Deck 2: Measuring and Evaluating Financial Position and Financial Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 2: Measuring and Evaluating Financial Position and Financial Performance

1

Which of the following CANNOT be classified as a current liability?

A) Accounts payable

B) Provision for long service leave

C) Loans

D) Inventory

A) Accounts payable

B) Provision for long service leave

C) Loans

D) Inventory

D

2

Which of the following accounts would appear in an income statement?

A) Accumulated depreciation

B) Cost of goods sold

C) Rent payable

D) None of the answers provided

A) Accumulated depreciation

B) Cost of goods sold

C) Rent payable

D) None of the answers provided

B

3

Which of the following is NOT an intangible asset?

A) Prepayment

B) Goodwill

C) Copyright

D) Brand name

A) Prepayment

B) Goodwill

C) Copyright

D) Brand name

A

4

To which balance sheet grouping does the item 'bank loan repayable in three years' belong?

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is NOT a liability?

A) Provision for long service leave

B) Interest payable

C) Share capital

D) Creditors

A) Provision for long service leave

B) Interest payable

C) Share capital

D) Creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

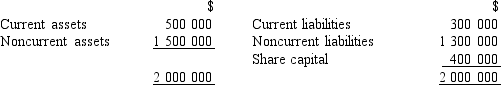

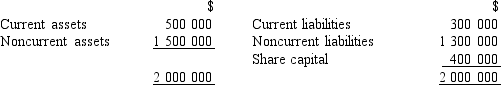

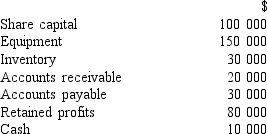

The summarised balance sheet of Apcor Ltd at 30 June 2016 was as follows:

What was Apcor Ltd's working capital at 30 June 2016?

A) $200 000

B) $400 000

C) $500 000

D) $2 000 000

What was Apcor Ltd's working capital at 30 June 2016?

A) $200 000

B) $400 000

C) $500 000

D) $2 000 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Great Escape Company has just purchased a supply of 80 000 litres of diesel fuel for its buses. The diesel fuel is an expense to the company in the accounting period in which the fuel is:

A) ordered from the supplier.

B) received from the supplier.

C) paid for.

D) consumed in the running of the buses.

A) ordered from the supplier.

B) received from the supplier.

C) paid for.

D) consumed in the running of the buses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is NOT true?

A) If total assets decreased by $30 000 during the period and shareholders' equity decreased by $20 000, liabilities decreased by $10 000 for the period.

B) If total assets decreased by $50 000 during the period and shareholders' equity decreased by $30 000, liabilities decreased by $80 000 for the period.

C) If the total assets owned by a company were $80 000 and shareholders' equity totalled $35 000 for the period, liabilities are $45 000.

D) If total assets increased by $45 000 for the period and liabilities decreased by $20 000, shareholders' equity increased by $65 000.

A) If total assets decreased by $30 000 during the period and shareholders' equity decreased by $20 000, liabilities decreased by $10 000 for the period.

B) If total assets decreased by $50 000 during the period and shareholders' equity decreased by $30 000, liabilities decreased by $80 000 for the period.

C) If the total assets owned by a company were $80 000 and shareholders' equity totalled $35 000 for the period, liabilities are $45 000.

D) If total assets increased by $45 000 for the period and liabilities decreased by $20 000, shareholders' equity increased by $65 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

To which balance sheet grouping does the item 'accounts payable' belong?

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

To which balance sheet grouping does the item 'wages payable' belong?

A) Current asset.

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

A) Current asset.

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is a liability?

A) Retained profits

B) Prepaid advertising

C) Accumulated depreciation

D) Expenses payable

A) Retained profits

B) Prepaid advertising

C) Accumulated depreciation

D) Expenses payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

To which balance sheet grouping does the item 'accounts receivable' belong?

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements about accumulated depreciation is true?

A) Accumulated depreciation is the amount of depreciation recognised at the date of disposal of the asset.

B) Cost less accumulated depreciation gives net book value.

C) Accumulated depreciation represents the depreciation charge for the current period.

D) Accumulated depreciation is ignored when an asset is sold.

A) Accumulated depreciation is the amount of depreciation recognised at the date of disposal of the asset.

B) Cost less accumulated depreciation gives net book value.

C) Accumulated depreciation represents the depreciation charge for the current period.

D) Accumulated depreciation is ignored when an asset is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements about assets is NOT true?

A) Assets provide future economic benefits.

B) Assets are economic resources controlled by an organisation.

C) Assets result from past transactions or other events.

D) Assets are recorded at the amount they can be sold for.

A) Assets provide future economic benefits.

B) Assets are economic resources controlled by an organisation.

C) Assets result from past transactions or other events.

D) Assets are recorded at the amount they can be sold for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is NOT true?

A) If total assets owned by a business total $110 000 and owners' equity totals $30 000, then liabilities total $80 000.

B) If total assets decreased by $30 000 during a specific period and owners' equity decreased by $35 000 during the same period, the period's change in total liabilities was a $65 000 increase.

C) If total assets decreased by $50 000 during a specific period and owners' equity decreased by $40 000 during the same period, the period's change in total liabilities was a $10 000 decrease.

D) If total assets increased by $75 000 during a specific period and liabilities decreased by $10 000 during the same period, the period's change in total owners' equity was an

$85 000 increase.

A) If total assets owned by a business total $110 000 and owners' equity totals $30 000, then liabilities total $80 000.

B) If total assets decreased by $30 000 during a specific period and owners' equity decreased by $35 000 during the same period, the period's change in total liabilities was a $65 000 increase.

C) If total assets decreased by $50 000 during a specific period and owners' equity decreased by $40 000 during the same period, the period's change in total liabilities was a $10 000 decrease.

D) If total assets increased by $75 000 during a specific period and liabilities decreased by $10 000 during the same period, the period's change in total owners' equity was an

$85 000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following questions CANNOT be answered from a balance sheet?

A) What has caused the changes in cash held during the period?

B) Is the company soundly financed?

C) Can the company pay its bills on time?

D) Should a dividend be declared?

A) What has caused the changes in cash held during the period?

B) Is the company soundly financed?

C) Can the company pay its bills on time?

D) Should a dividend be declared?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

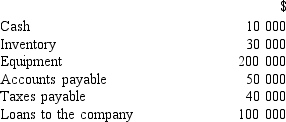

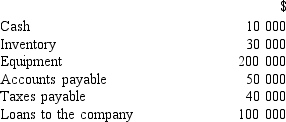

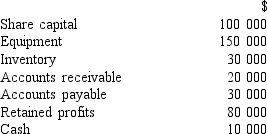

Given only the following information, what is the balance of shareholders' equity?

A) $40 000

B) $50 000

C) $100 000

D) $140 000

A) $40 000

B) $50 000

C) $100 000

D) $140 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements about a balance sheet is true?

A) A balance sheet presents the financial performance of a company for a period of time.

B) A balance sheet presents the company's financial position at a point in time.

C) A balance sheet shows which source of finance produced each asset.

D) A balance sheet includes all the resources of a company.

A) A balance sheet presents the financial performance of a company for a period of time.

B) A balance sheet presents the company's financial position at a point in time.

C) A balance sheet shows which source of finance produced each asset.

D) A balance sheet includes all the resources of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

To which balance sheet grouping does the item 'accumulated depreciation on equipment' belong?

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

A) Current asset

B) Noncurrent asset

C) Current liability

D) Noncurrent liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

The balance sheet of Hemp Ltd at 30 June 2016 showed: noncurrent assets $500 000; noncurrent liabilities $320 000; total liabilities $400 000; and shareholders' equity $300 000. What was the working capital of Hemp Ltd at 30 June 2016?

A) $120 000

B) $180 000

C) $200 000

D) $300 000

A) $120 000

B) $180 000

C) $200 000

D) $300 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company buys 60 refrigerators for $600 each. It sells 40 refrigerators for $1000 each. What is cost of goods sold?

A) $24 000

B) $36 000

C) $40 000

D) None of the answers provided

A) $24 000

B) $36 000

C) $40 000

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is NOT a revenue of a company?

A) Sale of goods

B) Dividends received on shares

C) Rent from premises

D) Issue of shares

A) Sale of goods

B) Dividends received on shares

C) Rent from premises

D) Issue of shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is total revenue for the period in which credit sales are $20 000, cash sales are $16 000 and $14 000 cash is received from a customer as a deposit for work done in the next period?

A) $34 000

B) $36 000

C) $50 000

D) $16 000

A) $34 000

B) $36 000

C) $50 000

D) $16 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the last wages bill for the year is paid on 28 June and $6000 is owing at 30 June in unpaid wages, then:

A) the $6000 would appear as accrued wages payable in the balance sheet but it would not be included in the expenses for the year.

B) the $6000 would appear as accrued wages payable in the balance sheet and would be included in the expenses for the year.

C) the $6000 would not be included in either the balance sheet or the profit and loss statement.

D) the $6000 would appear as an expense in the profit and loss statement.

A) the $6000 would appear as accrued wages payable in the balance sheet but it would not be included in the expenses for the year.

B) the $6000 would appear as accrued wages payable in the balance sheet and would be included in the expenses for the year.

C) the $6000 would not be included in either the balance sheet or the profit and loss statement.

D) the $6000 would appear as an expense in the profit and loss statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

Shareholders invest $100 000 in a business. Inventory of $80 000 is bought on credit and damaged inventory that was purchased on credit for $10 000 was returned. Equipment costing $200 000 was purchased, which was financed by a loan from the seller, repayable in five years. The business paid $40 000 to accounts payable. Total assets increased by:

A) $100 000.

B) $170 000.

C) $330 000.

D) none of the answers provided.

A) $100 000.

B) $170 000.

C) $330 000.

D) none of the answers provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true?

A) If the liabilities owed by a business total $450 000, then the assets also total $450 000.

B) If the assets owned by a business total $500 000, then shareholders' equity also totals $500 000.

C) If the assets owned by a business total $90 000 and liabilities total $50 000, then shareholders' equity totals $40 000.

D) If the assets owned by a business total $90 000 and liabilities total $50 000, then shareholders' equity totals $140 000.

A) If the liabilities owed by a business total $450 000, then the assets also total $450 000.

B) If the assets owned by a business total $500 000, then shareholders' equity also totals $500 000.

C) If the assets owned by a business total $90 000 and liabilities total $50 000, then shareholders' equity totals $40 000.

D) If the assets owned by a business total $90 000 and liabilities total $50 000, then shareholders' equity totals $140 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

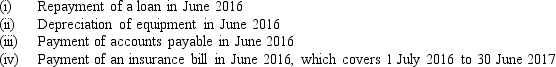

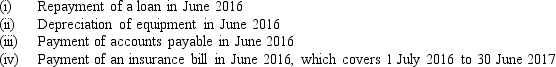

Consider the following transactions:

Which of the above transactions increase June 2016 expenses?

A) (ii) only

B) (i) and (ii) only

C) (i), (ii) and (iii) only.

D) (i), (ii) and (iv) only.

Which of the above transactions increase June 2016 expenses?

A) (ii) only

B) (i) and (ii) only

C) (i), (ii) and (iii) only.

D) (i), (ii) and (iv) only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is NOT an expense?

A) Dividends declared

B) Amount owed to electrician to be paid in the next period

C) Cost of goods sold

D) Wages

A) Dividends declared

B) Amount owed to electrician to be paid in the next period

C) Cost of goods sold

D) Wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a business pays a 12-month insurance premium of $1200 on 1 April 2016, at 30 June 2016 the prepayment will be equal to:

A) $0.

B) $300.

C) $900.

D) $1200.

A) $0.

B) $300.

C) $900.

D) $1200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

James has a business mowing lawns. On 31 December 2016, he has a utility truck worth $7000, a mower worth $250 and an edger worth $110. Fuel on hand cost $70. Customers owe him $360 and he owes his fuel supplier $90. He owes his sister $5000, which is a long-term loan, and he has $110 in his business bank account. What is James's current ratio?

A) 4.2:1

B) 4.7:1

C) 5:1

D) 6:1

A) 4.2:1

B) 4.7:1

C) 5:1

D) 6:1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company buys 100 televisions for $500 each. It sells 60 televisions for $900 each. What is the 'cost of goods sold' expense?

A) $50 000

B) $24 000

C) $54 000

D) $30 000

A) $50 000

B) $24 000

C) $54 000

D) $30 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

In which of the following circumstances is revenue NOT earned by a company?

A) In return for goods supplied, a customer paid $1000 in cash.

B) In return for goods supplied, a customer promised to pay $1000 later.

C) In return for goods supplied, a customer gave the company $1000 in equipment.

D) A customer paid $500 deposit for goods to be supplied in the next accounting period.

A) In return for goods supplied, a customer paid $1000 in cash.

B) In return for goods supplied, a customer promised to pay $1000 later.

C) In return for goods supplied, a customer gave the company $1000 in equipment.

D) A customer paid $500 deposit for goods to be supplied in the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is NOT a revenue of a company?

A) Cash sales

B) Credit sales

C) Interest on investments

D) Borrowing from a bank

A) Cash sales

B) Credit sales

C) Interest on investments

D) Borrowing from a bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is total revenue for the period in which: (i) credit sales are $100 000 of which $30 000 was received at year-end; (ii) $10 000 cash was received from customers for work done in the previous year; (iii) $12 000 was received from customers for work to be done in the next accounting period?

A) $30 000.

B) $100 000.

C) $110 000.

D) $112 000.

A) $30 000.

B) $100 000.

C) $110 000.

D) $112 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is NOT an expense of a company?

A) Cost of goods sold

B) Repayment of principal on a loan

C) Repayment of interest on a loan

D) Sales commission

A) Cost of goods sold

B) Repayment of principal on a loan

C) Repayment of interest on a loan

D) Sales commission

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

James has a business mowing lawns. On 31 December 2016, he has a utility truck worth $7000, a mower worth $250 and an edger worth $110. Fuel on hand cost $70. Customers owe him $360 and he owes his fuel supplier $90. He owes his sister $5000, which is a long-term loan, and he has $110 in his business bank account. What is James's owners' equity?

A) $110

B) $2590

C) $2810

D) $7810

A) $110

B) $2590

C) $2810

D) $7810

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

Bruce operates a coffee stall at the university. On 30 June 2016, he has $400 in his business bank account, the stall and equipment are worth $5200, ingredients on hand cost $60 and paper cups cost $10. Students owe him $120 and he owes his suppliers $370. He also owes his mother $4100, which enabled him to get started. What is Bruce's owners' equity?

A) $400

B) $1320

C) $4000

D) $5420

A) $400

B) $1320

C) $4000

D) $5420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is NOT an expense of a company?

A) Cost of goods sold

B) Dividends paid to shareholders

C) Interest for the period

D) Depreciation on factory

A) Cost of goods sold

B) Dividends paid to shareholders

C) Interest for the period

D) Depreciation on factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

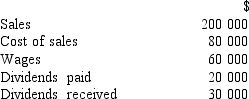

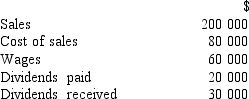

39

Given only the following information, calculate net profit.

A) $40 000

B) $60 000

C) $70 000

D) $90 000

A) $40 000

B) $60 000

C) $70 000

D) $90 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a company pays a 12-month insurance premium for $2400 on 1 June 2016, then at 30 June 2016 the accounts will show:

A) a prepayment of $2200 in the balance sheet and an insurance expense of $200 in the profit and loss account.

B) a prepayment of $200 in the balance sheet and an insurance expense of $2000 in the profit and loss account.

C) a $2400 asset in the balance sheet.

D) a $2400 expense in the profit and loss statement.

A) a prepayment of $2200 in the balance sheet and an insurance expense of $200 in the profit and loss account.

B) a prepayment of $200 in the balance sheet and an insurance expense of $2000 in the profit and loss account.

C) a $2400 asset in the balance sheet.

D) a $2400 expense in the profit and loss statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

The connecting link between the balance sheet and the income statement is:

A) dividends paid to shareholders.

B) the opening balance of retained profits.

C) total shareholders' equity.

D) net profit after tax.

A) dividends paid to shareholders.

B) the opening balance of retained profits.

C) total shareholders' equity.

D) net profit after tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Wages of $30 000 were paid in June for work done in June; $5000 of wages were owed at end of June for work done in June; and an invoice for $8000 was received for June advertising to be paid in July. What are total expenses for June 2016?

A) $30 000

B) $35 000

C) $43 000

D) $30 000

A) $30 000

B) $35 000

C) $43 000

D) $30 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is an intangible asset?

A) Prepaid insurance

B) Loan from bank

C) Patent

D) Equipment

A) Prepaid insurance

B) Loan from bank

C) Patent

D) Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

During 2016, JLK Ltd earned revenue of $2000 and a net profit of $500. Dividends of $400 were declared. At 1 January 2016, the balance of retained profits was $890, assets were $3800 and liabilities were $1500. What was the balance of JLK Ltd's retained profits at 31 December 2016?

A) $790

B) $890

C) $990

D) $2490

A) $790

B) $890

C) $990

D) $2490

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

During 2016, Beta Ltd incurred expenses of $250 and earned a net profit of $50. Retained profits at 1 January 2016 stood at $70 and dividends declared and paid totalled $30. What was the balance of Beta Ltd's retained profits at 31 December 2016?

A) $30

B) $50

C) $90

D) $150

A) $30

B) $50

C) $90

D) $150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

During 2016, Lift Ltd earned revenues of $500 and incurred expenses of $650. Retained profits at 1 January 2016 were $400, and at 31 December 2016 they were $225. What was the dividend declared by Lift Ltd during the year?

A) $25

B) $175

C) $325

D) None of the answers provided

A) $25

B) $175

C) $325

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company buys 100 computers for $1000 and sells 80 for $1200. What is gross profit?

A) $16 000

B) $20 000

C) $40 000

D) None of the answers provided

A) $16 000

B) $20 000

C) $40 000

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

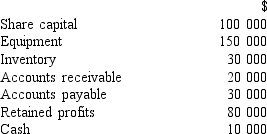

Use the information given below (as at 30 June 2016) to answer the following question.

Assume no dividends were declared during the year. What is the balance of total assets at 30 June 2016?

A) $200 000

B) $210 000

C) $290 000

D) $310 000

Assume no dividends were declared during the year. What is the balance of total assets at 30 June 2016?

A) $200 000

B) $210 000

C) $290 000

D) $310 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

The balance of retained profits at the beginning of a period was $1000 and at the end of the period it was $850. A dividend of $50 was declared and paid. What was the net profit/loss for the period?

A) Net loss $100

B) Net profit $100

C) Net loss $200

D) Net profit $200

A) Net loss $100

B) Net profit $100

C) Net loss $200

D) Net profit $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

During the year, Grasso Ltd sold 2000 items at $30 each. The cost price of the items was $22 each. Operating expenses totalled $7000 and income tax expense was $4000. What was the operating profit before tax of Grasso Ltd for the year?

A) $53 000

B) $16 000

C) $9000

D) $5000

A) $53 000

B) $16 000

C) $9000

D) $5000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

During 2016, Beta Ltd incurred expenses of $250 and earned a net profit of $50. Retained profits at 1 January 2016 stood at $70 and dividends declared and paid totalled $30. What were the revenues of Beta Ltd during 2016?

A) $200

B) $250

C) $300

D) $330

A) $200

B) $250

C) $300

D) $330

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

Gross profit is the difference between:

A) sales revenue and operating expenses.

B) sales revenue and cost of goods sold.

C) operating profit before tax and income tax expense.

D) sales and sales returns.

A) sales revenue and operating expenses.

B) sales revenue and cost of goods sold.

C) operating profit before tax and income tax expense.

D) sales and sales returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

During the year, Grasso Ltd sold 2000 items at $30 each. The cost price of the items was $22 each. Operating expenses totalled $7000 and income tax expense was $4000. What was the gross profit of Grasso Ltd for the year?

A) $60 000

B) $16 000

C) $11 000

D) $5000

A) $60 000

B) $16 000

C) $11 000

D) $5000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sales less cost of goods sold equals:

A) gross profit.

B) net profit.

C) net assets.

D) net sales.

A) gross profit.

B) net profit.

C) net assets.

D) net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

The following transactions, among others, occurred during February. Which transaction represented an expense during February?

A) Purchased a computer for $3000 cash.

B) Paid $3300 in settlement of a loan obtained three months earlier.

C) Paid $500 to a garage mechanic for automobile repair work performed in December.

D) Purchased $400 of petrol on account for the delivery trucks. Account will be paid during March.

A) Purchased a computer for $3000 cash.

B) Paid $3300 in settlement of a loan obtained three months earlier.

C) Paid $500 to a garage mechanic for automobile repair work performed in December.

D) Purchased $400 of petrol on account for the delivery trucks. Account will be paid during March.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements about retained profits is true?

A) Retained profits is the sum of past net profits/losses minus dividends declared.

B) Retained profits indicates the total profits earned by a company since its inception.

C) If a company does not pay a dividend, it cannot decrease.

D) Retained profits is the current year's profit.

A) Retained profits is the sum of past net profits/losses minus dividends declared.

B) Retained profits indicates the total profits earned by a company since its inception.

C) If a company does not pay a dividend, it cannot decrease.

D) Retained profits is the current year's profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

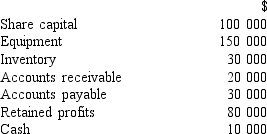

Use the information given below (as at 30 June 2016) to answer the following question.

Assume no dividends were declared during the year. If the balance of retained profits at the start of the year was $50 000, what was the profit for the year?

A) $30 000

B) $80 000

C) $50 000

D) $40 000

Assume no dividends were declared during the year. If the balance of retained profits at the start of the year was $50 000, what was the profit for the year?

A) $30 000

B) $80 000

C) $50 000

D) $40 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

During 2016, Lift Ltd earned revenues of $500 and incurred expenses of $650. Retained profits at 1 January 2016 were $400, and at 31 December 2016 they were $225. What was the net profit or loss of Lift Ltd for the year?

A) Net profit $150

B) Net profit $500

C) Net loss $150

D) Net loss $500

A) Net profit $150

B) Net profit $500

C) Net loss $150

D) Net loss $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is an expense?

A) Prepaid insurance

B) Dividends paid

C) Purchase of inventory

D) Wages owing but not paid at the end of the accounting period

A) Prepaid insurance

B) Dividends paid

C) Purchase of inventory

D) Wages owing but not paid at the end of the accounting period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

During the year ended 30 June 2016, March Ltd earned revenues of $1200 and incurred expenses of $800. Retained profits at 1 July 2015 were $700, and at 30 June 2016, $850. What was the dividend declared by March Ltd during the year?

A) $150

B) $250

C) $550

D) None of the answers provided

A) $150

B) $250

C) $550

D) None of the answers provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck