Deck 11: Stockholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/185

العب

ملء الشاشة (f)

Deck 11: Stockholders Equity

1

Stockholders' equity is composed of three parts: contributed capital, earnings retained in the business, and dividends paid.

False

2

Preferred stock receives first preference on voting rights.

False

3

A 15% stock dividend will increase the number of shares outstanding but the book value per share will decrease.

True

4

Stock dividends involve the issuance of additional shares of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

5

All issued stock is outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

6

A stock split is similar to a stock dividend in that it results in additional shares of stock outstanding and is nontaxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

7

When treasury stock is reissued and the cost is less than the reissue price, the difference increases additional paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

8

Stock dividends reduce the par value of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

9

Treasury stock is reported as a reduction in stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Treasury Stock account should be considered an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

11

The participating feature of stock allows stockholders to sell stock back to the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under IFRS, an item such as a convertible bond must be separated into two parts, showing one part in the Liability category and the other part in the Stockholders' Equity category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

13

When stock is issued for a noncash asset, the par value of the stock is the best indicator of the value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

14

When treasury stock is resold for an amount less than its cost, the difference between the sales price and the cost is deducted from the Additional Paid-In Capital-Treasury Stock account or the Retained Earnings account (if the Additional Paid-In Capital-Treasury Stock account does not exist).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

15

Treasury stock is stock that has been issued, but not currently outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

16

When stock is issued for cash, only the par value of the stock should be reported in the stock account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

17

The cumulative feature of stock allows the firm to eliminate a class of stock by paying the stockholders a specified amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

18

If 20,000 shares are authorized, 15,000 shares are issued, and 500 shares are held as treasury stock, a cash dividend of $1 per share would amount to $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

19

Cash dividends become a liability to a corporation on the date of record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

20

When the board of director's declares a cash or stock dividend, this action decreases Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

21

[APPENDIX] A sole proprietorship is a separate entity for legal purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

22

None of the Stockholders' Equity accounts are affected by the stock split.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the incomplete stockholders' equity section of Wilmerding Company's balance sheet as of December 31, 2016, to answer the following question. ? What is the amount of Wilmerding's retained earnings?

A) $130,000

B) $98,000

C) $860,000

D) $114,000

A) $130,000

B) $98,000

C) $860,000

D) $114,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

24

The all-inclusive income approach requires that all events and transactions that affect income should be reported on the income statement to help prevent the manipulation of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

25

[APPENDIX] A balance sheet of a sole proprietorship includes only the business assets and liabilities, not the personal assets of the owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

26

Book value is a measure of the market value of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

27

A 2-for-1 stock split increases the par value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

28

The issuance of stock is reported as a financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

29

The payment of dividends is a financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is false regarding the issue of stock versus the issue of bonds to raise capital?

A) The issuance of stock decreases several important financial ratios.

B) Issuing bonds dilutes the voting power of the stockholders.

C) Corporations are not required to return the investment to the stockholders.

D) Investors expect to earn a higher rate of return on stocks than bonds.

A) The issuance of stock decreases several important financial ratios.

B) Issuing bonds dilutes the voting power of the stockholders.

C) Corporations are not required to return the investment to the stockholders.

D) Investors expect to earn a higher rate of return on stocks than bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

31

[APPENDIX] A partnership can be owned by one or more entities or individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

32

An accounting transaction is not recorded when a corporation declares and executes a stock split.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

33

Book value indicates the rights that stockholders have, based on recorded values, to the net assets in the event of liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

34

The statement of stockholders' equity is useful in evaluating a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

35

Stock dividends affect the par value per share of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

36

The FASB has allowed certain items to be reported directly to stockholders' equity in an effort to mitigate the possibility of income fluctuating widely from period to period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is false regarding the issue of stock versus the issue of bonds to raise capital?

A) The payment of dividends is at the discretion of the board of directors.

B) The payment of interest on bonds payable is required by law.

C) Interest accrues, whereas dividends do not accrue.

D) The declaration of dividends reduces the amount of income taxes the corporation must pay.

A) The payment of dividends is at the discretion of the board of directors.

B) The payment of interest on bonds payable is required by law.

C) Interest accrues, whereas dividends do not accrue.

D) The declaration of dividends reduces the amount of income taxes the corporation must pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

38

All changes in all stockholders' equity accounts must be shown in the Stockholders' Equity section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company may prepare a statement of retained earnings instead of a statement of stockholders' equity if the only changes in the stockholders' equity accounts that occurred during the year are earnings and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

40

Comprehensive income is the increase in net assets resulting from all transactions occurring during an accounting period except stockholders' investments and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

41

Mendes Charters reported the following information at December 31, 2016: Preferred stock, par, 500 shares authorized, and outstanding;

Mendes' total contributed capital is

A) $650,000

B) $675,000

C) $1,500,000

D) $625,000

Mendes' total contributed capital is

A) $650,000

B) $675,000

C) $1,500,000

D) $625,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Stockholders' Equity section of the balance sheet of Sea Turtle Company reveals the following information: ? There have been two issues of stock since the corporation began business.The average issue price per share of stock was

A) $3.00.

B) $17.00.

C) $20.00.

D) Not enough information to determine.

A) $3.00.

B) $17.00.

C) $20.00.

D) Not enough information to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

43

Authorized stock represents the

A) maximum number of shares that can be issued.

B) number of shares that have been sold.

C) number of shares that are currently held by stockholders.

D) number of shares that have been repurchased by the corporation.

A) maximum number of shares that can be issued.

B) number of shares that have been sold.

C) number of shares that are currently held by stockholders.

D) number of shares that have been repurchased by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

44

Zelienople Co.reported the following information at December 31, 2016: The number of shares of common stock issued is

A) 5,000.

B) 200,000.

C) 500,000.

D) 550,000.

A) 5,000.

B) 200,000.

C) 500,000.

D) 550,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

45

Venture Enterprises' accountant determined the following: Where would this item be reported on Venture's financial statements?

A) In the Stockholders' Equity section of the balance sheet

B) In the Treasury Stock section of the balance sheet

C) On the statement of retained earnings

D) On both the balance sheet and statement of retained earnings

A) In the Stockholders' Equity section of the balance sheet

B) In the Treasury Stock section of the balance sheet

C) On the statement of retained earnings

D) On both the balance sheet and statement of retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

46

Anole Company

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

The number of Anole's unissued shares of common stock at December 31, 2016, is

A) 6,000.

B) 8,000.

C) 10,000.

D) 12,000.

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

The number of Anole's unissued shares of common stock at December 31, 2016, is

A) 6,000.

B) 8,000.

C) 10,000.

D) 12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

47

Anole Company

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

The amount of Anole's total contributed capital at December 31, 2016, is

A) $60,000.

B) $120,000.

C) $180,000.

D) $555,000.

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

The amount of Anole's total contributed capital at December 31, 2016, is

A) $60,000.

B) $120,000.

C) $180,000.

D) $555,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

48

Stockholders prefer to invest in preferred stock because

A) preferred stock confers preferred voting rights.

B) preferred stock can always be converted to common stock if they desire.

C) the dividends are generally increased each year.

D) the dividends are paid on preferred stock before they are paid on common stock.

A) preferred stock confers preferred voting rights.

B) preferred stock can always be converted to common stock if they desire.

C) the dividends are generally increased each year.

D) the dividends are paid on preferred stock before they are paid on common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

49

With regard to a corporation's stock, par value is

A) the current market price of the stock.

B) an arbitrary amount that exists to fulfill legal requirements.

C) the amount at which the stock has been repurchased.

D) the amount at which treasury stock can be sold.

A) the current market price of the stock.

B) an arbitrary amount that exists to fulfill legal requirements.

C) the amount at which the stock has been repurchased.

D) the amount at which treasury stock can be sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 1, 2016, Bogart Acres Company issued 10,000 shares of 10%, $20 par value cumulative preferred stock.In 2016 and 2017, no dividends were declared on preferred stock.In 2018, Bogart had a profitable year and decided to pay dividends to stockholders of both preferred and common stock.If it has $200,000 available for dividends in 2018, how much could it pay to the common stockholders?

A) $140,000

B) $160,000

C) $180,000

D) $200,000

A) $140,000

B) $160,000

C) $180,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is an account in stockholders' equity?

A) Dividends Payable

B) Loss on Sale of Equipment

C) Retained Earnings

D) Net income

A) Dividends Payable

B) Loss on Sale of Equipment

C) Retained Earnings

D) Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

52

Anole Company

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

Anole's total stockholders' equity reported on the balance sheet at December 31, 2016, is

A) $60,000.

B) $120,000.

C) $180,000.

D) $555,000.

Anole Company was incorporated as a new business on January 1, 2016.The company is authorized to issue 20,000 shares of $5 par value common stock and 10,000 shares of 6%, $10 par value, cumulative, participating preferred stock.On January 1, 2016, the company issued 8,000 shares of common stock for $15 per share and 2,000 shares of preferred stock for $30 per share.Net income for the year ended December 31, 2016, was $375,000.

Refer to the information about Anole Company.

Anole's total stockholders' equity reported on the balance sheet at December 31, 2016, is

A) $60,000.

B) $120,000.

C) $180,000.

D) $555,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is true with regard to contributed capital?

A) Preferred stock is stock that has been retired.

B) It is very unlikely corporations may have more than one class of stock outstanding.

C) The outstanding number of shares is the maximum number of shares that can be issued by a corporation.

D) The shares that are in the hands of the stockholders are said to be outstanding.

A) Preferred stock is stock that has been retired.

B) It is very unlikely corporations may have more than one class of stock outstanding.

C) The outstanding number of shares is the maximum number of shares that can be issued by a corporation.

D) The shares that are in the hands of the stockholders are said to be outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

54

With regard to preferred stock,

A) its issuance provides no flexibility to the issuing company because its terms always require mandatory dividend payments.

B) no dividends are expected by the stockholders.

C) its stockholders may have the right to participate, along with common stockholders, if an extra dividend is declared.

D) there is a legal requirement for a corporation to declare a dividend on preferred stock.

A) its issuance provides no flexibility to the issuing company because its terms always require mandatory dividend payments.

B) no dividends are expected by the stockholders.

C) its stockholders may have the right to participate, along with common stockholders, if an extra dividend is declared.

D) there is a legal requirement for a corporation to declare a dividend on preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the incomplete stockholders' equity section of Box Company's balance sheet as of December 31, 2016, to answer the following question. ? How many shares of common stock are outstanding?

A) 100,000

B) 98,000

C) 78,000

D) 68,000

A) 100,000

B) 98,000

C) 78,000

D) 68,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

56

Walton Corporation shows the following in the stockholders' equity section of its balance sheet: The stated value of its common stock is $0.50 and the total balance in the common stock account is $37,500.Also noted is that 5,000 shares are currently designated as treasury stock.The number of shares outstanding is

A) 80,000.

B) 75,000.

C) 72,500.

D) 70,000.

A) 80,000.

B) 75,000.

C) 72,500.

D) 70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

57

If Idaho Company has paid out more in dividends than it has had in net income, over the lifetime of the company, then the balances in the Stockholders' Equity should show:

A) a credit balance in the common stock account.

B) a credit balance in the Retained Earnings account.

C) a debit balance in the Common Stock account.

D) a debit balance in the Retained Earnings account.

A) a credit balance in the common stock account.

B) a credit balance in the Retained Earnings account.

C) a debit balance in the Common Stock account.

D) a debit balance in the Retained Earnings account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Retained Earnings account balance for a large corporation is $10,000,000.This amount represents

A) earnings that have not been distributed to shareholders.

B) cash in the bank.

C) the amount of cash available for dividends.

D) revenues for all past years of operations.

A) earnings that have not been distributed to shareholders.

B) cash in the bank.

C) the amount of cash available for dividends.

D) revenues for all past years of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

59

Winslow Corporation reported the following in the stockholders' equity section of its balance sheet at December 31, 2016: How many shares of stock are issued?

A) 9,000

B) 10,000

C) 10,100

D) Not enough information to determine.

A) 9,000

B) 10,000

C) 10,100

D) Not enough information to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

60

Dali Company has 15,000 shares of stock authorized at January 1.Dali issues 4,500 shares to the stockholders during the year and then the company repurchases 1,500 shares as treasury stock.Based on this information, how many shares are outstanding at December 31?

A) 15,000

B) 18,000

C) 4,500

D) 3,000

A) 15,000

B) 18,000

C) 4,500

D) 3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

61

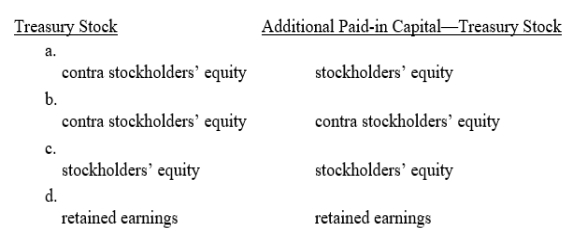

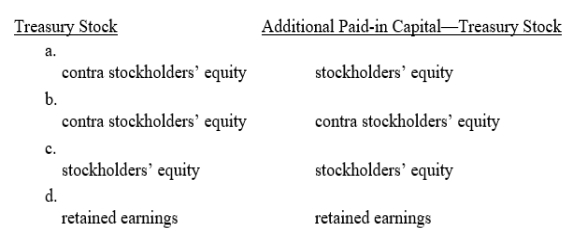

Which of the following combinations appropriately reflects the type of accounts represented by the Treasury Stock account and Additional Paid-in Capital-Treasury Stock account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

62

Ari's Cafe began operations on March 1, 2016.The corporate charter authorized the issuance of 3,000 shares of $2 par value common stock and 1,000 shares of $3 par value, 8% cumulative preferred stock.The company's fiscal year ends on February 28.Ari's sold 500 shares of common stock at $6 per share on April 1.What impact does the entry to record the April 1 transaction have on total stockholders' equity?

A) No effect

B) Increase by $1,000

C) Increase by $3,000

D) Increase by $6,000

A) No effect

B) Increase by $1,000

C) Increase by $3,000

D) Increase by $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company would repurchase its own stock for all of the following reasons except

A) it needs the stock for employee bonuses.

B) it wishes to make an investment in its own stock.

C) it wishes to prevent unwanted takeover attempts.

D) it wishes to improve the company's financial ratios.

A) it needs the stock for employee bonuses.

B) it wishes to make an investment in its own stock.

C) it wishes to prevent unwanted takeover attempts.

D) it wishes to improve the company's financial ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

64

Portland Sound Cafe began business on January 1, 2016.The corporate charter authorized issuance of 1,000 shares of no-par value common stock, of which 200 shares were issued, and 4,000 shares of $8 par value, 6% cumulative preferred stock, of which none were issued.Portland Sound sold 400 shares of common stock at $8 per share on May 1.The entry to record the issuance of the shares on May 1 will:

A) Increase Cash, $1,000; Increase Additional Paid-in Capital-Common, $320; Increase Common Stock, $680

B) Increase Cash, $3,200; Increase Additional Paid-in Capital-Common, $2,800; Increase Common Stock, $400

C) Increase Cash, $4,800; Increase Common Stock, $4,800

D) Increase Cash, $3,200; Increase Common Stock, $3,200

A) Increase Cash, $1,000; Increase Additional Paid-in Capital-Common, $320; Increase Common Stock, $680

B) Increase Cash, $3,200; Increase Additional Paid-in Capital-Common, $2,800; Increase Common Stock, $400

C) Increase Cash, $4,800; Increase Common Stock, $4,800

D) Increase Cash, $3,200; Increase Common Stock, $3,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

65

If a company issues $5 par value common stock,

A) $5 per share is presented in the common stock account on the balance sheet.

B) the minimum selling price is $5.

C) the shareholders will receive $5 in dividends.

D) liabilities are increased as a result of the transaction.

A) $5 per share is presented in the common stock account on the balance sheet.

B) the minimum selling price is $5.

C) the shareholders will receive $5 in dividends.

D) liabilities are increased as a result of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

66

Perry Corporation issues 20,000 shares of $0.50 par common stock for $6 per share; the Additional Paid-in Capital-Common account will increase by

A) $110,000

B) $10,000

C) $120,000.

D) $130,000.

A) $110,000

B) $10,000

C) $120,000.

D) $130,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

67

The stockholders' equity section of Twilight Time's balance sheet on January 1, 2016, appeared as follows: On March 1, 2016, Twilight reacquired 800 shares of common stock at $10 per share.Twilight sold 400 of the treasury shares on November 15 for $12 per share.The entry to record the sale on November 15 would show:

A) an increase in Gain on Sale of Treasury Stock, $800

B) an increase in Common Stock, $4,800

C) a decrease in Cash, $4,800

D) a decrease in Treasury Stock, $4,000

A) an increase in Gain on Sale of Treasury Stock, $800

B) an increase in Common Stock, $4,800

C) a decrease in Cash, $4,800

D) a decrease in Treasury Stock, $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

68

Poole Company began business on January 1, 2016.The corporate charter authorized issuance of 5,000 shares of $1 par value common stock, and 4,000 shares of $8 par value, 6% cumulative preferred stock.None of the preferred shares were issued.On July 1, Poole issued 1,000 shares of common stock in exchange for two years rent on a retail location.The cash rental price is $2,400 per month and the rental period begins on July 1.The correct entry to record the July 1 transaction will

A) Increase Cash, $57,600; Decrease Prepaid Rent, $57,600

B) Increase Prepaid Rent, $57,600; Increase Common Stock, $57,600

C) Increase Prepaid Rent, $57,600; Increase Common Stock, $1,000; Increase Additional Paid-in Capital-Common, $56,600

D) Increase Prepaid Rent, $57,600; Increase Common Stock, $5,000; Increase Additional Paid-in Capital-Common, $52,600

A) Increase Cash, $57,600; Decrease Prepaid Rent, $57,600

B) Increase Prepaid Rent, $57,600; Increase Common Stock, $57,600

C) Increase Prepaid Rent, $57,600; Increase Common Stock, $1,000; Increase Additional Paid-in Capital-Common, $56,600

D) Increase Prepaid Rent, $57,600; Increase Common Stock, $5,000; Increase Additional Paid-in Capital-Common, $52,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company issued 4,000 shares of $5 par common stock for $30 per share.The company purchased 1,200 shares as treasury stock at $32 per share.Later, the company reissued 400 shares of the treasury stock at $34 per share.Which of the following is true?

A) The Treasury Stock account should have a balance of $25,600.

B) The company has a gain of $800 that should appear on the income statement.

C) The Treasury Stock account should have a balance of $24,800.

D) The company has a gain of $1,600 that should appear on the income statement.

A) The Treasury Stock account should have a balance of $25,600.

B) The company has a gain of $800 that should appear on the income statement.

C) The Treasury Stock account should have a balance of $24,800.

D) The company has a gain of $1,600 that should appear on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

70

Museum Corporation acquired a new manufacturing building by issuing 10,000 shares of its $50 par value preferred stock with a $75 per share market price.Similar buildings have recently cost $780,000.What are the effects of this transaction on the accounting equation for Museum?

A) Building and Preferred Stock increase $780,000.

B) Building and Preferred Stock increase $500,000.

C) Building increases $780,000; Preferred Stock increases $500,000; Additional Paid-in Capital-Preferred increases $280,000.

D) Building increases $750,000; Preferred Stock increases $500,000; Additional Paid-in Capital-Preferred increases $250,000.

A) Building and Preferred Stock increase $780,000.

B) Building and Preferred Stock increase $500,000.

C) Building increases $780,000; Preferred Stock increases $500,000; Additional Paid-in Capital-Preferred increases $280,000.

D) Building increases $750,000; Preferred Stock increases $500,000; Additional Paid-in Capital-Preferred increases $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

71

Valor Company issued 5,000 shares of $1 par common stock for $30 per share, providing the company with $150,000 in cash.What effect, in addition to the increase in cash, does this transaction have on the accounting equation for Valor?

A) Common Stock increases $150,000.

B) Common Stock increases $5,000; Additional Paid-in Capital-Common increases $145,000.

C) Common Stock increases $5,000; Retained Earnings increases $145,000.

D) Common Stock increases $5,000; Gain on Sale of Common Stock increases $145,000.

A) Common Stock increases $150,000.

B) Common Stock increases $5,000; Additional Paid-in Capital-Common increases $145,000.

C) Common Stock increases $5,000; Retained Earnings increases $145,000.

D) Common Stock increases $5,000; Gain on Sale of Common Stock increases $145,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company purchased machinery by issuing 2,000 shares of $3 par value common stock.Since the company is new, there is no established market price for its stock.How would the company record the transaction?

A) In terms of the par value of the stock issued.

B) At the fair market value of the machine.

C) At the cost recorded by the previous owner of the machine.

D) Recording the transaction would be postponed until a market price for the stock could be determined.

A) In terms of the par value of the stock issued.

B) At the fair market value of the machine.

C) At the cost recorded by the previous owner of the machine.

D) Recording the transaction would be postponed until a market price for the stock could be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

73

Vegan Company reported the following: Common stock, $5 par, 200,000 shares authorized, 50,000 shares issued and outstanding

What is the effect of issuing 2,000 shares of common stock in exchange for land with valued by a realtor at $36,000 if the common stock sells for $12 per share and is regularly traded?

A) The Land account increases by $24,000.

B) Retained Earnings decreases by $10,000.

C) Common Stock increases by $36,000.

D) Additional Paid-in Capital - Common increases by $24,000.

What is the effect of issuing 2,000 shares of common stock in exchange for land with valued by a realtor at $36,000 if the common stock sells for $12 per share and is regularly traded?

A) The Land account increases by $24,000.

B) Retained Earnings decreases by $10,000.

C) Common Stock increases by $36,000.

D) Additional Paid-in Capital - Common increases by $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

74

Fairchild Company acquired a building valued at $210,000 for property tax purposes in exchange for 6,000 shares of its $10 par common stock.The stock is widely traded and selling for $31 per share.At what amount should the building be recorded by Fairchild Company?

A) $210,000

B) $60,000

C) $186,000

D) $150,000

A) $210,000

B) $60,000

C) $186,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

75

How is treasury stock shown on the balance sheet?

A) treasury stock is not shown on the balance sheet

B) an increase in stockholders' equity

C) a decrease in stockholders' equity

D) an asset

A) treasury stock is not shown on the balance sheet

B) an increase in stockholders' equity

C) a decrease in stockholders' equity

D) an asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

76

All of the following are reasons for a company to repurchase its previously issued stock, except:

A) to support the market price of the stock

B) to resell to employees

C) to increase the shares outstanding

D) for bonuses to employees

A) to support the market price of the stock

B) to resell to employees

C) to increase the shares outstanding

D) for bonuses to employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

77

Abilene Western Shop began business on January 1, 2016.The corporate charter authorized issuance of 10,000 shares of $2 par value common stock and 4,000 shares of $8 par value, 6% cumulative preferred stock.Abilene issued 2,400 shares of common stock for cash at $20 per share on January 2, 2016.What effect does the entry to record the issuance of stock have on total stockholders' equity?

A) Increase of $4,800

B) Decrease of $4,800

C) Increase of $48,000

D) Decrease of $48,000

A) Increase of $4,800

B) Decrease of $4,800

C) Increase of $48,000

D) Decrease of $48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

78

A new company issues 2,000 shares of $5 par common stock in exchange for the services of a lawyer during its first month of business.The lawyer's normal fee is $15,000 for similar work.Which of the following would be recorded if the stock is not currently trading?

A) A debit to Common Stock for $10,000

B) A credit to Common Stock for $15,000

C) A debit to Additional Paid-In Capital-Common Stock of $5,000

D) A credit to Additional Paid-In Capital-Common Stock of $5,000

A) A debit to Common Stock for $10,000

B) A credit to Common Stock for $15,000

C) A debit to Additional Paid-In Capital-Common Stock of $5,000

D) A credit to Additional Paid-In Capital-Common Stock of $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

79

Vegas Finance Company reported the following: Common stock, $10 par, 100,000 shares authorized, 80,000 shares issued and outstanding

What is the effect of issuing 1,000 shares of common stock at $15 per share?

A) Cash increases $10,000.

B) Common Stock increases $15,000.

C) Additional Paid-in Capital increases $5,000.

D) Retained Earnings increases $5,000.

What is the effect of issuing 1,000 shares of common stock at $15 per share?

A) Cash increases $10,000.

B) Common Stock increases $15,000.

C) Additional Paid-in Capital increases $5,000.

D) Retained Earnings increases $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck

80

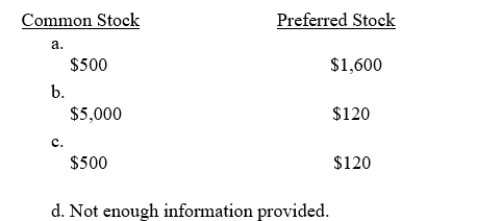

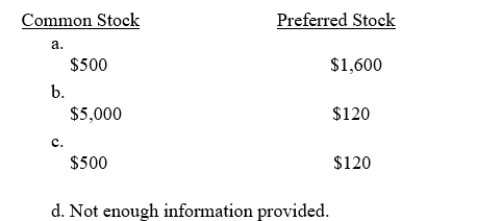

Montana City Company began business on January 1, 2016.The corporate charter authorized issuance of 500 shares of $1 par value common stock and 400 shares of $4 par value, 3% cumulative preferred stock.What is the maximum amount that can be reported on the balance sheet for Common Stock and Preferred Stock, respectively, if all of the stock is issued?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 185 في هذه المجموعة.

فتح الحزمة

k this deck