Deck 24: Performance Measurement and Responsibility Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 24: Performance Measurement and Responsibility Accounting

1

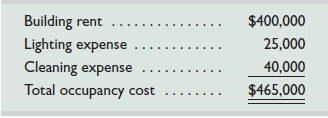

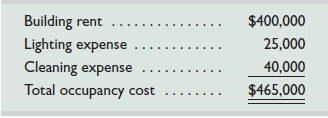

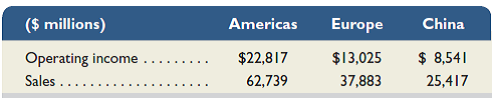

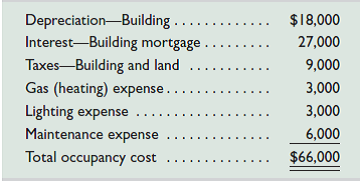

Harmon's has several departments that occupy all floors of a two-story building that includes a basement floor. Harmon rented this building under a long-term lease negotiated when rental rates were low. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded in this account for the current period follow.

The building has 7,500 square feet on each of the upper two floors but only 5,000 square feet in the basement. In prior periods, the accounting manager merely divided the $465,000 occupancy cost by 20,000 square feet to find an average cost of $23.25 per square foot and then charged each department a building occupancy cost equal to this rate times the number of square feet that it occupies.

Jordan Style manages a department that occupies 2,000 square feet of basement floor space. In discussing the departmental reports with other managers, she questions whether using the same rate per square foot for all departments makes sense because different floor space has different values. Style checked a recent real estate report of average local rental costs for similar space that shows first-floor space worth $40 per square foot, second-floor space worth $20 per square foot, and basement space worth $10 per square foot (excluding costs for lighting and cleaning).

Required

1. Allocate occupancy costs to Style's department using the current allocation method.

2. Allocate the building rent cost to Style's department in proportion to the relative market value of the floor space. Allocate to Style's department the lighting and cleaning costs in proportion to the square feet occupied (ignoring floor space market values). Then, compute the total occupancy cost allocated to Style's department.

Analysis Component

3. Which allocation method would you prefer if you were a manager of a basement department

The building has 7,500 square feet on each of the upper two floors but only 5,000 square feet in the basement. In prior periods, the accounting manager merely divided the $465,000 occupancy cost by 20,000 square feet to find an average cost of $23.25 per square foot and then charged each department a building occupancy cost equal to this rate times the number of square feet that it occupies.

Jordan Style manages a department that occupies 2,000 square feet of basement floor space. In discussing the departmental reports with other managers, she questions whether using the same rate per square foot for all departments makes sense because different floor space has different values. Style checked a recent real estate report of average local rental costs for similar space that shows first-floor space worth $40 per square foot, second-floor space worth $20 per square foot, and basement space worth $10 per square foot (excluding costs for lighting and cleaning).

Required

1. Allocate occupancy costs to Style's department using the current allocation method.

2. Allocate the building rent cost to Style's department in proportion to the relative market value of the floor space. Allocate to Style's department the lighting and cleaning costs in proportion to the square feet occupied (ignoring floor space market values). Then, compute the total occupancy cost allocated to Style's department.

Analysis Component

3. Which allocation method would you prefer if you were a manager of a basement department

In the given scenario, a company allocates cost on a physical allocation basis but some managers are proposing an allocation on a value basis.

The allocation of joint costs on a value basis means that the business allocates the cost to products based on certain grades and its relative production quantity. It determines the percentage of the total costs allocated to each product by the ratio of each product's sales value to the total value. The sales value is determined by multiplying the unit-selling price by the number of units.

1.

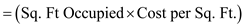

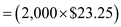

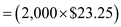

Based on the current cost physical allocation basis the resulting occupancy costs are simply the physical space occupied by the current cost per square foot, which in this scenario is $23.25/sq. ft.

AF's department occupies 2,000 sq. ft. so the cost calculation is:

2.

2.

In order to consider a value basis allocation the Controller had to split up the various occupancy costs incurred.

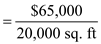

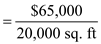

Lighting and cleaning costs totaling $65,000 would be applied at the original basis method. The cost can be determined by dividing that cost by the total number of square feet in the building which is 20,000 sq. ft.

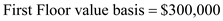

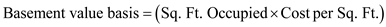

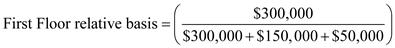

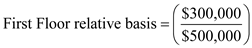

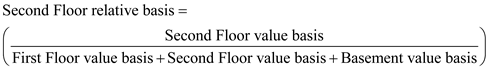

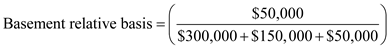

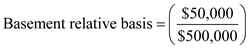

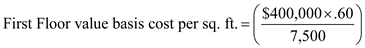

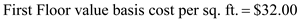

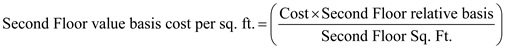

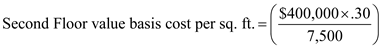

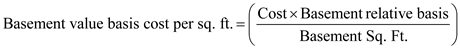

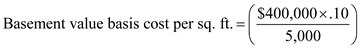

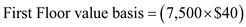

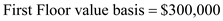

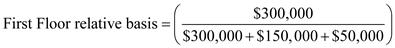

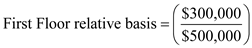

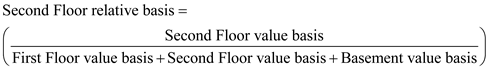

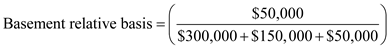

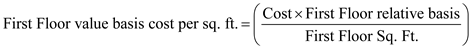

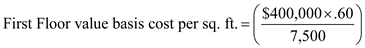

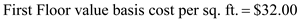

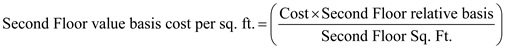

In order to allocate the remaining Building rent costs of $400,000 on a value basis allocation some addition calculations are needed.

In order to allocate the remaining Building rent costs of $400,000 on a value basis allocation some addition calculations are needed.

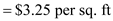

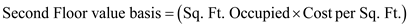

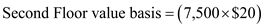

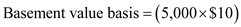

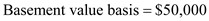

The scenario indicates that first floor space costs $40 per sq. ft., second floor space costs $20 per sq. ft., and basement space costs $10 per sq. ft. Therefore, to determine the value basis for allocating cost one must multiply the number of sq. ft. occupied by their relative cost.

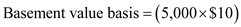

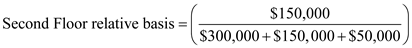

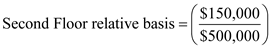

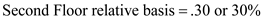

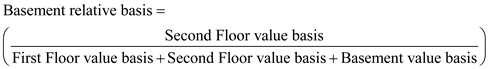

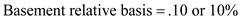

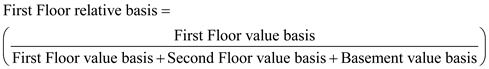

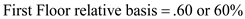

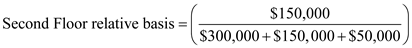

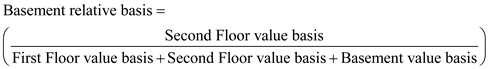

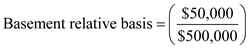

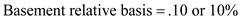

The relative basis of each item's value to the total value can now be determined so that the cost allocation percentage can be determined.

The relative basis of each item's value to the total value can now be determined so that the cost allocation percentage can be determined.

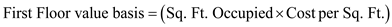

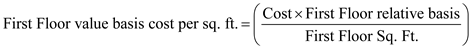

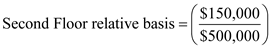

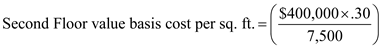

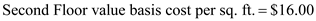

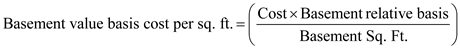

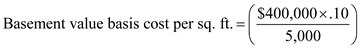

Since the cost was previously determined to be $400,000, the allocated joint cost of each item is simply the total cost multiplied by the relative basis for each item. It can then be divided by the total sq. ft. occupied by each floor to determine the cost per sq. ft.

Since the cost was previously determined to be $400,000, the allocated joint cost of each item is simply the total cost multiplied by the relative basis for each item. It can then be divided by the total sq. ft. occupied by each floor to determine the cost per sq. ft.

In order to apply the new blended cost basis for the department in question the cost per sq. ft. for each floor must be summed up. It is simply the adjusted original basis (for lighting and cleaning) plus the value basis (for building rent) for each floor.

In order to apply the new blended cost basis for the department in question the cost per sq. ft. for each floor must be summed up. It is simply the adjusted original basis (for lighting and cleaning) plus the value basis (for building rent) for each floor.

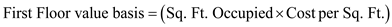

For the first floor the calculation is:

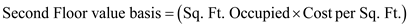

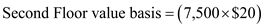

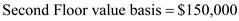

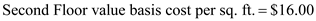

For the second floor the calculation is:

For the second floor the calculation is:

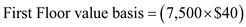

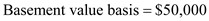

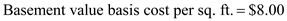

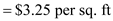

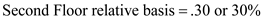

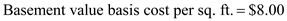

For the basement the calculation is:

For the basement the calculation is:

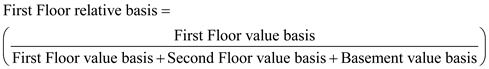

This can now be applied to the respective department.

This can now be applied to the respective department.

AF's department occupies 2,000 sq. ft. in the basement so the cost calculation is:

3.

3.

The manager of a second floor department would favor the blended value basis allocation because the cost allocation would be $17 per sq. ft. using the current allocation method versus $10.00 per sq. ft. using the blended value basis allocation.

The allocation of joint costs on a value basis means that the business allocates the cost to products based on certain grades and its relative production quantity. It determines the percentage of the total costs allocated to each product by the ratio of each product's sales value to the total value. The sales value is determined by multiplying the unit-selling price by the number of units.

1.

Based on the current cost physical allocation basis the resulting occupancy costs are simply the physical space occupied by the current cost per square foot, which in this scenario is $23.25/sq. ft.

AF's department occupies 2,000 sq. ft. so the cost calculation is:

2.

2. In order to consider a value basis allocation the Controller had to split up the various occupancy costs incurred.

Lighting and cleaning costs totaling $65,000 would be applied at the original basis method. The cost can be determined by dividing that cost by the total number of square feet in the building which is 20,000 sq. ft.

In order to allocate the remaining Building rent costs of $400,000 on a value basis allocation some addition calculations are needed.

In order to allocate the remaining Building rent costs of $400,000 on a value basis allocation some addition calculations are needed.The scenario indicates that first floor space costs $40 per sq. ft., second floor space costs $20 per sq. ft., and basement space costs $10 per sq. ft. Therefore, to determine the value basis for allocating cost one must multiply the number of sq. ft. occupied by their relative cost.

The relative basis of each item's value to the total value can now be determined so that the cost allocation percentage can be determined.

The relative basis of each item's value to the total value can now be determined so that the cost allocation percentage can be determined.

Since the cost was previously determined to be $400,000, the allocated joint cost of each item is simply the total cost multiplied by the relative basis for each item. It can then be divided by the total sq. ft. occupied by each floor to determine the cost per sq. ft.

Since the cost was previously determined to be $400,000, the allocated joint cost of each item is simply the total cost multiplied by the relative basis for each item. It can then be divided by the total sq. ft. occupied by each floor to determine the cost per sq. ft.

In order to apply the new blended cost basis for the department in question the cost per sq. ft. for each floor must be summed up. It is simply the adjusted original basis (for lighting and cleaning) plus the value basis (for building rent) for each floor.

In order to apply the new blended cost basis for the department in question the cost per sq. ft. for each floor must be summed up. It is simply the adjusted original basis (for lighting and cleaning) plus the value basis (for building rent) for each floor.For the first floor the calculation is:

For the second floor the calculation is:

For the second floor the calculation is:

For the basement the calculation is:

For the basement the calculation is:

This can now be applied to the respective department.

This can now be applied to the respective department.AF's department occupies 2,000 sq. ft. in the basement so the cost calculation is:

3.

3. The manager of a second floor department would favor the blended value basis allocation because the cost allocation would be $17 per sq. ft. using the current allocation method versus $10.00 per sq. ft. using the blended value basis allocation.

2

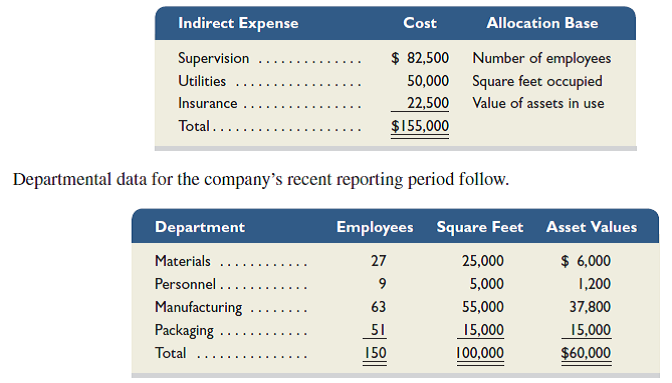

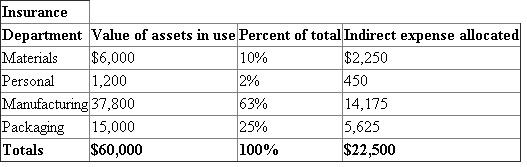

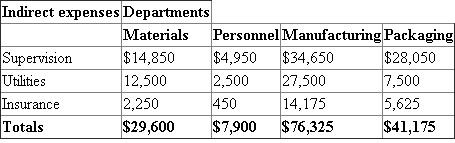

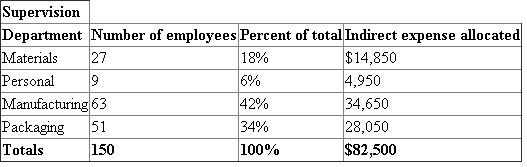

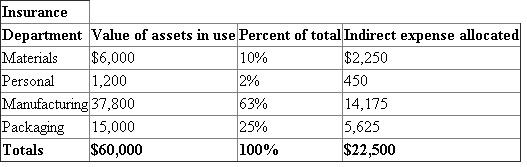

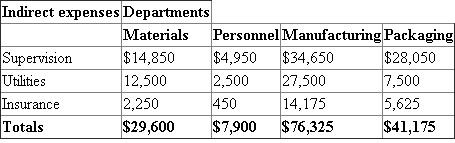

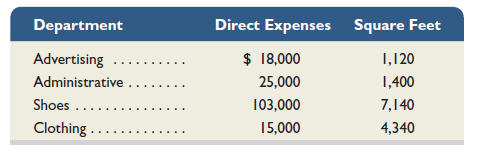

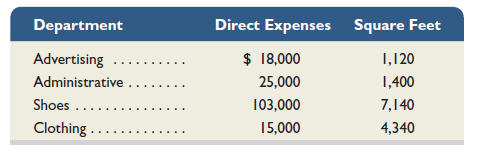

Woh Che Co. has four departments: materials, personnel, manufacturing, and packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow.

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

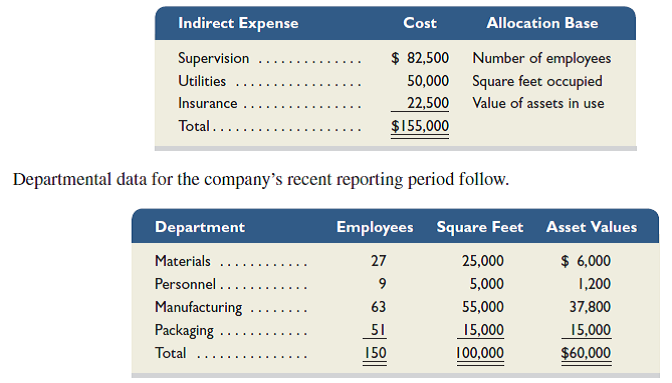

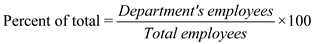

1)

The following table A shows the allocation of the indirect expenses across the four departments, which is as follows:

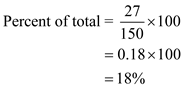

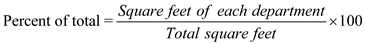

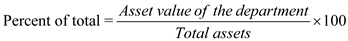

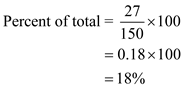

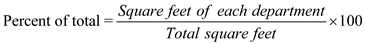

In the table A, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table A, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

Substitute 27 for ' Department employees ', 150 for ' Total employees '

Substitute 27 for ' Department employees ', 150 for ' Total employees '

Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is

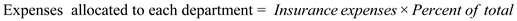

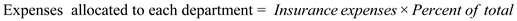

In the table A, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table A, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

Substitute $82,500 for ' Supervision expenses ' , 0.18 for ' Percent of total '

Substitute $82,500 for ' Supervision expenses ' , 0.18 for ' Percent of total '

Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is

The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.

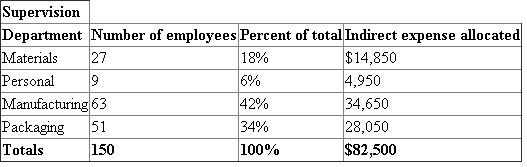

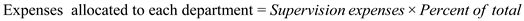

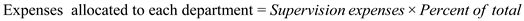

The following table B shows the allocation of the indirect expenses across the four departments, which is as follows:

In the table B, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table B, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

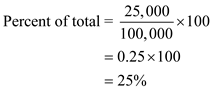

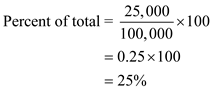

Substitute 25,000 for ' Square feet of each department', 100,000 for ' Total square feet '

Substitute 25,000 for ' Square feet of each department', 100,000 for ' Total square feet '

Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is

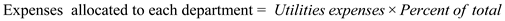

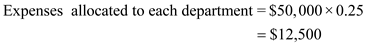

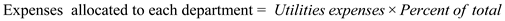

In the table B, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table B, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

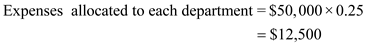

Substitute $50,000 for ' Utilities expenses' , 0.25 for ' Percent of total '

Substitute $50,000 for ' Utilities expenses' , 0.25 for ' Percent of total '

Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is

The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.

The following table C shows the allocation of the indirect expenses across the four departments, which is as follows:

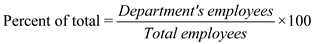

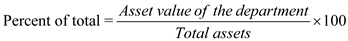

In the table C, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table C, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

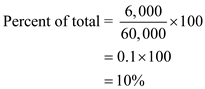

Substitute 6,000 for ' Asset value of the department ', 60,000 for ' Total assets '

Substitute 6,000 for ' Asset value of the department ', 60,000 for ' Total assets '

Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is

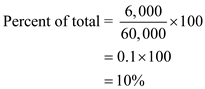

In the table C, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table C, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

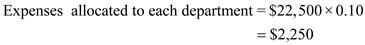

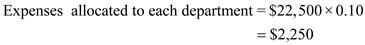

Substitute $22,500 for ' Insurance expenses' , 0.10 for ' Percent of total '

Substitute $22,500 for ' Insurance expenses' , 0.10 for ' Percent of total '

Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is

The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.

2)

The following table D shows the summary that reports the indirect expenses assigned to each of the four departments, which is as follows:

The following table A shows the allocation of the indirect expenses across the four departments, which is as follows:

In the table A, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table A, in the materials department, the percent of total is calculated by using the following formula, which is as follows: Substitute 27 for ' Department employees ', 150 for ' Total employees '

Substitute 27 for ' Department employees ', 150 for ' Total employees ' Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is In the table A, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table A, in the materials department, the expense allocated is calculated by using the following formula, which is as follows: Substitute $82,500 for ' Supervision expenses ' , 0.18 for ' Percent of total '

Substitute $82,500 for ' Supervision expenses ' , 0.18 for ' Percent of total ' Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.The following table B shows the allocation of the indirect expenses across the four departments, which is as follows:

In the table B, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table B, in the materials department, the percent of total is calculated by using the following formula, which is as follows: Substitute 25,000 for ' Square feet of each department', 100,000 for ' Total square feet '

Substitute 25,000 for ' Square feet of each department', 100,000 for ' Total square feet ' Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is In the table B, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table B, in the materials department, the expense allocated is calculated by using the following formula, which is as follows: Substitute $50,000 for ' Utilities expenses' , 0.25 for ' Percent of total '

Substitute $50,000 for ' Utilities expenses' , 0.25 for ' Percent of total ' Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.The following table C shows the allocation of the indirect expenses across the four departments, which is as follows:

In the table C, in the materials department, the percent of total is calculated by using the following formula, which is as follows:

In the table C, in the materials department, the percent of total is calculated by using the following formula, which is as follows: Substitute 6,000 for ' Asset value of the department ', 60,000 for ' Total assets '

Substitute 6,000 for ' Asset value of the department ', 60,000 for ' Total assets ' Therefore, the percent of total for materials department is

Therefore, the percent of total for materials department is In the table C, in the materials department, the expense allocated is calculated by using the following formula, which is as follows:

In the table C, in the materials department, the expense allocated is calculated by using the following formula, which is as follows: Substitute $22,500 for ' Insurance expenses' , 0.10 for ' Percent of total '

Substitute $22,500 for ' Insurance expenses' , 0.10 for ' Percent of total ' Therefore, the Expenses allocated to material department is

Therefore, the Expenses allocated to material department is The same procedure is followed in all the remaining departments.

The same procedure is followed in all the remaining departments.2)

The following table D shows the summary that reports the indirect expenses assigned to each of the four departments, which is as follows:

3

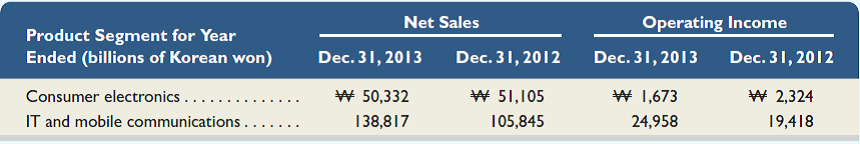

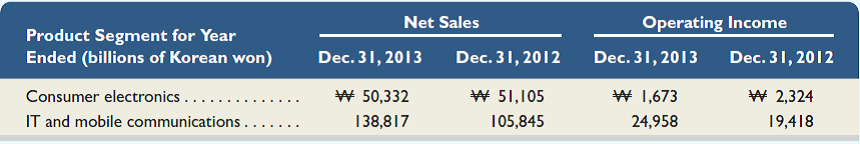

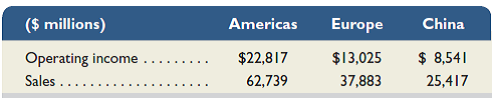

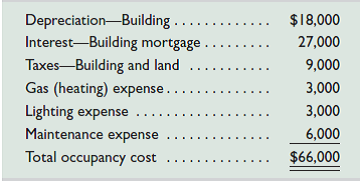

Selected product data from Samsung ( www.samsung.com ) follow.

Required

1. Compute the percentage growth in net sales for each product line from fiscal year 2012 to 2013. Round percents to one decimal.

2. Which product line's net sales grew the fastest

3. Which segment was the most profitable

4. How can Samsung's managers use this information

Required

1. Compute the percentage growth in net sales for each product line from fiscal year 2012 to 2013. Round percents to one decimal.

2. Which product line's net sales grew the fastest

3. Which segment was the most profitable

4. How can Samsung's managers use this information

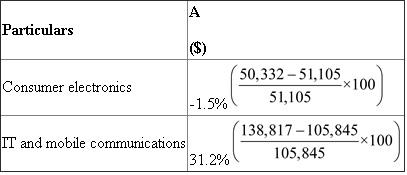

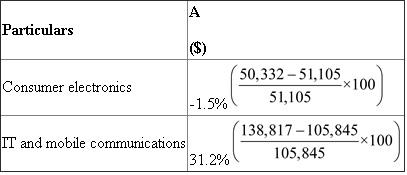

1.

Compute percentage increase in sales, current year sales will be reduced from previous year sales and it is divided by previous year sales as it is base amount.

Determine percentage growth in net sales in the books of S for 2013 as follows:

Thus, percentage growth net sales of consumer electronics shows a negative trend of

Thus, percentage growth net sales of consumer electronics shows a negative trend of

while that of IT and Mobile communication shows a positive trend of

while that of IT and Mobile communication shows a positive trend of

.

.

Note:

All the figures are denoted in .

2.

From above calculations, it has been observed that there is good scope in IT and Mobile communication segment to improve. It has increased by 31.2% when compared with previous year sales while sales of consumer electronics has reduced in current year as compared to previous year by 1.5%.

3.

Operating income of consumer electronics for 2013 is 1,673 billion of Korean while for the year 2012 is 2,324 billion of Korean.

Operating income of IT and Mobile communication for the year 2013 is 24,958 billion of Korean and for the year 2012 is 19,418 billion of Korean.

This indicates that the firm has earned more operating income in IT and Mobile communication as that of consumer electronics.

4.

The above mentioned data can be used by S Company management to determine long term goals and strategies. It can also be utilized for allocating resources to particular segment. An important aspect to be taken into consideration in the valuation of any firm is its ability to develop and expand its operations into new product lines beneficially.

It has been recommended that the company should continue to grow IT and mobile communications product sales as it is more profitable and its sales are increasing at a faster rate. Variability (or risk) can dismay additional investment to grow this segment. It should be taken into consideration economic and other risks in these kinds of product line expansions and cost apportionment decisions.

Compute percentage increase in sales, current year sales will be reduced from previous year sales and it is divided by previous year sales as it is base amount.

Determine percentage growth in net sales in the books of S for 2013 as follows:

Thus, percentage growth net sales of consumer electronics shows a negative trend of

Thus, percentage growth net sales of consumer electronics shows a negative trend of  while that of IT and Mobile communication shows a positive trend of

while that of IT and Mobile communication shows a positive trend of .

. Note:

All the figures are denoted in .

2.

From above calculations, it has been observed that there is good scope in IT and Mobile communication segment to improve. It has increased by 31.2% when compared with previous year sales while sales of consumer electronics has reduced in current year as compared to previous year by 1.5%.

3.

Operating income of consumer electronics for 2013 is 1,673 billion of Korean while for the year 2012 is 2,324 billion of Korean.

Operating income of IT and Mobile communication for the year 2013 is 24,958 billion of Korean and for the year 2012 is 19,418 billion of Korean.

This indicates that the firm has earned more operating income in IT and Mobile communication as that of consumer electronics.

4.

The above mentioned data can be used by S Company management to determine long term goals and strategies. It can also be utilized for allocating resources to particular segment. An important aspect to be taken into consideration in the valuation of any firm is its ability to develop and expand its operations into new product lines beneficially.

It has been recommended that the company should continue to grow IT and mobile communications product sales as it is more profitable and its sales are increasing at a faster rate. Variability (or risk) can dismay additional investment to grow this segment. It should be taken into consideration economic and other risks in these kinds of product line expansions and cost apportionment decisions.

4

Give two examples of products with joint costs.

Give two examples of products with joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

Heart Home Properties is developing a subdivision that includes 600 home lots. The 450 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 150 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $55,000 and for each Hilltop lot is $110,000. The developer acquired the land for $4,000,000 and spent another $3,500,000 on street and utilities improvements. Assign the joint land and improvement costs to the lots using the value basis of allocation and determine the average cost per lot.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

Mervon Company has two operating departments: mixing and bottling. Mixing has 300 employees and occupies 22,000 square feet. Bottling has 200 employees and occupies 18,000 square feet. Indirect factory costs for the current period follow: administrative, $160,000; and maintenance, $200,000. Administrative costs are allocated to operating departments based on the number of workers. Determine the administrative costs allocated to each operating department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

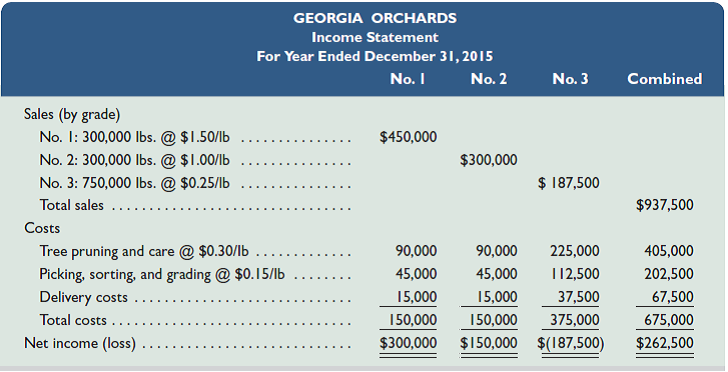

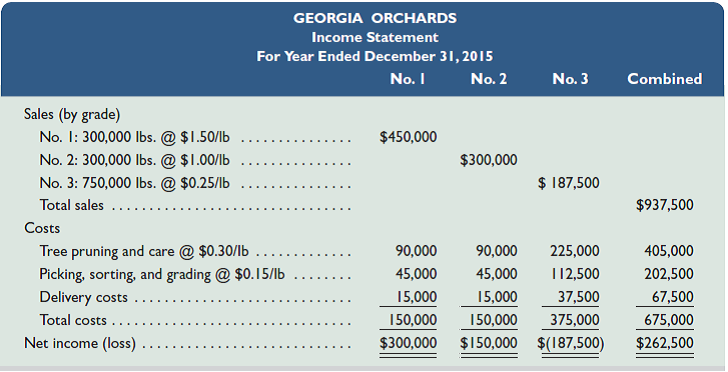

Georgia Orchards produced a good crop of peaches this year. After preparing the following income statement, the company believes it should have given its No. 3 peaches to charity and saved its efforts.

In preparing this statement, the company allocated joint costs among the grades on a physical basis as an equal amount per pound. The company's delivery cost records show that $30,000 of the $67,500 relates to crating the No. 1 and No. 2 peaches and hauling them to the buyer. The remaining $37,500 of delivery costs is for crating the No. 3 peaches and hauling them to the cannery.

Required

1. Prepare reports showing cost allocations on a sales value basis to the three grades of peaches. Separate the delivery costs into the amounts directly identifiable with each grade. Then allocate any shared delivery costs on the basis of the relative sales value of each grade.

2. Using your answers to part 1, prepare an income statement using the joint costs allocated on a sales value basis.

Analysis Component

3. Do you think delivery costs fit the definition of a joint cost Explain.

In preparing this statement, the company allocated joint costs among the grades on a physical basis as an equal amount per pound. The company's delivery cost records show that $30,000 of the $67,500 relates to crating the No. 1 and No. 2 peaches and hauling them to the buyer. The remaining $37,500 of delivery costs is for crating the No. 3 peaches and hauling them to the cannery.

Required

1. Prepare reports showing cost allocations on a sales value basis to the three grades of peaches. Separate the delivery costs into the amounts directly identifiable with each grade. Then allocate any shared delivery costs on the basis of the relative sales value of each grade.

2. Using your answers to part 1, prepare an income statement using the joint costs allocated on a sales value basis.

Analysis Component

3. Do you think delivery costs fit the definition of a joint cost Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

Suggest a reasonable basis for allocating each of the following indirect expenses to departments: (a) salary of a supervisor who manages several departments, (b) rent, (c) heat, (d) electricity for lighting, (e) janitorial services, (f) advertising, (g) expired insurance on equipment, and (h) property taxes on equipment.

Suggest a reasonable basis for allocating each of the following indirect expenses to departments: (a) salary of a supervisor who manages several departments, (b) rent, (c) heat, (d) electricity for lighting, (e) janitorial services, (f) advertising, (g) expired insurance on equipment, and (h) property taxes on equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

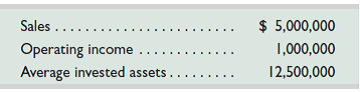

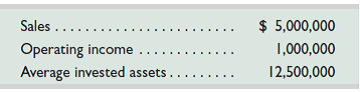

ZNet Co. is a web-based retail company. The company reports the following for 2015.

The company's CEO believes that sales for 2016 will increase by 20%, and both profit margin (%) and the level of average invested assets will be the same as for 2105.

1. Compute return on investment for 2105.

2. Compute profit margin for 2015.

3. If the CEO's forecast is correct, what will return on investment equal for 2016

4. If the CEO's forecast is correct, what will investment turnover equal for 2016

The company's CEO believes that sales for 2016 will increase by 20%, and both profit margin (%) and the level of average invested assets will be the same as for 2105.

1. Compute return on investment for 2105.

2. Compute profit margin for 2015.

3. If the CEO's forecast is correct, what will return on investment equal for 2016

4. If the CEO's forecast is correct, what will investment turnover equal for 2016

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

For a recent year L'Oréal reported operating profit of €3,385 (in millions) for its cosmetics division. Total assets were €12,888 (in millions) at the beginning of the year and €13,099 (in millions) at the end of the year. Compute return on investment for the year. State your answer as a percent, rounded to one decimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

Super Security Co. offers a range of security services for athletes and entertainers. Each type of service is considered within a separate department. Marc Pincus, the overall manager, is compensated partly on the basis of departmental performance by staying within the quarterly cost budget. He often revises operations to make sure departments stay within budget. Says Pincus, "I will not go over budget even if it means slightly compromising the level and quality of service. These are minor compromises that don't significantly affect my clients, at least in the short term."

Required

1. Is there an ethical concern in this situation If so, which parties are affected Explain.

2. Can Marc Pincus take action to eliminate or reduce any ethical concerns Explain.

3. What is Super Security's ethical responsibility in offering professional services

Required

1. Is there an ethical concern in this situation If so, which parties are affected Explain.

2. Can Marc Pincus take action to eliminate or reduce any ethical concerns Explain.

3. What is Super Security's ethical responsibility in offering professional services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

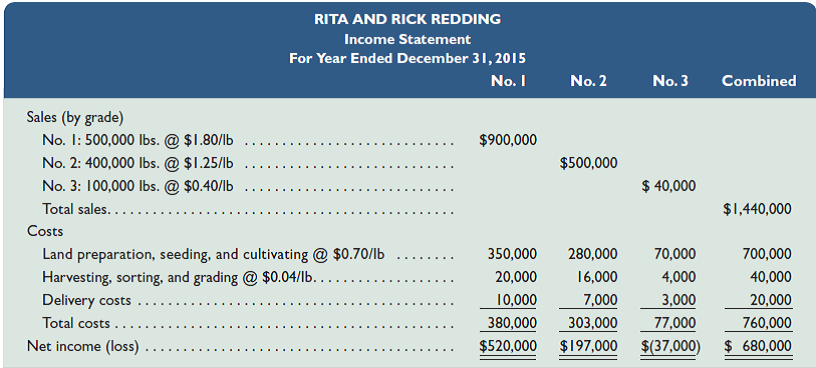

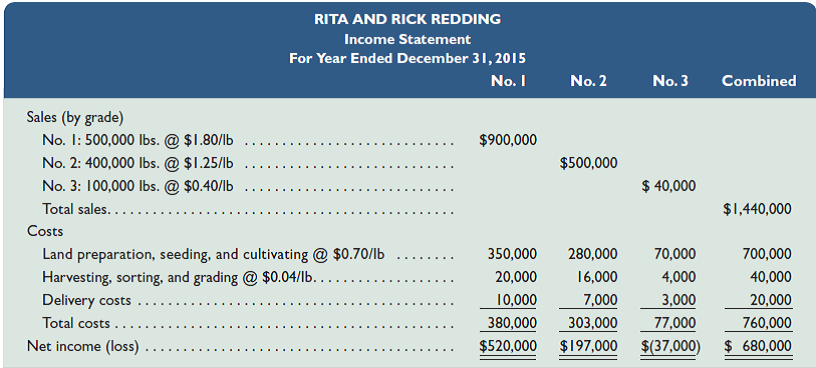

Rita and Rick Redding own and operate a tomato grove. After preparing the following income statement, Rita believes they should have offered the No. 3 tomatoes to the public for free and saved themselves time and money.

In preparing this statement, Rita and Rick allocated joint costs among the grades on a physical basis as an equal amount per pound. Also, their delivery cost records show that $17,000 of the $20,000 relates to crating the No. 1 and No. 2 tomatoes and hauling them to the buyer. The remaining $3,000 of delivery costs is for crating the No. 3 tomatoes and hauling them to the cannery.

Required

1. Prepare reports showing cost allocations on a sales value basis to the three grades of tomatoes. Separate the delivery costs into the amounts directly identifiable with each grade. Then allocate any shared delivery costs on the basis of the relative sales value of each grade. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

2. Using your answers to part 1, prepare an income statement using the joint costs allocated on a sales value basis.

Analysis Component

3. Do you think delivery costs fit the definition of a joint cost Explain.

In preparing this statement, Rita and Rick allocated joint costs among the grades on a physical basis as an equal amount per pound. Also, their delivery cost records show that $17,000 of the $20,000 relates to crating the No. 1 and No. 2 tomatoes and hauling them to the buyer. The remaining $3,000 of delivery costs is for crating the No. 3 tomatoes and hauling them to the cannery.

Required

1. Prepare reports showing cost allocations on a sales value basis to the three grades of tomatoes. Separate the delivery costs into the amounts directly identifiable with each grade. Then allocate any shared delivery costs on the basis of the relative sales value of each grade. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

2. Using your answers to part 1, prepare an income statement using the joint costs allocated on a sales value basis.

Analysis Component

3. Do you think delivery costs fit the definition of a joint cost Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

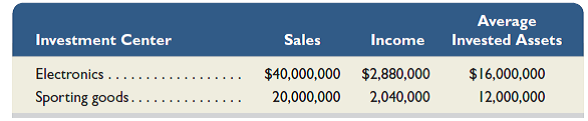

Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company

2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company

3. Assume the electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted Explain.

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company

2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company

3. Assume the electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

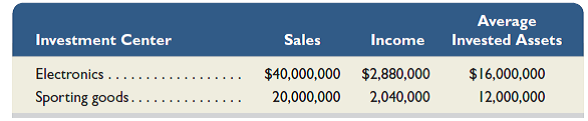

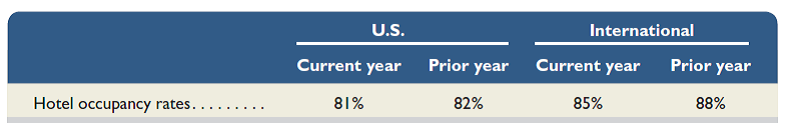

Walt Disney reports the following information for its two Parks and Resorts divisions.

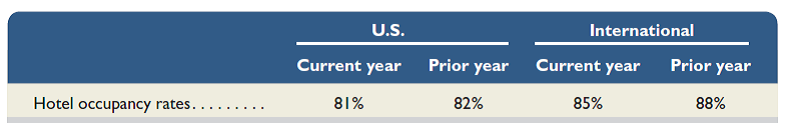

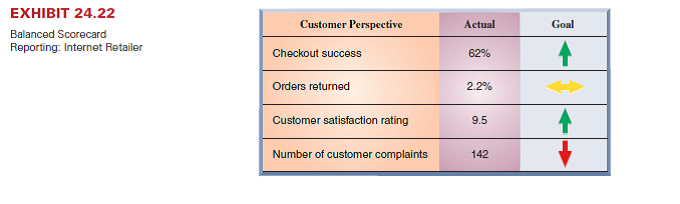

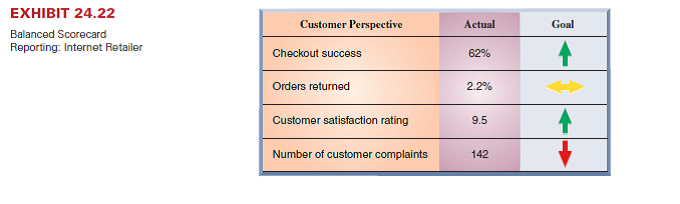

Assume Walt Disney uses a balanced scorecard and sets a target of 85% occupancy in its resorts. Using Exhibit 24.22 as a guide, show how the company's performance on hotel occupancy would appear on a balanced scorecard report.

Reference: Exhibit 24.22

Assume Walt Disney uses a balanced scorecard and sets a target of 85% occupancy in its resorts. Using Exhibit 24.22 as a guide, show how the company's performance on hotel occupancy would appear on a balanced scorecard report.

Reference: Exhibit 24.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

Can management of a company such as Samsung use cycle time and cycle efficiency as useful measures of performance Explain.

Can management of a company such as Samsung use cycle time and cycle efficiency as useful measures of performance Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

What are controllable costs

What are controllable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

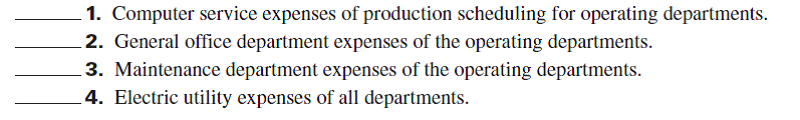

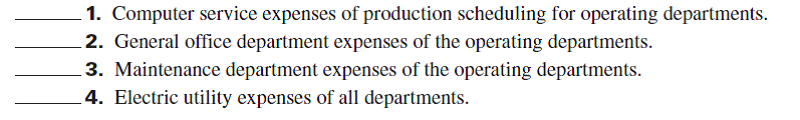

For each of the following types of indirect expenses and service department expenses, identify one allocation basis that could be used to distribute it to the departments indicated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

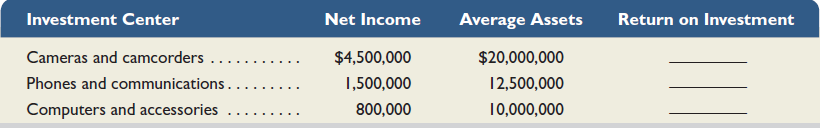

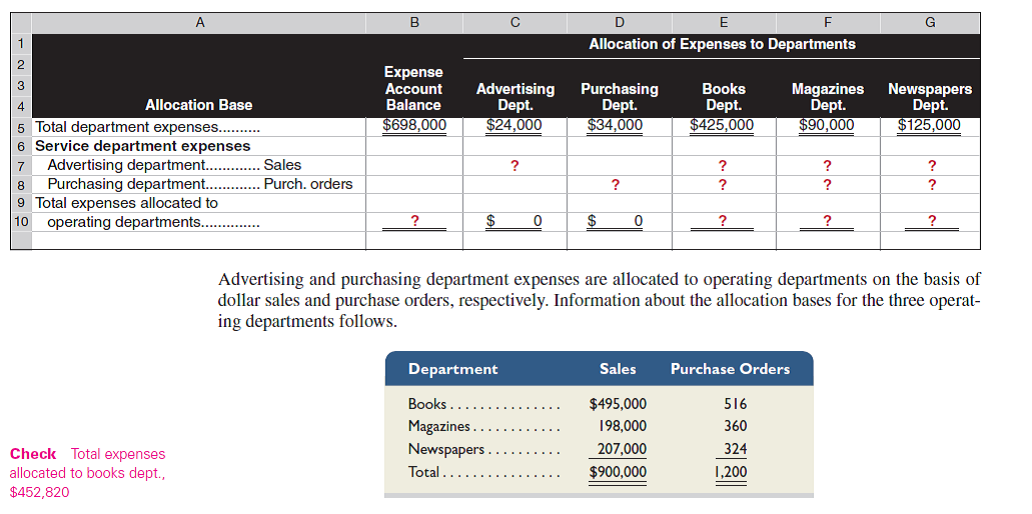

Compute return on investment for each of the divisions below (each is an investment center). Comment on the relative performance of each investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

Each Apple retail store has several departments. Why is it useful for its management to (a) collect accounting information about each department and (b) treat each department as a profit center

Each Apple retail store has several departments. Why is it useful for its management to (a) collect accounting information about each department and (b) treat each department as a profit center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $21 per pound and the flakes for $14 per pound. On average, 100 pounds of lobster are processed into 52 pounds of tails and 22 pounds of flakes, with 26 pounds of waste. Assume that the company purchased 2,400 pounds of lobster for $4.50 per pound and processed the lobsters with an additional labor cost of $1,800. No materials or labor costs are assigned to the waste. If 1,096 pounds of tails and 324 pounds of flakes are sold, what is (1) the allocated cost of the sold items and (2) the allocated cost of the ending inventory The company allocates joint costs on a value basis. (Round the dollar cost per pound to the nearest thousandth.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

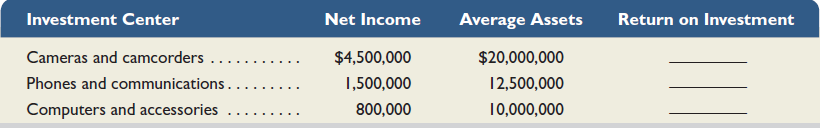

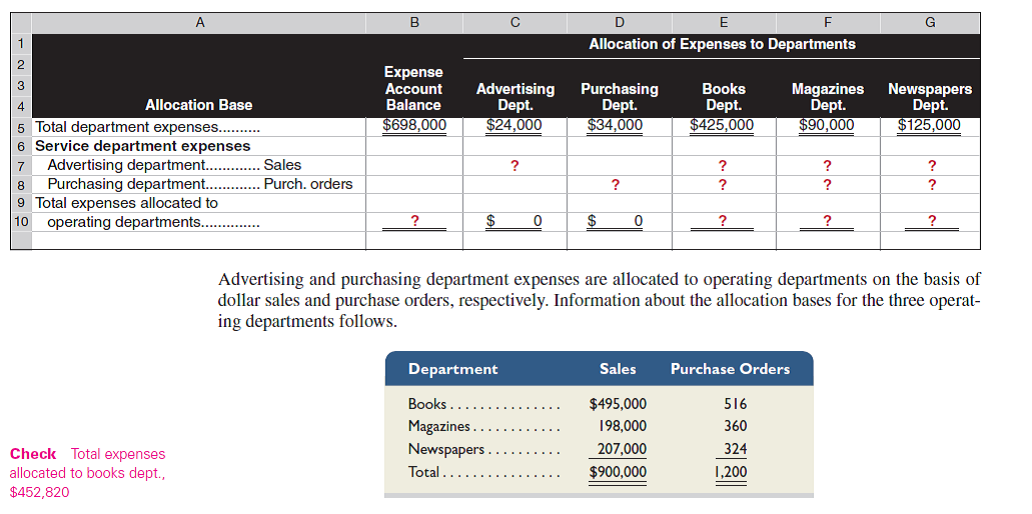

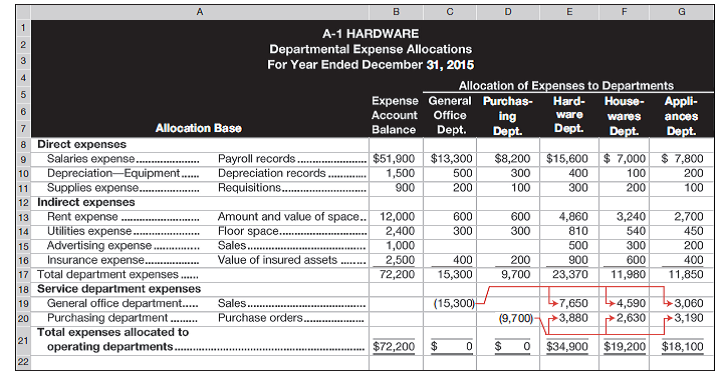

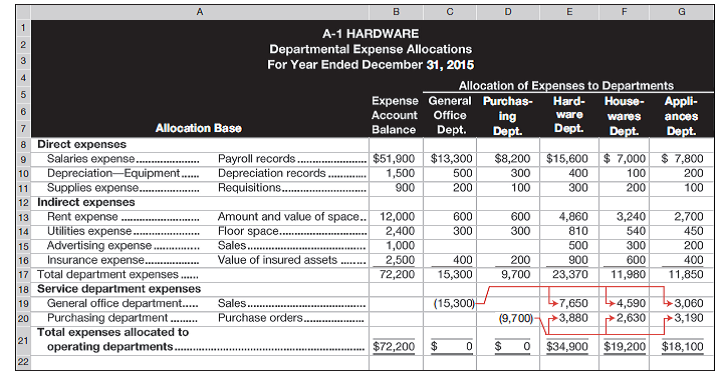

The following is a partially completed lower section of a departmental expense allocation spreadsheet for Cozy Bookstore. It reports the total amounts of direct and indirect expenses allocated to its five departments. Complete the spreadsheet by allocating the expenses of the two service departments (advertising and purchasing) to the three operating departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

Apple and Samsung compete across the world in several markets.

Required

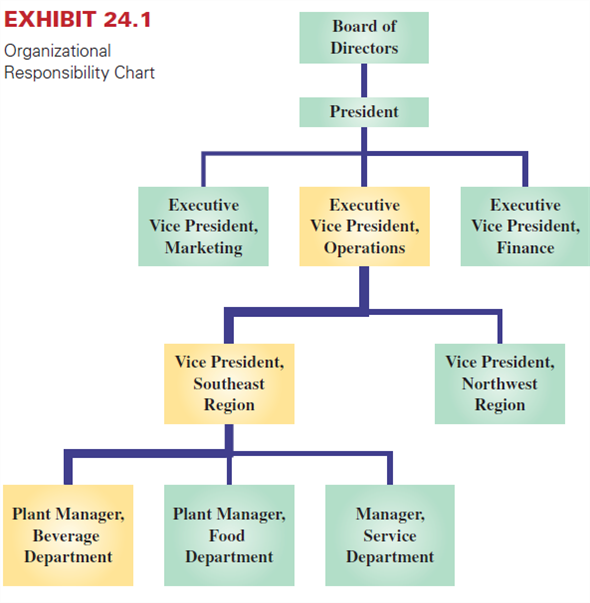

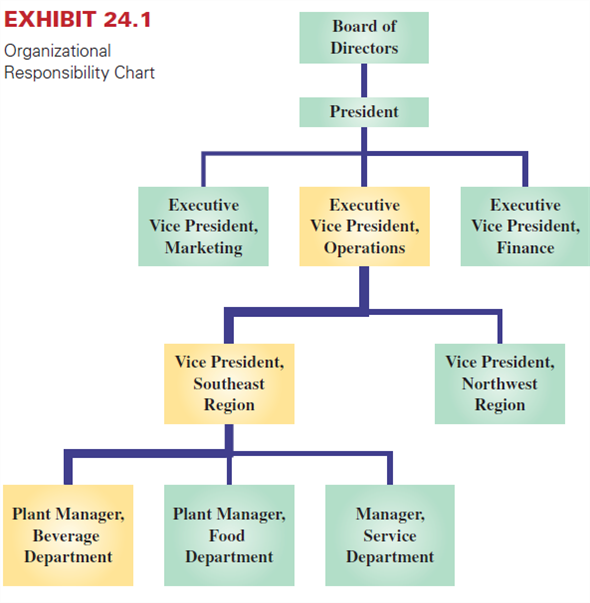

1. Design a three-tier responsibility accounting organizational chart assuming that you have available internal information for both companies. Use Exhibit 24.1 as an example. The goal of this assignment is to design a reporting framework for the companies; numbers are not required. Limit your reporting framework to sales activity only.

2. Explain why it is important to have similar performance reports when comparing performance within a company (and across different companies). Be specific in your response.

Reference: Exhibit 24.1

Required

1. Design a three-tier responsibility accounting organizational chart assuming that you have available internal information for both companies. Use Exhibit 24.1 as an example. The goal of this assignment is to design a reporting framework for the companies; numbers are not required. Limit your reporting framework to sales activity only.

2. Explain why it is important to have similar performance reports when comparing performance within a company (and across different companies). Be specific in your response.

Reference: Exhibit 24.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

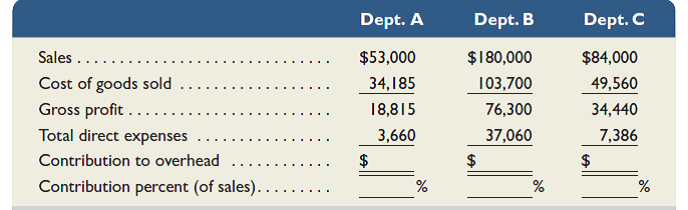

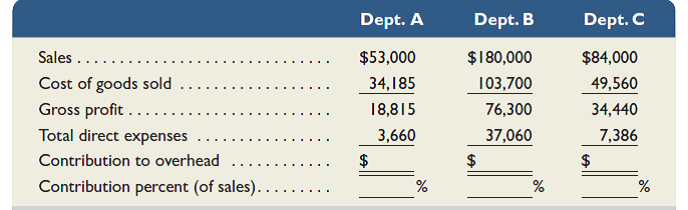

k this deck

23

Samsung has many departments. How is a department's contribution to overhead measured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

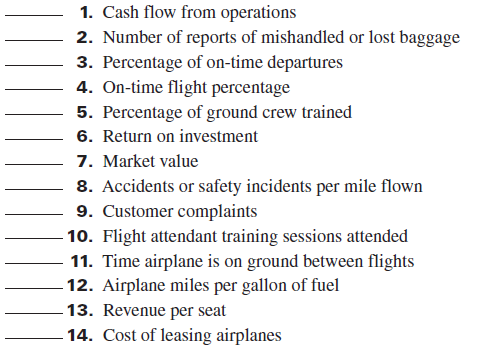

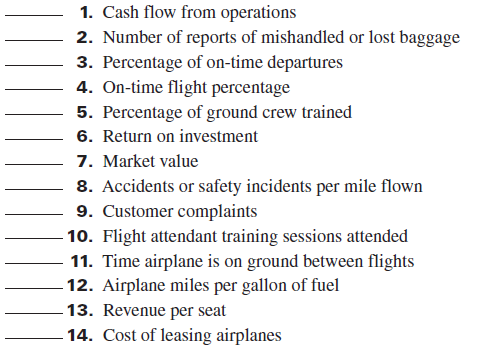

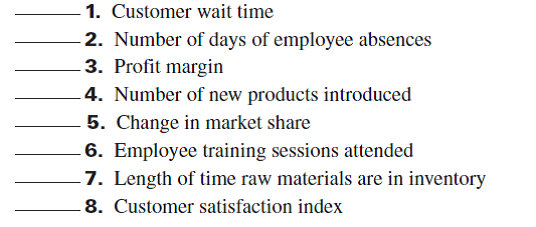

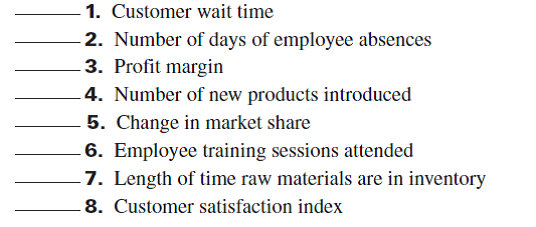

USA Airlines uses the following performance measures. Classify each of the performance measures below into the most likely balanced scorecard perspective it relates to. Label your answers using C (customer), P (internal process), I (innovation and growth), or F (financial).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

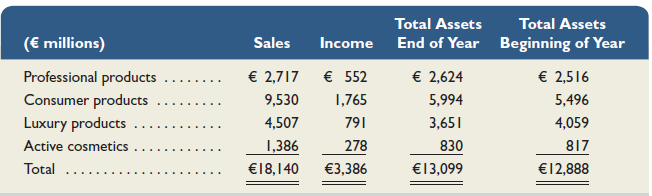

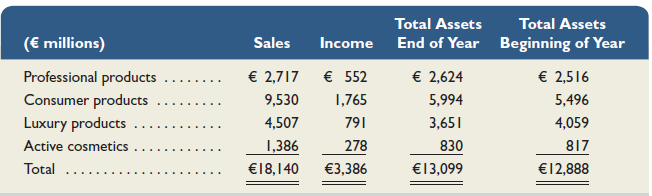

L'Oréal reports the following for a recent year for the major divisions in its cosmetics branch.

1. Compute profit margin for each division. State your answers as percents, rounded to two decimal places. Which L'Oréal division has the highest profit margin

2. Compute investment turnover for each division. Round your answers to two decimal places. Which L'Oréal division has the best investment turnover

1. Compute profit margin for each division. State your answers as percents, rounded to two decimal places. Which L'Oréal division has the highest profit margin

2. Compute investment turnover for each division. Round your answers to two decimal places. Which L'Oréal division has the best investment turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

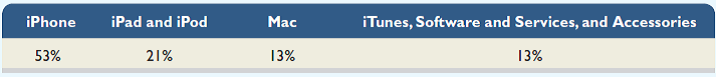

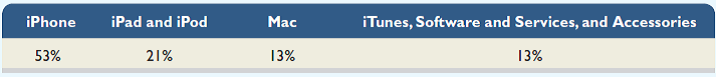

Review Apple 's income statement in Appendix A and identify its revenues for the years ended September 28, 2013, September 29, 2012, and September 24, 2011. For the year ended September 28, 2013, Apple reports the following product revenue mix. (Assume that its product revenue mix is the same for each of the three years reported when answering the requirements.)

Required

1. Compute the amount of revenue from each of its product lines for the years ended September 28, 2013, September 29, 2012, and September 24, 2011.

2. If Apple wishes to evaluate each of its product lines, how can it allocate its operating expenses to each of them to determine each product line's profitability

Fast Forward

3. Access Apple's annual report for a fiscal year ending after September 28, 2013, from its website ( Apple.com ) or the SEC's EDGAR database ( www.SEC.gov ). Locate its table of "Net Sales by Product" in the footnotes. How has its product mix changed from 2013

Required

1. Compute the amount of revenue from each of its product lines for the years ended September 28, 2013, September 29, 2012, and September 24, 2011.

2. If Apple wishes to evaluate each of its product lines, how can it allocate its operating expenses to each of them to determine each product line's profitability

Fast Forward

3. Access Apple's annual report for a fiscal year ending after September 28, 2013, from its website ( Apple.com ) or the SEC's EDGAR database ( www.SEC.gov ). Locate its table of "Net Sales by Product" in the footnotes. How has its product mix changed from 2013

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

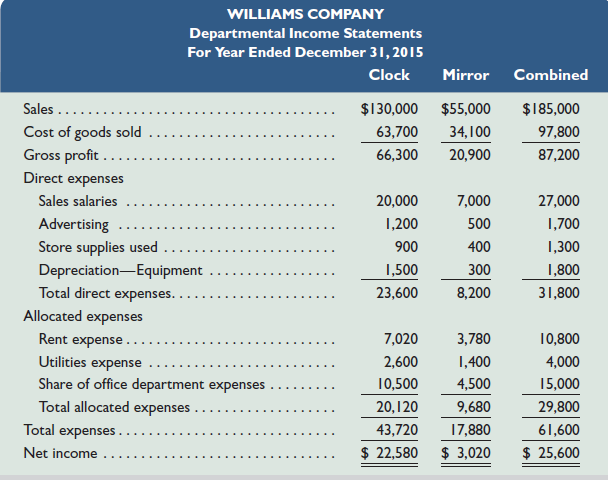

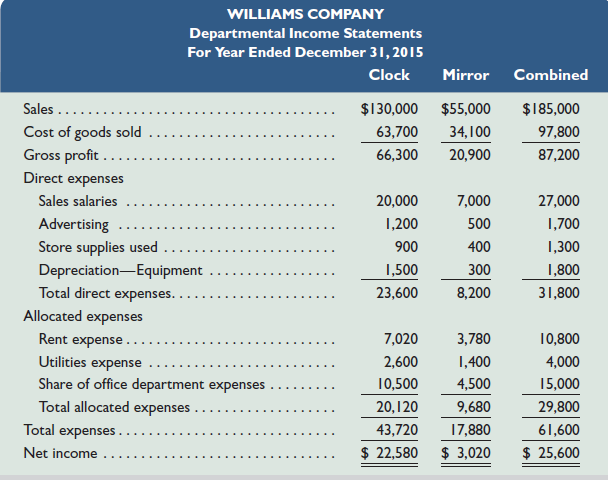

Williams Company began operations in January 2015 with two operating (selling) departments and one service (office) department. Its departmental income statements follow.

Williams plans to open a third department in January 2016 that will sell paintings. Management predicts that the new department will generate $50,000 in sales with a 55% gross profit margin and will require the following direct expenses: sales salaries, $8,000; advertising, $800; store supplies, $500; and equipment depreciation, $200. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened the new painting department will fill onefifth of the space presently used by the clock department and one-fourth used by the mirror department. Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the painting department to increase total office department expenses by $7,000. Since the painting department will bring new customers into the store, management expects sales in both the clock and mirror departments to increase by 8%. No changes for those departments' gross profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales.

Required

Prepare departmental income statements that show the company's predicted results of operations for calendar year 2016 for the three operating (selling) departments and their combined totals. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

Williams plans to open a third department in January 2016 that will sell paintings. Management predicts that the new department will generate $50,000 in sales with a 55% gross profit margin and will require the following direct expenses: sales salaries, $8,000; advertising, $800; store supplies, $500; and equipment depreciation, $200. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened the new painting department will fill onefifth of the space presently used by the clock department and one-fourth used by the mirror department. Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the painting department to increase total office department expenses by $7,000. Since the painting department will bring new customers into the store, management expects sales in both the clock and mirror departments to increase by 8%. No changes for those departments' gross profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales.

Required

Prepare departmental income statements that show the company's predicted results of operations for calendar year 2016 for the three operating (selling) departments and their combined totals. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

What are two main goals in managerial accounting for reporting on and analyzing departments

What are two main goals in managerial accounting for reporting on and analyzing departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

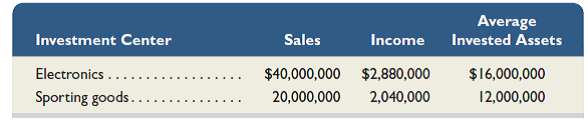

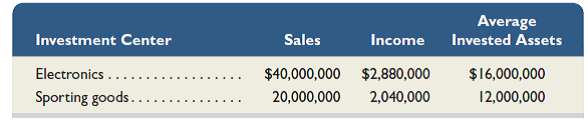

Refer to information in Exercise 24-9. Compute profit margin and investment turnover for each department. Which department generates the most net income per dollar of sales Which department is most efficient at generating sales from average invested assets

Reference: Exercise 24-9

Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company

2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company

3. Assume the electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted Explain.

Reference: Exercise 24-9

Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center).

1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company

2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company

3. Assume the electronics department is presented with a new investment opportunity that will yield a 15% return on investment. Should the new investment opportunity be accepted Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

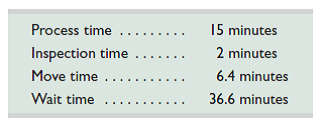

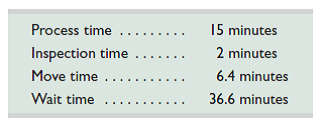

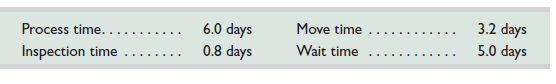

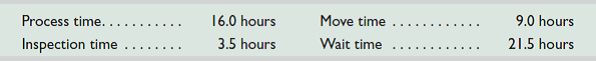

Compute and interpret ( a ) manufacturing cycle time and ( b ) manufacturing cycle efficiency using the following information from a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

Why are many companies divided into departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

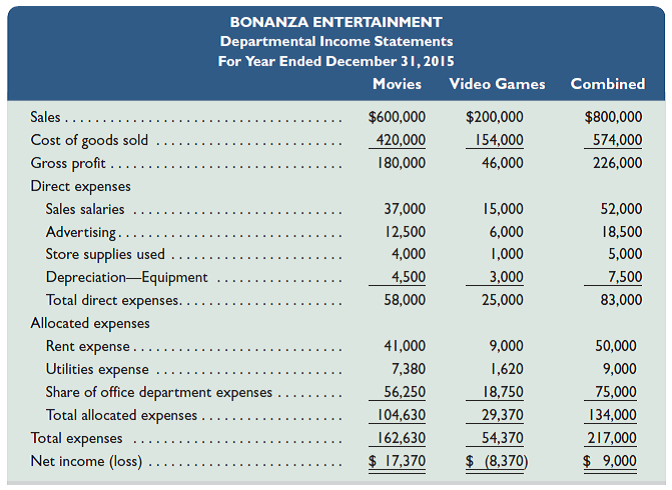

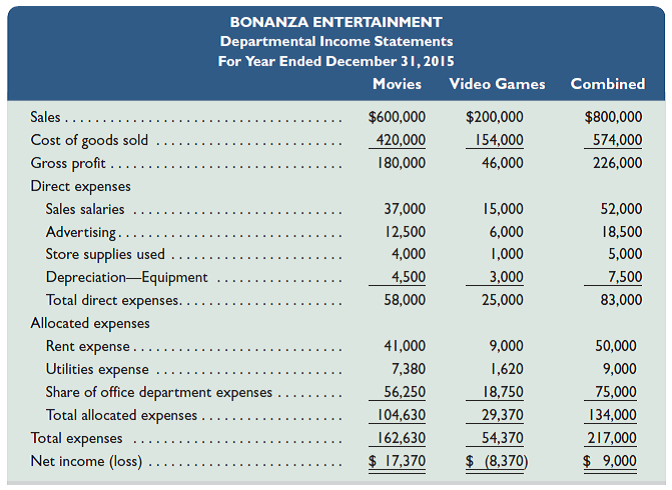

Bonanza Entertainment began operations in January 2015 with two operating (selling) departments and one service (office) department. Its departmental income statements follow.

The company plans to open a third department in January 2016 that will sell compact discs. Management predicts that the new department will generate $300,000 in sales with a 35% gross profit margin and will require the following direct expenses: sales salaries, $18,000; advertising, $10,000; store supplies, $2,000; and equipment depreciation, $1,200. The company will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new compact disc department will fill one-fourth of the space presently used by the movie department and one-third of the space used by the video game department. Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the compact disc department to increase total office department expenses by $10,000. Since the compact disc department will bring new customers into the store, management expects sales in both the movie and video game departments to increase by 8%. No changes for those departments' gross profit percents or for their direct expenses are expected, except for store supplies used, which will increase in proportion to sales.

Required

Prepare departmental income statements that show the company's predicted results of operations for calendar year 2016 for the three operating (selling) departments and their combined totals. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

The company plans to open a third department in January 2016 that will sell compact discs. Management predicts that the new department will generate $300,000 in sales with a 35% gross profit margin and will require the following direct expenses: sales salaries, $18,000; advertising, $10,000; store supplies, $2,000; and equipment depreciation, $1,200. The company will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new compact disc department will fill one-fourth of the space presently used by the movie department and one-third of the space used by the video game department. Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the compact disc department to increase total office department expenses by $10,000. Since the compact disc department will bring new customers into the store, management expects sales in both the movie and video game departments to increase by 8%. No changes for those departments' gross profit percents or for their direct expenses are expected, except for store supplies used, which will increase in proportion to sales.

Required

Prepare departmental income statements that show the company's predicted results of operations for calendar year 2016 for the three operating (selling) departments and their combined totals. (Round percents to the nearest one-tenth and dollar amounts to the nearest whole dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

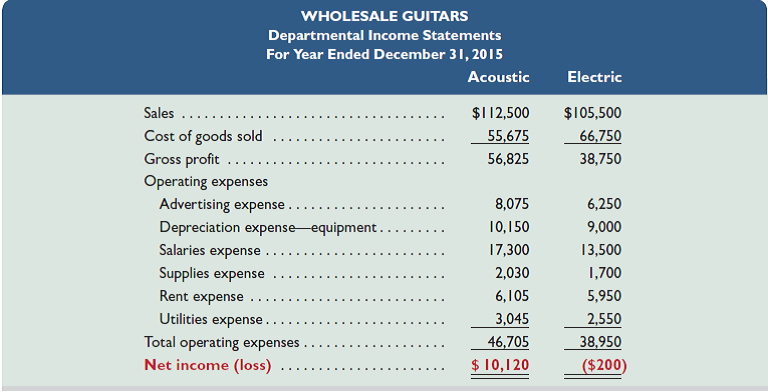

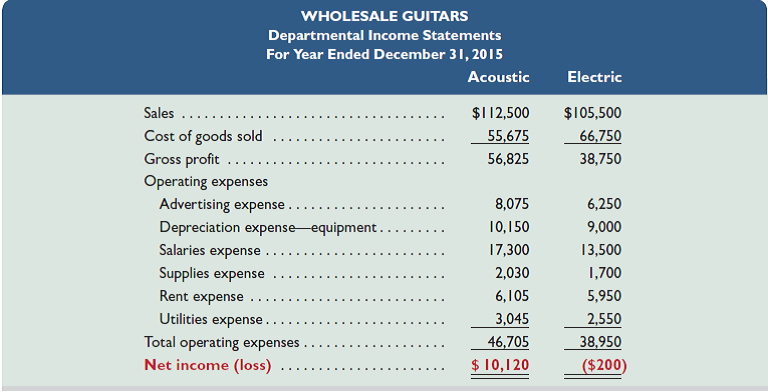

Below are departmental income statements for a guitar manufacturer. The manufacturer is considering dropping its electric guitar department since it has a net loss. The company classifies advertising, rent, and utilities expenses as indirect.

1. Prepare a departmental contribution report that shows each department's contribution to overhead.

2. Based on contribution to overhead, should the electric guitar department be eliminated

1. Prepare a departmental contribution report that shows each department's contribution to overhead.

2. Based on contribution to overhead, should the electric guitar department be eliminated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

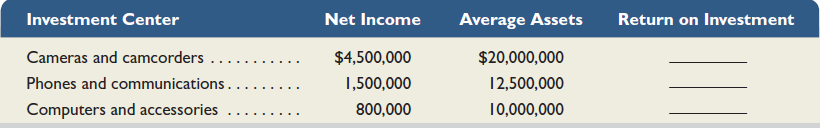

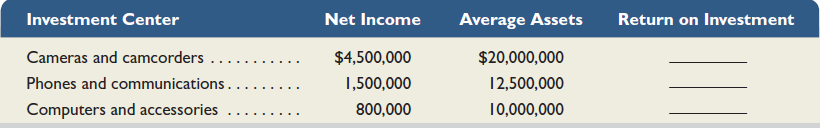

Refer to information in QS 24-9. Assume a target income of 12% of average invested assets. Compute residual income for each division.

Reference: QS 24-9.

Compute return on investment for each of the divisions below (each is an investment center). Comment on the relative performance of each investment center.

Reference: QS 24-9.

Compute return on investment for each of the divisions below (each is an investment center). Comment on the relative performance of each investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Apple delivers its products to locations around the world. List three controllable and three uncontrollable costs for its delivery department.

Apple delivers its products to locations around the world. List three controllable and three uncontrollable costs for its delivery department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

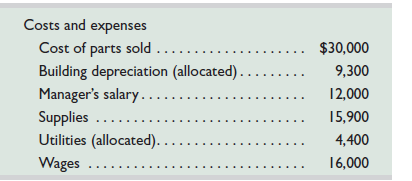

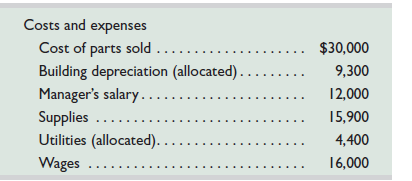

Marvin Dinardo manages an auto dealership's service department. Costs and expenses for a recent quarter for his department follows. List the controllable costs that would appear on a responsibility accounting report for the service department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

Mervon Company has two operating departments: mixing and bottling. Mixing has 300 employees and occupies 22,000 square feet. Bottling has 200 employees and occupies 18,000 square feet. Indirect factory costs for the current period follow: administrative, $160,000; and maintenance, $200,000. Administrative costs are allocated to operating departments based on the number of workers. Determine the administrative costs allocated to each operating department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

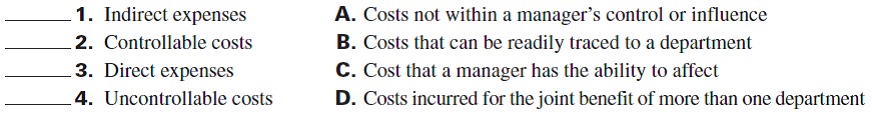

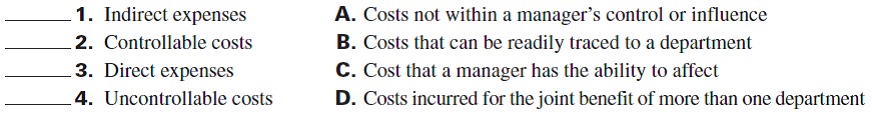

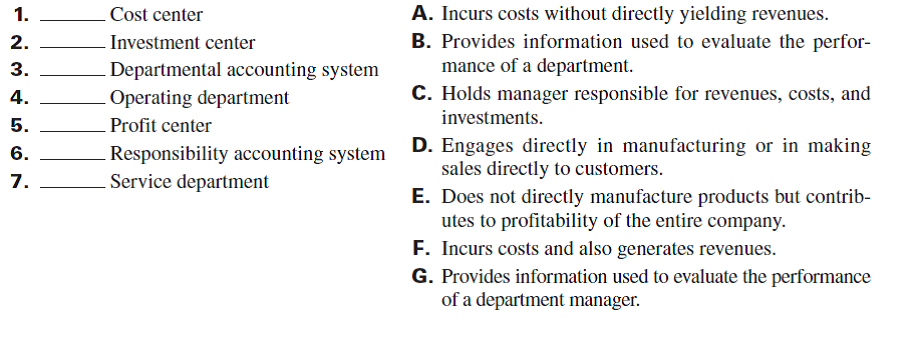

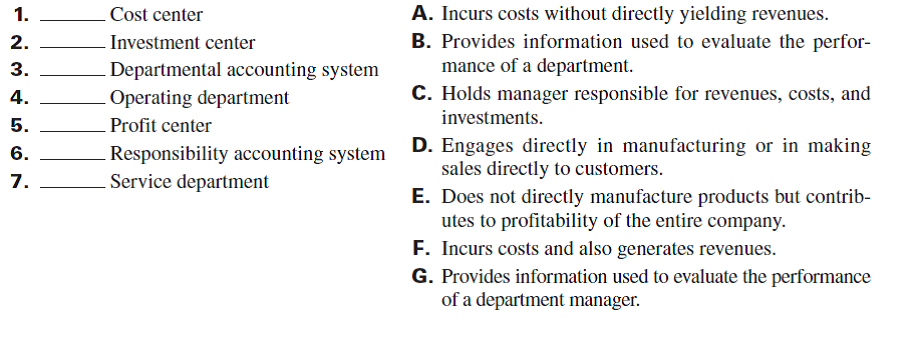

In each blank next to the following terms, place the identifying letter of its best description.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Google aims to give its managers timely cost reports. In responsibility accounting, who receives timely cost reports and specific cost information Explain.

Google aims to give its managers timely cost reports. In responsibility accounting, who receives timely cost reports and specific cost information Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

Oakwood Company produces maple bookcases to customer order. It received an order from a customer to produce 5,000 bookcases. The following information is available for the production of the bookcases.

1. Compute the company's manufacturing cycle time.

2. Compute the company's manufacturing cycle efficiency. Interpret your answer.

3. Oakwood believes it can reduce move time by 1.2 days and wait time by 2.8 days by adopting lean manufacturing techniques. Compute the company's manufacturing cycle efficiency assuming the company's predictions are correct.

1. Compute the company's manufacturing cycle time.

2. Compute the company's manufacturing cycle efficiency. Interpret your answer.

3. Oakwood believes it can reduce move time by 1.2 days and wait time by 2.8 days by adopting lean manufacturing techniques. Compute the company's manufacturing cycle efficiency assuming the company's predictions are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

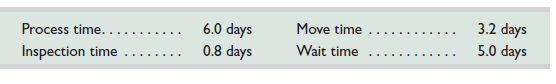

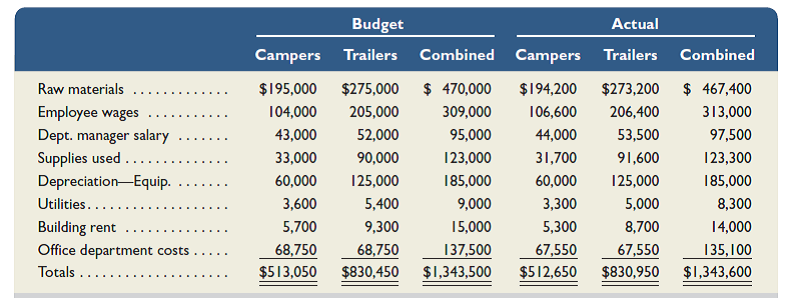

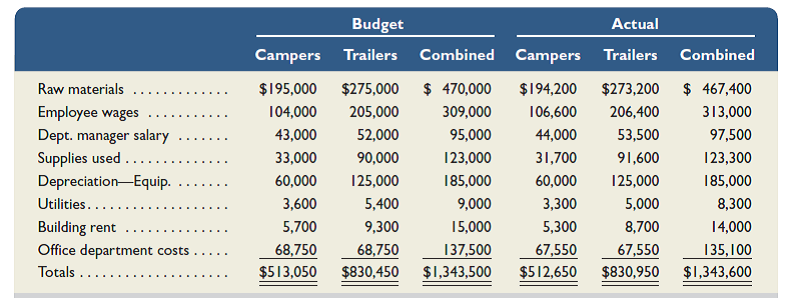

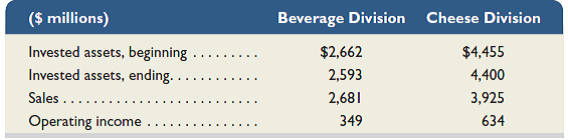

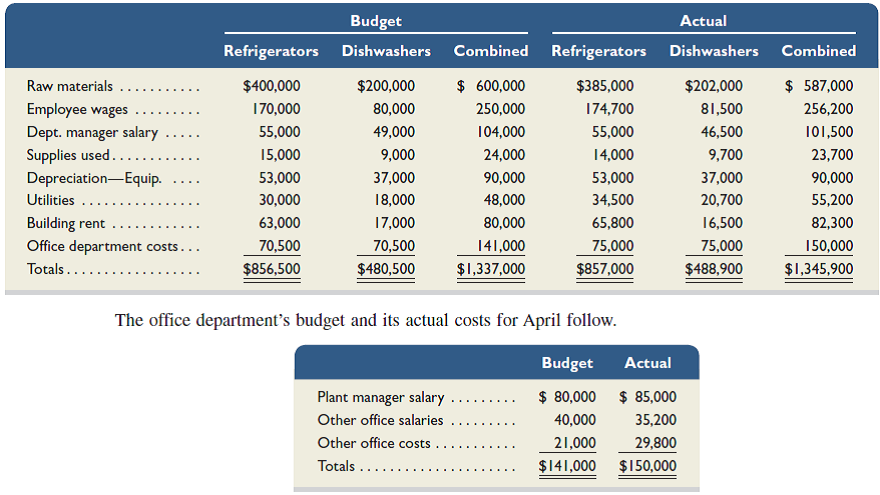

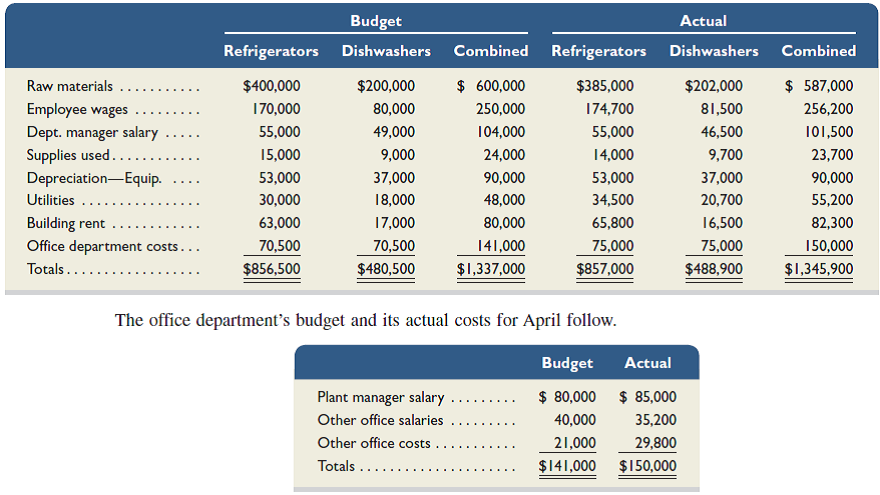

Billie Whitehorse, the plant manager of Travel Free's Indiana plant, is responsible for all of that plant's costs other than her own salary. The plant has two operating departments and one service department. The camper and trailer operating departments manufacture different products and have their own managers. The office department, which Whitehorse also manages, provides services equally to the two operating departments. A budget is prepared for each operating department and the office department. The company's responsibility accounting system must assemble information to present budgeted and actual costs in performance reports for each operating department manager and the plant manager. Each performance report includes only those costs that a particular operating department manager can control: raw materials, wages, supplies used, and equipment depreciation. The plant manager is responsible for the department managers' salaries, utilities, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The annual departmental budgets and actual costs for the two operating departments follow.

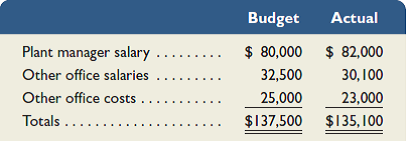

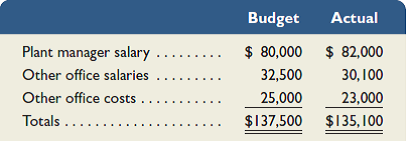

The office department's annual budget and its actual costs follow.

Required

1. Prepare responsibility accounting performance reports like those in Exhibit 24.2 that list costs controlled

by the following:

a. Manager of the camper department.

b. Manager of the trailer department.

c. Manager of the Indiana plant.

In each report, include the budgeted and actual costs and show the amount that each actual cost is over or under the budgeted amount.

Analysis Component

2. Did the plant manager or the operating department managers better manage costs Explain.

The office department's annual budget and its actual costs follow.

Required

1. Prepare responsibility accounting performance reports like those in Exhibit 24.2 that list costs controlled

by the following:

a. Manager of the camper department.

b. Manager of the trailer department.

c. Manager of the Indiana plant.

In each report, include the budgeted and actual costs and show the amount that each actual cost is over or under the budgeted amount.

Analysis Component

2. Did the plant manager or the operating department managers better manage costs Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

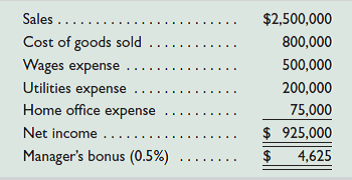

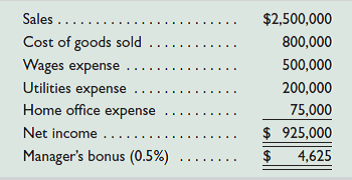

Improvement Station is a national home improvement chain with more than 100 stores throughout the country. The manager of each store receives a salary plus a bonus equal to a percent of the store's net income for the reporting period. The following net income calculation is on the Denver store manager's performance report for the recent monthly period.

In previous periods, the bonus had also been 0.5%, but the performance report had not included any charges for the home office expense, which is now assigned to each store as a percent of its sales.

Required

Assume that you are the national office manager. Write a half-page memorandum to your store managers explaining why home office expense is in the new performance report.

In previous periods, the bonus had also been 0.5%, but the performance report had not included any charges for the home office expense, which is now assigned to each store as a percent of its sales.

Required

Assume that you are the national office manager. Write a half-page memorandum to your store managers explaining why home office expense is in the new performance report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Brian Linton's company, United By Blue , sells jewelry and apparel. His company plans for continued expansion into other types of products.

Required

1. How can United By Blue use departmental income statements to assist in understanding and controlling operations

2. Are departmental income statements always the best measure of a department's performance Explain.

3. Provide examples of nonfinancial performance indicators United By Blue might use as part of a balance scorecard system of performance evaluation.

Required

1. How can United By Blue use departmental income statements to assist in understanding and controlling operations

2. Are departmental income statements always the best measure of a department's performance Explain.

3. Provide examples of nonfinancial performance indicators United By Blue might use as part of a balance scorecard system of performance evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

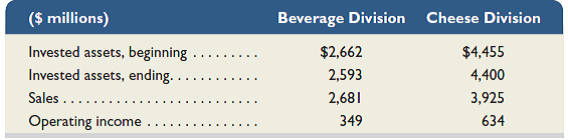

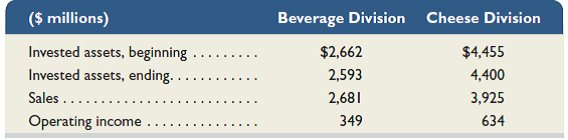

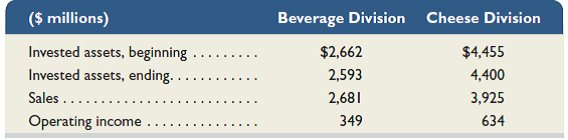

Kraft Foods Group reports the following for two of its divisions for a recent year. All numbers are in millions of dollars.

For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover for the year. Round answers to two decimal places.

For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover for the year. Round answers to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

The windshield division of Fast Car Co. makes windshields for use in Fast Car's assembly division. The windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshieldsper year. The market price is $450 per windshield. The windshield division incurs total fixed costs of $3,000,000 per year. If the windshield division is operating at full capacity, what transfer price should be used on transfers between the windshield and assembly divisions Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

Britney Brown, the plant manager of LMN Co.'s Chicago plant, is responsible for all of that plant's costs other than her own salary. The plant has two operating departments and one service department. The refrigerator and dishwasher operating departments manufacture different products and have their own managers. The office department, which Brown also manages, provides services equally to the two operating departments. A monthly budget is prepared for each operating department and the office department. The company's responsibility accounting system must assemble information to present budgeted and actual costs in performance reports for each operating department manager and the plant manager. Each performance report includes only those costs that a particular operating department manager can control: raw materials, wages, supplies used, and equipment depreciation. The plant manager is responsible for the department managers' salaries, utilities, building rent, office salaries other than her own, and other office costs plus all costs controlled by the two operating department managers. The April departmental budgets and actual costs for the two operating departments follow.

Required

1. Prepare responsibility accounting performance reports like those in Exhibit 24.2 that list costs controlled by the following:

a. Manager of the refrigerator department.

b. Manager of the dishwasher department.

c. Manager of the Chicago plant.

In each report, include the budgeted and actual costs for the month and show the amount by which each actual cost is over or under the budgeted amount.

Analysis Component

2. Did the plant manager or the operating department managers better manage costs Explain.

Required

1. Prepare responsibility accounting performance reports like those in Exhibit 24.2 that list costs controlled by the following:

a. Manager of the refrigerator department.

b. Manager of the dishwasher department.

c. Manager of the Chicago plant.

In each report, include the budgeted and actual costs for the month and show the amount by which each actual cost is over or under the budgeted amount.

Analysis Component

2. Did the plant manager or the operating department managers better manage costs Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

Controllable and uncontrollable costs must be identified with a particular________ and a definite _______period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

Is it possible to evaluate a cost center's profitability Explain.

Is it possible to evaluate a cost center's profitability Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

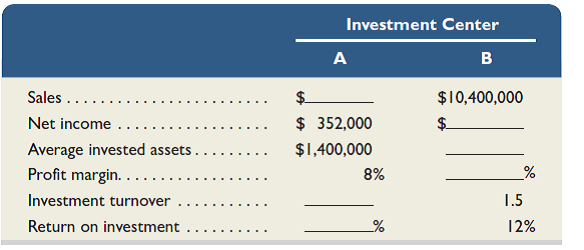

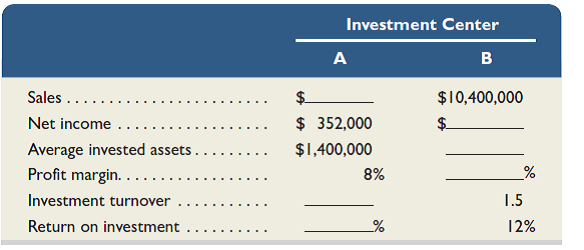

Fill in the blanks in the schedule below for two separate investment centers A and B. Round answers to the nearest whole percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

Define and describe cycle time and identify the components of cycle time.

Define and describe cycle time and identify the components of cycle time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

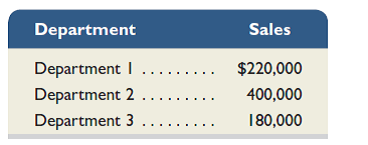

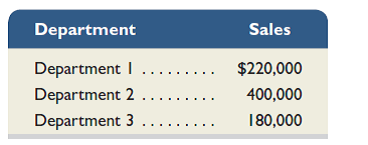

Macee Department Store has three departments, and it conducts advertising campaigns that benefit all departments. Advertising costs are $100,000 this year, and departmental sales for this year follow. How much advertising cost is allocated to each department if the allocation is based on departmental sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

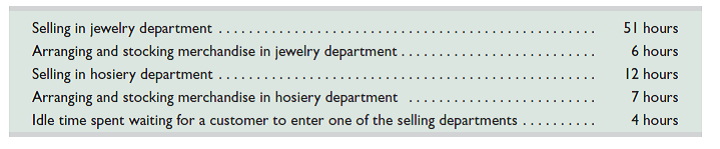

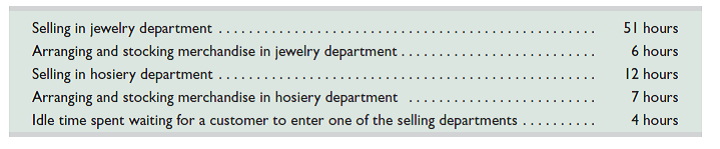

Jessica Porter works in both the jewelry department and the hosiery department of a retail store. Porter assists customers in both departments and arranges and stocks merchandise in both departments. The store allocates Porter's $30,000 annual wages between the two departments based on a sample of the time worked in the two departments. The sample is obtained from a diary of hours worked that Porter kept in a randomly chosen two-week period. The diary showed the following hours and activities spent in the two departments. Allocate Porter's annual wages between the two departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

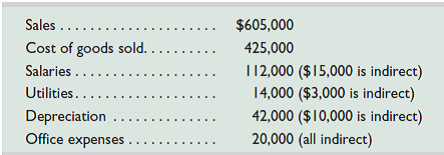

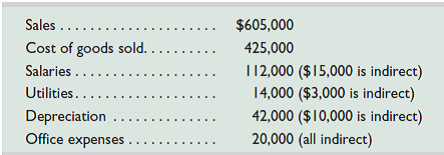

Jansen Company reports the following for its ski department for the year 2015. All of its costs are direct, except as noted.

Prepare a (1) departmental income statement for 2015 and (2) departmental contribution to overhead report for 2015. (3) Based on these two performance reports, should Jansen eliminate the ski department

Prepare a (1) departmental income statement for 2015 and (2) departmental contribution to overhead report for 2015. (3) Based on these two performance reports, should Jansen eliminate the ski department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is a transfer price Under what conditions is a market-based transfer price most likely to be used

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

Best Ink produces ink-jet printers for personal computers. It received an order for 500 printers from a customer. The following information is available for this order.

1. Compute the company's manufacturing cycle time.

2. Compute the company's manufacturing cycle efficiency. Interpret your answer.

3. Assume that Best Ink wishes to increase its manufacturing cycle efficiency to 0.80. What are some ways that it can accomplish this

1. Compute the company's manufacturing cycle time.

2. Compute the company's manufacturing cycle efficiency. Interpret your answer.

3. Assume that Best Ink wishes to increase its manufacturing cycle efficiency to 0.80. What are some ways that it can accomplish this

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

(This serial problem began in Chapter 1 and continues through most of the book. If previous chapter segments were not completed, the serial problem can begin at this point. It is helpful, but not necessary, to use the Working Papers that accompany the book.)

Santana Rey's two departments, computer consulting services and computer workstation furniture manufacturing, have each been profitable. Santana has heard of the balanced scorecard and wants you to provide details on how it could be used to measure performance of her departments.

Required

1. Explain the four performance perspectives included in a balanced scorecard.

2. For each of the four performance perspectives included in a balanced scorecard, provide examples of measures Santana could use to measure performance of her departments.

Santana Rey's two departments, computer consulting services and computer workstation furniture manufacturing, have each been profitable. Santana has heard of the balanced scorecard and wants you to provide details on how it could be used to measure performance of her departments.

Required

1. Explain the four performance perspectives included in a balanced scorecard.

2. For each of the four performance perspectives included in a balanced scorecard, provide examples of measures Santana could use to measure performance of her departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

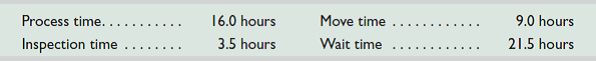

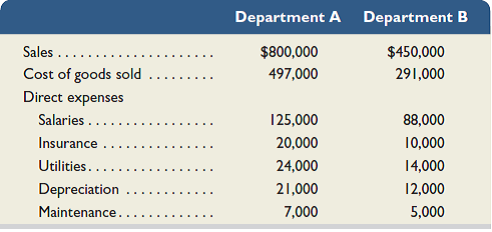

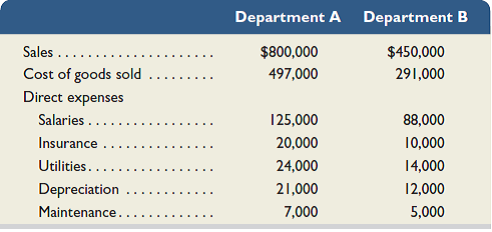

Vortex Company operates a retail store with two departments. Information about those departments follows.

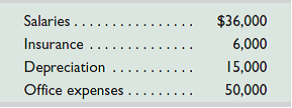

The company also incurred the following indirect costs.

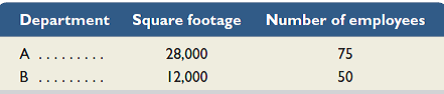

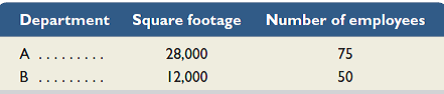

Indirect costs are allocated as follows: salaries on the basis of sales; insurance and depreciation on the basis of square footage; and office expenses on the basis of number of employees. Additional information about the departments follows.

Required

1. For each department, determine the departmental contribution to overhead and the departmental net income.

2. Should Department B be eliminated Explain.

The company also incurred the following indirect costs.

Indirect costs are allocated as follows: salaries on the basis of sales; insurance and depreciation on the basis of square footage; and office expenses on the basis of number of employees. Additional information about the departments follows.

Required

1. For each department, determine the departmental contribution to overhead and the departmental net income.

2. Should Department B be eliminated Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

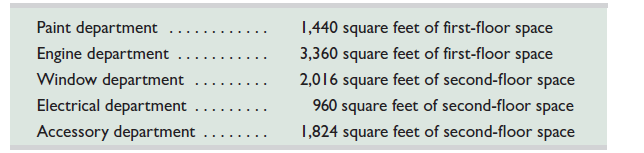

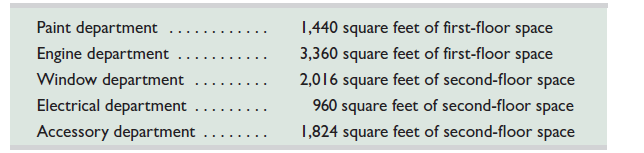

Car Mart pays $130,000 rent each year for its two-story building. The space in this building is occupied by five departments as specified here.

The company allocates 65% of total rent expense to the first floor and 35% to the second floor, and then allocates rent expense for each floor to the departments occupying that floor on the basis of space occupied. Determine the rent expense to be allocated to each department. (Round percents to the nearest onetenth and dollar amounts to the nearest whole dollar.)

The company allocates 65% of total rent expense to the first floor and 35% to the second floor, and then allocates rent expense for each floor to the departments occupying that floor on the basis of space occupied. Determine the rent expense to be allocated to each department. (Round percents to the nearest onetenth and dollar amounts to the nearest whole dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

Refer to the information in Exercise 24-11. Assume that each of the company's divisions has a required rate of return of 7%. Compute residual income for each division.

Reference: Exercise 24-11

Kraft Foods Group reports the following for two of its divisions for a recent year. All numbers are in millions of dollars.

For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover for the year. Round answers to two decimal places.

Reference: Exercise 24-11

Kraft Foods Group reports the following for two of its divisions for a recent year. All numbers are in millions of dollars.

For each division, compute (1) return on investment, (2) profit margin, and (3) investment turnover for the year. Round answers to two decimal places.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

The windshield division of Fast Car Co. makes windshields for use in Fast Car's assembly division. The windshield division incurs variable costs of $200 per windshield and has capacity to make 500,000 windshieldsper year. The market price is $450 per windshield. The windshield division incurs total fixed costs of $3,000,000 per year. If the windshield division is operating at full capacity, what transfer price should be used on transfers between the windshield and assembly divisions Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

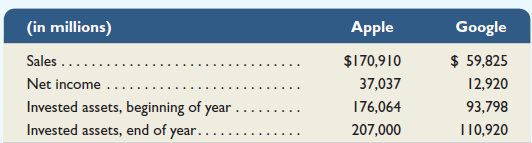

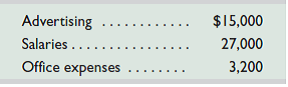

Apple and Google compete in several product categories. Sales, income, and asset information is provided for fiscal year 2013 for each company below.

Required

1. Compute profit margin for each company.

2. Compute investment turnover for each company.

Analysis Component

3. Using your answers to the questions above, compare the companies' performance for the year.

Required

1. Compute profit margin for each company.

2. Compute investment turnover for each company.

Analysis Component

3. Using your answers to the questions above, compare the companies' performance for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

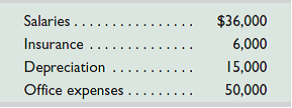

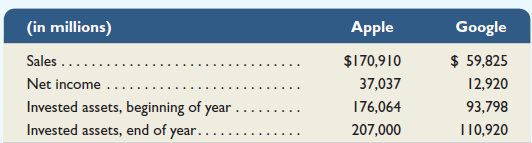

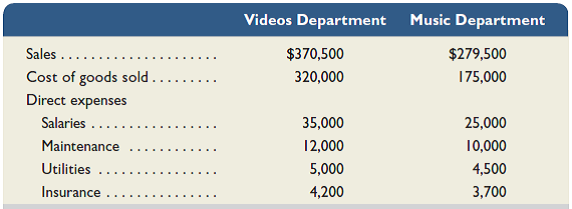

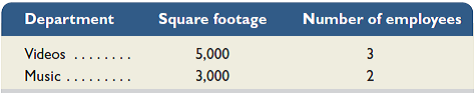

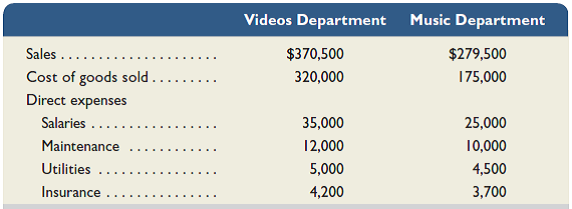

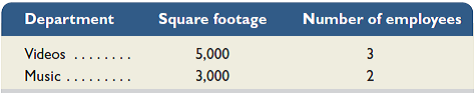

Sadar Company operates a store with two departments: videos and music. Information about those departments follows.

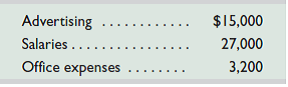

The company also incurred the following indirect costs.

Indirect costs are allocated as follows: advertising on the basis of sales; salaries on the basis of number of employees; and office expenses on the basis of square footage. Additional information about the departments follows.

Required

1. For each department, determine the departmental contribution to overhead and the departmental net income.

2. Should the video department be eliminated Explain.

The company also incurred the following indirect costs.