Deck 18: Reports on Audited Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/29

العب

ملء الشاشة (f)

Deck 18: Reports on Audited Financial Statements

1

Give examples of a client-imposed and a condition-imposed scope limitation. Why is a client-imposed limitation generally considered more serious?

Scope Limitation

The following are the examples of client-imposed and condition-imposed scope limitation:

Example of client - imposed scope limitation:

When a client requests the auditor not to disclose the accounts receivable because of adverse effect over customer relations, the auditor issues a qualified opinion depending on the materiality of accounts receivable.

Example of condition - imposed scope limitation:

When the auditor is not engaged to perform the audit until the year end of the period, he may not be able to observe inventory.

The auditor should be seriously alert when the client requests to place a limit on the scope of the engagement, because the client may be trying to prevent the auditor from ascertaining the material misstatements. According to accounting standards, if any limitations are forced by the client, then the auditor should refuse that opinion on the financial statements.

The following are the examples of client-imposed and condition-imposed scope limitation:

Example of client - imposed scope limitation:

When a client requests the auditor not to disclose the accounts receivable because of adverse effect over customer relations, the auditor issues a qualified opinion depending on the materiality of accounts receivable.

Example of condition - imposed scope limitation:

When the auditor is not engaged to perform the audit until the year end of the period, he may not be able to observe inventory.

The auditor should be seriously alert when the client requests to place a limit on the scope of the engagement, because the client may be trying to prevent the auditor from ascertaining the material misstatements. According to accounting standards, if any limitations are forced by the client, then the auditor should refuse that opinion on the financial statements.

2

Which of the following best describes the auditor's responsibility for "other information" included in the annual report to stockholders that contains financial statements and the auditor's report?

A) The auditor has no obligation to read the "other information."

B) The auditor has no obligation to corroborate the "other information" but should read the "other information" to determine whether it is materially inconsistent with the financial statements.

C) The auditor should extend the examination to the extent necessary to verify the "other information."

D) The auditor must modify the auditor's report to state that the other information "is unaudited" or "is not covered by the auditor's report."

A) The auditor has no obligation to read the "other information."

B) The auditor has no obligation to corroborate the "other information" but should read the "other information" to determine whether it is materially inconsistent with the financial statements.

C) The auditor should extend the examination to the extent necessary to verify the "other information."

D) The auditor must modify the auditor's report to state that the other information "is unaudited" or "is not covered by the auditor's report."

(B) The auditor has no obligation to corroborate the "other information", but should read the "other information" to determine whether it is materially inconsistent with the financial statements.

Justification :

The auditor has no interest in other information beyond the financial statements mentioned in the report. However, the auditor considers the information presented in the report to ensure the consistency of the other information with the information cited in the audited financial statements.

Justification :

The auditor has no interest in other information beyond the financial statements mentioned in the report. However, the auditor considers the information presented in the report to ensure the consistency of the other information with the information cited in the audited financial statements.

3

How does the materiality of a departure from GAAP affect the auditor's choice of financial statement audit reports?

Effect of Materiality by a Departure from GAAP

The auditor should issue a qualified or adverse opinion when the financial statements are materially affected by a departure from GAAP. If the financial statements do not include an acceptable accounting principle, the auditor issues a qualified or adverse opinion as discussed below:

• Qualified opinion : If the financial statements are fairly presented and are not in accordance with GAAP, the auditor issues a qualified opinion because the departure from GAAP is material.

• Adverse opinion : If the financial statements are fairly presented, and are not in accordance with GAAP, the auditor issues an adverse opinion. But this departure is pervasive, and its effects are highly material.

Note:

GAAP: Generally Accepted Accounting Principles

The auditor should issue a qualified or adverse opinion when the financial statements are materially affected by a departure from GAAP. If the financial statements do not include an acceptable accounting principle, the auditor issues a qualified or adverse opinion as discussed below:

• Qualified opinion : If the financial statements are fairly presented and are not in accordance with GAAP, the auditor issues a qualified opinion because the departure from GAAP is material.

• Adverse opinion : If the financial statements are fairly presented, and are not in accordance with GAAP, the auditor issues an adverse opinion. But this departure is pervasive, and its effects are highly material.

Note:

GAAP: Generally Accepted Accounting Principles

4

When reporting on financial statements prepared on the basis of accounting used for income tax purposes, the auditor should include in the report a paragraph that

A) Emphasizes that the financial statements have not been examined in accordance with generally accepted auditing standards.

B) Refers to the authoritative pronouncements that explain the income tax basis of accounting being used.

C) States that the income tax basis of accounting is a basis of accounting other than generally accepted accounting principles.

D) Justifies the use of the income tax basis of accounting.

A) Emphasizes that the financial statements have not been examined in accordance with generally accepted auditing standards.

B) Refers to the authoritative pronouncements that explain the income tax basis of accounting being used.

C) States that the income tax basis of accounting is a basis of accounting other than generally accepted accounting principles.

D) Justifies the use of the income tax basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

5

In 2011, your firm issued an unmodified report on Tosi Corporation, a private company. During 2013, Tosi entered its first lease transaction, which you have determined is material but not pervasive and meets the criteria for a capitalized lease. Tosi Corporation's management chooses to treat the transaction as an operating lease. What types of reports would you issue on the corporation's comparative financial statements for 2012 and 2013?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

6

When an auditor is asked to express an opinion on an entity's rent and royalty revenues, he or she may

A) Not accept the engagement because to do so would be tantamount to agreeing to issue a piecemeal opinion.

B) Not accept the engagement unless also engaged to audit the full financial statements of the entity.

C) Accept the engagement, provided the auditor's opinion is expressed in a special report.

D) Accept the engagement, provided distribution of the auditor's report is limited to the entity's management.

A) Not accept the engagement because to do so would be tantamount to agreeing to issue a piecemeal opinion.

B) Not accept the engagement unless also engaged to audit the full financial statements of the entity.

C) Accept the engagement, provided the auditor's opinion is expressed in a special report.

D) Accept the engagement, provided distribution of the auditor's report is limited to the entity's management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

7

What are the auditor's responsibilities for other information included in an entity's annual report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

8

For each of the following independent situations, indicate the type of financial statement audit report that you would issue and briefly explain your reasoning. Assume that all companies mentioned are private companies and that each item is at least material.

a. Barefield Corporation, a wholly owned subsidiary of Sandy, Inc., is audited by another CPA firm. As the auditor of Sandy, Inc., you have assured yourself of the other CPA firm's independence and professional reputation. However, you are unwilling to take complete responsibility for its audit work.

b. The management of Bonner Corporation has decided to exclude the statement of cash flows from its financial statements because it believes that its bankers do not find the statement to be very useful.

c. You are auditing Diverse Carbon, a manufacturer of nerve gas for the military, for the year ended September 30. On September 1, one of its manufacturing plants caught fire, releasing nerve gas into the surrounding area. Two thousand people were killed and numerous others paralyzed. The company's legal counsel indicates that the company is liable and that the amount of the liability can be reasonably estimated, but the company refuses to disclose this information in the financial statements.

d. During your audit of Cuccia Coal Company, the controller, Tracy Tricks, refuses to allow you to confirm accounts receivable because she is concerned about complaints from her customers. You are unable to satisfy yourself about accounts receivable by other audit procedures and you are concerned about Tracy's true motives.

e. On January 31, Asare Toy Manufacturing hired your firm to audit the company's financial statements for the prior year. You were unable to observe the client's inventory on December 31. However, you were able to satisfy yourself about the inventory balance using other auditing procedures.

f. Gelato Bros., Inc., leases its manufacturing facility from a partnership controlled by the chief executive officer and major shareholder of Gelato. Your review of the lease indicates that the rental terms are in excess of rental terms for similar buildings in the area. The company refuses to disclose this related-party transaction in the footnotes.

g. Johnstone Manufacturing Company has used the double-declining balance method to depreciate its machinery. During the current year, management switched to the straight-line method because it felt that it better represented the utilization of the assets. You concur with its decision. All information is adequately disclosed in the financial statements.

a. Barefield Corporation, a wholly owned subsidiary of Sandy, Inc., is audited by another CPA firm. As the auditor of Sandy, Inc., you have assured yourself of the other CPA firm's independence and professional reputation. However, you are unwilling to take complete responsibility for its audit work.

b. The management of Bonner Corporation has decided to exclude the statement of cash flows from its financial statements because it believes that its bankers do not find the statement to be very useful.

c. You are auditing Diverse Carbon, a manufacturer of nerve gas for the military, for the year ended September 30. On September 1, one of its manufacturing plants caught fire, releasing nerve gas into the surrounding area. Two thousand people were killed and numerous others paralyzed. The company's legal counsel indicates that the company is liable and that the amount of the liability can be reasonably estimated, but the company refuses to disclose this information in the financial statements.

d. During your audit of Cuccia Coal Company, the controller, Tracy Tricks, refuses to allow you to confirm accounts receivable because she is concerned about complaints from her customers. You are unable to satisfy yourself about accounts receivable by other audit procedures and you are concerned about Tracy's true motives.

e. On January 31, Asare Toy Manufacturing hired your firm to audit the company's financial statements for the prior year. You were unable to observe the client's inventory on December 31. However, you were able to satisfy yourself about the inventory balance using other auditing procedures.

f. Gelato Bros., Inc., leases its manufacturing facility from a partnership controlled by the chief executive officer and major shareholder of Gelato. Your review of the lease indicates that the rental terms are in excess of rental terms for similar buildings in the area. The company refuses to disclose this related-party transaction in the footnotes.

g. Johnstone Manufacturing Company has used the double-declining balance method to depreciate its machinery. During the current year, management switched to the straight-line method because it felt that it better represented the utilization of the assets. You concur with its decision. All information is adequately disclosed in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the auditor determines that other information contained with the audited financial statements is incorrect and the client refuses to correct the other information, what actions can the auditor take?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

10

For each of the following independent situations, indicate the reason for and the type of financial statement audit report that you would issue. Assume that all companies mentioned are private companies and that each item is at least material.

a. Thibodeau Mines, Inc., uses LIFO for valuing inventories held in the United States and FIFO for inventories produced and held in its foreign operations.

b. Walker Computers is suing your client, Super Software, for royalties over patent infringement. Super Software's outside legal counsel assures you that Walker's case is completely without merit.

c. In previous years, your client, Merc International, has consolidated its Panamanian subsidiary. Because of restrictions on repatriation of earnings placed on all foreign-owned corporations in Panama, Merc International has decided to account for the subsidiary on the equity basis in the current year. You concur with the change.

d. In prior years, Worcester Wool Mills has used current market prices to value its inventory of raw wool. During the current year, Worcester changed to FIFO for valuing raw wool.

e. Upon review of the recent history of the lives of its specialized automobiles, Gas Leak Technology justifiably changed the service lives for depreciation purposes on its autos from five years to three years. This change resulted in a material amount of additional depreciation expense.

f. During the audit of Brannon Bakery Equipment, you found that a material amount of inventory had been excluded from the company's financial statements. After discussing this problem with management, you become convinced that it was an unintentional oversight. Management appropriately corrected the error prior to your finalization of field work.

g. Jay Rich, CPA, holds 10 percent of the stock in Rothenburg Construction Company. The board of directors of Rothenburg asks Rich to conduct its audit. Rich completes the audit and determines that the financial statements present fairly in accordance with generally accepted accounting principles.

h. Ramamoorthi Savings and Loan's financial condition has been deteriorating for the last five years. Most of its problems result from loans made to real estate developers in Saint Johns County. Your review of the loan portfolio indicates that there should be a major increase in the loan-loss reserve. Based on your calculations, the proposed writedown of the loans will put Ramamoorthi into violation of the state's capital requirements. The client refuses to make the adjustment or to disclose the possible going concern issue in the notes to the financial statements.

a. Thibodeau Mines, Inc., uses LIFO for valuing inventories held in the United States and FIFO for inventories produced and held in its foreign operations.

b. Walker Computers is suing your client, Super Software, for royalties over patent infringement. Super Software's outside legal counsel assures you that Walker's case is completely without merit.

c. In previous years, your client, Merc International, has consolidated its Panamanian subsidiary. Because of restrictions on repatriation of earnings placed on all foreign-owned corporations in Panama, Merc International has decided to account for the subsidiary on the equity basis in the current year. You concur with the change.

d. In prior years, Worcester Wool Mills has used current market prices to value its inventory of raw wool. During the current year, Worcester changed to FIFO for valuing raw wool.

e. Upon review of the recent history of the lives of its specialized automobiles, Gas Leak Technology justifiably changed the service lives for depreciation purposes on its autos from five years to three years. This change resulted in a material amount of additional depreciation expense.

f. During the audit of Brannon Bakery Equipment, you found that a material amount of inventory had been excluded from the company's financial statements. After discussing this problem with management, you become convinced that it was an unintentional oversight. Management appropriately corrected the error prior to your finalization of field work.

g. Jay Rich, CPA, holds 10 percent of the stock in Rothenburg Construction Company. The board of directors of Rothenburg asks Rich to conduct its audit. Rich completes the audit and determines that the financial statements present fairly in accordance with generally accepted accounting principles.

h. Ramamoorthi Savings and Loan's financial condition has been deteriorating for the last five years. Most of its problems result from loans made to real estate developers in Saint Johns County. Your review of the loan portfolio indicates that there should be a major increase in the loan-loss reserve. Based on your calculations, the proposed writedown of the loans will put Ramamoorthi into violation of the state's capital requirements. The client refuses to make the adjustment or to disclose the possible going concern issue in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

11

List three examples of special reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

12

The CPA firm of May Marty has audited the consolidated financial statements of BGI Corporation, a private company. May Marty examined the parent company and all subsidiaries except for BGI-Western Corporation, which was audited by the CPA firm of Dey Dee. BGI-Western constituted approximately 10 percent of the consolidated assets and 6 percent of the consolidated revenue.

Dey Dee issued an unmodified opinion on the financial statements of BGI-Western. May Marty will be issuing an unmodified opinion on the consolidated financial statements of BGI.

Required:

a. What procedures should May Marty consider performing with respect to Dey Dee's examination of BGI-Western's financial statements regardless of whether reference is to be made to the other auditors?

b. Describe the various circumstances under which May Marty could take responsibility for the work of Dey Dee and make no reference to Dey Dee's examination of BGI-Western in its own report on the consolidated financial statements of BGI.

(AICPA, adapted)

Dey Dee issued an unmodified opinion on the financial statements of BGI-Western. May Marty will be issuing an unmodified opinion on the consolidated financial statements of BGI.

Required:

a. What procedures should May Marty consider performing with respect to Dey Dee's examination of BGI-Western's financial statements regardless of whether reference is to be made to the other auditors?

b. Describe the various circumstances under which May Marty could take responsibility for the work of Dey Dee and make no reference to Dey Dee's examination of BGI-Western in its own report on the consolidated financial statements of BGI.

(AICPA, adapted)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

13

List four bases for special purpose financial statements. Why is it important that the audit report clearly identify the basis of accounting used in the preparation of the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

14

Devon, Inc., a private company, engaged Rao to examine its financial statements for the year ended December 31, 2013. The financial statements of Devon, Inc., for the year ended December 31, 2012, were examined by Jones, whose March 30, 2013, auditor's report expressed an unqualified opinion. The report of Jones is not presented with the 2013-2012 comparative financial statements.

Rao's working papers contain the following information that does not appear in footnotes to the 2013 financial statements as prepared by Devon, Inc.:

• One director, appointed in 2013, was formerly a partner in Jones' accounting firm. Jones' firm provided financial consulting services to Devon during 2011 and 2010, for which Devon paid approximately $1,600 and $9,000, respectively.

• The company refused to capitalize certain lease obligations for equipment acquired in 2013. Capitalization of the leases in conformity with generally accepted accounting principles would have increased assets and liabilities by $312,000 and $387,000, respectively; decreased retained earnings as of December 31, 2013, by $75,000; and decreased net income and earnings per share by $75,000 and $.75, respectively, for the year then ended. Rao has concluded that the leases should have been capitalized.

• During the year, Devon changed its method of valuing inventory from the first-in, first-out method to the last-in, first-out method. This change was made because management believes LIFO more clearly reflects net income by providing a closer matching of current costs and current revenues. The change had the effect of reducing inventory at December 31, 2013, by $65,000 and net income and earnings per share by $38,000 and $.38, respectively, for the year then ended. The effect of the change on prior years was immaterial; accordingly, the change had no cumulative effect. Rao supports the company's position.

After completing the fieldwork on February 28, 2014, Rao concludes that the expression of an adverse opinion is not warranted.

Required:

Prepare the body of Rao's report, addressed to the board of directors, dated February 28, 2014, to accompany the 2013-2012 comparative financial statements. Rao has conducted an audit of Devon's internal controls over financial reporting based on the COSO framework. No material weaknesses were identified.

Rao's working papers contain the following information that does not appear in footnotes to the 2013 financial statements as prepared by Devon, Inc.:

• One director, appointed in 2013, was formerly a partner in Jones' accounting firm. Jones' firm provided financial consulting services to Devon during 2011 and 2010, for which Devon paid approximately $1,600 and $9,000, respectively.

• The company refused to capitalize certain lease obligations for equipment acquired in 2013. Capitalization of the leases in conformity with generally accepted accounting principles would have increased assets and liabilities by $312,000 and $387,000, respectively; decreased retained earnings as of December 31, 2013, by $75,000; and decreased net income and earnings per share by $75,000 and $.75, respectively, for the year then ended. Rao has concluded that the leases should have been capitalized.

• During the year, Devon changed its method of valuing inventory from the first-in, first-out method to the last-in, first-out method. This change was made because management believes LIFO more clearly reflects net income by providing a closer matching of current costs and current revenues. The change had the effect of reducing inventory at December 31, 2013, by $65,000 and net income and earnings per share by $38,000 and $.38, respectively, for the year then ended. The effect of the change on prior years was immaterial; accordingly, the change had no cumulative effect. Rao supports the company's position.

After completing the fieldwork on February 28, 2014, Rao concludes that the expression of an adverse opinion is not warranted.

Required:

Prepare the body of Rao's report, addressed to the board of directors, dated February 28, 2014, to accompany the 2013-2012 comparative financial statements. Rao has conducted an audit of Devon's internal controls over financial reporting based on the COSO framework. No material weaknesses were identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

15

In which of the following situations would an auditor ordinarily issue an unqualified/unmodified financial statement audit opinion with no explanatory (or emphasis-of-matter/other-matter) paragraph?

A) The auditor wishes to emphasize that the entity had significant related-party transactions.

B) The auditor decides to refer to the report of another auditor as a basis, in part, for the auditor's opinion.

C) The entity issues financial statements that present financial position and results of operations but omits the statement of cash flows.

D) The auditor has substantial doubt about the entity's ability to continue as a going concern, but the circumstances are fully disclosed in the financial statements.

A) The auditor wishes to emphasize that the entity had significant related-party transactions.

B) The auditor decides to refer to the report of another auditor as a basis, in part, for the auditor's opinion.

C) The entity issues financial statements that present financial position and results of operations but omits the statement of cash flows.

D) The auditor has substantial doubt about the entity's ability to continue as a going concern, but the circumstances are fully disclosed in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

16

On March 12, 2014, Kristen Valentine, CPAs, completed the audit of the financial statements of Modern Museum, Inc., for the year ended December 31, 2013. Modern is a privately held company. Modern Museum presents comparative financial statements on a modified cash basis. Assets, liabilities, fund balances, support, revenues, and expenses are recognized when cash is received or disbursed, except that Modern includes a provision for depreciation of buildings and equipment. Kristen Valentine believes that Modern's three financial statements, prepared in accordance with a basis of accounting other than generally accepted accounting principles, are adequate for Modern's needs and wishes to issue a special report on the financial statements. Kristen Valentine has gathered sufficient competent evidence to be satisfied that the financial statements are fairly presented according to the modified cash basis. Kristen Valentine audited Modern's 2012 financial statements and issued an auditor's special report expressing an unmodified opinion.

Required:

Draft the audit report to accompany Modern's comparative financial statements.

(AICPA, adapted)

Required:

Draft the audit report to accompany Modern's comparative financial statements.

(AICPA, adapted)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

17

A public entity changed from the straight-line method to the declining balance method of depreciation for all newly acquired assets. This change has no material effect on the current year's financial statements but is reasonably certain to have a substantial effect in later years. The client's financial statements contain no material misstatements and the auditor concurs with this change. If the change is disclosed in the notes to the financial statements, the auditor should issue a report with a(n)

A) "Except for" qualified opinion.

B) Explanatory paragraph.

C) Unqualified opinion.

D) Consistency modification.

A) "Except for" qualified opinion.

B) Explanatory paragraph.

C) Unqualified opinion.

D) Consistency modification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

18

For the year ended December 31, 2012, Friday Co., CPAs ("Friday"), audited the financial statements of Kim Company and expressed an unqualified opinion on the balance sheet only. Friday did not observe the taking of the physical inventory as of December 31, 2011, because that date was prior to its appointment as auditor. Friday was unable to satisfy itself regarding inventory by means of other auditing procedures, so it did not express an opinion on the other basic financial statements that year.

For the year ended December 31, 2013, Friday expressed an unqualified opinion on all the basic financial statements and satisfied itself as to the consistent application of generally accepted accounting principles.

The fieldwork was completed on March 12, 2014; the partner-in-charge reviewed the working papers and signed the auditor's report on March 19, 2014. The report on the comparative financial statements for 2013 and 2012 was delivered to Kim on March 21, 2014.

Required:

Prepare Friday's audit report that was submitted to Kim's board of directors on the 2013 and 2012 comparative financial statements. Kim is a public company. Friday has conducted an audit of Kim's internal controls over financial reporting based on the COSO framework. No material weaknesses were identified.

For the year ended December 31, 2013, Friday expressed an unqualified opinion on all the basic financial statements and satisfied itself as to the consistent application of generally accepted accounting principles.

The fieldwork was completed on March 12, 2014; the partner-in-charge reviewed the working papers and signed the auditor's report on March 19, 2014. The report on the comparative financial statements for 2013 and 2012 was delivered to Kim on March 21, 2014.

Required:

Prepare Friday's audit report that was submitted to Kim's board of directors on the 2013 and 2012 comparative financial statements. Kim is a public company. Friday has conducted an audit of Kim's internal controls over financial reporting based on the COSO framework. No material weaknesses were identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

19

An auditor includes a separate paragraph in an otherwise unmodified financial statement audit report to emphasize that the entity being reported upon had significant transactions with related parties. The inclusion of this separate paragraph

A) Is appropriate and would not negate the unmodified opinion.

B) Is considered an "except for" qualification of the opinion.

C) Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

D) Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation."

A) Is appropriate and would not negate the unmodified opinion.

B) Is considered an "except for" qualification of the opinion.

C) Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

D) Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following auditor's report was drafted by a staff accountant of Nathan and Matthew, CPAs, at the completion of the audit of the comparative financial statements of Monterey Partnership for the years ended December 31, 2013 and 2012. Monterey is a privately held company that prepares its financial statements on the income tax basis of accounting. The report was submitted to the engagement partner, who reviewed matters thoroughly and properly concluded that an unmodified opinion should be expressed. The draft of the report prepared by a staff account is as follows:

Auditor's Report

We have audited the accompanying financial statements of Monterey Partnership, which comprise the statements of assets, liabilities, and capital-income tax basis as of December 31, 2013, and the related statements of revenue and expenses-income tax basis and of changes in partners' capital accounts-income tax basis for the year then ended, and the related notes to the financial statements.

Auditor's Responsibility

We conducted our audit in accordance with standards established by the AICPA. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. An audit also includes evaluating the appropriateness of accounting policies used as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the assets, liabilities, and capital of Monterey Partnership as of December 31, 2013, and its revenue and expenses and changes in partners' capital accounts for the year then ended in conformity with generally accepted accounting principles applied on a consistent basis.

Basis of Accounting

We draw attention to Note 2 of the financial statements, which describes the basis of accounting. The financial statements are prepared on the basis of accounting the Partnership uses for income tax purposes. Accordingly, these financial statements are not designed for those who do not have access to the Partnership's tax returns. Our opinion is not modified with respect to this matter.

Nathan and Matthew, CPAs

April 3, 2014

Required:

Identify the errors and omissions in the auditor's report as drafted by the staff accountant. Group the errors and omissions by paragraph, where applicable. Do not redraft the report.

(AICPA, adapted)

Auditor's Report

We have audited the accompanying financial statements of Monterey Partnership, which comprise the statements of assets, liabilities, and capital-income tax basis as of December 31, 2013, and the related statements of revenue and expenses-income tax basis and of changes in partners' capital accounts-income tax basis for the year then ended, and the related notes to the financial statements.

Auditor's Responsibility

We conducted our audit in accordance with standards established by the AICPA. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. An audit also includes evaluating the appropriateness of accounting policies used as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the assets, liabilities, and capital of Monterey Partnership as of December 31, 2013, and its revenue and expenses and changes in partners' capital accounts for the year then ended in conformity with generally accepted accounting principles applied on a consistent basis.

Basis of Accounting

We draw attention to Note 2 of the financial statements, which describes the basis of accounting. The financial statements are prepared on the basis of accounting the Partnership uses for income tax purposes. Accordingly, these financial statements are not designed for those who do not have access to the Partnership's tax returns. Our opinion is not modified with respect to this matter.

Nathan and Matthew, CPAs

April 3, 2014

Required:

Identify the errors and omissions in the auditor's report as drafted by the staff accountant. Group the errors and omissions by paragraph, where applicable. Do not redraft the report.

(AICPA, adapted)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

21

Eagle Company, a public company, had a computer failure and lost part of its financial data. As a result, the auditor was unable to obtain sufficient audit evidence relating to Eagle's inventory account. Assuming the inventory account is at least material, the auditor would most likely choose either

A) A qualified opinion or a disclaimer of opinion.

B) A qualified opinion or an adverse opinion.

C) An unqualified opinion with no explanatory paragraph or an unqualified opinion with an explanatory paragraph.

D) A qualified opinion with no explanatory paragraph or a qualified opinion with an explanatory paragraph.

A) A qualified opinion or a disclaimer of opinion.

B) A qualified opinion or an adverse opinion.

C) An unqualified opinion with no explanatory paragraph or an unqualified opinion with an explanatory paragraph.

D) A qualified opinion with no explanatory paragraph or a qualified opinion with an explanatory paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

22

You are auditing the financial statements for your new client, Paper Packaging Corporation, a manufacturer of paper containers, for the year ended March 31, 2014. Paper Packaging's previous auditors had issued a going concern opinion on the March 31, 2013, financial statements for the following reasons:

• Paper Packaging had defaulted on $10 million of unregistered debentures sold to three insurance companies, which were due in 2013, and the default constituted a possible violation of other debt agreements.

• The interest and principal payments due on the remainder of a 10-year credit agreement, which began in 2009, would exceed the cash flows generated from operations in recent years.

• The company had disposed of certain operating units. The proceeds from the sale were subject to possible adjustment through arbitration proceedings, the outcome of which was uncertain at year-end.

• Various lawsuits were pending against the company.

• The company was in the midst of tax proceedings as a result of an examination of the company's federal income tax returns for a period of 12 years.

You find that the status of the above matters is as follows at year-end, March 31, 2014:

• The company is still in default on $4.6 million of the debentures due in 2013 but is trying to negotiate a settlement with remaining bondholders. A large number of bondholders have settled their claims at significantly less than par.

• The company has renegotiated the 2009 credit agreement, which provides for a two-year moratorium on principal payments and interest at 8 percent. It also limits net losses ($2.25 million for 2014) and requires a certain level of defined cumulative quarterly operating income to be maintained.

• The arbitration proceedings were resolved in 2014.

• The legal actions were settled in 2014.

• Most of the tax issues have been resolved, and, according to the company's outside legal counsel, those remaining will result in a net cash inflow to the company.

At year-end, Paper Packaging had a cash balance of $5.5 million and expects to generate a net cash flow of $3.2 million in the upcoming fiscal year.

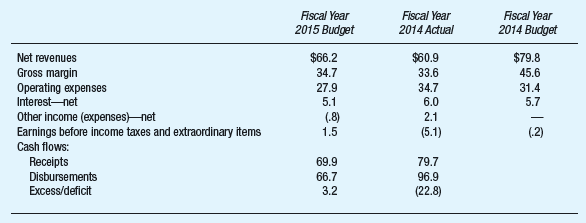

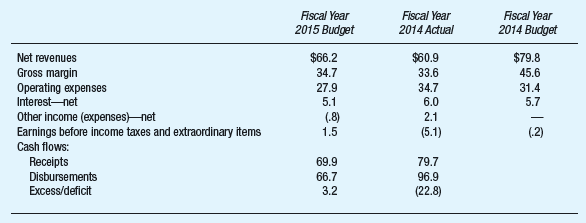

The following information about Paper Packaging's plans for its operations for the fiscal year ending in 2015 may also be useful in arriving at a decision.

Required (for this question, you may wish to reference extant auditing standards):

a. What should you consider in deciding whether to discuss a going concern uncertainty in your report?

b. How much influence should the report on the March 31, 2013, financial statements have on your decision?

c. Should your report for the year ended March 31, 2014, include a discussion of a going concern uncertainty? Briefly explain why or why not.

• Paper Packaging had defaulted on $10 million of unregistered debentures sold to three insurance companies, which were due in 2013, and the default constituted a possible violation of other debt agreements.

• The interest and principal payments due on the remainder of a 10-year credit agreement, which began in 2009, would exceed the cash flows generated from operations in recent years.

• The company had disposed of certain operating units. The proceeds from the sale were subject to possible adjustment through arbitration proceedings, the outcome of which was uncertain at year-end.

• Various lawsuits were pending against the company.

• The company was in the midst of tax proceedings as a result of an examination of the company's federal income tax returns for a period of 12 years.

You find that the status of the above matters is as follows at year-end, March 31, 2014:

• The company is still in default on $4.6 million of the debentures due in 2013 but is trying to negotiate a settlement with remaining bondholders. A large number of bondholders have settled their claims at significantly less than par.

• The company has renegotiated the 2009 credit agreement, which provides for a two-year moratorium on principal payments and interest at 8 percent. It also limits net losses ($2.25 million for 2014) and requires a certain level of defined cumulative quarterly operating income to be maintained.

• The arbitration proceedings were resolved in 2014.

• The legal actions were settled in 2014.

• Most of the tax issues have been resolved, and, according to the company's outside legal counsel, those remaining will result in a net cash inflow to the company.

At year-end, Paper Packaging had a cash balance of $5.5 million and expects to generate a net cash flow of $3.2 million in the upcoming fiscal year.

The following information about Paper Packaging's plans for its operations for the fiscal year ending in 2015 may also be useful in arriving at a decision.

Required (for this question, you may wish to reference extant auditing standards):

a. What should you consider in deciding whether to discuss a going concern uncertainty in your report?

b. How much influence should the report on the March 31, 2013, financial statements have on your decision?

c. Should your report for the year ended March 31, 2014, include a discussion of a going concern uncertainty? Briefly explain why or why not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

23

Tech Company has disclosed an uncertainty due to pending litigation. The auditor's decision to issue a qualified opinion on Tech's financial statements would most likely result from

A) A lack of sufficient evidence.

B) An inability to estimate the amount of loss.

C) The entity's lack of experience with such litigation.

D) A lack of insurance coverage for possible losses from such litigation.

A) A lack of sufficient evidence.

B) An inability to estimate the amount of loss.

C) The entity's lack of experience with such litigation.

D) A lack of insurance coverage for possible losses from such litigation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

24

In which of the following circumstances would an auditor usually choose between issuing a qualified opinion or a disclaimer of opinion on a client's financial statements?

A) Departure from generally accepted accounting principles.

B) Inadequate disclosure of accounting policies.

C) Inability to obtain sufficient competent evidence.

D) Unreasonable justification for a change in accounting principle.

A) Departure from generally accepted accounting principles.

B) Inadequate disclosure of accounting policies.

C) Inability to obtain sufficient competent evidence.

D) Unreasonable justification for a change in accounting principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

25

King, CPA, was engaged to audit the financial statements of Chang Company, a private company, after its fiscal year had ended. King neither observed the inventory count nor confirmed the receivables by direct communication with debtors but was satisfied that both were fairly stated after applying appropriate alternative procedures. King's financial statement audit report most likely contained a(n)

A) Qualified opinion.

B) Disclaimer of opinion.

C) Unmodified opinion.

D) Unmodified opinion with an emphasis-of-matter paragraph.

A) Qualified opinion.

B) Disclaimer of opinion.

C) Unmodified opinion.

D) Unmodified opinion with an emphasis-of-matter paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

26

Describe what is meant when an auditor is "associated with" a set of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

27

Comparative financial statements for a public company include the prior year's statements, which were audited by a predecessor auditor. The predecessor's report is not presented along with the comparative financial statements. If the predecessor's report was unqualified, the successor should

A) Express an opinion on the current year's statements alone and make no reference to the prior year's statements.

B) Indicate in the auditor's report that the predecessor auditor expressed an unqualified opinion.

C) Obtain a letter of representations from the predecessor concerning any matters that might affect the successor's opinion.

D) Request that the predecessor auditor reissue the prior year's report.

A) Express an opinion on the current year's statements alone and make no reference to the prior year's statements.

B) Indicate in the auditor's report that the predecessor auditor expressed an unqualified opinion.

C) Obtain a letter of representations from the predecessor concerning any matters that might affect the successor's opinion.

D) Request that the predecessor auditor reissue the prior year's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

28

Distinguish between accounting changes that affect consistency and changes that do not. To what does the word consistency refer? How is it possible for an accounting change to affect comparability but not consistency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck

29

When reporting on comparative financial statements for a private company, which of the following circumstances should ordinarily cause the auditor to change the previously issued opinion on the prior year's financial statements?

A) The prior year's financial statements are restated following the purchase of another company in the current year.

B) A departure from generally accepted accounting principles caused an adverse opinion on the prior year's financial statements, and those statements have been properly restated.

C) A change in accounting principle causes the auditor to make a consistency modification in the current year's audit report.

D) A scope limitation caused a qualified opinion on the prior year's financial statements, but the current year's opinion is properly unmodified.

A) The prior year's financial statements are restated following the purchase of another company in the current year.

B) A departure from generally accepted accounting principles caused an adverse opinion on the prior year's financial statements, and those statements have been properly restated.

C) A change in accounting principle causes the auditor to make a consistency modification in the current year's audit report.

D) A scope limitation caused a qualified opinion on the prior year's financial statements, but the current year's opinion is properly unmodified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 29 في هذه المجموعة.

فتح الحزمة

k this deck