Deck 12: Annuities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 12: Annuities

1

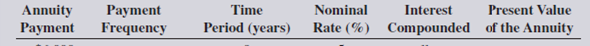

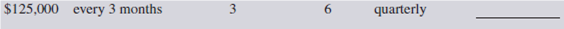

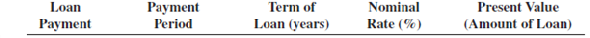

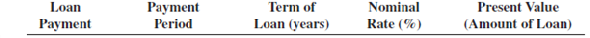

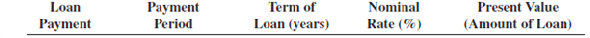

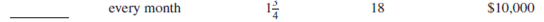

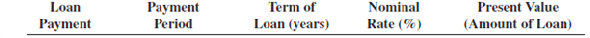

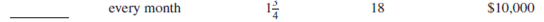

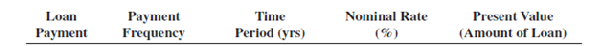

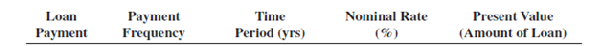

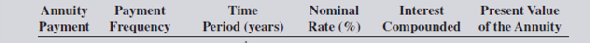

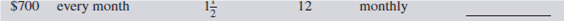

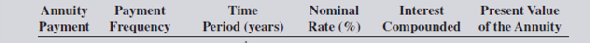

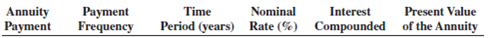

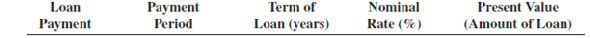

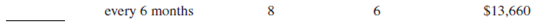

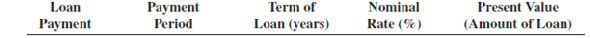

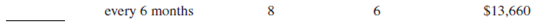

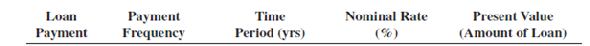

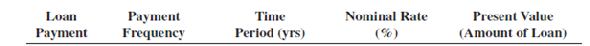

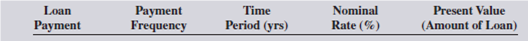

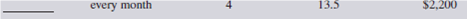

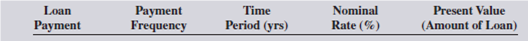

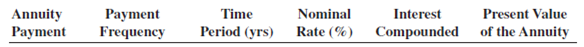

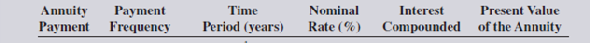

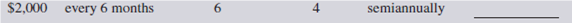

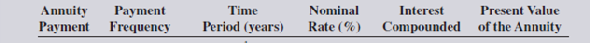

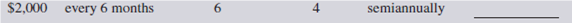

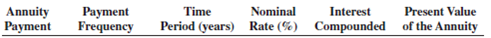

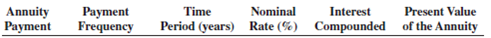

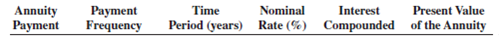

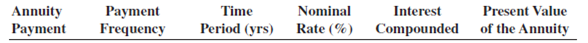

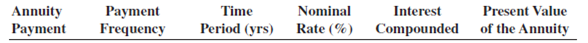

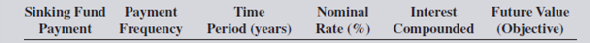

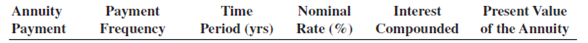

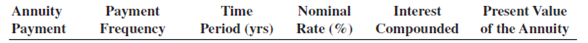

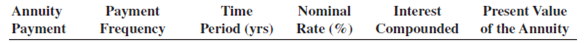

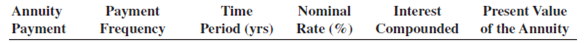

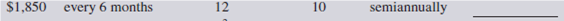

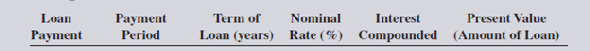

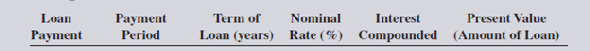

Use Table 12-2 to calculate the present value of the following ordinary annuities.

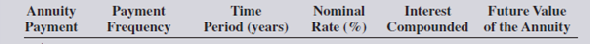

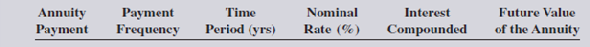

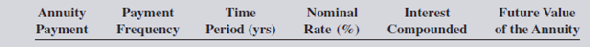

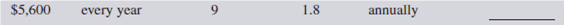

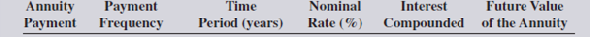

To calculate future value (Amount) of an ordinary Annuity, use the following steps.

1. Calculate the interest rate per period for the annuity (nominal rate periods per year)

2. Determine the number of periods of the annuity (years periods per year)

3. From table 12-1, locate the ordinary annuity table factor at the intersection on the rate-per-period column and the number-of-period row.

4. Calculate the future value of the ordinary annuity.

Future value ordinary annuity table factor Annuity payment

(Ordinary annuity)

Here,

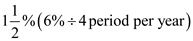

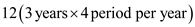

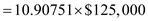

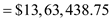

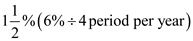

1. The rate per period is

2. The number of period is

2. The number of period is

3. From table

3. From table

, the table factor for

, the table factor for

periods is

periods is

.

.

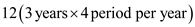

4. Future value

ordinary annuity table factor

ordinary annuity table factor

annuity payment.

annuity payment.

Therefore,

Present value

Therefore, the required present value is

Therefore, the required present value is

.

.

1. Calculate the interest rate per period for the annuity (nominal rate periods per year)

2. Determine the number of periods of the annuity (years periods per year)

3. From table 12-1, locate the ordinary annuity table factor at the intersection on the rate-per-period column and the number-of-period row.

4. Calculate the future value of the ordinary annuity.

Future value ordinary annuity table factor Annuity payment

(Ordinary annuity)

Here,

1. The rate per period is

2. The number of period is

2. The number of period is  3. From table

3. From table , the table factor for

, the table factor for  periods is

periods is .

.4. Future value

ordinary annuity table factor

ordinary annuity table factor  annuity payment.

annuity payment.Therefore,

Present value

Therefore, the required present value is

Therefore, the required present value is  .

. 2

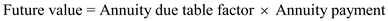

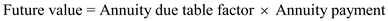

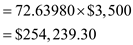

How much will $3,500 deposited at the beginning of each 3-month period be worth after 7 years at 12% interest compounded quarterly?

Calculate future value (Amount) of an annuity due, use the following steps.

Step 1. Calculate the number of periods of the annuity (years

periods per year) and add one period to the total.

periods per year) and add one period to the total.

Step 2. Calculate the interest rate per period (nominal rate

periods per year)

periods per year)

Step 3. From table

, locate the table factor at the intersection of the rate - per - period column and the number - of - period's row.

, locate the table factor at the intersection of the rate - per - period column and the number - of - period's row.

Step 4. Subtract

from the ordinary annuity table factor to get the annuity due table factor.

from the ordinary annuity table factor to get the annuity due table factor.

Step 5. Calculate the future value of the annuity due.

Here,

Here,

Step 1. Number of periods of the annuity due for a total is

Step 2. Interest rate per period is

Step 2. Interest rate per period is

.

.

Step 3. From table

, the ordinary annuity table factor at the intersection of the rate column and the periods row is

, the ordinary annuity table factor at the intersection of the rate column and the periods row is

.

.

Step 4. Subtract

from the table factor:

from the table factor:

Ordinary annuity table factor.

Ordinary annuity table factor.

Annuity due table factor.72.63980*3,500

Annuity due table factor.72.63980*3,500

Step 5. Future value

Therefore the required future value is

Therefore the required future value is

.

.

Step 1. Calculate the number of periods of the annuity (years

periods per year) and add one period to the total.

periods per year) and add one period to the total.Step 2. Calculate the interest rate per period (nominal rate

periods per year)

periods per year)Step 3. From table

, locate the table factor at the intersection of the rate - per - period column and the number - of - period's row.

, locate the table factor at the intersection of the rate - per - period column and the number - of - period's row.Step 4. Subtract

from the ordinary annuity table factor to get the annuity due table factor.

from the ordinary annuity table factor to get the annuity due table factor.Step 5. Calculate the future value of the annuity due.

Here,

Here,Step 1. Number of periods of the annuity due for a total is

Step 2. Interest rate per period is

Step 2. Interest rate per period is  .

.Step 3. From table

, the ordinary annuity table factor at the intersection of the rate column and the periods row is

, the ordinary annuity table factor at the intersection of the rate column and the periods row is  .

.Step 4. Subtract

from the table factor:

from the table factor: Ordinary annuity table factor.

Ordinary annuity table factor. Annuity due table factor.72.63980*3,500

Annuity due table factor.72.63980*3,500Step 5. Future value

Therefore the required future value is

Therefore the required future value is  .

. 3

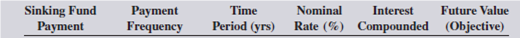

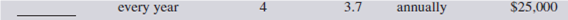

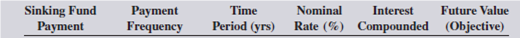

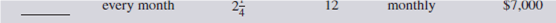

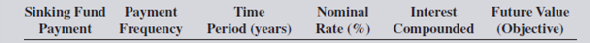

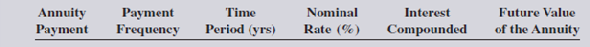

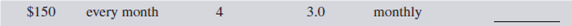

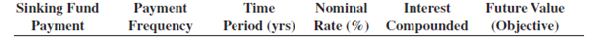

Sinking fund payment

To calculate sinking fund, use the formula sinking fund payment

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea7_e7a7_b1cd_bdfed7989a8c_SM2245_00.jpg) Where,

Where,

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eb8_b1cd_59f516027ad3_SM2245_00.jpg) Amount needed in the future.

Amount needed in the future.

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eb9_b1cd_1b7c0030ad55_SM2245_00.jpg) interest rate per period (nominal rate

interest rate per period (nominal rate

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eba_b1cd_012d53cf2518_SM2245_00.jpg) periods per year)

periods per year)

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebb_b1cd_1186163c837b_SM2245_00.jpg) number of periods (years

number of periods (years

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebc_b1cd_ebd8aad9a686_SM2245_00.jpg) periods per year)

periods per year)

Here,

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebd_b1cd_a93d169f7a58_SM2245_00.jpg) Therefore,

Therefore,

Sinking fund payment

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebe_b1cd_7972672fd1e9_SM2245_00.jpg)

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebf_b1cd_3dd1cd8c1888_SM2245_00.jpg) [Putting the values]

[Putting the values]

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d0_b1cd_ed67dbdad674_SM2245_00.jpg) [Add within parentheses]

[Add within parentheses]

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d1_b1cd_03a344530da7_SM2245_00.jpg) [Using calculator]

[Using calculator]

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d2_b1cd_0f14c1d7394c_SM2245_00.jpg) [Subtract the denominator]

[Subtract the denominator]

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d3_b1cd_5dfe677833c2_SM2245_00.jpg) [Divide using calculator]

[Divide using calculator]

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d4_b1cd_39b5fffcefc9_SM2245_00.jpg) [Multiply using calculator]

[Multiply using calculator]

Hence the required payment is

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d5_b1cd_b78768651989_SM2245_00.jpg) .

.

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea7_e7a7_b1cd_bdfed7989a8c_SM2245_00.jpg) Where,

Where,![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eb8_b1cd_59f516027ad3_SM2245_00.jpg) Amount needed in the future.

Amount needed in the future.![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eb9_b1cd_1b7c0030ad55_SM2245_00.jpg) interest rate per period (nominal rate

interest rate per period (nominal rate ![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0eba_b1cd_012d53cf2518_SM2245_00.jpg) periods per year)

periods per year)![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebb_b1cd_1186163c837b_SM2245_00.jpg) number of periods (years

number of periods (years ![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebc_b1cd_ebd8aad9a686_SM2245_00.jpg) periods per year)

periods per year)Here,

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebd_b1cd_a93d169f7a58_SM2245_00.jpg) Therefore,

Therefore,Sinking fund payment

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebe_b1cd_7972672fd1e9_SM2245_00.jpg)

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_0ebf_b1cd_3dd1cd8c1888_SM2245_00.jpg) [Putting the values]

[Putting the values]![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d0_b1cd_ed67dbdad674_SM2245_00.jpg) [Add within parentheses]

[Add within parentheses]![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d1_b1cd_03a344530da7_SM2245_00.jpg) [Using calculator]

[Using calculator]![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d2_b1cd_0f14c1d7394c_SM2245_00.jpg) [Subtract the denominator]

[Subtract the denominator]![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d3_b1cd_5dfe677833c2_SM2245_00.jpg) [Divide using calculator]

[Divide using calculator]![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d4_b1cd_39b5fffcefc9_SM2245_00.jpg) [Multiply using calculator]

[Multiply using calculator]Hence the required payment is

![To calculate sinking fund, use the formula sinking fund payment Where, Amount needed in the future. interest rate per period (nominal rate periods per year) number of periods (years periods per year) Here, Therefore, Sinking fund payment [Putting the values] [Add within parentheses] [Using calculator] [Subtract the denominator] [Divide using calculator] [Multiply using calculator] Hence the required payment is .](https://d2lvgg3v3hfg70.cloudfront.net/SM2245/11eb7a74_7ea8_35d5_b1cd_b78768651989_SM2245_00.jpg) .

. 4

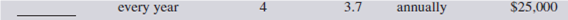

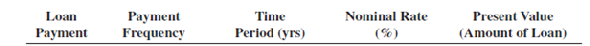

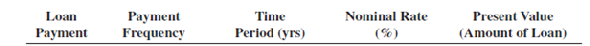

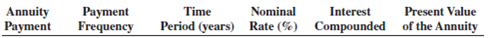

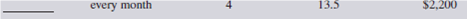

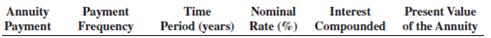

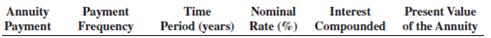

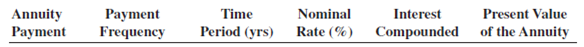

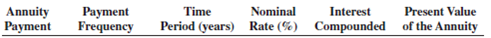

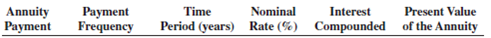

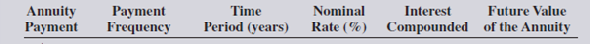

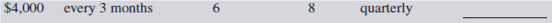

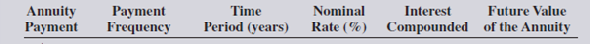

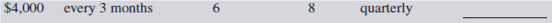

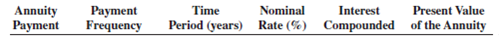

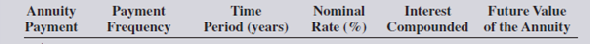

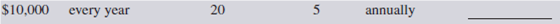

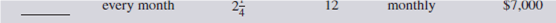

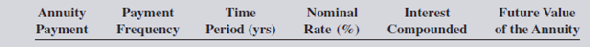

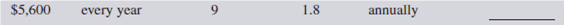

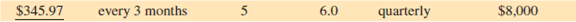

Use Table 12-1 to calculate the future value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

As part of your retirement plan, you have decided to deposit $3,000 at the beginning of each year into an account paying 5% interest compounded annually.

a. How much would the account be worth after 10 years?

b. How much would the account be worth after 20 years?

c. When you retire in 30 years, what will be the total worth of the account?

d. If you found a bank that paid 6% interest compounded annually rather than 5%, how much would you have in the account after 30 years?

e. Use the future value of an annuity due formula to calculate how much you would have in the account after 30 years if the bank in part d switched from annual compounding to monthly compounding and you deposited $250 at the beginning of each month instead of $3,000 at the beginning of each year.

a. How much would the account be worth after 10 years?

b. How much would the account be worth after 20 years?

c. When you retire in 30 years, what will be the total worth of the account?

d. If you found a bank that paid 6% interest compounded annually rather than 5%, how much would you have in the account after 30 years?

e. Use the future value of an annuity due formula to calculate how much you would have in the account after 30 years if the bank in part d switched from annual compounding to monthly compounding and you deposited $250 at the beginning of each month instead of $3,000 at the beginning of each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

Solve the following exercises by using Table 12-2.

Analysts at Sky West Airlines did a 3-year projection of expenses. They calculated that the company will need $15,800 at the beginning of each 6-month period to buy fuel, oil, lube, and parts for aircraft operations and maintenance. Sky West can get 6% interest compounded semiannually from its bank. How much should Sky West deposit now to support the next 3 years of operations and maintenance expenses

Analysts at Sky West Airlines did a 3-year projection of expenses. They calculated that the company will need $15,800 at the beginning of each 6-month period to buy fuel, oil, lube, and parts for aircraft operations and maintenance. Sky West can get 6% interest compounded semiannually from its bank. How much should Sky West deposit now to support the next 3 years of operations and maintenance expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

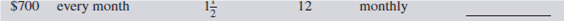

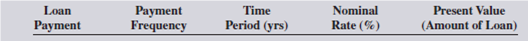

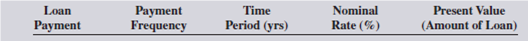

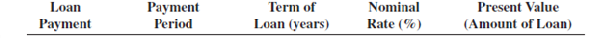

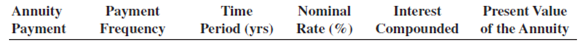

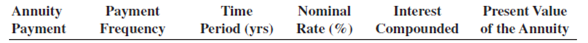

You have just been hired as a loan officer at the Eagle National Bank. Your first assignment is to calculate the amount of the periodic payment required to amortize (pay off) the following loans being considered by the bank (use Table 12-2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

Amortization payment

Randy Scott purchased a motorcycle for $8,500 with a loan amortized over 5 years at 7.2% interest. What equal monthly payments are required to amortize this loan?

Randy Scott purchased a motorcycle for $8,500 with a loan amortized over 5 years at 7.2% interest. What equal monthly payments are required to amortize this loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

The table factor for an annuity due is found by one period to the number of periods of the annuity and then subtracting from the resulting table factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

Write the formula for calculating an amortization payment by table

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sinking fund payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use Table 12-1 to calculate the future value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use Table 12-2 to calculate the present value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

Solve the following exercises by using formulas.

Present value of an ordinary annuity

Present value of an ordinary annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

You have just been hired as a loan officer at the Eagle National Bank. Your first assignment is to calculate the amount of the periodic payment required to amortize (pay off) the following loans being considered by the bank (use Table 12-2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Amortization payment

Betty Price purchased a new home for $225,000 with a 20% down payment and the remainder amortized over a 15-year period at 9% interest.

a. What amount did Betty finance?

b. What equal monthly payments are required to amortize this loan over 15 years?

c. What equal monthly payments are required if Betty decides to take a 20-year loan rather than a 15-year loan?

Betty Price purchased a new home for $225,000 with a 20% down payment and the remainder amortized over a 15-year period at 9% interest.

a. What amount did Betty finance?

b. What equal monthly payments are required to amortize this loan over 15 years?

c. What equal monthly payments are required if Betty decides to take a 20-year loan rather than a 15-year loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

What amount must be deposited now to withdraw $200 at the beginning of each month for 3 years if interest is 12% compounded monthly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amortization payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

Paragon Savings Loan is paying 6% interest compounded monthly. How much will $100 deposited at the end of each month be worth after 2 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use Table 12-2 to calculate the present value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Solve the following exercises by using formulas.

Present value of an ordinary annuity

Present value of an ordinary annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

You have just been hired as a loan officer at the Eagle National Bank. Your first assignment is to calculate the amount of the periodic payment required to amortize (pay off) the following loans being considered by the bank (use Table 12-2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

Amortization payment

The Shangri-La Hotel has a financial obligation of $1,000,000 due in 5 years for kitchen equipment. A sinking fund is established to meet this obligation at 7.5% interest compounded monthly.

a. What equal monthly sinking fund payments are required to accumulate the needed amount?

b. What is the total amount of interest earned in the account?

The Shangri-La Hotel has a financial obligation of $1,000,000 due in 5 years for kitchen equipment. A sinking fund is established to meet this obligation at 7.5% interest compounded monthly.

a. What equal monthly sinking fund payments are required to accumulate the needed amount?

b. What is the total amount of interest earned in the account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

Write the formula for calculating the future value of an ordinary annuity when using a calculator with an exponential function, yx , key.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

How much must be deposited now to withdraw $4,000 at the end of each year for 20 years if interest is 7% compounded annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

Amortization payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suntech Distributors, Inc., deposits $5,000 at the beginning of each 3-month period for 6 years in an account paying 8% interest compounded quarterly.

a. How much will be in the account at the end of the 6-year period?

b. What is the total amount of interest earned in this account?

a. How much will be in the account at the end of the 6-year period?

b. What is the total amount of interest earned in this account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use Table 12-2 to calculate the present value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

Solve the following exercises by using formulas.

Present value of an ordinary annuity

Present value of an ordinary annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

31

You have just been hired as a loan officer at the Eagle National Bank. Your first assignment is to calculate the amount of the periodic payment required to amortize (pay off) the following loans being considered by the bank (use Table 12-2).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

You are the vice president of finance for Neptune Enterprises, Inc., a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 8% compounded quarterly. It is estimated that $2,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 5% per year for the next 5 years.

a. Use the compound interest concept from Chapter 11 to determine how much will be required for the project, taking inflation into account.

b. What sinking fund payments will be required at the end of every 3-month period to accumulate the necessary funds?

a. Use the compound interest concept from Chapter 11 to determine how much will be required for the project, taking inflation into account.

b. What sinking fund payments will be required at the end of every 3-month period to accumulate the necessary funds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Mary Evans plans to buy a used car when she starts college three years from now. She can make deposits at the end of each month into a 6% sinking fund account compounded monthly. If she wants to have $14,500 available to buy the car, what should be the amount of her monthly sinking fund payments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

The town of Bay Harbor is planning to buy five new hybrid police cars in 4 years. The cars are expected to cost $38,500 each.

a. What equal quarterly payments must the city deposit into a sinking fund at 3.5% interest compounded quarterly to achieve its goal?

b. What is the total amount of interest earned in the account?

a. What equal quarterly payments must the city deposit into a sinking fund at 3.5% interest compounded quarterly to achieve its goal?

b. What is the total amount of interest earned in the account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

Dana Phipps deposits $85 each payday into an account at 12% interest compounded monthly. She gets paid on the last day of each month. How much will her account be worth at the end of 30 months?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use Table 12-2 to calculate the present value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Present value of an annuity due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

Solve the following exercises by using tables.

Everest Industries established a sinking fund to pay off a $10,000,000 loan that comes due in 8 years for a corporate yacht.

a. What equal payments must be deposited into the fund every 3 months at 6% interest compounded quarterly for Everest to meet this financial obligation?

b. What is the total amount of interest earned in this sinking fund account?

Everest Industries established a sinking fund to pay off a $10,000,000 loan that comes due in 8 years for a corporate yacht.

a. What equal payments must be deposited into the fund every 3 months at 6% interest compounded quarterly for Everest to meet this financial obligation?

b. What is the total amount of interest earned in this sinking fund account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

Write the formula for calculating the future value of an annuity due when using a calculator with an exponential function, ( yx ), key.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

A sinking fund is established by Alliance Industries at 8% interest compounded semiannually to meet a financial obligation of $1,800,000 in 4 years.

a. What periodic sinking fund payment is required every 6 months to reach the company's goal?

b. How much greater would the payment be if the interest rate was 6% compounded semiannually rather than 8%?

a. What periodic sinking fund payment is required every 6 months to reach the company's goal?

b. How much greater would the payment be if the interest rate was 6% compounded semiannually rather than 8%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Mesa Grande Bank is paying 9% interest compounded monthly.

a. If you deposit $100 into a savings plan at the beginning of each month, how much will it be worth in 10 years?

b. How much would the account be worth if the payments were made at the end of each month rather than at the beginning?

a. If you deposit $100 into a savings plan at the beginning of each month, how much will it be worth in 10 years?

b. How much would the account be worth if the payments were made at the end of each month rather than at the beginning?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

Jorge Otero has set up an annuity due with the United Credit Union. At the beginning of each month, $170 is electronically debited from his checking account and placed into a savings account earning 6% interest compounded monthly. What is the value of Jorge's account after 18 months?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use Table 12-2 to calculate the present value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

Present value of an annuity due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

Solve the following exercises by using tables.

Jennifer Kaufman bought a used Toyota Prius for $15,500. She made a $2,500 down payment and is financing the balance at Imperial Bank over a 3-year period at 12% interest. As her banker, calculate what equal monthly payments will be required by Jennifer to amortize the car loan.

Jennifer Kaufman bought a used Toyota Prius for $15,500. She made a $2,500 down payment and is financing the balance at Imperial Bank over a 3-year period at 12% interest. As her banker, calculate what equal monthly payments will be required by Jennifer to amortize the car loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use Table 12-1 to calculate the future value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

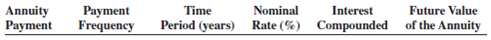

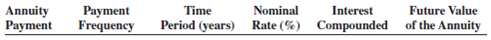

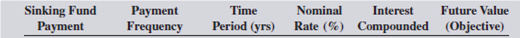

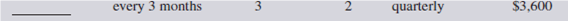

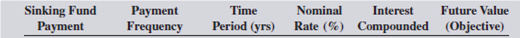

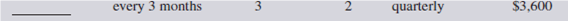

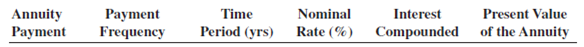

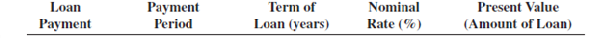

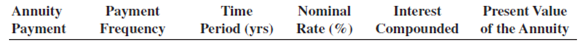

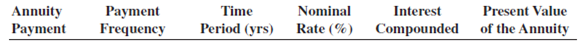

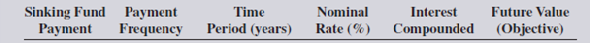

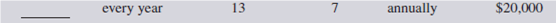

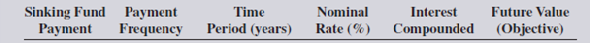

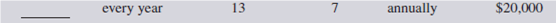

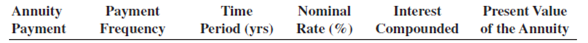

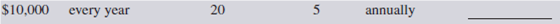

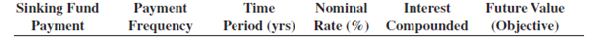

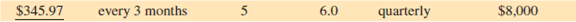

Use Table 12-1 to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity) for the following sinking funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

Lucky Strike, a bowling alley, purchased new equipment from Brunswick in the amount of $850,000. Brunswick is allowing Lucky Strike to amortize the cost of the equipment with monthly payments over 2 years at 12% interest. What equal monthly payments will be required to amortize this loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

Sandpiper Savings Loan is offering mortgages at 7.32% interest. What monthly payments would be required to amortize a loan of $200,000 for 25 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

When Ben Taylor was born, his parents began depositing $500 at the beginning of every year into an annuity to save for his college education. If the account paid 7% interest compounded annually for the first 10 years and then dropped to 5% for the next 8 years, how much is the account worth now that Ben is 18 years old and ready for college?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

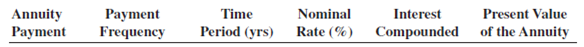

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

Present value of an annuity due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

Solve the following exercises by using tables.

Green Thumb Landscaping buys new lawn equipment every 3 years. It is estimated that $25,000 will be needed for the next purchase. The company sets up a sinking fund to save for this obligation.

a. What equal payments must be deposited every 6 months if interest is 8% compounded semiannually?

b. What is the total amount of interest earned by the sinking fund?

Green Thumb Landscaping buys new lawn equipment every 3 years. It is estimated that $25,000 will be needed for the next purchase. The company sets up a sinking fund to save for this obligation.

a. What equal payments must be deposited every 6 months if interest is 8% compounded semiannually?

b. What is the total amount of interest earned by the sinking fund?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

Payment or receipt of equal amounts of money per period for a specified amount of time is known as a(n)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

The lump sum amount of money that must be deposited today to provide a specified series of equal payments (annuity) in the future is known as the value of an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

Aaron Grider buys a home for $120,500. After a 15% down payment, the balance is financed at 8% interest for 9 years.

a. What equal quarterly payments will be required to amortize this mortgage loan?

b. What is the total amount of interest Aaron will pay on the loan?

a. What equal quarterly payments will be required to amortize this mortgage loan?

b. What is the total amount of interest Aaron will pay on the loan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

You are one of the retirement counselors at the Valley View Bank. You have been asked to give a presentation to a class of high school seniors about the importance of saving for retirement. Your boss, the vice president of the trust division, has designed an example for you to use in your presentation. The students are shown five retirement scenarios and are asked to guess which yields the most money. Note: All annuities are ordinary. Although some people stop investing, the money remains in the account at 10% interest compounded annually.

a. Look over each scenario and make an educated guess as to which investor will have the largest accumulation of money invested at 10% over the next 40 years. Then for your presentation, calculate the final value for each scenario.

• Venus invests $1,200 per year and stops after 15 years.

• Kevin waits 15 years, invests $1,200 per year for 15 years, and stops.

• Rafael waits 15 years, then invests $1,200 per year for 25 years.

• Magda waits 10 years, invests $1,500 per year for 15 years, and stops.

• Heather waits 10 years, then invests $1,500 per year for 30 years.

b. Based on the results, what message will this presentation convey to the students?

c. Recalculate each scenario as an annuity due.

d. How can the results be used in your presentation?

a. Look over each scenario and make an educated guess as to which investor will have the largest accumulation of money invested at 10% over the next 40 years. Then for your presentation, calculate the final value for each scenario.

• Venus invests $1,200 per year and stops after 15 years.

• Kevin waits 15 years, invests $1,200 per year for 15 years, and stops.

• Rafael waits 15 years, then invests $1,200 per year for 25 years.

• Magda waits 10 years, invests $1,500 per year for 15 years, and stops.

• Heather waits 10 years, then invests $1,500 per year for 30 years.

b. Based on the results, what message will this presentation convey to the students?

c. Recalculate each scenario as an annuity due.

d. How can the results be used in your presentation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Solve the following exercises by using formulas.

Ordinary Annuities

Ordinary Annuities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

Present value of an annuity due

As part of an inheritance, Joan Townsend will receive an annuity of $1,500 at the end of each month for the next 6 years. What is the present value of this inheritance at a rate of 2.4% interest compounded monthly?

As part of an inheritance, Joan Townsend will receive an annuity of $1,500 at the end of each month for the next 6 years. What is the present value of this inheritance at a rate of 2.4% interest compounded monthly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Solve the following exercises by using tables.

Paul and Donna Kelsch are planning a Mediterranean cruise in 4 years and will need $7,500 for the trip. They decide to set up a "sinking fund" savings account for the vacation. They intend to make regular payments at the end of each 3-month period into the account that pays 6% interest compounded quarterly. What periodic sinking fund payment will allow them to achieve their vacation goal?

Paul and Donna Kelsch are planning a Mediterranean cruise in 4 years and will need $7,500 for the trip. They decide to set up a "sinking fund" savings account for the vacation. They intend to make regular payments at the end of each 3-month period into the account that pays 6% interest compounded quarterly. What periodic sinking fund payment will allow them to achieve their vacation goal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use Table 12-1 to calculate the future value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use Table 12-1 to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity) for the following sinking funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Ordinary annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use Table 12-1 to calculate the future value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Solve the following exercises by using formulas.

Ordinary Annuities

Ordinary Annuities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Present value of an annuity due

Norm Legend has been awarded a scholarship from Canmore College. For the next 4 years, he will receive $3,500 for tuition and books at the beginning of each quarter. How much must the school set aside now in an account earning 3% interest compounded quarterly to pay Norm's scholarship?

Norm Legend has been awarded a scholarship from Canmore College. For the next 4 years, he will receive $3,500 for tuition and books at the beginning of each quarter. How much must the school set aside now in an account earning 3% interest compounded quarterly to pay Norm's scholarship?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

Solve the following exercises by using tables.

Valerie Ross is ready to retire and has saved $200,000 for that purpose. She wants to amortize (liquidate) that amount in a retirement fund so that she will receive equal annual payments over the next 25 years. At the end of the 25 years, no funds will be left in the account. If the fund earns 4% interest, how much will Valerie receive each year?

Valerie Ross is ready to retire and has saved $200,000 for that purpose. She wants to amortize (liquidate) that amount in a retirement fund so that she will receive equal annual payments over the next 25 years. At the end of the 25 years, no funds will be left in the account. If the fund earns 4% interest, how much will Valerie receive each year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

In a simple annuity, the number of compounding per year coincides with the number of annuity per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

The table factor for the present value of an annuity due is found by one period from the number of periods of the annuity and then adding to the resulting table factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Ordinary annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use Table 12-1 to calculate the future value of the following ordinary annuities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

Solve the following exercises by using formulas.

Ordinary Annuities

Ordinary Annuities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use Table 12-2 to calculate the present value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

Present value of an annuity due

Apollo Enterprises has been awarded an insurance settlement of $5,000 at the end of each 6-month period for the next 10 years.

a. As the accountant, calculate how much the insurance company must set aside now at 6% interest compounded semiannually to pay this obligation to Apollo.

b. How much would the insurance company have to invest now if the Apollo settlement was changed to $2,500 at the end of each 3-month period for 10 years and the insurance company earned 8% interest compounded quarterly?

c. How much would the insurance company have to invest now if the Apollo settlement was paid at the beginning of each 3-month period rather than at the end?

Apollo Enterprises has been awarded an insurance settlement of $5,000 at the end of each 6-month period for the next 10 years.

a. As the accountant, calculate how much the insurance company must set aside now at 6% interest compounded semiannually to pay this obligation to Apollo.

b. How much would the insurance company have to invest now if the Apollo settlement was changed to $2,500 at the end of each 3-month period for 10 years and the insurance company earned 8% interest compounded quarterly?

c. How much would the insurance company have to invest now if the Apollo settlement was paid at the beginning of each 3-month period rather than at the end?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

Solve the following exercises by using the sinking fund or amortization formula.

Sinking fund payment

Sinking fund payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use Table 12-1 to calculate the future value of the following annuities due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

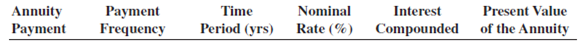

Use Table 12-2 to calculate the amount of the periodic payment required to amortize (pay off) the following loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck