Deck 8: Accounting for Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/193

العب

ملء الشاشة (f)

Deck 8: Accounting for Receivables

1

Under the direct write-off method, no attempt is made to match bad debt expense to sales revenues in the same accounting period.

True

2

The maturity date of a 1-month note receivable dated June 30 is July 30.

True

3

Notes or accounts receivables that result from sales transactions are often called

A)sales receivables.

B)non-trade receivables.

C)trade receivables.

D)merchandise receivables.

A)sales receivables.

B)non-trade receivables.

C)trade receivables.

D)merchandise receivables.

trade receivables.

4

Syfy Company on July 15 sells merchandise on account to Eureka Co.for $5,000, terms 2/10, n/30.On July 20, Eureka Co.returns merchandise worth $2,000 to Syfy Company.On July 24, payment is received from Eureka Co.for the balance due.What is the amount of cash received?

A)$2,900

B)$2,940

C)$3,000

D)$5,000

A)$2,900

B)$2,940

C)$3,000

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

5

When the allowance method of accounting for uncollectible accounts is used, Bad Debt Expense is recorded

A)in the year after the credit sale is made.

B)in the same year as the credit sale.

C)as each credit sale is made.

D)when an account is written off as uncollectible.

A)in the year after the credit sale is made.

B)in the same year as the credit sale.

C)as each credit sale is made.

D)when an account is written off as uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

6

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $32,000.If the balance of the Allowance for Doubtful Accounts is an $8,000 debit before adjustment, what is the amount of bad debt expense for that period?

A)$8,000

B)$24,000

C)$32,000

D)$40,000

A)$8,000

B)$24,000

C)$32,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

7

Herman Company has a debit balance of $5,000 in its Allowance for Doubtful Accounts before any adjustments are made at the end of the year.Based on review and aging of its accounts receivable at the end of the year, Herman estimates that $70,000 of its receivables are uncollectible.The amount of bad debt expense which should be reported for the year is:

A)$5,000.

B)$65,000.

C)$70,000.

D)$75,000.

A)$5,000.

B)$65,000.

C)$70,000.

D)$75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

8

A 60-day note receivable dated July 13 has a maturity date of

A)September 12.

B)September 11.

C)September 10.

D)September 13.

A)September 12.

B)September 11.

C)September 10.

D)September 13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

9

Notes receivable are recorded in the accounts at

A)cash (net) realizable value.

B)face value.

C)gross realizable value.

D)maturity value.

A)cash (net) realizable value.

B)face value.

C)gross realizable value.

D)maturity value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

10

The financial statements of Gervais Manufacturing Company report net sales of $500,000 and accounts receivable of $80,000 and $40,000 at the beginning and end of the year, respectively.What is the accounts receivable turnover for Gervais?

A)6.3 times

B)8.3 times

C)10 times

D)12.5 times

A)6.3 times

B)8.3 times

C)10 times

D)12.5 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which receivables accounting and reporting issue is essentially the same for IFRS and GAAP?

A)The use of allowance accounts and the allowance method.

B)Recording of discounts

C)Recording sales returns and allowances

D)All of these are essentially the same for IFRS and GAAP.

A)The use of allowance accounts and the allowance method.

B)Recording of discounts

C)Recording sales returns and allowances

D)All of these are essentially the same for IFRS and GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

12

On February 7, Jackson Company sold goods on account to Phillips Enterprises for $5,200, terms 2/10, n/30.On March 9, Phillips gave Jackson a 60-day, 12% promissory note in settlement of the account.Record the sale and the acceptance of the promissory note on the books of Jackson Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

13

Allowance for Doubtful Accounts is debited under the direct write-off method when an account is determined to be uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

14

The two key parties to a note are the maker and the payee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

15

The term "receivables" refers to

A)amounts due from individuals or companies.

B)merchandise to be collected from individuals or companies.

C)cash to be paid to creditors.

D)cash to be paid to debtors.

A)amounts due from individuals or companies.

B)merchandise to be collected from individuals or companies.

C)cash to be paid to creditors.

D)cash to be paid to debtors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

16

The existing balance in Allowance for Doubtful Accounts is considered in computing bad debt expense in the

A)direct write-off method.

B)percentage of receivables basis.

C)percentage of receivables basis and direct write-off method.

D)None of these choices are correct.

A)direct write-off method.

B)percentage of receivables basis.

C)percentage of receivables basis and direct write-off method.

D)None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

17

The net amount expected to be received in cash from receivables is called the

A)gross realizable value.

B)gross cash value.

C)allowance value.

D)cash (net) realizable value.

A)gross realizable value.

B)gross cash value.

C)allowance value.

D)cash (net) realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

18

Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $15,000.If the balance of the Allowance for Doubtful Accounts is a $2,000 credit before adjustment, what is the amount of bad debt expense for that period?

A)$2,000

B)$13,000

C)$15,000

D)$17,000

A)$2,000

B)$13,000

C)$15,000

D)$17,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

19

On October 1, 2021, Milago Company sells (factors) $700,000 of receivables to Beanfield Factors, Inc.Beanfield assesses a service charge of 3% of the amount of receivables sold.The journal entry to record the sale by Milago will include

A)a debit of $700,000 to Accounts Receivable.

B)a credit of $721,000 to Cash.

C)a debit of $721,000 to Cash.

D)a debit of $21,000 to Service Charge Expense.

A)a debit of $700,000 to Accounts Receivable.

B)a credit of $721,000 to Cash.

C)a debit of $721,000 to Cash.

D)a debit of $21,000 to Service Charge Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

20

The maturity value of a $50,000, 9%, 60-day note receivable dated July 3 is

A)$50,000.

B)$50,750.

C)$54,500.

D)$59,000.

A)$50,000.

B)$50,750.

C)$54,500.

D)$59,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

21

A note receivable is a negotiable instrument which

A)eliminates the need for a bad debts allowance.

B)can be transferred to another party by endorsement.

C)takes the place of checks in a business firm.

D)can only be collected by a bank.

A)eliminates the need for a bad debts allowance.

B)can be transferred to another party by endorsement.

C)takes the place of checks in a business firm.

D)can only be collected by a bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

22

The financial statements of Gervais Manufacturing Company report net sales of $500,000 and accounts receivable of $80,000 and $40,000 at the beginning and end of the year, respectively.What is the average collection period for accounts receivable in days?

A)29.2 days

B)36.5 days

C)44.0 days

D)57.9 days

A)29.2 days

B)36.5 days

C)44.0 days

D)57.9 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which use the term impairment to indicate that a receivable may not be collected?

A)Neither IFRS nor GAAP

B)Both IFRS and GAAP

C)IFRS, but not GAAP

D)GAAP, but not IFRS

A)Neither IFRS nor GAAP

B)Both IFRS and GAAP

C)IFRS, but not GAAP

D)GAAP, but not IFRS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

24

On March 9, Phillips gave Jackson Company a 60-day, 12% promissory note for $5,200.Phillips honors the note on May 8.Record the collection of the note and interest by Jackson assuming that no interest has been accrued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

25

Allowance for Doubtful Accounts is a contra asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

26

When the due date of a note is stated in months, the time factor in computing interest is the number of months divided by 360 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

27

A cash discount is usually granted to all of the following except

A)retail customers.

B)retailers.

C)wholesalers.

D)All of these answers are correct.

A)retail customers.

B)retailers.

C)wholesalers.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

28

When the allowance method is used to account for uncollectible accounts, Bad Debt Expense is debited when

A)a sale is made.

B)an account becomes bad and is written off.

C)management estimates the amount of uncollectible accounts.

D)a customer's account becomes past due.

A)a sale is made.

B)an account becomes bad and is written off.

C)management estimates the amount of uncollectible accounts.

D)a customer's account becomes past due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

29

When recording estimated uncollectible accounts using the allowance method, the adjusting entry includes a

A)debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

C)debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D)debit to Loss on Credit Sales Revenue and a credit to Accounts Receivable.

A)debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

C)debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D)debit to Loss on Credit Sales Revenue and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

30

Using the percentage of receivables method for recording bad debt expense, estimated uncollectible accounts total $14,000.If the balance of the Allowance for Doubtful Accounts is a $2,000 debit before adjustment, what is the amount of bad debt expense?

A)$2,000

B)$12,000

C)$14,000

D)$16,000

A)$2,000

B)$12,000

C)$14,000

D)$16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

31

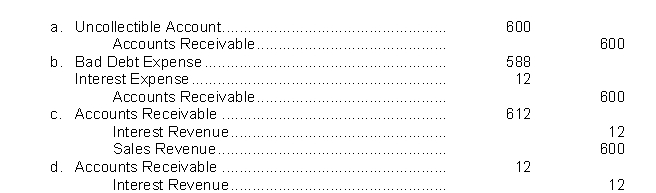

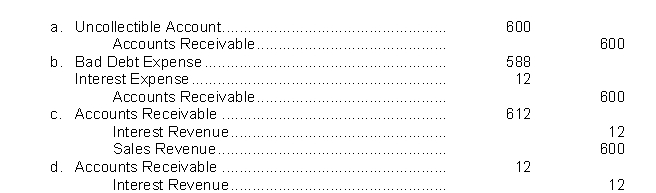

On March 1, 2021, Dick Miles purchased a suit at Kenny's Fine Apparel Store.The suit cost $600 and Dick used his Kenny credit card.Kenny charges 2% per month interest if payment on credit charges is not made within 30 days.On April 30, 2021, Dick had not yet made his payment.What entry should Kenny make on April 30th?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

32

A 90-day note dated May 14 has a maturity date of

A)August 14.

B)August 12.

C)August 13.

D)August 15.

A)August 14.

B)August 12.

C)August 13.

D)August 15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

33

A company that receives an interest-bearing note receivable will

A)debit Notes Receivable for the maturity value of the note.

B)credit Notes Receivable for the maturity value of the note.

C)debit Notes Receivable for the face value of the note.

D)credit Notes Receivable for the face value of the note.

A)debit Notes Receivable for the maturity value of the note.

B)credit Notes Receivable for the maturity value of the note.

C)debit Notes Receivable for the face value of the note.

D)credit Notes Receivable for the face value of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following are also called trade receivables?

A)Accounts receivable

B)Other receivables

C)Advances to employees

D)Income taxes refundable

A)Accounts receivable

B)Other receivables

C)Advances to employees

D)Income taxes refundable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

35

IFRS and GAAP accounting are the same for each of the following except for the

A)recording of receivables.

B)recognition of sales returns and allowances.

C)criteria used to determine the recording of a factoring transaction.

D)recognition of sales discounts.

A)recording of receivables.

B)recognition of sales returns and allowances.

C)criteria used to determine the recording of a factoring transaction.

D)recognition of sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

36

On March 9, Phillips gave Jackson Company a 60-day, 12% promissory note for $5,200.Phillips dishonors the note on May 8.Record the entry that Jackson would make when the note is dishonored, assuming that no interest has been accrued.Assume Jackson expects collection will occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cash realizable value is determined by subtracting Allowance for Doubtful Accounts from Net Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

38

The accounts receivable turnover is computed by dividing total sales by the average net receivables during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following is not a primary problem associated with accounts receivable?

A)Depreciating accounts receivable

B)Recognizing accounts receivable

C)Valuing accounts receivable

D)Disposing of accounts receivable

A)Depreciating accounts receivable

B)Recognizing accounts receivable

C)Valuing accounts receivable

D)Disposing of accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

40

When an account becomes uncollectible and must be written off,

A)Allowance for Doubtful Accounts should be credited.

B)Accounts Receivable should be credited.

C)Bad Debt Expense should be credited.

D)Sales Revenue should be debited.

A)Allowance for Doubtful Accounts should be credited.

B)Accounts Receivable should be credited.

C)Bad Debt Expense should be credited.

D)Sales Revenue should be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the allowance method of accounting for uncollectible accounts,

A)the cash realizable value of accounts receivable is greater before an account is written off than after it is written off.

B)Bad Debt Expense is debited when a specific account is written off as uncollectible.

C)the cash realizable value of accounts receivable in the balance sheet is the same before and after an account is written off.

D)Allowance for Doubtful Accounts is closed each year to Income Summary.

A)the cash realizable value of accounts receivable is greater before an account is written off than after it is written off.

B)Bad Debt Expense is debited when a specific account is written off as uncollectible.

C)the cash realizable value of accounts receivable in the balance sheet is the same before and after an account is written off.

D)Allowance for Doubtful Accounts is closed each year to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

42

Using the percentage-of-receivables basis, the uncollectible accounts for the year are estimated to be $38,000.If the balance for the Allowance for Doubtful Accounts is a $7,000 credit before adjustment, what is the amount of bad debt expense for the period?

A)$7,000

B)$31,000

C)$38,000

D)$45,000

A)$7,000

B)$31,000

C)$38,000

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

43

Jeff Retailers accepted $75,000 of Citibank Visa credit card charges for merchandise sold on July 1.Citibank charges 2% for its credit card use.The entry to record this transaction by Jeff Retailers will include a credit to Sales Revenue of $75,000 and a debit(s) to

A)Cash $73,500 and Service Charge Expense $1,500.

B)Accounts Receivable $73,500 and Service Charge Expense $1,500.

C)Cash $73,500 and Interest Expense $1,500.

D)Accounts Receivable $75,000.

A)Cash $73,500 and Service Charge Expense $1,500.

B)Accounts Receivable $73,500 and Service Charge Expense $1,500.

C)Cash $73,500 and Interest Expense $1,500.

D)Accounts Receivable $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

44

A 30-day note dated June 18 has a maturity date of

A)July 19.

B)July 18.

C)July 17.

D)July 16.

A)July 19.

B)July 18.

C)July 17.

D)July 16.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

45

The face value of a note refers to the amount

A)that can be received if sold to a factor.

B)borrowed plus interest received at maturity from the maker.

C)that is identified on the formal instrument of credit.

D)remaining after a service charge has been deducted.

A)that can be received if sold to a factor.

B)borrowed plus interest received at maturity from the maker.

C)that is identified on the formal instrument of credit.

D)remaining after a service charge has been deducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

46

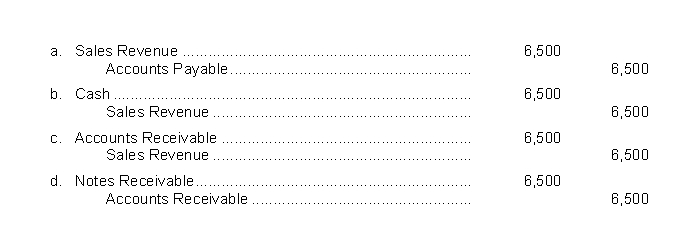

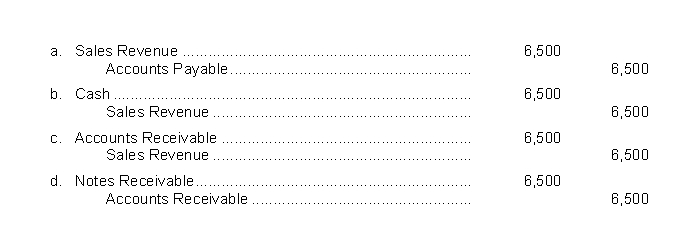

On February 1, 2021, Fugit Company sells merchandise on account to Armen Company for $6,500.The entry to record this transaction by Fugit Company is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

47

IFRS

A)implies that receivables with different characteristics should be reported separately.

B)requires that receivables with different characteristics should be reported separately.

C)implies that receivables with different characteristics should be reported as one unsegregated amount.

D)requires that receivables with different characteristics should be reported as one unsegregated amount.

A)implies that receivables with different characteristics should be reported separately.

B)requires that receivables with different characteristics should be reported separately.

C)implies that receivables with different characteristics should be reported as one unsegregated amount.

D)requires that receivables with different characteristics should be reported as one unsegregated amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

48

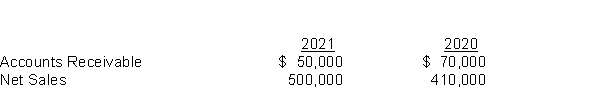

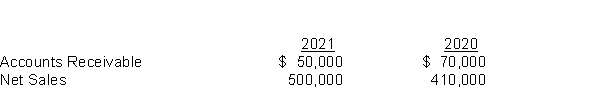

The following data exists for Carley Company.  Calculate the accounts receivable turnover and the average collection period for accounts receivable in days for 2021.

Calculate the accounts receivable turnover and the average collection period for accounts receivable in days for 2021.

Calculate the accounts receivable turnover and the average collection period for accounts receivable in days for 2021.

Calculate the accounts receivable turnover and the average collection period for accounts receivable in days for 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

49

Generally accepted accounting principles require that the direct write-off method be used for financial reporting purposes if it is also used for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

50

Both the gross amounts of receivables and the allowance for doubtful accounts should be reported in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

51

Trade accounts receivable are valued and reported on the balance sheet

A)in the investment section.

B)at gross amounts less sales returns and allowances.

C)at net realizable value.

D)only if they are not past due.

A)in the investment section.

B)at gross amounts less sales returns and allowances.

C)at net realizable value.

D)only if they are not past due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

52

The collection of an account that had been previously written off under the allowance method of accounting for uncollectibles

A)will increase income in the period it is collected.

B)will decrease income in the period it is collected.

C)requires a correcting entry for the period in which the account was written off.

D)does not affect income in the period it is collected.

A)will increase income in the period it is collected.

B)will decrease income in the period it is collected.

C)requires a correcting entry for the period in which the account was written off.

D)does not affect income in the period it is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

53

Allowance for Doubtful Accounts on the balance sheet

A)is offset against total current assets.

B)increases the cash realizable value of accounts receivable.

C)appears under the heading "Other Assets."

D)is offset against accounts receivable.

A)is offset against total current assets.

B)increases the cash realizable value of accounts receivable.

C)appears under the heading "Other Assets."

D)is offset against accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

54

Using the percentage-of-receivables basis, the uncollectible accounts for the year are estimated to be $38,000.If the balance for the Allowance for Doubtful Accounts is a $7,000 debit before adjustment, what is the amount of bad debt expense for the period?

A)$7,000

B)$31,000

C)$38,000

D)$45,000

A)$7,000

B)$31,000

C)$38,000

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

55

YZ Company accepted a national credit card for a $4,000 purchase.The cost of the goods sold is $2,400.The credit card company charges a 3% fee.What is the impact of this transaction on net operating income?

A)Increase by $1,480

B)Increase by $1,552

C)Increase by $1,600

D)Increase by $3,880

A)Increase by $1,480

B)Increase by $1,552

C)Increase by $1,600

D)Increase by $3,880

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

56

A promissory note

A)is not a formal credit instrument.

B)may be used to settle an accounts receivable.

C)has the party to whom the money is due as the maker.

D)cannot be factored to another party.

A)is not a formal credit instrument.

B)may be used to settle an accounts receivable.

C)has the party to whom the money is due as the maker.

D)cannot be factored to another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

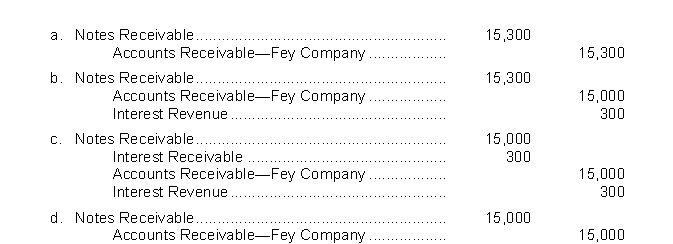

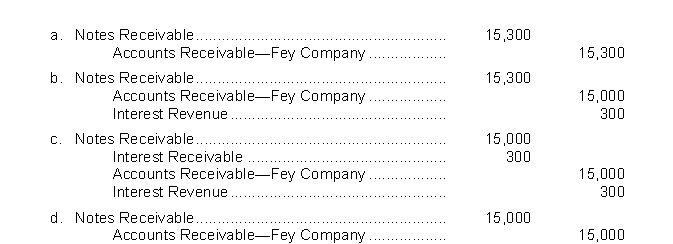

57

Reck Company receives a $15,000, 3-month, 8% promissory note from Fey Company in settlement of an open accounts receivable.What entry will Reck Company make upon receiving the note?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

58

Writing off an uncollectible account under the allowance method requires a debit to

A)Accounts Receivable.

B)Allowance for Doubtful Accounts.

C)Bad Debt Expense.

D)Uncollectible Accounts Expense.

A)Accounts Receivable.

B)Allowance for Doubtful Accounts.

C)Bad Debt Expense.

D)Uncollectible Accounts Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which board(s) has(have) worked to implement fair value measurement for financial instruments?

A)FASB, but not IASB

B)IASB, but not FASB

C)both FASB and IASB

D)neither FASB nor IASB

A)FASB, but not IASB

B)IASB, but not FASB

C)both FASB and IASB

D)neither FASB nor IASB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

60

Presented here are various receivable transactions entered into by Beran Tool Company.Indicate whether the receivables are reported as accounts receivable, notes receivable, or other receivables on the balance sheet.  f.Advanced $1,400 to a trusted employee.

f.Advanced $1,400 to a trusted employee.

f.Advanced $1,400 to a trusted employee.

f.Advanced $1,400 to a trusted employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

61

Under the allowance method, Bad Debt Expense is debited when an account is deemed uncollectible and must be written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

62

Notes receivable represent claims for which formal instruments of credit are issued as evidence of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

63

Three accounting issues associated with accounts receivable are

A)depreciating, returns, and valuing.

B)depreciating, valuing, and collecting.

C)recognizing, valuing, and disposing.

D)accrual, bad debts, and disposing.

A)depreciating, returns, and valuing.

B)depreciating, valuing, and collecting.

C)recognizing, valuing, and disposing.

D)accrual, bad debts, and disposing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

64

The cash realizable value is the difference between the

A)accounts receivable balance and the allowance for doubtful accounts balance.

B)net sales and the allowance account balance.

C)accounts receivable balance and bad debt expense.

D)net sales and bad debt expense.

A)accounts receivable balance and the allowance for doubtful accounts balance.

B)net sales and the allowance account balance.

C)accounts receivable balance and bad debt expense.

D)net sales and bad debt expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

65

When an account is written off using the allowance method, the

A)cash realizable value of accounts receivable will increase.

B)cash realizable value of accounts receivable will decrease.

C)allowance account will increase.

D)cash realizable value of accounts receivable will stay the same.

A)cash realizable value of accounts receivable will increase.

B)cash realizable value of accounts receivable will decrease.

C)allowance account will increase.

D)cash realizable value of accounts receivable will stay the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

66

In reviewing the accounts receivable, the cash realizable value is $16,000 before the write-off of a $1,500 account.What is the cash realizable value after the write-off?

A)$1,500

B)$14,500

C)$16,000

D)$17,500

A)$1,500

B)$14,500

C)$16,000

D)$17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

67

Major advantages of credit cards to the retailer include all of the following except the

A)issuer does the credit investigation of customers.

B)issuer undertakes the collection process.

C)retailer receives more cash from the credit card issuer.

D)All of these answers are correct.

A)issuer does the credit investigation of customers.

B)issuer undertakes the collection process.

C)retailer receives more cash from the credit card issuer.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is not true regarding a promissory note?

A)Promissory notes may not be transferred to another party by endorsement.

B)Promissory notes may be sold to another party.

C)Promissory notes give a stronger legal claim to the holder than accounts receivable.

D)Promissory notes may be bearer notes and not specifically identify the payee by name.

A)Promissory notes may not be transferred to another party by endorsement.

B)Promissory notes may be sold to another party.

C)Promissory notes give a stronger legal claim to the holder than accounts receivable.

D)Promissory notes may be bearer notes and not specifically identify the payee by name.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

69

When a note is accepted to settle an open account, Notes Receivable is debited for the note's

A)net realizable value.

B)maturity value.

C)face value.

D)face value plus interest.

A)net realizable value.

B)maturity value.

C)face value.

D)face value plus interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

70

When the allowance method of recognizing bad debt expense is used, the entry to recognize that expense

A)increases net income.

B)decreases current assets.

C)has no effect on current assets.

D)has no effect on net income.

A)increases net income.

B)decreases current assets.

C)has no effect on current assets.

D)has no effect on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which board(s) has(have) faced strong opposition when working to implement fair value measurement for financial instruments?

A)FASB, but not IASB

B)IASB, but not FASB

C)both FASB and IASB

D)neither FASB nor IASB

A)FASB, but not IASB

B)IASB, but not FASB

C)both FASB and IASB

D)neither FASB nor IASB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

72

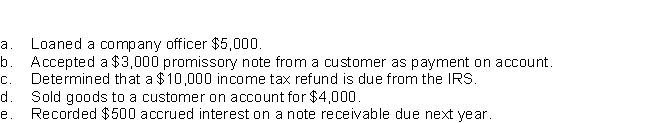

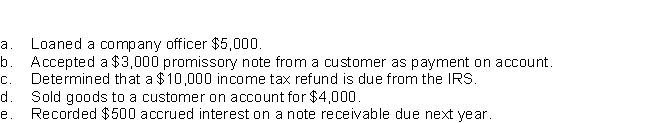

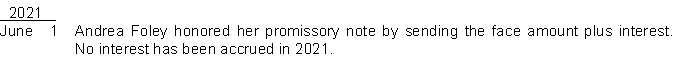

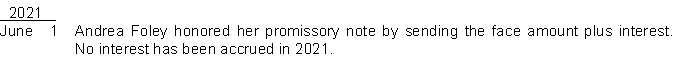

Prepare journal entries to record the following transactions entered into by Valente Company:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

73

Under the allowance method, the cash realizable value of receivables is the same both before and after an account has been written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Allowance for Doubtful Accounts is a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following would require a compound journal entry?

A)To record merchandise returned that was previously purchased on account.

B)To record sales on account.

C)To record purchases of inventory when a discount is offered for prompt payment.

D)To record collection of accounts receivable when a cash discount is taken.

A)To record merchandise returned that was previously purchased on account.

B)To record sales on account.

C)To record purchases of inventory when a discount is offered for prompt payment.

D)To record collection of accounts receivable when a cash discount is taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

76

An aging of a company's accounts receivable indicates that $14,000 are estimated to be uncollectible.If Allowance for Doubtful Accounts has a $1,100 credit balance, the adjustment to record bad debts for the period will require a

A)debit to Bad Debt Expense for $14,000.

B)debit to Allowance for Doubtful Accounts for $12,900.

C)debit to Bad Debt Expense for $12,900.

D)credit to Allowance for Doubtful Accounts for $14,000.

A)debit to Bad Debt Expense for $14,000.

B)debit to Allowance for Doubtful Accounts for $12,900.

C)debit to Bad Debt Expense for $12,900.

D)credit to Allowance for Doubtful Accounts for $14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

77

If an account is collected after having been previously written off,

A)the allowance account should be debited.

B)only the control account needs to be credited.

C)both income statement and balance sheet accounts will be affected.

D)there will be both a debit and a credit to accounts receivable.

A)the allowance account should be debited.

B)only the control account needs to be credited.

C)both income statement and balance sheet accounts will be affected.

D)there will be both a debit and a credit to accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

78

In 2021, Warehouse 13 had net credit sales of $750,000.On January 1, 2021, Allowance for Doubtful Accounts had a credit balance of $16,000.During 2021, $29,000 of uncollectible accounts receivable were written off.Past experience indicates that the allowance should be 10% of the balance in receivables (percentage-of-receivable basis).If the accounts receivable balance at December 31 was $150,000, what is the required adjustment to the Allowance for Doubtful Accounts at December 31, 2021?

A)$150,000

B)$29,000

C)$28,000

D)$31,000

A)$150,000

B)$29,000

C)$28,000

D)$31,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

79

The sale of receivables by a business

A)indicates that the business is in financial difficulty.

B)is generally the major revenue item on its income statement.

C)is an indication that the business is owned by a factor.

D)can be a quick way to generate cash for operating needs.

A)indicates that the business is in financial difficulty.

B)is generally the major revenue item on its income statement.

C)is an indication that the business is owned by a factor.

D)can be a quick way to generate cash for operating needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

80

The two key parties to a promissory note are the

A)maker and a bank.

B)debtor and the payee.

C)maker and the payee.

D)sender and the receiver.

A)maker and a bank.

B)debtor and the payee.

C)maker and the payee.

D)sender and the receiver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck