Deck 9: Liabilities and Sources of Financing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

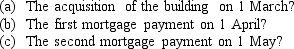

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/82

العب

ملء الشاشة (f)

Deck 9: Liabilities and Sources of Financing

1

Where an overdraft facility has been offered, the bank sees this as a semi-permanent source of finance, and prefers to see the account consistently overdrawn, as it will receive more fees through overdraft charges, thus reducing the risk of the finance.

False

2

If taxable income is $220 000, accounting profit is $200 000, interest payable is $20 000, interest is recognised for tax when paid and the tax rate is 30%, then we know that tax payable is $66 000, tax expense is $60 000 and a deferred tax asset of $6000 will be recorded in the balance sheet.

True

3

Financing through trade credit requires less security than financing through factoring.

True

4

Financing through accounts payable can result in opportunity costs where discounts are not taken up by the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

5

Accounting for income tax gives rise to temporary differences, which arise when the tax value and the carrying value of assets and liabilities differ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

6

If taxable income is $120 000, accounting profit is $130 000, interest receivable is $10 000, interest is recognised for tax when received and the tax rate is 30%, then we know that tax payable is

$36 000, tax expense is $39 000 and a deferred tax liability of $3000 will be recorded in the balance sheet.

$36 000, tax expense is $39 000 and a deferred tax liability of $3000 will be recorded in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

7

AKP enterprises have negotiated a lease for a photocopier. The useful life of the asset is eight years. The lease is non-cancellable and provides that the term of the lease is over three years with the present value of the lease payments being 55% of the fair value. Title will not pass at the end of the lease period. Using the criteria in AASB 117, the lease would definitely constitute a finance lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

8

Given a situation in which a company depreciates an asset using the straight-line method, but the tax rules stipulate that the asset should be depreciated using the reducing-balance method, this will, under normal circumstances, initially give rise to a future tax benefit to the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

9

As the effect that the collapse of an airline has on the tourist industry is seen to be industry-specific, it is a business risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

10

A bank overdraft is normally securitised over assets, either as a fixed charge over specific assets or as a floating charge over all assets; factoring is secured over specific assets being accounts receivable; whereas accounts payable generally require no security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

11

Trade credit is widely used as a source of finance but the importance and use of trade credit varies from industry to industry and within industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

12

Tax expense is the amount an entity remits to the tax department, and is determined by adjusting the tax-payable figure for increases/decreases in deferred tax payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

13

Business risk is industry-specific, whereas financial risk is more firm-specific.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

14

Trade credit is the finance provided by suppliers from selling goods on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under a hire-purchase agreement, ownership of the asset remains with the financier until all payments have been received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

16

The purchase of an asset using loan finance and the leasing of an asset under a finance lease will both result in ownership of the asset being transferred at the time of acquisition/beginning of lease and not when all payments have been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company's taxable income is the amount of profit determined by the tax commissioner on which the current income tax liability is determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

18

A major difference between accounting for an operating lease and a finance lease, in the books of the lessee, is that a finance lease will create an asset and a liability, whereas an operating lease will be treated as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

19

Working capital is represented by current assets less current liabilities for short-term working capital, whereas long-term working capital is total assets less total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

20

Temporary differences occur when an income or expense item enters into the calculations of accounting profit and taxable income in different periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

21

Partnerships may have more ability to raise equity finance than sole proprietorships, as partnerships tend to have more people to contribute funds, but limited companies have a wider range of equity options than partnerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

22

In an entity that is highly geared, the effect of a decrease in profits or an increase in interest rates will have a greater negative impact on returns to shareholders than it will on an entity that is not so highly geared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

23

AKP Ltd depreciates a non-current asset using the straight-line method. Tax law stipulates that the asset should be depreciated using the reducing-balance method at 1.5 times the straight line rate. Under normal circumstances, which of the following statements is correct?

A) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a deferred tax liability.

B) After year 1, the tax base of the asset is less than the accounting base and will give rise to a deferred tax liability.

C) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a deferred tax asset.

D) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a tax asset.

A) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a deferred tax liability.

B) After year 1, the tax base of the asset is less than the accounting base and will give rise to a deferred tax liability.

C) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a deferred tax asset.

D) After year 1, the tax base of the asset exceeds the accounting base and will give rise to a tax asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

24

A factoring company is a finance company that specialises in providing a service for the collection of payments from accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

25

The term 'working capital' is used to describe the:

A) amount of equity (ownership) capital in the firm.

B) portion of capital actively employed in generating revenues.

C) amount of debt (borrowed) capital in the firm.

D) cushion of current assets over current liabilities.

A) amount of equity (ownership) capital in the firm.

B) portion of capital actively employed in generating revenues.

C) amount of debt (borrowed) capital in the firm.

D) cushion of current assets over current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

26

Sporter Enterprises has incurred a tax loss in the current period. Under tax law, which of the following statements is not correct?

A) A deferred tax asset can be recognised if it is probable that Sporter will earn taxable income in the future.

B) Assuming all relevant tax laws have been adhered to, Sporter can carry the loss forward to reduce taxable income in future periods.

C) A deferred tax liability is created, as Sporter will have to pay tax on taxable income in the future.

D) Sporter cannot carry the loss forward as a deferred tax asset if it is probable that future taxable income will not be earned.

A) A deferred tax asset can be recognised if it is probable that Sporter will earn taxable income in the future.

B) Assuming all relevant tax laws have been adhered to, Sporter can carry the loss forward to reduce taxable income in future periods.

C) A deferred tax liability is created, as Sporter will have to pay tax on taxable income in the future.

D) Sporter cannot carry the loss forward as a deferred tax asset if it is probable that future taxable income will not be earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

27

Debentures are essentially the same as a long-term loan except that debentures are particular to limited companies and have a fixed interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements regarding tax-effect accounting is incorrect?

A) The tax-effect method of accounting for income tax determines that temporary differences may arise, resulting in the recognition of either a liability or an asset.

B) The tax-effect method for calculating income tax expense is where the taxable income is multiplied by the tax rate.

C) A tax loss can only be carried forward as a future tax benefit if it is probable that the entity will earn taxable income in the future.

D) A deferred tax liability will occur where taxable income is less than accounting profit in the current period.

A) The tax-effect method of accounting for income tax determines that temporary differences may arise, resulting in the recognition of either a liability or an asset.

B) The tax-effect method for calculating income tax expense is where the taxable income is multiplied by the tax rate.

C) A tax loss can only be carried forward as a future tax benefit if it is probable that the entity will earn taxable income in the future.

D) A deferred tax liability will occur where taxable income is less than accounting profit in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following terms best describes a firm-specific risk that an entity faces, as opposed to an industry-specific risk?

A) Investment risk

B) Financial risk

C) Market risk

D) Business risk

A) Investment risk

B) Financial risk

C) Market risk

D) Business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

30

A major discriminator between an operating lease and a finance lease is whether the risks and rewards of ownership have been substantially transferred to the lessee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

31

The sole source of equity finance for a company is contributed equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

32

The notion of substance over form may result in certain types of preference shares being classified as debt not equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

33

The primary sources of revenue for a factoring company are the interest earned on the finance provided and the fees for managing the collection of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

34

Classifying preference shares as debt not equity, would alter the gearing (leverage) of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

35

An entity that can only raise equity finance through a single owner's contributions and retained profits is a sole proprietorship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following must be known in order to determine the firm's total amount of working capital? Current assets Current liabilities

A) Yes Yes

B) Yes No

C) No Yes

D) No No

A) Yes Yes

B) Yes No

C) No Yes

D) No No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

37

The mix of debt finance and equity finance for a given entity is known as gearing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

38

Working capital is:

A) loan capital.

B) total assets less total liabilities.

C) current assets less current liabilities.

D) quick assets less current liabilities.

A) loan capital.

B) total assets less total liabilities.

C) current assets less current liabilities.

D) quick assets less current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

39

AKP Ltd uses the accrual-basis method of accounting for accounting profit. In the current accounting period, they have recognised income for interest not yet received. Taxable income is determined on a cash basis. Based on this information, which of the following statements is correct?

A) Taxable income will be greater than accounting profit, and will give rise to a deferred tax liability.

B) Taxable income will be less than accounting profit, and will give rise to a deferred tax liability.

C) Taxable income will be greater than accounting profit, and will give rise to a deferred tax benefit.

D) Taxable income will be less than accounting profit, and will give rise to a deferred tax benefit.

A) Taxable income will be greater than accounting profit, and will give rise to a deferred tax liability.

B) Taxable income will be less than accounting profit, and will give rise to a deferred tax liability.

C) Taxable income will be greater than accounting profit, and will give rise to a deferred tax benefit.

D) Taxable income will be less than accounting profit, and will give rise to a deferred tax benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

40

A choice between debt finance and equity finance will result in a trade-off between risk and return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

41

When a company obtains financial resources from owners, it is termed:

A) debt.

B) operating.

C) equity.

D) risk-free.

A) debt.

B) operating.

C) equity.

D) risk-free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

42

When a firm leases a resource for most of its useful life and controls the resource as though it had been purchased, the lease is treated as:

A) an operating lease.

B) a finance lease.

C) a primary lease.

D) a producing lease.

A) an operating lease.

B) a finance lease.

C) a primary lease.

D) a producing lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

43

Raffles Ltd began the financial year on 1 January with retained profits of $10 000 and by year end on 31 December retained profits had risen to $30 000. If a profit of $60 000 was earned during the year, then the amount declared and/or paid in dividends during the period would be:

A) $20 000.

B) $30 000.

C) $40 000.

D) $50 000.

A) $20 000.

B) $30 000.

C) $40 000.

D) $50 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

44

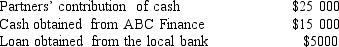

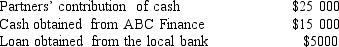

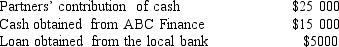

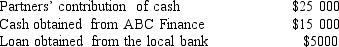

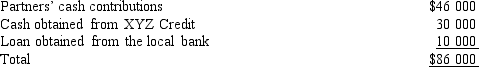

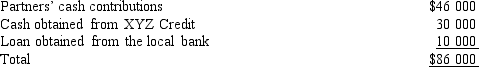

The following information applies to questions 23 and 24.

Kucinta Manufacturing Company started operations with the following capital:

What is the amount of equity financing for this partnership?

A) $30 000

B) $25 000

C) $45 000

D) $20 000

Kucinta Manufacturing Company started operations with the following capital:

What is the amount of equity financing for this partnership?

A) $30 000

B) $25 000

C) $45 000

D) $20 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

45

FF Ltd declared and paid $150 000 in dividends during the financial year ending 31 December. Closing retained profits as at 31 December were $860 000. What was opening retained profits at the beginning of the financial year on 1 January, if FF Ltd made a loss of $180 000 for the year ended 31 December?

A) $530 000

B) $860 000

C) $890 000

D) $1 190 000

A) $530 000

B) $860 000

C) $890 000

D) $1 190 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following amounts of capital were obtained to start operations of Yuppie Manufacturing at the beginning of the financial year:  What is the amount of equity financing for this firm?

What is the amount of equity financing for this firm?

A) $18 000

B) $62 000

C) $98 000

D) $126 000

What is the amount of equity financing for this firm?

What is the amount of equity financing for this firm?A) $18 000

B) $62 000

C) $98 000

D) $126 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

47

The major accounting difference between a finance lease and an operating lease is that finance leases:

A) involve larger amounts of funds.

B) are for longer periods of time.

C) involve the recognition of assets and liabilities.

D) are cancellable.

A) involve larger amounts of funds.

B) are for longer periods of time.

C) involve the recognition of assets and liabilities.

D) are cancellable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following provide resources to an organisation in exchange for future returns? Owners Liabilities creditors

A) No Yes

B) No No

C) Yes Yes

D) Yes No

A) No Yes

B) No No

C) Yes Yes

D) Yes No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a lessee enters into a finance lease agreement, it will record:

A) an asset only.

B) a liability only.

C) an asset and a liability.

D) an expense only.

A) an asset only.

B) a liability only.

C) an asset and a liability.

D) an expense only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following information applies to questions 23 and 24.

Kucinta Manufacturing Company started operations with the following capital:

What is the amount of debt financing for this partnership?

A) $5000

B) $45 000

C) $20 000

D) $15 000

Kucinta Manufacturing Company started operations with the following capital:

What is the amount of debt financing for this partnership?

A) $5000

B) $45 000

C) $20 000

D) $15 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is incorrect?

A) Preference shares usually have a fixed dividend and rate higher than ordinary shares in a situation where a company goes into liquidation.

B) A redeemable preference share with a fixed redemption date is classified as equity.

C) A non-redeemable cumulative preference share gives the right to be paid current or accumulated dividends before ordinary shareholders.

D) A non-redeemable cumulative preference is normally classified as equity.

A) Preference shares usually have a fixed dividend and rate higher than ordinary shares in a situation where a company goes into liquidation.

B) A redeemable preference share with a fixed redemption date is classified as equity.

C) A non-redeemable cumulative preference share gives the right to be paid current or accumulated dividends before ordinary shareholders.

D) A non-redeemable cumulative preference is normally classified as equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

52

A example of a source of medium-term finance is:

A) hire purchase.

B) debentures.

C) factoring.

D) equity finance.

A) hire purchase.

B) debentures.

C) factoring.

D) equity finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not an example of short-term finance?

A) Trade credit

B) Factoring

C) Finance lease

D) Bank overdraft

A) Trade credit

B) Factoring

C) Finance lease

D) Bank overdraft

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

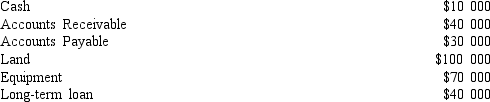

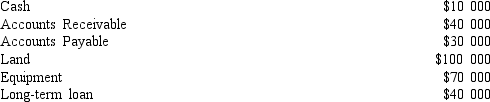

54

What is the total working capital for the following company?

A) $10 000

B) $20 000

C) $50 000

D) $150 000

A) $10 000

B) $20 000

C) $50 000

D) $150 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is not a characteristic of a finance lease?

A) It is generally non-cancellable.

B) The lessee guarantees that the lessor will receive a specific residual value from the sale of the asset at the end of the lease term.

C) It is like a rental agreement.

D) The lessee has the right to use the leased asset.

A) It is generally non-cancellable.

B) The lessee guarantees that the lessor will receive a specific residual value from the sale of the asset at the end of the lease term.

C) It is like a rental agreement.

D) The lessee has the right to use the leased asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements is incorrect?

A) A redeemable preference share that is redeemable by the holder is classified as equity if it is not probable that redemption will occur.

B) A redeemable preference share with a fixed redemption date is classified as debt.

C) Sole proprietorships, partnerships and limited companies can all raise equity finance from owners' contributions but only limited companies can issue ordinary shares.

D) A company distributes profits in the form of dividends, which is a reduction in retained profits, whereas distributions of profits by partnerships and sole proprietors are reductions in owners' equity.

A) A redeemable preference share that is redeemable by the holder is classified as equity if it is not probable that redemption will occur.

B) A redeemable preference share with a fixed redemption date is classified as debt.

C) Sole proprietorships, partnerships and limited companies can all raise equity finance from owners' contributions but only limited companies can issue ordinary shares.

D) A company distributes profits in the form of dividends, which is a reduction in retained profits, whereas distributions of profits by partnerships and sole proprietors are reductions in owners' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Shifting Sands Company has negotiated to lease a piece of equipment. The equipment has a useful life of 10 years. The lease is non-cancellable but there is only a minor penalty if the lessee returns the equipment before the expiry of the lease. The lease terms provide that the lease is over five years and the present value of the minimum lease payments is 60% of the fair value of the asset at the commencement of the lease. Shifting Sands records the lease payments as an expense in the statement of comprehensive income. Based on this information, which of the following statements is correct?

A) Assets and liabilities are understated as the lease should be a finance lease.

B) Assets and liabilities are not affected as the lease is an operating lease.

C) The non-cancellable nature of the lease determines that it should be a finance lease.

D) There is insufficient information to determine whether the lease is a finance or an operating lease.

A) Assets and liabilities are understated as the lease should be a finance lease.

B) Assets and liabilities are not affected as the lease is an operating lease.

C) The non-cancellable nature of the lease determines that it should be a finance lease.

D) There is insufficient information to determine whether the lease is a finance or an operating lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

58

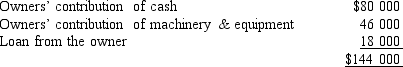

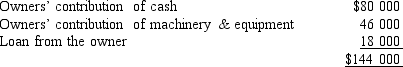

Deep Lake Lodging Company was established at the beginning of the financial year with the following capital:  What is the amount of equity financing for this firm?

What is the amount of equity financing for this firm?

A) $10 000

B) $40 000

C) $46 000

D) $76 000

What is the amount of equity financing for this firm?

What is the amount of equity financing for this firm?A) $10 000

B) $40 000

C) $46 000

D) $76 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

59

When a holder of preference shares has the right to receive all previously omitted dividends before ordinary shareholders receive any dividends, the preferred share is known as:

A) participating preferred.

B) cumulative preferred.

C) compensating preferred.

D) ex post rights preferred.

A) participating preferred.

B) cumulative preferred.

C) compensating preferred.

D) ex post rights preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

60

A preference share is preferred because:

A) it has a higher claim on dividends and assets than ordinary shares.

B) it is preferred by shareholders as a potentially better investment.

C) preferred shareholders have more voting rights than ordinary shareholders.

D) it has a higher claim on assets in liquidation than liabilities do.

A) it has a higher claim on dividends and assets than ordinary shares.

B) it is preferred by shareholders as a potentially better investment.

C) preferred shareholders have more voting rights than ordinary shareholders.

D) it has a higher claim on assets in liquidation than liabilities do.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

61

Retained profits can best be described as:

A) cash receipts minus expenses after adjustments.

B) net profit minus expenses after adjustments.

C) undistributed profits.

D) net profit minus cash disbursements after adjustments.

A) cash receipts minus expenses after adjustments.

B) net profit minus expenses after adjustments.

C) undistributed profits.

D) net profit minus cash disbursements after adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

62

The sources of equity finance for a company are:

A) contributed equity.

B) retained profits.

C) general reserves.

D) all of the above.

A) contributed equity.

B) retained profits.

C) general reserves.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

63

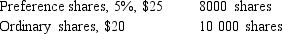

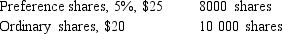

Blue Nose Cold Storage Company was incorporated two years ago on 1 January. Since then, the following shares have been issued:  On 31 December this year, the company declared and paid a total of $50 000 in dividends. This was the first dividend declared by the firm. That is, until this date no dividends had been declared or paid during the first two years of operations. If the preference shares are cumulative, what is the most that will be available out of the $50 000 dividend for payment to the ordinary shareholders?

On 31 December this year, the company declared and paid a total of $50 000 in dividends. This was the first dividend declared by the firm. That is, until this date no dividends had been declared or paid during the first two years of operations. If the preference shares are cumulative, what is the most that will be available out of the $50 000 dividend for payment to the ordinary shareholders?

A) $20 000

B) $30 000

C) $40 000

D) $50 000

On 31 December this year, the company declared and paid a total of $50 000 in dividends. This was the first dividend declared by the firm. That is, until this date no dividends had been declared or paid during the first two years of operations. If the preference shares are cumulative, what is the most that will be available out of the $50 000 dividend for payment to the ordinary shareholders?

On 31 December this year, the company declared and paid a total of $50 000 in dividends. This was the first dividend declared by the firm. That is, until this date no dividends had been declared or paid during the first two years of operations. If the preference shares are cumulative, what is the most that will be available out of the $50 000 dividend for payment to the ordinary shareholders?A) $20 000

B) $30 000

C) $40 000

D) $50 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

64

A shareholder makes an investment in a company. The net effect of this contribution is an increase in:

A) share capital only.

B) both assets and share capital.

C) both assets and liabilities.

D) both liabilities and share capital.

A) share capital only.

B) both assets and share capital.

C) both assets and liabilities.

D) both liabilities and share capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

65

Identify the correct statement below.

A) Bank overdrafts are classified as long-term loans in Australia.

B) Commitments are disclosed on the statement of comprehensive income because they affect net profit but not cash flow.

C) Finance leases are accounted for as if the leased items had been purchased.

D) The expense associated with operating leases is reported on the cash flow statement under the category of investing activities.

A) Bank overdrafts are classified as long-term loans in Australia.

B) Commitments are disclosed on the statement of comprehensive income because they affect net profit but not cash flow.

C) Finance leases are accounted for as if the leased items had been purchased.

D) The expense associated with operating leases is reported on the cash flow statement under the category of investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

66

Wilmington Fisheries had a Retained Profits account balance on 1 January of $12 000. During the year, the firm had net profit of $7200 and paid a $3600 cash dividend. What is the balance in Retained Profits at the end of the financial year on 31 December?

A) $12 200

B) $15 600

C) $19 600

D) $21 200

A) $12 200

B) $15 600

C) $19 600

D) $21 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain the concept of leverage. Why is this concept important for management?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

68

Where preference shares are redeemable at the discretion of the issuer, and shareholders have not been advised of the company's intention to redeem the shares they:

A) meet the definition of a liability.

B) represent debt.

C) are recognised as equity.

D) are recognised as a financial liability.

A) meet the definition of a liability.

B) represent debt.

C) are recognised as equity.

D) are recognised as a financial liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

69

Why do companies manage their working capital?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

70

Describe the nature and importance of working capital to a business entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following represent capital that has been earned by the profitable operation of a company? Paid-in capital Retained profits

A) Yes Yes

B) Yes No

C) No Yes

D) No No

A) Yes Yes

B) Yes No

C) No Yes

D) No No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

72

The term 'retained profits':

A) is representative of the cash that the corporation has available to pay dividends as of the balance sheet date.

B) is found among the assets on the balance sheet of any profitable corporation.

C) refers to an item whose value is always as large as, or larger than, that of cash on the balance sheet.

D) refers to an account balance found on the balance sheet of a corporation that has paid dividends of lesser amount than profits since the beginning of the corporation.

A) is representative of the cash that the corporation has available to pay dividends as of the balance sheet date.

B) is found among the assets on the balance sheet of any profitable corporation.

C) refers to an item whose value is always as large as, or larger than, that of cash on the balance sheet.

D) refers to an account balance found on the balance sheet of a corporation that has paid dividends of lesser amount than profits since the beginning of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

73

On 1 March, the Red Dour Inn Company purchased a motel for $1 000 000, paying 25% in cash and financing the remainder with a 20-year, 12% mortgage that requires monthly payments of $8258.14.

How would the Red Dour Inn record:

How would the Red Dour Inn record:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which type of shares has a higher claim on dividends and assets than ordinary shares?

A) Voting

B) Preference

C) Senior

D) Favoured

A) Voting

B) Preference

C) Senior

D) Favoured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

75

Describe the nature of trade credit, factoring and bank overdrafts as sources of short-term finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

76

Distinguish between an operating lease and a finance lease and describe how the separate classes of lease are accounted for in the books of the lessee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

77

Describe the nature and major sources of equity finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

78

Dividends on ordinary shares are:

A) expensed when paid.

B) expensed when incurred.

C) expensed at year end.

D) a reduction of retained profits.

A) expensed when paid.

B) expensed when incurred.

C) expensed at year end.

D) a reduction of retained profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

79

Davis Computer Company has total liabilities of $50 000, total assets of $280 000 and paid-up capital of $120 000. What is the amount of retained earnings and/or reserves?

A) $20 000

B) $110 000

C) $140 000

D) $160 000

A) $20 000

B) $110 000

C) $140 000

D) $160 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

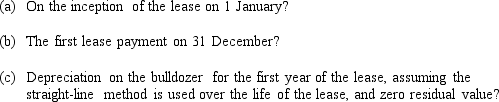

80

On 1 January, the Harglo Construction Company leased a bulldozer from ASIS Sales Corporation. The lease meets the criteria for classification as a finance (capital) lease and requires Harglo to make annual payments of $30 000 at the end of each of the next 10 years with the first payment due at the end of each year on 31 December. The present value of the lease payments is $200 000 based on an interest rate of 8%.

How would the lessee record:

How would the lessee record:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck