Deck 10: Income and Expenditures Equilibrium

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/135

العب

ملء الشاشة (f)

Deck 10: Income and Expenditures Equilibrium

1

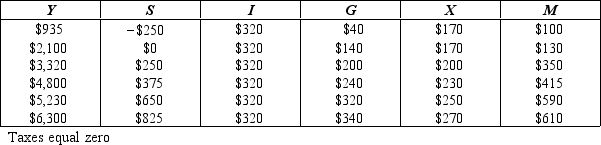

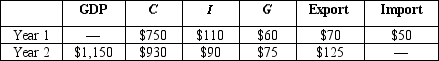

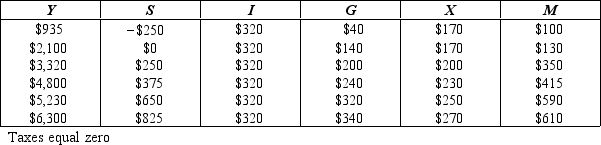

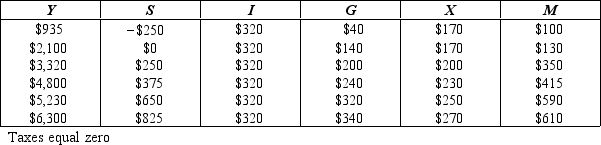

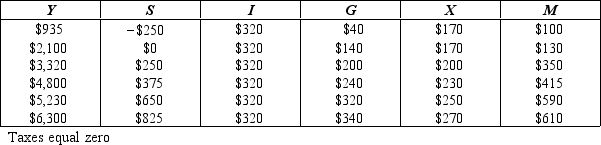

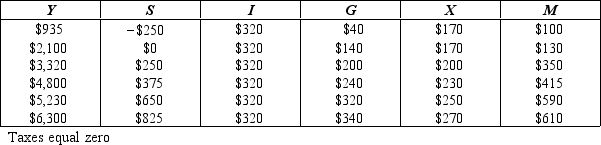

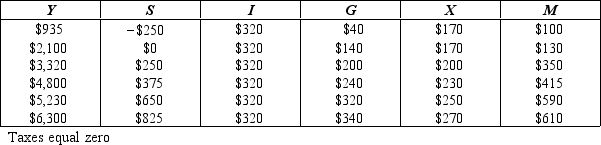

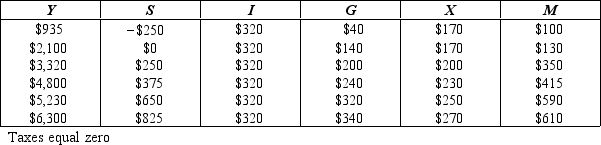

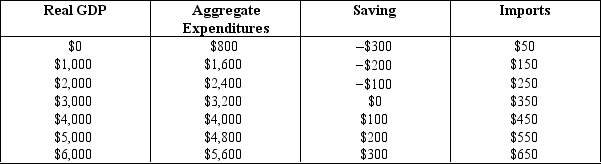

NARRBEGIN: Table 10.2

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. If autonomous saving decreases by $200, what will happen at the current equilibrium level of income?

A) Autonomous consumption spending will also decrease by $200, and so no change in equilibrium income occurs.

B) Total leakages in the economy will exceed total injections.

C) There will be pressure on real GDP to rise.

D) There will be pressure on the economy to contract.

E) Unplanned inventories in the economy will grow.

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. If autonomous saving decreases by $200, what will happen at the current equilibrium level of income?

A) Autonomous consumption spending will also decrease by $200, and so no change in equilibrium income occurs.

B) Total leakages in the economy will exceed total injections.

C) There will be pressure on real GDP to rise.

D) There will be pressure on the economy to contract.

E) Unplanned inventories in the economy will grow.

C

2

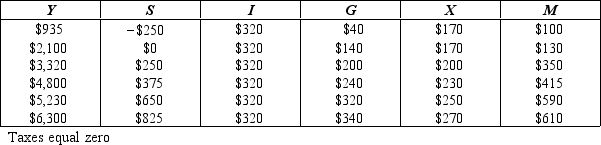

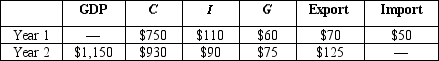

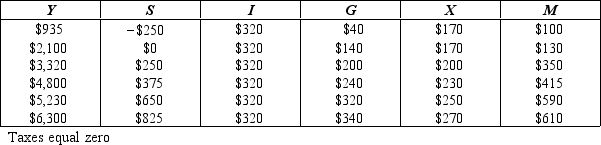

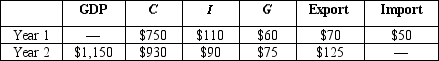

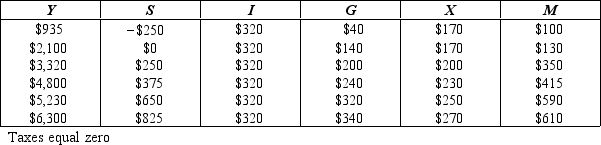

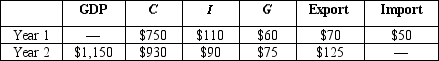

NARRBEGIN: Table 10.1

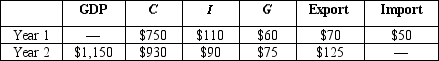

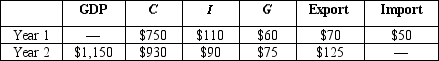

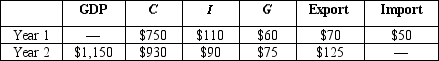

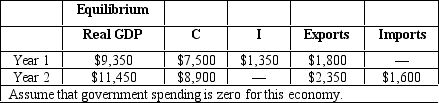

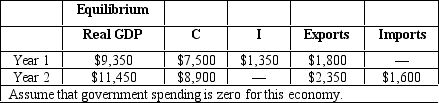

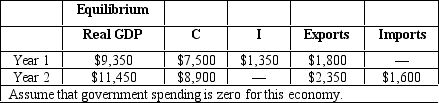

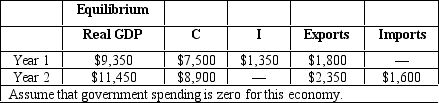

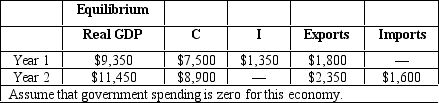

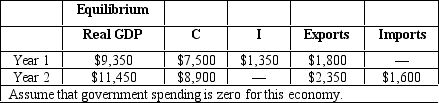

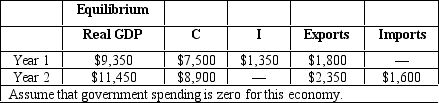

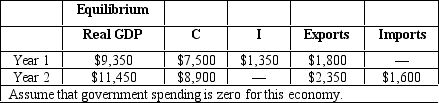

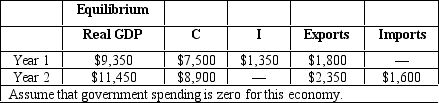

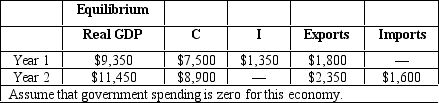

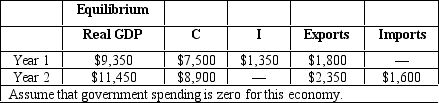

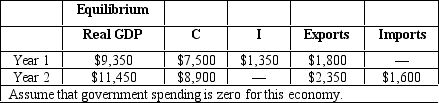

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What is the equilibrium level of real GDP in year 1?

A) $940

B) $1,040

C) $1,100

D) $1,050

E) $920

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What is the equilibrium level of real GDP in year 1?

A) $940

B) $1,040

C) $1,100

D) $1,050

E) $920

A

3

NARRBEGIN: Table 10.2

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. What is the equilibrium level of real GDP?

A) $935

B) $2,100

C) $3,320

D) $4,800

E) $5,230

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. What is the equilibrium level of real GDP?

A) $935

B) $2,100

C) $3,320

D) $4,800

E) $5,230

D

4

If aggregate expenditures are less than real GDP, then:

A) both inventories and real GDP will decline.

B) inventories will decline but real GDP will increase.

C) inventories will increase and real GDP will decline.

D) both inventories and real GDP will increase.

E) inventories will increase but real GDP will remain unchanged.

A) both inventories and real GDP will decline.

B) inventories will decline but real GDP will increase.

C) inventories will increase and real GDP will decline.

D) both inventories and real GDP will increase.

E) inventories will increase but real GDP will remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

5

Assume that an economy is in equilibrium with a budget deficit of $130 billion, positive net exports of $453 billion, and a saving level of $1,550 billion. If taxes are zero, then planned investment spending must be equal to:

A) $1,550 billion.

B) $130 billion.

C) $1,873 billion.

D) $1,227 billion.

E) $967 billion.

A) $1,550 billion.

B) $130 billion.

C) $1,873 billion.

D) $1,227 billion.

E) $967 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

6

NARRBEGIN: Table 10.1

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. If real GDP equals $1,000 in year 1, then:

A) unplanned inventory investment is zero.

B) unplanned inventories increase by $50.

C) inventories decrease by $100.

D) inventories increase by $60.

E) real GDP is less than aggregate expenditure.

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. If real GDP equals $1,000 in year 1, then:

A) unplanned inventory investment is zero.

B) unplanned inventories increase by $50.

C) inventories decrease by $100.

D) inventories increase by $60.

E) real GDP is less than aggregate expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

7

The equilibrium level of income will rise when:

A) planned consumption spending is less than real GDP.

B) taxes exceed saving.

C) supply exceeds demand.

D) planned inventory investment is negative.

E) aggregate expenditures exceed real GDP.

A) planned consumption spending is less than real GDP.

B) taxes exceed saving.

C) supply exceeds demand.

D) planned inventory investment is negative.

E) aggregate expenditures exceed real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

8

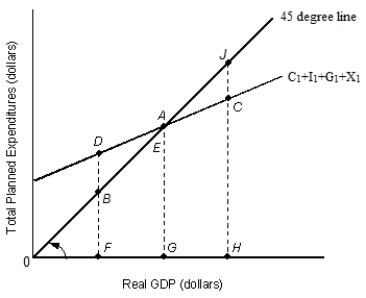

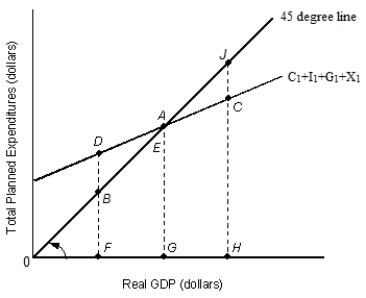

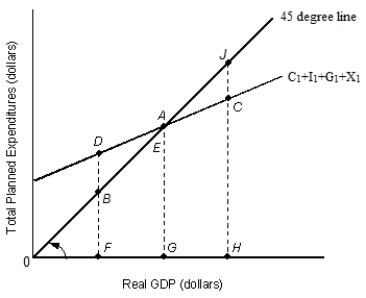

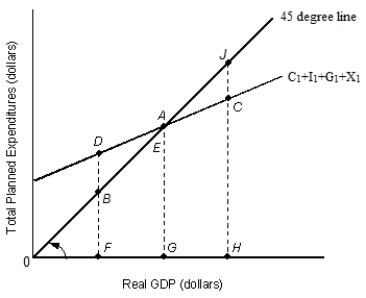

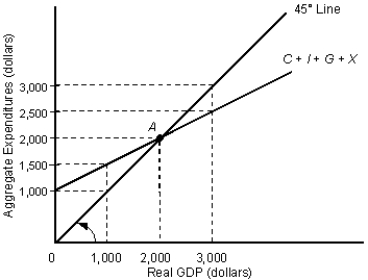

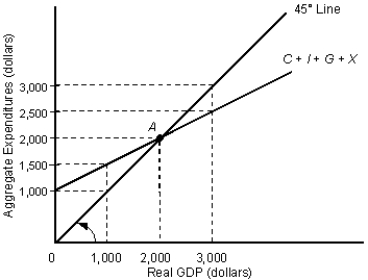

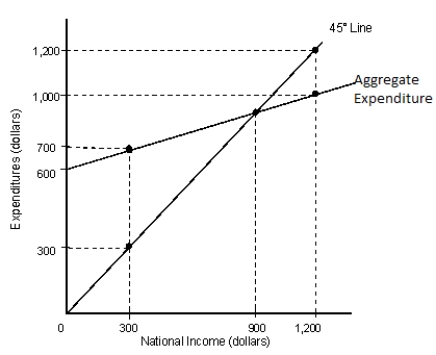

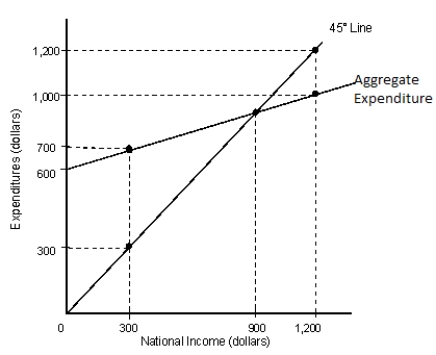

NARRBEGIN: Figure 10.1

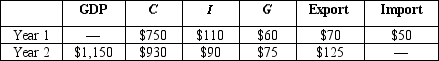

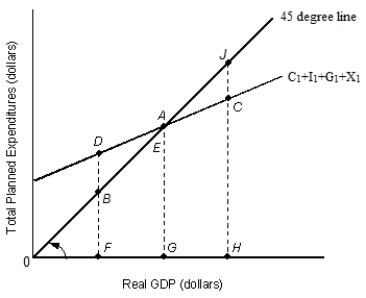

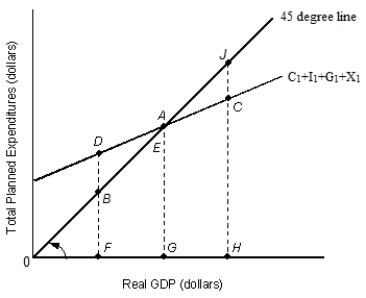

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:

C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

According to Figure 10.1, the economy will expand when aggregate expenditures are at:

A) point D.

B) point A.

C) point B.

D) point C.

E) point E.

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

According to Figure 10.1, the economy will expand when aggregate expenditures are at:

A) point D.

B) point A.

C) point B.

D) point C.

E) point E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

9

At the equilibrium level of income, which of the following is true?

A) Unplanned inventory changes are positive

B) Firms are unable to produce the desired rate of output

C) Autonomous consumption spending is equal to induced consumption spending

D) Aggregate expenditures equal real GDP

E) Unplanned investment spending is positive

A) Unplanned inventory changes are positive

B) Firms are unable to produce the desired rate of output

C) Autonomous consumption spending is equal to induced consumption spending

D) Aggregate expenditures equal real GDP

E) Unplanned investment spending is positive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

10

NARRBEGIN: Figure 10.1

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:

C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

Consider the economy described in Figure 10.1. Which of the following is true if the real GDP is equal to 0H?

A) Aggregate expenditures are greater than total income.

B) All economic resources are being used efficiently.

C) Households are dissaving an amount equal to DC.

D) Businesses accumulate unwanted inventories.

E) Unplanned investment will decline.

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

Consider the economy described in Figure 10.1. Which of the following is true if the real GDP is equal to 0H?

A) Aggregate expenditures are greater than total income.

B) All economic resources are being used efficiently.

C) Households are dissaving an amount equal to DC.

D) Businesses accumulate unwanted inventories.

E) Unplanned investment will decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

11

In macroeconomics, equilibrium is defined as the point at which:

A) the economy attains the highest level of GDP.

B) there is no unemployment in the economy.

C) people's plans match the reality.

D) people adjust their behavior to match plans with reality.

E) there is no inflation in the economy.

A) the economy attains the highest level of GDP.

B) there is no unemployment in the economy.

C) people's plans match the reality.

D) people adjust their behavior to match plans with reality.

E) there is no inflation in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

12

NARRBEGIN: Table 10.1

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What would be the new equilibrium level of real GDP in year 2 if net exports equaled zero?

A) $1,205

B) $1,095

C) $1,050

D) $1,170

E) $1,120

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What would be the new equilibrium level of real GDP in year 2 if net exports equaled zero?

A) $1,205

B) $1,095

C) $1,050

D) $1,170

E) $1,120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following can be considered an injection that can offset leakages in an economy and help it attain equilibrium?

A) Imports

B) Investment

C) Aid to foreign countries

D) Saving

E) Taxes

A) Imports

B) Investment

C) Aid to foreign countries

D) Saving

E) Taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

14

NARRBEGIN: Figure 10.1

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:

C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

According to Figure 10.1, when real GDP is at G:

A) there is pressure for the economy to expand.

B) there are unplanned reductions in inventory.

C) aggregate expenditures are less than real GDP.

D) the economy has achieved macroeconomic equilibrium.

E) there is pressure for the economy to contract.

The figure given below shows the aggregate expenditure curve of an open economy.

Figure 10.1

In the figure:

In the figure:C1: Consumption

I1: Investment

G1: Government spending

X1: Net Exports

According to Figure 10.1, when real GDP is at G:

A) there is pressure for the economy to expand.

B) there are unplanned reductions in inventory.

C) aggregate expenditures are less than real GDP.

D) the economy has achieved macroeconomic equilibrium.

E) there is pressure for the economy to contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

15

NARRBEGIN: Table 10.2

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. Calculate the level of consumption spending when the economy is in equilibrium.

A) $4,425

B) $4,010

C) $4,050

D) $5,175

E) $4,800

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. Calculate the level of consumption spending when the economy is in equilibrium.

A) $4,425

B) $4,010

C) $4,050

D) $5,175

E) $4,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

16

Assume we are at an income level where the C+I+G+X (consumption+investment+government spending+net exports) function lies above the 45-degree line. We can conclude that at this income level:

A) unplanned inventories are likely to accumulate.

B) the economy is in equilibrium.

C) households will save more money than they spend.

D) aggregate expenditures are less than output.

E) there will be pressure to expand production.

A) unplanned inventories are likely to accumulate.

B) the economy is in equilibrium.

C) households will save more money than they spend.

D) aggregate expenditures are less than output.

E) there will be pressure to expand production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

17

NARRBEGIN: Table 10.2

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. At an income level of $2,100:

A) leakages exceed injections by $800.

B) total output exceeds aggregate expenditures by $500.

C) injections exceed leakages by $500.

D) injections are equal to total output.

E) aggregate expenditures exceed total output by $500.

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. At an income level of $2,100:

A) leakages exceed injections by $800.

B) total output exceeds aggregate expenditures by $500.

C) injections exceed leakages by $500.

D) injections are equal to total output.

E) aggregate expenditures exceed total output by $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

18

NARRBEGIN: Table 10.2

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. Calculate the value of leakages from the economy when the economy is in equilibrium.

A) $770

B) $720

C) $790

D) $600

E) $410

The table given below shows the levels of national income (Y) and the corresponding levels of saving (S), investment (I), export (X), and import (M) of an open economy.

Table 10.2

Consider the economy described in Table 10.2. Calculate the value of leakages from the economy when the economy is in equilibrium.

A) $770

B) $720

C) $790

D) $600

E) $410

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

19

NARRBEGIN: Table 10.1

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. Assume that the economy is at equilibrium in both years. What are net exports for year 2?

A) $60

B) $125

C) $70

D) $55

E) $195

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. Assume that the economy is at equilibrium in both years. What are net exports for year 2?

A) $60

B) $125

C) $70

D) $55

E) $195

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

20

NARRBEGIN: Table 10.1

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What is the equilibrium level of imports in year 2?

A) $20

B) $50

C) $70

D) $100

E) $120

The table given below states the value of the GDP and the different components of aggregate expenditure for two years.

Table 10.1

Refer to Table 10.1. What is the equilibrium level of imports in year 2?

A) $20

B) $50

C) $70

D) $100

E) $120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

21

Suppose an economy operates at a real GDP level of $855, where saving = $400; investment = $95; government spending = $365; taxes = $130; imports = $210; exports = $170. Which of the following statements is true in the light of the given information?

A) Aggregate expenditures will fall, because total injections exceed total leakages by $110.

B) Real GDP will increase, because total injections are less than $855.

C) The economy will be in equilibrium, because leakages equal injections.

D) Real GDP will fall, because total leakages exceed total injections by $110.

E) Inventories will rise, because planned saving exceeds planned investment.

A) Aggregate expenditures will fall, because total injections exceed total leakages by $110.

B) Real GDP will increase, because total injections are less than $855.

C) The economy will be in equilibrium, because leakages equal injections.

D) Real GDP will fall, because total leakages exceed total injections by $110.

E) Inventories will rise, because planned saving exceeds planned investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

22

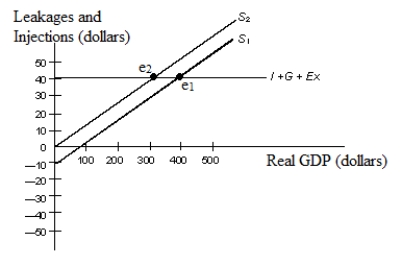

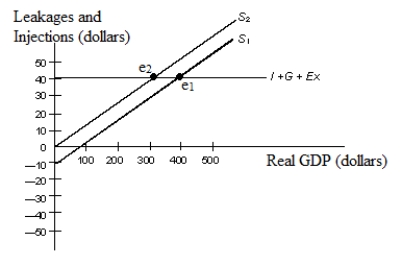

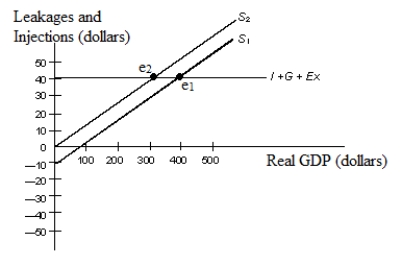

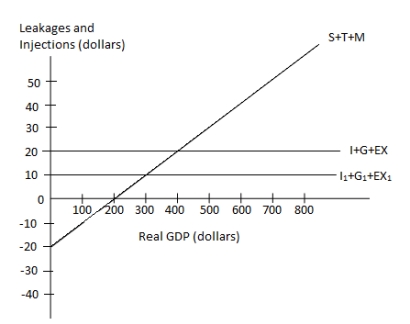

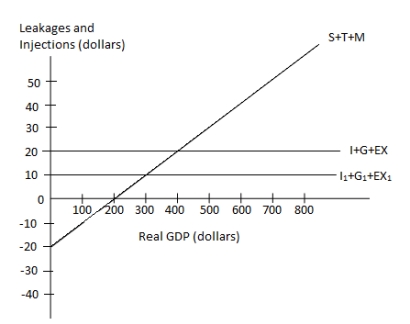

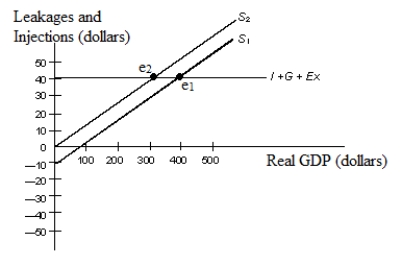

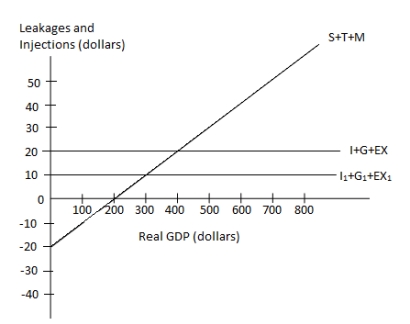

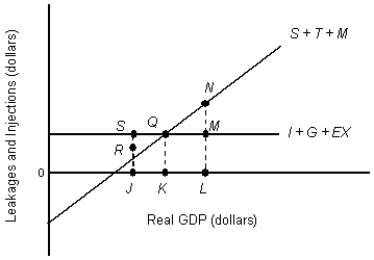

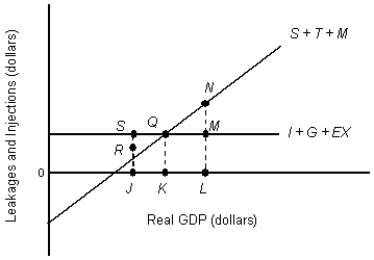

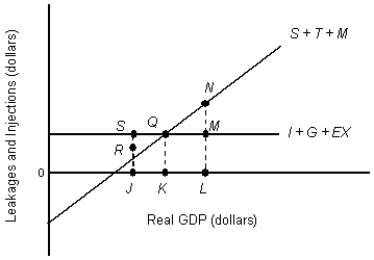

NARRBEGIN: Figure 10.3

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:

S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

Refer to Figure 10.3. If saving is represented by S1, at a real GDP level of $500:

A) leakages are greater than injections which will cause income to increase.

B) leakages are greater than injections which will cause income to decrease.

C) leakages are less than injections which will cause income to increase.

D) leakages are less than injections which will cause income to decrease.

E) leakages are equal to injections which will cause no change in income.

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

Refer to Figure 10.3. If saving is represented by S1, at a real GDP level of $500:

A) leakages are greater than injections which will cause income to increase.

B) leakages are greater than injections which will cause income to decrease.

C) leakages are less than injections which will cause income to increase.

D) leakages are less than injections which will cause income to decrease.

E) leakages are equal to injections which will cause no change in income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

23

The percentage of a change in income that is spent domestically is:

A) the sum of the MPC and the MPI.

B) the sum of the MPC and the MPS.

C) the difference between the MPC and the MPI.

D) the difference between the MPC and the MPI.

E) the sum of the MPS and the MPI.

A) the sum of the MPC and the MPI.

B) the sum of the MPC and the MPS.

C) the difference between the MPC and the MPI.

D) the difference between the MPC and the MPI.

E) the sum of the MPS and the MPI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

24

NARRBEGIN: Figure 10.3

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:

S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

Refer to Figure 10.3. The paradox of thrift might not be a problem if:

A) the average price level does not change in the short run.

B) the I + G + EX line were downward-sloping.

C) the I + G + EX line were constant at an intercept of $30.

D) the increase in saving was used to fund investment expenditures.

E) the I + G + EX line were constant at an intercept of $50.

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

Refer to Figure 10.3. The paradox of thrift might not be a problem if:

A) the average price level does not change in the short run.

B) the I + G + EX line were downward-sloping.

C) the I + G + EX line were constant at an intercept of $30.

D) the increase in saving was used to fund investment expenditures.

E) the I + G + EX line were constant at an intercept of $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

25

NARRBEGIN: Scenario 10.1

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. What is the marginal propensity to save for this economy?

A) 0.5

B) 0.25

C) 0.65

D) 0.35

E) Cannot be determined

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. What is the marginal propensity to save for this economy?

A) 0.5

B) 0.25

C) 0.65

D) 0.35

E) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose an economy has a government budget surplus of $100, net exports of -$400, and a planned investment level of $1,000. For this economy to be in equilibrium, saving must equal:

A) $700.

B) $500.

C) $750.

D) $250.

E) $300.

A) $700.

B) $500.

C) $750.

D) $250.

E) $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

27

NARRBEGIN: Scenario 10.1

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

What is the marginal propensity to consume for the economy described in Scenario 10.1?

A) 0.45

B) 0.85

C) 0.65

D) 0.35

E) Cannot be determined

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

What is the marginal propensity to consume for the economy described in Scenario 10.1?

A) 0.45

B) 0.85

C) 0.65

D) 0.35

E) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

28

The spending multiplier measures the change in equilibrium income that results from a change in:

A) consumption.

B) planned investment.

C) savings.

D) net exports.

E) autonomous expenditures.

A) consumption.

B) planned investment.

C) savings.

D) net exports.

E) autonomous expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assume that an increase of $300 in exports leads to an increase of $750 in equilibrium income. If the marginal propensity to import equals 1/10, the marginal propensity to save must be _____.

A) 0.60

B) 0.50

C) 0.40

D) 0.30

E) 0.25

A) 0.60

B) 0.50

C) 0.40

D) 0.30

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

30

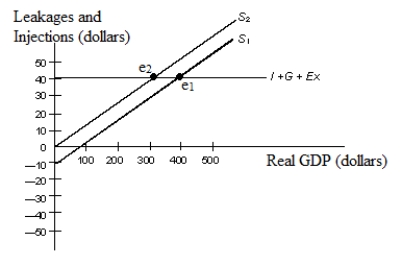

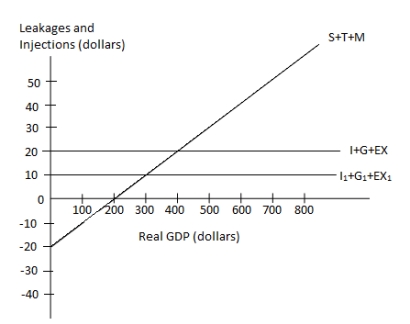

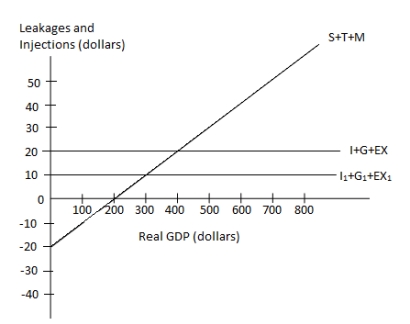

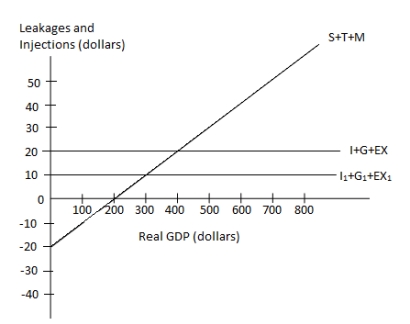

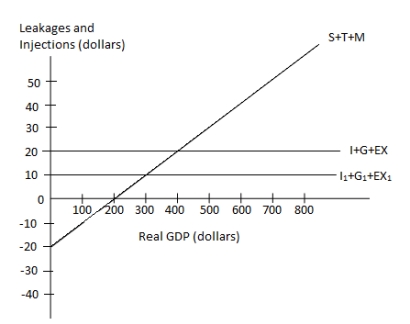

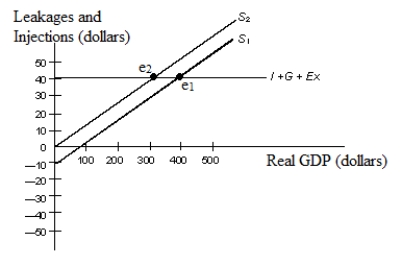

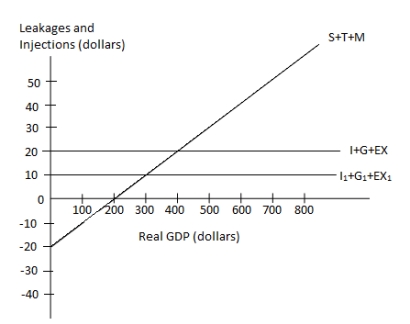

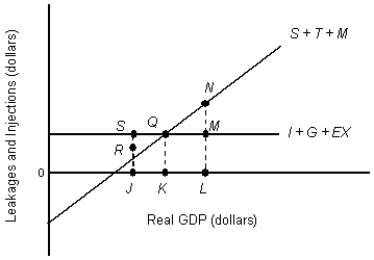

NARRBEGIN: Figure 10.2

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:

I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. Suppose that I+G+EX equals $20 and the economy is in equilibrium. What is the amount of saving when T = $0 and M = $5 at the equilibrium level?

A) $0

B) $10

C) $15

D) $20

E) $25

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. Suppose that I+G+EX equals $20 and the economy is in equilibrium. What is the amount of saving when T = $0 and M = $5 at the equilibrium level?

A) $0

B) $10

C) $15

D) $20

E) $25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

31

NARRBEGIN: Figure 10.2

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:

I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

According to Figure 10.2, real GDP of $200 indicates a point where:

A) total leakages exceed total injections.

B) aggregate expenditures exceed total output.

C) consumers engage in dissaving.

D) the economy is in macroeconomic equilibrium.

E) unplanned inventory changes will be positive.

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

According to Figure 10.2, real GDP of $200 indicates a point where:

A) total leakages exceed total injections.

B) aggregate expenditures exceed total output.

C) consumers engage in dissaving.

D) the economy is in macroeconomic equilibrium.

E) unplanned inventory changes will be positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

32

Suppose in an economy, investment = $40, saving = $50, government spending+export = $100 and taxes+imports = $110. Then for this economy, total leakages exceed total injections by:

A) $30.

B) $25.

C) $10.

D) $45.

E) $20.

A) $30.

B) $25.

C) $10.

D) $45.

E) $20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ceteris paribus, a downward shift in the net exports function will cause:

A) equilibrium real GDP to decrease.

B) equilibrium real GDP to increase.

C) savings to decrease.

D) net exports to increase.

E) government budget deficit to decline.

A) equilibrium real GDP to decrease.

B) equilibrium real GDP to increase.

C) savings to decrease.

D) net exports to increase.

E) government budget deficit to decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

34

If Saving+Tax+Import > Investment+Government spending+Export, then _____ must fall to establish macroeconomic equilibrium.

A) net exports

B) gross exports

C) nominal GDP

D) real GDP

E) government spending

A) net exports

B) gross exports

C) nominal GDP

D) real GDP

E) government spending

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

35

At each round of the multiplier process, increases in income:

A) leak out of the expenditures stream in the form of investment and taxes.

B) leak out of the expenditures stream in the form of saving and imports.

C) are matched by a smaller increase in expenditures.

D) result in even greater increases in expenditures due to investment and exports.

E) result in no change in total expenditures.

A) leak out of the expenditures stream in the form of investment and taxes.

B) leak out of the expenditures stream in the form of saving and imports.

C) are matched by a smaller increase in expenditures.

D) result in even greater increases in expenditures due to investment and exports.

E) result in no change in total expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

36

NARRBEGIN: Figure 10.2

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:

I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. When total injections equal $20, the equilibrium level of real GDP is:

A) $100.

B) $200.

C) $300.

D) $400.

E) $500.

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. When total injections equal $20, the equilibrium level of real GDP is:

A) $100.

B) $200.

C) $300.

D) $400.

E) $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

37

NARRBEGIN: Figure 10.3

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:

S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

In Figure 10.3, which of the following represents the paradox of thrift?

A) A shift of the saving curve from S2 to S1.

B) A shift of the saving curve from S1 to S2.

C) A change in equilibrium from e2 to e1.

D) A change in equilibrium real GDP from $300 to $400.

E) A change in equilibrium real GDP from $100 to $400.

The figure given below represents the leakages and injections in an economy.

Figure 10.3

In the figure:

In the figure:S1 and S2: Saving functions

I: Investment

G: Government spending

EX: Net exports

In Figure 10.3, which of the following represents the paradox of thrift?

A) A shift of the saving curve from S2 to S1.

B) A shift of the saving curve from S1 to S2.

C) A change in equilibrium from e2 to e1.

D) A change in equilibrium real GDP from $300 to $400.

E) A change in equilibrium real GDP from $100 to $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

38

NARRBEGIN: Figure 10.2

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:

I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. A decline in total injections by $10:

A) will cause equilibrium income to rise to $400.

B) will result in a disequilibrium of $200 in the economy.

C) will cause the total leakages curve to shift inward by $10.

D) will cause equilibrium income to fall to $300.

E) will not affect equilibrium income.

The figure given below represents the leakages and injections in an economy.

Figure 10.2

In the figure:

In the figure:I, I1: Investment;

G: Government spending;

EX, EX1: Exports;

T: Taxes; and

M: Imports.

Refer to Figure 10.2. A decline in total injections by $10:

A) will cause equilibrium income to rise to $400.

B) will result in a disequilibrium of $200 in the economy.

C) will cause the total leakages curve to shift inward by $10.

D) will cause equilibrium income to fall to $300.

E) will not affect equilibrium income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

39

Savings are good for a family. If all families increase savings, the economy is better off. This fallacy of composition is called:

A) the paradox of time.

B) the paradox of dissaving.

C) the paradox of thrift.

D) the paradox of value.

E) the paradox of choice.

A) the paradox of time.

B) the paradox of dissaving.

C) the paradox of thrift.

D) the paradox of value.

E) the paradox of choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

40

Assume that the marginal propensity to consume equals 0.75 and the marginal propensity to import equals 0.10. By how much does spending on domestic goods increase if income increases by $300?

A) $195

B) $225

C) $30

D) $300

E) $75

A) $195

B) $225

C) $30

D) $300

E) $75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

41

NARRBEGIN: Scenario 10.1

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. Calculate the value of the spending multiplier.

A) 2.86

B) 0.286

C) 1.54

D) 0.154

E) 0.35

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. Calculate the value of the spending multiplier.

A) 2.86

B) 0.286

C) 1.54

D) 0.154

E) 0.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

42

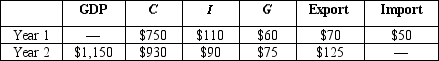

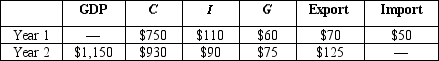

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Consider Table 10.3 to calculate the value of the MPC.

A) 0.75

B) 0.67

C) 0.25

D) 0.33

E) 0.80

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Consider Table 10.3 to calculate the value of the MPC.

A) 0.75

B) 0.67

C) 0.25

D) 0.33

E) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

43

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. To increase equilibrium real GDP in an open economy to $12,000 in year 3, all else equal to that in year 2, investment would have to increase by:

A) $258.

B) $550.

C) $2,262.

D) $1,100.

E) $1,155.

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. To increase equilibrium real GDP in an open economy to $12,000 in year 3, all else equal to that in year 2, investment would have to increase by:

A) $258.

B) $550.

C) $2,262.

D) $1,100.

E) $1,155.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

44

If an economy consumes 75 percent of any increase in real GDP and spends 10 percent of this increased income on imports, then a decline in government spending by $60 million will result in a total reduction in equilibrium income of:

A) $171.43 million.

B) $123.47 million.

C) $151.63 million.

D) $73.47 million.

E) $71.43 million.

A) $171.43 million.

B) $123.47 million.

C) $151.63 million.

D) $73.47 million.

E) $71.43 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

45

NARRBEGIN: Scenario 10.2

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. What is the marginal propensity to save of this economy?

A) 0.2

B) 0.3

C) 0.7

D) 0.9

E) 0.6

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. What is the marginal propensity to save of this economy?

A) 0.2

B) 0.3

C) 0.7

D) 0.9

E) 0.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

46

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. What will be the value of the spending multiplier?

A) 1

B) 0.47

C) 5

D) 1.25

E) 2.13

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. What will be the value of the spending multiplier?

A) 1

B) 0.47

C) 5

D) 1.25

E) 2.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

47

Consider an economy that is in equilibrium with real GDP = $5,000, MPS = 1/4 and MPI = 1/5. What will be the new equilibrium level of income if planned investment spending increases by $500?

A) $15,000

B) $7,000

C) $6,111

D) $5,500

E) $5,000

A) $15,000

B) $7,000

C) $6,111

D) $5,500

E) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

48

If equilibrium income is $500 billion, MPC = 0.8, MPI = 0.2 and autonomous government spending increases by $20 billion, the new equilibrium income will be _____.

A) $600 billion.

B) $550 billion.

C) $525 billion.

D) $520 billion.

E) $500 billion.

A) $600 billion.

B) $550 billion.

C) $525 billion.

D) $520 billion.

E) $500 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is the value of the spending multiplier when MPC = 0.85 and MPI = 0.3?

A) 1.82

B) 0.85

C) 2.22

D) 1.18

E) 2.50

A) 1.82

B) 0.85

C) 2.22

D) 1.18

E) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

50

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. The change in investment spending from year 1 to year 2 is:

A) $1,800.

B) $450.

C) $945.

D) $214.

E) $2,100.

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. The change in investment spending from year 1 to year 2 is:

A) $1,800.

B) $450.

C) $945.

D) $214.

E) $2,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

51

If MPS is equal to 0.15 and MPI is equal to 0.10, an initial change in expenditures of $19,000 would result in a total change in income equal to _____.

A) $19,000

B) $16,150

C) $20,000

D) $76,000

E) $126,667

A) $19,000

B) $16,150

C) $20,000

D) $76,000

E) $126,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a closed economy that does not have international trade, the spending multiplier equals _____.

A) 1/MPS

B) 1/MPC

C) 1/(MPC-1)

D) 1/(1-MPS)

E) 1/(1+MPS)

A) 1/MPS

B) 1/MPC

C) 1/(MPC-1)

D) 1/(1-MPS)

E) 1/(1+MPS)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

53

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. The equilibrium value of imports in year 1 is:

A) $1,600

B) $1,450.

C) $1,400.

D) $1,300.

E) $1,200.

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

Refer to Table 10.3. The equilibrium value of imports in year 1 is:

A) $1,600

B) $1,450.

C) $1,400.

D) $1,300.

E) $1,200.

فتح الحزمة

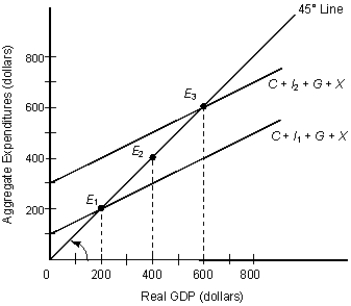

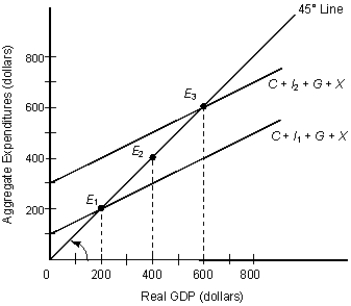

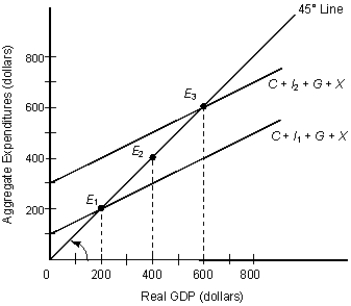

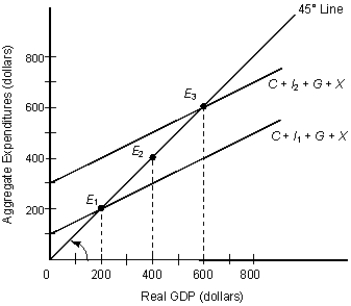

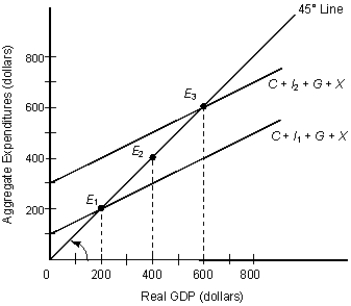

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

54

NARRBEGIN: Table 10.3

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

According to the information provided in Table 10.3, the MPI equals _____.

A) +0.12

B) -0.33

C) -0.21

D) +0.14

E) MPS

The table given below reports the value of real GDP and its components consumption (C), investment (I), exports, and imports for two consecutive years.

Table 10.3

According to the information provided in Table 10.3, the MPI equals _____.

A) +0.12

B) -0.33

C) -0.21

D) +0.14

E) MPS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

55

Suppose equilibrium income decreases by $600 as a result of a change in government spending. If the multiplier is 3, what is the change in government spending?

A) Government sending will decrease by $1,800

B) Government sending will decrease by $600

C) Government sending will decrease by $200

D) Government sending will increase by $400

E) Government sending will increase by $1,200

A) Government sending will decrease by $1,800

B) Government sending will decrease by $600

C) Government sending will decrease by $200

D) Government sending will increase by $400

E) Government sending will increase by $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider a closed economy described by AE (aggregate expenditures) = 800,000 + 0.75Y Assume that this economy is initially in equilibrium. But now the government implements a program to improve highways that will cost $1 million. This implies that equilibrium real GDP will:

A) decrease by $1 million.

B) decrease by $4 million.

C) increase by $1 million.

D) increase by $4 million.

E) decrease by $800,000.

A) decrease by $1 million.

B) decrease by $4 million.

C) increase by $1 million.

D) increase by $4 million.

E) decrease by $800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

57

In an economy that has no foreign trade, if real GDP declines by $160 million following a decline in investment spending of $40 million, then the marginal propensity to consume must be equal to _____.

A) 2

B) 0.33

C) 4

D) 0.75

E) 0.4

A) 2

B) 0.33

C) 4

D) 0.75

E) 0.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

58

NARRBEGIN: Scenario 10.2

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. What is the spending multiplier of this economy?

A) 2

B) 1.4

C) 0.7

D) 0.9

E) Cannot be determined with the information given

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. What is the spending multiplier of this economy?

A) 2

B) 1.4

C) 0.7

D) 0.9

E) Cannot be determined with the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

59

NARRBEGIN: Scenario 10.2

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. If a tourist visits the country and spends $100 that she brought with her, then what will happen to the equilibrium real GDP?

A) It will not change

B) It will increase by $100

C) It will increase by $200

D) It will increase by $143

E) It will increase by $90

Scenario 10.2

A hypothetical open economy has a marginal propensity to import (MPI) equal to 0.2 and a marginal propensity to consume equal to 0.7. Assume that the economy is initially in equilibrium.

Refer to Scenario 10.2. If a tourist visits the country and spends $100 that she brought with her, then what will happen to the equilibrium real GDP?

A) It will not change

B) It will increase by $100

C) It will increase by $200

D) It will increase by $143

E) It will increase by $90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

60

NARRBEGIN: Scenario 10.1

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. The new equilibrium level of GDP for the economy will be:

A) one billion higher.

B) 350 millions higher.

C) 65 millions higher.

D) 227.5 millions higher.

E) 227.5 millions lower.

Scenario 10.1

Imagine an economy that does not have international trade and is originally in equilibrium. Then the government increases the level of spending by $350 million because it received a gift from abroad. In this economy, only 65 cents of every dollar is spent, and the rest is saved.

Refer to Scenario 10.1. The new equilibrium level of GDP for the economy will be:

A) one billion higher.

B) 350 millions higher.

C) 65 millions higher.

D) 227.5 millions higher.

E) 227.5 millions lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

61

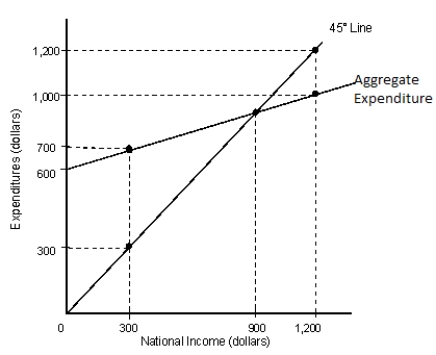

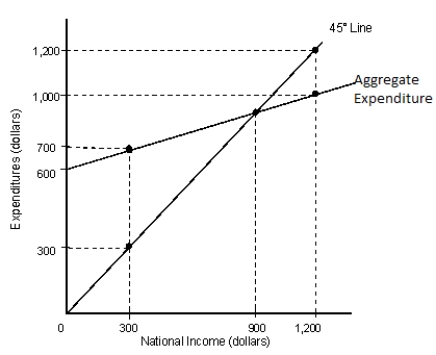

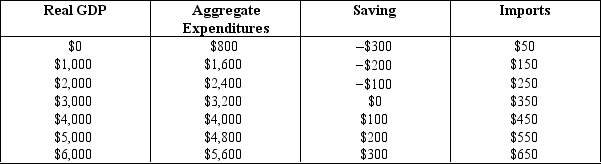

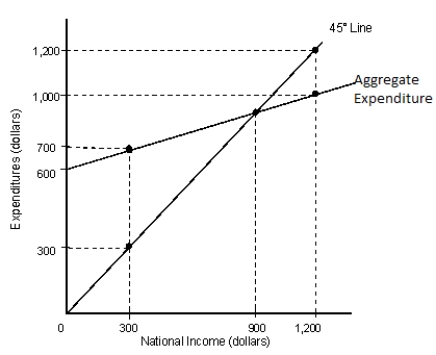

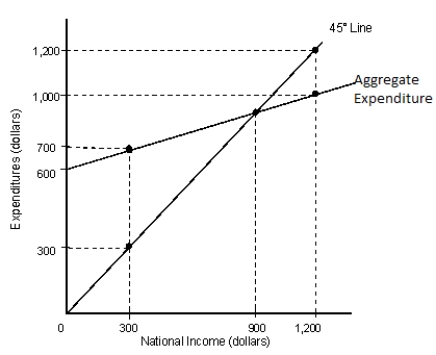

NARRBEGIN: Figure 10.7

The figure given below shows the macroeconomic equilibrium of a country.

Figure 10.7

Refer to Figure 10.7. What is the size of the GDP gap if potential GDP equals $3,000?

A) $500

B) $1,000

C) $2,000

D) $2,500

E) $3,000

The figure given below shows the macroeconomic equilibrium of a country.

Figure 10.7

Refer to Figure 10.7. What is the size of the GDP gap if potential GDP equals $3,000?

A) $500

B) $1,000

C) $2,000

D) $2,500

E) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

62

NARRBEGIN: Figure 10.5

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. Assume that there is a recessionary gap that can be closed by a $500 increase in planned aggregate expenditures. If the economy is initially in equilibrium with a real GDP level of $900, then the target or potential level of real GDP must be:

A) $333.33.

B) $400.

C) $750.

D) $1,400.

E) $1,650.

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. Assume that there is a recessionary gap that can be closed by a $500 increase in planned aggregate expenditures. If the economy is initially in equilibrium with a real GDP level of $900, then the target or potential level of real GDP must be:

A) $333.33.

B) $400.

C) $750.

D) $1,400.

E) $1,650.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

63

NARRBEGIN: Figure 10.5

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. Suppose that instead of there being a recessionary gap, the economy is characterized by an equilibrium real GDP level of $900 that exceeds the natural unemployment or potential real GDP level by $600. This so-called expansionary gap can be closed by:

A) increasing planned aggregate expenditures by $400.

B) lowering government purchases by $600.

C) lowering autonomous consumption spending by $400.

D) increasing planned aggregate expenditures by $900.

E) lowering autonomous net exports by $600.

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. Suppose that instead of there being a recessionary gap, the economy is characterized by an equilibrium real GDP level of $900 that exceeds the natural unemployment or potential real GDP level by $600. This so-called expansionary gap can be closed by:

A) increasing planned aggregate expenditures by $400.

B) lowering government purchases by $600.

C) lowering autonomous consumption spending by $400.

D) increasing planned aggregate expenditures by $900.

E) lowering autonomous net exports by $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

64

Assume that potential GDP is $200 billion and the multiplier equals 5. The recessionary gap is $10 billion. What is the actual level of equilibrium income?

A) $200 billion

B) $150 billion

C) $100 billion

D) $80 billion

E) $50 billion

A) $200 billion

B) $150 billion

C) $100 billion

D) $80 billion

E) $50 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

65

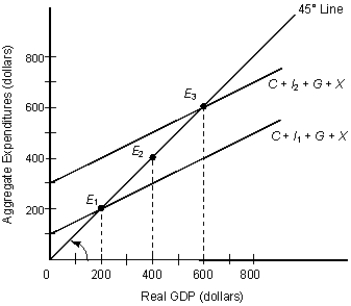

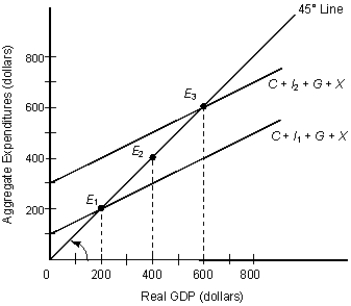

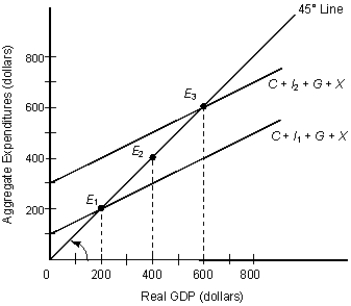

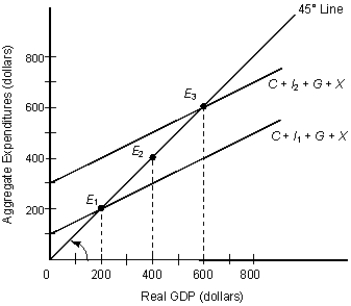

NARRBEGIN: Figure 10.4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:

C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. Starting at equilibrium level E3 equilibrium level E1 will be reached if aggregate expenditure:

A) decreases by $200.

B) increases by $200.

C) decreases by $100.

D) increases by $100.

E) increases by $50.

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. Starting at equilibrium level E3 equilibrium level E1 will be reached if aggregate expenditure:

A) decreases by $200.

B) increases by $200.

C) decreases by $100.

D) increases by $100.

E) increases by $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

66

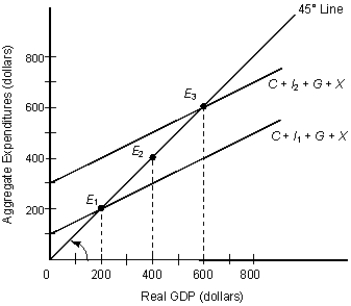

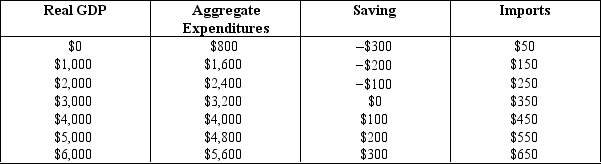

NARRBEGIN: Table 10.4

The table given below shows the real GDP, aggregate expenditures, saving, and imports of an economy.

Table 10.4

Refer to Table 10.4. Given a potential GDP of $6,000, the recessionary gap equals _____.

A) $200

B) $400

C) $1,000

D) $2,000

E) $5,000

The table given below shows the real GDP, aggregate expenditures, saving, and imports of an economy.

Table 10.4

Refer to Table 10.4. Given a potential GDP of $6,000, the recessionary gap equals _____.

A) $200

B) $400

C) $1,000

D) $2,000

E) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

67

NARRBEGIN: Figure 10.4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:

C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. Compute the increase in investment spending from I1 to I2.

A) $600.

B) $100.

C) $200.

D) $400.

E) $300.

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. Compute the increase in investment spending from I1 to I2.

A) $600.

B) $100.

C) $200.

D) $400.

E) $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate the marginal propensity to save for the economy from the information given in Table 10.4.

A) 0.9

B) 0.8

C) 0.5

D) 0.2

E) 0.1

A) 0.9

B) 0.8

C) 0.5

D) 0.2

E) 0.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

69

NARRBEGIN: Figure 10.4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:

C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. If autonomous government expenditures increase by $250 billion, equilibrium real GDP will:

A) rise by $250 billion.

B) fall by 300 billion

C) rise by $500 billion.

D) rise by $75 billion.

E) rise by $100 billion.

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. If autonomous government expenditures increase by $250 billion, equilibrium real GDP will:

A) rise by $250 billion.

B) fall by 300 billion

C) rise by $500 billion.

D) rise by $75 billion.

E) rise by $100 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

70

NARRBEGIN: Table 10.4

The table given below shows the real GDP, aggregate expenditures, saving, and imports of an economy.

Table 10.4

Refer to Table 10.4. Suppose the economy is currently in equilibrium and the potential GDP of the economy is $6,000. The current GDP gap equals _____.

A) $400

B) $1,000

C) $2,000

D) $3,000

E) $6,000

The table given below shows the real GDP, aggregate expenditures, saving, and imports of an economy.

Table 10.4

Refer to Table 10.4. Suppose the economy is currently in equilibrium and the potential GDP of the economy is $6,000. The current GDP gap equals _____.

A) $400

B) $1,000

C) $2,000

D) $3,000

E) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

71

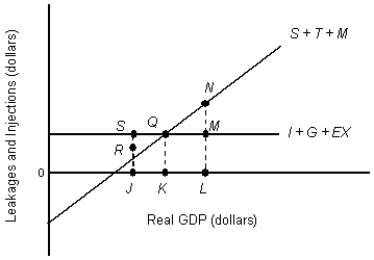

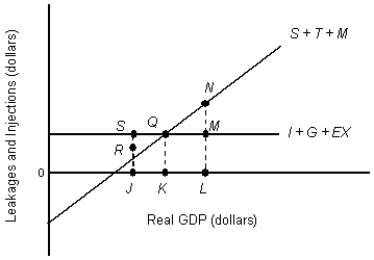

NARRBEGIN: Figure 10.6

The figure given below represents the leakages and injections of an economy.

Figure 10.6

In Figure 10.6, if 0L is the potential level of real GDP, then KL represents:

A) excess GDP.

B) real GDP.

C) the multiplier effect.

D) the GDP gap.

E) the recessionary gap.

The figure given below represents the leakages and injections of an economy.

Figure 10.6

In Figure 10.6, if 0L is the potential level of real GDP, then KL represents:

A) excess GDP.

B) real GDP.

C) the multiplier effect.

D) the GDP gap.

E) the recessionary gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

72

If the spending multiplier equals 5 and equilibrium income is $2 billion below potential GDP, then _____ to reach the potential real GDP level.

A) total spending needs to increase by $0.1 billion

B) real GDP needs to increase by $1.2 billion

C) total spending needs to decrease by $6 billion

D) real GDP needs to decrease by $12 billion

E) total spending needs to increase by $0.4 billion

A) total spending needs to increase by $0.1 billion

B) real GDP needs to increase by $1.2 billion

C) total spending needs to decrease by $6 billion

D) real GDP needs to decrease by $12 billion

E) total spending needs to increase by $0.4 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

73

Calculate the marginal propensity to consume for the economy from the information given in Table 10.4.

A) 0.9

B) 0.8

C) 0.5

D) 0.2

E) 0.1

A) 0.9

B) 0.8

C) 0.5

D) 0.2

E) 0.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

74

Assume that a GDP gap can be closed by a $200 initial change in planned spending. The MPS is 0.3 and the MPI equals 0.1. If the economy is currently in equilibrium with an income level of $600, potential GDP equals:

A) $1,600.

B) $1,100.

C) $800.

D) $600.

E) $400.

A) $1,600.

B) $1,100.

C) $800.

D) $600.

E) $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

75

NARRBEGIN: Figure 10.6

The figure given below represents the leakages and injections of an economy.

Figure 10.6

Refer to Figure 10.6. If 0L represents potential GDP, the GDP gap can be closed by increasing autonomous expenditures by an amount equal to line segment _____.

A) NM

B) NL

C) ML

D) OK

E) QK

The figure given below represents the leakages and injections of an economy.

Figure 10.6

Refer to Figure 10.6. If 0L represents potential GDP, the GDP gap can be closed by increasing autonomous expenditures by an amount equal to line segment _____.

A) NM

B) NL

C) ML

D) OK

E) QK

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

76

NARRBEGIN: Figure 10.6

The figure given below represents the leakages and injections of an economy.

Figure 10.6

In Figure 10.6, the economy is in equilibrium at point _____.

A) S

B) Q

C) N

D) R

E) M

The figure given below represents the leakages and injections of an economy.

Figure 10.6

In Figure 10.6, the economy is in equilibrium at point _____.

A) S

B) Q

C) N

D) R

E) M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

77

NARRBEGIN: Figure 10.5

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. If the target or potential level of real GDP is $1,200, then at an equilibrium real GDP level of $900:

A) the GDP gap is zero.

B) there exists a recessionary gap that could be closed by a $200 decrease in planned aggregate expenditures.

C) the GDP gap is $200.

D) actual real GDP exceeds potential real GDP by $300.

E) there exists a recessionary gap that could be closed by a $200 increase in autonomous investment spending.

The figure given below depicts macroeconomic equilibrium in a closed economy. Assume that the spending multiplier in this economy is 1.5.

Figure 10.5

Refer to Figure 10.5. If the target or potential level of real GDP is $1,200, then at an equilibrium real GDP level of $900:

A) the GDP gap is zero.

B) there exists a recessionary gap that could be closed by a $200 decrease in planned aggregate expenditures.

C) the GDP gap is $200.

D) actual real GDP exceeds potential real GDP by $300.

E) there exists a recessionary gap that could be closed by a $200 increase in autonomous investment spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

78

NARRBEGIN: Figure 10.4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:

C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. The spending multiplier is _____.

A) 2

B) 3

C) 6

D) 0.5

E) 1.2

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

Refer to Figure 10.4. The spending multiplier is _____.

A) 2

B) 3

C) 6

D) 0.5

E) 1.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

79

Calculate the spending multiplier from the information given in Table 10.4.

A) 5

B) 4

C) 2

D) 0.2

E) 0.1

A) 5

B) 4

C) 2

D) 0.2

E) 0.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

80

NARRBEGIN: Figure 10.4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:

C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

In Figure 10.4, calculate the marginal propensity to consume.

A) 0.67

B) 0.50

C) 0.25

D) 0.33

E) 4

The figure given below represents the macroeconomic equilibrium in the aggregate income and aggregate expenditure framework. Assume that MPI is equal to zero.

Figure 10.4

In the figure:

In the figure:C: Consumption

I1 and I2: Investment

G: Government Spending

X: Exports

In Figure 10.4, calculate the marginal propensity to consume.

A) 0.67

B) 0.50

C) 0.25

D) 0.33

E) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck