Deck 5: The Standard Trade Model

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/12

العب

ملء الشاشة (f)

Deck 5: The Standard Trade Model

1

Assume Norway and Sweden trade with each other, with Norway exporting fish to Sweden, and Sweden exporting Volvos (automobiles) to Norway. Illustrate the gains from trade between the two countries using the standard trade model, assuming first that tastes for the goods are the same in both countries, but that the production possibility frontiers differ: Norway has a long coast that borders on the north Atlantic, making it relatively more productive in fishing. Sweden has a greater endowment of capital, making it relatively more productive in automobiles.

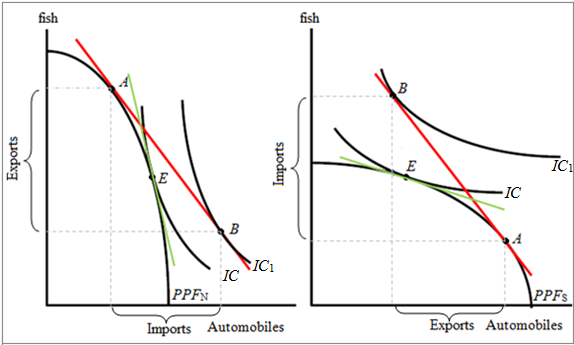

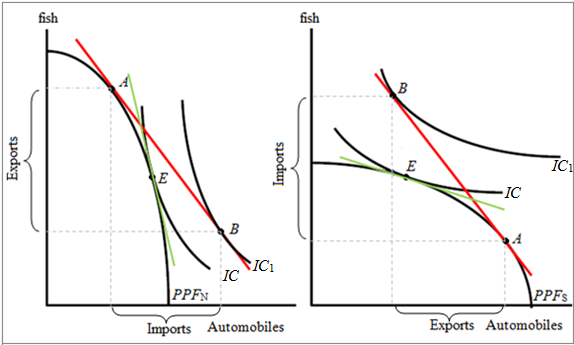

Under standard trade model, production possibilities frontiers are, isovalue lines, and indifference curves are combined together to illustrate the trade patterns between countries and the resultant gains from the trade. In the given case, Norway and Sweden will have two different production possibility curves which are represented as PPF N and PPF S in the following diagrams.

Figure (a)for Norway Figure (b)for Sweden

PPF of Norway Sweden

PPF of Norway Sweden

PPF N and PPF S indicate the different combinations of fish and automobiles that can be produced within the given resources of each country. It is to be noticed that PPF N will be a steeper one implying that the country is relatively more productive in fishing and PPF S will be a flatter one implying the country is relatively more productive in automobiles.

In the absence of trade, the economy of the Norway and Sweden will produce at a point on the respective PPF s where it is tangent to the respective highest possible isovalue line (a line along which the value of output is constant and whose slope is equal to minus the ratio of relative price of the two goods). As, we know that the value of an economy's consumption equals the value of its production, so the production point and the consumption point must lie on the same isovalue line. Therefore, in a pre-trade situation, at the point of tangency between PPF S and isovalue lines, the respective highest indifference curve will also be tangent which is shown by point E in figure (a)for Norway and in figure (b)for Sweden.

When trade is opened between the two countries, the isovalue lines in Norway and Sweden will shift as shown in the respective figures in red color. The movement of production and trade will move production from point E to point A in both the countries. At the new production point, both countries will be able to trade to a final consumption point (point B )on a higher indifference curve IC 1 than the original indifference curve IC. At point B , consumers of both the countries are better off. At point B , Norway's exports fish are matched by Sweden's imports of fish. In the same way, the amount of exports of automobiles of Sweden is matched by that of Norway's imports. Thus, both Norway and Sweden gain from trade.

Figure (a)for Norway Figure (b)for Sweden

PPF of Norway Sweden

PPF of Norway Sweden PPF N and PPF S indicate the different combinations of fish and automobiles that can be produced within the given resources of each country. It is to be noticed that PPF N will be a steeper one implying that the country is relatively more productive in fishing and PPF S will be a flatter one implying the country is relatively more productive in automobiles.

In the absence of trade, the economy of the Norway and Sweden will produce at a point on the respective PPF s where it is tangent to the respective highest possible isovalue line (a line along which the value of output is constant and whose slope is equal to minus the ratio of relative price of the two goods). As, we know that the value of an economy's consumption equals the value of its production, so the production point and the consumption point must lie on the same isovalue line. Therefore, in a pre-trade situation, at the point of tangency between PPF S and isovalue lines, the respective highest indifference curve will also be tangent which is shown by point E in figure (a)for Norway and in figure (b)for Sweden.

When trade is opened between the two countries, the isovalue lines in Norway and Sweden will shift as shown in the respective figures in red color. The movement of production and trade will move production from point E to point A in both the countries. At the new production point, both countries will be able to trade to a final consumption point (point B )on a higher indifference curve IC 1 than the original indifference curve IC. At point B , consumers of both the countries are better off. At point B , Norway's exports fish are matched by Sweden's imports of fish. In the same way, the amount of exports of automobiles of Sweden is matched by that of Norway's imports. Thus, both Norway and Sweden gain from trade.

2

In the trade scenario in problem 1, due to overfishing, Norway becomes unable to catch the quantity of fish that it could in previous years. This change causes both a reduction in the potential quantity of fish that can be produced in Norway and an increase in the relative world price for fish,

a. Show how the overfishing problem can result in a decline in welfare for Norway.

b. Also show how it is possible that the overfishing problem could result in an increase in welfare for Norway.

a. Show how the overfishing problem can result in a decline in welfare for Norway.

b. Also show how it is possible that the overfishing problem could result in an increase in welfare for Norway.

Gains from trade refer to net benefits due to allowing free trade with each other and increasing the volume of trade with lower tariffs. Thus, gains from trade increase the consumer surplus, and producer surplus and welfare of the countries.

Assumptions:

1. There are two countries (country N, and country S)2. There are two goods (fish, and Volvos)3. Tastes and preferences are same in both countries.

In the problem, it is given that country N specializes in the production of fish due to having a long coast that borders on the north Atlantic. Thus, the country N is exporting fish to country S.

Country S specializes in the production of Volvos due to having a greater endowment of capital. Thus, the country S is exporting Volvos to country N.

Thus, both the countries are gaining from the trade. Welfare in both countries increases as the two countries move from production patterns governed by domestic prices to production governed by world prices.

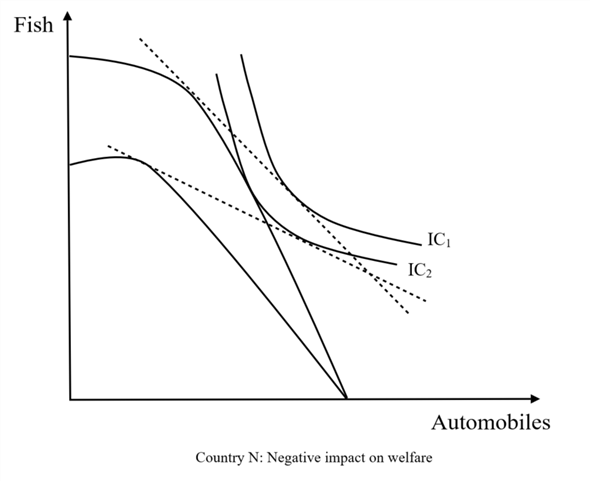

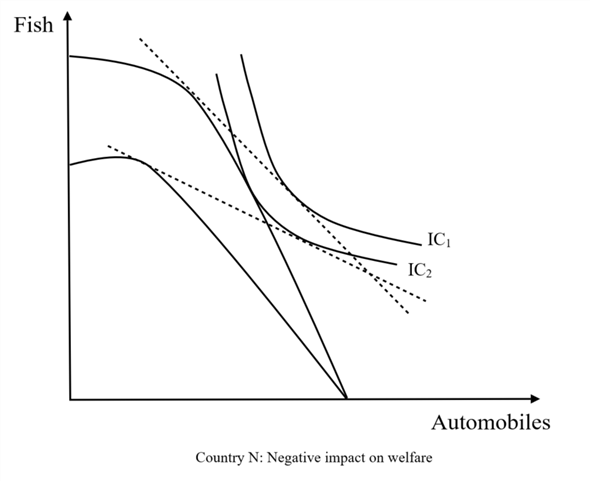

a)The overfishing problem can result in a decline in welfare for country N.

Due to over fishing, there is reduction of country N production possibilities away from fish. This is happened due to fall in the production of fish relative to automobiles. Thus, country N moves down to IC 2 which represent fall in welfare.

Due to over fishing, there is reduction of country N production possibilities away from fish. This is happened due to fall in the production of fish relative to automobiles. Thus, country N moves down to IC 2 which represent fall in welfare.

The reduction of country N 's production possibilities away from fish cause the production of fish relative to automobiles to fall. Thus, despite the higher relative price of fish exports, country ' N ' moves down to a lower indifference curve representing a drop in welfare.

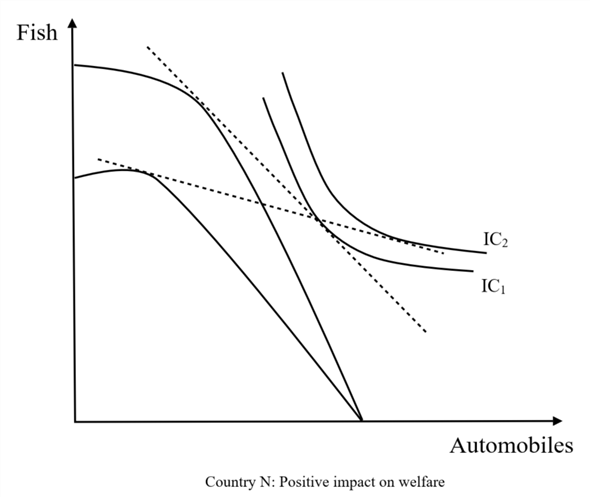

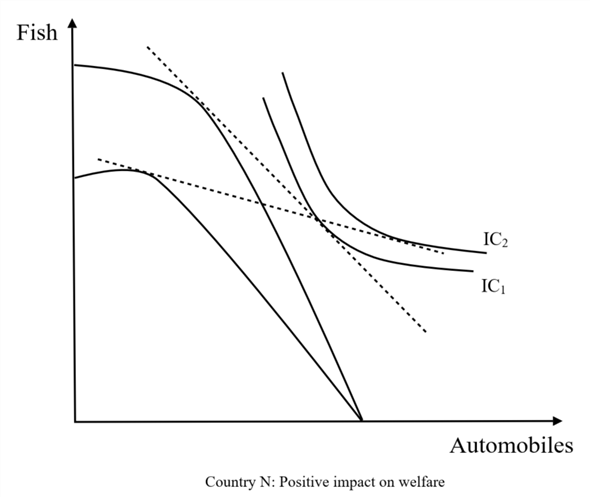

b)The overfishing problem could result in an increase in welfare for Norway.

The increase in the relative price of fish shifts causes country N 's relative production of fish to rise (despite the reduction in fish productivity). Thus, the increase in the relative price

The increase in the relative price of fish shifts causes country N 's relative production of fish to rise (despite the reduction in fish productivity). Thus, the increase in the relative price

of fish exports allows country ' N ' to move to a higher indifference curve and higher welfare.

Thus, from the above diagrams, it is clear that both countries are gaining from trade. In the above graphs, indifference curves shift to rightward from IC1 to IC2. This means, the welfare of both countries increase due to the free trade.

Assumptions:

1. There are two countries (country N, and country S)2. There are two goods (fish, and Volvos)3. Tastes and preferences are same in both countries.

In the problem, it is given that country N specializes in the production of fish due to having a long coast that borders on the north Atlantic. Thus, the country N is exporting fish to country S.

Country S specializes in the production of Volvos due to having a greater endowment of capital. Thus, the country S is exporting Volvos to country N.

Thus, both the countries are gaining from the trade. Welfare in both countries increases as the two countries move from production patterns governed by domestic prices to production governed by world prices.

a)The overfishing problem can result in a decline in welfare for country N.

Due to over fishing, there is reduction of country N production possibilities away from fish. This is happened due to fall in the production of fish relative to automobiles. Thus, country N moves down to IC 2 which represent fall in welfare.

Due to over fishing, there is reduction of country N production possibilities away from fish. This is happened due to fall in the production of fish relative to automobiles. Thus, country N moves down to IC 2 which represent fall in welfare.The reduction of country N 's production possibilities away from fish cause the production of fish relative to automobiles to fall. Thus, despite the higher relative price of fish exports, country ' N ' moves down to a lower indifference curve representing a drop in welfare.

b)The overfishing problem could result in an increase in welfare for Norway.

The increase in the relative price of fish shifts causes country N 's relative production of fish to rise (despite the reduction in fish productivity). Thus, the increase in the relative price

The increase in the relative price of fish shifts causes country N 's relative production of fish to rise (despite the reduction in fish productivity). Thus, the increase in the relative price of fish exports allows country ' N ' to move to a higher indifference curve and higher welfare.

Thus, from the above diagrams, it is clear that both countries are gaining from trade. In the above graphs, indifference curves shift to rightward from IC1 to IC2. This means, the welfare of both countries increase due to the free trade.

3

In some economies relative supply may be unresponsive to changes in prices. For example, if factors of production were completely immobile between sectors, the production possibility frontier would be right-angled, and output of the two goods would not depend on their relative prices. Is it still true in this case that a rise in the terms of trade increases welfare? Analyze graphically.

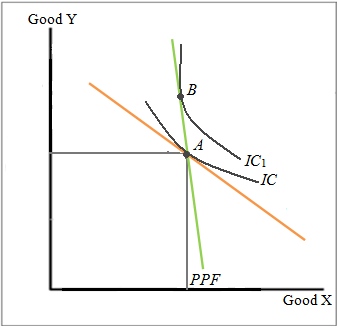

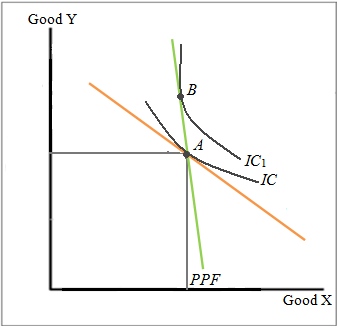

________________________________________________________________________Changes in relative price generally affects the relative supply of goods. But sometimes countries are unresponsive to a change in relative price. If there is no substitution of factors of production between various sectors, the relative supply cannot be altered. In such cases, the production possibility frontier ( PPF )will be right-angled indicating that the country will produce the two goods in rigid ratio and the output of the two goods is free from the relative prices. The shape of the PPF will be rectangle-shaped which is shown in the diagram below:

Right-angled PPF

Right-angled PPF

The production point on the rectangle-shaped PPF is the corner point A at which the original relative price line (red color)is tangent. The consumption point is also at the point A where the red relative price line is tangent to the highest indifference curve IC. Now, when terms of trade improve, there will be no change in the production point because of immobility of factors of production. But the relative price line will rotate clockwise so that the new relative price line (green color)still touches the original production point A. The new relative price line will be tangent to a higher indifference curve IC 1 at point B. This indicates that a rise in terms of trade increases the welfare. Even though the country does not produce more, its export earnings are more than its import payments which enables them to improve their welfare.

Right-angled PPF

Right-angled PPF The production point on the rectangle-shaped PPF is the corner point A at which the original relative price line (red color)is tangent. The consumption point is also at the point A where the red relative price line is tangent to the highest indifference curve IC. Now, when terms of trade improve, there will be no change in the production point because of immobility of factors of production. But the relative price line will rotate clockwise so that the new relative price line (green color)still touches the original production point A. The new relative price line will be tangent to a higher indifference curve IC 1 at point B. This indicates that a rise in terms of trade increases the welfare. Even though the country does not produce more, its export earnings are more than its import payments which enables them to improve their welfare.

4

The counterpart to immobile factors on the supply side would be lack of substitution on the demand side. Imagine an economy where consumers always buy goods in rigid proportions-for example, one yard of cloth for every pound of food-regardless of the prices of the two goods. Show that an improvement in the terms of trade benefits this economy as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

5

Japan primarily exports manufactured goods, while importing raw materials such as food and oil. Analyze the impact on Japan's terms of trade of the following events:

a. A war in the Middle East disrupts oil supply.

b. Korea develops the ability to produce automobiles that it can sell in Canada and the United States.

c. U.S. engineers develop a fusion reactor that replaces fossil fuel electricity plants.

d. A harvest failure in Russia.

e. A reduction in Japan's tariffs on imported beef and citrus fruit.

a. A war in the Middle East disrupts oil supply.

b. Korea develops the ability to produce automobiles that it can sell in Canada and the United States.

c. U.S. engineers develop a fusion reactor that replaces fossil fuel electricity plants.

d. A harvest failure in Russia.

e. A reduction in Japan's tariffs on imported beef and citrus fruit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Internet has allowed for increased trade in services such as programming and technical support, a development that has lowered the prices of such services relative to those of manufactured goods. India in particular has been recently viewed as an "exporter" of technology-based services, an area in which the United States had been a major exporter. Using manufacturing and services as tradable goods, create a standard trade model for the U.S. and Indian economies that shows how relative price declines in exportable services that lead to the "outsourcing" of services can reduce welfare in the United States and increase welfare in India.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

7

Countries A and B have two factors of production, capital and labor, with which they produce two goods, X and Y. Technology is the same in the two countries. X is capital-intensive; A is capital-abundant. Analyze the effects on the terms of trade and on the two countries' welfare of the following:

a. An increase in A's capital stock.

b. An increase in A's labor supply.

c. An increase in B's capital stock.

d. An increase in B's labor supply.

a. An increase in A's capital stock.

b. An increase in A's labor supply.

c. An increase in B's capital stock.

d. An increase in B's labor supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

8

Economic growth is just as likely to worsen a country's terms of trade as it is to improve them. Why, then, do most economists regard immiserizing growth, where growth actually hurts the growing country, as unlikely in practice?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

9

From an economic point of view, India and China are somewhat similar: Both are huge, low-wage countries, probably with similar patterns of comparative advantage, which until recently were relatively closed to international trade. China was the first to open up. Now that India is also opening up to world trade, how would you expect this to affect the welfare of China? Of the United States? (Hint: Think of adding a new economy identical to that of China to the world economy.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose Country X subsidizes its exports and Country Y imposes a "countervailing" tariff that offsets the subsidy's effect, so that in the end, relative prices in Country Y are unchanged. What happens to the terms of trade? What about welfare in the two countries? Suppose, on the other hand, that Country Y retaliates with an export subsidy of its own. Contrast the result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

11

Explain the analogy between international borrowing and lending and ordinary international trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following countries would you expect to have intertemporal production possibilities biased toward current consumption goods, and which biased toward future consumption goods? a. A country like Argentina or Canada in the last century that has only recently been opened for large-scale settlement and is receiving large inflows of immigrants.

B) A country like the United Kingdom in the late 19th century or the United States today that leads the world technologically but is seeing that lead eroded as other countries catch up.

C) A country like Saudi Arabia that has discovered large oil reserves that can be exploited with little new investment.

D) A country that has discovered large oil reserves that can be exploited only with massive investment, such as Norway, whose oil lies under the North Sea.

E) A country like South Korea that has discovered the knack of producing industrial goods and is rapidly gaining on advanced countries.

B) A country like the United Kingdom in the late 19th century or the United States today that leads the world technologically but is seeing that lead eroded as other countries catch up.

C) A country like Saudi Arabia that has discovered large oil reserves that can be exploited with little new investment.

D) A country that has discovered large oil reserves that can be exploited only with massive investment, such as Norway, whose oil lies under the North Sea.

E) A country like South Korea that has discovered the knack of producing industrial goods and is rapidly gaining on advanced countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck