Deck 16: Accounting for State and Local Governments, Part I

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 16: Accounting for State and Local Governments, Part I

1

What are the basic financial statements that a state or local government now produces

There are only two statements that make up the government-wide statements. These two statements are the Statement of Net Assets and the Statement of Activities. However, due to the amount of fund financial statements, the only two fundamental statements are the Balance Sheet for governmental funds and the Statement of Revenues, Expenditures, and Changes in Fund Balances for the same funds. Examples of these fundamental statements are shown in Exhibits 16.3 and 16.4, respectively.

There are also a number of different funds implemented by the state to monitor all the different areas of spending. There are three categories these funds fall under: governmental, proprietary, and fiduciary.

There are also a number of different funds implemented by the state to monitor all the different areas of spending. There are three categories these funds fall under: governmental, proprietary, and fiduciary.

2

What are the four fund types within the fiduciary funds What types of events does each report

Fiduciary funds account for any assets that are trustee held for external parties. These use the economic resources measurement focus and accrual accounting and are omitted completely from government-wide financial statements. The four are listed below.

1. Investment Trust Funds - This accounts for outside investment pools when the local government accepts monetary resources from other governments to increase its monetary holdings for further investment.

2. Private-Purpose Trust Funds - This holds monies in a trustee like capacity when they are for the benefit of certain external parties. Some of these external parties include specific individuals, private organizations, or other governments.

3. Pension Trust Funds - This fund is for the employee retirement system. This fund has the potential to become quite large as the need to provide financial security for government workers increases.

4. Agency Funds - The fiduciary fund records any governmental resources being held for individuals, private organizations, or other specified governmental areas. An example would be a city government collecting taxes and tolls on behalf of another city or state government.

1. Investment Trust Funds - This accounts for outside investment pools when the local government accepts monetary resources from other governments to increase its monetary holdings for further investment.

2. Private-Purpose Trust Funds - This holds monies in a trustee like capacity when they are for the benefit of certain external parties. Some of these external parties include specific individuals, private organizations, or other governments.

3. Pension Trust Funds - This fund is for the employee retirement system. This fund has the potential to become quite large as the need to provide financial security for government workers increases.

4. Agency Funds - The fiduciary fund records any governmental resources being held for individuals, private organizations, or other specified governmental areas. An example would be a city government collecting taxes and tolls on behalf of another city or state government.

3

At what point in time does a governmental fund report an expenditure

Using modified accrual accounting, expenditures are reported when a claim is established against financial resources and must be settled within the following period. Governments are required by the GASB to disclose the length of time for the change in current financial resources to occur. This is usually dictated to be 60 days into the next period but it can be more or less depending on the claim.

4

In government-wide financial statements, how do intra-activity and interactivity transactions differ How is each type of transaction reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

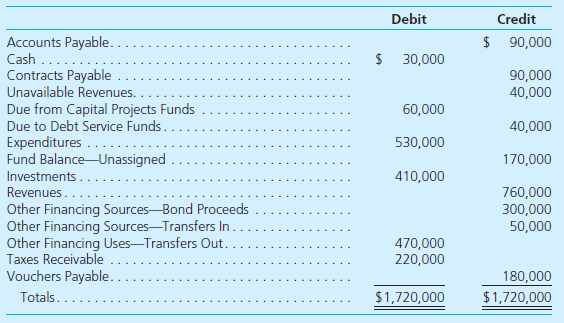

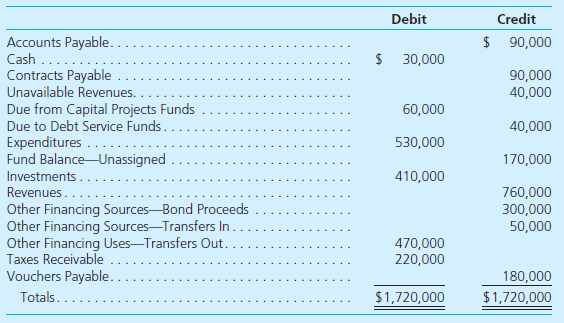

The following trial balance is taken from the General Fund of the City of Jennings for the year ending December 31, 2015. Prepare a condensed statement of revenues, expenditures, and other changes in fund balance and also prepare a condensed balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assume that the City of Coyote has already produced its financial statements for December 31, 2015, and the year then ended. The city's general fund was only for education and parks. Its capital projects funds worked with each of these functions at times during the current year. The city also had established an enterprise fund to account for its art museum.

The government-wide financial statements indicated the following figures:

• Education reported net expenses of $600,000.

• Parks reported net expenses of $100,000.

• Art museum reported net revenues of $50,000.

• General government revenues for the year were $800,000 with an overall increase in the city's net position of $150,000.

The fund financial statements indicated the following for the entire year:

• The general fund reported a $30,000 increase in its fund balance.

• The capital projects fund reported a $40,000 increase in its fund balance.

• The enterprise fund reported a $60,000 increase in its net position.

The CPA firm of Abernethy and Chapman has been asked to review several transactions that occurred during 2015 and indicate how to correct any erroneous reporting and the impact of each error. View each of the following situations as independent.

During 2015, the City of Coyote's General Fund received $10,000, which was recorded as a general revenue when it was actually a program revenue earned by its park program.

a. What was the correct overall change for 2015 in the net position reported on the government- wide financial statements

b. In the general information above, the parks reported net expenses for the period of $100,000. What was the correct amount of net expenses reported by the parks

The government-wide financial statements indicated the following figures:

• Education reported net expenses of $600,000.

• Parks reported net expenses of $100,000.

• Art museum reported net revenues of $50,000.

• General government revenues for the year were $800,000 with an overall increase in the city's net position of $150,000.

The fund financial statements indicated the following for the entire year:

• The general fund reported a $30,000 increase in its fund balance.

• The capital projects fund reported a $40,000 increase in its fund balance.

• The enterprise fund reported a $60,000 increase in its net position.

The CPA firm of Abernethy and Chapman has been asked to review several transactions that occurred during 2015 and indicate how to correct any erroneous reporting and the impact of each error. View each of the following situations as independent.

During 2015, the City of Coyote's General Fund received $10,000, which was recorded as a general revenue when it was actually a program revenue earned by its park program.

a. What was the correct overall change for 2015 in the net position reported on the government- wide financial statements

b. In the general information above, the parks reported net expenses for the period of $100,000. What was the correct amount of net expenses reported by the parks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

Search the Internet for the official website of one or more state or local governments. After reviewing this website, determine whether the latest comprehensive annual financial report (CAFR) is available on the site. For example, the most recent comprehensive annual financial report for the City of Sacramento can be found at http://www.cityofsacramento.org/finance/accounting/ documents/2012CAFR.pdf and the comprehensive annual financial report for the City of Phoenix can be found at http://phoenix.gov/citygovernment/financial/reports/cafr/index.html. Use the financial statements that you locate to answer the following questions.

Required

1. How does the audit opinion given to this city by its independent auditors differ from the audit opinion rendered on the financial statements for a for-profit business

2. A reconciliation should be presented to explain the difference between the net changes in fund balances for the governmental funds (fund financial statements) and the change in net position for the governmental activities (government-wide financial statements). What were several of the largest reasons for the difference

3. What were the city's largest sources of general revenues

4. What was the total amount of expenditures recorded by the general fund during the period How were those expenditures classified

5. What assets are reported for the general fund

6. Review the notes to the financial statements and then determine the number of days the government uses to define the end-of-year financial resources that are viewed as currently available.

7. Did the size of the general fund balance increase or decrease during the most recent year and by how much

Required

1. How does the audit opinion given to this city by its independent auditors differ from the audit opinion rendered on the financial statements for a for-profit business

2. A reconciliation should be presented to explain the difference between the net changes in fund balances for the governmental funds (fund financial statements) and the change in net position for the governmental activities (government-wide financial statements). What were several of the largest reasons for the difference

3. What were the city's largest sources of general revenues

4. What was the total amount of expenditures recorded by the general fund during the period How were those expenditures classified

5. What assets are reported for the general fund

6. Review the notes to the financial statements and then determine the number of days the government uses to define the end-of-year financial resources that are viewed as currently available.

7. Did the size of the general fund balance increase or decrease during the most recent year and by how much

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

A government expects to receive revenues of $400.000 but has approved expenditures of $430,000. The anticipated shortage will have an impact on which of the following terms

A) Interperiod equity.

B) Modified accrual accounting.

C) Consumption accounting.

D) Account groups.

A) Interperiod equity.

B) Modified accrual accounting.

C) Consumption accounting.

D) Account groups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

A purchase order for $3,000 is recorded in the General Fund for the purchase of a new computer. The computer is received at an actual cost of $3,020. Which of the following is correct

a. Machinery is increased in the General Fund by $3,020.

b. An encumbrance account is reduced by $3,020.

c. An expenditure is increased by $3,020.

d. An expenditure is recorded for the additional $20.

a. Machinery is increased in the General Fund by $3,020.

b. An encumbrance account is reduced by $3,020.

c. An expenditure is increased by $3,020.

d. An expenditure is recorded for the additional $20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

A city issues five-year bonds payable to finance construction of a new school. What recording should be made

A) Report the liability in the government-wide financial statements; show an other financing source in the fund financial statements.

B) Report a liability in the government-wide financial statements and in the fund financial statements.

C) Show an other financing source in the government-wide financial statements and in the fund financial statements.

D) Show an other financing source in the government-wide financial statements; report a liability in the fund financial statements.

A) Report the liability in the government-wide financial statements; show an other financing source in the fund financial statements.

B) Report a liability in the government-wide financial statements and in the fund financial statements.

C) Show an other financing source in the government-wide financial statements and in the fund financial statements.

D) Show an other financing source in the government-wide financial statements; report a liability in the fund financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

Cash of $60,000 is transferred from the General Fund to the Debt Service Fund. What is reported on the fund financial statements

a. No reporting is made.

b. Other Financing Sources increase by $60,000; Other Financing Uses increase by $60,000.

c. Revenues increase by $60,000; Expenditures increase by $60,000.

d. Revenues increase by $60,000; Expenses increase by $60,000.

a. No reporting is made.

b. Other Financing Sources increase by $60,000; Other Financing Uses increase by $60,000.

c. Revenues increase by $60,000; Expenditures increase by $60,000.

d. Revenues increase by $60,000; Expenses increase by $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

A city has only one activity, its school system. The school system is accounted for within the general fund. For convenience, assume that, at the start of 2015, the school system and the city have no assets. During the year, the city assessed $400,000 in property taxes. Of this amount, it collected $320,000 during the year, received $50,000 within a few weeks after the end of the year, and expected the remainder to be collected about six months later. The city makes the following payments during 2015: salary expense, $100,000; rent expense, $70,000; equipment (received on January 1 with a 5-year life and no salvage value), $50,000; land, $30,000; and maintenance expense, $20,000.

In addition, on the last day of the year, the city purchased a $200,000 building by signing a long-term liability. The building has a 20-year life and no salvage value, and the liability accrues interest at a 10 percent annual rate. The city also buys two computers on the last day of the year for $4,000 each. One will be paid for in 30 days and the other in 90 days. The computers should last for four years and have no salvage value. During the year, the school system charged students $3,000 for school fees and collected the entire amount. Any depreciation is recorded using the straight-line method.

a. Produce a statement of net position and a statement of activities for this city's government wide financial statements.

b. Produce a balance sheet and a statement of revenues, expenditures, and changes in fund balance for the fund financial statements. Assume that available is defined by the city as anything to be received within 60 days.

In addition, on the last day of the year, the city purchased a $200,000 building by signing a long-term liability. The building has a 20-year life and no salvage value, and the liability accrues interest at a 10 percent annual rate. The city also buys two computers on the last day of the year for $4,000 each. One will be paid for in 30 days and the other in 90 days. The computers should last for four years and have no salvage value. During the year, the school system charged students $3,000 for school fees and collected the entire amount. Any depreciation is recorded using the straight-line method.

a. Produce a statement of net position and a statement of activities for this city's government wide financial statements.

b. Produce a balance sheet and a statement of revenues, expenditures, and changes in fund balance for the fund financial statements. Assume that available is defined by the city as anything to be received within 60 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

Go to the website www.gasb.org and click on "Projects" included in the list that runs across the top of the page. Then click on "Current Projects." Click on one of the current projects that is listed. Read the sections that are titled "Project Plan" and "Current Developments."

Required

Write a memo to explain the reason that this issue has been chosen for study by GASB. Describe the progress that has been made to date as well as the potential impact on state and local government accounting.

Required

Write a memo to explain the reason that this issue has been chosen for study by GASB. Describe the progress that has been made to date as well as the potential impact on state and local government accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

What measurement focus is used in fund financial statements for governmental funds, and what system is applied to determine the timing of revenue and expenditure recognition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

What are the two major divisions reported in government-wide financial statements What funds are not reported in these financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

How do governmental funds report capital outlay in fund financial statements How do government-wide financial statements report capital expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is an internal exchange transaction, and how is it reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

The City of Havisham has a fiscal year ending December 31, Year 5. If the city were to produce financial statements right now, the following figures would be included:

-- Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000

-- Business-type activities: Assets = $500,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000

-- Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000

-- Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000

Other information: The city council is considered the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year.

For each of the following, indicate whether the overall statement is true or false. Assume that each situation is independent of all others.

a. In the information provided about the city, an error has apparently been made because the amount of proprietary fund assets ($700,000) cannot be greater than the amount of business-type activity assets ($500,000).

b. A separate governmental fund (such as money designated for the construction of Highway 61) is reporting assets totaling $32,000. Based on that information alone, this fund must be reported separately as a major fund.

c. The city starts a bus system to help eliminate traffic congestion. Passengers are charged a nickel for each trip although that fee will not come close to covering the cost of the bus system or pay for its debts. The bus system must be reported as a part of the general fund rather than as a separate enterprise fund.

d. The city council passes an annual budget for all general fund activities. Revenues are expected to be $1 million and approved expenditures are $900,000. These budgetary amounts are recorded through a journal entry at the beginning of the year (an entry that is removed at the end of the year). In recording this budget, an estimated revenue account is debited for $1 million.

e. The city council passes an annual budget for all general fund activities. Revenues are expected to be $1 million and approved expenditures are $900,000. These budgetary amounts are recorded through a journal entry at the beginning of the year (that entry is removed at the end of the year). In recording this budget, an expenditures account is debited for $900,000.

f. The government paid for a 3-year insurance policy on January 1, Year 5, for its school system. If the purchases method had been used, the amount of expenditures reported by the city would be larger for that year than if the consumption method had been used.

g. Money received from an income tax is classified as derived tax revenue.

h. After the provided figures were determined, officials learned that the city was entitled to an additional $100,000 in taxes on income earned during Year 5. Starting on January 1, Year 6, the city will collect $1,000 per day of this amount for the next 98 days (the final $2,000 is expected to be uncollectible). As a result of this discovery, the reported change in net position for the governmental activities in government-wide statements for Year 5 will go up by $98,000.

i. The police department ordered equipment on October 17, Year 5, for $43,000. The equipment was received on December 29, Year 5, but at a cost of $44,000. In the general fund, the encumbrance account was credited for $44,000 and the expenditure account was debited for $44,000 to indicate the switch from monetary commitment to liability.

j. The police department ordered equipment on October 17, Year 5, for $43,000. The equipment was not received prior to the end of Year 5. The police chief authorized the department to accept and pay for the equipment when it arrived in Year 6. In reporting fund financial statements at the end of Year 5, a fund balance-committed of $43,000 should be reported on the balance sheet for the governmental funds.

k. A cash amount of $32,000 is transferred from the general fund to a capital projects fund. On the statement of activities, for the government-wide financial statements, this transaction is shown as both a transfer in and a transfer out.

-- Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000

-- Business-type activities: Assets = $500,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000

-- Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000

-- Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000

Other information: The city council is considered the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year.

For each of the following, indicate whether the overall statement is true or false. Assume that each situation is independent of all others.

a. In the information provided about the city, an error has apparently been made because the amount of proprietary fund assets ($700,000) cannot be greater than the amount of business-type activity assets ($500,000).

b. A separate governmental fund (such as money designated for the construction of Highway 61) is reporting assets totaling $32,000. Based on that information alone, this fund must be reported separately as a major fund.

c. The city starts a bus system to help eliminate traffic congestion. Passengers are charged a nickel for each trip although that fee will not come close to covering the cost of the bus system or pay for its debts. The bus system must be reported as a part of the general fund rather than as a separate enterprise fund.

d. The city council passes an annual budget for all general fund activities. Revenues are expected to be $1 million and approved expenditures are $900,000. These budgetary amounts are recorded through a journal entry at the beginning of the year (an entry that is removed at the end of the year). In recording this budget, an estimated revenue account is debited for $1 million.

e. The city council passes an annual budget for all general fund activities. Revenues are expected to be $1 million and approved expenditures are $900,000. These budgetary amounts are recorded through a journal entry at the beginning of the year (that entry is removed at the end of the year). In recording this budget, an expenditures account is debited for $900,000.

f. The government paid for a 3-year insurance policy on January 1, Year 5, for its school system. If the purchases method had been used, the amount of expenditures reported by the city would be larger for that year than if the consumption method had been used.

g. Money received from an income tax is classified as derived tax revenue.

h. After the provided figures were determined, officials learned that the city was entitled to an additional $100,000 in taxes on income earned during Year 5. Starting on January 1, Year 6, the city will collect $1,000 per day of this amount for the next 98 days (the final $2,000 is expected to be uncollectible). As a result of this discovery, the reported change in net position for the governmental activities in government-wide statements for Year 5 will go up by $98,000.

i. The police department ordered equipment on October 17, Year 5, for $43,000. The equipment was received on December 29, Year 5, but at a cost of $44,000. In the general fund, the encumbrance account was credited for $44,000 and the expenditure account was debited for $44,000 to indicate the switch from monetary commitment to liability.

j. The police department ordered equipment on October 17, Year 5, for $43,000. The equipment was not received prior to the end of Year 5. The police chief authorized the department to accept and pay for the equipment when it arrived in Year 6. In reporting fund financial statements at the end of Year 5, a fund balance-committed of $43,000 should be reported on the balance sheet for the governmental funds.

k. A cash amount of $32,000 is transferred from the general fund to a capital projects fund. On the statement of activities, for the government-wide financial statements, this transaction is shown as both a transfer in and a transfer out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

The City of Bainland has been undergoing financial difficulties because of a decrease in its tax base caused by corporations leaving the area. On January 1, 2015, the city has a fund balance of only $400,000 in its governmental funds. In 2014, the city had revenues of $1.4 million and expenditures of $1.48 million. The city's treasurer has forecast that, unless something is done, revenues will decrease at 2 percent per year while expenditures will increase at 3 percent per year.

Required

1. Create a spreadsheet to predict in what year the government will have a zero fund balance.

2. One proposal is that the city slash its expenditures by laying off government workers. That will lead to a 3 percent decrease in expenditures each year rather than a 3 percent increase. However, because of the unemployment, the city will receive less tax revenue. Thus, instead of a 2 percent decrease in revenues, the city expects a 5 percent decrease per year. Adapt the spreadsheet created in requirement (1) to predict what year the government will have a zero fund balance if this option is taken.

3. Another proposal is to increase spending to draw new businesses to the area. This action will lead to a 7 percent increase in expenditures every year, but revenues are expected to rise by 4 percent per year. Adapt the spreadsheet created in requirement (1) to predict what year the government will have a zero fund balance under this option.

Required

1. Create a spreadsheet to predict in what year the government will have a zero fund balance.

2. One proposal is that the city slash its expenditures by laying off government workers. That will lead to a 3 percent decrease in expenditures each year rather than a 3 percent increase. However, because of the unemployment, the city will receive less tax revenue. Thus, instead of a 2 percent decrease in revenues, the city expects a 5 percent decrease per year. Adapt the spreadsheet created in requirement (1) to predict what year the government will have a zero fund balance if this option is taken.

3. Another proposal is to increase spending to draw new businesses to the area. This action will lead to a 7 percent increase in expenditures every year, but revenues are expected to rise by 4 percent per year. Adapt the spreadsheet created in requirement (1) to predict what year the government will have a zero fund balance under this option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

A citizen of the City of Townsend gives it a gift of $22,000 in investments. The citizen requires that the investments be held but any resulting income must be used to help maintain the city's cemetery. In which fund should this asset be reported

A) Special Revenue Funds.

B) Capital Projects Funds.

C) Permanent Funds.

D) General Fund.

A) Special Revenue Funds.

B) Capital Projects Funds.

C) Permanent Funds.

D) General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

At the end of the current year, a government reports a fund balance-assigned of $9,000 in connection with an encumbrance. What information is being conveyed

a. A donor has given the government $9,000 that must be used in a specified fashion.

b. The government has made $9,000 in commitments in one year that will be honored in the subsequent year.

c. Encumbrances exceeded expenditures by $9,000 during the current year.

d. The government spent $9,000 less than was appropriated.

a. A donor has given the government $9,000 that must be used in a specified fashion.

b. The government has made $9,000 in commitments in one year that will be honored in the subsequent year.

c. Encumbrances exceeded expenditures by $9,000 during the current year.

d. The government spent $9,000 less than was appropriated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

The City of Dylan issues a 10-year bond payable of $1 million at face value on the first day of Year 1. Debt issuance costs of $10,000 are paid on that day. For government-wide financial statements, how is this debt issuance cost reported

A) $1,000 is recorded as an expense and $9,000 is recorded as an asset.

B) $1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources.

C) $10,000 is recorded as an expense.

D) $10,000 is recorded as an asset.

A) $1,000 is recorded as an expense and $9,000 is recorded as an asset.

B) $1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources.

C) $10,000 is recorded as an expense.

D) $10,000 is recorded as an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cash of $20,000 is transferred from the General Fund to the Enterprise Fund to pay for work that was done. What is reported on the government-wide financial statements

a. No reporting is made.

b. Other Financing Sources increase by $20,000; Other Financing Uses increase by $20,000.

c. Revenues increase by $20,000; Expenditures increase by $20,000.

d. Revenues increase by $20,000; Expenses increase by $20,000.

a. No reporting is made.

b. Other Financing Sources increase by $20,000; Other Financing Uses increase by $20,000.

c. Revenues increase by $20,000; Expenditures increase by $20,000.

d. Revenues increase by $20,000; Expenses increase by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

The City of Gargery has a fiscal year ending December 31, Year 5. If the city were to produce financial statements right now, the following figures would be included:

-- Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000.

-- Business-type activities: Assets = $=00,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000.

-- Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000.

-- Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000.

Other information: The city council is viewed as the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year.

For each of the following, indicate whether the overall statement is true or false. Assume that each situation is independent of all others.

a. A cash amount of $19,000 is transferred from the general fund to an internal service fund to pay for work that was done by the print shop for the school system. On the statement of revenues, expenditures, and other changes in fund balances for the Governmental Funds (in the fund financial statements), this resource outflow is reported as an other financing use.

b. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. Per legal requirements, these taxes were solely to finance government operations in Year 6. Starting on January 1, Year 6, the city will collect $1,000 per day for the next 98 days (the final $2,000 is expected to be uncollectible). The change in net position for the governmental activities in the government-wide statements reported for Year 5 should be increased by $98,000.

c. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. Per legal requirements, these taxes were solely to finance government operations in Year 6. Starting on January 1, Year 6, the city will collect $1,000 per day for the next 98 days (the final $2,000 is expected to be uncollectible). The change in fund balances for the Governmental Funds reported for Year 5 should be increased by $60,000.

d. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. As per legal requirements, these taxes were solely to finance government operations in Year 6. The government collected $5,000 on December 30, Year 5, but the rest will not be collected until June of Year 6. On fund financial statements for the Governmental Funds as of December 31, Year 5, the total liability balance will be increased by $5,000.

e. Investments with a value of $5 million are given to the city by a donor. All income earned from these investments must be used to construct a small library in one of the local neighborhoods but the investments must be held forever. In Year 5, income of $480,000 was received from these investments. However, none of this money has yet been spent. On fund financial statements, the year-end balance sheet for the Governmental Funds must show a "fund balance-restricted" of $5 million and a "fund balance-committed" of $480,000.

f. The State of Virginia requires the City of Gargery to buy equipment to monitor local air quality. The state awards the city $100,000 to help pay for the equipment. This grant is known as a voluntary nonexchange transaction so that this revenue is not recognized until all eligibility requirements are met.

g. The city constructs curbing for a neighborhood in a special assessment project in which the individuals whose property is benefiting from the curbs will pay for the work. The city has no legal responsibility for this work so it is recorded in an agency fund. The money collected should be reported as program revenues on the statement of activities in the government- wide financial statements.

h. On January 1, Year 5, the city is awarded a grant for $130,000 with this money to be used to supplement the salaries of the police and fire department workers. No money will be received by the city until after the salaries have been paid. On December 30, Year 5, all $130,000 is distributed to the appropriate workers and the city applies for reimbursement to receive the grant money. The money will be received within the next month. The $130,000 revenue is recognized in the government-wide financial statements in Year 5 but not in the fund financial statements for Year 5.

-- Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000.

-- Business-type activities: Assets = $=00,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000.

-- Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000.

-- Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000.

Other information: The city council is viewed as the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year.

For each of the following, indicate whether the overall statement is true or false. Assume that each situation is independent of all others.

a. A cash amount of $19,000 is transferred from the general fund to an internal service fund to pay for work that was done by the print shop for the school system. On the statement of revenues, expenditures, and other changes in fund balances for the Governmental Funds (in the fund financial statements), this resource outflow is reported as an other financing use.

b. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. Per legal requirements, these taxes were solely to finance government operations in Year 6. Starting on January 1, Year 6, the city will collect $1,000 per day for the next 98 days (the final $2,000 is expected to be uncollectible). The change in net position for the governmental activities in the government-wide statements reported for Year 5 should be increased by $98,000.

c. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. Per legal requirements, these taxes were solely to finance government operations in Year 6. Starting on January 1, Year 6, the city will collect $1,000 per day for the next 98 days (the final $2,000 is expected to be uncollectible). The change in fund balances for the Governmental Funds reported for Year 5 should be increased by $60,000.

d. Assume that after the provided figures were determined, city officials learned that $100,000 in property taxes had been assessed but not recorded on December 29, Year 5. As per legal requirements, these taxes were solely to finance government operations in Year 6. The government collected $5,000 on December 30, Year 5, but the rest will not be collected until June of Year 6. On fund financial statements for the Governmental Funds as of December 31, Year 5, the total liability balance will be increased by $5,000.

e. Investments with a value of $5 million are given to the city by a donor. All income earned from these investments must be used to construct a small library in one of the local neighborhoods but the investments must be held forever. In Year 5, income of $480,000 was received from these investments. However, none of this money has yet been spent. On fund financial statements, the year-end balance sheet for the Governmental Funds must show a "fund balance-restricted" of $5 million and a "fund balance-committed" of $480,000.

f. The State of Virginia requires the City of Gargery to buy equipment to monitor local air quality. The state awards the city $100,000 to help pay for the equipment. This grant is known as a voluntary nonexchange transaction so that this revenue is not recognized until all eligibility requirements are met.

g. The city constructs curbing for a neighborhood in a special assessment project in which the individuals whose property is benefiting from the curbs will pay for the work. The city has no legal responsibility for this work so it is recorded in an agency fund. The money collected should be reported as program revenues on the statement of activities in the government- wide financial statements.

h. On January 1, Year 5, the city is awarded a grant for $130,000 with this money to be used to supplement the salaries of the police and fire department workers. No money will be received by the city until after the salaries have been paid. On December 30, Year 5, all $130,000 is distributed to the appropriate workers and the city applies for reimbursement to receive the grant money. The money will be received within the next month. The $130,000 revenue is recognized in the government-wide financial statements in Year 5 but not in the fund financial statements for Year 5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is not a governmental fund

A) Special Revenue Fund.

B) Internal Service Fund.

C) Capital Projects Fund.

D) Debt Service Fund.

A) Special Revenue Fund.

B) Internal Service Fund.

C) Capital Projects Fund.

D) Debt Service Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

What measurement focus is used in government-wide financial statements, and what system is applied to determine the timing of revenue and expense recognition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

Fund financial statements have separate columns for each activity. Which activities are reported in this manner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

What are the two different ways that supplies and prepaid items can be recorded on fund financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cash of $20,000 is transferred from the General Fund to the Enterprise Fund to pay for work that was done. What is reported on the fund financial statements

A) No reporting is made.

B) Other Financing Sources increase by $20,000; Other Financing Uses increase by $20,000.

C) Revenues increase by $20,000; Expenditures increase by $20,000.

D) Revenues increase by $20,000; Expenses increase by $20,000.

A) No reporting is made.

B) Other Financing Sources increase by $20,000; Other Financing Uses increase by $20,000.

C) Revenues increase by $20,000; Expenditures increase by $20,000.

D) Revenues increase by $20,000; Expenses increase by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following transactions relate to the General Fund of the city of Lost Angels for the year ending December 31, 2015. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the purchases method is applied to the supplies and that receipt within 60 days is used as the definition of available resources.

a. Collected property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be collected within 30 days, and the remainder will be received in about five months after the end of the year.

b. Spent $200,000 on four new police cars with 10-year lives. A price of $207,000 had been anticipated when the cars were ordered. The city calculates all depreciation using the straight-line method with no salvage value. The half-year convention is used.

c. Transferred $90,000 to a debt service fund.

d. Issued a long-term bond for $200,000 on July 1. Interest at a 10 percent annual rate will be paid each year starting on June 30, 2016.

e. Ordered a new computer with a 5-year life for $40,000.

f. Paid salaries of $30,000. Another $10,000 is owed at the end of the year but will not be paid for 30 days.

g. Received the new computer but at a cost of $41,000; payment is to be made in 45 days.

h. Bought supplies for $10,000 in cash.

i. Used $8,000 of the supplies in ( h ).

a. Collected property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be collected within 30 days, and the remainder will be received in about five months after the end of the year.

b. Spent $200,000 on four new police cars with 10-year lives. A price of $207,000 had been anticipated when the cars were ordered. The city calculates all depreciation using the straight-line method with no salvage value. The half-year convention is used.

c. Transferred $90,000 to a debt service fund.

d. Issued a long-term bond for $200,000 on July 1. Interest at a 10 percent annual rate will be paid each year starting on June 30, 2016.

e. Ordered a new computer with a 5-year life for $40,000.

f. Paid salaries of $30,000. Another $10,000 is owed at the end of the year but will not be paid for 30 days.

g. Received the new computer but at a cost of $41,000; payment is to be made in 45 days.

h. Bought supplies for $10,000 in cash.

i. Used $8,000 of the supplies in ( h ).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

How have users' needs impacted the development of accounting principles for state and local government units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of thefollowing statements is correct about the reporting of governmental funds

A) Fund financial statements measure economic resources.

B) Government-wide financial statements measure only current financial resources.

C) Fund financial statements measure both economic resources and current financial resources.

D) Government-wide financial statements measure economic resources.

A) Fund financial statements measure economic resources.

B) Government-wide financial statements measure only current financial resources.

C) Fund financial statements measure both economic resources and current financial resources.

D) Government-wide financial statements measure economic resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

A government buys equipment for its police department at a cost of $54,000. Which of the following is not true

a. Equipment will increase by $54,000 in the government-wide financial statements.

b. Depreciation in connection with this equipment will be reported in the fund financial statements.

c. The equipment will not appear within the reported assets in the fund financial statements.

d. An expenditure for $54,000 will be reported in the fund financial statements.

a. Equipment will increase by $54,000 in the government-wide financial statements.

b. Depreciation in connection with this equipment will be reported in the fund financial statements.

c. The equipment will not appear within the reported assets in the fund financial statements.

d. An expenditure for $54,000 will be reported in the fund financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

The City of Frost has a 20-year debt outstanding. On the last day of the current year, this debt has an outstanding balance of $4.8 million and five years remaining until it is due. On that date, the debt is paid off early for $5 million. A new debt is issued (with a lower interest rate) for $5.4 million. How is the $200,000 between the amount paid and the outstanding balance of $4.8 million recognized on government-wide financial statements

A) As an expense.

B) As a reduction in liabilities.

C) As a deferred outflow of resources on the statement of net position.

D) As an asset on the statement of net position.

A) As an expense.

B) As a reduction in liabilities.

C) As a deferred outflow of resources on the statement of net position.

D) As an asset on the statement of net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

The board of commissioners of the City of Hartmoore adopted a general fund budget for the year ending June 30, 2015, that included revenues of $1,000,000, bond proceeds of $400,000, appropriations of $900,000, and operating transfers out of $300,000. If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year What later entry is required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the transactions in problem (47) but prepare a statement of net position for the government- wide financial statements. Assume that the general fund had $180,000 in cash on the first day of the year and no other assets or liabilities. No amount was restricted, committed, or assigned.

REF:

The following transactions relate to the General Fund of the city of Lost Angels for the year ending December 31, 2015. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the purchases method is applied to the supplies and that receipt within 60 days is used as the definition of available resources.

a. Collected property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be collected within 30 days, and the remainder will be received in about five months after the end of the year.

b. Spent $200,000 on four new police cars with 10-year lives. A price of $207,000 had been anticipated when the cars were ordered. The city calculates all depreciation using the straight-line method with no salvage value. The half-year convention is used.

c. Transferred $90,000 to a debt service fund.

d. Issued a long-term bond for $200,000 on July 1. Interest at a 10 percent annual rate will be paid each year starting on June 30, 2016.

e. Ordered a new computer with a 5-year life for $40,000.

f. Paid salaries of $30,000. Another $10,000 is owed at the end of the year but will not be paid for 30 days.

g. Received the new computer but at a cost of $41,000; payment is to be made in 45 days.

h. Bought supplies for $10,000 in cash.

i. Used $8,000 of the supplies in ( h ).

REF:

The following transactions relate to the General Fund of the city of Lost Angels for the year ending December 31, 2015. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the purchases method is applied to the supplies and that receipt within 60 days is used as the definition of available resources.

a. Collected property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be collected within 30 days, and the remainder will be received in about five months after the end of the year.

b. Spent $200,000 on four new police cars with 10-year lives. A price of $207,000 had been anticipated when the cars were ordered. The city calculates all depreciation using the straight-line method with no salvage value. The half-year convention is used.

c. Transferred $90,000 to a debt service fund.

d. Issued a long-term bond for $200,000 on July 1. Interest at a 10 percent annual rate will be paid each year starting on June 30, 2016.

e. Ordered a new computer with a 5-year life for $40,000.

f. Paid salaries of $30,000. Another $10,000 is owed at the end of the year but will not be paid for 30 days.

g. Received the new computer but at a cost of $41,000; payment is to be made in 45 days.

h. Bought supplies for $10,000 in cash.

i. Used $8,000 of the supplies in ( h ).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

The City of Hampshore is currently preparing financial statements for the past fiscal year. The city manager is concerned because the city encountered some unusual transactions during the current fiscal period and is unsure as to their handling.

Required

Locate a copy (either in hard copy or online) of GASB's Codification of Governmental Accounting and Reporting Standards. Either through an online search or a review of the index, answer each of the following questions.

1. For government accounting, what is the definition of an extraordinary item

2. For government accounting, what is the definition of a special item

3. On government-wide financial statements, how should extraordinary items and special items be reported

Required

Locate a copy (either in hard copy or online) of GASB's Codification of Governmental Accounting and Reporting Standards. Either through an online search or a review of the index, answer each of the following questions.

1. For government accounting, what is the definition of an extraordinary item

2. For government accounting, what is the definition of a special item

3. On government-wide financial statements, how should extraordinary items and special items be reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

What assets are viewed as current financial resources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

The General Fund of a city reports assets of $300,000 and liabilities of $200,000 in the fund financial statements. Explain what is meant by each of the following balances: fund balance-nonspendable of $40,000, fund balance-restricted of $28,000, fund balance-committed of $ 17,000, fund balance- -assigned of $4,000, and fund balance-unassigned of $ 11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

What are the four classifications of nonexchange revenues that a state or local government can recognize In each case, when are revenues normally recognized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

A city orders a new computer for its General Fund at an anticipated cost of $88,000. Its actual cost when received is $89,400. Payment is subsequently made. Give all required journal entries for fund and government-wide financial statements. What information do the government-wide financial statements present What information do the fund financial statements present

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

Government officials of the City of Jones expect to receive general fund revenues of $400,000 in 2015 but approve spending only $380,000. Later in the year, as they receive more information, they increase the revenue projection to $420,000. Officials also approve the spending of an additional $15,000. For each of the following, indicate whether the statement is true or false and, if false, explain why.

a. In recording this budget, appropriations should be credited initially for $380,000.

b. The city must disclose this budgetary data within the required supplemental information section reported after the notes to the financial statements.

c. When reporting budgetary information for the year, three figures should be reported: amended budget, initial budget, and actual figures.

d. In making the budgetary entry, a debit must be made to some type of Fund Balance account to indicate the projected surplus and its effect on the size of the fund.

e. The reporting of the budget is reflected in the government-wide financial statements.

a. In recording this budget, appropriations should be credited initially for $380,000.

b. The city must disclose this budgetary data within the required supplemental information section reported after the notes to the financial statements.

c. When reporting budgetary information for the year, three figures should be reported: amended budget, initial budget, and actual figures.

d. In making the budgetary entry, a debit must be made to some type of Fund Balance account to indicate the projected surplus and its effect on the size of the fund.

e. The reporting of the budget is reflected in the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

Go to the website www.gasb.org and click on "About GASB" included in the list that runs across the top of the page. Then click on "Mission, Vision, and Core Values." Read the information provided by GASB.

Required

Assume that a financial analyst with whom you are working is interested in knowing more about the purpose of GASB. Write a short memo explaining the work of GASB based on its vision, mission, core values, and goals.

Required

Assume that a financial analyst with whom you are working is interested in knowing more about the purpose of GASB. Write a short memo explaining the work of GASB based on its vision, mission, core values, and goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is correct about the reporting of governmental funds

A) Fund financial statements measure revenues and expenditures based on modified accrual accounting.

B) Government-wide financial statements measure revenues and expenses based on modified accrual accounting.

C) Fund financial statements measure revenues and expenses based on accrual accounting.

D) Government-wide financial statements measure revenues and expenditures based on accrual accounting.

A) Fund financial statements measure revenues and expenditures based on modified accrual accounting.

B) Government-wide financial statements measure revenues and expenses based on modified accrual accounting.

C) Fund financial statements measure revenues and expenses based on accrual accounting.

D) Government-wide financial statements measure revenues and expenditures based on accrual accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

A city acquires supplies for its fire department and uses the consumption method of accounting. Which of the following statements is true tor the fund statements

a. An expenditures account was debited at the time of receipt.

b. An expense is recorded as the supplies are consumed.

c. An inventory account is debited at the time of the acquisition.

d. The supplies are recorded within the General Fixed Assets Account Group.

a. An expenditures account was debited at the time of receipt.

b. An expense is recorded as the supplies are consumed.

c. An inventory account is debited at the time of the acquisition.

d. The supplies are recorded within the General Fixed Assets Account Group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

A $110,000 payment is made on a long-term liability. Of this amount, $10,000 represents interest. Which of the following is not true

a. Reduce liabilities by $100,000 in the government-wide financial statements.

b. Record a $110.000 expenditure in the fund financial statements.

c. Reduce liabilities by $100,000 in the fund financial statements.

d. Recognize $10,000 interest expense in the government-wide financial statements.

a. Reduce liabilities by $100,000 in the government-wide financial statements.

b. Record a $110.000 expenditure in the fund financial statements.

c. Reduce liabilities by $100,000 in the fund financial statements.

d. Recognize $10,000 interest expense in the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

Cash of $90,000 is transferred from a city's General Fund to start construction on a police station. The city issues a bond at its $1.8 million face value. The police station is built for $1.89 million. Prepare all necessary journal entries for these transactions for fund and government-wide financial statements. Assume that the city does not record the commitment. What information do the government-wide financial statements present What information do the fund financial statements present

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

On December 1, 2015, a state government awards a city government a grant of $1 million to be used specifically to provide hot lunches for all schoolchildren. No money is received until June 1, 2016. For each of the following, indicate whether the statement is true or false and, if false, explain why.

a. Because the government received no money until June 1, 2016, no amount of revenue can be recognized in 2015 on the government-wide financial statements.

b. If this grant has no eligibility requirements and the money is properly spent in September 2016 for the hot lunches, the revenue should be recognized during that September.

c. Because this money came from the state government and because that government specified its use, this is a government-mandated nonexchange transaction.

d. If the government had received the money on December 1, 2015, but eligibility reimbursement requirements had not been met yet, unearned revenue of $1 million would have been recognized on the government-wide financial statements.

a. Because the government received no money until June 1, 2016, no amount of revenue can be recognized in 2015 on the government-wide financial statements.

b. If this grant has no eligibility requirements and the money is properly spent in September 2016 for the hot lunches, the revenue should be recognized during that September.

c. Because this money came from the state government and because that government specified its use, this is a government-mandated nonexchange transaction.

d. If the government had received the money on December 1, 2015, but eligibility reimbursement requirements had not been met yet, unearned revenue of $1 million would have been recognized on the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is the purpose of a Special Revenue Fund

A) To account for revenues legally or externally restricted as an operating expenditure.

B) To account for ongoing activities.

C) To account for gifts when only subsequently earned income can be expended.

D) To account for the cost of long-lived assets bought with designated funds.

A) To account for revenues legally or externally restricted as an operating expenditure.

B) To account for ongoing activities.

C) To account for gifts when only subsequently earned income can be expended.

D) To account for the cost of long-lived assets bought with designated funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

In applying the current financial resources measurement focus, when are liabilities recognized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

Why are budgetary entries recorded in the individual funds of a state or local government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

When is a receivable recognized for property tax assessments When is the revenue recognized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

The governmental funds of the City of Westchester report $445,000 in assets and $140,000 in liabilities. The following are some of the assets reported by this government.

• Prepaid items-$7,000

• Cash from a bond issuance that must be spent within the school system according to the indenture-$80,000

• Supplies-$5,000

• Investments given by a citizen that will be sold with the proceeds used to beautify a public park-$33,000

• Cash that the assistant director of finance has designated for use in upgrading the local roads-$40,000

• Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$53,000

• Cash that the city council (the highest level of authority in the government) has voted to use to renovate a school gymnasium-$62,000

On a balance sheet for the governmental funds, what fund balance amounts will be reported by the City of Westchester

• Prepaid items-$7,000

• Cash from a bond issuance that must be spent within the school system according to the indenture-$80,000

• Supplies-$5,000

• Investments given by a citizen that will be sold with the proceeds used to beautify a public park-$33,000

• Cash that the assistant director of finance has designated for use in upgrading the local roads-$40,000

• Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$53,000

• Cash that the city council (the highest level of authority in the government) has voted to use to renovate a school gymnasium-$62,000

On a balance sheet for the governmental funds, what fund balance amounts will be reported by the City of Westchester

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

Indicate (i) how each of the following transactions impacts the fund balance of the General Fund, and its classifications, for fund financial statements and (ii) what the impact is on the net asset balance of the Government Activities on the government-wide financial statements.

a. Issue a five-year bond for $6 million to finance general operations.

b. Pay cash of $ 149,000 for a truck to be used by the police department.

c. The fire department pays $ 17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles.

d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.

e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.

f. Businesses make sales of $20 million during the current year. The government charges a 5 percent sales tax. Half of this amount is to be collected 10 days after the end of the year with the remainder to be collected 14 weeks after the end of the year. "Available" has been defined by this government as 75 days.

g. Order a computer for the school system at an anticipated cost of $23,000.

h. A cash transfer of $18,000 is approved from the General Fund to a Capital Projects Fund.

a. Issue a five-year bond for $6 million to finance general operations.

b. Pay cash of $ 149,000 for a truck to be used by the police department.

c. The fire department pays $ 17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles.

d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.

e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.

f. Businesses make sales of $20 million during the current year. The government charges a 5 percent sales tax. Half of this amount is to be collected 10 days after the end of the year with the remainder to be collected 14 weeks after the end of the year. "Available" has been defined by this government as 75 days.

g. Order a computer for the school system at an anticipated cost of $23,000.

h. A cash transfer of $18,000 is approved from the General Fund to a Capital Projects Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

Why have accountability and control been so important in the traditional accounting for state and local governments units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

During the current year, a government buys land for $80,000. Which of the following is not true

A) The land could be reported as an asset by the business-type activities in the government- wide financial statements.

B) The land could be reported as an asset by the governmental activities in the government- wide financial statements.

C) The land could be reported as an asset by the proprietary funds in the fund financial statements.

D) The land could be reported as an asset by the governmental funds in the fund financial statements.

A) The land could be reported as an asset by the business-type activities in the government- wide financial statements.

B) The land could be reported as an asset by the governmental activities in the government- wide financial statements.

C) The land could be reported as an asset by the proprietary funds in the fund financial statements.

D) The land could be reported as an asset by the governmental funds in the fund financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

An income tax is an example of which of the following

a. Derived tax revenue.

b. Imposed nonexchange revenue.

c. Government-mandated nonexchange revenue.

d. Voluntary nonexchange transaction.

a. Derived tax revenue.

b. Imposed nonexchange revenue.

c. Government-mandated nonexchange revenue.

d. Voluntary nonexchange transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

A city constructs a special assessment project (a sidewalk) for which it is secondarily liable. The city issues bonds of $90,000. It authorizes another $10,000 that is transferred out of the General Fund. The sidewalk is built for $100,000. The citizens are billed for $90,000. They pay this amount and the debt is paid off. Where is the $100,000 expenditure for construction recorded

a. It is not recorded by the city.

b. It is recorded in the Agency Fund.

c. It is recorded in the General Fund.

d. It is recorded in the Capital Projects Fund.

a. It is not recorded by the city.

b. It is recorded in the Agency Fund.

c. It is recorded in the General Fund.

d. It is recorded in the Capital Projects Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

Government officials of Hampstead County ordered a computer near the end of the current fiscal year for $6,400 for the police department. It did not arrive prior to the end of the year. At its final meeting of the year, the city council (the highest decision-making authority for the government) agreed to pay for the computer when it arrived in the subsequent year. In producing a set of government-wide financial statements and a set of fund financial statements for the current year, how will this purchase order be reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fund A transfers $20,000 to Fund B. For each of the following, indicate whether the statement is true or false and, if false, explain why.

a. If Fund A is the General Fund and Fund B is an Enterprise Fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.

b. If Fund A is the General Fund and Fund B is a Debt Service Fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.

c. If Fund A is the General Fund and Fund B is an Enterprise Fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes for the governmental funds within the fund financial statements.

d. If Fund A is the General Fund and Fund B is a Special Revenue Fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes within the fund financial statements.

e. If Fund A is the General Fund and Fund B is an Internal Service Fund and this is for work done, the General Fund will report an expense of $20,000 within the fund financial statements.

a. If Fund A is the General Fund and Fund B is an Enterprise Fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.

b. If Fund A is the General Fund and Fund B is a Debt Service Fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.

c. If Fund A is the General Fund and Fund B is an Enterprise Fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes for the governmental funds within the fund financial statements.

d. If Fund A is the General Fund and Fund B is a Special Revenue Fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes within the fund financial statements.

e. If Fund A is the General Fund and Fund B is an Internal Service Fund and this is for work done, the General Fund will report an expense of $20,000 within the fund financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

The City of Danmark is preparing financial statements. Officials are currently working on the statement of activities within the government-wide financial statements. A question has arisen as to whether a particular revenue should be identified on government-wide statements as a program revenue or a general revenue.

Required