Deck 27: Investment, the Capital Market, and the Wealth of Nations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 27: Investment, the Capital Market, and the Wealth of Nations

1

Suppose you are contemplating the purchase of a commercial lawn mower at a cost of $10, 000. The expected lifetime of the machine is three years. You can lease the asset to a local business for $4,000 annually (payable at the end of each year) for three years. The lessee is responsible for the upkeep and maintenance of the machine during the three-year period. If you can borrow (and lend) money at an interest rate of 8 percent, will the investment be a profitable undertaking? Is the project profitable at an interest rate of 12 percent? Provide calculations in support of your answer.

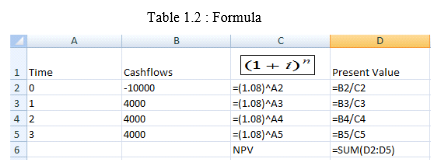

In order to calculate the best possible option, calculate the net present value of the project. If the net present value of the project is greater than 0, then the project is profitable, otherwise it is not.

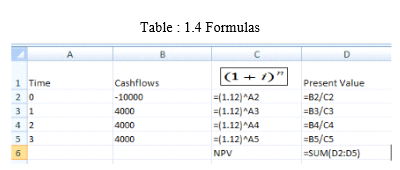

Net present value is the sum of all future cashflows discounted to the present time. It is calculated by using the following formula:

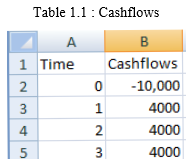

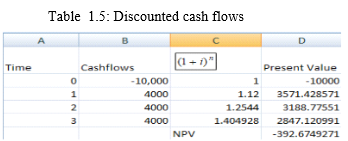

The cashflows are as follows:

The cashflows are as follows:

It is given that

It is given that

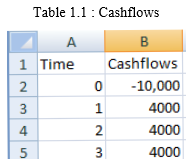

To calculate discounted cash flows, divide each cashflow with

To calculate discounted cash flows, divide each cashflow with

where n is the number of years.

where n is the number of years.

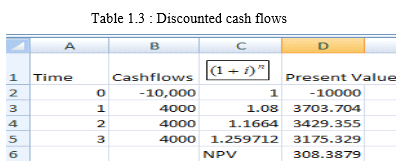

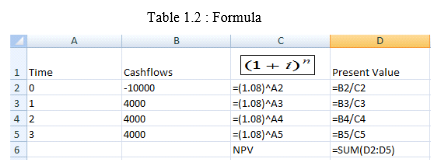

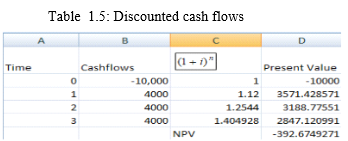

The above table represents the discounted cash flows.

The above table represents the discounted cash flows.

The NPV 0, therefore the project is profitable at

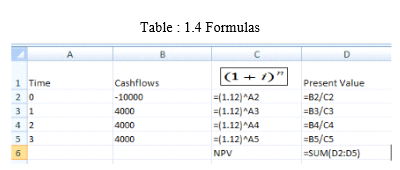

Suppose now that

Suppose now that

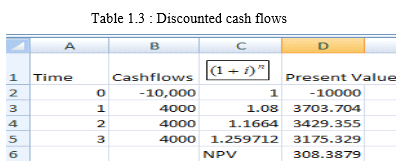

then the values are as follows:

then the values are as follows:

The above tables represent the calculations for discounted cash flows when

The above tables represent the calculations for discounted cash flows when

The NPV 0, therefore project is not profitable at

The NPV 0, therefore project is not profitable at

Thus, it can be concluded that the project is profitable if the interest of lending and borrowing is 8% but it is not profitable if the same is 12%.

Thus, it can be concluded that the project is profitable if the interest of lending and borrowing is 8% but it is not profitable if the same is 12%.

Net present value is the sum of all future cashflows discounted to the present time. It is calculated by using the following formula:

The cashflows are as follows:

The cashflows are as follows: It is given that

It is given that  To calculate discounted cash flows, divide each cashflow with

To calculate discounted cash flows, divide each cashflow with  where n is the number of years.

where n is the number of years.

The above table represents the discounted cash flows.

The above table represents the discounted cash flows.The NPV 0, therefore the project is profitable at

Suppose now that

Suppose now that  then the values are as follows:

then the values are as follows:

The above tables represent the calculations for discounted cash flows when

The above tables represent the calculations for discounted cash flows when  The NPV 0, therefore project is not profitable at

The NPV 0, therefore project is not profitable at  Thus, it can be concluded that the project is profitable if the interest of lending and borrowing is 8% but it is not profitable if the same is 12%.

Thus, it can be concluded that the project is profitable if the interest of lending and borrowing is 8% but it is not profitable if the same is 12%. 2

Alicia's philosophy of life is summed up by the proverb "A penny saved is a penny earned." She plans and saves for the future. In contrast, Mike's view is "Life is uncertain; eat dessert first." Mike wants as much as possible now.

a. Who has the highest rate of time preference?

b. Do people like Alicia benefit from the presence of people like Mike?

c. Do people like Mike benefit from the presence of people like Alicia? Explain.

a. Who has the highest rate of time preference?

b. Do people like Alicia benefit from the presence of people like Mike?

c. Do people like Mike benefit from the presence of people like Alicia? Explain.

People like Alicia do not get benefited with the presence of people like Mike as such people only believe in consuming and not saving. Money supply increases as a result of their consumption expenditures which lead to high inflation and lower interest rates. This leads to lower interest incomes being earned by investors like Alicia.

People like Mike do get benefited with presence of people like Alicia as they derive their income from the money invested by people like Alicia. Such people invest money, as a result of which money gets circulated in the economy and people like Mike derive their money from them. This happens because the invested money leads to more investment and thus more jobs in the economy which helps people like Mike to earn a living for themselves.

People like Mike do get benefited with presence of people like Alicia as they derive their income from the money invested by people like Alicia. Such people invest money, as a result of which money gets circulated in the economy and people like Mike derive their money from them. This happens because the invested money leads to more investment and thus more jobs in the economy which helps people like Mike to earn a living for themselves.

3

Some countries with very low incomes per capita are unable to save very much. Are people in these countries helped or hurt by people in high-income countries with much higher rates of saving?

Countries with low incomes per capita are not able to save much because of lack of funds or incomes they are faced with. Such countries are definitely helped by countries with high saving rates as people in such countries have high saving and investment rates, which leads to more jobs in the economy. These jobs are taken up by people from low incomes countries, which leads to more incomes and thus more savings for them.

4

According to a news item, the owner of a lottery ticket paying $3 million over twenty years is offering to sell the ticket for $1.2 million cash now. "Who knows?" the ticket owner explained. "We might not even be here in 20 years, and I do not want to leave it to the dinosaurs."

a. If the ticket pays $150,000 per year at the end of each year for the next twenty years, what is the present value of the ticket when the appropriate rate for discounting the future income is thought to be 10 percent?

b. If the discount rate is in the 10 percent range, is the sale price of $1.2 million reasonable?

c. Can you think of any disadvantages of buying the lottery earnings rather than a bond?

a. If the ticket pays $150,000 per year at the end of each year for the next twenty years, what is the present value of the ticket when the appropriate rate for discounting the future income is thought to be 10 percent?

b. If the discount rate is in the 10 percent range, is the sale price of $1.2 million reasonable?

c. Can you think of any disadvantages of buying the lottery earnings rather than a bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose you are moving into a new apartment you expect to rent for five years. The owner of the apartment offers to provide you with a used refrigerator for free and promises to maintain and repair the refrigerator during the next five years. You also have the option of buying a new energy-efficient refrigerator (with a five-year free maintenance agreement) for $700. The new refrigerator will reduce your electric bill by $150 per year and will have a market value of $200 after five years. If necessary, you can borrow money from the bank at an 8 percent rate of interest. Which option should you choose?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose that you are considering whether to enroll in a summer computer-training program that costs $2,500. If you take the program, you will have to give up $1,500 of earnings from your summer job. You figure that the program will increase your earnings by $500 per year for each of the next ten years. Beyond that, it is not expected to affect your earnings. If you take the program, you will have to borrow the funds at an 8 percent rate of interest. From a strictly monetary viewpoint, should you enroll in the program?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

"In a world of uncertainty, it is important that entrepreneurs be able to introduce new products and try out innovative ideas. But it is also important that unproductive projects be brought to a halt." Evaluate this statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

Will political officials be more likely to channel funds into wealth-creating projects than private investors and entrepreneurs? Why or why not? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

How would the following changes influence the rate of interest in the United States?

a. an increase in the positive time preference of lenders

b. an increase in the positive time preference of borrowers

c. an increase in domestic inflation

d. increased uncertainty about a nuclear war

e. improved investment opportunities in Europe

a. an increase in the positive time preference of lenders

b. an increase in the positive time preference of borrowers

c. an increase in domestic inflation

d. increased uncertainty about a nuclear war

e. improved investment opportunities in Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is capital investment? Why do business firms often use machinery and other capital assets to produce goods and services?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

How are human and physical capital investment decisions similar? How do they differ? What determines the profitability of a physical capital investment? Do human capital investors make profits? If so, what is the source of the profit? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

A lender made the following statement to a borrower: "You are borrowing $1,000, which is to be repaid in twelve monthly installments of $100 each. Your total interest charge is $200, which means your interest rate is 20 percent." Is the effective interest rate on the loan really 20 percent? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a market economy, investors have a strong incentive to undertake profitable investments. What makes an investment profitable? Do profitable investments create wealth? Why or why not? Do all investments create wealth? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

Over long periods of time, the rate of return of an average investment in the stock market has exceeded the return on high-quality bonds. Is the higher return on stocks surprising? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

The interest rates charged on outstanding credit card balances are generally higher than the interest rate that banks charge customers with a good credit rating. Why do you think the credit card rate is so high? Should the government impose an interest rate ceiling of, say, 10 percent? If it did, who would be hurt and who would be helped? Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the money rate of interest on a low-risk government bond is 10 percent and the inflation rate for the last several years has been steady at 4 percent, what is the estimated real rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck