Deck 9: Merchandising Companies: Worksheets and Financial Statements Perpetual

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/163

العب

ملء الشاشة (f)

Deck 9: Merchandising Companies: Worksheets and Financial Statements Perpetual

1

The Sales Returns and Allowances account and the Sales Discounts account are both classified as expense accounts.

False

2

When merchandising companies receive cash before goods are delivered, they credit Unearned Sales Revenue.

True

3

A company's unadjusted balance in Inventory will usually not agree with the actual amount of inventory on hand at year-end.

True

4

Sales revenue minus operating expenses equals gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

5

The major difference for a merchandising firm in the income statement columns of the worksheet is the presence of Cost of Goods Sold, Freight-Out (or Delivery Expense), and the accounts related to net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

6

The multiple-step form of the income statement is easier to read than the single-step form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

7

Net sales appears on both the multiple-step and single-step forms of an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

8

Nonoperating activities exclude revenues and expenses that result from secondary or auxiliary operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

9

The steps in the accounting cycle are different for a merchandising company than for a service company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a worksheet, Inventory will be shown in the trial balance (Dr.), adjusted trial balance (Dr.) and income statement (Dr.) columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

11

The major difference for a merchandising firm in the balance sheet columns of the worksheet is the presence of Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the recorded inventory is greater than the physical inventory count, the adjusting entry required will decrease cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a worksheet, cost of goods sold will be shown in the trial balance (Dr.), adjusted trial balance (Dr.) and income statement (Dr.) columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

14

Inventory is classified as an asset on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

15

A merchandising company has different types of adjusting entries than a service company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the actual inventory is greater than the unadjusted balance in Inventory, Cost of Goods Sold will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

17

A merchandising company using a perpetual inventory system will usually need to make an adjusting entry to ensure that the recorded inventory agrees with physical inventory count.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

18

Operating expenses are different for merchandising and service enterprises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

19

A multiple-step income statement provides users with more information about a company's income performance than a single-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

20

When goods are delivered after an advance receipt of cash, Unearned Sales Revenue is decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

21

The major difference between the balance sheets of a service company and a merchandising company is inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

22

Closing entries are prepared at the end of each week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a merchandising company sells land at more than its cost, the gain should be reported in the sales revenue section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Income Summary account is credited in the entry which closes Sales Returns and Allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

25

A gain on disposal of plant assets and interest expense are reported under other revenues and gains in a multiple-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

26

A single-step income statement reports all revenues, both operating and other revenues and gains, at the top of the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

27

Gross profit is a measure of the overall profitability of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

28

If net sales are $800,000 and cost of goods sold is $600,000, the gross profit rate is 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Income Summary account is debited in the entry which closes Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

30

Gross profit appears on both the multiple-step and single-step forms of an income statement for a merchandising company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

31

In a multiple-step income statement, income from operations excludes other revenues and gains and other expenses and losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

32

After a merchandising company has posted closing entries, all temporary accounts and Inventory have zero balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

33

The entry to close the contra revenue accounts will debit these accounts and credit Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

34

Gross profit represents the merchandising profit of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

35

For a merchandising company, all accounts that affect the determination of income are closed to the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

36

A merchandising company's temporary accounts include Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

37

The gross profit rate is computed by dividing cost of goods sold by net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

38

Sales returns and allowances and sales discounts are subtracted from sales in reporting net sales in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

39

Income Summary is debited in the entry which closes Sales Discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

40

Contra revenue accounts are not closed to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

41

Pancho Steinberg's sells gift cards to customers. On November 2, a customer purchased a $200 gift card. On December 15, the gift card recipient uses the gift card as payment for a small banquet. Pancho Steinberg's records

A) $200 revenue in November.

B) $200 revenue in December.

C) $100 revenue in November and $100 sales revenue in December.

D) $150 revenue in November and $50 sales revenue in December.

A) $200 revenue in November.

B) $200 revenue in December.

C) $100 revenue in November and $100 sales revenue in December.

D) $150 revenue in November and $50 sales revenue in December.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

42

When goods are delivered after an advance receipt of cash,

A) Cash is debited.

B) Unearned Sales Revenue is debited.

C) Unearned Sales Revenue is credited.

D) Sales Revenue is debited.

A) Cash is debited.

B) Unearned Sales Revenue is debited.

C) Unearned Sales Revenue is credited.

D) Sales Revenue is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following accounts has a normal credit balance?

A) Sales Returns and Allowances

B) Sales Discounts

C) Sales Revenue

D) Selling Expense

A) Sales Returns and Allowances

B) Sales Discounts

C) Sales Revenue

D) Selling Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

44

The entries to close Sales Discounts, Sales Returns and Allowances, Freight-Out, Inventory and Cost of Goods Sold all require credits to these accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the worksheet, Cost of Goods Sold appears in the

A) Trial Balance credit column.

B) Balance Sheet debit column.

C) Adjusted Trial Balance debit column.

D) Income Statement credit column.

A) Trial Balance credit column.

B) Balance Sheet debit column.

C) Adjusted Trial Balance debit column.

D) Income Statement credit column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

46

If the Inventory account is determined by a physical count of the inventory to be overstated, a merchandising company using a perpetual system will record an adjusting entry which includes a

A) debit to Income Summary.

B) credit to Income Summary.

C) debit to Cost of Goods Sold.

D) credit to Cost of Goods Sold.

A) debit to Income Summary.

B) credit to Income Summary.

C) debit to Cost of Goods Sold.

D) credit to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Inventory account balance appearing in a perpetual inventory worksheet represents the

A) ending inventory.

B) beginning inventory.

C) cost of merchandise purchased.

D) cost of merchandise sold.

A) ending inventory.

B) beginning inventory.

C) cost of merchandise purchased.

D) cost of merchandise sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

48

When cash is received before goods are delivered,

A) Cash is credited.

B) Unearned Sales Revenue is debited.

C) Unearned Sales Revenue is credited.

D) Revenue is credited.

A) Cash is credited.

B) Unearned Sales Revenue is debited.

C) Unearned Sales Revenue is credited.

D) Revenue is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

49

The respective normal account balances of Unearned Revenue, Inventory, and Cost of Goods Sold are

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following accounts does not have a normal credit balance?

A) Gain on Disposal of Plant Assets

B) Sales Discounts

C) Unearned Revenue

D) Sales Revenues

A) Gain on Disposal of Plant Assets

B) Sales Discounts

C) Unearned Revenue

D) Sales Revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

51

When the physical count of Barr Company inventory had a cost of $4,380 at year-end and the unadjusted balance in Inventory is $4,600, Barr will have to make the following entry:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

52

The respective normal account balances of Sales Revenue, Sales Returns and Allowances, and Sales Discounts are

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

53

The respective normal account balances of Sales Revenue, Freight-Out, and Cost of Goods Sold are

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

54

In a worksheet for a merchandising company, Inventory would appear in the

A) trial balance and adjusted trial balance columns only.

B) trial balance and balance sheet columns only.

C) trial balance, adjusted trial balance, and balance sheet columns.

D) trial balance, adjusted trial balance, and income statement columns.

A) trial balance and adjusted trial balance columns only.

B) trial balance and balance sheet columns only.

C) trial balance, adjusted trial balance, and balance sheet columns.

D) trial balance, adjusted trial balance, and income statement columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

55

Caine Company has net sales of $74,000, cost of goods sold of $42,000 and operating expenses of $17,000 for the year ended December 31. Caine's gross profit is

A) $0.

B) $15,000.

C) $32,000.

D) $59,000.

A) $0.

B) $15,000.

C) $32,000.

D) $59,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

56

A merchandising company using a perpetual system may record an adjusting entry due to an inventory count by

A) debiting Income Summary.

B) crediting Income Summary.

C) debiting Cost of Goods Sold.

D) debiting Sales Revenue.

A) debiting Income Summary.

B) crediting Income Summary.

C) debiting Cost of Goods Sold.

D) debiting Sales Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

57

The physical count of Grey Company inventory determined that inventory with a cost of $144,500 was on hand at year-end. If the unadjusted balance in the Inventory account was $139,600, the company will make the following adjusting entry:

A)

B)

C)

D) No adjusting entry is required.

A)

B)

C)

D) No adjusting entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the actual inventory from the physical count is greater than the unadjusted balance in Inventory,

A) Cost of Goods Sold is credited.

B) Inventory is credited.

C) Sales Revenue is credited.

D) Sales Revenue is debited.

A) Cost of Goods Sold is credited.

B) Inventory is credited.

C) Sales Revenue is credited.

D) Sales Revenue is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

59

A merchandising company using a perpetual system will make

A) the same number of adjusting entries as a service company does.

B) one more adjusting entry than a service company does.

C) one less adjusting entry than a service company does.

D) different types of adjusting entries compared to a service company.

A) the same number of adjusting entries as a service company does.

B) one more adjusting entry than a service company does.

C) one less adjusting entry than a service company does.

D) different types of adjusting entries compared to a service company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

60

The physical count of Pope Company inventory determined that inventory with a cost of $44,200 was on hand at year-end. If the unadjusted balance in the Inventory account is $44,600, Pope will make the following entry:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

61

The operating expense section of an income statement for a wholesaler would not include

A) freight-out.

B) utilities expense.

C) cost of goods sold.

D) insurance expense.

A) freight-out.

B) utilities expense.

C) cost of goods sold.

D) insurance expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

62

The sales revenue section of a multiple-step income statement for a retailer would not include

A) Sales discounts.

B) Sales revenue.

C) Net sales.

D) Interest Revenue.

A) Sales discounts.

B) Sales revenue.

C) Net sales.

D) Interest Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

63

Income from operations will always result if

A) the cost of goods sold exceeds operating expenses.

B) revenues exceed cost of goods sold.

C) revenues exceed operating expenses.

D) gross profit exceeds operating expenses.

A) the cost of goods sold exceeds operating expenses.

B) revenues exceed cost of goods sold.

C) revenues exceed operating expenses.

D) gross profit exceeds operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

64

In terms of liquidity, inventory is

A) more liquid than cash.

B) more liquid than accounts receivable.

C) more liquid than prepaid expenses.

D) less liquid than store equipment.

A) more liquid than cash.

B) more liquid than accounts receivable.

C) more liquid than prepaid expenses.

D) less liquid than store equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

65

All of the following would be reported as non-operating items except

A) Loss on disposal of plant assets.

B) Interest revenue.

C) Interest expense.

D) Depreciation expense.

A) Loss on disposal of plant assets.

B) Interest revenue.

C) Interest expense.

D) Depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

66

All of the following items would be reported as other expenses and losses except

A) freight-out.

B) casualty losses.

C) interest expense.

D) loss from employees' strikes.

A) freight-out.

B) casualty losses.

C) interest expense.

D) loss from employees' strikes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

67

Income from operations appears on

A) both a multiple-step and a single-step income statement.

B) neither a multiple-step nor a single-step income statement.

C) a single-step income statement.

D) a multiple-step income statement.

A) both a multiple-step and a single-step income statement.

B) neither a multiple-step nor a single-step income statement.

C) a single-step income statement.

D) a multiple-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is not a true statement about a multiple-step income statement?

A) With the exception of Delivery Expense, operating expenses are similar for merchandising and service enterprises.

B) There may be a section for non-operating activities such as interest revenue and gains on the sale of assets other than inventory.

C) There may be a section for operating assets.

D) It will report the calculation of gross profit.

A) With the exception of Delivery Expense, operating expenses are similar for merchandising and service enterprises.

B) There may be a section for non-operating activities such as interest revenue and gains on the sale of assets other than inventory.

C) There may be a section for operating assets.

D) It will report the calculation of gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which one of the following would appear on the income statement of both a merchandising company and a service company?

A) Gross profit

B) Operating expenses

C) Sales revenues

D) Cost of goods sold

A) Gross profit

B) Operating expenses

C) Sales revenues

D) Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

70

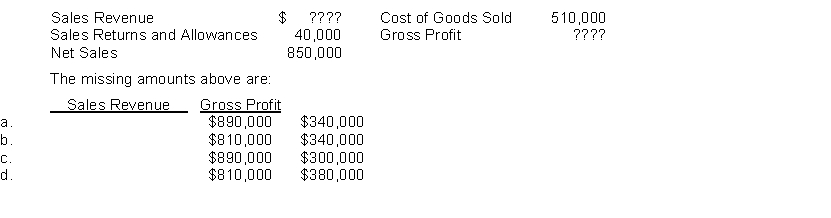

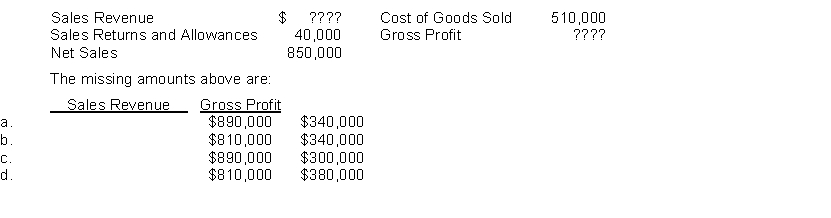

Chen Company's financial information is presented below.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

71

The sales revenue section of a multiple-step income statement for a retailer would not include

A) Sales discounts.

B) Sales revenue.

C) Sales returns and allowances.

D) Gain on the sale of plant assets.

A) Sales discounts.

B) Sales revenue.

C) Sales returns and allowances.

D) Gain on the sale of plant assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

72

The sales revenue section of an income statement for a retailer would not include

A) Sales discounts.

B) Sales revenue.

C) Net sales.

D) Cost of goods sold.

A) Sales discounts.

B) Sales revenue.

C) Net sales.

D) Cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

73

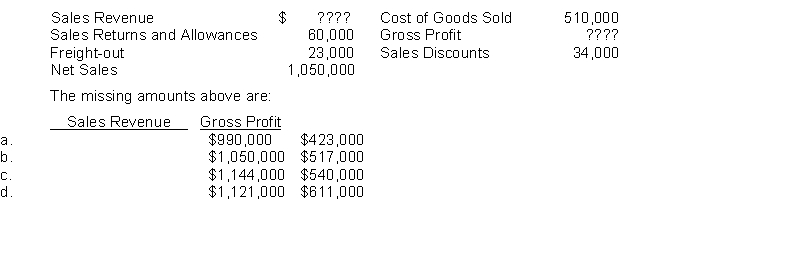

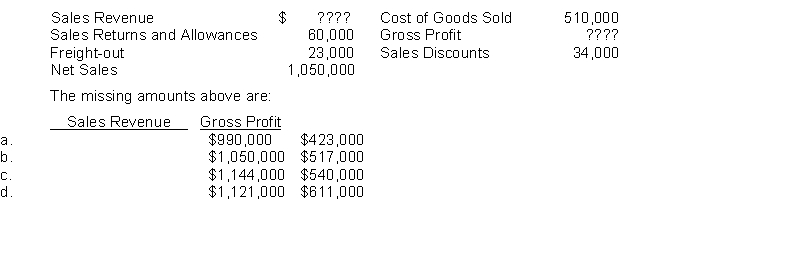

Yang Company's financial information is presented below.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a company has net sales of $600,000 and cost of goods sold of $372,000, the gross profit percentage is

A) 22%.

B) 38%.

C) 62%.

D) 100%.

A) 22%.

B) 38%.

C) 62%.

D) 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

75

The gross profit rate is computed by dividing gross profit by

A) cost of goods sold.

B) net income.

C) net sales.

D) sales revenue.

A) cost of goods sold.

B) net income.

C) net sales.

D) sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

76

Gross profit does not appear

A) on a multiple-step income statement.

B) on a single-step income statement.

C) to be relevant in analyzing the operation of a merchandiser.

D) on the income statement if the periodic inventory system is used because it cannot be calculated.

A) on a multiple-step income statement.

B) on a single-step income statement.

C) to be relevant in analyzing the operation of a merchandiser.

D) on the income statement if the periodic inventory system is used because it cannot be calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which one of the following would be reported as an operating expense on a multiple-step income statement of an online retailer but not a local accounting firm?

A) Freight-out

B) Insurance expense

C) Utilities expense

D) Depreciation expense

A) Freight-out

B) Insurance expense

C) Utilities expense

D) Depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

78

Martin Company reported the following balances at June 30, 2020: Net sales for the month is

A) $7,300

B) $15,500.

C) $15,700.

D) $16,500.

A) $7,300

B) $15,500.

C) $15,700.

D) $16,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company shows the following balances: What is the gross profit rate?

A) 34%

B) 46%

C) 66%

D) 54%

A) 34%

B) 46%

C) 66%

D) 54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which one of the following is shown on a multiple-step but not on a single-step income statement?

A) Net sales

B) Net income

C) Gross profit

D) Cost of goods sold

A) Net sales

B) Net income

C) Gross profit

D) Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck