Deck 21: Variable Costing for Management Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 21: Variable Costing for Management Analysis

1

Ethics and professional conduct in business

The Southwest Division of Texcaliber Inc. uses absorption costing for profit reporting. The general manager of the Southwest Division is concerned about meeting the income objectives of the division. At the beginning of the reporting period, the division had an adequate supply of inventory. The general manager has decided to increase production of goods in the plant in order to allocate fixed manufacturing cost over a greater number of units. Unfortunately, the increased production cannot be sold and will increase the inventory. However, the impact on earnings will be positive because the lower cost per unit will be matched against sales. The general manager has come to Aston Melon, the controller, to determine exactly how much additional production is required in order to increase net income enough to meet the division's profit objectives. Aston analyzes the data and determines that the inventory will need to be increased by 30% in order to absorb enough fixed costs and meet the income objective. Aston reports this information to the division manager.

Discuss whether Aston is acting in an ethical manner.

The Southwest Division of Texcaliber Inc. uses absorption costing for profit reporting. The general manager of the Southwest Division is concerned about meeting the income objectives of the division. At the beginning of the reporting period, the division had an adequate supply of inventory. The general manager has decided to increase production of goods in the plant in order to allocate fixed manufacturing cost over a greater number of units. Unfortunately, the increased production cannot be sold and will increase the inventory. However, the impact on earnings will be positive because the lower cost per unit will be matched against sales. The general manager has come to Aston Melon, the controller, to determine exactly how much additional production is required in order to increase net income enough to meet the division's profit objectives. Aston analyzes the data and determines that the inventory will need to be increased by 30% in order to absorb enough fixed costs and meet the income objective. Aston reports this information to the division manager.

Discuss whether Aston is acting in an ethical manner.

Comment the Ethical manner of Aston:

S Division of TI uses absorption costing for reporting income statement figures. The general manager of the division is under pressure to meet income targets. He is planning to increase production even though there are no corresponding customer orders.

Aston, the controller of production, is acting with integrity by reporting the information to the division manager. As a controller, he has overall jurisdiction over the operations.

However, he may not have the powers to question the general manager's actions of increasing production solely for meeting the division's profit targets.

By reporting the matter to the division manager, Aston is indirectly questioning the decision of the general manager.

It is the responsibility of the divisional manager to present a true picture of the division's performance. Condoning the general manager's actions would show a lack of integrity for the following reasons:

• The division is resorting to a deliberate increase in production without corresponding customer demand in order to show increased earnings. The result is that fixed costs are allocated over a larger inventory base. This effectively decreases the unit cost of production decreases for the same sales level and artificially boosts net income for the period. The fixed costs become part of unsold inventory and thus get transferred to the balance sheet.

• The true state of profitability and net income is glossed over and hidden behind artificial reporting. The income information in such financial reports can be misleading to senior management.

• Since there is an avenue available to cover up lackluster performance, there is no incentive to improve performance and profitability. Senior management, believing that the division's performance is good, will not intervene to improve things.

• Increasing production without corresponding sales (production exceeds sales) provides short-term benefits. When inventory gets used later, the costs must be allocated to the period's sales, reducing profits for the subsequent reporting period. Therefore the general manager's action will adversely affect future period net income.

• The objective of financial reporting is to present a true picture of the company's affairs to users. The general manager has utilized a loophole in absorption costing under GAAP, which permits transfer of fixed costs to inventory. This is tantamount to misrepresentation.

S Division of TI uses absorption costing for reporting income statement figures. The general manager of the division is under pressure to meet income targets. He is planning to increase production even though there are no corresponding customer orders.

Aston, the controller of production, is acting with integrity by reporting the information to the division manager. As a controller, he has overall jurisdiction over the operations.

However, he may not have the powers to question the general manager's actions of increasing production solely for meeting the division's profit targets.

By reporting the matter to the division manager, Aston is indirectly questioning the decision of the general manager.

It is the responsibility of the divisional manager to present a true picture of the division's performance. Condoning the general manager's actions would show a lack of integrity for the following reasons:

• The division is resorting to a deliberate increase in production without corresponding customer demand in order to show increased earnings. The result is that fixed costs are allocated over a larger inventory base. This effectively decreases the unit cost of production decreases for the same sales level and artificially boosts net income for the period. The fixed costs become part of unsold inventory and thus get transferred to the balance sheet.

• The true state of profitability and net income is glossed over and hidden behind artificial reporting. The income information in such financial reports can be misleading to senior management.

• Since there is an avenue available to cover up lackluster performance, there is no incentive to improve performance and profitability. Senior management, believing that the division's performance is good, will not intervene to improve things.

• Increasing production without corresponding sales (production exceeds sales) provides short-term benefits. When inventory gets used later, the costs must be allocated to the period's sales, reducing profits for the subsequent reporting period. Therefore the general manager's action will adversely affect future period net income.

• The objective of financial reporting is to present a true picture of the company's affairs to users. The general manager has utilized a loophole in absorption costing under GAAP, which permits transfer of fixed costs to inventory. This is tantamount to misrepresentation.

2

What types of costs are customarily included in the cost of manufactured products under (a) the absorption costing concept and (b) the variable costing concept?

a. Absorption Costing:

Under Absorption Costing, the cost of manufactured goods includes:

1. Direct materials costs

2. Direct labor costs

3. Factory overhead costs consisting of (i) variable and (ii) fixed factory overheads.

b. Variable Costing:

Under Variable Costing, only variable costs are included for determining the cost of goods manufactured. Fixed costs relating to factory overheads are treated as a period expense. The costs included are:

1. Direct materials costs

2. Direct labor costs

3. Variable factory overheads

The cost of goods manufactured will be higher when Absorption Costing is adopted, as it includes fixed factory overheads also.

Under Absorption Costing, the cost of manufactured goods includes:

1. Direct materials costs

2. Direct labor costs

3. Factory overhead costs consisting of (i) variable and (ii) fixed factory overheads.

b. Variable Costing:

Under Variable Costing, only variable costs are included for determining the cost of goods manufactured. Fixed costs relating to factory overheads are treated as a period expense. The costs included are:

1. Direct materials costs

2. Direct labor costs

3. Variable factory overheads

The cost of goods manufactured will be higher when Absorption Costing is adopted, as it includes fixed factory overheads also.

3

Inventory valuation under absorption costing and variable costing

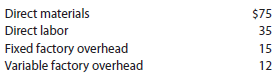

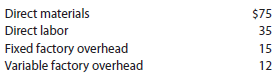

At the end of the first year of operations, 6,400 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows:

Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.

At the end of the first year of operations, 6,400 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows:

Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.

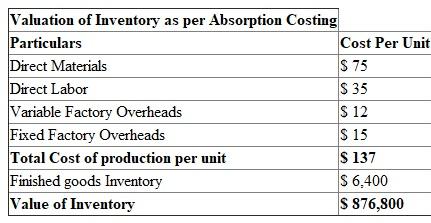

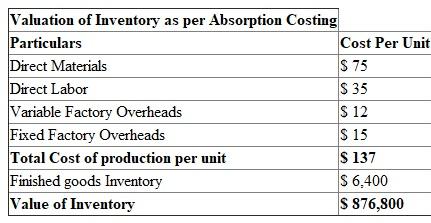

a. Absorption costing:

Under the absorption costing approach all the costs incurred for manufacturing a product will be allocated to the costs. The cost incurred for manufacturing will consist of direct material, direct labor, variable overhead and fixed overheads. The absorption costing includes both fixed and variable overheads.

Calculate Valuation of Closing Inventory as per Absorption Costing:

Under absorption costing the fixed manufacturing costs are treated as manufacturing costs and are added to direct material, direct labor and other direct expenses to arrive at costs of goods sold.

Consider the below table:

Therefore from the above calculations, it is clear that the value of Inventory calculated using absorption costing is $876,800

Therefore from the above calculations, it is clear that the value of Inventory calculated using absorption costing is $876,800

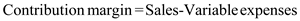

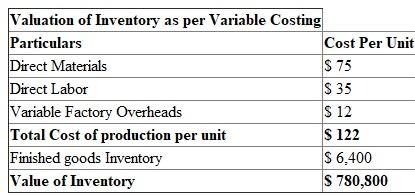

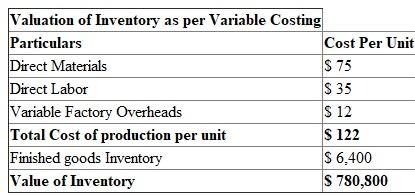

b. Variable costing:

• Under variable costing, all the variable costs are treated as product costs. All the fixed costs are treated as period costs. Therefore, all the costs related to the manufacturing of products, that will vary will the production such as direct material, direct labor and variable manufacturing overhead are treated as product costs.

• Further, costs such as selling and administration expenses which are fixed in nature, are treated as period costs, as these expenses are incurred throughout the period irrespective of production.

Calculate Valuation of Closing Inventory as per Variable Costing:

Under variable costing concept, fixed manufacturing costs are not included while calculating the cost of goods sold. Hence to calculate the contribution margin, variable costing uses the below formula:

Consider Below Table:

Consider Below Table:

Therefore from the above calculations, it is clear that the value of Inventory calculated using Variable costing is $780,800.

Therefore from the above calculations, it is clear that the value of Inventory calculated using Variable costing is $780,800.

Under the absorption costing approach all the costs incurred for manufacturing a product will be allocated to the costs. The cost incurred for manufacturing will consist of direct material, direct labor, variable overhead and fixed overheads. The absorption costing includes both fixed and variable overheads.

Calculate Valuation of Closing Inventory as per Absorption Costing:

Under absorption costing the fixed manufacturing costs are treated as manufacturing costs and are added to direct material, direct labor and other direct expenses to arrive at costs of goods sold.

Consider the below table:

Therefore from the above calculations, it is clear that the value of Inventory calculated using absorption costing is $876,800

Therefore from the above calculations, it is clear that the value of Inventory calculated using absorption costing is $876,800 b. Variable costing:

• Under variable costing, all the variable costs are treated as product costs. All the fixed costs are treated as period costs. Therefore, all the costs related to the manufacturing of products, that will vary will the production such as direct material, direct labor and variable manufacturing overhead are treated as product costs.

• Further, costs such as selling and administration expenses which are fixed in nature, are treated as period costs, as these expenses are incurred throughout the period irrespective of production.

Calculate Valuation of Closing Inventory as per Variable Costing:

Under variable costing concept, fixed manufacturing costs are not included while calculating the cost of goods sold. Hence to calculate the contribution margin, variable costing uses the below formula:

Consider Below Table:

Consider Below Table: Therefore from the above calculations, it is clear that the value of Inventory calculated using Variable costing is $780,800.

Therefore from the above calculations, it is clear that the value of Inventory calculated using Variable costing is $780,800. 4

Variable costing

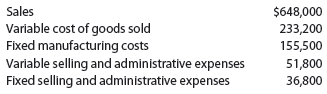

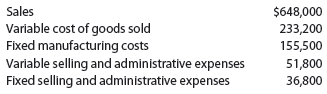

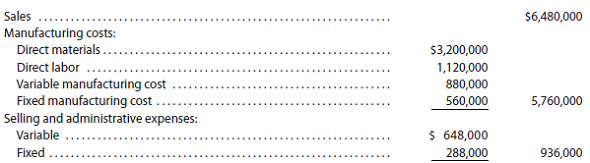

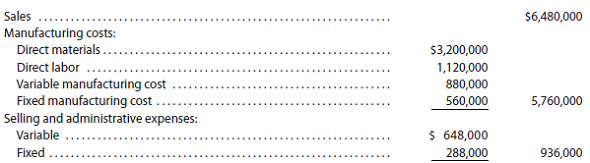

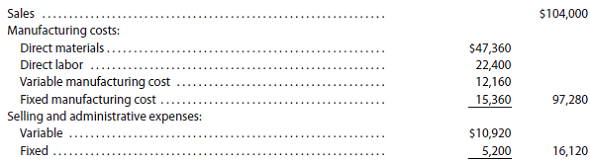

Light Company has the following information for January:

Determine (a) the manufacturing margin, (b) the contribution margin, and (c) income from operations for Light Company for the month of January.

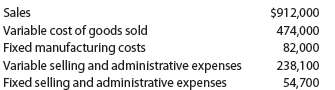

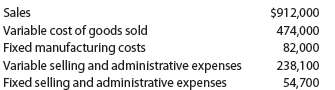

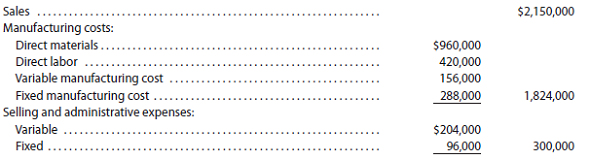

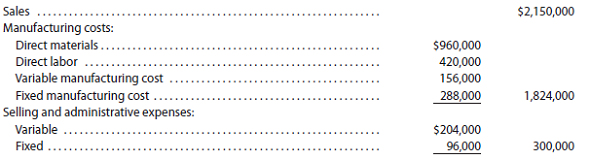

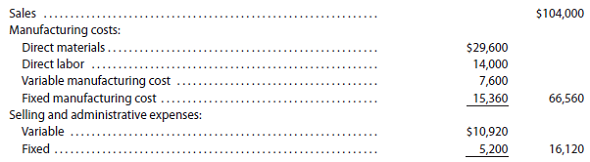

Marley Company has the following information for March:

Determine (a) the manufacturing margin, (b) the contribution margin, and (c) income from operations for Marley Company for the month of March.

Light Company has the following information for January:

Determine (a) the manufacturing margin, (b) the contribution margin, and (c) income from operations for Light Company for the month of January.

Marley Company has the following information for March:

Determine (a) the manufacturing margin, (b) the contribution margin, and (c) income from operations for Marley Company for the month of March.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

Absorption and variable costing income statements

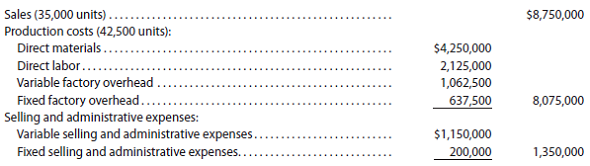

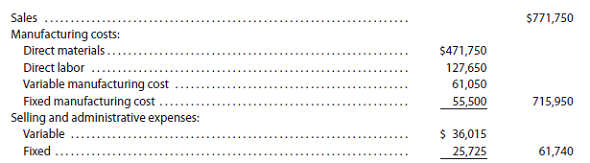

During the first month of operations ended May 31016, Frost Point Fridge Company manufactured 40,000 mini refrigerators, of which 36,000 were sold. Operating data for the month are summarized as follows:

Instructions

1. Prepare an income statement based on the absorption costing concept.

2. Prepare an income statement based on the variable costing concept.

3. Explain the reason for the difference in the amount of income from operations reported in (1) and (2).

During the first month of operations ended May 31016, Frost Point Fridge Company manufactured 40,000 mini refrigerators, of which 36,000 were sold. Operating data for the month are summarized as follows:

Instructions

1. Prepare an income statement based on the absorption costing concept.

2. Prepare an income statement based on the variable costing concept.

3. Explain the reason for the difference in the amount of income from operations reported in (1) and (2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Absorption and variable costing income statements

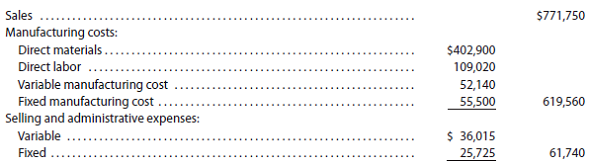

During the first month of operations ended July 31, 2016, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows:

Instructions

1. Prepare an income statement based on the absorption costing concept.

2. Prepare an income statement based on the variable costing concept.

3. Explain the reason for the difference in the amount of income from operations reported in (1) and (2).

During the first month of operations ended July 31, 2016, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows:

Instructions

1. Prepare an income statement based on the absorption costing concept.

2. Prepare an income statement based on the variable costing concept.

3. Explain the reason for the difference in the amount of income from operations reported in (1) and (2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

Inventories under absorption costing

BendOR, Inc. manufactures control panels for the electronics industry and has just completed its first year of operations. The following discussion took place between the controller, Gordon Merrick, and the company president, Matt McCray:

Matt: I've been looking over our first year's performance by quarters. Our earnings have been increasing each quarter, even though our sales have been flat and our prices and costs have not changed. Why is this?

Gordon: Our actual sales have stayed even throughout the year, but we've been increasing the utilization of our factory every quarter. By keeping our factory utilization high, we will keep our costs down by allocating the fixed plant costs over a greater number of units. Naturally, this causes our cost per unit to be lower than it would be otherwise.

Matt: Yes, but what good is this if we have been unable to sell everything that we make? Our inventory is also increasing.

Gordon: This is true. However, our unit costs are lower because of the additional production. When these lower costs are matched against sales, it has a positive impact on our earnings.

Matt: Are you saying that we are able to create additional earnings merely by building inventory? Can this be true? Gordon: Well, I've never thought about it quite that way... but I guess so.

Gordon: Well, I've never thought about it quite that way... but I guess so.

Matt: And another thing. What will happen if we begin to reduce our production in order to liquidate the inventory? Don't tell me our earnings will go down even though our production effort drops!

Gordon: Well...

Matt: There must be a better way. I'd like our quarterly income statements to reflect what's really going on. I don't want our income reports to reward building inventory and penalize reducing inventory.

Gordon: I'm not sure what I can do-we have to follow generally accepted accounting principles.

1. Why does reporting income under generally accepted accounting principles "reward" building inventory and "penalize" reducing inventory?

2. What advice would you give to Gordon in responding to Matt's concern about the present method of profit reporting?

BendOR, Inc. manufactures control panels for the electronics industry and has just completed its first year of operations. The following discussion took place between the controller, Gordon Merrick, and the company president, Matt McCray:

Matt: I've been looking over our first year's performance by quarters. Our earnings have been increasing each quarter, even though our sales have been flat and our prices and costs have not changed. Why is this?

Gordon: Our actual sales have stayed even throughout the year, but we've been increasing the utilization of our factory every quarter. By keeping our factory utilization high, we will keep our costs down by allocating the fixed plant costs over a greater number of units. Naturally, this causes our cost per unit to be lower than it would be otherwise.

Matt: Yes, but what good is this if we have been unable to sell everything that we make? Our inventory is also increasing.

Gordon: This is true. However, our unit costs are lower because of the additional production. When these lower costs are matched against sales, it has a positive impact on our earnings.

Matt: Are you saying that we are able to create additional earnings merely by building inventory? Can this be true? Gordon: Well, I've never thought about it quite that way... but I guess so.

Gordon: Well, I've never thought about it quite that way... but I guess so.

Matt: And another thing. What will happen if we begin to reduce our production in order to liquidate the inventory? Don't tell me our earnings will go down even though our production effort drops!

Gordon: Well...

Matt: There must be a better way. I'd like our quarterly income statements to reflect what's really going on. I don't want our income reports to reward building inventory and penalize reducing inventory.

Gordon: I'm not sure what I can do-we have to follow generally accepted accounting principles.

1. Why does reporting income under generally accepted accounting principles "reward" building inventory and "penalize" reducing inventory?

2. What advice would you give to Gordon in responding to Matt's concern about the present method of profit reporting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which type of manufacturing cost (direct materials, direct labor, variable factory overhead, fixed factory overhead) is included in the cost of goods manufactured under the absorption costing concept but is excluded from the cost of goods manufactured under the variable costing concept?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

Income statements under absorption costing and variable costing

Frigid Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1, 2016, and operated at 100% of capacity during the first month. The following data summarize the results for July:

a. Prepare an income statement according to the absorption costing concept.

b. Prepare an income statement according to the variable costing concept.

c. What is the reason for the difference in the amount of income from operations reported in (a) and (b)?

Frigid Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1, 2016, and operated at 100% of capacity during the first month. The following data summarize the results for July:

a. Prepare an income statement according to the absorption costing concept.

b. Prepare an income statement according to the variable costing concept.

c. What is the reason for the difference in the amount of income from operations reported in (a) and (b)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

Variable costing-production exceeds sales

Fixed manufacturing costs are $60 per unit, and variable manufacturing costs are $150 per unit. Production was 453,000 units, while sales were 426,000 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

Fixed manufacturing costs are $44 per unit, and variable manufacturing costs are $100 per unit. Production was 67,200 units, while sales were 50,400 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

Fixed manufacturing costs are $60 per unit, and variable manufacturing costs are $150 per unit. Production was 453,000 units, while sales were 426,000 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

Fixed manufacturing costs are $44 per unit, and variable manufacturing costs are $100 per unit. Production was 67,200 units, while sales were 50,400 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

Income statements under absorption costing and variable costing

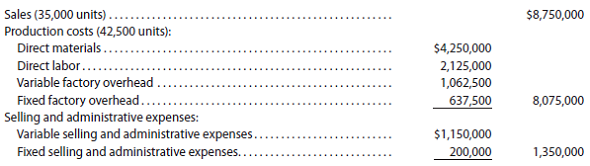

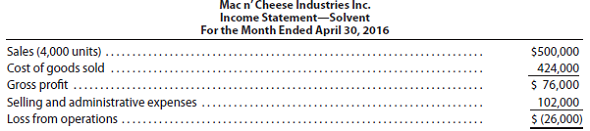

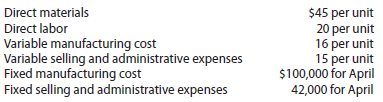

The demand for solvent, one of numerous products manufactured by Mac n' Cheese Industries Inc., has dropped sharply because of recent competition from a similar product. The company's chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on June 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed.

The controller has been asked by the president of the company for advice on whether to continue production during May or to suspend the manufacture of solvent until June 1. The controller has assembled the following pertinent data:

The production costs and selling and administrative expenses, based on production of 4,000 units in April, are as follows:

Sales for May are expected to drop about 20% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of May is expected to be inconsequential.

Instructions

1. Prepare an estimated income statement in absorption costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.

2. Prepare an estimated income statement in variable costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.

3. What would be the estimated loss in income from operations if the solvent production were temporarily suspended for May?

4. What advice should the controller give to management?

The demand for solvent, one of numerous products manufactured by Mac n' Cheese Industries Inc., has dropped sharply because of recent competition from a similar product. The company's chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on June 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed.

The controller has been asked by the president of the company for advice on whether to continue production during May or to suspend the manufacture of solvent until June 1. The controller has assembled the following pertinent data:

The production costs and selling and administrative expenses, based on production of 4,000 units in April, are as follows:

Sales for May are expected to drop about 20% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of May is expected to be inconsequential.

Instructions

1. Prepare an estimated income statement in absorption costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.

2. Prepare an estimated income statement in variable costing form for May for solvent, assuming that production continues during the month. Round amounts to two decimals.

3. What would be the estimated loss in income from operations if the solvent production were temporarily suspended for May?

4. What advice should the controller give to management?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

Income statements under absorption costing and variable costing

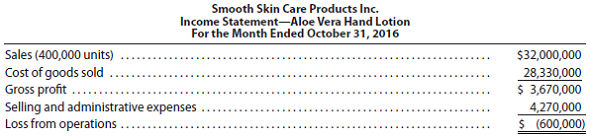

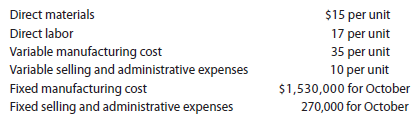

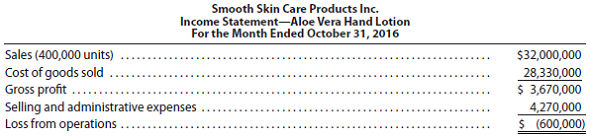

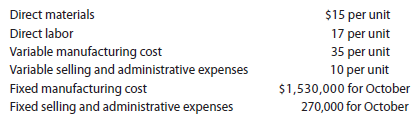

The demand for aloe vera hand lotion, one of numerous products manufactured by Smooth Skin Care Products Inc., has dropped sharply because of recent competition from a similar product. The company's chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on December 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed.

The controller has been asked by the president of the company for advice on whether to continue production during November or to suspend the manufacture of aloe vera hand lotion until December 1. The controller has assembled the following pertinent data:

The production costs and selling and administrative expenses, based on production of 400,000 units in October, are as follows:

Sales for November are expected to drop about 20% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with aloe vera hand lotion. The inventory of aloe vera hand lotion at the beginning and end of November is expected to be inconsequential.

Instructions

1. Prepare an estimated income statement in absorption costing form for November for aloe vera hand lotion, assuming that production continues during the month.

2. Prepare an estimated income statement in variable costing form for November for aloe vera hand lotion, assuming that production continues during the month.

3. What would be the estimated loss in income from operations if the aloe vera hand lotion production were temporarily suspended for November?

4. What advice should the controller give to management?

The demand for aloe vera hand lotion, one of numerous products manufactured by Smooth Skin Care Products Inc., has dropped sharply because of recent competition from a similar product. The company's chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on December 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed.

The controller has been asked by the president of the company for advice on whether to continue production during November or to suspend the manufacture of aloe vera hand lotion until December 1. The controller has assembled the following pertinent data:

The production costs and selling and administrative expenses, based on production of 400,000 units in October, are as follows:

Sales for November are expected to drop about 20% below those of the preceding month. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with aloe vera hand lotion. The inventory of aloe vera hand lotion at the beginning and end of November is expected to be inconsequential.

Instructions

1. Prepare an estimated income statement in absorption costing form for November for aloe vera hand lotion, assuming that production continues during the month.

2. Prepare an estimated income statement in variable costing form for November for aloe vera hand lotion, assuming that production continues during the month.

3. What would be the estimated loss in income from operations if the aloe vera hand lotion production were temporarily suspended for November?

4. What advice should the controller give to management?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

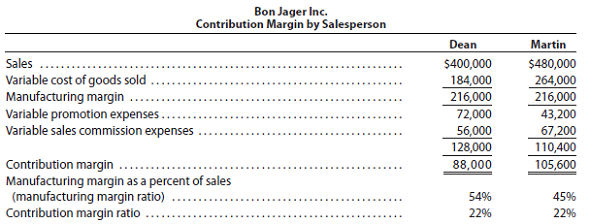

Segmented contribution margin analysis

Bon Jager Inc. manufactures and sells devices used in cardiovascular surgery. The company has two salespersons, Dean and Martin.

A contribution margin by salesperson report was prepared as follows:

Interpret the report, and provide recommendations to the two salespersons for improving profitability.

Bon Jager Inc. manufactures and sells devices used in cardiovascular surgery. The company has two salespersons, Dean and Martin.

A contribution margin by salesperson report was prepared as follows:

Interpret the report, and provide recommendations to the two salespersons for improving profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following costs would be included in the cost of a manufactured product according to the variable costing concept: (a) rent on factory building, (b) direct materials, (c) property taxes on factory building, (d) electricity purchased to operate factory equipment, (e) salary of factory supervisor, (f) depreciation on factory building, (g) direct labor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

Income statements under absorption costing and variable costing

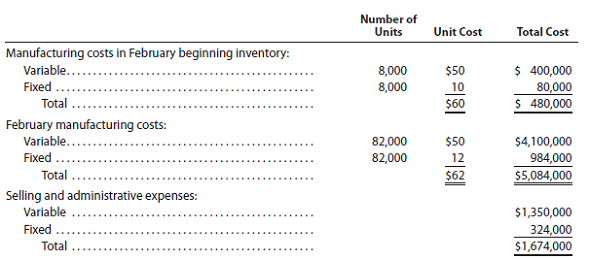

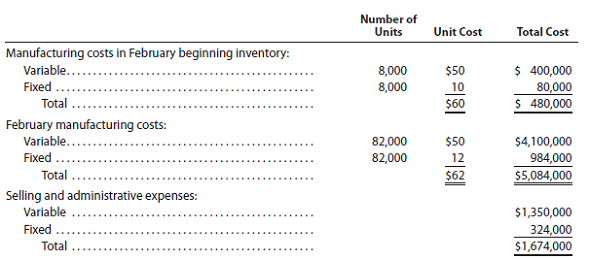

Bionic Cotton Inc. manufactures and sells high-quality sporting goods equipment under its highly recognizable Cool Cat logo. The company began operations on January 1, 2016, and operated at 100% of capacity (90,000 units) during the first month, creating an ending inventory of 8,000 units. During February, the company produced 82,000 garments during the month but sold 90,000 units at $100 per unit. The February manufacturing costs and selling and administrative expenses were as follows:

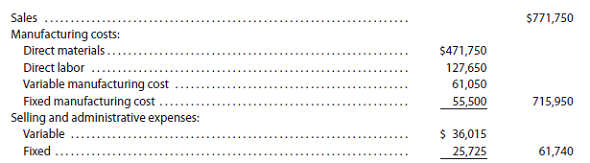

a. Prepare an income statement according to the absorption costing concept for February.

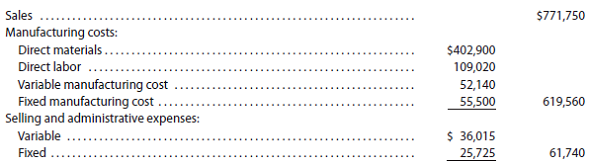

b. Prepare an income statement according to the variable costing concept for February.

c. What is the reason for the difference in the amount of income from operations reported in (a) and (b)?

Bionic Cotton Inc. manufactures and sells high-quality sporting goods equipment under its highly recognizable Cool Cat logo. The company began operations on January 1, 2016, and operated at 100% of capacity (90,000 units) during the first month, creating an ending inventory of 8,000 units. During February, the company produced 82,000 garments during the month but sold 90,000 units at $100 per unit. The February manufacturing costs and selling and administrative expenses were as follows:

a. Prepare an income statement according to the absorption costing concept for February.

b. Prepare an income statement according to the variable costing concept for February.

c. What is the reason for the difference in the amount of income from operations reported in (a) and (b)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

Variable costing-sales exceed production

The beginning inventory is 11,600 units. All of the units that were manufactured during the period and 11,600 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $32 per unit, and variable manufacturing costs are $72 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

The beginning inventory is 52,800 units. All of the units that were manufactured during the period and 52,800 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $14.70 per unit, and variable manufacturing costs are $30 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

The beginning inventory is 11,600 units. All of the units that were manufactured during the period and 11,600 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $32 per unit, and variable manufacturing costs are $72 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

The beginning inventory is 52,800 units. All of the units that were manufactured during the period and 52,800 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $14.70 per unit, and variable manufacturing costs are $30 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

Absorption and variable costing income statements for two months and analysis

During the first month of operations ended March 31, 2016, Hip and Conscious Clothing Company produced 55,500 designer cowboy hats, of which 51,450 were sold. Operating data for the month are summarized as follows:

During April, Hip and Conscious Clothing produced 47,400 designer cowboy hats and sold 51,450 cowboy hats. Operating data for April are summarized as follows:

Instructions

1. Using the absorption costing concept, prepare income statements for (a) March and (b) April.

2. Using the variable costing concept, prepare income statements for (a) March and (b) April.

3. a. Explain the reason for the differences in the amount of income from operations in (1) and (2) for March.

?b. Explain the reason for the differences in the amount of income from operations in (1) and (2) for April.

4. Based on your answers to (1) and (2), did Hip and Conscious Clothing Company operate more profitably in March or in April? Explain.

During the first month of operations ended March 31, 2016, Hip and Conscious Clothing Company produced 55,500 designer cowboy hats, of which 51,450 were sold. Operating data for the month are summarized as follows:

During April, Hip and Conscious Clothing produced 47,400 designer cowboy hats and sold 51,450 cowboy hats. Operating data for April are summarized as follows:

Instructions

1. Using the absorption costing concept, prepare income statements for (a) March and (b) April.

2. Using the variable costing concept, prepare income statements for (a) March and (b) April.

3. a. Explain the reason for the differences in the amount of income from operations in (1) and (2) for March.

?b. Explain the reason for the differences in the amount of income from operations in (1) and (2) for April.

4. Based on your answers to (1) and (2), did Hip and Conscious Clothing Company operate more profitably in March or in April? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

Absorption and variable costing income statements for two months and analysis

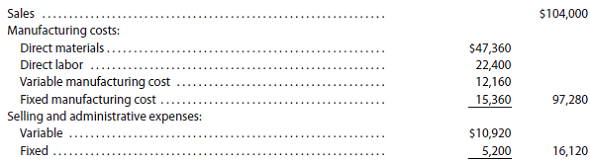

During the first month of operations ended July 31, 2016, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows:

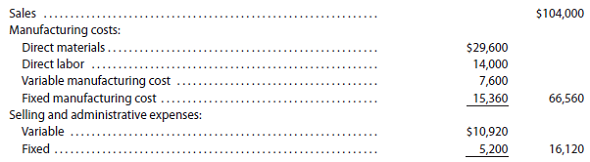

During August Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows:

Instructions

1. Using the absorption costing concept, prepare income statements for (a) July and (b) August.

2. Using the variable costing concept, prepare income statements for (a) July and (b) August.

3. a. Explain the reason for the differences in the amount of income from operations in (1) and (2) for July.

b. Explain the reason for the differences in the amount of income from operations in (1) and (2) for August.

4. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain.

During the first month of operations ended July 31, 2016, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows:

During August Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows:

Instructions

1. Using the absorption costing concept, prepare income statements for (a) July and (b) August.

2. Using the variable costing concept, prepare income statements for (a) July and (b) August.

3. a. Explain the reason for the differences in the amount of income from operations in (1) and (2) for July.

b. Explain the reason for the differences in the amount of income from operations in (1) and (2) for August.

4. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

Margin analysis

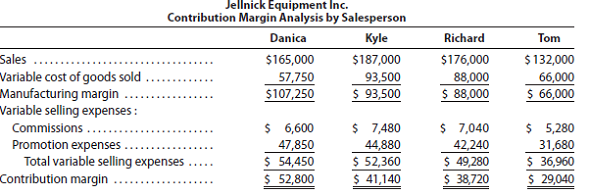

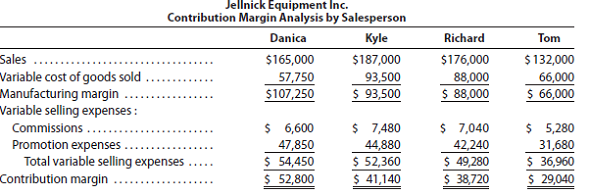

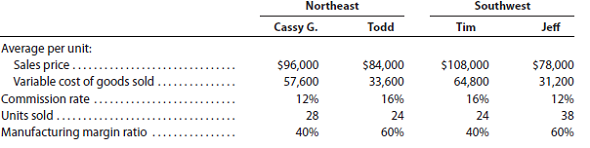

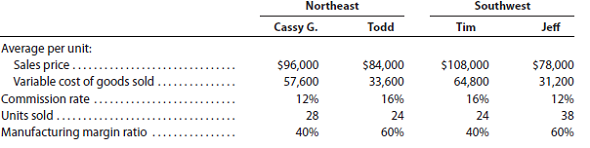

Jellnick Equipment Inc. manufactures and sells kitchen cooking products throughout the state. The company employs four salespersons. The following contribution margin by salesperson analysis was prepared:

1. Calculate the manufacturing margin as a percent of sales and the contribution margin ratio for each salesperson.

2. Explain the results of the analysis.

Jellnick Equipment Inc. manufactures and sells kitchen cooking products throughout the state. The company employs four salespersons. The following contribution margin by salesperson analysis was prepared:

1. Calculate the manufacturing margin as a percent of sales and the contribution margin ratio for each salesperson.

2. Explain the results of the analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

In the variable costing income statement, how are the fixed manufacturing costs reported, and how are the fixed selling and administrative expenses reported?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

Cost of goods manufactured, using variable costing and absorption costing

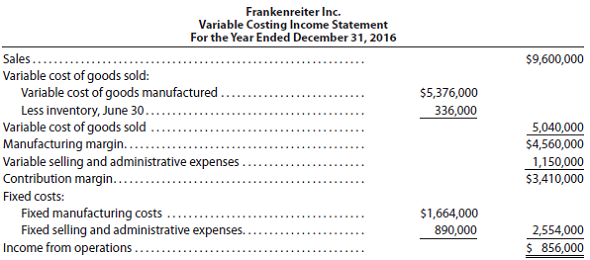

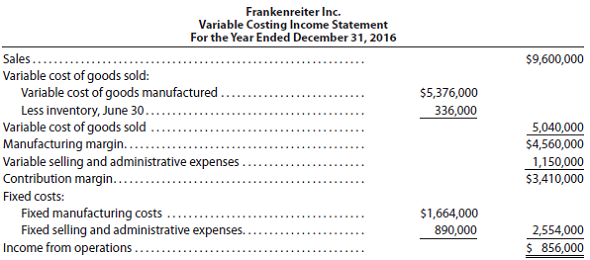

On December 31, the end of the first year of operations, Frankenreiter Inc. manufactured 25,600 units and sold 24,000 units. The following income statement was prepared, based on the variable costing concept:

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

On December 31, the end of the first year of operations, Frankenreiter Inc. manufactured 25,600 units and sold 24,000 units. The following income statement was prepared, based on the variable costing concept:

Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Analyzing income under absorption and variable costing

Variable manufacturing costs are $13 per unit, and fixed manufacturing costs are $75,000. Sales are estimated to be 12,000 units.

a. How much would absorption costing income from operations differ between a plan to produce 12,000 units and a plan to produce 15,000 units?

b. How much would variable costing income from operations differ between the two production plans?

Variable manufacturing costs are $126 per unit, and fixed manufacturing costs are $157,500. Sales are estimated to be 10,000 units.

a. How much would absorption costing income from operations differ between a plan to produce 10,000 units and a plan to produce 15,000 units?

b. How much would variable costing income from operations differ between the two production plans?

Variable manufacturing costs are $13 per unit, and fixed manufacturing costs are $75,000. Sales are estimated to be 12,000 units.

a. How much would absorption costing income from operations differ between a plan to produce 12,000 units and a plan to produce 15,000 units?

b. How much would variable costing income from operations differ between the two production plans?

Variable manufacturing costs are $126 per unit, and fixed manufacturing costs are $157,500. Sales are estimated to be 10,000 units.

a. How much would absorption costing income from operations differ between a plan to produce 10,000 units and a plan to produce 15,000 units?

b. How much would variable costing income from operations differ between the two production plans?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Salespersons' report and analysis

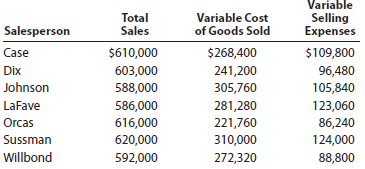

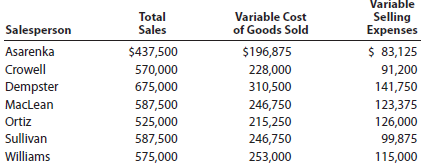

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Instructions

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round whole percents to a single digit.

2. Which salesperson generated the highest contribution margin ratio for the year and why?

3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

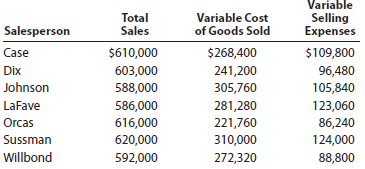

Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows:

Instructions

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. Round whole percents to a single digit.

2. Which salesperson generated the highest contribution margin ratio for the year and why?

3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

Salespersons' report and analysis

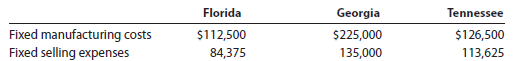

Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows:

Instructions

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.)

2. Which salesperson generated the highest contribution margin ratio for the year and why?

3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows:

Instructions

1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.)

2. Which salesperson generated the highest contribution margin ratio for the year and why?

3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

Contribution margin analysis

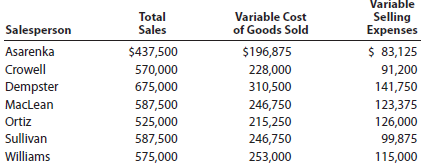

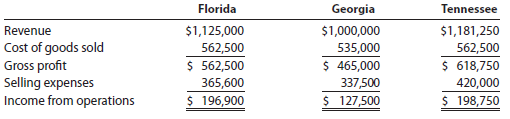

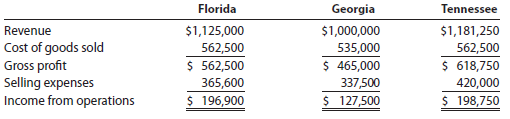

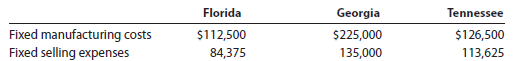

Trans Sport Company sells sporting goods to retailers in three different states-Florida, Georgia, and Tennessee. The following profit analysis by state was prepared by the company:

The following fixed costs have also been provided:

In addition, assume that inventories have been negligible.

Management believes it could increase state sales by 20%, without increasing any of the fixed costs, by spending an additional $42,200 per state on advertising.

1. Prepare a contribution margin by state report for Trans Sport Company.

2. Determine how much state operating profit will be generated for an additional $42,200 per state on advertising.

3. Which state will provide the greatest profit return for a $42,200 increase in advertising? Why?

Trans Sport Company sells sporting goods to retailers in three different states-Florida, Georgia, and Tennessee. The following profit analysis by state was prepared by the company:

The following fixed costs have also been provided:

In addition, assume that inventories have been negligible.

Management believes it could increase state sales by 20%, without increasing any of the fixed costs, by spending an additional $42,200 per state on advertising.

1. Prepare a contribution margin by state report for Trans Sport Company.

2. Determine how much state operating profit will be generated for an additional $42,200 per state on advertising.

3. Which state will provide the greatest profit return for a $42,200 increase in advertising? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Since all costs of operating a business are controllable, what is the significance of the term noncon-trollable cost ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Variable costing income statement

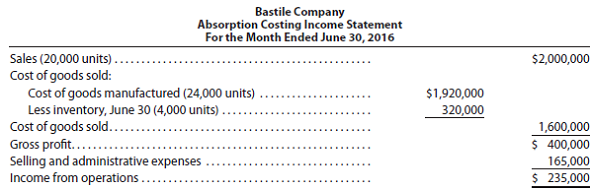

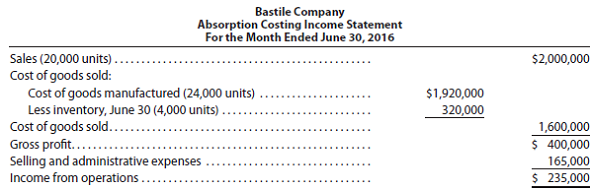

On June 30, the end of the first month of operations, Bastile Company prepared the following income statement, based on the absorption costing concept:

If the fixed manufacturing costs were $192,000 and the variable selling and administrative expenses were $92,400 prepare an income statement according to the variable costing concept.

On June 30, the end of the first month of operations, Bastile Company prepared the following income statement, based on the absorption costing concept:

If the fixed manufacturing costs were $192,000 and the variable selling and administrative expenses were $92,400 prepare an income statement according to the variable costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Contribution margin by segment

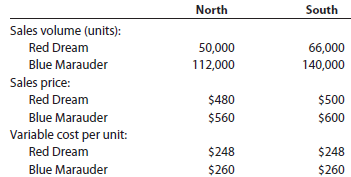

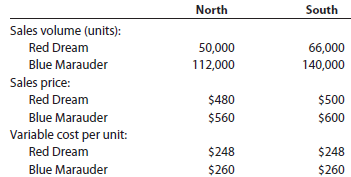

The following information is for Olivio Coaster Bikes Inc.:

Determine the contribution margin for (a) Red Dream and (b) North Region.

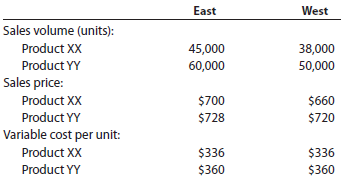

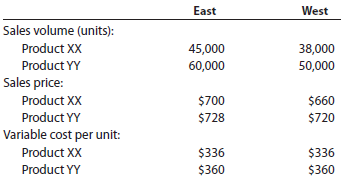

The following information is for LaPlanche Industries Inc.:

Determine the contribution margin for (a) Product YY and (b) West Region.

The following information is for Olivio Coaster Bikes Inc.:

Determine the contribution margin for (a) Red Dream and (b) North Region.

The following information is for LaPlanche Industries Inc.:

Determine the contribution margin for (a) Product YY and (b) West Region.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Segment variable costing income statement and effect on income of change in operations

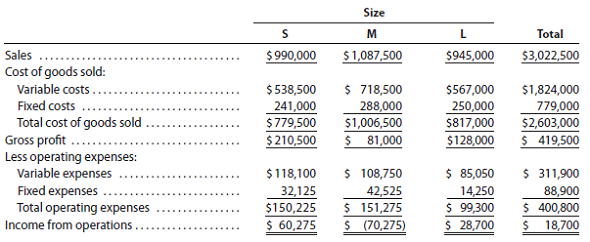

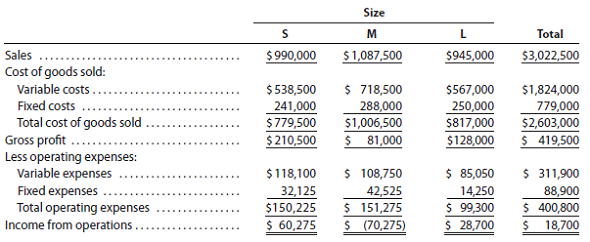

Valdespin Company manufactures three sizes of camping tents-small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $46,080 and $32,240 respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $34,560 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

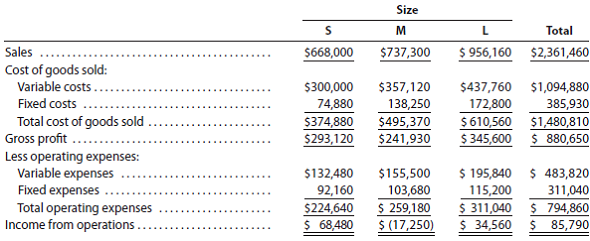

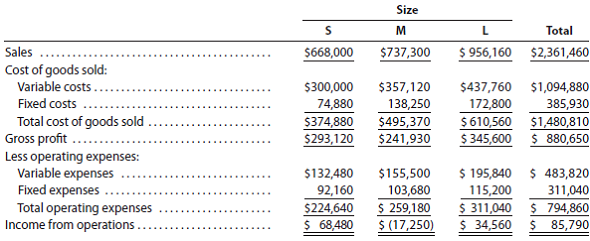

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 2016, is as follows:

Instructions

1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the "Total" column, to determine income from operations.

2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the "Total" column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses.

4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

Valdespin Company manufactures three sizes of camping tents-small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $46,080 and $32,240 respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $34,560 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 2016, is as follows:

Instructions

1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the "Total" column, to determine income from operations.

2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the "Total" column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses.

4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Variable costing income statement and effect on income of change in operations

Kimbrell Inc. manufactures three sizes of utility tables-small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $142,500 and $28,350, respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $85,050 for the salary of an assistant brand manager (classified as a fixed operating expense) would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended December 31, 2016, is as follows:

Instructions

1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the "Total" column, to determine income from operations.

2. Based on the income statement prepared in (1) and the other data presented above, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the "Total" column. For purposes of this problem, the additional expenditure of $85,050 for the assistant brand manager's salary can be added to the fixed operating expenses.

4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

Kimbrell Inc. manufactures three sizes of utility tables-small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $142,500 and $28,350, respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $85,050 for the salary of an assistant brand manager (classified as a fixed operating expense) would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended December 31, 2016, is as follows:

Instructions

1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the "Total" column, to determine income from operations.

2. Based on the income statement prepared in (1) and the other data presented above, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the "Total" column. For purposes of this problem, the additional expenditure of $85,050 for the assistant brand manager's salary can be added to the fixed operating expenses.

4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

Absorption costing Group Project

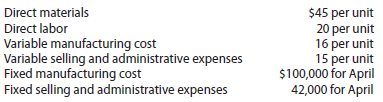

Craig Company is a family-owned business in which you own 20% of the common stock and your brothers and sisters own the remaining shares. The employment contract of Craig's new president, Ajay Pinder, stipulates a base salary of $140,000 per year plus 10% of income from operations in excess of $670,000. Craig uses the absorption costing method of reporting income from operations, which has averaged approximately $670,000 for the past several years.

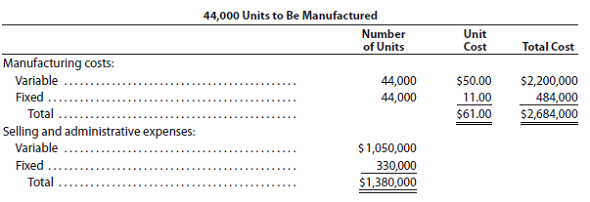

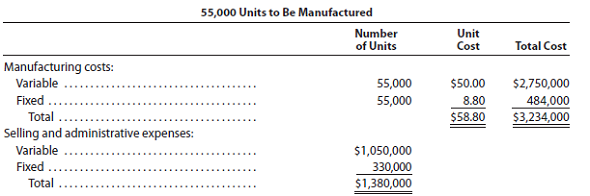

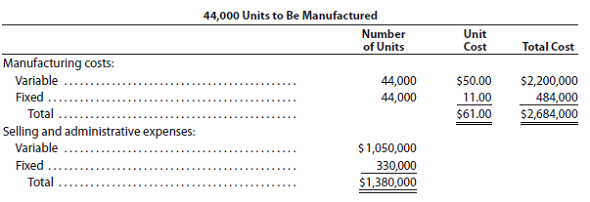

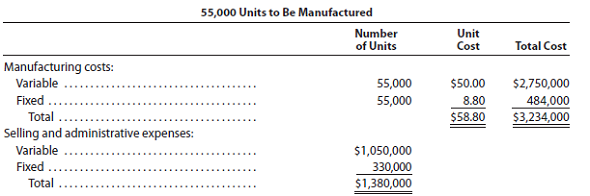

Sales for 2016, Pinder's first year as president of Craig Company, are estimated at 44,000 units at a selling price of $106 per unit. To maximize the use of Craig's productive capacity, Pinder has decided to manufacture 55,000 units, rather than the 44,000 units of estimated sales. The beginning inventory at January 1, 2016, is insignificant in amount, and the manufacturing costs and selling and administrative expenses for the production of 44,000 and 55,000 units are as follows:

1. In one group, prepare an absorption costing income statement for the year ending December 31, 2016, based on sales of 44,000 units and the manufacture of 44,000 units. In the other group, conduct the same analysis, assuming production of 55,000 units.

2. Explain the difference in the income from operations reported in (1).

3. Compute Pinder's total salary for the year 2016, based on sales of 44,000 units and the manufacture of 44,000 units (Group 1) and 55,000 units (Group 2). Compare your answers.

4. In addition to maximizing the use of Craig Company's productive capacity, why might Pinder wish to manufacture 55,000 units rather than 44,000 units?

5. Can you suggest an alternative way in which Pinder's salary could be determined, using a base salary of $140,000 and 10% of income from operations in excess of $670,000, so that the salary could not be increased by simply manufacturing more units?

Craig Company is a family-owned business in which you own 20% of the common stock and your brothers and sisters own the remaining shares. The employment contract of Craig's new president, Ajay Pinder, stipulates a base salary of $140,000 per year plus 10% of income from operations in excess of $670,000. Craig uses the absorption costing method of reporting income from operations, which has averaged approximately $670,000 for the past several years.

Sales for 2016, Pinder's first year as president of Craig Company, are estimated at 44,000 units at a selling price of $106 per unit. To maximize the use of Craig's productive capacity, Pinder has decided to manufacture 55,000 units, rather than the 44,000 units of estimated sales. The beginning inventory at January 1, 2016, is insignificant in amount, and the manufacturing costs and selling and administrative expenses for the production of 44,000 and 55,000 units are as follows:

1. In one group, prepare an absorption costing income statement for the year ending December 31, 2016, based on sales of 44,000 units and the manufacture of 44,000 units. In the other group, conduct the same analysis, assuming production of 55,000 units.

2. Explain the difference in the income from operations reported in (1).

3. Compute Pinder's total salary for the year 2016, based on sales of 44,000 units and the manufacture of 44,000 units (Group 1) and 55,000 units (Group 2). Compare your answers.

4. In addition to maximizing the use of Craig Company's productive capacity, why might Pinder wish to manufacture 55,000 units rather than 44,000 units?

5. Can you suggest an alternative way in which Pinder's salary could be determined, using a base salary of $140,000 and 10% of income from operations in excess of $670,000, so that the salary could not be increased by simply manufacturing more units?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Discuss how financial data prepared on the basis of variable costing can assist management in the development of short-run pricing policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

Absorption costing income statement

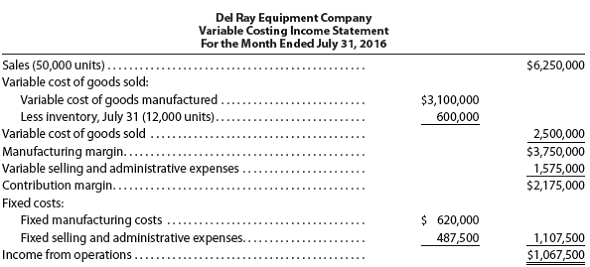

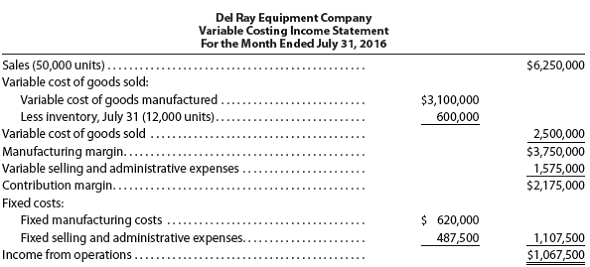

On July 31, the end of the first month of operations, Del Ray Equipment Company prepared the following income statement, based on the variable costing concept:

Prepare an income statement under absorption costing.

On July 31, the end of the first month of operations, Del Ray Equipment Company prepared the following income statement, based on the variable costing concept:

Prepare an income statement under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Contribution margin analysis

The actual price for a product was $28 per unit, while the planned price was $25 per unit. The volume decreased by 20,000 units to 410,000 actual total units. Determine (a) the sales quantity factor and (b) the unit price factor for sales.

The actual variable cost of goods sold for a product was $140 per unit, while the planned variable cost of goods sold was $136 per unit. The volume increased by 2,400 units to 14,000 actual total units. Determine (a) the variable cost quantity factor and (b) the unit cost factor for variable cost of goods sold.

The actual price for a product was $28 per unit, while the planned price was $25 per unit. The volume decreased by 20,000 units to 410,000 actual total units. Determine (a) the sales quantity factor and (b) the unit price factor for sales.

The actual variable cost of goods sold for a product was $140 per unit, while the planned variable cost of goods sold was $136 per unit. The volume increased by 2,400 units to 14,000 actual total units. Determine (a) the variable cost quantity factor and (b) the unit cost factor for variable cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Contribution margin analysis

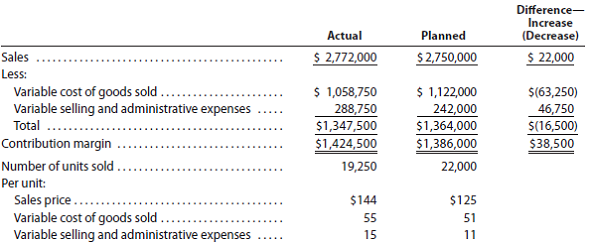

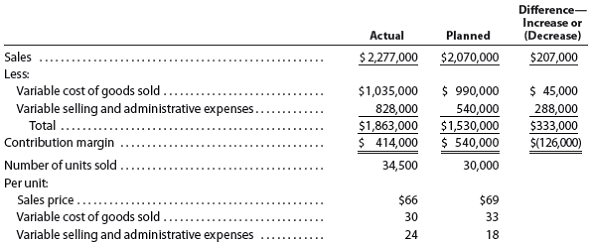

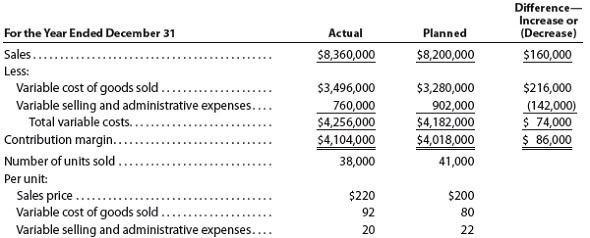

Dozier Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $38,500 from the planned level of $1,386,000 The president of Dozier Industries Inc. has expressed some concern about such a small increase and has requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

Instructions

1. Prepare a contribution margin analysis report for the year ended December 31.

2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment:

It looks as if the price increase of $19 had the effect of decreasing sales volume. However, this was a favorable tradeoff. The variable cost of goods sold was less than planned. Apparently, we are efficiently managing our variable cost of goods sold. However, the variable selling and administrative expenses appear out of control. Let's look into these expenses and get them under control! Also, let's consider increasing the sales price to $160 and continue this favorable tradeoff between higher price and lower volume.

Do you agree with the president's comment? Explain.

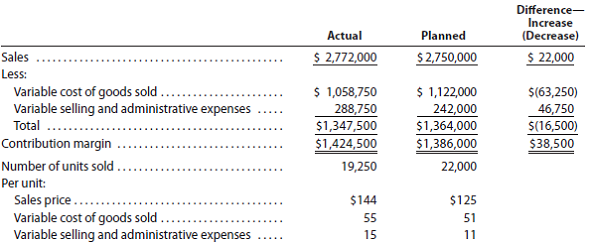

Dozier Industries Inc. manufactures only one product. For the year ended December 31, the contribution margin increased by $38,500 from the planned level of $1,386,000 The president of Dozier Industries Inc. has expressed some concern about such a small increase and has requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

Instructions

1. Prepare a contribution margin analysis report for the year ended December 31.

2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment:

It looks as if the price increase of $19 had the effect of decreasing sales volume. However, this was a favorable tradeoff. The variable cost of goods sold was less than planned. Apparently, we are efficiently managing our variable cost of goods sold. However, the variable selling and administrative expenses appear out of control. Let's look into these expenses and get them under control! Also, let's consider increasing the sales price to $160 and continue this favorable tradeoff between higher price and lower volume.

Do you agree with the president's comment? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Contribution margin analysis

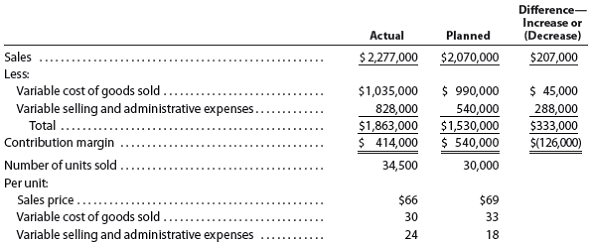

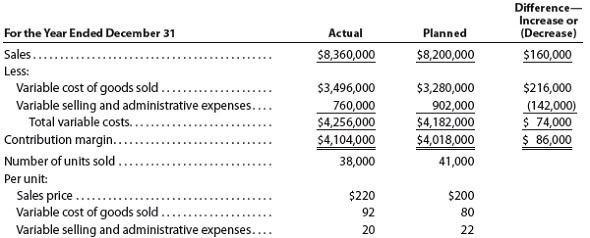

Mathews Company manufactures only one product. For the year ended December 31, the contribution margin decreased by $126,000 from the planned level of $540,000. The president of Mathews Company has expressed some concern about this decrease and has requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

Instructions

1. Prepare a contribution margin analysis report for the year ended December 31.

2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment:

It looks as if the price decrease of $3.00 had the effect of increasing sales. However, we lost control over the variable cost of goods sold and variable selling and administrative expenses. Let's look into these expenses and get them under control! Also, let's consider decreasing the sales price to $60 to increase sales further.

Do you agree with the president's comment? Explain.

Mathews Company manufactures only one product. For the year ended December 31, the contribution margin decreased by $126,000 from the planned level of $540,000. The president of Mathews Company has expressed some concern about this decrease and has requested a follow-up report.

The following data have been gathered from the accounting records for the year ended December 31:

Instructions

1. Prepare a contribution margin analysis report for the year ended December 31.

2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment:

It looks as if the price decrease of $3.00 had the effect of increasing sales. However, we lost control over the variable cost of goods sold and variable selling and administrative expenses. Let's look into these expenses and get them under control! Also, let's consider decreasing the sales price to $60 to increase sales further.

Do you agree with the president's comment? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

Why might management analyze product profitability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Variable costing income statement

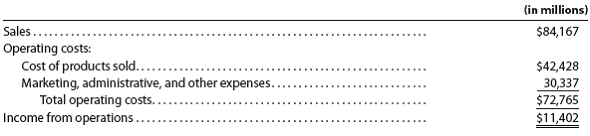

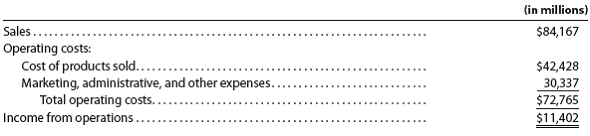

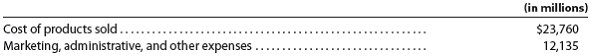

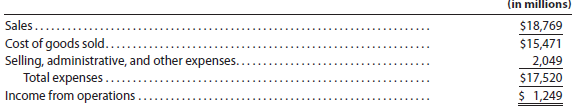

The following data were adapted from a recent income statement of Procter Gamble Company:

Assume that the variable amount of each category of operating costs is as follows:

a. Based on the data given, prepare a variable costing income statement for Procter Gamble Company, assuming that the company maintained constant inventory levels during the period.

b. If Procter Gamble reduced its inventories during the period, what impact would that have on the income from operations determined under absorption costing?

The following data were adapted from a recent income statement of Procter Gamble Company:

Assume that the variable amount of each category of operating costs is as follows:

a. Based on the data given, prepare a variable costing income statement for Procter Gamble Company, assuming that the company maintained constant inventory levels during the period.

b. If Procter Gamble reduced its inventories during the period, what impact would that have on the income from operations determined under absorption costing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

Explain why rewarding sales personnel on the basis of total sales might not be in the best interests of a business whose goal is to maximize profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

Estimated income statements, using absorption and variable costing

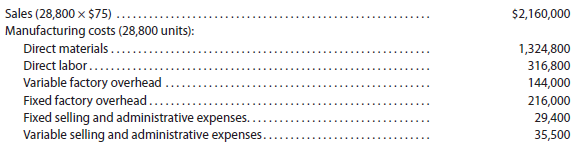

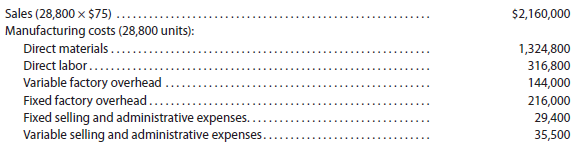

Prior to the first month of operations ending July 31, 2016, Muzenski Industries Inc. estimated the following operating results:

The company is evaluating a proposal to manufacture 36,000 units instead of 28,800 units, thus creating an ending inventory of 7,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses.

a. Prepare an estimated income statement, comparing operating results if 28,800 and 36,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format.

b. What is the reason for the difference in income from operations reported for the two levels of production by the absorption costing income statement?

Prior to the first month of operations ending July 31, 2016, Muzenski Industries Inc. estimated the following operating results:

The company is evaluating a proposal to manufacture 36,000 units instead of 28,800 units, thus creating an ending inventory of 7,200 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses.

a. Prepare an estimated income statement, comparing operating results if 28,800 and 36,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format.

b. What is the reason for the difference in income from operations reported for the two levels of production by the absorption costing income statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

Discuss the two factors affecting both sales and variable costs to which a change in contribution margin can be attributed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

Variable and absorption costing

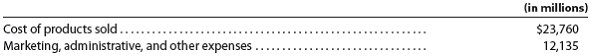

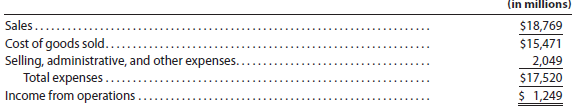

Ansara Company had the following abbreviated income statement for the year ended December 31, 2016:

Assume that there were $3,860 million fixed manufacturing costs and $1,170 million fixed selling, administrative, and other costs for the year.

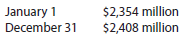

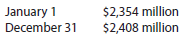

The finished goods inventories at the beginning and end of the year from the balance sheet were as follows:

Assume that 30% of the beginning and ending inventory consists of fixed costs. Assume work in process and materials inventory were unchanged during the period.

a. Prepare an income statement according to the variable costing concept for Ansara Company for 2016.

b. Explain the difference between the amount of income from operations reported under the absorption costing and variable costing concepts.

Ansara Company had the following abbreviated income statement for the year ended December 31, 2016:

Assume that there were $3,860 million fixed manufacturing costs and $1,170 million fixed selling, administrative, and other costs for the year.