Deck 7: Supply, Demand and Government Policies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/23

العب

ملء الشاشة (f)

Deck 7: Supply, Demand and Government Policies

1

EXPLICIT AND IMPLICIT COSTS Amos McCoy is currently raising corn on his 100-acre farm and earning an accounting profit of $100 per acre. However, if he raised soybeans, he could earn $200 per acre. Is he currently earning an economic profit? Why or why not?

Accounting profit

Accounting profit is defined as the total revenue minus explicit costs of a firm.

Economic profit

Economic profit is defined as a firm's total revenue minus all costs, both implicit and explicit costs. Economic profit takes into account the opportunity cost of all resources used in production.

Accounting profit does not include implicit costs. While raising corn, Firm A is incurring opportunity cost for not raising soybeans.

Accounting profit earned = $100 per acre

Instead of corn, if he raised soybeans, earnings would be $200 per acre.Therefore, the economic profit is $200 per acre.Opportunity cost

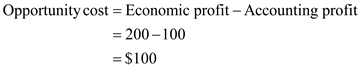

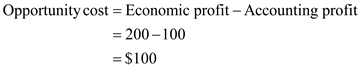

The opportunity cost of not raising soybeans is calculated as follows:

The opportunity cost of not raising soybeans is

The opportunity cost of not raising soybeans is

.

.

Thus, Firm A is not earning economic profit as the accounting profit and the opportunity cost are the same. If both the Accounting Profit and the Opportunity Cost are same then the economic profit will be zero. Rather, it is making economic loss by the amount of opportunity cost ($100), despite the fact that it is earning an accounting profit.

Accounting profit is defined as the total revenue minus explicit costs of a firm.

Economic profit

Economic profit is defined as a firm's total revenue minus all costs, both implicit and explicit costs. Economic profit takes into account the opportunity cost of all resources used in production.

Accounting profit does not include implicit costs. While raising corn, Firm A is incurring opportunity cost for not raising soybeans.

Accounting profit earned = $100 per acre

Instead of corn, if he raised soybeans, earnings would be $200 per acre.Therefore, the economic profit is $200 per acre.Opportunity cost

The opportunity cost of not raising soybeans is calculated as follows:

The opportunity cost of not raising soybeans is

The opportunity cost of not raising soybeans is  .

.Thus, Firm A is not earning economic profit as the accounting profit and the opportunity cost are the same. If both the Accounting Profit and the Opportunity Cost are same then the economic profit will be zero. Rather, it is making economic loss by the amount of opportunity cost ($100), despite the fact that it is earning an accounting profit.

2

EXPLICIT AND IMPLICIT COSTS Determine whether each of the following is an explicit cost or an implicit cost:

a. Payments for labor purchased in the labor market

b. A firm's use of a warehouse that it owns and could rent to another firm

c. Rent paid for the use of a warehouse not owned by the firm

d. The wages that owners could earn if they did not work for themselves

a. Payments for labor purchased in the labor market

b. A firm's use of a warehouse that it owns and could rent to another firm

c. Rent paid for the use of a warehouse not owned by the firm

d. The wages that owners could earn if they did not work for themselves

Explicit and Implicit costs

a.Payments for labor purchased in the labor market are explicit costs.

b.A firm's use of a warehouse that it owns and could rent to another firm is an implicit cost as it cannot have a specified value and is not recorded as a separate cost.

c.Rent paid for the use of a warehouse not owned by the firm is an explicit cost as it directly pays the amount and can be recorded as a separate cost.

d.The wages that the owners could earn if they did not work for themselves are implicit costs as it cannot be identified and recorded.

a.Payments for labor purchased in the labor market are explicit costs.

b.A firm's use of a warehouse that it owns and could rent to another firm is an implicit cost as it cannot have a specified value and is not recorded as a separate cost.

c.Rent paid for the use of a warehouse not owned by the firm is an explicit cost as it directly pays the amount and can be recorded as a separate cost.

d.The wages that the owners could earn if they did not work for themselves are implicit costs as it cannot be identified and recorded.

3

ALTERNATIVE MEASURES OF PROFIT Calculate the accounting profit or loss as well as the economic profit or loss in each of the following situations:

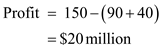

a. A firm with total revenues of $150 million, explicit costs of $90 million, and implicit costs of $40 million

b. A firm with total revenues of $125 million, explicit costs of $100 million, and implicit costs of $30 million

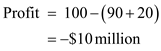

c. A firm with total revenues of $100 million, explicit costs of $90 million, and implicit costs of $20 million

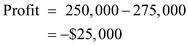

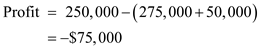

d. A firm with total revenues of $250,000, explicit costs of $275,000, and implicit costs of $50,000

a. A firm with total revenues of $150 million, explicit costs of $90 million, and implicit costs of $40 million

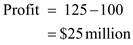

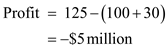

b. A firm with total revenues of $125 million, explicit costs of $100 million, and implicit costs of $30 million

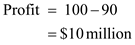

c. A firm with total revenues of $100 million, explicit costs of $90 million, and implicit costs of $20 million

d. A firm with total revenues of $250,000, explicit costs of $275,000, and implicit costs of $50,000

Alternative measures of profit

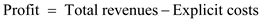

Accounting Profit:

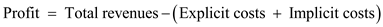

Accounting profit of a firm can be calculated as follows:

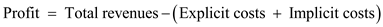

…… (1)Economic Profit:

…… (1)Economic Profit:

Economic profit of a firm can be calculated as follows:

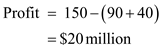

…… (2)a.Total revenue of a firm = $150 million

…… (2)a.Total revenue of a firm = $150 million

Explicit costs = $90 million

Implicit costs = $40 million

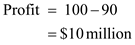

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain the accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is

million.

million.

Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain the economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is

million.

million.

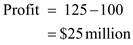

b.Total revenue of a firm = $125 million

Explicit costs = $100 million

Implicit costs = $30 million

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain the accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is

million.

million.

Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain the economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is

million.

million.

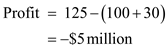

c.Total revenue of a firm = $100 million.

Explicit costs = $90 million.

Implicit costs = $20 million.

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is

million.

million.

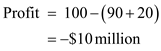

Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is

million.

million.

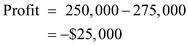

d.Total revenue of a firm = $250,000.

Explicit costs = $275,000.

Implicit costs = $50,000.

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is

.

.

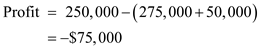

Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is

.

.

Accounting Profit:

Accounting profit of a firm can be calculated as follows:

…… (1)Economic Profit:

…… (1)Economic Profit: Economic profit of a firm can be calculated as follows:

…… (2)a.Total revenue of a firm = $150 million

…… (2)a.Total revenue of a firm = $150 millionExplicit costs = $90 million

Implicit costs = $40 million

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain the accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is  million.

million.Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain the economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is  million.

million.b.Total revenue of a firm = $125 million

Explicit costs = $100 million

Implicit costs = $30 million

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain the accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is  million.

million.Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain the economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is  million.

million.c.Total revenue of a firm = $100 million.

Explicit costs = $90 million.

Implicit costs = $20 million.

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is  million.

million.Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is  million.

million.d.Total revenue of a firm = $250,000.

Explicit costs = $275,000.

Implicit costs = $50,000.

Accounting Profit: of a firm

Substitute the respective values in Equation (1) to obtain accounting profit of a firm.

Thus, the accounting profit of the firm is

Thus, the accounting profit of the firm is  .

.Economic Profit: of a firm

Substitute the respective values in Equation (2) to obtain economic profit of a firm.

Thus, the economic profit of the firm is

Thus, the economic profit of the firm is  .

. 4

ALTERNATIVE MEASURES OF PROFIT Why is it reasonable to think of normal profit as a type of cost to the firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

5

SHORT RUN VERSUS LONG RUN What distinguishes a firm's short-run period from its long-run period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

6

LAW OF DIMINISHING MARGINAL RETURNS As a farmer, you must decide how many times during the year to plant a new crop. Also, you must decide how far apart to space the plants. Will diminishing returns be a factor in your decision making? If so, how will it affect your decisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

7

MARGINAL COST What is the difference between fixed cost and variable cost? Does each type of cost affect short-run marginal cost? If yes, explain how each affects marginal cost. If no, explain why each does or does not affect marginal cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

8

MARGINAL COST Explain why the marginal cost of production must increase if the marginal product of the variable resource is decreasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

9

COSTS IN THE SHORT RUN What effect would each of the following have on a firm's short-run marginal cost curve and its fixed cost curve?

a. An increase in the wage rate

b. A decrease in property taxes

c. A rise in the purchase price of new capital

d. A rise in energy prices

a. An increase in the wage rate

b. A decrease in property taxes

c. A rise in the purchase price of new capital

d. A rise in energy prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

10

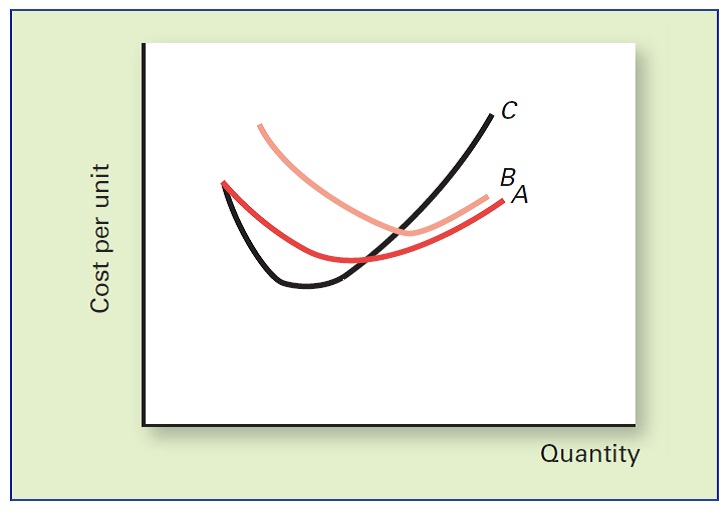

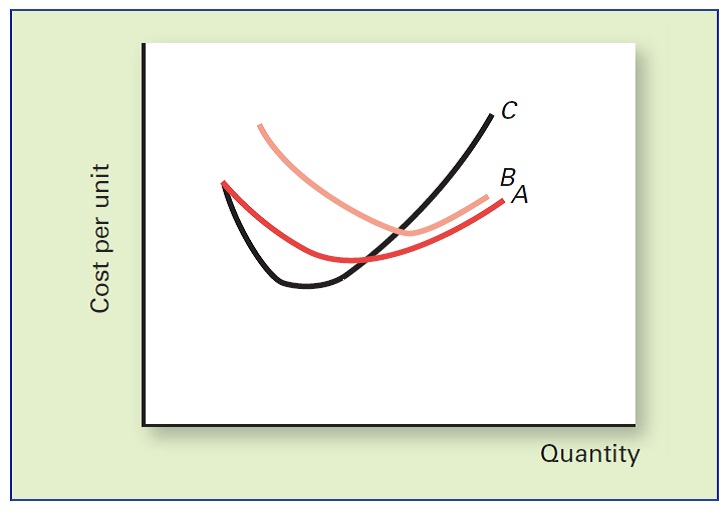

Costs in the Short Run Identify each of the curves in the following graph:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

11

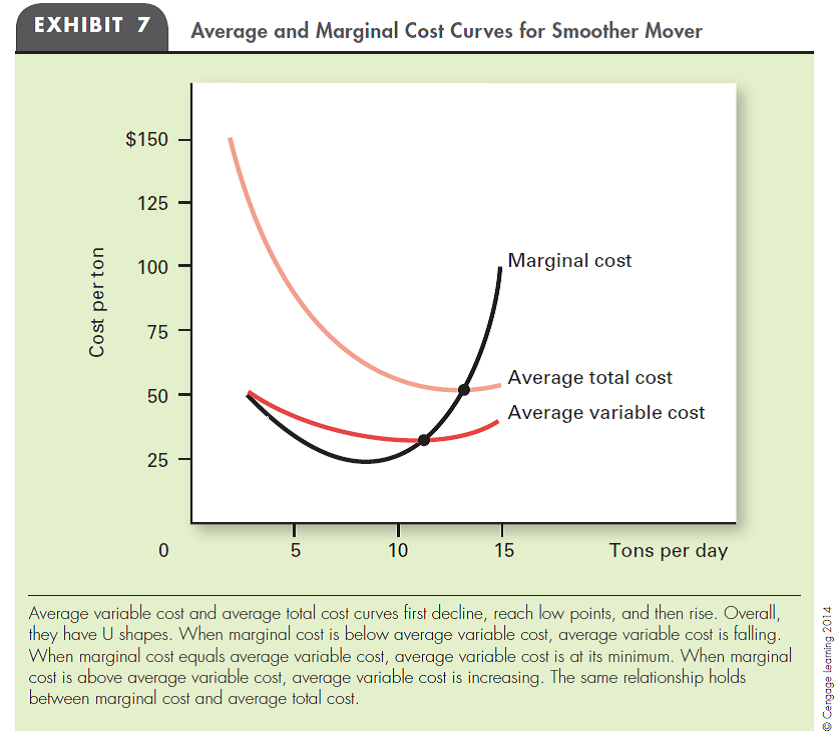

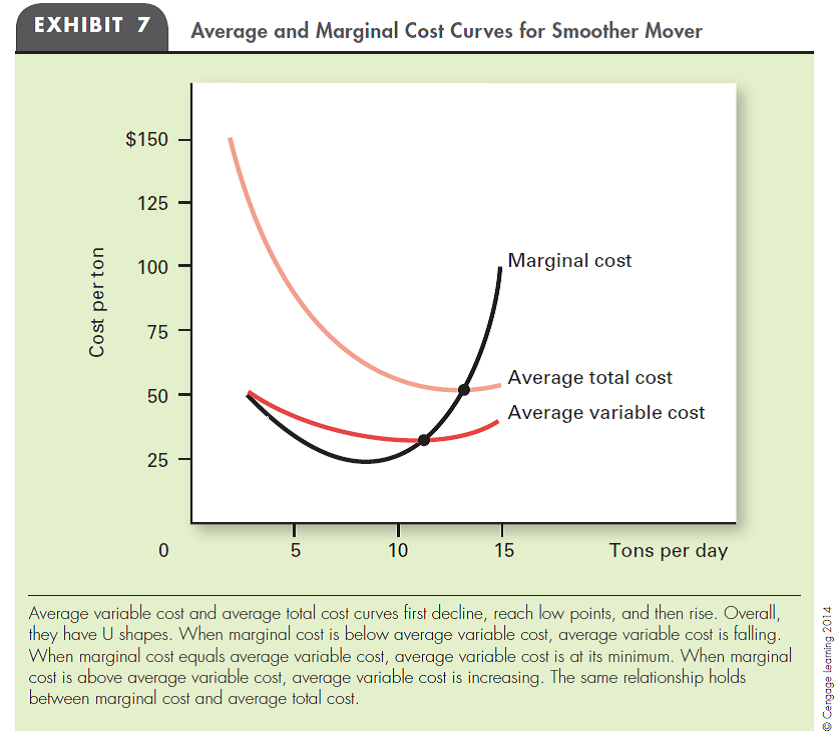

MARGINAL COST AND AVERAGE COST Explain why the marginal cost curve must intersect the average total cost curve and the average variable cost curve at their minimum points. Why do the average total cost and average variable cost curves get closer to one another as output increases?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

12

MARGINAL COST AND AVERAGE COST In Exhibit 7 in this chapter, the output level where average total cost is at a minimum is greater than the output level where average variable cost is at a minimum. Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

13

LONG-RUN AVERAGE COST CURVE What types of changes could shift the long-run average cost curve? How would these changes also affect the short-run average total cost curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

14

LONG-RUN AVERAGE COST CURVE Explain the shape of the long-run average cost curve. What does "minimum efficient scale" mean?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

15

Case Study: At the Movies

The case study notes that the concession stand accounts for well over half the profits at most theaters. Given this, what are the benefits of the staggered movie times allowed by multiple screens? What is the benefit to a multiscreen theater of locating at a shopping mall?

The case study notes that the concession stand accounts for well over half the profits at most theaters. Given this, what are the benefits of the staggered movie times allowed by multiple screens? What is the benefit to a multiscreen theater of locating at a shopping mall?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

16

Case Study: Scale Economies and Diseconomies at McDonald's How does having a menu that is uniform around the country provide McDonald's with economies of scale? How is menu planning made more complex by expanding into other countries?

Reference Case Study:

World of Business

Scale Economies and Diseconomies at McDonald's McDonald's experiences economies of scale at the plant, or restaurant, level because of its specialization of labor and machines, but it also benefits from economies of scale at the firm level. Experience gained from decades of selling hamburgers can be shared with new managers through centralized training programs. Costly research and efficient production techniques can also be shared across thousands of locations. For example, McDonald's took three years to decide on the exact temperature of the holding cabinets for its hamburger patties. What's more, the cost of advertising and promoting McDonald's through sponsorship of world events such as the Olympics can be spread across 32,000 restaurants in more than 120 countries.

Some diseconomies may also arise in such large-scale operations. The fact that the menu must be reasonably uniform across thousands of locations means that if customers in some parts of the country or the world do not like a product, it may not get on the menu, even though it might be popular elsewhere. Another problem with a uniform menu is that the ingredients must be available around the world and cannot be subject to droughts or sharp swings in price. For example, McDonald's considered adding a shrimp salad to the menu but decided not to when advised the move could deplete the nation's shrimp supply.

McDonald's has moved aggressively into overseas markets (about 10 percent of the beef sold in Japan goes into McDonald's hamburgers). Planning across so many markets has grown increasingly complex. For example, McDonald's is kosher in Israel, closes five times a day for Muslim prayer in Saudi Arabia, and serves mutton burgers in India, where cows are worshiped, not eaten. Running a worldwide operation also exposes the company to regional risks, such as environmental protests in Brazil, mad-cow disease in Europe, and terrorist bombings of outlets in France, Indonesia, Russia, and Turkey.

Change usually comes slowly in some large corporations, but the profit motive has forced McDonald's to reinvent itself. McDonald's has reorganized its U.S. operation into regions, allowing managers in each region more leeway in pricing and promotion. McDonald's has also become more flexible by putting mini-restaurants in airports, gas stations, and Wal-Marts. The company has been opening new stores and closing unprofitable ones. And McDonald's has reduced the time required to develop new products. For example, whereas Chicken McNuggets were seven years in the making, Chicken Wraps took less than a year to develop. This greater flexibility across countries and regions, the increased willingness to close unprofitable restaurants, and the reduction in product development time all reflect McDonald's effort to cope with diseconomies of scale.

Reference Case Study:

World of Business

Scale Economies and Diseconomies at McDonald's McDonald's experiences economies of scale at the plant, or restaurant, level because of its specialization of labor and machines, but it also benefits from economies of scale at the firm level. Experience gained from decades of selling hamburgers can be shared with new managers through centralized training programs. Costly research and efficient production techniques can also be shared across thousands of locations. For example, McDonald's took three years to decide on the exact temperature of the holding cabinets for its hamburger patties. What's more, the cost of advertising and promoting McDonald's through sponsorship of world events such as the Olympics can be spread across 32,000 restaurants in more than 120 countries.

Some diseconomies may also arise in such large-scale operations. The fact that the menu must be reasonably uniform across thousands of locations means that if customers in some parts of the country or the world do not like a product, it may not get on the menu, even though it might be popular elsewhere. Another problem with a uniform menu is that the ingredients must be available around the world and cannot be subject to droughts or sharp swings in price. For example, McDonald's considered adding a shrimp salad to the menu but decided not to when advised the move could deplete the nation's shrimp supply.

McDonald's has moved aggressively into overseas markets (about 10 percent of the beef sold in Japan goes into McDonald's hamburgers). Planning across so many markets has grown increasingly complex. For example, McDonald's is kosher in Israel, closes five times a day for Muslim prayer in Saudi Arabia, and serves mutton burgers in India, where cows are worshiped, not eaten. Running a worldwide operation also exposes the company to regional risks, such as environmental protests in Brazil, mad-cow disease in Europe, and terrorist bombings of outlets in France, Indonesia, Russia, and Turkey.

Change usually comes slowly in some large corporations, but the profit motive has forced McDonald's to reinvent itself. McDonald's has reorganized its U.S. operation into regions, allowing managers in each region more leeway in pricing and promotion. McDonald's has also become more flexible by putting mini-restaurants in airports, gas stations, and Wal-Marts. The company has been opening new stores and closing unprofitable ones. And McDonald's has reduced the time required to develop new products. For example, whereas Chicken McNuggets were seven years in the making, Chicken Wraps took less than a year to develop. This greater flexibility across countries and regions, the increased willingness to close unprofitable restaurants, and the reduction in product development time all reflect McDonald's effort to cope with diseconomies of scale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

17

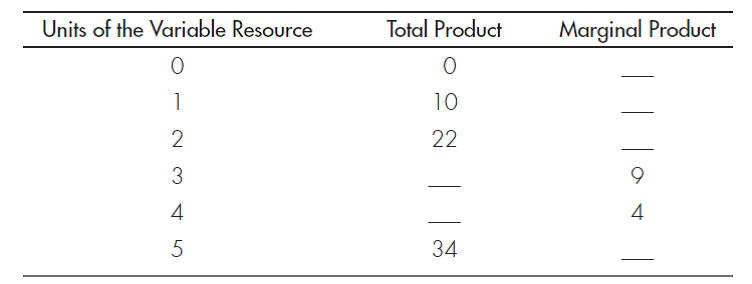

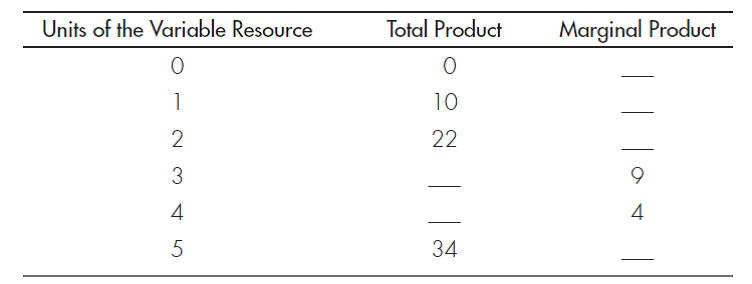

PRODUCTION IN THE SHORT RUN Complete the following table. At what point does diminishing marginal returns set in?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

18

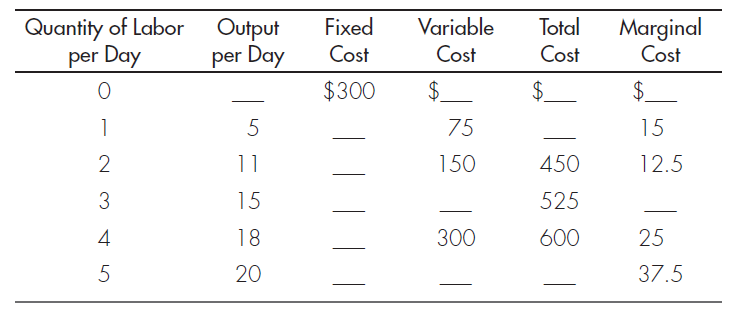

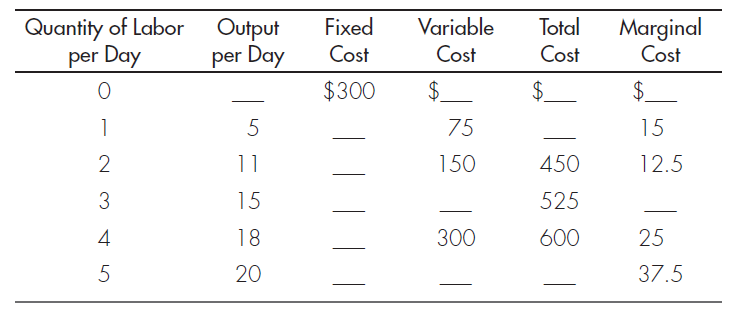

TOTAL COST AND MARGINAL COST Complete the following table, assuming that each unit of labor costs $75 per day.

a. Graph the fixed cost, variable cost, and total cost curves for these data.

b. What is the marginal product of the third unit of labor?

c. What is average total cost when output is 18 units per day?

a. Graph the fixed cost, variable cost, and total cost curves for these data.

b. What is the marginal product of the third unit of labor?

c. What is average total cost when output is 18 units per day?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

19

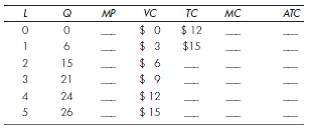

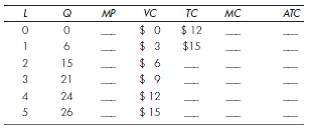

Total Cost and Marginal Cost Complete the following table, where L is units of labor, Q is units of output, and MP is the marginal product of labor.

a. At what level of labor input do the marginal returns from labor begin to diminish?

b. What is the average variable cost when Q = 24?

c. What is this firm's fixed cost?

d. What is the wage rate per day?

a. At what level of labor input do the marginal returns from labor begin to diminish?

b. What is the average variable cost when Q = 24?

c. What is this firm's fixed cost?

d. What is the wage rate per day?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

20

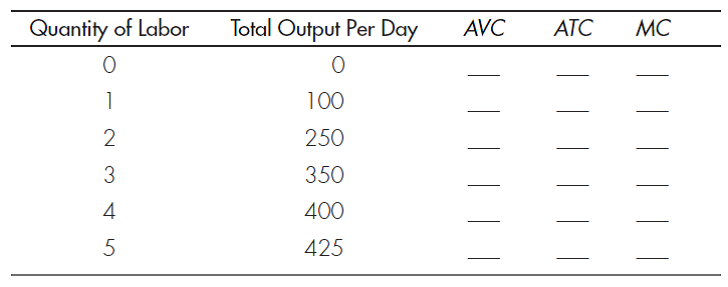

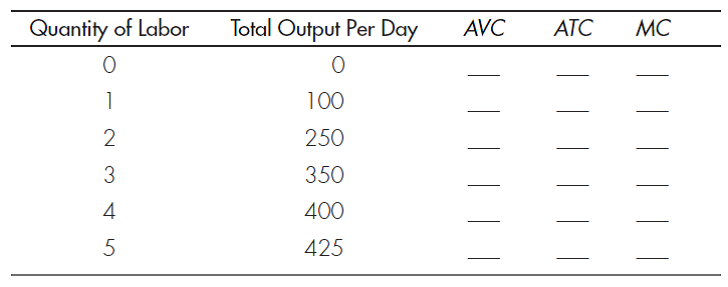

RELATIONSHIP BETWEEN MARGINAL COST AND AVERAGE COST Assume that labor and capital are the only inputs used by a firm. Capital is fixed at 5 units, which cost $100 each per day. Workers can be hired for $200 each per day. Complete the following table to show average variable cost ( AVC ), average total cost ( ATC ), and marginal cost ( MC ).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

21

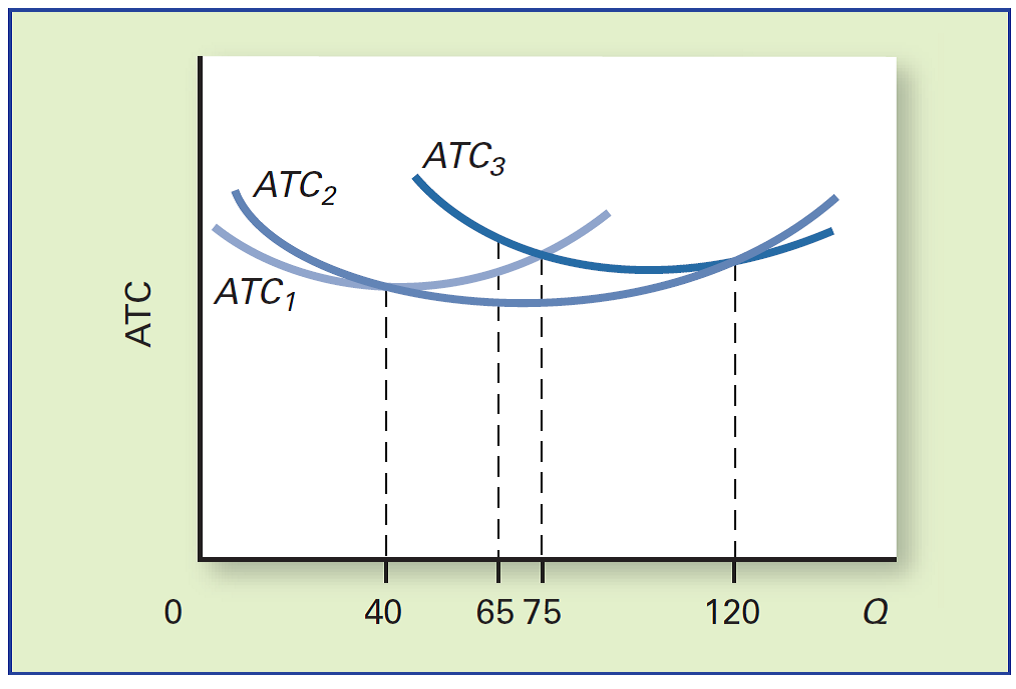

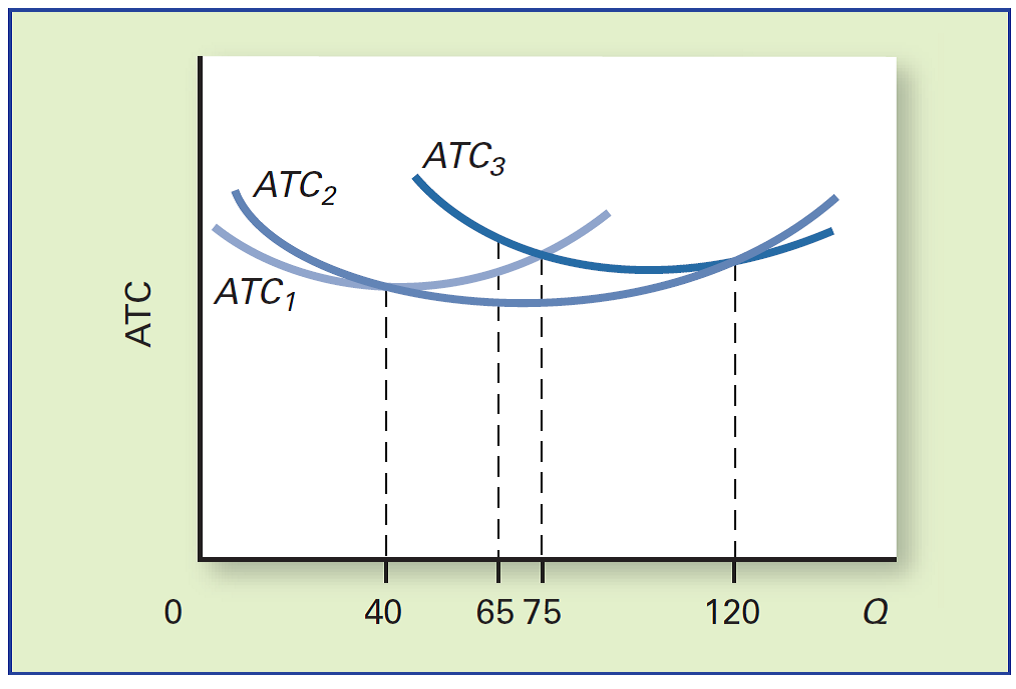

LONG-RUN COSTS Suppose the firm has only three possible scales of production as shown below:

a. Which scale of production is most efficient when Q = 65?

b. Which scale of production is most efficient when Q = 75?

c. Trace out the long-run average cost curve on the diagram.

a. Which scale of production is most efficient when Q = 65?

b. Which scale of production is most efficient when Q = 75?

c. Trace out the long-run average cost curve on the diagram.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

22

CHOICE OF INPUT COMBINATIONS Suppose that a firm's cost per unit of labor is $100 per day and its cost per unit of capital is $400 per day.

a. Draw the isocost line for a total cost per day of $2,000. Label the axes.

b. If the firm is producing efficiently, what is the marginal rate of technical substitution between labor and capital?

c. Demonstrate your answer to part (b) using isocost lines and isoquant curves.

a. Draw the isocost line for a total cost per day of $2,000. Label the axes.

b. If the firm is producing efficiently, what is the marginal rate of technical substitution between labor and capital?

c. Demonstrate your answer to part (b) using isocost lines and isoquant curves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck

23

THE EXPANSION PATH How are the expansion path and the long-run average cost curve related?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 23 في هذه المجموعة.

فتح الحزمة

k this deck