Deck 12: Project Risk and Uncertainty

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 12: Project Risk and Uncertainty

1

Susan Campbell is thinking about going into the motel business near Disney World in Orlando, Florida. The cost to build a motel is $2,200,000. The lot costs $600,000. Furniture and furnishings cost $400,000 and should be recovered in eight years (seven-year MACRS property), while the motel building should be recovered in 39 years (39-year MACRS real property placed in service on January 1st). The land will appreciate at an annual rate of 5% over the project period, but the building will have a zero salvage value after 25 years. When the motel is full (100% capacity), it takes in (receipts) $4,000 per day, 365 days per year. Exclusive of depreciation, the motel has fixed operating expenses of $230,000 per year. The variable operating expenses are $170,000 at 100% capacity, and these vary directly with percent capacity down to zero at 0% capacity. If the interest is 10% compounded annually, at what percent capacity over 25 years must the motel operate in order for Susan to break even (Assume that Susan's tax rate is 31%.)

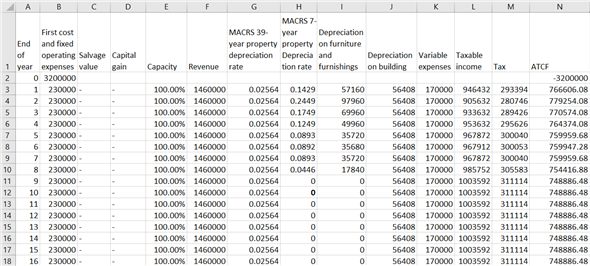

Land costs $600,000, and Furniture and furnishing costs $400,000, and building costs $2,200,000. The entire first cost is $3,200,000. For furniture and furnishing, the depreciation rates are as per MACRS 7-year property depreciation rates. The building is 39-year real property places on the 1 st of January, which means the depreciation rate is 2.564%. Land appreciates by 5% every year.

The tax rate is 0.31. The after-tax MARR is 0.10.

Fixed and variable expenses are given for 100% capacity. And they vary proportionately with capacity percentage. Yearly revenue is $1460,000 (= 4000×365) when capacity is 100%. Revenue also varies with capacity percentage.

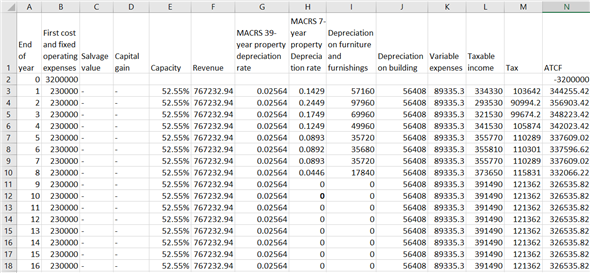

Calculate the net present worth of after-tax cash flows. To do that, set up a spreadsheet, assuming that the capacity is 100%.

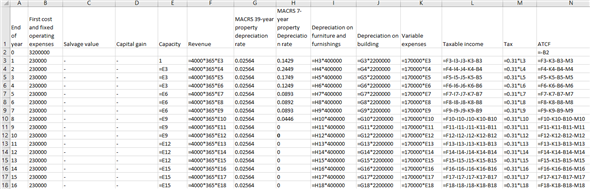

The spreadsheet will be as follows:

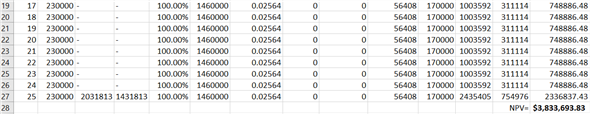

Make sure that formula for each cell is exactly as shown in the following screenshot. This is very necessary to apply What-If analysis in the next step.

Make sure that formula for each cell is exactly as shown in the following screenshot. This is very necessary to apply What-If analysis in the next step.

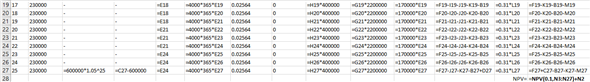

Now click on the data tab. Click on "what if analysis." Then click on "Goal seek." After that set cell N28 to 0 by changing cell E3. Press Enter.

Now click on the data tab. Click on "what if analysis." Then click on "Goal seek." After that set cell N28 to 0 by changing cell E3. Press Enter.

As shown in cell Column E in the screenshot above, the capacity that will make the motel breakeven, i.e. the capacity that will make the net present worth zero, is 52.55%.

As shown in cell Column E in the screenshot above, the capacity that will make the motel breakeven, i.e. the capacity that will make the net present worth zero, is 52.55%.

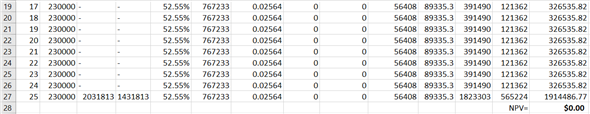

The tax rate is 0.31. The after-tax MARR is 0.10.

Fixed and variable expenses are given for 100% capacity. And they vary proportionately with capacity percentage. Yearly revenue is $1460,000 (= 4000×365) when capacity is 100%. Revenue also varies with capacity percentage.

Calculate the net present worth of after-tax cash flows. To do that, set up a spreadsheet, assuming that the capacity is 100%.

The spreadsheet will be as follows:

Make sure that formula for each cell is exactly as shown in the following screenshot. This is very necessary to apply What-If analysis in the next step.

Make sure that formula for each cell is exactly as shown in the following screenshot. This is very necessary to apply What-If analysis in the next step.

Now click on the data tab. Click on "what if analysis." Then click on "Goal seek." After that set cell N28 to 0 by changing cell E3. Press Enter.

Now click on the data tab. Click on "what if analysis." Then click on "Goal seek." After that set cell N28 to 0 by changing cell E3. Press Enter.

As shown in cell Column E in the screenshot above, the capacity that will make the motel breakeven, i.e. the capacity that will make the net present worth zero, is 52.55%.

As shown in cell Column E in the screenshot above, the capacity that will make the motel breakeven, i.e. the capacity that will make the net present worth zero, is 52.55%. 2

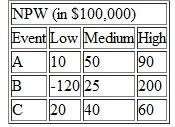

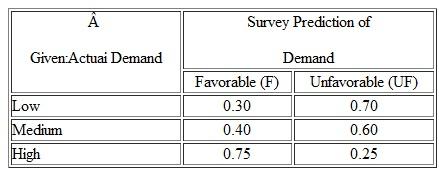

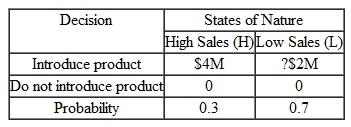

As a plant manager of a firm, you are trying to decide whether to open a new factory outlet store, which would cost about $500,000. Success of the outlet store depends on demand in the new region. If demand is high, you expect to gain $ 1 million per year; if demand is average, the gain is $500,000; and if demand is low, you lose $80,000. From your knowledge of the region and your product, you feel that the chances are 0.4 that sales will be average and equally likely that they will be high or low (0.3, respectively). Assume that the firm's MARR is known to be 15%, and the marginal tax rate will be 40%. Also, assume that the salvage value of the store at the end of 15 years will be about $100,000. The store will be depreciated under a 39-year property class.

(a) If the new outlet store will be in business for 15 years, should you open it How much would you be willing to pay to know the true state of nature

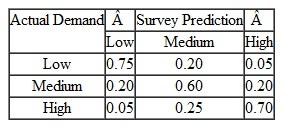

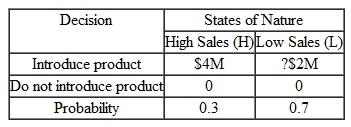

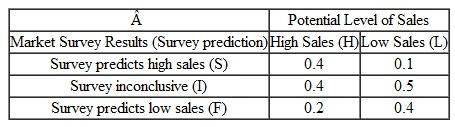

(b) Suppose a market survey is available at $1,000, with the following reliability (the values shown were obtained from past experience, where actual demand was compared with predictions made by the survey):

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information

(a) If the new outlet store will be in business for 15 years, should you open it How much would you be willing to pay to know the true state of nature

(b) Suppose a market survey is available at $1,000, with the following reliability (the values shown were obtained from past experience, where actual demand was compared with predictions made by the survey):

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample information

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the sample informationThe twelfth chapter in the textbook asks one to look at various ways uncertainty can be calculated in an engineering economic situation. This includes doing a break-even analysis, measuring the nature of machine risk, developing simulation models, and more.

For this problem that is present here, we have a plant manager of a firm which is trying to decide between opening a new factory outlet store which would cost initially $500,000.00. Mentioned in the text the need of determining whether or not the area would support the store and sales would range between $1,000,000.00 on the high demand, $500,000.00 for moderate demand, and a loss of $80,000.00 otherwise.

Note that from knowledge of the area that it would be built in shows that there is a 40.00% chance that sales would be average and a 30.00% chance that it would not be good or be on the high side. Additional assumptions provided show that the MARR is 15.00% and the salvage value of the store is $100,000.00 which would be depreciated under a MACRS schedule of a 39-year real property timeline.

If the new outlet store will be open for the next 15 years, should the business owner open it How much should one be willing to pay in order to know the true statement here Also, assume that there is a survey available which can be had for $1,000.00 and demand was compared by the survey. What would a strategy provide which would maximize the expected payoff after taking the market survey What would the EVPI be after taking the survey and what would the true worth be of the sample info

A general word of caution right from the get go here is that this is a somewhat complex problem that will require one to dedicate at least a good 30-35 minutes or so to complete. There are a number of steps that can be a bit tricky and also deceiving which can throw one off when they least expect it to happen. Thus, please follow carefully below as we work through this problem together. It isn't as bad as the statement seems but focus is definitely recommended here.

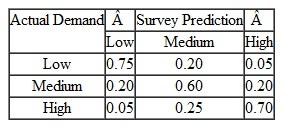

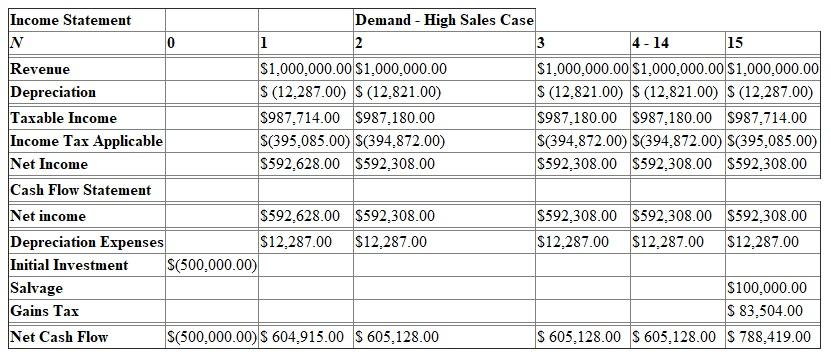

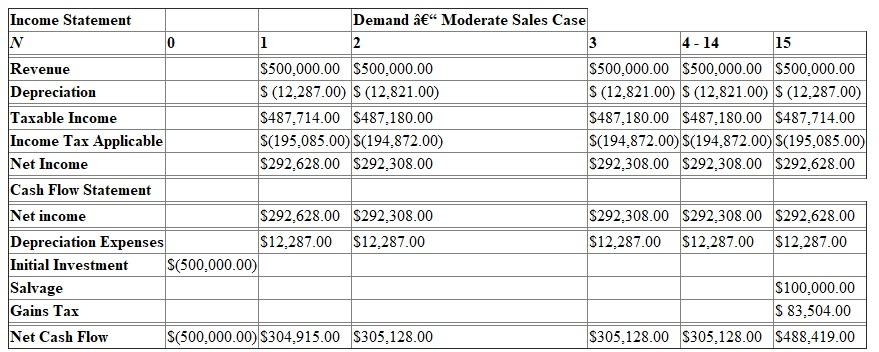

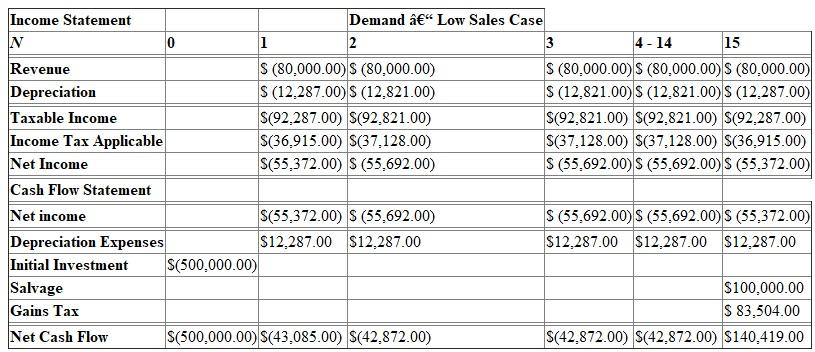

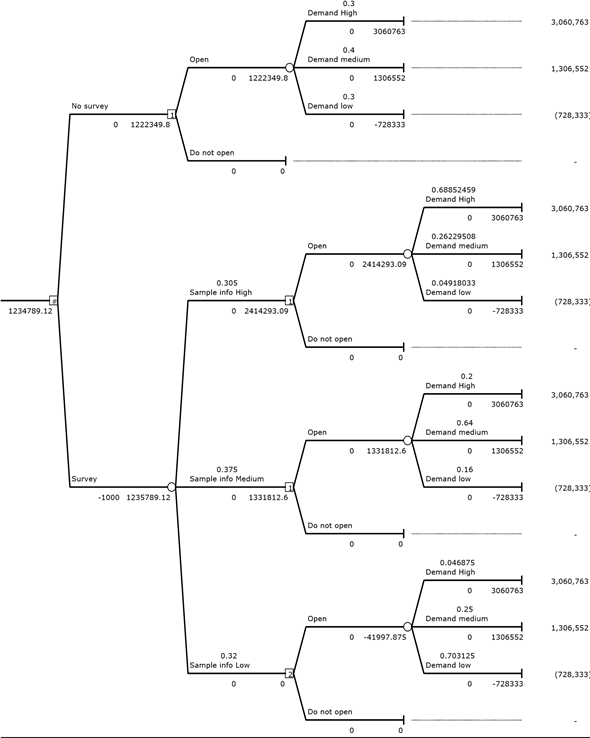

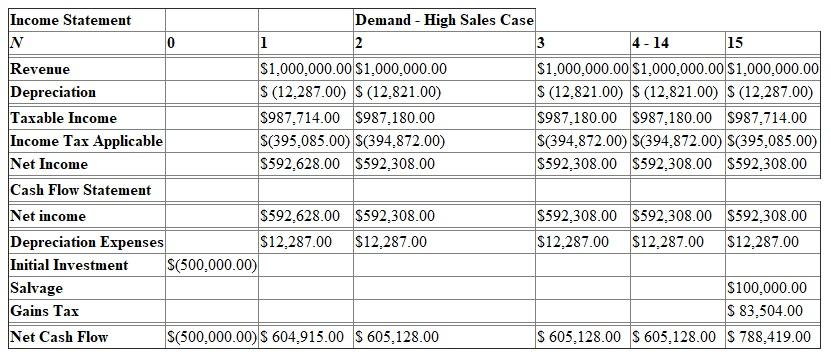

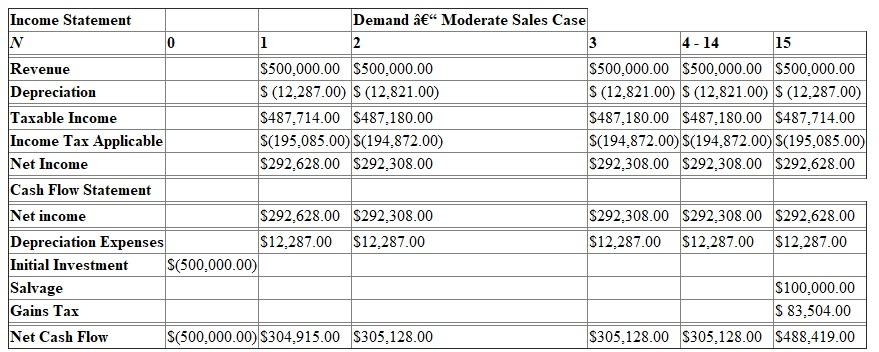

a) The first question that must be answered he is to determine the expected value of the three (3) outcomes that could happen over the course of the 15 year time period. Shown below to get one started is the demand cases (high, moderate, and low) and their present worths. The income statements and cash flow statements are standard issue of course for each option and one should jot down the present worth values as we will need those in a few minutes. To not delay the inevitable, here they are for one:

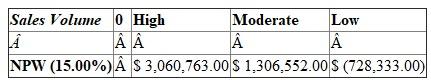

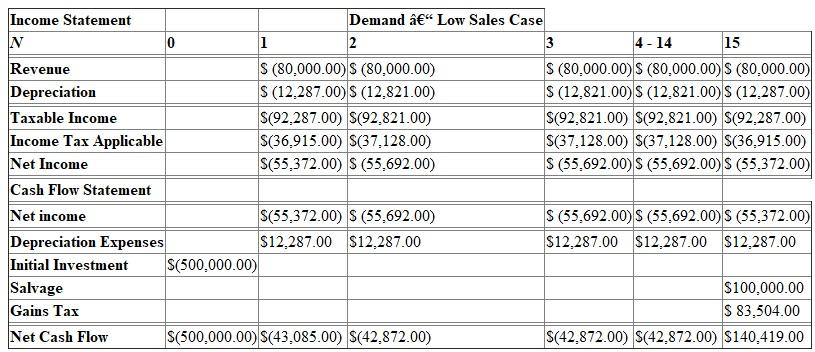

The next thing that one would need to do here is to determine the net present worths of the three (3) sales volumes that are shown here. Note that these are based off the MARR of 15.00% which was stated at the top of the problem. To summarize what is going on here, the net present worths are shown below for one to see with the three (3) options:

The next thing that one would need to do here is to determine the net present worths of the three (3) sales volumes that are shown here. Note that these are based off the MARR of 15.00% which was stated at the top of the problem. To summarize what is going on here, the net present worths are shown below for one to see with the three (3) options:

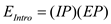

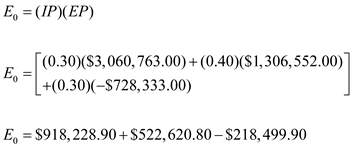

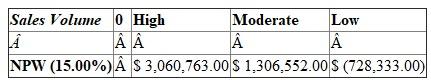

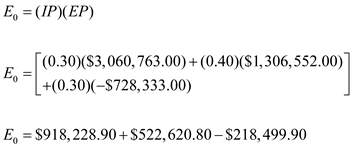

Now that we have the yucky stuff out of the way, we can now work on the expected value that is applicable to the problem here. We first need a formula which we can apply here which will take into account the probabilities of each of the sales volumes occurring at the success rate mentioned above. This is shown as well as the applicable calculations:

Now that we have the yucky stuff out of the way, we can now work on the expected value that is applicable to the problem here. We first need a formula which we can apply here which will take into account the probabilities of each of the sales volumes occurring at the success rate mentioned above. This is shown as well as the applicable calculations:

….. (1)

….. (1)

Where…

IP = the revenue amount for applicable to the situation and

EP = the corresponding probability for that outcome.

As a precaution, one should be careful of the calculations here. Shown below is the summarized view of these calculations taking place:

E 0 = $1,222,349.80

E 0 = $1,222,349.80

Thus, the expected value for the store to be open 15 years is a positive $1,222,349.80. Since this is well above the minimum of $0.00 profit, they should execute the opening of the store. The other part of the puzzle here asks one to determine how much one would need to pay at a maximum for the store. This would require one to get the expected value of a perfect situation (EPPI). When we look at the equation above, we simply drop off the annual revenue that would be a result of low sales volume. When this is done, we would have a net value of $1,440,849.70.

Conclusively speaking, one would need to take the difference of this value just calculated with the expected value of the store opened for 15 years (which is $1,222,349.80. As of a result, one could pay up to $218,499.90 given the nature of the beast here.

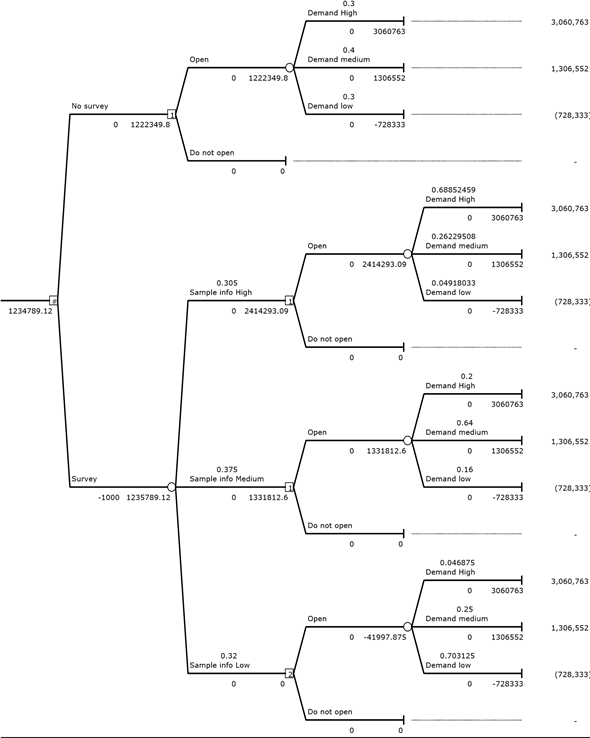

b) The second part of the problem asks one to determine the strategy that would maximize the expected payoff after applying the market strategy into the mix. We also need to calculate the EVPI after take the survey and the true worth of the sample information.

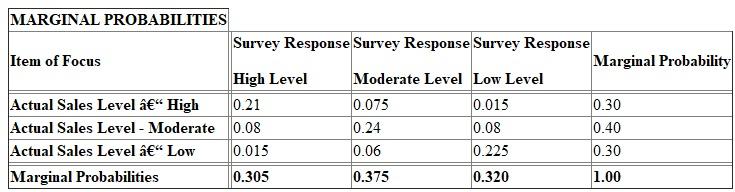

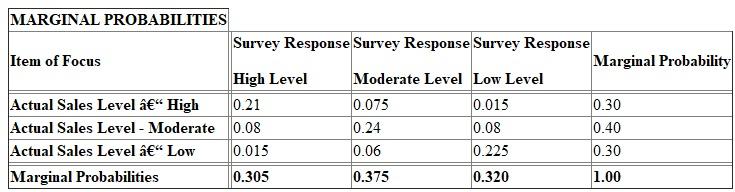

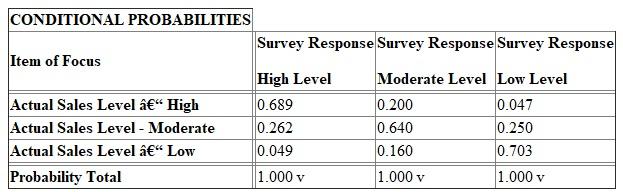

The first thing that one would need to do is to determine the joint and marginal probabilities of the survey. Note that the chart below will show the high and low sales levels and the sum of these probabilities are the marginal probabilities that are active here. Also included are conditional probabilities as well. These are critically important in order to answer the questions that are shown below:

Now that we have the prep information on the board, what are the optimal decisions here It is quite obvious that one would not want to open a store when there is a loss involved and would occur for a 15 year period. Thus, the plant manager should choose one where there is a high or moderate result with respect to the sales volumes. Otherwise, the store should not be opened.

Now that we have the prep information on the board, what are the optimal decisions here It is quite obvious that one would not want to open a store when there is a loss involved and would occur for a 15 year period. Thus, the plant manager should choose one where there is a high or moderate result with respect to the sales volumes. Otherwise, the store should not be opened.

The next thing that one would need to do is to calculate the expected value of perfect information with the survey in hand. This is done by calculating the expected value of the perfect information (which would be the probability totals shown in the first chart above for the problem at hand. Another tidbit to note is that we would throw out the low volume option. When one applies the formula in the same fashion as before, we would get the value of EEPI as $1,235,789.12.

Now that we have the value in place, all one would have to do is to take the difference between the EPPI and EV (which we got in the first part) to get the net expected value of perfect information with the survey applied. When this is done, we would get a net result of $205,060.68.

Extending this further, the other item that one has to do is to get the expected value of the sample information. When one does this, this would result in difference between the EVPI without the survey information and the EVPI with survey information. Thus, when this is calculated, we would have a net result impact from the survey of $13,439.32. In other words, this favors the survey being used which will help generate additional worth and expected value.

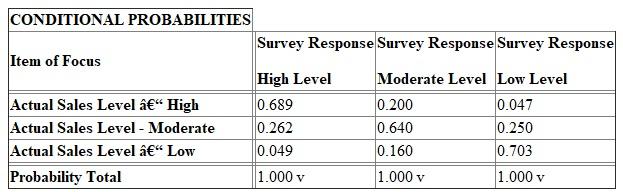

To conclude this part of the problem, the decision tree applicable to the situation is shown below for one to see as well. This applies the information that has been said throughout the problem in a more graphical representation. Presented to one is the applicable decision tree here:

For this problem that is present here, we have a plant manager of a firm which is trying to decide between opening a new factory outlet store which would cost initially $500,000.00. Mentioned in the text the need of determining whether or not the area would support the store and sales would range between $1,000,000.00 on the high demand, $500,000.00 for moderate demand, and a loss of $80,000.00 otherwise.

Note that from knowledge of the area that it would be built in shows that there is a 40.00% chance that sales would be average and a 30.00% chance that it would not be good or be on the high side. Additional assumptions provided show that the MARR is 15.00% and the salvage value of the store is $100,000.00 which would be depreciated under a MACRS schedule of a 39-year real property timeline.

If the new outlet store will be open for the next 15 years, should the business owner open it How much should one be willing to pay in order to know the true statement here Also, assume that there is a survey available which can be had for $1,000.00 and demand was compared by the survey. What would a strategy provide which would maximize the expected payoff after taking the market survey What would the EVPI be after taking the survey and what would the true worth be of the sample info

A general word of caution right from the get go here is that this is a somewhat complex problem that will require one to dedicate at least a good 30-35 minutes or so to complete. There are a number of steps that can be a bit tricky and also deceiving which can throw one off when they least expect it to happen. Thus, please follow carefully below as we work through this problem together. It isn't as bad as the statement seems but focus is definitely recommended here.

a) The first question that must be answered he is to determine the expected value of the three (3) outcomes that could happen over the course of the 15 year time period. Shown below to get one started is the demand cases (high, moderate, and low) and their present worths. The income statements and cash flow statements are standard issue of course for each option and one should jot down the present worth values as we will need those in a few minutes. To not delay the inevitable, here they are for one:

The next thing that one would need to do here is to determine the net present worths of the three (3) sales volumes that are shown here. Note that these are based off the MARR of 15.00% which was stated at the top of the problem. To summarize what is going on here, the net present worths are shown below for one to see with the three (3) options:

The next thing that one would need to do here is to determine the net present worths of the three (3) sales volumes that are shown here. Note that these are based off the MARR of 15.00% which was stated at the top of the problem. To summarize what is going on here, the net present worths are shown below for one to see with the three (3) options: Now that we have the yucky stuff out of the way, we can now work on the expected value that is applicable to the problem here. We first need a formula which we can apply here which will take into account the probabilities of each of the sales volumes occurring at the success rate mentioned above. This is shown as well as the applicable calculations:

Now that we have the yucky stuff out of the way, we can now work on the expected value that is applicable to the problem here. We first need a formula which we can apply here which will take into account the probabilities of each of the sales volumes occurring at the success rate mentioned above. This is shown as well as the applicable calculations: ….. (1)

….. (1)Where…

IP = the revenue amount for applicable to the situation and

EP = the corresponding probability for that outcome.

As a precaution, one should be careful of the calculations here. Shown below is the summarized view of these calculations taking place:

E 0 = $1,222,349.80

E 0 = $1,222,349.80 Thus, the expected value for the store to be open 15 years is a positive $1,222,349.80. Since this is well above the minimum of $0.00 profit, they should execute the opening of the store. The other part of the puzzle here asks one to determine how much one would need to pay at a maximum for the store. This would require one to get the expected value of a perfect situation (EPPI). When we look at the equation above, we simply drop off the annual revenue that would be a result of low sales volume. When this is done, we would have a net value of $1,440,849.70.

Conclusively speaking, one would need to take the difference of this value just calculated with the expected value of the store opened for 15 years (which is $1,222,349.80. As of a result, one could pay up to $218,499.90 given the nature of the beast here.

b) The second part of the problem asks one to determine the strategy that would maximize the expected payoff after applying the market strategy into the mix. We also need to calculate the EVPI after take the survey and the true worth of the sample information.

The first thing that one would need to do is to determine the joint and marginal probabilities of the survey. Note that the chart below will show the high and low sales levels and the sum of these probabilities are the marginal probabilities that are active here. Also included are conditional probabilities as well. These are critically important in order to answer the questions that are shown below:

Now that we have the prep information on the board, what are the optimal decisions here It is quite obvious that one would not want to open a store when there is a loss involved and would occur for a 15 year period. Thus, the plant manager should choose one where there is a high or moderate result with respect to the sales volumes. Otherwise, the store should not be opened.

Now that we have the prep information on the board, what are the optimal decisions here It is quite obvious that one would not want to open a store when there is a loss involved and would occur for a 15 year period. Thus, the plant manager should choose one where there is a high or moderate result with respect to the sales volumes. Otherwise, the store should not be opened.The next thing that one would need to do is to calculate the expected value of perfect information with the survey in hand. This is done by calculating the expected value of the perfect information (which would be the probability totals shown in the first chart above for the problem at hand. Another tidbit to note is that we would throw out the low volume option. When one applies the formula in the same fashion as before, we would get the value of EEPI as $1,235,789.12.

Now that we have the value in place, all one would have to do is to take the difference between the EPPI and EV (which we got in the first part) to get the net expected value of perfect information with the survey applied. When this is done, we would get a net result of $205,060.68.

Extending this further, the other item that one has to do is to get the expected value of the sample information. When one does this, this would result in difference between the EVPI without the survey information and the EVPI with survey information. Thus, when this is calculated, we would have a net result impact from the survey of $13,439.32. In other words, this favors the survey being used which will help generate additional worth and expected value.

To conclude this part of the problem, the decision tree applicable to the situation is shown below for one to see as well. This applies the information that has been said throughout the problem in a more graphical representation. Presented to one is the applicable decision tree here:

3

Sensitivity Analysis

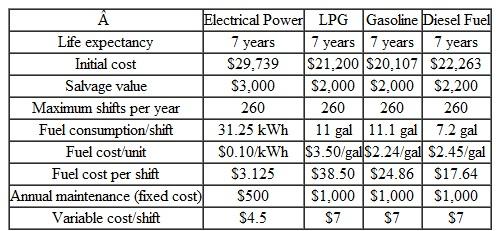

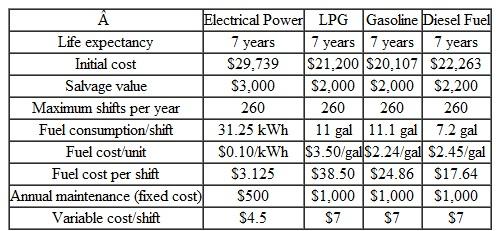

Green Management Company is considering the acquisition of a new eighteen-wheeler.

• The truck's base price is $80,000, and it will cost another $20,000 to modify it for special use by the company.

• This truck falls into the MACRS five-year class. It will be sold after three years for $30,000.

• The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

• The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

(a) Is this project acceptable, based on the most likely estimates given in the problem

(b) If the truck's base price is $95,000, what would be the required savings in leasing so that the project would remain profitable

Green Management Company is considering the acquisition of a new eighteen-wheeler.

• The truck's base price is $80,000, and it will cost another $20,000 to modify it for special use by the company.

• This truck falls into the MACRS five-year class. It will be sold after three years for $30,000.

• The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

• The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

(a) Is this project acceptable, based on the most likely estimates given in the problem

(b) If the truck's base price is $95,000, what would be the required savings in leasing so that the project would remain profitable

Modified Accelerated Cost Recovery System (MACRS): In this method, the life of asset refers to the period which has defined by the maker of the asset. This system of depreciation uses some specified percentage, on which asset is depreciated over its life. These percentages are organized in such a way, so that in the earlier years asset get depreciated by higher amount and later by lower amounts.

In the given case, a company has considering the acquisition of eighteen wheeler. The base price is $80,000 and has a useful life of 3 years. Its salvage value is $30,000. Marginal tax rate is given to be 40%.

a.

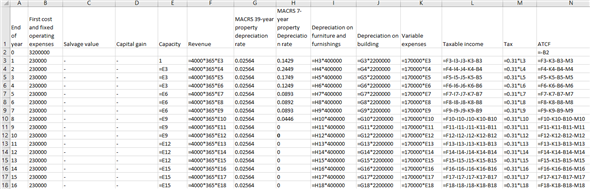

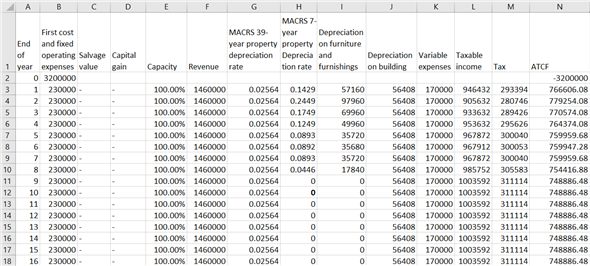

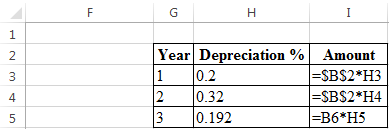

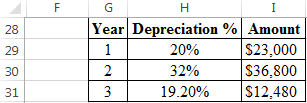

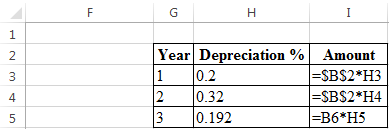

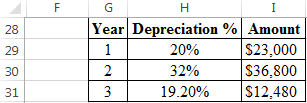

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation using the 5-years MACRS property depreciation rate as follows:

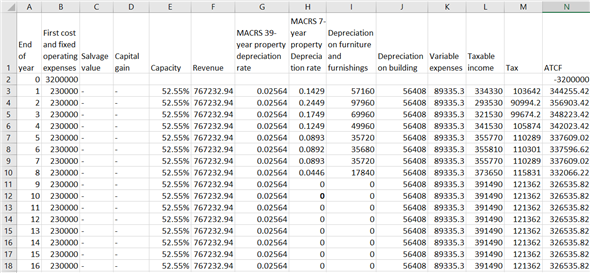

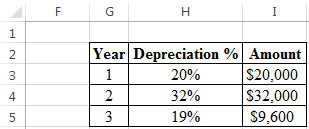

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet:

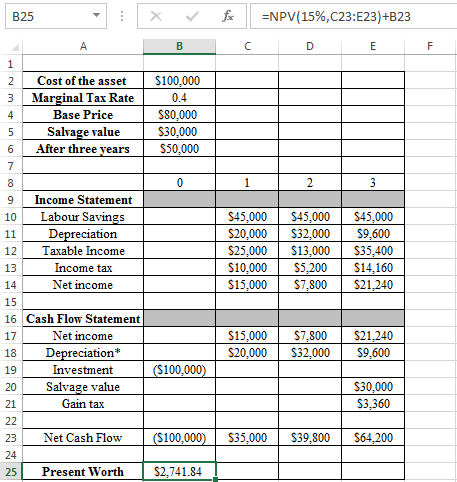

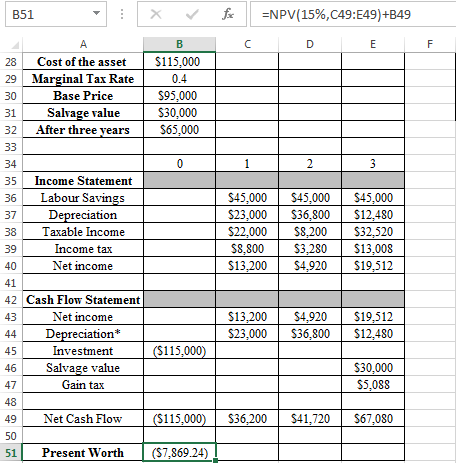

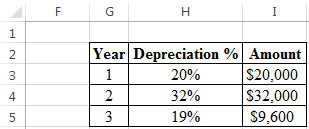

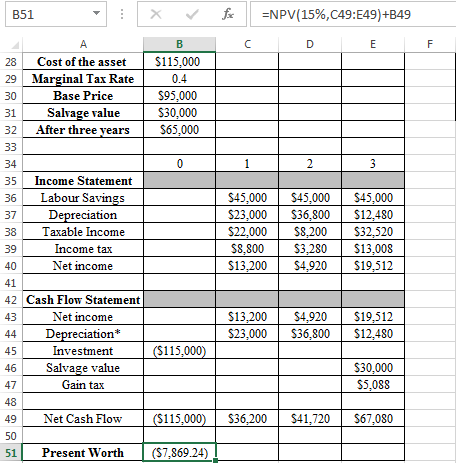

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

The above excel shows that the present worth calculated in cell B25 is $2,741.84. Since, the present worth is positive, thus the project is acceptable.

The above excel shows that the present worth calculated in cell B25 is $2,741.84. Since, the present worth is positive, thus the project is acceptable.

b.

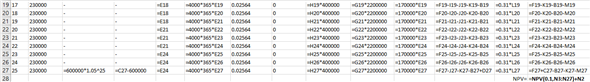

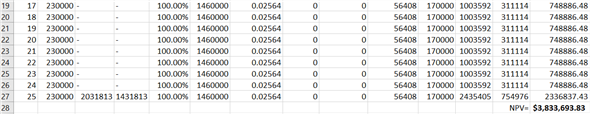

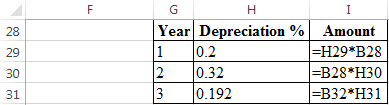

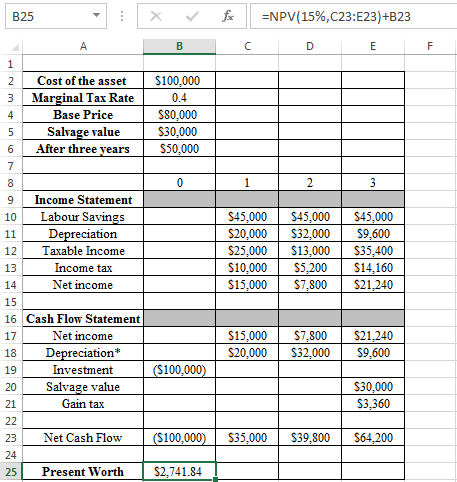

Now, if the base price changes to $95,000, the acceptability of project is to determine. In order to do this, first determine the amount of depreciation using 5-Year MACRS property depreciation rate as follows:

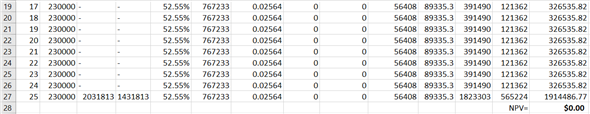

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet:

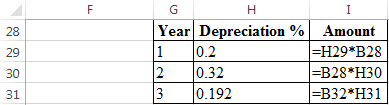

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

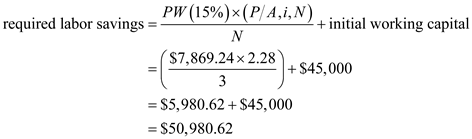

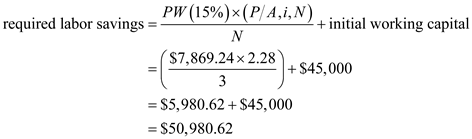

Since, the present worth with new base price is computed as negative value $7,869.24, so in order to accept project the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

Since, the present worth with new base price is computed as negative value $7,869.24, so in order to accept project the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

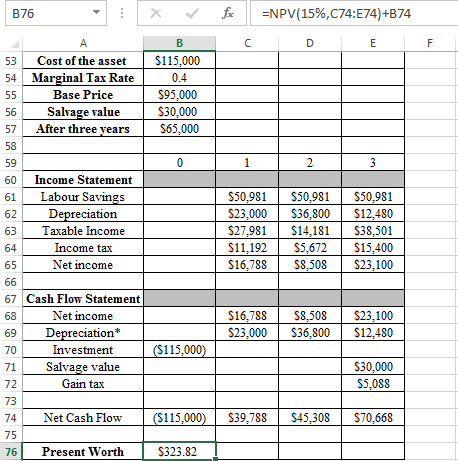

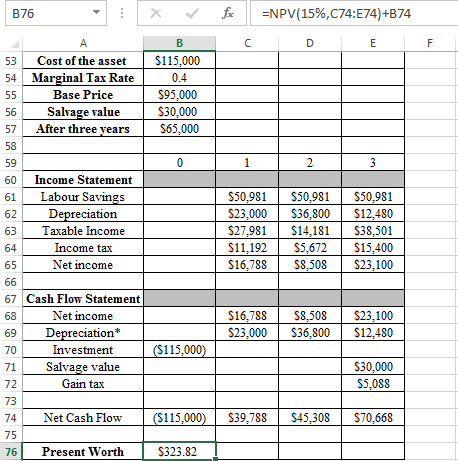

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

The following excel shows that, if company choose labor savings equal to $50,982.62, then the present worth becomes positive. The calculation is shown in the following excel:

Hence, in order to accept the project the required labor savings is

Hence, in order to accept the project the required labor savings is

.

.

In the given case, a company has considering the acquisition of eighteen wheeler. The base price is $80,000 and has a useful life of 3 years. Its salvage value is $30,000. Marginal tax rate is given to be 40%.

a.

It is required to find the project acceptability and for that, it is needed to find the present worth. First, calculate the depreciation using the 5-years MACRS property depreciation rate as follows:

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet: Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows:

Now, in order to determine the acceptability of project, the present worth is calculated using NPV function of excel as follows: The above excel shows that the present worth calculated in cell B25 is $2,741.84. Since, the present worth is positive, thus the project is acceptable.

The above excel shows that the present worth calculated in cell B25 is $2,741.84. Since, the present worth is positive, thus the project is acceptable. b.

Now, if the base price changes to $95,000, the acceptability of project is to determine. In order to do this, first determine the amount of depreciation using 5-Year MACRS property depreciation rate as follows:

The calculated value of depreciation is shown in the following spreadsheet:

The calculated value of depreciation is shown in the following spreadsheet: Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows:

Now, if the base price changes to $95,000, the present worth is to compute at 15% MARR to determine the required labor savings. The present worth with new base price is computed as follows: Since, the present worth with new base price is computed as negative value $7,869.24, so in order to accept project the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows:

Since, the present worth with new base price is computed as negative value $7,869.24, so in order to accept project the present worth should be positive. And, in order to make present worth positive, the minimum required labor savings is calculated as follows: Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable.

Thus, if company choose labor saving at least $50,980.62 , then only the present worth become positive and the project become acceptable. The following excel shows that, if company choose labor savings equal to $50,982.62, then the present worth becomes positive. The calculation is shown in the following excel:

Hence, in order to accept the project the required labor savings is

Hence, in order to accept the project the required labor savings is .

. 4

A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $45.90 per bulb and last 14,600 hours before burning out. The new bulb (at $60 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is $16.00. The lights are on 19 hours a day, 365 days a year. If the firm's MARR is 15%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb (Assume that the firm's marginal tax rate is 40%.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

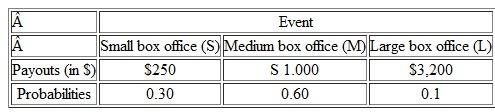

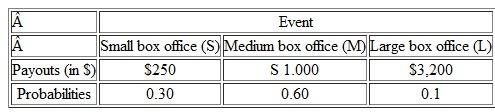

Jay Olsen, a writer of novels, just has completed a new thriller novel. A movie company and a TV network both want exclusive rights to market his new' title If he signs with the network, he will receive a single lump sum of $900, but if he signs with the movie company, the amount he will receive depends on how successful the movie is at the box office. (All $ units are in thousands.)

• TV Network: $900

• Movie

Table

(a)Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that he is a risk-neutral person interested in maximizing the expected monetary value.)

(a)Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that he is a risk-neutral person interested in maximizing the expected monetary value.)

(b)How much would he be willing to pay to know the true slate of nature

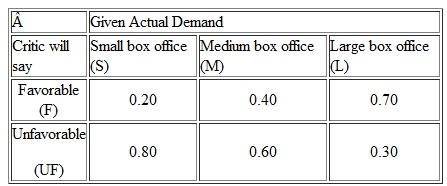

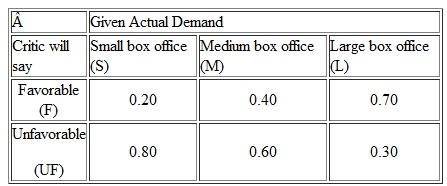

(c) Jay can send his novel to a prominent movie critic to assess the potential box office success. From his past experience, the movie critic's reliability of predicting the box office success is as follows. Favorable prediction means that it is highly likely the movie

For example, when the true state of nature is "S", the movie critic will say "F" with a 20% probability.

For example, when the true state of nature is "S", the movie critic will say "F" with a 20% probability.

Determine Jay's strategy that maximizes the expected payoff after receiving the movie critic's report. In doing so. compute the EVPT after taking the survey. What is the true worth of the market survey

• TV Network: $900

• Movie

Table

(a)Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that he is a risk-neutral person interested in maximizing the expected monetary value.)

(a)Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that he is a risk-neutral person interested in maximizing the expected monetary value.)(b)How much would he be willing to pay to know the true slate of nature

(c) Jay can send his novel to a prominent movie critic to assess the potential box office success. From his past experience, the movie critic's reliability of predicting the box office success is as follows. Favorable prediction means that it is highly likely the movie

For example, when the true state of nature is "S", the movie critic will say "F" with a 20% probability.

For example, when the true state of nature is "S", the movie critic will say "F" with a 20% probability.Determine Jay's strategy that maximizes the expected payoff after receiving the movie critic's report. In doing so. compute the EVPT after taking the survey. What is the true worth of the market survey

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

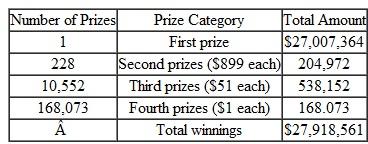

In Virginia's six-number lottery (or lotto) players pick six numbers from 1 to 44. The winning combination is determined by a machine that looks like a popcorn machine, except that it is filled with numbered table-tennis balls. The Virginia lottery drawing offered the prizes shown in Table, assuming that the first prize is not shared with a ticket price of $1.

Common among regular lottery players is this dream: waiting until the jackpot reaches an astronomical sum and then buying every possible number, thereby guaranteeing a winner. Sure, it would cost millions of dollars, but the payoff would be much greater. Is it worth trying How do the odds of winning the first prize change as you increase the number of tickets purchased

TABLE ST 12.1 Virginia Lottery Prizes

Common among regular lottery players is this dream: waiting until the jackpot reaches an astronomical sum and then buying every possible number, thereby guaranteeing a winner. Sure, it would cost millions of dollars, but the payoff would be much greater. Is it worth trying How do the odds of winning the first prize change as you increase the number of tickets purchased

TABLE ST 12.1 Virginia Lottery Prizes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

Robert Cooper is considering purchasing a piece of business rental property containing stores and offices at a cost of $250,000. Cooper estimates that annual disbursements (other than income taxes) will be about $12,000. The property is expected to appreciate at the annual rate of 5%. Cooper expects to retain the property for 20 years once it is acquired. Then it will be depreciated as a 39-year real-property class (MACRS), assuming that the property will be placed in service on January 1st. Cooper's marginal tax rate is 30% and his MARR is 15%. What would be the minimum annual total of rental receipts that would make the investment break even

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

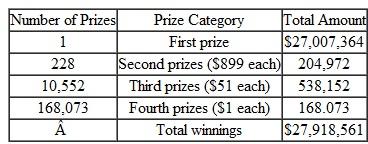

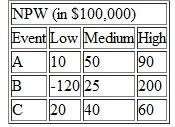

A machine shop specializing in industrial pumps is experiencing a substantial backlog, and the shop's management is considering three courses of action:

• Arrange for subcontracting (A)

• Construct new facilities (B)

• Do nothing (C)

The correct choice depends largely upon demand, which may be low, medium, or high. By consensus, management estimates the respective demand probabilities as 0.2, 0.5, and 0.3. The management estimates the profits when choosing from the three alternatives (A, B, and C) under the differing probable levels of demand. These profits are already expressed in terms of NPW.

(a) Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that you are a risk-neutral person so that you are interested in maximizing the expected monetary value.)

(a) Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that you are a risk-neutral person so that you are interested in maximizing the expected monetary value.)

(b) How much would you be willing to pay to know the true state of nature

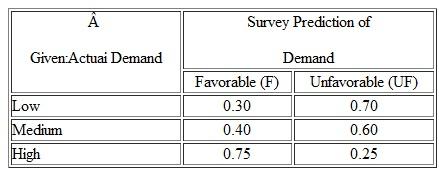

(c) Suppose a market survey can be undertaken with the following reliability (values obtained from past experience where actual demand was compared with predictions made by the market survey). Favorable prediction means that there would be sufficient demand for the product in the market place.

Determine the strategy that maximizes the expected payoff alter taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the market survey

Determine the strategy that maximizes the expected payoff alter taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the market survey

• Arrange for subcontracting (A)

• Construct new facilities (B)

• Do nothing (C)

The correct choice depends largely upon demand, which may be low, medium, or high. By consensus, management estimates the respective demand probabilities as 0.2, 0.5, and 0.3. The management estimates the profits when choosing from the three alternatives (A, B, and C) under the differing probable levels of demand. These profits are already expressed in terms of NPW.

(a) Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that you are a risk-neutral person so that you are interested in maximizing the expected monetary value.)

(a) Which option would you recommend based on the expected monetary value (EMV) criterion (Assume that you are a risk-neutral person so that you are interested in maximizing the expected monetary value.)(b) How much would you be willing to pay to know the true state of nature

(c) Suppose a market survey can be undertaken with the following reliability (values obtained from past experience where actual demand was compared with predictions made by the market survey). Favorable prediction means that there would be sufficient demand for the product in the market place.

Determine the strategy that maximizes the expected payoff alter taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the market survey

Determine the strategy that maximizes the expected payoff alter taking the market survey. In doing so, compute the EVPI after taking the survey. What is the true worth of the market survey

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

The Wellington Construction Company is considering acquiring a new earthmover. The mover's basic price is $90,000, and it will cost another $18,000 to modify it for special use by the company. This earthmover falls into the MACRS five-year class. It will be sold after four years for $30,000. The purchase of the earthmover will have no effect on revenues, but it is expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 10%.

(a) Is this project acceptable, based on the most likely estimates given

(b) Suppose that the project will require an increase in net working capital (spare-parts inventory) of $5,000, which will be recovered at the end of year 4. Taking this new requirement into account, would the project still be acceptable

(c) If the firm's MARR is increased to 18% and with the working capital requirement from (b) not in effect, what would be the required savings in labor so that the project remains profitable

(a) Is this project acceptable, based on the most likely estimates given

(b) Suppose that the project will require an increase in net working capital (spare-parts inventory) of $5,000, which will be recovered at the end of year 4. Taking this new requirement into account, would the project still be acceptable

(c) If the firm's MARR is increased to 18% and with the working capital requirement from (b) not in effect, what would be the required savings in labor so that the project remains profitable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Two different methods of solving a production problem are under consideration. Both methods are expected to be obsolete in six years. Method A would cost $80,000 initially and have annual operating costs of $22,000 a year. Method B would cost $52,000 and costs $17,000 a year to operate. The salvage value realized would be $20,000 with method A and $15,000 with method B. Investments in both methods are subject to a five-year MACRS property class. The firm's marginal income tax rate is 40%. The firm's MARR is 20%. What would be the required additional annual revenue for method A such that an engineer would be indifferent to choosing one method over the other

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

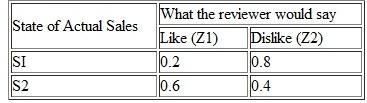

An acquisition editor is trying to decide whether or not to publish a highly technical manuscript he has received. In making a decision he feels that it is sufficient to imagine that there are just two states of nature which are

• S1, the book will sell just an average of 500 copies per year (primarily from library adoptions);

• S2, the average annual sales will be 3,000 copies.

The prior probabilities that he assigns to these slates of nature are 0.50 and 0.50, respectively. The discounted profits if he publishes the book are projected to be ($30,000, loss), and +$40,000, respectively. Of course, the discounted profit is $0 if he does not publish it.

To gain additional information, the publisher can send the manuscript to a reviewer. From previous experience with this reviewer, the publisher feels that the conditional probabilities of the state of nature given this response from the reviewer are respectively as follows:

Should the publisher publish the book To answer this question, do the following:

Should the publisher publish the book To answer this question, do the following:

(a) What is the prior optimal act (before sending out the manuscript to the reviewer)

(b) Calculate the EVPI before sending the manuscript out for review.

(c) What is the posterior optimal act Draw the decision tree.

(d) What is the EVPI after finding out that the reviewer liked the manuscript

(e) What is the EVPI after finding out that the reviewer disliked the manuscript

(f) Calculate the EVSI.

(g) Suppose that it costs $4,500 to gel the manuscript reviewed. Is it worth doing it What is the ENGS

• S1, the book will sell just an average of 500 copies per year (primarily from library adoptions);

• S2, the average annual sales will be 3,000 copies.

The prior probabilities that he assigns to these slates of nature are 0.50 and 0.50, respectively. The discounted profits if he publishes the book are projected to be ($30,000, loss), and +$40,000, respectively. Of course, the discounted profit is $0 if he does not publish it.

To gain additional information, the publisher can send the manuscript to a reviewer. From previous experience with this reviewer, the publisher feels that the conditional probabilities of the state of nature given this response from the reviewer are respectively as follows:

Should the publisher publish the book To answer this question, do the following:

Should the publisher publish the book To answer this question, do the following:(a) What is the prior optimal act (before sending out the manuscript to the reviewer)

(b) Calculate the EVPI before sending the manuscript out for review.

(c) What is the posterior optimal act Draw the decision tree.

(d) What is the EVPI after finding out that the reviewer liked the manuscript

(e) What is the EVPI after finding out that the reviewer disliked the manuscript

(f) Calculate the EVSI.

(g) Suppose that it costs $4,500 to gel the manuscript reviewed. Is it worth doing it What is the ENGS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

The city of Opelika was having a problem locating land for a new sanitary landfill when the Alabama Energy Extension Service offered the solution of burning the solid waste to generate steam. At the same time, Uniroyal Tire Company seemed to be having a similar problem disposing of solid waste in the form of rubber tires. It was determined that there would be about 200 tons per day of waste to be burned, including municipal and industrial

waste. The city is considering building a waste-fired steam plant, which would cost $6,688,800. To finance the construction cost, the city will issue resource-recovery revenue bonds in the amount of $7,000,000 at an interest rate of 11.5%. Bond interest is payable annually. The differential amount between the actual construction costs and the amount of bond financing

($7,000,000 $6,688,800 = $311,200)

will be used to settle the bond discount and expenses associated with the bond financing. The expected life of the steam plant is 20 years. The expected salvage value is estimated to be about $300,000. The expected labor costs are $335,000 per year. The annual operating and maintenance costs (including fuel, electricity, maintenance, and water) are expected to be $175,000. The plant would generate 9,360 pounds of waste, along with 7,200 pounds of waste after incineration, which will have to be disposed of as landfill. At the present rate of $19.45 per pound, this will cost the city a total of $322,000 per year.

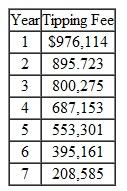

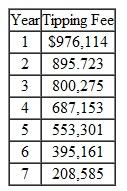

The revenues for the steam plant will come from two sources: (1) sales of steam and (2) tipping fees for disposal. The city expects 20% downtime per year for the waste-fired steam plant. With an input of 200 tons per day and 3.01 pounds of steam per pound of refuse, a maximum of 1,327,453 pounds of steam can be produced per day. However, with 20% downtime, the actual output would be 1,061,962 pounds of steam per day. The initial steam charge will be approximately $4.00 per thousand pounds, which will bring in $1,550,520 in steam revenue the first year and every year thereafter. The tipping fee is used in conjunction with the sale of steam to offset the total plant cost. It is the goal of the Opelika steam plant to phase out the tipping fee as soon as possible. The tipping fee will be $20.85 per ton in the first year of plant operation and will be phased out at the end of the eighth year. The scheduled tipping fee assessment is as follows:

(a) At an interest rate of 10%, would the steam plant generate sufficient revenue to recover the initial investment

(a) At an interest rate of 10%, would the steam plant generate sufficient revenue to recover the initial investment

(b) At an interest rate of 10%, what would be the minimum charge (per thousand pounds) for steam sales to make the project break even

(c) Perform a sensitivity analysis to determine the input variable of the plant's downtime.

waste. The city is considering building a waste-fired steam plant, which would cost $6,688,800. To finance the construction cost, the city will issue resource-recovery revenue bonds in the amount of $7,000,000 at an interest rate of 11.5%. Bond interest is payable annually. The differential amount between the actual construction costs and the amount of bond financing

($7,000,000 $6,688,800 = $311,200)

will be used to settle the bond discount and expenses associated with the bond financing. The expected life of the steam plant is 20 years. The expected salvage value is estimated to be about $300,000. The expected labor costs are $335,000 per year. The annual operating and maintenance costs (including fuel, electricity, maintenance, and water) are expected to be $175,000. The plant would generate 9,360 pounds of waste, along with 7,200 pounds of waste after incineration, which will have to be disposed of as landfill. At the present rate of $19.45 per pound, this will cost the city a total of $322,000 per year.

The revenues for the steam plant will come from two sources: (1) sales of steam and (2) tipping fees for disposal. The city expects 20% downtime per year for the waste-fired steam plant. With an input of 200 tons per day and 3.01 pounds of steam per pound of refuse, a maximum of 1,327,453 pounds of steam can be produced per day. However, with 20% downtime, the actual output would be 1,061,962 pounds of steam per day. The initial steam charge will be approximately $4.00 per thousand pounds, which will bring in $1,550,520 in steam revenue the first year and every year thereafter. The tipping fee is used in conjunction with the sale of steam to offset the total plant cost. It is the goal of the Opelika steam plant to phase out the tipping fee as soon as possible. The tipping fee will be $20.85 per ton in the first year of plant operation and will be phased out at the end of the eighth year. The scheduled tipping fee assessment is as follows:

(a) At an interest rate of 10%, would the steam plant generate sufficient revenue to recover the initial investment

(a) At an interest rate of 10%, would the steam plant generate sufficient revenue to recover the initial investment (b) At an interest rate of 10%, what would be the minimum charge (per thousand pounds) for steam sales to make the project break even

(c) Perform a sensitivity analysis to determine the input variable of the plant's downtime.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Rocky Mountain Publishing Company is considering introducing a new morning newspaper in Denver. Its direct competitor charges $0.25 at retail with $0.05 going to the retailer. For the level of news coverage the company desires, it determines the fixed cost of editors, reporters, rent, press-room expenses, and wire-service charges to be $300,000 per month. The variable cost of ink and paper is $0.10 per copy, but advertising revenues of $0.05 per paper will be generated. To print the morning paper, the publisher has to purchase a new printing press, which will cost $600,000. The press machine will be depreciated according to a seven-year MACRS class. The press machine will be used for 10 years, at which time its salvage value would be about $100,000. Assume 300 issues per year, a 40% tax rate, and a 13% MARR. How many copies per day must be sold to break even at a retail selling price of $0.25 per paper

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Minnesota Metal Forming Company has just invested $500,000 of fixed capital in a manufacturing process that is estimated to generate an after-tax annual cash flow of $200,000 in each of the next five years. At the end of year 5, no further market for the product and no salvage value for the manufacturing process is expected. If a manufacturing problem delays the start-up of the plant for one year (leaving only four years of process life), what additional after-tax cash flow will be needed to maintain the same internal rate of return as would be experienced if no delay occurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

A corporation is trying to decide whether to buy the patent for a product designed by another company. The decision to buy will mean an investment of $8 million, and the demand for the product is not known. If demand is light, the company expects a return of $1.3 million each year for three years. If demand is moderate, the rerurn will be $2.5 million each year for four years, and high demand means a return of $4 million each year for four years. It is estimated the probability of a high demand is 0.4, and the probability of a light demand is 0.2. The firm's (risk-free) interest rate is 12%. Calculate the expected present worth of the patent. On this basis, should the company make the investment (All figures represent after-tax values.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

A local telephone company is considering installing a new phone line for a new row of apartment complexes. Two types of cables are being examined: conventional copper wire and fiber optics. Transmission by copper-wire cables, although cumbersome, involves much less complicated and less expensive support hardware than do fiber optics. The local company may use five different types of copper wire cables: 100 pairs, 200 pairs, 300 pairs, 600 pairs, and 900 pairs per cable, in calculating the cost of cable, the following equation is used:

Cost = [cost per foot + cost per pair (number of pairs)](length)

where

22-gauge copper wire = $ 1.692 per fool

and

Cost per pair = $0,013 per pair

The annual cost of the cable as a percentage of the initial cost is 18.4%. The life of the system is 30 years. In fiber optics, a cable is referred to as a ribbon. One ribbon contains 12 fibers, grouped in fours; therefore, one ribbon contains three groups of 4 fibers. Each group can produce 672 lines (equivalent to 672 pairs of wires), and since each ribbon contains three groups, the total capacity of the ribbon is 2,016 lines. To transmit signals via fiber optics, many modulators, waveguides, and terminators are needed to convert the signals from electric currents to modulated light waves Fiberoptic ribbon costs $15,000 per mile. At each end of the ribbon. three terminators are needed, one for each group of 4 fibers, at a cost of $30,000 per terminator. Twenty-one modulating systems are needed at each end of the ribbon, at a cost of $12,092 for a unit in the central office and $21.21 % for a unit in the field. Every 22,000 feet, a repeater is required to keep the modulated Light waves in the ribbon at an intensity that is intelligible for detection. The unit cost of this repeater is $ 15,000. The annual cost, including income taxes for the 21 modulating systems, is 12.5% of the initial cost of the units. The annual cost of the ribbon itself is 17.8% of the initial cost. The life of the whole system is 30 years. (All figures represent after-tax costs.)

(a) Suppose that the apartments are located 5 miles from the phone company's central switching system and that about 2,000 telephones will be required. This would require either 2,000 pairs of copper wire or one fiberoptic ribbon and related hardware. If the telephone company's interest rate is 15%, which option is more economical

(b) hi part (a), suppose that the apartments are located 10 miles or 25 miles from the phone company's central switching system. Which option is more economically attractive under each scenario

Cost = [cost per foot + cost per pair (number of pairs)](length)

where

22-gauge copper wire = $ 1.692 per fool

and

Cost per pair = $0,013 per pair

The annual cost of the cable as a percentage of the initial cost is 18.4%. The life of the system is 30 years. In fiber optics, a cable is referred to as a ribbon. One ribbon contains 12 fibers, grouped in fours; therefore, one ribbon contains three groups of 4 fibers. Each group can produce 672 lines (equivalent to 672 pairs of wires), and since each ribbon contains three groups, the total capacity of the ribbon is 2,016 lines. To transmit signals via fiber optics, many modulators, waveguides, and terminators are needed to convert the signals from electric currents to modulated light waves Fiberoptic ribbon costs $15,000 per mile. At each end of the ribbon. three terminators are needed, one for each group of 4 fibers, at a cost of $30,000 per terminator. Twenty-one modulating systems are needed at each end of the ribbon, at a cost of $12,092 for a unit in the central office and $21.21 % for a unit in the field. Every 22,000 feet, a repeater is required to keep the modulated Light waves in the ribbon at an intensity that is intelligible for detection. The unit cost of this repeater is $ 15,000. The annual cost, including income taxes for the 21 modulating systems, is 12.5% of the initial cost of the units. The annual cost of the ribbon itself is 17.8% of the initial cost. The life of the whole system is 30 years. (All figures represent after-tax costs.)

(a) Suppose that the apartments are located 5 miles from the phone company's central switching system and that about 2,000 telephones will be required. This would require either 2,000 pairs of copper wire or one fiberoptic ribbon and related hardware. If the telephone company's interest rate is 15%, which option is more economical

(b) hi part (a), suppose that the apartments are located 10 miles or 25 miles from the phone company's central switching system. Which option is more economically attractive under each scenario

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

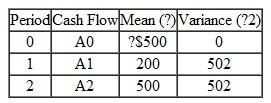

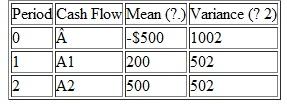

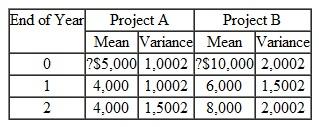

Consider the following investment cash flows over a two-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.3

(b) In part (a)-(1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix B.)

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.3

(b) In part (a)-(1), if random variables ( A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be negative. (See Appendix B.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

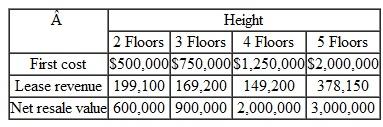

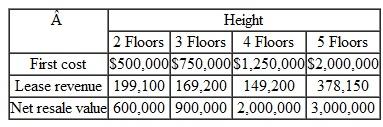

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The relevant net annual revenues and salvage values on after-tax basis are as given in Table.

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range

TABLE 4

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value (In other words, the true value was 10% lower than that of the original estimate.)

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range

TABLE 4

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value (In other words, the true value was 10% lower than that of the original estimate.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

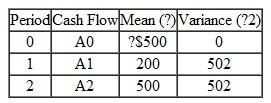

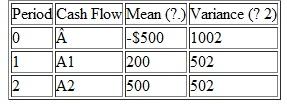

Consider the following investment cash flows over a 2-year life:

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if

1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.5, but 01 = 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

(a) Compute the mean and variance of PW of this project at i = 10% if

(a) Compute the mean and variance of PW of this project at i = 10% if1. A 0 , A 1 and A 2 are mutually independent.

2. A 1 and A 2 are partially correlated with 12 = 0.5, but 01 = 02 = 0.2

3. A 0 , A 1 , and A 2 are perfectly positively correlated.

(b) In part (a)( 1), if random variables ( A 0 , A 1 and A 2 ) are normally distributed with the mean and variance as specified in the table, compute the probability that the PW will be greater than $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

Capstone Turbine Corporation is the world's leading provider of micro-turbine based MicroCHP (combined heat and power) systems for clean, continuous, distributed-generation electricity. The MicroCHP unit is a compact turbine generator that delivers electricity on-site or close to the point where it is needed. Designed to operate on a variety of gaseous and liquid fuels, this form of distributed-generation technology first debuted in 1998. The microturbine is designed to operate on demand or continuously for up to a year between recommended maintenance (filter cleaning/replacement). The generator is cooled by airflow into the gas turbine, thus eliminating the need for liquid cooling. It can make electricity from a variety of fuels-natural gas, kerosene, diesel oil, and even waste gases from landfills, sewage plants, and oilfields.

Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, power quality and reliability, and hybrid electric vehicles. And, unlike traditional backup power, this solution can support everyday energy needs and generate favorable payback. With the current design, which has a 60-KW rating, one of Capstone's generators would cost about $84,000. The

expected annual expenses, including capital costs as well as operating costs, would run close to $19,000. These expenses yield an annual savings of close to $25,000 compared with the corresponding expenses for a conventional generator of the same size.

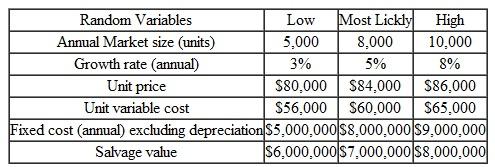

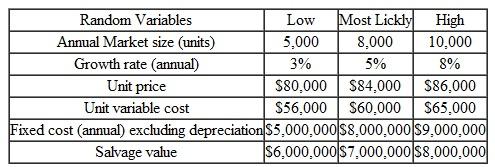

Capstone is considering a full-scale production of the system unit for residential use. The project requires an initial investment of $55 million. The company has prepared the financial data in Table ST 12.4 related to the project.

The initial investment can be depreciated on a seven-year MACRS, and the project is expected to have an economic service life of eight years. The firm's marginal tax rate is 35%, and its MARR is known to be 15%. Capstone will conduct the economic analysis based on the following implicit model of cash flow.

• n = 0: Cashflow = $55million

• n =1 to 8: Cash flow = (revenue costs depreciation)(1 tax rate) + depreciation

• Revenues = market size × unit price ×

(1 + growth rate) (n 1)

• Costs = (market size) X variable unit

cost × (1 + growth rate) (n 1)

+ Fixed cost (excluding depreciation)

• n 8: Adjust the cash flow in year 8 to reflect the gains tax (loss credit) and the salvage value

Assume that each random variable in Table is triangularly distributed with the parameters specified. Using your choice of software (such as Excel, @Risk, or Crystal Ball), develop the NPW distribution of the project.

(a) Document the procedure to obtain your NPW distribution.

(b) Compute the mean and variable of the NPW distribution.

(c) Determine the probability the actual NPW would be below the expected NPW.

TABLE ST 12.4

Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, power quality and reliability, and hybrid electric vehicles. And, unlike traditional backup power, this solution can support everyday energy needs and generate favorable payback. With the current design, which has a 60-KW rating, one of Capstone's generators would cost about $84,000. The

expected annual expenses, including capital costs as well as operating costs, would run close to $19,000. These expenses yield an annual savings of close to $25,000 compared with the corresponding expenses for a conventional generator of the same size.

Capstone is considering a full-scale production of the system unit for residential use. The project requires an initial investment of $55 million. The company has prepared the financial data in Table ST 12.4 related to the project.

The initial investment can be depreciated on a seven-year MACRS, and the project is expected to have an economic service life of eight years. The firm's marginal tax rate is 35%, and its MARR is known to be 15%. Capstone will conduct the economic analysis based on the following implicit model of cash flow.

• n = 0: Cashflow = $55million

• n =1 to 8: Cash flow = (revenue costs depreciation)(1 tax rate) + depreciation

• Revenues = market size × unit price ×

(1 + growth rate) (n 1)

• Costs = (market size) X variable unit

cost × (1 + growth rate) (n 1)

+ Fixed cost (excluding depreciation)

• n 8: Adjust the cash flow in year 8 to reflect the gains tax (loss credit) and the salvage value

Assume that each random variable in Table is triangularly distributed with the parameters specified. Using your choice of software (such as Excel, @Risk, or Crystal Ball), develop the NPW distribution of the project.

(a) Document the procedure to obtain your NPW distribution.

(b) Compute the mean and variable of the NPW distribution.

(c) Determine the probability the actual NPW would be below the expected NPW.

TABLE ST 12.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

A financial investor has an investment portfolio worth $350,000. A bond in the portfolio will mature next month and provide him with $25,000 to reinvest. The choices have been narrowed down to the following two options.

• Option 1: Reinvest in a foreign bond that will mature in one year. This will entail a brokerage fee of $150. For simplicity, assume that the bond will provide interest of $2,450, $2,000, or $1,675 over the one-year period and that the probabilities of these occurrences are assessed to be 0.25, 0.45, and 0.30, respectively.

• Option 2: Reinvest in a $25,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 7.5%.

(a) Which form of reinvestment should the investor choose in order to maximize his expected financial gain

(b) If the investor can obtain professional investment advice from Salomon Brothers, Inc., what would be the maximum amount the investor should pay for this service

• Option 1: Reinvest in a foreign bond that will mature in one year. This will entail a brokerage fee of $150. For simplicity, assume that the bond will provide interest of $2,450, $2,000, or $1,675 over the one-year period and that the probabilities of these occurrences are assessed to be 0.25, 0.45, and 0.30, respectively.

• Option 2: Reinvest in a $25,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 7.5%.

(a) Which form of reinvestment should the investor choose in order to maximize his expected financial gain

(b) If the investor can obtain professional investment advice from Salomon Brothers, Inc., what would be the maximum amount the investor should pay for this service

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

A special-purpose milling machine was purchased four years ago for $20,000. It was estimated at that time that this machine would have a life of 10 years, a salvage value of $1,000, and a cost of removal of $1,500. These estimates are still good. This machine has annual operating costs of $2,000, and its current book value is $13,000 (Based on "alternative MACRS," a straight-line depreciation with a half-year convention with zero salvage value). If the machine is retained for its entire 10-year life, the remaining annual depreciation schedule would be $2,000 for years 5 through 10. A new machine that is more efficient will reduce operating costs to $1,000, but it will require an investment of $ 12,000. The life of the new machine is estimated to be six years with a salvage value of $2,000. The new machine would fall into the five-year MACRS property class. An offer of $6,000 for the old machine has been made, and the purchaser would pay for removal of the machine. The firm's marginal tax rate is 40%, and its required minimum rate of return is 10%.

(a) What incremental cash flows will occur at the end of years 0 through 6 as a result of replacing the old machine Should the old machine be replaced now

(b) Suppose that the annual operating costs for the old milling machine would increase at an annual rate of 5% over the remaining service life of

the machine. With this change in future operating costs for the old machine, would the answer in part (a) change

(c) What is the minimum salvage value for the old machine at the year 0 so that both alternatives are economically equivalent

(a) What incremental cash flows will occur at the end of years 0 through 6 as a result of replacing the old machine Should the old machine be replaced now

(b) Suppose that the annual operating costs for the old milling machine would increase at an annual rate of 5% over the remaining service life of

the machine. With this change in future operating costs for the old machine, would the answer in part (a) change

(c) What is the minimum salvage value for the old machine at the year 0 so that both alternatives are economically equivalent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Kellogg Company is considering the following investment project and has estimated all cost and revenues in constant dollars. The project requires the purchase of a $9,000 asset, which will be used for only two years (the project life).

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

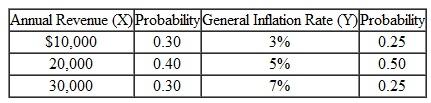

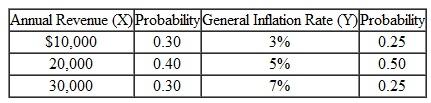

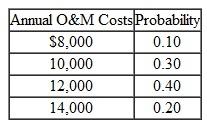

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS property (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part (a), compute the variance of the NPW of the investment.

TABLE 20

• The salvage value of this asset at the end of two years is expected to be $4,000.

• The project requires an investment of $2,000 in working capital, and this amount will be fully recovered at the end of the project year.

• The annual revenue, as well as general inflation, are discrete random variables but can be described by the probability distributions in Table (both random variables are statistically independent).

• The investment will be classified as a three-year MACRS property (tax life).

• It is assumed that the revenues, salvage value, and working capital are responsive to the general inflation rate.

• The revenue and inflation rate dictated during the first year will prevail over the remainder of the project period.

• The marginal income tax rate for the firm is 40%. The firm's inflation-free interest rate ( i ) is 10%.

(a) Determine the NPW as a function of X and Y.

(b) In part (a), compute the expected NPW of this investment.

(c) In part (a), compute the variance of the NPW of the investment.

TABLE 20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

A firm is considering whether to market a new type of computer game during the upcoming Christmas season. The profit contribution of this computer game will depend on the extent of the demand , where denotes the number of thousands of copies of the computer game to be sold. It is estimated that the net profit of marketing the computer game will be approximately 2 2 500,000 dollars. Assume that the firm's initial prediction of demand distribution on is a uniform density on the interval 0 M. In terms of M determine the following.

a. For what value of the demand should the firm market the new type of toy

b. What is the expected value of

c. How much should the firm be willing to pay to find out exactly what the demand will be

a. For what value of the demand should the firm market the new type of toy

b. What is the expected value of

c. How much should the firm be willing to pay to find out exactly what the demand will be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

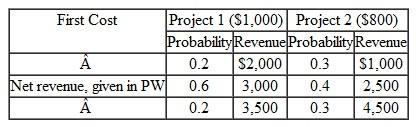

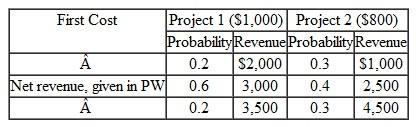

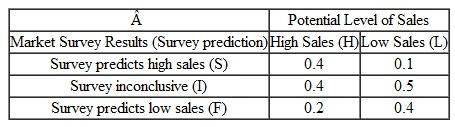

A manufacturing firm is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value. The initial cost and the net year-end revenue for each project are given in Table.

Assume that both projects are statistically independent of each other.

(a) If you are an expected-value maximizer, which project would you select

(b) If you also consider the variance of the project, which project would you select

TABLE P 12.21 Comparison of Mutually Exclusive Projects

Assume that both projects are statistically independent of each other.

(a) If you are an expected-value maximizer, which project would you select

(b) If you also consider the variance of the project, which project would you select

TABLE P 12.21 Comparison of Mutually Exclusive Projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

A company is currently paying a sales representative $0.60 per mile to drive her car for company business. The company is considering supplying the representative with a car, which would involve the following: A car costs $25,000, has a service life of 5 years, and a market value of $5,000 at the end of that time. Monthly storage costs for the car are $200, and the cost of fuel, tires, and maintenance is 20 cents per mile. The car will be depreciated by MACRS, using a recovery period of 5 years (20%, 32%, 19.20%, 11.52%, and 11.52%). The firm's marginal tax rate is 40%.

• Suppose that the required travel by the sales person would be 30,000 miles per year. Which option would be better at i = 15%

• What annual mileage must a salesman travel by car for the cost of the two methods of providing transportation to be equal if the interest rate is 15%

(a) Determine the annual net cash flows from the project.

(b) Perform a sensitivity analysis on the project ' s data, varying savings in telephone bills and savings in deadhead miles. Assume that each of these variables can deviate from its base-case expected value by ±10%, ±20%, and ±30%.

(c) Prepare sensitivity diagrams and interpret the results.

• Suppose that the required travel by the sales person would be 30,000 miles per year. Which option would be better at i = 15%

• What annual mileage must a salesman travel by car for the cost of the two methods of providing transportation to be equal if the interest rate is 15%

(a) Determine the annual net cash flows from the project.

(b) Perform a sensitivity analysis on the project ' s data, varying savings in telephone bills and savings in deadhead miles. Assume that each of these variables can deviate from its base-case expected value by ±10%, ±20%, and ±30%.

(c) Prepare sensitivity diagrams and interpret the results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

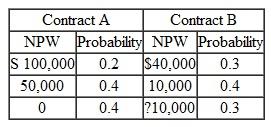

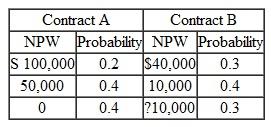

27