Deck 11: Worksheet to Debits and Credits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 11: Worksheet to Debits and Credits

1

A trial balance is prepared to check on the arithmetical accuracy of the ledger.

True

2

An increase in assets and an increase in liabilities is the same as saying assets have been debited and liabilities have been credited.

True

3

The worksheet approach and the T account approach to recording transactions are not really comparable, as the worksheet approach uses increases and decreases whereas the T account approach uses debits and credits.

True

4

The owner of an entity pays cash into the company's cash at bank account. The effect of this is to record an increase to cash on the left-hand side of the worksheet and an increase to equity on the right-hand side of the worksheet. This is the same as recording a debit on the left-hand side of the T account Cash at Bank and a credit on the right-hand side of the T account Owners' Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

A credit entry is used to record increases to:

A) accounts receivable.

B) accounts payable.

C) wages expense.

D) cash.

A) accounts receivable.

B) accounts payable.

C) wages expense.

D) cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

Decreases in assets are credited, and increases in liabilities are debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

As used in accounting, what do the terms 'debit' and 'credit' mean?

A) The bad and good things, respectively, that happen to a business

B) Increases and decreases, respectively

C) Left and right sides, respectively, of a T ledger account

D) First and second, respectively

A) The bad and good things, respectively, that happen to a business

B) Increases and decreases, respectively

C) Left and right sides, respectively, of a T ledger account

D) First and second, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

The recording of transactions in the worksheet and ledger both revolve around the principle of duality and the accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following does not normally have a credit balance?

A) Asset

B) Liability

C) Equity

D) Revenue

A) Asset

B) Liability

C) Equity

D) Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

On 1 August XYZ Ltd issued $240 000 shares to shareholders in exchange for cash of $100 000 and land of $140 000. This transaction would be recorded in the general ledger as:

A) a debit to cash and land and a credit to share capital.

B) a credit to cash and land and a debit to share capital.

C) an increase to cash and land and a decrease to share capital.

D) a decrease to cash, and an increase to land and share capital.

A) a debit to cash and land and a credit to share capital.

B) a credit to cash and land and a debit to share capital.

C) an increase to cash and land and a decrease to share capital.

D) a decrease to cash, and an increase to land and share capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

The ledger accounts for accumulated depreciation and allowance for doubtful debts:

A) would normally hold credit balances.

B) would normally hold debit balances.

C) represent expenses.

D) represent liabilities.

A) would normally hold credit balances.

B) would normally hold debit balances.

C) represent expenses.

D) represent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

When using an extended trial balance approach to recording end-of-period adjustments, there is a risk of errors and omissions as this approach will only result in the recording of one side of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

An accounting journal is a book of original entry that is prepared to record transactions in chronological order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following accounts normally has a debit balance?

A) Liabilities

B) Owners' equity

C) Revenues

D) Expenses

A) Liabilities

B) Owners' equity

C) Revenues

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

An accounting journal:

A) is an original book of entry in accounting records.

B) records transactions on a chronological basis.

C) provides the information for recording in the ledger.

D) all of the above.

A) is an original book of entry in accounting records.

B) records transactions on a chronological basis.

C) provides the information for recording in the ledger.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

If an entity paid $200 for two months' rent in advance on 1 June and recorded it all as rent expense on that date, which of the following would be the necessary adjusting entry at 30 June?

A) Debit rent expense $100 and credit prepaid rent $100

B) Debit prepaid rent $100 and credit rent expense $100

C) Debit rent expense $200 and credit prepaid rent $200

D) Debit prepaid rent $200 and credit rent expense $200

A) Debit rent expense $100 and credit prepaid rent $100

B) Debit prepaid rent $100 and credit rent expense $100

C) Debit rent expense $200 and credit prepaid rent $200

D) Debit prepaid rent $200 and credit rent expense $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following accounts would be increased by a debit entry?

A) Accounts receivable

B) Owners' equity

C) Accounts payable

D) Sales

A) Accounts receivable

B) Owners' equity

C) Accounts payable

D) Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements about double-entry bookkeeping is true?

A) The double-entry principle is referred to as accrual accounting.

B) For each transaction or economic event the total amount debited must equal the total amount credited.

C) If one account is increased, then another account must be decreased.

D) The total number of accounts debited must equal the total number of accounts credited.

A) The double-entry principle is referred to as accrual accounting.

B) For each transaction or economic event the total amount debited must equal the total amount credited.

C) If one account is increased, then another account must be decreased.

D) The total number of accounts debited must equal the total number of accounts credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

The recording of transactions in the ledger always involves:

A) same number of debit and credit entries.

B) same dollar amounts of debits and credits.

C) the original recording of the transaction.

D) plenty of work for accountants.

A) same number of debit and credit entries.

B) same dollar amounts of debits and credits.

C) the original recording of the transaction.

D) plenty of work for accountants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

Increases in assets involve debits and increases to equity and liabilities involve credits under a ledger-based approach to recording transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

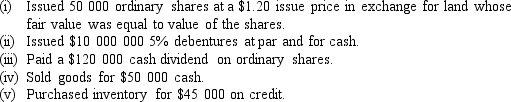

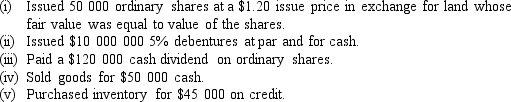

Prepare general journal entries for the following independent events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Income and expenses affect the profits made by an entity. Which of the following statements best describes how this fact is consistent with the accounting equation and the debit and credit rule?

A) Income increases equity and so should be a debit and expenses decrease equity and so should be a credit.

B) Income increases equity and so should be a credit and expenses decrease equity and so should be a debit.

C) Income decreases equity and so should be a debit and expenses increase equity and so should be a credit.

D) Income and expenses both affect equity and so both should be a credit if they are increasing.

A) Income increases equity and so should be a debit and expenses decrease equity and so should be a credit.

B) Income increases equity and so should be a credit and expenses decrease equity and so should be a debit.

C) Income decreases equity and so should be a debit and expenses increase equity and so should be a credit.

D) Income and expenses both affect equity and so both should be a credit if they are increasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

Discuss the role that journals, the ledger, debits and credits and the trial balance play in the traditional approach to recording transactions (events).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

XYZ receives $1000 in June for rent from a client for the month of July. How should this be recorded by XYZ assuming a balance date of 30 June?

A) Debit cash $1000 and credit accounts receivable $1000

B) Debit cash $1000 and credit unearned revenue $1000

C) Debit unearned revenue $1000 and credit cash $1000

D) Debit cash $1000 and credit prepaid rent $1000

A) Debit cash $1000 and credit accounts receivable $1000

B) Debit cash $1000 and credit unearned revenue $1000

C) Debit unearned revenue $1000 and credit cash $1000

D) Debit cash $1000 and credit prepaid rent $1000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an entity paid $200 for two months' rent in advance on 1 June and recorded it all as prepaid rent on that date, which of the following would be the necessary adjusting entry at 30 June?

A) Debit rent expense $100 and credit prepaid rent $100

B) Debit prepaid rent $100 and credit rent expense $100

C) Debit rent expense $200 and credit prepaid rent $200

D) Debit prepaid rent $200 and credit rent expense $200

A) Debit rent expense $100 and credit prepaid rent $100

B) Debit prepaid rent $100 and credit rent expense $100

C) Debit rent expense $200 and credit prepaid rent $200

D) Debit prepaid rent $200 and credit rent expense $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

The balance sheet lists final account balances for which of the following elements of financial statements?

A) Assets and liabilities

B) Income and expenses

C) Assets, liabilities and owners' equity

D) Income, expenses and profit and loss

A) Assets and liabilities

B) Income and expenses

C) Assets, liabilities and owners' equity

D) Income, expenses and profit and loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

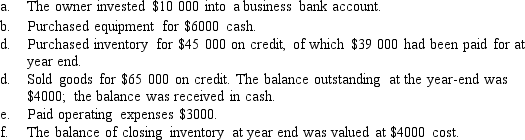

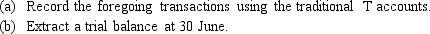

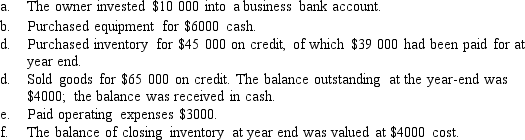

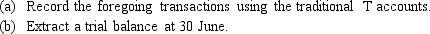

The following transactions relate to Murali Traders for the year ended 30 June - the first year of operation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck