Deck 12: The Economics of Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/25

العب

ملء الشاشة (f)

Deck 12: The Economics of Information

1

A risk-neutral consumer is deciding whether to purchase a homogeneous product from one of two firms. One firm produces an unreliable product and the other a reliable product. At the time of the sale, the consumer is unable to distinguish between the two firms' products. From the consumer's perspective, there is an equal chance that a given firm's product is reliable or unreliable.

The maximum amount this consumer will pay for an unreliable product is $0, while she will pay $100 for a reliable product.

a. Given this uncertainty, what is the most this consumer will pay to purchase one unit of this product?

b. How much will this consumer be willing to pay for the product if the firm offering the reliable product includes a warranty that will protect the consumer? Explain.

The maximum amount this consumer will pay for an unreliable product is $0, while she will pay $100 for a reliable product.

a. Given this uncertainty, what is the most this consumer will pay to purchase one unit of this product?

b. How much will this consumer be willing to pay for the product if the firm offering the reliable product includes a warranty that will protect the consumer? Explain.

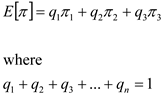

Consumer ascertains that there is an equal chance that a product may be reliable or unreliable. This suggests that the probability that the product is reliable is 0.5 and so is the probability of the product being unreliable.Consumer is willing to pay $0 for unreliable product and $100 for a reliable one.a)Given the information the consumer is acquainted with, consumer must choose the expected price valuation method to decide the maximum value she should place for one unit of the product. The expected value of the product is given by:

Hence, the maximum amount consumer should be willing to pay for a product in the event of uncertainty is $50.

Hence, the maximum amount consumer should be willing to pay for a product in the event of uncertainty is $50.

b)If the manufacturer of the reliable product includes a warranty, it sends a signal to the consumer about the product quality. With the assurance that the company will bear the cost of repair for any damage caused to the product, the consumer will purchase only this product believing it to be a reliable one.Given that the product is assured from different damage, the consumer is ready to pay amount which is equal to his maximum willingness to pay.

Therefore, the consumer will pay $100 as the product is reliable and has warranty attached with it.

Hence, the maximum amount consumer should be willing to pay for a product in the event of uncertainty is $50.

Hence, the maximum amount consumer should be willing to pay for a product in the event of uncertainty is $50.b)If the manufacturer of the reliable product includes a warranty, it sends a signal to the consumer about the product quality. With the assurance that the company will bear the cost of repair for any damage caused to the product, the consumer will purchase only this product believing it to be a reliable one.Given that the product is assured from different damage, the consumer is ready to pay amount which is equal to his maximum willingness to pay.

Therefore, the consumer will pay $100 as the product is reliable and has warranty attached with it.

2

You are considering a $500,000 investment in the fast-food industry and have narrowed your choice to either a McDonald's or a Penn Station East Coast Subs franchise. McDonald's indicates that, based on the location where you are proposing to open a new restaurant, there is a 25 percent probability that aggregate 10-year profits (net of the initial investment) will be $16 million, a 50 percent probability that profits will be $8 million, and a 25 percent probability that profits will be -$1.6 million. The aggregate 10-year profit projections (net of the initial investment) for a Penn Station East Coast Subs franchise is $48 million with a 2.5 percent probability, $8 million with a 95 percent probability, and -$48 million with a 2.5 percent probability. Considering both the risk and expected profitability of these two investment opportunities, which is the better investment? Explain carefully.

Out of the two fast food chains, investment should be made in that franchise from which the expected value profits is more and the risk associated with the project is less.

Expected value of a variable, here profit, is the sum of the probabilities that different profits will occur multiplied with the resulting payoffs. In the given case, the aggregate 10-year profits by both the fast-food giants acquire a typical form of the expected profit function as:

For MD, the expected profits are:

For MD, the expected profits are:

Similarly, the expected profits for PSECS franchise are:

Similarly, the expected profits for PSECS franchise are:

Note that the expected profits from both the investments are $7.6 million. Therefore, the project with lower associated risk will be chosen. Compute variance which acts as a measure of riskiness of an investment project.

Note that the expected profits from both the investments are $7.6 million. Therefore, the project with lower associated risk will be chosen. Compute variance which acts as a measure of riskiness of an investment project.

Variance is the sum of probabilities that different profits will occur multiplied by the square of the deviations from the mean of the resulting profits. For the case given, compute the variance as:

Variance for the investment in MD is:

Variance for the investment in MD is:

Similarly, variance for the investment in PSECS is:

Similarly, variance for the investment in PSECS is:

Observe that the expected profit of both projects was $7.6 million, the risk associated with the investment in PSECS is more than the risk involved in MD on the account of higher variance in the former option. Hence the better investment plan would be an investment in Md.

Observe that the expected profit of both projects was $7.6 million, the risk associated with the investment in PSECS is more than the risk involved in MD on the account of higher variance in the former option. Hence the better investment plan would be an investment in Md.

Expected value of a variable, here profit, is the sum of the probabilities that different profits will occur multiplied with the resulting payoffs. In the given case, the aggregate 10-year profits by both the fast-food giants acquire a typical form of the expected profit function as:

For MD, the expected profits are:

For MD, the expected profits are: Similarly, the expected profits for PSECS franchise are:

Similarly, the expected profits for PSECS franchise are: Note that the expected profits from both the investments are $7.6 million. Therefore, the project with lower associated risk will be chosen. Compute variance which acts as a measure of riskiness of an investment project.

Note that the expected profits from both the investments are $7.6 million. Therefore, the project with lower associated risk will be chosen. Compute variance which acts as a measure of riskiness of an investment project.Variance is the sum of probabilities that different profits will occur multiplied by the square of the deviations from the mean of the resulting profits. For the case given, compute the variance as:

Variance for the investment in MD is:

Variance for the investment in MD is: Similarly, variance for the investment in PSECS is:

Similarly, variance for the investment in PSECS is: Observe that the expected profit of both projects was $7.6 million, the risk associated with the investment in PSECS is more than the risk involved in MD on the account of higher variance in the former option. Hence the better investment plan would be an investment in Md.

Observe that the expected profit of both projects was $7.6 million, the risk associated with the investment in PSECS is more than the risk involved in MD on the account of higher variance in the former option. Hence the better investment plan would be an investment in Md. 3

You are a bidder in an independent private values auction, and you value the object at $4,000. Each bidder perceives that valuations are uniformly distributed between $1,500 and $9,000. Determine your optimal bidding strategy in a first-price, sealed-bid auction when the total number of bidders (including you) is:

a. 2.

b. 10.

c. 100.

a. 2.

b. 10.

c. 100.

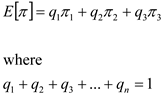

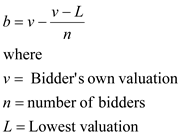

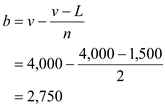

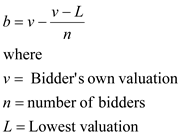

In a first-price, sealed-bid auction with independent private valuation, the optimal strategy be a bidder is to bid less than her evaluation of the item.

Given the number of bidders to be n, all considering the evaluations to be uniformly distributed, the optimal bid by any player is given by:

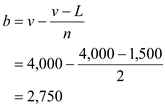

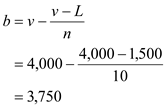

a)Given the values of v = $4,000, L = $1,500 and n = 2, the optimal bid is:

a)Given the values of v = $4,000, L = $1,500 and n = 2, the optimal bid is:

Hence the optimal bid by the player in the first-price, sealed-bid auction with 2 bidders is $2,750

Hence the optimal bid by the player in the first-price, sealed-bid auction with 2 bidders is $2,750

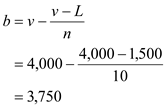

b)Consider now the values of v = $4,000, L = $1,500 same as before but take n = 10, the optimal bid with 10 bidders is:

Hence the optimal bid by the player in the first-price, sealed-bid auction with 10 bidders is $3,750

Hence the optimal bid by the player in the first-price, sealed-bid auction with 10 bidders is $3,750

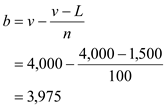

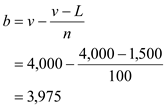

c)Keeping the values of v = $4,000, L = $1,500 intact and the number of bidders becoming n = 100, the optimal bid changes to:

Hence the optimal bid by the player in the first-price, sealed-bid auction with 100 bidders is $3,975

Hence the optimal bid by the player in the first-price, sealed-bid auction with 100 bidders is $3,975

Given the number of bidders to be n, all considering the evaluations to be uniformly distributed, the optimal bid by any player is given by:

a)Given the values of v = $4,000, L = $1,500 and n = 2, the optimal bid is:

a)Given the values of v = $4,000, L = $1,500 and n = 2, the optimal bid is: Hence the optimal bid by the player in the first-price, sealed-bid auction with 2 bidders is $2,750

Hence the optimal bid by the player in the first-price, sealed-bid auction with 2 bidders is $2,750 b)Consider now the values of v = $4,000, L = $1,500 same as before but take n = 10, the optimal bid with 10 bidders is:

Hence the optimal bid by the player in the first-price, sealed-bid auction with 10 bidders is $3,750

Hence the optimal bid by the player in the first-price, sealed-bid auction with 10 bidders is $3,750 c)Keeping the values of v = $4,000, L = $1,500 intact and the number of bidders becoming n = 100, the optimal bid changes to:

Hence the optimal bid by the player in the first-price, sealed-bid auction with 100 bidders is $3,975

Hence the optimal bid by the player in the first-price, sealed-bid auction with 100 bidders is $3,975 4

Online MBA programs significantly reduce the cost to existing managers of obtaining an MBA, as they permit students to maintain their existing residence and employment while working toward an advanced degree in business. Based on your knowledge of the economics of information and student characteristics, compare and contrast the likely characteristics of students enrolled in traditional MBA programs with those enrolled in online MBA programs, and discuss how potential employers might use information about where a candidate obtained his or her MBA degree to screen potential MBA job applicants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

5

You are one of five risk-neutral bidders participating in an independent private values auction. Each bidder perceives that all other bidders' valuations for the item are evenly distributed between $10,000 and $30,000. For each of the following auction types, determine your optimal bidding strategy if you value the item at $22,000.

a. First-price, sealed-bid auction.

b. Dutch auction.

c. Second-price, sealed-bid auction.

d. English auction.

a. First-price, sealed-bid auction.

b. Dutch auction.

c. Second-price, sealed-bid auction.

d. English auction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

6

Prosecutors representing the Securities and Exchange Commission recently announced criminal charges against 13 individuals for engaging in insider trading. According to the SEC's director of enforcement, a trading ring acting on inside information "compromises the markets' integrity and investors' trust...." Explain why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

7

The text points out that asymmetric information can have deleterious effects on market outcomes.

a. Explain how asymmetric information about a hidden action or a hidden characteristic can lead to moral hazard or adverse selection.

b. Discuss a few tactics that managers can use to overcome these problems.

a. Explain how asymmetric information about a hidden action or a hidden characteristic can lead to moral hazard or adverse selection.

b. Discuss a few tactics that managers can use to overcome these problems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

8

An advertisement in the local paper offers a "fully loaded" car that is only six months old and has only been driven 5,000 miles at a price that is 20 percent lower than the average selling price of a brand new car with the same options. Use precise economic terminology to explain whether this discount most likely reflects a "fantastic deal" or something else.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

9

Life insurance policies typically have clauses stipulating the insurance company will not pay claims arising from suicide for a specified term-typically two years from the date the policy was issued. Use precise economic terminology to explain the likely impact on an insurance company's bottom line if it were to eliminate such a clause.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

10

The FCC has hired you as a consultant to design an auction to sell wireless spectrum rights. The FCC indicates that its goal of using auctions to sell these spectrum rights is to generate revenue. Since most bidders are large telecommunications companies, you rationally surmise that all participants in the auction are risk neutral. Which auction type-first-price, second-price, English, or Dutch-would you recommend if all bidders value spectrum rights identically but have different estimates of the true underlying value of spectrum rights? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

11

As the manager of Smith Construction, you need to make a decision on the number of homes to build in a new residential area where you are the only builder. Unfortunately, you must build the homes before you learn how strong demand is for homes in this large neighborhood. There is a 60 percent chance of low demand and a 40 percent chance of high demand. The corresponding (inverse) demand functions for these two scenarios are P = 300,000 - 400 Q and P = 500,000 - 275 Q, respectively. Your cost function is C ( Q ) = 140,000 + 240,000 Q. How many new homes should you build, and what profits can you expect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

12

Life insurance companies require applicants to submit to a physical examination as proof of insurability prior to issuing standard life insurance policies. In contrast, credit card companies offer their customers a type of insurance called "credit life insurance" which pays off the credit card balance if the cardholder dies. Would you expect insurance premiums to be higher (per dollar of death benefits) on standard life or credit life policies? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

13

BK Books is an online book retailer that also has 10,000 "bricks and mortar" outlets worldwide. You are a risk-neutral manager within the Corporate Finance Division and are in dire need of a new financial analyst. You only interview students from the top MBA programs in your area. Thanks to your screening mechanisms and contacts, the students you interview ultimately differ only with respect to the wage that they are willing to accept. About 10 percent of acceptable candidates are willing to accept a salary of $70,000, while 90 percent demand a salary of $100,000. There are two phases to the interview process that every interviewee must go through. Phase 1 is the initial one-hour on-campus interview. All candidates interviewed in Phase 1 are also invited to Phase 2 of the interview, which consists of a five-hour office visit. In all, you spend six hours interviewing each candidate and value this time at $900. In addition, it costs a total of $4,900 in travel expenses to interview each candidate. You are very impressed with the first interviewee completing both phases of BK Books's interviewing process, and she has indicated that her reservation salary is $100,000. Should you make her an offer at that salary or continue the interviewing process? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

14

Your instructor may assign additional problem-solving exercises (called memos ) that require you to apply some of the tools you learned in this chapter to make a recommendation based on an actual business scenario. Some of these memos accompany the Time Warner case (pages 561-597 of your textbook). Additional memos, as well as data that may be useful for your analysis, are available online at www.mhhe.com/baye8e.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

15

Congress enacted the Health Insurance Portability and Accountability Act (HIPAA) to potentially help millions of employees gain access to group health insurance. The key provision of HIPAA requires insurance companies and health insurance plans administered by employers who self-insure to provide all employees access to health insurance regardless of previous medical conditions. This provision is known as "guaranteed issue" and is a controversial topic in the insurance industry. Explain why this is controversial legislation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

16

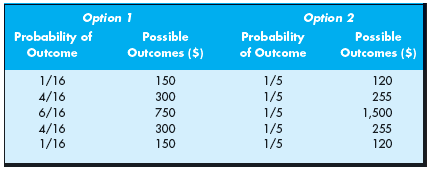

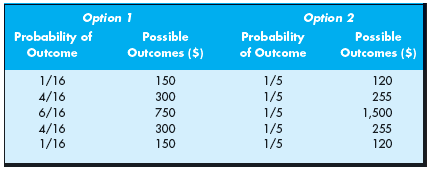

Consider the two options in the following table, both of which have random outcomes:

a. Determine the expected value of each option.

b. Determine the variance and standard deviation of each option.

c. Which option is most risky?

a. Determine the expected value of each option.

b. Determine the variance and standard deviation of each option.

c. Which option is most risky?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

17

Since the late 1990s, more than 25 domestic steel companies have filed for bankruptcy. A combination of low prices with strong competition by foreign competitors and so-called "legacy costs" of unions are cited as the primary reasons why so many steel companies are filing for bankruptcy. In 2002, as Brownstown Steel Corp. was in the process of restructuring its loans to avoid bankruptcy, its lenders requested that the firm disclose full information about its revenues and costs. Explain why Brownstown's management was reluctant to release this information to its lenders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

18

If your instructor has adopted Connect for the course and you are an active subscriber, you can practice with the questions presented above, along with many alternative versions of these questions. Your instructor may also assign a subset of these problems and/or their alternative versions as a homework assignment through Connect, allowing for immediate feedback of grades and correct answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

19

This past year, Used Imported Autos sold very few cars and lost over $500,000. As a consequence, its manager is contemplating two strategies to increase its sales volume. The low-cost strategy involves changing the dealership name to Quality Used Imported Autos to signal to customers that the company sells high-quality cars. The high-cost strategy involves issuing a 10-point auto inspection on all used cars on the lot and offering consumers a 30-day warranty on every used car sold. Which of these two strategies do you think would have the greatest impact on sales volume? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

20

For each of the following scenarios, determine whether the decision maker is risk neutral, risk averse, or risk loving.

a. A manager prefers a 20 percent chance of receiving $1,400 and an 80 percent chance of receiving $500 to receiving $680 for sure.

b. A shareholder prefers receiving $920 with certainty to an 80 percent chance of receiving $1,100 and a 20 percent chance of receiving $200.

c. A consumer is indifferent between receiving $1,360 for sure and a lottery that pays $2,000 with a 60 percent probability and $400 with a 40 percent probability.

a. A manager prefers a 20 percent chance of receiving $1,400 and an 80 percent chance of receiving $500 to receiving $680 for sure.

b. A shareholder prefers receiving $920 with certainty to an 80 percent chance of receiving $1,100 and a 20 percent chance of receiving $200.

c. A consumer is indifferent between receiving $1,360 for sure and a lottery that pays $2,000 with a 60 percent probability and $400 with a 40 percent probability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

21

Pelican Point Financial Group's clientele consists of two types of investors. The first type of investor makes many transactions in a given year and has a net worth of over $1.5 million. These investors seek unlimited access to investment consultants and are willing to pay up to $20,000 annually for no-fee-based transactions, or alternatively, $40 per trade. The other type of investor also has a net worth of over $1.5 million but makes few transactions each year and therefore is willing to pay $120 per trade. As the manager of Pelican Point Financial Group, you are unable to determine whether any given individual is a high- or low-volume transaction investor. Design a self-selection mechanism that permits you to identify each type of investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

22

Your store sells an item desired by a consumer. The consumer is using an opti mal search strategy; the accompanying graph shows the consumer's expected benefits and costs of searching for a lower price.

a. What is the consumer's reservation price?

b. If your price is $3 and the consumer visits your store, will she purchase the item or continue to search? Explain.

c. Suppose the consumer's cost of each search rises to $16. What is the highest price you can charge and still sell the item to the consumer if she visits your store?

d. Suppose the consumer's cost of each search falls to $2. If the consumer finds a store charging $3, will she purchase at that price or continue to search?

a. What is the consumer's reservation price?

b. If your price is $3 and the consumer visits your store, will she purchase the item or continue to search? Explain.

c. Suppose the consumer's cost of each search rises to $16. What is the highest price you can charge and still sell the item to the consumer if she visits your store?

d. Suppose the consumer's cost of each search falls to $2. If the consumer finds a store charging $3, will she purchase at that price or continue to search?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

23

CPT Inc. is a local manufacturer of conveyor systems. Last year, CPT sold over $2 million worth of conveyor systems that netted the company $100,000 in profits. Raw materials and labor are CPT' s biggest expenses. Spending on structural steel alone amounted to over $500,000, or 25 percent of total sales. In an effort to reduce costs, CPT now uses an online procurement procedure that is best described as a first-price, sealed-bid auction. The bidders in these auctions utilize the steel for a wide variety of purposes, ranging from art to skyscrapers. This suggests that bidders value the steel independently, although it is perceived that bidder valuations are evenly distributed between $8,000 and $25,000. You are the purchasing manager at CPT and are bidding on three tons of six-inch hot-rolled channel steel against four other bidders. Your company values the three tons of channel steel at $16,000. What is your optimal bid?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

24

You are the manager of a firm that sells a "commodity" in a market that resembles perfect competition, and your cost function is C ( Q ) =2 Q +3 Q 2. Unfortunately, due to production lags, you must make your output decision prior to knowing for certain the price that will prevail in the market. You believe that there is a 70 percent chance the market price will be $200 and a 30 percent chance it will be $600.

a. Calculate the expected market price.

b. What output should you produce in order to maximize expected profits?

c. What are your expected profits?

a. Calculate the expected market price.

b. What output should you produce in order to maximize expected profits?

c. What are your expected profits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

25

Recently, PeopleSoft announced that its second-quarter net income was down by nearly 70 percent. The company's CEO attributes the poor performance to an ongoing hostile takeover battle against its rival, Oracle (PeopleSoft has reportedly spent over $10.5 million to defend itself). Analysts, however, are quick to note that PeopleSoft's revenue estimates were adjusted downward from approximately $680 million to $660 million. Suppose that Oracle perceives that there is a 70 percent probability that PeopleSoft's decline in net income is merely the transitory result of efforts to fight the takeover. In this case, the present value of PeopleSoft's stream of profits is $10 billion. However, Oracle perceives that there is a 30 percent chance that PeopleSoft's lower net income figures stem from long-term structural changes in the demand for PeopleSoft's services, and that the present value of its profit stream is only $2 billion. You are a decision-maker at Oracle and know that your current takeover bid is $7 billion. You have just learned that a rival bidder-SAP-perceives that there is an 80 percent probability that the present value of PeopleSoft's stream of profits is $10 billion and a 20 percent probability of being only $2 billion. Based on this information, should you increase your bid or hold firm to your $7 billion offer? Explain carefully.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck