Deck 19: Managing Net Working Capital

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/21

العب

ملء الشاشة (f)

Deck 19: Managing Net Working Capital

1

What are blocked funds How can a corporation structure its foreign affiliates to mitigate problems with blocked funds

When the government of a foreign country makes its nation currency completely inconvertible into foreign currency gives birth to the blocked funds for an MNC. Even if foreign exchange controls that impose unattractive foreign exchange rates can also makes the host country currency unattractive and constrain a firm.

If the profits from the local affiliate cannot repatriate, the local manager should be given the power to invest in any zero net present value investment. These investments include the commercial bonds and the equities of the other firms. If none of these investments appear to be attractive, the firm can engage in additional direct investment in the country by purchasing local real estate, either land or building. The multinational corporation to use its working capital is to have local affiliate contract with other firms operating in the country to supply goods or service for the parent and its other affiliates.

If the profits from the local affiliate cannot repatriate, the local manager should be given the power to invest in any zero net present value investment. These investments include the commercial bonds and the equities of the other firms. If none of these investments appear to be attractive, the firm can engage in additional direct investment in the country by purchasing local real estate, either land or building. The multinational corporation to use its working capital is to have local affiliate contract with other firms operating in the country to supply goods or service for the parent and its other affiliates.

2

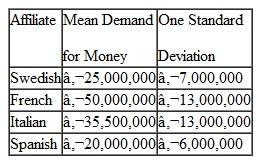

Euroshipping Corporation maintains separate production and distribution facilities in Sweden, France, Spain, and Italy. The corporate headquarters is in France. As a consultant to the treasurer of Euroshipping, you have been asked to estimate how much money the firm could save by creating a centralized cash management pool. Currently, each affiliate maintains precautionary cash balances equal to three standard deviations above its expected demand for cash.

By how much could Euroshipping reduce its overall demand for cash if it were to create a centralized cash pool for the four affiliates (Assume that the cash needs are normally distributed and are independent of each other.)

By how much could Euroshipping reduce its overall demand for cash if it were to create a centralized cash pool for the four affiliates (Assume that the cash needs are normally distributed and are independent of each other.)

By how much could Euroshipping reduce its overall demand for cash if it were to create a centralized cash pool for the four affiliates (Assume that the cash needs are normally distributed and are independent of each other.)

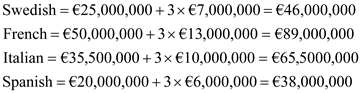

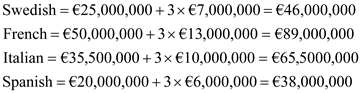

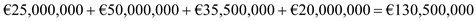

By how much could Euroshipping reduce its overall demand for cash if it were to create a centralized cash pool for the four affiliates (Assume that the cash needs are normally distributed and are independent of each other.)With the information given, currently each of the four affiliates is holding cash equal to the mean of their perceived demand plus three standard deviations. The total demand for cash by each affiliate as followings:

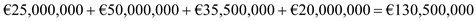

The total demand for cash sums these demands to give €238,500,000.

The total demand for cash sums these demands to give €238,500,000.

If we summarize the cash management, the sum of the means and variance would be sum of the variance because cash are independent for each other. Thus, the cash of centralized cash pool as followings:

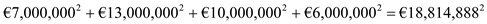

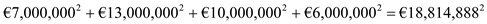

The variance of the demand for cash of centralized cash pool is as followings:

The variance of the demand for cash of centralized cash pool is as followings:

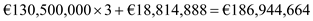

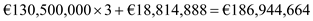

Thus, total demand for cash by the centralized pool is as follows:

Thus, total demand for cash by the centralized pool is as follows:

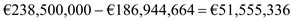

The demand for cash from the centralized cash pool is as follows:

The demand for cash from the centralized cash pool is as follows:

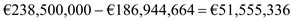

Therefore, total demand for cash in centralized cash pool is less than the total demand for cash from the separate affiliates.

Therefore, total demand for cash in centralized cash pool is less than the total demand for cash from the separate affiliates.

The total demand for cash sums these demands to give €238,500,000.

The total demand for cash sums these demands to give €238,500,000.If we summarize the cash management, the sum of the means and variance would be sum of the variance because cash are independent for each other. Thus, the cash of centralized cash pool as followings:

The variance of the demand for cash of centralized cash pool is as followings:

The variance of the demand for cash of centralized cash pool is as followings: Thus, total demand for cash by the centralized pool is as follows:

Thus, total demand for cash by the centralized pool is as follows: The demand for cash from the centralized cash pool is as follows:

The demand for cash from the centralized cash pool is as follows: Therefore, total demand for cash in centralized cash pool is less than the total demand for cash from the separate affiliates.

Therefore, total demand for cash in centralized cash pool is less than the total demand for cash from the separate affiliates. 3

What is a fronting loan How does its structure potentially create value for a multinational corporation

Flow of loan from a parent company to the affiliate company by using a large international bank as a financial intermediary is known as Fronting loan. It is risk free because it is fully collateralized by the deposit of the parent. The bank willingly participates for a small fee, and earned in the form of a spread between the deposit rate that is paid to the parent and the rate which is charged to the foreign affiliate.

Fronting loan's structure creates value for Multinational Corporation to give tax advantage because International banks can refuse to finance a country's international trade. It also can hammer the government's ability to borrow funds, whereas Multinational Corporation can do little more than threaten not to invest in the country in the future.

Fronting loan's structure creates value for Multinational Corporation to give tax advantage because International banks can refuse to finance a country's international trade. It also can hammer the government's ability to borrow funds, whereas Multinational Corporation can do little more than threaten not to invest in the country in the future.

4

What is net working capital Why should it be considered an investment that a firm must make to increase its future profitability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

5

Why is the threat of devaluation an insufficient reason for a firm to build up its stocks of inventories

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

6

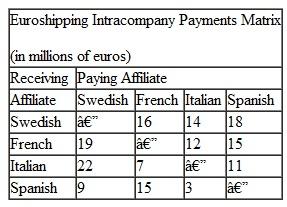

Euroshipping is also considering developing a multilateral netting system.

a. Given the cumulative monthly payments in the following payments matrix, derive the minimum transfers that could be made.

b. If the transaction costs on these fund transfers are 0.45%, how much would the company save by switching to a multilateral netting system

b. If the transaction costs on these fund transfers are 0.45%, how much would the company save by switching to a multilateral netting system

a. Given the cumulative monthly payments in the following payments matrix, derive the minimum transfers that could be made.

b. If the transaction costs on these fund transfers are 0.45%, how much would the company save by switching to a multilateral netting system

b. If the transaction costs on these fund transfers are 0.45%, how much would the company save by switching to a multilateral netting system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

7

What are the five tasks involved in issuing trade credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

8

What distinguishes international cash management from purely domestic cash management In particular, what constraints arise in the international environment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is wrong with the rule that firms should invoice their customers in hard currencies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

10

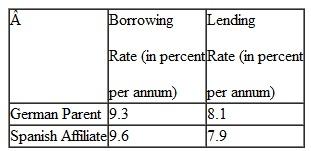

Suppose the euro borrowing and lending rates for a German parent and its Spanish affiliate for a 90-day period are as follows:

In each of the following cases, determine the direction funds should flow and the return to the MNC of transferring EUR1,000,000:

In each of the following cases, determine the direction funds should flow and the return to the MNC of transferring EUR1,000,000:

a. The German parent has positive funds; the Spanish affiliate has negative funds.

b. The German parent has negative funds; the Spanish affiliate has positive funds.

c. The German parent has positive funds; the Spanish affiliate has positive funds.

d. The German parent has negative funds; the Spanish affiliate has negative funds.

In each of the following cases, determine the direction funds should flow and the return to the MNC of transferring EUR1,000,000:

In each of the following cases, determine the direction funds should flow and the return to the MNC of transferring EUR1,000,000:a. The German parent has positive funds; the Spanish affiliate has negative funds.

b. The German parent has negative funds; the Spanish affiliate has positive funds.

c. The German parent has positive funds; the Spanish affiliate has positive funds.

d. The German parent has negative funds; the Spanish affiliate has negative funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

11

Why does it make sense for a multinational corporation to allow its foreign customers to pay on credit if there is rationing in the foreign credit market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

12

Why is it important for a foreign affiliate to have a well-defined dividend policy for repatriating profits to its parent corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

13

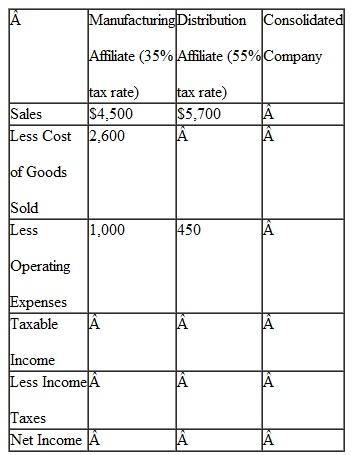

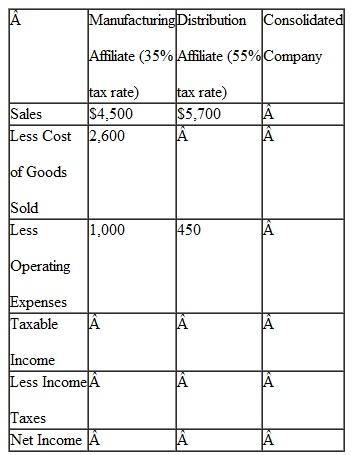

Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate. The relevant tax information, operating expenses, and cost of goods sold are given in the following table. Fill out the entries in the table and determine how the overall income of the consolidated company would change if it were to increase the transfer price by $500:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the difference between a royalty and a fee

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a manufacturing affiliate faces a 55% income tax rate, and its distribution affiliate faces a 40% income tax rate and a 15% import tariff, should transfer prices be high or low

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

16

What are the determinants of leading and lagging payments between related international affiliates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

17

Caterpillar is selling earthmoving equipment to an Indonesian construction company. Caterpillar must choose whether to denominate the contract in U.S. dollars or in Indonesian rupiah. Suppose that the spot exchange rate is IDR9,150 / $ and that there is no forward market. Suppose, too, that there is a possibility that the rupiah will be devalued relative to the dollar during the next year. If Caterpillar prices the contract in dollars, it will charge $15,000,000 and will expect to be paid in 1 year. It is also willing to discuss pricing the machines in rupiah. The Indonesian firm thinks that there is a 60% chance the exchange rate will remain the same and a 40% chance it will increase to IDR9,300/ $. Caterpillar thinks that there is a 65% probability of the exchange rate remaining the same and a 35% probability that it will increase to ID9,450/$. How should the deal be priced, and who will bear the risk of devaluation of the rupiah

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

18

What principles determine the appropriateness of transfer prices under U.S. regulations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

19

Web Question: Go to the PwC Web site related to transfer pricing at www.pwc.com/gx/en/internationaltransfer- pricing and download the latest version of their manual on international transfer pricing. Determine how Venezuela handles transfer pricing and what the penalties are for non-compliance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

20

How can transfer pricing be used to shift income around the world

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

21

How can transfer pricing be used to avoid tariffs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck