Deck 3: Opportunity Cost of Capital and Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 3: Opportunity Cost of Capital and Capital Budgeting

1

Ab Landlord owns a dilapidated 30-year-old apartment building in Los Angeles. The net cash flow from renting the apartments last year was $200,000. She expects that inflation will cause the net cash flows from renting the apartments to increase at a rate of 10 percent per year (next year's net cash flows will be $220,000, the following year's $242,000, etc.). The remaining useful life of the apartment building is 10 years. A developer wants to buy the apartment building from Landlord, demolish it, and construct luxury condominiums. He offers Landlord $1.5 million for the apartments.

Assume there are no taxes. The market rate of return for investments of this type is 16 percent and is expected to remain at that level in the future. The 16 percent interest rate includes an expected inflation rate of 10.5 percent. The real rate of interest is 5 percent:

1.16=(1.05)(1.105)

Required:

a. Evaluate the developer's offer and make a recommendation to Landlord. Support your conclusions with neatly labeled calculations where possible. Note that the $1.5 million purchase offer would be paid immediately, whereas the first cash flow from retaining the building is not received until the end of the first year.

b. Suppose that Los Angeles imposes rent controls, so that Landlord will not be able to increase her rents except to the extent justified by increases in costs such as maintenance. Effectively, the future net cash flows from rents will remain constant at $200,000 per year. Does the imposition of rent controls change Landlord's decision on the developer's offer Support your answer with neatly labeled calculations where possible.

Assume there are no taxes. The market rate of return for investments of this type is 16 percent and is expected to remain at that level in the future. The 16 percent interest rate includes an expected inflation rate of 10.5 percent. The real rate of interest is 5 percent:

1.16=(1.05)(1.105)

Required:

a. Evaluate the developer's offer and make a recommendation to Landlord. Support your conclusions with neatly labeled calculations where possible. Note that the $1.5 million purchase offer would be paid immediately, whereas the first cash flow from retaining the building is not received until the end of the first year.

b. Suppose that Los Angeles imposes rent controls, so that Landlord will not be able to increase her rents except to the extent justified by increases in costs such as maintenance. Effectively, the future net cash flows from rents will remain constant at $200,000 per year. Does the imposition of rent controls change Landlord's decision on the developer's offer Support your answer with neatly labeled calculations where possible.

Capital Budgeting

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

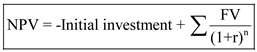

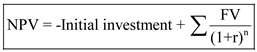

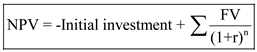

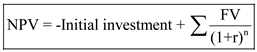

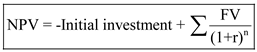

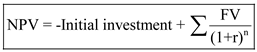

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r

Time period is n

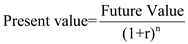

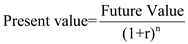

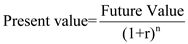

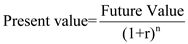

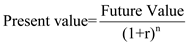

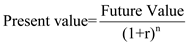

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r

Time period is n

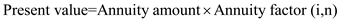

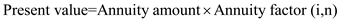

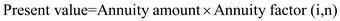

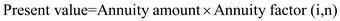

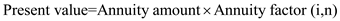

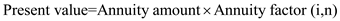

Use the below formula to calculate present value of annuity cash flow

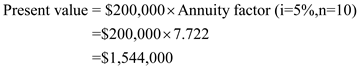

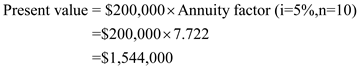

a.In this case we would compare the present value of renting apartment with the cash offer receive to purchase the apartment. The option which provide for higher present value should be accepted. In real term the rent of apartment for each year would be same that is $200,000 and we would use real interest rate of 5% to calculate present value of cash flow. The annuity factor is calculated using present value of annuity table where i=5% and in period n=10 would give annuity factor of 7.722

a.In this case we would compare the present value of renting apartment with the cash offer receive to purchase the apartment. The option which provide for higher present value should be accepted. In real term the rent of apartment for each year would be same that is $200,000 and we would use real interest rate of 5% to calculate present value of cash flow. The annuity factor is calculated using present value of annuity table where i=5% and in period n=10 would give annuity factor of 7.722

Calculate present value of renting apartment as shown below

Thus, present value of renting apartment is

Thus, present value of renting apartment is

The present value of renting apartment is higher than cash offer received to purchase the property and thus L should continue to rent the property instead of selling it.

The present value of renting apartment is higher than cash offer received to purchase the property and thus L should continue to rent the property instead of selling it.

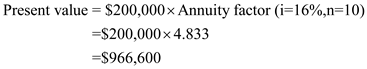

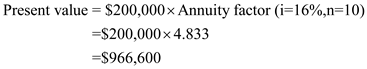

b.In this case there would be no increase in rent cost and thus no inflation is considered. We would therefore calculate present value of renting apartment with rent of $200,000 and using the expected rate of 16%. The annuity factor is calculated using present value of annuity table where i=16% and in period n=10 would give annuity factor of 4.833

Calculate present value of renting apartment as shown below

Thus, present value of renting apartment is

Thus, present value of renting apartment is

The present value of renting apartment is lower than cash offer received to purchase the property and thus L should sell the property at $1.5 million.

The present value of renting apartment is lower than cash offer received to purchase the property and thus L should sell the property at $1.5 million.

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r Time period is n

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r Time period is n

Use the below formula to calculate present value of annuity cash flow

a.In this case we would compare the present value of renting apartment with the cash offer receive to purchase the apartment. The option which provide for higher present value should be accepted. In real term the rent of apartment for each year would be same that is $200,000 and we would use real interest rate of 5% to calculate present value of cash flow. The annuity factor is calculated using present value of annuity table where i=5% and in period n=10 would give annuity factor of 7.722

a.In this case we would compare the present value of renting apartment with the cash offer receive to purchase the apartment. The option which provide for higher present value should be accepted. In real term the rent of apartment for each year would be same that is $200,000 and we would use real interest rate of 5% to calculate present value of cash flow. The annuity factor is calculated using present value of annuity table where i=5% and in period n=10 would give annuity factor of 7.722Calculate present value of renting apartment as shown below

Thus, present value of renting apartment is

Thus, present value of renting apartment is  The present value of renting apartment is higher than cash offer received to purchase the property and thus L should continue to rent the property instead of selling it.

The present value of renting apartment is higher than cash offer received to purchase the property and thus L should continue to rent the property instead of selling it.b.In this case there would be no increase in rent cost and thus no inflation is considered. We would therefore calculate present value of renting apartment with rent of $200,000 and using the expected rate of 16%. The annuity factor is calculated using present value of annuity table where i=16% and in period n=10 would give annuity factor of 4.833

Calculate present value of renting apartment as shown below

Thus, present value of renting apartment is

Thus, present value of renting apartment is  The present value of renting apartment is lower than cash offer received to purchase the property and thus L should sell the property at $1.5 million.

The present value of renting apartment is lower than cash offer received to purchase the property and thus L should sell the property at $1.5 million. 2

Geico is considering expanding an existing plant on a piece of land it already owns. The land was purchased 15 years ago for $325,000 and its current market appraisal is $820,000. A capital budgeting analysis shows that the plant expansion has a net present value of $130,000. The expansion will cost $1.73 million, and the discounted cash inflows are $1.86 million. The expansion cost of $1.73 million does not include any provision for the cost of the land. The manager preparing the analysis argues that the historical cost of the land is a sunk cost, and, since the firm intends to keep the land whether or not the expansion project is accepted, the current appraisal value is irrelevant.

Should the land be included in the analysis If so, how

Should the land be included in the analysis If so, how

Capital Budgeting

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r

Time period is n

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r

Time period is n

Use the below formula to calculate present value of annuity cash flow

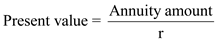

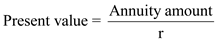

Use the below formula to calculate present value of perpetuity

Use the below formula to calculate present value of perpetuity

In the given case the cost of land should be considered in the project costs. The land would not be sold does not mean that it is free. The use of land for current project would restrict the use of land for other projects and thus the future use of land is restricted. If the proceeds from sale of land were invested in government bond paying 8% coupon rate then this would be the opportunity costs of using the land and should be considered in the investment project. The opportunity costs would have been $65,600 ($820,000*8%) if land was sold at its appraised value of $820,000.

In the given case the cost of land should be considered in the project costs. The land would not be sold does not mean that it is free. The use of land for current project would restrict the use of land for other projects and thus the future use of land is restricted. If the proceeds from sale of land were invested in government bond paying 8% coupon rate then this would be the opportunity costs of using the land and should be considered in the investment project. The opportunity costs would have been $65,600 ($820,000*8%) if land was sold at its appraised value of $820,000.

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r Time period is n

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r Time period is n

Use the below formula to calculate present value of annuity cash flow

Use the below formula to calculate present value of perpetuity

Use the below formula to calculate present value of perpetuity  In the given case the cost of land should be considered in the project costs. The land would not be sold does not mean that it is free. The use of land for current project would restrict the use of land for other projects and thus the future use of land is restricted. If the proceeds from sale of land were invested in government bond paying 8% coupon rate then this would be the opportunity costs of using the land and should be considered in the investment project. The opportunity costs would have been $65,600 ($820,000*8%) if land was sold at its appraised value of $820,000.

In the given case the cost of land should be considered in the project costs. The land would not be sold does not mean that it is free. The use of land for current project would restrict the use of land for other projects and thus the future use of land is restricted. If the proceeds from sale of land were invested in government bond paying 8% coupon rate then this would be the opportunity costs of using the land and should be considered in the investment project. The opportunity costs would have been $65,600 ($820,000*8%) if land was sold at its appraised value of $820,000. 3

Suppose the market rate of interest is 10 percent and you have just won a $1 million lottery that entitles you to $100,000 at the end of each of the next 10 years.

Required:

a. What is the minimum lump-sum cash payment you would be willing to take now in lieu of the 10-year annuity

b. What is the minimum lump sum you would be willing to accept at the end of the 10 years in lieu of the annuity

c. Suppose three years have passed; you have just received the third payment and you have seven left when the lottery promoters approach you with an offer to settle up for cash. What is the minimum you would accept at the end of year 3

d. How would your answer to (a) change if the first payment came immediately (at t = 0) and the remaining payments were at the beginning instead of the end of each year

Required:

a. What is the minimum lump-sum cash payment you would be willing to take now in lieu of the 10-year annuity

b. What is the minimum lump sum you would be willing to accept at the end of the 10 years in lieu of the annuity

c. Suppose three years have passed; you have just received the third payment and you have seven left when the lottery promoters approach you with an offer to settle up for cash. What is the minimum you would accept at the end of year 3

d. How would your answer to (a) change if the first payment came immediately (at t = 0) and the remaining payments were at the beginning instead of the end of each year

Capital Budgeting

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r

Time period is n

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r

Time period is n

Use the below formula to calculate present value of annuity cash flow

1.

1.

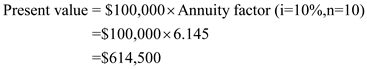

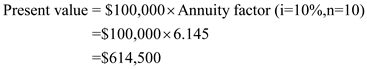

The minimum lump sum payment one would be willing to pay is present value of cash payment of $100,000 received for 10 years. We would use present value of annuity table as cash flow of $100,000 is received each year. The annuity factor is calculated using present value of annuity table where i=10% and in period n=10 would give annuity factor of 6.145

Calculate minimum lump sum amount you should be willing to pay as shown below

Thus, minimum lump sum amount you should be willing to pay is

Thus, minimum lump sum amount you should be willing to pay is

2.

2.

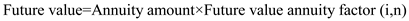

Use the below formula to calculate future value of annuity payment

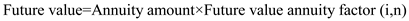

In this case the minimum sum you would be willing to accept is the future value of annuity cash flow of $100,000. This would require use of future value of annuity table. The annuity factor is calculated using future value of annuity table where i=10% and in period n=10 would give annuity factor of 15.937.

In this case the minimum sum you would be willing to accept is the future value of annuity cash flow of $100,000. This would require use of future value of annuity table. The annuity factor is calculated using future value of annuity table where i=10% and in period n=10 would give annuity factor of 15.937.

Calculate minimum lump sum amount you should be willing to accept as shown below

Thus, minimum lump sum amount you should willing to accept is

Thus, minimum lump sum amount you should willing to accept is

3.

3.

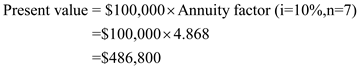

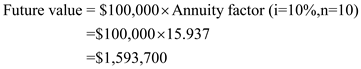

In this case we would calculate present value of $100,000 cash flow to be received for next 7 years. We would use present value of annuity table as cash flow of $100,000 is received each year. The annuity factor is calculated using present value of annuity table where i=10% and in period n=7 would give annuity factor of 4.868

Calculate amount you would be willing to accept at end of 3 years as shown below

Thus, amount you would be willing to accept at end of 3 years is

Thus, amount you would be willing to accept at end of 3 years is

4.

4.

In order to convert the end of payment to beginning year payment, to the present value calculated in (a) of $614,500 we would multiply 1+r. In this case the minimum payment required would be $675,900 ($614,500*1.10)Thus, minimum lump sum amount you should be willing to pay is

Capital budgeting is the process used by the company to evaluate the capital investment that are available. The company uses various capital budgeting methods to evaluate whether the company should invest in the particular project that is whether the project is profitable for the company.

Net present value

Net present value refers to present value of cash inflow less present value of cash outflow. This considers the cash inflow and outflow and also considers time value of money.

Use the below formula to calculate net present value

Discount rate is r

Discount rate is r Time period is n

Present value

Present value calculates the value of money today which is to be received in future date. It calculates how much the future value is worth today. Present value can be calculated using the present value table or present value formula.Formula to calculate present value of lump sum amount

Interest rate is r

Interest rate is r Time period is n

Use the below formula to calculate present value of annuity cash flow

1.

1.The minimum lump sum payment one would be willing to pay is present value of cash payment of $100,000 received for 10 years. We would use present value of annuity table as cash flow of $100,000 is received each year. The annuity factor is calculated using present value of annuity table where i=10% and in period n=10 would give annuity factor of 6.145

Calculate minimum lump sum amount you should be willing to pay as shown below

Thus, minimum lump sum amount you should be willing to pay is

Thus, minimum lump sum amount you should be willing to pay is  2.

2.Use the below formula to calculate future value of annuity payment

In this case the minimum sum you would be willing to accept is the future value of annuity cash flow of $100,000. This would require use of future value of annuity table. The annuity factor is calculated using future value of annuity table where i=10% and in period n=10 would give annuity factor of 15.937.

In this case the minimum sum you would be willing to accept is the future value of annuity cash flow of $100,000. This would require use of future value of annuity table. The annuity factor is calculated using future value of annuity table where i=10% and in period n=10 would give annuity factor of 15.937.Calculate minimum lump sum amount you should be willing to accept as shown below

Thus, minimum lump sum amount you should willing to accept is

Thus, minimum lump sum amount you should willing to accept is  3.

3. In this case we would calculate present value of $100,000 cash flow to be received for next 7 years. We would use present value of annuity table as cash flow of $100,000 is received each year. The annuity factor is calculated using present value of annuity table where i=10% and in period n=7 would give annuity factor of 4.868

Calculate amount you would be willing to accept at end of 3 years as shown below

Thus, amount you would be willing to accept at end of 3 years is

Thus, amount you would be willing to accept at end of 3 years is  4.

4.In order to convert the end of payment to beginning year payment, to the present value calculated in (a) of $614,500 we would multiply 1+r. In this case the minimum payment required would be $675,900 ($614,500*1.10)Thus, minimum lump sum amount you should be willing to pay is

4

A proposed cost-saving device has an installed cost of $59,400. It will be depreciated for tax purposes on a straight-line basis over three years (zero salvage), although its actual life will be five years. The tax rate is 34 percent and the required rate of return on investments of this type is 10 percent.

What must be the pretax cost savings per year to favor the investment Assume a zero salvage value for the device at the end of the five years.

What must be the pretax cost savings per year to favor the investment Assume a zero salvage value for the device at the end of the five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

Mr. Jones intends to retire in 20 years at the age of 65. As yet he has not provided for retirement income, and he wants to set up a periodic savings plan to do this. If he makes equal annual payments into a savings account that pays 4 percent interest per year, how large must his payments be to ensure that after retirement he will be able to draw $30,000 per year from this account until he is 80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

An investment project involves the purchase of equipment at a cost of $100 million. For tax purposes, the equipment has a life of five years and will be depreciated on a straight-line basis. Inflation is expected to be 5 percent and the real interest rate is 5 percent. The tax rate is 40 percent.

What is the present value of the depreciation tax shield for the machine

What is the present value of the depreciation tax shield for the machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

An investment under consideration has a payback of five years and a cost of $1,200. If the required return is 20 percent, what is the worst-case NPV Explain fully.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

A home identical to yours in your neighborhood sold last week for $150,000. Your home has a $120,000 assumable, 8 percent mortgage (compounded annually) with 30 years remaining. An assumable mortgage is one that the new buyer can assume at the old terms, continuing to make payments at the original interest rate. The house that recently sold did not have an assumable mortgage; that is, the buyers had to finance the house at the current market rate of interest, which is 15 percent. What price should you ask for your home

A third home, again identical to the one that sold for $150,000, is also being offered for sale. The only difference between this third home and the $150,000 home is the property taxes. The $150,000 home's property taxes are $3,000 per year, while the third home's property taxes are $2,000 per year. The differences in the property taxes are due to vagaries in how the property tax assessors assessed the taxes when the homes were built. In this tax jurisdiction, once annual taxes are set, they are fixed for the life of the home. Assuming the market rate of interest is still 15 percent, what should be the price of this third home

A third home, again identical to the one that sold for $150,000, is also being offered for sale. The only difference between this third home and the $150,000 home is the property taxes. The $150,000 home's property taxes are $3,000 per year, while the third home's property taxes are $2,000 per year. The differences in the property taxes are due to vagaries in how the property tax assessors assessed the taxes when the homes were built. In this tax jurisdiction, once annual taxes are set, they are fixed for the life of the home. Assuming the market rate of interest is still 15 percent, what should be the price of this third home

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

An investment opportunity that will involve an investment of $1,000 will generate $300 per year for five years and then earn $140 per year forever.

What is the net present value of this investment, assuming the interest rate is 14 percent

What is the net present value of this investment, assuming the interest rate is 14 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose you are the manager of a mortgage department at a savings bank. Under the state usury law, the maximum interest rate allowed for mortgages is 10 percent compounded annually.

Required:

a. If you granted a $50,000 mortgage at the maximum rate for 30 years, what would be the equal annual payments

b. If the current market internal rate on similar mortgages is 12 percent, how much money does the bank lose by issuing the mortgage described in (a)

c. The usury law does not prohibit banks from charging points. One point means that the borrower pays 1 percent of the $50,000 loan back to the lending institution at the inception of the loan. That is, if one point is charged, the repayments are computed as in (a), but the borrower receives only $49,500. How many points must the bank charge to earn 12 percent on the 10 percent loan

Required:

a. If you granted a $50,000 mortgage at the maximum rate for 30 years, what would be the equal annual payments

b. If the current market internal rate on similar mortgages is 12 percent, how much money does the bank lose by issuing the mortgage described in (a)

c. The usury law does not prohibit banks from charging points. One point means that the borrower pays 1 percent of the $50,000 loan back to the lending institution at the inception of the loan. That is, if one point is charged, the repayments are computed as in (a), but the borrower receives only $49,500. How many points must the bank charge to earn 12 percent on the 10 percent loan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

The demand for DVD players is expanding rapidly, but the industry is highly competitive. A plant to make DVD players costs $40 million, has an annual capacity of 100,000 units, and has an indefinite physical life. The variable production cost per unit is $20 and is not expected to change. If the cost of capital is 10 percent, what is the price of a DVD player

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm that purchases electric power from the local utility is considering the alternative of generating its own electricity. The current cost of obtaining the firm's electricity from its local utility is $42,000 per year. The cost of a steam generator (installed) is $140,000 and annual maintenance and fuel expenses are estimated at $22,000. The generator is expected to last for 10 years, at which time it will be worthless. The cost of capital is 10 percent and the firm pays no taxes.

Required:

a. Should the firm install the electric generator Why or why not

b. The engineers have calculated that with an additional investment of $40,000, the excess steam from the generator can be used to heat the firm's buildings. The current cost of heating the buildings with purchased steam is $21,000 per year. If the generator is to be used for heat as well as electricity, additional fuel and maintenance costs of $10,000 per year will be incurred. Should the firm invest in the generator and the heating system

Show all calculations.

Required:

a. Should the firm install the electric generator Why or why not

b. The engineers have calculated that with an additional investment of $40,000, the excess steam from the generator can be used to heat the firm's buildings. The current cost of heating the buildings with purchased steam is $21,000 per year. If the generator is to be used for heat as well as electricity, additional fuel and maintenance costs of $10,000 per year will be incurred. Should the firm invest in the generator and the heating system

Show all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

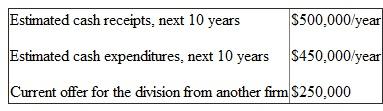

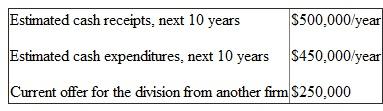

Several years ago, your firm paid $25,000,000 for Clean Tooth, a small, high-technology company that manufactures laser-based tooth cleaning equipment. unfortunately, due to extensive production line and sales resistance problems, the company is considering selling the division as part of a "modernization program." Based on current information, the following are the estimated accounting numbers if the company continues to operate the division:

Assume

Assume

1. The firm is in the 0 percent tax bracket (no income taxes).

2. There are no additional expenses associated with the sale.

3. After year 10, the division will have sales (and expenses) of 0.

4. Estimates are completely certain.

Should the firm sell the division for $250,000

Assume

Assume1. The firm is in the 0 percent tax bracket (no income taxes).

2. There are no additional expenses associated with the sale.

3. After year 10, the division will have sales (and expenses) of 0.

4. Estimates are completely certain.

Should the firm sell the division for $250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

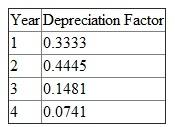

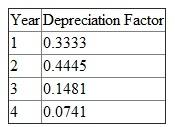

Watson's Bay Co. is considering a contract to manufacture didgeridoos. Producing didgeridoos will require an investment in equipment of $100,000 and operating costs of $15 per didgeridoo produced. The contract calls for the company to deliver 3,000 didgeridoos a year for each of four years at a price of $30 per didgeridoo. At the end of four years the equipment is expected to be sold for $10,000. The equipment will be depreciated as follows:

The depreciation factor is applied to the full cost of the equipment (i.e., salvage value is not considered when depreciation is determined). The tax rate is 33 percent and the market rate of return for investments of this risk is 20 percent. Should Watson's Bay Co. take the contract to manufacture didgeridoos

The depreciation factor is applied to the full cost of the equipment (i.e., salvage value is not considered when depreciation is determined). The tax rate is 33 percent and the market rate of return for investments of this risk is 20 percent. Should Watson's Bay Co. take the contract to manufacture didgeridoos

The depreciation factor is applied to the full cost of the equipment (i.e., salvage value is not considered when depreciation is determined). The tax rate is 33 percent and the market rate of return for investments of this risk is 20 percent. Should Watson's Bay Co. take the contract to manufacture didgeridoos

The depreciation factor is applied to the full cost of the equipment (i.e., salvage value is not considered when depreciation is determined). The tax rate is 33 percent and the market rate of return for investments of this risk is 20 percent. Should Watson's Bay Co. take the contract to manufacture didgeridoos

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

You are considering buying a $50,000 car. The dealer has offered you a 13.6 percent loan with 30 equal monthly payments. On questioning him, you find that the interest charge of $17,000 (or 0.136X$50,000 X2.5 years) is added to the $50,000 for a total amount of $67,000. The payments are $2,233.33 a month ($67,000

30). What is the approximate effective annual interest rate

30). What is the approximate effective annual interest rate

30). What is the approximate effective annual interest rate

30). What is the approximate effective annual interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Linda Lion Co. has an investment opportunity that involves a current outlay of $1,000 for equipment. The investment will yield net cash inflows for four years. The net cash inflow at the end of the first year will be $400. Later years' cash inflows grow at the general rate of inflation. The equipment will be depreciated to zero on a straight-line basis, and there will be no salvage value at the end of four years. The tax rate is 40 percent, and the real rate of return required on investments of this risk is 10 percent.

Required:

a. Should Linda Lion take the investment if the general rate of inflation is 5 percent

b. Is your answer different if the general rate of inflation is 15 percent Explain why or why not.

Required:

a. Should Linda Lion take the investment if the general rate of inflation is 5 percent

b. Is your answer different if the general rate of inflation is 15 percent Explain why or why not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

Using your knowledge of the relationship between inflation and nominal interest rates, and assuming that the savings were invested in government bills, comment briefly on the analysis presented in the following letter from the National Taxpayers Union:

Dear Friend:

You know how much it costs you to join National Taxpayers Union-$15 a year. You may think that you can save that $1.25 a month by not confirming your membership. But are you sure Is it really cheaper for you not to join than it is to pitch in and fight

Consider this simple arithmetic: Before taxes were raised to their present level, the average family saved $1,000 per year. You may have saved this much in the past. Over your 45-year work cycle this savings, with compound interest, should accumulate to $230,000. That would yield an annual income of $13,800 without ever touching the principal.

But when inflation rose to 6 percent, it canceled out the interest rate, reducing the value of your savings to the amount that you put in-$45,000.

With inflation as it is today, the value of your savings would end up being worth only about $16,000, which could yield a monthly income worth only about $70. That represents a clear and direct loss to you of more than $1,000 per month of retirement income plus more than $200,000 of capital confiscated through riskless government.

Think about it. The cost of big government to you is enormous and growing. Even if you don't think you have that much to lose, you do. Everything you have left will be wiped out unless there is a massive "taxpayers' revolt" to bring inflation and high taxes under control. The $1.25 per month that you spend to support this effort is a bargain considering that the certain alternative is bankruptcy for you and the whole country.

Dear Friend:

You know how much it costs you to join National Taxpayers Union-$15 a year. You may think that you can save that $1.25 a month by not confirming your membership. But are you sure Is it really cheaper for you not to join than it is to pitch in and fight

Consider this simple arithmetic: Before taxes were raised to their present level, the average family saved $1,000 per year. You may have saved this much in the past. Over your 45-year work cycle this savings, with compound interest, should accumulate to $230,000. That would yield an annual income of $13,800 without ever touching the principal.

But when inflation rose to 6 percent, it canceled out the interest rate, reducing the value of your savings to the amount that you put in-$45,000.

With inflation as it is today, the value of your savings would end up being worth only about $16,000, which could yield a monthly income worth only about $70. That represents a clear and direct loss to you of more than $1,000 per month of retirement income plus more than $200,000 of capital confiscated through riskless government.

Think about it. The cost of big government to you is enormous and growing. Even if you don't think you have that much to lose, you do. Everything you have left will be wiped out unless there is a massive "taxpayers' revolt" to bring inflation and high taxes under control. The $1.25 per month that you spend to support this effort is a bargain considering that the certain alternative is bankruptcy for you and the whole country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

Dakota Mining is considering operating a strip mine, the cost of which is $4.4 million. Cash returns will be $27.7 million, all received at the end of the first year. The land must be returned to its natural state at a cost of $25 million, payable after two years. What is the project's internal rate of return

Required:

a. Should the project be accepted if the market rate of return is 8 percent

b. If the market rate of return is 14 percent

Explain your reasoning.

Required:

a. Should the project be accepted if the market rate of return is 8 percent

b. If the market rate of return is 14 percent

Explain your reasoning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

A present investment of $50,000 is expected to yield receipts of $8,330 a year for seven years. What is the internal rate of return on this investment (Show your calculations.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

Farmers in a valley are subject to occasional flooding when heavy rains cause the river to overflow. They have asked the federal government to build a dam upstream to prevent flooding. The construction cost of this project is to be repaid by the farm owners without interest over a period of years. The cost is $300 an acre. If a farm has 100 acres, a total of $30,000 is to be repaid. No payments at all are to be made for the first five years. Then $1,000 is to be paid at the end of each year for 30 years to pay off the $30,000.

Is the farmer receiving a subsidy Why If the interest rate is 10 percent, what is the approximate capitalized value of the subsidy (if any) Show all calculations.

Is the farmer receiving a subsidy Why If the interest rate is 10 percent, what is the approximate capitalized value of the subsidy (if any) Show all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

Overland Steel operates a coal-burning steel mill in New York state. Changes in the state's air quality control laws will result in this mill's incurring a $1,000 per day fine (which will be paid at the end of the year) if it continues to operate. The mill currently operates every day of the year.

The mill was built 20 years ago at a cost of $15 million and has a remaining undepreciated book value of $3 million. The expected remaining useful life of the mill is 30 years.

The firm can sell the mill to a developer who wants to build a shopping center on the site. The buyer will pay $1 million for the site if the company demolishes the mill and prepares the site for the developer. Demolition and site preparation costs are estimated at $650,000.

Alternatively, the firm could install pollution control devices and other modernization devices at an initial outlay of $2.75 million. These improvements do not extend the useful life or salvage value of the plant, but they do reduce net operating costs by $25,000 per year in addition to eliminating the $1,000 per day fine. Currently, the net cash flows of operating the plant are $450,000 per year before any fines.

Assume

1. The market rate of interest is 14 percent.

2. There are no taxes.

3. The annual cash flow estimates given above are constant over the next 30 years.

4. At the end of the 30 years, the mill has an estimated salvage value of $2 million whether or not the pollution equipment has been installed.

Required:

Evaluate the various courses of action available to management and make a recommendation. Support your conclusions with neatly labeled calculations where possible.

The mill was built 20 years ago at a cost of $15 million and has a remaining undepreciated book value of $3 million. The expected remaining useful life of the mill is 30 years.

The firm can sell the mill to a developer who wants to build a shopping center on the site. The buyer will pay $1 million for the site if the company demolishes the mill and prepares the site for the developer. Demolition and site preparation costs are estimated at $650,000.

Alternatively, the firm could install pollution control devices and other modernization devices at an initial outlay of $2.75 million. These improvements do not extend the useful life or salvage value of the plant, but they do reduce net operating costs by $25,000 per year in addition to eliminating the $1,000 per day fine. Currently, the net cash flows of operating the plant are $450,000 per year before any fines.

Assume

1. The market rate of interest is 14 percent.

2. There are no taxes.

3. The annual cash flow estimates given above are constant over the next 30 years.

4. At the end of the 30 years, the mill has an estimated salvage value of $2 million whether or not the pollution equipment has been installed.

Required:

Evaluate the various courses of action available to management and make a recommendation. Support your conclusions with neatly labeled calculations where possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

Is it preferable to use an accelerated depreciation method rather than the straight-line method for tax purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose that a mining operation has spent $8 million developing an ore deposit in South America. Current expectations are that the deposit will require two years of development and will result in a realizable cash flow of $10 million at that time. The company engineer has discovered a new way of extracting the ore in only one year, but the procedure would necessitate an immediate outlay of $1 million.

Required:

a. Compute the IRR for the new outlay. (Note: There are two solutions! One is 787 percent. Find the other one.)

b. Based on your answer to (a), use the IRR criterion to determine if the company should make the outlay. Assume the market interest rate is 15 percent on one- and two-year bonds.

Required:

a. Compute the IRR for the new outlay. (Note: There are two solutions! One is 787 percent. Find the other one.)

b. Based on your answer to (a), use the IRR criterion to determine if the company should make the outlay. Assume the market interest rate is 15 percent on one- and two-year bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

Black Feather Indian Nation is a 900 square-mile territory in North Dakota that has the legal right to sell gasoline without having to collect or pay state and federal taxes on it. Gasoline in North Dakota sells for $1.20 per gallon, which includes $0.50 of taxes. The reservation is in a rural part of North Dakota and is within 3-20 miles of five small cities, each with a population of between 20,000 and 60,000 people.

Black Feather Indian Nation asks your consulting firm to advise it about entering the retail gasoline business. It can buy gasoline at the wholesale delivered price of $0.65 per gallon. The Nation is considering building five stations on the perimeter of its territory to sell tax-free gasoline to nonBlack Feather consumers for $0.70 per gallon. The total cost of the five stations, new road signs, and working capital is $4 million.

The consulting partner of your firm in charge of this assignment is preparing the firm's proposal to the Nation. He asks you to prepare a short memo outlining the analysis you think is necessary to answer this question: "Should the Black Feather Indian Nation invest $4 million and enter the retail gasoline business "

Required:

Your memo should contain the following elements:

a. An outline of the general methodology (approach) you propose.

b. A detailed list of the data you propose to collect to implement the methodology suggested in (a). For each data item, describe how you plan to use the data.

Black Feather Indian Nation asks your consulting firm to advise it about entering the retail gasoline business. It can buy gasoline at the wholesale delivered price of $0.65 per gallon. The Nation is considering building five stations on the perimeter of its territory to sell tax-free gasoline to nonBlack Feather consumers for $0.70 per gallon. The total cost of the five stations, new road signs, and working capital is $4 million.

The consulting partner of your firm in charge of this assignment is preparing the firm's proposal to the Nation. He asks you to prepare a short memo outlining the analysis you think is necessary to answer this question: "Should the Black Feather Indian Nation invest $4 million and enter the retail gasoline business "

Required:

Your memo should contain the following elements:

a. An outline of the general methodology (approach) you propose.

b. A detailed list of the data you propose to collect to implement the methodology suggested in (a). For each data item, describe how you plan to use the data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

Jasper, Inc., is considering two mutually exclusive investments. Alternative A has a current outlay of $300,000 and returns $100,300 a year for five years. Alternative B has a current outlay of $150,000 and returns $55,783 a year for five years.

Required:

a. Calculate the internal rate of return for each alternative.

b. Which alternative should Jasper take if the required rate of return for similar projects in the capital market is 15 percent

Required:

a. Calculate the internal rate of return for each alternative.

b. Which alternative should Jasper take if the required rate of return for similar projects in the capital market is 15 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

You have just purchased a house and have obtained a 30-year, $200,000 mortgage with an interest rate of 10 percent.

Required:

a. What is your annual payment

b. Assuming you bought the house on January 1, what is the principal balance after one year After 10 years

c. After four years, mortgage rates drop to 8 percent for 30-year fixed-rate mortgages. You still have the old 10 percent mortgage you signed four years ago and you plan to live in the house for another five years. The total cost to refinance the mortgage is $3,000, including legal fees, closing costs, and points. The rate on a five-year CD is 6 percent. Should you refinance your mortgage or invest the $3,000 in a CD The 6 percent CD rate is your opportunity cost of capital.

Required:

a. What is your annual payment

b. Assuming you bought the house on January 1, what is the principal balance after one year After 10 years

c. After four years, mortgage rates drop to 8 percent for 30-year fixed-rate mortgages. You still have the old 10 percent mortgage you signed four years ago and you plan to live in the house for another five years. The total cost to refinance the mortgage is $3,000, including legal fees, closing costs, and points. The rate on a five-year CD is 6 percent. Should you refinance your mortgage or invest the $3,000 in a CD The 6 percent CD rate is your opportunity cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

a. Scottie Corporation has been offered a contract to produce 100 castings a year for five years at a price of $200 per casting. Producing the castings will require an investment in the plant of $35,000 and operating costs of $50 per casting produced. For tax purposes, depreciation will be on a straight-line basis over five years, with a full year's depreciation taken in both the beginning and ending years. The tax rate is 40 percent and the market's required rate of return on investments of this type is 10 percent. Assume cash flows except the initial investment occur at the end of the relevant years. Should Scottie accept the contract

b. Suppose that the contract in (a) involves the use of some warehouse space that Scottie can neither use in the business nor rent out. Just before Scottie accepts or rejects the contract, Kampmeier Realty offers to rent the space for $3,000 a year for five years if Scottie renovates the space. The renovations would cost $10,000. The renovations also would be depreciated on a straight-line basis over five years, and the required return on the rental project is also 10 percent.

(i) Does the rental offer change the net present value of the casting contract Show all calculations.

(ii) Is the annual rent for the space an opportunity cost of the casting order Why or why not

b. Suppose that the contract in (a) involves the use of some warehouse space that Scottie can neither use in the business nor rent out. Just before Scottie accepts or rejects the contract, Kampmeier Realty offers to rent the space for $3,000 a year for five years if Scottie renovates the space. The renovations would cost $10,000. The renovations also would be depreciated on a straight-line basis over five years, and the required return on the rental project is also 10 percent.

(i) Does the rental offer change the net present value of the casting contract Show all calculations.

(ii) Is the annual rent for the space an opportunity cost of the casting order Why or why not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

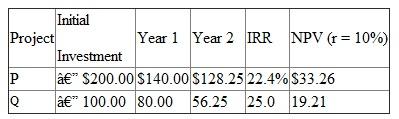

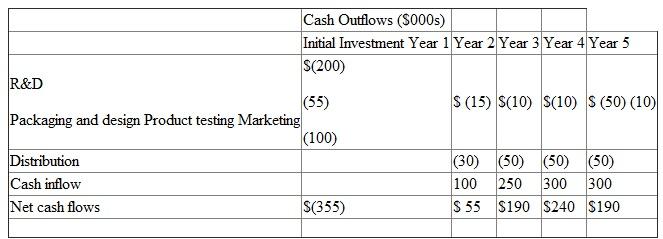

Just One, Inc., has two mutually exclusive investment projects, P and Q, shown below. Suppose the market interest rate is 10 percent.

The ranking of projects differs, depending on the use of IRR or NPV measures. Which project should be selected Why is the IRR ranking misleading

The ranking of projects differs, depending on the use of IRR or NPV measures. Which project should be selected Why is the IRR ranking misleading

The ranking of projects differs, depending on the use of IRR or NPV measures. Which project should be selected Why is the IRR ranking misleading

The ranking of projects differs, depending on the use of IRR or NPV measures. Which project should be selected Why is the IRR ranking misleading

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Flower City Grocery is faced with the following capital budgeting decision. Its display freezer system must be repaired. The cost of this repair will be $1,000 and the system will be usable for another five years. Alternatively, the firm could purchase a new freezer system for $5,000 and sell the old one for $500. The new freezer system has more display space and will increase the profits attributable to frozen foods by 30 percent. Profits for that department were $5,000 in the last fiscal year. The company's cost of capital is 9 percent. Ignoring taxes, what should the firm do

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

Weil Inc. is examining a new project. Weil expects to sell 500 units per year at $20 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $20 X 500 = $10,000 per year. The relevant discount rate is 20 percent, and the initial investment is $45,000.

Required:

a. What is the net present value

b. Assume now that after the first year, the project can be dismantled and sold for $40,000.

If the expected number of units sold in each of the remaining nine years is revised to equal the number of units sold in the first year, at what level of first-year sales would it make sense to abandon the project

c. Now suppose that there are only two possible sales levels: 750 units and 250 units. If 750 units are sold in the first year, sales in years 2 through 10 will be 750 units. If 250 units are sold in the first year, sales in future years will be 250 units. If the two sales levels in year 1 are equally likely, what is the NPV of the project Consider the possibility of abandonment (at a salvage value of $40,000) in answering the question.

d. What is the value of the option to abandon in (c)

Required:

a. What is the net present value

b. Assume now that after the first year, the project can be dismantled and sold for $40,000.

If the expected number of units sold in each of the remaining nine years is revised to equal the number of units sold in the first year, at what level of first-year sales would it make sense to abandon the project

c. Now suppose that there are only two possible sales levels: 750 units and 250 units. If 750 units are sold in the first year, sales in years 2 through 10 will be 750 units. If 250 units are sold in the first year, sales in future years will be 250 units. If the two sales levels in year 1 are equally likely, what is the NPV of the project Consider the possibility of abandonment (at a salvage value of $40,000) in answering the question.

d. What is the value of the option to abandon in (c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

Equity Corp. paid a consultant to study the desirability of installing some new equipment. The consultant recently submitted the following analysis:

The corporate tax rate is 40 percent. Should Equity Corp. accept the project

The corporate tax rate is 40 percent. Should Equity Corp. accept the project

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

The city of Toledo has received a proposal to build a new multipurpose outdoor sports stadium. The expected life of the stadium is 20 years. It will be financed by a 20-year bond paying 8 percent interest annually. The stadium's primary tenant will be the city's Triple-A baseball team, the Red Hots. The plan's backers anticipate that the site also will be used for rock concerts and college and high school sports. The city does not pay any taxes. The city's cost of capital is 8 percent. The costs and estimated revenues are presented below.

Required:

a. Should the city build the stadium (Assume payments remade at the end of the year.)

b. The Red Hots have threatened to move out of Toledo if they do not get a new stadium. The city comptroller estimates that the move will cost the city $350,000 per year for 10 years in lost taxes, parking, and other fees. Should the city build the stadium now State your reasoning.

Required:

a. Should the city build the stadium (Assume payments remade at the end of the year.)

b. The Red Hots have threatened to move out of Toledo if they do not get a new stadium. The city comptroller estimates that the move will cost the city $350,000 per year for 10 years in lost taxes, parking, and other fees. Should the city build the stadium now State your reasoning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

A punch press currently in use has a book value of $1,800 and needs design modifications totaling $16,200, which would be capitalized at the present time and depreciated. The press can be sold for $2,600 now, but it could be used for three more years if the necessary modifications were made, at the end of which time it would have no salvage value.

A new punch press can be purchased at an invoice price of $26,900 to replace the present equipment. Freight-in will amount to $800, and installation will cost $500. These expenses will be depreciated, along with the invoice price, over the life of the machine. Because of the nature of the product manufactured, the new machine also will have an expected life of three years and will have no salvage value at the end of that time.

using the old machine, operating profits before taxes and depreciation (revenues less costs) are $10,000 the first year and $8,000 in each of the next two years. using the new machine, operating profits before taxes and depreciation (revenues less costs) are $18,000 in the first year and $14,000 in each of the next two years.

Corporate income taxes are 40 percent, and the same tax rate is applicable to gains or losses on sales of equipment. Both the present and proposed equipment would be depreciated on a straight-line basis over three years. Assuming the company wants to earn a 10 percent rate of return after taxes, should it modify the old machine or purchase the new one

A new punch press can be purchased at an invoice price of $26,900 to replace the present equipment. Freight-in will amount to $800, and installation will cost $500. These expenses will be depreciated, along with the invoice price, over the life of the machine. Because of the nature of the product manufactured, the new machine also will have an expected life of three years and will have no salvage value at the end of that time.

using the old machine, operating profits before taxes and depreciation (revenues less costs) are $10,000 the first year and $8,000 in each of the next two years. using the new machine, operating profits before taxes and depreciation (revenues less costs) are $18,000 in the first year and $14,000 in each of the next two years.

Corporate income taxes are 40 percent, and the same tax rate is applicable to gains or losses on sales of equipment. Both the present and proposed equipment would be depreciated on a straight-line basis over three years. Assuming the company wants to earn a 10 percent rate of return after taxes, should it modify the old machine or purchase the new one

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment used to manufacture the product is specialized but can be readily sold as used equipment. What, if anything, is wrong with a decision rule for this case that says, "Keep producing the product as long as its contribution to net earnings is positive" [Contribution to net earnings, where

![Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment used to manufacture the product is specialized but can be readily sold as used equipment. What, if anything, is wrong with a decision rule for this case that says, Keep producing the product as long as its contribution to net earnings is positive [Contribution to net earnings, where is the tax rate, is (1 - ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]](https://d2lvgg3v3hfg70.cloudfront.net/SM1504/11eb7e66_bc0b_67d2_b1f4_7bf11b0f04cc_SM1504_00.jpg) is the tax rate, is (1 -

is the tax rate, is (1 -

![Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment used to manufacture the product is specialized but can be readily sold as used equipment. What, if anything, is wrong with a decision rule for this case that says, Keep producing the product as long as its contribution to net earnings is positive [Contribution to net earnings, where is the tax rate, is (1 - ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]](https://d2lvgg3v3hfg70.cloudfront.net/SM1504/11eb7e66_bc0b_67d3_b1f4_257ad89dfc1e_SM1504_00.jpg) ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]

) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]

![Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment used to manufacture the product is specialized but can be readily sold as used equipment. What, if anything, is wrong with a decision rule for this case that says, Keep producing the product as long as its contribution to net earnings is positive [Contribution to net earnings, where is the tax rate, is (1 - ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]](https://d2lvgg3v3hfg70.cloudfront.net/SM1504/11eb7e66_bc0b_67d2_b1f4_7bf11b0f04cc_SM1504_00.jpg) is the tax rate, is (1 -

is the tax rate, is (1 - ![Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment used to manufacture the product is specialized but can be readily sold as used equipment. What, if anything, is wrong with a decision rule for this case that says, Keep producing the product as long as its contribution to net earnings is positive [Contribution to net earnings, where is the tax rate, is (1 - ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]](https://d2lvgg3v3hfg70.cloudfront.net/SM1504/11eb7e66_bc0b_67d3_b1f4_257ad89dfc1e_SM1504_00.jpg) ) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]

) (Sales - Variable cost - Depreciation on equipment used to manufacture product).]

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

The PQR Coal Company has several conventional and strip mining operations. Recently, new legislation has made strip mining, which produces coal of high sulfur content, unprofitable, so those operations will be discontinued. Unfortunately, PQR purchased $1 million of earth-moving equipment for the strip mines two years ago and this equipment is not particularly well-suited to conventional mining.

Ms. Big, the president, suggests that since the equipment can be sold for $500,000, it should be scrapped. In her words, "I learned a long time ago that when you make mistakes it's best to admit them and take your lumps. By ignoring sunk costs you aren't tempted to throw good money after bad. The original value of the equipment is gone."

A new employee, Mr. Embeay, has suggested that the equipment should be adapted to the conventional operations. He argues, "We are about to spend $800,000 on some new conventional equipment. However, for a smaller expenditure of $250,000 we can adapt the old equipment to perform the same task. Of course, it will cost about $20,000 per year more to operate over the assumed 10-year lives of each alternative. But at an interest rate of 10 percent, the inclusion of the present value of $20,000 per year for 10 years and the initial $250,000 is still less than $800,000 for new equipment. While it's true that we should ignore sunk costs, at least this way we can cut our losses somewhat." Who's correct Why What should PQR do Why

Ms. Big, the president, suggests that since the equipment can be sold for $500,000, it should be scrapped. In her words, "I learned a long time ago that when you make mistakes it's best to admit them and take your lumps. By ignoring sunk costs you aren't tempted to throw good money after bad. The original value of the equipment is gone."

A new employee, Mr. Embeay, has suggested that the equipment should be adapted to the conventional operations. He argues, "We are about to spend $800,000 on some new conventional equipment. However, for a smaller expenditure of $250,000 we can adapt the old equipment to perform the same task. Of course, it will cost about $20,000 per year more to operate over the assumed 10-year lives of each alternative. But at an interest rate of 10 percent, the inclusion of the present value of $20,000 per year for 10 years and the initial $250,000 is still less than $800,000 for new equipment. While it's true that we should ignore sunk costs, at least this way we can cut our losses somewhat." Who's correct Why What should PQR do Why

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

Two types of machine tools are available for performing a particular job in Apex Corporation. Tool A has an initial investment of $52,000, with operating costs of $26,000 per year, an economic service life of 12 years, and a salvage value of $6,000 at the end of that period. Tool B has an initial investment of $41,000, with operating costs of $32,000 per year, an economic service life of 12 years, and a salvage value of $4,500 at the end of that period. The tax rate is 40 percent, the depreciation method is sum of the years' digits, and the tax life for depreciation equals the economic service life.

Required:

a. Assuming the cost of capital is 8 percent, which tool should be purchased

b. How would your answer to (a) change if double-declining-balance depreciation were used (You may assume that you are allowed to switch to straight-line depreciation at any point during the asset's life.)

Required:

a. Assuming the cost of capital is 8 percent, which tool should be purchased

b. How would your answer to (a) change if double-declining-balance depreciation were used (You may assume that you are allowed to switch to straight-line depreciation at any point during the asset's life.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

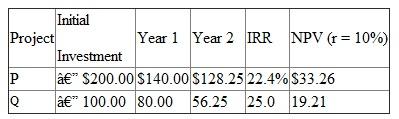

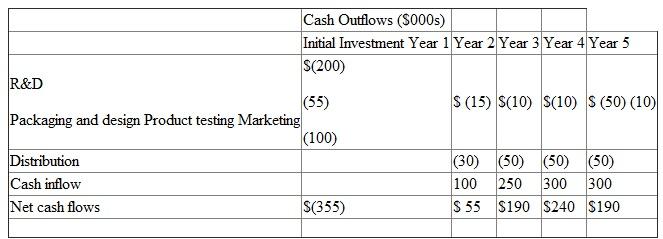

37

At the beginning of year 1, Northern Sun, Inc., a food processing concern, is considering a new line of frozen entrees. The accompanying table shows projected cash outflows and inflows. Assume that all inflows and outflows are end-of-period payments.

Required:

Required:

The company's cost of capital is 10 percent. Compute the following:

a. Net present value.

b. Payback.

Required:

Required: The company's cost of capital is 10 percent. Compute the following:

a. Net present value.

b. Payback.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

The National Direct Student Loan (NDSL) program allows college students to borrow funds from the federal government. The contract stipulates that the annual percentage rate of interest is 0 percent until 12 months after the student ceases his or her formal education (defined as at least half-time enrollment). At that time, interest becomes 4 percent per year. The maximum repayment period is 10 years. Assume that the student borrows $10,000 in the beginning of the first year of college and completes his or her education in four years. Loan repayments begin one year after graduation

Required:

a. Assuming that the student elects the maximum payment period, what are the uniform annual loan repayments (Assume all repayments occur at the end of the year.)

b. If the rate of interest on savings deposits is 6 percent, what is the minimum amount the student has to have in a bank account one year after graduation to make the loan payments calculated in (a)

c. Are recipients of the NDSL program receiving a subsidy If so, what is the present value of the subsidy when the loan is taken out

Required:

a. Assuming that the student elects the maximum payment period, what are the uniform annual loan repayments (Assume all repayments occur at the end of the year.)

b. If the rate of interest on savings deposits is 6 percent, what is the minimum amount the student has to have in a bank account one year after graduation to make the loan payments calculated in (a)

c. Are recipients of the NDSL program receiving a subsidy If so, what is the present value of the subsidy when the loan is taken out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

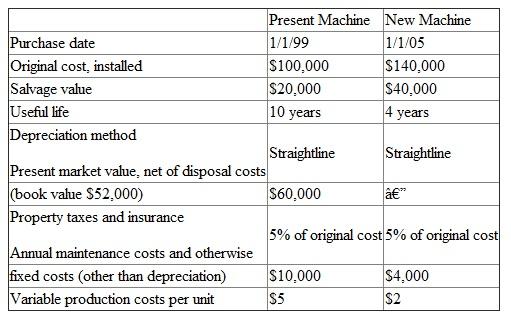

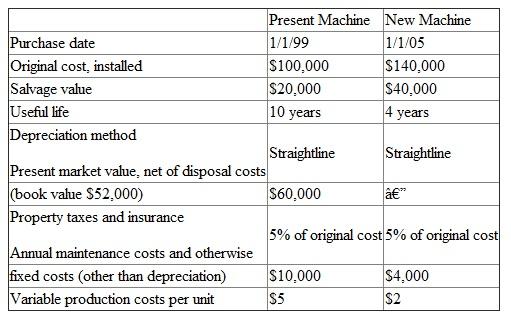

Eastern Educational Services is considering the following proposal to sell its teaching machine and purchase a new, improved machine. The following data are presented by the department head:

Additional information:

Additional information:

1. The company expects to produce 10,000 units a year selling at $10 each with either machine.

2. The company's tax rate is 40 percent on all income and expenses.

3. All annual income and expenses are assumed to occur at year-end.

4. The company's cost of capital is 12 percent after taxes.

5. The firm is located in a European country where capital gains are taxed at 40 percent. Capital gains are computed as the difference between the sales price and book value (original cost less accumulated depreciation).

Required:

a. Present a financial analysis in which you evaluate the proposal. A clear presentation is important.

b. Would you be more likely, less likely, or equally likely to recommend the purchase of the new machine given the following:

(i) The company's discount rate is increased.

(ii) The new machine can be depreciated by the double-declining-balance method.

Additional information:

Additional information:1. The company expects to produce 10,000 units a year selling at $10 each with either machine.

2. The company's tax rate is 40 percent on all income and expenses.

3. All annual income and expenses are assumed to occur at year-end.

4. The company's cost of capital is 12 percent after taxes.

5. The firm is located in a European country where capital gains are taxed at 40 percent. Capital gains are computed as the difference between the sales price and book value (original cost less accumulated depreciation).

Required:

a. Present a financial analysis in which you evaluate the proposal. A clear presentation is important.

b. Would you be more likely, less likely, or equally likely to recommend the purchase of the new machine given the following:

(i) The company's discount rate is increased.

(ii) The new machine can be depreciated by the double-declining-balance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck