Deck 9: Accounting for Depreciation and Income Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 9: Accounting for Depreciation and Income Taxes

1

Identify which of the following expenditures is considered as a capital expenditure that must be capitalized (depreciated):

(a) Purchase land to build a warehouse at $300,000.

(b) Purchased a copy machine at $15,000.

(c) Installed a conveyor system at a cost of $55,000 to automate some part of production processes.

(d) Painted the office building, both interior and exterior, at a cost of $22,000.

(e) Repaved the parking lot at a cost of $25,000.

(f) Installed a purified water fountain in the employee lounge at a cost of $3,000.

(g) Purchased a spare part for a stamping machine at a cost of $3,800.

(h) Paid $12,000 to lease a dump truck for six months.

(i) Purchased a patent on an energy-saving device over five years at a cost of $30,000.

(a) Purchase land to build a warehouse at $300,000.

(b) Purchased a copy machine at $15,000.

(c) Installed a conveyor system at a cost of $55,000 to automate some part of production processes.

(d) Painted the office building, both interior and exterior, at a cost of $22,000.

(e) Repaved the parking lot at a cost of $25,000.

(f) Installed a purified water fountain in the employee lounge at a cost of $3,000.

(g) Purchased a spare part for a stamping machine at a cost of $3,800.

(h) Paid $12,000 to lease a dump truck for six months.

(i) Purchased a patent on an energy-saving device over five years at a cost of $30,000.

Depreciation:

Depreciation refers to decrease in the value of asset over the period of time. In order to maintain the asset with the same condition (Avoid the reduction in the asset value) firm has to incur some cost equal to depreciation value.

a.Purchase of land:

To maintain the land for the present use over the years it requires some maintenance cost. Thus, it involves depreciation.

b.Purchase of coffee machine:

To maintain the coffee machine's efficiency at same level over the years, it requires maintenance cost. Thus, it involves depreciation.

c.Installing conveyor system:

Conveyor system is the part of the system which can be considered as the spare parts of the system. It does not require any maintenance cost. If the spare parts not working properly, then it will be replaced. Thus, it does not involves depreciation..

d.Painting the building:

Painting the building is kind of maintenance cost. Thus, it does not involve depreciation :

e. Repaved the parking lot:

Re paved the parking lot is considered as an asset. It requires the maintenance cost to maintain its present level of use over the year. Thus, it involves depreciation.

f. Installing water purifier:

Water purifier requires maintenance cost to keep its efficiency level remain same over the years. Thus, it involves depreciation.

g. Purchase of spare parts:

Spare parts do not require any maintenance cost.. If the spare parts not working properly, then it will be replaced. Thus, it does not involve depreciation.

h. Lease payment for truck:

Truck requires maintenance cost to keep its efficiency same level over the six month period. Thu s, it involves depreciation.

i. Purchase of patent:

Patent does ot requires any maintenance cost. Thus, it does not involve depreciation.

Depreciation refers to decrease in the value of asset over the period of time. In order to maintain the asset with the same condition (Avoid the reduction in the asset value) firm has to incur some cost equal to depreciation value.

a.Purchase of land:

To maintain the land for the present use over the years it requires some maintenance cost. Thus, it involves depreciation.

b.Purchase of coffee machine:

To maintain the coffee machine's efficiency at same level over the years, it requires maintenance cost. Thus, it involves depreciation.

c.Installing conveyor system:

Conveyor system is the part of the system which can be considered as the spare parts of the system. It does not require any maintenance cost. If the spare parts not working properly, then it will be replaced. Thus, it does not involves depreciation..

d.Painting the building:

Painting the building is kind of maintenance cost. Thus, it does not involve depreciation :

e. Repaved the parking lot:

Re paved the parking lot is considered as an asset. It requires the maintenance cost to maintain its present level of use over the year. Thus, it involves depreciation.

f. Installing water purifier:

Water purifier requires maintenance cost to keep its efficiency level remain same over the years. Thus, it involves depreciation.

g. Purchase of spare parts:

Spare parts do not require any maintenance cost.. If the spare parts not working properly, then it will be replaced. Thus, it does not involve depreciation.

h. Lease payment for truck:

Truck requires maintenance cost to keep its efficiency same level over the six month period. Thu s, it involves depreciation.

i. Purchase of patent:

Patent does ot requires any maintenance cost. Thus, it does not involve depreciation.

2

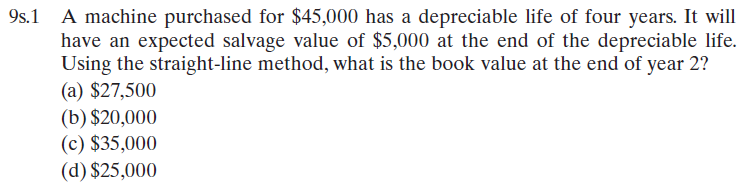

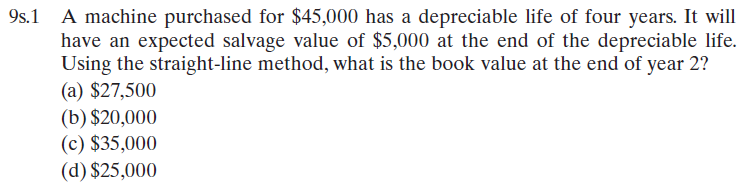

A machine purchased for $45,000 has a depreciable life of four years. It will have an expected salvage value of $5,000 at the end of the depreciable life. Using the straight-line method, what is the book value at the end of year 2? (a) $27,500

(b) $20,000

(c) $35,000

(d) $25,000

(b) $20,000

(c) $35,000

(d) $25,000

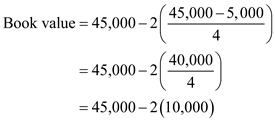

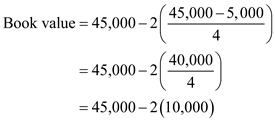

Given information:

• Price of machine is $45,000.

• Salvage value is $5,000.

• Depreciation period is 4 years.

• Time period is 2 years.

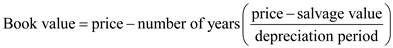

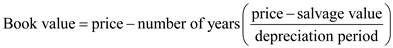

Book value:

Book value can be calculated by using the following formula. …… (1)Substitute the respective values in Equation (1) to calculate the book value at the end of year 2.

…… (1)Substitute the respective values in Equation (1) to calculate the book value at the end of year 2.

Book value at end of the year 2 is

Book value at end of the year 2 is  .

.

Hence, option (d) is correct.

• Price of machine is $45,000.

• Salvage value is $5,000.

• Depreciation period is 4 years.

• Time period is 2 years.

Book value:

Book value can be calculated by using the following formula.

…… (1)Substitute the respective values in Equation (1) to calculate the book value at the end of year 2.

…… (1)Substitute the respective values in Equation (1) to calculate the book value at the end of year 2.

Book value at end of the year 2 is

Book value at end of the year 2 is  .

.Hence, option (d) is correct.

3

You purchased a machine four years ago at a cost of $5,000. It has a book value of $1,300. It can be sold now for $2,300, or it could be used for three more years, at the end of which time it would have no salvage value. Assuming it is kept for three more years, what is the amount of economic loss during this ownership?

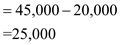

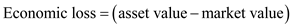

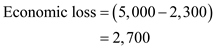

Given information:

• Price of machine is $5,000.

• Book value after 4 year is $1,300.

• Machine can be sold at the value of $2,300 after 4 years.

• There is no salvage value if the machine is used for 3 more years.

• Double decline balance method is used for depreciation.

• Time period is 2 years.

Economic loss for first four years:

Economic loss can be calculated by using the following formula. …… (1)Substitute the respective values in Equation (1) to calculate the economic loss for the first 4 years.

…… (1)Substitute the respective values in Equation (1) to calculate the economic loss for the first 4 years.  Economic loss at end of the year 4 is

Economic loss at end of the year 4 is  .

.

Economic loss for three more years' usage:

Substitute the respective values in Equation (1) to calculate the economic loss for 3 more years. Economic loss for 3 more years is

Economic loss for 3 more years is  .

.

• Price of machine is $5,000.

• Book value after 4 year is $1,300.

• Machine can be sold at the value of $2,300 after 4 years.

• There is no salvage value if the machine is used for 3 more years.

• Double decline balance method is used for depreciation.

• Time period is 2 years.

Economic loss for first four years:

Economic loss can be calculated by using the following formula.

…… (1)Substitute the respective values in Equation (1) to calculate the economic loss for the first 4 years.

…… (1)Substitute the respective values in Equation (1) to calculate the economic loss for the first 4 years.  Economic loss at end of the year 4 is

Economic loss at end of the year 4 is  .

. Economic loss for three more years' usage:

Substitute the respective values in Equation (1) to calculate the economic loss for 3 more years.

Economic loss for 3 more years is

Economic loss for 3 more years is  .

. 4

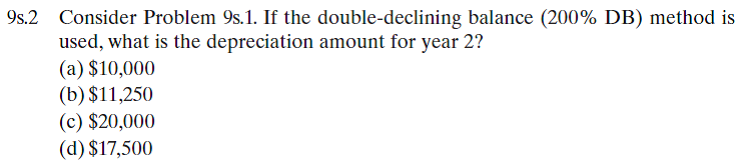

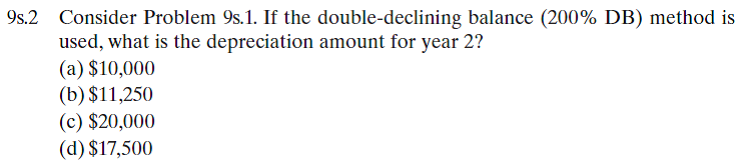

Consider Problem 9s.1. If the double-declining balance (200% DB) method is used, what is the depreciation amount for year 2? (a) $10,000

(b) $11,250

(c) $20,000

(d) $17,500

(b) $11,250

(c) $20,000

(d) $17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

A builder paid $120,000 for a house and lot. The value of the land was appraised at $65,000, and the value of the house at $55,000. The house was then torn down at an additional cost of $8,000 so that a warehouse could be built on the lot at a cost of $50,000. What is the total value of the property with the warehouse? For depreciation purposes, what is the cost basis for the warehouse?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Consider problem 9s.2. Suppose the salvage value at the end of year 4 is estimated to be $10,000 instead of $5,000. If the 200% method is used, what is the depreciation amount for year 3? a. $5,625

B) $10,000

C) $12,000

D) $18,000

B) $10,000

C) $12,000

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

Nelson Company purchased equipment and incurred the following costs:

Cash price = $55,000

Sales taxes = $4,400

Insurance during transit = $400

Site preparation, installation, and testing = $2,300

What amount should be used as the cost basis of the equipment?

Cash price = $55,000

Sales taxes = $4,400

Insurance during transit = $400

Site preparation, installation, and testing = $2,300

What amount should be used as the cost basis of the equipment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

A trucking company computes depreciation on its vehicles by a mileage basis. Suppose a delivery truck has a cost of $20,000, a salvage value of $2,000, and an estimated useful life of 200,000 miles. Determine the depreciation rate per mile. (a) $0.08

(b) $0.09

(c) $0.10

(d) $0.11

(b) $0.09

(c) $0.10

(d) $0.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

You purchased a new molding machine for $155,000 by trading in a similar machine that had a book value of $18,000. Assuming that the trade-in allowance was $20,000 and that $85,000 cash was paid for the new asset, what is the cost basis of the new molding machine for depreciation purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company purchased a drill press priced at $170,000 in year 0. The company additionally incurred $30,000 for site preparation and labor to install the machine. The drill press was classified as a seven-year MACRS class property. The company is considering selling the drill press for $70,000 at the end of year 4. Compute the book value at the end of year 4 that should be used in calculating the taxable gains. (a) $62,480

(b) $53,108

(c) $63,725

(d) $74,970

(b) $53,108

(c) $63,725

(d) $74,970

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

You acquire a grinder priced at $65,000 by trading in a similar grinder and paying cash for the remaining balance. Assuming that the trade-in allowance is $11,000 and the book value of the asset traded in is $12,000, what is the cost basis of the new grinder for the computation of depreciation for tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose that you placed a commercial building (warehouse) in service in January. The cost of property is $300,000, which includes the $100,000 value of land. Determine the amount of depreciation that is allowed during the first year of ownership. (a) $7,692

(b) $5,128

(c) $7,372

(d) $4,915

(b) $5,128

(c) $7,372

(d) $4,915

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

To automate one of its production processes, Milwaukee Corporation bought three flexible manufacturing cells at a price of $400,000 each. When they were delivered, Milwaukee paid freight charges of $30,000 and handling fees of $15,000. Site preparation for these cells cost $50,000. Six employees, each earning $15 an hour, worked five 40-hour weeks to set up and test the manufacturing cells. Special wiring and other materials applicable to the new manufacturing cells cost $2,000. Determine the cost basis (the amount to be capitalized) for these cells.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Centronix Corporation purchased new equipment with an estimated useful life of five years. The cost of the equipment was $200,000, and the residual (salvage) value was estimated to be $25,000. In purchasing the new equipment, an old machine was traded in that had an original cost of $180,000, and had been depreciated at the rate of $18,000 a year. The trade-in allowance was $21,000, and accumulated depreciation amounted to $144,000 at the time of the exchange. What should be the cost basis of the new equipment for tax depreciation purposes? (a) $200,000

(b) $215,000

(c) $175,000

(d) $190,000

(b) $215,000

(c) $175,000

(d) $190,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

El Dorado Machinery Company purchased a delivery truck at a cost of $32,000 on February 8, 2012. The truck has a useful life of six years with an estimated salvage value of $5,000. Compute the annual depreciation for the first two years using

(a) The straight-line method.

(b) The 150% declining-balance method.

(a) The straight-line method.

(b) The 150% declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

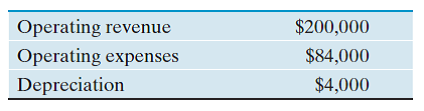

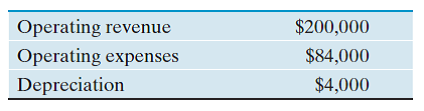

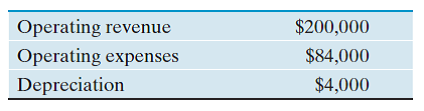

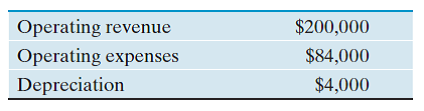

Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year:

If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

(a) $28,700

(b) $81,200

(c) $78,400

(d) $25,900

If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

(a) $28,700

(b) $81,200

(c) $78,400

(d) $25,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

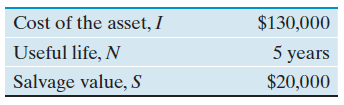

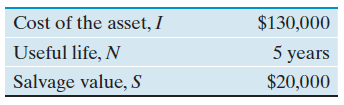

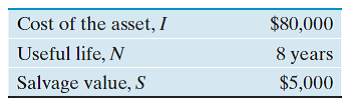

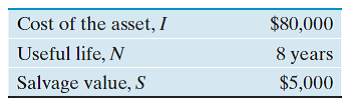

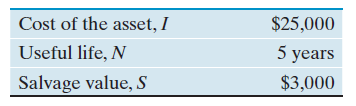

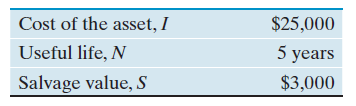

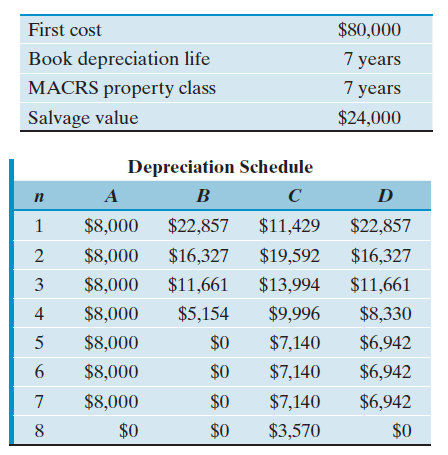

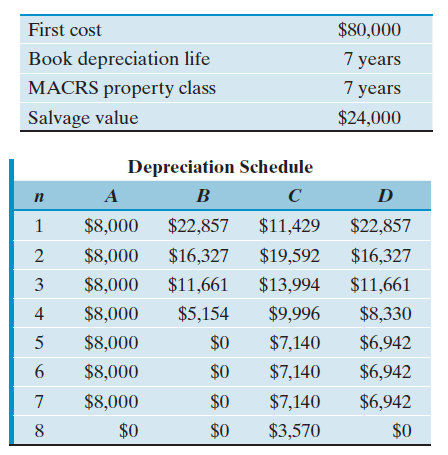

Consider the following data on an asset:

Compute the annual depreciation allowance and the resulting book values using the following methods:

(a) The straight-line depreciation method.

(b) The double-declining-balance method.

Compute the annual depreciation allowance and the resulting book values using the following methods:

(a) The straight-line depreciation method.

(b) The double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

In Problem 9s.8, assume for the moment that (1) all sales were for cash and (2) all costs, except depreciation, were paid during year 1. How much cash would have been generated from operations? (a) $82,400

(b) $32,700

(c) $85,200

(d) $3,400

9s)8 Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year:

If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

(a) $28,700

(b) $81,200

(c) $78,400

(d) $25,900

(b) $32,700

(c) $85,200

(d) $3,400

9s)8 Omar Shipping Company bought a tugboat for $75,000 (year 0) and expected to use it for five years after which it will be sold for $12,000. Suppose the company estimates the following revenues and expenses from the tugboat investment for the first operating year:

If the company pays taxes at the rate of 30% on its taxable income, what is the net income during the first year?

(a) $28,700

(b) $81,200

(c) $78,400

(d) $25,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

Compute the double-declining-balance depreciation schedule for an asset with the following data:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

Minolta Machine Shop just purchased a computer-controlled vertical drill press for $100,000. The drill press is classified as a three-year MACRS property. Minolta is planning to use the press for five years. Then Minolta will sell the press at the end of its service life for $20,000. The annual revenues are estimated to be $110,000. If the estimated net cash flow at the end of year 5 is $30,000, what are the estimated operating and maintenance expenses in year 5? Minolta's income tax rate is 40%. (a) $60,000

(b) $65,000

(c) $80,000

(d) $88,333

(b) $65,000

(c) $80,000

(d) $88,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

A firm is trying to decide whether to keep an item of construction equipment another year. The firm is using the DDB method for book purposes, and this is the fourth year of ownership of the equipment. The item cost $200,000 when it was new. What is the depreciation in year 3? Assume that the depreciable life of the equipment is eight years with zero salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Consider a five-year MACRS asset, which can be purchased at $80,000. The salvage value of this asset is expected to be $42,000 at the end of three years. What is the amount of gain (or loss) when the asset is disposed of at the end of three years? (a) Gain $11,280

(b) Gain $9,860

(c) Loss $9,860

(d) Gain $18,960

(b) Gain $9,860

(c) Loss $9,860

(d) Gain $18,960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Consider the following data on an asset:

Compute the annual depreciation allowances and the resulting book values by using the DDB method and then switching to the SL method.

Compute the annual depreciation allowances and the resulting book values by using the DDB method and then switching to the SL method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

You purchased a stamping machine that cost $60,000 five years ago. At that time, the machine was estimated to have a service life of five years with salvage value of $5,000. These estimates are still good. The property has been depreciated according to a seven-year MACRS property class. Now (at the end of year 5 from purchase) you are considering selling the machine at $10,000. What book value should you use in determining the taxable gains? (a) $10,000

(b) $13,386

(c) $16,065

(d) $17,520

(b) $13,386

(c) $16,065

(d) $17,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

The double-declining-balance method is to be used for an asset with a cost of $90,000, estimated salvage value of $12,000, and estimated useful life of five years. (a) What is the depreciation for the first three tax years, assuming that the asset was placed in service at the beginning of the year?

(b) If switching to the straight-line method is allowed, when is the optimal time to switch?

(b) If switching to the straight-line method is allowed, when is the optimal time to switch?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Compute the 175% DB depreciation schedule for an asset with the following data:

(a) What is the value of ??

(b) What is the amount of depreciation for the first full year of use?

(c) What is the book value of the asset at the end of the fourth year?

(a) What is the value of ??

(b) What is the amount of depreciation for the first full year of use?

(c) What is the book value of the asset at the end of the fourth year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Sanders LLC purchased new packaging equipment with an estimated useful life of five years. The cost of the equipment was $30,000, and the salvage value was estimated to be $3,000 at the end of five years. Compute the annual depreciation expenses through the five-year life of the equipment under each of the following methods of book depreciation:

(a) The straight-line method.

(b) The double-declining-balance method. (Limit the depreciation expense in the fifth year to an amount that will cause the book value of the equipment at year-end to equal the $3,000 estimated salvage value.)

(a) The straight-line method.

(b) The double-declining-balance method. (Limit the depreciation expense in the fifth year to an amount that will cause the book value of the equipment at year-end to equal the $3,000 estimated salvage value.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

You purchased a molding machine at a cost of $88,000. It has an estimated useful life of 12 years with a salvage value of $8,000. Determine the following:

(a) The amount of annual depreciation computed by the straight-line method.

(b) The amount of depreciation for the third year computed by using the double declining-balance method.

(a) The amount of annual depreciation computed by the straight-line method.

(b) The amount of depreciation for the third year computed by using the double declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

New York Limousine Service owns 10 limos and uses the units-of-production method in computing depreciations on its limos. Each limo costing $32,000 is expected to be driven 200,000 miles and is expected to have a salvage value of $3,000. Limo #1 was driven 24,000 miles in year 1 and 28,000 miles in year 2. Determine the depreciation for each year and the book value at the end of year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

A truck for hauling coal has an estimated net cost of $85,000 and is expected to give service for 250,000 miles, resulting in a salvage value of $5,000. Compute the allowed depreciation amount for the truck usage at 55,000 miles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

A diesel-powered generator with a cost of $60,000 is expected to have a useful operating life of 50,000 hours. The expected salvage value of this generator is $8,000. In its first operating year, the generator was operated for 5,000 hours. Determine the depreciation for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

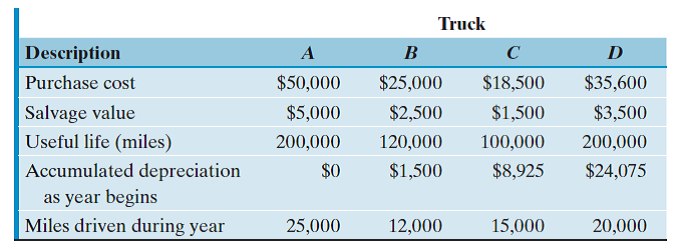

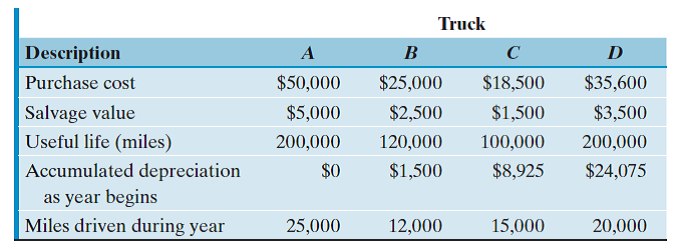

Ingot Land Company owns four trucks dedicated primarily to its landfill business. The company's accounting record indicates the following:

Determine the amount of depreciation for each truck during the year.

Determine the amount of depreciation for each truck during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

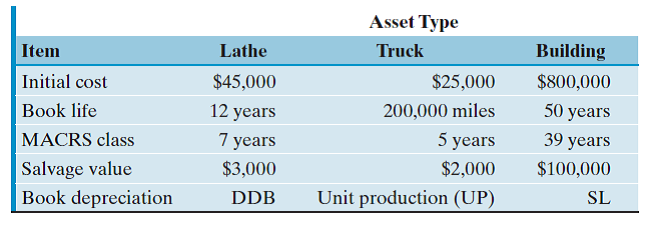

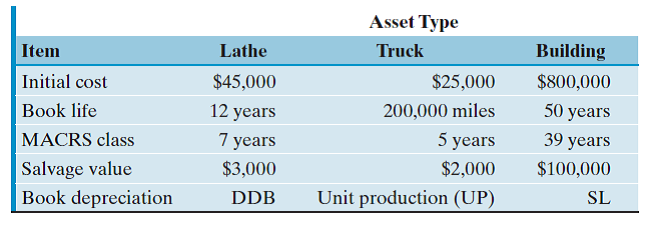

A manufacturing company has purchased three assets:

The truck was depreciated by the units-of-production method. Usage of the truck was 22,000 miles and 25,000 miles during the first two years, respectively.

(a) Calculate the book depreciation for each asset for the first two years.

(b) If the lathe is to be depreciated over the early portion of its life by the DDB method and then by a switch to the SL method for the remainder of its life, when should the switch occur?

The truck was depreciated by the units-of-production method. Usage of the truck was 22,000 miles and 25,000 miles during the first two years, respectively.

(a) Calculate the book depreciation for each asset for the first two years.

(b) If the lathe is to be depreciated over the early portion of its life by the DDB method and then by a switch to the SL method for the remainder of its life, when should the switch occur?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Davis Machine Works purchased a stamping machine for $135,000 on February 1, 2012. The machine is expected to have a useful life of 10 years, salvage value of $12,000, production of 250,000 units, and number of working hours of 30,000. During 2012, Davis used the stamping machine for 2,450 hours to produce 23,450 units. From the information given, compute the book depreciation expense for 2012 under each of the following methods:

(a) Straight-line

(b) Units of production

(c) Working hours

(d) Double-declining-balance (without conversion to straight-line depreciation)

(a) Straight-line

(b) Units of production

(c) Working hours

(d) Double-declining-balance (without conversion to straight-line depreciation)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

A local private hospital has just purchased a new computerized patient information system with an installed cost of $220,000. The information system is treated as five-year MACRS property. The system would have a salvage value of about $20,000 at the end of five years. What are the yearly depreciation allowances?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Belmont Paving Company purchased a hauling truck on January 8, 2012, at a cost of $37,000. The truck has a useful life of eight years with an estimated salvage value of $6,000. The straight-line method is used for book purposes. For tax purposes, the truck would be depreciated by MACRS over its five-year class life. Determine the annual depreciation amount to be taken over the useful life of the hauling truck for both book and tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

AG M Cutting Tools Company purchased a new abrasive jet-cutting machine in 2012 at a cost of $180,000. The company also paid $5,000 to have the equipment delivered and installed. The cutting machine has an estimated useful life of 12 years, but it will be depreciated by MACRS over its seven-year class life.

(a) What is the cost basis of the cutting equipment?

(b) What will be the depreciation allowance in each year of the seven-year class life for the cutting machine?

(a) What is the cost basis of the cutting equipment?

(b) What will be the depreciation allowance in each year of the seven-year class life for the cutting machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

A stamping machine is classified as seven-year MACRS property. The cost basis for the machine is $120,000, and the expected salvage value is $10,000 at the end of 12 years. Compute the book value at the end of three years for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

A hot-and-cold forming machine was purchased at a cost of $65,000. It has an estimated useful life of six years with salvage value of $8,000. It was placed in service on March 1 of the current fiscal year, which ends on December 31. The asset falls into a seven-year MACRS property category. Determine the annual depreciation amounts over the machinery's useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

In 2012, you purchased a spindle machine (seven-year MACRS property class) for $28,000, which you placed in service in January. Compute the depreciation allowances for the machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

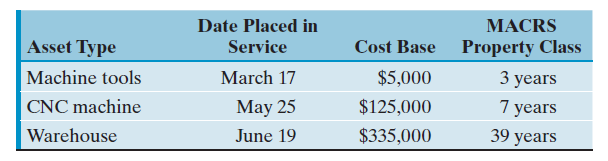

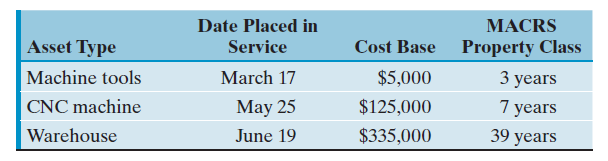

In 2012, three assets were purchased and placed in service by a firm:

Compute the depreciation allowances for each asset.

Compute the depreciation allowances for each asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

On October 3, Kim Bailey paid $250,000 for a residential rental property. This purchase price represents $200,000 for the building and $50,000 for the land. Five years later, on June 25, she sold the property for $250,000. Compute the MACRS depreciation for each of the five calendar years during which she had the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

On October 1, you purchased a residential home in which to locate your professional office for $180,000. The appraisal is divided into $30,000 for the land and $150,000 for the building.

(a) In your first year of ownership, how much can you deduct for depreciation for tax purposes?

(b) Suppose that you sold the property at $197,000 at the end of the fourth year of ownership. What is the book value of the property?

(a) In your first year of ownership, how much can you deduct for depreciation for tax purposes?

(b) Suppose that you sold the property at $197,000 at the end of the fourth year of ownership. What is the book value of the property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Ray Electric Company purchased a 10,000 ft 2 office space for $1,000,000 to relocate its engineering office on May 1, 2012. Determine the allowed depreciation in years 2012 and 2013. ( Note : There is no land value included in the purchase price.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Consider the data in the following two tables:

Identify the depreciation method used for each depreciation schedule as one of the following:

(a) Double-declining-balance depreciation

(b) Straight-line depreciation

(c) DDB with conversion to straight-line depreciation, assuming a zero salvage value

(d) MACRS seven-year depreciation with the half-year convention

(e) Double-declining-balance (with conversion to straight-line depreciation)

Identify the depreciation method used for each depreciation schedule as one of the following:

(a) Double-declining-balance depreciation

(b) Straight-line depreciation

(c) DDB with conversion to straight-line depreciation, assuming a zero salvage value

(d) MACRS seven-year depreciation with the half-year convention

(e) Double-declining-balance (with conversion to straight-line depreciation)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

At the beginning of the fiscal year, G J Company acquired new equipment at a cost of $100,000. The equipment has an estimated life of five years and an estimated salvage value of $10,000.

(a) Determine the annual depreciation (for financial reporting) for each of the five years of estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by using (1) the straight-line method and (2) the double-declining- balance method.

(b) Determine the annual depreciation for tax purposes, assuming that the equipment falls into the seven-year MACRS property class.

(c) Assume that the equipment was depreciated under MACRS for a seven-year property class. In the first month of the fourth year, the equipment was traded in for similar equipment priced at $112,000. The trade-in allowance on the old equipment was $20,000, and cash was paid for the balance. What is the cost basis of the new equipment for computing the amount of depreciation for income-tax purposes?

(a) Determine the annual depreciation (for financial reporting) for each of the five years of estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by using (1) the straight-line method and (2) the double-declining- balance method.

(b) Determine the annual depreciation for tax purposes, assuming that the equipment falls into the seven-year MACRS property class.

(c) Assume that the equipment was depreciated under MACRS for a seven-year property class. In the first month of the fourth year, the equipment was traded in for similar equipment priced at $112,000. The trade-in allowance on the old equipment was $20,000, and cash was paid for the balance. What is the cost basis of the new equipment for computing the amount of depreciation for income-tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new press cost $3,800,000, and it falls into the seven-year MACRS property class. The company has to pay property taxes to the local township for ownership of this forging machine at a rate of 1.2% on the beginning book value of each year.

(a) Determine the book value of the asset at the beginning of each tax year.

(b) Determine the amount of property taxes over the machine's depreciable life. Corporate Taxes and Accounting Profits (Net Income)

(a) Determine the book value of the asset at the beginning of each tax year.

(b) Determine the amount of property taxes over the machine's depreciable life. Corporate Taxes and Accounting Profits (Net Income)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Lynn Construction Company had a gross income of $34,000,000 in tax-year 1, $5,000,000 in salaries, $4,000,000 in wages, $1,000,000 in depreciation expenses, a loan principal payment of $200,000, and a loan interest payment of $210,000.

(a) What is the marginal tax rate for Lynn Construction in tax-year 1?

(b) What is the average tax rate in tax-year 1?

(c) Determine the net income of the company in tax-year 1.

(a) What is the marginal tax rate for Lynn Construction in tax-year 1?

(b) What is the average tax rate in tax-year 1?

(c) Determine the net income of the company in tax-year 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

A consumer electronics company was formed to sell a portable handset system. The company purchased a warehouse and converted it into a manufacturing plant for $2,000,000 (including the purchase price of the warehouse). It completed installation of assembly equipment worth $1,500,000 on December 31. The plant began operation on January 1. The company had a gross income of $2,500,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $1,280,000. The depreciation expenses for capital expenditures amounted to $128,000.

(a) Compute the taxable income of this company.

(b) How much will the company pay in federal income taxes for the year?

(a) Compute the taxable income of this company.

(b) How much will the company pay in federal income taxes for the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

ABC Corporation will commence operations on January 1, 2013. The company projects the following financial performance during its first year of operation:

Sales revenues are estimated at $2,500,000.

Labor, material, and overhead costs are projected at $800,000.

The company will purchase a warehouse worth $500,000 in February.

To finance this warehouse, on January 1 the company will issue $500,000 of long-term bonds, which carry an interest rate of 10%. The first interest payment will occur on December 31.

For depreciation purposes, the purchase cost of the warehouse is divided into $100,000 for the land and $400,000 for the building. The building is classified into the 39-year MACRS real-property class and will be depreciated accordingly.

On January 5, the company will purchase $200,000 of equipment that has a five-year MACRS class life.

(a) Determine the total depreciation expenses allowed in 2013.

(b) Determine ABC's tax liability in 2013.

Sales revenues are estimated at $2,500,000.

Labor, material, and overhead costs are projected at $800,000.

The company will purchase a warehouse worth $500,000 in February.

To finance this warehouse, on January 1 the company will issue $500,000 of long-term bonds, which carry an interest rate of 10%. The first interest payment will occur on December 31.

For depreciation purposes, the purchase cost of the warehouse is divided into $100,000 for the land and $400,000 for the building. The building is classified into the 39-year MACRS real-property class and will be depreciated accordingly.

On January 5, the company will purchase $200,000 of equipment that has a five-year MACRS class life.

(a) Determine the total depreciation expenses allowed in 2013.

(b) Determine ABC's tax liability in 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Consider a five-year MACRS asset that was purchased for $76,000. Compute the gain or loss amounts if the asset were disposed of in (a) year 3 with a salvage value of $20,000;

(b) year 5 with a salvage value of $10,000; (c) year 6 with a salvage value of $5,000.

(b) year 5 with a salvage value of $10,000; (c) year 6 with a salvage value of $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

An electrical appliance company purchased an industrial robot costing $320,000 in year 0. The industrial robot, to be used for welding operations, is classified as a seven-year MACRS recovery property. If the robot is to be sold after five years, compute the amounts of gains (losses) for the following three salvage values, assuming that both capital gains and ordinary incomes are taxed at 35%:

(a) $15,000

(b) $125,460

(c) $200,000

(a) $15,000

(b) $125,460

(c) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

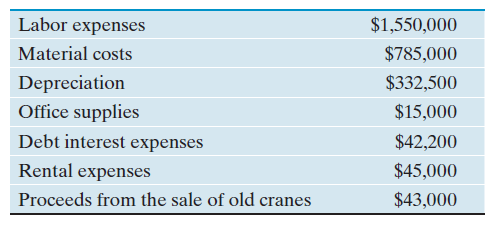

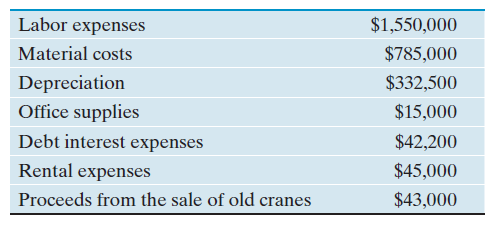

Auburn Crane, Inc., a hydraulic crane service company, had sales revenues of $4,250,000 during tax year 2013. The following table provides other financial information relating to the tax year:

The sold cranes had a combined book value of $30,000 at the time of sale.

(a) Determine the taxable income for 2013.

(b) Determine the taxable gains for 2013.

(c) Determine the amount of income taxes and gains taxes (or loss credits) for 2013.

The sold cranes had a combined book value of $30,000 at the time of sale.

(a) Determine the taxable income for 2013.

(b) Determine the taxable gains for 2013.

(c) Determine the amount of income taxes and gains taxes (or loss credits) for 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

Electronic Measurement and Control Company (EMCC) has developed a laser speed detector that emits infrared light invisible to humans and radar detectors alike. For full-scale commercial marketing, EMCC needs to invest $5 million in new manufacturing facilities. The system is priced at $3,000 per unit. The company expects to sell 5,000 units annually over the next five years. The new manufacturing facilities will be depreciated according to a seven-year MACRS property class. The expected salvage value of the manufacturing facilities at the end of five years is $1.6 million. The manufacturing cost for the detector is $1,200 per unit excluding depreciation expenses. The operating and maintenance costs are expected to run to $1.2 million per year. EMCC has a combined federal and state income-tax rate of 35%, and undertaking this project will not change this current marginal tax rate.

(a) Determine the incremental taxable income, income taxes, and net income that would result from undertaking this new product for the next five years.

(b) Determine the gains or losses associated with the disposal of the manufacturing facilities at the end of five years.

(a) Determine the incremental taxable income, income taxes, and net income that would result from undertaking this new product for the next five years.

(b) Determine the gains or losses associated with the disposal of the manufacturing facilities at the end of five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

A machine now in use that was purchased three years ago at a cost of $4,000 has a book value of $2,000. It can be sold now for $2,500, or it could be used for three more years, at the end of which time it would have no salvage value. The annual O M costs amount to $10,000 for the machine. If the machine is sold, a new machine can be purchased at an invoice price of $14,000 to replace the present equipment. Freight will amount to $800, and the installation cost will be $200. The new machine has an expected service life of five years and will have no salvage value at the end of that time. With the new machine, the expected direct cash savings amount to $8,000 the first year and $7,000 in O M for each of the next two years. Corporate income taxes are at an annual rate of 40%, and the net capital gain is taxed at the ordinary income-tax rate. The present machine has been depreciated according to a straight-line method, and the proposed machine would be depreciated on a seven-year MACRS schedule. Consider each of the following questions independently:

(a) If the old asset is to be sold now, what would be the amount of its equivalent book value?

(b) For depreciation purposes, what would be the first cost of the new machine (depreciation base)?

(c) If the old machine is to be sold now, what would be the amount of taxable gains and the gains tax?

(d) If the old machine is sold for $5,000 now instead of $2,500, what would be the amount of the gains tax?

(e) If the old machine had been depreciated by 175% DB and then by a switch to SL depreciation, what would be the current book value?

(f) If the old machine were not replaced by the new one and has been depreciated by the 175% DB method, when would be the time to switch from DB to SL depreciation?

(a) If the old asset is to be sold now, what would be the amount of its equivalent book value?

(b) For depreciation purposes, what would be the first cost of the new machine (depreciation base)?

(c) If the old machine is to be sold now, what would be the amount of taxable gains and the gains tax?

(d) If the old machine is sold for $5,000 now instead of $2,500, what would be the amount of the gains tax?

(e) If the old machine had been depreciated by 175% DB and then by a switch to SL depreciation, what would be the current book value?

(f) If the old machine were not replaced by the new one and has been depreciated by the 175% DB method, when would be the time to switch from DB to SL depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

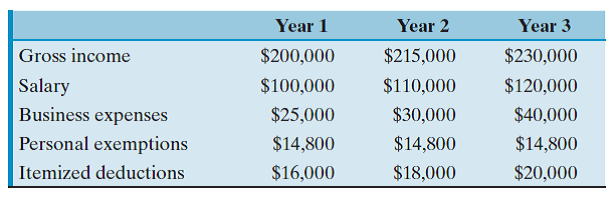

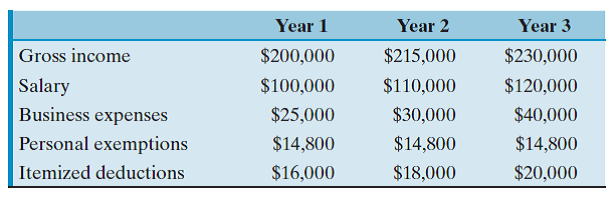

Phillip Zodrow owns and operates a small unincorporated plumbing service business, Zodrow Plumbing Service (ZPS). Phillip is married and has two children, so he claims four exemptions on his tax return. As business grows steadily, tax considerations are important to him. Therefore, Phillip is considering incorporation of the business. Under either form of the business (corporation or sole ownership), the family will initially own 100% of the firm. Phillip plans to finance the firm's expected growth by drawing a salary just sufficient for his family's living expenses and by retaining all other income in the business. He estimates the income and expenses over the next three years to be as follows:

Which form of business (corporation or sole ownership) will allow Phillip to pay the lowest taxes (and retain the most income) during the three years? Personal income-tax brackets and amounts of personal exemption are updated yearly, so you need to consult the IRS tax manual for the tax rates, as well as for the exemptions, that are applicable to the tax years.

Which form of business (corporation or sole ownership) will allow Phillip to pay the lowest taxes (and retain the most income) during the three years? Personal income-tax brackets and amounts of personal exemption are updated yearly, so you need to consult the IRS tax manual for the tax rates, as well as for the exemptions, that are applicable to the tax years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Julie Magnolia has $50,000 cash to invest for three years. Two types of bonds are available for consideration. She can buy a tax-exempt Arizona state bond that pays interest of 9.5% per year, or she can buy a corporate bond. Julie's marginal tax rate is 25% for both ordinary income and capital gains. Assume that any investment decision considered will not change her marginal tax bracket.

(a) If Julie were looking for a corporate bond that was just as safe as the state bond, what interest rate on the corporate bond is required so that Julie would be indifferent between the two bonds? There would be no capital gains or losses at the time of her trading the bond.

(b) In (a), suppose at the time of trading (year 3) that the corporate bond is expected to be sold at a price 5% higher than its face value. What interest rate on the corporate bond is required so that Julie would be indifferent between the two bonds?

(c) Alternatively, Julie can invest the amount in a tract of land that could be sold at $75,000 (after she pays the real-estate commission) at the end of year 3. Is this investment better than the state bond?

(a) If Julie were looking for a corporate bond that was just as safe as the state bond, what interest rate on the corporate bond is required so that Julie would be indifferent between the two bonds? There would be no capital gains or losses at the time of her trading the bond.

(b) In (a), suppose at the time of trading (year 3) that the corporate bond is expected to be sold at a price 5% higher than its face value. What interest rate on the corporate bond is required so that Julie would be indifferent between the two bonds?

(c) Alternatively, Julie can invest the amount in a tract of land that could be sold at $75,000 (after she pays the real-estate commission) at the end of year 3. Is this investment better than the state bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck