Deck 15: International Trade Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 15: International Trade Policy

1

Use the following information to work the Problem.

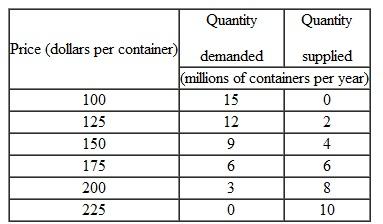

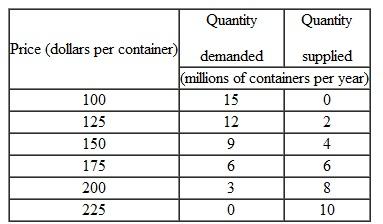

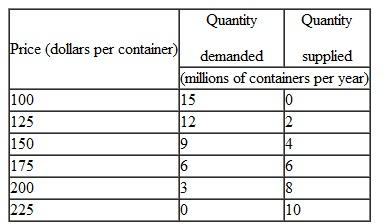

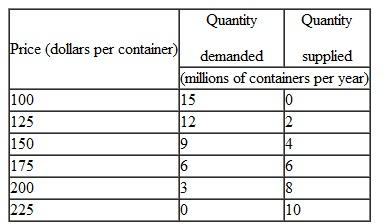

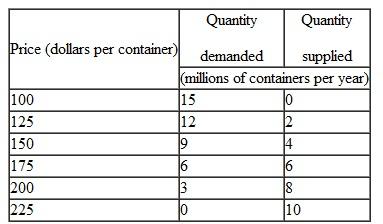

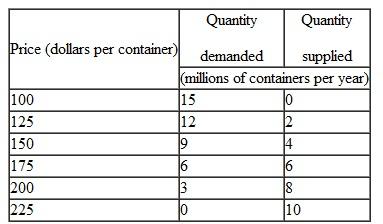

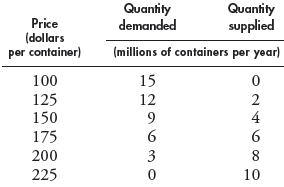

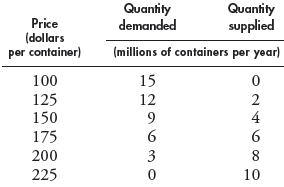

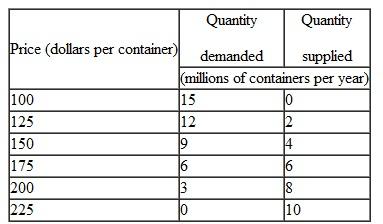

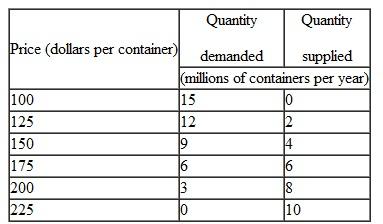

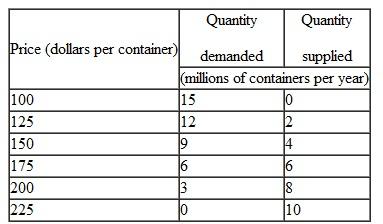

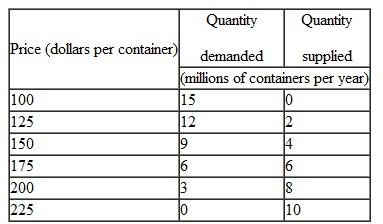

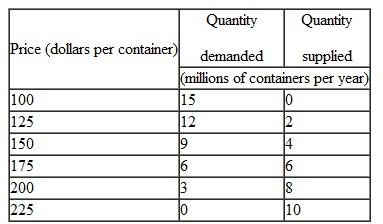

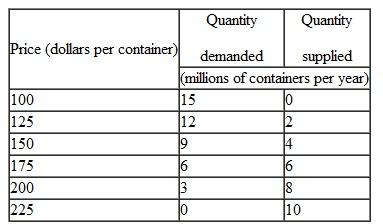

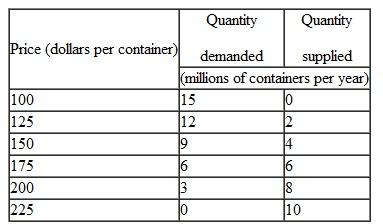

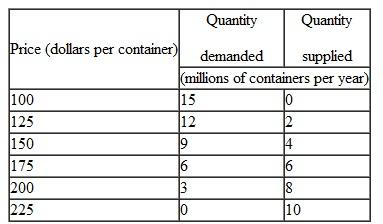

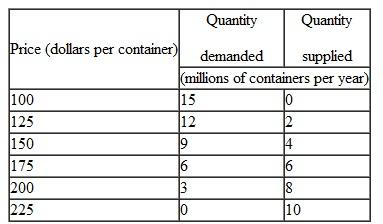

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

a. Without international trade, what would be the price of a container of roses and how many containers of roses a year would be bought and sold in the United States

b. At the price in your answer to part (a), does the United States or the rest of the world have a comparative advantage in producing roses

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.a. Without international trade, what would be the price of a container of roses and how many containers of roses a year would be bought and sold in the United States

b. At the price in your answer to part (a), does the United States or the rest of the world have a comparative advantage in producing roses

(a) Without International trade the price of a container will be $175 and quantity demanded will be equal to quantity supplied that is 6 millions of containers per year.

(b) Wholesalers can buy roses at auction from Holland fro $125 which is less than the domestic prices. Thus rest of the world has comparative advantage in producing roses except US.

(b) Wholesalers can buy roses at auction from Holland fro $125 which is less than the domestic prices. Thus rest of the world has comparative advantage in producing roses except US.

2

Use the following information to work the Problem.

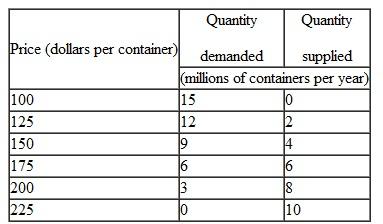

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

If U.S. wholesalers buy roses at the lowest possible price, how many do they buy from U.S. growers and how many do they import

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.If U.S. wholesalers buy roses at the lowest possible price, how many do they buy from U.S. growers and how many do they import

If the US wholesalers buy roses at the lowest possible prices that is at $125 so, at this price quantity demanded is 12 million while quantity supplied is only 2 millions. Hence, import would be of 10 millions of containers per year.

3

Use the following information to work the Problem.

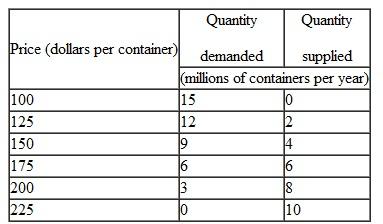

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

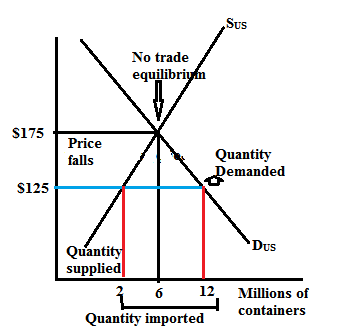

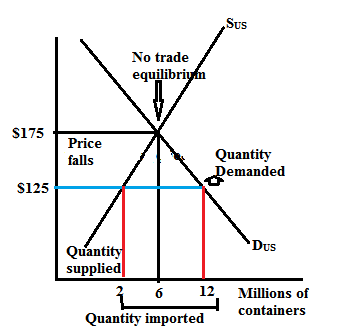

Draw a graph to illustrate the U.S. wholesale market for roses. Show the equilibrium in that market with no international trade and the equilibrium with free trade. Mark the quantity of roses produced in the United States, the quantity imported, and the total quantity bought.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.Draw a graph to illustrate the U.S. wholesale market for roses. Show the equilibrium in that market with no international trade and the equilibrium with free trade. Mark the quantity of roses produced in the United States, the quantity imported, and the total quantity bought.

The below graph represents the equilibrium prices without international trade and with international trade.

The demand curve D US and the supply curve S US show the demand and supply in the US domestic market only. The demand curve tells us the quantity of roses that Americans are willing to buy at various prices. The supply curve tells us the quantity of roses that US makers are willing to sell at various prices.

The demand curve D US and the supply curve S US show the demand and supply in the US domestic market only. The demand curve tells us the quantity of roses that Americans are willing to buy at various prices. The supply curve tells us the quantity of roses that US makers are willing to sell at various prices.

Without International trade the price of a container will be $175 and quantity demanded will be equal to quantity supplied that is 6 millions of containers per year.

If the US wholesalers buy roses at the lowest possible prices that is at $125 so, at this price quantity demanded is 12 million while quantity supplied is only 2 millions. Hence, import would be of 10 millions of containers per year

The demand curve D US and the supply curve S US show the demand and supply in the US domestic market only. The demand curve tells us the quantity of roses that Americans are willing to buy at various prices. The supply curve tells us the quantity of roses that US makers are willing to sell at various prices.

The demand curve D US and the supply curve S US show the demand and supply in the US domestic market only. The demand curve tells us the quantity of roses that Americans are willing to buy at various prices. The supply curve tells us the quantity of roses that US makers are willing to sell at various prices.Without International trade the price of a container will be $175 and quantity demanded will be equal to quantity supplied that is 6 millions of containers per year.

If the US wholesalers buy roses at the lowest possible prices that is at $125 so, at this price quantity demanded is 12 million while quantity supplied is only 2 millions. Hence, import would be of 10 millions of containers per year

4

Use the information on the U.S. wholesale market for roses in Problem 1 to

a. Explain who gains and who loses from free international trade in roses compared to a situation in which Americans buy only roses grown in the United States.

b. Calculate the value of the roses imported into the United States.

Problem 1

Use the following data to work Problem.

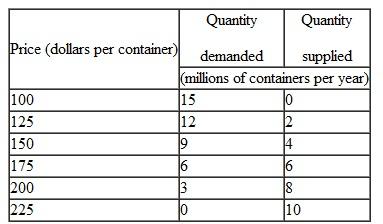

Wholesalers buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Problem

a. Without international trade, what would be the price of a container of roses and how many containers of roses a year would be bought and sold in the United States

b. At the price in your answer to part (a), does the United States or the rest of the world have a comparative advantage in producing roses

a. Explain who gains and who loses from free international trade in roses compared to a situation in which Americans buy only roses grown in the United States.

b. Calculate the value of the roses imported into the United States.

Problem 1

Use the following data to work Problem.

Wholesalers buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Problem

a. Without international trade, what would be the price of a container of roses and how many containers of roses a year would be bought and sold in the United States

b. At the price in your answer to part (a), does the United States or the rest of the world have a comparative advantage in producing roses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

If the United States puts a tariff of $25 per container on imports of roses, explain how the U.S. price of roses, the quantity of roses bought, the quantity produced in the United States, and the quantity imported change.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.If the United States puts a tariff of $25 per container on imports of roses, explain how the U.S. price of roses, the quantity of roses bought, the quantity produced in the United States, and the quantity imported change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Who gains and who loses from this tariff

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.Who gains and who loses from this tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Draw a graph of the U.S. market for roses to illustrate the gains and losses from the tariff and on the graph identify the gains and losses, and the tariff revenue.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.Draw a graph of the U.S. market for roses to illustrate the gains and losses from the tariff and on the graph identify the gains and losses, and the tariff revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

If the United States puts an import quota on roses of 5 million containers, what happens to the U.S. price of roses, the quantity of roses bought, the quantity produced in the United States, and the quantity imported

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.If the United States puts an import quota on roses of 5 million containers, what happens to the U.S. price of roses, the quantity of roses bought, the quantity produced in the United States, and the quantity imported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Who gains and who loses from this quota

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.Who gains and who loses from this quota

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use the information on the U.S. wholesale market for roses to Problem.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Draw a graph to illustrate the gains and losses from the import quota and on the graph identify the gains and losses, and the importers' profit.

Wholesalers of roses (the firms that supply your local flower shop with roses for Valentine's Day) buy and sell roses in containers that hold 120 stems. The table provides information about the wholesale market for roses in the United States. The demand schedule is the wholesalers' demand and the supply schedule is the U.S. rose growers' supply.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.

Wholesalers can buy roses at auction in Aalsmeer, Holland, for $125 per container.Draw a graph to illustrate the gains and losses from the import quota and on the graph identify the gains and losses, and the importers' profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

Chinese Tire Maker Rejects Charge of Defects U.S. regulators ordered the recall of more than 450,000 faulty tires. The Chinese producer of the tires disputed the allegations and hinted that the recall might be an effort to hamper Chinese exports to the United States.

Source: International Herald Tribune, June 26, 2007

a. What does the news clip imply about the comparative advantage of producing tires in the United States and China

b. Could product quality be a valid argument against free trade If it could, explain how.

Source: International Herald Tribune, June 26, 2007

a. What does the news clip imply about the comparative advantage of producing tires in the United States and China

b. Could product quality be a valid argument against free trade If it could, explain how.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

How Global Markets Work

Suppose that the world price of sugar is 10 cents a pound, the United States does not trade internationally, and the equilibrium price of sugar in the United States is 20 cents a pound. The United States then begins to trade internationally.

a. How does the price of sugar in the United States change

b. Do U.S. consumers buy more or less sugar

c. Do U.S. sugar growers produce more or less sugar

d. Does the United States export or import sugar and why

Suppose that the world price of sugar is 10 cents a pound, the United States does not trade internationally, and the equilibrium price of sugar in the United States is 20 cents a pound. The United States then begins to trade internationally.

a. How does the price of sugar in the United States change

b. Do U.S. consumers buy more or less sugar

c. Do U.S. sugar growers produce more or less sugar

d. Does the United States export or import sugar and why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

How Global Markets Work

Suppose that the world price of steel is $100 a ton, India does not trade internationally, and the equilibrium price of steel in India is $60 a ton. India then begins to trade internationally.

a. How does the price of steel in India change

b. How does the quantity of steel produced in India change

c. How does the quantity of steel bought by India change

d. Does India export or import steel and why

Suppose that the world price of steel is $100 a ton, India does not trade internationally, and the equilibrium price of steel in India is $60 a ton. India then begins to trade internationally.

a. How does the price of steel in India change

b. How does the quantity of steel produced in India change

c. How does the quantity of steel bought by India change

d. Does India export or import steel and why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

How Global Markets Work

A semiconductor is a key component in your laptop, cell phone, and iPod. The table provides information about the market for semiconductors in the United States.

Producers of semiconductors can get $18 a unit on the world market.

Producers of semiconductors can get $18 a unit on the world market.

a. With no international trade, what would be the price of a semiconductor and how many semiconductors a year would be bought and sold in the United States

b. Does the United States have a comparative advantage in producing semiconductors

A semiconductor is a key component in your laptop, cell phone, and iPod. The table provides information about the market for semiconductors in the United States.

Producers of semiconductors can get $18 a unit on the world market.

Producers of semiconductors can get $18 a unit on the world market.a. With no international trade, what would be the price of a semiconductor and how many semiconductors a year would be bought and sold in the United States

b. Does the United States have a comparative advantage in producing semiconductors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

How Global Markets Work

Act Now, Eat Later

The hunger crisis in poor countries has its roots in U.S. and European policies of subsidizing the diversion of food crops to produce biofuels like corn-based ethanol. That is, doling out subsidies to put the world's dinner into the gas tank.

a. What is the effect on the world price of corn of the increased use of corn to produce ethanol in the United States and Europe

b. How does the change in the world price of corn affect the quantity of corn produced in a poor developing country with a comparative advantage in producing corn, the quantity it consumes, and the quantity that it either exports or imports

Act Now, Eat Later

The hunger crisis in poor countries has its roots in U.S. and European policies of subsidizing the diversion of food crops to produce biofuels like corn-based ethanol. That is, doling out subsidies to put the world's dinner into the gas tank.

a. What is the effect on the world price of corn of the increased use of corn to produce ethanol in the United States and Europe

b. How does the change in the world price of corn affect the quantity of corn produced in a poor developing country with a comparative advantage in producing corn, the quantity it consumes, and the quantity that it either exports or imports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

Draw a graph of the market for corn in the poor developing country in Problem 15(b) to show the changes in the price of corn, the quantity produced, and the quantity consumed by people in that country.

Problem 1

Act Now, Eat Later

The hunger crisis in poor countries has its roots in U.S. and European policies of subsidizing the diversion of food crops to produce biofuels like corn-based ethanol. That is, doling out subsidies to put the world's dinner into the gas tank.

Source: Time , May 5, 2008

a. What is the effect on the world price of corn of the increased use of corn to produce ethanol in the United States and Europe

b. How does the change in the world price of corn affect the quantity of corn produced in a poor developing country with a comparative advantage in producing corn, the quantity it consumes, and the quantity that it either exports or imports

Problem 1

Act Now, Eat Later

The hunger crisis in poor countries has its roots in U.S. and European policies of subsidizing the diversion of food crops to produce biofuels like corn-based ethanol. That is, doling out subsidies to put the world's dinner into the gas tank.

Source: Time , May 5, 2008

a. What is the effect on the world price of corn of the increased use of corn to produce ethanol in the United States and Europe

b. How does the change in the world price of corn affect the quantity of corn produced in a poor developing country with a comparative advantage in producing corn, the quantity it consumes, and the quantity that it either exports or imports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

How Global Markets Work

Use the following news clip to work the Problem.

South Korea to Resume U.S. Beef Imports

South Korea will reopen its market to most U.S. beef. South Korea banned imports of U.S. beef in 2003 amid concerns over a case of mad cow disease in the United States. The ban closed what was then the third-largest market for U.S. beef exporters.

a. Explain how South Korea's import ban on U.S. beef affected beef producers and consumers in South Korea.

b. Draw a graph of the market for beef in South Korea to illustrate your answer to part (a). Identify the Korean winners and losers from this policy. Is this policy in Korea's interest

Use the following news clip to work the Problem.

South Korea to Resume U.S. Beef Imports

South Korea will reopen its market to most U.S. beef. South Korea banned imports of U.S. beef in 2003 amid concerns over a case of mad cow disease in the United States. The ban closed what was then the third-largest market for U.S. beef exporters.

a. Explain how South Korea's import ban on U.S. beef affected beef producers and consumers in South Korea.

b. Draw a graph of the market for beef in South Korea to illustrate your answer to part (a). Identify the Korean winners and losers from this policy. Is this policy in Korea's interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the following news clip to work Problem.

South Korea to Resume U.S. Beef Imports

South Korea will reopen its market to most U.S. beef. South Korea banned imports of U.S. beef in 2003 amid concerns over a case of mad cow disease in the United States. The ban closed what was then the third-largest market for U.S. beef exporters.

Source: CNN, May 29, 2008

Problem

a. Assuming that South Korea is the only importer of U.S. beef, explain how South Korea's import ban on U.S. beef affected beef producers and consumers in the United States.

b. Draw a graph of the U.S. market for beef to illustrate your answer to part (a). International Trade Restrictions

South Korea to Resume U.S. Beef Imports

South Korea will reopen its market to most U.S. beef. South Korea banned imports of U.S. beef in 2003 amid concerns over a case of mad cow disease in the United States. The ban closed what was then the third-largest market for U.S. beef exporters.

Source: CNN, May 29, 2008

Problem

a. Assuming that South Korea is the only importer of U.S. beef, explain how South Korea's import ban on U.S. beef affected beef producers and consumers in the United States.

b. Draw a graph of the U.S. market for beef to illustrate your answer to part (a). International Trade Restrictions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

International Trade Restrictions

Use the following information to work the Problem.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Explain how the price that U.S. consumers pay for goods from Mexico and the quantity of U.S. imports from Mexico have changed. Who are the winners and who are the losers from this free trade

Use the following information to work the Problem.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Explain how the price that U.S. consumers pay for goods from Mexico and the quantity of U.S. imports from Mexico have changed. Who are the winners and who are the losers from this free trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

International Trade Restrictions

Use the following information to work the Problem.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Explain how the quantity of U.S. exports to Mexico and the U.S. government's tariff revenue from trade with Mexico have changed.

Use the following information to work the Problem.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Explain how the quantity of U.S. exports to Mexico and the U.S. government's tariff revenue from trade with Mexico have changed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following information to work Problem.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Problem

Suppose that in 2015 tomato growers in Florida lobby the U.S. government to impose an import quota on Mexican tomatoes. Explain who in the United States would gain and who would lose from such an import quota.

Before 1995, trade between the United States and Mexico was subject to tariffs. In 1995, Mexico joined NAFTA and all U.S. and Mexican tariffs have gradually been removed.

Problem

Suppose that in 2015 tomato growers in Florida lobby the U.S. government to impose an import quota on Mexican tomatoes. Explain who in the United States would gain and who would lose from such an import quota.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

International Trade Restrictions

Use the following information to work the Problem.

Suppose that in response to huge job losses in the U.S. textile industry, Congress imposes a 100 percent tariff on imports of textiles from China.

Explain how the tariff on textiles will change the price that U.S. buyers pay for textiles, the quantity of textiles imported, and the quantity of textiles produced in the United States.

Use the following information to work the Problem.

Suppose that in response to huge job losses in the U.S. textile industry, Congress imposes a 100 percent tariff on imports of textiles from China.

Explain how the tariff on textiles will change the price that U.S. buyers pay for textiles, the quantity of textiles imported, and the quantity of textiles produced in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

International Trade Restrictions

Use the following information to work the Problem.

Suppose that in response to huge job losses in the U.S. textile industry, Congress imposes a 100 percent tariff on imports of textiles from China.

Explain how the U.S. and Chinese gains from trade will change. Who in the United States will lose and who will gain

Use the following information to work the Problem.

Suppose that in response to huge job losses in the U.S. textile industry, Congress imposes a 100 percent tariff on imports of textiles from China.

Explain how the U.S. and Chinese gains from trade will change. Who in the United States will lose and who will gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

International Trade Restrictions

Use the following information to work the Problem.

With free trade between Australia and the United States, Australia would export beef to the United States. But the United States imposes an import quota on Australian beef.

Explain how this quota influences the price that U.S. consumers pay for beef, the quantity of beef produced in the United States, and the U.S. and the Australian gains from trade.

Use the following information to work the Problem.

With free trade between Australia and the United States, Australia would export beef to the United States. But the United States imposes an import quota on Australian beef.

Explain how this quota influences the price that U.S. consumers pay for beef, the quantity of beef produced in the United States, and the U.S. and the Australian gains from trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

International Trade Restrictions

Use the following information to work the Problem.

With free trade between Australia and the United States, Australia would export beef to the United States. But the United States imposes an import quota on Australian beef.

Explain who in the United States gains from the quota on beef imports and who loses.

Use the following information to work the Problem.

With free trade between Australia and the United States, Australia would export beef to the United States. But the United States imposes an import quota on Australian beef.

Explain who in the United States gains from the quota on beef imports and who loses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Case Against Protection

Trading Up

The cost of protecting jobs in uncompetitive sectors through tariffs is high: Saving a job in the sugar industry costs American consumers $826,000 in higher prices a year; saving a dairy industry job costs $685,000 per year; and saving a job in the manufacturing of women's handbags costs $263,000.

a. What are the arguments for saving the jobs mentioned in this news clip

b. Explain why these arguments are faulty.

c. Is there any merit to saving these jobs

Trading Up

The cost of protecting jobs in uncompetitive sectors through tariffs is high: Saving a job in the sugar industry costs American consumers $826,000 in higher prices a year; saving a dairy industry job costs $685,000 per year; and saving a job in the manufacturing of women's handbags costs $263,000.

a. What are the arguments for saving the jobs mentioned in this news clip

b. Explain why these arguments are faulty.

c. Is there any merit to saving these jobs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

After you have studied Economics in the News on pp. 390-391, answer the following questions.

a. What is the TPP

b. Who in the United States would benefit and who would lose from a successful TPP

c. Illustrate your answer to part (b) with an appropriate graphical analysis assuming that tariffs are not completely eliminated.

d. Who in Japan and other TPP nations would benefit and who would lose from a successful TPP

e. Illustrate with an appropriate graphical analysis who in Japan would benefit and who would lose from a successful TPP, assuming that all Japan's import quotas and tariffs are completely eliminated.

a. What is the TPP

b. Who in the United States would benefit and who would lose from a successful TPP

c. Illustrate your answer to part (b) with an appropriate graphical analysis assuming that tariffs are not completely eliminated.

d. Who in Japan and other TPP nations would benefit and who would lose from a successful TPP

e. Illustrate with an appropriate graphical analysis who in Japan would benefit and who would lose from a successful TPP, assuming that all Japan's import quotas and tariffs are completely eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

E.U. Agrees to Trade Deal with South Korea

Italy has dropped its resistance to a E.U. trade agreement with South Korea, which will wipe out $2 billion in annual duties on E.U. exports. Italians argued that the agreement, which eliminates E.U. duties on South Korean cars, would put undue pressure on its own automakers.

Source: The Financial Times , September 16, 2010

a. What is a free-trade agreement What is its aim

b. Explain how a tariff on E.U. car imports changes E.U. production of cars, purchases of cars, and imports of cars. Illustrate your answer with an appropriate graphical analysis.

c. Explain who gains and who loses from this free-trade deal in cars.

d. Explain why Italian automakers opposed cuts in car import tariffs.

Italy has dropped its resistance to a E.U. trade agreement with South Korea, which will wipe out $2 billion in annual duties on E.U. exports. Italians argued that the agreement, which eliminates E.U. duties on South Korean cars, would put undue pressure on its own automakers.

Source: The Financial Times , September 16, 2010

a. What is a free-trade agreement What is its aim

b. Explain how a tariff on E.U. car imports changes E.U. production of cars, purchases of cars, and imports of cars. Illustrate your answer with an appropriate graphical analysis.

c. Explain who gains and who loses from this free-trade deal in cars.

d. Explain why Italian automakers opposed cuts in car import tariffs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck