Deck 13: Revenue and Expense Recognition: Additional Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 13: Revenue and Expense Recognition: Additional Concepts

1

Which of the following is NOT necessary in order to recognise revenue under the percentage of completion method?

A) Total costs for the project are reasonably determinable.

B) The contract price (total revenue) must be reasonably certain.

C) There must be a reasonable assurance of payment.

D) Engineering estimates of the percentage of completion have been made.

A) Total costs for the project are reasonably determinable.

B) The contract price (total revenue) must be reasonably certain.

C) There must be a reasonable assurance of payment.

D) Engineering estimates of the percentage of completion have been made.

D

2

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the third year if the completion of production method was used?

A) $360 000

B) $440 000

C) $800 000

D) $400 000

A) $360 000

B) $440 000

C) $800 000

D) $400 000

C

3

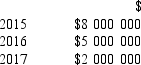

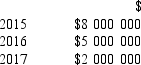

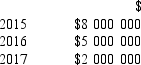

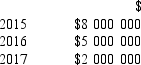

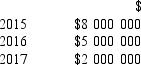

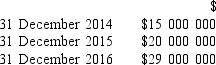

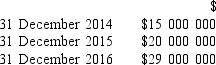

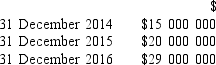

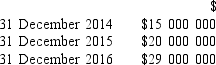

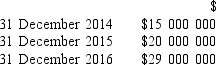

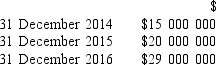

On 1 January 2015, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2015?

A) $800 000

B) $2 000 000

C) $3 200 000

D) $1 300 000

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2015?

A) $800 000

B) $2 000 000

C) $3 200 000

D) $1 300 000

C

4

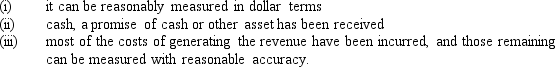

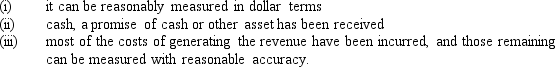

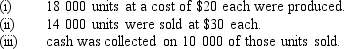

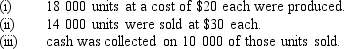

Revenue should be recognised when:

A) (i) and (ii) only

B) (i) and (iii) only

C) (ii) and (iii) only

D) (i), (ii) and (iii)

A) (i) and (ii) only

B) (i) and (iii) only

C) (ii) and (iii) only

D) (i), (ii) and (iii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the second year if the percentage of completion method was used?

A) $200 000

B) $240 000

C) $440 000

D) $1 500 000

A) $200 000

B) $240 000

C) $440 000

D) $1 500 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

Multi-Storey Builders Ltd had a large three-year project with total revenue of $8 000 000 and estimated total costs of $6 500 000. The project was 20 per cent complete at the end of the first year, 70 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the second year if the percentage of completion method was used?

A) $300 000

B) $750 000

C) $1 050 000

D) $0

A) $300 000

B) $750 000

C) $1 050 000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following transactions should not result in revenue recognition in 2016?

A) Services for a customer were carried out on credit in 2016, to be collected in 2017.

B) Services were carried out for a customer for cash in 2016.

C) Payment was received from a customer in 2016, for services provided in 2015.

D) Goods were sold to a customer on credit in 2016, with cash to be collected in 2017.

A) Services for a customer were carried out on credit in 2016, to be collected in 2017.

B) Services were carried out for a customer for cash in 2016.

C) Payment was received from a customer in 2016, for services provided in 2015.

D) Goods were sold to a customer on credit in 2016, with cash to be collected in 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the third year if the percentage of completion method was used?

A) $800 000

B) $440 000

C) $400 000

D) $360 000

A) $800 000

B) $440 000

C) $400 000

D) $360 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

Although revenue may be recognised at various points in the revenue generation sequence, it is normally recognised when:

A) customers forward a firm order.

B) the product is delivered to customer.

C) the customer pays for the goods.

D) the warranty period expires.

A) customers forward a firm order.

B) the product is delivered to customer.

C) the customer pays for the goods.

D) the warranty period expires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

Multi-Storey Builders Ltd had a large three-year project with total revenue of $8 000 000 and estimated total costs of $6 500 000. The project was 20 per cent complete at the end of the first year, 70 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the second year if the completed contract method was used?

A) $300 000

B) $750 000

C) $1 050 000

D) $0

A) $300 000

B) $750 000

C) $1 050 000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

Highrise Constructions Ltd had a large three-year project with total revenue of $5 000 000 and estimated total costs of $4 200 000. The project was 25 per cent complete at the end of the first year, 55 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the first year if the percentage of completion method was used?

A) $200 000

B) $240 000

C) $250 000

D) $800 000

A) $200 000

B) $240 000

C) $250 000

D) $800 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

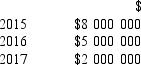

On 1 January 2015, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

A) $2 000 000

B) $3,200 000

C) $6 000 000

D) $7 000 000

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2016?

A) $2 000 000

B) $3,200 000

C) $6 000 000

D) $7 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

Multi-Storey Builders Ltd had a large three-year project with total revenue of $8 000 000 and estimated total costs of $6 500 000. The project was 20 per cent complete at the end of the first year, 70 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the third year if the percentage of completion method was used?

A) $450 000

B) $750 000

C) $1 500 000

D) $240 000

A) $450 000

B) $750 000

C) $1 500 000

D) $240 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements about the critical event in the revenue-generation sequence is true?

A) The most common critical event used is the receipt of cash from the customer.

B) The critical event is the point that can be readily documented and at which all revenue is recognised.

C) There can never be several critical events in a firm's operating cycle.

D) Revenue can be recognised even though no action relating to the contract has been completed.

A) The most common critical event used is the receipt of cash from the customer.

B) The critical event is the point that can be readily documented and at which all revenue is recognised.

C) There can never be several critical events in a firm's operating cycle.

D) Revenue can be recognised even though no action relating to the contract has been completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

The most common critical event in the revenue generation sequence is:

A) manufacture of the goods.

B) delivery to customer.

C) collection of cash.

D) receipt of the order.

A) manufacture of the goods.

B) delivery to customer.

C) collection of cash.

D) receipt of the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

Revenue from a credit sale should not be recognised until:

A) the goods have been paid for.

B) the warranty period has expired.

C) collection is reasonably assured.

D) it is certain that the goods will not be returned.

A) the goods have been paid for.

B) the warranty period has expired.

C) collection is reasonably assured.

D) it is certain that the goods will not be returned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

Multi-Storey Builders Ltd had a large three-year project with total revenue of $8 000 000 and estimated total costs of $6 500 000. The project was 20 per cent complete at the end of the first year, 70 per cent complete at the end of the second year and 100 per cent complete at the end of the third year. Revenues and costs were as estimated. How much profit was earned during the first year if the percentage of completion method was used?

A) $300 000

B) $750 000

C) $1 500 000

D) $1 600 000

A) $300 000

B) $750 000

C) $1 500 000

D) $1 600 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

Revenue recognition means that:

A) revenue is not recorded until payment by the customer.

B) the recording of expenses is delayed until the related revenue has been earned.

C) revenue is recorded when earned.

D) revenue when a deposit is received.

A) revenue is not recorded until payment by the customer.

B) the recording of expenses is delayed until the related revenue has been earned.

C) revenue is recorded when earned.

D) revenue when a deposit is received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

With respect to services provided, it is customary to recognise revenue when the:

A) customer requests the service.

B) supplier agrees to provide the service.

C) service is provided.

D) service is paid for.

A) customer requests the service.

B) supplier agrees to provide the service.

C) service is provided.

D) service is paid for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under which of the following circumstances would revenue normally be recognised?

A) A customer pays an overdue account.

B) A customer pays for goods in advance of production.

C) The business makes a cash purchase of merchandise.

D) The business makes a cash sale of merchandise.

A) A customer pays an overdue account.

B) A customer pays for goods in advance of production.

C) The business makes a cash purchase of merchandise.

D) The business makes a cash sale of merchandise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

At what point would you expect the builder of a football stadium to recognise revenue?

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

The profit for a particular project of Blue Fin Ltd, using the percentage of completion method, was $470 000 for year 1 and $690 000 for year 2 (completion). What difference would there be to profit for year 2 if the completion of production method were used?

A) Profit would be $1 160 000 higher.

B) Profit would be $690 000 higher.

C) Profit would be $470 000 lower.

D) Profit would be $470 000 higher.

A) Profit would be $1 160 000 higher.

B) Profit would be $690 000 higher.

C) Profit would be $470 000 lower.

D) Profit would be $470 000 higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

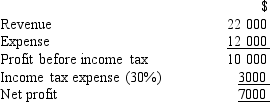

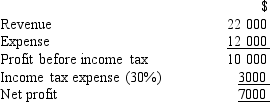

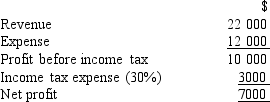

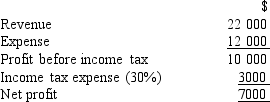

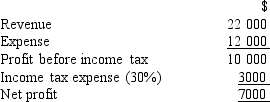

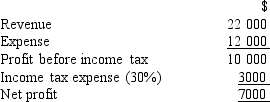

The income statement of Berrima Barbed Wire Ltd is:

If revenue increased by 30 per cent, with no effect on expenses other than income tax, what would be the effect on net after tax profit?

A) It would increase by $6600.

B) It would decrease by $6600.

C) It would increase by $4620.

D) It would decrease by $4620.

If revenue increased by 30 per cent, with no effect on expenses other than income tax, what would be the effect on net after tax profit?

A) It would increase by $6600.

B) It would decrease by $6600.

C) It would increase by $4620.

D) It would decrease by $4620.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

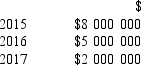

On 1 January 2015, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2017?

A) $7 000 000

B) $6 000 000

C) $800 000

D) $280 000

The project was completed in December 2017. Using the percentage of completion method, what profit would Romulus Ltd report in 2017?

A) $7 000 000

B) $6 000 000

C) $800 000

D) $280 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

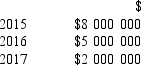

On 1 January 2015, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:

The project was completed in December 2017. Using the completed contract method, how much profit would Romulus Ltd report in 2017?

A) $0

B) $800 000

C) $5 000 000

D) $6 000 000

The project was completed in December 2017. Using the completed contract method, how much profit would Romulus Ltd report in 2017?

A) $0

B) $800 000

C) $5 000 000

D) $6 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

The percentage of completion profit for a particular project of Redgate Ltd was $200 000 for year 1 and $220 000 for year 2 (completion). What difference would there be in profit for year 2 if the completion of production method were used?

A) Profit would be $200 000 higher.

B) Profit would be $200 000 lower.

C) Profit would be $220 000 higher.

D) Profit would be $420 000 higher.

A) Profit would be $200 000 higher.

B) Profit would be $200 000 lower.

C) Profit would be $220 000 higher.

D) Profit would be $420 000 higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

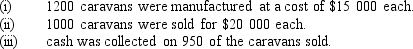

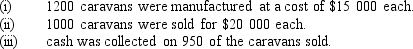

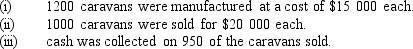

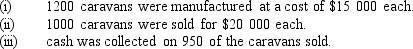

Holidays Ltd manufactures caravans. Transactions for the year ended 30 June 2016 were as follows:

What was the reported profit for the year ended 30 June 2016 if revenue was recognised when cash was received?

A) $5 000 000

B) $6 000 000

C) $24 000 000

D) $4 000 000

What was the reported profit for the year ended 30 June 2016 if revenue was recognised when cash was received?

A) $5 000 000

B) $6 000 000

C) $24 000 000

D) $4 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

At what point would you expect revenue from sales of software by a computer store to be recognised?

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

On 1 January 2014, Peter Ltd signed a contract worth $64 000 000 to construct the Cycling Stadium. The stadium was to be built over three years, with progress payments as follows:

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2014 if the percentage of completion method was used?

A) $3 281 250

B) $4 200 000

C) $4 900 000

D) $5 600 000

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2014 if the percentage of completion method was used?

A) $3 281 250

B) $4 200 000

C) $4 900 000

D) $5 600 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

The percentage of completion profit for a particular project of Redgate Ltd was $200 000 for year 1 and $220 000 for year 2 (completion). What difference would there be to the total profit for the two years if the completion of production method were used?

A) Profit would be $200 000 higher.

B) Profit would be $420 000 higher.

C) Profit would be $420 000 lower.

D) There would be no difference.

A) Profit would be $200 000 higher.

B) Profit would be $420 000 higher.

C) Profit would be $420 000 lower.

D) There would be no difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

Opec Ltd manufactures crystal balls. Transactions for year ended 31 December 2016 were as follows:

What was the reported profit for the year 2016?

A) $100 000

B) $140 000

C) $180 000

D) $350 000

What was the reported profit for the year 2016?

A) $100 000

B) $140 000

C) $180 000

D) $350 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

At what point would you expect revenue from sales of building materials to be recognised?

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

A) During production

B) On completion of production

C) At point of sale or delivery

D) When cash is received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

On 1 January 2014, Peter Ltd signed a contract worth $64 000 000 to construct the Cycling Stadium. The stadium was to be built over three years, with progress payments as follows:

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2016 if the percentage of completion method was used?

A) $3 500 000

B) $5 600 000

C) $6 343 750

D) $14 000 000

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2016 if the percentage of completion method was used?

A) $3 500 000

B) $5 600 000

C) $6 343 750

D) $14 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

Holidays Ltd manufactures caravans. Transactions for the year ended 30 June 2016 were as follows:

What was the reported profit for the year ended 30 June 2016 if revenue was recognised at the point of sale?

A) $4 750 000

B) $5 000 000

C) $6 000 000

D) $2 000 000

What was the reported profit for the year ended 30 June 2016 if revenue was recognised at the point of sale?

A) $4 750 000

B) $5 000 000

C) $6 000 000

D) $2 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

Junction Company had the following transactions, among others, during August. Which transaction represented an expense during August?

A) It paid $3300 in settlement of a loan obtained three months earlier.

B) It paid $500 for advertising performed in June.

C) It purchased $500 of repairs on account for the delivery truck; the account will be paid during September.

D) It paid dividend to shareholders.

A) It paid $3300 in settlement of a loan obtained three months earlier.

B) It paid $500 for advertising performed in June.

C) It purchased $500 of repairs on account for the delivery truck; the account will be paid during September.

D) It paid dividend to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

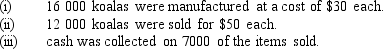

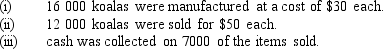

Toy Company manufactures toy koalas. Transactions for the year 2016 were as follows:

What was the reported profit for the year 2016 if revenue was recognised at the point of sale?

A) $140 000

B) $240 000

C) $320 000

D) $350 000

What was the reported profit for the year 2016 if revenue was recognised at the point of sale?

A) $140 000

B) $240 000

C) $320 000

D) $350 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

On 1 January 2014, Peter Ltd signed a contract worth $64 000 000 to construct the Cycling Stadium. The stadium was to be built over three years, with progress payments as follows:

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2015 if the percentage of completion method was used?

A) $5 600 000

B) $4 375 000

C) $3 500 000

D) $10 500 000

Estimated costs were $50 000 000. The project was 35 per cent complete at the end of 2014, 75 per cent complete at the end of 2015 and 100 per cent complete at the end of 2016. Revenues and costs were as estimated. How much profit was earned during 2015 if the percentage of completion method was used?

A) $5 600 000

B) $4 375 000

C) $3 500 000

D) $10 500 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

The profit for a particular project of Blue Fin Ltd, using the percentage of completion method, was $470 000 for year 1 and $690 000 for year 2 (completion). What difference would there be to profit for year 1 if the completion of production method were used?

A) Profit would be $470 000 lower.

B) Profit would be $470 000 higher.

C) There would be no difference.

D) It cannot be determined from the above information.

A) Profit would be $470 000 lower.

B) Profit would be $470 000 higher.

C) There would be no difference.

D) It cannot be determined from the above information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

The profit for a particular project of Blue Fin Ltd, using the percentage of completion method, was $470 000 for year 1 and $690 000 for year 2 (completion). What difference would there be to the total profit for two years if the completion of production method were used?

A) Profit would be $1 160 000 higher.

B) Profit would be $690 000 higher.

C) Profit would be $470 000 higher.

D) There would be no difference.

A) Profit would be $1 160 000 higher.

B) Profit would be $690 000 higher.

C) Profit would be $470 000 higher.

D) There would be no difference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

The percentage of completion profit for a particular project of Redgate Ltd was $200 000 for year 1 and $220 000 for year 2 (completion). What difference would there be in profit for year 1 if the completion of production method were used?

A) Profit would be $200 000 higher.

B) Profit would be $200 000 lower.

C) There would be no difference.

D) It cannot be determined from the above information.

A) Profit would be $200 000 higher.

B) Profit would be $200 000 lower.

C) There would be no difference.

D) It cannot be determined from the above information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on 2016 net profit?

A) It is $1800 too low.

B) It is $3000 too low.

C) It is $1800 too high.

D) It is $3000 too high.

A) It is $1800 too low.

B) It is $3000 too low.

C) It is $1800 too high.

D) It is $3000 too high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on the 2015 net profit?

A) It is $3000 too high.

B) It is $1800 too high.

C) It is $1200 too high.

D) Profit is not affected.

A) It is $3000 too high.

B) It is $1800 too high.

C) It is $1200 too high.

D) Profit is not affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. Assuming that the dividend is unchanged, what is the effect of the error on retained profits at end of 2015?

A) It is $1200 too high.

B) It is $1800 too high.

C) It is $3000 too high.

D) There is no effect.

A) It is $1200 too high.

B) It is $1800 too high.

C) It is $3000 too high.

D) There is no effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on 2015 cash from operations?

A) There is no cash effect.

B) It is $1200 too high.

C) It is $1800 too high.

D) It is $3000 too high.

A) There is no cash effect.

B) It is $1200 too high.

C) It is $1800 too high.

D) It is $3000 too high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

The income statement of Berrima Barbed Wire Ltd is:

If the rate of income tax were raised to 40 per cent, what would be the effect on net profit?

A) It would increase by $700.

B) It would decrease by $700.

C) It would increase by $1000.

D) It would decrease by $1000.

If the rate of income tax were raised to 40 per cent, what would be the effect on net profit?

A) It would increase by $700.

B) It would decrease by $700.

C) It would increase by $1000.

D) It would decrease by $1000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. Assuming that the dividend is unchanged, what is the effect of the error on retained profits at end of 2016?

A) It is $1800 too low.

B) It is $3000 too low.

C) It is $1800 too high.

D) There is no effect.

A) It is $1800 too low.

B) It is $3000 too low.

C) It is $1800 too high.

D) There is no effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

The income statement of Berrima Barbed Wire Ltd is:

If salaries expense amounting to $3000 were eliminated, what would be the effect on net profit after tax?

A) It would decrease by $2100.

B) It would decrease by $3000.

C) It would increase by $2100.

D) It would increase by $3000.

If salaries expense amounting to $3000 were eliminated, what would be the effect on net profit after tax?

A) It would decrease by $2100.

B) It would decrease by $3000.

C) It would increase by $2100.

D) It would increase by $3000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

Leslie Ltd has found an error in its revenue account: an invoice for $3000 was recorded as revenue in 2015 when it should have been recorded in 2016. The company's income tax rate is 40 per cent and there was no corresponding error in cost of goods sold. What is the effect of the error on 2016 cash from operations?

A) It is $3000 too high.

B) It is $1800 too high.

C) It is $1800 too low.

D) There is no cash effect.

A) It is $3000 too high.

B) It is $1800 too high.

C) It is $1800 too low.

D) There is no cash effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck