Deck 17: Accounting for State and Local Governments, Part II

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 17: Accounting for State and Local Governments, Part II

1

A city government has a 9-year capital lease for property being used within the general fund. The lease was signed on January 1, 2015. Minimum lease payments total $90,000 starting at the end of the first year but have a current present value of $69,000. Annual payments are $10,000, and the interest rate being applied is 10 percent. What liability is reported on the fund financial statements as of December 31, 2015, after the first payment has been made

A) $-0-.

B) $59,000.

C) $65,900.

D) $80,000.

A) $-0-.

B) $59,000.

C) $65,900.

D) $80,000.

In Fund financial statements, the general fund reports neither capital asset nor long-term liability. Those accounts neither are not current financial resources nor are they claim to current financial resources. Instead, expenditure and another financing source are established to reflect the transaction.

In Fund Financial Statements, it records only expenditures for the governmental funds. As a result, no assets are reported other than current financial resources such as cash, receivables and investments. All Capital assets are recorded as expenditures at the time of acquisition.

In the present case, on January 1, 2015, a city signs a 9 year capital lease for property being used within the general fund. The city government has a 9-year capital lease for property and the lease was signed on January 1, 2015. Minimum lease payments total $90,000 starting at the end of the first year but have a current present value of $69,000. The interest rate applied is 10 percent. The first lease annual payment of payment $10,000 was paid at the end of the first year, December 31, 2015.

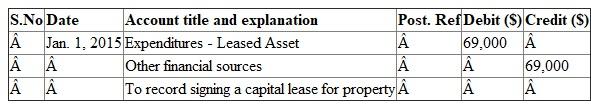

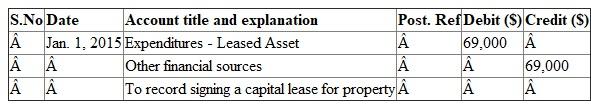

The general fund records the following entry on fund financial statements on January 1, 2015:

The general fund reports neither capital asset nor long-term liability. Instead, an expenditure and an other financing source are established to reflect the transaction.

The general fund reports neither capital asset nor long-term liability. Instead, an expenditure and an other financing source are established to reflect the transaction.

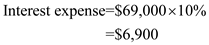

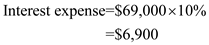

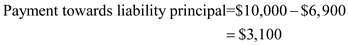

In reporting Fund financial statements, when the first lease annual amount is paid at the end of the year, the interest portion of the annual payment is considered as expenditure for interest, and the rest in an expenditure that reduces the principal.

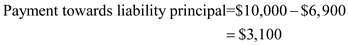

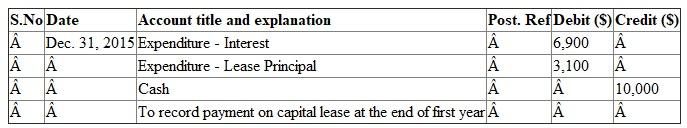

The following entry is made on the Fund financial statements for the payment made at the end of the first year:

The following entry is made on the Fund financial statements for the payment made at the end of the first year:

The expenditure - interest is debited with interest portion of $6,900 of the annual payment and the remainder of $3,100 of the annual payment is debited as Expenditure - Lease Principal. Total amount of annual payment is credited with cash.

The expenditure - interest is debited with interest portion of $6,900 of the annual payment and the remainder of $3,100 of the annual payment is debited as Expenditure - Lease Principal. Total amount of annual payment is credited with cash.

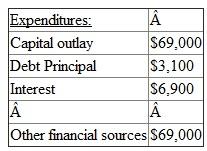

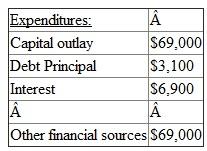

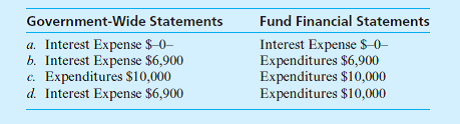

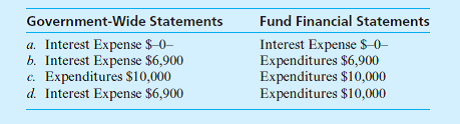

From the above entries, it can be said that the following figures will be found in the Fund financial statements at the end of first year, December 31, 2015.

It can be concluded that after paying the first lease payment on December 31, 2015, there will be no liability reported on the Fund Financial Statements as of December 31, 2015. Hence, Option a. of $ 0- is correct.

It can be concluded that after paying the first lease payment on December 31, 2015, there will be no liability reported on the Fund Financial Statements as of December 31, 2015. Hence, Option a. of $ 0- is correct.

In Fund Financial Statements, it records only expenditures for the governmental funds. As a result, no assets are reported other than current financial resources such as cash, receivables and investments. All Capital assets are recorded as expenditures at the time of acquisition.

In the present case, on January 1, 2015, a city signs a 9 year capital lease for property being used within the general fund. The city government has a 9-year capital lease for property and the lease was signed on January 1, 2015. Minimum lease payments total $90,000 starting at the end of the first year but have a current present value of $69,000. The interest rate applied is 10 percent. The first lease annual payment of payment $10,000 was paid at the end of the first year, December 31, 2015.

The general fund records the following entry on fund financial statements on January 1, 2015:

The general fund reports neither capital asset nor long-term liability. Instead, an expenditure and an other financing source are established to reflect the transaction.

The general fund reports neither capital asset nor long-term liability. Instead, an expenditure and an other financing source are established to reflect the transaction. In reporting Fund financial statements, when the first lease annual amount is paid at the end of the year, the interest portion of the annual payment is considered as expenditure for interest, and the rest in an expenditure that reduces the principal.

The following entry is made on the Fund financial statements for the payment made at the end of the first year:

The following entry is made on the Fund financial statements for the payment made at the end of the first year: The expenditure - interest is debited with interest portion of $6,900 of the annual payment and the remainder of $3,100 of the annual payment is debited as Expenditure - Lease Principal. Total amount of annual payment is credited with cash.

The expenditure - interest is debited with interest portion of $6,900 of the annual payment and the remainder of $3,100 of the annual payment is debited as Expenditure - Lease Principal. Total amount of annual payment is credited with cash. From the above entries, it can be said that the following figures will be found in the Fund financial statements at the end of first year, December 31, 2015.

It can be concluded that after paying the first lease payment on December 31, 2015, there will be no liability reported on the Fund Financial Statements as of December 31, 2015. Hence, Option a. of $ 0- is correct.

It can be concluded that after paying the first lease payment on December 31, 2015, there will be no liability reported on the Fund Financial Statements as of December 31, 2015. Hence, Option a. of $ 0- is correct. 2

The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of the municipal building. Which of the following is true for reporting the gift on the government-wide financial statements

A) A capital asset of $240,000 must be reported.

B) No capital asset will be reported.

C) If conditions are met, recording the sculpture as a capital asset is optional.

D) The sculpture will be recorded but only for the amount paid by the city.

A) A capital asset of $240,000 must be reported.

B) No capital asset will be reported.

C) If conditions are met, recording the sculpture as a capital asset is optional.

D) The sculpture will be recorded but only for the amount paid by the city.

Sculpture does not meet certain criteria to be reported as an asset. However, it will be reported as a revenue because city has received something valuable and has improved its net position by $240,000 (value of sculpture).

Thus, the correct answer is

.

.

Thus, the correct answer is

.

. 3

The City of Bacon is located in the County of Pork. The city has a school system and reports buildings at a net $3.6 million although they are actually worth $4.2 million. The county has another school system and reports buildings at a net $5.2 million although they are actually worth $5.6 million. Both school systems are viewed as special purpose governments. If the school systems are combined in a merger, what should be reported for the buildings

A) $8.6 million.

B) $8.8 million.

C) $9.4 million.

D) $9.8 million.

A) $8.6 million.

B) $8.8 million.

C) $9.4 million.

D) $9.8 million.

The city has a school system and reports buildings at a net $3.6 million although they are actually worth $4.2 million. The county has another school system and reports buildings at a net $5.2 million although they are actually worth $5.6 million. Both school systems are viewed as special purpose governments. These two school systems are combined in a merger.

A merger is a combination of a two legally separate entities that are brought together to form a new entity and no significant consideration is exchanged. A merger is also said to exist if one of those entities ceases to exist while the other continues. The combination of two school systems might well meet the criteria to be deemed a merger.

In a merger, the net carrying values for all assets, overdue outflows of resources, liabilities, and overdue inflow of resources are simply combined in government accounting. No additional account balances are created and recognized as a result of this type of combination.

In the present case, one school system reports buildings at a net $3.6 million and other school system reports buildings at a net $5.2 million although both the school system's buildings actually worth a different value. In the merger of these two school systems, the net carrying values of buildings of both the school systems should be simply combined in government accounting. It means the net carrying values of $3.6 million and $5.2 million of both the school system's buildings are to be simply combined in the merger.

Hence, the value to be reported for buildings in the merger of two school systems should be $8.8 million ($3.6 million + $5.2 million).

From the above, it can be concluded that the value should be reported for buildings in the merger is $8.8 million.

Hence, Option b. of $8.8 million is correct.

A merger is a combination of a two legally separate entities that are brought together to form a new entity and no significant consideration is exchanged. A merger is also said to exist if one of those entities ceases to exist while the other continues. The combination of two school systems might well meet the criteria to be deemed a merger.

In a merger, the net carrying values for all assets, overdue outflows of resources, liabilities, and overdue inflow of resources are simply combined in government accounting. No additional account balances are created and recognized as a result of this type of combination.

In the present case, one school system reports buildings at a net $3.6 million and other school system reports buildings at a net $5.2 million although both the school system's buildings actually worth a different value. In the merger of these two school systems, the net carrying values of buildings of both the school systems should be simply combined in government accounting. It means the net carrying values of $3.6 million and $5.2 million of both the school system's buildings are to be simply combined in the merger.

Hence, the value to be reported for buildings in the merger of two school systems should be $8.8 million ($3.6 million + $5.2 million).

From the above, it can be concluded that the value should be reported for buildings in the merger is $8.8 million.

Hence, Option b. of $8.8 million is correct.

4

The City of Lawrence opens a solid waste landfill in 2015 that is at 54 percent of capacity on December 31, 2015. The city had initially anticipated closure costs of $2 million but later that year decided that closure costs would actually be $2.4 million. None of these costs will be incurred until 2019 when the landfill is scheduled to be closed.

a. What will appear on the government-wide finance al statements for this landfill for the year ended December 31, 2015

b. Assuming that the landfill is recorded within the general fund, what will appear on the fund financial statements for this landfill for the year ended December 31, 2015

a. What will appear on the government-wide finance al statements for this landfill for the year ended December 31, 2015

b. Assuming that the landfill is recorded within the general fund, what will appear on the fund financial statements for this landfill for the year ended December 31, 2015

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

The City of Wolfe has issued its financial statements for Year 4 (assume that the city uses a calendar year). The city maintains the General Fund made up of two functions: (1) education and (2) parks. The city also utilizes capital projects funds for ongoing construction and an enterprise fund to account for its art museum. It also has one discretely presented component unit.

The government-wide financial statements indicated the following Year 4 totals:

Education had net expenses of $710,000.

Parks had net expenses of $130,000.

Art museum had net revenues of $80,000.

General revenues were $900,000; the overall increase in net assets was $140,000.

The fund financial statements issued for Year 4 indicated the following:

The General Fund had an increase of $30,000 in its fund balance.

The Capital Projects Fund had an increase of $40,000 in its fund balance.

The Enterprise Fund had an increase of $60,000 in its net assets,

Officials for Wolfe define "available" as current financial resources to be paid or collected within 60 days.

On the first day of the year, the City of Wolfe bought $20,000 of equipment with a five-year life and no salvage value for its school system. It was. capitalized but no other entries were ever made. The machine was monitored using the modified approach.

a. Based on the information provided above, what was the correct overall change in the net assets in the government-wide financial statements

b. What was the correct amount of net expenses for education in the government-wide statements

The government-wide financial statements indicated the following Year 4 totals:

Education had net expenses of $710,000.

Parks had net expenses of $130,000.

Art museum had net revenues of $80,000.

General revenues were $900,000; the overall increase in net assets was $140,000.

The fund financial statements issued for Year 4 indicated the following:

The General Fund had an increase of $30,000 in its fund balance.

The Capital Projects Fund had an increase of $40,000 in its fund balance.

The Enterprise Fund had an increase of $60,000 in its net assets,

Officials for Wolfe define "available" as current financial resources to be paid or collected within 60 days.

On the first day of the year, the City of Wolfe bought $20,000 of equipment with a five-year life and no salvage value for its school system. It was. capitalized but no other entries were ever made. The machine was monitored using the modified approach.

a. Based on the information provided above, what was the correct overall change in the net assets in the government-wide financial statements

b. What was the correct amount of net expenses for education in the government-wide statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

Read the following journal article: "25 Years of State and Local Governmental Financial Reporting-An Accounting Standards Perspective," The Government Accountants Journal, Fall 1992. Or, as a second possibility, do a search of books in the college library for advanced accounting textbooks or government accounting textbooks that were published prior to 2000.

Required

Accounting for state and local governments has changed considerably in just the last 10-20 years. Write a report to highlight some of the differences you noted between the process described before 2000 and that which has been presented in this chapter and the preceding one in this textbook.

Required

Accounting for state and local governments has changed considerably in just the last 10-20 years. Write a report to highlight some of the differences you noted between the process described before 2000 and that which has been presented in this chapter and the preceding one in this textbook.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

A landfill is scheduled to be filled to capacity gradually over a 10-year period. However, at the end of the first year of operations, the landfill is only 7 percent filled. How much liability for closure and postclosure costs should be recognized on government-wide financial statements How much liability should be recognized on fund financial statements assuming that the landfill is recorded in an enterprise fund How much liability should be recognized on fund financial statements assuming that the landfill is recorded in the General Fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

What does the management's discussion and analysis (MD A) normally include Where does a state or local government present this information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Why does a government determine the net expenses or revenues for each of the functions within its statement of activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

The City of Columbus has approximately 2,000 employees. For the past three decades, the city has provided its employees with a defined benefit pension plan. The plan contract calls for specific payment amounts to be made to each retiree based on a set formula. Money is transferred periodically to a pension trust fund where it is accumulated and invested so that eventual payments can be made.

a. Describe how the city determines the amount (if any) of a net pension liability that should be reported within its government-wide financial statements.

b. Describe how the city determines the amount (if any) of pension expense that should be reported within its government-wide financial statements.

c. How is the pension reported in the fund financial statements for the governmental funds

a. Describe how the city determines the amount (if any) of a net pension liability that should be reported within its government-wide financial statements.

b. Describe how the city determines the amount (if any) of pension expense that should be reported within its government-wide financial statements.

c. How is the pension reported in the fund financial statements for the governmental funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

A police department leases a car on July 1. Year I, with five annual payments of $20,000 each. It immediately makes the first payment, and the present value of the annuity due is $78,000 based on an assumed rate of 10 percent. The ear has a five-year life. Assume that this is a capitalized lease. Indicate whether each of the following independent statements is true or false and briefly explain each answer.

a. The fund financial statements will show a total liability of $3.900 at the end of Year 1.

b. The government-wide financial statements will slum a total liability of $58.000 at the end of Year 1.

c. The government-wide financial statements will show total interest expense of $2,900 in Year 1.

d. The fund financial statements will show total expenditures of $20,000 in Year 1.

e. The government-wide financial statements will show a net leased asset of $70,200 at the end of Year 1.

f. If this were an ordinary annuity so that the first payment was made in Year 2, no expenditure would be reported in the fund financial statements in Year I.

g. If the car had an eight-year useful life, this contract could not be a capitalized lease.

h. Over the entire life of the car, the amount of expense recognized in the government-wide financial statements will be the same as the amount of expenditures recognized in the fund financial statements.

a. The fund financial statements will show a total liability of $3.900 at the end of Year 1.

b. The government-wide financial statements will slum a total liability of $58.000 at the end of Year 1.

c. The government-wide financial statements will show total interest expense of $2,900 in Year 1.

d. The fund financial statements will show total expenditures of $20,000 in Year 1.

e. The government-wide financial statements will show a net leased asset of $70,200 at the end of Year 1.

f. If this were an ordinary annuity so that the first payment was made in Year 2, no expenditure would be reported in the fund financial statements in Year I.

g. If the car had an eight-year useful life, this contract could not be a capitalized lease.

h. Over the entire life of the car, the amount of expense recognized in the government-wide financial statements will be the same as the amount of expenditures recognized in the fund financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

Read the following articles and any other papers that are available on setting governmental accounting standards:

"The Governmental Accounting Standards Board: Factors Influencing Its Operation and Initial Technical Agenda," Government Accountants Journal, Spring 2000.

"Governmental Accounting Standards Come of Age: Highlights from the First 20 Years," Government Finance Review, April 2005.

"Forward-Looking Information: What It Is and Why It Matters," Government Accountants Journal, December 1, 2010.

"Citizen-Centric Reporting," Journal of Government Financial Management, Fall 2010.

"A Century of Governmental Accounting and Financial Reporting Leadership," Government Finance Review, April 2006.

"The GASB Turns 25: A Retrospective," Government Finance Review, April 2009.

"Proposed Changes to the Process Used to Set the GASB's Technical Agenda," Government Finance Review, April 1, 2013.

Required

Write a short paper discussing the evolution of governmental accounting.

"The Governmental Accounting Standards Board: Factors Influencing Its Operation and Initial Technical Agenda," Government Accountants Journal, Spring 2000.

"Governmental Accounting Standards Come of Age: Highlights from the First 20 Years," Government Finance Review, April 2005.

"Forward-Looking Information: What It Is and Why It Matters," Government Accountants Journal, December 1, 2010.

"Citizen-Centric Reporting," Journal of Government Financial Management, Fall 2010.

"A Century of Governmental Accounting and Financial Reporting Leadership," Government Finance Review, April 2006.

"The GASB Turns 25: A Retrospective," Government Finance Review, April 2009.

"Proposed Changes to the Process Used to Set the GASB's Technical Agenda," Government Finance Review, April 1, 2013.

Required

Write a short paper discussing the evolution of governmental accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

A city creates a solid waste landfill. It assesses every person or company that uses the landfill a charge based on the amount of materials contributed. In which of the following will the landfill probably be recorded

A) General Fund.

B) Special revenues funds.

C) Internal service funds.

D) Enterprise funds.

A) General Fund.

B) Special revenues funds.

C) Internal service funds.

D) Enterprise funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

In problem (12), which of the following statements is true about reporting a revenue

a. A revenue will be reported.

b. Revenue is reported but only if the asset is reported.

c. If the asset is not capitalized, no revenue should be recognized.

d. As a gift, no revenue would ever be reported.

a. A revenue will be reported.

b. Revenue is reported but only if the asset is reported.

c. If the asset is not capitalized, no revenue should be recognized.

d. As a gift, no revenue would ever be reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

For component units, what is the difference in discrete presentation and blending

A) A blended component unit is shown to the left of the statements: a discretely presented component unit is shown to the right.

B) A blended component unit is shown at the bottom of the statements; a discretely presented component unit is shown within the statements like a fund.

C) A blended component unit is shown within the statements like a fund; a discretely presented component unit is shown to the right.

D) A blended component unit is shown to the right of the statements; a discretely presented component unit is shown in completely separate statements.

A) A blended component unit is shown to the left of the statements: a discretely presented component unit is shown to the right.

B) A blended component unit is shown at the bottom of the statements; a discretely presented component unit is shown within the statements like a fund.

C) A blended component unit is shown within the statements like a fund; a discretely presented component unit is shown to the right.

D) A blended component unit is shown to the right of the statements; a discretely presented component unit is shown in completely separate statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

On January 1, 2015, a rich citizen of the Town of Ristoni donates a painting valued at $300,000 to be displayed to the public in a government building. Although this painting meets the three criteria to qualify as an artwork, town officials choose to record it as an asset. There are no eligibility requirements for the gift. The asset is judged to be inexhaustible so that depreciation will not be reported.

A) For the year ended December 31, 2015, what will be reported on government-wide financial statements in connection with this gift

B) How does the answer to requirement ( a ) change if the government decides to depreciate this asset over a 10-year period using straight-line depreciation

C) How does the answer to requirement ( a ) change if the government decides not to capitalize the asset

A) For the year ended December 31, 2015, what will be reported on government-wide financial statements in connection with this gift

B) How does the answer to requirement ( a ) change if the government decides to depreciate this asset over a 10-year period using straight-line depreciation

C) How does the answer to requirement ( a ) change if the government decides not to capitalize the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

A city has a solid waste landfill that was filled 12 percent in Year 1 and 26 percent in Year 2. During those periods, the government expected that total closure costs would be $2 million. As a result, it paid $50,000 to an environmental company on July 1 of each of these two years. Such payments will continue for several years to come. Indicate whether each of the following independent statements is true or false and briefly explain each answer. The city has a December 31 year-end.

a. The government-wide financial statements will show a $230,000 expense in Year 2 but only if reported in an enterprise fund.

b. The fund financial statements will show a $50,000 liability in Year 2 if this landfill is reported in the General Fund.

c. The fund financial statements will show a $50,000 liability at the end of Year 2 if this landfill is reported in an enterprise fund.

d. If this landfill is reported in an enterprise fund, the government-wide financial statements and the fund financial statements will basically have the same reporting.

e. The government-wide financial statements will show a $420,000 liability at the end of Year 2.

f. Over the landfill's entire life, the amount of expense recognized in the government-wide financial statements will be the same as the amount of expenditures recognized in the fund financial statements. Assume the landfill is reported in the General Fund.

a. The government-wide financial statements will show a $230,000 expense in Year 2 but only if reported in an enterprise fund.

b. The fund financial statements will show a $50,000 liability in Year 2 if this landfill is reported in the General Fund.

c. The fund financial statements will show a $50,000 liability at the end of Year 2 if this landfill is reported in an enterprise fund.

d. If this landfill is reported in an enterprise fund, the government-wide financial statements and the fund financial statements will basically have the same reporting.

e. The government-wide financial statements will show a $420,000 liability at the end of Year 2.

f. Over the landfill's entire life, the amount of expense recognized in the government-wide financial statements will be the same as the amount of expenditures recognized in the fund financial statements. Assume the landfill is reported in the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

Prior to the creation of government-wide financial statements, the City of Loveland did not report the cost of its infrastructure assets. Now city officials are attempting to determine reported values for major infrastructure assets that it had obtained prior to the preparation of these statements. The chief concern is determining a value for the city's hundreds of miles of roads that were built at various times over the past 20-25 years. Each road is assumed to last for 50 years (depreciation is 2 percent per year).

As of December 31, 2015, city engineers believed that one mile of new road would cost $2.3 million. For convenience, each road is assumed to have been acquired as of January 1 of the year in which it was put into operation. Officials have done some investigation and believe that the cost of constructing a mile of road has increased by 8 percent each year over the past 30 years.

Required

Build a spreadsheet to determine the value that should now be reported for each mile of road depending on the year it was put into operation. For example, what reported value should be disclosed in the government-wide financial statements for 10 miles of roads put into operation on January 1, 1999

As of December 31, 2015, city engineers believed that one mile of new road would cost $2.3 million. For convenience, each road is assumed to have been acquired as of January 1 of the year in which it was put into operation. Officials have done some investigation and believe that the cost of constructing a mile of road has increased by 8 percent each year over the past 30 years.

Required

Build a spreadsheet to determine the value that should now be reported for each mile of road depending on the year it was put into operation. For example, what reported value should be disclosed in the government-wide financial statements for 10 miles of roads put into operation on January 1, 1999

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

A city operates a solid waste landfill. This facility is 11 percent full after the first year of operation and 24 percent after the second year. How much expense should be recognized on the government-wide financial statements in the second year for closure costs Assuming that the landfill is reported in the General Fund, what expenditure should be recognized in the second year on the fund financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

What does a comprehensive annual financial report (known as the CAFR) include

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

How are internal service funds reported on government-wide financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

On January 1, 2015, the City of Graf pays $60,000 for a work of art to display in the local library. The city will take appropriate measures to protect and preserve the piece. However, if the work is ever sold, the money received will go into unrestricted funds. The work is viewed as inexhaustible, but the city has opted to depreciate this cost over 20 years (using the straight-line method).

A) How is this work to be reported on the government-wide financial statements for the year ended December 31, 2015

B) How is this work to be reported in the fund financial statements for the year ended December 31, 2015

A) How is this work to be reported on the government-wide financial statements for the year ended December 31, 2015

B) How is this work to be reported in the fund financial statements for the year ended December 31, 2015

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the same information as in problem (50) except that, by the end of Year 3, the landfill is 40 percent tilled. The city now realizes that the total closure costs will be $3 million. Indicate whether each of the following independent statements is true or false and briefly explain each answer.

a. If the city had known the costs were going to be $3 million from the beginning, the reporting on the fund financial statements would have been different in the past years if the landfill had been reported in an enterprise fund.

b. If the landfill is monitored in the General Fund, a liability will be reported for the governmental activities in the government-wide financial statements at the end of Year 3.

c. A $680,000 expense should be recognized in Year 3 in the government-wide financial statements.

d. Because the closure costs reflect a future flow of cash, any liability reported in the government-wide financial statements must be reported at present value.

a. If the city had known the costs were going to be $3 million from the beginning, the reporting on the fund financial statements would have been different in the past years if the landfill had been reported in an enterprise fund.

b. If the landfill is monitored in the General Fund, a liability will be reported for the governmental activities in the government-wide financial statements at the end of Year 3.

c. A $680,000 expense should be recognized in Year 3 in the government-wide financial statements.

d. Because the closure costs reflect a future flow of cash, any liability reported in the government-wide financial statements must be reported at present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

A city government has obtained an asset through a capital lease. Which of the following is true for the government-wide financial statements

a. The accounting parallels that used in for-profit accounting.

b. The city must report an other financing source.

c. The city must report an expenditure.

d. Recognition of depreciation is optional.

a. The accounting parallels that used in for-profit accounting.

b. The city must report an other financing source.

c. The city must report an expenditure.

d. Recognition of depreciation is optional.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and post closure is estimated at $I million. None of this amount will be paid until the landfill has reached its capacity.

Which of the following is true for the Year 2 government-wide financial statements

A) Both expense and liability will be zero.

B) Both expense and liability will be $I 10.000.

C) Expense will be $110,000 and liability will be $190,000.

D) Expense will be $I00,000 and liability will be $200,000.

Which of the following is true for the Year 2 government-wide financial statements

A) Both expense and liability will be zero.

B) Both expense and liability will be $I 10.000.

C) Expense will be $110,000 and liability will be $190,000.

D) Expense will be $I00,000 and liability will be $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

A city builds sidewalks throughout its various neighborhoods at a cost of $2.1 million. Which of the following is not true

A) Because the sidewalks qualify as infrastructure, the asset is viewed in the same way as land so that no depreciation is recorded.

B) Depreciation is required unless the modified approach is utilized.

C) The modified approach recognizes maintenance expense in lieu of depreciation expense for qualifying infrastructure assets.

D) The modified approach is allowed only if the city maintains the network of sidewalks at least at a predetermined condition.

A) Because the sidewalks qualify as infrastructure, the asset is viewed in the same way as land so that no depreciation is recorded.

B) Depreciation is required unless the modified approach is utilized.

C) The modified approach recognizes maintenance expense in lieu of depreciation expense for qualifying infrastructure assets.

D) The modified approach is allowed only if the city maintains the network of sidewalks at least at a predetermined condition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

A government reports that its public safety function had expenses of $900,000 last year and program revenues of $200,000 so that its net expenses were $700,000. On which financial statement is this information presented

A) Statement of activities.

B) Statement of cash flows.

C) Statement of revenues and expenditures.

D) Statement of net assets.

A) Statement of activities.

B) Statement of cash flows.

C) Statement of revenues and expenditures.

D) Statement of net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

A city government adds street lights within its boundaries at a total cost of $300,000. The lights should burn for at least 10 years but can last significantly longer if maintained properly. The city sets up a system to monitor these lights with the goal that 97 percent will be working at any one time. During the year, the city spends $48,000 to clean and repair the lights so that they are working according to the specified conditions. However, it spends another $78,000 to construct lights for several new streets in the city.

Describe the various ways these costs could be reported on government-wide statements.

Describe the various ways these costs could be reported on government-wide statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

A city receives a copy of its original charter from the year 1799 as a gift from a citizen. The document will be put under glass and displayed in the city hall for all to see. The fair value is estimated at $10,000. Indicate whether each of the following independent statements is true or false and briefly explain each answer.

A) If the city government does not have a policy for handling any proceeds if it ever sells the document, the city must report a $10,000 asset within its government-wide financial statements.

B) Assume that this gift qualifies for optional handling and that the city chooses to report it as an asset. For the government-wide financial statements, depreciation is required.

C) Assume this gift qualifies for optional handling and the document is deemed to be exhaustible. The city must report an immediate expense of $10,000 in the government-wide financial statements.

D) Assume that this gift qualifies for optional handling. The city must make a decision as to whether to recognize a revenue of $10,000 in the government-wide financial statements.

E) Assume that this gift qualifies for optional handling. The city can choose to report the gift in the statement of net activities for the government-wide financial statements in a way so that there is no overall net effect.

A) If the city government does not have a policy for handling any proceeds if it ever sells the document, the city must report a $10,000 asset within its government-wide financial statements.

B) Assume that this gift qualifies for optional handling and that the city chooses to report it as an asset. For the government-wide financial statements, depreciation is required.

C) Assume this gift qualifies for optional handling and the document is deemed to be exhaustible. The city must report an immediate expense of $10,000 in the government-wide financial statements.

D) Assume that this gift qualifies for optional handling. The city must make a decision as to whether to recognize a revenue of $10,000 in the government-wide financial statements.

E) Assume that this gift qualifies for optional handling. The city can choose to report the gift in the statement of net activities for the government-wide financial statements in a way so that there is no overall net effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

What criteria does a state or local government apply to determine whether to capitalize a lease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

A teacher working for the City of Lights will be provided with a defined benefit pension plan. The city sets up a pension trust fund to monitor the resources held for these future payments. How is the amount of net pension liability to be reported in the government-wide financial statements determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

A primary government can be either a general purpose government or a special purpose government. What is the difference in these two How does an activity qualify as a special purpose government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

In governmental accounting, what is the difference between an acquisition and a merger What differences exist between the accounting for an acquisition and for a merger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

The City of Francois, Texas, has begun the process of producing its current comprehensive annual financial report (CAFR). Several organizations that operate within the city are related in some way to the primary government. The city's accountant is attempting to determine how these organizations should be included in the reporting process.

a. What is the major criterion for inclusion in a government's CAFR

b. How does an activity or function qualify as a special purpose government

c. How is the legal separation of a special purpose government evaluated

d. How is the fiscal independence of a special purpose government evaluated

e. What is a component unit, and how is it normally reported on government-wide financial statements

f. How does a primary government prove that it can impose its will on a component unit

g. What does the blending of a component unit mean

a. What is the major criterion for inclusion in a government's CAFR

b. How does an activity or function qualify as a special purpose government

c. How is the legal separation of a special purpose government evaluated

d. How is the fiscal independence of a special purpose government evaluated

e. What is a component unit, and how is it normally reported on government-wide financial statements

f. How does a primary government prove that it can impose its will on a component unit

g. What does the blending of a component unit mean

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

A city starts a public library that has separate incorporation and gets some of its money for operations from the state and some from private donations. Indicate whether each of the following independent statements is true or false and briefly explain each answer.

a. If the city appoints 9 of the 10 directors, it must report the library as a component unit.

b. If the library is a component unit and its financial results are shown as part of the governmental activities of the city, it is known as a blended component unit.

c. If the library appoints its own board but the city must approve its budget, the library must be reported as a blended component unit.

a. If the city appoints 9 of the 10 directors, it must report the library as a component unit.

b. If the library is a component unit and its financial results are shown as part of the governmental activities of the city, it is known as a blended component unit.

c. If the library appoints its own board but the city must approve its budget, the library must be reported as a blended component unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

The City of Abernethy has three large bridges built in the later part of the 1980s that were not capitalized at the time. In creating government-wide financial statements, the city's accountant is interested in receiving suggestions as to how to determine a valid amount to report currently for these bridges.

Required

Use a copy of the GASB Codification of Governmental Accounting and Financial Reporting Standards as the basis for writing a report to this accountant to indicate various ways to make this calculation. Use the Topical Index or skim Section 1400 which covers "Reporting Capital Assets."

Use examples that will help illustrate the process.

Required

Use a copy of the GASB Codification of Governmental Accounting and Financial Reporting Standards as the basis for writing a report to this accountant to indicate various ways to make this calculation. Use the Topical Index or skim Section 1400 which covers "Reporting Capital Assets."

Use examples that will help illustrate the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and post closure is estimated at $I million. None of this amount will be paid until the landfill has reached its capacity.

If this landfill is judged to be a proprietary fund, what liability will be reported at the end of the second year on fund financial statements

A) $-0-.

B) $110,000

C) $190,000.

D) $200,000.

If this landfill is judged to be a proprietary fund, what liability will be reported at the end of the second year on fund financial statements

A) $-0-.

B) $110,000

C) $190,000.

D) $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is true about use of the modified approach

a. It can be applied to all capital assets of a state or local government.

b. It is used to adjust depreciation expense either up or down based on conditions for the period.

c. It is required for infrastructure assets.

d. For qualified assets, it eliminates the recording of depreciation.

a. It can be applied to all capital assets of a state or local government.

b. It is used to adjust depreciation expense either up or down based on conditions for the period.

c. It is required for infrastructure assets.

d. For qualified assets, it eliminates the recording of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

Government-wide financial statements make a distinction between program revenues and general revenues. How is that difference shown

A) Program revenues are offset against the expenses of a specific function; general revenues are assigned to governmental activities and business-type activities in general.

B) General revenues are shown at the top of the statement of revenues and expenditures; program revenues are shown at the bottom.

C) General revenues are labeled as operating revenues; program revenues are shown as miscellaneous income.

D) General revenues are broken down by type; program revenues are reported as a single figure for the government.

A) Program revenues are offset against the expenses of a specific function; general revenues are assigned to governmental activities and business-type activities in general.

B) General revenues are shown at the top of the statement of revenues and expenditures; program revenues are shown at the bottom.

C) General revenues are labeled as operating revenues; program revenues are shown as miscellaneous income.

D) General revenues are broken down by type; program revenues are reported as a single figure for the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

The County of Maxnell decides to create a sanitation department and offer its services to the public for a fee. As a result, county officials plan to account for this activity within the enterprise funds. Make journal entries for this operation for the following 2015 transactions as well as necessary adjusting entries at the end of the year. Assume that the information is being gathered for fund financial statements. Only entries for the sanitation department are required here:

January 1-Received unrestricted funds of $160,000 from the general fund as permanent financing.

February 1-Borrowed an additional $130,000 from a local bank at a 12 percent annual interest rate.

March 1-Ordered a truck at an expected cost of $108,000.

April 1-Received the truck and made full payment. The actual cost amounted to $110,000. The truck has a 10-year life and no salvage value. Straight-line depreciation is to be used.

May 1-Received a $20,000 cash grant from the state to help supplement the pay of the sanitation workers. The money must be used for that purpose.

June 1-Rented a garage for the truck at a cost of $1,000 per month and paid 12 months of rent in advance.

July 1-Charged citizens $13,000 for services. Of this amount, $11,000 has been collected.

August 1-Made a $10,000 cash payment on the 12 percent note of February 1. This payment covers both interest and principal.

September 1-Paid salaries of $18,000 using the grant received on May 1.

October 1-Paid truck maintenance costs of $1,000.

November 1-Paid additional salaries of $10,000, first using the rest of the grant money received May 1.

December 31-Sent invoices totaling $19,000 to customers for services over the past six months. Collected $3,000 cash immediately.

January 1-Received unrestricted funds of $160,000 from the general fund as permanent financing.

February 1-Borrowed an additional $130,000 from a local bank at a 12 percent annual interest rate.

March 1-Ordered a truck at an expected cost of $108,000.

April 1-Received the truck and made full payment. The actual cost amounted to $110,000. The truck has a 10-year life and no salvage value. Straight-line depreciation is to be used.

May 1-Received a $20,000 cash grant from the state to help supplement the pay of the sanitation workers. The money must be used for that purpose.

June 1-Rented a garage for the truck at a cost of $1,000 per month and paid 12 months of rent in advance.

July 1-Charged citizens $13,000 for services. Of this amount, $11,000 has been collected.

August 1-Made a $10,000 cash payment on the 12 percent note of February 1. This payment covers both interest and principal.

September 1-Paid salaries of $18,000 using the grant received on May 1.

October 1-Paid truck maintenance costs of $1,000.

November 1-Paid additional salaries of $10,000, first using the rest of the grant money received May 1.

December 31-Sent invoices totaling $19,000 to customers for services over the past six months. Collected $3,000 cash immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

The City of Dickens has a fiscal year ending December 31, Year 5. The city council is viewed as the highest level of decision-making authority for the government. For each of the following, indicate whether the overall statement is true or false. Assume that each situation is independent of all others.

a. On December 30, Year 5, the city spends $900,000 on a sidewalk project that is not a special assessment. On the Year 5 financial statements, a reconciliation is presented that starts with the total change in fund balances for the governmental funds and works down to end with the total change in net position for the governmental activities. As a result of this acquisition, this $900,000 must be subtracted as part of this reconciliation.

b. All members of the board of directors for a nature museum are appointed by the city. This fact alone makes this nature museum a component unit of the city.

c. The city appoints none of the governing board of a parks commission. This fact alone prohibits this parks commission from being a component unit of the city.

d. The city has a school system with a separately elected governing board (elected by the public). This fact alone makes the school system a special purpose government with its own financial reporting to be made.

e. The modified approach applies only to infrastructure assets.

f. The modified approach has become widely used in state and local government accounting over the last few years.

g. The city's school system charges students a $10 per person fee each year. In the statement of activities, this fee should be shown as miscellaneous revenue directly under the general revenues.

h. The city receives a work of art worth $100,000 as a gift and also spends $70,000 in cash to buy a second art work. Both art works will be exhibited publicly and properly protected and preserved. The city council passes a resolution that if either item is ever sold the proceeds will be used to buy replacement art works. Both of the art works are viewed as inexhaustible. The city has the option to report both of these pieces of art as expenses rather than as assets in the government-wide financial statements.

i. Assume that the city issues 30-day revenue anticipation notes on December 30, Year 5, to finance the government until new taxes are collected. These notes are issued at their face value of $500,000. On the Year 5 financial statements, there is a reconciliation that starts with the total change in fund balances for the governmental funds and works down to end with the total change in the net position for the governmental activities. As a result of the bond issuance, this $500,000 must be subtracted as part of this reconciliation.

a. On December 30, Year 5, the city spends $900,000 on a sidewalk project that is not a special assessment. On the Year 5 financial statements, a reconciliation is presented that starts with the total change in fund balances for the governmental funds and works down to end with the total change in net position for the governmental activities. As a result of this acquisition, this $900,000 must be subtracted as part of this reconciliation.

b. All members of the board of directors for a nature museum are appointed by the city. This fact alone makes this nature museum a component unit of the city.

c. The city appoints none of the governing board of a parks commission. This fact alone prohibits this parks commission from being a component unit of the city.

d. The city has a school system with a separately elected governing board (elected by the public). This fact alone makes the school system a special purpose government with its own financial reporting to be made.

e. The modified approach applies only to infrastructure assets.

f. The modified approach has become widely used in state and local government accounting over the last few years.

g. The city's school system charges students a $10 per person fee each year. In the statement of activities, this fee should be shown as miscellaneous revenue directly under the general revenues.

h. The city receives a work of art worth $100,000 as a gift and also spends $70,000 in cash to buy a second art work. Both art works will be exhibited publicly and properly protected and preserved. The city council passes a resolution that if either item is ever sold the proceeds will be used to buy replacement art works. Both of the art works are viewed as inexhaustible. The city has the option to report both of these pieces of art as expenses rather than as assets in the government-wide financial statements.

i. Assume that the city issues 30-day revenue anticipation notes on December 30, Year 5, to finance the government until new taxes are collected. These notes are issued at their face value of $500,000. On the Year 5 financial statements, there is a reconciliation that starts with the total change in fund balances for the governmental funds and works down to end with the total change in the net position for the governmental activities. As a result of the bond issuance, this $500,000 must be subtracted as part of this reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

Go to www.phoenix.gov and do a search for the term "CAFR." Those results should lead to the latest CAFR for the City of Phoenix, Arizona. The financial statements for a state and local government must include a Management's Discussion and Analysis of the information being reported. Read this section of the Phoenix CAFR.

Required

Write a report indicating the types of information found in this government's MD A.

Required

Write a report indicating the types of information found in this government's MD A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

The City of Ronchester has a defined benefit pension plan for its firefighters. How is the amount of pension expense determined that should be recognized in the current year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Willingham Museum qualifies as a component unit of the City of Willingham. How does an activity or function qualify to be a component unit of a primary government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

A general purpose government takes over a special purpose government in an acquisition. The consideration is larger than the acquisition value of all assets and liabilities. How is the excess reported

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

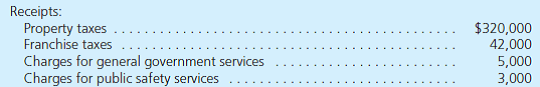

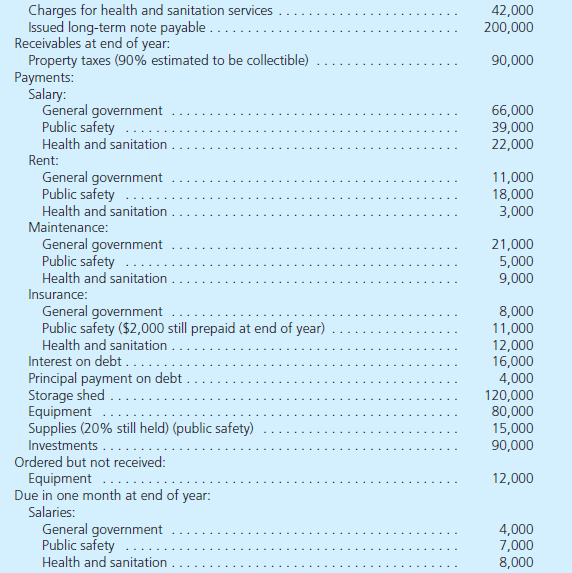

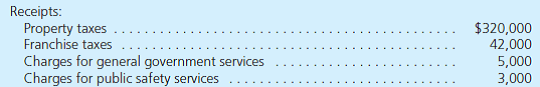

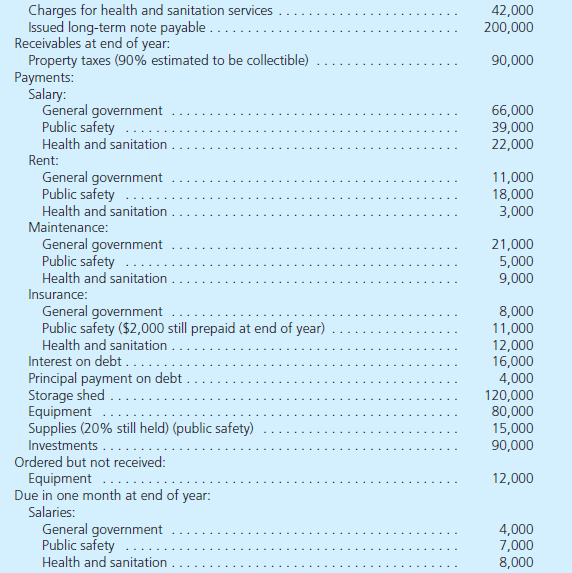

The following information pertains to the City of Williamson for 2015, its first year of legal existence. For convenience, assume that all transactions are for the general fund, which has three separate functions: general government, public safety, and health and sanitation.

Compensated absences legally owed to general government workers at year-end total $13,000. These amounts will not be taken by the employees until late in the year 2016. The city received a piece of art this year as a donation. It is valued at $14,000. It will be used for general government purposes. There are no eligibility requirements. The city chose not to capitalize this property.

The general government uses the storage shed that was acquired this year. It is being depreciated over 10 years using the straight-line method with no salvage value. The city uses the equipment for health and sanitation and depreciates it using the straight-line method over five years with no salvage value.

The investments are valued at $103,000 at the end of the year.

For the equipment that has been ordered but not yet received, the City Council (the highest decision-making body in the government) has voted to honor the commitment when the equipment is received.

a. Prepare a statement of activities and a statement of net position for governmental activities for December 31, 2015, and the year then ended.

b. Prepare a statement of revenues, expenditures, and other changes in fund balances and a balance sheet for the general fund as of December 31, 2015, and the year then ended. Assume that the city applies the consumption method.

Compensated absences legally owed to general government workers at year-end total $13,000. These amounts will not be taken by the employees until late in the year 2016. The city received a piece of art this year as a donation. It is valued at $14,000. It will be used for general government purposes. There are no eligibility requirements. The city chose not to capitalize this property.

The general government uses the storage shed that was acquired this year. It is being depreciated over 10 years using the straight-line method with no salvage value. The city uses the equipment for health and sanitation and depreciates it using the straight-line method over five years with no salvage value.

The investments are valued at $103,000 at the end of the year.

For the equipment that has been ordered but not yet received, the City Council (the highest decision-making body in the government) has voted to honor the commitment when the equipment is received.

a. Prepare a statement of activities and a statement of net position for governmental activities for December 31, 2015, and the year then ended.

b. Prepare a statement of revenues, expenditures, and other changes in fund balances and a balance sheet for the general fund as of December 31, 2015, and the year then ended. Assume that the city applies the consumption method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

The City of Larissa recently opened a solid waste landfill to serve the area's citizens and businesses.

The city's accountant has gone to city officials for guidance as to whether to record the landfill within the General Fund or as a separate enterprise fund. Officials have asked for guidance on how to make that decision and how the answer will impact the government's financial reporting.

Required

Write a memo to the government officials describing the factors that should influence the decision as to the fund in which to report the landfill. Describe the impact that this decision will have on the city's future comprehensive annual financial reports.

The city's accountant has gone to city officials for guidance as to whether to record the landfill within the General Fund or as a separate enterprise fund. Officials have asked for guidance on how to make that decision and how the answer will impact the government's financial reporting.

Required

Write a memo to the government officials describing the factors that should influence the decision as to the fund in which to report the landfill. Describe the impact that this decision will have on the city's future comprehensive annual financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

A city starts a solid waste landfill that it expects to fill to capacity gradually over a 10-year period. At the end of the first year, it is 8 percent filled. At the end of the second year, it is 19 percent filled. Currently, the cost of closure and post closure is estimated at $I million. None of this amount will be paid until the landfill has reached its capacity.

If this landfill is judged to be a governmental fund, what liability will be reported at the end of the second year on fund financial statements

A) $-0-.

B) $110,000.

C) $190,000.

D) $200,000.

If this landfill is judged to be a governmental fund, what liability will be reported at the end of the second year on fund financial statements

A) $-0-.

B) $110,000.

C) $190,000.

D) $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is true about the management's discussion and analysis (MD A)

a. It is an optional addition to the comprehensive annual financial report, but the GASB encourages its inclusion.

b. It adds a verbal explanation for the numbers and trends presented in the financial statements.

c. It appears at the very end of a government's comprehensive annual financial report.

d. It replaces a portion of the fund financial statements traditionally presented by a state or local government.

a. It is an optional addition to the comprehensive annual financial report, but the GASB encourages its inclusion.

b. It adds a verbal explanation for the numbers and trends presented in the financial statements.

c. It appears at the very end of a government's comprehensive annual financial report.

d. It replaces a portion of the fund financial statements traditionally presented by a state or local government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is true about the statement of cash flows for the proprietary funds of a state or local government

a. The indirect method of reporting cash flows from operating activities is allowed although the direct method is recommended.

b. The structure of the statement is virtually identical to that of a for-profit business.

c. The statement is divided into four separate sections of cash flows.

d. Amounts spent on capital assets are reported in a separate section from amounts raised to finance those capital assets.

a. The indirect method of reporting cash flows from operating activities is allowed although the direct method is recommended.

b. The structure of the statement is virtually identical to that of a for-profit business.

c. The statement is divided into four separate sections of cash flows.

d. Amounts spent on capital assets are reported in a separate section from amounts raised to finance those capital assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

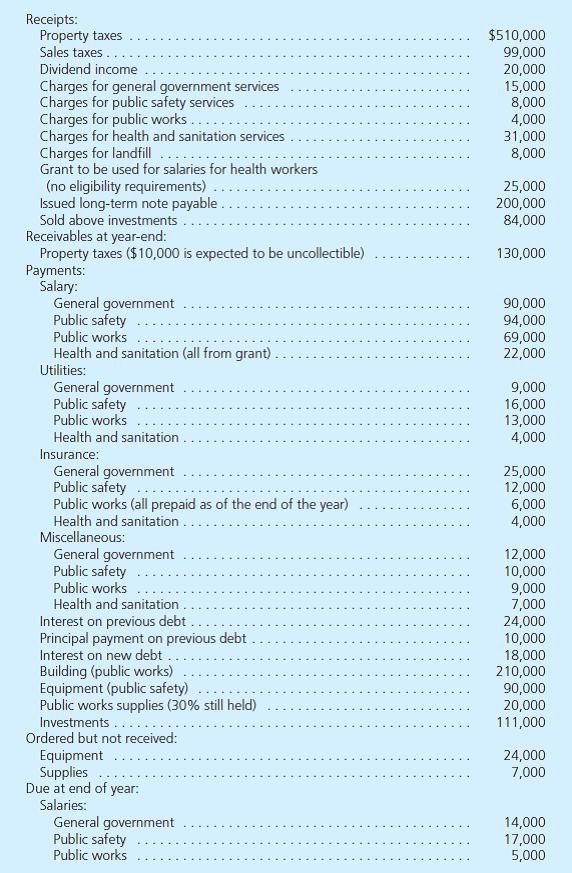

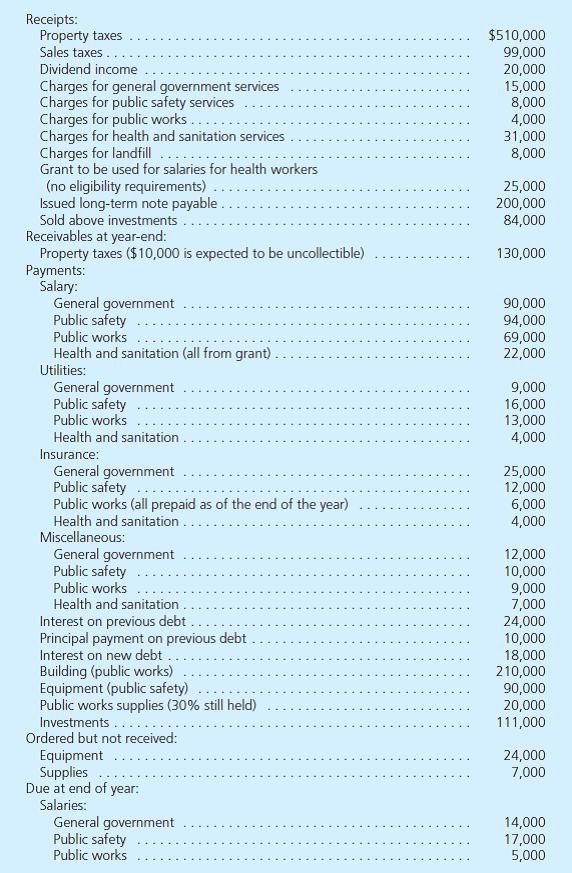

The City of Bernard starts the year of 2015 with the following unrestricted amounts in its general fund: cash of $20,000 and investments of $70,000. In addition, it holds a small building bought on January 1, 2014, for general government purposes for $300,000 and related long-term debt of $240,000. The building is being depreciated on the straight-line method over 10 years. The interest rate is 10 percent. The general fund has four separate functions: general government, public safety, public works, and health and sanitation. Other information includes the following:

The city leased a truck on the last day of the year. The first payment will be made at the end of the next year. Total payments will amount to $90,000 but have a present value of $64,000.

The city started a landfill this year that it is recording within its general fund. It is included as a public works function. Closure costs today would be $260,000 although the landfill is not expected to be filled for nine more years. The city has incurred no costs to date although the landfill is now 15 percent filled.

For the equipment and supplies that have been ordered but not yet received, the City Council (the highest decision-making body in the government) has voted to honor the commitment when the items are received.

The new building is being depreciated over 20 years using the straight-line method and no salvage value, whereas depreciation of the equipment is similar except that its life is only 10 years. Assume the city records a full year's depreciation in the year of acquisition.

The investments are valued at $116,000 at year-end.

a. Prepare a statement of activities and a statement of net position for governmental activities for December 31, 2015, and the year then ended.

b. Prepare a statement of revenues, expenditures, and other changes in fund balances and a balance sheet for the general fund as of December 31, 2015, and the year then ended. Assume that the purchases method is being applied.

The city leased a truck on the last day of the year. The first payment will be made at the end of the next year. Total payments will amount to $90,000 but have a present value of $64,000.

The city started a landfill this year that it is recording within its general fund. It is included as a public works function. Closure costs today would be $260,000 although the landfill is not expected to be filled for nine more years. The city has incurred no costs to date although the landfill is now 15 percent filled.

For the equipment and supplies that have been ordered but not yet received, the City Council (the highest decision-making body in the government) has voted to honor the commitment when the items are received.

The new building is being depreciated over 20 years using the straight-line method and no salvage value, whereas depreciation of the equipment is similar except that its life is only 10 years. Assume the city records a full year's depreciation in the year of acquisition.

The investments are valued at $116,000 at year-end.

a. Prepare a statement of activities and a statement of net position for governmental activities for December 31, 2015, and the year then ended.

b. Prepare a statement of revenues, expenditures, and other changes in fund balances and a balance sheet for the general fund as of December 31, 2015, and the year then ended. Assume that the purchases method is being applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

A city government has a six-year capital lease for property being used within the General Fund. Minimum lease payments total $70,000 starting next year but have a current present value of $49,000. What is the total amount of expenditures to be recognized on the fund financial statements over the six-year period

A) $-0-.

B) $49,000.

C) $70,000.

D) $119,000.

A) $-0-.

B) $49,000.

C) $70,000.

D) $119,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

The City of Salem is given a painting by Picasso to display in its city hall. Under what condition will the city not report this painting as a capital asset on its government-wide financial statements If it does report the painting as a capital asset, must the city report depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the difference between a blended component unit and a discretely presented component unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

What are some of the major differences that exist between private colleges and universities and public colleges and universities that affect financial reporting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

The City of Pfeiffer starts the year of 2015 with the general fund and an enterprise fund. The general fund has two activities: education and parks/recreation. For convenience, assume that the general fund holds $123,000 cash and a new school building costing $1 million. The city utilizes straight-line depreciation. The building has a 20-year life and no salvage value. The enterprise fund has $62,000 cash and a new $600,000 civic auditorium with a 30-year life and no salvage value. The enterprise fund monitors just one activity, the rental of the civic auditorium for entertainment and other cultural affairs.

The following transactions for the city take place during 2015. Assume that the city's fiscal year ends on December 31.

a. Decides to build a municipal park and transfers $70,000 into a capital projects fund and immediately expends $20,000 for a piece of land. The creation of this fund and this transfer were made by the highest level of government authority.

b. Borrows $110,000 cash on a long-term bond for use in creating the new municipal park.

c. Assesses property taxes on the first day of the year. The assessment, which is immediately enforceable, totals $600,000. Of this amount, $510,000 will be collected during 2015 and another $50,000 is expected in the first month of 2016. The remainder is expected about halfway through 2016.

d. Constructs a building in the park in ( b ) for $80,000 cash so that local citizens can play basketball and other sports. It is put into service on July 1 and should last 10 years with no salvage value.

e. Builds a sidewalk around the new park for $10,000 cash and puts it into service on July 1. It should last for 10 years, but the city plans to keep it up to a predetermined quality level so that it will last almost indefinitely.

f. Opens the park and charges an entrance fee of only a token amount so that it records the park, therefore, in the general fund. Collections during this first year total $8,000.

g. Buys a new parking deck for $200,000, paying $20,000 cash and signing a long-term note for the rest. The parking deck, which is to go into operation on July 1, is across the street from the civic auditorium and is considered part of that activity. It has a 20-year life and no salvage value.

h. Receives a $100,000 cash grant for the city school system that must be spent for school lunches for the poor. Appropriate spending of these funds is viewed as an eligibility requirement of this grant. During the current year, $37,000 of the amount received was properly spent.

i. Charges students in the school system a total fee of $6,000 for books and the like. Of this amount, 90 percent is collected during 2015 with the remainder expected to be collected in the first few weeks of 2016.

j. Buys school supplies for $22,000 cash and uses $17,000 of them. The general fund uses the purchases method.

k. Receives a painting by a local artist to be displayed in the local school. It qualifies as a work of art, and officials have chosen not to capitalize it. The painting has a value of $80,000. It is viewed as inexhaustible.

l. Transfers $20,000 cash from the general fund to the enterprise fund as a capital contribution.

m. Orders a school bus for $99,000.

n. Receives the school bus and pays an actual cost of $102,000. The bus is put into operation on October 1 and should last for five years with no salvage value.

o. Pays salaries of $240,000 to school teachers. In addition, owes and will pay $30,000 during the first two weeks of 2016. Vacations worth $23,000 have also been earned but will not be taken until July 2016.

p. Pays salaries of $42,000 to city auditorium workers. In addition, owes and will pay $3,000 in the first two weeks of 2016. Vacations worth $5,000 have also been earned but will not be taken until July 2016.