Deck 12: Project Risk and Uncertainty

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 12: Project Risk and Uncertainty

1

Sensitivity Analysis

Green Management Company is considering the acquisition of a new eighteen-wheeler.

• The truck's base price is $80,000, and it will cost another $20,000 to modify it for special use by the company.

• This truck falls into the MACRS five-year class. It will be sold after three years for $30,000.

• The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

• The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

(a) Is this project acceptable, based on the most likely estimates given in the problem?

(b) If the truck's base price is $95,000, what would be the required savings in leasing so that the project would remain profitable?

Green Management Company is considering the acquisition of a new eighteen-wheeler.

• The truck's base price is $80,000, and it will cost another $20,000 to modify it for special use by the company.

• This truck falls into the MACRS five-year class. It will be sold after three years for $30,000.

• The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

• The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

(a) Is this project acceptable, based on the most likely estimates given in the problem?

(b) If the truck's base price is $95,000, what would be the required savings in leasing so that the project would remain profitable?

Modified Accelerated Cost Recovery System (MACRS): In this method, the life of asset refers to the period which has defined by the maker of the asset. This system of depreciation uses some specified percentage, on which asset is depreciated over its life. These percentages are organized in such a way so that in the earlier years asset get depreciated by the higher amount and later by lower amounts.

In the given case, a company has considered the acquisition of eighteen-wheeler. The base price is $80,000 and has a useful life of 3 years. Its salvage value is $30,000. The marginal tax rate is given to be 40%.

a.

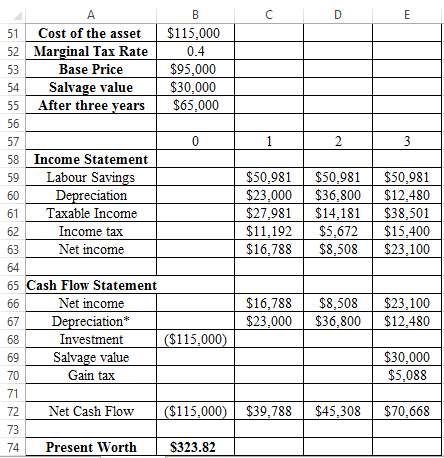

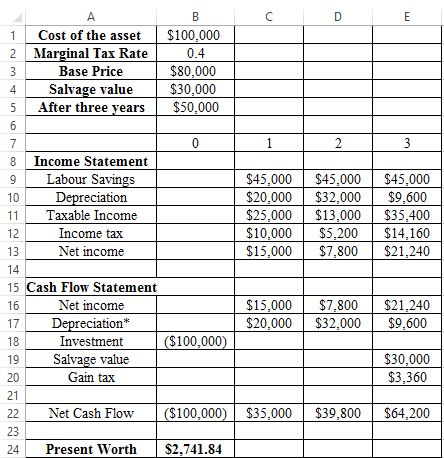

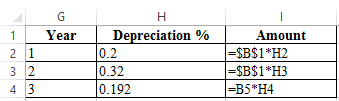

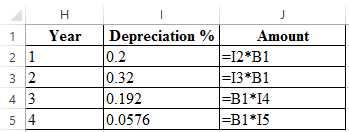

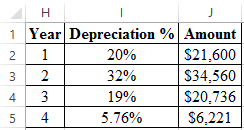

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation using the 5-years MACRS property depreciation rate as follows:

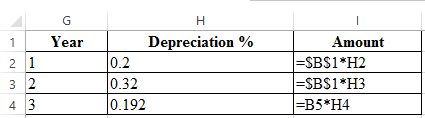

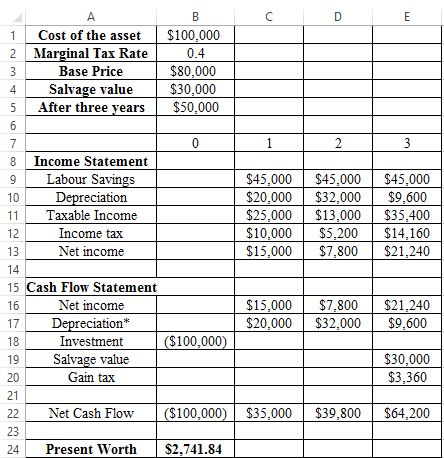

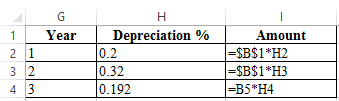

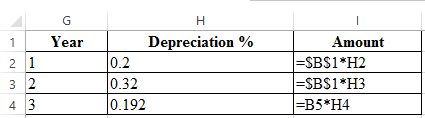

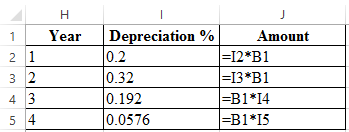

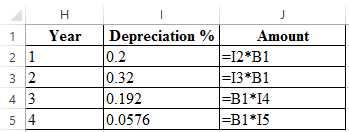

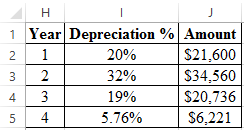

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet:

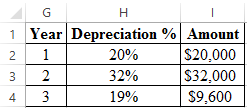

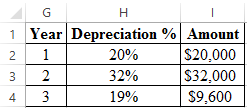

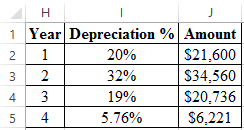

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

The above excel shows that the present worth calculated in cell B24 is

The above excel shows that the present worth calculated in cell B24 is

. Since the present worth is positive, thus the project is acceptable.

. Since the present worth is positive, thus the project is acceptable.

b.

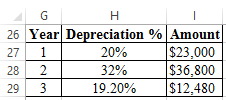

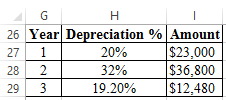

Now, if the base price changes to $95,000, the acceptability of project is to determine. In order to do this, first determine the amount of depreciation using 5-Year MACRS property depreciation rate as follows:

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet:

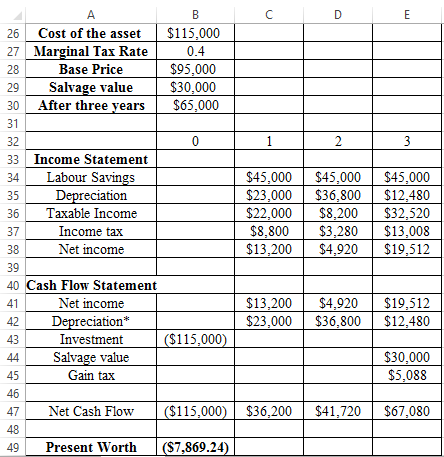

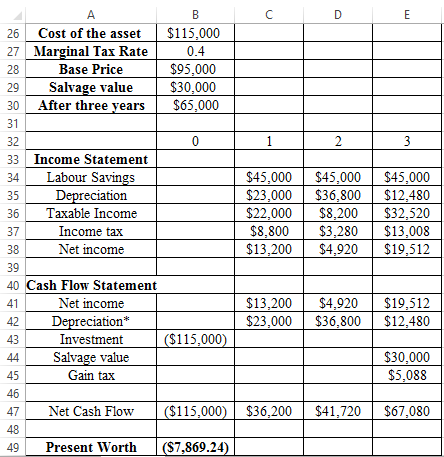

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

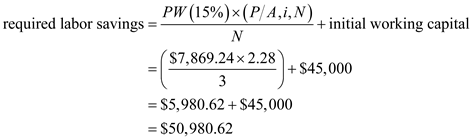

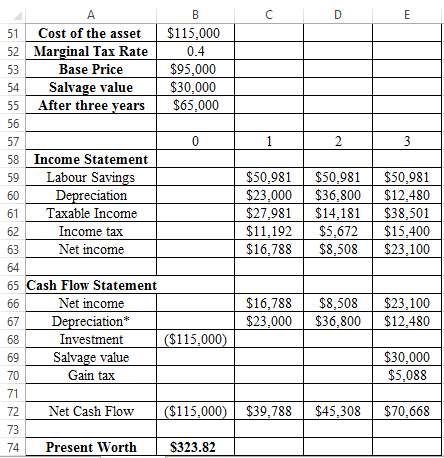

Since the present worth with new base price is computed as negative value $7,869.24, so in order to accept the project, the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

Since the present worth with new base price is computed as negative value $7,869.24, so in order to accept the project, the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

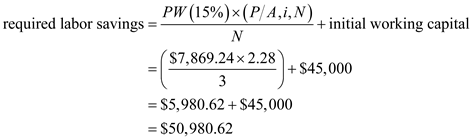

The following excel shows that, if company choose labor savings equal to $50,982.62, then the present worth becomes positive. The calculation is shown in the following excel:

Hence, in order to accept the project the required labor savings is

Hence, in order to accept the project the required labor savings is

.

.

In the given case, a company has considered the acquisition of eighteen-wheeler. The base price is $80,000 and has a useful life of 3 years. Its salvage value is $30,000. The marginal tax rate is given to be 40%.

a.

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation using the 5-years MACRS property depreciation rate as follows:

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet: Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows: The above excel shows that the present worth calculated in cell B24 is

The above excel shows that the present worth calculated in cell B24 is . Since the present worth is positive, thus the project is acceptable.

. Since the present worth is positive, thus the project is acceptable. b.

Now, if the base price changes to $95,000, the acceptability of project is to determine. In order to do this, first determine the amount of depreciation using 5-Year MACRS property depreciation rate as follows:

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet: Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows: Since the present worth with new base price is computed as negative value $7,869.24, so in order to accept the project, the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

Since the present worth with new base price is computed as negative value $7,869.24, so in order to accept the project, the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows: Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable. The following excel shows that, if company choose labor savings equal to $50,982.62, then the present worth becomes positive. The calculation is shown in the following excel:

Hence, in order to accept the project the required labor savings is

Hence, in order to accept the project the required labor savings is .

. 2

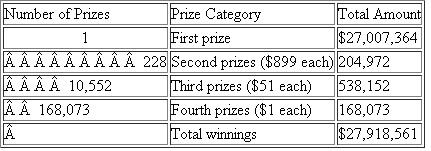

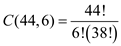

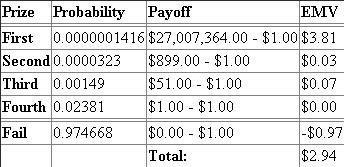

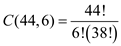

In Virginia's six-number lottery (or lotto) players pick six numbers from 1 to 44. The winning combination is determined by a machine that looks like a popcorn machine, except that it is filled with numbered table-tennis balls. The Virginia lottery drawing offered the prizes shown in Table, assuming that the first prize is not shared with a ticket price of $1. Common among regular lottery players is this dream: waiting until the jackpot reaches an astronomical sum and then buying every possible number, thereby guaranteeing a winner. Sure, it would cost millions of dollars, but the payoff would be much greater. Is it worth trying? How do the odds of winning the first prize change as you increase the number of tickets purchased?

Table

Virginia Lottery Prizes

Table

Virginia Lottery Prizes

The twelfth chapter in the textbook asks one to look at various ways uncertainty can be calculated in an engineering economic situation. This includes doing a break-even analysis, measuring the nature of machine risk, developing simulation models, and more.

For this short case study, we have a situation where we are looking at a state's lottery numbers which have a range of 1 to 44. Note that in the lottery, there are six (6) numbers that can be drawn from the machine for a drawing. Presented in a table that is provided to one to look at is the payout distribution for the lottery drawing. As mentioned in the text, one is more inclined to buy a ticket when the stakes go through the roof. Here, what would the odds be to hit the jackpot when the number of tickets purchased is increased

Also, it is worth trying

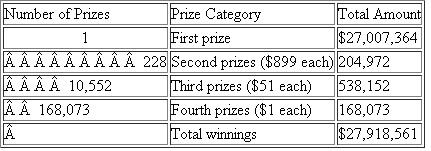

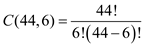

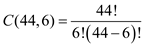

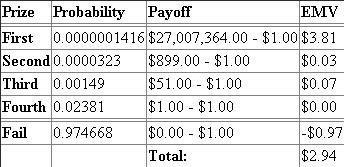

The best way to solve a problem like this (which is a classic problem in statistical analysis) is to first determine the possibilities that are available. This would require the use of factoids (or x !) in order to get the total number of combinations. Shown below is the formula that one would need to use here. Note that we already know how many balls are in the machine (44) and that six (6) are needed to get a jackpot win of millions of dollars in cash and prizes:

….. (1)

….. (1)

C (44, 6) = 7,059,052 possibilities

C (44, 6) = 7,059,052 possibilities

Thus, it would be a longshot to win the lottery. In other words, the value above is stating that there are only 7,059,052 possibilities that six (6) numbers can be drawn out of a pool of 44 balls. In another viewpoint, the chance of adding $1.00 more to the kitty to try to hit the big money is a very tiny

chance that one would. To help affirm this, shown below is the probability distribution of someone winning a prize as well as the expected monetary worth (EMV):

chance that one would. To help affirm this, shown below is the probability distribution of someone winning a prize as well as the expected monetary worth (EMV):

For this short case study, we have a situation where we are looking at a state's lottery numbers which have a range of 1 to 44. Note that in the lottery, there are six (6) numbers that can be drawn from the machine for a drawing. Presented in a table that is provided to one to look at is the payout distribution for the lottery drawing. As mentioned in the text, one is more inclined to buy a ticket when the stakes go through the roof. Here, what would the odds be to hit the jackpot when the number of tickets purchased is increased

Also, it is worth trying

The best way to solve a problem like this (which is a classic problem in statistical analysis) is to first determine the possibilities that are available. This would require the use of factoids (or x !) in order to get the total number of combinations. Shown below is the formula that one would need to use here. Note that we already know how many balls are in the machine (44) and that six (6) are needed to get a jackpot win of millions of dollars in cash and prizes:

….. (1)

….. (1) C (44, 6) = 7,059,052 possibilities

C (44, 6) = 7,059,052 possibilities Thus, it would be a longshot to win the lottery. In other words, the value above is stating that there are only 7,059,052 possibilities that six (6) numbers can be drawn out of a pool of 44 balls. In another viewpoint, the chance of adding $1.00 more to the kitty to try to hit the big money is a very tiny

chance that one would. To help affirm this, shown below is the probability distribution of someone winning a prize as well as the expected monetary worth (EMV):

chance that one would. To help affirm this, shown below is the probability distribution of someone winning a prize as well as the expected monetary worth (EMV):

3

The Wellington Construction Company is considering acquiring a new earthmover. The mover's basic price is $90,000, and it will cost another $18,000 to modify it for special use by the company. This earthmover falls into the MACRS five-year class. It will be sold after four years for $30,000. The purchase of the earthmover will have no effect on revenues, but it is expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 10%.

(a) Is this project acceptable, based on the most likely estimates given?

(b) Suppose that the project will require an increase in net working capital (spare-parts inventory) of $5,000, which will be recovered at the end of year 4. Taking this new requirement into account, would the project still be acceptable?

(c) If the firm's MARR is increased to 18% and with the working capital requirement from (b) not in effect, what would be the required savings in labor so that the project remains profitable?

(a) Is this project acceptable, based on the most likely estimates given?

(b) Suppose that the project will require an increase in net working capital (spare-parts inventory) of $5,000, which will be recovered at the end of year 4. Taking this new requirement into account, would the project still be acceptable?

(c) If the firm's MARR is increased to 18% and with the working capital requirement from (b) not in effect, what would be the required savings in labor so that the project remains profitable?

Modified Accelerated Cost Recovery System (MACRS): In this method, the life of asset refers to the period which has defined by the maker of the asset. This system of depreciation uses some specified percentage, on which asset is depreciated over its life. These percentages are organized in such a way, so that in the earlier years asset get depreciated by higher amount and later by lower amounts.

In the given case, a company has considering the new earthmover. The base price is $90,000 and has a useful life of 4 years. Its salvage value is $30,000. Marginal tax rate is given to be 40%.

a.

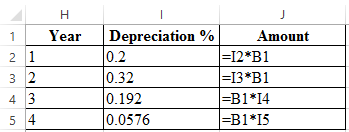

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation rate using depreciation rate of 5-Year MACRS property as follows:

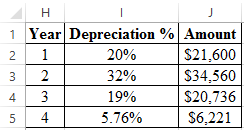

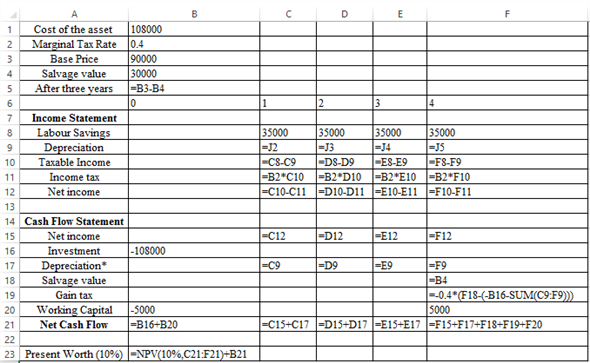

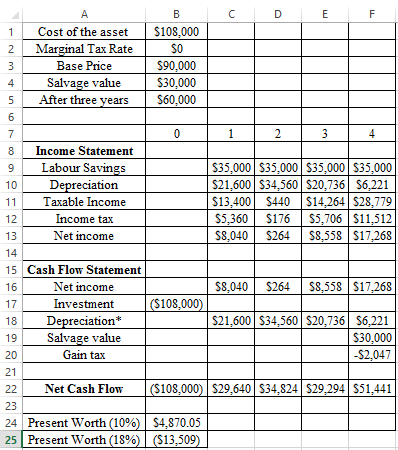

The calculated value of depreciation shown below:

The calculated value of depreciation shown below:

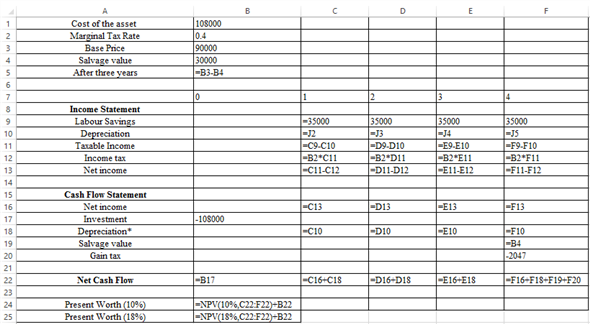

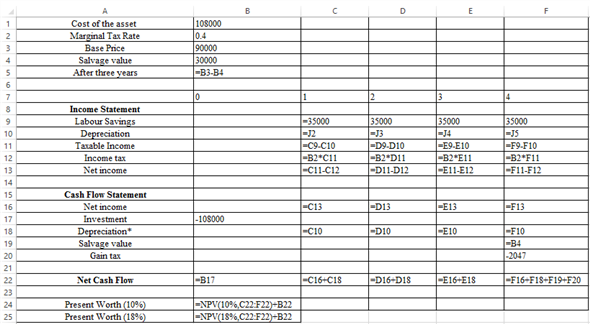

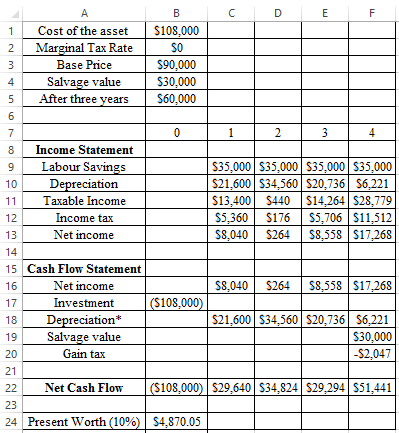

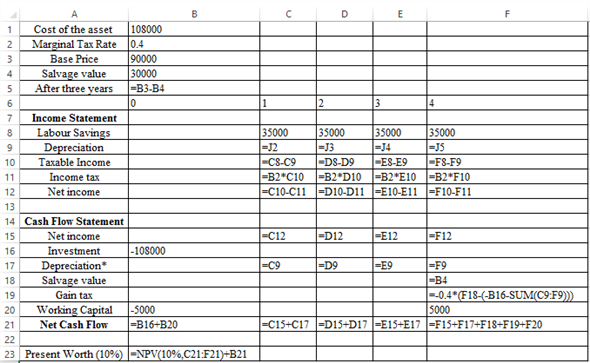

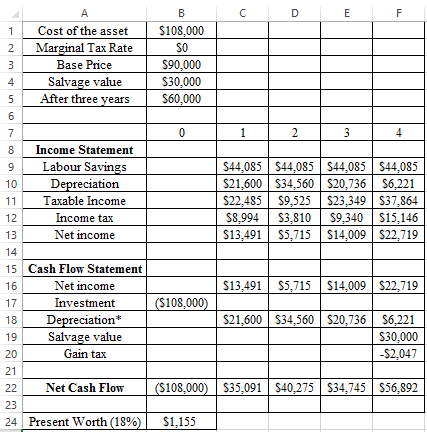

The calculation for present worth is shown in the following excel:

The calculation for present worth is shown in the following excel:

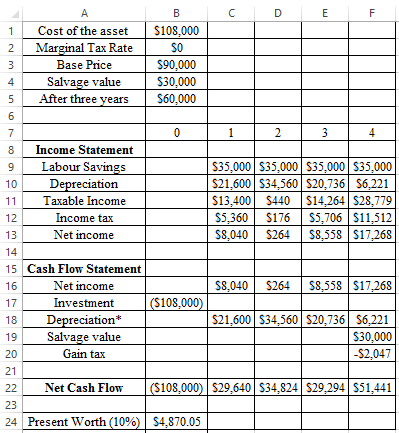

The Present worth is calculated in the cell B24 as shown below:

The Present worth is calculated in the cell B24 as shown below:

Since, the present worth is $4,870.05, thus this project is worth undertaking as its present value is coming out to be positive.

Since, the present worth is $4,870.05, thus this project is worth undertaking as its present value is coming out to be positive.

b.

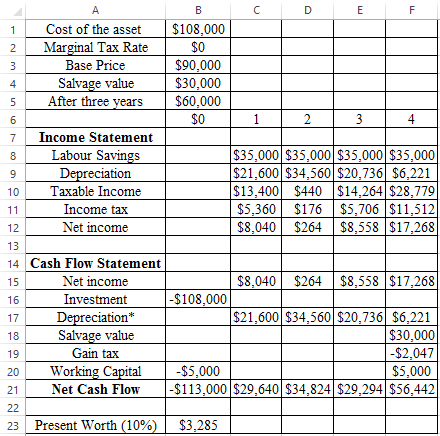

Now, the net working capital of the project has increased to $5,000, so it is required to find still the project is worth undertaking or not. First, calculate the depreciation rate using depreciation rate of 5-Year MACRS property as follows:

The calculated value of depreciation rate is shown below:

The calculated value of depreciation rate is shown below:

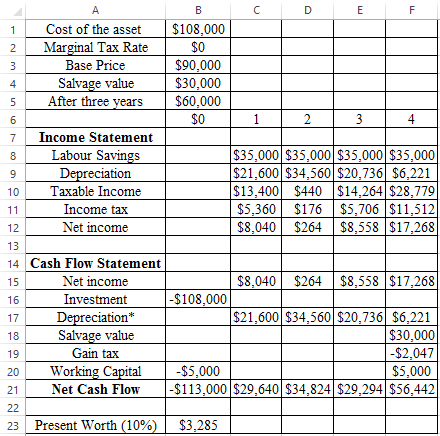

The Present worth is calculated in the cell B23 as shown below:

The Present worth is calculated in the cell B23 as shown below:

The calculated value of present worth (cell B23) is shown in the following spreadsheet:

The calculated value of present worth (cell B23) is shown in the following spreadsheet:

As the above excel shows that the present worth is

As the above excel shows that the present worth is

, which is positive. Hence, the project is still acceptable.

, which is positive. Hence, the project is still acceptable.

c.

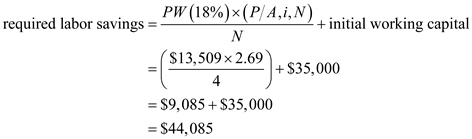

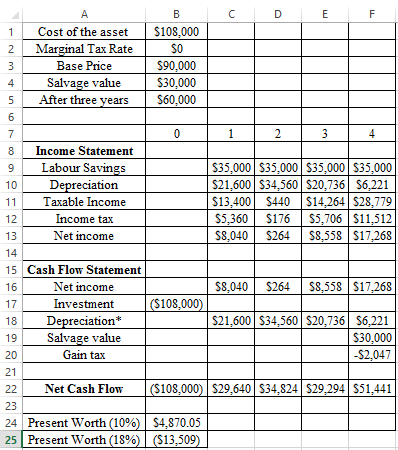

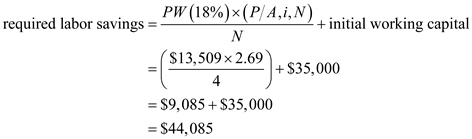

Now, the MARR has increased to 18% and not consider working capital into account. In this part, the labor savings is required to determine. First, determine the present worth at 18% MARR as follows:

Since, the present worth at 18% MARR is comes out to be negative, thus one must choose such amount of working capital so that the value of present worth become positive. The required labor savings can be determined as follows:

Since, the present worth at 18% MARR is comes out to be negative, thus one must choose such amount of working capital so that the value of present worth become positive. The required labor savings can be determined as follows:

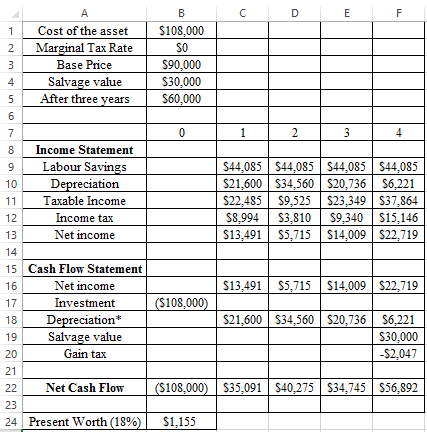

Thus, the new working capital should be at least $44,085, so that present worth at 18% becomes positive. Considering the working capital as $44,085, the calculation of present worth is shown in the following excel (cell B24):

Thus, the new working capital should be at least $44,085, so that present worth at 18% becomes positive. Considering the working capital as $44,085, the calculation of present worth is shown in the following excel (cell B24):

As the above excel shows that present worth becomes $1,155 with working capital of $44,085. Hence, the company must choose working capital

As the above excel shows that present worth becomes $1,155 with working capital of $44,085. Hence, the company must choose working capital

.

.

In the given case, a company has considering the new earthmover. The base price is $90,000 and has a useful life of 4 years. Its salvage value is $30,000. Marginal tax rate is given to be 40%.

a.

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation rate using depreciation rate of 5-Year MACRS property as follows:

The calculated value of depreciation shown below:

The calculated value of depreciation shown below: The calculation for present worth is shown in the following excel:

The calculation for present worth is shown in the following excel: The Present worth is calculated in the cell B24 as shown below:

The Present worth is calculated in the cell B24 as shown below: Since, the present worth is $4,870.05, thus this project is worth undertaking as its present value is coming out to be positive.

Since, the present worth is $4,870.05, thus this project is worth undertaking as its present value is coming out to be positive. b.

Now, the net working capital of the project has increased to $5,000, so it is required to find still the project is worth undertaking or not. First, calculate the depreciation rate using depreciation rate of 5-Year MACRS property as follows:

The calculated value of depreciation rate is shown below:

The calculated value of depreciation rate is shown below: The Present worth is calculated in the cell B23 as shown below:

The Present worth is calculated in the cell B23 as shown below: The calculated value of present worth (cell B23) is shown in the following spreadsheet:

The calculated value of present worth (cell B23) is shown in the following spreadsheet: As the above excel shows that the present worth is

As the above excel shows that the present worth is , which is positive. Hence, the project is still acceptable.

, which is positive. Hence, the project is still acceptable.c.

Now, the MARR has increased to 18% and not consider working capital into account. In this part, the labor savings is required to determine. First, determine the present worth at 18% MARR as follows:

Since, the present worth at 18% MARR is comes out to be negative, thus one must choose such amount of working capital so that the value of present worth become positive. The required labor savings can be determined as follows:

Since, the present worth at 18% MARR is comes out to be negative, thus one must choose such amount of working capital so that the value of present worth become positive. The required labor savings can be determined as follows: Thus, the new working capital should be at least $44,085, so that present worth at 18% becomes positive. Considering the working capital as $44,085, the calculation of present worth is shown in the following excel (cell B24):

Thus, the new working capital should be at least $44,085, so that present worth at 18% becomes positive. Considering the working capital as $44,085, the calculation of present worth is shown in the following excel (cell B24): As the above excel shows that present worth becomes $1,155 with working capital of $44,085. Hence, the company must choose working capital

As the above excel shows that present worth becomes $1,155 with working capital of $44,085. Hence, the company must choose working capital .

. 4

The city of Opelika was having a problem locating land for a new sanitary landfill when the Alabama Energy Extension Service offered the solution of burning the solid waste to generate steam. At the same time, Uniroyal Tire Company seemed to be having a similar problem disposing of solid waste in the form of rubber tires. It was determined that there would be about 200 tons per day of waste to be burned, including municipal and industrial waste. The city is considering building a waste-fired steam Plant, which would cost $6,688,800. To finance the construction cost, the city will issue resource-recovery revenue bonds in the amount of $7,000,000 it an interest rate of 1 1.5%. Bond interest is payable annually. The differential amount between the actual construction costs and the amount of bond financing

($7,000,000 ? $6,688,800 = $311,200)

will be used to settle the bond discount and expenses associated with the bond financing. The expected life of the steam plant is 20 years. The expected salvage value is estimated to be about $300,000. The expected labor costs are $335,000 per year. The annual operating and maintenance costs (including fuel, electricity, maintenance, and water) are expected to be $ 175,000. The plant would generate 9,360 pounds of waste, along with 7,200 pounds of waste after incineration, which will have to be disposed of as landfill. At the present rate of $19.45 per pound, this will cost the city a total of $322,000 per year.

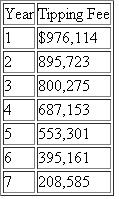

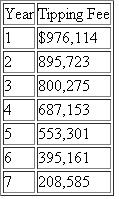

The revenues for the steam plant will come from two sources: (1) sales of steam and (2) tipping fees for disposal. The city expects 20% downtime per year for the waste-fired steam plant. With an input of 200 tons per day and 3.01 pounds of steam per pound of refuse, a maximum of 1,327,453 pounds of steam can be produced per day. However, with 20% downtime, the actual output would be 1,061,962 pounds of steam per day. The initial steam charge will be approximately $4.00 per thousand pounds, which will bring in $1,550,520 in steam revenue the first year and every year thereafter. The tipping fee is used in conjunction with the sale of steam to offset the total plant cost. It is the goal of the Opelika steam plant to phase out the tipping fee as soon as possible. The tipping fee will be $20.85 per ton in the first year of plant operation and will be phased out at the end of the eighth year. The scheduled tipping fee assessment is as follows:

(a) At an interest rate of 10%. would the steam plant generate sufficient revenue to recover the initial investment?

(a) At an interest rate of 10%. would the steam plant generate sufficient revenue to recover the initial investment?

(b) At an interest rate of 10%, what would be the minimum charge (per thousand pounds) for steam sales to make the project break even?

(c) Perform a sensitivity analysis to determine the input variable of the plant's downtime.

($7,000,000 ? $6,688,800 = $311,200)

will be used to settle the bond discount and expenses associated with the bond financing. The expected life of the steam plant is 20 years. The expected salvage value is estimated to be about $300,000. The expected labor costs are $335,000 per year. The annual operating and maintenance costs (including fuel, electricity, maintenance, and water) are expected to be $ 175,000. The plant would generate 9,360 pounds of waste, along with 7,200 pounds of waste after incineration, which will have to be disposed of as landfill. At the present rate of $19.45 per pound, this will cost the city a total of $322,000 per year.

The revenues for the steam plant will come from two sources: (1) sales of steam and (2) tipping fees for disposal. The city expects 20% downtime per year for the waste-fired steam plant. With an input of 200 tons per day and 3.01 pounds of steam per pound of refuse, a maximum of 1,327,453 pounds of steam can be produced per day. However, with 20% downtime, the actual output would be 1,061,962 pounds of steam per day. The initial steam charge will be approximately $4.00 per thousand pounds, which will bring in $1,550,520 in steam revenue the first year and every year thereafter. The tipping fee is used in conjunction with the sale of steam to offset the total plant cost. It is the goal of the Opelika steam plant to phase out the tipping fee as soon as possible. The tipping fee will be $20.85 per ton in the first year of plant operation and will be phased out at the end of the eighth year. The scheduled tipping fee assessment is as follows:

(a) At an interest rate of 10%. would the steam plant generate sufficient revenue to recover the initial investment?

(a) At an interest rate of 10%. would the steam plant generate sufficient revenue to recover the initial investment?(b) At an interest rate of 10%, what would be the minimum charge (per thousand pounds) for steam sales to make the project break even?

(c) Perform a sensitivity analysis to determine the input variable of the plant's downtime.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Minnesota Metal Forming Company has just invested $500,000 of fixed capital in a manufacturing process that is estimated to generate an after-tax annual cash flow of $200,000 in each of the next five years. At the end of year 5, no further market for the product and no salvage value for the manufacturing process is expected. If a manufacturing problem delays the start-up of the plant for one year (leaving only four years of process life), what additional after-tax cash flow will be needed to maintain the same internal rate of return as would be experienced if no delay occurred?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

A local telephone company is considering installing a new phone line for a new row of apartment complexes. Two types of cables are being examined: conventional copper wire and fiber optics. Transmission by copper-wire cables, although cumbersome, involves much less complicated and less expensive support hardware than do fiber optics. The local company may use five different types of copper wire cables: 100 pairs, 200 pairs, 300 pairs, 600 pairs, and 900 pairs per cable, in calculating the cost of cable, the following equation is used:

Cost = [cost per foot + cost per pair (number of pairs)](length)

where

22-gauge copper wire = $ 1.692 per fool

and

Cost per pair = $0,013 per pair

The annual cost of the cable as a percentage of the initial cost is 18.4%. The life of the system is 30 years. In fiber optics, a cable is referred to as a ribbon. One ribbon contains 12 fibers, grouped in fours; therefore, one ribbon contains three groups of 4 fibers. Each group can produce 672 lines (equivalent to 672 pairs of wires), and since each ribbon contains three groups, the total capacity of the ribbon is 2,016 lines. To transmit signals via fiber optics, many modulators, waveguides, and terminators are needed to convert the signals from electric currents to modulated light waves Fiberoptic ribbon costs $15,000 per mile. At each end of the ribbon. three terminators are needed, one for each group of 4 fibers, at a cost of $30,000 per terminator. Twenty-one modulating systems are needed at each end of the ribbon, at a cost of $12,092 for a unit in the central office and $21.21 % for a unit in the field. Every 22,000 feet, a repeater is required to keep the modulated Light waves in the ribbon at an intensity that is intelligible for detection. The unit cost of this repeater is $ 15,000. The annual cost, including income taxes for the 21 modulating systems, is 12.5% of the initial cost of the units. The annual cost of the ribbon itself is 17.8% of the initial cost. The life of the whole system is 30 years. (All figures represent after-tax costs.)

(a) Suppose that the apartments are located 5 miles from the phone company's central switching system and that about 2,000 telephones will be required. This would require either 2,000 pairs of copper wire or one fiberoptic ribbon and related hardware. If the telephone company's interest rate is 15%, which option is more economical?

(b) hi part (a), suppose that the apartments are located 10 miles or 25 miles from the phone company's central switching system. Which option is more economically attractive under each scenario?

Cost = [cost per foot + cost per pair (number of pairs)](length)

where

22-gauge copper wire = $ 1.692 per fool

and

Cost per pair = $0,013 per pair

The annual cost of the cable as a percentage of the initial cost is 18.4%. The life of the system is 30 years. In fiber optics, a cable is referred to as a ribbon. One ribbon contains 12 fibers, grouped in fours; therefore, one ribbon contains three groups of 4 fibers. Each group can produce 672 lines (equivalent to 672 pairs of wires), and since each ribbon contains three groups, the total capacity of the ribbon is 2,016 lines. To transmit signals via fiber optics, many modulators, waveguides, and terminators are needed to convert the signals from electric currents to modulated light waves Fiberoptic ribbon costs $15,000 per mile. At each end of the ribbon. three terminators are needed, one for each group of 4 fibers, at a cost of $30,000 per terminator. Twenty-one modulating systems are needed at each end of the ribbon, at a cost of $12,092 for a unit in the central office and $21.21 % for a unit in the field. Every 22,000 feet, a repeater is required to keep the modulated Light waves in the ribbon at an intensity that is intelligible for detection. The unit cost of this repeater is $ 15,000. The annual cost, including income taxes for the 21 modulating systems, is 12.5% of the initial cost of the units. The annual cost of the ribbon itself is 17.8% of the initial cost. The life of the whole system is 30 years. (All figures represent after-tax costs.)

(a) Suppose that the apartments are located 5 miles from the phone company's central switching system and that about 2,000 telephones will be required. This would require either 2,000 pairs of copper wire or one fiberoptic ribbon and related hardware. If the telephone company's interest rate is 15%, which option is more economical?

(b) hi part (a), suppose that the apartments are located 10 miles or 25 miles from the phone company's central switching system. Which option is more economically attractive under each scenario?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

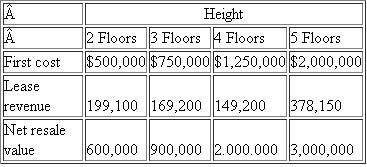

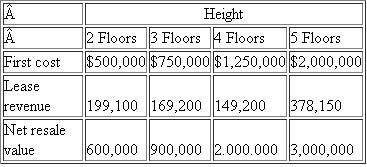

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The relevant net annual revenues and salvage values on after-tax basis are as given in Table.

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range from 5% to 30%. For each building height, find the range of values of i for which that building height is the most economical.

(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value? (In other words, the true value was 10% lower than that of the original estimate.)

Table

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range from 5% to 30%. For each building height, find the range of values of i for which that building height is the most economical.

(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value? (In other words, the true value was 10% lower than that of the original estimate.)

Table

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

Capstone Turbine Corporation is the world's leading provider of microturbine based MicroCHP (combined heat and power) systems for clean, continuous, distributed-generation electricity. The MicroCHP unit is a compact turbine generator that delivers electricity onsite or close to the point where it is needed. Designed to operate on a variety of gaseous and liquid fuels, this form of distributed-generation technology first debuted in 1998. The microturbine is designed to operate on demand or continuously for up to one year between recommended maintenance (filter cleaning/replacement). The generator is cooled by airflow into the gas turbine, thus eliminating the need for liquid cooling. It can make electricity from a variety of fuels-natural gas, kerosene, diesel oil, and even waste gases from landfills, sewage plants, and oilfields.

Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, power quality and reliability, and hybrid electric vehicles. And, unlike traditional backup power, this solution can support everyday energy needs and generate favorable payback. With the current design, which has a 60-KW rating, one of Capstone's generators would cost about $84,000. The expected annual expenses, including capital costs as well as operating costs, would run close to $19,000. These expenses yield an annual savings of close to $25,000 compared with the corresponding expenses for a conventional generator of the same size.

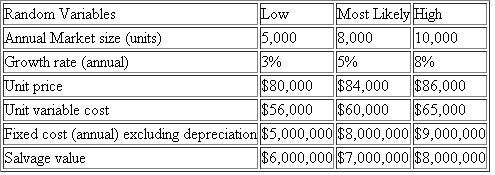

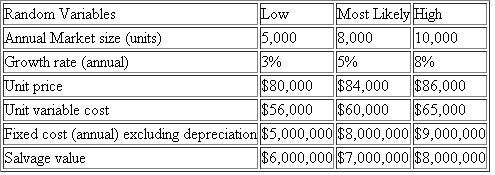

Capstone is considering a full-scale production of the system unit for residential use. The project requires an initial investment of $55 million. The company has prepared the financial data in Table related to the project.

The initial investment can be depreciated on a seven-year MACRS, and the project is expected to have an economic service life of eight years. The firm's marginal tax rate is 35%, and its MARR is known to be 15%. Capstone will conduct the economic analysis based on the following implicit model of cash flow.

• n = 0: Cash flow = ?$55 million

• n = 1 to 8: Cash flow = (revenue ? costs ?depreciation)(l ? tax rate) + depreciation

• Revenues = market size × unit price × (1 +growth rate) (n?l)

• Costs = (market size) × variable unit cost × (1 + growth rate) (n?1) + Fixed cost (excluding depreciation)

• n = 8: Adjust the cash flow in year 8 to reflect the gains tax (loss credit) and the salvage value

Assume that each random variable in Table is triangularly distributed with the parameters specified. Using your choice of software (such as Excel, @Risk, or Crystal Ball), develop the NPW distribution of the project.

(a) Document the procedure to obtain your NPW distribution.

(b) Compute the mean and variable of the NPW distribution.

(c) Determine the probability the actual NPW would be below the expected NPW.

Table

Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, power quality and reliability, and hybrid electric vehicles. And, unlike traditional backup power, this solution can support everyday energy needs and generate favorable payback. With the current design, which has a 60-KW rating, one of Capstone's generators would cost about $84,000. The expected annual expenses, including capital costs as well as operating costs, would run close to $19,000. These expenses yield an annual savings of close to $25,000 compared with the corresponding expenses for a conventional generator of the same size.

Capstone is considering a full-scale production of the system unit for residential use. The project requires an initial investment of $55 million. The company has prepared the financial data in Table related to the project.

The initial investment can be depreciated on a seven-year MACRS, and the project is expected to have an economic service life of eight years. The firm's marginal tax rate is 35%, and its MARR is known to be 15%. Capstone will conduct the economic analysis based on the following implicit model of cash flow.

• n = 0: Cash flow = ?$55 million

• n = 1 to 8: Cash flow = (revenue ? costs ?depreciation)(l ? tax rate) + depreciation

• Revenues = market size × unit price × (1 +growth rate) (n?l)

• Costs = (market size) × variable unit cost × (1 + growth rate) (n?1) + Fixed cost (excluding depreciation)

• n = 8: Adjust the cash flow in year 8 to reflect the gains tax (loss credit) and the salvage value

Assume that each random variable in Table is triangularly distributed with the parameters specified. Using your choice of software (such as Excel, @Risk, or Crystal Ball), develop the NPW distribution of the project.

(a) Document the procedure to obtain your NPW distribution.

(b) Compute the mean and variable of the NPW distribution.

(c) Determine the probability the actual NPW would be below the expected NPW.

Table

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

A special-purpose milling machine was purchased four years ago for $20,000. It was estimated at that time that this machine would have a life of 10 years, a salvage value of $1,000, and a cost of removal of $1,500. These estimates are still good. This machine has annual operating costs of $2,000, and its current book value is $13,000 (based on "alternative MACRS," a straight-line depreciation with a half-year convention with zero salvage value). If the machine is retained for its entire 10-year life, the remaining annual depreciation schedule would be $2,000 for years 5 through 10. A new machine that is more efficient will reduce operating costs to $1,000, but it will require an investment of $12,000. The life of the new machine is estimated to be six years with a salvage value of $2,000. The new machine would fall into the five-year MACRS property class. An offer of $6,000 for the old machine has been made, and the purchaser would pay to removal of the machine. The firm's marginal tax rate is 40%, and its required minimum rate of return is 10%.

(a) What incremental cash flows will occur at the end of years 0 through 6 as a result of replacing the old machine? Should the old machine be replaced now?

(b) Suppose that the annual operating costs for the old milling machine would increase at an annual rate of 5% over the remaining service life of the machine. With this change in future operating costs for the old machine, would the answer in part (a) change?

(c) What is the minimum salvage value for the old machine at the year 0 so that both alternatives are economically equivalent?

(a) What incremental cash flows will occur at the end of years 0 through 6 as a result of replacing the old machine? Should the old machine be replaced now?

(b) Suppose that the annual operating costs for the old milling machine would increase at an annual rate of 5% over the remaining service life of the machine. With this change in future operating costs for the old machine, would the answer in part (a) change?

(c) What is the minimum salvage value for the old machine at the year 0 so that both alternatives are economically equivalent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

A firm is considering whether to market a new type of computer game during the upcoming Christmas season. The profit contribution of this computer game will depend on the extent of the demand ? , where ? denotes the number of thousands of copies of the computer game to be sold. It is estimated that the net profit of marketing the computer game will be approximately 2 ? 2 ? 500,000 dollars. Assume that the firm's initial prediction of demand distribution on ? is a uniform density on the interval 0 ? ? ? M. In terms of M determine the following.

a. For what value of the demand ? should the firm market the new type of toy?

b. What is the expected value of ? ?

c. How much should the firm be willing to pay to find out exactly what the demand ? will be?

a. For what value of the demand ? should the firm market the new type of toy?

b. What is the expected value of ? ?

c. How much should the firm be willing to pay to find out exactly what the demand ? will be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company is currently paying a sales representative $0.60 per mile to drive her car for company business. The company is considering supplying the representative with a car, which would involve the following: A car costs $25,000, has a service life of 5 years, and a market value of $5,000 at the end of that time. Monthly storage costs for the car are $200, and the cost of fuel, tires, and maintenance is 20 cents per mile. The car will be depreciated by MACRS, using a recovery period of 5 years (20%, 32%, 19.20%, 11.52%, and 11.52%). The firm's marginal tax rate is 40%.

• Suppose that the required travel by the sales person would be 30,000 miles per year. Which option would be better at i = 15%?

• What annual mileage must a salesman travel by car for the cost of the two methods of providing transportation to be equal if the interest rate is 15%?

(a) Determine the annual net cash flows from the project.

(b) Perform a sensitivity analysis on the project ' s data, varying savings in telephone bills and savings in deadhead miles. Assume that each of these variables can deviate from its base-case expected value by ±10%, ±20%, and ±30%.

(c) Prepare sensitivity diagrams and interpret the results.

• Suppose that the required travel by the sales person would be 30,000 miles per year. Which option would be better at i = 15%?

• What annual mileage must a salesman travel by car for the cost of the two methods of providing transportation to be equal if the interest rate is 15%?

(a) Determine the annual net cash flows from the project.

(b) Perform a sensitivity analysis on the project ' s data, varying savings in telephone bills and savings in deadhead miles. Assume that each of these variables can deviate from its base-case expected value by ±10%, ±20%, and ±30%.

(c) Prepare sensitivity diagrams and interpret the results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

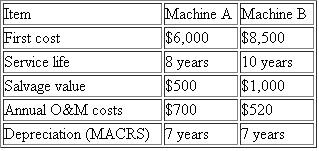

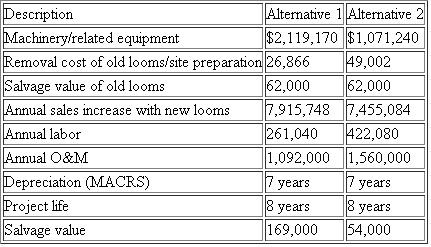

A small manufacturing firm is considering purchasing a new boring machine to modernize one of its production lines. Two types of boring machines are available on the market. The lives of machine A and machine B are eight years and 10 years, respectively. The machines have the following receipts and disbursements:

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.

(a) Which machine would be most economical to purchase under an infinite planning horizon? Explain any assumption that you need to make about future alternatives.

(b) Determine the break-even annual O M costs for machine A so that the annual equivalent cost of machine A is the same as that of machine B.

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economical?

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.

Use a MARR (after tax) of 10% and a marginal tax rate of 30%, and answer the following questions.(a) Which machine would be most economical to purchase under an infinite planning horizon? Explain any assumption that you need to make about future alternatives.

(b) Determine the break-even annual O M costs for machine A so that the annual equivalent cost of machine A is the same as that of machine B.

(c) Suppose that the required service life of the machine is only five years. The salvage values at the end of the required service period are estimated to be $3,000 for machine A and $3,500 for machine B. Which machine is more economical?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

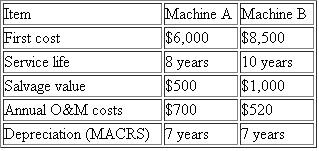

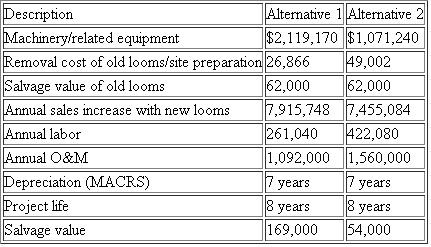

The management of Langdale Mill is considering replacing a number of old looms in the mill's weave room. The looms to be replaced are two 86-inch President looms, sixteen 54-inch President looms, and twenty-two 72-inch Draper X-P2 looms.

The company may either replace the old looms with new ones of the same kind or buy 21 new shutterless Pignone looms (Table). The first alternative requires purchasing 40 new President and Draper looms and scrapping the old looms. The second alternative involves scrapping the 40 old looms, relocating 12 Picanol looms, and constructing a concrete floor, plus purchasing the 21 Pignone looms and various related equipment.

The firm's MARR is 18%, set by corporate executives who feel that various investment opportunities available for the mills will guarantee a rate of return on investment of at least 18%. The mill's marginal tax rate is 40%.

(a) Perform a sensitivity analysis on the project's data varying the operating revenue, labor cost, annual O M cost, and MARR. Assume that each of these variables can deviate from its base- case expected value by ±10%, by ±20%, and by ±30%.

(b) From the results of part (a), prepare sensitivity diagrams and interpret the results.

table

The company may either replace the old looms with new ones of the same kind or buy 21 new shutterless Pignone looms (Table). The first alternative requires purchasing 40 new President and Draper looms and scrapping the old looms. The second alternative involves scrapping the 40 old looms, relocating 12 Picanol looms, and constructing a concrete floor, plus purchasing the 21 Pignone looms and various related equipment.

The firm's MARR is 18%, set by corporate executives who feel that various investment opportunities available for the mills will guarantee a rate of return on investment of at least 18%. The mill's marginal tax rate is 40%.

(a) Perform a sensitivity analysis on the project's data varying the operating revenue, labor cost, annual O M cost, and MARR. Assume that each of these variables can deviate from its base- case expected value by ±10%, by ±20%, and by ±30%.

(b) From the results of part (a), prepare sensitivity diagrams and interpret the results.

table

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

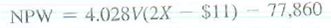

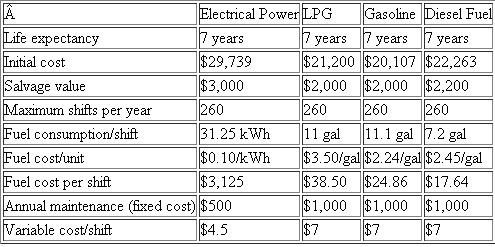

Mike Lazenby, an industrial engineer at Energy Conservation Service, has found that the anticipated profitability of a newly developed water-heater temperature-control device can be measured by present worth with the formula

where V is the number of units produced and sold and X is the sales price per unit. Mike also has found that the value of the parameter V could occur anywhere over the range from 1,000 to 6.000 units and that of the parameter X anywhere between $20 and $45 per unit. Develop a sensitivity graph as a function of the number of units produced and the sales price per unit.

where V is the number of units produced and sold and X is the sales price per unit. Mike also has found that the value of the parameter V could occur anywhere over the range from 1,000 to 6.000 units and that of the parameter X anywhere between $20 and $45 per unit. Develop a sensitivity graph as a function of the number of units produced and the sales price per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

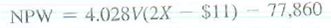

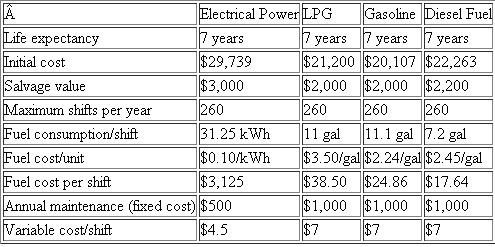

A local U.S. Postal Service office is considering purchasing a 4,000-pound forklift truck, which will be used primarily for processing incoming as well as outgoing postal packages. Forklift trucks traditionally have been fueled by either gasoline, liquid propane gas (LPG), or diesel fuel. Battery-powered electric forklifts, however, are increasingly popular in many industrial sectors due to the economic and environmental benefits that accrue from their use. Therefore, the postal service is interested in comparing forklifts that use the four different types of fuel (Table). The purchase costs as well as annual operating and maintenance costs are provided by a local utility company and the Lead Industries Association. Annual fuel and maintenance costs are measured in terms of number of shifts per year, where one shift is equivalent to eight hours of operation. The postal service is unsure of the number of shifts per year, but it expects it should be somewhere between 200 and 260 shifts. Since the U.S. Postal Service does not pay income taxes, no depreciation or tax information is required. The U.S. government uses 10% as an interest rate for any project evaluation of this nature. Develop a sensitivity graph that shows how the choice of alternatives changes as a function of number of shifts per year.

Table

Table

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

Break-Even Analysis

Susan Campbell is thinking about going into the motel business near Disney World in Orlando, Florida. The cost to build a motel is $2,200,000. The lot costs $600,000. Furniture and furnishings cost $400,000 and should be recovered in eight years (seven-year MACRS property), while the motel building should be recovered in 39 years (39-year MACRS real property placed in service on January 1st). The land will appreciate at an annual rate of 5% over the project period, but the building will have a zero salvage value after 25 years. When the motel is full (100% capacity), it takes in (receipts) $4,000 per day, 365 days per year. Exclusive of depreciation, the motel has fixed operating expenses of $230,000 per year. The variable operating expenses are $170,000 at 100% capacity, and these vary directly with percent capacity down to zero at 0% capacity. If the interest is 10% compounded annually, at what percent capacity over 25 years must the motel operate in order for Susan to break even? (Assume that Susan's tax rate is 31%.)

Susan Campbell is thinking about going into the motel business near Disney World in Orlando, Florida. The cost to build a motel is $2,200,000. The lot costs $600,000. Furniture and furnishings cost $400,000 and should be recovered in eight years (seven-year MACRS property), while the motel building should be recovered in 39 years (39-year MACRS real property placed in service on January 1st). The land will appreciate at an annual rate of 5% over the project period, but the building will have a zero salvage value after 25 years. When the motel is full (100% capacity), it takes in (receipts) $4,000 per day, 365 days per year. Exclusive of depreciation, the motel has fixed operating expenses of $230,000 per year. The variable operating expenses are $170,000 at 100% capacity, and these vary directly with percent capacity down to zero at 0% capacity. If the interest is 10% compounded annually, at what percent capacity over 25 years must the motel operate in order for Susan to break even? (Assume that Susan's tax rate is 31%.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $45.90 per bulb and last 14,600 hours before burning out. The new bulb (at $60 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is $16.00. The lights are on 19 hours a day, 365 days a year. If the firm's MARR is 15%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? (Assume that the firm's marginal tax rate is 40%.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

Robert Cooper is considering purchasing a piece of business rental property containing stores and offices at a cost of $250,000. Cooper estimates that annual disbursements (other than income taxes) will be about $12,000. The property is expected to appreciate at the annual rate of 5%. Cooper expects to retain the property for 20 years once it is acquired. Then it will be depreciated as a 39-year real-property class (MACRS), assuming that the property will be placed in service on January 1st. Cooper's marginal tax rate is 30% and his MARR is 15%. What would be the minimum annual total of rental receipts that would make the investment break even?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

Two different methods of solving a production problem are under consideration. Both methods are expected to be obsolete in six years. Method A would cost $80,000 initially and have annual operating costs of $22,000 per year. Method B would cost $52,000 and costs $17,000 per year to operate. The salvage value realized would be $20,000 with Method A and $15,000 with Method B. Investments in both methods are subject to a five-year MACRS property class. The firm's marginal income tax rate is 40%. The firm's MARR is 20%. What would be the required additional annual revenue for Method A such that an engineer would be indifferent to choosing one method over the other?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Rocky Mountain Publishing Company is considering introducing a new morning newspaper in Denver. Its direct competitor charges $0.25 at retail with $0.05 going to the retailer. For the level of news coverage the company desires, it determines the fixed cost of editors, reporters, rent, pressroom expenses, and wire-service charges to be $300,000 per month. The variable cost of ink and paper is $0.10 per copy, but advertising revenues of $0.05 per paper will be generated. To print the morning paper, the publisher has to purchase a new printing press, which will cost $600,000. The press machine will be depreciated according to a seven-year MACRS class. The press machine will be used for 10 years, at which time its salvage value would be about $100,000. Assume 300 issues per year, a 40% tax rate, anti a 13% MARR. How many copies per day must be sold to break even at a retail selling price of $0.25 per paper?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

Probabilistic Analysis

A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision to buy will mean an investment of $8 million, and the demand for the product is not known. If demand is light, the company expects a return of $1.3 million each year for three years. If demand is moderate, the return will be $2.5 million each year for four years, and high demand means a return of $4 million each year for four years. It is estimated the probability of a high demand is 0.4, and the probability of a light demand is 0.2. The firm's (risk-free) interest rate is 12%. Calculate the expected present worth of the patent. On this basis, should the company make the investment? (All figures represent after-tax values.)

A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision to buy will mean an investment of $8 million, and the demand for the product is not known. If demand is light, the company expects a return of $1.3 million each year for three years. If demand is moderate, the return will be $2.5 million each year for four years, and high demand means a return of $4 million each year for four years. It is estimated the probability of a high demand is 0.4, and the probability of a light demand is 0.2. The firm's (risk-free) interest rate is 12%. Calculate the expected present worth of the patent. On this basis, should the company make the investment? (All figures represent after-tax values.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

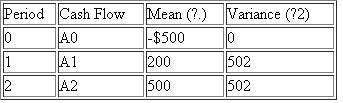

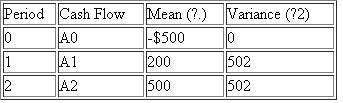

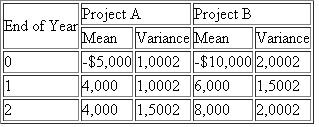

Consider the following investment cash flows over a two-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with ? 12 = 0.3.

(b) In part (a)( 1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix C.)

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with ? 12 = 0.3.

(b) In part (a)( 1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix C.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

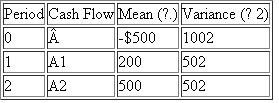

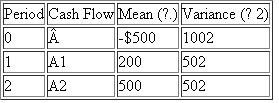

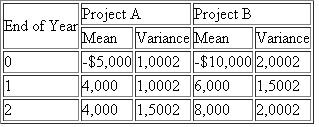

Consider the following investment cash flows over a 2-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with ? 12 = 0.5, but ? 01 = ? 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with ? 12 = 0.5, but ? 01 = ? 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

A financial investor has an investment portfolio worth $350,000. A bond in the portfolio will mature next month and provide him with $25,000 to reinvest. The choices have been narrowed down to the following two options.

• Option 1: Reinvest in a foreign bond that will mature in one year. This will entail a brokerage fee of $150. For simplicity, assume that the bond will provide interest of $2,450, $2,000, or $1,675 over the one-year period and that the probabilities of these occurrences are assessed to be 0.25, 0.45, and 0.30, respectively.

• Option 2: Reinvest in a $25,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 7.5%.

(a) Which form of reinvestment should the investor choose in order to maximize his expected financial gain?

(b) If the investor can obtain professional investment advice from Salomon Brothers, Inc., what would be the maximum amount the investor should pay for this service?

• Option 1: Reinvest in a foreign bond that will mature in one year. This will entail a brokerage fee of $150. For simplicity, assume that the bond will provide interest of $2,450, $2,000, or $1,675 over the one-year period and that the probabilities of these occurrences are assessed to be 0.25, 0.45, and 0.30, respectively.

• Option 2: Reinvest in a $25,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 7.5%.

(a) Which form of reinvestment should the investor choose in order to maximize his expected financial gain?

(b) If the investor can obtain professional investment advice from Salomon Brothers, Inc., what would be the maximum amount the investor should pay for this service?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Kellogg Company is considering the following investment project and has estimated all cost and revenues in constant dollars. The project requires the purchase of a $9,000 asset, which will be used for only two years (the project life).

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

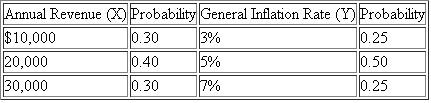

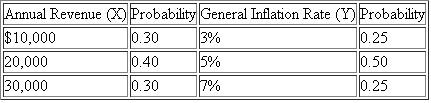

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS properly (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i' ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part 00 compute the variance of the NPW of the investment.

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS properly (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i' ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part 00 compute the variance of the NPW of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

Comparing Risky Projects

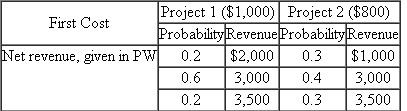

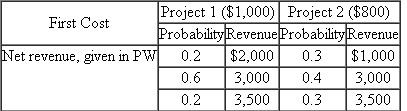

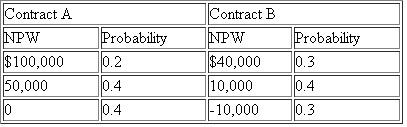

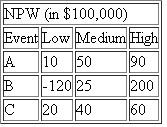

A manufacturing firm is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value. The initial cost and the net year-end revenue for each project are given in Table.

Table

Assume that both projects are statistically independent of each other.

Assume that both projects are statistically independent of each other.

(a) If you are an expected-value maximizer, which project would you select?

(b) If you also consider the variance of the project, which project would you select?

A manufacturing firm is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value. The initial cost and the net year-end revenue for each project are given in Table.

Table

Assume that both projects are statistically independent of each other.

Assume that both projects are statistically independent of each other.(a) If you are an expected-value maximizer, which project would you select?

(b) If you also consider the variance of the project, which project would you select?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

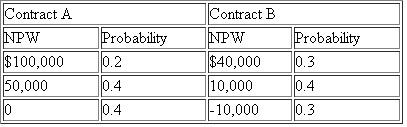

A business executive is trying to decide whether to undertake one of two contracts or neither one. He has simplified the situation somewhat and feels that it is sufficient to imagine that the contracts provide alternatives as given in Table.

Table

(a) Should the executive undertake either one of the contracts? If so, which one? What would he do if he made decisions with an eye toward maximizing his expected NPW

(a) Should the executive undertake either one of the contracts? If so, which one? What would he do if he made decisions with an eye toward maximizing his expected NPW

(b) What would be the probability that contract A would result in a larger profit than that of contract B?

Table

(a) Should the executive undertake either one of the contracts? If so, which one? What would he do if he made decisions with an eye toward maximizing his expected NPW

(a) Should the executive undertake either one of the contracts? If so, which one? What would he do if he made decisions with an eye toward maximizing his expected NPW(b) What would be the probability that contract A would result in a larger profit than that of contract B?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

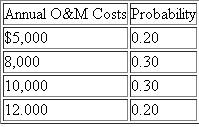

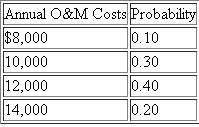

Two alternative machines are being considered for a cost-reduction project.

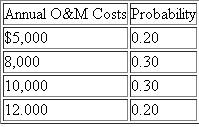

• Machine A has a first cost of $60,000 and a salvage value (after tax) of $22,000 at the end of six years of service life. The probabilities of annual after-tax operating costs of this machine are estimated as follows:

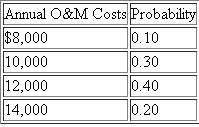

• Machine B has an initial cost of $35,000, and its estimated salvage value (after tax) at the end of four years of service is negligible. The annual after-tax operating costs are estimated to be as follows:

• Machine B has an initial cost of $35,000, and its estimated salvage value (after tax) at the end of four years of service is negligible. The annual after-tax operating costs are estimated to be as follows:

The MARR on this project is 10%. The required service period of these machines is estimated to be 12 years, and no technological advance in either machine is expected.

The MARR on this project is 10%. The required service period of these machines is estimated to be 12 years, and no technological advance in either machine is expected.

(a) Assuming independence, calculate the mean and variance for the equivalent annual cost of operating each machine.

(b) From the results of part (a), calculate the probability that the annual cost of operating machine A will exceed the cost of operating machine B

• Machine A has a first cost of $60,000 and a salvage value (after tax) of $22,000 at the end of six years of service life. The probabilities of annual after-tax operating costs of this machine are estimated as follows:

• Machine B has an initial cost of $35,000, and its estimated salvage value (after tax) at the end of four years of service is negligible. The annual after-tax operating costs are estimated to be as follows:

• Machine B has an initial cost of $35,000, and its estimated salvage value (after tax) at the end of four years of service is negligible. The annual after-tax operating costs are estimated to be as follows: The MARR on this project is 10%. The required service period of these machines is estimated to be 12 years, and no technological advance in either machine is expected.

The MARR on this project is 10%. The required service period of these machines is estimated to be 12 years, and no technological advance in either machine is expected.(a) Assuming independence, calculate the mean and variance for the equivalent annual cost of operating each machine.

(b) From the results of part (a), calculate the probability that the annual cost of operating machine A will exceed the cost of operating machine B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

Two mutually exclusive investment projects are under consideration. It is assumed that the cash flows are statistically independent random variables with means and variances estimated as given in Table.

(a) For each project, determine the mean and standard deviation of the NTW, using an inrest rate of 15%.

(a) For each project, determine the mean and standard deviation of the NTW, using an inrest rate of 15%.

(b) On the basis of the results of part (a) which project would you recommend?

(a) For each project, determine the mean and standard deviation of the NTW, using an inrest rate of 15%.

(a) For each project, determine the mean and standard deviation of the NTW, using an inrest rate of 15%.(b) On the basis of the results of part (a) which project would you recommend?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

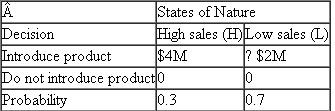

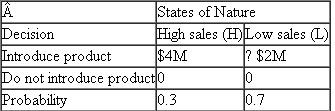

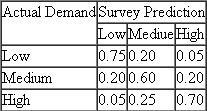

Your company must decide whether or not to introduce a new product. The sales of the product will be either at a high level (a success) or quite low (a flop). The conditional value for this decision is as follows:

Your company has the option to conduct a market survey lo better ascertain the true market demand.

Your company has the option to conduct a market survey lo better ascertain the true market demand.

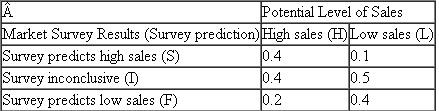

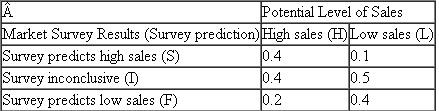

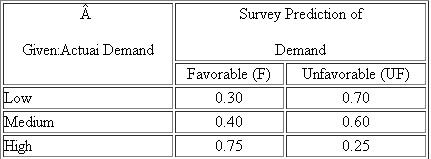

The survey will cost $0.2M. The survey does not provide perfect information about the sales, but there are three possible outcomes from the survey: (1) the survey may predict success (high sales) for the new product; (2) the survey may predict that the new product will fail (low sales); or (3) the survey result may be inconclusive. You are given the following notation and information:

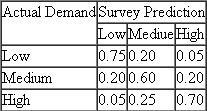

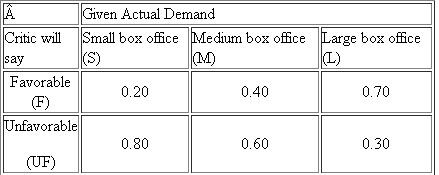

Conditional Probabilities of Survey Predictions, Given Potential Sales

To evaluate the economic worth of the survey, answer the following questions.

To evaluate the economic worth of the survey, answer the following questions.

(a) Based on expected monetary value, what is your decision before taking the survey?

(b) What is the expected value of perfect information before taking the survey?

(c) Draw the complete decision tree diagram with the survey option.

(d) What is the expected value of perfect information after you have taken the survey?

(e) What is the worth of the survey information?

(f) What is the best course of action?

Your company has the option to conduct a market survey lo better ascertain the true market demand.

Your company has the option to conduct a market survey lo better ascertain the true market demand.The survey will cost $0.2M. The survey does not provide perfect information about the sales, but there are three possible outcomes from the survey: (1) the survey may predict success (high sales) for the new product; (2) the survey may predict that the new product will fail (low sales); or (3) the survey result may be inconclusive. You are given the following notation and information:

Conditional Probabilities of Survey Predictions, Given Potential Sales

To evaluate the economic worth of the survey, answer the following questions.

To evaluate the economic worth of the survey, answer the following questions.(a) Based on expected monetary value, what is your decision before taking the survey?

(b) What is the expected value of perfect information before taking the survey?

(c) Draw the complete decision tree diagram with the survey option.

(d) What is the expected value of perfect information after you have taken the survey?

(e) What is the worth of the survey information?

(f) What is the best course of action?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

Delta College's campus police are quite concerned with ever-growing weekend parties taking place at the various dormitories on the campus, where alcohol is commonly served to underage college students. According to reliable information, on a given Saturday night, one may observe a party to take place 60% of the time. Police Lieutenant Shark usually receives a tip regarding student drinking that is to take place in one of the residence halls the next weekend. According to Officer Shark, this tipster has been correct 40% of the time when the party is planned. The tipster has been also correct 80% of the time when the party does not take place. (That is, the tipster says that no party is planned.) If Officer Shark does not raid the residence hall in question at the time of the supposed party, he loses 10 career progress points. (The police chief gets complete information on whether there was a party only after the weekend.) If he leads a raid and the tip is false, he loses 50 career progress points, whereas if the tip is correct, he earns 100 points. Certainly he could raid always, of never, or do the opposite of what the tip says

(a) What is the probability that no party is actually planned even though the tipster says that there will be a party?

(b) If the lieutenant wishes to maximize his expected career progress points, what should he do before getting any tip?

(c) What is the EVPI (in terms of career points)

(a) What is the probability that no party is actually planned even though the tipster says that there will be a party?

(b) If the lieutenant wishes to maximize his expected career progress points, what should he do before getting any tip?

(c) What is the EVPI (in terms of career points)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

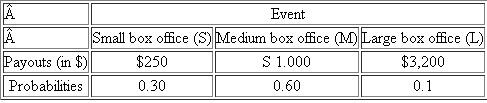

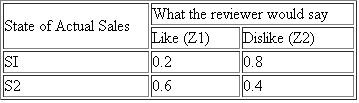

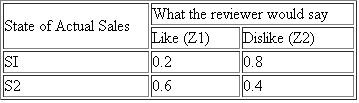

As a plant manager of a corporation, you are trying to decide whether to open a new factory outlet store, which would cost about $500,000. Success of the outlet store depends on demand in the new region. If demand is high, you expect to gain $1 million per year; if demand is average, the gain is $500,000; and if demand is low. you lose $80,000. From your knowledge of the region and your product, you feel that the chances are 0.4 that sales will be average and equally likely that they will be high or low (0.3, respectively). Assume that the firm's MARR is known to be 15%, and the marginal tax rate will be 40%. Also, assume that the salvage value of the store at the end of 15 years will be about $100,000. The store will be depreciated under a 39-year property class.

(a) If the new outlet store will be in business for 15 years, should you open it? How much would you be willing to pay to know the true state of nature?

(b) Suppose a market survey is available at $1,000, with the following reliability (the values shown were obtained from past experience, where actual demand was compared with predictions made by the survey):

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information?

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information?

(a) If the new outlet store will be in business for 15 years, should you open it? How much would you be willing to pay to know the true state of nature?

(b) Suppose a market survey is available at $1,000, with the following reliability (the values shown were obtained from past experience, where actual demand was compared with predictions made by the survey):

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information?

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33