Deck 8: Supply, Demand and Government Policies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

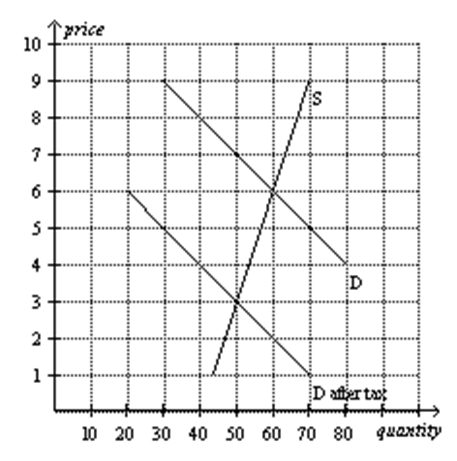

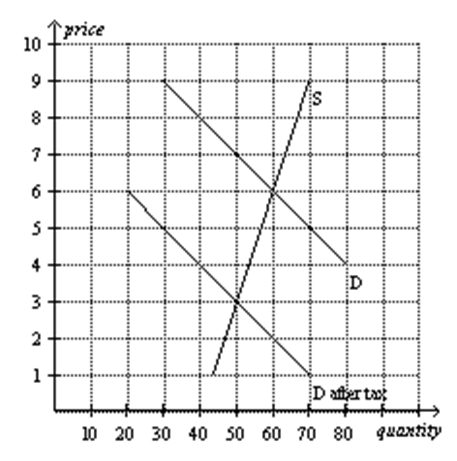

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 8: Supply, Demand and Government Policies

1

A R10 tax on football boots will always raise the price that the buyers pay for football boots by R10.

False

2

A subsidy given to suppliers has the effect of shifting the demand curve outwards.

False

3

-Refer to the table above. In the supply and demand schedules for socks shown here, if a price floor of R60 is imposed by the government, there will be a

A) surplus of socks equal to 8 pairs.

B) shortage of socks equal to 5 pairs.

C) surplus of socks equal to 6 pairs.

D) market clearing quantity of 6 pairs of socks exchanged.

shortage of socks equal to 5 pairs.

4

The ultimate burden of a tax falls most heavily on the side of the market that is less elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

-Refer to the table above. In the supply and demand schedules for socks shown here, if a price ceiling of R60 is imposed by the government, there will be a

A) shortage of socks equal to 6 pairs.

B) shortage of socks equal to 5 pairs.

C) a surplus of socks equal to 5 pairs.

D) a surplus of socks equal to 8 pairs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Government-created price floors are typically imposed to

A) help consumers.

B) help producers.

C) raise tax revenue.

D) shift the supply curve to the right.

A) help consumers.

B) help producers.

C) raise tax revenue.

D) shift the supply curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

A binding price ceiling creates

A) a shortage or a surplus depending on whether the price ceiling is set above or below the equilibrium price.

B) a surplus.

C) a shortage.

D) an equilibrium.

A) a shortage or a surplus depending on whether the price ceiling is set above or below the equilibrium price.

B) a surplus.

C) a shortage.

D) an equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

- Refer to the table above. In the supply and demand schedules for socks shown here, if a price floor of R100 is imposed by the government, there will be a

A) surplus of socks equal to 8 pairs.

B) shortage of socks equal to 16 pairs.

C) surplus of socks equal to 6 pairs.

D) market clearing quantity of 6 pairs of socks exchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

A price ceiling that is not a binding constraint today could cause a shortage in the future if demand were to increase and raise the equilibrium price above the fixed price ceiling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

A tax creates a tax wedge between a buyer and a seller. This causes the price paid by the buyer to rise, the price received by the seller to fall, and the quantity sold to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

For a price ceiling to be a binding constraint on the market, the government must set it

A) above the equilibrium price.

B) below the equilibrium price.

C) precisely at the equilibrium price.

D) at any price because all price ceilings are binding constraints.

A) above the equilibrium price.

B) below the equilibrium price.

C) precisely at the equilibrium price.

D) at any price because all price ceilings are binding constraints.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

Rent controls typically end up

A) increasing rents received by landlords.

B) raising property values.

C) encouraging landlords to overspend on maintenance.

D) discouraging new housing construction.

A) increasing rents received by landlords.

B) raising property values.

C) encouraging landlords to overspend on maintenance.

D) discouraging new housing construction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

A price floor set above the equilibrium price is a binding constraint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

-Refer to the table above. In the supply and demand schedules for socks shown here, if a price ceiling of R60 is imposed by the government, the quantity of socks actually purchased will be

A) 5

B) 10

C) 4

D) 6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the equilibrium price of bread is R20 and the government imposes a R15.00 price ceiling on the price of bread,

A) more bread will be produced to meet the increased demand.

B) there will be a shortage of bread.

C) the demand for bread will decrease because suppliers will reduce their supply.

D) a surplus of bread will emerge.

A) more bread will be produced to meet the increased demand.

B) there will be a shortage of bread.

C) the demand for bread will decrease because suppliers will reduce their supply.

D) a surplus of bread will emerge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

A tax collected from buyers has an equivalent impact to a same size tax collected from sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

Suppose the equilibrium price for apartments is R5 000 per month and the government imposes rent controls of R2 500. Which of the following is unlikely to occur as a result of the rent controls?

A) There may be long lines of buyers waiting for apartments.

B) Landlords may discriminate among apartment renters.

C) Landlords may be offered bribes to rent apartments.

D) There will be a shortage of housing.

E) The quality of apartments will improve.

A) There may be long lines of buyers waiting for apartments.

B) Landlords may discriminate among apartment renters.

C) Landlords may be offered bribes to rent apartments.

D) There will be a shortage of housing.

E) The quality of apartments will improve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the equilibrium price of petrol is R10.00 per litre and the government places a price ceiling on petrol of R15.00 per litre, the result will be a shortage of petrol.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

A price ceiling set below the equilibrium price causes a surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

A 10 per cent increase in the minimum wage is more likely to raise unemployment among teenage workers than among mid-career professional workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements about a binding price ceiling is true?

A) The shortage created by the price ceiling is greater in the short run than in the long run.

B) The surplus created by the price ceiling is greater in the short run than in the long run.

C) The surplus created by the price ceiling is greater in the long run than in the short run.

D) The shortage created by the price ceiling is greater in the long run than in the short run.

A) The shortage created by the price ceiling is greater in the short run than in the long run.

B) The surplus created by the price ceiling is greater in the short run than in the long run.

C) The surplus created by the price ceiling is greater in the long run than in the short run.

D) The shortage created by the price ceiling is greater in the long run than in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

The quantity sold in a market will decrease if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) All of the above are correct.

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

A tax of R1.00 per litre on petrol

A) places a tax wedge of R1.00 between the price the buyers pay and the price the sellers receive.

B) decreases the price the sellers receive by R1.00 per litre.

C) increases the price the buyers pay by R1.00 per litre.

D) increases the price the buyers pay by precisely R0.50 and reduces the price received by sellers by precisely R0.50.

A) places a tax wedge of R1.00 between the price the buyers pay and the price the sellers receive.

B) decreases the price the sellers receive by R1.00 per litre.

C) increases the price the buyers pay by R1.00 per litre.

D) increases the price the buyers pay by precisely R0.50 and reduces the price received by sellers by precisely R0.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Within the supply and demand model, a tax collected from the sellers of a good shifts the

A) demand curve downward by the size of the tax per unit.

B) supply curve downward by the size of the tax per unit.

C) demand curve upward by the size of the tax per unit.

D) supply curve upward by the size of the tax per unit.

A) demand curve downward by the size of the tax per unit.

B) supply curve downward by the size of the tax per unit.

C) demand curve upward by the size of the tax per unit.

D) supply curve upward by the size of the tax per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is an example of a price floor?

A) The minimum wage.

B) Rent controls.

C) Restricting petrol prices to R10.00 per litre when the equilibrium price is R15.00 per litre.

D) All of these answers are price floors.

A) The minimum wage.

B) Rent controls.

C) Restricting petrol prices to R10.00 per litre when the equilibrium price is R15.00 per litre.

D) All of these answers are price floors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true if the government places a price ceiling on petrol at R15.00 per litre and the equilibrium price is R10.00 per litre?

A) A significant increase in the demand for petrol could cause the price ceiling to become a binding constraint.

B) A significant increase in the supply of petrol could cause the price ceiling to become a binding constraint.

C) There will be a shortage of petrol.

D) There will be a surplus of petrol.

A) A significant increase in the demand for petrol could cause the price ceiling to become a binding constraint.

B) A significant increase in the supply of petrol could cause the price ceiling to become a binding constraint.

C) There will be a shortage of petrol.

D) There will be a surplus of petrol.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following takes place when a tax is placed on a good?

A) A decrease in the price buyers pay, an increase in the price sellers receive, and a decrease in the quantity sold.

B) An increase in the price buyers pay, a decrease in the price sellers receive, and an increase in the quantity sold.

C) A decrease in the price buyers pay, an increase in the price sellers receive, and an increase in the quantity sold.

D) An increase in the price buyers pay, a decrease in the price sellers receive, and a decrease in the quantity sold.

A) A decrease in the price buyers pay, an increase in the price sellers receive, and a decrease in the quantity sold.

B) An increase in the price buyers pay, a decrease in the price sellers receive, and an increase in the quantity sold.

C) A decrease in the price buyers pay, an increase in the price sellers receive, and an increase in the quantity sold.

D) An increase in the price buyers pay, a decrease in the price sellers receive, and a decrease in the quantity sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

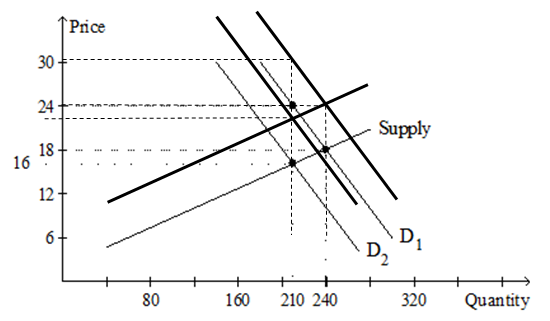

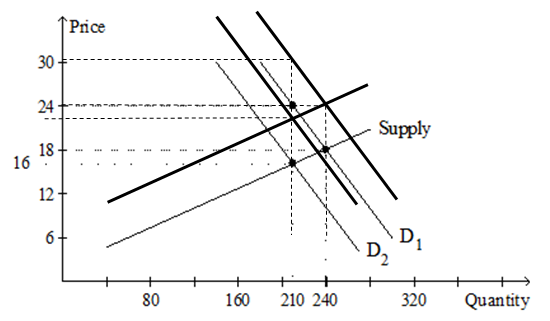

Refer to the graph above. What is the amount of the tax per unit?

A) R80

B) R60

C) R40

D) R20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Refer to the graph above. Which of the following statements is correct?

A) The amount of the tax per unit is R60.

B) The tax leaves the size of the market unchanged.

C) The tax is levied on buyers of the good, rather than on sellers.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

The tax burden will fall most heavily on sellers of the good when the demand curve

A) is relatively steep, and the supply curve is relatively flat.

B) is relatively flat, and the supply curve is relatively steep.

C) and the supply curve are both relatively flat.

D) and the supply curve are both relatively steep.

A) is relatively steep, and the supply curve is relatively flat.

B) is relatively flat, and the supply curve is relatively steep.

C) and the supply curve are both relatively flat.

D) and the supply curve are both relatively steep.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

The burden of a tax falls more heavily on the sellers in a market when

A) both supply and demand are elastic.

B) both supply and demand are inelastic.

C) demand is inelastic and supply is elastic.

D) demand is elastic and supply is inelastic.

A) both supply and demand are elastic.

B) both supply and demand are inelastic.

C) demand is inelastic and supply is elastic.

D) demand is elastic and supply is inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

When a tax is collected from the buyers in a market,

A) the tax burden falls most heavily on the buyers.

B) the buyers bear the burden of the tax.

C) the sellers bear the burden of the tax.

D) the tax burden on the buyers and sellers is the same as an equivalent tax collected from the sellers.

A) the tax burden falls most heavily on the buyers.

B) the buyers bear the burden of the tax.

C) the sellers bear the burden of the tax.

D) the tax burden on the buyers and sellers is the same as an equivalent tax collected from the sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

The surplus caused by a binding price floor will be greatest if

A) demand is inelastic and supply is elastic.

B) supply is inelastic and demand is elastic.

C) both supply and demand are elastic.

D) both supply and demand are inelastic.

A) demand is inelastic and supply is elastic.

B) supply is inelastic and demand is elastic.

C) both supply and demand are elastic.

D) both supply and demand are inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Taxes levied directly on consumers

A) always hurt consumers rather than producers.

B) always hurt producers rather than consumers.

C) generate more revenue than taxes levied on producers.

D) have the same effect as taxes directly levied on producers.

A) always hurt consumers rather than producers.

B) always hurt producers rather than consumers.

C) generate more revenue than taxes levied on producers.

D) have the same effect as taxes directly levied on producers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

The tax per unit on a good is the

A) difference between the list price and the actual price paid by the buyer.

B) licensing fees and other business taxes paid by sellers, averaged over the total quantity of goods sold.

C) difference between the total price paid by the buyer and the price received by the seller.

D) difference between wholesale and retail prices.

A) difference between the list price and the actual price paid by the buyer.

B) licensing fees and other business taxes paid by sellers, averaged over the total quantity of goods sold.

C) difference between the total price paid by the buyer and the price received by the seller.

D) difference between wholesale and retail prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

Within the supply and demand model, a tax collected from the buyers of a good shifts the

A) supply curve downward by the size of the tax per unit.

B) supply curve upward by the size of the tax per unit.

C) demand curve upward by the size of the tax per unit.

D) demand curve downward by the size of the tax per unit.

A) supply curve downward by the size of the tax per unit.

B) supply curve upward by the size of the tax per unit.

C) demand curve upward by the size of the tax per unit.

D) demand curve downward by the size of the tax per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following causes a surplus of a good?

A) A binding price floor.

B) A binding price ceiling.

C) A tax on the good.

D) More than one of the above is correct.

A) A binding price floor.

B) A binding price ceiling.

C) A tax on the good.

D) More than one of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the government imposes a binding price floor on sugar, it may also have to

A) establish programs to expand supply in the private sector.

B) establish programs to reduce demand in the private sector.

C) produce some sugar itself.

D) purchase the surplus sugar.

A) establish programs to expand supply in the private sector.

B) establish programs to reduce demand in the private sector.

C) produce some sugar itself.

D) purchase the surplus sugar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which side of the market is more likely to lobby government for a price floor?

A) The buyers.

B) Neither buyers nor sellers desire a price floor.

C) The sellers.

D) Both buyers and sellers desire a price floor.

A) The buyers.

B) Neither buyers nor sellers desire a price floor.

C) The sellers.

D) Both buyers and sellers desire a price floor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

A price floor

A) always determines the price at which a good must be sold.

B) sets a legal maximum on the price at which a good can be sold.

C) is not a binding constraint if it is set above the equilibrium price.

D) sets a legal minimum on the price at which a good can be sold.

A) always determines the price at which a good must be sold.

B) sets a legal maximum on the price at which a good can be sold.

C) is not a binding constraint if it is set above the equilibrium price.

D) sets a legal minimum on the price at which a good can be sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

The government is thinking about increasing the tax on petrol to raise additional revenue rather than to promote conservation. The tax will result in the greatest amount of tax revenue if the price elasticity of demand for petrol equals:

A) 1.8

B) 1.4

C) 1.0

D) 0.5

A) 1.8

B) 1.4

C) 1.0

D) 0.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about the burden of a tax is correct?

A) The tax burden generated from a tax placed on a good that consumers perceive to be a necessity will fall most heavily on the sellers of the good.

B) The burden of a tax falls on the side of the market (buyers or sellers) from which it is collected.

C) The distribution of the burden of a tax is determined by the relative elasticities of supply and demand and is not determined by legislation.

D) The tax burden falls most heavily on the side of the market (buyers or sellers) that is most willing to leave the market when price movements are unfavourable to them.

A) The tax burden generated from a tax placed on a good that consumers perceive to be a necessity will fall most heavily on the sellers of the good.

B) The burden of a tax falls on the side of the market (buyers or sellers) from which it is collected.

C) The distribution of the burden of a tax is determined by the relative elasticities of supply and demand and is not determined by legislation.

D) The tax burden falls most heavily on the side of the market (buyers or sellers) that is most willing to leave the market when price movements are unfavourable to them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

The government is thinking about increasing the tax on petrol to promote conservation. The tax will discourage the consumption of petrol most when the price elasticity of demand equals:

A) 0.1

B) 0.7

C) 1.3

D) 2.0

A) 0.1

B) 0.7

C) 1.3

D) 2.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

Using the graph below, analyse the effect a R3 000 price ceiling would have on the market for mountain bikes. Would this be a binding price ceiling?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

Subsidies are levied when a government wants to:

A) increase its tax revenues.

B) encourage the consumption of a good it thinks is currently under-produced.

C) decrease the demand for a product.

D) provide consumers with a disincentive to buy.

A) increase its tax revenues.

B) encourage the consumption of a good it thinks is currently under-produced.

C) decrease the demand for a product.

D) provide consumers with a disincentive to buy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

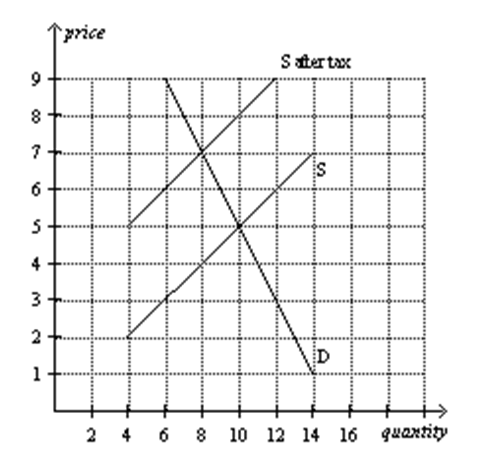

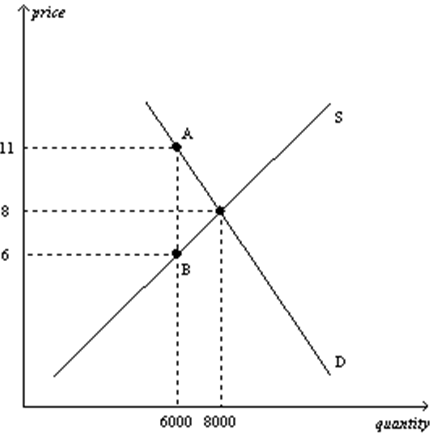

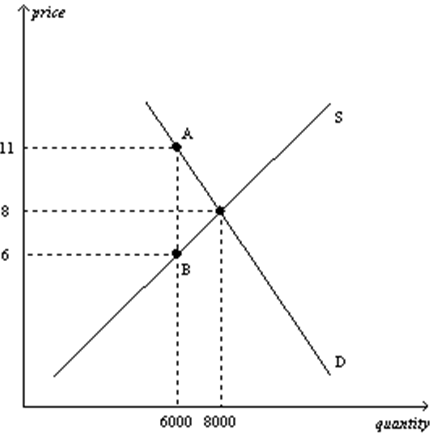

Using the graph below, answer the following questions:

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. R7

f. R3

g. As a result of the tax, the level of market activity has fallen, from 60 units bought and sold to only 50 units bought and sold.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. R7

f. R3

g. As a result of the tax, the level of market activity has fallen, from 60 units bought and sold to only 50 units bought and sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Using the graph below, analyse the effect a R7 000 price floor would have on this market for mountain bikes. Would this be a binding price floor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is the difference between a price ceiling and a price floor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

A subsidy is the opposite of a tax. The government pays buyers a R0.50 subsidy for each bus ticket purchased.

a) What happens to the effective price paid by consumers buying bus tickets, the effective price received by bus companies and the quantity traded? Create a graph to justify your answer.

b) Who gains and who loses from this policy?

a) What happens to the effective price paid by consumers buying bus tickets, the effective price received by bus companies and the quantity traded? Create a graph to justify your answer.

b) Who gains and who loses from this policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

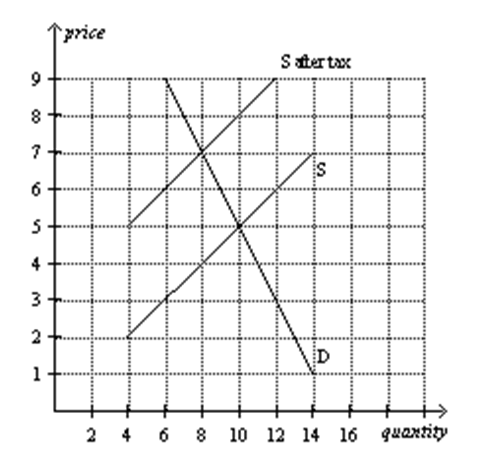

Using the graph below, answer the following questions:

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is correct? A tax burden…

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is less elastic.

C) falls more heavily on the side of the market that is closest to unit elastic.

D) is distributed independently of the relative elasticities of supply and demand.

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is less elastic.

C) falls more heavily on the side of the market that is closest to unit elastic.

D) is distributed independently of the relative elasticities of supply and demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

A tax placed on a good that is a necessity for consumers will likely generate a tax burden that

A) falls more heavily on sellers.

B) falls entirely on sellers.

C) falls more heavily on buyers.

D) is evenly distributed between buyers and sellers.

A) falls more heavily on sellers.

B) falls entirely on sellers.

C) falls more heavily on buyers.

D) is evenly distributed between buyers and sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Why would policymakers choose to impose a price ceiling or price floor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

For which of the following products would the burden of a tax likely fall more heavily on the sellers?

A) Clothing.

B) Food.

C) Housing.

D) Entertainment.

A) Clothing.

B) Food.

C) Housing.

D) Entertainment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Using the graph below, in which the vertical distance between points A and B represents the tax in the market, answer the following questions:

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

How does elasticity affect the burden of a tax? Justify your answer using supply and demand diagrams.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

The government decides to reduce air pollution by reducing the use of petrol. It imposes a tax of R0.50 on each litre of petrol sold.

a. Should it impose this tax on petrol companies or motorists? Create a graph to justify your answer.

b. If demand for petrol were more elastic, would this tax be more or less effective in reducing the quantity of petrol consumed?

c. To what extent are consumers of petrol and oil industry workers affected by this tax?

a. Should it impose this tax on petrol companies or motorists? Create a graph to justify your answer.

b. If demand for petrol were more elastic, would this tax be more or less effective in reducing the quantity of petrol consumed?

c. To what extent are consumers of petrol and oil industry workers affected by this tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

The burden of a tax falls more heavily on the buyers in a market when

A) both supply and demand are inelastic.

B) demand is elastic and supply is inelastic.

C) both supply and demand are elastic.

D) demand is inelastic and supply is elastic.

A) both supply and demand are inelastic.

B) demand is elastic and supply is inelastic.

C) both supply and demand are elastic.

D) demand is inelastic and supply is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck