Deck 4: Completing the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/167

العب

ملء الشاشة (f)

Deck 4: Completing the Accounting Cycle

1

The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial balance.

False

2

An incorrect debit to Accounts Receivable instead of the correct account Notes Receivable does not require a correcting entry because total assets will not be misstated.

False

3

The post-closing trial balance is entered in the first two columns of a worksheet.

False

4

The Dividends account is closed to the Income Summary account in order to properly determine net income (or loss) for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

5

If total credits in the income statement columns of a worksheet exceed total debits, the enterprise has net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Dividends account is a permanent account whose balance is carried forward to the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

7

Closing entries are journalized after adjusting entries have been journalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

8

The adjusted trial balance columns of a worksheet are obtained by subtracting the adjustment columns from the trial balance columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

9

After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

10

The balance of the depreciation expense account will appear in the income statement debit column of a worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

11

A business entity has only one accounting cycle over its economic existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

12

Both correcting entries and adjusting entries always affect at least one statement of financial position account and one income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

13

Correcting entries are made any time an error is discovered even though it may not be at the end of an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

14

Closing revenue and expense accounts to the Income Summary account is an optional bookkeeping procedure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

15

Closing entries are unnecessary if the business plans to continue operating in the future and issue financial statements each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

16

The adjustments on a worksheet can be posted directly to the accounts in the ledger from the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

17

A worksheet is a mandatory form that must be prepared along with an income statement and statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

18

It is not necessary to prepare formal financial statements if a worksheet has been prepared because financial position and net income are shown on the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a worksheet is used, financial statements can be prepared before adjusting entries are journalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

20

Closing the Dividends account to Retained Earnings is not necessary if net income is greater than dividends paid during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

21

Preparing a worksheet involves

A)two steps.

B)three steps.

C)four steps.

D)five steps.

A)two steps.

B)three steps.

C)four steps.

D)five steps.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

22

Long-term investments would appear in the property, plant, and equipment section of the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

23

After a worksheet has been completed, the statement columns contain all data that are required for the preparation of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

24

In one closing entry, the Dividends account is credited and Income Summary is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

25

A company's operating cycle and fiscal year are usually the same length of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

26

IFRS requires that current asset be reported in the order of their liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

27

After the adjusting entries are journalized and posted to the accounts in the general ledger, the balance of each account should agree with the balance shown on the

A)adjusted trial balance.

B)post-closing trial balance.

C)the general journal.

D)adjustments columns of the worksheet.

A)adjusted trial balance.

B)post-closing trial balance.

C)the general journal.

D)adjustments columns of the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cash and office supplies are both classified as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

29

Current liabilities are obligations that the company is to pay within the coming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company's liquidity is concerned with the relationship between long-term investments and long-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

31

The information for preparing a trial balance on a worksheet is obtained from

A)financial statements.

B)general ledger accounts.

C)general journal entries.

D)business documents.

A)financial statements.

B)general ledger accounts.

C)general journal entries.

D)business documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the total debit column exceeds the total credit column of the income statement columns on a worksheet, then the company has

A)earned net income for the period.

B)an error because debits do not equal credits.

C)suffered a net loss for the period.

D)to make an adjusting entry.

A)earned net income for the period.

B)an error because debits do not equal credits.

C)suffered a net loss for the period.

D)to make an adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

33

The operating cycle of a company is the average time required to collect the receivables resulting from producing revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

34

A liability is classified as a current liability if the company is to pay it within the forthcoming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

35

Intangible assets are customarily the first items listed on a classified statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

36

The adjustments entered in the adjustments columns of a worksheet are

A)not journalized.

B)posted to the ledger but not journalized.

C)not journalized until after the financial statements are prepared.

D)journalized before the worksheet is completed.

A)not journalized.

B)posted to the ledger but not journalized.

C)not journalized until after the financial statements are prepared.

D)journalized before the worksheet is completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

37

To close net income to Retained Earnings Income Summary is debited and Retained Earnings is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

38

The operating cycle of a company is determined by the number of years the company has been operating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

39

Current assets are listed in the reverse order of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

40

The post-closing trial balance will contain only statement of equity accounts and statement of financial position accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

41

The account, Supplies, will appear in the following debit columns of the worksheet.

A)Trial balance

B)Adjusted trial balance

C)Statement of financial position

D)All of these

A)Trial balance

B)Adjusted trial balance

C)Statement of financial position

D)All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

42

To enter the net income (or loss) for the period into the above worksheet requires an entry to the

To enter the net income (or loss) for the period into the above worksheet requires an entry to theA)income statement debit column and the statement of financial position credit column.

B)income statement credit column and the statement of financial position debit column.

C)income statement debit column and the income statement credit column.

D)statement of financial position debit column and the statement of financial position credit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Statement of Financial Position columns of the worksheet contain data for what financial statement?

A)Income Statement.

B)Retained Earnings Statement.

C)Statement of Cash Flows.

D)None.

A)Income Statement.

B)Retained Earnings Statement.

C)Statement of Cash Flows.

D)None.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following accounts is least likely to have its balance change on the worksheet?

A)Salaries Payable.

B)Supplies.

C)Accumulated Depreciation.

D)Sharer Capital-ordinary.

A)Salaries Payable.

B)Supplies.

C)Accumulated Depreciation.

D)Sharer Capital-ordinary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following permanent account is changed during the closing process?

A)Share Capital-ordinary.

B)Retained Earnings.

C)Unearned Revenue.

D)None of the above.

A)Share Capital-ordinary.

B)Retained Earnings.

C)Unearned Revenue.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

46

A worksheet can be thought of as a(n)

A)permanent accounting record.

B)optional device used by accountants.

C)part of the general ledger.

D)part of the journal.

A)permanent accounting record.

B)optional device used by accountants.

C)part of the general ledger.

D)part of the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

47

When constructing a worksheet, accounts are often needed that are not listed in the trial balance already entered on the worksheet from the ledger.Where should these additional accounts be shown on the worksheet?

A)They should be inserted in alphabetical order into the trial balance accounts already given.

B)They should be inserted in chart of account order into the trial balance already given.

C)They should be inserted on the lines immediately below the trial balance totals.

D)They should not be inserted on the trial balance until the next accounting period.

A)They should be inserted in alphabetical order into the trial balance accounts already given.

B)They should be inserted in chart of account order into the trial balance already given.

C)They should be inserted on the lines immediately below the trial balance totals.

D)They should not be inserted on the trial balance until the next accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assuming that there is a net loss for the period, debits equal credits in all but which section of the worksheet?

A)Income statement columns

B)Adjustments columns

C)Trial balance columns

D)Adjusted trial balance columns

A)Income statement columns

B)Adjustments columns

C)Trial balance columns

D)Adjusted trial balance columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

49

The permanent accounts appear on which financial statement?

A)Statement of Financial Position.

B)Income Statement.

C)Retained Earning Statements.

D)Statement of Cash Flows.

A)Statement of Financial Position.

B)Income Statement.

C)Retained Earning Statements.

D)Statement of Cash Flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the total debits exceed total credits in the statement of financial position columns of the worksheet, equity

A)will increase because net income has occurred.

B)will decrease because a net loss has occurred.

C)is in error because a mistake has occurred.

D)will not be affected.

A)will increase because net income has occurred.

B)will decrease because a net loss has occurred.

C)is in error because a mistake has occurred.

D)will not be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

51

The net income (or loss) for the period

A)is found by computing the difference between the income statement credit column and the statement of financial position credit column on the worksheet.

B)cannot be found on the worksheet.

C)is found by computing the difference between the income statement columns of the worksheet.

D)is found by computing the difference between the trial balance totals and the adjusted trial balance totals.

A)is found by computing the difference between the income statement credit column and the statement of financial position credit column on the worksheet.

B)cannot be found on the worksheet.

C)is found by computing the difference between the income statement columns of the worksheet.

D)is found by computing the difference between the trial balance totals and the adjusted trial balance totals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

52

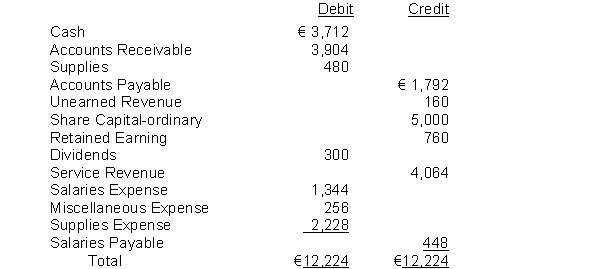

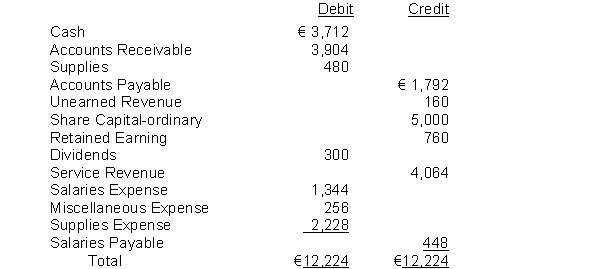

Use the following data, taken from the adjusted trial balance, for

What will be the total of the Statement of Financial Position credit column?

A)12,224

B)8,160

C)11,988

D)8,396

What will be the total of the Statement of Financial Position credit column?

A)12,224

B)8,160

C)11,988

D)8,396

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following data, taken from the adjusted trial balance, for

What amount will be reflected for Retained Earning in the Statement of Financial Position columns of the worksheet?

A)996

B)760

C)696

D)1,060

What amount will be reflected for Retained Earning in the Statement of Financial Position columns of the worksheet?

A)996

B)760

C)696

D)1,060

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

54

When using a worksheet, adjusting entries are journalized

A)after the worksheet is completed and before financial statements are prepared.

B)before the adjustments are entered on to the worksheet.

C)after the worksheet is completed and after financial statements have been prepared.

D)before the adjusted trial balance is extended to the proper financial statement columns.

A)after the worksheet is completed and before financial statements are prepared.

B)before the adjustments are entered on to the worksheet.

C)after the worksheet is completed and after financial statements have been prepared.

D)before the adjusted trial balance is extended to the proper financial statement columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

55

A worksheet is a multiple column form that facilitates the

A)identification of events.

B)measurement process.

C)preparation of financial statements.

D)analysis process.

A)identification of events.

B)measurement process.

C)preparation of financial statements.

D)analysis process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

56

The temporary account balances ultimately wind up in what account?

A)Income Summary.

B)Retained Earnings.

C)Share Capital-ordinary.

D)Comprehensive Income.

A)Income Summary.

B)Retained Earnings.

C)Share Capital-ordinary.

D)Comprehensive Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

57

Adjusting entries are prepared from

A)source documents.

B)the adjustments columns of the worksheet.

C)the general ledger.

D)last year's worksheet.

A)source documents.

B)the adjustments columns of the worksheet.

C)the general ledger.

D)last year's worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

58

The worksheet does not show

A)net income or loss for the period.

B)revenue and expense account balances.

C)the ending balance in Retained Earnings .

D)the trial balance before adjustments.

A)net income or loss for the period.

B)revenue and expense account balances.

C)the ending balance in Retained Earnings .

D)the trial balance before adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

59

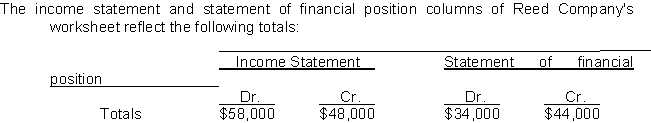

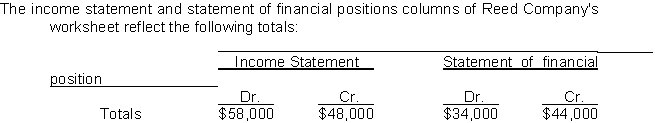

The net income (or loss) for the period is

The net income (or loss) for the period isA)$48,000 income.

B)$10,000 income.

C)$10,000 loss.

D)not determinable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following companies would be least likely to use a worksheet to facilitate the adjustment process?

A)Large company with numerous accounts

B)Small company with numerous accounts

C)All companies, since worksheets are required under generally accepted accounting principles

D)Small company with few accounts

A)Large company with numerous accounts

B)Small company with numerous accounts

C)All companies, since worksheets are required under generally accepted accounting principles

D)Small company with few accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

61

The entry to close the revenue account includes a

The entry to close the revenue account includes aA)debit to Income Summary for ₤3,400.

B)credit to Income Summary for ₤3,400.

C)debit to Income Summary for ₤7,000.

D)credit to Income Summary for ₤7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

62

Closing entries are necessary for

A)permanent accounts only.

B)temporary accounts only.

C)both permanent and temporary accounts.

D)permanent or real accounts only.

A)permanent accounts only.

B)temporary accounts only.

C)both permanent and temporary accounts.

D)permanent or real accounts only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

63

Closing entries are made

A)in order to terminate the business as an operating entity.

B)so that all assets, liabilities, and equity accounts will have zero balances when the next accounting period starts.

C)in order to transfer net income (or loss) and dividends to Retained Earnings .

D)so that financial statements can be prepared.

A)in order to terminate the business as an operating entity.

B)so that all assets, liabilities, and equity accounts will have zero balances when the next accounting period starts.

C)in order to transfer net income (or loss) and dividends to Retained Earnings .

D)so that financial statements can be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

64

Closing entries

A)are prepared before the financial statements.

B)reduce the number of permanent accounts.

C)cause the revenue and expense accounts to have zero balances.

D)summarize the activity in every account.

A)are prepared before the financial statements.

B)reduce the number of permanent accounts.

C)cause the revenue and expense accounts to have zero balances.

D)summarize the activity in every account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

65

Closing entries are journalized and posted

A)before the financial statements are prepared.

B)after the financial statements are prepared.

C)at management's discretion.

D)at the end of each interim accounting period.

A)before the financial statements are prepared.

B)after the financial statements are prepared.

C)at management's discretion.

D)at the end of each interim accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

66

The closing entry process consists of closing

A)all asset and liability accounts.

B)out the retained earnings account.

C)all permanent accounts.

D)all temporary accounts.

A)all asset and liability accounts.

B)out the retained earnings account.

C)all permanent accounts.

D)all temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

67

Each of the following accounts is closed to Income Summary except

A)Expenses.

B)Dividends

C)Revenues.

D)All of these are closed to Income Summary.

A)Expenses.

B)Dividends

C)Revenues.

D)All of these are closed to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

68

The most efficient way to accomplish closing entries is to

A)credit the income summary account for each revenue account balance.

B)debit the income summary account for each expense account balance.

C)credit the dividends account balance directly to the income summary account.

D)credit the income summary account for total revenues and debit the income summary account for total expenses.

A)credit the income summary account for each revenue account balance.

B)debit the income summary account for each expense account balance.

C)credit the dividends account balance directly to the income summary account.

D)credit the income summary account for total revenues and debit the income summary account for total expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

69

If Income Summary has a credit balance after revenues and expenses have been closed into it, the closing entry for Income Summary will include a

A)debit to Retained Earnings.

B)debit to Dividends

C)credit to Retained Earnings.

D)credit to Dividends.

A)debit to Retained Earnings.

B)debit to Dividends

C)credit to Retained Earnings.

D)credit to Dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is a true statement about closing the books of a corporation?

A)Expenses are closed to the Expense Summary account.

B)Only revenues are closed to the Income Summary account.

C)Revenues and expenses are closed to the Income Summary account.

D)Revenues, expenses, and the dividends account are closed to the Income Summary account.

A)Expenses are closed to the Expense Summary account.

B)Only revenues are closed to the Income Summary account.

C)Revenues and expenses are closed to the Income Summary account.

D)Revenues, expenses, and the dividends account are closed to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

71

The balance in the income summary account before it is closed will be equal to

A)the net income or loss on the income statement.

B)the beginning balance in the retained earnings account.

C)the ending balance in the retained earnings account.

D)zero.

A)the net income or loss on the income statement.

B)the beginning balance in the retained earnings account.

C)the ending balance in the retained earnings account.

D)zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

72

Closing entries are

A)an optional step in the accounting cycle.

B)posted to the ledger accounts from the worksheet.

C)made to close permanent or real accounts.

D)journalized in the general journal.

A)an optional step in the accounting cycle.

B)posted to the ledger accounts from the worksheet.

C)made to close permanent or real accounts.

D)journalized in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

73

The income summary account

A)is a permanent account.

B)appears on the statement of financial position.

C)appears on the income statement.

D)is a temporary account.

A)is a permanent account.

B)appears on the statement of financial position.

C)appears on the income statement.

D)is a temporary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

74

After closing entries are posted, the balance in the retained earnings account in the ledger will be equal to

A)the beginning retained earnings reported on the retained earnings statement.

B)the amount of the retained earnings reported on the statement of financial positions.

C)zero.

D)the net income for the period.

A)the beginning retained earnings reported on the retained earnings statement.

B)the amount of the retained earnings reported on the statement of financial positions.

C)zero.

D)the net income for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

75

The Income Summary account is an important account that is used

A)during interim periods.

B)in preparing adjusting entries.

C)annually in preparing closing entries.

D)annually in preparing correcting entries.

A)during interim periods.

B)in preparing adjusting entries.

C)annually in preparing closing entries.

D)annually in preparing correcting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

76

Closing entries may be prepared from all but which one of the following sources?

A)Adjusted balances in the ledger

B)Income statement and statement of financial position columns of the worksheet

C)statement of financial position

D)Income and retained earnings statements

A)Adjusted balances in the ledger

B)Income statement and statement of financial position columns of the worksheet

C)statement of financial position

D)Income and retained earnings statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

77

In order to close the Dividends account, the

A)income summary account should be debited.

B)income summary account should be credited.

C)retained earnings account should be credited.

D)retained earnings account should be debited.

A)income summary account should be debited.

B)income summary account should be credited.

C)retained earnings account should be credited.

D)retained earnings account should be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

78

The final closing entry to be journalized is typically the entry that closes the

A)revenue accounts.

B)dividends account.

C)retained earnings account.

D)expense accounts.

A)revenue accounts.

B)dividends account.

C)retained earnings account.

D)expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

79

In preparing closing entries

A)each revenue account will be credited.

B)each expense account will be credited.

C)the retained earnings account will be debited if there is net income for the period.

D)the dividends account will be debited.

A)each revenue account will be credited.

B)each expense account will be credited.

C)the retained earnings account will be debited if there is net income for the period.

D)the dividends account will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

80

An error has occurred in the closing entry process if

A)revenue and expense accounts have zero balances.

B)the retained earnings account is credited for the amount of net income.

C)the dividends account is closed to the retained earnings account.

D)the Statement of financial position accounts have zero balances.

A)revenue and expense accounts have zero balances.

B)the retained earnings account is credited for the amount of net income.

C)the dividends account is closed to the retained earnings account.

D)the Statement of financial position accounts have zero balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck