Deck 6: Fundamentals of Credit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/45

العب

ملء الشاشة (f)

Deck 6: Fundamentals of Credit Analysis

1

The two components of credit risk are default probability and:

A) spread risk.

B) loss severity.

C) market liquidity risk.

A) spread risk.

B) loss severity.

C) market liquidity risk.

B

2

in order to analyze the collateral of a company a credit analyst should assess the:

A) cash flows of the company.

B) soundness of management's strategy.

C) value of the company's assets in relation to the level of debt.

A) cash flows of the company.

B) soundness of management's strategy.

C) value of the company's assets in relation to the level of debt.

C

3

loss severity is best described as the:

A) default probability multiplied by the loss given default.

B) portion of a bond's value recovered by bondholders in the event of default.

C) portion of a bond's value, including unpaid interest, an investor loses in the event of default.

A) default probability multiplied by the loss given default.

B) portion of a bond's value recovered by bondholders in the event of default.

C) portion of a bond's value, including unpaid interest, an investor loses in the event of default.

C

4

Holding all other factors constant, the most likely effect of low demand and heavy new issue supply on bond yield spreads is that yield spreads will:

A) widen.

B) tighten.

C) not be affected.

A) widen.

B) tighten.

C) not be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

5

Funds from operations (FFo) of Pay Handle ltd increased in 2011. in 2011 the total debt of the company remained unchanged, while additional common shares were issued.

Pay Handle ltd's ability to service its debt in 2011, as compared to 2010, most likely:

A) improved.

B) worsened.

C) remained the same.

Pay Handle ltd's ability to service its debt in 2011, as compared to 2010, most likely:

A) improved.

B) worsened.

C) remained the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

6

The risk that a bond's creditworthiness declines is best described by:

A) credit migration risk.

B) market liquidity risk.

C) spread widening risk.

A) credit migration risk.

B) market liquidity risk.

C) spread widening risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

7

in order to determine the capacity of a company, it would be most appropriate to analyze the:

A) company's strategy.

B) growth prospects of the industry.

C) aggressiveness of the company's accounting policies.

A) company's strategy.

B) growth prospects of the industry.

C) aggressiveness of the company's accounting policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

9

Stedsmart ltd and Fignermo ltd are alike with respect to financial and operating char- acteristics, except that Stedsmart ltd has less publicly traded debt outstanding than

Fignermo ltd. Stedsmart ltd is most likely to have:

A) no market liquidity risk.

B) lower market liquidity risk.

C) higher market liquidity risk.

Fignermo ltd. Stedsmart ltd is most likely to have:

A) no market liquidity risk.

B) lower market liquidity risk.

C) higher market liquidity risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

10

during bankruptcy proceedings of a firm, the priority of claims was not strictly adhered to. Which of the following is the least likely explanation for this outcome?

A) Senior creditors compromised.

B) The value of secured assets was less than the amount of the claims.

C) A judge's order resulted in actual claims not adhering to strict priority of claims.

A) Senior creditors compromised.

B) The value of secured assets was less than the amount of the claims.

C) A judge's order resulted in actual claims not adhering to strict priority of claims.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

11

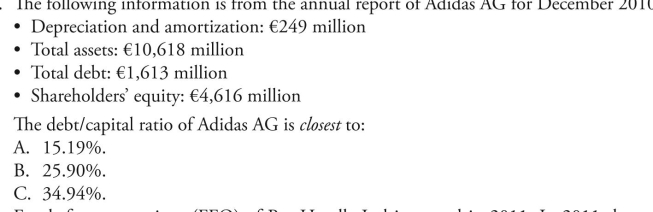

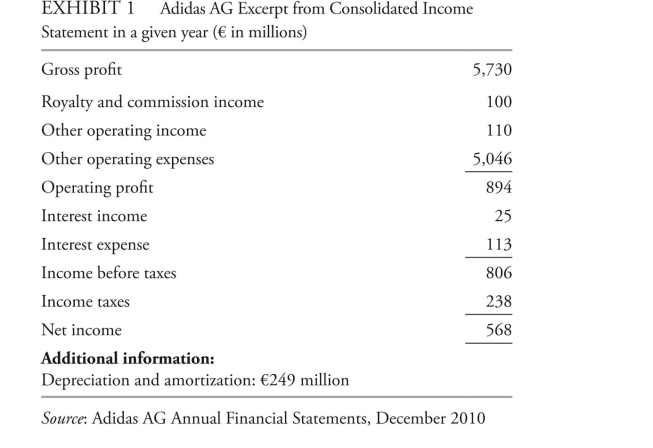

based on the information provided in Exhibit 1, the EbiTdA interest coverage ratio of Adidas AG is closest to:

A) 7.91x.

B) 10.12x.

C) 12.99x.

A) 7.91x.

B) 10.12x.

C) 12.99x.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

12

if goodwill makes up a large percentage of a company's total assets, this most likely indi- cates that:

A) the company has low free cash flow before dividends.

B) there is a low likelihood that the market price of the company's common stock is below book value.

C) a large percentage of the company's assets are not of high quality.

A) the company has low free cash flow before dividends.

B) there is a low likelihood that the market price of the company's common stock is below book value.

C) a large percentage of the company's assets are not of high quality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

13

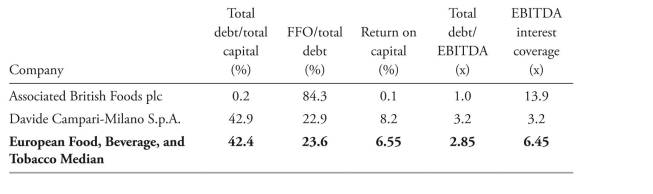

based on the information in Exhibit 2, Grupa Zywiec SA's credit risk is most likely: ExHibiT 2 European Food, beverage, and Tobacco industry and Grupa Zywiec SA Selected Financial Ratios for 2010

A) lower than the industry.

B) higher than the industry.

C) the same as the industry.

A) lower than the industry.

B) higher than the industry.

C) the same as the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

14

A credit analyst is evaluating the creditworthiness of three companies: a construction company, a travel and tourism company, and a beverage company. both the construction

And travel and tourism companies are cyclical, whereas the beverage company is non-

Cyclical. The construction company has the highest debt level of the three companies. The

Highest credit risk is most likely exhibited by the:

A) construction company.

B) beverage company.

C) travel and tourism company.

And travel and tourism companies are cyclical, whereas the beverage company is non-

Cyclical. The construction company has the highest debt level of the three companies. The

Highest credit risk is most likely exhibited by the:

A) construction company.

B) beverage company.

C) travel and tourism company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

15

Credit risk of a corporate bond is best described as the:

A) risk that an issuer's creditworthiness deteriorates.

B) probability that the issuer fails to make full and timely payments.

C) risk of loss resulting from the issuer failing to make full and timely payments.

A) risk that an issuer's creditworthiness deteriorates.

B) probability that the issuer fails to make full and timely payments.

C) risk of loss resulting from the issuer failing to make full and timely payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

16

For a high-quality debt issuer with a large amount of publicly traded debt, bond investors tend to devote most effort to assessing the issuer's:

A) default risk.

B) loss severity.

C) market liquidity risk.

A) default risk.

B) loss severity.

C) market liquidity risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

17

in the event of default, the recovery rate of which of the following bonds would most likely be the highest?

A) First mortgage debt

B) Senior unsecured debt

C) Junior subordinate debt

A) First mortgage debt

B) Senior unsecured debt

C) Junior subordinate debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

18

A fixed income analyst is least likely to conduct an independent analysis of credit risk because credit rating agencies:

A) may at times mis-rate issues.

B) often lag the market in pricing credit risk.

C) cannot foresee future debt-financed acquisitions.

A) may at times mis-rate issues.

B) often lag the market in pricing credit risk.

C) cannot foresee future debt-financed acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

19

The risk that the price at which investors can actually transact differs from the quoted price in the market is called:

A) spread risk.

B) credit migration risk.

C) market liquidity risk.

A) spread risk.

B) credit migration risk.

C) market liquidity risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

20

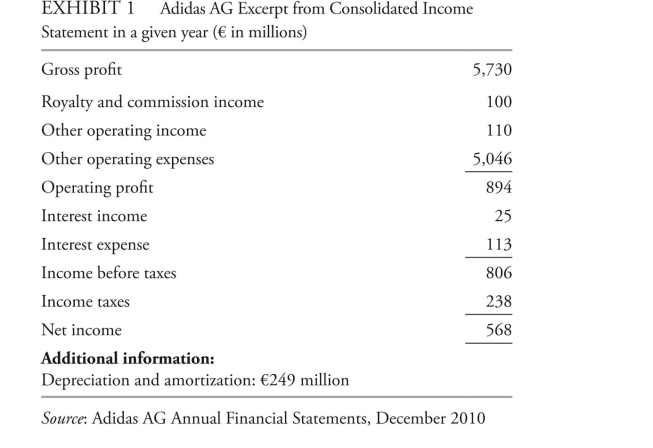

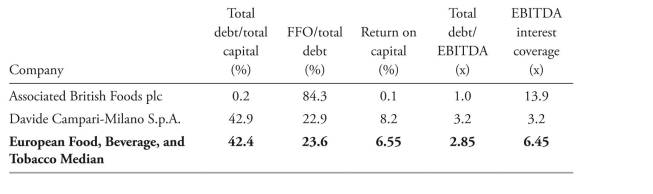

based on the information in Exhibit 3, the credit rating of davide Campari-Milano S.p.A. is most likely:ExHibiT 3 European Food, beverage, and Tobacco industry; Associated british Foods plc; and

Davide Campari-Milano S.p.A. Selected Financial Ratios, 2010

A) lower than Associated british Foods plc.

B) higher than Associated british Foods plc.

C) the same as Associated british Foods plc.

Davide Campari-Milano S.p.A. Selected Financial Ratios, 2010

A) lower than Associated british Foods plc.

B) higher than Associated british Foods plc.

C) the same as Associated british Foods plc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

21

A senior unsecured credit instrument holds a higher priority of claims than one ranked as:

A) mortgage debt.

B) second lien loan.

C) senior subordinated.

A) mortgage debt.

B) second lien loan.

C) senior subordinated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

22

in a bankruptcy proceeding, when the absolute priority of claims is enforced:

A) senior subordinated creditors rank above second lien holders.

B) preferred equity shareholders rank above unsecured creditors.

C) creditors with a secured claim have the first right to the value of that specific property.

A) senior subordinated creditors rank above second lien holders.

B) preferred equity shareholders rank above unsecured creditors.

C) creditors with a secured claim have the first right to the value of that specific property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

23

The rating agency process whereby the credit ratings on issues are moved up or down from the issuer rating best describes:

A) notching.

B) pari passu ranking.

C) cross-default provisions.

A) notching.

B) pari passu ranking.

C) cross-default provisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

24

in credit analysis, capacity is best described as the:

A) quality of management.

B) ability of the borrower to make its debt payments on time.

C) quality and value of the assets supporting an issuer's indebtedness.

A) quality of management.

B) ability of the borrower to make its debt payments on time.

C) quality and value of the assets supporting an issuer's indebtedness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

25

Credit yield spreads most likely widen in response to:

A) high demand for bonds.

B) weak performance of equities.

C) strengthening economic conditions.

A) high demand for bonds.

B) weak performance of equities.

C) strengthening economic conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

26

Among the Four Cs of credit analysis, the recognition of revenue prematurely most likely reflects a company's:

A) character.

B) covenants.

C) collateral.

A) character.

B) covenants.

C) collateral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

27

When determining the capacity of a borrower to service debt, a credit analyst should be- gin with an examination of:

A) industry structure.

B) industry fundamentals.

C) company fundamentals.

A) industry structure.

B) industry fundamentals.

C) company fundamentals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

28

An issuer credit rating usually applies to a company's:

A) secured debt.

B) subordinated debt.

C) senior unsecured debt.

A) secured debt.

B) subordinated debt.

C) senior unsecured debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

29

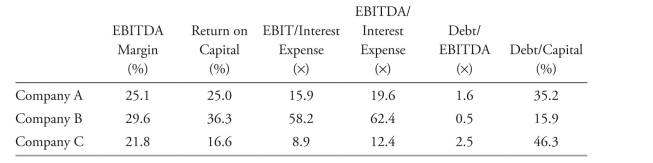

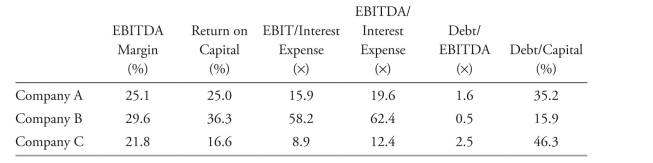

Use the following Exhibit for Questions 39 and 40

ExHibiT 4 industrial Comparative Ratio Analysis, year 20xx

based on only the leverage ratios in Exhibit 4, the company with the highest credit risk is:

A) Company A. b. Company b.

C) Company C.

ExHibiT 4 industrial Comparative Ratio Analysis, year 20xx

based on only the leverage ratios in Exhibit 4, the company with the highest credit risk is:

A) Company A. b. Company b.

C) Company C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

30

in the event of default, which of the following is most likely to have the highest recovery rate?

A) Second lien

B) Senior unsecured

C) Senior subordinated

A) Second lien

B) Senior unsecured

C) Senior subordinated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

31

The factor considered by rating agencies when a corporation has debt at both its parent holding company and operating subsidiaries is best referred to as:

A) credit migration risk.

B) corporate family rating.

C) structural subordination.

A) credit migration risk.

B) corporate family rating.

C) structural subordination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

32

The process of moving credit ratings of different issues up or down from the issuer rating in response to different payment priorities is best described as:

A) notching.

B) structural subordination.

C) cross-default provisions.

A) notching.

B) structural subordination.

C) cross-default provisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following corporate debt instruments has the highest seniority ranking?

A) Second lien

B) Senior unsecured

C) Senior subordinated

A) Second lien

B) Senior unsecured

C) Senior subordinated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following accounting issues should mostly likely be considered a character warning flag in credit analysis?

A) Expensing items immediately

B) Changing auditors infrequently

C) Significant off-balance-sheet financing

A) Expensing items immediately

B) Changing auditors infrequently

C) Significant off-balance-sheet financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which type of security is most likely to have the same rating as the issuer?

A) Preferred stock

B) Senior secured bond

C) Senior unsecured bond

A) Preferred stock

B) Senior secured bond

C) Senior unsecured bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

36

The priority of claims for senior subordinated debt is:

A) lower than for senior unsecured debt.

B) the same as for senior unsecured debt.

C) higher than for senior unsecured debt.

A) lower than for senior unsecured debt.

B) the same as for senior unsecured debt.

C) higher than for senior unsecured debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which industry characteristic most likely has a positive effect on a company's ability to service debt?

A) low barriers to entry in the industry

B) High number of suppliers to the industry

C) broadly dispersed market share among large number of companies in the industry

A) low barriers to entry in the industry

B) High number of suppliers to the industry

C) broadly dispersed market share among large number of companies in the industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

38

The expected loss for a given debt instrument is estimated as the product of default prob- ability and:

A) (1 + Recovery rate).

B) (1 − Recovery rate).

C) 1/(1 + Recovery rate).

A) (1 + Recovery rate).

B) (1 − Recovery rate).

C) 1/(1 + Recovery rate).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements about credit ratings is most accurate?

A) Credit ratings can migrate over time.

B) Changes in bond credit ratings precede changes in bond prices.

C) Credit ratings are focused on expected loss rather than risk of default.

A) Credit ratings can migrate over time.

B) Changes in bond credit ratings precede changes in bond prices.

C) Credit ratings are focused on expected loss rather than risk of default.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

40

The notching adjustment for corporate bonds rated Aa2/AA is most likely:

A) larger than the notching adjustment for corporate bonds rated b2/b.

B) the same as the notching adjustment for corporate bonds rated b2/b.

C) smaller than the notching adjustment for corporate bonds rated b2/b.

A) larger than the notching adjustment for corporate bonds rated b2/b.

B) the same as the notching adjustment for corporate bonds rated b2/b.

C) smaller than the notching adjustment for corporate bonds rated b2/b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

41

The factor that most likely results in corporate credit spreads widening is:

A) an improving credit cycle.

B) weakening economic conditions.

C) a period of high demand for bonds.

A) an improving credit cycle.

B) weakening economic conditions.

C) a period of high demand for bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

42

in contrast to high-yield credit analysis, investment-grade analysis is more likely to rely on:

A) spread risk.

B) an assessment of bank credit facilities.

C) matching of liquidity sources to upcoming debt maturities.

A) spread risk.

B) an assessment of bank credit facilities.

C) matching of liquidity sources to upcoming debt maturities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following factors would best justify a decision to avoid investing in a coun- try's sovereign debt?

A) Freely floating currency

B) A population that is not growing

C) Suitable checks and balances in policymaking

A) Freely floating currency

B) A population that is not growing

C) Suitable checks and balances in policymaking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

44

Credit spreads are most likely to widen:

A) in a strengthening economy.

B) as the credit cycle improves.

C) in periods of heavy new issue supply and low borrower demand.

A) in a strengthening economy.

B) as the credit cycle improves.

C) in periods of heavy new issue supply and low borrower demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following factors in credit analysis is more important for general obligation non-sovereign government debt than for sovereign debt?

A) Per capita income

B) Power to levy and collect taxes

C) Requirement to balance an operating budget

A) Per capita income

B) Power to levy and collect taxes

C) Requirement to balance an operating budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck