Deck 21: The Balance of Payments, Exchange Rates, and Trade Deficits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

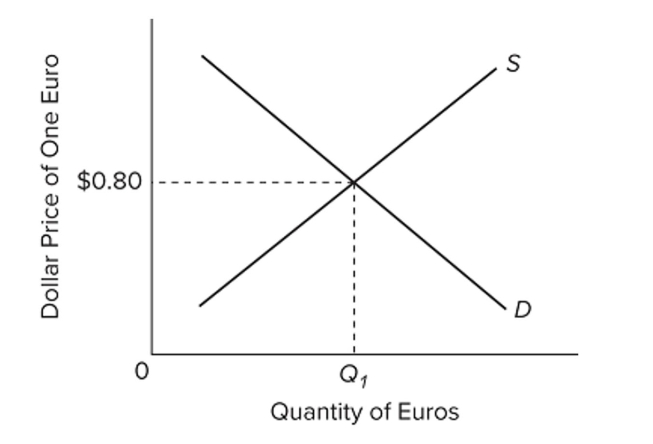

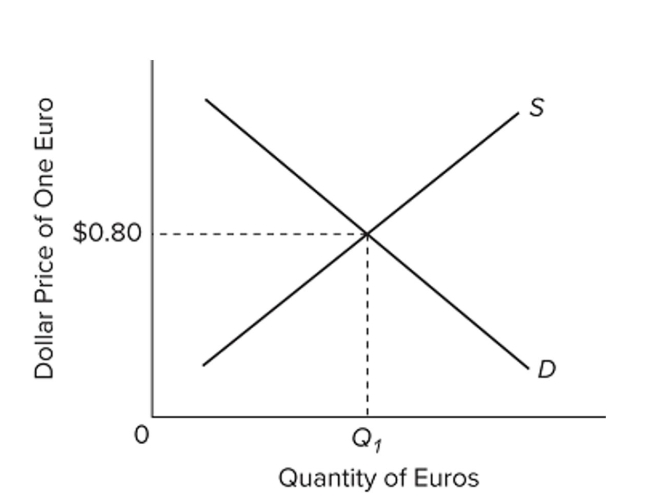

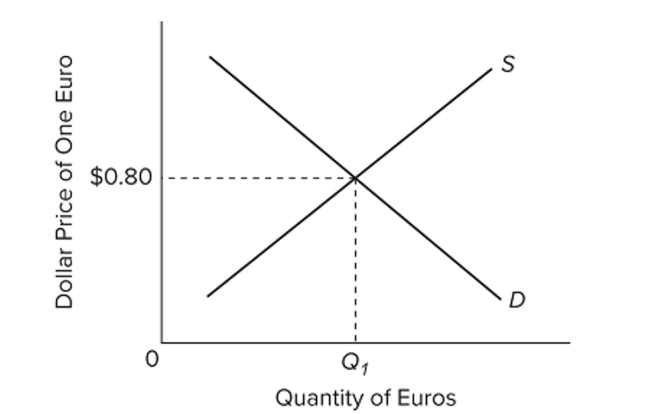

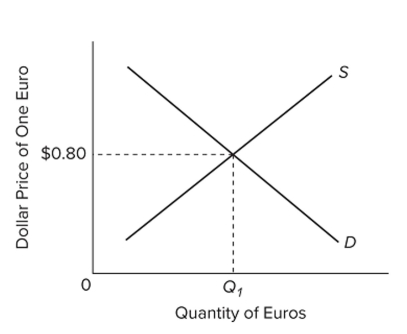

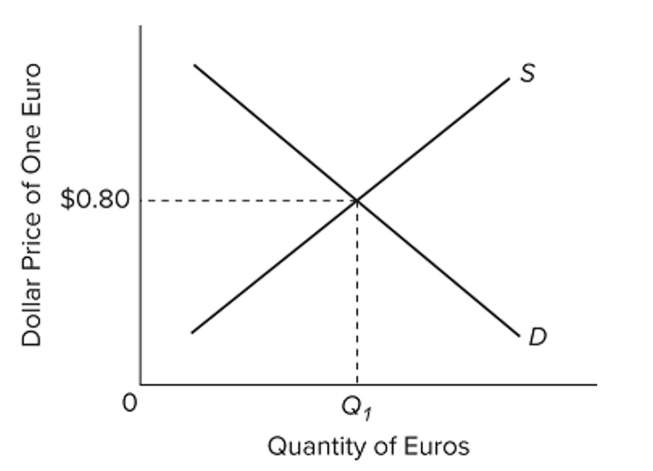

سؤال

سؤال

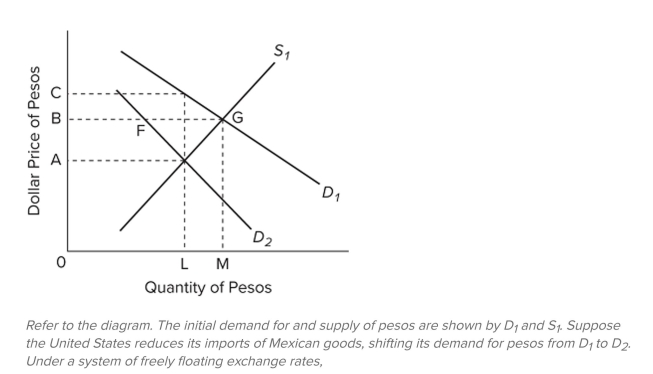

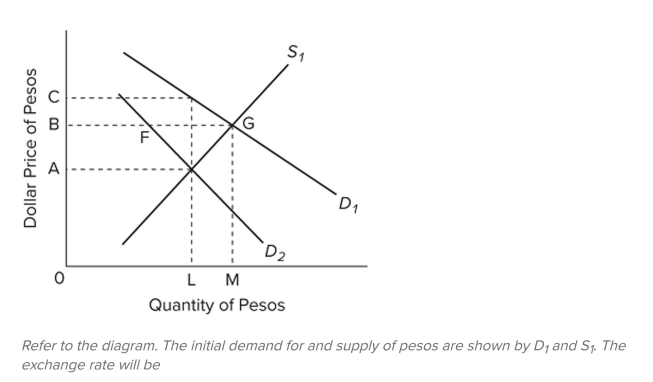

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/315

العب

ملء الشاشة (f)

Deck 21: The Balance of Payments, Exchange Rates, and Trade Deficits

1

If a U.S. importer can purchase 10,000 British pounds for $20,000, the rate of exchange is

A) $1 = 2 British pounds in the United States.

B) $2 = 1 British pound in the United States.

C) $1 = 2 British pounds in Great Britain.

D) $0.50 = 1 British pound in Great Britain.

A) $1 = 2 British pounds in the United States.

B) $2 = 1 British pound in the United States.

C) $1 = 2 British pounds in Great Britain.

D) $0.50 = 1 British pound in Great Britain.

$2 = 1 British pound in the United States.

2

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. The U.S. balance on current account is a

A) $40 billion surplus.

B) $25 billion de?cit.

C) $25 billion surplus.

D) $30 billion de?cit.

A) $40 billion surplus.

B) $25 billion de?cit.

C) $25 billion surplus.

D) $30 billion de?cit.

$25 billion de?cit.

3

In 2018, the capital account in the U.S. balance of payments was in

A) deficit, and larger than the current account deficit.

B) surplus, and larger than the current account surplus.

C) deficit, and smaller than the current account deficit.

D) balance, with no deficit or surplus.

A) deficit, and larger than the current account deficit.

B) surplus, and larger than the current account surplus.

C) deficit, and smaller than the current account deficit.

D) balance, with no deficit or surplus.

balance, with no deficit or surplus.

4

In international financial transactions, what are the only two things that individuals and firms can exchange?

A) currency and real assets

B) services and manufactured goods

C) assets and currently produced goods and services

D) currency and currently produced goods and services

A) currency and real assets

B) services and manufactured goods

C) assets and currently produced goods and services

D) currency and currently produced goods and services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

5

There must always be a balance of a nation's

A) goods exports and gold imports.

B) total international payments.

C) imports and exports of goods and services.

D) net transfers and net investment income.

A) goods exports and gold imports.

B) total international payments.

C) imports and exports of goods and services.

D) net transfers and net investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following combinations is plausible, as it relates to a nation's balance of payments?

A) Current account = +$40 billion; capital account = −$10 billion; financial account = −$50 billion.

B) Current account = +$50 billion; capital account = −$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$10 billion.

A) Current account = +$40 billion; capital account = −$10 billion; financial account = −$50 billion.

B) Current account = +$50 billion; capital account = −$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$10 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

7

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. The United States has a balance of goods

A) de?cit of $10 billion.

B) surplus of $30 billion.

C) de?cit of $30 billion.

D) surplus of $20 billion.

A) de?cit of $10 billion.

B) surplus of $30 billion.

C) de?cit of $30 billion.

D) surplus of $20 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

8

The current account section in a nation's balance of payments includes

A) its goods exports and imports and its services exports and imports.

B) foreign purchases of domestic assets.

C) purchases of foreign assets.

D) all of these.

A) its goods exports and imports and its services exports and imports.

B) foreign purchases of domestic assets.

C) purchases of foreign assets.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

9

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. The U.S. balance on goods and services is a

A) $10 billion de?cit.

B) $20 billion de?cit.

C) $30 billion surplus.

D) $30 billion de?cit.

A) $10 billion de?cit.

B) $20 billion de?cit.

C) $30 billion surplus.

D) $30 billion de?cit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

10

In 2018, the capital and financial account in the U.S. balance of payments was in

A) deficit, and smaller than the current account deficit.

B) surplus, and equal to the current account deficit.

C) balance, with no deficit or surplus.

D) surplus, and smaller than the current account deficit.

A) deficit, and smaller than the current account deficit.

B) surplus, and equal to the current account deficit.

C) balance, with no deficit or surplus.

D) surplus, and smaller than the current account deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

11

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. Item 6 indicates that

A) the United States used $15 billion of its international monetary reserves to balance its international payments.

B) the United States provided $15 billion of foreign aid to developing nations.

C) Americans provided a net amount of $15 billion in remittances to the rest of the world.

D) Americans received a net amount of $15 billion in remittances from the rest of the world.

A) the United States used $15 billion of its international monetary reserves to balance its international payments.

B) the United States provided $15 billion of foreign aid to developing nations.

C) Americans provided a net amount of $15 billion in remittances to the rest of the world.

D) Americans received a net amount of $15 billion in remittances from the rest of the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

12

A nation's capital and financial account

A) contains inflows of money but not outflows of money.

B) includes service exports and service imports.

C) includes both inflows of money and outflows of money.

D) includes net investment income and net transfers.

A) contains inflows of money but not outflows of money.

B) includes service exports and service imports.

C) includes both inflows of money and outflows of money.

D) includes net investment income and net transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would call for outflows of money from the United States?

A) The United States exports computer software.

B) The United States purchases assets abroad.

C) Foreigners purchase assets in the United States.

D) Foreign tourists spend money in the United States.

A) The United States exports computer software.

B) The United States purchases assets abroad.

C) Foreigners purchase assets in the United States.

D) Foreign tourists spend money in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

14

In the U.S. balance of payments, foreign purchases of assets in the United States are a

A) money outflow.

B) money inflow.

C) current account item.

D) debit, or outpayment.

A) money outflow.

B) money inflow.

C) current account item.

D) debit, or outpayment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

15

"International trade" refers to

A) purchasing or selling currently produced goods or services across an international border.

B) any transaction across an international border.

C) any financial transaction across an international border.

D) buying or selling of preexisting assets across an international border.

A) purchasing or selling currently produced goods or services across an international border.

B) any transaction across an international border.

C) any financial transaction across an international border.

D) buying or selling of preexisting assets across an international border.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following would call for inflows of money to the United States?

A) Gold flows into the United States.

B) U.S. firms sell insurance to Brazilian shippers.

C) The United States sends foreign aid to developing countries.

D) The United States imports German automobiles.

A) Gold flows into the United States.

B) U.S. firms sell insurance to Brazilian shippers.

C) The United States sends foreign aid to developing countries.

D) The United States imports German automobiles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

17

The financial account balance is a nation's

A) net investment income minus its net transfers.

B) exports of goods and services minus its imports of goods and services.

C) sale of real and financial assets to people living abroad minus its purchases of real and financial assets from foreigners.

D) domestic investment spending minus domestic saving.

A) net investment income minus its net transfers.

B) exports of goods and services minus its imports of goods and services.

C) sale of real and financial assets to people living abroad minus its purchases of real and financial assets from foreigners.

D) domestic investment spending minus domestic saving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

18

International transactions fall into what two broad categories?

A) manufacturing trade and services trade

B) international trade and international asset transactions

C) currency transactions and services trade

D) newly created assets and preexisting assets

A) manufacturing trade and services trade

B) international trade and international asset transactions

C) currency transactions and services trade

D) newly created assets and preexisting assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the U.S. balance of payments, U.S. purchases of assets abroad are a(n)

A) money outflow.

B) money inflow.

C) current account item.

D) inpayment.

A) money outflow.

B) money inflow.

C) current account item.

D) inpayment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following combinations is plausible, as it relates to a nation's balance of payments?

A) Current account = +$40 billion; capital account = +$20 billion; financial account = −$50 billion.

B) Current account = −$50 billion; capital account = +$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$50 billion.

A) Current account = +$40 billion; capital account = +$20 billion; financial account = −$50 billion.

B) Current account = −$50 billion; capital account = +$20 billion; financial account = +$30 billion.

C) Current account = +$10 billion; capital account = +$40 billion; financial account = +$50 billion.

D) Current account = +$30 billion; capital account = −$20 billion; financial account = −$50 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

21

It may be misleading to label a trade deficit as unfavorable or adverse, because

A) the multiplier does not apply to a trade deficit.

B) a trade deficit increases a nation's aggregate output and employment.

C) a nation's consumers benefit from a trade deficit during the period it occurs.

D) a trade deficit precludes inflation.

A) the multiplier does not apply to a trade deficit.

B) a trade deficit increases a nation's aggregate output and employment.

C) a nation's consumers benefit from a trade deficit during the period it occurs.

D) a trade deficit precludes inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a nation's goods exports are $55 billion, while its goods imports are $50 billion, we can conclude with certainty that this nation has a

A) balance of trade (goods) surplus.

B) balance of payments surplus.

C) positive balance on its current account.

D) positive balance on goods and services.

A) balance of trade (goods) surplus.

B) balance of payments surplus.

C) positive balance on its current account.

D) positive balance on goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

23

The plus items in the table are "export-type" entries and the minus items are "import-type" entries in the balance of payments for the hypothetical country of Zippo. Zippo has

A) a current account surplus.

B) a ?nancial account de?cit.

C) a trade surplus on goods and services.

D) neither a balance of payments de?cit nor a surplus.

A) a current account surplus.

B) a ?nancial account de?cit.

C) a trade surplus on goods and services.

D) neither a balance of payments de?cit nor a surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

24

The plus items in the table are "export-type" entries and the minus items are "import-type" entries in the balance of payments for the hypothetical country of Zippo. Zippo has a

A) current account surplus.

B) ?nancial account de?cit.

C) ?nancial account surplus.

D) surplus on goods and services.

A) current account surplus.

B) ?nancial account de?cit.

C) ?nancial account surplus.

D) surplus on goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

25

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. The United States' balance of capital and ?nancial account is a

A) surplus of $5.

B) de?cit of $10.

C) surplus of $25.

D) de?cit of $5.

A) surplus of $5.

B) de?cit of $10.

C) surplus of $25.

D) de?cit of $5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is not included in the current account of a nation's balance of payments?

A) its goods exports

B) its goods imports

C) its net investment income

D) its purchases of real assets abroad.

A) its goods exports

B) its goods imports

C) its net investment income

D) its purchases of real assets abroad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following, other things equal, will directly alter the U.S. balance of trade?

A) an increase in the balance on capital account

B) a decrease in U.S. goods exports

C) an increase in net transfers

D) a decrease in U.S. purchases of assets abroad

A) an increase in the balance on capital account

B) a decrease in U.S. goods exports

C) an increase in net transfers

D) a decrease in U.S. purchases of assets abroad

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

28

The plus items in the table are "export-type" entries and the minus items are "import-type" entries in the balance of payments for the hypothetical country of Zippo. The current account items for Zippo

Are

A) 1, 2, 3, and 4.

B) 1, 3, 4, 5, 7, and 9.

C) 6 and 8.

D) 1, 2, 4, 7, and 9.

Are

A) 1, 2, 3, and 4.

B) 1, 3, 4, 5, 7, and 9.

C) 6 and 8.

D) 1, 2, 4, 7, and 9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the balance of payments of the United States, U.S. goods imports are recorded as a

A) positive entry.

B) capital account entry.

C) current account entry.

D) financial account entry.

A) positive entry.

B) capital account entry.

C) current account entry.

D) financial account entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

30

The table contains balance of payments data (+ and -) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on the capital and financial account shows a

A) de?cit of $5 billion.

B) surplus of $10 billion.

C) de?cit of $10 billion.

D) surplus of $5 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

31

The plus items in the table are "export-type" entries and the minus items are "import-type" entries in the balance of payments for the hypothetical country of Zippo. Zippo has a

A) current account de?cit.

B) capital account de?cit.

C) balance of payments de?cit.

D) trade surplus on goods and services.

A) current account de?cit.

B) capital account de?cit.

C) balance of payments de?cit.

D) trade surplus on goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

32

The table contains balance of payments data (+ and -) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on the financial account shows a

A) de?cit of $10 billion.

B) surplus of $5 billion.

C) de?cit of $28 billion.

D) surplus of $13 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

33

A deficit on the current account

A) normally causes a surplus on the capital and financial account.

B) normally causes a deficit on the capital and financial account.

C) has no relationship to the capital and financial account.

D) means that a nation is making international transfers.

A) normally causes a surplus on the capital and financial account.

B) normally causes a deficit on the capital and financial account.

C) has no relationship to the capital and financial account.

D) means that a nation is making international transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

34

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. The United States' balance on ?nancial account is a

A) $20 billion surplus.

B) $15 billion surplus.

C) $30 billion de?cit.

D) $20 billion de?cit.

A) $20 billion surplus.

B) $15 billion surplus.

C) $30 billion de?cit.

D) $20 billion de?cit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

35

The plus items in the table are "export-type" entries and the minus items are "import-type" entries in the balance of payments for the hypothetical country of Zippo. The ?nancial account items for Zippo

Are

A) 1, 2, 3, and 4.

B) 1, 3, 4, 5, 7, and 9.

C) 6 and 8.

D) 1, 2, 4, 7, and 9.

Are

A) 1, 2, 3, and 4.

B) 1, 3, 4, 5, 7, and 9.

C) 6 and 8.

D) 1, 2, 4, 7, and 9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which one of the following will not directly affect the U.S. balance on the current account?

A) an increase in U.S. goods imports

B) a decrease in U.S. net investment income

C) an increase in U.S. purchases of assets abroad

D) an increase in U.S. imports of services

A) an increase in U.S. goods imports

B) a decrease in U.S. net investment income

C) an increase in U.S. purchases of assets abroad

D) an increase in U.S. imports of services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

37

The table contains balance of payments data (+ and ?) for the hypothetical nation of Zabella. All ?gures are in billions of dollars. Zabella has a balance of trade (goods)

A) de?cit of $10 billion.

B) surplus of $5 billion.

C) surplus of $10 billion.

D) de?cit of $5 billion.

A) de?cit of $10 billion.

B) surplus of $5 billion.

C) surplus of $10 billion.

D) de?cit of $5 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

38

The table contains balance of payments data ( and -) for the hypothetical nation of Zabella. All figures are in billions of dollars. Zabella's balance on goods and services shows a

A) $5 billion de?cit.

B) $5 billion surplus.

C) $10 billion surplus.

D) $15 billion de?cit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

39

The table contains hypothetical data for the U.S. balance of payments. All ?gures are in billions of dollars. Item 5 indicates

A) that the United States' current account was in surplus.

B) the size of the net in?ow of foreign investment to the United States that occurred in 2012.

C) the net amount Americans received as interest and dividends on existing U.S. investments abroad.

D) the net amount Americans paid as interest and dividends on existing foreign investments in the United States.

A) that the United States' current account was in surplus.

B) the size of the net in?ow of foreign investment to the United States that occurred in 2012.

C) the net amount Americans received as interest and dividends on existing U.S. investments abroad.

D) the net amount Americans paid as interest and dividends on existing foreign investments in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

40

In the balance of payments of the United States, inflows of money to the United States are recorded as

A) a positive entry.

B) a current account entry.

C) a negative entry.

D) net investment income.

A) a positive entry.

B) a current account entry.

C) a negative entry.

D) net investment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

41

Suppose the balance on the current account is +$50 billion and the balance on the capital account is +$1 billion. The balance on the financial account is

A) −$51 billion.

B) −$50 billion.

C) −$49 billion.

D) +$51 billion.

A) −$51 billion.

B) −$50 billion.

C) −$49 billion.

D) +$51 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

42

In the U.S. balance of payments account for a certain year, a positive number in the financial account means a

A) net buildup of assets held by the U.S.

B) net reduction in the ownership of assets by U.S. interests.

C) buildup of total foreign debt.

D) reduction of total foreign debt.

A) net buildup of assets held by the U.S.

B) net reduction in the ownership of assets by U.S. interests.

C) buildup of total foreign debt.

D) reduction of total foreign debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the exchange rate between the U.S. dollar and the Japanese yen is $1 = 200 yen, then the dollar price of yen is

A) $0.005.

B) $0.05.

C) $0.50.

D) $5.

A) $0.005.

B) $0.05.

C) $0.50.

D) $5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

44

Appreciation of the Canadian dollar will

A) intensify an existing disequilibrium in Canada's balance of payments.

B) make Canada's exports less expensive and its imports more expensive.

C) make Canada's exports more expensive and its imports less expensive.

D) make Canada's exports and imports both more expensive.

A) intensify an existing disequilibrium in Canada's balance of payments.

B) make Canada's exports less expensive and its imports more expensive.

C) make Canada's exports more expensive and its imports less expensive.

D) make Canada's exports and imports both more expensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

45

In a nation's balance of payments, which one of the following items is always recorded as a positive entry?

A) goods imports

B) balance on capital account

C) U.S. purchases of assets abroad

D) exports of services

A) goods imports

B) balance on capital account

C) U.S. purchases of assets abroad

D) exports of services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following are hypothetical exchange rates: 2 euros = 1 pound; $1 = 2 pounds. We can conclude that

A) $1 = 4 euros.

B) $1 = 0.5 euro.

C) 1 euro = $0.50.

D) 1 euro = $2.

A) $1 = 4 euros.

B) $1 = 0.5 euro.

C) 1 euro = $0.50.

D) 1 euro = $2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose the balance on the financial account is −$300 billion and the balance on the capital account is +$5 billion. The size of the current account is

A) +$295 billion.

B) −$295 billion.

C) +$305 billion.

D) +$5 billion.

A) +$295 billion.

B) −$295 billion.

C) +$305 billion.

D) +$5 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the dollar price of yen rises, then

A) the yen price of dollars also rises.

B) the dollar depreciates relative to the yen.

C) the yen depreciates relative to the dollar.

D) the dollar will buy fewer U.S. goods.

A) the yen price of dollars also rises.

B) the dollar depreciates relative to the yen.

C) the yen depreciates relative to the dollar.

D) the dollar will buy fewer U.S. goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

49

Suppose the balance on the current account is +$100 billion and the balance on the capital account is −$1 billion. The balance on the financial account is

A) +$101 billion.

B) −$100 billion.

C) −$99 billion.

D) −$101 billion.

A) +$101 billion.

B) −$100 billion.

C) −$99 billion.

D) −$101 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

50

In considering euros and dollars, the exchange rates for the euro and the dollar

A) are directly related.

B) are inversely related.

C) are unrelated.

D) move in the same direction.

A) are directly related.

B) are inversely related.

C) are unrelated.

D) move in the same direction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the exchange rate changes so that more Mexican pesos are required to buy a dollar, then

A) the peso has appreciated in value.

B) Americans will buy more Mexican goods and services.

C) more U.S. goods and services will be demanded by the Mexicans.

D) the dollar has depreciated in value.

A) the peso has appreciated in value.

B) Americans will buy more Mexican goods and services.

C) more U.S. goods and services will be demanded by the Mexicans.

D) the dollar has depreciated in value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose the balance on the financial account is +$200 billion and the balance on the capital account is +$2 billion. The size of the current account is

A) +$200 billion.

B) −$202 billion.

C) −$198 billion.

D) +$2 billion.

A) +$200 billion.

B) −$202 billion.

C) −$198 billion.

D) +$2 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

53

In 2018, the United States' balance on goods was

A) −$891 billion.

B) +$891 billion.

C) −$486 billion.

D) +$1,672 billion.

A) −$891 billion.

B) +$891 billion.

C) −$486 billion.

D) +$1,672 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

54

Depreciation of the dollar will

A) decrease the prices of both U.S. imports and exports.

B) increase the prices of both U.S. imports and exports.

C) decrease the prices of U.S. imports but increase the prices to foreigners of U.S. exports.

D) increase the prices of U.S. imports but decrease the prices to foreigners of U.S. exports.

A) decrease the prices of both U.S. imports and exports.

B) increase the prices of both U.S. imports and exports.

C) decrease the prices of U.S. imports but increase the prices to foreigners of U.S. exports.

D) increase the prices of U.S. imports but decrease the prices to foreigners of U.S. exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the rate of exchange for a pound is $4, the rate of exchange for the dollar is

A) ¼ pound.

B) 4 pounds.

C) $0.25.

D) $1.00.

A) ¼ pound.

B) 4 pounds.

C) $0.25.

D) $1.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

56

If the equilibrium exchange rate changes so that fewer dollars are needed to buy a South Korean won, then

A) Americans will buy fewer Korean goods and services.

B) the won has appreciated in value.

C) fewer U.S. goods and services will be demanded by the South Koreans.

D) the dollar has depreciated in value.

A) Americans will buy fewer Korean goods and services.

B) the won has appreciated in value.

C) fewer U.S. goods and services will be demanded by the South Koreans.

D) the dollar has depreciated in value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

57

A market in which the money of one nation is exchanged for the money of another nation is a

A) resource market.

B) bond market.

C) stock market.

D) foreign exchange market.

A) resource market.

B) bond market.

C) stock market.

D) foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

58

In considering the market for yen and dollars, when the dollar depreciates,

A) the yen appreciates.

B) the yen will also depreciate.

C) the yen may either appreciate or depreciate.

D) U.S. net exports to Japan will fall.

A) the yen appreciates.

B) the yen will also depreciate.

C) the yen may either appreciate or depreciate.

D) U.S. net exports to Japan will fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following are hypothetical exchange rates: $1 = 140 yen; 1 Swiss franc = $0.10. We can conclude that

A) 1 yen = 280 Swiss francs.

B) 1 yen = 14 Swiss francs.

C) 1 Swiss franc = 28 yen.

D) 1 Swiss franc = 14 yen.

A) 1 yen = 280 Swiss francs.

B) 1 yen = 14 Swiss francs.

C) 1 Swiss franc = 28 yen.

D) 1 Swiss franc = 14 yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

60

With which of the following countries does the United States have its largest goods and services deficit?

A) Canada

B) Germany

C) Japan

D) China

A) Canada

B) Germany

C) Japan

D) China

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

61

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a rightward shift of the supply curve would

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a rightward shift of the supply curve wouldA) appreciate the euro.

B) cause a surplus of euros.

C) decrease the equilibrium quantity of euros.

D) appreciate the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

62

The U.S. demand for euros is

A) downsloping because, at lower dollar prices for euros, Americans will want to buy more European goods and services.

B) downsloping because, at higher dollar prices for euros, Americans will want to buy more European goods and services.

C) downsloping because the dollar price of euros and the euro price of dollars are directly related.

D) upsloping because a higher dollar price of euros makes European goods and services more attractive to Americans.

A) downsloping because, at lower dollar prices for euros, Americans will want to buy more European goods and services.

B) downsloping because, at higher dollar prices for euros, Americans will want to buy more European goods and services.

C) downsloping because the dollar price of euros and the euro price of dollars are directly related.

D) upsloping because a higher dollar price of euros makes European goods and services more attractive to Americans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

63

A) gold would flow from Mexico to the United States.

B) the dollar price of pesos would fall from B dollars equals 1 peso to A dollars equals 1 peso.

C) a problem of rationing a shortage of pesos would arise in the United States.

D) the dollar price of pesos would increase to C dollars equals 1 peso.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

64

The U.S. demand for British pounds is

A) downsloping because a higher dollar price of pounds means British goods are cheaper to Americans.

B) downsloping because a lower dollar price of pounds means British goods are more expensive to Americans.

C) upsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

D) downsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

A) downsloping because a higher dollar price of pounds means British goods are cheaper to Americans.

B) downsloping because a lower dollar price of pounds means British goods are more expensive to Americans.

C) upsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

D) downsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

65

In 1985, the exchange rate between the U.S. dollar and the Japanese yen was $1 = 262 yen; in 2003, the rate was $1 = 110 yen. Which one of the following might be a plausible explanation for the

Change in the dollar-yen exchange rate from 1985 to 2003?

A) Japan exported much more to the United States during this period than it imported from the United States.

B) Japan greatly increased its purchases of military equipment from the United States during this period.

C) Japan's economy grew far faster than the U.S. economy during this period.

D) Japan's government devalued the yen during this period.

Change in the dollar-yen exchange rate from 1985 to 2003?

A) Japan exported much more to the United States during this period than it imported from the United States.

B) Japan greatly increased its purchases of military equipment from the United States during this period.

C) Japan's economy grew far faster than the U.S. economy during this period.

D) Japan's government devalued the yen during this period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

66

In 1985, the exchange rate between the U.S. dollar and the Japanese yen was $1 = 262 yen; in 2003, the rate was $1 = 110 yen. Between 1985 and 2003, the

A) dollar appreciated in value relative to the yen.

B) yen appreciated in value relative to the dollar.

C) dollar price of yen fell.

D) yen price of dollars rose.

A) dollar appreciated in value relative to the yen.

B) yen appreciated in value relative to the dollar.

C) dollar price of yen fell.

D) yen price of dollars rose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following have substantially equivalent effects on a nation's volume of exports and imports?

A) exchange rate appreciation and a decrease in the domestic supply of money

B) exchange rate appreciation and domestic deflation

C) exchange rate depreciation and domestic deflation

D) exchange rate depreciation and domestic inflation

A) exchange rate appreciation and a decrease in the domestic supply of money

B) exchange rate appreciation and domestic deflation

C) exchange rate depreciation and domestic deflation

D) exchange rate depreciation and domestic inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

68

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a leftward shift of the demand curve would

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a leftward shift of the demand curve wouldA) depreciate the dollar.

B) appreciate the euro.

C) reduce the equilibrium quantity of euros.

D) cause a surplus of euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

69

Under a system of freely flexible (floating) exchange rates, a U.S. trade deficit with Mexico will tend to cause

A) the U.S. government to ration pesos to U.S. importers.

B) a flow of gold from the United States to Mexico.

C) an increase in the peso price of dollars.

D) an increase in the dollar price of pesos.

A) the U.S. government to ration pesos to U.S. importers.

B) a flow of gold from the United States to Mexico.

C) an increase in the peso price of dollars.

D) an increase in the dollar price of pesos.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

70

A) M dollars for one peso.

B) B dollars for one peso.

C) A dollars for one peso.

D) C dollars for one peso.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

71

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a leftward shift of the supply curve would

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a leftward shift of the supply curve wouldA) appreciate the euro.

B) cause a shortage of euros.

C) increase the equilibrium quantity of euros.

D) appreciate the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

72

The table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra. Assume that a system of ?exible exchange rates is in place. The exchange rate is

A) 4 libras for one dollar.

B) 0.25 libra for one dollar.

C) 0.40 libra for one dollar.

D) 3 libras for one dollar.

A) 4 libras for one dollar.

B) 0.25 libra for one dollar.

C) 0.40 libra for one dollar.

D) 3 libras for one dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following will generate a demand for country X's currency in the foreign exchange market?

A) travel by citizens of country X in other countries

B) the desire of foreigners to buy stocks and bonds of firms in country X

C) the imports of country X

D) charitable contributions by country X's citizens to citizens of developing nations

A) travel by citizens of country X in other countries

B) the desire of foreigners to buy stocks and bonds of firms in country X

C) the imports of country X

D) charitable contributions by country X's citizens to citizens of developing nations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

74

The table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra. Assume that a system of ?exible exchange rates is in place. Suppose that Libra decided to import

More U.S. products. We would expect the quantity of libras

A) demanded at each dollar price to rise and the dollar to depreciate relative to the libra.

B) demanded at each dollar price to fall and the dollar to appreciate relative to the libra.

C) supplied at each dollar price to rise and the dollar to appreciate relative to the libra.

D) supplied at each dollar price to fall and the dollar to depreciate relative to the libra.

More U.S. products. We would expect the quantity of libras

A) demanded at each dollar price to rise and the dollar to depreciate relative to the libra.

B) demanded at each dollar price to fall and the dollar to appreciate relative to the libra.

C) supplied at each dollar price to rise and the dollar to appreciate relative to the libra.

D) supplied at each dollar price to fall and the dollar to depreciate relative to the libra.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

75

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a rightward shift of the demand curve would

The accompanying diagram represents a flexible exchange market for foreign currency. Other things equal, a rightward shift of the demand curve wouldA) depreciate the dollar.

B) appreciate the dollar.

C) reduce the equilibrium quantity of euros.

D) depreciate the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

76

The U.S. supply of Japanese yen is

A) downsloping because a lower dollar price of yen means U.S. goods are cheaper to the Japanese.

B) upsloping because when the dollar price of yen rises (and the yen price of a dollar falls) it means that U.S. goods are cheaper to the Japanese.

C) upsloping because when the dollar price of yen falls (and the yen price of a dollar rises) it means that U.S. goods are cheaper to the Japanese.

D) downsloping because a higher dollar price of yen means U.S. goods are cheaper to the Japanese.

A) downsloping because a lower dollar price of yen means U.S. goods are cheaper to the Japanese.

B) upsloping because when the dollar price of yen rises (and the yen price of a dollar falls) it means that U.S. goods are cheaper to the Japanese.

C) upsloping because when the dollar price of yen falls (and the yen price of a dollar rises) it means that U.S. goods are cheaper to the Japanese.

D) downsloping because a higher dollar price of yen means U.S. goods are cheaper to the Japanese.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the U.S. dollar depreciates relative to the Russian ruble, the ruble

A) will be less expensive to Americans.

B) may either appreciate or depreciate relative to the dollar.

C) will appreciate relative to the dollar.

D) will depreciate relative to the dollar.

A) will be less expensive to Americans.

B) may either appreciate or depreciate relative to the dollar.

C) will appreciate relative to the dollar.

D) will depreciate relative to the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

78

80 for 1 euro,

A) the quantity of euros demanded equals the quantity supplied.

B) the dollar-euro exchange rate is unstable.

C) the dollar price of 1 euro equals the euro price of 1 dollar.

D) there will be a surplus of euros in the foreign exchange market.

A) the quantity of euros demanded equals the quantity supplied.

B) the dollar-euro exchange rate is unstable.

C) the dollar price of 1 euro equals the euro price of 1 dollar.

D) there will be a surplus of euros in the foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

79

The accompanying diagram represents a flexible exchange market for foreign currency. At the equilibrium exchange rate,

The accompanying diagram represents a flexible exchange market for foreign currency. At the equilibrium exchange rate,A) $8 will buy 1 euro.

B) 0.8 euros will buy $1.

C) 1.25 euros will buy $1.

D) $1 will buy 8 euros.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck

80

The table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra. Assume that a system of ?exible exchange rates is in place. The equilibrium dollar price of libras is

A) $5.

B) $4.

C) $3.

D) $2.

A) $5.

B) $4.

C) $3.

D) $2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 315 في هذه المجموعة.

فتح الحزمة

k this deck