Deck 6: Inventories

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/176

العب

ملء الشاشة (f)

Deck 6: Inventories

1

Raw materials inventories are the goods that a manufacturer has completed and are ready to be sold to customers.

False

2

Under the lower-of-cost-or-net realizable value basis, net realizable value is the net amount that a company expects to receive from the sale of inventory.

True

3

Inventory is

A)reported under the classification of Property, Plant, and Equipment on the balance sheet.

B)often reported as a miscellaneous expense on the income statement.

C)reported as a current asset on the balance sheet.

D)generally valued at the price for which the goods can be sold.

A)reported under the classification of Property, Plant, and Equipment on the balance sheet.

B)often reported as a miscellaneous expense on the income statement.

C)reported as a current asset on the balance sheet.

D)generally valued at the price for which the goods can be sold.

reported as a current asset on the balance sheet.

4

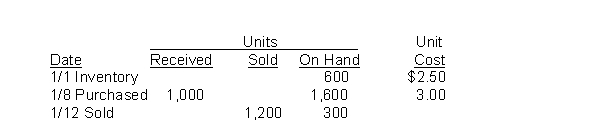

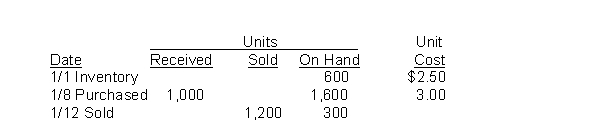

Nick's Place recorded the following data:  The weighted-average unit cost of the inventory at January 31 is:

The weighted-average unit cost of the inventory at January 31 is:

A)$2.50.

B)$2.75.

C)$2.81.

D)$3.400.

The weighted-average unit cost of the inventory at January 31 is:

The weighted-average unit cost of the inventory at January 31 is:A)$2.50.

B)$2.75.

C)$2.81.

D)$3.400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

5

The selection of an appropriate inventory cost flow assumption for an individual company is made by

A)the external auditors.

B)the SEC.

C)the internal auditors.

D)management.

A)the external auditors.

B)the SEC.

C)the internal auditors.

D)management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

6

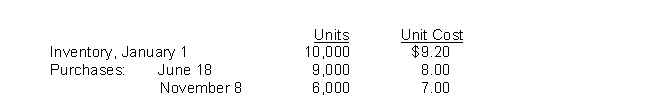

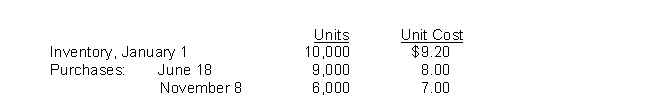

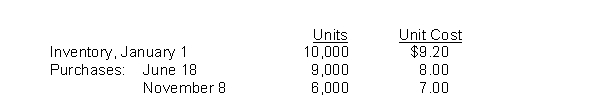

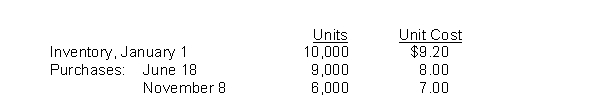

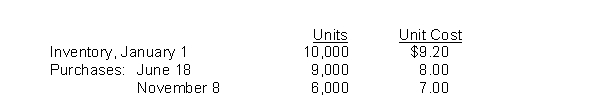

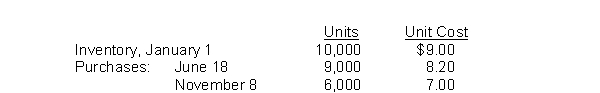

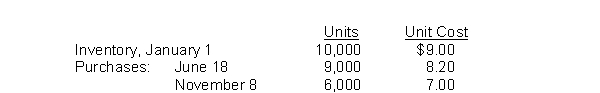

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.Under the LIFO method, cost of goods sold is

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.Under the LIFO method, cost of goods sold is

A)$28,000.

B)$169,200.

C)$173,040.

D)$178,000.

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.Under the LIFO method, cost of goods sold is

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.Under the LIFO method, cost of goods sold isA)$28,000.

B)$169,200.

C)$173,040.

D)$178,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

7

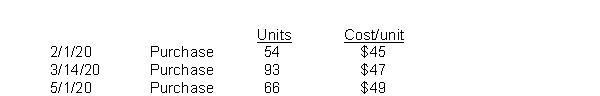

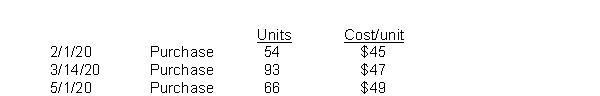

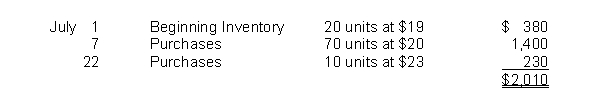

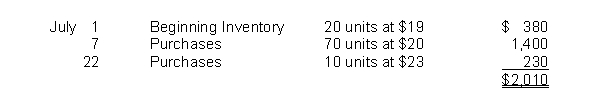

Romanoff Industries had the following inventory transactions occur during 2022:  The company sold 150 units at $70 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income (rounded to whole dollars) using FIFO?

The company sold 150 units at $70 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income (rounded to whole dollars) using FIFO?

A)$2,322

B)$2,486

C)$3,318

D)$3,552

The company sold 150 units at $70 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income (rounded to whole dollars) using FIFO?

The company sold 150 units at $70 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's after-tax income (rounded to whole dollars) using FIFO?A)$2,322

B)$2,486

C)$3,318

D)$3,552

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which costing method cannot be used to determine the cost of inventory items before lower-of-cost-or-net realizable value is applied?

A)Specific identification

B)FIFO

C)LIFO

D)All of these methods can be used.

A)Specific identification

B)FIFO

C)LIFO

D)All of these methods can be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

9

The following information is available for Everett Company at December 31, 2022: beginning inventory $80,000; ending inventory $120,000; cost of goods sold $1,050,000; and sales $1,800,000.Everett's inventory turnover in 2022 is

A)8.7 times.

B)10.5 times.

C)13.2 times.

D)18 times.

A)8.7 times.

B)10.5 times.

C)13.2 times.

D)18 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

10

Turturro Department Store utilizes the retail inventory method to estimate its inventories.It calculated its cost to retail ratio during the period at 75%.Goods available for sale at retail amounted to $600,000 and goods were sold during the period for $420,000.The estimated cost of the ending inventory is

A)$135,000.

B)$180,000.

C)$315,000.

D)$450,000.

A)$135,000.

B)$180,000.

C)$315,000.

D)$450,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under IFRS, companies can choose which inventory systems?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

12

Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

13

Accountants believe that the write down from cost to net realizable value should not be made in the period in which the price decline occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

14

Items waiting to be used in production are considered to be

A)raw materials.

B)work in progress.

C)finished goods.

D)merchandise inventory.

A)raw materials.

B)work in progress.

C)finished goods.

D)merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

15

Inventoriable costs include all of the following except the

A)freight costs incurred when buying inventory.

B)costs of the purchasing and warehousing departments.

C)cost of the beginning inventory.

D)cost of goods purchased.

A)freight costs incurred when buying inventory.

B)costs of the purchasing and warehousing departments.

C)cost of the beginning inventory.

D)cost of goods purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following inventory methods is often impractical to use?

A)Specific identification

B)LIFO

C)FIFO

D)Average cost

A)Specific identification

B)LIFO

C)FIFO

D)Average cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

17

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit is

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit is

A)$8.00.

B)$8.01.

C)$8.24.

D)$9.30.

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit is

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.The weighted-average cost per unit isA)$8.00.

B)$8.01.

C)$8.24.

D)$9.30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

18

Companies adopt different cost flow methods for each of the following reasons except

A)balance sheet effects.

B)cost effects.

C)income statements effects.

D)tax effects.

A)balance sheet effects.

B)cost effects.

C)income statements effects.

D)tax effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

19

Inventory is reported in the financial statements at

A)cost.

B)market.

C)the higher-of-cost-or-net realizable value.

D)the lower-of-cost-or-net realizable value.

A)cost.

B)market.

C)the higher-of-cost-or-net realizable value.

D)the lower-of-cost-or-net realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following information was available for Pete Company at December 31, 2022: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $984,000; and sales $1,350,000.Pete's inventory turnover in 2022 was

A)10.9 times.

B)12.3 times.

C)14.1 times.

D)16.9 times.

A)10.9 times.

B)12.3 times.

C)14.1 times.

D)16.9 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

21

TB Nelson Company prepares monthly financial statements and uses the gross profit method to estimate ending inventories.Historically, the company has had a 40% gross profit rate.During June, net sales amounted to $180,000; the beginning inventory on June 1 was $54,000; and the cost of goods purchased during June amounted to $90,000.The estimated cost of TB Nelson Company's inventory on June 30 is

A)$21,600.

B)$36,000.

C)$72,000.

D)$126,000.

A)$21,600.

B)$36,000.

C)$72,000.

D)$126,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

22

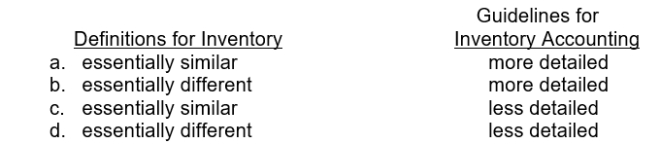

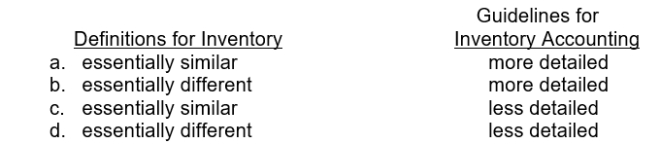

GAAP's definition for inventory and provision of guidelines for inventory accounting, as compared to IFRS, are: Guidelines for

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

23

Goods out on consignment should be included in the inventory of the consignor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

24

Inventory turnover is calculated as cost of goods sold divided by ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a manufacturing business, inventory that is ready for sale is called

A)raw materials inventory.

B)work in process inventory.

C)finished goods inventory.

D)store supplies inventory.

A)raw materials inventory.

B)work in process inventory.

C)finished goods inventory.

D)store supplies inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

26

Beginning inventory plus the cost of goods purchased equals

A)cost of goods sold.

B)cost of goods available for sale.

C)net purchases.

D)total goods purchased.

A)cost of goods sold.

B)cost of goods available for sale.

C)net purchases.

D)total goods purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not a common cost flow assumption used in costing inventory?

A)First-in, first-out

B)Middle-in, first-out

C)Last-in, first-out

D)Average cost

A)First-in, first-out

B)Middle-in, first-out

C)Last-in, first-out

D)Average cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

28

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.If the company uses FIFO, what is the gross profit for the period?

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.If the company uses FIFO, what is the gross profit for the period?

A)$95,000

B)$99,266

C)$99,960

D)$103,800

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.If the company uses FIFO, what is the gross profit for the period?

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.If the company uses FIFO, what is the gross profit for the period?A)$95,000

B)$99,266

C)$99,960

D)$103,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

29

In periods of rising prices, the inventory method which results in the inventory value on the balance sheet that is closest to current cost is the

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)tax method.

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)tax method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

30

The lower-of-cost-or-net realizable value basis of valuing inventories is an example of

A)comparability.

B)the historical cost principle.

C)conservatism.

D)consistency.

A)comparability.

B)the historical cost principle.

C)conservatism.

D)consistency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following information was available for Pete Company at December 31, 2022: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $984,000; and sales $1,350,000.Pete's days in inventory in 2022 was

A)21.6 days.

B)25.9 days.

C)29.7 days.

D)33.5 days.

A)21.6 days.

B)25.9 days.

C)29.7 days.

D)33.5 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

32

Goods in transit should be included in the inventory of the buyer when the

A)public carrier accepts the goods from the seller.

B)goods reach the buyer.

C)terms of sale are FOB destination.

D)terms of sale are FOB shipping point.

A)public carrier accepts the goods from the seller.

B)goods reach the buyer.

C)terms of sale are FOB destination.

D)terms of sale are FOB shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

33

Inventories are defined by IFRS as items which are

A)held-for-sale in the ordinary course of business.

B)in the process of production for sale in the ordinary course of business.

C)in the form of materials or supplies to be consumed in the production process or in the providing of services.

D)All of these answers are correct.

A)held-for-sale in the ordinary course of business.

B)in the process of production for sale in the ordinary course of business.

C)in the form of materials or supplies to be consumed in the production process or in the providing of services.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

34

The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a company uses the FIFO cost flow assumption, the cost of goods sold for the period will be the same under a perpetual or periodic inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

36

The factor which determines whether or not goods should be included in a physical count of inventory is

A)physical possession.

B)legal title.

C)management's judgment.

D)whether or not the purchase price has been paid.

A)physical possession.

B)legal title.

C)management's judgment.

D)whether or not the purchase price has been paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cost of goods sold is computed from the following equation:

A)beginning inventory - cost of goods purchased + ending inventory.

B)sales - cost of goods purchased + beginning inventory - ending inventory.

C)sales + gross profit - ending inventory + beginning inventory.

D)beginning inventory + cost of goods purchased - ending inventory.

A)beginning inventory - cost of goods purchased + ending inventory.

B)sales - cost of goods purchased + beginning inventory - ending inventory.

C)sales + gross profit - ending inventory + beginning inventory.

D)beginning inventory + cost of goods purchased - ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

38

The accounting principle that requires that the cost flow assumption be consistent with the physical movement of goods is

A)called the expense recognition principle.

B)called the consistency principle.

C)nonexistent; that is, there is no accounting requirement.

D)called the physical flow assumption.

A)called the expense recognition principle.

B)called the consistency principle.

C)nonexistent; that is, there is no accounting requirement.

D)called the physical flow assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

39

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the difference in taxes if LIFO rather than FIFO is used?

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the difference in taxes if LIFO rather than FIFO is used?

A)$1,760 additional taxes

B)$992 additional taxes

C)$786 additional taxes

D)$992 tax savings

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the difference in taxes if LIFO rather than FIFO is used?

A physical inventory on December 31 shows 4,000 units on hand.Eneri sells the units for $13 each.The company has an effective tax rate of 20%.Eneri uses the periodic inventory method.What is the difference in taxes if LIFO rather than FIFO is used?A)$1,760 additional taxes

B)$992 additional taxes

C)$786 additional taxes

D)$992 tax savings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

40

Two companies report the same cost of goods available for sale but each employs a different inventory costing method.If the price of goods has increased during the period, then the company using

A)LIFO will have the highest ending inventory.

B)FIFO will have the highest cost of good sold.

C)FIFO will have the highest ending inventory.

D)LIFO will have the lowest cost of goods sold.

A)LIFO will have the highest ending inventory.

B)FIFO will have the highest cost of good sold.

C)FIFO will have the highest ending inventory.

D)LIFO will have the lowest cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the lower-of-cost-or-net realizable value basis in valuing inventory, net realizable value is the

A)net amount a company expects to receive from the sale of inventory.

B)selling price.

C)historical cost plus 10%.

D)selling price less markup.

A)net amount a company expects to receive from the sale of inventory.

B)selling price.

C)historical cost plus 10%.

D)selling price less markup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

42

Delmar Company had beginning inventory of $90,000, ending inventory of $110,000, cost of goods sold of $600,000, and sales of $960,000.Delmar's days in inventory is:

A)38.0 days.

B)54.3 days.

C)60.8 days.

D)67.5 days.

A)38.0 days.

B)54.3 days.

C)60.8 days.

D)67.5 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

43

Inventory items on an assembly line in various stages of production are classified as

A)Finished goods.

B)Work in process.

C)Raw materials.

D)Merchandise inventory.

A)Finished goods.

B)Work in process.

C)Raw materials.

D)Merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

44

The only acceptable cost flow assumptions under IFRS are

A)FIFO and LIFO.

B)FIFO and average.

C)LIFO and average.

D)FIFO, LIFO and average.

A)FIFO and LIFO.

B)FIFO and average.

C)LIFO and average.

D)FIFO, LIFO and average.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

45

Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

46

In applying the LIFO assumption in a perpetual inventory system, the cost of the units most recently purchased prior to sale is allocated first to the units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

47

If goods in transit are shipped FOB destination

A)the seller has legal title to the goods until they are delivered.

B)the buyer has legal title to the goods until they are delivered.

C)the transportation company has legal title to the goods while the goods are in transit.

D)no one has legal title to the goods until they are delivered.

A)the seller has legal title to the goods until they are delivered.

B)the buyer has legal title to the goods until they are delivered.

C)the transportation company has legal title to the goods while the goods are in transit.

D)no one has legal title to the goods until they are delivered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

48

A company just starting in business purchased three merchandise inventory items at the following prices: first purchase $64; second purchase $76; and third purchase $68.If the company sold two units for a total of $200 and used FIFO costing, the gross profit for the period would be

A)$56.

B)$60.

C)$62.

D)$68.

A)$56.

B)$60.

C)$62.

D)$68.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is true regarding inventory cost flow assumptions?

A)A company may use more than one costing method concurrently.

B)A company must comply with the method specified by industry standards.

C)A company must use the same method for domestic and foreign operations.

D)A company may never change its inventory costing method once it has chosen a method.

A)A company may use more than one costing method concurrently.

B)A company must comply with the method specified by industry standards.

C)A company must use the same method for domestic and foreign operations.

D)A company may never change its inventory costing method once it has chosen a method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

50

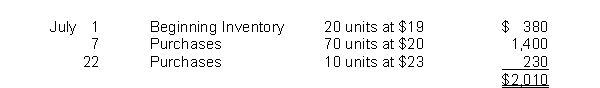

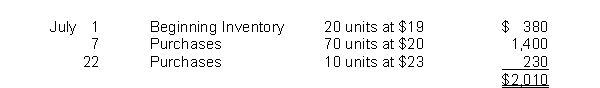

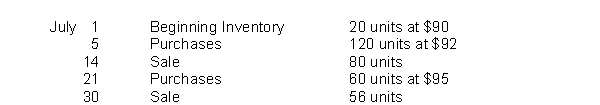

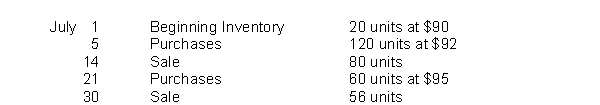

Priscilla has the following inventory information.  A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the average-cost method, the value of ending inventory (rounded to the nearest dollar) is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the average-cost method, the value of ending inventory (rounded to the nearest dollar) is

A)$680.

B)$704.

C)$723.

D)$730.

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the average-cost method, the value of ending inventory (rounded to the nearest dollar) is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the average-cost method, the value of ending inventory (rounded to the nearest dollar) isA)$680.

B)$704.

C)$723.

D)$730.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

51

If companies have identical inventoriable costs but use different inventory flow assumptions when the cost of goods has not been constant, then the

A)cost of goods sold of the companies will be identical.

B)cost of goods available for sale of the companies will be identical.

C)ending inventory of the companies will be identical.

D)net income of the companies will be identical.

A)cost of goods sold of the companies will be identical.

B)cost of goods available for sale of the companies will be identical.

C)ending inventory of the companies will be identical.

D)net income of the companies will be identical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

52

The lower-of-cost-or-net realizable value (LCNRV) basis may be used with all of the following methods except

A)average cost.

B)FIFO.

C)LIFO.

D)The LCNRV basis may be used with all of these.

A)average cost.

B)FIFO.

C)LIFO.

D)The LCNRV basis may be used with all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

53

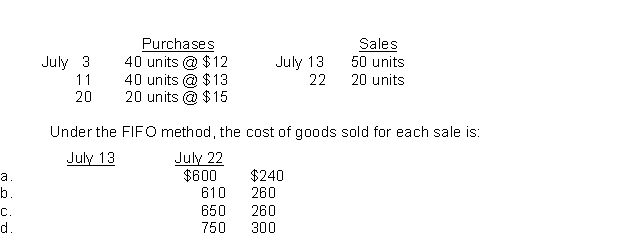

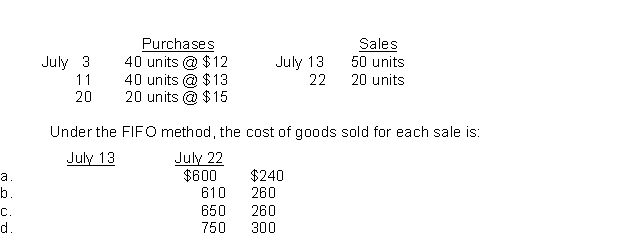

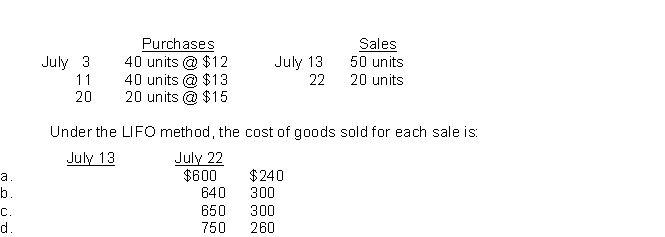

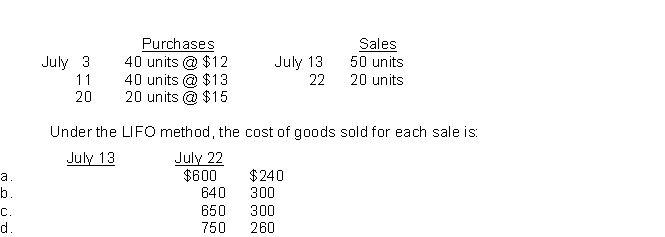

During July, the following purchases and sales were made by Big Dan Company.There was no beginning inventory.Big Dan Company uses a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

54

The cost flow method that often parallels the actual physical flow of merchandise is the

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)gross profit method.

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)gross profit method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

55

LIFO can be used

A)under neither GAAP nor IFRS.

B)under IFRS but not GAAP.

C)under GAAP but not IFRS.

D)under both GAAP and IFRS.

A)under neither GAAP nor IFRS.

B)under IFRS but not GAAP.

C)under GAAP but not IFRS.

D)under both GAAP and IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

56

The first-in, first-out (FIFO) inventory method results in an ending inventory valued at the most recent cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

57

Under generally accepted accounting principles, management has the choice of physically counting inventory on hand at the end of the year or using the gross profit method to estimate the ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

58

An auto manufacturer would classify vehicles in various stages of production as

A)finished goods.

B)merchandise inventory.

C)raw materials.

D)work in process.

A)finished goods.

B)merchandise inventory.

C)raw materials.

D)work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

59

The LIFO inventory method assumes that the cost of the latest units purchased are

A)the last to be allocated to cost of goods sold.

B)the first to be allocated to ending inventory.

C)the first to be allocated to cost of goods sold.

D)not allocated to cost of goods sold or ending inventory.

A)the last to be allocated to cost of goods sold.

B)the first to be allocated to ending inventory.

C)the first to be allocated to cost of goods sold.

D)not allocated to cost of goods sold or ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is correct with respect to inventories?

A)The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold.

B)It is generally good business management to sell the most recently acquired goods first.

C)Under FIFO, the ending inventory is based on the latest units purchased.

D)FIFO seldom coincides with the actual physical flow of inventory.

A)The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold.

B)It is generally good business management to sell the most recently acquired goods first.

C)Under FIFO, the ending inventory is based on the latest units purchased.

D)FIFO seldom coincides with the actual physical flow of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

61

Priscilla has the following inventory information.  A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for July is

A)$1,280.

B)$1,287

C)$1,306.

D)$1,330.

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for July isA)$1,280.

B)$1,287

C)$1,306.

D)$1,330.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

62

In a period of increasing prices, which inventory flow assumption will result in the lowest amount of income tax expense?

A)FIFO

B)LIFO

C)Average Cost

D)Income tax expense for the period will be the same under all assumptions.

A)FIFO

B)LIFO

C)Average Cost

D)Income tax expense for the period will be the same under all assumptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

63

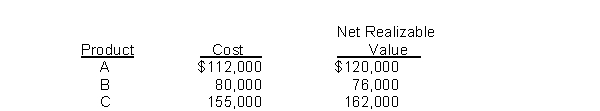

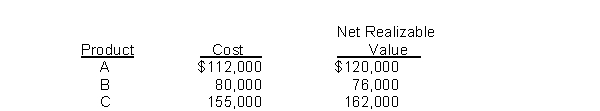

Alfalfa Company developed the following information about its inventories in applying the lower-of-cost-or-net realizable value (LCNRV) basis in valuing inventories:  If Alfalfa applies the LCNRV basis, the value of the inventory reported on the balance sheet would be

If Alfalfa applies the LCNRV basis, the value of the inventory reported on the balance sheet would be

A)$343,000.

B)$347,000.

C)$358,000.

D)$362,000.

If Alfalfa applies the LCNRV basis, the value of the inventory reported on the balance sheet would be

If Alfalfa applies the LCNRV basis, the value of the inventory reported on the balance sheet would beA)$343,000.

B)$347,000.

C)$358,000.

D)$362,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

64

During July, the following purchases and sales were made by Big Dan Company.There was no beginning inventory.Big Dan Company uses a perpetual inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

65

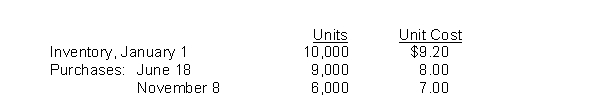

Goodman Company's inventory records show the following data:  A physical inventory on December 31 shows 6,000 units on hand.Under the FIFO method, the December 31 inventory is

A physical inventory on December 31 shows 6,000 units on hand.Under the FIFO method, the December 31 inventory is

A)$42,000.

B)$49,200.

C)$49,392.

D)$54,000.

A physical inventory on December 31 shows 6,000 units on hand.Under the FIFO method, the December 31 inventory is

A physical inventory on December 31 shows 6,000 units on hand.Under the FIFO method, the December 31 inventory isA)$42,000.

B)$49,200.

C)$49,392.

D)$54,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

66

IFRS defines net realizable value for lower-of-cost-or net realizable value as

A)estimated selling price less costs to complete and sell.

B)estimated selling price in the normal course of business.

C)net market value.

D)replacement cost less costs of disposal.

A)estimated selling price less costs to complete and sell.

B)estimated selling price in the normal course of business.

C)net market value.

D)replacement cost less costs of disposal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

67

The expense recognition principle requires that the cost of goods sold be matched against the ending merchandise inventory in order to determine income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

68

The retail inventory method requires a company to value its inventory on the balance sheet at retail prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following should be included in the physical inventory of a company?

A)Goods held on consignment from another company.

B)Goods in transit to another company shipped FOB shipping point.

C)Goods in transit from another company shipped FOB shipping point.

D)Goods in transit to or from another company shipped FOB shipping point.

A)Goods held on consignment from another company.

B)Goods in transit to another company shipped FOB shipping point.

C)Goods in transit from another company shipped FOB shipping point.

D)Goods in transit to or from another company shipped FOB shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

70

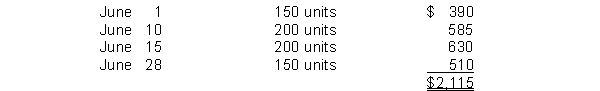

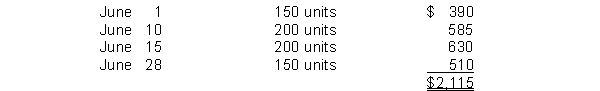

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A)$683.

B)$825.

C)$1,290.

D)$1,432.

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June isA)$683.

B)$825.

C)$1,290.

D)$1,432.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

71

The cost of goods available for sale is allocated to the cost of goods sold and the

A)beginning inventory.

B)ending inventory.

C)cost of goods purchased.

D)gross profit.

A)beginning inventory.

B)ending inventory.

C)cost of goods purchased.

D)gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

72

Priscilla has the following inventory information.  A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A)$1,280.

B)$1,287.

C)$1,306.

D)$1,330.

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 31 reveals that there are 35 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July isA)$1,280.

B)$1,287.

C)$1,306.

D)$1,330.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

73

The specific identification method of costing inventories is used when the

A)physical flow of units cannot be determined.

B)company sells large quantities of relatively low cost homogeneous items.

C)company sells large quantities of relatively low cost heterogeneous items.

D)company sells a limited quantity of high-unit cost items.

A)physical flow of units cannot be determined.

B)company sells large quantities of relatively low cost homogeneous items.

C)company sells large quantities of relatively low cost heterogeneous items.

D)company sells a limited quantity of high-unit cost items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

74

Switzer, Inc.has 8 computers which have been part of the inventory for over two years.Each computer cost $600 and originally retailed for $900.At the statement date, each computer has a net realizable value of $400.What value should Switzer, Inc., have for the computers at the end of the year?

A)$2,400.

B)$3,200.

C)$4,800.

D)$7,200.

A)$2,400.

B)$3,200.

C)$4,800.

D)$7,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

75

Pappy's Staff has the following inventory information.  Assuming that a perpetual inventory system is used, what is the ending inventory on a FIFO basis?

Assuming that a perpetual inventory system is used, what is the ending inventory on a FIFO basis?

A)$5,848

B)$5,860

C)$6,068

D)$6,346

Assuming that a perpetual inventory system is used, what is the ending inventory on a FIFO basis?

Assuming that a perpetual inventory system is used, what is the ending inventory on a FIFO basis?A)$5,848

B)$5,860

C)$6,068

D)$6,346

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

76

In a period of inflation, the cost flow method that results in the lowest income taxes is the

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)gross profit method.

A)FIFO method.

B)LIFO method.

C)average-cost method.

D)gross profit method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

77

GAAP defines net realizable value for lower-of-cost-or net realizable value essentially as

A)net market value.

B)estimated selling price in the normal course of business.

C)estimated selling price less costs to complete and sell.

D)replacement cost less costs of disposal.

A)net market value.

B)estimated selling price in the normal course of business.

C)estimated selling price less costs to complete and sell.

D)replacement cost less costs of disposal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

78

The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

79

Finished goods are a classification of inventory for a manufacturer that are completed and ready for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

80

Manufacturers usually classify inventory into all the following general categories except

A)work in process

B)finished goods

C)merchandise inventory

D)raw materials

A)work in process

B)finished goods

C)merchandise inventory

D)raw materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck