Deck 13: Financial Statements and Closing Procedures

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/43

العب

ملء الشاشة (f)

Deck 13: Financial Statements and Closing Procedures

1

Preparing classified financial statements.

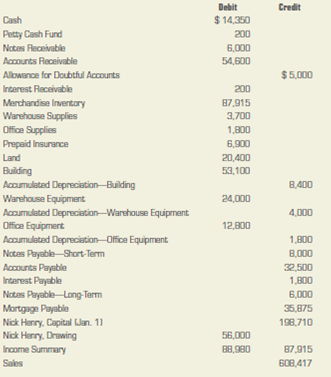

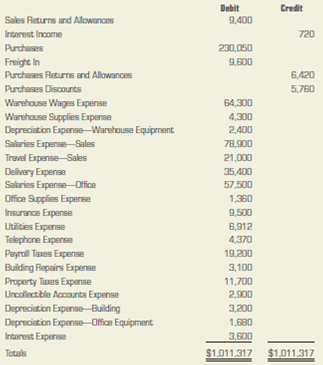

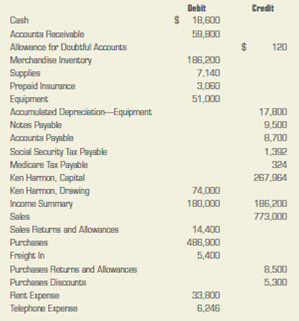

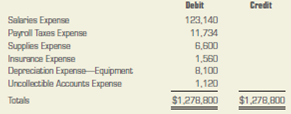

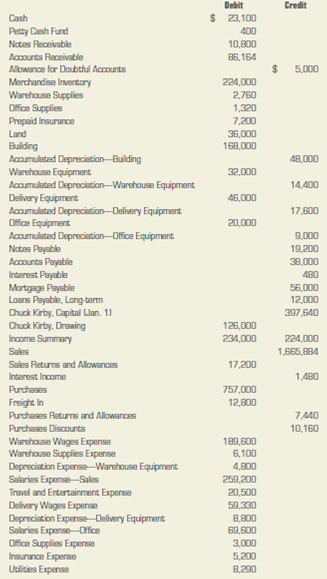

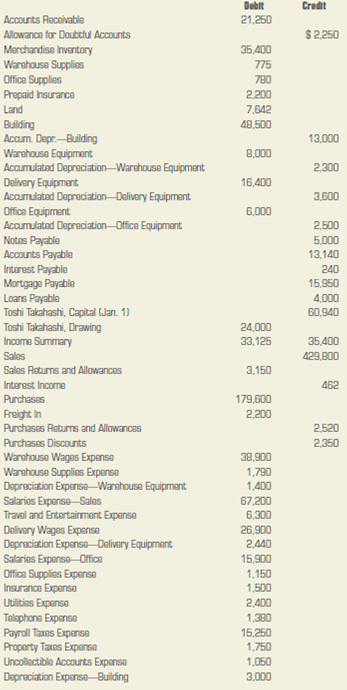

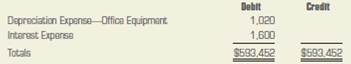

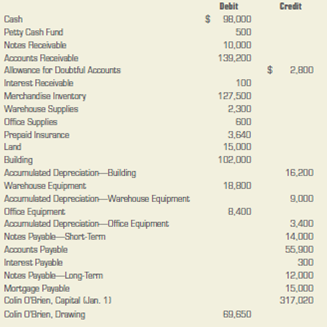

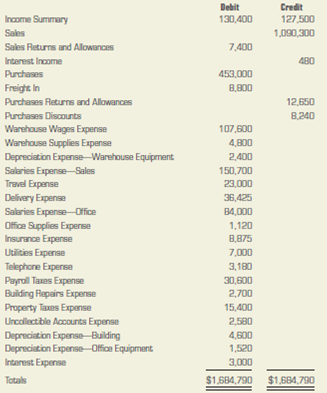

Hog Wild is a retail firm that sells motorcycles, parts, and accessories. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

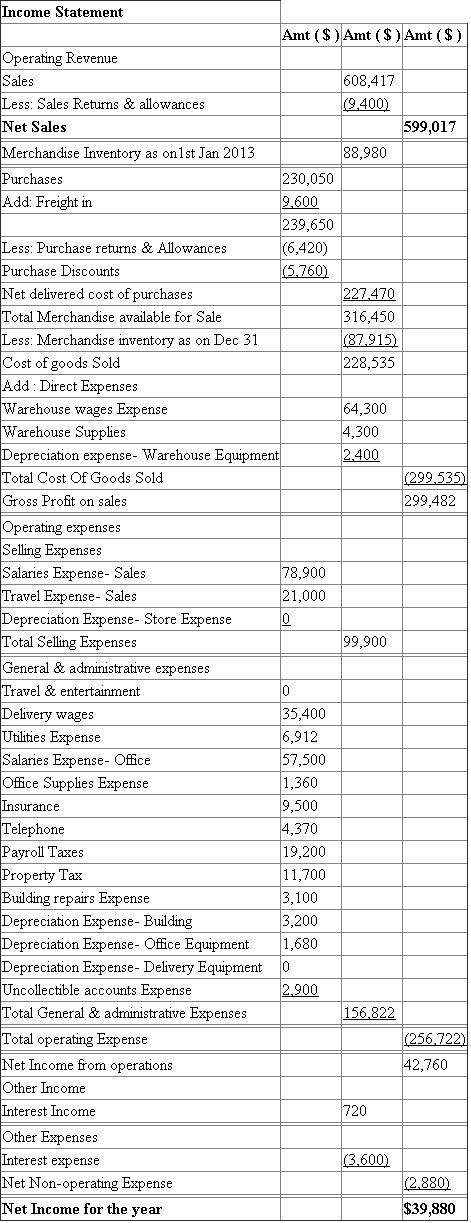

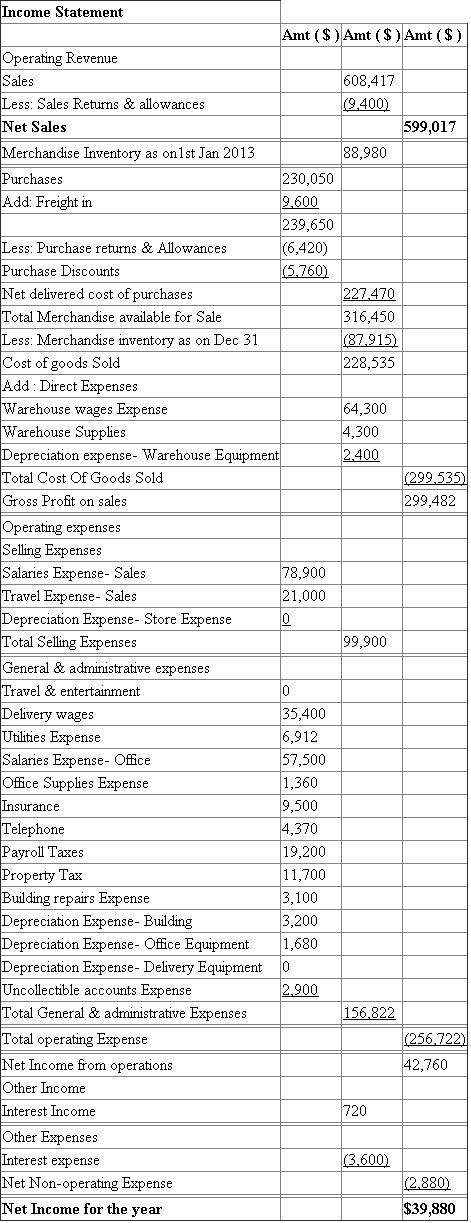

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the long-term notes extend for more than one year.

ACCOUNTS

Analyze: What is the inventory turnover for Hog Wild?

Hog Wild is a retail firm that sells motorcycles, parts, and accessories. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the long-term notes extend for more than one year.

ACCOUNTS

Analyze: What is the inventory turnover for Hog Wild?

Income Statement of H W for the year ended 31.12.2013:

2)

2)

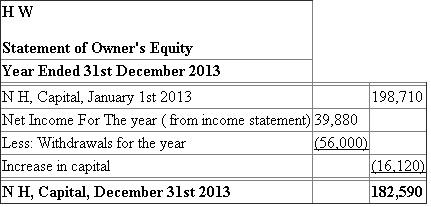

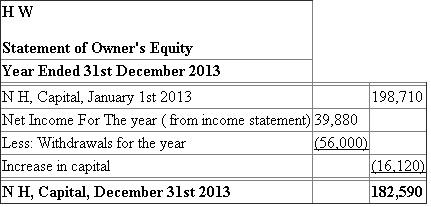

Prepare statement of owner's equity:

Stockholders' equity is main portion of the balance sheet. It represents the amounts that are collected from investors by issuing stocks (Common and preferred) and retained earnings. Common stock, preferred stock, additional capital in excess of par, retained earnings, and treasury stock are some of the items included in this section.

This statement shows the activity in the owner's equity or Capital account for a period.

1. Include the balance in the Capital account at the beginning of the period.

2. Add any additional investments.

3. Add net income or subtract net loss calculated in the Income statement

4. Subtract the withdrawals made by owner.

5. Get the ending capital, which is to be transferred to the balance sheet.

Statement of Owner's equity as follows:

3)

3)

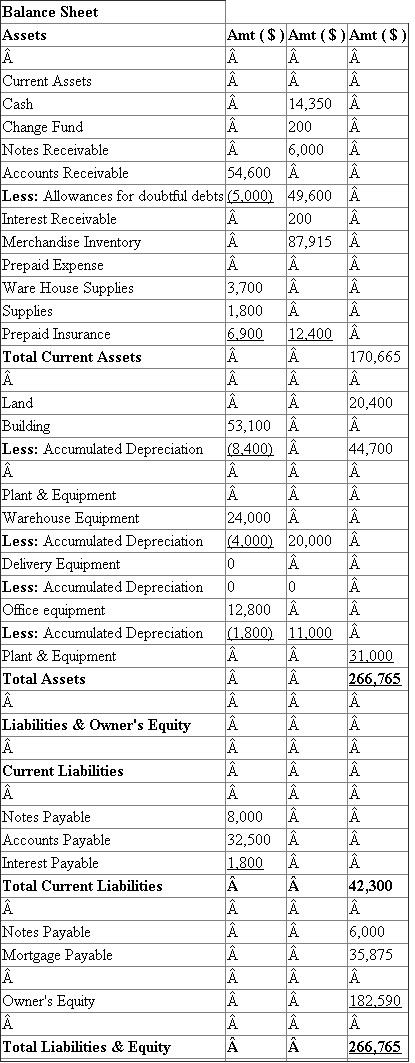

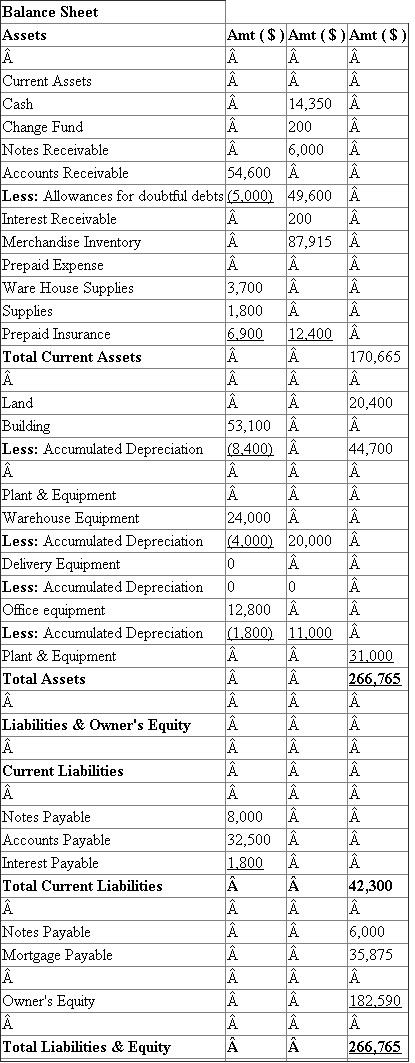

Prepare balance sheet:

Balance sheet is a statement of financial position. It is one of the main reports in financial statements. It shows the financial position of the company. Balance sheet will be prepared for a specific period. It summarizes a company's assets, liabilities and shareholders' equity. It is prepared by using accounting equation that is 'Assets = Liabilities + Stockholders' Equity'.

Classified Balance Sheet of "HW" as on 31-12-2013

2)

2) Prepare statement of owner's equity:

Stockholders' equity is main portion of the balance sheet. It represents the amounts that are collected from investors by issuing stocks (Common and preferred) and retained earnings. Common stock, preferred stock, additional capital in excess of par, retained earnings, and treasury stock are some of the items included in this section.

This statement shows the activity in the owner's equity or Capital account for a period.

1. Include the balance in the Capital account at the beginning of the period.

2. Add any additional investments.

3. Add net income or subtract net loss calculated in the Income statement

4. Subtract the withdrawals made by owner.

5. Get the ending capital, which is to be transferred to the balance sheet.

Statement of Owner's equity as follows:

3)

3) Prepare balance sheet:

Balance sheet is a statement of financial position. It is one of the main reports in financial statements. It shows the financial position of the company. Balance sheet will be prepared for a specific period. It summarizes a company's assets, liabilities and shareholders' equity. It is prepared by using accounting equation that is 'Assets = Liabilities + Stockholders' Equity'.

Classified Balance Sheet of "HW" as on 31-12-2013

2

Should a manager be concerned if the balance sheet shows a large increase in current liabilities and a large decrease in current assets? Explain your answer.

Large increase in current liabilities and large decrease in current assets indicates that the enterprise is unable to manage its working capital properly. In due course of time it will have an adverse impact on the routine activities of the enterprise as working capital is vital for core business operations of the enterprise.

This means that the overall business and the profitability of the enterprise will reduce if this situation is not corrected.

A Manager should improve this situation by following measures:

• Negotiating discount with suppliers.

• Eliminating unnecessary provisions.

• Adopting a clear cut working capital policy.

This means that the overall business and the profitability of the enterprise will reduce if this situation is not corrected.

A Manager should improve this situation by following measures:

• Negotiating discount with suppliers.

• Eliminating unnecessary provisions.

• Adopting a clear cut working capital policy.

3

What are the steps in the accounting cycle?

Following are the steps in Accounting Cycle:

1. Analysis of Transactions :

In this step an accounting system collects data from various source documents and determines the accounts and amounts that will be affected.

2. Journalize the data in the Transactions :

In this step the transactions are recorded either in a general journal or a special journal.

3. Posting the data into the respective Ledgers :

Post Journalizing the data is transferred into respective ledgers which enables in classification of various transactions in a systematic manner.

4. Preparation of Worksheet :

A Worksheet is prepared at the end of each period. This worksheet acts as a bridge between Ledger Accounts and the final Financial Statements wherein numerous nominal statements are made before finalization.

• Trial Balance section is used to check the equalization of Debit Credit Balances of General Ledger.

• Adjustment section records all the adjustment entries enabling the recording of incomes and expenses on accrual basis of accounting.

• Adjusted Trial Balance section is used to record updated Ledger Balances post adjustment so that equality of Debit and credit balances can be verified.

• Income Statement and Balance Sheet sections of the Worksheet help in orderly arrangement of data.

5. Preparation of Financial statements :

From the Worksheet a formal set of financial statements are prepared as per the requirement of federal law and accepted accounting practice. These financial statements assist the stakeholders of the organization and users of financial statements in understanding the financial position and performance of the organization.

6. Journalizing the post adjusting entries and post-closing entries to create a permanent record of changes shown in worksheet, close nominal accounts and transfer the results of operations to Owner's Equity.

7. Preparation of Post- Closing Trail balance :

This helps in ensuring that all nominal accounts have been closed and only General accounts are still in balance.

8. Interpretation of Financial Information by various tools of Analysis like Trend Analysis, Ratio Analysis etc.

1. Analysis of Transactions :

In this step an accounting system collects data from various source documents and determines the accounts and amounts that will be affected.

2. Journalize the data in the Transactions :

In this step the transactions are recorded either in a general journal or a special journal.

3. Posting the data into the respective Ledgers :

Post Journalizing the data is transferred into respective ledgers which enables in classification of various transactions in a systematic manner.

4. Preparation of Worksheet :

A Worksheet is prepared at the end of each period. This worksheet acts as a bridge between Ledger Accounts and the final Financial Statements wherein numerous nominal statements are made before finalization.

• Trial Balance section is used to check the equalization of Debit Credit Balances of General Ledger.

• Adjustment section records all the adjustment entries enabling the recording of incomes and expenses on accrual basis of accounting.

• Adjusted Trial Balance section is used to record updated Ledger Balances post adjustment so that equality of Debit and credit balances can be verified.

• Income Statement and Balance Sheet sections of the Worksheet help in orderly arrangement of data.

5. Preparation of Financial statements :

From the Worksheet a formal set of financial statements are prepared as per the requirement of federal law and accepted accounting practice. These financial statements assist the stakeholders of the organization and users of financial statements in understanding the financial position and performance of the organization.

6. Journalizing the post adjusting entries and post-closing entries to create a permanent record of changes shown in worksheet, close nominal accounts and transfer the results of operations to Owner's Equity.

7. Preparation of Post- Closing Trail balance :

This helps in ensuring that all nominal accounts have been closed and only General accounts are still in balance.

8. Interpretation of Financial Information by various tools of Analysis like Trend Analysis, Ratio Analysis etc.

4

Spector Company had an increase in sales and net income during its last fiscal year, but cash decreased and the firm was having difficulty paying its bills by the end of the year. What factors might cause a shortage of cash even though a firm is profitable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

5

How do current liabilities and long-term liabilities differ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the owner invests additional capital in the business during the month, how would that new investment be shown in the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

7

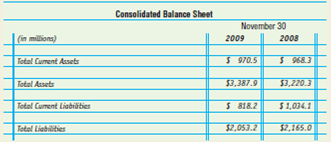

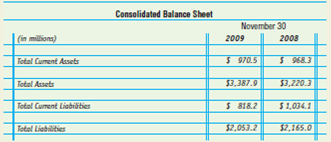

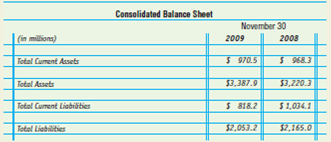

McCormick and Company, Incorporated reported the following in its 2009 Annual Report:

Analyze:

The company reported net sales of $3,192 million and gross profit of $1,327 million for its fiscal year ended November 30, 2009. What is the gross profit percentage for this period?

Analyze:

The company reported net sales of $3,192 million and gross profit of $1,327 million for its fiscal year ended November 30, 2009. What is the gross profit percentage for this period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

8

Recording closing entries.

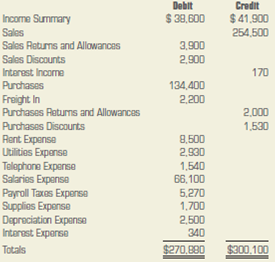

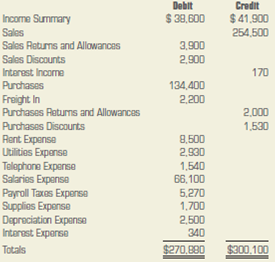

On December 31, 2013, the Income Statement section of the worksheet for Thomason Company contained the following information. Give the entries that should be made in the general journal to close the revenue, cost of goods sold, expense, and other temporary accounts. Use journal page 16.

INCOME STATEMENT SECTION

Assume further that the owner of the firm is Bobby Thomason and that the Bobby Thomason, Drawing account had a balance of $26,200 on December 31, 2013.

On December 31, 2013, the Income Statement section of the worksheet for Thomason Company contained the following information. Give the entries that should be made in the general journal to close the revenue, cost of goods sold, expense, and other temporary accounts. Use journal page 16.

INCOME STATEMENT SECTION

Assume further that the owner of the firm is Bobby Thomason and that the Bobby Thomason, Drawing account had a balance of $26,200 on December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which section of the income statement contains information about the purchases made during the period and the beginning and ending inventories?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

10

The latest income statement prepared at Wilkes Company shows that net sales increased by 10 percent over the previous year and selling expenses increased by 25 percent. Do you think that management should investigate the reasons for the increase in selling expenses? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

11

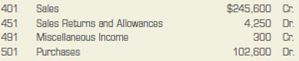

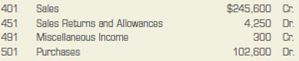

Preparing a classified income statement.

The worksheet of Alec's Office Supplies contains the following revenue, cost, and expense accounts. Prepare a classified income statement for this firm for the year ended December 31, 2013. The merchandise inventory amounted to $58,775 on January 1, 2013, and $51,725 on December 31, 2013. The expense accounts numbered 611 through 617 represent selling expenses, and those numbered 631 through 646 represent general and administrative expenses.

ACCOUNTS

The worksheet of Alec's Office Supplies contains the following revenue, cost, and expense accounts. Prepare a classified income statement for this firm for the year ended December 31, 2013. The merchandise inventory amounted to $58,775 on January 1, 2013, and $51,725 on December 31, 2013. The expense accounts numbered 611 through 617 represent selling expenses, and those numbered 631 through 646 represent general and administrative expenses.

ACCOUNTS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

12

What information is provided by the statement of owner's equity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

13

Preparing classified financial statements.

Obtain all data necessary from the worksheet prepared for The Wine Shop in Problem 12.6A at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The company does not classify its operating expenses as selling expenses and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the year.

3. Prepare a classified balance sheet as of December 31, 2013.

Analyze: What is the inventory turnover for The Wine Shop?

Obtain all data necessary from the worksheet prepared for The Wine Shop in Problem 12.6A at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The company does not classify its operating expenses as selling expenses and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the year.

3. Prepare a classified balance sheet as of December 31, 2013.

Analyze: What is the inventory turnover for The Wine Shop?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

14

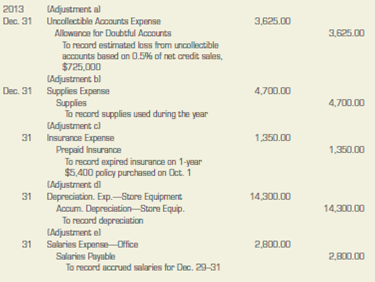

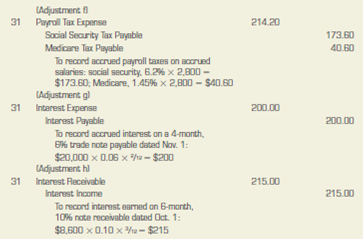

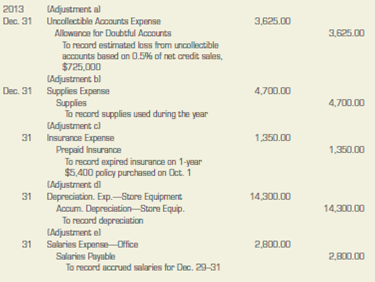

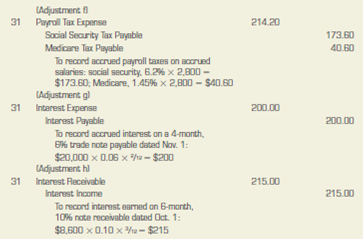

Journalizing reversing entries.

Examine the following adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general journal as of January 1, 2014. Include appropriate descriptions.

Examine the following adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general journal as of January 1, 2014. Include appropriate descriptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

15

Preparing classified financial statements.

Obtain all data necessary from the worksheet prepared for The Game Place in Problem 12.6B at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The company does not classify its operating expenses as selling expenses and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the year.

3. Prepare a classified balance sheet as of December 31, 2013.

Analyze: What is the amount of working capital for The Game Place?

Obtain all data necessary from the worksheet prepared for The Game Place in Problem 12.6B at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The company does not classify its operating expenses as selling expenses and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the year.

3. Prepare a classified balance sheet as of December 31, 2013.

Analyze: What is the amount of working capital for The Game Place?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why is it useful for management to compare a firm's financial statements with financial information from other companies in the same industry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the difference, if any, between the classification Other Revenue and Expense and the classification Extraordinary Gains and Losses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

18

For the last three years, the balance sheet of Desai Hardware Center, a large retail store, has shown a substantial increase in merchandise inventory. Why might management be concerned about this development?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

19

What account balances or other amount are included on two different financial statements for the period? Which statements are involved?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

20

Classifying income statement items.

The accounts listed on the next page appear on the worksheet of Giddy's Craft Store. Indicate the section of the classified income statement in which each account will be reported.

SECTIONS OF CLASSIFIED INCOME STATEMENT

a. Operating Revenue

b. Cost of Goods Sold

c. Operating Expenses

d. Other Income

e. Other Expenses

ACCOUNTS

1. Purchases Returns and Allowances

2. Telephone Expense

3. Sales Returns and Allowances

4. Purchases

5. Interest Income

6. Merchandise Inventory

7. Interest Expense

8. Sales

9. Depreciation Expense-Store Equipment

10. Rent Expense

The accounts listed on the next page appear on the worksheet of Giddy's Craft Store. Indicate the section of the classified income statement in which each account will be reported.

SECTIONS OF CLASSIFIED INCOME STATEMENT

a. Operating Revenue

b. Cost of Goods Sold

c. Operating Expenses

d. Other Income

e. Other Expenses

ACCOUNTS

1. Purchases Returns and Allowances

2. Telephone Expense

3. Sales Returns and Allowances

4. Purchases

5. Interest Income

6. Merchandise Inventory

7. Interest Expense

8. Sales

9. Depreciation Expense-Store Equipment

10. Rent Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the purpose of the balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

22

Preparing a postclosing trial balance.

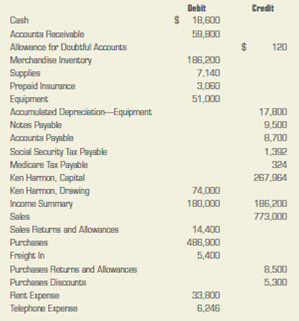

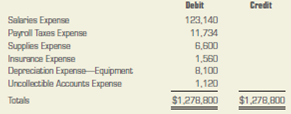

The Adjusted Trial Balance section of the worksheet for Harmon Farm Supply follows. The owner made no additional investments during the year. Prepare a postclosing trial balance for the firm on December 31, 2013.

ACCOUNTS

The Adjusted Trial Balance section of the worksheet for Harmon Farm Supply follows. The owner made no additional investments during the year. Prepare a postclosing trial balance for the firm on December 31, 2013.

ACCOUNTS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

23

Preparing classified financial statements.

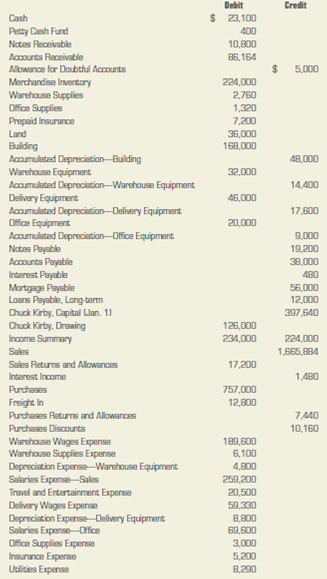

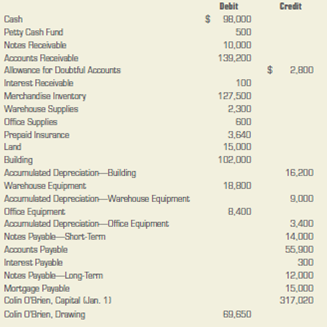

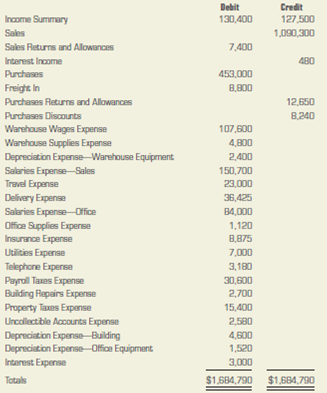

Wood Design Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the loans extend for more than a year.

ACCOUNTS

Analyze: What is the current ratio for this business?

Wood Design Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the loans extend for more than a year.

ACCOUNTS

Analyze: What is the current ratio for this business?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

24

Preparing a statement of owner's equity.

The worksheet of Alec's Office Supplies contains the following owner's equity accounts. Use this data and the net income determined in Exercise 13.3 to prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

ACCOUNTS

The worksheet of Alec's Office Supplies contains the following owner's equity accounts. Use this data and the net income determined in Exercise 13.3 to prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

ACCOUNTS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is the purpose of the postclosing trial balance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

26

Preparing classified financial statements.

Lite Speed Electronics is a retail store that sells computers and computer supplies. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the loans extend for more than one year.

ACCOUNTS

Analyze: What is the gross profit percentage for the period ended December 31, 2013?

Lite Speed Electronics is a retail store that sells computers and computer supplies. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the loans extend for more than one year.

ACCOUNTS

Analyze: What is the gross profit percentage for the period ended December 31, 2013?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

27

Journalizing adjusting, closing, and reversing entries.

Obtain all data that is necessary from the worksheet prepared for Whatnots in Problem 12.5B at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Record adjusting entries in the general journal as of December 31, 2013. Use 29 as the first journal page number. Include descriptions for the entries.

2. Record closing entries in the general journal as of December 31, 2013. Include descriptions.

3. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

Analyze: Assuming that the company did not record a reversing entry for salaries payable, what entry is required when salaries of $2,600 are paid on January 4? (Ignore payroll taxes withheld.)

Obtain all data that is necessary from the worksheet prepared for Whatnots in Problem 12.5B at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

1. Record adjusting entries in the general journal as of December 31, 2013. Use 29 as the first journal page number. Include descriptions for the entries.

2. Record closing entries in the general journal as of December 31, 2013. Include descriptions.

3. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

Analyze: Assuming that the company did not record a reversing entry for salaries payable, what entry is required when salaries of $2,600 are paid on January 4? (Ignore payroll taxes withheld.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

28

Calculating ratios.

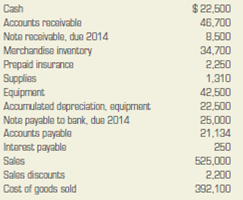

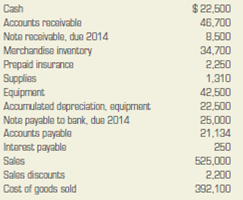

The following selected accounts were taken from the financial records of Santa Barbara Distributors at December 31, 2013. All accounts have normal balances.

Merchandise inventory at December 31, 2012 was $57,558. Based on the account balances above, calculate the following:

a. The gross profit percentage

b. Working capital

c. The current ratio

d. The inventory turnover

The following selected accounts were taken from the financial records of Santa Barbara Distributors at December 31, 2013. All accounts have normal balances.

Merchandise inventory at December 31, 2012 was $57,558. Based on the account balances above, calculate the following:

a. The gross profit percentage

b. Working capital

c. The current ratio

d. The inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

29

Why should management be concerned about the efficiency of the end-of-period procedures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

30

Why is it important to compare the financial statements of the current year with those of prior years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

31

What accounts appear on the postclosing trial balance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

32

McCormick and Company, Incorporated reported the following in its 2009 Annual Report:

Analyze:

Did the current ratio improve from 2008 to 2009?

Analyze:

Did the current ratio improve from 2008 to 2009?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

33

What are current assets that usually are classified as Current Assets on the balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the totals of the adjusted trial balance Debit and Credit columns are equal, but the postclosing trial balance does not balance, what is the likely cause of the problem?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

35

What are operating expenses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

36

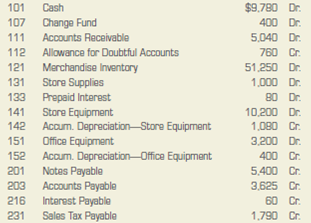

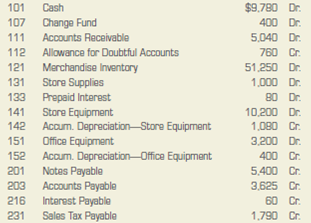

Preparing a classified balance sheet.

The worksheet of Alec's Office Supplies contains the following asset and liability accounts. The balance of the Notes Payable account consists of notes that are due within a year. Prepare a balance sheet dated December 31, 2013. Obtain the ending capital for the period from the statement of owner's equity completed in Exercise 13.4.

ACCOUNTS

The worksheet of Alec's Office Supplies contains the following asset and liability accounts. The balance of the Notes Payable account consists of notes that are due within a year. Prepare a balance sheet dated December 31, 2013. Obtain the ending capital for the period from the statement of owner's equity completed in Exercise 13.4.

ACCOUNTS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

37

What types of adjustments are reversed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

38

Classifying balance sheet items.

The following accounts appear on the worksheet of Giddy's Craft Store at December 31, 2013. Indicate the section of the classified balance sheet in which each account will be reported.

SECTIONS OF CLASSIFIED BALANCE SHEET

a. Current Assets

b. Plant and Equipment

c. Current Liabilities

d. Long-Term Liabilities

e. Owner's Equity

ACCOUNTS

1. Accounts Receivable

2. Delivery Van

3. Prepaid Insurance

4. Notes Payable, due 2014

5. Store Supplies

6. Accounts Payable

7. Merchandise Inventory

8. Ray Lynch, Capital

9. Cash

10. Unearned Subscriptions Income

The following accounts appear on the worksheet of Giddy's Craft Store at December 31, 2013. Indicate the section of the classified balance sheet in which each account will be reported.

SECTIONS OF CLASSIFIED BALANCE SHEET

a. Current Assets

b. Plant and Equipment

c. Current Liabilities

d. Long-Term Liabilities

e. Owner's Equity

ACCOUNTS

1. Accounts Receivable

2. Delivery Van

3. Prepaid Insurance

4. Notes Payable, due 2014

5. Store Supplies

6. Accounts Payable

7. Merchandise Inventory

8. Ray Lynch, Capital

9. Cash

10. Unearned Subscriptions Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

39

Journalizing adjusting and reversing entries.

The data below concerns adjustments to be made at Vaughn Company.

INSTRUCTIONS

1. Record the adjusting entries in the general journal as of December 31, 2013. Use 25 as the first journal page number. Include descriptions.

2. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

ADJUSTMENTS

a. On October 1, 2013, the firm signed a lease for a warehouse and paid rent of $17,700 in advance for a six-month period.

b. On December 31, 2013, an inventory of supplies showed that items costing $1,840 were on hand. The balance of the Supplies account was $11,120.

c. A depreciation schedule for the firm's equipment shows that a total of $8,200 should be charged off as depreciation for 2013.

d. On December 31, 2013, the firm owed salaries of $4,400 that will not be paid until January 2014.

e. On December 31, 2013, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries.

f. On September 1, 2013, the firm received a five-month, 8 percent note for $4,500 from a customer with an overdue balance.

Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1, 2014?

The data below concerns adjustments to be made at Vaughn Company.

INSTRUCTIONS

1. Record the adjusting entries in the general journal as of December 31, 2013. Use 25 as the first journal page number. Include descriptions.

2. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

ADJUSTMENTS

a. On October 1, 2013, the firm signed a lease for a warehouse and paid rent of $17,700 in advance for a six-month period.

b. On December 31, 2013, an inventory of supplies showed that items costing $1,840 were on hand. The balance of the Supplies account was $11,120.

c. A depreciation schedule for the firm's equipment shows that a total of $8,200 should be charged off as depreciation for 2013.

d. On December 31, 2013, the firm owed salaries of $4,400 that will not be paid until January 2014.

e. On December 31, 2013, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries.

f. On September 1, 2013, the firm received a five-month, 8 percent note for $4,500 from a customer with an overdue balance.

Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1, 2014?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

40

On December 31, Klien Company made an adjusting entry debiting Interest Receivable and crediting Interest Income for $300 of accrued interest. What reversing entry, if any, should be recorded for this item on January 1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

41

Preparing classified financial statements.

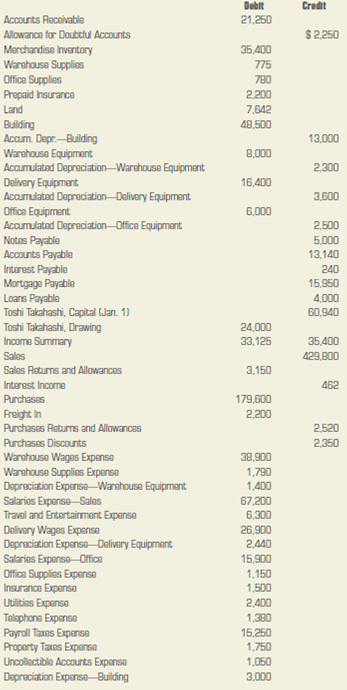

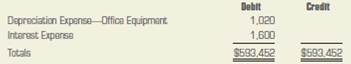

Good to Go Auto Products distributes automobile parts to service stations and repair shops. The adjusted trial balance data that follows is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the long-term notes extend for more than one year.

ACCOUNTS

Analyze: What percentage of total operating expenses is attributable to warehouse expenses?

Good to Go Auto Products distributes automobile parts to service stations and repair shops. The adjusted trial balance data that follows is from the firm's worksheet for the year ended December 31, 2013.

INSTRUCTIONS

1. Prepare a classified income statement for the year ended December 31, 2013. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

2. Prepare a statement of owner's equity for the year ended December 31, 2013. No additional investments were made during the period.

3. Prepare a classified balance sheet as of December 31, 2013. The mortgage and the long-term notes extend for more than one year.

ACCOUNTS

Analyze: What percentage of total operating expenses is attributable to warehouse expenses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

42

Journalizing adjusting and reversing entries.

The data below concerns adjustments to be made at Ramos Company.

INSTRUCTIONS

1. Record the adjusting entries in the general journal as of December 31, 2013. Use 25 as the first journal page number. Include descriptions.

2. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

ADJUSTMENTS

a. On August 1, 2013, the firm signed a one-year advertising contract with a trade magazine and paid the entire amount, $17,700, in advance. Prepaid Advertising had a balance of $17,700 on December 31, 2013.

b. On December 31, 2013, an inventory of supplies showed that items costing $2,840 were on hand. The balance of the Supplies account was $11,120.

c. A depreciation schedule for the firm's store equipment shows that a total of $9,200 should be charged off as depreciation for 2013.

d. On December 31, 2013, the firm owed salaries of $4,400 that will not be paid until January 2014.

e. On December 31, 2013, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries.

f. On December 1, 2013, the firm received a five-month, 8 percent note for $4,500 from a customer with an overdue balance.

Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Advertising account on December 31?

The data below concerns adjustments to be made at Ramos Company.

INSTRUCTIONS

1. Record the adjusting entries in the general journal as of December 31, 2013. Use 25 as the first journal page number. Include descriptions.

2. Record reversing entries in the general journal as of January 1, 2014. Include descriptions.

ADJUSTMENTS

a. On August 1, 2013, the firm signed a one-year advertising contract with a trade magazine and paid the entire amount, $17,700, in advance. Prepaid Advertising had a balance of $17,700 on December 31, 2013.

b. On December 31, 2013, an inventory of supplies showed that items costing $2,840 were on hand. The balance of the Supplies account was $11,120.

c. A depreciation schedule for the firm's store equipment shows that a total of $9,200 should be charged off as depreciation for 2013.

d. On December 31, 2013, the firm owed salaries of $4,400 that will not be paid until January 2014.

e. On December 31, 2013, the firm owed the employer's social security (6.2 percent) and Medicare (1.45 percent) taxes on all accrued salaries.

f. On December 1, 2013, the firm received a five-month, 8 percent note for $4,500 from a customer with an overdue balance.

Analyze: After the adjusting entries have been posted, what is the balance of the Prepaid Advertising account on December 31?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

43

Various adjustments made at Acres Company are listed below. Which of the adjustments would normally be reversed?

a. Adjustment for accrued payroll taxes expense

b. Adjustment for supplies used

c. Adjustment for depreciation on the building

d. Adjustment for estimated uncollectible accounts

e. Adjustment for accrued interest income

f. Adjustment for beginning inventory

g. Adjustment for ending inventory

h. Adjustment to record portion of insurance premiums that have expired

a. Adjustment for accrued payroll taxes expense

b. Adjustment for supplies used

c. Adjustment for depreciation on the building

d. Adjustment for estimated uncollectible accounts

e. Adjustment for accrued interest income

f. Adjustment for beginning inventory

g. Adjustment for ending inventory

h. Adjustment to record portion of insurance premiums that have expired

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck