Deck 2: Unit 11-20

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 2: Unit 11-20

1

You are responsible for the audit of the tangible non-current assets of Glub Ltd, a company engaged in the manufacture and supply of soft drinks and other beverages to the retail, catering and leisure industries. From your discussions with the finance director, you find out that a capital expenditure budget is prepared annually.

Departmental managers can authorise capital expenditure up to £5,000, as long as it is within their budget. Board approval is required for amounts above this threshold but the managing director, who is also the major shareholder in the company, does not always adhere to this policy. He often commits the company to acquiring assets without considering how they are to be financed, leaving the finance director to arrange the borrowings.

Capital expenditure proposal forms are required to be completed but this is not always done, particularly when items are required in an emergency, and there is no formal policy in respect of obtaining quotes for major items of expenditure. There is a tangible non-current asset register which is reconciled to the nominal ledger on a monthly basis. No other checking procedures involving the non-current asset register are undertaken.

In July 201X, the company commenced construction of a new packing line. The line was completed in November 201X. Costs recorded in the tangible non-current asset register include materials, own and sub-contract labour, and overheads.

The overheads included are simply the overhead recovery rate used when pricing products and include all overheads, both direct and indirect. The company borrowed money to build the packing line and has included the interest on the loan as part of the construction cost.

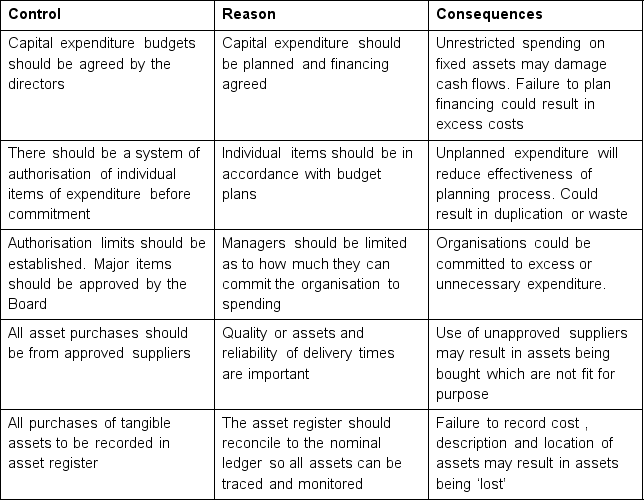

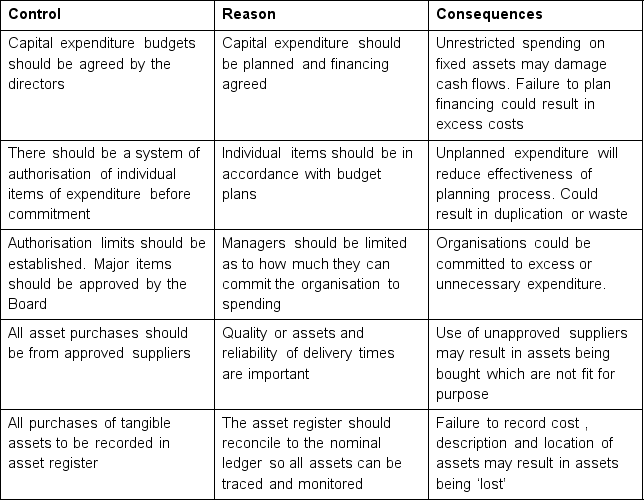

(a) Identify four controls which should be in place to control the purchase of tangible fixed assets and explain why they are necessary and the consequences to the company if they are not in place

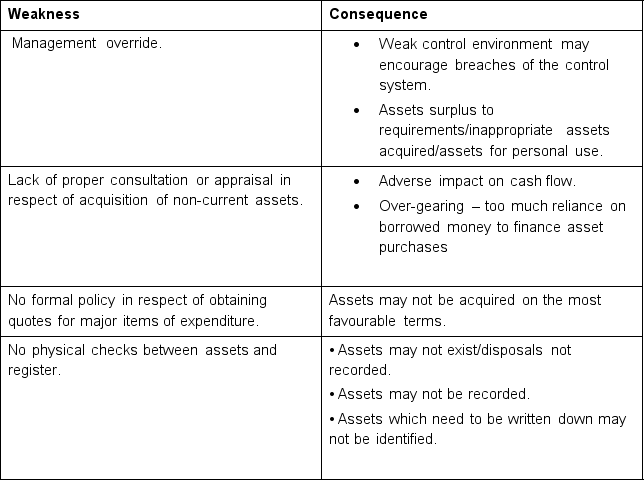

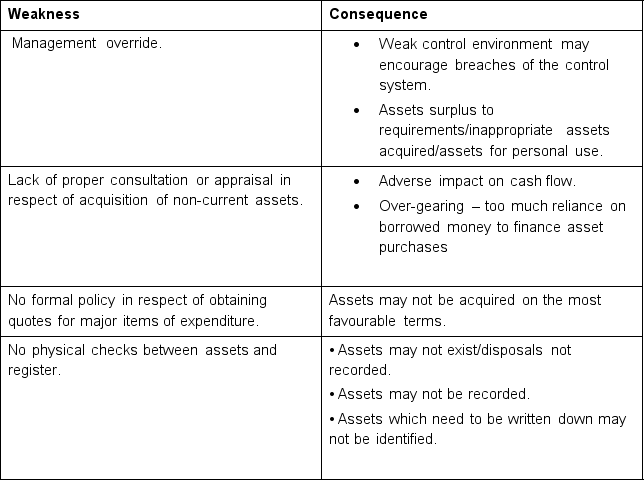

(b) Identify weaknesses in the system described above and, for each weakness, explain the consequences that could result from it.

(c) In respect of the new packing line what evidence will the auditors need in order to confirm that the expenditure has been correctly include in the financial statements? Comment particularly on the inclusion of overheads and financing costs

Departmental managers can authorise capital expenditure up to £5,000, as long as it is within their budget. Board approval is required for amounts above this threshold but the managing director, who is also the major shareholder in the company, does not always adhere to this policy. He often commits the company to acquiring assets without considering how they are to be financed, leaving the finance director to arrange the borrowings.

Capital expenditure proposal forms are required to be completed but this is not always done, particularly when items are required in an emergency, and there is no formal policy in respect of obtaining quotes for major items of expenditure. There is a tangible non-current asset register which is reconciled to the nominal ledger on a monthly basis. No other checking procedures involving the non-current asset register are undertaken.

In July 201X, the company commenced construction of a new packing line. The line was completed in November 201X. Costs recorded in the tangible non-current asset register include materials, own and sub-contract labour, and overheads.

The overheads included are simply the overhead recovery rate used when pricing products and include all overheads, both direct and indirect. The company borrowed money to build the packing line and has included the interest on the loan as part of the construction cost.

(a) Identify four controls which should be in place to control the purchase of tangible fixed assets and explain why they are necessary and the consequences to the company if they are not in place

(b) Identify weaknesses in the system described above and, for each weakness, explain the consequences that could result from it.

(c) In respect of the new packing line what evidence will the auditors need in order to confirm that the expenditure has been correctly include in the financial statements? Comment particularly on the inclusion of overheads and financing costs

(a)

(b)

(b)

-Weak control environment may encourage breaches of the control system.

-Weak control environment may encourage breaches of the control system.

-Assets surplus to requirements/inappropriate assets acquired/assets for personal use.

-Adverse impact on cash flow.

-Over-gearing - too much reliance on borrowed money to finance asset purchases

(c)

-Check expenditure in accordance with approved capital budgets

-Check within authority limits

-Check purchases of materials to invoices

-Check inclusion of labour costs to time sheets and pay rates. Check calculations of overtime.

-Check authorisation of materials and labour costs

-Review basis of calculation of overhead rate - only direct overheads to be included (exclude general admin o/h, sales and marketing costs, non specific costs e.g. audit fees etc)

-Interest on finance to be included only on finance specifically raised for the project. Apportionment of general interest charge is not allowed

(b)

(b) -Weak control environment may encourage breaches of the control system.

-Weak control environment may encourage breaches of the control system.-Assets surplus to requirements/inappropriate assets acquired/assets for personal use.

-Adverse impact on cash flow.

-Over-gearing - too much reliance on borrowed money to finance asset purchases

(c)

-Check expenditure in accordance with approved capital budgets

-Check within authority limits

-Check purchases of materials to invoices

-Check inclusion of labour costs to time sheets and pay rates. Check calculations of overtime.

-Check authorisation of materials and labour costs

-Review basis of calculation of overhead rate - only direct overheads to be included (exclude general admin o/h, sales and marketing costs, non specific costs e.g. audit fees etc)

-Interest on finance to be included only on finance specifically raised for the project. Apportionment of general interest charge is not allowed

2

The external auditor should undertake analytical procedures as part of the planning process in order to identify the risk of a possible misstatement of figures in the financial statements. The results of the analytical procedures conducted on the financial statements of an audit client are listed below.

Select whether the results indicate that cash and bank balances and trade receivables might have been under or overstated.

The results show that, compared to the previous year:

a. Inventory has reduced by 5%, trade payables have increased by 7% and trade receivables have reduced by 10%. Cash and bank balances have reduced by 11%

b. There has been no change in credit control procedures or length of credit given to customers. Sales revenues have increased by 9%. Trade receivables have increased by 15%.

Select whether the results indicate that cash and bank balances and trade receivables might have been under or overstated.

The results show that, compared to the previous year:

a. Inventory has reduced by 5%, trade payables have increased by 7% and trade receivables have reduced by 10%. Cash and bank balances have reduced by 11%

b. There has been no change in credit control procedures or length of credit given to customers. Sales revenues have increased by 9%. Trade receivables have increased by 15%.

a. Understated b. Overstated

3

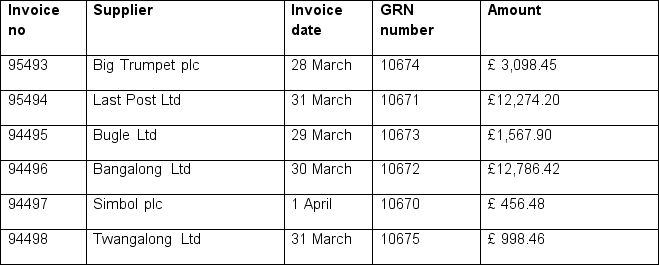

The audit work requires the verification of cut -off procedures to ensure that all transactions are recorded in the correct accounting period.

During the yearend inventory count on 31 March 201X the audit team recorded the following transactions.

The last Goods Received Note number was 10672.

Which invoices should be recorded in purchases for the year?

During the yearend inventory count on 31 March 201X the audit team recorded the following transactions.

The last Goods Received Note number was 10672.

Which invoices should be recorded in purchases for the year?

b) 95494, 94496 and 94497

4

Auditors use samples in their audit testing. In which of the following situations is the use of sampling not appropriate

A) When the population is homogenous

B) When all items in the population have an equal chance of being selected

C) When the population is very small and all the items are material

D) When the population consists of a large number of transactions

A) When the population is homogenous

B) When all items in the population have an equal chance of being selected

C) When the population is very small and all the items are material

D) When the population consists of a large number of transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

You are auditing Megabuild plc a company which builds large projects mostly overseas. At present it is building a dam in the Philippines, a motorway in South Africa and a holiday village in France.

The audit team has been asked to devise audit procedures for the verification of work in progress balances as part of inventories. From the test below select whether you would include them as valid tests or exclude them as invalid.

The audit team has been asked to devise audit procedures for the verification of work in progress balances as part of inventories. From the test below select whether you would include them as valid tests or exclude them as invalid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

State whether the following are true or false in relation to the auditor and fraud

a. It is the auditor's responsibility to follow up possible indicators of fraud uncovered during the course of their audit testing work even if they are not material

b. External auditors must approach their audit testing with an attitude of professional scepticism

c. Management can rely on auditors to detect fraud as this is one of the auditor's duties under ISA 240 'The auditor's responsibilities relating to fraud in an audit of financial statements'

d. Auditor's must consider the effect any fraud which has been uncovered might have on their audit opinion

a. It is the auditor's responsibility to follow up possible indicators of fraud uncovered during the course of their audit testing work even if they are not material

b. External auditors must approach their audit testing with an attitude of professional scepticism

c. Management can rely on auditors to detect fraud as this is one of the auditor's duties under ISA 240 'The auditor's responsibilities relating to fraud in an audit of financial statements'

d. Auditor's must consider the effect any fraud which has been uncovered might have on their audit opinion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

Two types of computer-assisted audit techniques (CAAT) are test data and audit software.

For each of the procedures listed below, select the type of CAAT which would be used to perform that procedure.

a. Select all sales ledger accounts showing a credit balance for review

b. Input of inventory (stock) issues in excess of balance of inventory (stock) items shown as held on inventory records

c. Select all accounts in receivables (sales) ledger where balance exceeds credit limit

For each of the procedures listed below, select the type of CAAT which would be used to perform that procedure.

a. Select all sales ledger accounts showing a credit balance for review

b. Input of inventory (stock) issues in excess of balance of inventory (stock) items shown as held on inventory records

c. Select all accounts in receivables (sales) ledger where balance exceeds credit limit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

You are auditing Twinkles Ltd which runs a chain of jewellery shops and you are responsible for the audit of inventory. Counting and indentifying the items of jewellery is not a difficulty but verifying the value of the inventory is a major planning issue. How would you gather sufficient appropriate evidence to validate the value of inventories in this case?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

You are the auditor of an engineering firm called Thumpit & Hope Ltd. You are planning for a physical inventory count at the company's warehouse on 31 August 201X. The company assembles domestic appliances, and inventory of finished appliances, unassembled parts and sundry inventories are stored in the warehouse which is adjacent to the company's assembly plant.

The plant will continue to produce goods during the stock count until 5 pm on 31 August 201X. On 30 August 201X, the warehouse staff will deliver the estimated quantities of unassembled parts and sundry inventories which will be required for production for 31 August 201X; however emergency requisitions by the factory will be filled on 31 August. During the inventory count, the warehouse staff will continue to receive parts and sundry inventories, and to despatch finished appliances. Appliances which are completed on 31 August 201X will remain in the assembly plant until after the physical inventory count has been completed.

Describe the procedures which Thumpit & Hope Ltd should establish in order to ensure that all inventory items are counted and that no item is counted twice.

The plant will continue to produce goods during the stock count until 5 pm on 31 August 201X. On 30 August 201X, the warehouse staff will deliver the estimated quantities of unassembled parts and sundry inventories which will be required for production for 31 August 201X; however emergency requisitions by the factory will be filled on 31 August. During the inventory count, the warehouse staff will continue to receive parts and sundry inventories, and to despatch finished appliances. Appliances which are completed on 31 August 201X will remain in the assembly plant until after the physical inventory count has been completed.

Describe the procedures which Thumpit & Hope Ltd should establish in order to ensure that all inventory items are counted and that no item is counted twice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

Greenfumb is a company which operates a chain of garden centres specialising in the retailing of high quality garden products and the provision of landscaping services. Following information from one of the employees, it was discovered that the financial controller had used company cheques and bank transfers to pay for goods and services for his own use. Although the amounts involved were immaterial in the context of the financial statements, it transpired that this had been going on for several years.

The managing director is considering whether the company's auditors were negligent. He has requested that your firm undertakes a detailed independent review of Greenfumb's purchase and payments system in order to establish any shortcomings in its policies and procedures, so that they can be rectified.

Required:

(a) Distinguish between the responsibilities of the management and the statutory auditor of a limited company for the prevention and the detection of fraud and outline how these responsibilities are discharged.

(b) Prepare a list of questions in respect of internal control procedures, answers to which would establish whether there are any shortcomings in Greenfumb's purchase and payments system.

The managing director is considering whether the company's auditors were negligent. He has requested that your firm undertakes a detailed independent review of Greenfumb's purchase and payments system in order to establish any shortcomings in its policies and procedures, so that they can be rectified.

Required:

(a) Distinguish between the responsibilities of the management and the statutory auditor of a limited company for the prevention and the detection of fraud and outline how these responsibilities are discharged.

(b) Prepare a list of questions in respect of internal control procedures, answers to which would establish whether there are any shortcomings in Greenfumb's purchase and payments system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

Identify the role of internal audit in managing risk. Set out what the role of internal audit is in the risk management process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

As part of verification techniques in respect of revenues an auditor will inspect sales invoices. The auditor will gain assurance about different assertions depending on the information on the invoice.

In respect of the information below, select the assertion for which that information will provide assurance.

a. Date of the invoice

b. Description of the item sold

c. Monetary amount

In respect of the information below, select the assertion for which that information will provide assurance.

a. Date of the invoice

b. Description of the item sold

c. Monetary amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

The external auditor may seek to place reliance on internal controls in order to restrict substantive testing.

In each of the following circumstances, select whether the external auditor is likely to place reliance or place no reliance on internal controls.

a. A company with an independent internal audit department

b. A family company where the financial director is related to the chief executive

c. A company where a fraud committed by the purchasing manager has been uncovered

State the main ways in which auditors can gather the evidence they need and provide an example of each method

In each of the following circumstances, select whether the external auditor is likely to place reliance or place no reliance on internal controls.

a. A company with an independent internal audit department

b. A family company where the financial director is related to the chief executive

c. A company where a fraud committed by the purchasing manager has been uncovered

State the main ways in which auditors can gather the evidence they need and provide an example of each method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

State whether the following are true or false in relation to computer assisted audit techniques

a. The use of CAAT's enables auditors to examine large populations of data

b. Auditors use test data to test controls within the client's computer system

c. Modern software makes the use of CAATs cheap and easy to do so audit staff don't need any special training

d. Embedded software can provide continuous monitoring of client data

a. The use of CAAT's enables auditors to examine large populations of data

b. Auditors use test data to test controls within the client's computer system

c. Modern software makes the use of CAATs cheap and easy to do so audit staff don't need any special training

d. Embedded software can provide continuous monitoring of client data

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

In recent years there has been an increase in the number of larger companies outsourcing their internal audit function, often to their external auditors.

One of your audit clients is considering establishing a new internal audit function, either by recruiting its own internal auditors or by contracting with your firm for the provision of internal audit services.

Describe the advantages and disadvantages of the external auditors providing an internal audit service to their clients.

The advantages of having the external audit firm perform the internal audit work will include:

(i) The new internal auditors should be skilled in carrying out audit work, so the learning time for the staff should be short compared with setting up an internal audit department within the company.

(ii) The audit procedures and standards should be consistent with those of the external auditor. Thus, the external audit staff should be able to use more of the internal auditor's work in coming to their audit opinion. This should reduce the cost of the external audit.

(iii) The audit firm may be able to provide staff with a wider range of skills than the client may be able to recruit as employees. For instance, the audit firm may be able to provide specialists in computer auditing, where it would not be economical to have a computer audit specialist as an employee.

The disadvantages of the external audit firm performing the internal audit work will include:

(i) There may be problems with who is in charge of the internal audit staff. The internal audit staff will be employees of the external audit firm. The client company will probably have less control over the internal audit staff, and this may create problems over the work they do and the reports they make.

(ii) For ethical reasons, the internal auditors may be restricted in the work they do. For instance, they may be prevented from preparing the financial statements and making management decisions. Thus, they may not be able to decide the form and controls for a whole accounting system.

(iii) The internal audit staff will be skilled at performing work similar to the external auditors, but they may have limited skills and experience of other work carried out by internal auditors (e.g. advising on the purchase of a business).

(iv) Using the external audit firm to perform internal audit work is likely to be more expensive than the company employing its own internal audit staff, as the external audit firm will want to cover its costs and make a profit on the work.

(v) There may be problems with the internal audit staff changing from time to time. The external audit firm will probably want to provide the maximum staff to the client when the audit firm are less busy and fewer staff when they are busy. Having different staff at different times will require the new staff to learn about the client's business. This learning time is likely to be greater than if the client employed its own staff.

(vi) The requirement of the external audit function to have to perform external audits (when it is busy) may mean that the client does not have sufficient internal audit staff during periods when it wants them (e.g. at the yearend for counts and to help in preparation of the annual financial statements).

21 The Banzai company operates from four locations together with a Head office where all administrative processes are carried out. All locations are networked together with a server placed at each location to enable fast direct communication and data transfer. Access to all files on the Head Office server is permitted by each of the other locations; although it is the responsibility of the site manager to restrict this access as he considers appropriate.

All staff are paid on a salaried basis. There are currently ten staff at the Head Office plus five at each of the locations. The payroll is managed at Head Office by the Head of Office Services who relies on monthly input from each of the site managers as follows.

-All employees have to submit a timesheet at the end of each month showing hours worked during the month.

-If they have worked less than the minimum hours of 30 then a reason for this has to be supplied by the employee and approved by the site manager.

-If such absence was not for an authorised reason then the appropriate deduction is made from the salary amount.

-The timesheet should also record sicknesses, holidays or other approved absences.

-At the end of each month the site manager has to complete a summary form detailing any sicknesses, holidays or other absences. All absences must be supported by a form explaining reasons and authorised by the manager. All sicknesses must be accompanied by a Doctor's certificate if appropriate.

-The site Manager is also responsible for recruitment and staff leavers, and must inform the Office Manager of all such instances so that the personnel records can be set up.

-Recruitment of new staff should only take place following authorisation from the Managing Director who is located at Head Office.

-All monthly input to the Head of Office Services is via email from each of the site managers and from the individual employees.

You are an audit senior working for Tickett & Run on the audit of Banzai and have been asked by the Audit Manager to complete the audit of salaries.

a) What are the control objectives for the salaries system?

b) Outline what you perceive the risks to be in the audit of the salaries system.

c) List the tests of control that you would perform as part of the audit testing on the Salaries system.

d) List four substantive tests that you would perform as part of the audit testing on the salaries system.

One of your audit clients is considering establishing a new internal audit function, either by recruiting its own internal auditors or by contracting with your firm for the provision of internal audit services.

Describe the advantages and disadvantages of the external auditors providing an internal audit service to their clients.

The advantages of having the external audit firm perform the internal audit work will include:

(i) The new internal auditors should be skilled in carrying out audit work, so the learning time for the staff should be short compared with setting up an internal audit department within the company.

(ii) The audit procedures and standards should be consistent with those of the external auditor. Thus, the external audit staff should be able to use more of the internal auditor's work in coming to their audit opinion. This should reduce the cost of the external audit.

(iii) The audit firm may be able to provide staff with a wider range of skills than the client may be able to recruit as employees. For instance, the audit firm may be able to provide specialists in computer auditing, where it would not be economical to have a computer audit specialist as an employee.

The disadvantages of the external audit firm performing the internal audit work will include:

(i) There may be problems with who is in charge of the internal audit staff. The internal audit staff will be employees of the external audit firm. The client company will probably have less control over the internal audit staff, and this may create problems over the work they do and the reports they make.

(ii) For ethical reasons, the internal auditors may be restricted in the work they do. For instance, they may be prevented from preparing the financial statements and making management decisions. Thus, they may not be able to decide the form and controls for a whole accounting system.

(iii) The internal audit staff will be skilled at performing work similar to the external auditors, but they may have limited skills and experience of other work carried out by internal auditors (e.g. advising on the purchase of a business).

(iv) Using the external audit firm to perform internal audit work is likely to be more expensive than the company employing its own internal audit staff, as the external audit firm will want to cover its costs and make a profit on the work.

(v) There may be problems with the internal audit staff changing from time to time. The external audit firm will probably want to provide the maximum staff to the client when the audit firm are less busy and fewer staff when they are busy. Having different staff at different times will require the new staff to learn about the client's business. This learning time is likely to be greater than if the client employed its own staff.

(vi) The requirement of the external audit function to have to perform external audits (when it is busy) may mean that the client does not have sufficient internal audit staff during periods when it wants them (e.g. at the yearend for counts and to help in preparation of the annual financial statements).

21 The Banzai company operates from four locations together with a Head office where all administrative processes are carried out. All locations are networked together with a server placed at each location to enable fast direct communication and data transfer. Access to all files on the Head Office server is permitted by each of the other locations; although it is the responsibility of the site manager to restrict this access as he considers appropriate.

All staff are paid on a salaried basis. There are currently ten staff at the Head Office plus five at each of the locations. The payroll is managed at Head Office by the Head of Office Services who relies on monthly input from each of the site managers as follows.

-All employees have to submit a timesheet at the end of each month showing hours worked during the month.

-If they have worked less than the minimum hours of 30 then a reason for this has to be supplied by the employee and approved by the site manager.

-If such absence was not for an authorised reason then the appropriate deduction is made from the salary amount.

-The timesheet should also record sicknesses, holidays or other approved absences.

-At the end of each month the site manager has to complete a summary form detailing any sicknesses, holidays or other absences. All absences must be supported by a form explaining reasons and authorised by the manager. All sicknesses must be accompanied by a Doctor's certificate if appropriate.

-The site Manager is also responsible for recruitment and staff leavers, and must inform the Office Manager of all such instances so that the personnel records can be set up.

-Recruitment of new staff should only take place following authorisation from the Managing Director who is located at Head Office.

-All monthly input to the Head of Office Services is via email from each of the site managers and from the individual employees.

You are an audit senior working for Tickett & Run on the audit of Banzai and have been asked by the Audit Manager to complete the audit of salaries.

a) What are the control objectives for the salaries system?

b) Outline what you perceive the risks to be in the audit of the salaries system.

c) List the tests of control that you would perform as part of the audit testing on the Salaries system.

d) List four substantive tests that you would perform as part of the audit testing on the salaries system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

In relation to selecting customers in a circularisation of receivables:

(i) explain how you would use monetary unit sampling to select the customers to

circularise

(ii) consider the criteria you would use to select individual customers for circularisation

using judgement

(iii) discuss the advantages and disadvantages of using monetary unit sampling (in (i)

above) as compared with judgement (in (ii) above) to select the customers to circularise. Your answer should consider the reasons why it is undesirable only to use judgement to select the customers for circularisation.

(i) explain how you would use monetary unit sampling to select the customers to

circularise

(ii) consider the criteria you would use to select individual customers for circularisation

using judgement

(iii) discuss the advantages and disadvantages of using monetary unit sampling (in (i)

above) as compared with judgement (in (ii) above) to select the customers to circularise. Your answer should consider the reasons why it is undesirable only to use judgement to select the customers for circularisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

List the main characteristics of good audit evidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not a test using sampling?

A) Select every tenth goods received note and match to the purchase invoice

B) Randomly pick a number of disposals of non -current (fixed) assets from the non-current assets register and inspect authorisation for sale documents and sales invoices

C) Select all payables (purchase) ledger balances in excess of £15,000 and reconcile to suppliers statements

D) Test all calculations of wages paid and deductions from payroll in week 31

A) Select every tenth goods received note and match to the purchase invoice

B) Randomly pick a number of disposals of non -current (fixed) assets from the non-current assets register and inspect authorisation for sale documents and sales invoices

C) Select all payables (purchase) ledger balances in excess of £15,000 and reconcile to suppliers statements

D) Test all calculations of wages paid and deductions from payroll in week 31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

ISA 230 'Audit documentation states:

'The objective of the auditor is to prepare documentation that provides:

(a) A sufficient and appropriate record of the basis for the auditor's report; and

(b) Evidence that the audit was planned and performed in accordance with ISAs (UK and Ireland) and applicable legal and regulatory requirements.'

Briefly indicate what should be included as part of audit documentation and outline the implications for the audit team as to what to include and what to exclude

'The objective of the auditor is to prepare documentation that provides:

(a) A sufficient and appropriate record of the basis for the auditor's report; and

(b) Evidence that the audit was planned and performed in accordance with ISAs (UK and Ireland) and applicable legal and regulatory requirements.'

Briefly indicate what should be included as part of audit documentation and outline the implications for the audit team as to what to include and what to exclude

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

Accounting systems have control objectives and control procedures to mitigate the risks that the control objective is not met.

For each of the following, select whether they are a control objective, risk, or control procedure.

a. Organisations sell goods or services to customers with poor credit ratings

b. Goods are purchased only from approved suppliers

c. All purchase invoices must be matched to purchase orders and goods received notes

For each of the following, select whether they are a control objective, risk, or control procedure.

a. Organisations sell goods or services to customers with poor credit ratings

b. Goods are purchased only from approved suppliers

c. All purchase invoices must be matched to purchase orders and goods received notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

Explain the differences between

-an accrual

-a provision

-a contingent liability

Explain the audit objectives, including the assertions to be validated, in the audit of provisions and how an auditor might approach the process of evidence gathering.

-an accrual

-a provision

-a contingent liability

Explain the audit objectives, including the assertions to be validated, in the audit of provisions and how an auditor might approach the process of evidence gathering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Set out the audit objectives for the audit of a purchases and expenses system including the relevant assertions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain what is meant by the following terms:

(i) Audit risk

(ii) Inherent risk

(iii) Control risk

(iv) Detection risk

(i) Audit risk

(ii) Inherent risk

(iii) Control risk

(iv) Detection risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

You are the audit manager in charge of the audit of Gorilla plc. You are about to brief junior members of the audit team prior to the audit of the Statement of Financial Position. Write some notes in preparation for your meeting with the audit juniors to explain the assertions in relation to current assets and what each of the assertions means.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Explain the basic principles of risk based auditing. Set out five examples each of

-Strategic risks

-Operational risks

-Strategic risks

-Operational risks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

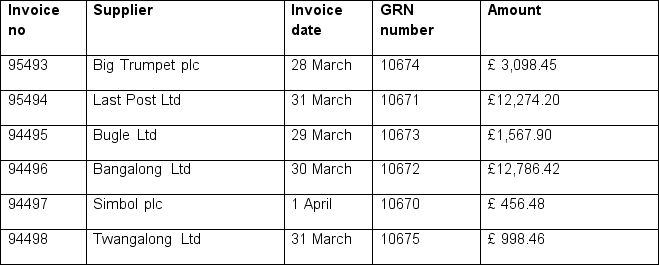

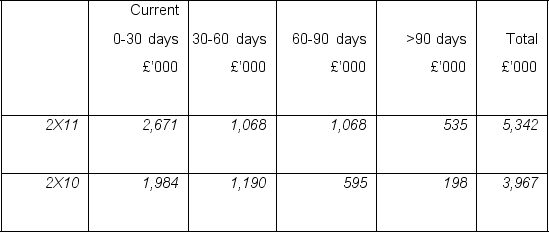

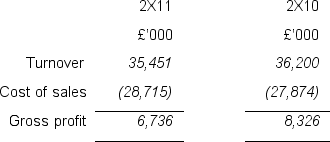

You are the audit senior of Wellington Ltd for the year end 31 December 201X, in charge of trade receivables. You are about to start your yearend work and have been given the following extracts by your audit manager for you to consider as part of your planning and analytical review stage.

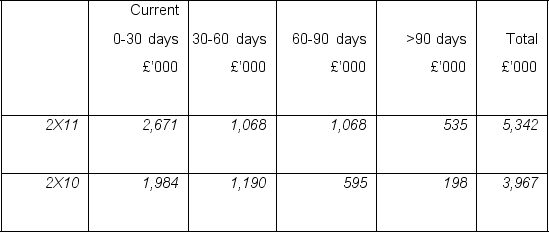

Receivables ledger (ageing extract)

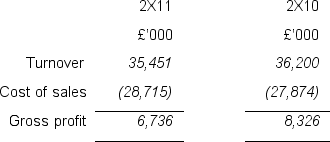

Income statement (extract)

a() Calculate ratios or percentages that will help your analysis of the sales and trade receivables position for the two years.

b() Explain some of the concerns you have following your initial analysis (in part a) and the resulting potential implications for your audit.

c() You sent out a receivables circularization on the year end balances. Describe the process you would have gone through to do this.

d() Some of the debtors have not responded to your circularization. List the procedures you would now follow for these balances

Receivables ledger (ageing extract)

Income statement (extract)

a() Calculate ratios or percentages that will help your analysis of the sales and trade receivables position for the two years.

b() Explain some of the concerns you have following your initial analysis (in part a) and the resulting potential implications for your audit.

c() You sent out a receivables circularization on the year end balances. Describe the process you would have gone through to do this.

d() Some of the debtors have not responded to your circularization. List the procedures you would now follow for these balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

Hung Lo Ltd is a wholesaler of furniture (such as chairs, tables and cupboards). Hung Lo buys the furniture from six major manufacturers and sells them to over 600 different customers ranging from large retail chain stores to smaller owner-controlled businesses. All financial accounts transaction information is stored on Hung Lo's computer systems. Previous audits have tended to adopt an 'audit around the computer' approach.

You are the audit manager in charge of the audit. For the first time at this client, you have decided to use audit software to assist with the audit of the financial systems.

Computer staff at Hung Lo are happy to help the auditor, although they cannot confirm that all the systems documentation is complete. They have warned you that Hung Lo's accounting software is run using very old operating systems which may not be compatible with more modern programs.

The change in audit approach has been taken mainly to gain a full understanding of Hung Lo's computer systems prior to new internet modules being added next year. To limit the possibility of damage to Hung Lo's computer files, copy files will be provided by Hung Lo's computer staff for the auditor to use with their own audit software.

Following a discussion with the management at Hung Lo Ltd you understand that the internal audit department are prepared to assist with the statutory audit. Specifically, the chief internal auditor is prepared to provide you with some documentation on the computerised wages systems at Hung Lo Ltd. The documentation provides details of the software and shows diagrammatically how transactions are processed through the inventory system. This documentation can be used to significantly decrease the time needed to understand the computer systems and enable audit software to be used on this year's audit.

Based on the information above explain the additional problems the auditors face when considering the use of audit software at Hung Lo Ltd. For each problem, explain how it might be resolved.

You are the audit manager in charge of the audit. For the first time at this client, you have decided to use audit software to assist with the audit of the financial systems.

Computer staff at Hung Lo are happy to help the auditor, although they cannot confirm that all the systems documentation is complete. They have warned you that Hung Lo's accounting software is run using very old operating systems which may not be compatible with more modern programs.

The change in audit approach has been taken mainly to gain a full understanding of Hung Lo's computer systems prior to new internet modules being added next year. To limit the possibility of damage to Hung Lo's computer files, copy files will be provided by Hung Lo's computer staff for the auditor to use with their own audit software.

Following a discussion with the management at Hung Lo Ltd you understand that the internal audit department are prepared to assist with the statutory audit. Specifically, the chief internal auditor is prepared to provide you with some documentation on the computerised wages systems at Hung Lo Ltd. The documentation provides details of the software and shows diagrammatically how transactions are processed through the inventory system. This documentation can be used to significantly decrease the time needed to understand the computer systems and enable audit software to be used on this year's audit.

Based on the information above explain the additional problems the auditors face when considering the use of audit software at Hung Lo Ltd. For each problem, explain how it might be resolved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck