Deck 11: Corporations: Organisations, Stock Transactions and Stockholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

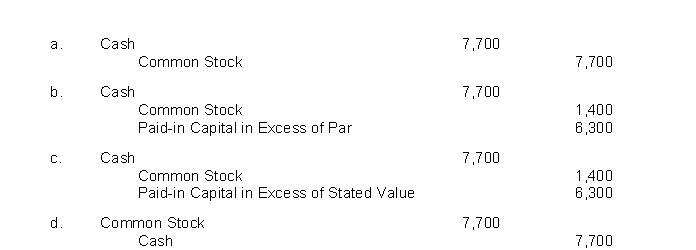

سؤال

سؤال

سؤال

سؤال

سؤال

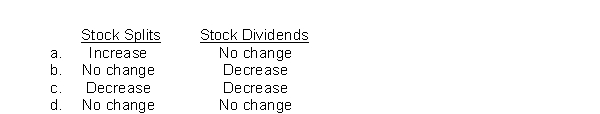

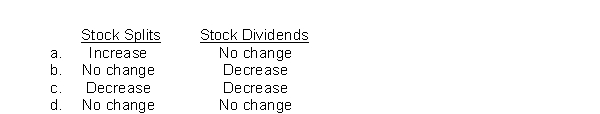

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

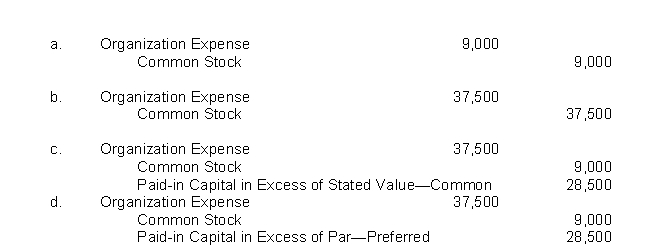

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/222

العب

ملء الشاشة (f)

Deck 11: Corporations: Organisations, Stock Transactions and Stockholders Equity

1

A corporation is not an entity that is separate and distinct from its owners.

False

2

Dividends in arrears on cumulative preferred stock are considered a liability.

False

3

Retained earnings that are restricted are unavailable for dividends.

True

4

A stock dividend results in an increase in paid-in capital in the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

5

A corporate board of directors does not generally

A)select officers.

B)formulate operating policies.

C)declare dividends.

D)execute policy.

A)select officers.

B)formulate operating policies.

C)declare dividends.

D)execute policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

6

A corporation has the following account balances: Common Stock, $1 par value, $60,000; Paid-in Capital in Excess of Par, $1,300,000.Based on this information, the

A)legal capital is $1,360,000.

B)number of shares issued are 60,000.

C)number of shares outstanding are 1,360,000.

D)average price per share issued is $22.50.

A)legal capital is $1,360,000.

B)number of shares issued are 60,000.

C)number of shares outstanding are 1,360,000.

D)average price per share issued is $22.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

7

Carson Packaging Corporation began business in 2021 by issuing 30,000 shares of $3 par common stock for $8 per share and 12,000 shares of 6%, $10 par preferred stock for par.At year-end, the common stock had a market value of $12.On its December 31, 2021 balance sheet, Carson Packaging would report

A)Common Stock of $360,000.

B)Common Stock of $90,000.

C)Common Stock of $240,000.

D)Paid-In Capital of $90,000.

A)Common Stock of $360,000.

B)Common Stock of $90,000.

C)Common Stock of $240,000.

D)Paid-In Capital of $90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

8

If preferred stock is cumulative, the

A)preferred dividends not declared in a given year are called dividends in arrears.

B)preferred stockholders and the common stockholders receive equal dividends.

C)preferred stockholders and the common stockholders receive the same total dollar amount of dividends.

D)common stockholders will share in the preferred dividends.

A)preferred dividends not declared in a given year are called dividends in arrears.

B)preferred stockholders and the common stockholders receive equal dividends.

C)preferred stockholders and the common stockholders receive the same total dollar amount of dividends.

D)common stockholders will share in the preferred dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

9

Treasury stock is

A)stock issued by the U.S.Treasury Department.

B)stock purchased by a corporation and held as an investment in its treasury.

C)corporate stock issued by the treasurer of a company.

D)a corporation's own stock which has been reacquired but not retired.

A)stock issued by the U.S.Treasury Department.

B)stock purchased by a corporation and held as an investment in its treasury.

C)corporate stock issued by the treasurer of a company.

D)a corporation's own stock which has been reacquired but not retired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

10

Dividends Payable is classified as a

A)long-term liability.

B)contra stockholders' equity account to Retained Earnings.

C)current liability.

D)stockholders' equity account.

A)long-term liability.

B)contra stockholders' equity account to Retained Earnings.

C)current liability.

D)stockholders' equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

11

Crawl Inc.has 1,000 shares of 6%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2020, and December 31, 2021.The board of directors declared and paid a $2,000 dividend in 2020.In 2021, $10,000 of dividends are declared and paid.What are the dividends received by the common stockholders in 2021?

A)$6,000

B)$5,000

C)$4,000

D)$3,000

A)$6,000

B)$5,000

C)$4,000

D)$3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

12

Common Stock Dividends Distributable is classified as a(n)

A)asset account.

B)stockholders' equity account.

C)expense account.

D)liability account.

A)asset account.

B)stockholders' equity account.

C)expense account.

D)liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

13

Car and Auto Sisters had retained earnings of $18,000 on the balance sheet but disclosed in the footnotes that $3,000 of retained earnings was restricted for plant expansion and $1,000 was restricted for bond repayments.Cash of $2,000 had been set aside for the plant expansion.How much of retained earnings is available for dividends?

A)$14,000

B)$15,000

C)$18,000

D)$12,000

A)$14,000

B)$15,000

C)$18,000

D)$12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

14

King Corporation had net income of $260,000 and paid dividends of $40,000 to common stockholders and $10,000 to preferred stockholders in 2021.King Corporation's common stockholders' equity at the beginning and end of 2021 was $870,000 and $1,130,000, respectively.There are 100,000 weighted-average shares of common stock outstanding. King Corporation's return on common stockholders' equity was

A)18.6%.

B)25%.

C)21%.

D)22.1%.

A)18.6%.

B)25%.

C)21%.

D)22.1%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

15

A corporation can be organized for the purpose of making a profit or it may be not-for-profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

16

Treasury Stock is a contra stockholders' equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

17

Restricted retained earnings are available for preferred stock dividends but unavailable for common stock dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

18

In the stockholders' equity section, paid-in capital and retained earnings are reported and the specific sources of paid-in capital are identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

19

A typical organization chart showing delegation of authority would show

A)stockholders delegating to the board of directors.

B)the board of directors delegating to stockholders.

C)the chief executive officer delegating to the board of directors.

D)the controller delegating to the chief executive officer.

A)stockholders delegating to the board of directors.

B)the board of directors delegating to stockholders.

C)the chief executive officer delegating to the board of directors.

D)the controller delegating to the chief executive officer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

20

The authorized stock of a corporation

A)only reflects the initial capital needs of the company.

B)is indicated in its by-laws.

C)is indicated in its charter.

D)must be recorded in a formal accounting entry.

A)only reflects the initial capital needs of the company.

B)is indicated in its by-laws.

C)is indicated in its charter.

D)must be recorded in a formal accounting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

21

Hsu, Inc.issued 10,000 shares of stock at a stated value of $8/share.The total issue of stock sold for $15 per share.The journal entry to record this transaction would include a

A)debit to Cash for $80,000.

B)credit to Common Stock for $80,000.

C)credit to Paid-in Capital in Excess of Par for $150,000.

D)credit to Common Stock for $150,000.

A)debit to Cash for $80,000.

B)credit to Common Stock for $80,000.

C)credit to Paid-in Capital in Excess of Par for $150,000.

D)credit to Common Stock for $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Northern Corporation issues 7,000 shares of $100 par value preferred stock for cash at $120 per share.The entry to record the transaction will consist of a debit to Cash for $840,000 and a credit or credits to

A)Preferred Stock for $840,000.

B)Paid-in Capital from Preferred Stock for $840,000.

C)Preferred Stock for $700,000 and Retained Earnings for $140,000.

D)Preferred Stock for $700,000 and Paid-in Capital in Excess of Par-Preferred Stock for $140,000.

A)Preferred Stock for $840,000.

B)Paid-in Capital from Preferred Stock for $840,000.

C)Preferred Stock for $700,000 and Retained Earnings for $140,000.

D)Preferred Stock for $700,000 and Paid-in Capital in Excess of Par-Preferred Stock for $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

23

The acquisition of treasury stock by a corporation

A)increases its total assets and total stockholders' equity.

B)decreases its total assets and total stockholders' equity.

C)has no effect on total assets and total stockholders' equity.

D)requires that a gain or loss be recognized on the income statement.

A)increases its total assets and total stockholders' equity.

B)decreases its total assets and total stockholders' equity.

C)has no effect on total assets and total stockholders' equity.

D)requires that a gain or loss be recognized on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

24

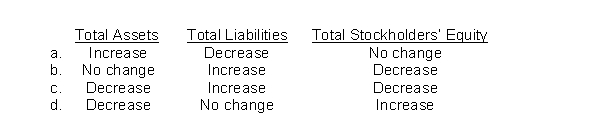

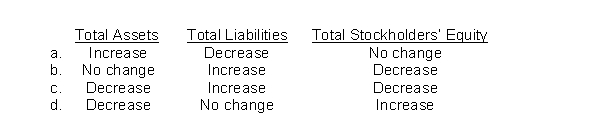

Indicate the respective effects of the declaration of a cash dividend on the following balance sheet sections:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cork Inc.declared a $160,000 cash dividend.It currently has 6,000 shares of 6%, $100 par value cumulative preferred stock outstanding.It is one year in arrears on its preferred stock.How much cash will Cork distribute to the common stockholders?

A)$88,000.

B)$72,000.

C)$124,000.

D)None of these answers are correct.

A)$88,000.

B)$72,000.

C)$124,000.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

26

The effect of a stock dividend is to

A)decrease total assets and stockholders' equity.

B)change the composition of stockholders' equity.

C)decrease total assets and total liabilities.

D)increase the book value per share of common stock.

A)decrease total assets and stockholders' equity.

B)change the composition of stockholders' equity.

C)decrease total assets and total liabilities.

D)increase the book value per share of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

27

Moore, Inc.had 250,000 shares of common stock outstanding before a stock split occurred, and 1,000,000 shares outstanding after the stock split.The stock split was

A)2-for-4.

B)5-for-1.

C)1-for-4.

D)4-for-1.

A)2-for-4.

B)5-for-1.

C)1-for-4.

D)4-for-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

28

Assume that all balance sheet amounts for Marley Company represent average balance figures.  What is the return on common stockholders' equity for Marley?

What is the return on common stockholders' equity for Marley?

A)19.3%

B)16.7%

C)12.5%

D)10.0%

What is the return on common stockholders' equity for Marley?

What is the return on common stockholders' equity for Marley?A)19.3%

B)16.7%

C)12.5%

D)10.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

29

A corporation acts under its own name rather than in the name of its stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

30

The number of common shares outstanding can never be greater than the number of shares issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

31

A retained earnings statement shows the same information as a corporation income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following is a privately held corporation?

A)Intel

B)General Electric

C)Caterpillar Inc.

D)Cargill Inc.

A)Intel

B)General Electric

C)Caterpillar Inc.

D)Cargill Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

33

The officer who is generally responsible for maintaining the cash position of the corporation is the

A)controller.

B)treasurer.

C)cashier.

D)internal auditor.

A)controller.

B)treasurer.

C)cashier.

D)internal auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

34

When stock is issued for legal services, the transaction is recorded by debiting Organization Expense for the

A)stated value of the stock.

B)par value of the stock.

C)market value of the stock.

D)book value of the stock.

A)stated value of the stock.

B)par value of the stock.

C)market value of the stock.

D)book value of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

35

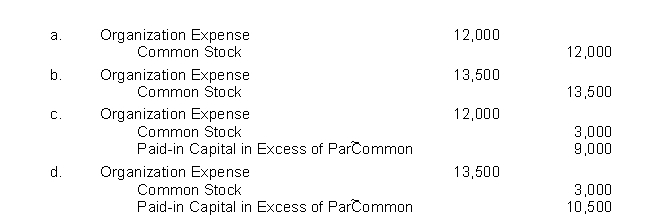

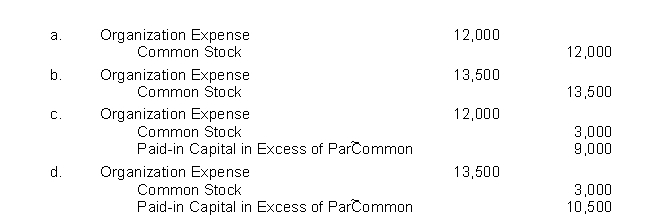

S.Lamar performed legal services for E.Garr.Due to a cash shortage, an agreement was reached whereby E.Garr would pay S.Lamar a legal fee of approximately $12,000 by issuing 3,000 shares of its common stock (par $1).The stock trades on a daily basis and the market price of the stock on the day the debt was settled is $4.50 per share.Given this information, the journal entry for E.Garr.to record this transaction is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

36

Accounting for treasury stock is done by the

A)FIFO method.

B)LIFO method.

C)cost method.

D)lower of cost or market method.

A)FIFO method.

B)LIFO method.

C)cost method.

D)lower of cost or market method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

37

Treasury stock should be reported in the financial statements of a corporation as a(n)

A)investment.

B)liability.

C)deduction from total paid-in capital.

D)deduction from total paid-in capital and retained earnings.

A)investment.

B)liability.

C)deduction from total paid-in capital.

D)deduction from total paid-in capital and retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements about dividends is not accurate?

A)Many companies declare and pay cash dividends quarterly.

B)Low dividends may mean high stock returns.

C)The board of directors is obligated to declare dividends.

D)A legal dividend may not be a feasible one.

A)Many companies declare and pay cash dividends quarterly.

B)Low dividends may mean high stock returns.

C)The board of directors is obligated to declare dividends.

D)A legal dividend may not be a feasible one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

39

Land, Inc.has retained earnings of $800,000 and total stockholders' equity of $2,000,000. It has 300,000 shares of $5 par value common stock outstanding, which is currently selling for $30 per share.If Land declares a 10% stock dividend on its common stock

A)net income will decrease by $150,000.

B)retained earnings will decrease by $150,000 and total stockholders' equity will increase by $150,000.

C)retained earnings will decrease by $900,000 and total stockholders' equity will increase by $900,000.

D)retained earnings will decrease by $900,000 and total paid-in capital will increase by $900,000.

A)net income will decrease by $150,000.

B)retained earnings will decrease by $150,000 and total stockholders' equity will increase by $150,000.

C)retained earnings will decrease by $900,000 and total stockholders' equity will increase by $900,000.

D)retained earnings will decrease by $900,000 and total paid-in capital will increase by $900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a corporation declares a 10% stock dividend on its common stock, the account to be debited on the date of declaration is

A)Common Stock Dividends Distributable.

B)Common Stock.

C)Paid-in Capital in Excess of Par.

D)Stock Dividends.

A)Common Stock Dividends Distributable.

B)Common Stock.

C)Paid-in Capital in Excess of Par.

D)Stock Dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

41

Restricting retained earnings for the cost of treasury stock purchased is a

A)contractual restriction.

B)legal restriction.

C)stock restriction.

D)voluntary restriction.

A)contractual restriction.

B)legal restriction.

C)stock restriction.

D)voluntary restriction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

42

Bacon Corporation began business by issuing 180,000 shares of $5 par value common stock for $25 per share.During its first year, the corporation sustained a net loss of $30,000.The year-end balance sheet would show

A)Common stock of $900,000.

B)Common stock of $4,500,000.

C)Total paid-in capital of $4,470,000.

D)Total paid-in capital of $930,000.

A)Common stock of $900,000.

B)Common stock of $4,500,000.

C)Total paid-in capital of $4,470,000.

D)Total paid-in capital of $930,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a corporation pays taxes on its income, then stockholders will not have to pay taxes on the dividends received from that corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

44

The acquisition of treasury stock by a corporation increases total assets and total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

45

A detailed stockholders' equity section in the balance sheet will list the names of individuals who are eligible to receive dividends on the date of record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

46

The dominant form of business organization in the United States in terms of dollar sales volume, earnings, and employees is

A)the sole proprietorship.

B)the partnership.

C)the corporation.

D)not known.

A)the sole proprietorship.

B)the partnership.

C)the corporation.

D)not known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

47

The chief accounting officer in a corporation is the

A)treasurer.

B)president.

C)controller.

D)vice-president of finance.

A)treasurer.

B)president.

C)controller.

D)vice-president of finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

48

If Vickers Company issues 5,000 shares of $5 par value common stock for $175,000,

A)Common Stock will be credited for $175,000.

B)Paid-In Capital in Excess of Par will be credited for $25,000.

C)Paid-In Capital in Excess of Par will be credited for $150,000.

D)Cash will be debited for $150,000.

A)Common Stock will be credited for $175,000.

B)Paid-In Capital in Excess of Par will be credited for $25,000.

C)Paid-In Capital in Excess of Par will be credited for $150,000.

D)Cash will be debited for $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

49

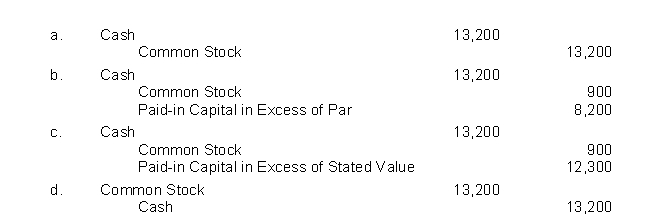

Jarrett Company issued 900 shares of no-par common stock for $13,200.Which of the following journal entries would 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

50

Treasury stock is generally accounted for by the

A)cost method.

B)market value method.

C)par value method.

D)stated value method.

A)cost method.

B)market value method.

C)par value method.

D)stated value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company would not acquire treasury stock

A)in order to reissue shares to officers.

B)as an asset investment.

C)in order to increase trading of the company's stock.

D)to have additional shares available to use in acquisitions of other companies.

A)in order to reissue shares to officers.

B)as an asset investment.

C)in order to increase trading of the company's stock.

D)to have additional shares available to use in acquisitions of other companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

52

The cumulative effect of the declaration and payment of a cash dividend on a company's balance sheet is to

A)decrease current liabilities and stockholders' equity.

B)increase total assets and stockholders' equity.

C)increase current liabilities and stockholders' equity.

D)decrease stockholders' equity and total assets.

A)decrease current liabilities and stockholders' equity.

B)increase total assets and stockholders' equity.

C)increase current liabilities and stockholders' equity.

D)decrease stockholders' equity and total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

53

On December 31, 2021, Stock, Inc.has 4,000 shares of 6% $100 par value cumulative preferred stock and 60,000 shares of $10 par value common stock outstanding.On December 31, 2021, the directors declare a $20,000 cash dividend.The entry to record the declaration of the dividend would include:

A)a credit of $4,000 to Cash Dividends.

B)a note in the financial statements that dividends of $4 per share are in arrears on preferred stock for 2021.

C)a debit of $20,000 to Common Stock.

D)a credit of $20,000 to Dividends Payable.

A)a credit of $4,000 to Cash Dividends.

B)a note in the financial statements that dividends of $4 per share are in arrears on preferred stock for 2021.

C)a debit of $20,000 to Common Stock.

D)a credit of $20,000 to Dividends Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which one of the following events would not require a formal journal entry on a corporation's books?

A)2-for-1 stock split

B)100% stock dividend

C)2% stock dividend

D)$1 per share cash dividend

A)2-for-1 stock split

B)100% stock dividend

C)2% stock dividend

D)$1 per share cash dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

55

The numerator in the payout ratio is

A)total cash dividends declared.

B)total cash dividends paid.

C)cash dividends declared on common stock.

D)cash dividends declared on preferred stock.

A)total cash dividends declared.

B)total cash dividends paid.

C)cash dividends declared on common stock.

D)cash dividends declared on preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

57

A corporation must be incorporated in each state in which it does business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

58

Treasury stock should not be classified as a current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

59

Common Stock Dividends Distributable is shown within the Paid-in Capital subdivision of the stockholders' equity section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

60

Under the corporate form of business organization,

A)a stockholder is personally liable for the debts of the corporation.

B)stockholders' acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation.

C)the corporation's life is stipulated in its charter.

D)stockholders wishing to sell their corporation shares must get the approval of other stockholders.

A)a stockholder is personally liable for the debts of the corporation.

B)stockholders' acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation.

C)the corporation's life is stipulated in its charter.

D)stockholders wishing to sell their corporation shares must get the approval of other stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

61

The ability of a corporation to obtain capital is

A)enhanced because of limited liability and ease of share transferability.

B)less than a partnership.

C)restricted because of the limited life of the corporation.

D)about the same as a partnership.

A)enhanced because of limited liability and ease of share transferability.

B)less than a partnership.

C)restricted because of the limited life of the corporation.

D)about the same as a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

62

If common stock is issued for an amount greater than par value, the excess should be credited to

A)Cash.

B)Retained Earnings.

C)Paid-in Capital in Excess of Par.

D)Legal Capital.

A)Cash.

B)Retained Earnings.

C)Paid-in Capital in Excess of Par.

D)Legal Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

63

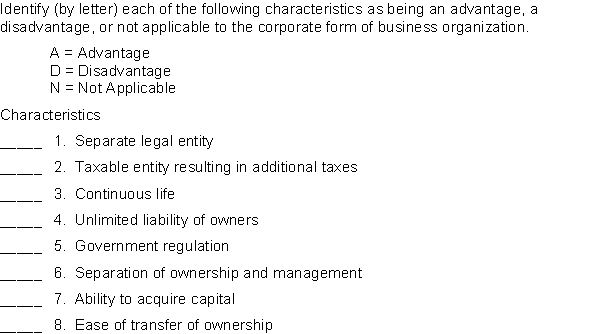

Darman Company issued 700 shares of no-par common stock for $7,700.Which of the following journal entries would 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

64

Treasury Stock is a(n)

A)contra asset account.

B)retained earnings account.

C)asset account.

D)contra stockholders' equity account.

A)contra asset account.

B)retained earnings account.

C)asset account.

D)contra stockholders' equity account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

65

Each of the following decreases retained earnings except a

A)cash dividend.

B)liquidating dividend.

C)stock dividend.

D)All of these decrease retained earnings.

A)cash dividend.

B)liquidating dividend.

C)stock dividend.

D)All of these decrease retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

66

eris, Inc.has 1,000 shares of 6%, $10 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2021.What is the annual dividend on the preferred stock?

A)$6 per share

B)$600 in total

C)$6,000 in total

D)$.06 per share

A)$6 per share

B)$600 in total

C)$6,000 in total

D)$.06 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

67

A stockholder who receives a stock dividend would

A)expect the market price per share to increase.

B)own more shares of stock.

C)expect retained earnings to increase.

D)expect the par value of the stock to change.

A)expect the market price per share to increase.

B)own more shares of stock.

C)expect retained earnings to increase.

D)expect the par value of the stock to change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

68

Stock dividends and stock splits have the following effects on retained earnings:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the board of directors authorizes a $100,000 restriction of retained earnings for a future plant expansion, the effect of this action is to

A)decrease total assets and total stockholders' equity.

B)increase stockholders' equity and decrease total liabilities.

C)decrease total retained earnings and increase total liabilities.

D)reduce the amount of retained earnings available for dividend declarations.

A)decrease total assets and total stockholders' equity.

B)increase stockholders' equity and decrease total liabilities.

C)decrease total retained earnings and increase total liabilities.

D)reduce the amount of retained earnings available for dividend declarations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

70

On July 6, Clayton Corporation issued 3,000 shares of its $1.50 par common stock.The market price of the stock on that date was $18 per share.Journalize the issuance of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

71

A stockholder has the right to vote in the election of the board of directors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

72

Treasury stock purchased for $25 per share that is reissued at $20 per share results in a Loss on Sale of Treasury Stock being recognized on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

73

Return on common stockholders' equity is computed by dividing net income by ending stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

74

Stockholders of a corporation directly elect

A)the president of the corporation.

B)the board of directors.

C)the treasurer of the corporation.

D)all of the employees of the corporation.

A)the president of the corporation.

B)the board of directors.

C)the treasurer of the corporation.

D)all of the employees of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following statements concerning taxation is accurate?

A)Partnerships pay state income taxes but not federal income taxes.

B)Corporations pay federal income taxes but not state income taxes.

C)Corporations pay federal and state income taxes.

D)Only the owners must pay taxes on corporate income.

A)Partnerships pay state income taxes but not federal income taxes.

B)Corporations pay federal income taxes but not state income taxes.

C)Corporations pay federal and state income taxes.

D)Only the owners must pay taxes on corporate income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

76

If stock is issued for a noncash asset, the asset should be recorded on the books of the corporation at

A)fair value.

B)cost.

C)zero.

D)a nominal amount.

A)fair value.

B)cost.

C)zero.

D)a nominal amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

77

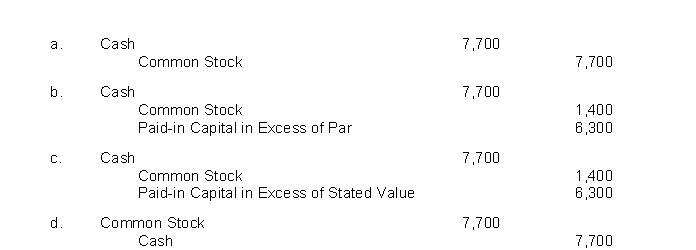

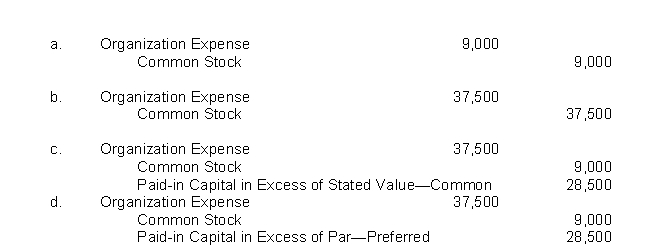

Ralston Company is authorized to issue 10,000 shares of 8%, $100 par value preferred stock and 500,000 shares of no-par common stock with a stated value of $1 per share.If Ralston issues 9,000 shares of common stock to pay its recent attorney's bill of $37,500 for legal services rendered in the organization of the corporation, which of the following would 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

78

Seven thousand shares of treasury stock of Marker, Inc., previously acquired at $14 per share, are sold at $20 per share.The entry to record this transaction will include a

A)credit to Treasury Stock for $140,000.

B)debit to Paid-In Capital from Treasury Stock for $42,000.

C)debit to Treasury Stock for $98,000.

D)credit to Paid-In Capital from Treasury Stock for $42,000.

A)credit to Treasury Stock for $140,000.

B)debit to Paid-In Capital from Treasury Stock for $42,000.

C)debit to Treasury Stock for $98,000.

D)credit to Paid-In Capital from Treasury Stock for $42,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which one of the following is not necessary in order for a corporation to pay a cash dividend?

A)Adequate cash

B)Approval of stockholders

C)Declaration of dividends by the board of directors

D)Retained earnings

A)Adequate cash

B)Approval of stockholders

C)Declaration of dividends by the board of directors

D)Retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck

80

Win, Inc.has 10,000 shares of 7%, $100 par value, cumulative preferred stock and 100,000 shares of $1 par value common stock outstanding at December 31, 2021.If the board of directors declares a $70,000 dividend, the

A)preferred shareholders will receive 1/10th of what the common shareholders will receive.

B)preferred shareholders will receive the entire $70,000.

C)$70,000 will be held as restricted retained earnings and paid out at some future date.

D)preferred shareholders will receive $35,000 and the common shareholders will receive $35,000.

A)preferred shareholders will receive 1/10th of what the common shareholders will receive.

B)preferred shareholders will receive the entire $70,000.

C)$70,000 will be held as restricted retained earnings and paid out at some future date.

D)preferred shareholders will receive $35,000 and the common shareholders will receive $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 222 في هذه المجموعة.

فتح الحزمة

k this deck