Deck 13: Understanding Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 13: Understanding Financial Statements

1

Definitional problems: Listed are eight terms that relate to financial statements:

1. Balance-sheet statement

2. Income statement

3. Cash-flow statement

4. Operating activities

5. Investment activities

6. Financing activities

7. Treasury account

8. Capital account

Choose the term from the list that most appropriately completes each of the following statements:

As an outside investor, you would view a firm's _________ as the most important financial report for gauging the quality of earnings.

Retained earnings as reported in the _________ represent income earned by the firm in past years that has not been paid out as dividends.

The _________ is designed to show how a firm's operations have affected its cash position by providing actual net cash flows into or out of the firm during some specified period.

Typically, a firm's cash flow statement is categorized into three activities: _________, _________ , and __________.

When you issue stock, the money raised beyond the par value is shown in the _________ in the balance-sheet statement.

1. Balance-sheet statement

2. Income statement

3. Cash-flow statement

4. Operating activities

5. Investment activities

6. Financing activities

7. Treasury account

8. Capital account

Choose the term from the list that most appropriately completes each of the following statements:

As an outside investor, you would view a firm's _________ as the most important financial report for gauging the quality of earnings.

Retained earnings as reported in the _________ represent income earned by the firm in past years that has not been paid out as dividends.

The _________ is designed to show how a firm's operations have affected its cash position by providing actual net cash flows into or out of the firm during some specified period.

Typically, a firm's cash flow statement is categorized into three activities: _________, _________ , and __________.

When you issue stock, the money raised beyond the par value is shown in the _________ in the balance-sheet statement.

a.Income statement:

Income statement is one of the financial statements of firms. It shows all revenues received from the sales of products and service and expenses occurred during a particular period. Hence, income statement of a firm is considered as an important financial report to measure the quality of earnings.

b.Balance sheet:

Balance sheet is one of the financial statements which show the summary of financial balances of the firm including details of assets, liabilities and owner's equity. Hence, balance sheet represe nts i ncome ea rned b y t he f irm in pas t years t hat h as not bee n p aid o ut as d ividends.

c.Cash flow statement:

Cash flow statement known is a financial statement shows the in and out flow of cash of a firm during a particular period. Hence, the cash flow statement is designed to show how a firm's operations have affected its cash position by providing actual net cash flows in or out of the firm during some specified period.

d.

c.Categories of firm's cash flow statement:

Cash flow statement is a financial statement showing in and out flow of cash of a firm during a particular period. A firm's cash flow statement has been categorized in to three activities as explained below:

• Operating activities : activities like productions, sales and delivery of the product of a firm and payment collections from customers are the operating activities in cash flow statement of a firm.

• Investing activities : activities like purchase and sale of assets like, land building etc, loans made for suppliers and payments to mergers are investing activities in cash flow statement of a firm.

• Financing activities : activities in the form of cash inflow from investors like banks, shareholders and cash outflows from the firm to shareholders in the form of dividends are financing activities.

e.

Capital account:

Capital account is one of the components of balance of payment. It reflects the net change in ownership of national assets. Surplus in capital account refers to the money inflow to the country and deficit in capital account refers to the money out flow from the country. Hence, when a stock is issued, the m oney r aised b eyond t he p ar v alue i s s hown in th e capital account i n the ba lance-shee t s tatement.

Income statement is one of the financial statements of firms. It shows all revenues received from the sales of products and service and expenses occurred during a particular period. Hence, income statement of a firm is considered as an important financial report to measure the quality of earnings.

b.Balance sheet:

Balance sheet is one of the financial statements which show the summary of financial balances of the firm including details of assets, liabilities and owner's equity. Hence, balance sheet represe nts i ncome ea rned b y t he f irm in pas t years t hat h as not bee n p aid o ut as d ividends.

c.Cash flow statement:

Cash flow statement known is a financial statement shows the in and out flow of cash of a firm during a particular period. Hence, the cash flow statement is designed to show how a firm's operations have affected its cash position by providing actual net cash flows in or out of the firm during some specified period.

d.

c.Categories of firm's cash flow statement:

Cash flow statement is a financial statement showing in and out flow of cash of a firm during a particular period. A firm's cash flow statement has been categorized in to three activities as explained below:

• Operating activities : activities like productions, sales and delivery of the product of a firm and payment collections from customers are the operating activities in cash flow statement of a firm.

• Investing activities : activities like purchase and sale of assets like, land building etc, loans made for suppliers and payments to mergers are investing activities in cash flow statement of a firm.

• Financing activities : activities in the form of cash inflow from investors like banks, shareholders and cash outflows from the firm to shareholders in the form of dividends are financing activities.

e.

Capital account:

Capital account is one of the components of balance of payment. It reflects the net change in ownership of national assets. Surplus in capital account refers to the money inflow to the country and deficit in capital account refers to the money out flow from the country. Hence, when a stock is issued, the m oney r aised b eyond t he p ar v alue i s s hown in th e capital account i n the ba lance-shee t s tatement.

2

Which of the following statements is most correct? (a) The balance sheet statement summarizes how much the firm owns as well as owes for a typical operating period.

(b) The income statement summarizes the net income produced by the corporation at a specified reporting date.

(c) The cash flow statement summarizes how the corporation generated cash during the operating period.

(d) None of the above.

(b) The income statement summarizes the net income produced by the corporation at a specified reporting date.

(c) The cash flow statement summarizes how the corporation generated cash during the operating period.

(d) None of the above.

The financial reports give the financial status of the businesses and help in decision making.The balance sheet tells the firm's financial position at the end of the reporting period. It states items under categories: assets, liabilities and stockholders' equity. Assets show the amount of dollars that the firm owns during the reporting period. The liabilities show the amount of money that firm owes, and stockholders equity tells the portion of assets that is invested by owners of the firm.

Therefore, statement (a) is correct.

The income statement summarizes the net income of the firm during a stated period rather than at a specific date. Thus, statement (b) is not correct.

The cash flow statement also includes financing and investing activities of the firm in addition to net income. The cash flow statement not only shows how the firm generated cash during the operating period but also how it used it during the period.Thus, statement (c) is not correct.

Therefore, statement (a) is correct.

The income statement summarizes the net income of the firm during a stated period rather than at a specific date. Thus, statement (b) is not correct.

The cash flow statement also includes financing and investing activities of the firm in addition to net income. The cash flow statement not only shows how the firm generated cash during the operating period but also how it used it during the period.Thus, statement (c) is not correct.

3

Definitional problems: Listed are 11 terms that relate to ratio analysis:

1. Book value per share

2. Inventory turnover

3. Debt-to-equity ratio

4. Average collection period

5. Average sales period

6. Return on common equity

7. Earnings per share

8. Price/earnings ratio

9. Return on total assets

10. Current ratio

11. Accounts-receivable turnover

Choose the financial ratio or term from the list that most appropriately completes each of the following statements:

The _________ tends to have an effect on the market price per share as reflected in the price/earnings ratio.

The _________ indicates whether a stock is relatively cheap or relatively expensive in relation to current earnings.

The _________ measures the amount that would be distributed to holders of common stock if all assets were sold at their balance-sheet carrying amount and if all creditors were paid off.

The _________ is a rough measure of how many times a company's accounts receivable have been turned into cash during the year.

The _________ is a measure of the amount of assets being provided by creditors for each dollar of assets being provided by the stockholders.

The _________ measures how well management has employed its assets.

1. Book value per share

2. Inventory turnover

3. Debt-to-equity ratio

4. Average collection period

5. Average sales period

6. Return on common equity

7. Earnings per share

8. Price/earnings ratio

9. Return on total assets

10. Current ratio

11. Accounts-receivable turnover

Choose the financial ratio or term from the list that most appropriately completes each of the following statements:

The _________ tends to have an effect on the market price per share as reflected in the price/earnings ratio.

The _________ indicates whether a stock is relatively cheap or relatively expensive in relation to current earnings.

The _________ measures the amount that would be distributed to holders of common stock if all assets were sold at their balance-sheet carrying amount and if all creditors were paid off.

The _________ is a rough measure of how many times a company's accounts receivable have been turned into cash during the year.

The _________ is a measure of the amount of assets being provided by creditors for each dollar of assets being provided by the stockholders.

The _________ measures how well management has employed its assets.

Earnings per share:

Investor buy share of a company based on the earnings per share. Hence, earnings per share which reflect as price/earnings ratio will affect the market price. Thus, the correct option for the first fill in the blank is 'Earning per share'.

Price/earnings ratio:

Whether a stock is relatively cheap or expensive in relation to current earning can be observed based on the price/earnings ratio. Thus, the correct option for the second fill in the blank is 'Price/earning ratio'.

Book value per share:

The book value per share shows the amount the holder of common stock would get if all assets were sold at the amount stated in the balance sheet. Thus, the correct option for the third fill in the blank is 'book value per share'.

Account receivable turn over:

The number of times a company's accounts receivable turn in to cash during a year can be roughly measured as account receivable turn over. Thus, the correct option for the fourth fill in the blank is 'account receivable turn over'.

Debt to equity ratio:

Amount of assets provided by creditor for each dollar of assets provided by the stock holder can be measured as the debt to equity ratio. Thus, the correct option for the fifth fill in the blank is 'debt to equity ratio'.

Return to total assets:

Better utilization of asset that is usage of assets by the management in a best way can be judged from the return to total assets. Thus, the correct option for the sixth fill in the blank is 'return to total asset.

Investor buy share of a company based on the earnings per share. Hence, earnings per share which reflect as price/earnings ratio will affect the market price. Thus, the correct option for the first fill in the blank is 'Earning per share'.

Price/earnings ratio:

Whether a stock is relatively cheap or expensive in relation to current earning can be observed based on the price/earnings ratio. Thus, the correct option for the second fill in the blank is 'Price/earning ratio'.

Book value per share:

The book value per share shows the amount the holder of common stock would get if all assets were sold at the amount stated in the balance sheet. Thus, the correct option for the third fill in the blank is 'book value per share'.

Account receivable turn over:

The number of times a company's accounts receivable turn in to cash during a year can be roughly measured as account receivable turn over. Thus, the correct option for the fourth fill in the blank is 'account receivable turn over'.

Debt to equity ratio:

Amount of assets provided by creditor for each dollar of assets provided by the stock holder can be measured as the debt to equity ratio. Thus, the correct option for the fifth fill in the blank is 'debt to equity ratio'.

Return to total assets:

Better utilization of asset that is usage of assets by the management in a best way can be judged from the return to total assets. Thus, the correct option for the sixth fill in the blank is 'return to total asset.

4

Which of the following statements is most correct? (a) Working capital measures the company's ability to repay current liabilities using only current assets.

(b) The days sales outstanding (DSO) represents the average length of time that the firm must wait after making a sale before receiving cash.

(c) The lower debt ratio, the more the protection afforded creditors in the event of liquidation.

(d) All of the above.

(b) The days sales outstanding (DSO) represents the average length of time that the firm must wait after making a sale before receiving cash.

(c) The lower debt ratio, the more the protection afforded creditors in the event of liquidation.

(d) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

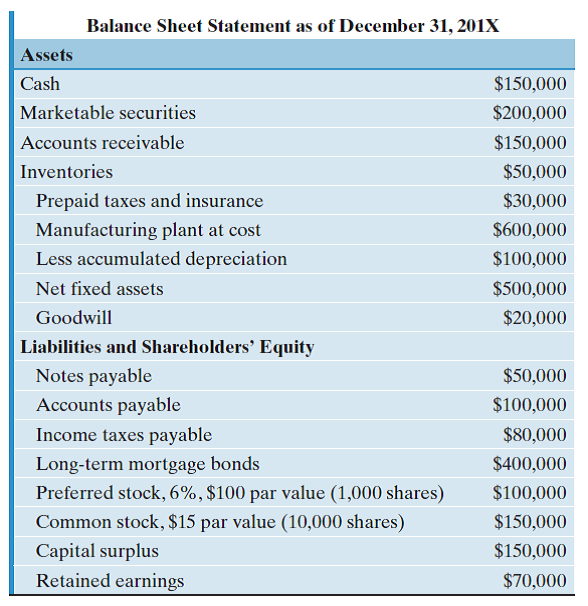

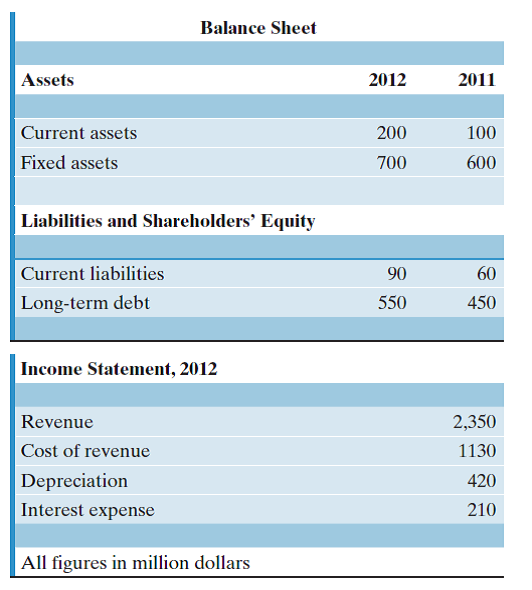

Consider the following balance-sheet entries for Delta Corporation:

(a) Compute the following for the firm:

Current assets: $ _________

Current liabilities: $ _________

Working capital: $ _________

Shareholders' equity: $ _________

(b) If the firm had a net income after taxes of $500,000, what are the earnings per share?

(c) When the firm issued its common stock, what was the market price of the stock per share?

(a) Compute the following for the firm:

Current assets: $ _________

Current liabilities: $ _________

Working capital: $ _________

Shareholders' equity: $ _________

(b) If the firm had a net income after taxes of $500,000, what are the earnings per share?

(c) When the firm issued its common stock, what was the market price of the stock per share?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is most correct? (a) P/E ratios are higher for firms with high growth prospects, other things held constant, but they are lower for riskier firms.

(b) Higher market/book (MB) ratios are generally associated with firms that have a high rate of return on common equity.

(c) A high quick ratio is not always a good indication of a well-managed liquidity position.

(d) All of the above.

(b) Higher market/book (MB) ratios are generally associated with firms that have a high rate of return on common equity.

(c) A high quick ratio is not always a good indication of a well-managed liquidity position.

(d) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

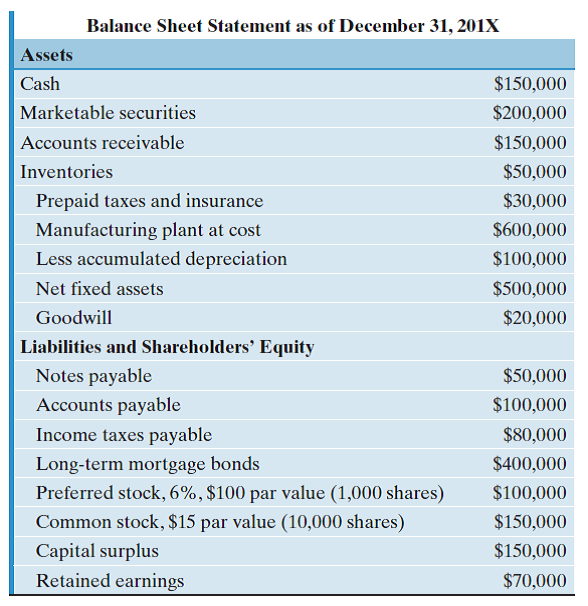

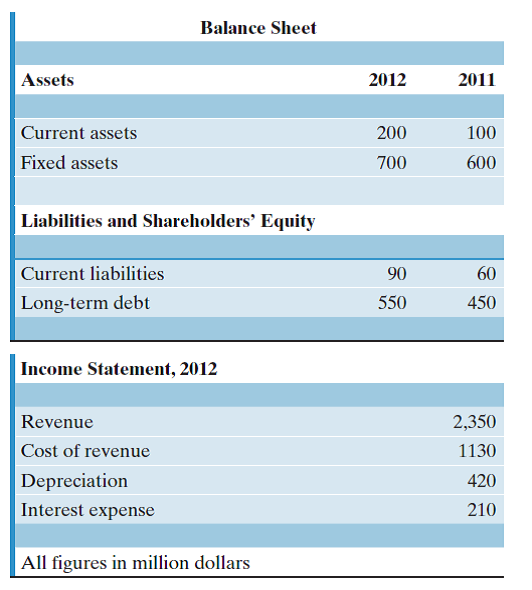

Birmingham Steels has the following (incomplete) balance sheet and income statement.

(a) Determine the shareholders' equity in 2011 and 2012.

(b) Determine the net working capital in 2011 and 2012.

(c) Assuming that Birmingham Steels has a 35% tax rate, determine the income taxes paid in year 2012.

(d) What is cash generated from operation in year 2012?

(a) Determine the shareholders' equity in 2011 and 2012.

(b) Determine the net working capital in 2011 and 2012.

(c) Assuming that Birmingham Steels has a 35% tax rate, determine the income taxes paid in year 2012.

(d) What is cash generated from operation in year 2012?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is most correct? (a) A decline in inventory turnover ratio suggests that the firm's liquidity position is improving.

(b) The profit margin on sales is calculated by dividing net operating income by sales

(c) When a corporation buys back its own stock, this is called Treasury Stock. The firm's cash and equity are both reduced.

(d) None of the above.

(b) The profit margin on sales is calculated by dividing net operating income by sales

(c) When a corporation buys back its own stock, this is called Treasury Stock. The firm's cash and equity are both reduced.

(d) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

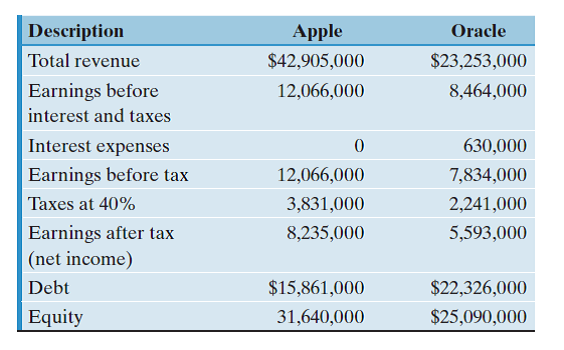

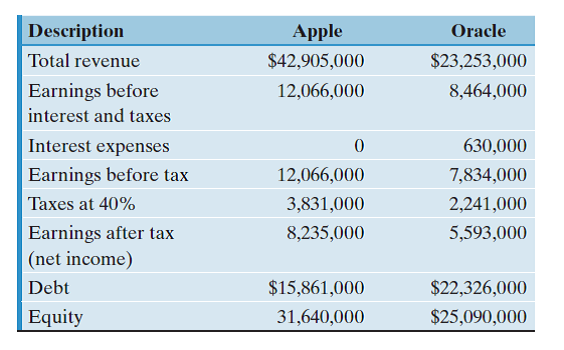

The following data are available for two companies, Apple and Oracle, all stated in thousands of dollars.

(a) Calculate each company's return on equity (ROE) and return on assets (ROA).

(b) Which company has performed better in terms of profitability?

(c) If the two companies were combined (merged), what would be the impact on the results on ROE? Under what conditions would such a combination make sense?

(a) Calculate each company's return on equity (ROE) and return on assets (ROA).

(b) Which company has performed better in terms of profitability?

(c) If the two companies were combined (merged), what would be the impact on the results on ROE? Under what conditions would such a combination make sense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is most correct? (a) Generally, firms with high profit margins have high asset turnover ratios.

(b) Having a high current ratio and a high quick ratio is always a good indication a firm is managing its liquidity position well.

(c) Knowing that return on assets (ROA) measures the firm's effective utilization of assets without considering how these assets are financed, two firms with the same EBIT must have the same ROA.

(d) One way to improve the current ratio is to use cash to pay off current liabilities.

(b) Having a high current ratio and a high quick ratio is always a good indication a firm is managing its liquidity position well.

(c) Knowing that return on assets (ROA) measures the firm's effective utilization of assets without considering how these assets are financed, two firms with the same EBIT must have the same ROA.

(d) One way to improve the current ratio is to use cash to pay off current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

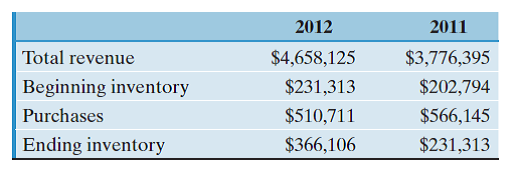

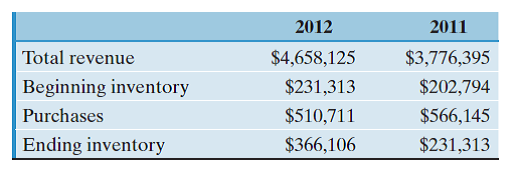

The following data were taken from the income statements of Metronix Corporation.

Compute the inventory-turnover ratio for each year. What conclusions concerning the management of the inventory can be drawn from the data?

Compute the inventory-turnover ratio for each year. What conclusions concerning the management of the inventory can be drawn from the data?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

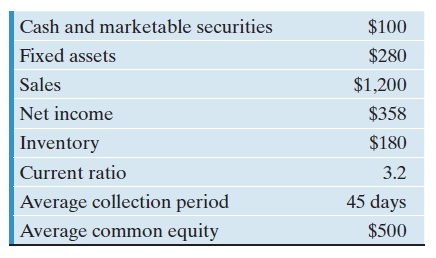

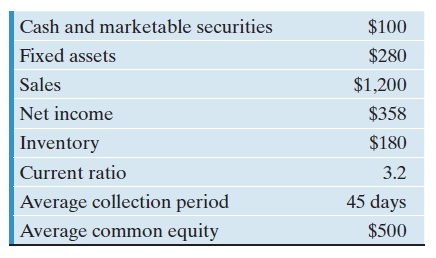

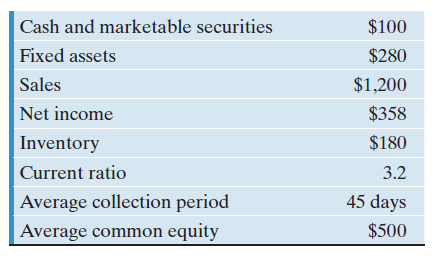

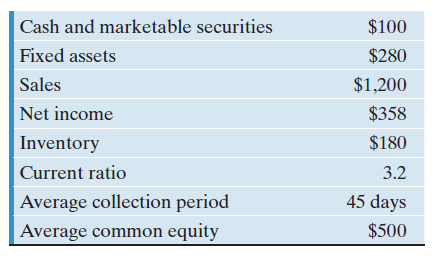

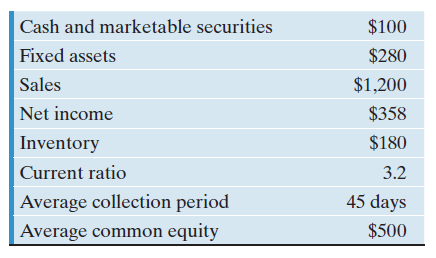

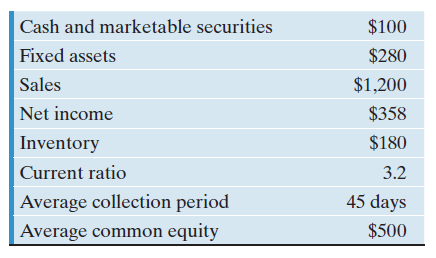

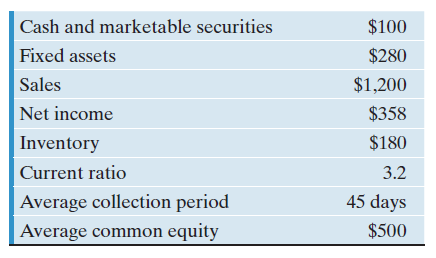

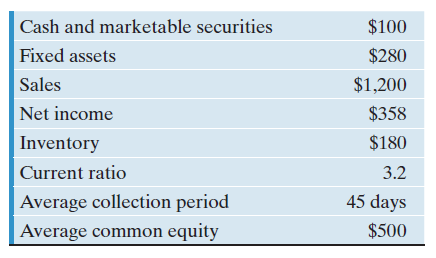

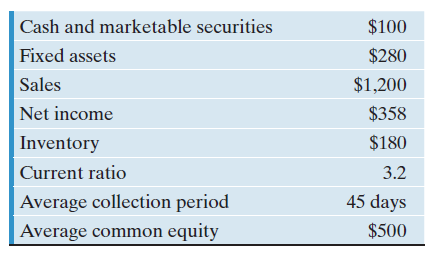

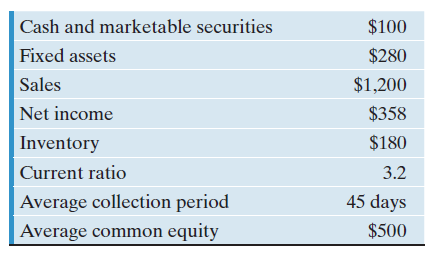

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Find Fisher's accounts receivable.

(a) $147.95

(b) $127.65

(c) $225.78

(b) $290.45

Find Fisher's accounts receivable.

(a) $147.95

(b) $127.65

(c) $225.78

(b) $290.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

If Company A uses more debt than Company B and both companies have identical operations in terms of sales, operating costs, etc., which of the following statements is true? (a) Company B will definitely have a higher current ratio.

(b) Company B has a higher profit margin on sales than Company A.

(c) The two companies have the identical profit margin on sales.

(d) Company B's return on total assets would be higher.

(b) Company B has a higher profit margin on sales than Company A.

(c) The two companies have the identical profit margin on sales.

(d) Company B's return on total assets would be higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Calculate the amount of current assets.

(a) $223

(b) $248

(c) $280

(b) $428

Calculate the amount of current assets.

(a) $223

(b) $248

(c) $280

(b) $428

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

You are looking to buy stock in a high-growth company. Which of the following ratios best indicates the company's growth potential? (a) Debt ratio

(b) Price/earnings ratio

(c) Profit margin

(d) Total-assets-turnover ratio

(b) Price/earnings ratio

(c) Profit margin

(d) Total-assets-turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Determine the amount of current liabilities.

(a) $156

(b) $134

(c) $244

(b) $334

Determine the amount of current liabilities.

(a) $156

(b) $134

(c) $244

(b) $334

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is false? (a) The quickest way to determine whether a firm has too much debt is to calculate the debt-to-equity ratio.

(b) The best guideline to determine the firm's liquidity is to calculate the current ratio.

(c) From the investor's point of view, the rate of return on common equity is a good indicator of whether the firm is generating an acceptable return to the investor.

(d) We can determine the operating margin by expressing net income as a percentage of total sales.

(b) The best guideline to determine the firm's liquidity is to calculate the current ratio.

(c) From the investor's point of view, the rate of return on common equity is a good indicator of whether the firm is generating an acceptable return to the investor.

(d) We can determine the operating margin by expressing net income as a percentage of total sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Determine the amount of total assets.

(a) $528

(b) $428

(c) $328

(b) $708

Determine the amount of total assets.

(a) $528

(b) $428

(c) $328

(b) $708

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

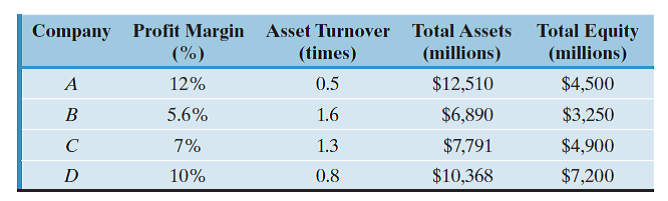

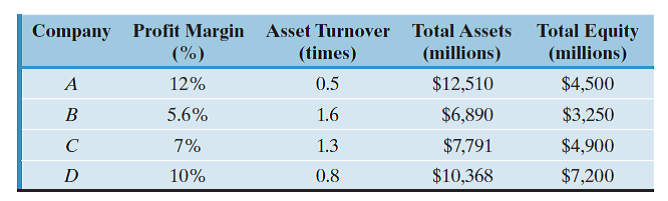

The table that follows summarizes the financial performances of four companies in the year 2012. From the given information, which company generated the highest return on equity?

(a) Company A

(b) Company B

(c) Company C

(d) Company D

(a) Company A

(b) Company B

(c) Company C

(d) Company D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Calculate the amount of the long-term debt.

(a) $134

(b) $500

(c) $74

(b) $208

Calculate the amount of the long-term debt.

(a) $134

(b) $500

(c) $74

(b) $208

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

J. C. Olson Co. had earnings per share of $8 in 2012, and it paid a $4 dividend. Book value per share at year-end was $80. During the same period, the total retained earnings increased by $24 million. Olson has no preferred stock, and no new common stock was issued during the year. If Olson's year-end debt (which equals its total liabilities) was $240 million, what was the company's year-end debt ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

The following data apply to the next six problems. Consider Fisher Company's financial data as follows (unit: millions of dollars except ratio figures):

Calculate the profit margin.

(a) 20%

(b) 30%

(c) 35%

(d) 40%

Calculate the profit margin.

(a) 20%

(b) 30%

(c) 35%

(d) 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

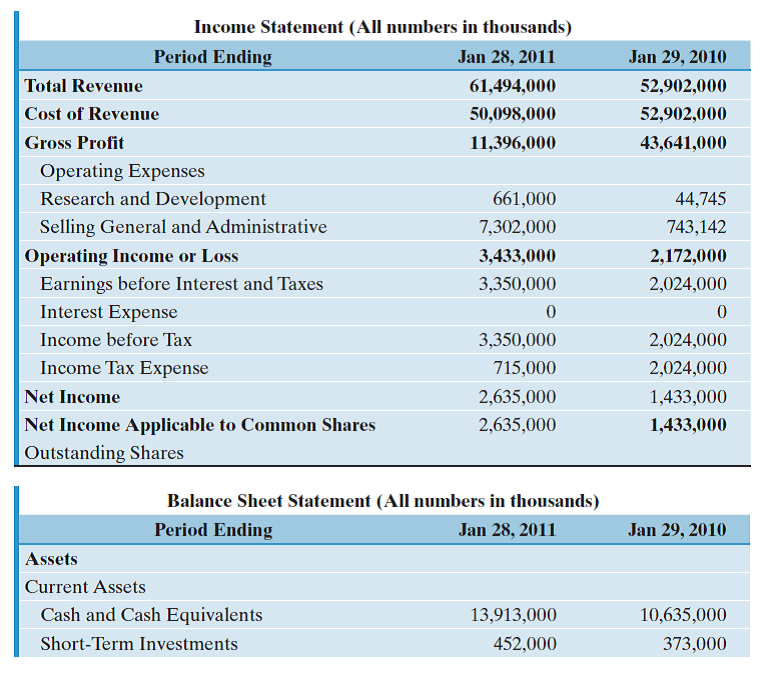

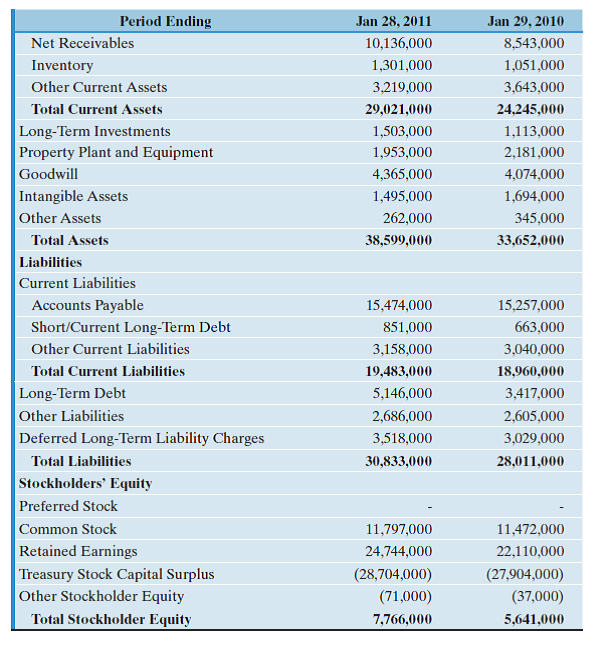

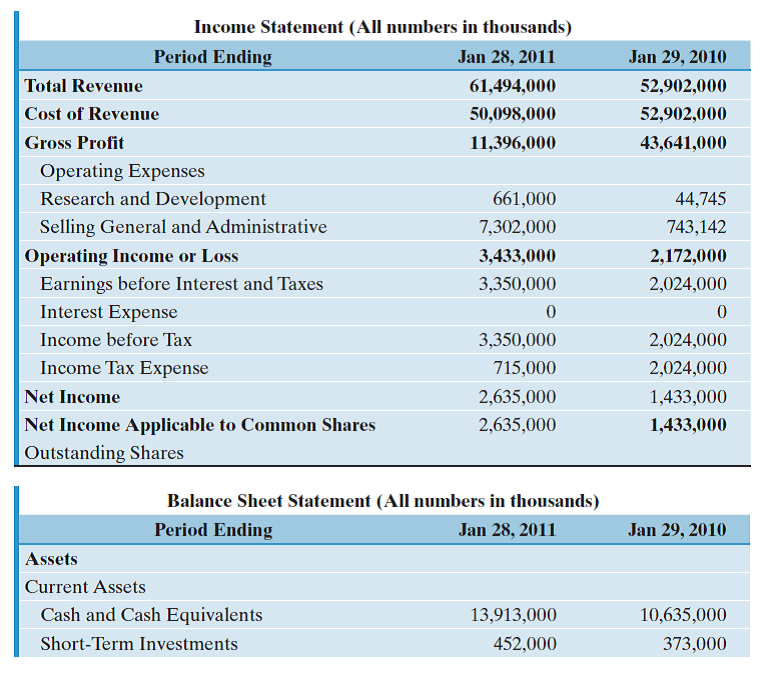

Consider the following financial statements for Dell Corporation:

The closing stock price for Dell was $13.47 on January 28, 2011. The numbers of

outstanding shares were 1,944 million in 2011 and 1,944 million in 2010, respectively.

The income tax rates were 21.3% in 2011 and 29.2% in 2010. From the

financial data presented, compute the following financial ratios for 2011, and

make an informed analysis of Dell's financial health:

(a) Debt ratio

(b) Times-interest-earned ratio

(c) Current ratio

(d) Quick (acid test) ratio

(e) Inventory-turnover ratio

(f) Days-sales-outstanding ratio

(g) Total-assets-turnover ratio

(h) Profit margin on sales

(i) Return on total assets

(j) Return on common equity

(k) Price/earnings ratio

(l) Book value per share

The closing stock price for Dell was $13.47 on January 28, 2011. The numbers of

outstanding shares were 1,944 million in 2011 and 1,944 million in 2010, respectively.

The income tax rates were 21.3% in 2011 and 29.2% in 2010. From the

financial data presented, compute the following financial ratios for 2011, and

make an informed analysis of Dell's financial health:

(a) Debt ratio

(b) Times-interest-earned ratio

(c) Current ratio

(d) Quick (acid test) ratio

(e) Inventory-turnover ratio

(f) Days-sales-outstanding ratio

(g) Total-assets-turnover ratio

(h) Profit margin on sales

(i) Return on total assets

(j) Return on common equity

(k) Price/earnings ratio

(l) Book value per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

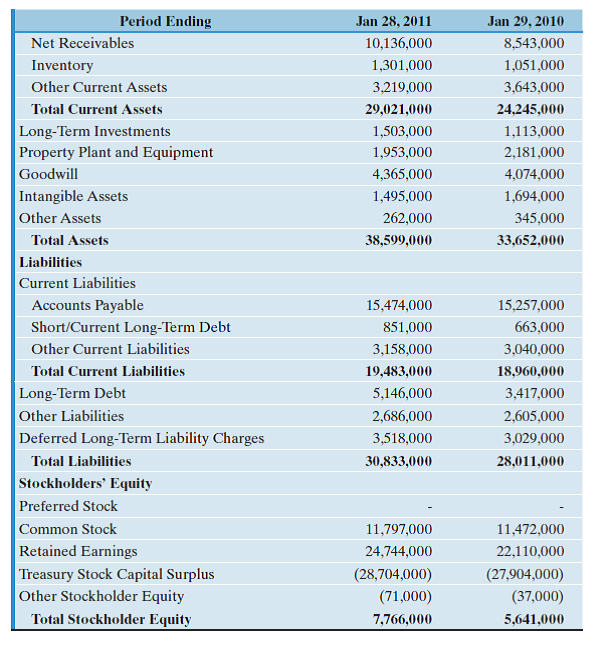

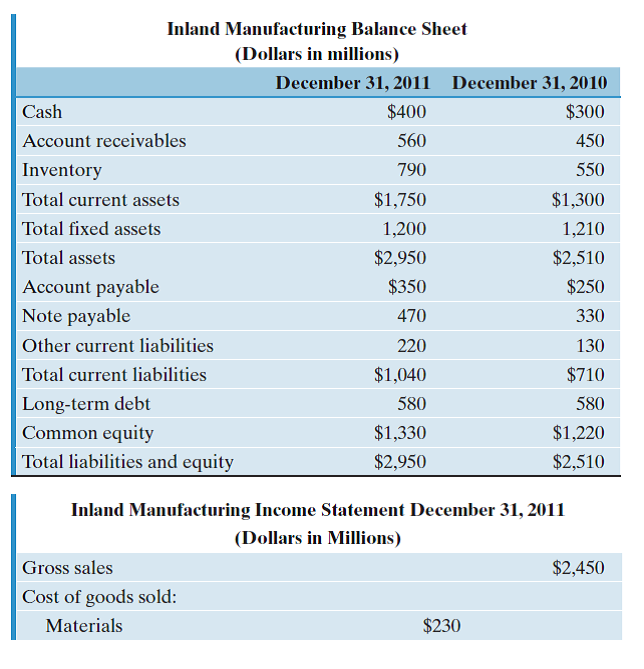

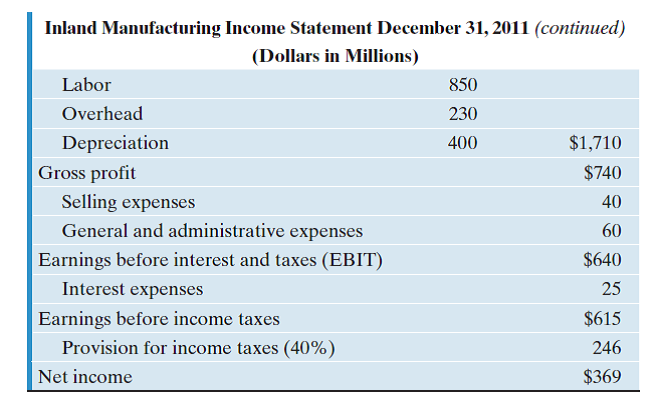

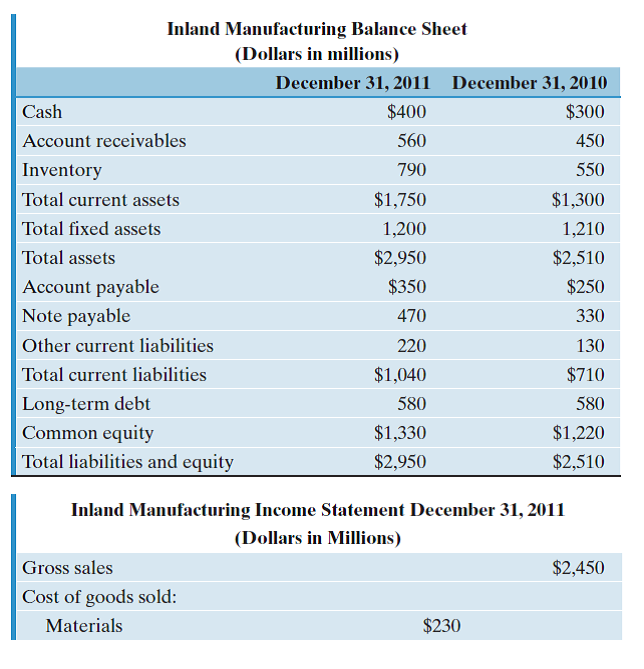

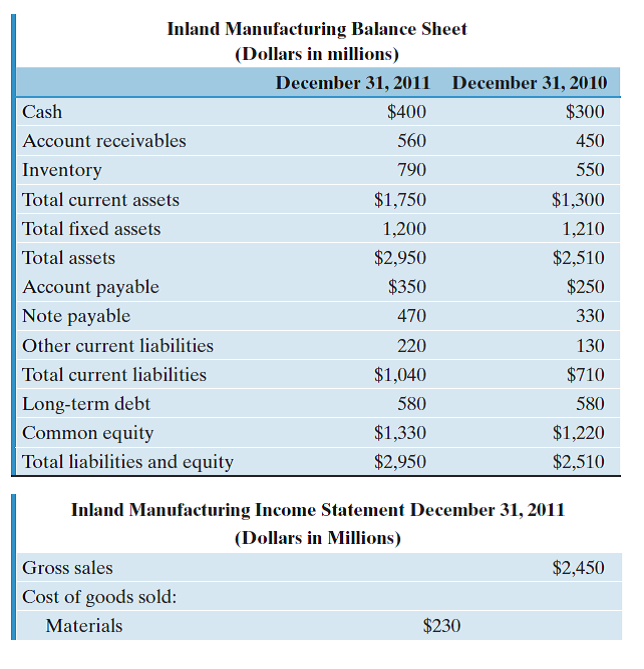

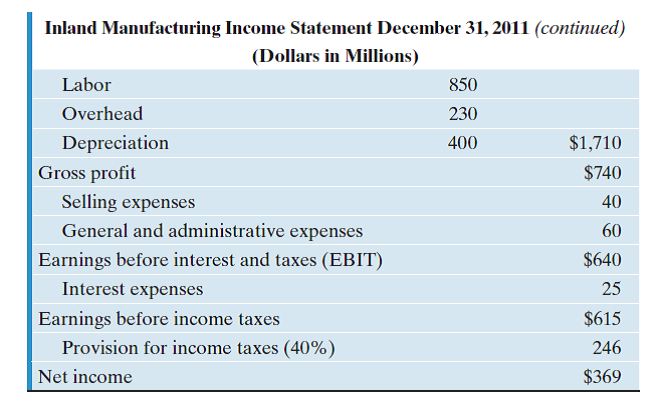

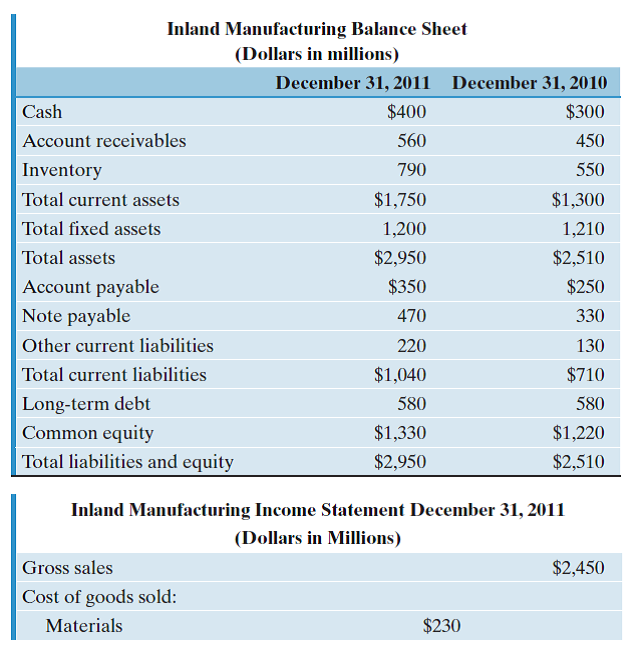

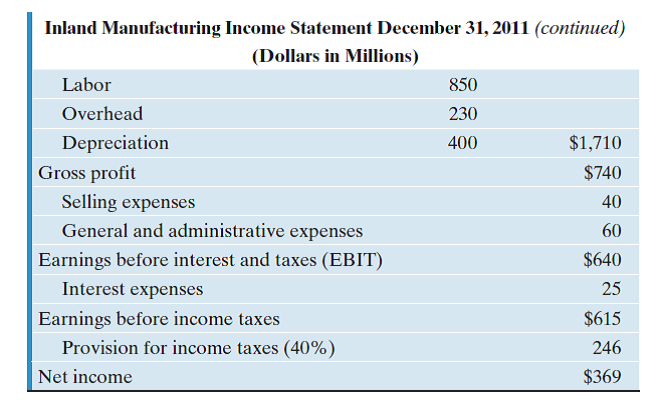

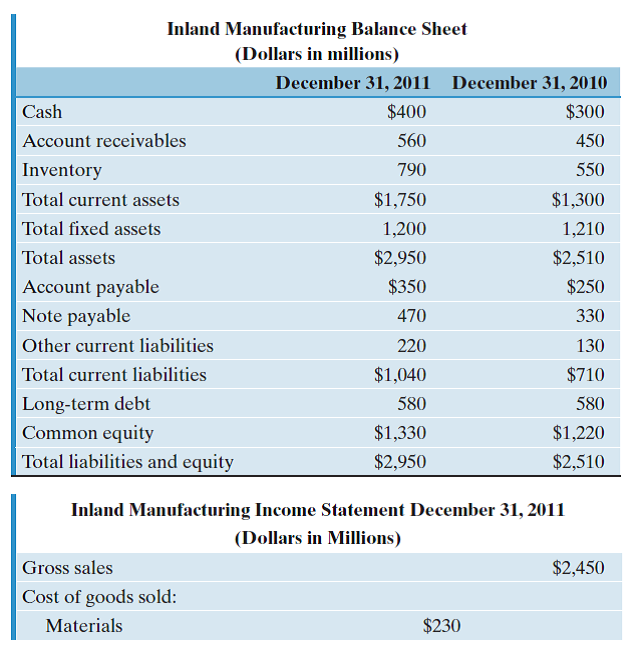

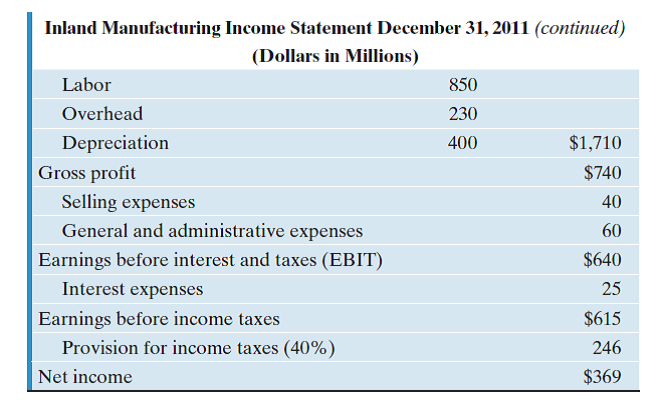

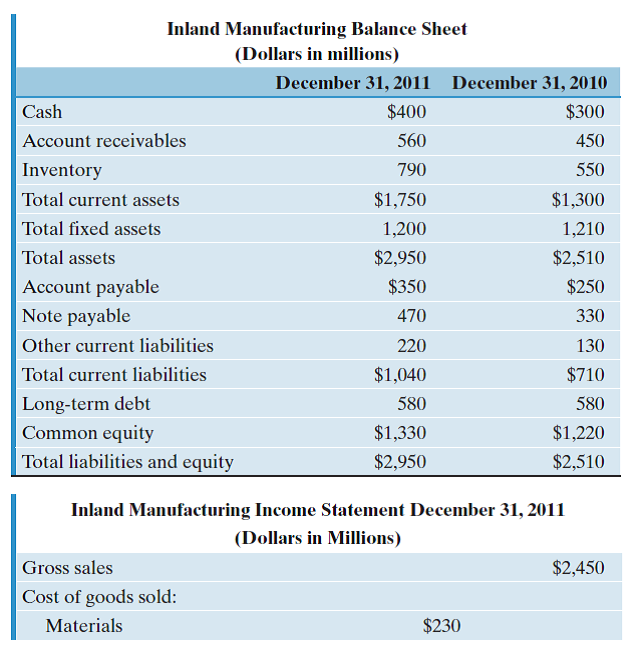

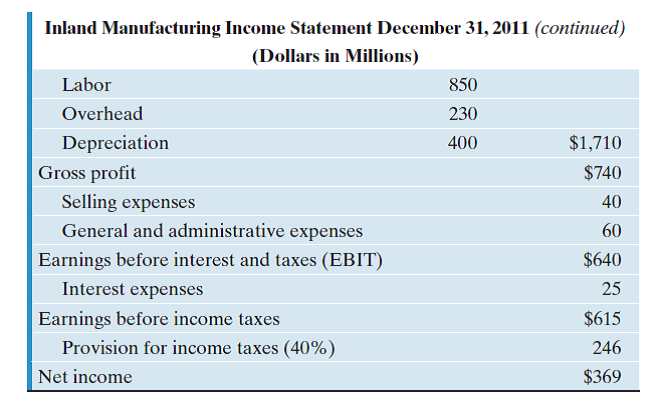

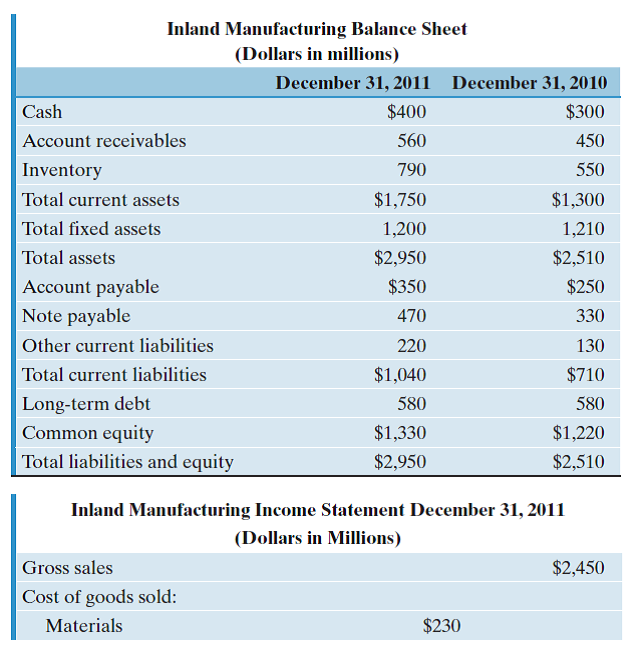

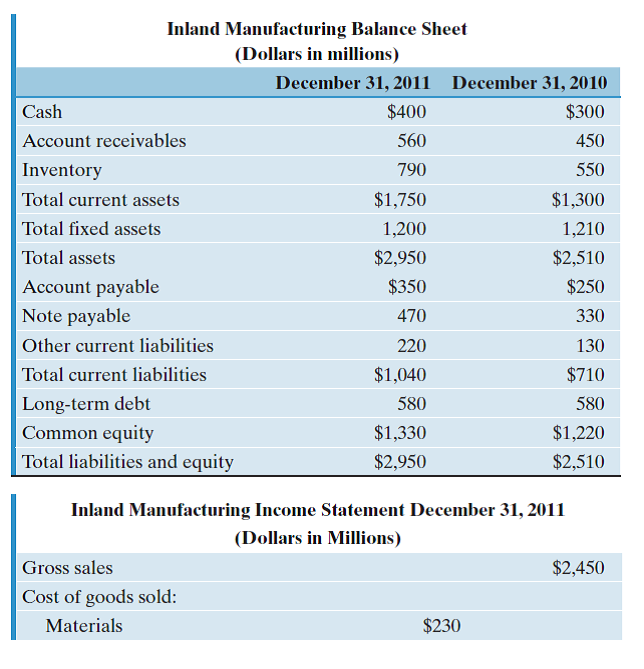

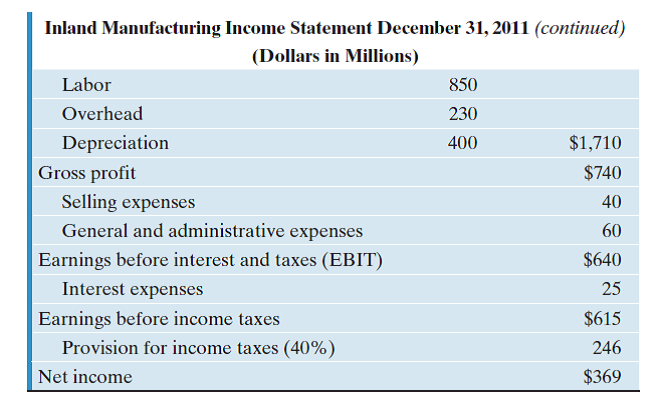

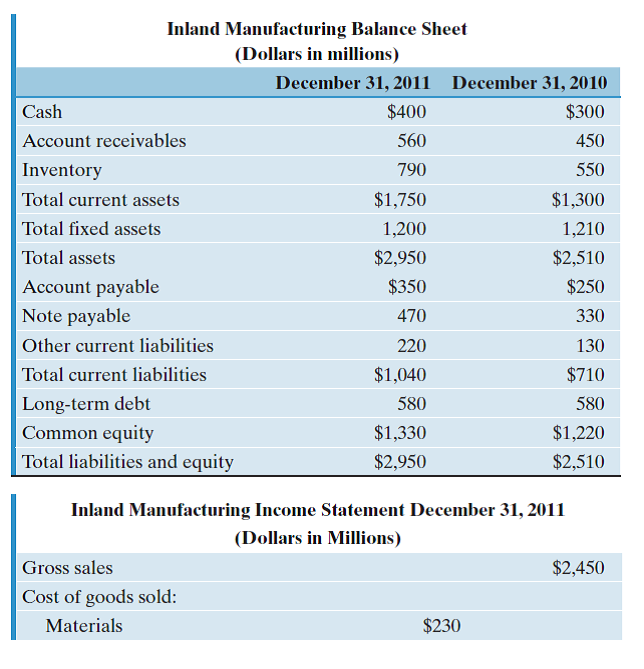

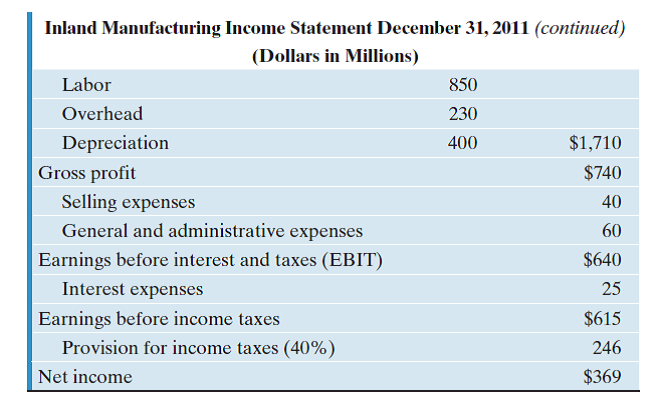

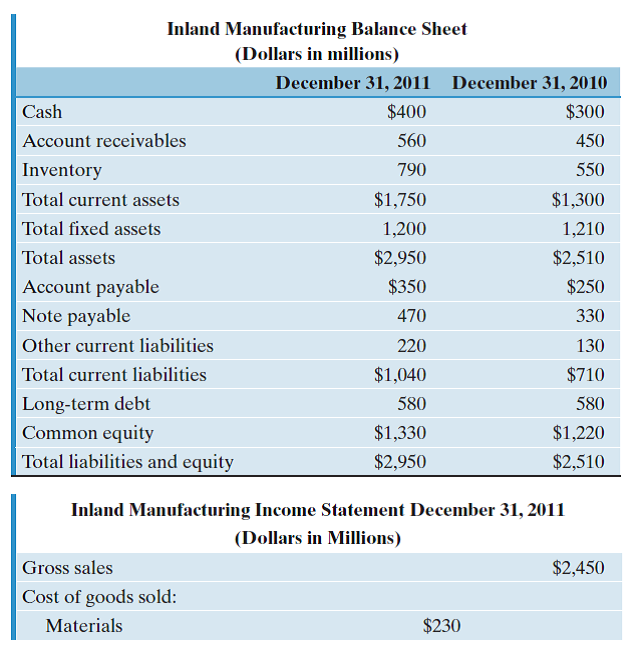

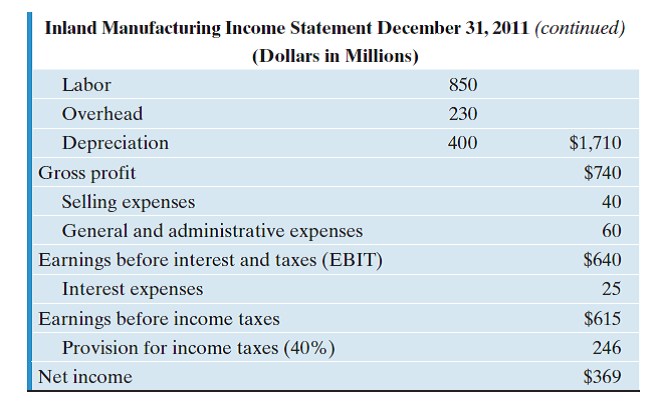

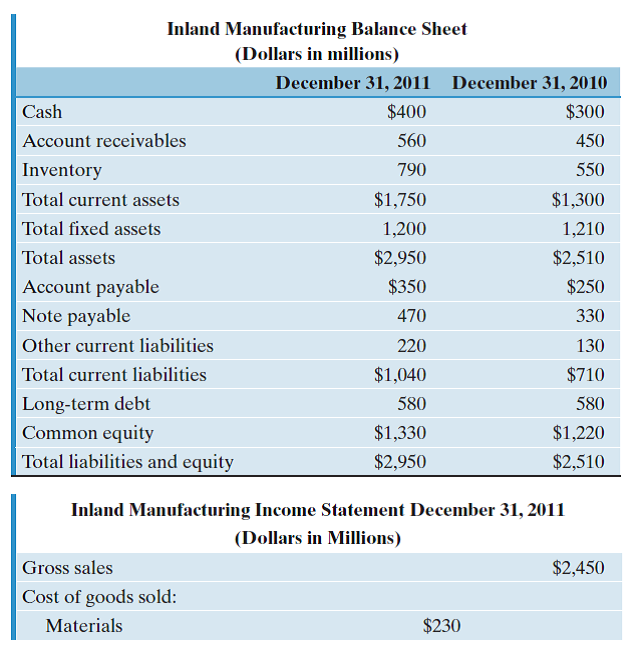

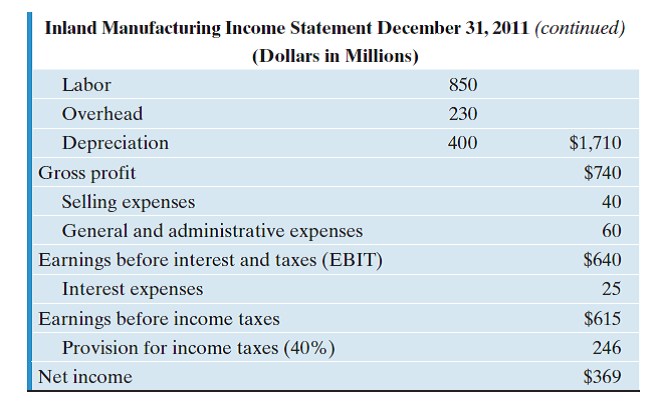

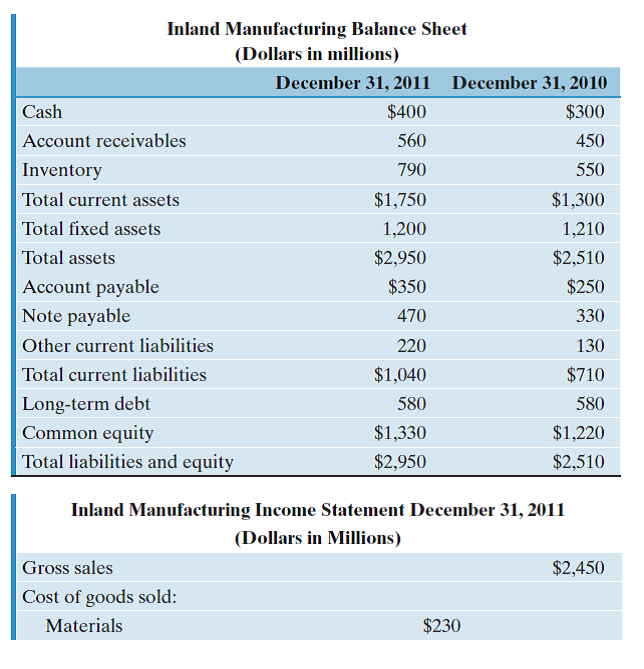

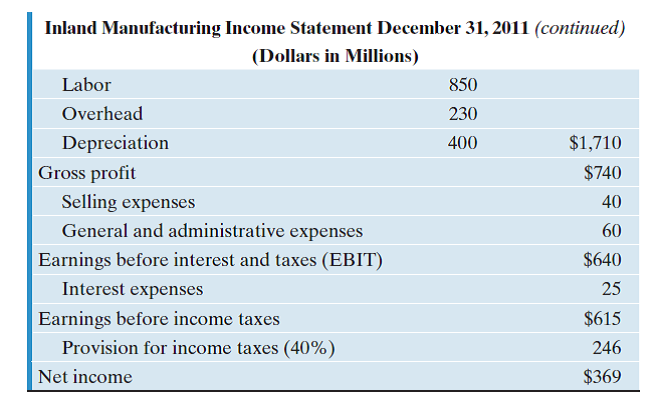

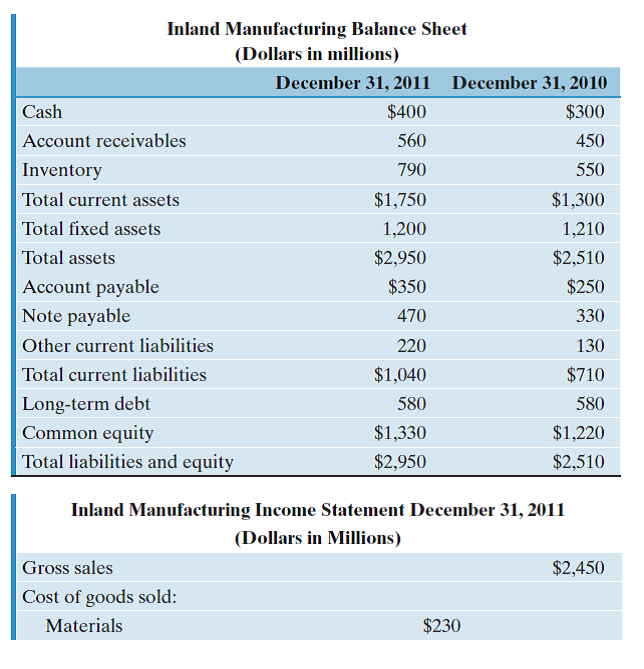

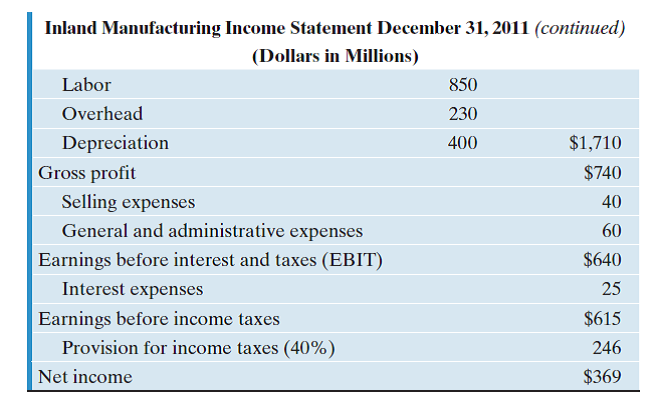

The following financial statements apply to the next six problems, 13s.12-13s.18.

Calculate the liquidity ratios, that is, the current and quick ratios.

(a) (1.68, 0.92)

(b) (1.56, 0.92)

(c) (1.68, 0.82)

(d) None of the above

Calculate the liquidity ratios, that is, the current and quick ratios.

(a) (1.68, 0.92)

(b) (1.56, 0.92)

(c) (1.68, 0.82)

(d) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

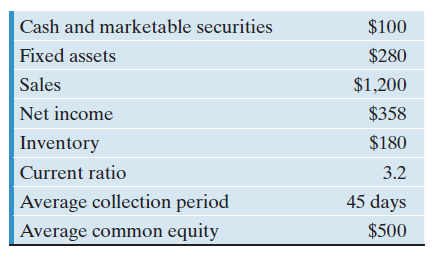

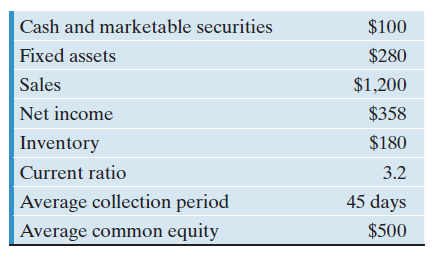

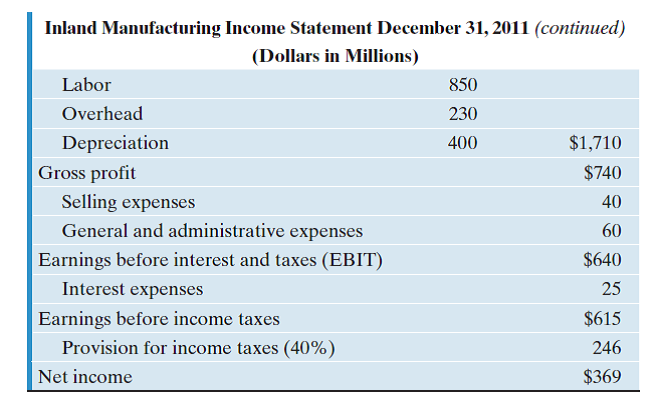

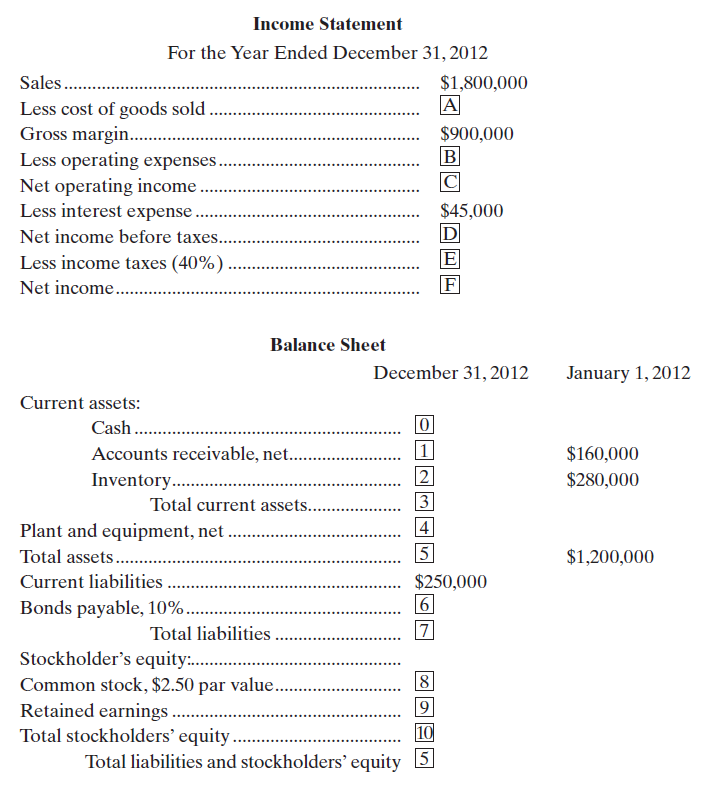

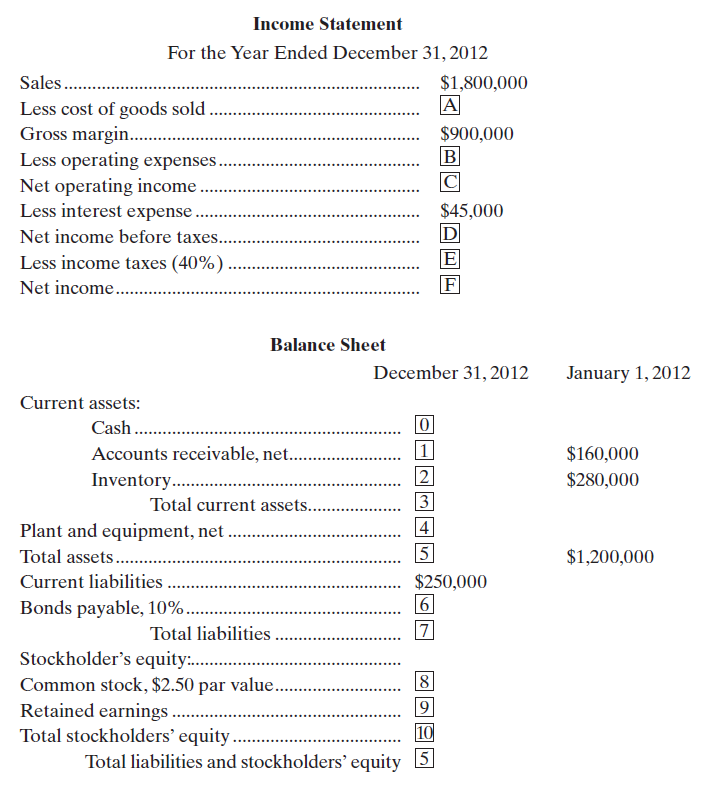

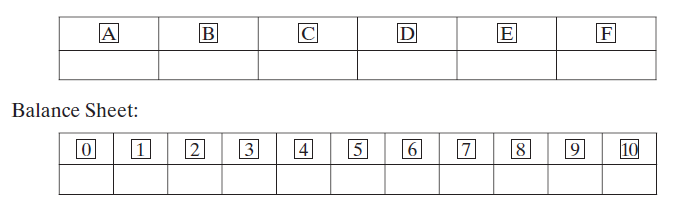

Incomplete financial statements for ABC Company are as follows:

The following additional information is available about the company:

(a) Selected financial ratios computed from the preceding statements are given as follows:

Current ratio 2.40 to 1

Quick (acid-test) ratio 1.12 to 1

Average collection period 24.3333 days

Inventory turnover 6.0 times

Debt-to-equity ratio 0.875 to 1

Earnings per share $4.05

Return on total assets 14%

(b) All sales during the year were on account.

(c) The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change throughout the year.

(d) There were no issues or retirements of common stock during the year. Required: Compute the missing amounts on the company's financial statements.

Income Statement:

The following additional information is available about the company:

(a) Selected financial ratios computed from the preceding statements are given as follows:

Current ratio 2.40 to 1

Quick (acid-test) ratio 1.12 to 1

Average collection period 24.3333 days

Inventory turnover 6.0 times

Debt-to-equity ratio 0.875 to 1

Earnings per share $4.05

Return on total assets 14%

(b) All sales during the year were on account.

(c) The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change throughout the year.

(d) There were no issues or retirements of common stock during the year. Required: Compute the missing amounts on the company's financial statements.

Income Statement:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

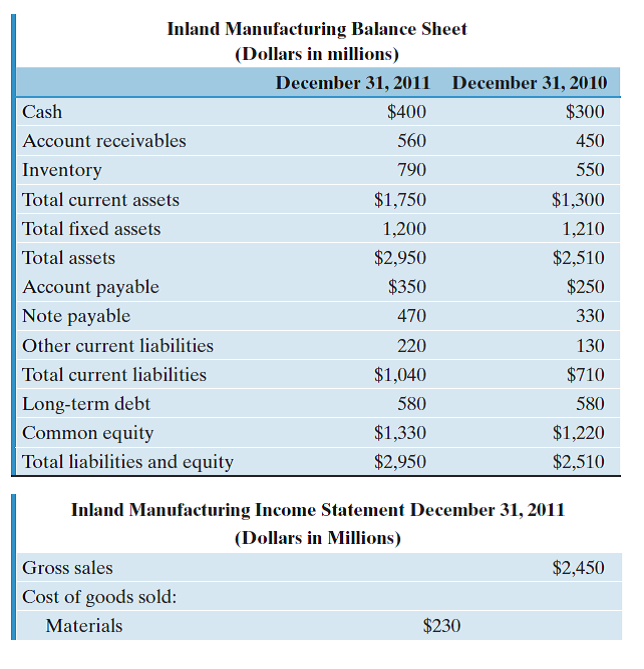

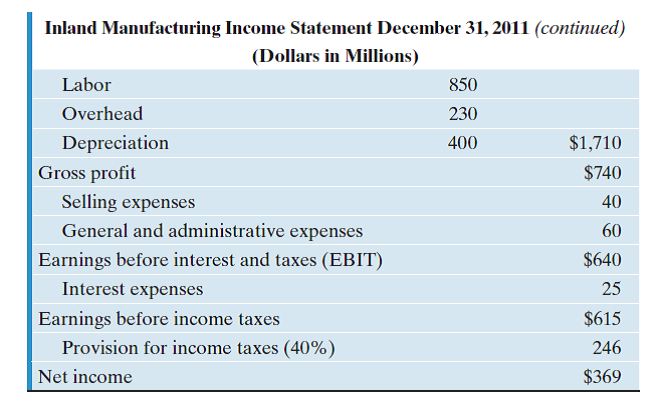

The following financial statements apply to the next six problems, 13s.12-13s.18.

Calculate the debt management ratios, that is, the debt and times-interest-earned ratios.

(a) (1.22, 12.56)

(b) (0.55, 26.60)

(c) (0.75, 26.60

(b) (1.22, 22.55)

Calculate the debt management ratios, that is, the debt and times-interest-earned ratios.

(a) (1.22, 12.56)

(b) (0.55, 26.60)

(c) (0.75, 26.60

(b) (1.22, 22.55)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is incorrect? (a) Holding on to cash is the most risk-free investment option.

(b) To maximize your return on total assets (ignoring financial risk), you must put all your money into the same type of investment category.

(c) Diversification among well-chosen investments can reduce market volatility.

(d) Broader diversification among well-chosen assets always leads to a higher return without increasing additional risk.

(b) To maximize your return on total assets (ignoring financial risk), you must put all your money into the same type of investment category.

(c) Diversification among well-chosen investments can reduce market volatility.

(d) Broader diversification among well-chosen assets always leads to a higher return without increasing additional risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

The following financial statements apply to the next six problems, 13s.12-13s.18.

Calculate the inventory-turnover ratio.

(a) 3.66

(b) 7.33

(c) 2.88

(b) 4.21

Calculate the inventory-turnover ratio.

(a) 3.66

(b) 7.33

(c) 2.88

(b) 4.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

Consider the Coca-Cola Company and Pepsi-Cola Company. Both companies compete with each other in the soft-drink sector. Get the most recent annual report for each company, and answer the following questions. ( Note : You can visit the firms' websites to download their annual reports. Look for "Investor' Relations.")

(a) Review the most recent financial statements and comment on each company's financial performance in the following areas:

Asset management

Liquidity

Debt management

Profitability

Market value

(b) Check the current stock prices for both companies. The stock ticker symbols are KO for Coca-Cola and PEP for Pepsi. Based on your analysis in part (a), in which company would you invest your money and why?

(a) Review the most recent financial statements and comment on each company's financial performance in the following areas:

Asset management

Liquidity

Debt management

Profitability

Market value

(b) Check the current stock prices for both companies. The stock ticker symbols are KO for Coca-Cola and PEP for Pepsi. Based on your analysis in part (a), in which company would you invest your money and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following financial statements apply to the next six problems, 13s.12-13s.18.

Calculate the return on equity.

(a) 14%

(b) 29%

(c) 15%

(d) None of the above

Calculate the return on equity.

(a) 14%

(b) 29%

(c) 15%

(d) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

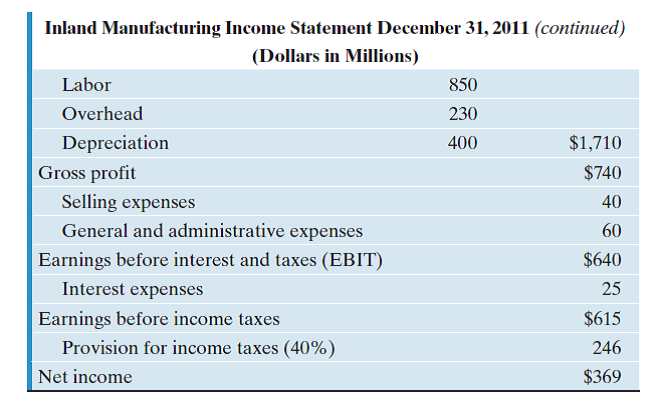

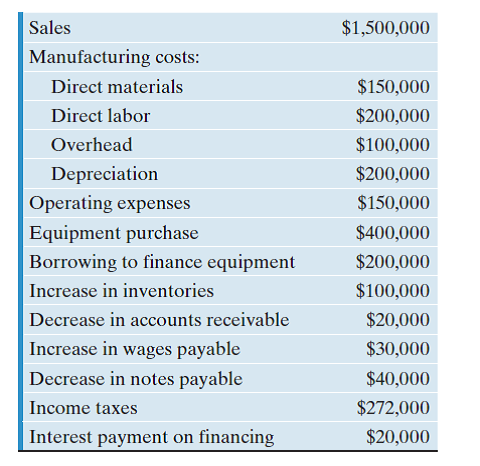

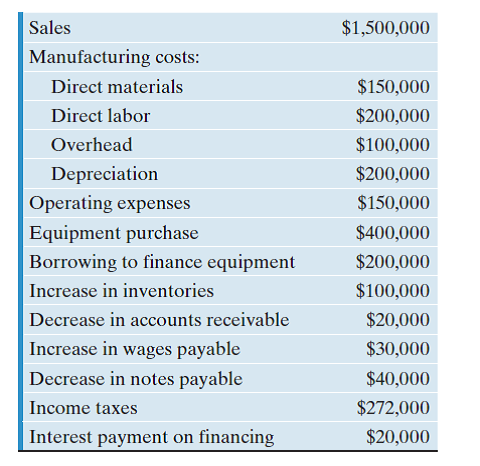

31

A chemical-processing firm is planning on adding a second polyethylene plant at another location. The financial information for the first project year is provided as follows:

(a) Compute the working-capital requirement during this project period.

(b) What is the taxable income during this project period?

(c) What is the net income during this project period?

(d) Compute the net cash flow from this project during the first year.

(a) Compute the working-capital requirement during this project period.

(b) What is the taxable income during this project period?

(c) What is the net income during this project period?

(d) Compute the net cash flow from this project during the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following financial statements apply to the next six problems, 13s.12-13s.18.

Calculate the price/earnings ratio. Inland had an average of 100 million shares outstanding during 2005, and the stock price on December 31, 2005, was $35.

(a) 2.63

(b) 13.3

(c) 9.49

(b) 5.23

Calculate the price/earnings ratio. Inland had an average of 100 million shares outstanding during 2005, and the stock price on December 31, 2005, was $35.

(a) 2.63

(b) 13.3

(c) 9.49

(b) 5.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

Compare Google and Baidu, a Chinese search engine, using a thorough financial ratios analysis.

Part A: For each company, compute all the ratios listed in Figure 13.7 for the current year (or the most recent financial statements available) (i.e., debt management, liquidity, asset management, market trend, and profitability).

Part B: Compare and contrast these companies using the ratios you calculated from part A.

Part C: Carefully read and summarize the "Risk Management" or "hedging" practices described in the financial statements for each company.

Parts D: If you were a mutual fund manager and could invest in only one of these companies, which one would you select and why? Be sure to justify your answer using your results from parts A, B, and C.

I would recommend using the companies' websites to acquire the financial statements. This assignment should be typed, single spaced, with between two and five pages of discussion (not counting any tables or calculations). Include a table that summarizes all comparative ratio calculations.

Part A: For each company, compute all the ratios listed in Figure 13.7 for the current year (or the most recent financial statements available) (i.e., debt management, liquidity, asset management, market trend, and profitability).

Part B: Compare and contrast these companies using the ratios you calculated from part A.

Part C: Carefully read and summarize the "Risk Management" or "hedging" practices described in the financial statements for each company.

Parts D: If you were a mutual fund manager and could invest in only one of these companies, which one would you select and why? Be sure to justify your answer using your results from parts A, B, and C.

I would recommend using the companies' websites to acquire the financial statements. This assignment should be typed, single spaced, with between two and five pages of discussion (not counting any tables or calculations). Include a table that summarizes all comparative ratio calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following financial statements apply to the next six problems, 13s.12-13s.18.

If Inland uses $350 of cash to pay off $350 of its accounts payable, what is the new current ratio after this action?

(a) 1.68

(b) 2.03

(c) 3.12

(b) 1.45

If Inland uses $350 of cash to pay off $350 of its accounts payable, what is the new current ratio after this action?

(a) 1.68

(b) 2.03

(c) 3.12

(b) 1.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following financial statements apply to the next six problems, 13s.12-13s.18.

If Inland uses its $400 cash balance to pay off $400 of its long-term debt, what will be its new current ratio?

(a) 1.68

(b) 2.03

(c) 1.35

(b) 3.12

If Inland uses its $400 cash balance to pay off $400 of its long-term debt, what will be its new current ratio?

(a) 1.68

(b) 2.03

(c) 1.35

(b) 3.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck