Deck 2: Analysis of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 2: Analysis of Financial Statements

1

The information contained in the annual report is used by investors to form expectations about future earnings and dividends.

True

2

Taxes, payment patterns, and reporting considerations, as well as credit sales and non-cash costs, are reasons why operating cash flows can differ from accounting profits.

True

3

Ratio analysis involves a comparison of the relationships between financial statement accounts so as to analyse the financial position and strength of a firm.

True

4

A statement reporting the impact of a firm's operating, investing, and financing activities on cash flows over an accounting is the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Determining whether a firm's financial position is improving or deteriorating requires analysis of more than one set of financial statements.Trend analysis is one method of measuring a firm's performance over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

A decline in the inventory turnover ratio suggests that the firm's liquidity position is improving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

On the statement of financial position, total assets must equal total liabilities plus shareholders equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a firm has high current and quick ratios, this always is a good indication that a firm is managing its liquidity position well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Depreciation, as shown on the statement of comprehensive income, is regarded as a use of cash because it is an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

Non-cash assets are expected to produce cash over time but the amount of cash they eventually produce could be higher or lower than the values at which the assets are carried on the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

An increase in an asset account is a source of cash, whereas an increase in a liability account is a use of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

The statement of financial position is a financial statement measuring the flow of funds into and out of various accounts over time while the statement of comprehensive income measures the progress of the firm at a point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

The statement of financial position presents a summary of the firm's revenues and expenses over an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

The statement of comprehensive income measures the flow of funds into (i.e.revenue) and out of (i.e.expenses) the firm over a certain time period.It is always based on accounting data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

One of the biggest noncash items on the statement of comprehensive income is depreciation which needs to be subtracted from net income to determine cash flows for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

Profitability ratios show the combined effects of liquidity, asset management, and debt management on operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

A firm's net income reported on its statement of comprehensive income must equal the operating cash flows on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

When a firm pays off a loan using cash, the source of funds is the decrease in the asset account, cash, while the use of funds involves a decrease in a liability account, debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

The degree to which the managers of a firm attempt to magnify the returns to owners' capital through the use of financial leverage is captured in debt management ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

The current ratio and inventory turnover ratio measure the liquidity of a firm.The current ratio measures the relation of a firm's current assets to its current liabilities and the inventory turnover ratio measures how rapidly a firm turns its inventory back into a "quick" asset or cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

Other things held constant, which of the following will not affect the quick ratio? (Assume that current assets equal current liabilities.)

A) Fixed assets are sold for cash.

B) Cash is used to purchase inventories.

C) Cash is used to pay off accounts payable.

D) Accounts receivable are collected.

E) Long-term debt is issued to pay off a short-term bank loan.

A) Fixed assets are sold for cash.

B) Cash is used to purchase inventories.

C) Cash is used to pay off accounts payable.

D) Accounts receivable are collected.

E) Long-term debt is issued to pay off a short-term bank loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a firm conducts a share repurchase, it increases an equity account which is an example of a source of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose a firm wants to maintain a specific TIE ratio.If the firm knows the level of its debt, the interest rate it will pay on that debt and the applicable tax rate, the firm can then calculate the earnings level required to maintain its target TIE ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

Funds supplied by ordinary shareholders mainly includes share capital, paid-in capital, and retained earnings, while total equity is comprised of ordinary equity plus preference shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

Suppose two firms with the same amount of assets pay the same interest rate on their debt and earn the same rate of return on their assets, and that ROA is positive.However, one firm has a higher debt ratio.Under these conditions, the firm with the higher debt ratio will also have a higher rate of return on common equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

We can use the fixed asset turnover ratio to legitimately compare firms in different industries as long as all the firms being compared are using the same proportion of fixed assets to total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

The financial position of companies whose business is seasonal can be dramatically different depending upon the time of year chosen to construct financial statements.This time sensitivity is especially true with respect to the firm's statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

The fixed charge coverage ratio recognises that firms often lease equipment under contract and thus, some firms must meet more than just their scheduled interest payments out of earnings.Therefore, the fixed charge coverage is more inclusive than the TIE ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

A liquid asset is an asset that can be easily converted into cash without a significant loss of its original value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

In order to accurately estimate cash flow from operations, depreciation must be added back to net income.The reason for this is that even though depreciation is deducted from revenue it is really a non-cash charge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

Changes in the statement of financial position accounts are necessary for

A) A typical ratio analysis.

B) Pro forma statement of financial position construction.

C) Statement of cash flows construction.

D) Profit and loss analysis.

E) Pro forma statement of comprehensive income construction.

A) A typical ratio analysis.

B) Pro forma statement of financial position construction.

C) Statement of cash flows construction.

D) Profit and loss analysis.

E) Pro forma statement of comprehensive income construction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the current ratio of Firm A is greater than the current ratio of Firm B, we cannot be sure that the quick ratio of Firm A is greater than that of Firm B.However, if the quick ratio of Firm A exceeds that of Firm B, we can be assured that Firm A's current ratio also exceeds B's current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

Genzyme Corporation has seen its days sales outstanding (DSO) decline from 38 days last year to 22 days this implying that more of the firm's suppliers are being paid on time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a firm conducts a seasoned equity offering, it increases an equity account which is an example of a source of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

Retained earnings is the cash that has been generated by the firm through its operations which has not been paid out to shareholders as dividends.Retained earnings are kept in cash or near cash accounts and thus, these cash accounts, when added together, will always be equal to the total retained earnings of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

If sales decrease and financial leverage increases, we can say with certainty that the profit margin on sales will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

In accounting, emphasis is placed on determining net income.In finance, the primary emphasis also is on net income because that is what investors use to value the firm.However, a secondary consideration is cash flow because that's what is used to run the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

Selling new shares is an equity transaction; it does not affect any asset or liability account and therefore, does not appear on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

The inventory turnover and current ratios are related.The combination of a high current ratio and a low inventory turnover ratio relative to the industry norm might indicate that the firm is maintaining too high an inventory level or that part of the inventory is obsolete or damaged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

Current cash flow from existing assets is highly relevant to the investor.However, the value of the firm depends primarily upon its growth opportunities.As a result, profit projections from those opportunities are the only relevant future flows with which investors are concerned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

A firm's current ratio has steadily increased over the past 5 years, from 1.9 five years ago to 3.8 today.What would a financial analyst be most justified in concluding?

A) The firm's fixed assets turnover probably has improved.

B) The firm's liquidity position probably has improved.

C) The firm's share price probably has increased.

D) Each of the above is likely to have occurred.

E) The analyst would be unable to draw any conclusions from this information.

A) The firm's fixed assets turnover probably has improved.

B) The firm's liquidity position probably has improved.

C) The firm's share price probably has increased.

D) Each of the above is likely to have occurred.

E) The analyst would be unable to draw any conclusions from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about ratio analysis is incorrect?

A) Classifying a large, well-diversified firm into a single industry often is difficult because many of the firm's divisions are involved with different products from different industries.

B) As a rule of thumb, it is safe to conclude that any firm with a current ratio greater than 1.0 should be able to meet its current obligations-that is, pay bills that come due in the current period.[Current ratio = (Current assets) / (Current liabilities)]

C) Sometimes firms attempt to use "window dressing" techniques to make their financial statements look better than they actually are in the current period.

D) Computing the values of the ratios is fairly simple; the toughest and most important part of ratio analysis is interpretation of the values derived from the computations.

E) General conclusions about a firm should not be made by examining one or a few ratios-ratio analysis should be comprehensive.

A) Classifying a large, well-diversified firm into a single industry often is difficult because many of the firm's divisions are involved with different products from different industries.

B) As a rule of thumb, it is safe to conclude that any firm with a current ratio greater than 1.0 should be able to meet its current obligations-that is, pay bills that come due in the current period.[Current ratio = (Current assets) / (Current liabilities)]

C) Sometimes firms attempt to use "window dressing" techniques to make their financial statements look better than they actually are in the current period.

D) Computing the values of the ratios is fairly simple; the toughest and most important part of ratio analysis is interpretation of the values derived from the computations.

E) General conclusions about a firm should not be made by examining one or a few ratios-ratio analysis should be comprehensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

Other things held constant, which of the following will not affect the current ratio, assuming an initial current ratio greater than 1.0?

A) Fixed assets are sold for cash.

B) Long-term debt is issued to pay off current liabilities.

C) Accounts receivable are collected.

D) Cash is used to pay off accounts payable.

E) A bank loan is obtained, and the proceeds are credited to the firm's checking account.

A) Fixed assets are sold for cash.

B) Long-term debt is issued to pay off current liabilities.

C) Accounts receivable are collected.

D) Cash is used to pay off accounts payable.

E) A bank loan is obtained, and the proceeds are credited to the firm's checking account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

Other things held constant, if a firm holds cash in excess of their optimal level in a non-interest bearing account, this will tend to lower the firm's

A) Profit margin.

B) Total asset turnover.

C) Return on equity.

D) All of the above.

E) Answers b and c above.

A) Profit margin.

B) Total asset turnover.

C) Return on equity.

D) All of the above.

E) Answers b and c above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

If your goal is determine how effectively a firm is managing its assets, which of the following sets of ratios would you examine?

A) profit margin, current ratio, fixed charge coverage ratio

B) quick ratio, debt ratio, time interest earned

C) inventory turnover ratio, days sales outstanding, fixed asset turnover ratio

D) total assets turnover ratio, price earnings ratio, return on total assets

E) time interest earned, profit margin, fixed asset turnover ratio

A) profit margin, current ratio, fixed charge coverage ratio

B) quick ratio, debt ratio, time interest earned

C) inventory turnover ratio, days sales outstanding, fixed asset turnover ratio

D) total assets turnover ratio, price earnings ratio, return on total assets

E) time interest earned, profit margin, fixed asset turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following actions will cause an increase in the quick ratio in the short run?

A) R1,000 worth of inventory is sold, and an account receivable is created.The receivable exceeds the inventory by the amount of profit of the sale, which is added to retained earnings.

B) A small subsidiary which was acquired for R100,000 two years ago and which was generating profits at the rate of 10 percent is sold for R100,000 cash.(Average company profits are 15 percent of assets.)

C) Marketable securities are sold at cost.

D) All of the above.

E) Answers a and b above.

A) R1,000 worth of inventory is sold, and an account receivable is created.The receivable exceeds the inventory by the amount of profit of the sale, which is added to retained earnings.

B) A small subsidiary which was acquired for R100,000 two years ago and which was generating profits at the rate of 10 percent is sold for R100,000 cash.(Average company profits are 15 percent of assets.)

C) Marketable securities are sold at cost.

D) All of the above.

E) Answers a and b above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

As a short-term creditor concerned with a company's ability to meet its financial obligation to you, which one of the following combinations of ratios would you most likely prefer?

A) 0.5 0.5 0.33

B) 1.0 1.0 0.50

C) 1.5 1.5 0.50

D) 2.0 1.0 0.67

E) 2.5 0.5 0.71

A) 0.5 0.5 0.33

B) 1.0 1.0 0.50

C) 1.5 1.5 0.50

D) 2.0 1.0 0.67

E) 2.5 0.5 0.71

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following ratios measures how effectively a firm is managing its assets?

A) quick ratio

B) times interest earned

C) profit margin

D) inventory turnover ratio

E) price earnings ratio

A) quick ratio

B) times interest earned

C) profit margin

D) inventory turnover ratio

E) price earnings ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements shows the portion of the firm's earnings that has been saved rather than paid out as dividends?

A) statement of financial position

B) statement of comprehensive income

C) statement of changes in equity

D) cash flow statement

E) proxy statement

A) statement of financial position

B) statement of comprehensive income

C) statement of changes in equity

D) cash flow statement

E) proxy statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

An analysis of a firm's financial ratios over time that is used to determine the improvement or deterioration in its financial situation is called

A) sensitivity analysis

B) DuPont chart

C) ratio analysis

D) progress chart

E) trend analysis

A) sensitivity analysis

B) DuPont chart

C) ratio analysis

D) progress chart

E) trend analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

All of the following represent cash outflows to the firm except

A) Taxes.

B) Interest payments.

C) Dividends.

D) Purchase of plant and equipment.

E) Depreciation.

A) Taxes.

B) Interest payments.

C) Dividends.

D) Purchase of plant and equipment.

E) Depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following groups probably would not be interested in the financial statement analysis of a firm?

A) creditors

B) management of the firm

C) shareholders

D) Internal Revenue Service

E) All of the above would be interested in the financial statement analysis.

A) creditors

B) management of the firm

C) shareholders

D) Internal Revenue Service

E) All of the above would be interested in the financial statement analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is correct?

A) In the text, depreciation is regarded as a use of cash because it reduces fixed assets, which then must be replaced.

B) If a company uses some of its cash to pay off short-term debt, then its current ratio will always decline, given the way ratio is calculated, other things held constant.

C) During a recession, it is reasonable to think that most companies inventory turnover ratios will change while their fixed asset turnover ratio will remain fairly constant.

D) During a recession, we can be confident that most companies' DSOs (or ACPs) will decline because their sales will probably decline.

E) Each of the above statements is false.

A) In the text, depreciation is regarded as a use of cash because it reduces fixed assets, which then must be replaced.

B) If a company uses some of its cash to pay off short-term debt, then its current ratio will always decline, given the way ratio is calculated, other things held constant.

C) During a recession, it is reasonable to think that most companies inventory turnover ratios will change while their fixed asset turnover ratio will remain fairly constant.

D) During a recession, we can be confident that most companies' DSOs (or ACPs) will decline because their sales will probably decline.

E) Each of the above statements is false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

When constructing a Statement of Cash Flows, which of the following actions would be considered a source of funds?

A) increase in the cash account

B) decrease in accounts payable

C) increase in inventory

D) increase in long-term bonds

E) increase in fixed assets

A) increase in the cash account

B) decrease in accounts payable

C) increase in inventory

D) increase in long-term bonds

E) increase in fixed assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

The annual report contains all of the following financial statements except

A) Statement of comprehensive income.

B) Statement of changes in long-term financing.

C) Cash flow statement.

D) Statement of financial position.

E) Statement of changes in equity.

A) Statement of comprehensive income.

B) Statement of changes in long-term financing.

C) Cash flow statement.

D) Statement of financial position.

E) Statement of changes in equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements is most correct?

A) An increase in a firm's debt ratio, with no changes in its sales and operating costs, could be expected to lower its profit margin on sales.

B) An increase in DSO, other things held constant, would generally lead to an increase in the total asset turnover ratio.

C) An increase on the DSO, other things held constant, would generally lead to an increase in the ROE.

D) In a competitive economy, where all firms earn similar returns on equity, one would expect to find lower profit margins for airlines, which require a lot of fixed assets relative to sales, than for fresh fish markets.

E) It is more important to adjust the Debt/Asset ratio than the inventory turnover ratio to account for seasonal fluctuations.

A) An increase in a firm's debt ratio, with no changes in its sales and operating costs, could be expected to lower its profit margin on sales.

B) An increase in DSO, other things held constant, would generally lead to an increase in the total asset turnover ratio.

C) An increase on the DSO, other things held constant, would generally lead to an increase in the ROE.

D) In a competitive economy, where all firms earn similar returns on equity, one would expect to find lower profit margins for airlines, which require a lot of fixed assets relative to sales, than for fresh fish markets.

E) It is more important to adjust the Debt/Asset ratio than the inventory turnover ratio to account for seasonal fluctuations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following financial statements includes information about a firm's assets, equity, and liabilities?

A) Statement of comprehensive income

B) Cash flow statement

C) Statement of financial position

D) Statement of changes in equity

E) All of the above

A) Statement of comprehensive income

B) Cash flow statement

C) Statement of financial position

D) Statement of changes in equity

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following financial statements shows a firm's financing activities (how funds were generated) and investment activities (how funds were used) over a particular period of time?

A) statement of financial position

B) statement of comprehensive income

C) statement of changes in equity

D) cash flow statement

E) proxy statement

A) statement of financial position

B) statement of comprehensive income

C) statement of changes in equity

D) cash flow statement

E) proxy statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following ratios measures the extent to which operating income can decline before the firm is unable to meet its annual interest costs

A) fixed charge coverage ratio

B) debt ratio

C) times-interest-earned ratio

D) return on equity

E) profit margin

A) fixed charge coverage ratio

B) debt ratio

C) times-interest-earned ratio

D) return on equity

E) profit margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is correct?

A) The annual report contains four basic financial statements: the statement of comprehensive income; statement of financial position; statement of cash flows; and statement of changes in long-term financing.

B) Although the annual report is geared toward the average shareholder, it represents financial analysts' most complete source of financial information about the firm.

C) The key importance of annual report information is that it is used by investors when they form their expectations about the firm's future earnings and dividends and the riskiness of those cash flows.

D) The annual report provides no relevant information for use by financial analysts or by the investing public.

E) None of the above statements is correct.

A) The annual report contains four basic financial statements: the statement of comprehensive income; statement of financial position; statement of cash flows; and statement of changes in long-term financing.

B) Although the annual report is geared toward the average shareholder, it represents financial analysts' most complete source of financial information about the firm.

C) The key importance of annual report information is that it is used by investors when they form their expectations about the firm's future earnings and dividends and the riskiness of those cash flows.

D) The annual report provides no relevant information for use by financial analysts or by the investing public.

E) None of the above statements is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

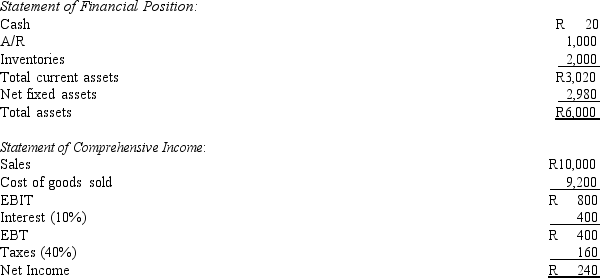

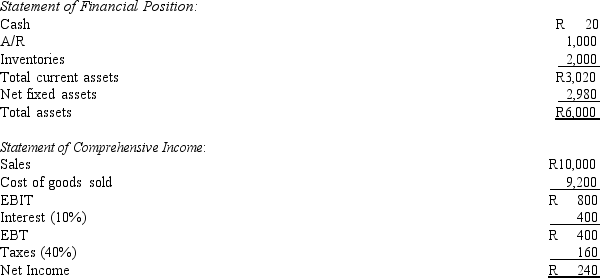

Chauke Company had the following partial statement of financial position and complete statement of comprehensive income information for last year:  The industry average DSO is 30 (360-day basis).Chauke plans to change its credit policy so as to cause its DSO to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Chaukes' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the statement of financial position?

The industry average DSO is 30 (360-day basis).Chauke plans to change its credit policy so as to cause its DSO to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Chaukes' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the statement of financial position?

A) 33.33%

B) 45.28%

C) 52.75%

D) 60.00%

E) 65.71%

The industry average DSO is 30 (360-day basis).Chauke plans to change its credit policy so as to cause its DSO to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Chaukes' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the statement of financial position?

The industry average DSO is 30 (360-day basis).Chauke plans to change its credit policy so as to cause its DSO to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate), what will Chaukes' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the statement of financial position?A) 33.33%

B) 45.28%

C) 52.75%

D) 60.00%

E) 65.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

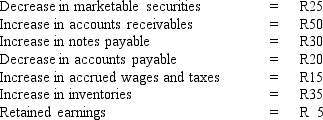

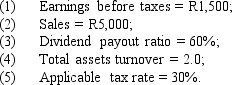

Determine the increase or decrease in cash for Rinky Supply Company for last year, given the following information.(Assume no other changes occurred during the past year.)

A) -R50

B) +R40

C) -R30

D) +R20

E) -R10

A) -R50

B) +R40

C) -R30

D) +R20

E) -R10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements is most correct?

A) firms with relatively low debt ratios have higher expected returns when the business is good.

B) firms with relatively low debt ratios are exposed to risk of loss when the business is poor.

C) firms with relatively high debt ratios have higher expected returns when the business is bad.

D) firms with relatively high debt ratios have higher expected returns when the business is good.

E) none of the above.

A) firms with relatively low debt ratios have higher expected returns when the business is good.

B) firms with relatively low debt ratios are exposed to risk of loss when the business is poor.

C) firms with relatively high debt ratios have higher expected returns when the business is bad.

D) firms with relatively high debt ratios have higher expected returns when the business is good.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

A firm has a profit margin of 15 percent on sales of R20,000,000.If the firm has debt of R7,500,000, total assets of R22,500,000, and an after-tax interest cost on total debt of 5 percent, what is the firm's ROA?

A) 8.4%

B) 10.9%

C) 12.0%

D) 13.3%

E) 15.1%

A) 8.4%

B) 10.9%

C) 12.0%

D) 13.3%

E) 15.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

Cannon Company has enjoyed a rapid increase in sales in recent years, following a decision to sell on credit.However, the firm has noticed a recent increase in its collection period.Last year, total sales were R1 million, and R250,000 of these sales were on credit.During the year, the accounts receivable account averaged R41,664.It is expected that sales will increase in the forthcoming year by 50 percent, and, while credit sales should continue to be the same proportion of total sales, it is expected that the days sales outstanding will also increase by 50 percent.If the resulting increase in accounts receivable must be financed by external funds, how much external funding will Cannon need?

A) R41,664

B) R52,086

C) R47,359

D) R106,471

E) R93,750

A) R41,664

B) R52,086

C) R47,359

D) R106,471

E) R93,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

Alumbat Corporation has R800,000 of debt outstanding, and it pays an interest rate of 10 percent annually on its bank loan.Alumbat's annual sales are R3,200,000; its average tax rate is 40 percent; and its net profit margin on sales is 6 percent.If the company does not maintain a TIE ratio of at least 4 times, its bank will refuse to renew its loan, and bankruptcy will result.What is Alumbat's current TIE ratio?

A) 2.4

B) 3.4

C) 3.6

D) 4.0

E) 5.0

A) 2.4

B) 3.4

C) 3.6

D) 4.0

E) 5.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following statements is correct?

A) If Company A has a higher debt ratio that Company B, then we can be sure that A will have a lower times-interest-earned ratio than B.

B) Suppose two companies have identical operations in terms of sales, cost of goods sold, interest rate on debt, and assets.However, Company A used more debt than Company B; that is, Company A has a higher debt ratio.Under these conditions, we would expect B's profit margin to be higher than A's.

C) The ROE of any company which is earning positive profits and which has a positive net worth (or common equity) must exceed the company's ROA.

D) Statements a, b, and c are all true.

E) Statements a, b, and c are all false.

A) If Company A has a higher debt ratio that Company B, then we can be sure that A will have a lower times-interest-earned ratio than B.

B) Suppose two companies have identical operations in terms of sales, cost of goods sold, interest rate on debt, and assets.However, Company A used more debt than Company B; that is, Company A has a higher debt ratio.Under these conditions, we would expect B's profit margin to be higher than A's.

C) The ROE of any company which is earning positive profits and which has a positive net worth (or common equity) must exceed the company's ROA.

D) Statements a, b, and c are all true.

E) Statements a, b, and c are all false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

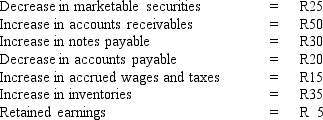

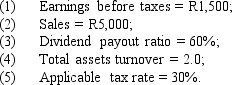

Assume Meyer Corporation is 100 percent equity financed.Calculate the return on equity, given the following information:

A) 25%

B) 30%

C) 35%

D) 42%

E) 50%

A) 25%

B) 30%

C) 35%

D) 42%

E) 50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

Pepsi Corporation's current ratio is 0.5, while Coke Company's current ratio is 1.5.Both firms want to "window dress" their coming end-of-year financial statements.As part of their window dressing strategy, each firm will double its current liabilities by adding short-term debt and placing the funds obtained in the cash account.Which of the statements below best describes the actual results of these transactions?

A) The transactions will have no effect on the current ratios.

B) The current ratios of both firms will be increased.

C) The current ratios of both firms will be decreased.

D) Only Pepsi Corporation's current ratio will be increased.

E) Only Coke Company's current ratio will be increased.

A) The transactions will have no effect on the current ratios.

B) The current ratios of both firms will be increased.

C) The current ratios of both firms will be decreased.

D) Only Pepsi Corporation's current ratio will be increased.

E) Only Coke Company's current ratio will be increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

The Ramaphosa Company is a relatively small, privately owned firm.Last year the company had after-tax income of R15,000, and 10,000 shares were outstanding.The owners were trying to determine the market value of the shares, prior to taking the company public.A similar firm which is publicly traded had a price/earnings ratio of 5.0.Using only the information given, estimate the market value of one share of Ramaphosa's stock.

A) R10.00

B) R7.50

C) R5.00

D) R2.50

E) R1.50

A) R10.00

B) R7.50

C) R5.00

D) R2.50

E) R1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Meryl Corporation's ordinary shares currently are selling at R100 per share, which represents a P/E ratio of 10.If the firm has 100 ordinary shares outstanding, a return on equity of 20 percent, and a debt ratio of 60 percent, what is its return on total assets (ROA)?

A) 8.0%

B) 10.0%

C) 12.0%

D) 16.7%

E) 20.0%

A) 8.0%

B) 10.0%

C) 12.0%

D) 16.7%

E) 20.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

All other things constant, an increase in a firm's profit margin would

A) increase the additional funds needed for financing a growth in operations.

B) decrease the additional funds needed for financing a growth in operations.

C) have no effect on the additional funds needed for financing a growth in operations.

D) decrease its taxes.

E) none of the above.

A) increase the additional funds needed for financing a growth in operations.

B) decrease the additional funds needed for financing a growth in operations.

C) have no effect on the additional funds needed for financing a growth in operations.

D) decrease its taxes.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

Bubbles Soap Corporation has a quick ratio of 1.0 and a current ratio of 2.0 implying that

A) the value of current assets is equal to the value of inventory.

B) the value of current assets is equal to the value of current liabilities.

C) the value of current liabilities is equal to the value of inventory.

D) All of the above.

E) None of the above.

A) the value of current assets is equal to the value of inventory.

B) the value of current assets is equal to the value of current liabilities.

C) the value of current liabilities is equal to the value of inventory.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

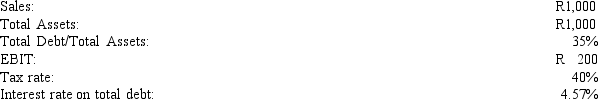

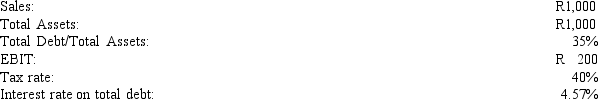

The Amber Company has the following characteristics:  What is Amber's ROE?

What is Amber's ROE?

A) 11.04%

B) 12.31%

C) 16.99%

D) 28.31%

E) 30.77%

What is Amber's ROE?

What is Amber's ROE?A) 11.04%

B) 12.31%

C) 16.99%

D) 28.31%

E) 30.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

Aurillo Equipment Company (AEC) projected that its ROE for next year would be just 6%.However, the financial staff has determined that the firm can increase its ROE by refinancing some high interest bonds currently outstanding.The firm's total debt will remain at R200,000 and the debt ratio will hold constant at 80%, but the interest rate on the refinanced debt will be 10%.The rate on the old debt is 14%.Refinancing will not affect sales which are projected to be R300,000.EBIT will be 11% of sales, and the firm's tax rate is 40%.If AEC refinances its high interest bonds, what will be its projected new ROE?

A) 3.0%

B) 8.2%

C) 10.0%

D) 15.6%

E) 18.7%

A) 3.0%

B) 8.2%

C) 10.0%

D) 15.6%

E) 18.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

A firm has total interest charges of R10,000 per year, sales of R1 million, a tax rate of 40 percent, and a net profit margin of 6 percent.What is the firm's times-interest-earned ratio?

A) 16 times

B) 10 times

C) 7 times

D) 11 times

E) 20 times

A) 16 times

B) 10 times

C) 7 times

D) 11 times

E) 20 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

Sibanda Inc.sells all its merchandise on credit.It has a profit margin of 4 percent, days sales outstanding equal to 60 days, receivables of R150,000, total assets of R3 million, and a debt ratio of 0.64.What is the firm's return on equity (ROE)?

A) 7.1%

B) 33.3%

C) 3.3%

D) 71.0%

E) 8.1%

A) 7.1%

B) 33.3%

C) 3.3%

D) 71.0%

E) 8.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

You are given the following information about a firm: The growth rate equals 8 percent; return on assets (ROA) is 10 percent; the debt ratio is 20 percent; and the shares are selling at R36 each.What is the return on equity (ROE)?

A) 14.0%

B) 12.5%

C) 15.0%

D) 2.5%

E) 13.5%

A) 14.0%

B) 12.5%

C) 15.0%

D) 2.5%

E) 13.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

If Khaba Corporation has sales of R2 million per year (all credit) and days sales outstanding of 35 days, what is its average amount of accounts receivable outstanding (assume a 360 day year)?

A) R194,444

B) R57,143

C) R5,556

D) R97,222

E) R285,714

A) R194,444

B) R57,143

C) R5,556

D) R97,222

E) R285,714

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

Yesterday, Pula Corporation purchased (and received) raw materials on credit from its supplier.All else equal, if Pula's current ratio was 2.0 before the purchase, what effect did this transaction have on Pula's current ratio?

A) increased

B) decreased

C) stayed the same

D) There is not enough information to answer this question.

E) None of the above is a correct answer.

A) increased

B) decreased

C) stayed the same

D) There is not enough information to answer this question.

E) None of the above is a correct answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck