Deck 9: Depreciation and Corporate Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 9: Depreciation and Corporate Taxes

1

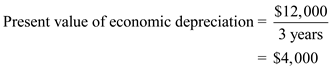

A machine now in use was purchased four years ago at a cost of $30,000. It has a book value of $9,369. It can be sold for $12,000, but it could be used for three more years, at the end of which time, it would have no salvage value. What is the current amount of economic depreciation for this asset?

Economic depreciation can be defined as the reduction in the price of the stock of a firm, company or country either due to physical wear and tear, changes in the buying pattern or unfashionableness.

The book value is the amount or the value of an asset as mentioned in the firm accounts.

It is given that the cost price of the machine 4 years ago was $30,000. The book value is $9,369 and it can be sold for $12,000. The life remaining of the asset is 3 years.

The present value of economic depreciation can be computed as shown below:

Hence, the present value of economic depreciation is

Hence, the present value of economic depreciation is

.

.

The book value is the amount or the value of an asset as mentioned in the firm accounts.

It is given that the cost price of the machine 4 years ago was $30,000. The book value is $9,369 and it can be sold for $12,000. The life remaining of the asset is 3 years.

The present value of economic depreciation can be computed as shown below:

Hence, the present value of economic depreciation is

Hence, the present value of economic depreciation is .

. 2

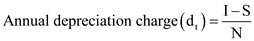

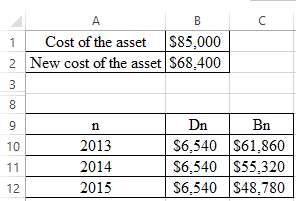

On January 2, 20l0, the Allen Flour Company purchased a new machine at a cost of $82,000. Installation costs for the machine were $3,000. The machine was expected to have a useful life of 10 years, with a salvage value of $3,000. The company uses straight-line depreciation for financial reporting. On January 3, 2013, the machine broke down, and an extraordinary repair had to be made to the machine at a cost of $8,000. The repair extended the machine's life to 13 years, but left the salvage value unchanged. On January 2, 2016, an improvement was made to the machine in the amount of $5,000 that increased the machine's productivity and increased the salvage value (to $6,000), but did not affect the remaining- useful life. Determine depreciation expenses every December 31st for the years 2010, 2013, and 2016.

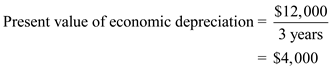

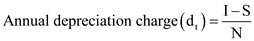

Simple line depreciation is considered as the most simple and best method of depreciation. To calculate the annual depreciation charge, a simple formula is used which is shown below:

Where I represent cost of the equipment, S represents salvage value and N represents the life of the project.

Where I represent cost of the equipment, S represents salvage value and N represents the life of the project.

The question requires us to calculate the depreciation of a new machine on every 31 st December for the years 2010, 2013 and 2016 where the cost of the machine is $82,000 and its installation cost is $3,000. Machine has expected useful life of 10 years, its salvage value is $3,000.

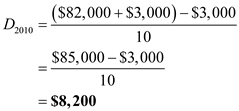

Book depreciation expense for 2010 can be calculated as given below:

Hence, the Book depreciation expense for 2010 is

Hence, the Book depreciation expense for 2010 is

.

.

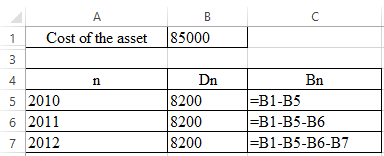

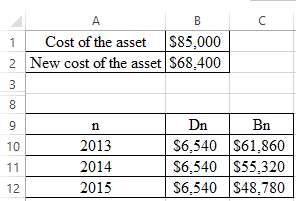

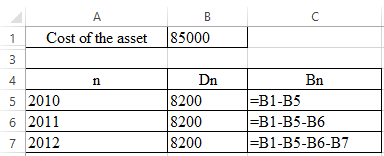

Calculation for the book value of the machine for the next 3 years is given in the table mentioned below:

Calculated book values are found to be:

Calculated book values are found to be:

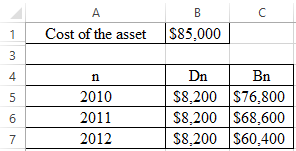

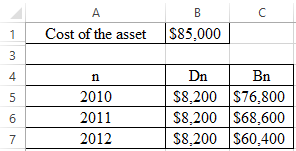

Now, it is required to calculate the depreciation expenses for 2013. In 2013, $8,000 was spent on repairing of machine. The calculations for depreciation are given below:

Now, it is required to calculate the depreciation expenses for 2013. In 2013, $8,000 was spent on repairing of machine. The calculations for depreciation are given below:

Hence, the Book depreciation expense for 2013 is

Hence, the Book depreciation expense for 2013 is

.

.

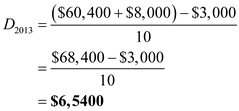

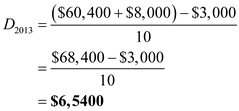

Calculation for the book value of the machine for the next 3 years is given in the table mentioned below:

Calculated book values are found to be:

Calculated book values are found to be:

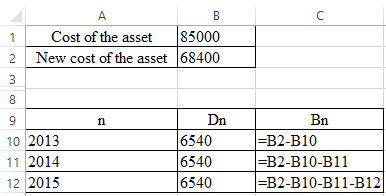

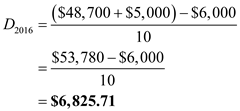

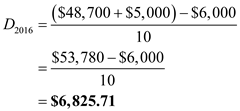

Now, it is required to calculate the depreciation expenses for 2016. On 2 nd January 2016, $5,000 was spent in order to make improvements in machine which lead to increase in its salvage value to $6,000. So, the depreciation expense would be:

Now, it is required to calculate the depreciation expenses for 2016. On 2 nd January 2016, $5,000 was spent in order to make improvements in machine which lead to increase in its salvage value to $6,000. So, the depreciation expense would be:

Hence, the Book depreciation expense for 2016 is

Hence, the Book depreciation expense for 2016 is

.

.

Where I represent cost of the equipment, S represents salvage value and N represents the life of the project.

Where I represent cost of the equipment, S represents salvage value and N represents the life of the project.The question requires us to calculate the depreciation of a new machine on every 31 st December for the years 2010, 2013 and 2016 where the cost of the machine is $82,000 and its installation cost is $3,000. Machine has expected useful life of 10 years, its salvage value is $3,000.

Book depreciation expense for 2010 can be calculated as given below:

Hence, the Book depreciation expense for 2010 is

Hence, the Book depreciation expense for 2010 is .

.Calculation for the book value of the machine for the next 3 years is given in the table mentioned below:

Calculated book values are found to be:

Calculated book values are found to be: Now, it is required to calculate the depreciation expenses for 2013. In 2013, $8,000 was spent on repairing of machine. The calculations for depreciation are given below:

Now, it is required to calculate the depreciation expenses for 2013. In 2013, $8,000 was spent on repairing of machine. The calculations for depreciation are given below: Hence, the Book depreciation expense for 2013 is

Hence, the Book depreciation expense for 2013 is .

.Calculation for the book value of the machine for the next 3 years is given in the table mentioned below:

Calculated book values are found to be:

Calculated book values are found to be: Now, it is required to calculate the depreciation expenses for 2016. On 2 nd January 2016, $5,000 was spent in order to make improvements in machine which lead to increase in its salvage value to $6,000. So, the depreciation expense would be:

Now, it is required to calculate the depreciation expenses for 2016. On 2 nd January 2016, $5,000 was spent in order to make improvements in machine which lead to increase in its salvage value to $6,000. So, the depreciation expense would be:  Hence, the Book depreciation expense for 2016 is

Hence, the Book depreciation expense for 2016 is .

. 3

You sold an automobile at a price of $14,000. The automobile was purchased three years ago for $20,000. The car had been depreciated according to a five-year MACRS property class, and the book value was $5,760. What is the amount of economic depreciation?

The ninth chapter that is in the text focuses on various ways depreciation is calculated as well as various situations where corporate income taxes are calculated as well. Some of the items mentioned include MACRS depreciation, economic depreciation, tax rate analysis, and more.

For the question needing answered here, we have an automobile that one sold for a price of $14,000.00. When it was purchased three (3) years ago, the initial cost of the vehicle was $20,000.00. The depreciation schedule was a five (5) year MACRS property class timeframe and the net book value was $5,760.00. In this situation, what was the economic depreciation value for the car

When doing a problem like this, one needs to take a gander at the section which on economic depreciation in the early parts of the chapter. Here, the one thing that should be noted is that economic depreciation is the loss of value that is for a purchased asset minus the price that it can be sold at a specific point of time (whether current or in the near future).

Applicable to the situation here, we have an initial cost of $20,000.00 for the asset and a market selling price of $14,000.00. Note that in this situation, this is the price the car was sold far. Though the asset value of the vehicle is $5,760.00, this is the value that one would not want to use in order to get the economic depreciation value for an asset. Rather, it is important to remember that this is the difference between the initial purchase price and the market selling price at a current (or near current) point in time.

Thus, when we take these two values and get the net difference, the economic depreciation value here is $6,000.00. As one can see here, it is slightly above the netted depreciation cost for the vehicle in question.

For the question needing answered here, we have an automobile that one sold for a price of $14,000.00. When it was purchased three (3) years ago, the initial cost of the vehicle was $20,000.00. The depreciation schedule was a five (5) year MACRS property class timeframe and the net book value was $5,760.00. In this situation, what was the economic depreciation value for the car

When doing a problem like this, one needs to take a gander at the section which on economic depreciation in the early parts of the chapter. Here, the one thing that should be noted is that economic depreciation is the loss of value that is for a purchased asset minus the price that it can be sold at a specific point of time (whether current or in the near future).

Applicable to the situation here, we have an initial cost of $20,000.00 for the asset and a market selling price of $14,000.00. Note that in this situation, this is the price the car was sold far. Though the asset value of the vehicle is $5,760.00, this is the value that one would not want to use in order to get the economic depreciation value for an asset. Rather, it is important to remember that this is the difference between the initial purchase price and the market selling price at a current (or near current) point in time.

Thus, when we take these two values and get the net difference, the economic depreciation value here is $6,000.00. As one can see here, it is slightly above the netted depreciation cost for the vehicle in question.

4

On March 17, 2013, the Wildcat Oil Company began operations at its Louisiana oil field. The oil field had been acquired several years earlier at a cost of $32.5 million. The field is estimated to contain 6.5 million barrels of oil and to have a salvage value of $3 million both before and after all of the oil is pumped out. Equipment costing $480,000 was purchased for use at the oil field. The equipment will have no economic usefulness once the Louisiana field is depleted; therefore, it is depreciated on a units-of-production method. In addition, Wildcat Oil built a pipeline at a cost of $2,880,000 to serve the Louisiana field. Although this pipeline is physically capable of being used for many years, its economic usefulness is limited to the productive life of the Louisiana field; therefore, the pipeline has no salvage value. Depreciation of the pipeline is based on the estimated number of barrels of oil to be produced. Production at the Louisiana oil field amounted to 420,000 barrels in 2015 and 510,000 barrels in 2016.

(a) Compute the per barrel depletion rate of the oil field during the years 2015 and 2016.

(b) Compute the per barrel depreciation rates of the equipment and the pipeline during the years 2015 and 2016.

(a) Compute the per barrel depletion rate of the oil field during the years 2015 and 2016.

(b) Compute the per barrel depreciation rates of the equipment and the pipeline during the years 2015 and 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

The General Service Contractor Company paid $400,000 for a house and lot. The value of the land was appraised at $155,000 and the value of the house at $245,000. The house was then torn down at an additional cost of $15,000 so that a warehouse could be built on the combined lots at a cost of $l,250,000. What is the value of the property with the warehouse? For depreciation purposes, what is the cost basis for the warehouse?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Electronic Measurement and Control Company (EMCC) has developed a laser speed detector that emits infrared light, which is invisible to humans and radar detectors alike. For full-scale commercial marketing, EMCC needs to invest $5 million in new manufacturing facilities. The system is priced at$5,000 perunit. The company expects to sell 5,000 units annually over the next five years. The new manufacturing facilities will be depreciated according to a seven-year MACRS property class. The expected salvage value of the manufacturing facilities at the end of five years is $1.6 million. The manufacturing cost for the detector is $1,200 per unit, excluding depreciation expenses. The operating and maintenance costs are expected to run to $1.2 million per year. EMCC has a combined federal and state income tax rate of35%, and undertaking this project will not change this current marginal tax rate.

(a) Determine, for the next five years, the incremental taxable income, income taxes, and net income due to undertaking this new product.

(b) Determine the gains or losses associated with the disposal of the manufacturing facilities at the end of five years.

(a) Determine, for the next five years, the incremental taxable income, income taxes, and net income due to undertaking this new product.

(b) Determine the gains or losses associated with the disposal of the manufacturing facilities at the end of five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

To automate one of its production processes, the Milwaukee Corporation bought three flexible manufacturing cells at a price of $400.000 each. When they were delivered, Milwaukee paid freight charges of $20,000 and handling fees of $15,000. Site preparation for these cells cost $45,000. Six foremen, each earning $20 an hour, worked five 40-hour weeks to set up and test the manufacturing cells. Special wiring and other materials applicable to the new manufacturing cells cost $3,500. Determine the cost basis (amount to be capitalized) for these cells.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

Diamonid is a start-up diamond-coating company that is planning to manufacture a microwave plasma reactor that synthesizes diamonds. Diamonid anticipates that the industry demand for diamonds will skyrocket over the next decade for use in industrial drills, high-performance microchips, and artificial human joints, among other things. Diamonid has decided to raise $50 million through issuing common stocks for investment in plant ($10 million) and equipment ($40 million) improvements. Each reactor can be sold at a price of $100,000 per unit. Diamonid can expect to sell 300 units per year during the next 8 years. The unit manufacturing cost is estimated at $30,000. Excluding depreciation. The operating and maintenance cost for the plant is estimated at $12 million per year. Diamonid expects to phase out the operation at the end of eight years, revamp the plant and equipment, and adopt a new diamond-manufacturing technology. At that time, Diamonid estimates that the salvage values for the plant and equipment will be about 60% and 10% of the original investments, respectively. The plant and equipment will be depreciated according to 39-year real property (placed in service in January) and seven-year MACRS, respectively. Diamonid pays 5% of slate and local income taxes on its taxable income.

(a) If the 2015 corporate tax system continues over the project life, determine the combined stale and federal income tax rate each year.

(b) Determine the gains or losses at the time the plant is revamped.

(c) Determine the net income each year over the plant life.

(a) If the 2015 corporate tax system continues over the project life, determine the combined stale and federal income tax rate each year.

(b) Determine the gains or losses at the time the plant is revamped.

(c) Determine the net income each year over the plant life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

A new drill press was purchased for $148,000 by trading in a similar machine that had a book value of $46,220. Assuming that the trade-in allowance is $40,000 and that $108,000 cash is to be paid for the new asset, what is the cost basis of the new asset for depreciation purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

A lift truck priced at $38,000 is acquired by trading in a similar lift truck and paying cash for the remaining balance. Assuming that the trade-in allowance is $9,000 and the book value of the asset traded in is $7,808, what is the cost basis of the new asset for the computation of depreciation for tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

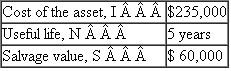

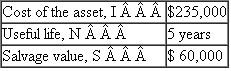

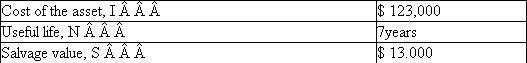

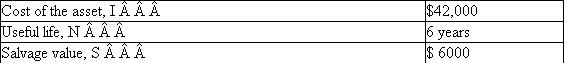

Consider the following data on an asset:

Compute the annual depreciation allowances and the resulting book values, using

Compute the annual depreciation allowances and the resulting book values, using

(a) The straight-line depreciation method.

(b) The double-declining-balance method.

Compute the annual depreciation allowances and the resulting book values, using

Compute the annual depreciation allowances and the resulting book values, using(a) The straight-line depreciation method.

(b) The double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm is trying to decide whether to keep an item of construction equipment for another year. The firm has been using DDB for book purposes, and this is the fourth year of ownership of the equipment, which cost $125,000 new. The useful life of the asset was eight years. What was the depreciation in year 3?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

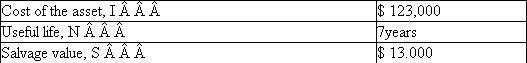

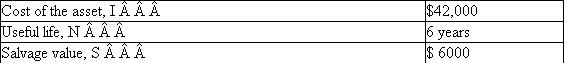

Consider the following data on an asset:

Compute the annual depreciation allowances and the resulting book values, initially using the DDB and then switching to SL.

Compute the annual depreciation allowances and the resulting book values, initially using the DDB and then switching to SL.

Compute the annual depreciation allowances and the resulting book values, initially using the DDB and then switching to SL.

Compute the annual depreciation allowances and the resulting book values, initially using the DDB and then switching to SL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

The double-declining-balance method is to be used for an asset with a cost of $88,000, an estimated salvage value of $ 13,000, and an estimated useful life of six years.

(a) What is the depreciation for the first three fiscal years, assuming that the asset was placed in service at the beginning of the year?

(b) If switching to the straight-line method is allowed, when is the optimal time to switch?

(a) What is the depreciation for the first three fiscal years, assuming that the asset was placed in service at the beginning of the year?

(b) If switching to the straight-line method is allowed, when is the optimal time to switch?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

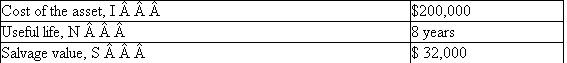

Compute the double-declining-balance (DDB) depreciation schedule for the following asset:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

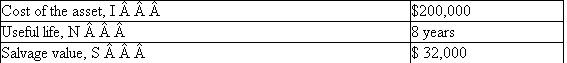

Compute the DDB depreciation schedule for the following asset:

(a) What is the value of ? ?

(a) What is the value of ? ?

(b) What is the amount of depreciation for the second full year of use of the asset?

(c) What is the book value of the asset at the end of the fourth year?

(a) What is the value of ? ?

(a) What is the value of ? ?(b) What is the amount of depreciation for the second full year of use of the asset?

(c) What is the book value of the asset at the end of the fourth year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Upjohn Company purchased new packaging equipment with an estimated useful life of five years. The cost of the equipment was $55,000, and the salvage value was estimated to be $5,000 at the end of year 5. Compute the annual depreciation expenses over the five-year life of the equipment under each of the following methods of book depreciation:

(a) Straight-line method

(b) Double-declining-balance method

(a) Straight-line method

(b) Double-declining-balance method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

A secondhand bulldozer acquired at the beginning of the fiscal year at a cost of $56,000 has an estimated salvage value of $6,500 and an estimated useful life of 12 years. Determine the following.

(a) The amount of annual depreciation by the straight-line method.

(b) The amount of depreciation for the third year, computed by the double-declining-balance method.

(a) The amount of annual depreciation by the straight-line method.

(b) The amount of depreciation for the third year, computed by the double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a dump truck for hauling coal has an estimated net cost of $90,000 and is expected to give service for 250.000 miles, resulting in a salvage value of $5,000, what would be the depreciation per mile? Compute the allowed depreciation amount for the same truck's usage amounting to 30,000 miles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

A diesel-powered generator with a cost of $68,000 is expected to have a useful operating life of 50,000 hours. The expected salvage value of this generator is $7,500. In its first operating year, the generator was operated for 5,500 hours. Determine the depreciation for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Collins Metal Shop purchased a stamping machine for $257,000 on March 1, 2015. The machine is expected to have a useful life of 10 years, a salvage value of $32,000, a production of 250,000 units, and working hours of 30,000. During 2016, Denver used the stamping machine for 2,450 hours to produce 23,450 units. From the information given, compute the book depreciation expense for 2016 under each of the following methods.

(a) Straight-line

(b) Units-of-production

(c) Working hours

(d) Double-declining-balance (without conversion to straight-line)

(e) Double-declining-balance (with conversion to straight-line)

(a) Straight-line

(b) Units-of-production

(c) Working hours

(d) Double-declining-balance (without conversion to straight-line)

(e) Double-declining-balance (with conversion to straight-line)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

The M M Company purchased a new punch press in 2005 at a cost of $265,000, M M also paid $46,000 to have the punch press delivered and installed. The punch press has an estimated useful life of 12 years, but it will be depreciated using MACRS over its seven-year property class life.

(a) What is the cost basis of the punch press?

(b) What will be the depreciation allowance in each year over seven years?

(a) What is the cost basis of the punch press?

(b) What will be the depreciation allowance in each year over seven years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Vermont Construction Company purchased a hauling truck on January 1, 2009 at a cost of $35,000. The truck has a useful life of eight years with an estimated salvage value of $6,000. The straight-line method is used for book purposes. For tax purposes, the truck would be depreciated with the MACRS method over its five-year class life. Determine the annual depreciation amount to be taken over the useful life of the hauling truck for both book and tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Harris Foundry Company purchased new casting equipment in 2010 at a cost of $ 190,000. Harris also paid $25,000 to have the equipment delivered and installed. The casting machine has an estimated useful life of 10 years, but it will be depreciated with MACRS over its seven-year class life.

(a) What is the cost basis of the casting equipment'?

(b) What will be the depreciation allowance in which year of the seven-year class life of the casting equipment?

(a) What is the cost basis of the casting equipment'?

(b) What will be the depreciation allowance in which year of the seven-year class life of the casting equipment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

The ABC Corporation placed an asset it service three years ago. The company uses the MACRS method (seven-year life) for tax purposes and the straight-line method (seven-year useful life) for financial reporting purposes. The cost of the asset is $100,000, and the salvage value used for depreciating purposes is $20,000. What is the difference in the current book value obtained using both methods?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

A machine is classified as seven-year MACRS property Compute the book value for tax purposes at the end of three years. The cost basis is $185,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

A piece of machinery purchased at a cost of $92,000 has an estimated salvage value of $12,000 and an estimated useful life of five years. It was placed in service on May 1st of the current fiscal year, which ends on December 31st. The asset falls into a seven-year MACRS properly category. Determine the depreciation amounts over the useful life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose that a taxpayer places in service a $50,000 asset that is assigned to the six-year class (say, a new properly class) with a half-year convention. Develop the MACRS deductions (assuming a 200% declining-balance rate), followed by switching to straight-line with the half-year convention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

On April 1st, Leo Smith paid $310,000 for a residential rental property. This purchase price represents $250,000 for the building and $60,000 for the land. Five years later, on November 1st. he sold the property for $400,000. Compute the MACRS depreciation for each of the five calendar years during which he had the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

In 2016, you purchased a spindle machine (seven-year MACRS property) for $53,000, which you placed in service in January. Using the calendar year as your tax year, compute the depreciation allowances over seven years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

On October 1st, you purchased a residential home in which to locate your professional office for $350,000. The appraisal is divided into $80,000 for the land and $270,000 for the building.

(a) In your first year of ownership, how much can you deduct for depreciation for tax purposes?

(b) Suppose that the property was sold at $375,000 at the end of fourth year of ownership. What is the book value of the property?

(a) In your first year of ownership, how much can you deduct for depreciation for tax purposes?

(b) Suppose that the property was sold at $375,000 at the end of fourth year of ownership. What is the book value of the property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

For each of four assets in the Table 1, determine the missing amounts (for asset type III, the annual usage is 15,000 miles).

Table 1

Table 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

At the beginning of the fiscal year, the Borland Company acquired new equipment at a cost of $89,000. The equipment has an estimated life of five years and an estimated salvage value of $10.000.

(a) Determine the annual depreciation (for financial reporting) for each of the five years of the estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year. Use (1) the straight-line method and (2) the double-declining-balance method for each.

(b) Determine the annual depreciation for tax purposes, assuming that the equipment falls into a seven-year MACRS property class.

(c) Assume that the equipment was depreciated under seven-year MACRS. In the first month of the fourth year, the equipment was traded in for similar equipment priced at $92,000. The trade-in allowance on the old equipment was $20,000, and cash was paid for the balance. What is the cost basis of the new equipment for computing the amount of depreciation for income tax purposes?

(a) Determine the annual depreciation (for financial reporting) for each of the five years of the estimated useful life of the equipment, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year. Use (1) the straight-line method and (2) the double-declining-balance method for each.

(b) Determine the annual depreciation for tax purposes, assuming that the equipment falls into a seven-year MACRS property class.

(c) Assume that the equipment was depreciated under seven-year MACRS. In the first month of the fourth year, the equipment was traded in for similar equipment priced at $92,000. The trade-in allowance on the old equipment was $20,000, and cash was paid for the balance. What is the cost basis of the new equipment for computing the amount of depreciation for income tax purposes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Early in 2015, the Atlantic Mining Company began operation at its West Virginia mine. The mine had been acquired at a cost of $8,900,000 in 2013, and is expected to contain 4 million tons of silver and to have a residual value of $ 1,500,000 (once the silver is depleted). Before beginning mining operations. The company installed equipment at a cost of $2,500,000. This equipment will have no economic usefulness once the silver is depleted. Therefore, depreciation of the equipment is based upon the estimated number of tons of ore produced each year. Ore removed from the West Virginia mine amounted to 550.000 tons in 2015 and 688,000 tons in 2016.

(a) Compute the per ton depletion rate of the mine and the per ton depreciation rate of the mining equipment.

(b) Determine the depletion expense for the mine and the depreciation expense for the mining equipment.

(a) Compute the per ton depletion rate of the mine and the per ton depreciation rate of the mining equipment.

(b) Determine the depletion expense for the mine and the depreciation expense for the mining equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Suppose you bought a timber tract for $850,000, and the land was worth as much as $250,000. An estimated 6.8 million board feet (MBF) of standing timber was in the tract. If you cut 1.5 MBF of timber for this fiscal year, determine your depletion allowance for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

A gold mine with an estimated deposit of 500.000 ounces of gold is purchased for $80 million. The mine has a gross income of $48,365,000 for the year, obtained from selling 52,000 ounces of gold. Mining expenses before depletion equal $22,250,000. Compute the percentage depletion allowance. Would it the advantageous to apply cost depletion rather than percentage depletion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

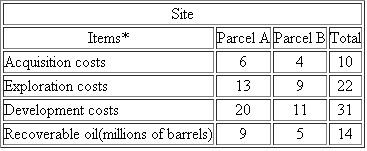

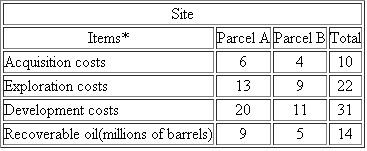

The Oklahoma Oil Company incurred acquisition, exploration, and development costs during 2016 as given in Table 1.

Table 1

The market price of oil during 2016 was $60 per barrel.

The market price of oil during 2016 was $60 per barrel.

(a) Determine the cost basis for depletion on each parcel.

(b) During 2016, 1,200,000 barrels were extracted from parcel A at a production cost of $3,600,000. Determine the depletion charge allowed for parcel A.

(c) In part (b), if Oklahoma Oil Company sold 1,000,000 of the 1,200,000 barrels extracted during 2016 at a price of $75 per barrel, the sales revenue would be $75,000,000. If it qualified for the use of percentage depletion (15%), what would be the allowed depletion amount for 2016?

(d) During 2016, 800,000 barrels were extracted (and sold) from parcel B al a production cost of $3,000,000. Assume that, during 2017, it is ascertained that the remaining proven reserves on parcel B total only 4.000,000 barrels (instead of the expected 4,200,000). This revision in proven reserves is considered a change in an accounting estimate that must be corrected during the current and future years. (A correction of previous years' depletion amounts is not permitted.) If 1,000,000 barrels are extracted during 2017, what is the total depletion charge allowed, according to the unit cost method?

Table 1

The market price of oil during 2016 was $60 per barrel.

The market price of oil during 2016 was $60 per barrel.(a) Determine the cost basis for depletion on each parcel.

(b) During 2016, 1,200,000 barrels were extracted from parcel A at a production cost of $3,600,000. Determine the depletion charge allowed for parcel A.

(c) In part (b), if Oklahoma Oil Company sold 1,000,000 of the 1,200,000 barrels extracted during 2016 at a price of $75 per barrel, the sales revenue would be $75,000,000. If it qualified for the use of percentage depletion (15%), what would be the allowed depletion amount for 2016?

(d) During 2016, 800,000 barrels were extracted (and sold) from parcel B al a production cost of $3,000,000. Assume that, during 2017, it is ascertained that the remaining proven reserves on parcel B total only 4.000,000 barrels (instead of the expected 4,200,000). This revision in proven reserves is considered a change in an accounting estimate that must be corrected during the current and future years. (A correction of previous years' depletion amounts is not permitted.) If 1,000,000 barrels are extracted during 2017, what is the total depletion charge allowed, according to the unit cost method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

A coal mine expected to contain 6.5 million tons of coal was purchased at a cost of $30 million. One million tons of coals for steel making are produced this year. The gross income for this coal is $15,000,000 and operating costs (excluding depletion expenses) are $ 1,850,000. If you know that coal has a 10% depletion allowance, what will be the depletion allowance?

(a) Cost depletion.

(b) Percentage depletion.

(a) Cost depletion.

(b) Percentage depletion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Perkins Construction Company bought a building for $800,000 to be used as a warehouse. A number of major structural repairs completed at the beginning of the current year at a cost of $ 125,000 are expected to extend the life of the building 10 years beyond the original estimate. For book purposes, the building has been depreciated by the straight-line method for 25 years. The salvage value is expected to be negligible and has been ignored. The book value of the building before the structural repairs is $400,000.

(a) What has the amount of annual depreciation been in past years?

(b) What is the book value of the building after the repairs have been recorded?

(c) What is the amount of depreciation for the current year, according to the straight-line method? (Assume that the repairs were completed at the very beginning of the year.)

(d) For tax purposes, what is the amount of depreciation for the current year, assuming that the building belongs to a 39-year real property class?

(a) What has the amount of annual depreciation been in past years?

(b) What is the book value of the building after the repairs have been recorded?

(c) What is the amount of depreciation for the current year, according to the straight-line method? (Assume that the repairs were completed at the very beginning of the year.)

(d) For tax purposes, what is the amount of depreciation for the current year, assuming that the building belongs to a 39-year real property class?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

The Dow Ceramic Company purchased a glass-molding machine in January 2010 for $180,000. The company has been depreciating the machine over an estimated useful life of 10 years, assuming no salvage value, by the straight-line method of depreciation. For tax purposes, the machine has been depreciated as seven-year MACRS property. At the beginning of 2013, Dow overhauled the machine at a cost of $45,000. As a result of the overhaul, Dow estimated that the useful life of the machine would extend live years beyond the original estimate.

(a) Calculate the book depreciation for the year 2016.

(b) Calculate the tax depreciation for the year 2016.

(a) Calculate the book depreciation for the year 2016.

(b) Calculate the tax depreciation for the year 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

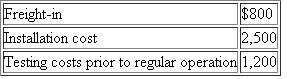

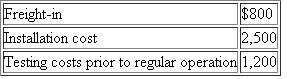

On January 2, 2013, the Hines Food Processing Company purchased a machine that dispenses a premeasured amount of tomato juice into a can. The machine cost $85,000, and its useful life was estimated at eight years, with a salvage value of $4,000. Al the time it purchased the machine, Hines incurred the following additional expenses:

Book depreciation was calculated by the straight-line method, but for tax purposes, the machine was classified as a seven-year MACRS property. In January 2015, accessories costing $5,000 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine's life nor provided any additional salvage value.

Book depreciation was calculated by the straight-line method, but for tax purposes, the machine was classified as a seven-year MACRS property. In January 2015, accessories costing $5,000 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine's life nor provided any additional salvage value.

(a) Calculate the book depreciation expense for 2016.

(b) Calculate the tax depreciation expense for 2016.

Book depreciation was calculated by the straight-line method, but for tax purposes, the machine was classified as a seven-year MACRS property. In January 2015, accessories costing $5,000 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine's life nor provided any additional salvage value.

Book depreciation was calculated by the straight-line method, but for tax purposes, the machine was classified as a seven-year MACRS property. In January 2015, accessories costing $5,000 were added to the machine to reduce its operating costs. These accessories neither prolonged the machine's life nor provided any additional salvage value.(a) Calculate the book depreciation expense for 2016.

(b) Calculate the tax depreciation expense for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

In tax year 1, an electronics-packaging firm had a gross income of $35,000,000, $6,000,000 in salaries, $7,000,000 in wages, $800,000 in depreciation expenses, a loan principal payment of $200,000, and a loan interest payment of $150,000. Determine the net income of the company in tax year 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse and converted it into a manufacturing plant for $6,000,000. It completed installation of assembly equipment worth $1,500,000 on December 31st. The plant began operation on January 1st. The company had a gross income of $8,500,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $2,280,000. The depreciation expenses for capital expenditures amounted to $456,000.

(a) Compute the taxable income of this company.

(b) How much will the company pay in federal income taxes for the year?

(a) Compute the taxable income of this company.

(b) How much will the company pay in federal income taxes for the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

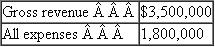

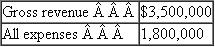

44

The Huron Rooling Company had gross revenues of $3,500,000 from operations. Financial transactions were posted during the year as

The old equipment had a book value of $75,000 at the time of its sale.

The old equipment had a book value of $75,000 at the time of its sale.

(a) What is Huron's income tax liability?

(b) What is Huron's operating income?

The old equipment had a book value of $75,000 at the time of its sale.

The old equipment had a book value of $75,000 at the time of its sale.(a) What is Huron's income tax liability?

(b) What is Huron's operating income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Company J bought a piece of equipment for $200,000. This equipment has a useful life of 10 years and a salvage value of $40,000. The company has been using the seven-year MACRS properly class to depreciate the asset for tax purposes. At the end of year 4, the company sold the equipment for $120,000. The tax rate is 40%. What are the net proceeds (after tax) from the sale of the equipment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider a five-year MACRS asset purchased at $80,000. (Note that a five-year MACRS property class is depreciated over six years due to the half-year convention. The applicable salvage values would be $40,000 in year 3, $30,000 in year 5, and $10,000 in year 6.) Compute the gain or loss amounts when the asset is disposed of in

(a) Year 3.

(b) Year 5.

(c) Year 6.

(a) Year 3.

(b) Year 5.

(c) Year 6.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

In year 0, an electrical appliance company purchased an industrial robot costing $350,000. The robot is to be used for welding operations, classified as seven-year recovery property, and has been depreciated by the MACRS method. If the robot is to be sold after five years, compute the amounts of gains (losses) for the following two salvage values (assume that both capital gains and ordinary incomes are taxed at 34%):

(a) $20,000

(b) $99,000

(a) $20,000

(b) $99,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

You purchased a lift truck that cost $50,000 four years ago. At that time, the truck was estimated to have a service life of eight years with a salvage value of $5,000. These estimates are still good. The property has been depreciated according to a five-year MACRS property class. Now (at the end of year 4 from purchase), you are considering selling the truck for $20,000. What book value should be used in determining the taxable gains?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Sunrise, Inc., bought a machine for $80,000 on January 2, 2014. Management expects to use the machine for eight years, at the end of which time, it will have a $20,000 salvage value. Consider the following questions independently.

(a) If Sunrise uses straight-line depreciation, what will be the book value of the machine on December 31, 2017?

(b) If Sunrise uses double-declining-balance depreciation, what will be the depreciation expense for 2017?

(c) If Sunrise uses double-declining-balance depreciation, followed by switching to straight-line depreciation, when will be the optimal time to switch?

(d) If Sunrise uses a seven-year MACRS and sells the machine on April 1, 2018 at a price of $38,000, what will be the taxable gains?

(a) If Sunrise uses straight-line depreciation, what will be the book value of the machine on December 31, 2017?

(b) If Sunrise uses double-declining-balance depreciation, what will be the depreciation expense for 2017?

(c) If Sunrise uses double-declining-balance depreciation, followed by switching to straight-line depreciation, when will be the optimal time to switch?

(d) If Sunrise uses a seven-year MACRS and sells the machine on April 1, 2018 at a price of $38,000, what will be the taxable gains?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Hillside Machine Shop expects to have an annual taxable income of $425,000 from its regular business over the next six years. The company is considering acquiring a new milling machine during year 0. The machine's price is $200,000 installed. The machine falls into the MACRS seven-year class, and it will have an estimated salvage value of $50.000 at the end of six years. I he machine is expected to generate additional before-tax revenue of $80,000 per year.

(a) What is the total amount of economic depreciation for the milling machine if the asset is sold at $50,000 at the end of six years?

(b) Determine the company's marginal tax rates over the next six years with the machine.

(c) Determine the company's average tax rates over the next six years with the machine.

(a) What is the total amount of economic depreciation for the milling machine if the asset is sold at $50,000 at the end of six years?

(b) Determine the company's marginal tax rates over the next six years with the machine.

(c) Determine the company's average tax rates over the next six years with the machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Columbus Electrical Company expects to have an annual taxable income of $650,000 from its residential accounts over the next two years. The company is bidding on a two-year wiring service for a large apartment complex. This commercial service requires the purchase of a new truck equipped with wire-pulling tools at a cost of $60,000. The equipment falls into the MACRS five-year class and will be retained for future use (instead of being sold) after two years, indicating no gain or loss on the property. The project will bring in additional annual revenue of $220,000, but it is expected to incur additional annual operating costs of $150,000. Compute the marginal tax rate applicable to the project's operating profits for the next two years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Florida Citrus Corporation estimates its taxable income for next year at $2,500,000. The company is considering expanding its product line by introducing pineapple-orange juice for the next year. The market responses could be good, fair, or poor. Depending on the market response, the expected additional taxable incomes are (1) $2,000,000 for a good response, (2) $500,000 for a fair response, and (3) a $100,000 loss for a poor response.

(a) Determine the marginal tax rate applicable to each situation.

(b) Determine the average tax rate that results from each situation.

(a) Determine the marginal tax rate applicable to each situation.

(b) Determine the average tax rate that results from each situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Simon Machine Tools Company is considering purchasing a new set of machine tools to process special orders. The following financial information is available.

• Without the project, the company expects to have a taxable income of $350,000 each year from its regular business over the next three years.

• With the three-year project, the purchase of a new set of machine tools at a cost of $50,000 is required, the equipment falls into the MACRS three-year class. The tools will be sold for $10,000 at the end of project life. The project will be bringing in additional annual revenue of $80,000, but it is expected to incur additional annual operating costs of $20,000.

(a) What are the additional taxable incomes (due to undertaking the project) during each of years 1 through 3?

(b) What are the additional income taxes (due to undertaking the new orders) during each of years 1 through 3?

(c) Compute the gain taxes when the asset is disposed of at the end of year 3.

• Without the project, the company expects to have a taxable income of $350,000 each year from its regular business over the next three years.

• With the three-year project, the purchase of a new set of machine tools at a cost of $50,000 is required, the equipment falls into the MACRS three-year class. The tools will be sold for $10,000 at the end of project life. The project will be bringing in additional annual revenue of $80,000, but it is expected to incur additional annual operating costs of $20,000.

(a) What are the additional taxable incomes (due to undertaking the project) during each of years 1 through 3?

(b) What are the additional income taxes (due to undertaking the new orders) during each of years 1 through 3?

(c) Compute the gain taxes when the asset is disposed of at the end of year 3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

Consider a corporation whose taxable income without state income tax is

If the marginal federal tax rate is 35% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 35% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 35% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 35% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

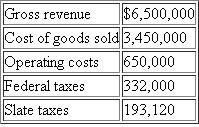

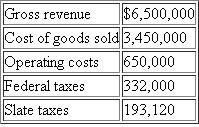

A corporation has the following financial information for a typical operating year.

(a) On the basis of this financial information, determine both federal and stale marginal tax rates.

(a) On the basis of this financial information, determine both federal and stale marginal tax rates.

(b) Determine the combined marginal tax rate for this corporation.

(a) On the basis of this financial information, determine both federal and stale marginal tax rates.

(a) On the basis of this financial information, determine both federal and stale marginal tax rates.(b) Determine the combined marginal tax rate for this corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Van-Line Company, a small electronics repair firm, expects an annual income of $170.000 from its regular business. The company is considering expanding its repair business to include flat-panel HDTV installation service. The expansion would bring in an additional annual income of$50,000, but it also will require an additional expense of $20,000 each year over the next three years. Using applicable current tax rates, answer the following.

(a) What is the marginal tax rate in tax year 1?

(b) What is the average lax rate in tax year 1 ?

(c) Suppose that the new business expansion requires a capital investment of $20,000 worth of special tools (a three-year MACRS property). At i = 10%, what is the PW of the total income taxes to be paid over the project life?

(a) What is the marginal tax rate in tax year 1?

(b) What is the average lax rate in tax year 1 ?

(c) Suppose that the new business expansion requires a capital investment of $20,000 worth of special tools (a three-year MACRS property). At i = 10%, what is the PW of the total income taxes to be paid over the project life?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new press cost $3,500,000, and it falls into a seven-year MACRS property class. The company has to pay property taxes to the local township for ownership of this forging machine at a rate of 1.2% on the beginning book value of each year.

(a) Determine the book value of the asset at the beginning of each tax year.

(b) Determine the amount of property taxes over the machine's depreciable life.

(a) Determine the book value of the asset at the beginning of each tax year.

(b) Determine the amount of property taxes over the machine's depreciable life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck