Deck 11: Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/21

العب

ملء الشاشة (f)

Deck 11: Liabilities

1

A company borrowed $1 million on 1 June 2018, with principal and interest to be repaid in three years' time. The interest rate is 12 per cent per annum. What is the interest expense for the year ended 30 June 2018?

A) $0

B) $10 000

C) $120 000

D) None of the above

A) $0

B) $10 000

C) $120 000

D) None of the above

B

2

Interest owed to the bank by MNO Ltd would appear on MNO's balance sheet as:

A) accounts payable.

B) an accrual on the balance sheet.

C) a provision on the balance sheet.

D) contingent liability.

A) accounts payable.

B) an accrual on the balance sheet.

C) a provision on the balance sheet.

D) contingent liability.

B

3

Jones Ltd sold a machine on credit for $11 000 including GST of 10 per cent. The journal entry to record this transaction would include:

A) DR Accounts receivable $10 000

B) CR Sales $11 000

C) CR GST payable $1 000

D) None of the above

A) DR Accounts receivable $10 000

B) CR Sales $11 000

C) CR GST payable $1 000

D) None of the above

C

4

When a liability increases, which of the following is correct?

A) An expense may increase.

B) An asset may decrease.

C) Shareholders' equity may increase.

D) Revenue may increase.

A) An expense may increase.

B) An asset may decrease.

C) Shareholders' equity may increase.

D) Revenue may increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a business collects GST from customers, it records:

A) a contra asset.

B) a liability.

C) an expense.

D) an asset.

A) a contra asset.

B) a liability.

C) an expense.

D) an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

6

RST has been sued by a competitor for a potential copyright infringement. Legal advice is divided over the likelihood of the success of the claim and the likely damages, if any. It would be shown as:

A) an accrual on the balance sheet.

B) a provision on the balance sheet.

C) a contingent liability on the balance sheet.

D) a contingent liability in the notes to the accounts.

A) an accrual on the balance sheet.

B) a provision on the balance sheet.

C) a contingent liability on the balance sheet.

D) a contingent liability in the notes to the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

7

The auditors informed the company that the provision for long service leave was understated by $100 000 at 30 June 2019 and that the account should be adjusted. The effect of the adjustment would be:

A) liabilities increase and profit decreases.

B) liabilities increase but profit is unaffected.

C) profit increases but there is no effect on liabilities.

D) there is no effect on either profit or liabilities.

A) liabilities increase and profit decreases.

B) liabilities increase but profit is unaffected.

C) profit increases but there is no effect on liabilities.

D) there is no effect on either profit or liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

8

When unearned revenue increases:

A) cash increases.

B) an expense increases.

C) revenue increases.

D) None of the above.

A) cash increases.

B) an expense increases.

C) revenue increases.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

9

Amounts owing to an advertising company as per an invoice received would appear on the balance sheet as:

A) accounts payable.

B) accruals.

C) provisions.

D) contingent liability.

A) accounts payable.

B) accruals.

C) provisions.

D) contingent liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following would NOT be shown as a contingent liability?

A) Estimated future cost of providing superannuation for work already carried out by employees

B) A dispute with the taxation department where legal advice suggests that the company will win the dispute

C) A company providing a guarantee to a lender for a loan taken out by a subsidiary company where a default on the loan is very unlikely

D) A company defending a claim for unspecified damages where the amount of the claim cannot be reliably measured

A) Estimated future cost of providing superannuation for work already carried out by employees

B) A dispute with the taxation department where legal advice suggests that the company will win the dispute

C) A company providing a guarantee to a lender for a loan taken out by a subsidiary company where a default on the loan is very unlikely

D) A company defending a claim for unspecified damages where the amount of the claim cannot be reliably measured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is NOT a liability?

A) Provision for warranty

B) Allowance for doubtful debts

C) Unearned revenue

D) Revenue received in advance

A) Provision for warranty

B) Allowance for doubtful debts

C) Unearned revenue

D) Revenue received in advance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

12

A retailer buys 200 tables at $550 each (including GST of $50) and sells all of them for $880 each (including GST of $80). How much needs to be remitted to the tax department?

A) $6 000

B) $10 000

C) $16 000

D) None of the above

A) $6 000

B) $10 000

C) $16 000

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

13

Future warranty costs related to this year's sales will appear in the balance sheet under:

A) an accrual on the balance sheet.

B) a provision on the balance sheet.

C) a contingent liability on the balance sheet.

D) a contingent liability in the notes to the accounts.

A) an accrual on the balance sheet.

B) a provision on the balance sheet.

C) a contingent liability on the balance sheet.

D) a contingent liability in the notes to the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is a liability?

A) Revenue received in advance

B) Accrued revenue

C) Accumulated depreciation

D) None of the above

A) Revenue received in advance

B) Accrued revenue

C) Accumulated depreciation

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

15

Assume that on 1 January 2019 the company issued $100 000 10-year bonds with a 10 per cent coupon rate paid semi-annually. The bond is issued to yield a 12 per cent return to investors selling for $88 529. Which of the following would be part of the journal entry on 1 January 2019?

A) DR Discount on bonds $11 471

B) DR Premium on bonds $11 471

C) CR Discount on bonds $11 471

D) CR Premium on bonds $11 471

A) DR Discount on bonds $11 471

B) DR Premium on bonds $11 471

C) CR Discount on bonds $11 471

D) CR Premium on bonds $11 471

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

16

XYZ Ltd provides a service on credit, charging $2 000 + $200 GST. The journal entry would include:

A) DR Accounts receivable $2 000

B) CR Sales $2 000

C) DR GST Payable $200

D) CR Sales $2 200

A) DR Accounts receivable $2 000

B) CR Sales $2 000

C) DR GST Payable $200

D) CR Sales $2 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume that on 1 January 2019 a company issued $100 000 10-year bonds with a 10 per cent coupon rate paid semi-annually. The bond is issued to yield a 12 per cent return to investors selling for $88 529. What would be the debit journal entry to record the sale of the bond on 1 January 2019?

A) DR Cash $88 529

B) DR Cash $100 000

C) DR Bonds $88 529

D) DR Bonds $100 000

A) DR Cash $88 529

B) DR Cash $100 000

C) DR Bonds $88 529

D) DR Bonds $100 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following items would NOT be recognised as a liability?

A) Advances from customers for goods and services to be delivered later

B) Estimated warranty on products sold during the year

C) A dispute with a customer where there is some possibility that the company could lose the dispute

D) Amounts owing in wages for work done this period to be paid in the next period

A) Advances from customers for goods and services to be delivered later

B) Estimated warranty on products sold during the year

C) A dispute with a customer where there is some possibility that the company could lose the dispute

D) Amounts owing in wages for work done this period to be paid in the next period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

19

An employee earns $1 000 a week and the following deductions are made: income tax $150, superannuation $90 and union dues $20. The journal entry to record this transaction would include:

A) DR Wages expense $740

B) CR Wages payable $1 000

C) DR Wages expense $1 000

D) None of the above

A) DR Wages expense $740

B) CR Wages payable $1 000

C) DR Wages expense $1 000

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is NOT a liability?

A) Unearned revenue

B) Provision for employee entitlements

C) Revenue received in advance

D) Accrued revenue

A) Unearned revenue

B) Provision for employee entitlements

C) Revenue received in advance

D) Accrued revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck

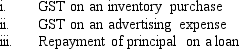

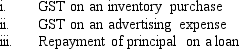

21

Which of the following are expenses?

A) ii only

B) i and ii only

C) i, ii and iii

D) None of the above

A) ii only

B) i and ii only

C) i, ii and iii

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 21 في هذه المجموعة.

فتح الحزمة

k this deck