Deck 9: Advanced Topics for State and Local Governments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/9

العب

ملء الشاشة (f)

Deck 9: Advanced Topics for State and Local Governments

1

Obtain an annual report from a public college or university and answer the following questions:

a. Does the institution report as a special-purpose entity engaged in (1) governmental- and business-type activities or (2) business-type activities only Are the financial statements appropriate, based on the choice made by the institution (The remaining questions assume the institution reports as a special-purpose entity engaged only in business-type activities.)

b. Does the institution report a Statement of Net Position Is the statement in a classified format What are the categories of Net Position reported on the Statement List the major restrictions appearing in restricted portion of Net Position. Is Unrestricted Net Position a positive or negative amount

c. Does the institution report a Statement of Revenues, Expenses and Changes in Net Position If so, is a measure of operations (such as operating income) reported Are scholarships and fellowships, for which no service is provided, deducted from student tuition and fees Is the state appropriation for operations shown as a nonoperating revenue Are capital appropriations, capital gifts and grants, additions to permanent endowments, and any special or extraordinary items shown after nonoperating revenues (expenses)

d. Does the institution report a Statement of Cash Flows Is the direct method used, as required by GASB Are the four categories required by GASB shown If not, which is not shown Are interest receipts shown as cash provided by investing activities and interest payments shown as cash used for financing activities Is a reconciliation schedule prepared, reconciling operating income to cash provided (used) for operations Is the state appropriation for operations shown as cash provided by financing activities

a. Does the institution report as a special-purpose entity engaged in (1) governmental- and business-type activities or (2) business-type activities only Are the financial statements appropriate, based on the choice made by the institution (The remaining questions assume the institution reports as a special-purpose entity engaged only in business-type activities.)

b. Does the institution report a Statement of Net Position Is the statement in a classified format What are the categories of Net Position reported on the Statement List the major restrictions appearing in restricted portion of Net Position. Is Unrestricted Net Position a positive or negative amount

c. Does the institution report a Statement of Revenues, Expenses and Changes in Net Position If so, is a measure of operations (such as operating income) reported Are scholarships and fellowships, for which no service is provided, deducted from student tuition and fees Is the state appropriation for operations shown as a nonoperating revenue Are capital appropriations, capital gifts and grants, additions to permanent endowments, and any special or extraordinary items shown after nonoperating revenues (expenses)

d. Does the institution report a Statement of Cash Flows Is the direct method used, as required by GASB Are the four categories required by GASB shown If not, which is not shown Are interest receipts shown as cash provided by investing activities and interest payments shown as cash used for financing activities Is a reconciliation schedule prepared, reconciling operating income to cash provided (used) for operations Is the state appropriation for operations shown as cash provided by financing activities

The solution to this problem will differ from student to student, assuming each has a different college financial report.

2

GASB provides guidance for reporting by special-purpose entities. That guidance depends upon whether special-purpose entities are engaged in activities that are governmental-type, business-type only, or fiduciary-type only. Discuss the guidance and list required basic financial statements for:

a. Governments engaged in governmental-type activities. Include those that are engaged in governmental- and business-type activities, more than one governmental activity, and only one governmental activity.

b. Governments engaged in business-type activities only.

c. Governments engaged in fiduciary-type activities only.

a. Governments engaged in governmental-type activities. Include those that are engaged in governmental- and business-type activities, more than one governmental activity, and only one governmental activity.

b. Governments engaged in business-type activities only.

c. Governments engaged in fiduciary-type activities only.

Governmental funds balance sheet

Government activities are financed by taxes, intergovernmental revenue and other revenue. The revenue from these activities are reported in government fund and internal service fund. Special purpose government fund undertakes one single type of government activity and these funds can combine fund and government wide financial statement. This is undertaken by preparing reconciliation. In case of special purpose entity balance sheet or statement of net assets is prepared. The first three column of statement is prepared using current financial resources measurement focus and modified accrual basis of accounting. After that adjustment column is added to convert to economic resource measurement and accrual basis of accounting which is needed in government wide statement.

a.

In case of government engaged in governmental type of activities need not prepare separate fund and government wide statement. They can combine both the statement together. Also, special purpose government engaged in only governmental type of activities are required to provide complete financial reporting which is part of their financial statement. They need to provide notes to financial statement, details on enterprise fund statement and other supplementary information.

b.

In case of government engaged in only business type activities are required to prepare proprietary funds statement of net assets, statement of revenue, expenses and changes in fund net assets and cash flow statement.

c.

In case of governments engaged in only fiduciary type of services the statement required to be prepared include statement of fiduciary net assets, changes in fiduciary net assets, notes to financial statement.

Government activities are financed by taxes, intergovernmental revenue and other revenue. The revenue from these activities are reported in government fund and internal service fund. Special purpose government fund undertakes one single type of government activity and these funds can combine fund and government wide financial statement. This is undertaken by preparing reconciliation. In case of special purpose entity balance sheet or statement of net assets is prepared. The first three column of statement is prepared using current financial resources measurement focus and modified accrual basis of accounting. After that adjustment column is added to convert to economic resource measurement and accrual basis of accounting which is needed in government wide statement.

a.

In case of government engaged in governmental type of activities need not prepare separate fund and government wide statement. They can combine both the statement together. Also, special purpose government engaged in only governmental type of activities are required to provide complete financial reporting which is part of their financial statement. They need to provide notes to financial statement, details on enterprise fund statement and other supplementary information.

b.

In case of government engaged in only business type activities are required to prepare proprietary funds statement of net assets, statement of revenue, expenses and changes in fund net assets and cash flow statement.

c.

In case of governments engaged in only fiduciary type of services the statement required to be prepared include statement of fiduciary net assets, changes in fiduciary net assets, notes to financial statement.

3

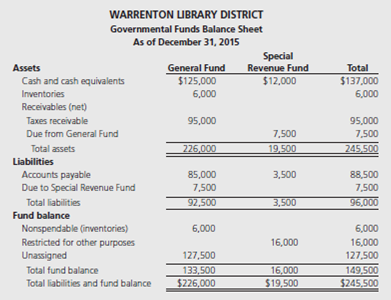

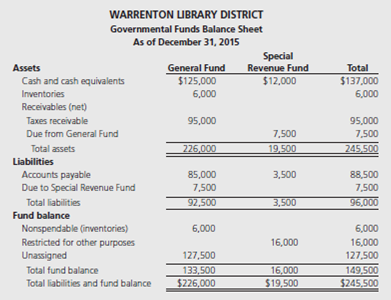

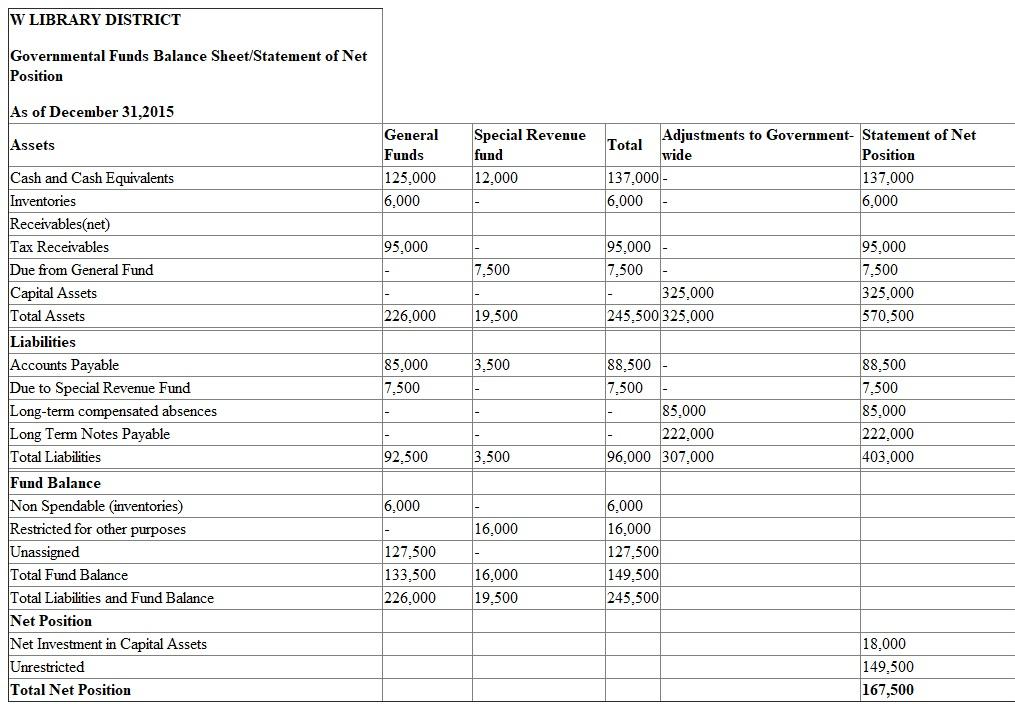

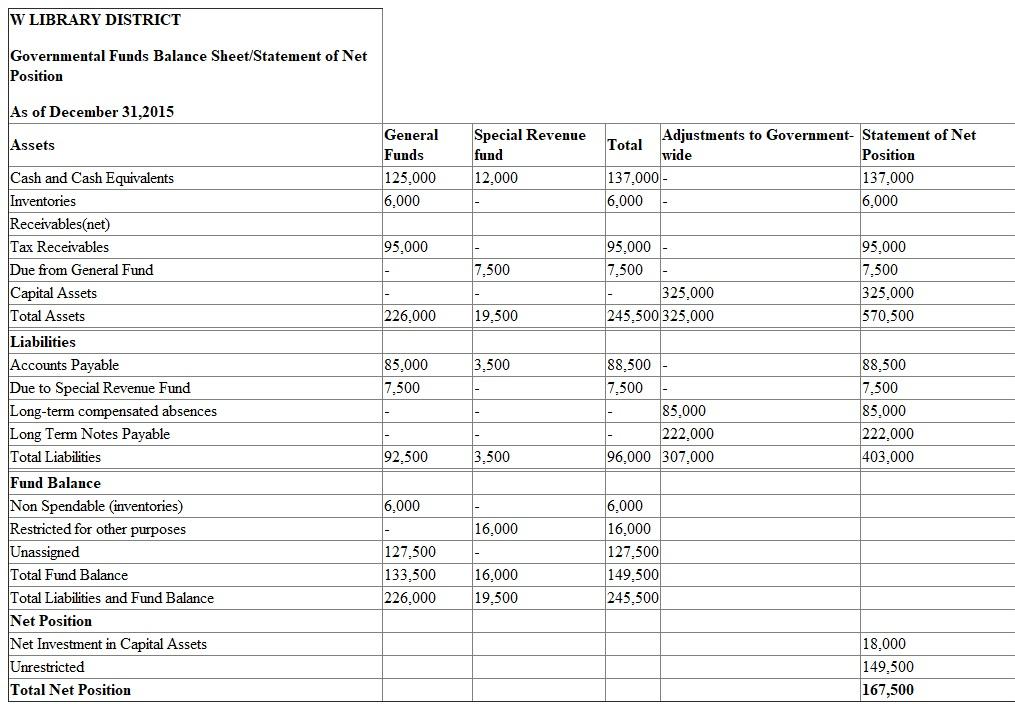

Presented below is the governmental funds balance sheet for the Warrenton Library District, a special-purpose entity engaged in a single governmental activity. Prepare a combined Governmental Funds Balance Sheet/Statement of Net Position in the format presented in Illustration 9-2.

Additional information:

a. Capital assets (net of accumulated depreciation) amounted to $325,000 at year-end.

b. The liability for long-term compensated absences is estimated to be $85,000 at year-end.

c. Long-term notes payable amounted to $222,000 at year-end.

Additional information:

a. Capital assets (net of accumulated depreciation) amounted to $325,000 at year-end.

b. The liability for long-term compensated absences is estimated to be $85,000 at year-end.

c. Long-term notes payable amounted to $222,000 at year-end.

Usually the balance sheet of any firm, institution or government is prepared and reported to indicate the position of assets and liabilities year over year. However the balance sheet reporting for firms and governments differs in its nature of transactions also the firm balance sheets are reported as per the FASB or GAAP but whereas the balance sheet of governments are reported as per the GASB. The GASB has classified the reporting as general purpose and special purpose balance sheet on the basis of activities in which government is involved.

Balance sheet:

Balance sheet is a statement of financial position. It is one of the main reports in financial statements. It shows the financial position of the company. Balance sheet will be prepared for a specific period. It summarizes a company's assets, liabilities and shareholders' equity. It is prepared by using accounting equation that is 'Assets = Liabilities + Stockholders' Equity'.

Steps to compute net position:

• Total assets are derived from current assets, long term investments, property, plant, and equipment, and intangible assets.

• The total liability is derived from current liability, long term debt, contributed capital, and retained earnings.

• Then enter net investment in capital assets, restricted and unrestricted.

• Add net investment in capital assets, restricted and unrestricted to arrive at total net position.

Therefore, Total net position is $167,500.

Therefore, Total net position is $167,500.

Balance sheet:

Balance sheet is a statement of financial position. It is one of the main reports in financial statements. It shows the financial position of the company. Balance sheet will be prepared for a specific period. It summarizes a company's assets, liabilities and shareholders' equity. It is prepared by using accounting equation that is 'Assets = Liabilities + Stockholders' Equity'.

Steps to compute net position:

• Total assets are derived from current assets, long term investments, property, plant, and equipment, and intangible assets.

• The total liability is derived from current liability, long term debt, contributed capital, and retained earnings.

• Then enter net investment in capital assets, restricted and unrestricted.

• Add net investment in capital assets, restricted and unrestricted to arrive at total net position.

Therefore, Total net position is $167,500.

Therefore, Total net position is $167,500. 4

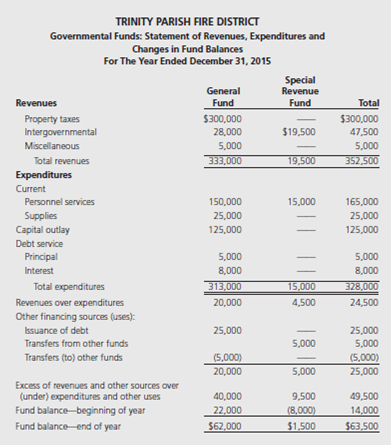

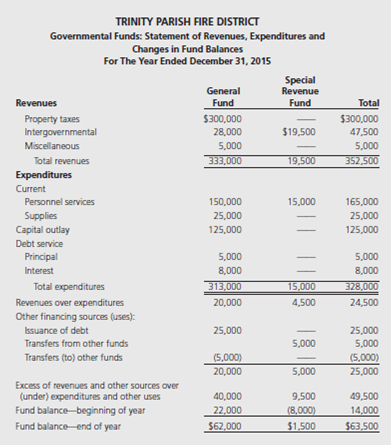

Presented below is the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balance the Trinity Parish Fire District, a specialpurpose entity engaged in a single governmental activity. Prepare a combined Governmental Funds Balance Sheet/Statement of Net Position in the format presented in Illustration 9-3.

Additional information:

a. Property taxes expected to be collected more than 60 days following year-end are deferred in the fund-basis statements. Deferred taxes totaled $39,000 at the end of 2014 and $36,000 at the end of 2015.

b. The current year provision for depreciation totaled $59,000.

c. Interest on long-term notes payable is paid monthly (no accrual is necessary).

d. Total Net Position on the December 31, 2014, Statement of Net Position totaled $128,000.

Additional information:

a. Property taxes expected to be collected more than 60 days following year-end are deferred in the fund-basis statements. Deferred taxes totaled $39,000 at the end of 2014 and $36,000 at the end of 2015.

b. The current year provision for depreciation totaled $59,000.

c. Interest on long-term notes payable is paid monthly (no accrual is necessary).

d. Total Net Position on the December 31, 2014, Statement of Net Position totaled $128,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

5

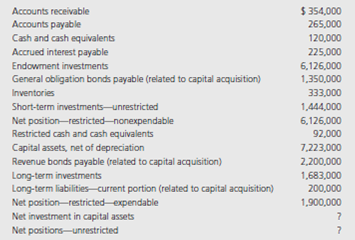

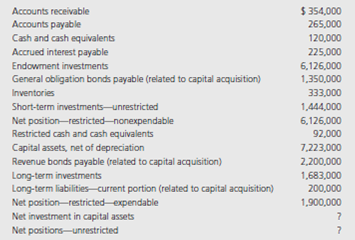

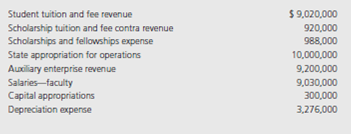

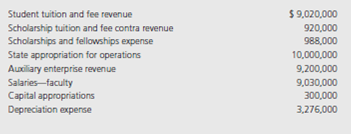

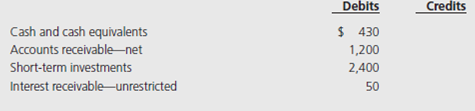

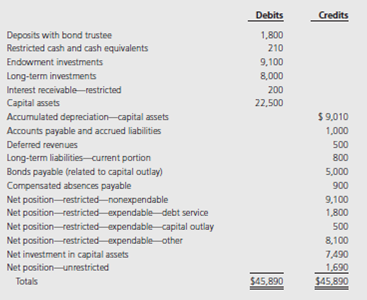

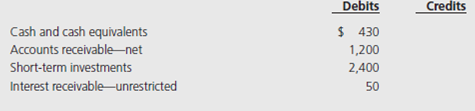

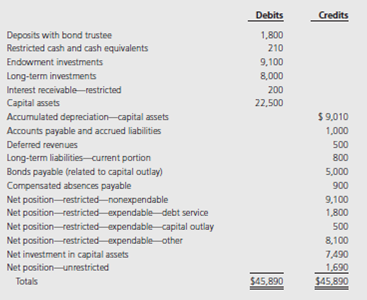

Southern State University had the following account balances as of June 30, 2015. Debits are not distinguished from credits, so assume all accounts have a "normal" balance:

Required:

Prepare, in good form, a Statement of Net Position for Southern State University as of June 30, 2015.

Required:

Prepare, in good form, a Statement of Net Position for Southern State University as of June 30, 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

6

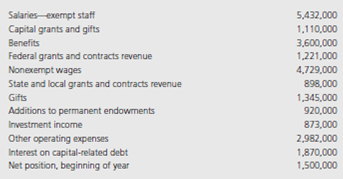

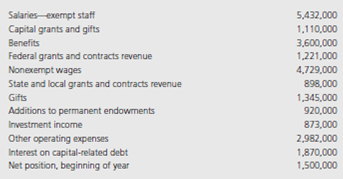

Western State University had the following account balances for the year ended and as of June 30, 2015. Debits are not distinguished from credits, so assume all accounts have a "normal" balance.

Required:

Prepare, in good form, a Statement of Revenues, Expenses, and Changes in Net Position for Western State University for the year ended June 30, 2015.

Required:

Prepare, in good form, a Statement of Revenues, Expenses, and Changes in Net Position for Western State University for the year ended June 30, 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

7

The New City College reported deferred revenues of $612,000 as of July 1, 2014, the first day of its fiscal year. Record the following transactions related to student tuition and fees and related scholarship allowances for New City College for the year ended June 30, 2015.

a. The deferred revenues related to unearned revenues for the summer session, which ended in August.

b. During the fiscal year ended June 30, 2015, student tuition and fees were assessed in the amount of $12,000,000. Of that amount $9,650,000 was collected in cash. Also of that amount, $639,000 pertained to that portion of the summer session that took place after June 30.

c. Student scholarships, for which no services were required, amounted to $787,000. Students applied these scholarships to their tuition bills at the beginning of each semester.

d. Student scholarships and fellowships, for which services were required, such as graduate assistantships, amounted to $760,000. These students also applied their scholarship and fellowship awards to their tuition bills at the beginning of each semester.

a. The deferred revenues related to unearned revenues for the summer session, which ended in August.

b. During the fiscal year ended June 30, 2015, student tuition and fees were assessed in the amount of $12,000,000. Of that amount $9,650,000 was collected in cash. Also of that amount, $639,000 pertained to that portion of the summer session that took place after June 30.

c. Student scholarships, for which no services were required, amounted to $787,000. Students applied these scholarships to their tuition bills at the beginning of each semester.

d. Student scholarships and fellowships, for which services were required, such as graduate assistantships, amounted to $760,000. These students also applied their scholarship and fellowship awards to their tuition bills at the beginning of each semester.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

8

Eastern State College had the following trial balance as of July 1, 2014, the first day of its fiscal year (in thousands):

During the fiscal year ended June 30, 2015, the following transactions occurred (amounts are in thousands):

1. Student tuition and fees were assessed in the amount of $18,350. Scholarship allowances were made, for which no services were required, in the amount of $1,490. Graduate and other assistantships were awarded, for which services were required, in the amount of $1,420. All scholarship and assistantship allowances were credited against student's bills. Collections were made on account in the amount of $15,700.

2. The $500 in deferred revenues relate to cash collected prior to June 30, 2014, and to tuition revenue that should be recognized in the current year. Also $720 of the tuition and fees in (1) above applies to fees that should be recognized as revenue in the year ended June 30, 2016 (i.e., next year).

3. State appropriations were received in cash as follows: $13,020 for general operations and $800 for capital outlay, set aside for specific projects.

4. Federal grants and contracts, for restricted purposes, were received in cash in the amount of $2,310. State and local grants and contracts, also for restricted purposes, were received in cash in the amount of $890.

5. Revenues from auxiliary enterprise operations amounted to $12,450, of which $12,100 was received in cash.

6. Contributions were received in cash as follows: unrestricted, $650; restricted for capital projects, $300; restricted for other purposes, $500.

7. Donors contributed $600 for endowments, the principal of which may not be expended. The income from these endowments is all restricted for operating purposes. The cash was immediately invested.

8. Interest receivable at the beginning of the year was collected (both unrestricted and restricted).

9. During the year, investment income was earned on investments whose income is unrestricted in the amount of $200, of which $175 was received in cash. Investment income was earned on investments whose income is restricted in the amount of $1,500, of which $1,250 was received in cash.

10. All accounts payable and accrued liabilities as of the end of the previous year were paid in cash at year-end, using unrestricted cash.

11. Unrestricted expenses amounted to: salaries-faculty, $14,123; salaries-exempt staff, $10,111; nonexempt wages, $6,532; benefits, $6,112; other operating expenses, $1,100. Cash was paid in the amount of $36,878; the remainder was payable at year-end.

12. Restricted expenses amounted to: salaries-faculty, $2,256; salaries-exempt staff, $745; nonexempt wages, $213; benefits, $656; other operations, $1,100. Cash was paid in the amount of $4,612; the remainder was payable at year-end.

13. Depreciation was recorded in the amount of $1,370, all charged as unrestricted expense.

14. During the year, expenditures were made for property, plant, and equipment in the amount of $3,195, of which $1,050 was from resources restricted for capital outlay and the remainder was from unrestricted cash.

15. Interest on bonds payable, all related to capital outlay purchases, amounted to $348; all but $22 was paid in cash. Bonds were paid in the amount of $800; next year, $300 will be payable. No new revenue bonds were issued during the year. Unrestricted cash was used for all these transactions.

16. An additional $100 was deposited with the bond trustee, in accord with legal requirements.

17. The accrued liability for compensated absences increased by $88 during the year.

18. All short-term investments existing at the beginning of the year were sold for $2,450. New short-term investments were purchased for $2,650. Unrealized gains were recorded at year-end as follows: short-term investments (unrestricted), $40; long-term investments (restricted) $120; endowment investments, $61.

19. Closing entries were prepared, separately, for each net position class.

Required:

Use the Excel template provided to complete the following requirements:

a. Prepare journal entries for each of the above transactions and post these to T-accounts.

b. Prepare closing entries and calculate the ending balance for each class of net position.

c. Prepare a Statement of Net Position as of June 30, 2015.

d. Prepare a Statement of Revenues, Expenses, and Changes in Net Position for the year ending June 30, 2015.

During the fiscal year ended June 30, 2015, the following transactions occurred (amounts are in thousands):

1. Student tuition and fees were assessed in the amount of $18,350. Scholarship allowances were made, for which no services were required, in the amount of $1,490. Graduate and other assistantships were awarded, for which services were required, in the amount of $1,420. All scholarship and assistantship allowances were credited against student's bills. Collections were made on account in the amount of $15,700.

2. The $500 in deferred revenues relate to cash collected prior to June 30, 2014, and to tuition revenue that should be recognized in the current year. Also $720 of the tuition and fees in (1) above applies to fees that should be recognized as revenue in the year ended June 30, 2016 (i.e., next year).

3. State appropriations were received in cash as follows: $13,020 for general operations and $800 for capital outlay, set aside for specific projects.

4. Federal grants and contracts, for restricted purposes, were received in cash in the amount of $2,310. State and local grants and contracts, also for restricted purposes, were received in cash in the amount of $890.

5. Revenues from auxiliary enterprise operations amounted to $12,450, of which $12,100 was received in cash.

6. Contributions were received in cash as follows: unrestricted, $650; restricted for capital projects, $300; restricted for other purposes, $500.

7. Donors contributed $600 for endowments, the principal of which may not be expended. The income from these endowments is all restricted for operating purposes. The cash was immediately invested.

8. Interest receivable at the beginning of the year was collected (both unrestricted and restricted).

9. During the year, investment income was earned on investments whose income is unrestricted in the amount of $200, of which $175 was received in cash. Investment income was earned on investments whose income is restricted in the amount of $1,500, of which $1,250 was received in cash.

10. All accounts payable and accrued liabilities as of the end of the previous year were paid in cash at year-end, using unrestricted cash.

11. Unrestricted expenses amounted to: salaries-faculty, $14,123; salaries-exempt staff, $10,111; nonexempt wages, $6,532; benefits, $6,112; other operating expenses, $1,100. Cash was paid in the amount of $36,878; the remainder was payable at year-end.

12. Restricted expenses amounted to: salaries-faculty, $2,256; salaries-exempt staff, $745; nonexempt wages, $213; benefits, $656; other operations, $1,100. Cash was paid in the amount of $4,612; the remainder was payable at year-end.

13. Depreciation was recorded in the amount of $1,370, all charged as unrestricted expense.

14. During the year, expenditures were made for property, plant, and equipment in the amount of $3,195, of which $1,050 was from resources restricted for capital outlay and the remainder was from unrestricted cash.

15. Interest on bonds payable, all related to capital outlay purchases, amounted to $348; all but $22 was paid in cash. Bonds were paid in the amount of $800; next year, $300 will be payable. No new revenue bonds were issued during the year. Unrestricted cash was used for all these transactions.

16. An additional $100 was deposited with the bond trustee, in accord with legal requirements.

17. The accrued liability for compensated absences increased by $88 during the year.

18. All short-term investments existing at the beginning of the year were sold for $2,450. New short-term investments were purchased for $2,650. Unrealized gains were recorded at year-end as follows: short-term investments (unrestricted), $40; long-term investments (restricted) $120; endowment investments, $61.

19. Closing entries were prepared, separately, for each net position class.

Required:

Use the Excel template provided to complete the following requirements:

a. Prepare journal entries for each of the above transactions and post these to T-accounts.

b. Prepare closing entries and calculate the ending balance for each class of net position.

c. Prepare a Statement of Net Position as of June 30, 2015.

d. Prepare a Statement of Revenues, Expenses, and Changes in Net Position for the year ending June 30, 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

9

The fund-basis financial statements of Cherokee Library District (a special-purpose government engaged only in governmental activities) have been completed for the year 2015 and appear in the second and third tabs of the Excel spreadsheet provided with this exercise. The following information is also available:

a. Capital assets

• Capital assets purchased in previous years through governmentaltype funds totaled $19,500,000 and had accumulated depreciation of $6,330,000.

• Depreciation on capital assets used in governmental-type activities amounted to $418,000 for 2015.

• No capital assets were sold or disposed of in 2015, and all purchases are properly reflected in the fund-basis statements as capital expenditures.

b. Long-term debt

• There was $10,700,000 of outstanding long-term notes associated with governmental-type funds as of January 1, 2015. Interest is paid monthly.

• December 31, 2015, notes with a face value of $6,370,000 were issued at par. In addition, principal payments totaled $1,340,000.

• The notes, and any retained percentage on construction contracts, are associated with the purchase of capital assets.

c. Deferred inflows

• Deferred inflows are comprised solely of property taxes expected to be collected more than 60 days after year-end. The balance of deferred taxes at the end of 2014 was $87,500.

d. Transfers: Transfers were between governmental-type funds.

e. Beginning net position for the government-wide statements totaled $20,107,321 as of January 1, 2015. This amount has already been entered in the Statement of Activities.

Required:

Use the Excel template provided to complete the following requirements; a separate tab is provided for each requirement.

a. Prepare the journal entries necessary to convert the governmental fund financial statements to the accrual basis of accounting.

b. Post the journal entries to the (shaded) Adjustments column to produce a Statement of Activities. You do not have to post amounts debited or credited to "(beginning) net position." These have been reflected in item e above.

c. Post the journal entries to the (shaded) Adjustments column to produce a Statement of Net Position. Calculate the appropriate amounts for the Net Position accounts, assuming there are no restricted net position.

a. Capital assets

• Capital assets purchased in previous years through governmentaltype funds totaled $19,500,000 and had accumulated depreciation of $6,330,000.

• Depreciation on capital assets used in governmental-type activities amounted to $418,000 for 2015.

• No capital assets were sold or disposed of in 2015, and all purchases are properly reflected in the fund-basis statements as capital expenditures.

b. Long-term debt

• There was $10,700,000 of outstanding long-term notes associated with governmental-type funds as of January 1, 2015. Interest is paid monthly.

• December 31, 2015, notes with a face value of $6,370,000 were issued at par. In addition, principal payments totaled $1,340,000.

• The notes, and any retained percentage on construction contracts, are associated with the purchase of capital assets.

c. Deferred inflows

• Deferred inflows are comprised solely of property taxes expected to be collected more than 60 days after year-end. The balance of deferred taxes at the end of 2014 was $87,500.

d. Transfers: Transfers were between governmental-type funds.

e. Beginning net position for the government-wide statements totaled $20,107,321 as of January 1, 2015. This amount has already been entered in the Statement of Activities.

Required:

Use the Excel template provided to complete the following requirements; a separate tab is provided for each requirement.

a. Prepare the journal entries necessary to convert the governmental fund financial statements to the accrual basis of accounting.

b. Post the journal entries to the (shaded) Adjustments column to produce a Statement of Activities. You do not have to post amounts debited or credited to "(beginning) net position." These have been reflected in item e above.

c. Post the journal entries to the (shaded) Adjustments column to produce a Statement of Net Position. Calculate the appropriate amounts for the Net Position accounts, assuming there are no restricted net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck