Deck 3: Introduction to Fixed-Income Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/44

العب

ملء الشاشة (f)

Deck 3: Introduction to Fixed-Income Valuation

1

A zero-coupon bond matures in 15 years. At a market discount rate of 4.5% per year and assuming annual compounding, the price of the bond per 100 of par value is closest to:

A) 51.30.

B) 51.67.

C) 71.62.

A) 51.30.

B) 51.67.

C) 71.62.

B

2

A bond offers an annual coupon rate of 4%, with interest paid semi-annually. The bond matures in two years. At a market discount rate of 6%, the price of this bond per 100 of

Par value is closest to:

A) 93.07.

B) 96.28.

C) 96.33.

Par value is closest to:

A) 93.07.

B) 96.28.

C) 96.33.

B

3

All three bonds pay interest annually.

-based upon the given sequence of spot rates, the price of bond Y is closest to:

A) 87.50.

B) 92.54.

C) 92.76.

92.76.

4

All three bonds pay interest annually.

-based upon the given sequence of spot rates, the price of bond x is closest to:

A) 95.02.

B) 95.28.

C) 97.63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

5

The following information relates to Questions

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The full price that bond G settles at on 16 June 2020 is closest to:

A) 102.36.

B) 103.10.

C) 103.65.

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The full price that bond G settles at on 16 June 2020 is closest to:

A) 102.36.

B) 103.10.

C) 103.65.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

6

Relative to bond C, for a 200 basis point decrease in the required rate of return, bond b will most likely exhibit a(n):

A) equal percentage price change.

B) greater percentage price change.

C) smaller percentage price change.

A) equal percentage price change.

B) greater percentage price change.

C) smaller percentage price change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

7

An investor considers the purchase of a 2-year bond with a 5% coupon rate, with interest paid annually. Assuming the sequence of spot rates shown below, the price of the bond is Closest to:

A) 101.93.

B) 102.85.

C) 105.81.

A) 101.93.

B) 102.85.

C) 105.81.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

8

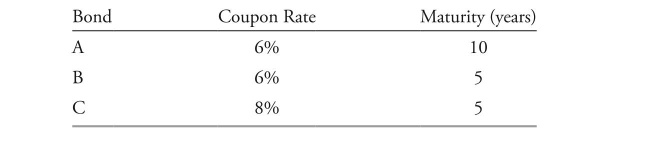

Which bond offers the lowest yield-to-maturity?

A) bond A

B) bond b

C) bond C

A) bond A

B) bond b

C) bond C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

10

A bond with two years remaining until maturity offers a 3% coupon rate with interest paid annually. At a market discount rate of 4%, the price of this bond per 100 of par value

Is closest to:

A) 95.34.

B) 98.00.

C) 98.11.

Is closest to:

A) 95.34.

B) 98.00.

C) 98.11.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

11

The following information relates to Questions

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The accrued interest per 100 of par value for bond G on the settlement date of 16 June 2020 is closest to:

A) 0.46.

B) 0.73.

C) 0.92.

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The accrued interest per 100 of par value for bond G on the settlement date of 16 June 2020 is closest to:

A) 0.46.

B) 0.73.

C) 0.92.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

12

bond dealers most often quote the:

A) flat price.

B) full price.

C) full price plus accrued interest.

A) flat price.

B) full price.

C) full price plus accrued interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

13

A portfolio manager is considering the purchase of a bond with a 5.5% coupon rate that pays interest annually and matures in three years. If the required rate of return on the

Bond is 5%, the price of the bond per 100 of par value is closest to:

A) 98.65.

B) 101.36.

C) 106.43.

Bond is 5%, the price of the bond per 100 of par value is closest to:

A) 98.65.

B) 101.36.

C) 106.43.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

14

A bond offers an annual coupon rate of 5%, with interest paid semi-annually. The bond matures in seven years. At a market discount rate of 3%, the price of this bond per 100 of

Par value is closest to:

A) 106.60.

B) 112.54.

C) 143.90.

Par value is closest to:

A) 106.60.

B) 112.54.

C) 143.90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

15

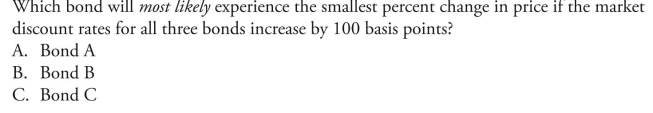

Which bond will most likely experience the greatest percentage change in price if the mar- ket discount rates for all three bonds increase by 100 basis points?

A) bond A

B) bond b

C) bond C

A) bond A

B) bond b

C) bond C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

16

An investor who owns a bond with a 9% coupon rate that pays interest semi-annually and matures in three years is considering its sale. If the required rate of return on the bond is

11%, the price of the bond per 100 of par value is closest to:

A) 95.00.

B) 95.11.

C) 105.15.

11%, the price of the bond per 100 of par value is closest to:

A) 95.00.

B) 95.11.

C) 105.15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

17

The following information relates to Questions 11 and 12

The following information relates to Questions 11 and 12  All three bonds are currently trading at par value.

All three bonds are currently trading at par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

18

A 3-year bond offers a 10% coupon rate with interest paid annually. Assuming the follow- ing sequence of spot rates, the price of the bond is closest to:

A) 96.98.

B) 101.46.

C) 102.95.

A) 96.98.

B) 101.46.

C) 102.95.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

19

Consider the following two bonds that pay interest annually: At a market discount rate of 4%, the price difference between bond A and bond b per 100 of par value is closest to:

A) 3.70.

B) 3.77.

C) 4.00.

A) 3.70.

B) 3.77.

C) 4.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

20

All three bonds pay interest annually.

-based upon the given sequence of spot rates, the yield-to-maturity of bond Z is closest to:

A) 9.00%.

B) 9.92%.

C) 11.93%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

21

A yield curve constructed from a sequence of yields-to-maturity on zero-coupon bonds is the:

A) par curve.

B) spot curve.

C) forward curve.

A) par curve.

B) spot curve.

C) forward curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

22

A 365-day year bank certificate of deposit has an initial principal amount of uSd 96.5 million and a redemption amount due at maturity of uSd 100 million. The number of

Days between settlement and maturity is 350. The bond equivalent yield is closest to:

A) 3.48%.

B) 3.65%.

C) 3.78%.

Days between settlement and maturity is 350. The bond equivalent yield is closest to:

A) 3.48%.

B) 3.65%.

C) 3.78%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

24

The following information relates to Questions

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-first-call is closest to:

A) 3.12%.

B) 6.11%.

C) 6.25%.

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-first-call is closest to:

A) 3.12%.

B) 6.11%.

C) 6.25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

25

When underwriting new corporate bonds, matrix pricing is used to get an estimate of the:

A) required yield spread over the benchmark rate.

B) market discount rate of other comparable corporate bonds.

C) yield-to-maturity on a government bond having a similar time-to-maturity.

A) required yield spread over the benchmark rate.

B) market discount rate of other comparable corporate bonds.

C) yield-to-maturity on a government bond having a similar time-to-maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following information relates to Questions

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-maturity is closest to:

A) 2.88%.

B) 5.77%.

C) 5.94%.

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-maturity is closest to:

A) 2.88%.

B) 5.77%.

C) 5.94%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

27

The following information relates to Questions

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-second-call is closest to:

A) 2.97%.

B) 5.72%.

C) 5.94%.

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's annual yield-to-second-call is closest to:

A) 2.97%.

B) 5.72%.

C) 5.94%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

28

A bond with 20 years remaining until maturity is currently trading for 111 per 100 of par value. The bond offers a 5% coupon rate with interest paid semi-annually. The bond's

Annual yield-to-maturity is closest to:

A) 2.09%.

B) 4.18%.

C) 4.50%.

Annual yield-to-maturity is closest to:

A) 2.09%.

B) 4.18%.

C) 4.50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

29

The spread component of a specific bond's yield-to-maturity is least likely impacted by changes in:

A) its tax status.

B) its quality rating.

C) inflation in its currency of denomination.

A) its tax status.

B) its quality rating.

C) inflation in its currency of denomination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

30

The bond equivalent yield of a 180-day banker's acceptance quoted at a discount rate of4.25% for a 360-day year is closest to:

A) 4.31%.

B) 4.34%.

C) 4.40%.

A) 4.31%.

B) 4.34%.

C) 4.40%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

31

Matrix pricing allows investors to estimate market discount rates and prices for bonds:

A) with different coupon rates.

B) that are not actively traded.

C) with different credit quality.

A) with different coupon rates.

B) that are not actively traded.

C) with different credit quality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

32

A 5-year, 5% semi-annual coupon payment corporate bond is priced at 104.967 per 100 of par value. The bond's yield-to-maturity, quoted on a semi-annual bond basis, is3.897%. An analyst has been asked to convert to a monthly periodicity. under this con-

Version, the yield-to-maturity is closest to:

Version, the yield-to-maturity is closest to:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements describing a par curve is incorrect?

A) A par curve is obtained from a spot curve.

B) All bonds on a par curve are assumed to have different credit risk.

C) A par curve is a sequence of yields-to-maturity such that each bond is priced at par value.

A) A par curve is obtained from a spot curve.

B) All bonds on a par curve are assumed to have different credit risk.

C) A par curve is a sequence of yields-to-maturity such that each bond is priced at par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

34

An analyst evaluates the following information relating to floating rate notes (FRns) is- sued at par value that have 3-month libor as a reference rate: based only on the information provided, the FRn that will be priced at a premium on the next reset date is:

A) FRn x.

B) FRn Y.

C) FRn Z.

A) FRn x.

B) FRn Y.

C) FRn Z.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following information relates to Questions

All rates are annual rates stated for a periodicity of one (effective annual rates).

-The 3-year implied spot rate is closest to:

A) 1.18%.

B) 1.94%.

C) 2.28%.

All rates are annual rates stated for a periodicity of one (effective annual rates).

-The 3-year implied spot rate is closest to:

A) 1.18%.

B) 1.94%.

C) 2.28%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

36

The following information relates to Questions

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The flat price for bond G on the settlement date of 16 June 2020 is closest to:

A) 102.18.

B) 103.10.

C) 104.02.

bond G, described in the exhibit below, is sold for settlement on 16 June 2020.

-The flat price for bond G on the settlement date of 16 June 2020 is closest to:

A) 102.18.

B) 103.10.

C) 104.02.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

37

The following information relates to Questions

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's yield-to-worst is closest to:

A) 2.88%.

B) 5.77%.

C) 6.25%.

A bond with 5 years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semi-annually. The bond is first callable in 3 years, and is callable after that date on coupon dates according to the following schedule:

-The bond's yield-to-worst is closest to:

A) 2.88%.

B) 5.77%.

C) 6.25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

38

The annual yield-to-maturity, stated for with a periodicity of 12, for a 4-year, zero-coupon bond priced at 75 per 100 of par value is closest to:

A) 6.25%.

B) 7.21%.

C) 7.46%.

A) 6.25%.

B) 7.21%.

C) 7.46%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

39

The following information relates to Questions

All rates are annual rates stated for a periodicity of one (effective annual rates).

-The value per 100 of par value of a two-year, 3.5% coupon bond, with interest payments paid annually, is closest to:

A) 101.58.

B) 105.01.

C) 105.82.

All rates are annual rates stated for a periodicity of one (effective annual rates).

-The value per 100 of par value of a two-year, 3.5% coupon bond, with interest payments paid annually, is closest to:

A) 101.58.

B) 105.01.

C) 105.82.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

40

The rate, interpreted to be the incremental return for extending the time-to-maturity of an investment for an additional time period, is the:

A) add-on rate.

B) forward rate.

C) yield-to-maturity.

A) add-on rate.

B) forward rate.

C) yield-to-maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

41

The following information relates to Question 42

both bonds pay interest annually. The current three-year EuR interest rate swap benchmark is 2.12%.

-The G-spread in basis points (bps) on the uK corporate bond is closest to:

A) 264 bps.

B) 285 bps.

C) 300 bps.

both bonds pay interest annually. The current three-year EuR interest rate swap benchmark is 2.12%.

-The G-spread in basis points (bps) on the uK corporate bond is closest to:

A) 264 bps.

B) 285 bps.

C) 300 bps.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

42

An option-adjusted spread (oAS) on a callable bond is the Z-spread:

A) over the benchmark spot curve.

B) minus the standard swap rate in that currency of the same tenor.

C) minus the value of the embedded call option expressed in basis points per year.

A) over the benchmark spot curve.

B) minus the standard swap rate in that currency of the same tenor.

C) minus the value of the embedded call option expressed in basis points per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

43

A corporate bond offers a 5% coupon rate and has exactly 3 years remaining to maturity. Interest is paid annually. The following rates are from the benchmark spot curve: The bond is currently trading at a Z-spread of 234 basis points. The value of the bond is

closest to:

A) 92.38.

B) 98.35.

C) 106.56.

closest to:

A) 92.38.

B) 98.35.

C) 106.56.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck

44

The yield spread of a specific bond over the standard swap rate in that currency of the same tenor is best described as the:

A) I-spread.

B) Z-spread.

C) G-spread.

A) I-spread.

B) Z-spread.

C) G-spread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 44 في هذه المجموعة.

فتح الحزمة

k this deck