Deck 17: Monetary Policy Targets and Goals

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 17: Monetary Policy Targets and Goals

1

During the 1970s, the Federal Reserve targeted monetary aggregates like M1 and M2.

False

2

The long term goal of keeping inflation low can conflict with the short term goal of lowering unemployment.

True

3

Regulation Q helped lower macroeconomic volatility in the United States starting in the late 1980s.

False

4

According to the Taylor Rule, if the output gap falls, the targeted interest rate should fall as well, .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

One of the Federal Reserve's goals is 0% unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

Open market operations has always been the primary tool of the Fed for controlling prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

A major time consistency issue for monetary policy has to do with the trade-off between output growth and unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

Monetary policy that attempts to fix interest rates at a constant value is anti-cyclical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

Canada was the first country to formally adopt inflation targeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

According to the Taylor Rule, if inflation rises by 2%, then the targeted interest rate should rise by more than 2%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Fed is the single reason for the reduction in volatility between 1985 and 2007.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

The establishment of the FDIC created a time consistency issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

Raising the reserve requirement led to a worsening of the Great Depression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

Before 1979, the Federal Reserve tended to raise interest rates in a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

A central bank cannot target money supply growth and interest rates at the same time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

By treaty, the primary goal of the ECB is stable prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

Between 1985 and 2007, the GDP growth in the United States was noticeably less volatile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

A central bank using the Taylor Rule is only concerned about inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Federal Reserve has not formally adopted inflation targeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

Interest rate targeting was a primary cause of the Great Inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Federal Reserve monetized the debt during WWII, leading to deflation after the war.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

When the Fed keeps the fed funds rate near what the Taylor Rule prescribes, the economy has flourished.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

A central bank would increase the money supply to

A) lower inflation.

B) lower unemployment.

C) lower GDP growth.

D) none of the above.

A) lower inflation.

B) lower unemployment.

C) lower GDP growth.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Taylor Rule would be implemented by a central bank using

A) changes in the reserve requirement.

B) discount lending.

C) open market operations.

D) all of the above.

A) changes in the reserve requirement.

B) discount lending.

C) open market operations.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

One advantage of the Taylor Rule is that it would never require a negative nominal interest rate target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

A central bank would increase interest rates to

A) lower inflation.

B) raise employment.

C) stimulate the economy.

D) all of the above.

A) lower inflation.

B) raise employment.

C) stimulate the economy.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

Monetary policy improved after 1979 since it

A) was pro-cyclical.

B) was anti-cyclical.

C) targeted monetary aggregates.

D) targeted long term interest rates.

A) was pro-cyclical.

B) was anti-cyclical.

C) targeted monetary aggregates.

D) targeted long term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

One reason for the decreased economic volatility starting in the 1980s was

A) better monetary policy.

B) more volatile oil prices.

C) less regulation of the stock market.

D) all of the above.

A) better monetary policy.

B) more volatile oil prices.

C) less regulation of the stock market.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

Lowering interest rates has the effect of making domestic good more expensive for foreigners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

The natural rate of unemployment is estimated to be less than 4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

Decreased macroeconomic volatility is attributable to the Fed

A) switching from pro-cyclical to anti-cyclical monetary policy.

B) switching from anti-cyclical to pro-cyclical monetary policy.

C) officially adopting the Taylor Rule.

D) none of the above.

A) switching from pro-cyclical to anti-cyclical monetary policy.

B) switching from anti-cyclical to pro-cyclical monetary policy.

C) officially adopting the Taylor Rule.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

Raising interest rates could have the effect of decreasing exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

Central banks try to use their influence over the money supply to change interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the middle years of the first decade of the new millennium, the Fed kept the federal funds target well above what was called for by the Taylor rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

If central banks decrease interest rates, this is likely to slow the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

The decision on whether to default on a loan or debt raises a time consistency problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

A central bank that is concerned about deflation will try to raise interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

Policy that tends to make recessions worse and booms inflationary is called pro-cyclical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

A central bank would lower interest rates to

A) decrease inflation.

B) raise unemployment.

C) stimulate GDP growth.

D) all of the above.

A) decrease inflation.

B) raise unemployment.

C) stimulate GDP growth.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

An interest rate and a money aggregate cannot be controlled at the same time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

It is difficult to know if a monetary policy is effective due to

A) the time it takes to implement a policy.

B) the unpredictability of the financial cycle.

C) the volatility of the market.

D) none of the above.

A) the time it takes to implement a policy.

B) the unpredictability of the financial cycle.

C) the volatility of the market.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

When monetary policymakers are unable to solve the time consistency problem, the primary result is

A) low growth.

B) high unemployment.

C) high inflation.

D) none of the above.

A) low growth.

B) high unemployment.

C) high inflation.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

According to the Taylor Rule, if the output gap falls by 2% and inflation rises by 2%, then the federal funds rate should rise by

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

According to the Taylor Rule, if the output gap rises by 2% and inflation rises by 1%, then the federal funds rate should rise by

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Federal Reserve began using open market operations in the

A) 1920s.

B) 1930s.

C) 1940s.

D) 1970s.

A) 1920s.

B) 1930s.

C) 1940s.

D) 1970s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

The adoption of inflation targeting has often led to problems in the

A) short run.

B) long run.

C) both of the above.

D) neither of the above.

A) short run.

B) long run.

C) both of the above.

D) neither of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

The period of time when the Fed was essentially monetizing the debt was

A) the Great Depression.

B) the Great Inflation.

C) WWI.

D) WWII.

A) the Great Depression.

B) the Great Inflation.

C) WWI.

D) WWII.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

A serious mistake monetary policymakers made during the Great Depression was

A) targeting monetary aggregates.

B) monetizing the debt.

C) raising the reserve requirement.

D) none of the above.

A) targeting monetary aggregates.

B) monetizing the debt.

C) raising the reserve requirement.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a central bank is using the Taylor Rule and decides to lower its inflation target, this will lead to ____ interest rate targets.

A) higher

B) lower

C) unchanged

D) cannot be determined

A) higher

B) lower

C) unchanged

D) cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following central bank policies would be pro-cyclical?

A) fixing an interest rate at a constant value

B) fixing the money supply at a constant value

C) inflation targeting

D) none of the above

A) fixing an interest rate at a constant value

B) fixing the money supply at a constant value

C) inflation targeting

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Taylor Rule is a formula for how the federal funds rate should respond to changes in the

A) inflation gap.

B) output gap.

C) the equilibrium real federal funds rate.

D) all of the above.

A) inflation gap.

B) output gap.

C) the equilibrium real federal funds rate.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Federal Reserve chairman credited with ending the Great Inflation is

A) Ben Bernanke.

B) Alan Greenspan.

C) Paul Volker.

D) none of the above.

A) Ben Bernanke.

B) Alan Greenspan.

C) Paul Volker.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

53

According to the Taylor Rule, if the output gap rises by 1% and inflation rises by 2%, then the federal funds rate should rise by

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

A) 2.0%.

B) 2.5%.

C) 3.0%.

D) 3.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

54

According to the Taylor Rule, if the output gap rises by 2% and the inflation gap rises by 1%, then the real federal funds rate should rise by

A) 1.5%.

B) 2.0%.

C) 2.5%.

D) 3.0%.

A) 1.5%.

B) 2.0%.

C) 2.5%.

D) 3.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is one problem with targeting monetary aggregates?

A) The impact of policy changes is hard to determine.

B) It is pro-cyclical.

C) It leads to low volatility in interest rates.

D) All of the above.

A) The impact of policy changes is hard to determine.

B) It is pro-cyclical.

C) It leads to low volatility in interest rates.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

56

According to the Taylor Rule, if the output gap rises by 3% and inflation falls by 1%, then the federal funds rate should

A) fall by 2%.

B) fall by 1%.

C) remain unchanged.

D) rise by 1%.

A) fall by 2%.

B) fall by 1%.

C) remain unchanged.

D) rise by 1%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

57

If a central bank is following a policy of fixing an interest rate at a constant value, then, if the economy expands, the bank will respond by

A) shifting the demand for money to the left.

B) shifting the demand for money to the right.

C) shifting the supply of money to the left.

D) shifting the supply of money to the right.

A) shifting the demand for money to the left.

B) shifting the demand for money to the right.

C) shifting the supply of money to the left.

D) shifting the supply of money to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

58

Formally adopting inflation targeting can lead to

A) a short run recession.

B) long run price stability.

C) a loss of independence for the central bank.

D) all of the above.

A) a short run recession.

B) long run price stability.

C) a loss of independence for the central bank.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

59

According to the Taylor Rule, if the output gap falls by 2% and the inflation gap rises by 1%, then the real federal funds rate should be

A) lowered by 1.0%.

B) lowered by 0.5%.

C) left unchanged.

D) raised by 1.0%.

A) lowered by 1.0%.

B) lowered by 0.5%.

C) left unchanged.

D) raised by 1.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following countries had some success with targeting monetary aggregates?

A) Germany

B) United States

C) New Zealand

D) none of the above

A) Germany

B) United States

C) New Zealand

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

61

Formal adoption of inflation targeting can lead to a loss of independence for a central bank. Briefly explain why this is not necessarily a problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

62

The textbook says that fixing an interest rate is pro-cyclical, but the Fed now uses something like a Taylor Rule, which targets an interest rate. Why isn't this a contradiction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

63

The equilibrium real fed funds rate is 2%, the inflation target is 2% and the growth rate of potential output is 3%. If inflation is 8% and output growth is 6%, find the federal funds rate recommended by the Taylor Rule. (Note: The output gap is output growth minus potential output growth.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the equilibrium real fed funds rate and the inflation target are 2%, actual inflation is 4%, and the output gap is 1%, find the federal funds rate recommended by the Taylor Rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

65

What was the Fed's primary goal during WWII, and what was the result following the war?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

66

Why do people speculate that the Feds haven't adopted explicit targets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

67

The equilibrium real fed funds rate is 2%, the inflation target is 2% and the growth rate of potential output is 3%. If inflation is -1% and GDP growth is 0%, find the federal funds rate recommended by the Taylor Rule. What is an additional problem in this situation? (Note: The output gap is output growth minus potential output growth.)

The recommended fed funds rate is -2%, but nominal rate can't fall below zero (for any sustained period of time).

The recommended fed funds rate is -2%, but nominal rate can't fall below zero (for any sustained period of time).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

68

How did Regulation Q dampen economic growth in the 1970s?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

69

Some students end up cramming for finals. Explain why this is a result of a time consistency problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

70

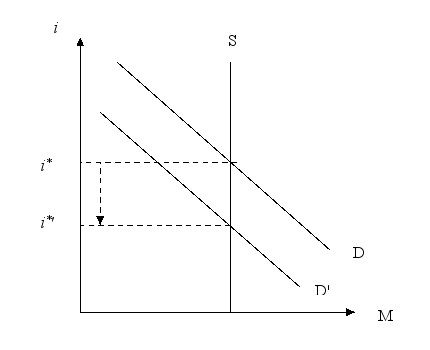

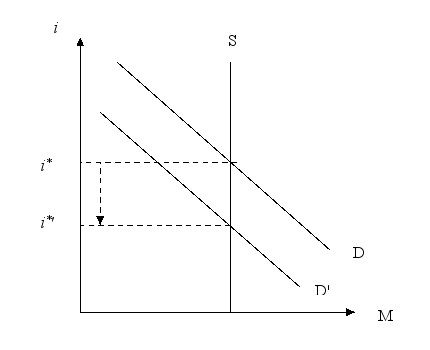

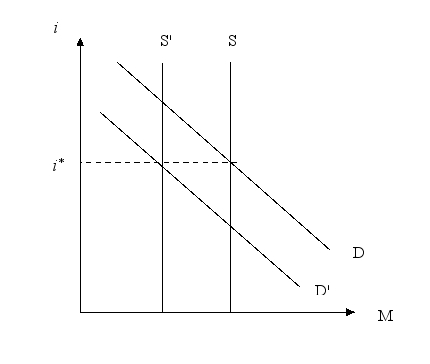

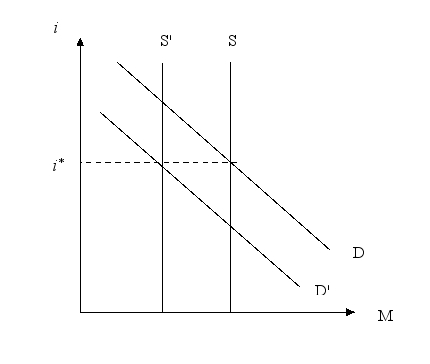

A central bank adopts a policy of fixing the supply of money at a constant value. Use a graph of the supply and demand for money to show the effect of a recession on interest rates. Is the policy pro-cyclical or anti-cyclical? Explain briefly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

71

When the Fed was created, what was its primary intended function?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

72

If the equilibrium real fed funds rate is 2%, the inflation gap is 1%, and the output gap is 2%, find the real federal funds rate recommended by the Taylor Rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

73

What are the two goals that can be in conflict, leading to the time consistency problem for monetary policymakers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Taylor principle says that the real federal funds rate should rise if inflation rises. Write the equation for the Taylor Rule in terms of the real rate and explain whether it satisfies the Taylor principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

75

According to their mandates, who is more concerned about inflation, the Fed or the ECB?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a central bank adopts a policy of fixing an interest rate at a constant value and the economy enters a recession, what would happen to money supply and demand? Explain with a graph. Is this policy pro-cyclical or anti-cyclical?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the equilibrium real fed funds rate and the inflation target are 2%, actual inflation is 3%, and the output gap is -1%, find the real federal funds rate recommended by the Taylor Rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck