed and variable components of transportation costs. The activity base used by Boston Railroad is a measure of railroad operating activity, termed "gross-ton miles," which is the total number of tons multiplied by the miles moved.

Determine the variable cost per gross-ton mile and the total fixed cost.

Boston Railroad decided to use the high-low method and operating data from the past six months to estimate the fixed and variable components of transportation costs. The activity base used by Boston Railroad is a measure of railroad operating activity, termed "gross-ton miles," which is the total number of tons multiplied by the miles moved.

Determine the variable cost per gross-ton mile and the total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

How does the sales mix affect the calculation of the break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

Contribution margin ratio

a. Segar Company budgets sales of $3,200,000, fixed costs of $700,000, and variable costs of $2,240,000. What is the contribution margin ratio for Segar Company?

b. If the contribution margin ratio for Domino Company is 35%, sales were $2,100,000, and fixed costs were $400,000, what was the income from operations?

a. Segar Company budgets sales of $3,200,000, fixed costs of $700,000, and variable costs of $2,240,000. What is the contribution margin ratio for Segar Company?

b. If the contribution margin ratio for Domino Company is 35%, sales were $2,100,000, and fixed costs were $400,000, what was the income from operations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

What does operating leverage measure, and how is it computed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

Contribution margin and contribution margin ratio

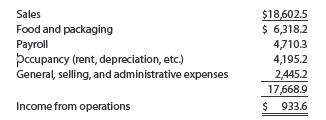

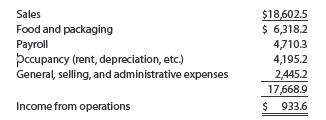

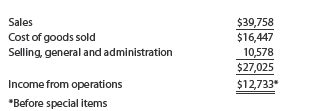

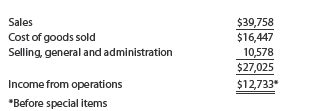

For a recent year, McDonald's company-owned restaurants had the following sales and expenses (in millions):

Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses.

a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place).

b. What is McDonald's contribution margin ratio? Round to one decimal place.

c. How much would income from operations increase if same-store sales increased by $900 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place).

For a recent year, McDonald's company-owned restaurants had the following sales and expenses (in millions):

Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses.

a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place).

b. What is McDonald's contribution margin ratio? Round to one decimal place.

c. How much would income from operations increase if same-store sales increased by $900 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million (one decimal place).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Break-even sales and sales to realize income from operations

For the current year ended March 31, Benatar Company expects fixed costs of $1,250,000, a unit variable cost of $140, and a unit selling price of $100.

a. Compute the anticipated break-even sales (units).

b. Compute the sales (units) required to realize income from operations of $150,000.

For the current year ended March 31, Benatar Company expects fixed costs of $1,250,000, a unit variable cost of $140, and a unit selling price of $100.

a. Compute the anticipated break-even sales (units).

b. Compute the sales (units) required to realize income from operations of $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

Break-even sales

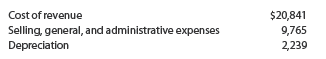

Anheuser-Busch InBev Companies, Inc. , reported the following operating information for a recent year (in millions):

In addition, assume that Anheuser-Busch InBev sold 320 million barrels of beer during the year. Assume that variable costs were 70% of the cost of goods sold and 40% of selling, general, and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Anheuser-Busch InBev expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $400 million.

a. Compute the break-even number of barrels for the current year. Note : For the selling price per barrel and variable costs per barrel, round to the nearest cent. Also, round the break-even to the nearest barrel.

b. Compute the anticipated break-even number of barrels for the following year.

Anheuser-Busch InBev Companies, Inc. , reported the following operating information for a recent year (in millions):

In addition, assume that Anheuser-Busch InBev sold 320 million barrels of beer during the year. Assume that variable costs were 70% of the cost of goods sold and 40% of selling, general, and administration expenses. Assume that the remaining costs are fixed. For the following year, assume that Anheuser-Busch InBev expects pricing, variable costs per barrel, and fixed costs to remain constant, except that new distribution and general office facilities are expected to increase fixed costs by $400 million.

a. Compute the break-even number of barrels for the current year. Note : For the selling price per barrel and variable costs per barrel, round to the nearest cent. Also, round the break-even to the nearest barrel.

b. Compute the anticipated break-even number of barrels for the following year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

Break-even sales

Currently, the unit selling price of a product is $160, the unit variable cost is $120, and the total fixed costs are $725,000. A proposal is being evaluated to increase the unit selling price to $170.

a. Compute the current break-even sales (units).

b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant.

Currently, the unit selling price of a product is $160, the unit variable cost is $120, and the total fixed costs are $725,000. A proposal is being evaluated to increase the unit selling price to $170.

a. Compute the current break-even sales (units).

b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

Break-even analysis

The Junior League of Yadkinville, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $18 per copy. The chairwoman of the cookbook development committee estimated that the club needed to sell 2,000 books to break even on its $4,000 investment. What is the variable cost per unit assumed in the Junior League's analysis?

The Junior League of Yadkinville, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $18 per copy. The chairwoman of the cookbook development committee estimated that the club needed to sell 2,000 books to break even on its $4,000 investment. What is the variable cost per unit assumed in the Junior League's analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

Break-even analysis

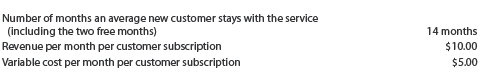

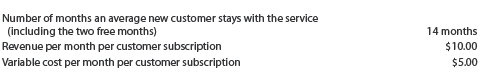

Media outlets such as ESPN and Fox Sports often have Web sites that provide in-depth coverage of news and events. Portions of these Web sites are restricted to members who pay a monthly subscription to gain access to exclusive news and commentary. These Web sites typically offer a free trial period to introduce viewers to the Web site. Assume that during a recent fiscal year, ESPN.com spent $4,200,000 on a promotional campaign for the ESPN.com Web site that offered two free months of service for new subscribers. In addition, assume the following information:

Determine the number of new customer accounts needed to break even on the cost of the promotional campaign. In forming your answer, (1) treat the cost of the promotional campaign as a fixed cost, and (2) treat the revenue less variable cost per account for the subscription period as the unit contribution margin.

Media outlets such as ESPN and Fox Sports often have Web sites that provide in-depth coverage of news and events. Portions of these Web sites are restricted to members who pay a monthly subscription to gain access to exclusive news and commentary. These Web sites typically offer a free trial period to introduce viewers to the Web site. Assume that during a recent fiscal year, ESPN.com spent $4,200,000 on a promotional campaign for the ESPN.com Web site that offered two free months of service for new subscribers. In addition, assume the following information:

Determine the number of new customer accounts needed to break even on the cost of the promotional campaign. In forming your answer, (1) treat the cost of the promotional campaign as a fixed cost, and (2) treat the revenue less variable cost per account for the subscription period as the unit contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

Break-even analysis for a service company

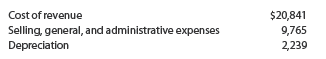

Sprint Nextel is one of the largest digital wireless service providers in the United States. In a recent year, it had approximately 32.5 million direct subscribers (accounts) that generated revenue of $35,345 million. Costs and expenses for the year were as follows (in millions):

Assume that 70% of the cost of revenue and 30% of the selling, general, and administrative expenses are variable to the number of direct subscribers (accounts).

a. What is Sprint Nextel's break-even number of accounts, using the data and assumptions given? Round units (accounts) and per-account amounts to one decimal place.

b. How much revenue per account would be sufficient for Sprint Nextel to break even if the number of accounts remained constant?

Sprint Nextel is one of the largest digital wireless service providers in the United States. In a recent year, it had approximately 32.5 million direct subscribers (accounts) that generated revenue of $35,345 million. Costs and expenses for the year were as follows (in millions):

Assume that 70% of the cost of revenue and 30% of the selling, general, and administrative expenses are variable to the number of direct subscribers (accounts).

a. What is Sprint Nextel's break-even number of accounts, using the data and assumptions given? Round units (accounts) and per-account amounts to one decimal place.

b. How much revenue per account would be sufficient for Sprint Nextel to break even if the number of accounts remained constant?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

Cost-volume-profit chart

For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the relevant range are $2,500,000.

a. Construct a cost-volume-profit chart.

b. Estimate the break-even sales (dollars) by using the cost-volume-profit chart constructed in part (a).

c. What is the main advantage of presenting the cost-volume-profit analysis in graphic form rather than equation form?

For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the relevant range are $2,500,000.

a. Construct a cost-volume-profit chart.

b. Estimate the break-even sales (dollars) by using the cost-volume-profit chart constructed in part (a).

c. What is the main advantage of presenting the cost-volume-profit analysis in graphic form rather than equation form?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

Profit-volume chart

Using the data for Loudermilk Inc. in Exercise 19-17, (a) determine the maximum possible operating loss, (b) compute the maximum possible operating profit, (c) construct a profit-volume chart, and (d) estimate the break-even sales (units) by using the profit-volume chart constructed in part (c).

Using the data for Loudermilk Inc. in Exercise 19-17, (a) determine the maximum possible operating loss, (b) compute the maximum possible operating profit, (c) construct a profit-volume chart, and (d) estimate the break-even sales (units) by using the profit-volume chart constructed in part (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

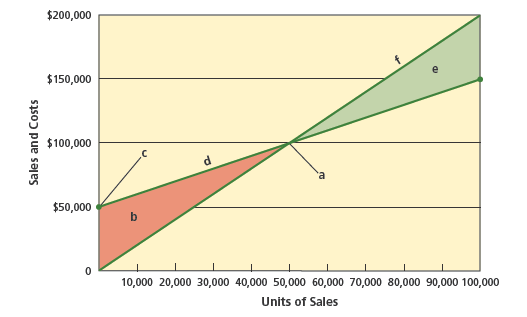

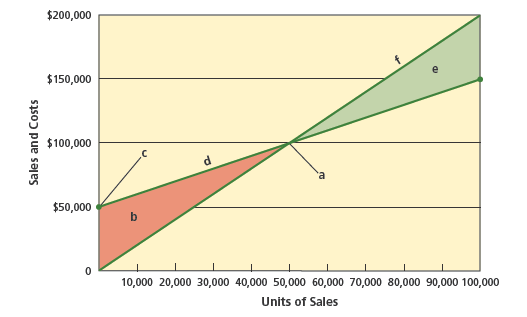

Break-even chart

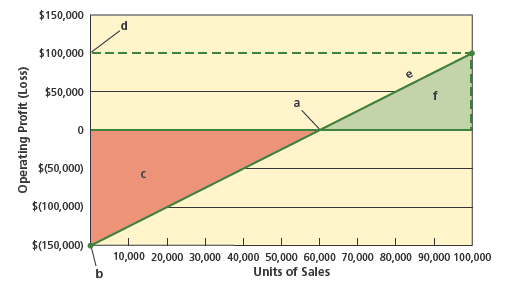

Name the following chart, and identify the items represented by the letters (a) through (f):

Name the following chart, and identify the items represented by the letters (a) through (f):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

Break-even chart

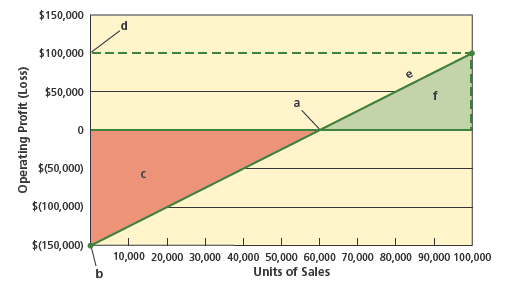

Name the following chart, and identify the items represented by the letters (a) through (f):

Name the following chart, and identify the items represented by the letters (a) through (f):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

Sales mix and break-even sales

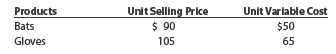

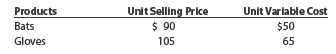

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows:

a. Compute the break-even sales (units) for the overall product, E.

b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point?

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows:

a. Compute the break-even sales (units) for the overall product, E.

b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

Break-even sales and sales mix for a service company

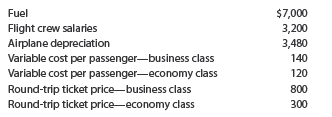

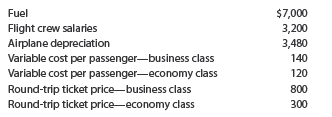

Zero Turbulence Airline provides air transportation services between Los Angeles, California, and Kona, Hawaii. A single Los Angeles to Kona round-trip flight has the following operating statistics:

It is assumed that the fuel, crew salaries, and airplane depreciation are fixed, regardless of the number of seats sold for the round-trip flight.

a. Compute the break-even number of seats sold on a single round-trip flight for the overall product, E. Assume that the overall product mix is 10% business class and 90% economy class tickets.

b. How many business class and economy class seats would be sold at the break-even point?

Zero Turbulence Airline provides air transportation services between Los Angeles, California, and Kona, Hawaii. A single Los Angeles to Kona round-trip flight has the following operating statistics:

It is assumed that the fuel, crew salaries, and airplane depreciation are fixed, regardless of the number of seats sold for the round-trip flight.

a. Compute the break-even number of seats sold on a single round-trip flight for the overall product, E. Assume that the overall product mix is 10% business class and 90% economy class tickets.

b. How many business class and economy class seats would be sold at the break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Margin of safety

a. If Canace Company, with a break-even point at $960,000 of sales, has actual sales of $1,200,000, what is the margin of safety expressed (1) in dollars and (2) as a percentage of sales?

b. If the margin of safety for Canace Company was 20%, fixed costs were $1,875,000, and variable costs were 80% of sales, what was the amount of actual sales (dollars)? ( Hint: Determine the break-even in sales dollars first.)

a. If Canace Company, with a break-even point at $960,000 of sales, has actual sales of $1,200,000, what is the margin of safety expressed (1) in dollars and (2) as a percentage of sales?

b. If the margin of safety for Canace Company was 20%, fixed costs were $1,875,000, and variable costs were 80% of sales, what was the amount of actual sales (dollars)? ( Hint: Determine the break-even in sales dollars first.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

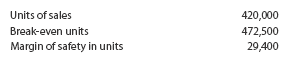

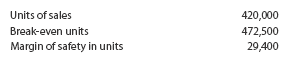

Break-even and margin of safety relationships

At a recent staff meeting, the management of Boost Technologies Inc. was considering discontinuing the Rocket Man line of electronic games from the product line. The chief financial analyst reported the following current monthly data for the Rocket Man:

For what reason would you question the validity of these data?