Deck 12: Money, Banking, Prices, and Monetary Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 12: Money, Banking, Prices, and Monetary Policy

1

If R > q, then

A)the marginal benefit of using cash exceeds the marginal cost.

B)the nominal interest rate is not in equilibrium.

C)the real interest rate does not reach its equilibrium value.

D)the marginal cost of using the credit card exceeds the marginal benefit.

E)the marginal benefit of using the credit card exceeds the marginal cost.

A)the marginal benefit of using cash exceeds the marginal cost.

B)the nominal interest rate is not in equilibrium.

C)the real interest rate does not reach its equilibrium value.

D)the marginal cost of using the credit card exceeds the marginal benefit.

E)the marginal benefit of using the credit card exceeds the marginal cost.

E

2

The real return on bonds is

A)the return someone receives from holding a real bond from the current to the future period.

B)the return someone receives from holding a nominal bond from the current to the future period.

C)always greater than the nominal return.

D)always equal to the nominal return.

E)R.

A)the return someone receives from holding a real bond from the current to the future period.

B)the return someone receives from holding a nominal bond from the current to the future period.

C)always greater than the nominal return.

D)always equal to the nominal return.

E)R.

B

3

To increase the nominal money supply, the government can

A)temporarily increase government spending, with an increase in either taxes or the quantity of government bonds.

B)engage in open market sales of interest-bearing debt.

C)reduce the quantity of government bonds, with an increase in government spending or taxes.

D)increase government spending and taxes by the same amount.

E)drop money out of helicopters.

A)temporarily increase government spending, with an increase in either taxes or the quantity of government bonds.

B)engage in open market sales of interest-bearing debt.

C)reduce the quantity of government bonds, with an increase in government spending or taxes.

D)increase government spending and taxes by the same amount.

E)drop money out of helicopters.

E

4

Money is useful in exchange when

A)credit transactions are difficult.

B)interest rates are high.

C)there is a single coincidence of wants.

D)there are several monetary aggregates.

E)inflation is rising.

A)credit transactions are difficult.

B)interest rates are high.

C)there is a single coincidence of wants.

D)there are several monetary aggregates.

E)inflation is rising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

The excess demand for overnight funds is

A)perfectly elastic.

B)decreasing with the overnight interest rate.

C)perfectly inelastic.

D)zero.

E)increasing with the overnight interest rate.

A)perfectly elastic.

B)decreasing with the overnight interest rate.

C)perfectly inelastic.

D)zero.

E)increasing with the overnight interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a corridor system, if the excess demand for reserves is zero when the overnight interest rate is lower than the central bank's target

A)the central bank should borrow to achieve its target.

B)the corridor system is not working.

C)the central bank should impose a reserve requirement.

D)the central bank should increase its deposit rate.

E)the central bank should lend to achieve its target.

A)the central bank should borrow to achieve its target.

B)the corridor system is not working.

C)the central bank should impose a reserve requirement.

D)the central bank should increase its deposit rate.

E)the central bank should lend to achieve its target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Government printing of money to finance government spending is called

A)an open market sale.

B)an open-market purchase.

C)seigniorage.

D)sterilization.

E)irresponsible.

A)an open market sale.

B)an open-market purchase.

C)seigniorage.

D)sterilization.

E)irresponsible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

Fiat money is

A)currency found in Europe.

B)Canadian currency in Canada.

C)commodity-based paper money.

D)money in chartered banks.

E)commodity money.

A)currency found in Europe.

B)Canadian currency in Canada.

C)commodity-based paper money.

D)money in chartered banks.

E)commodity money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use of money to save up for a future cash purchase would be an example of money's role as a

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

The double coincidence of wants problem is solved by

A)government intervention.

B)specialization.

C)monetary aggregates.

D)credit markets.

E)the use of money.

A)government intervention.

B)specialization.

C)monetary aggregates.

D)credit markets.

E)the use of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

The inflation tax is

A)a tax on nominal goods.

B)the sales tax.

C)a tax introduced in the early 1980s to fight inflation.

D)the revenue from open market purchases.

E)the revenue from seigniorage.

A)a tax on nominal goods.

B)the sales tax.

C)a tax introduced in the early 1980s to fight inflation.

D)the revenue from open market purchases.

E)the revenue from seigniorage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Quantitative easing occurs when the central bank

A)increases its interest rate target.

B)purchases long-term assets.

C)performs a helicopter drop.

D)purchases short-term assets.

E)engages in open market operations.

A)increases its interest rate target.

B)purchases long-term assets.

C)performs a helicopter drop.

D)purchases short-term assets.

E)engages in open market operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

An open market purchase

A)causes decrease in the money supply.

B)is a purchase by the government of goods and services.

C)is a purchase of money by the central bank.

D)is a sale of government bonds by the central bank.

E)is a purchase of government bonds by the central bank.

A)causes decrease in the money supply.

B)is a purchase by the government of goods and services.

C)is a purchase of money by the central bank.

D)is a sale of government bonds by the central bank.

E)is a purchase of government bonds by the central bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Debit cards and online banking has

A)increased the riskiness of banks.

B)decreased the riskiness of banks.

C)increased the cost of banking transactions and reduced the demand for money.

D)lowered the cost of banking transactions and reduced the demand for money.

E)lowered the cost of banking transactions and increased the demand for money.

A)increased the riskiness of banks.

B)decreased the riskiness of banks.

C)increased the cost of banking transactions and reduced the demand for money.

D)lowered the cost of banking transactions and reduced the demand for money.

E)lowered the cost of banking transactions and increased the demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following is included in M3, but not in M2?

A)Canadian currency held by foreigners

B)personal term deposits

C)Bank of Canada term deposits

D)foreign currency deposits of residents of Canada

E)Eurodollars

A)Canadian currency held by foreigners

B)personal term deposits

C)Bank of Canada term deposits

D)foreign currency deposits of residents of Canada

E)Eurodollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

The zero lower bound is

A)conventional monetary policy.

B)the constraint that the nominal interest rate cannot fall below zero.

C)the constraint that consumption cannot fall below zero.

D)illegal.

E)the lower bound on money supply growth.

A)conventional monetary policy.

B)the constraint that the nominal interest rate cannot fall below zero.

C)the constraint that consumption cannot fall below zero.

D)illegal.

E)the lower bound on money supply growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is included in M2, but NOT in M1?

A)currency (outside the Bank of Canada and the vaults of depository institutions)

B)nonpersonal notice deposits

C)demand deposits

D)travelers' cheques

E)personal savings deposits

A)currency (outside the Bank of Canada and the vaults of depository institutions)

B)nonpersonal notice deposits

C)demand deposits

D)travelers' cheques

E)personal savings deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

In a corridor system

A)reserves must be sufficiently large.

B)interest rates are determined by fiscal policy.

C)the Bank rate determines the overnight interest rate.

D)the central bank must intervene each day to peg the overnight interest rate.

E)the interest rate on deposits at the central bank determines the overnight interest rate.

A)reserves must be sufficiently large.

B)interest rates are determined by fiscal policy.

C)the Bank rate determines the overnight interest rate.

D)the central bank must intervene each day to peg the overnight interest rate.

E)the interest rate on deposits at the central bank determines the overnight interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

At the zero lower bound

A)open market purchases of government bonds by the central bank have no effects.

B)monetary policy has the usual effects.

C)consumption goes to zero.

D)conventional monetary policy is all that works.

E)government spending has no effects.

A)open market purchases of government bonds by the central bank have no effects.

B)monetary policy has the usual effects.

C)consumption goes to zero.

D)conventional monetary policy is all that works.

E)government spending has no effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

The nominal interest rate cannot fall below zero because

A)inflation is generally too low.

B)financial markets do allow for arbitrage opportunities.

C)inflation is generally too high.

D)central banks are engaged in interest rate targeting.

E)financial markets cannot allow for arbitrage opportunities.

A)inflation is generally too low.

B)financial markets do allow for arbitrage opportunities.

C)inflation is generally too high.

D)central banks are engaged in interest rate targeting.

E)financial markets cannot allow for arbitrage opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Monetary aggregates are

A)the various roles of money.

B)currency in the hands of the public and demand deposits.

C)different definitions of money.

D)high-powered money.

E)the money at the Bank of Canada.

A)the various roles of money.

B)currency in the hands of the public and demand deposits.

C)different definitions of money.

D)high-powered money.

E)the money at the Bank of Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

The monetary intertemporal model contains the fact that

A)the foreign sector does not matter.

B)the Bank of Canada supplies money.

C)interest rates are determined by the federal government.

D)interest rates are determined by the chartered banks.

E)transactions require money and transactions services supplied by banks.

A)the foreign sector does not matter.

B)the Bank of Canada supplies money.

C)interest rates are determined by the federal government.

D)interest rates are determined by the chartered banks.

E)transactions require money and transactions services supplied by banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

The monetary base includes

A)M0 and M1.

B)inside money.

C)all money available outside of the financial system.

D)money drawn from credit cards.

E)currency outside banks only.

A)M0 and M1.

B)inside money.

C)all money available outside of the financial system.

D)money drawn from credit cards.

E)currency outside banks only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

In the monetary intertemporal model, changing M

A)has real consequences.

B)affects output directly.

C)has no impact on prices or inflation.

D)affects the price level.

E)is used to create economic growth in the short run.

A)has real consequences.

B)affects output directly.

C)has no impact on prices or inflation.

D)affects the price level.

E)is used to create economic growth in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

The quantity of money in circulation is governed by

A)individual consumers.

B)the central bank.

C)provincial governments.

D)chartered banks.

E)the federal government.

A)individual consumers.

B)the central bank.

C)provincial governments.

D)chartered banks.

E)the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

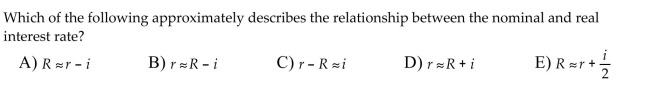

The real interest rate is approximately equal to

A)the nominal interest rate minus the inflation rate.

B)one divided by the nominal interest rate minus the inflation rate.

C)the growth in real GDP.

D)the nominal interest rate.

E)the nominal interest rate plus the inflation rate.

A)the nominal interest rate minus the inflation rate.

B)one divided by the nominal interest rate minus the inflation rate.

C)the growth in real GDP.

D)the nominal interest rate.

E)the nominal interest rate plus the inflation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

A classical dichotomy refers to the fact that

A)classical theory predicts negative effects of high inflation.

B)the real variables in the model are determined independently of the money market.

C)the real variables are jointly determined depending on what happens in the money market.

D)the real interest rate differs from the nominal interest rate.

E)real and nominal variables are often different.

A)classical theory predicts negative effects of high inflation.

B)the real variables in the model are determined independently of the money market.

C)the real variables are jointly determined depending on what happens in the money market.

D)the real interest rate differs from the nominal interest rate.

E)real and nominal variables are often different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the monetary intertemporal model, the supply of money is determined by

A)the sale of bonds by the chartered banks.

B)the Bank of Canada.

C)foreign capital flows.

D)private sector transactions.

E)the government merged with the Bank of Canada.

A)the sale of bonds by the chartered banks.

B)the Bank of Canada.

C)foreign capital flows.

D)private sector transactions.

E)the government merged with the Bank of Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

An open-market operation refers to

A)changing the money supply by changing government spending.

B)an exchange of domestic money for foreign money by the monetary authority.

C)an exchange of money for interest-bearing debt by the monetary authority.

D)changing the money supply by changing taxes.

E)seigniorage.

A)changing the money supply by changing government spending.

B)an exchange of domestic money for foreign money by the monetary authority.

C)an exchange of money for interest-bearing debt by the monetary authority.

D)changing the money supply by changing taxes.

E)seigniorage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

Unconventional monetary policy includes

A)money growth targeting.

B)negative nominal interest rates and quantitative easing.

C)abolishing the central bank.

D)tax incentives and interest rate increases.

E)money growth targeting and tariffs.

A)money growth targeting.

B)negative nominal interest rates and quantitative easing.

C)abolishing the central bank.

D)tax incentives and interest rate increases.

E)money growth targeting and tariffs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Buying an item with cash would be an example of money's role as a

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

The demand for money is determined by

A)the behaviour of the private sector.

B)the behaviour of the consumer and the firm.

C)the behaviour of the government.

D)the behaviour of the chartered banks.

E)the behaviour of the Bank of Canada.

A)the behaviour of the private sector.

B)the behaviour of the consumer and the firm.

C)the behaviour of the government.

D)the behaviour of the chartered banks.

E)the behaviour of the Bank of Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Nominal bonds can be issued by

A)chartered banks.

B)government, consumers, or business firms.

C)business firms.

D)government and consumers.

E)the Bank of Canada.

A)chartered banks.

B)government, consumers, or business firms.

C)business firms.

D)government and consumers.

E)the Bank of Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

To increase the nominal money supply, the Bank of Canada can engage in

A)seigniorage.

B)reducing inflation.

C)open market purchases.

D)increasing taxes.

E)open market sales.

A)seigniorage.

B)reducing inflation.

C)open market purchases.

D)increasing taxes.

E)open market sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is an example of the role of banks?

A)help control the amount of currency in circulation

B)financial intermediaries

C)manage stock portfolios

D)manage the money supply

E)create money

A)help control the amount of currency in circulation

B)financial intermediaries

C)manage stock portfolios

D)manage the money supply

E)create money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

The nominal money supply is

A)horizontal at P*.

B)horizontal at M.

C)determined by the market for goods.

D)determined by equilibrium in the market for credit card balances.

E)exogenous.

A)horizontal at P*.

B)horizontal at M.

C)determined by the market for goods.

D)determined by equilibrium in the market for credit card balances.

E)exogenous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

The two most common types of money in circulation in Canada today consist of

A)transaction deposits at banks and commodity money.

B)fiat money and transaction deposits at banks.

C)commodity-backed paper currency and fiat money.

D)private bank notes and commodity money.

E)private bank notes and commodity-backed paper currency.

A)transaction deposits at banks and commodity money.

B)fiat money and transaction deposits at banks.

C)commodity-backed paper currency and fiat money.

D)private bank notes and commodity money.

E)private bank notes and commodity-backed paper currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Price tags attached to goods for purchase at a store would be an example of money's role as a

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

A)medium of exchange.

B)store of value.

C)unit of account.

D)store of wealth.

E)standard of deferred payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

Real money demand is a function of

A)increasing real income and decreasing nominal interest rates.

B)increasing real income and increasing inflation rates.

C)increasing real income and decreasing inflation rates.

D)the level of transactions in the economy.

E)increasing real income.

A)increasing real income and decreasing nominal interest rates.

B)increasing real income and increasing inflation rates.

C)increasing real income and decreasing inflation rates.

D)the level of transactions in the economy.

E)increasing real income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

The most distinguishing economic feature of money is its

A)store of value role.

B)medium of exchange role.

C)unit of account role.

D)standard of deferred payment role.

E)store of wealth role.

A)store of value role.

B)medium of exchange role.

C)unit of account role.

D)standard of deferred payment role.

E)store of wealth role.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Double coincidence of wants means

A)two economic agents want different sets of goods.

B)households want more of leisure and consumption.

C)two economic agents want to exchange the goods they have.

D)households prefer to double the quantity of their goods.

E)households prefer a diverse set of goods.

A)two economic agents want different sets of goods.

B)households want more of leisure and consumption.

C)two economic agents want to exchange the goods they have.

D)households prefer to double the quantity of their goods.

E)households prefer a diverse set of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Monetary aggregates are useful indirect measures of

A)the monetary base.

B)aggregate economic activity.

C)inflation.

D)interest rates.

E)the role of money.

A)the monetary base.

B)aggregate economic activity.

C)inflation.

D)interest rates.

E)the role of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

In a floor system

A)the central bank's deposit rate determines the overnight interest rate.

B)interest rates are highly variable.

C)the central bank must intervene each day to achieve its interest rate target.

D)the central bank's lending rate determines the overnight interest rate.

E)reserves are essentially zero.

A)the central bank's deposit rate determines the overnight interest rate.

B)interest rates are highly variable.

C)the central bank must intervene each day to achieve its interest rate target.

D)the central bank's lending rate determines the overnight interest rate.

E)reserves are essentially zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Negative nominal interest rates

A)cannot happen because of the zero lower bound.

B)can be implemented because the effective lower bound is negative.

C)are not unconventional monetary policy.

D)will reduce investment.

E)are part of conventional monetary policy.

A)cannot happen because of the zero lower bound.

B)can be implemented because the effective lower bound is negative.

C)are not unconventional monetary policy.

D)will reduce investment.

E)are part of conventional monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

An increase in the perceived instability of banks

A)leads to bank failure.

B)decreases the demand for money.

C)increases people's dependence on banks for transactions.

D)led to the elimination of reserve requirements in 1992.

E)increases the demand for money.

A)leads to bank failure.

B)decreases the demand for money.

C)increases people's dependence on banks for transactions.

D)led to the elimination of reserve requirements in 1992.

E)increases the demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

The most narrowly defined monetary aggregate is

A)M2++.

B)M2.

C)currency outside banks.

D)L.

E)M1.

A)M2++.

B)M2.

C)currency outside banks.

D)L.

E)M1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

If an increase in the level of the money supply results in a proportionate increase in prices with no effect on any real variables, we say that

A)the Fisher relationship holds.

B)money demand is neutral.

C)money is superneutral.

D)money is neutral.

E)money is the most preferred store of value.

A)the Fisher relationship holds.

B)money demand is neutral.

C)money is superneutral.

D)money is neutral.

E)money is the most preferred store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Real money demand depends

A)negatively on the inflation rate.

B)negatively on the nominal interest rate.

C)positively on the inflation rate.

D)positively on the nominal interest rate.

E)positively on the consumer's savings rate.

A)negatively on the inflation rate.

B)negatively on the nominal interest rate.

C)positively on the inflation rate.

D)positively on the nominal interest rate.

E)positively on the consumer's savings rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

A liquidity trap occurs when

A)the central bank does not print enough currency.

B)consumers are too reliant on credit cards for purchases.

C)the real interest rate is zero.

D)the real interest rate is very high.

E)too many arbitrage opportunities exist.

A)the central bank does not print enough currency.

B)consumers are too reliant on credit cards for purchases.

C)the real interest rate is zero.

D)the real interest rate is very high.

E)too many arbitrage opportunities exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Equilibrium in the credit card market

A)results in a larger volume of real transactions.

B)determines the demand for money.

C)occurs if the marginal benefit exceeds the marginal cost of credit card balances.

D)raises the real interest rate.

E)is equal to nominal income earned during the day.

A)results in a larger volume of real transactions.

B)determines the demand for money.

C)occurs if the marginal benefit exceeds the marginal cost of credit card balances.

D)raises the real interest rate.

E)is equal to nominal income earned during the day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

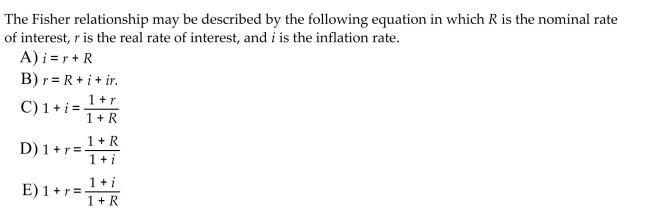

The Fisher effect is

A)the effect of money supply growth on inflation.

B)the effect of inflation on the nominal interest rate.

C)the effect of the money supply on the price level.

D)the effect of government spending on output.

E)the effect of inflation on the real interest rate.

A)the effect of money supply growth on inflation.

B)the effect of inflation on the nominal interest rate.

C)the effect of the money supply on the price level.

D)the effect of government spending on output.

E)the effect of inflation on the real interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

The most significant problem in trying to empirically measure the real rate of interest is that

A)interest rates fluctuate so much from day to day.

B)there are so many different nominal interest rates.

C)expected inflation is unobservable.

D)banks infrequently change the prime rate of interest.

E)there are so many different types of bonds.

A)interest rates fluctuate so much from day to day.

B)there are so many different nominal interest rates.

C)expected inflation is unobservable.

D)banks infrequently change the prime rate of interest.

E)there are so many different types of bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

The marginal cost of financial transactions rises with the volume of financial transactions due to

A)congestion.

B)power failure.

C)bank failure.

D)reserve requirements.

E)perceived instability of banks.

A)congestion.

B)power failure.

C)bank failure.

D)reserve requirements.

E)perceived instability of banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Barter, the exchange of goods for goods, relates to

A)a single coincidence of wants.

B)a double coincidence of wants.

C)the role of money as a medium of exchange.

D)the role of the monetary base.

E)money as a store of value.

A)a single coincidence of wants.

B)a double coincidence of wants.

C)the role of money as a medium of exchange.

D)the role of the monetary base.

E)money as a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Quantitative easing may work because

A)interest rate increases are not an option.

B)on net, this increases the effective quantity of liquid assets in the economy.

C)the central bank says they will.

D)open market operations always work at the zero lower bound.

E)it eases the strain on the government surplus.

A)interest rate increases are not an option.

B)on net, this increases the effective quantity of liquid assets in the economy.

C)the central bank says they will.

D)open market operations always work at the zero lower bound.

E)it eases the strain on the government surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

If the nominal interest rate rises

A)consumers and firms are less inclined to use credit cards.

B)there is substantial inflation in the economy.

C)inflation is declining.

D)real interest rates are declining.

E)the opportunity cost of holding cash rises.

A)consumers and firms are less inclined to use credit cards.

B)there is substantial inflation in the economy.

C)inflation is declining.

D)real interest rates are declining.

E)the opportunity cost of holding cash rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Neutrality of money refers to

A)a one-time change in the money supply has a one-time change in economic activity.

B)a one-time change in the money supply has no real consequence for the economy.

C)a one-time change in the money supply affects consumption and investment decisions only.

D)money being a medium of exchange for everyone.

E)a certain percentage change in the money supply has the same percentage change in economic activity.

A)a one-time change in the money supply has a one-time change in economic activity.

B)a one-time change in the money supply has no real consequence for the economy.

C)a one-time change in the money supply affects consumption and investment decisions only.

D)money being a medium of exchange for everyone.

E)a certain percentage change in the money supply has the same percentage change in economic activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

If R < q, then

A)the marginal benefit of using the credit card exceeds the marginal cost.

B)the nominal interest rate is not in equilibrium.

C)the marginal benefit of using cash exceeds the marginal cost.

D)the real interest rate does not reach its equilibrium value.

E)the marginal cost of using the credit card exceeds the marginal benefit.

A)the marginal benefit of using the credit card exceeds the marginal cost.

B)the nominal interest rate is not in equilibrium.

C)the marginal benefit of using cash exceeds the marginal cost.

D)the real interest rate does not reach its equilibrium value.

E)the marginal cost of using the credit card exceeds the marginal benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

The monetary intertemporal model assumes that

A)after leaving the credit market, consumers do not go to work.

B)the real interest rate equals the nominal interest rate.

C)all credit card balances are paid off at the end of the day.

D)the federal government makes all the decisions about interest rates.

E)all transactions in the credit market are carried out using credit cards.

A)after leaving the credit market, consumers do not go to work.

B)the real interest rate equals the nominal interest rate.

C)all credit card balances are paid off at the end of the day.

D)the federal government makes all the decisions about interest rates.

E)all transactions in the credit market are carried out using credit cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Central banks in the world are increasingly experimenting with unconventional monetary policies. Describe

two types of unconventional monetary policies, and discuss why these policies may or may not work.

two types of unconventional monetary policies, and discuss why these policies may or may not work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Money supply targeting

A)is superior to nominal interest rate targeting in maintaining price stability.

B)performs poorly.

C)is very successful in maintaining price stability.

D)is used by most monetary authorities today.

E)will result in a high rate of inflation.

A)is superior to nominal interest rate targeting in maintaining price stability.

B)performs poorly.

C)is very successful in maintaining price stability.

D)is used by most monetary authorities today.

E)will result in a high rate of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Lower inflation over the long run tends to be associated with

A)higher real interest rates.

B)higher government spending.

C)lower nominal interest rates.

D)more international trade.

E)lower taxation.

A)higher real interest rates.

B)higher government spending.

C)lower nominal interest rates.

D)more international trade.

E)lower taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Unpredictable shocks to the financial system

A)increase the demand for money.

B)affect small depositors more so than large depositors.

C)reduce the demand for money.

D)result in money neutrality.

E)cause consumers and firms to switch to credit cards.

A)increase the demand for money.

B)affect small depositors more so than large depositors.

C)reduce the demand for money.

D)result in money neutrality.

E)cause consumers and firms to switch to credit cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck