Deck 15: Capital Investment Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/30

العب

ملء الشاشة (f)

Deck 15: Capital Investment Decisions

1

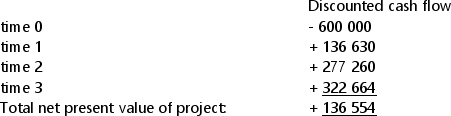

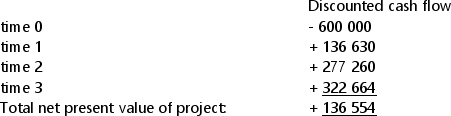

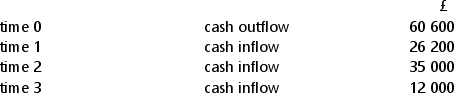

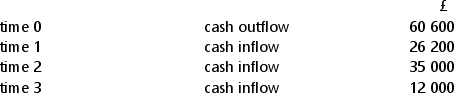

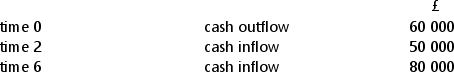

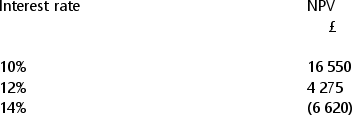

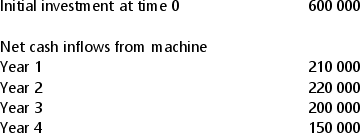

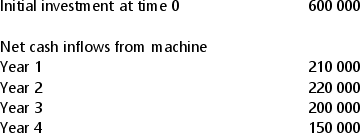

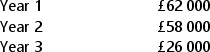

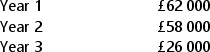

The management accountant of Enn Corporation Limited has produced the following schedule showing the net present value of cash flows associated with a proposed investment project:  What is the ratio of cash flows to initial investment in the project (to two decimal places)?

What is the ratio of cash flows to initial investment in the project (to two decimal places)?

A)4.39

B)0.23

C)1.23

D)0.81

What is the ratio of cash flows to initial investment in the project (to two decimal places)?

What is the ratio of cash flows to initial investment in the project (to two decimal places)?A)4.39

B)0.23

C)1.23

D)0.81

1.23

2

Assuming a constant discount rate of 8% the present value of £3315 receivable at the end of year 6 is (to the nearest £):

A)£5601

B)£5284

C)£1962

D)£2080

A)£5601

B)£5284

C)£1962

D)£2080

£1962

3

Which of the following statements are correct?

A.The payback method of investment appraisal takes no account of the time value of money

B. The internal rate of return method of investment appraisal takes no account of the time value of money.

A)Both of them

B)A only

C)B only

D)Neither of them

A.The payback method of investment appraisal takes no account of the time value of money

B. The internal rate of return method of investment appraisal takes no account of the time value of money.

A)Both of them

B)A only

C)B only

D)Neither of them

A only

4

Which one of the following statements is correct? IRR is the discount rate which, when applied to the expected cash flows from a project:

A)proves whether the project is worth undertaking or not

B)produces a net present value of zero

C)produces a positive net present value

D)proves that the discount rate is appropriate to the business

A)proves whether the project is worth undertaking or not

B)produces a net present value of zero

C)produces a positive net present value

D)proves that the discount rate is appropriate to the business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which one of the following statements is correct? The discounting factor for an investment over 6 years at 18% is (to 4 decimal places):

A)0.3503

B)0.3704

C)2.8547

D)2.6998

A)0.3503

B)0.3704

C)2.8547

D)2.6998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

6

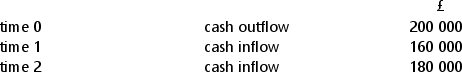

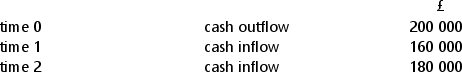

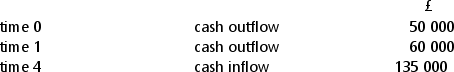

A project has the following projected cash inflows and outflows:  The relevant discount factor is 7%.

The relevant discount factor is 7%.

What is the net present value of the project (to the nearest £)?

A)£97 958

B)£177 287

C)£106 748

D)£107 360

The relevant discount factor is 7%.

The relevant discount factor is 7%.What is the net present value of the project (to the nearest £)?

A)£97 958

B)£177 287

C)£106 748

D)£107 360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

7

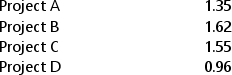

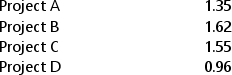

The directors of Dave's Fashions Limited are currently appraising four possible capital investment opportunities. The projects produce the following ratios of cash flows to initial investment:

Which of the following statements are correct?

Which of the following statements are correct?

A. Project B produces the highest positive ratio of cash flows to initial investment

B. The net present value of Project D is a negative figure

A)Neither of them

B)Both of them

C)A only

D)B only

Which of the following statements are correct?

Which of the following statements are correct?A. Project B produces the highest positive ratio of cash flows to initial investment

B. The net present value of Project D is a negative figure

A)Neither of them

B)Both of them

C)A only

D)B only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which one of the following statements is correct? The discount rate applicable to a particular business organization is often referred to as its:

A)cost of capital

B)dividend

C)capital ratio

D)interest payable

A)cost of capital

B)dividend

C)capital ratio

D)interest payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

9

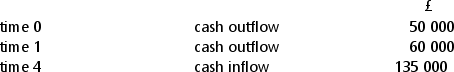

A project has the following projected cash inflows and outflows:  The relevant discount factor is 8%

The relevant discount factor is 8%

What is the present value of the project (to the nearest £)?

A)£23 640

B)£2955

C)£11 666

D)£3190

The relevant discount factor is 8%

The relevant discount factor is 8%What is the present value of the project (to the nearest £)?

A)£23 640

B)£2955

C)£11 666

D)£3190

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

10

A project has the following projected cash inflows and outflows:  The relevant discount factor is 8%

The relevant discount factor is 8%

What is the net present value of the project (to the nearest £)?

A)£54 879

B)£37 727

C)£35 550

D)£33 281

The relevant discount factor is 8%

The relevant discount factor is 8%What is the net present value of the project (to the nearest £)?

A)£54 879

B)£37 727

C)£35 550

D)£33 281

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

11

Pelmette and Oxbow Limited is appraising a potential new product which will involve the purchase of new production machinery.The company has just paid for a market research survey to gauge likely public interest in the project. Which one of the following statements is correct?

For capital investment appraisal purposes the expenditure on the market research survey is classified as a:

A)standard cost

B)fixed cost

C)capital cost

D)sunk cost

For capital investment appraisal purposes the expenditure on the market research survey is classified as a:

A)standard cost

B)fixed cost

C)capital cost

D)sunk cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

12

Assuming a constant discount rate of 16% the present value of £58 270 receivable at the end of year 9 is (to the nearest £):

A)£221 559

B)£15 325

C)£14 678

D)£231 322

A)£221 559

B)£15 325

C)£14 678

D)£231 322

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

13

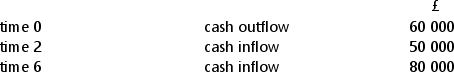

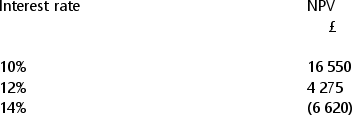

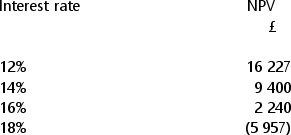

The following net present values have been calculated at a range of interest rates for a project:  Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

A)13.21%

B)13.10%

C)12.78%

D)13.00%

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?A)13.21%

B)13.10%

C)12.78%

D)13.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

14

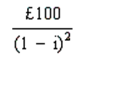

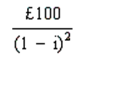

Which one of the following formulae shows the value of £100 invested now at a rate of 10% for 2 years?

A)£100 x (1 + i)2

B)

C)£100 x (1 - i)2

D)

A)£100 x (1 + i)2

B)

C)£100 x (1 - i)2

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

15

A project has the following projected cash inflows and outflows:  The relevant discount factor is 11%

The relevant discount factor is 11%

What is the present value of the project (to the nearest £)?

A)£11 621 positive NPV

B)£15 129 negative NPV

C)£92 978 positive NPV

D)£5512 positive NPV

The relevant discount factor is 11%

The relevant discount factor is 11%What is the present value of the project (to the nearest £)?

A)£11 621 positive NPV

B)£15 129 negative NPV

C)£92 978 positive NPV

D)£5512 positive NPV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following statements is correct? At the end of year 5, £3000 invested now at time 0, at an annual interest rate of 12% will be worth (to the nearest £):

A)£2287

B)£1702

C)£5287

D)£4800

A)£2287

B)£1702

C)£5287

D)£4800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

17

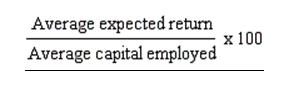

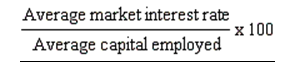

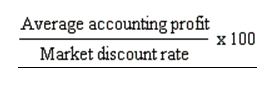

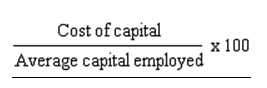

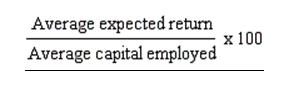

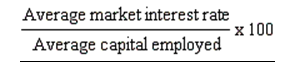

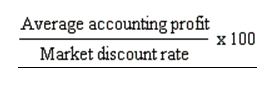

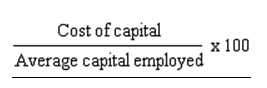

Which one of the following formulae shows the correct approach to calculating Accounting Rate of Return?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which is the missing phrase in the following sentence? A weakness of the ____ method of investment appraisal is that it cannot be used where the pattern of cash flows is irregular, with a mixture of cash inflows and cash outflows.

A)net present value

B)accounting rate of return

C)payback

D)internal rate of return

A)net present value

B)accounting rate of return

C)payback

D)internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which investment appraisal technique calculates the discount rate which, applied to expected cash flows, produces a net present value of zero?

A)Accounting rate of return

B)External rate of return

C)Internal rate of return

D)Capital rationing

A)Accounting rate of return

B)External rate of return

C)Internal rate of return

D)Capital rationing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

20

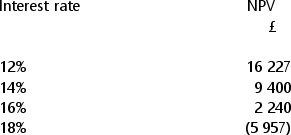

The following net present values have been calculated at a range of interest rates for a project:  Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

A)16.55%

B)17.00%

C)17.45%

D)17.21%

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?

Using linear interpolation, what is the best estimate of the internal rate of return of this project (calculated to two decimal places)?A)16.55%

B)17.00%

C)17.45%

D)17.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

21

The financial director of Hooper Staithes Limited is currently appraising a proposed investment in a new building.Relevant information about projected cash flows is as follows:  Which one of the following statements is correct?

Which one of the following statements is correct?

The payback period for the proposed investment is (to the nearest month)?

A)6 years and 6 months

B)6 years and 4 months

C)6 years

D)6 years and 8 months

Which one of the following statements is correct?

Which one of the following statements is correct?The payback period for the proposed investment is (to the nearest month)?

A)6 years and 6 months

B)6 years and 4 months

C)6 years

D)6 years and 8 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

22

The directors of Ovoid Pendragon Limited are currently appraising a proposed investment which will involve a cash outflow at time 0 of £132 000.The projected cash inflow arising from the project in year 1 is £36 000.This is expected to increase at a compound rate of 10% in years 2 to 4. What is the payback period of the project to the nearest month?

A)3 years and 4 months

B)3 years and 9 months

C)3 years and 3 months

D)3 years and 2 months

A)3 years and 4 months

B)3 years and 9 months

C)3 years and 3 months

D)3 years and 2 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

23

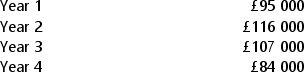

Pillforth Proust Limited is planning to invest £250 000 in a machine.The company estimates that the residual value of the machine at the end of year 4 will be £50 000, at which time it will be sold.A policy of straight line depreciation will be applied. Cash flows arising from the investment, before taking depreciation into account, are estimated as follows:

What is the accounting rate of return on this investment (to one decimal place)?

What is the accounting rate of return on this investment (to one decimal place)?

A)67.3%

B)50.5%

C)33.7%

D)40.2%

What is the accounting rate of return on this investment (to one decimal place)?

What is the accounting rate of return on this investment (to one decimal place)?A)67.3%

B)50.5%

C)33.7%

D)40.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

24

Smedworth & Formby Limited is considering the investment of £250 000 in a machine at time 0.It is estimated that the machine will produce cash inflows of £125 000 in year 1, £116 000 in year 2 and £107 000 in year 3.The company's cost of capital is 9%. What is the net present value of the investment (to the nearest £)?

A)£34 977

B)£43 642

C)£65 587

D)£44 937

A)£34 977

B)£43 642

C)£65 587

D)£44 937

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

25

The directors of Godfrey and Glamorgan Limited are currently considering the replacement of part of their production line.Relevant data for machine Z are as follows:  Which one of the following statements is correct?

Which one of the following statements is correct?

The payback period for the proposed investment is (to the nearest month):

A)4 years

B)2 years and 10 months

C)2 years and 2 months

D)1 year and 10 months

Which one of the following statements is correct?

Which one of the following statements is correct?The payback period for the proposed investment is (to the nearest month):

A)4 years

B)2 years and 10 months

C)2 years and 2 months

D)1 year and 10 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

26

Morgana Fitzhoward Limited is planning an investment in a machine of £400 000 at time 0.It is projected that cash flows arising from this investment will be £168 000 in year 1, £238 000 in year 2, and £242 000 in year 3. The company's cost of capital is 14%.

What is the net present value of the project (to the nearest £)?

A)£101 487

B)£142 981

C)£82 334

D)£93 861

What is the net present value of the project (to the nearest £)?

A)£101 487

B)£142 981

C)£82 334

D)£93 861

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

27

Burroughs Benstead Limited is planning an immediate investment of £500 000 in machinery.The project in which the machinery will be used is planned to last exactly five years.At the end of this period, the machinery will be scrapped, and is not expected to retain any residual value.The company's policy is to depreciate machinery on the straight line basis over its estimated useful life. Cash flows arising from the project, before taking depreciation into account, are projected to be as follows:

What is the accounting rate of return on this project?

What is the accounting rate of return on this project?

A)43.2%

B)46.3%

C)23.2%

D)86.3%

What is the accounting rate of return on this project?

What is the accounting rate of return on this project?A)43.2%

B)46.3%

C)23.2%

D)86.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

28

The directors of Bobcat and Blister Limited are currently appraising a proposed investment which will involve a cash outflow at time 0 of £97 200.The projected cash inflow arising from the project in year 1 is £28 000.The cash inflow is expected to rise by 9% in year 2, to remain at the same level as year 2 in year 3, and then to fall back to £25 200 in each of years 4 and 5. What is the payback period of the project to the nearest month?

A)5 years

B)3 years and 4 months

C)3 years and 5 months

D)3 years and 8 months

A)5 years

B)3 years and 4 months

C)3 years and 5 months

D)3 years and 8 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

29

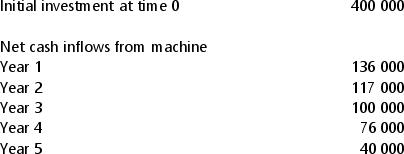

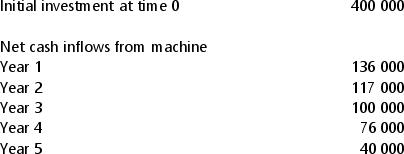

The directors of Boggust and Berlin Limited are currently appraising a proposed investment in a machine.Relevant information is as follows  Which one of the following statements is correct?

Which one of the following statements is correct?

The payback period for the proposed investment is (to the nearest month):

A)3 years and 7.4 months

B)2 years and 4.6 months

C)5 years

D)3 years and 4.6 months

Which one of the following statements is correct?

Which one of the following statements is correct?The payback period for the proposed investment is (to the nearest month):

A)3 years and 7.4 months

B)2 years and 4.6 months

C)5 years

D)3 years and 4.6 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

30

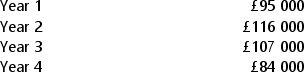

Skuse and Mayworth Limited is considering the investment of £136 000 in a new piece of machinery.Budgeted cash inflows from the project, before taking depreciation into account, are as follows:  The company's policy is to depreciate machinery on the reducing balance basis at a rate of 25% each year.In the case of this investment, it is assumed that the machine would be sold for its residual value at the end of year 3.

The company's policy is to depreciate machinery on the reducing balance basis at a rate of 25% each year.In the case of this investment, it is assumed that the machine would be sold for its residual value at the end of year 3.

What is the accounting rate of return on this investment (to one decimal place)?

A)33.0%

B)23.2%

C)17.3%

D)57.1%

The company's policy is to depreciate machinery on the reducing balance basis at a rate of 25% each year.In the case of this investment, it is assumed that the machine would be sold for its residual value at the end of year 3.

The company's policy is to depreciate machinery on the reducing balance basis at a rate of 25% each year.In the case of this investment, it is assumed that the machine would be sold for its residual value at the end of year 3.What is the accounting rate of return on this investment (to one decimal place)?

A)33.0%

B)23.2%

C)17.3%

D)57.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck