Deck 5: Job-Order Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

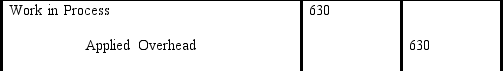

سؤال

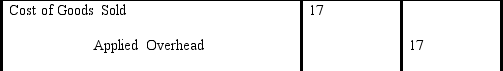

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/196

العب

ملء الشاشة (f)

Deck 5: Job-Order Costing

1

Manufacturing and service firms producing unique products or services require job-order accounting systems.

True

2

Production costs consist of direct materials, direct labor, and overhead.

True

3

The key feature of job-order costing is that the cost of one job differs from that of another job and must be kept track of separately.

True

4

Departmental overheads cannot be added together to get plantwide overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the overhead variance is immaterial, it is allocated among the ending balances of Work in Process, Finished Goods, and Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

6

Using a time ticket, the cost accounting department can enter the cost of direct materials onto the correct job-order cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

7

The difference between actual overhead and applied overhead is called an overhead variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

8

The use of normal costing means that actual overhead costs are assigned directly to jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

9

Costs reported on the financial statements must be estimated costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

10

Actual overhead is reconciled with applied overhead at the beginning of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

11

The cost of goods sold appearing on the income statement as an expense is the normal cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

12

The raw materials account is an inventory account located on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

13

A job-order cost sheet is the source document where direct labor costs are assigned to individual jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

14

In an actual cost system, actual direct materials, actual direct labor and estimated overhead are used to determine unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

15

Actual overhead is used to arrive at the cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

16

The use of a departmental rate has the advantage of being simple and reduces data collection requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

17

The three manufacturing cost elements are direct materials, direct labor, and overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

18

There are other source documents besides the time ticket and the material requisition form used to fill out the job-order cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

19

The work-in-process account consists of all the job-order cost sheets for the completed jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

20

If actual overhead is greater than applied overhead, the variance is called underapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

21

MATCHING

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

A costing system that accumulates production costs by process or by department for a given period of time

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

A costing system that accumulates production costs by process or by department for a given period of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

22

MATCHING

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

A costing system in which costs are collected and assigned to units of production for each individual job

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

A costing system in which costs are collected and assigned to units of production for each individual job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

23

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The amount by which applied overhead exceeds actual overhead

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The amount by which applied overhead exceeds actual overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

24

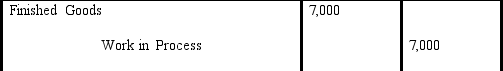

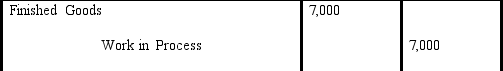

In job-order costing, the journal entry for a completed job costing $7,000 but not sold is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

25

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

An overhead rate computed using estimated data

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

An overhead rate computed using estimated data

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

26

When materials are put into production, they are taken from the Raw Materials account and put into the Work in Process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

27

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The difference between actual overhead and applied overhead

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The difference between actual overhead and applied overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

28

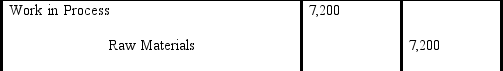

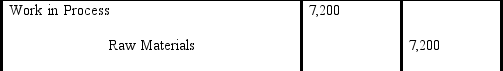

In job-order costing, the journal entry for $7,200 raw materials requisitioned for use in production is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

29

Actual overhead costs are accumulated in the overhead control account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

30

Overhead costs are assigned to Finished Goods using a predetermined rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

31

The cost of completed units is always debited to Work-in-Process and credited to Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

32

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

Overhead assigned to production using predetermined rates

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

Overhead assigned to production using predetermined rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

33

MATCHING

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

An approach that assigns the actual costs of direct materials and direct labor to products but uses a predetermined rate to assign overhead costs

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

An approach that assigns the actual costs of direct materials and direct labor to products but uses a predetermined rate to assign overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

34

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The amount by which actual overhead exceeds applied overhead

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

The amount by which actual overhead exceeds applied overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

35

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

A single overhead rate calculated using all estimated overhead for a factory divided by the estimated activity level across the entire factory

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

A single overhead rate calculated using all estimated overhead for a factory divided by the estimated activity level across the entire factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

36

In job-order costing, the journal entry for overhead applied at the rate of $3 per direct labor hour when 210 direct labor hours were worked is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

37

The journal entry for $17 of underapplied overhead is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

38

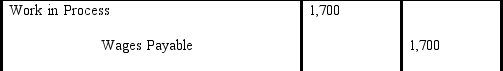

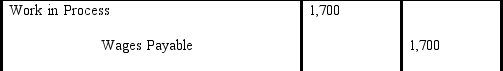

In job-order costing, the journal entry for $1,700 of unpaid direct labor is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

39

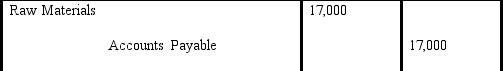

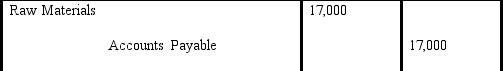

The journal entry for $17,000 materials purchased on account is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

40

MATCHING

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

An approach that assigns actual costs of direct materials, direct labor, and overhead to products

Match each item with the correct statement below.

a.

actual cost system

b.

job-order costing system

c.

normal cost system

d.

process-costing system

An approach that assigns actual costs of direct materials, direct labor, and overhead to products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

41

In a _______________________________ costs are accumulated by job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

42

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

costs of product are removed from finished goods and added to cost of goods sold

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

costs of product are removed from finished goods and added to cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

43

Strict ______________________ are rarely used because they cannot provide accurate unit cost information on a timely basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

44

Match each item with the correct statement below. Answers may be used more than once.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form is filled out by each employee every day.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form is filled out by each employee every day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

45

Match each item with the correct statement below. Answers may be used more than once.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

The job order number, or name, head this form.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

The job order number, or name, head this form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

46

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

actual overhead is reconciled with applied overhead

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

actual overhead is reconciled with applied overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

47

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

cost of materials is removed from materials account and added to work-in- process account

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

cost of materials is removed from materials account and added to work-in- process account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

48

__________________________ is a costing system that accumulates production costs by process or by department for a given period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

49

Match each item with the correct statement below. Answers may be used more than once.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

Every time a new job is started this is prepared.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

Every time a new job is started this is prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

50

Match each item with the correct statement below.

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

Estimated overhead for a single department divided by the estimated activity level for that same department

a.

predetermined overhead rate

b.

plantwide overhead rate

c.

departmental overhead rate

d.

overhead variance

e.

overapplied overhead

f.

underapplied overhead

g.

applied overhead

h.

normal cost of goods sold

Estimated overhead for a single department divided by the estimated activity level for that same department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

51

A _______ is one distinct unit or set of units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

52

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

schedule of costs of goods sold is prepared

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

schedule of costs of goods sold is prepared

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

53

_________________ is found by multiplying the predetermined overhead rate by the actual use of the associated activity for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

54

Match each item with the correct statement below. Answers may be used more than once.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form may be used to maintain proper control over a firm's inventory of direct materials.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form may be used to maintain proper control over a firm's inventory of direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

55

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

immaterial overhead variance closed to costs of goods sold

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

immaterial overhead variance closed to costs of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

56

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

direct materials, direct labor and applied overhead are totaled to yield manufacturing cost of job

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

direct materials, direct labor and applied overhead are totaled to yield manufacturing cost of job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

57

A(n) ___________________________ determines unit cost by adding actual direct materials, actual direct labor, and estimated overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

58

Match the following cost flows with the proper event in a job-costing firm:

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

the costs of job are transferred from the work-in-process account to finished goods account

a.

completion of job

b.

end of each accounting period

c.

materials are moved from storage into production

d.

product is sold

e.

end of year

the costs of job are transferred from the work-in-process account to finished goods account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

59

The ___________________________ is calculated at the beginning of the year by dividing the total estimated annual overhead by the total estimated level of cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

60

Match each item with the correct statement below. Answers may be used more than once.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form asks for the type, quantity, and unit price of direct materials.

a.

Job-order cost sheet

b.

Time ticket

c.

Materials requisition form

This form asks for the type, quantity, and unit price of direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

61

When units are sold, their total cost is debited to _______________ and credited to ____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

62

The difference between actual overhead and applied overhead is called a (n) _________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

63

A _____________________ is a single overhead rate calculated by using all estimated overhead for a factory divided by the estimated activity level across the entire factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

64

Applied overhead costs are charged to ________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

65

If actual overhead is greater than applied overhead, then the variance is called ___________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

66

Production costs do not include

A) direct materials.

B) direct labor.

C) variable overhead.

D) fixed overhead.

E) All of these are production costs.

A) direct materials.

B) direct labor.

C) variable overhead.

D) fixed overhead.

E) All of these are production costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is the assignment process used with normal costing?

A) Actual direct materials, actual direct labor and actual overhead cost are assigned to products.

B) Actual direct materials cost is assigned to products, but direct labor and overhead costs are assigned using predetermined rates.

C) Actual direct labor cost is assigned to products, but direct material and overhead costs are assigned using predetermined rates.

D) Actual direct material and direct labor costs are assigned to products, but overhead costs are assigned using predetermined rates.

E) All manufacturing costs are assigned using predetermined rates.

A) Actual direct materials, actual direct labor and actual overhead cost are assigned to products.

B) Actual direct materials cost is assigned to products, but direct labor and overhead costs are assigned using predetermined rates.

C) Actual direct labor cost is assigned to products, but direct material and overhead costs are assigned using predetermined rates.

D) Actual direct material and direct labor costs are assigned to products, but overhead costs are assigned using predetermined rates.

E) All manufacturing costs are assigned using predetermined rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

68

A __________________________ is used by the cost accounting department to enter the cost of direct materials onto the correct job-order cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following are easy to trace to individual jobs?

A) direct materials and overhead

B) direct materials and direct labor

C) direct labor and overhead

D) overhead and indirect labor

E) depreciation on machinery and indirect labor

A) direct materials and overhead

B) direct materials and direct labor

C) direct labor and overhead

D) overhead and indirect labor

E) depreciation on machinery and indirect labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

70

The ____________________ of allocation recognizes all interactions among support departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which method of measuring costs associated with production is more widely used in practice?

A) normal Costing

B) actual Costing

C) both are used equally.

D) neither one is used.

E) cannot be determined.

A) normal Costing

B) actual Costing

C) both are used equally.

D) neither one is used.

E) cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not a characteristic of job-order costing?

A) Wide variety of distinct products.

B) Unit cost is computed by dividing process costs of the period by the units produced in the period.

C) Unit cost is computed by dividing total job costs by units produced on that job.

D) Costs accumulated by job.

E) Typically, the cost of one job is different from that of another job.

A) Wide variety of distinct products.

B) Unit cost is computed by dividing process costs of the period by the units produced in the period.

C) Unit cost is computed by dividing total job costs by units produced on that job.

D) Costs accumulated by job.

E) Typically, the cost of one job is different from that of another job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

73

_________________________ is the amount that appears as an expense on the income statement after the adjustment for the period's overhead variance is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

74

________________________ are directly responsible for creating the products or services sold to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

75

The cost of goods sold before an adjustment for an overhead variance is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

76

Firms in the ____ business are most likely to use a process-costing system.

A) printing

B) dental

C) construction

D) petroleum

E) automobile repair

A) printing

B) dental

C) construction

D) petroleum

E) automobile repair

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

77

How are unit costs calculated?

A) by dividing total cost associated with the units produced by the unit cost

B) by adding all variable costs per unit associated with the units produced

C) by dividing total fixed costs by the number of units produced

D) by dividing total cost associated with the units produced by the number of units produced

E) by adding unit variable costs to total fixed costs

A) by dividing total cost associated with the units produced by the unit cost

B) by adding all variable costs per unit associated with the units produced

C) by dividing total fixed costs by the number of units produced

D) by dividing total cost associated with the units produced by the number of units produced

E) by adding unit variable costs to total fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

78

A source document by which direct labor costs are assigned to individual jobs is known as a _______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

79

When materials are requested for production the cost is removed from ____________ and added to ____________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck

80

The _____________________ is subsidiary to the work-in-process account and is the primary document for accumulating all costs related to a particular job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 196 في هذه المجموعة.

فتح الحزمة

k this deck